The Fractional Step Method versus the Radial Basis Functions for Option Pricing with Correlated Stochastic Processes

Abstract

1. Introduction

2. Exchange Option

3. The Fractional Step Method

4. The Radial Basis Functions

5. Numerical Experiments

5.1. General Setting

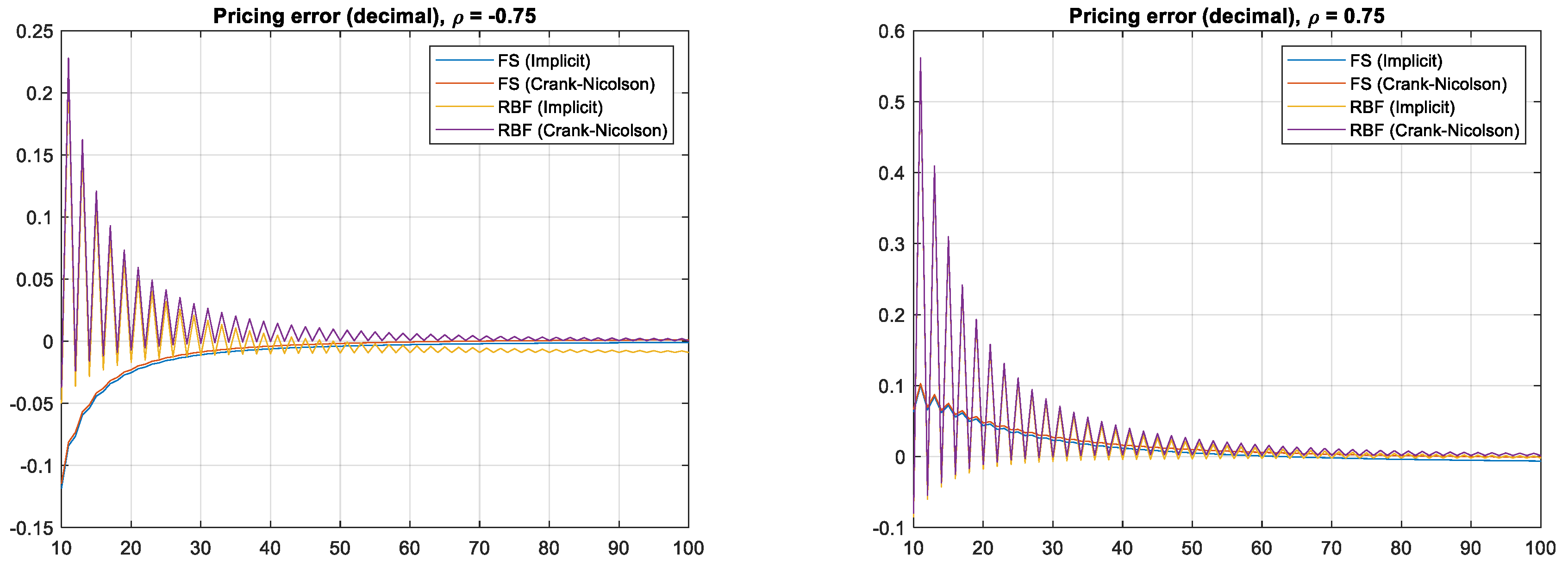

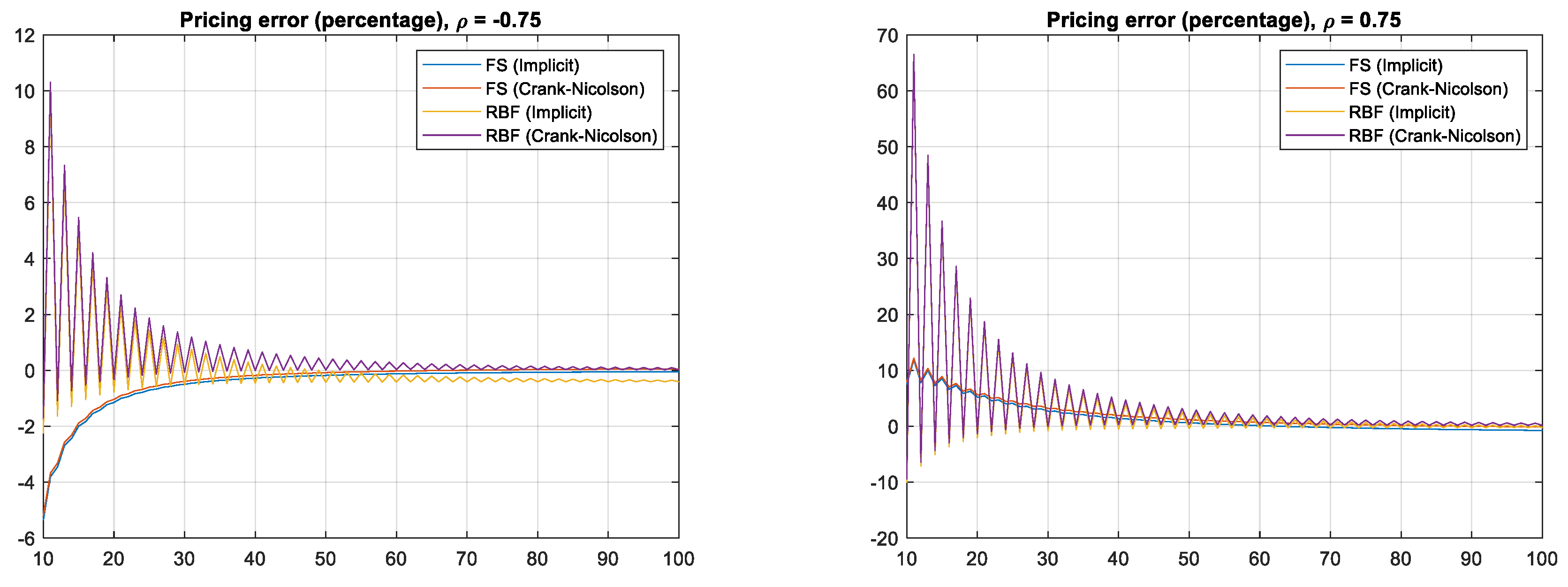

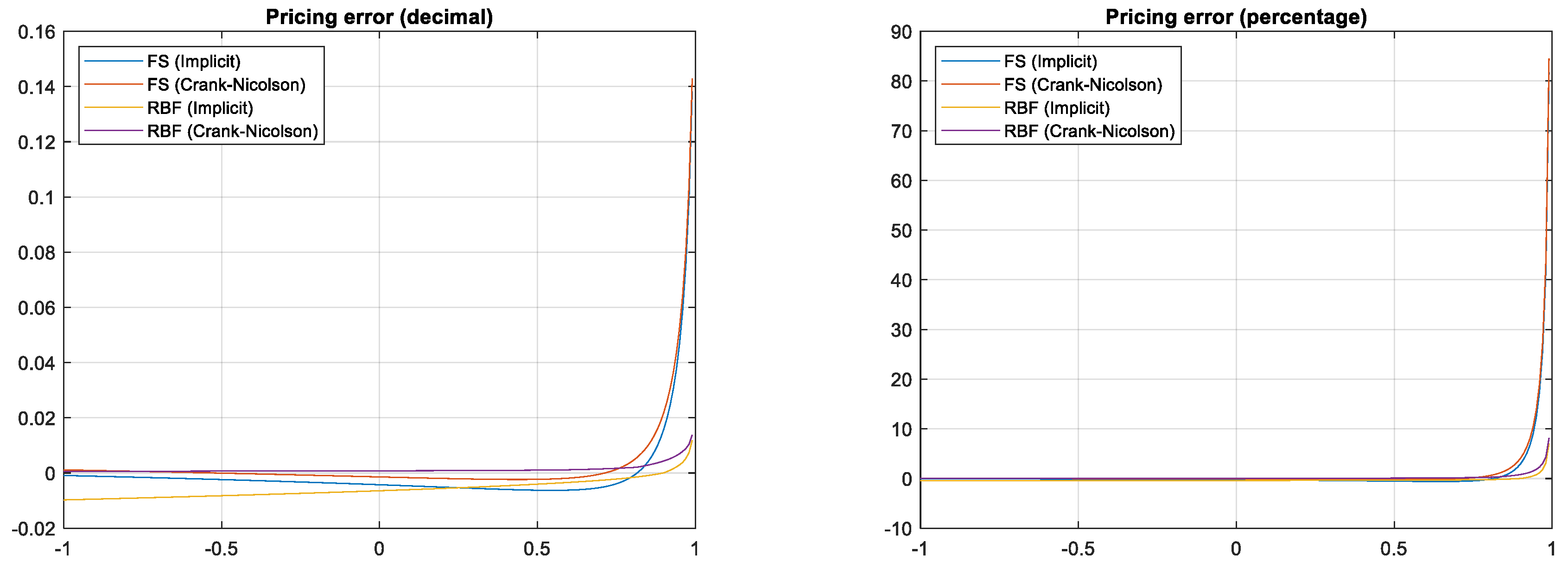

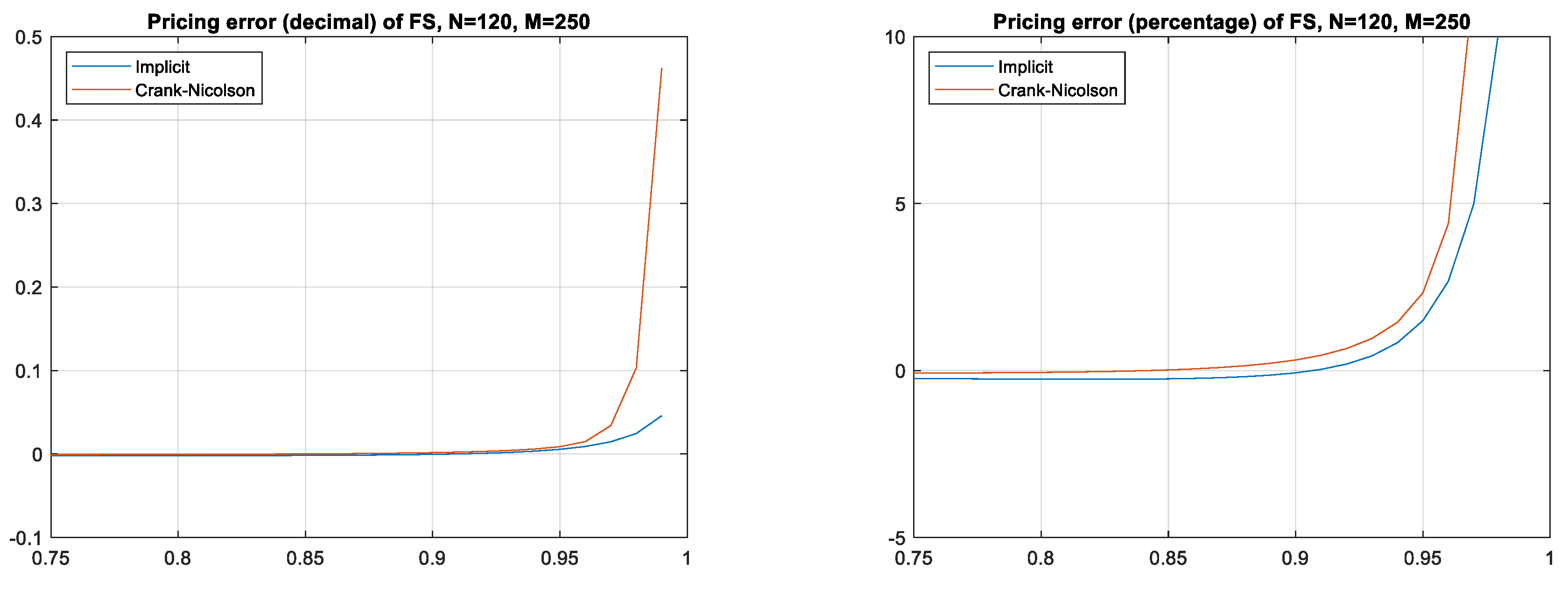

5.2. Number of Partitions of Space Dimension

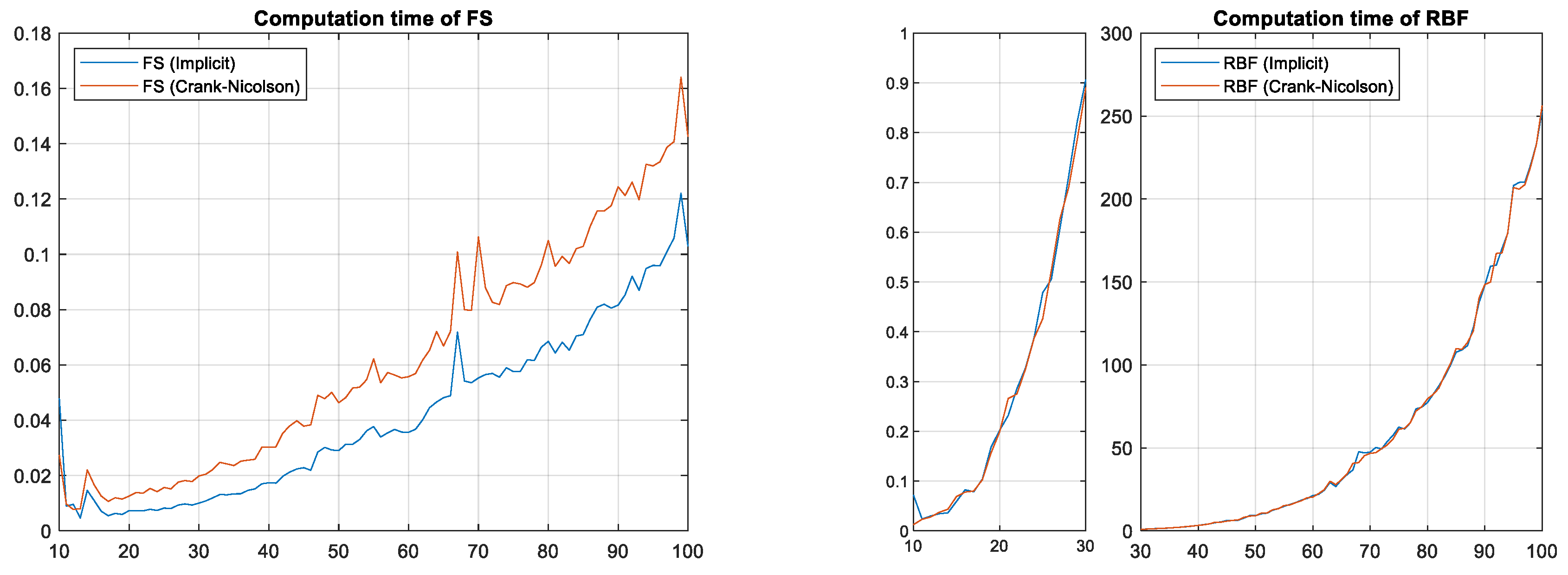

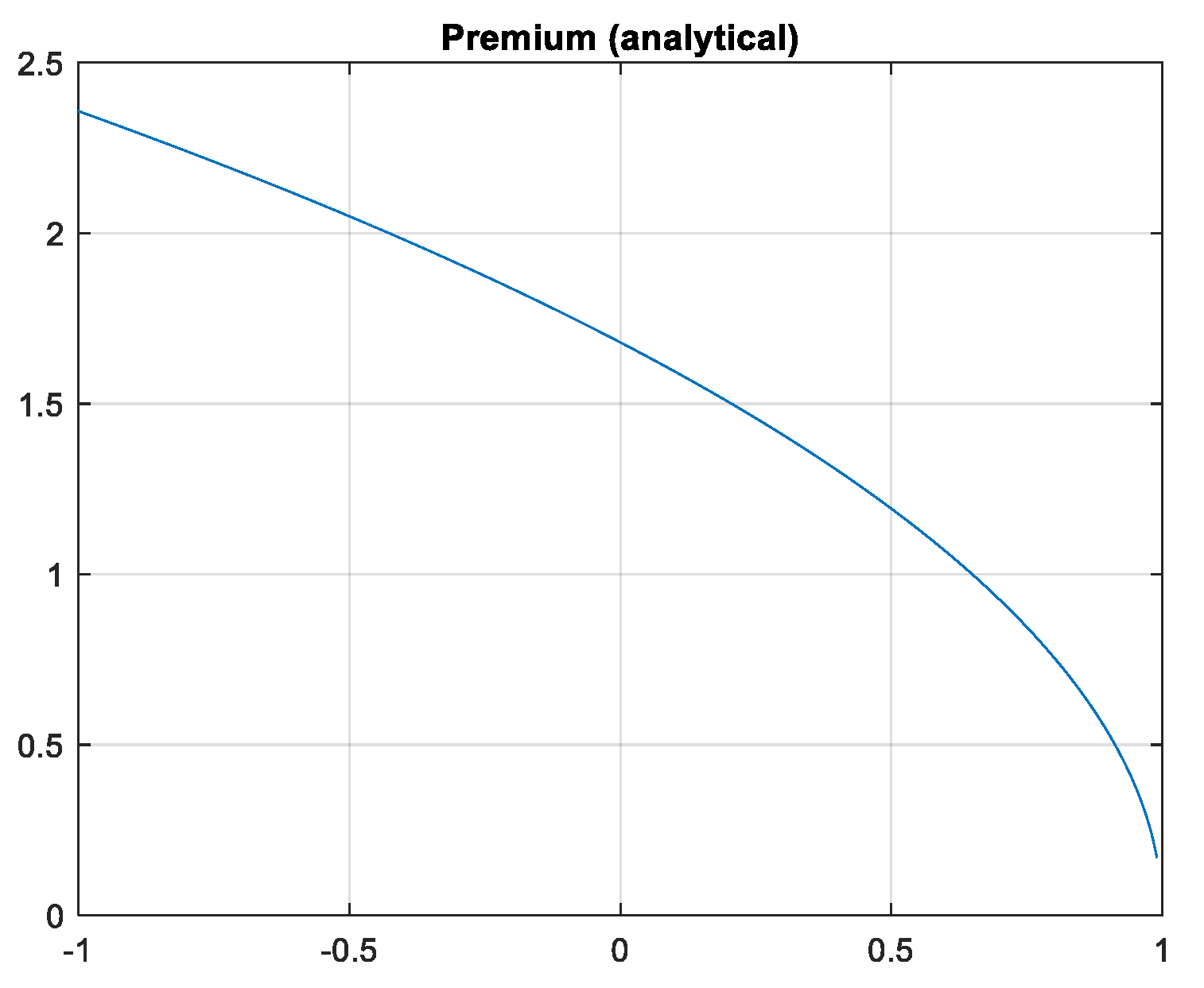

5.3. Errors with Respect to Correlation

6. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Amin, Kaushik I., and Robert A. Jarrow. 1992. Pricing options on risky assets in a stochastic interest rate economy. Mathematical Finance 2: 217–37. [Google Scholar] [CrossRef]

- Ballestra, Luca Vincenzo, and Graziella Pacelli. 2013. Pricing European and American options with two stochastic factors: A highly efficient radial basis function approach. Journal of Economic Dynamics and Control 37: 1142–67. [Google Scholar] [CrossRef]

- Brummelhuis, Raymond, and Ron T. L. Chan. 2014. A radial basis function scheme for option pricing in exponential Lévy models. Applied Mathematical Finance 21: 238–69. [Google Scholar] [CrossRef]

- Chan, Ron Tat Lung. 2016. Adaptive radial basis function methods for pricing options under jump-diffusion models. Computational Economics 47: 623–43. [Google Scholar] [CrossRef]

- Company, Rafael, Vera N. Egorova, Lucas Jódar, and Fazlollah Soleymani. 2018. A local radial basis function method for high-dimensional American option pricing problems. Mathematical Modelling and Analysis 23: 117–38. [Google Scholar] [CrossRef]

- Duffy, Daniel J. 2006. Finite Difference Methods in Financial Engineering: A partial Differential Equation Approach. Sussex: John Wiley & Sons, Inc. [Google Scholar]

- Fasshauer, Gregory E. 2007. Meshfree Approximation Methods with Matlab. Singapore: World Scientific. [Google Scholar]

- Golbabai, Ahmad, Davood Ahmadian, and Mariyan Milev. 2012. Radial basis functions with application to finance: American put option under jump diffusion. Mathematical and Computer Modelling 55: 1354–62. [Google Scholar] [CrossRef]

- Goto, Yumi, Zhai Fei, Shen Kan, and Eisuke Kita. 2007. Options valuation by using radial basis function approximation. Engineering Analysis with Boundary Elements 31: 836–43. [Google Scholar] [CrossRef]

- Heath, David, Robert Jarrow, and Andrew Morton. 1992. Bond pricing and the term structure of interest rates: A new methodology for contingent claims valuation. Econometrica 60: 77–105. [Google Scholar] [CrossRef]

- Hendricks, Christian, Matthias Ehrhardt, and Michael Günther. 2016. High-order ADI schemes for diffusion equations with mixed derivatives in the combination technique. Applied Numerical Mathematics 101: 36–52. [Google Scholar] [CrossRef]

- Heston, Steven L. 1993. A closed-form solution for options with stochastic volatility with applications to bond and currency options. The Review of Financial Studies 6: 327–43. [Google Scholar] [CrossRef]

- Hon, Yiu-Chung, and Xian-Zhong Mao. 1998. A Radial Basis Function Method for Solving Options Pricing Model. Working paper. Hong Kong: City University of Hong Kong. [Google Scholar]

- Ikonen, Samuli, and Jari Toivane. 2007. Componentwise splitting methods for pricing American options under stochastic volatility. International Journal of Theoretical and Applied Finance 10: 331–61. [Google Scholar] [CrossRef]

- In’t Hout, K. J., and S. Foulon. 2010. ADI finite difference schemes for option pricing in the Heston model with correlation. International Journal of Numerical Analysis and Modeling 7: 303–20. [Google Scholar]

- Itkin, Andrey, and Peter Carr. 2008. A Finite-Difference Approach to the Pricing of Barrier Options in Stochastic Skew Models. Working paper. UCLA College: Los Angeles. [Google Scholar]

- Jäckel, Peter. 2002. Monte Carlo Methods in Finance. Sussex: John Wiley & Sons, Ltd. [Google Scholar]

- Jebreen, Haifa Bin. 2019. A Gaussian radial basis function-finite difference technique to simulate the HCIR equation. Journal of Computational and Applied Mathematics 347: 181–95. [Google Scholar] [CrossRef]

- Jeong, Darae, and Junseok Kim. 2013. A comparison study of ADI and operator splitting methods on option pricing models. Journal of Computational and Applied Mathematics 247: 162–71. [Google Scholar] [CrossRef]

- Kadalbajoo, Mohan K., Alpesh Kumar, and Lok Pati Tripathi. 2016. A radial basis function based implicit–explicit method for option pricing under jump-diffusion models. Applied Numerical Mathematics 110: 159–73. [Google Scholar] [CrossRef]

- Lando, David. 1998. On Cox processes and credit risky securities. Review of Derivatives Research 2: 99–120. [Google Scholar] [CrossRef]

- Liu, Gui-Rong. 2009. Meshfree Methods: Moving Beyond the Finite Element Method, 2nd ed. Boca Raton: CRC Press. [Google Scholar]

- Liu, Gui-Rong, and Yuan-Tong Gu. 2005. An Introduction to Meshfree Methods and Their Programming. Berlin: Springer. [Google Scholar]

- Lung, Ron Tat, and Chan Simon Hubbert. 2014. Options pricing under the one-dimensional jump-diffusion model using the radial basis function interpolation scheme. Review of Derivatives Research 17: 161–89. [Google Scholar]

- Margrabe, William. 1978. The value of an option to exchange one asset for another. The Journal of Finance 33: 177–86. [Google Scholar] [CrossRef]

- Mollapouras, Reza, Ali Fereshtian, and Michèle Vanmaele. 2019. Radial basis functions with partition of unity method for American options with stochastic volatility. Computational Economics 53: 259–87. [Google Scholar] [CrossRef]

- Saib, Aslam Aly El-Faïdal, Désiré Yannick Tangman, and Muddun Bhuruth. 2012. A new radial basis functions method for pricing American options under Merton’s jump-diffusion model. International Journal of Computer Mathematics 89: 1164–85. [Google Scholar] [CrossRef]

- Shcherbakov, Victor, and Elisabeth Larsson. 2016. Radial basis function partition of unity methods for pricing vanilla basket options. Computers & Mathematics with Applications 71: 185–200. [Google Scholar]

- Shreve, Steven E. 2004. Stochastic Calculus for Finance I: The Binomial Asset Pricing Model. New York: Springer. [Google Scholar]

- Toivanen, Jari. 2010. A componentwise splitting method for pricing American options under the Bates model. In Applied and Numerical Partial Differential Equations. Edited by Fitzgibbon William, Yuri Kuznetsov, Pekka Neittaanmäki, Jacques Périaux and Olivier Pironneau. New York: Springer, pp. 213–27. [Google Scholar]

- Yanenko, Nikolaj N. 1971. The Method of Fractional Steps. Berlin: Springer. [Google Scholar]

| 1 | Several studies employ the ADI finite difference method to evaluate PDEs with mixed derivatives (Hendricks et al. 2016; In’t Hout and Foulon 2010; Jeong and Kim 2013). |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kagraoka, Y. The Fractional Step Method versus the Radial Basis Functions for Option Pricing with Correlated Stochastic Processes. Int. J. Financial Stud. 2020, 8, 77. https://doi.org/10.3390/ijfs8040077

Kagraoka Y. The Fractional Step Method versus the Radial Basis Functions for Option Pricing with Correlated Stochastic Processes. International Journal of Financial Studies. 2020; 8(4):77. https://doi.org/10.3390/ijfs8040077

Chicago/Turabian StyleKagraoka, Yusho. 2020. "The Fractional Step Method versus the Radial Basis Functions for Option Pricing with Correlated Stochastic Processes" International Journal of Financial Studies 8, no. 4: 77. https://doi.org/10.3390/ijfs8040077

APA StyleKagraoka, Y. (2020). The Fractional Step Method versus the Radial Basis Functions for Option Pricing with Correlated Stochastic Processes. International Journal of Financial Studies, 8(4), 77. https://doi.org/10.3390/ijfs8040077