The Influence of Corporate Networks on the Competitive Advantage of High Technology Enterprises in China: The Mediating Effects of Dynamic Capacities and Ambidextrous Combination

Abstract

:1. Introduction

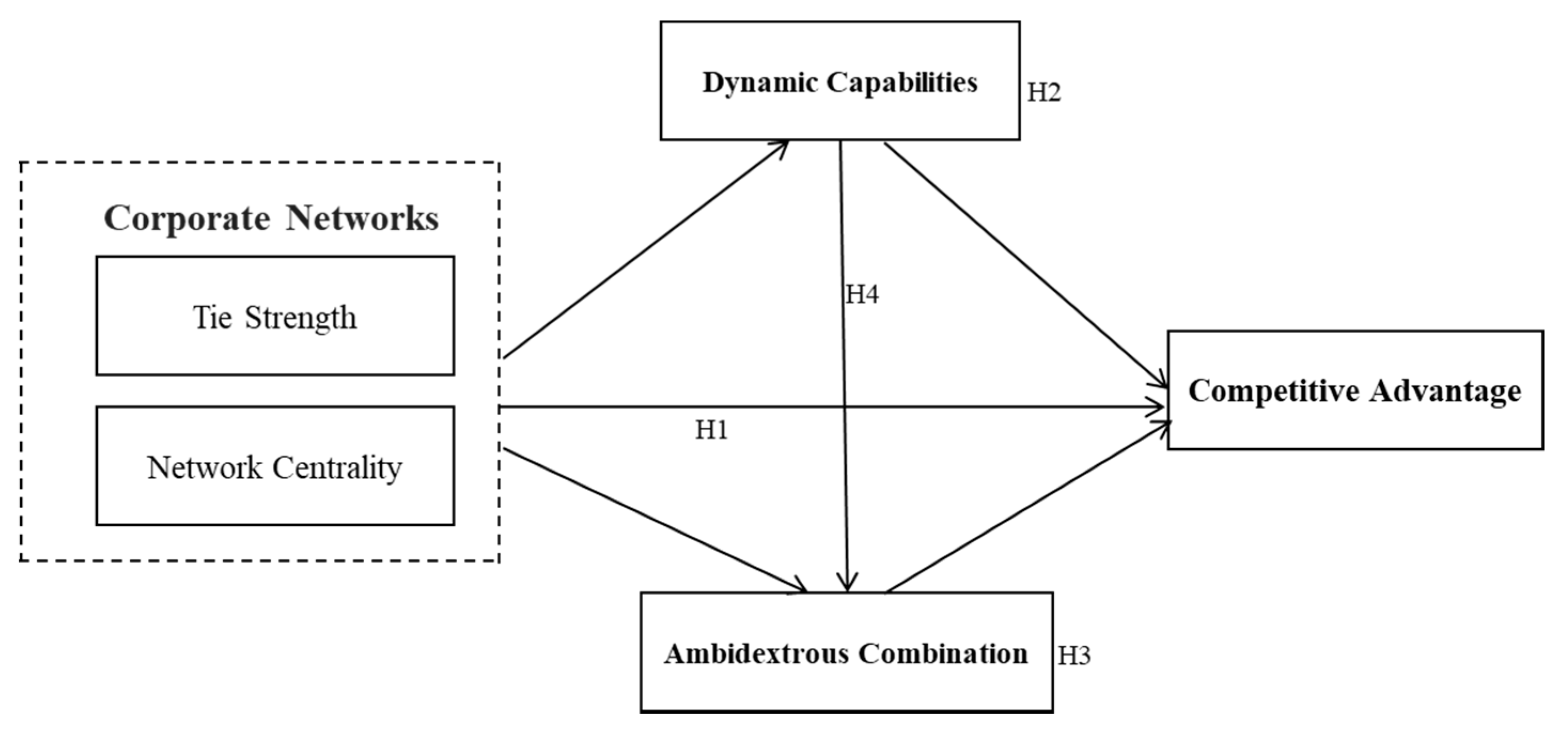

2. Theories and Hypothesis

2.1. Corporate Networks and Competitive Advantage

2.2. The Mediating Effect of Dynamic Capabilities

2.3. Corporate Network and Dynamic Capabilities

2.4. Dynamic Capabilities and Competitive Advantage

2.5. Corporate Network, Dynamic Capabilities and Competitive Advantage

2.6. The Mediating Effect of Ambidextrous Combination

2.7. Corporate Network and Ambidextrous Combination

2.8. Ambidextrous Combination and Competitive Advantage

2.9. Corporate Network, Ambidextrous Combination and Competitive Advantage

2.10. The Mediating Effect of the Interaction Effect of Dynamic Capabilities and Ambidextrous Combination

3. Methodology and Measurement

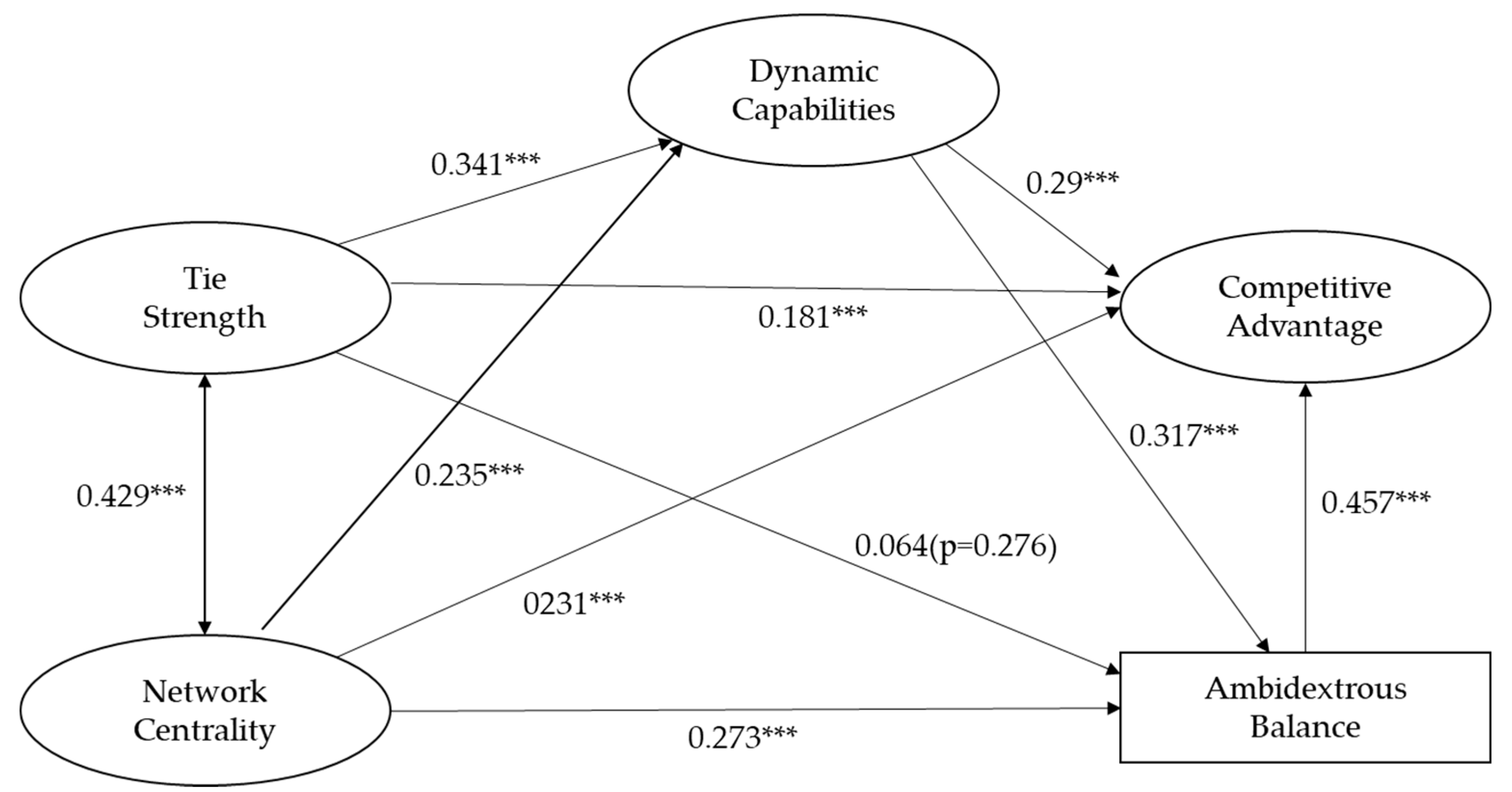

4. Empirical Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Items | Loadings |

|---|---|

| Tie Strength: | |

| TS1: our company maintains frequent contact with other organizations | 0.729 |

| TS2: our company and other organizations keep mutual trust and have common interests | 0.678 |

| TS3: there are many opportunities for communication and cooperation between our company and other organizations | 0.682 |

| TS4: our company maintains close contact with other organizations | 0.748 |

| TS5: our company has established strategic alliances with other organizations | 0.872 |

| Network Centrality: | |

| NC1: most local companies know our company’s name | 0.767 |

| NC2: other local companies have no difficulty in exchanging knowledge and technology with our company | 0.78 |

| NC3: other companies usually exchange knowledge and technology with our company | 0.767 |

| NC4: other local companies often obtain technical or business knowledge from us when they need technical support | 0.8 |

| NC5: other local companies often provide technical or business knowledge to our company when we need technical advice or support | 0.767 |

| Exploratory Innovation: | |

| ERII: our company always tries to introduce new products | 0.779 |

| ERI2: our company always tries to expand its product range | 0.648 |

| ERI3: our company always tries to open up new markets | 0.705 |

| ERI4: our company always tries to enter new technological fields | 0.758 |

| Exploitative Innovation: | |

| EII1: our company always tries to improve the existing products | 0.789 |

| EII2: our company always tries to improve the product flexibility | 0.665 |

| EII3: our company always tries to reduce the production cost | 0.693 |

| EII4: our company always tries to enhance the existing market | 0.815 |

| Dynamic Capabilities-Sensing Capability: | |

| SC1: our company frequently scans the environment to identify new business opportunities | 0.775 |

| SC2: our company often reviews our product development efforts to ensure that they are in line with what the customers want | 0.751 |

| SC3: our company uses established processes to identify target market segments/changing customer needs | 0.839 |

| SC4: Our company never uses new ideas for product improvement and innovation | 0.803 |

| Dynamic Capabilities-Absorptive Capacity: | |

| AC1: our company can often quickly acquire new knowledge | 0.748 |

| AC2: Our company cannot perceive the changes that new knowledge brings to the enterprise | 0.686 |

| AC3: our company can easily connect existing knowledge with new insights | 0.803 |

| AC4: our company can quickly use the new knowledge to develop new products/new services | 0.769 |

| AC5: our company can quickly use the new knowledge to revise the rules and regulations of the company | 0.772 |

| Dynamic Capabilities-Integration and Reconstruction Capabilities: | |

| IR1: our company can successfully create new or substantially changed ways to achieve our targets and objectives | 0.787 |

| IR2: our company can successfully adjust our business processes in response to shifts in our business priorities | 0.735 |

| IR3: our company can successfully reconfigure our business processes to come up with new productive assets | 0.731 |

| IR41: our company can successfully and quickly assign resources to meet task requirements | 0.764 |

| IR5: our company can successfully coordinate different departments to meet task requirements | 0.802 |

| IR6: internal communication and external communication are important to our company | 0.787 |

| Competitive Advantage: | |

| CA1: our company has a low-cost advantage compared to other competitors | 0.753 |

| CA2: our company has better quality products or services than our competitors | 0.79 |

| CA3: our company has more R&D capabilities and innovation than competitors | 0.758 |

| CA4: our company has better managerial capability than competitors | 0.784 |

| CA5: our company has a better image than competitors | 0.775 |

| CA6: the market growth of our company exceeds that of our competitors | 0.749 |

| CA7: our company has a higher profit level than competitors; | 0.768 |

| CA8: our company is the first mover in important fields and occupies an important position | 0.79 |

References

- Asemi, A., A. Safari, and A. A. Zavareh. 2011. The role of management information system (MIS) and Decision support system (DSS) for manager’s decision making process. International Journal of Business and Management 6: 164–73. [Google Scholar] [CrossRef]

- Atuahene-Gima, K. 2005. Resolving the capability–rigidity paradox in new product innovation. Journal of Marketing 69: 61–83. [Google Scholar] [CrossRef]

- Baron, R. M., and D. A. Kenny. 1986. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology 51: 1173. [Google Scholar] [CrossRef]

- Basole, R. C. 2016. Topological analysis and visualization of interfirm collaboration networks in the electronics industry. Decision Support Systems 83: 22–31. [Google Scholar] [CrossRef]

- Birkinshaw, J., and K. Gupta. 2013. Clarifying the distinctive contribution of ambidexterity to the field of organization studies. Academy of Management Perspectives 27: 287–98. [Google Scholar] [CrossRef]

- Bourdieu, P. 1986. The forms of capital. In The Sociology of Economic Life. Edited by M. Granovetter and R. Swedberg. Milton Park: Routledge, pp. 241–58. [Google Scholar]

- Burt, R. S. 2009. Structural holes: The Social Structure of Competition. Harvard: Harvard University Press. [Google Scholar]

- Burt, R. S., and K. Burzynska. 2017. Chinese entrepreneurs, social networks, and guanxi. Management and Organization Review 13: 221–60. [Google Scholar] [CrossRef] [Green Version]

- Cao, Q., E. Gedajlovic, and H. Zhang. 2009. Unpacking organizational ambidexterity: Dimensions, contingencies, and synergistic effects. Organization Science 20: 781–96. [Google Scholar] [CrossRef]

- Cao, Q., Z. Simsek, and J. J. Jansen. 2015. CEO social capital and entrepreneurial orientation of the firm: Bonding and bridging effects. Journal of Management 41: 1957–81. [Google Scholar] [CrossRef]

- Chen, Y.-S., S.-B. Lai, and C.-T. Wen. 2006. The influence of green innovation performance on corporate advantage in Taiwan. Journal of Business Ethics 67: 331–39. [Google Scholar] [CrossRef]

- Chen, L., W. Zheng, B. Yang, and S. Bai. 2016. Transformational leadership, social capital and organizational innovation. Leadership & Organization Development Journal 37: 843–59. [Google Scholar]

- Chuluun, T., A. Prevost, and A. Upadhyay. 2017. Firm network structure and innovation. Journal of Corporate Finance 44: 193–214. [Google Scholar] [CrossRef]

- Cohen, W. M., and D. A. Levinthal. 1990. Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly 35: 128–52. [Google Scholar] [CrossRef]

- Cui, Z., B. Yu, and K. Cui. 2008. The Empirical Research on the Impact Factors of the Absorptive Capacity of Enterprises. Journal of Harbin Institute of Technology 10: 27–132. [Google Scholar]

- Ebben, J. J., and A. C. Johnson. 2005. Efficiency, flexibility, or both? Evidence linking strategy to performance in small firms. Strategic Management Journal 26: 1249–59. [Google Scholar] [CrossRef]

- El-Kassar, A.-N., and S. K. Singh. 2019. Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technological Forecasting and Social Change 144: 483–98. [Google Scholar] [CrossRef]

- Enkel, E., S. Heil, M. Hengstler, and H. Wirth. 2017. Exploratory and exploitative innovation: To what extent do the dimensions of individual level absorptive capacity contribute? Technovation 60: 29–38. [Google Scholar] [CrossRef]

- Fornell, C., and D. F. Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Galati, F., and B. Bigliardi. 2017. Does different NPD project’s characteristics lead to the establishment of different NPD networks? A knowledge perspective. Technology Analysis & Strategic Management 29: 1196–209. [Google Scholar]

- Gibson, C. B., and J. Birkinshaw. 2004. The antecedents, consequences, and mediating role of organizational ambidexterity. Academy of Management Journal 47: 209–26. [Google Scholar]

- Griffin, A., and J. R. Hauser. 1993. The voice of the customer. Marketing Science 12: 1–27. [Google Scholar] [CrossRef]

- Gulati, R. 1999. Network location and learning: The influence of network resources and firm capabilities on alliance formation. Strategic Management Journal 20: 397–420. [Google Scholar] [CrossRef]

- Guo, J., B. Guo, J. Zhou, and X. Wu. 2020. How does the ambidexterity of technological learning routine affect firm innovation performance within industrial clusters? The moderating effects of knowledge attributes. Technological Forecasting and Social Change 155: 119990. [Google Scholar] [CrossRef]

- Hansen, M. T. 1999. The search-transfer problem: The role of weak ties in sharing knowledge across organization subunits. Administrative Science Quarterly 44: 82–111. [Google Scholar] [CrossRef] [Green Version]

- Harrison, J. S., D. A. Bosse, and R. A. Phillips. 2010. Managing for stakeholders, stakeholder utility functions, and competitive advantage. Strategic Management Journal 31: 58–74. [Google Scholar] [CrossRef]

- Hart, S. L. 1995. A natural-resource-based view of the firm. Academy of Management Review 20: 986–1014. [Google Scholar] [CrossRef] [Green Version]

- Hashim, R., A. Bock, and S. Cooper. 2015. The relationship between absorptive capacity and green innovation. World Acad. Sci. Eng. Technol 9: 1040–47. [Google Scholar]

- Hayibor, S. 2017. Stakeholder Action: Predictors of Punitive and Prosocial Stakeholder Behaviours’, Stakeholder Management (Business and Society 360, Volume 1). Bingley: Emerald Publishing Limited. [Google Scholar]

- He, Z.-L., and P.-K. Wong. 2004. Exploration vs. exploitation: An empirical test of the ambidexterity hypothesis. Organization Science 15: 481–94. [Google Scholar]

- Helfat, C. E., S. Finkelstein, W. Mitchell, M. Peteraf, H. Singh, D. Teece, and S. Winter. 2007. Dynamic Capabilities: Foundations in Dynamic Capabilities: Understanding Strategic Change in Organizations. Sydney: Blackwell Publishing. [Google Scholar]

- Ho, R. 2006. Handbook of Univariate and Multivariate Data Analysis and Interpretation with SPSS. Boca Raton: CRC Press. [Google Scholar]

- Hoarau, H. 2014. Knowledge acquisition and assimilation in tourism-innovation processes. Scandinavian Journal of Hospitality and Tourism 14: 135–51. [Google Scholar] [CrossRef] [Green Version]

- Hou, G., and H. Xue. 2017. Cluster network relationship, knowledge acquisition and collaborative innovation performance. Science Research Management 38: 1–9. [Google Scholar]

- Hsu, L. C., and C. H. Wang. 2012. Clarifying the effect of intellectual capital on performance: The mediating role of dynamic capability. British Journal of Management 23: 179–205. [Google Scholar]

- Huang, L., M. Idir, C. Zuo, K. Kaznatcheev, L. Zhou, and A. Asundi. 2015. Comparison of two-dimensional integration methods for shape reconstruction from gradient data. Optics and Lasers in Engineering 64: 1–11. [Google Scholar] [CrossRef]

- Huggins, R., D. Prokop, and P. Thompson. 2019. Universities and open innovation: The determinants of network centrality. The Journal of Technology Transfer, 1–40. [Google Scholar] [CrossRef] [Green Version]

- Inkpen, A. C., and E. W. Tsang. 2005. Social capital, networks, and knowledge transfer. Academy of Management Review 30: 146–65. [Google Scholar] [CrossRef] [Green Version]

- Jansen, J. J., Z. Simsek, and Q. Cao. 2012. Ambidexterity and performance in multiunit contexts: Cross-level moderating effects of structural and resource attributes. Strategic Management Journal 33: 1286–303. [Google Scholar] [CrossRef]

- Jian, Z., C. Wang, and J. H. Chen. 2015. Strategic Orientation, Dynamic Capability and Technological Innovation: Moderating Role of Environmental Uncertainty. R&D Management 27: 65–76. [Google Scholar]

- Junni, P., R. M. Sarala, V. Taras, and S. Y. Tarba. 2013. Organizational ambidexterity and performance: A meta-analysis. Academy of Management Perspectives 27: 299–312. [Google Scholar] [CrossRef]

- Karamanos, A. G. 2016. Effects of a firm’s and their partners’ alliance ego–network structure on its innovation output in an era of ferment. R&d Management 46: 261–76. [Google Scholar]

- Katila, R., and G. Ahuja. 2002. Something old, something new: A longitudinal study of search behavior and new product introduction. Academy of Management Journal 45: 1183–94. [Google Scholar]

- Kessler, J. B., and S. Leider. 2012. Norms and contracting. Management Science 58: 62–77. [Google Scholar] [CrossRef] [Green Version]

- Kollmann, T., and C. Stöckmann. 2014. Filling the entrepreneurial orientation–performance gap: The mediating effects of exploratory and exploitative innovations. Entrepreneurship Theory and Practice 38: 1001–26. [Google Scholar] [CrossRef]

- Leonidou, L. C., C. N. Leonidou, T. A. Fotiadis, and A. Zeriti. 2013. Resources and capabilities as drivers of hotel environmental marketing strategy: Implications for competitive advantage and performance. Tourism Management 35: 94–110. [Google Scholar] [CrossRef]

- Li, W., R. Veliyath, and J. Tan. 2013. Network characteristics and firm performance: An examination of the relationships in the context of a cluster. Journal of Small Business Management 51: 1–22. [Google Scholar] [CrossRef]

- Lin, N. 2008. A network theory of social capital. The Handbook of Social Capital 50: 89. [Google Scholar]

- Lin, C. J., and C. C. Chen. 2015. The responsive–integrative framework, outside–in and inside–out mechanisms and ambidextrous innovations. International Journal of Technology Management 67: 148–73. [Google Scholar] [CrossRef]

- MacKinnon, D. P., A. J. Fairchild, and M. S. Fritz. 2007. Mediation analysis. Annual Review of Psychology 58: 593–614. [Google Scholar] [CrossRef] [PubMed]

- March, J. G. 1991. Exploration and exploitation in organizational learning. Organization Science 2: 71–87. [Google Scholar] [CrossRef]

- Mentzer, J. T., W. DeWitt, J. S. Keebler, S. Min, N. W. Nix, C. D. Smith, and Z. G. Zacharia. 2001. Defining supply chain management. Journal of Business Logistics 22: 1–25. [Google Scholar] [CrossRef]

- Mikalef, P., and A. Pateli. 2017. Information technology-enabled dynamic capabilities and their indirect effect on competitive performance: Findings from PLS-SEM and fsQCA. Journal of Business Research 70: 1–16. [Google Scholar] [CrossRef]

- Minglong, W. 2009. Structural Equation Model: Operation and Application of AMOS. Chongqing University Press 7: 39–59. [Google Scholar]

- NBC News. 2021. U.S. Sanctions Chinese Computer Makers in Widening Tech Fight. April 19. Available online: https://www.nbcnews.com/tech/tech-news/us-sanctions-chinese-computer-makers-widening-tech-fight-rcna631 (accessed on 27 April 2020).

- Osman, L. H. B. 2015. How structure influence relational capital: The impact of network communication in centralized structure. VFAST Transactions on Education and Social Sciences 7: 57–68. [Google Scholar] [CrossRef]

- Pavlou, P. A., and O. A. El Sawy. 2011. Understanding the elusive black box of dynamic capabilities. Decision Sciences 42: 239–73. [Google Scholar] [CrossRef]

- Phelps, C. C. 2010. A longitudinal study of the influence of alliance network structure and composition on firm exploratory innovation. Academy of Management Journal 53: 890–913. [Google Scholar] [CrossRef] [Green Version]

- Pinho, J. C., and C. Prange. 2016. The effect of social networks and dynamic internationalization capabilities on international performance. Journal of World Business 51: 391–403. [Google Scholar] [CrossRef]

- Preacher, K. J., D. D. Rucker, and A. F. Hayes. 2007. Addressing moderated mediation hypotheses: Theory, methods, and prescriptions. Multivariate Behavioral Research 42: 185–227. [Google Scholar] [CrossRef]

- Protogerou, A., Y. Caloghirou, and S. Lioukas. 2012. Dynamic capabilities and their indirect impact on firm performance. Industrial and Corporate Change 21: 615–47. [Google Scholar] [CrossRef]

- Quintane, E., R. M. Casselman, B. S. Reiche, and P. A. Nylund. 2011. Innovation as a knowledge-based outcome. Journal of Knowledge Management 15: 928–47. [Google Scholar] [CrossRef]

- Rodrigo-Alarcón, J., P. M. García-Villaverde, M. J. Ruiz-Ortega, and G. Parra-Requena. 2018. From social capital to entrepreneurial orientation: The mediating role of dynamic capabilities. European Management Journal 36: 195–209. [Google Scholar]

- Rogan, M., and M. L. Mors. 2014. A network perspective on individual-level ambidexterity in organizations. Organization Science 25: 1860–77. [Google Scholar] [CrossRef] [Green Version]

- Sanchez-Famoso, V., A. Maseda, and T. Iturralde. 2014. The role of internal social capital in organisational innovation. An Empirical Study of Family Firms. European Management Journal 32: 950–62. [Google Scholar] [CrossRef]

- Shaarawy, N., and H. Abdelghaffar. 2017. Achieving successful knowledge sharing through enterprise social network collaboration. The Business & Management Review 8: 1–15. [Google Scholar]

- Shu, C., A. L. Page, S. Gao, and X. Jiang. 2012. Managerial ties and firm innovation: Is knowledge creation a missing link? Journal of Product Innovation Management 29: 125–43. [Google Scholar] [CrossRef]

- Stuck, J., T. Broekel, and J. Revilla Diez. 2016. Network structures in regional innovation systems. European Planning Studies 24: 423–42. [Google Scholar] [CrossRef] [Green Version]

- Teece, D.J. 2007. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strategic Management Journal 28: 1319–50. [Google Scholar] [CrossRef] [Green Version]

- Teece, D.J. 2018a. Business models and dynamic capabilities. Long Range Planning 51: 40–49. [Google Scholar] [CrossRef]

- Teece, D.J. 2018b. Dynamic capabilities as (workable) management systems theory. Journal of Management & Organization 24: 359–68. [Google Scholar]

- Tsai, F.-S. 2016. Knowing what we know differently: Knowledge heterogeneity and dynamically ambidextrous innovation. Journal of Organizational Change Management 29: 1162–88. [Google Scholar] [CrossRef]

- Tsou, H.-T., and S. H.-Y. Hsu. 2015. Performance effects of technology–organization–environment openness, service co-production, and digital-resource readiness: The case of the IT industry. International Journal of Information Management 35: 1–14. [Google Scholar] [CrossRef]

- Wang, C. L., and P. K. Ahmed. 2007. Dynamic capabilities: A review and research agenda. International Journal of Management Reviews 9: 31–51. [Google Scholar] [CrossRef]

- Wang, W., Q. Cao, L. Qin, Y. Zhang, T. Feng, and L. Feng. 2019. Uncertain environment, dynamic innovation capabilities and innovation strategies: A case study on Qihoo 360. Computers in Human Behavior 95: 284–94. [Google Scholar] [CrossRef]

- Wilden, R., S. P. Gudergan, B. B. Nielsen, and I. Lings. 2013. Dynamic capabilities and performance: Strategy, structure and environment. Long Range Planning 46: 72–96. [Google Scholar] [CrossRef] [Green Version]

- Xie, X., Y. Gao, Z. Zang, and X. Meng. 2019. Collaborative ties and ambidextrous innovation: Insights from internal and external knowledge acquisition. Industry and Innovation 27: 1–26. [Google Scholar] [CrossRef]

- Xue, M., F. Boadu, and Y. Xie. 2019. The Penetration of Green Innovation on Firm Performance: Effects of Absorptive Capacity and Managerial Environmental Concern. Sustainability 11: 2455. [Google Scholar] [CrossRef] [Green Version]

- Zahra, S.A., and G. George. 2002. Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review 27: 185–203. [Google Scholar] [CrossRef] [Green Version]

- Zhang, J., and W.-p. Wu. 2017. Leveraging internal resources and external business networks for new product success: A dynamic capabilities perspective. Industrial Marketing Management 61: 170–81. [Google Scholar] [CrossRef]

| No. | Constructs | Cronbach’s α | CR 1 | AVE | SQRT (AVE) | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Competitive Advantage | 0.921 | 0.92 | 0.59 | 0.77 | 1 | |||||

| 2 | Tie Strength | 0.85 | 0.86 | 0.56 | 0.75 | 0.56 | 1 | ||||

| 3 | Network Centrality | 0.88 | 0.88 | 0.6 | 0.78 | 0.61 | 0.43 | 1 | |||

| 4 | Dynamic Capability | 0.80 | 0.58 | 0.76 | 0.66 | 0.44 | 0.38 | 1 | |||

| 4.1 | Sensing Capability | 0.87 | 0.87 | 0.62 | 0.79 | ||||||

| 4.2 | Absorptive Capability | 0.86 | 0.87 | 0.57 | 0.76 | ||||||

| 4.3 | Integration and Reconstruction | 0.89 | 0.89 | 0.59 | 0.77 | ||||||

| 5 | Exploratory Innovation | 0.81 | 0.81 | 0.52 | 0.72 | 0.70 | 0.26 | 0.36 | 0.38 | 1 | |

| 6 | Exploitative Innovation | 0.83 | 0.83 | 0.55 | 0.74 | 0.71 | 0.32 | 0.43 | 0.48 | 0.57 | 1 |

| Num | Constructs | Mean | S. D. | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|---|---|

| 1 | Tie Strength | 3.589 | 0.775 | 1 | ||||

| 2 | Network Centrality | 3.490 | 0.827 | 0.377 ** | 1 | |||

| 3 | Dynamic Capability | 3.423 | 0.708 | 0.365 ** | 0.319 ** | 1 | ||

| 4 | Competitive Advantage | 3.543 | 0.821 | 0.501 ** | 0.550 ** | 0.560 ** | 1 | |

| 5 | Ambidextrous Combination | 7.140 | 1.359 | 0.299 ** | 0.395 ** | 0.396 ** | 0.713 ** | 1 |

| Path | Standardized Value | Bias-Corrected 95% | Results | |

|---|---|---|---|---|

| Lower | Upper | |||

| Indirect Effect | ||||

| TS-DC-CA | 0.099 | 0.045 | 0.168 | supported |

| NC-DC-CA | 0.068 | 0.026 | 0.154 | supported |

| TS-AM-CA | 0.029 | −0.033 | 0.103 | rejected |

| NC-AM-CA | 0.125 | 0.044 | 0.219 | supported |

| TS-DC-AM | 0.108 | 0.038 | 0.210 | supported |

| NC-DC-AM | 0.075 | 0.02 | 0.188 | supported |

| TS-DC-AM-CA | 0.049 | 0.019 | 0.099 | supported |

| NC-DC-AM-CA | 0.034 | 0.01 | 0.089 | supported |

| Direct Effect | ||||

| TS-CA | 0.181 | 0.071 | 0.281 | supported |

| NC-CA | 0.231 | 0.085 | 0.359 | supported |

| TS-AM | 0.064 | −0.073 | 0.210 | rejected |

| NC-AM | 0.273 | 0.101 | 0.427 | supported |

| Groups | Model | Path | Manufacturing | Service | Critical Ratios | ||

| Estimate | p | Estimate | p | ||||

| Industry Category | CFA | ERI4<---ERI | 0.781 | *** | 0.752 | *** | 2.74 |

| PATH | CA<---RI | 0.394 | *** | 0.105 | 0.040 | −4.145 | |

| CA<---NC | 0.577 | *** | 0.148 | 0.003 | −5.767 | ||

| AM<---NC | 0.525 | *** | 0.162 | 0.021 | −2.992 | ||

| CA<---CD | 0.139 | 0.007 | 0.511 | *** | 4.865 | ||

| Groups | Model | Path | <300 | >300 | Critical Ratios | ||

| Estimate | p | Estimate | p | ||||

| Size Category | CFA | TS4<---RI | 0.719 | *** | 0.819 | *** | 2.58 |

| TS5<---RI | 0.857 | *** | 0.906 | *** | 2.4 | ||

| IR4<---IR | 0.729 | *** | 0.844 | *** | 2.874 | ||

| PATH | AM<---DC | 0.464 | *** | 0.005 | 0.969 | −2.81 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, H.; Zhang, Z. The Influence of Corporate Networks on the Competitive Advantage of High Technology Enterprises in China: The Mediating Effects of Dynamic Capacities and Ambidextrous Combination. Int. J. Financial Stud. 2021, 9, 42. https://doi.org/10.3390/ijfs9030042

Wang H, Zhang Z. The Influence of Corporate Networks on the Competitive Advantage of High Technology Enterprises in China: The Mediating Effects of Dynamic Capacities and Ambidextrous Combination. International Journal of Financial Studies. 2021; 9(3):42. https://doi.org/10.3390/ijfs9030042

Chicago/Turabian StyleWang, Huayun, and Zhuoran Zhang. 2021. "The Influence of Corporate Networks on the Competitive Advantage of High Technology Enterprises in China: The Mediating Effects of Dynamic Capacities and Ambidextrous Combination" International Journal of Financial Studies 9, no. 3: 42. https://doi.org/10.3390/ijfs9030042

APA StyleWang, H., & Zhang, Z. (2021). The Influence of Corporate Networks on the Competitive Advantage of High Technology Enterprises in China: The Mediating Effects of Dynamic Capacities and Ambidextrous Combination. International Journal of Financial Studies, 9(3), 42. https://doi.org/10.3390/ijfs9030042