Quality Determination of the Saudi Retail Banking System and the Challenges of Vision 2030

Abstract

1. Introduction

2. Literature Review

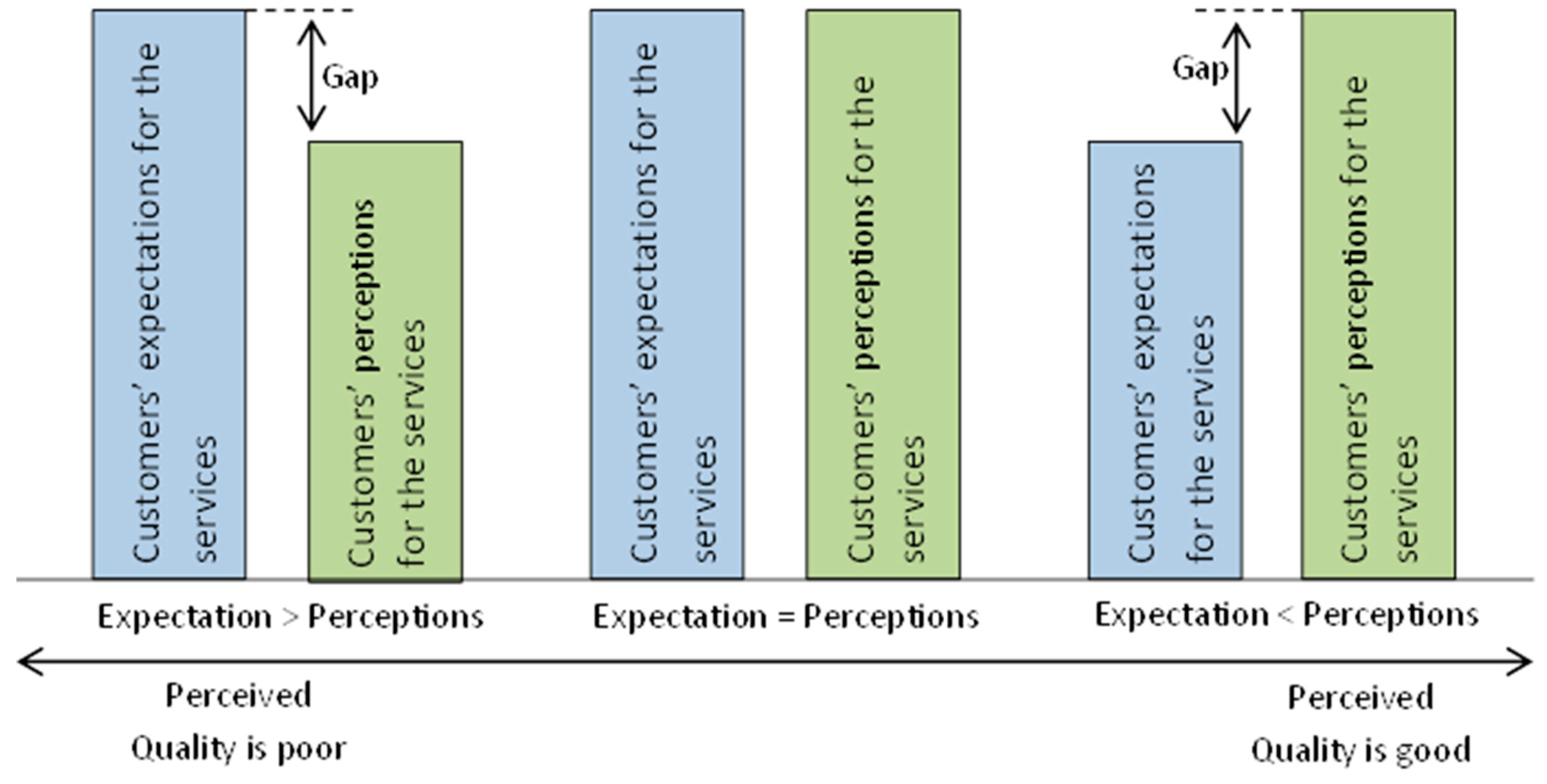

SERVQUAL Model

3. Problem Statement

3.1. Study Objectives

- (1)

- Provide justification for applying an integrated SERVQUAL model, in the light of discussion presented elsewhere, to measure banking service quality in a broad spectrum.

- (2)

- Apply the modified SERVQUAL model to identify quality issues in the services of Saudi Arabian banks.

- (3)

- Examine and compare quality gaps between national and multinational banks operating in the KSA.

- (4)

- Suggest remedies to resolve quality issues and provide dimensions for further research.

3.2. Hypotheses

4. Research Methodology

4.1. What Is the Best Approach for Measuring Quality Gaps?

4.2. Technical and Functional Quality Measures

4.3. Questionnaire Development

4.4. Data Collection

4.5. Data Tabulation

5. Statistical Models and Data Quality Interpretation

5.1. Profile Analysis of Banking Service Users

5.2. Cronbach’s α: Data Reliability Test

5.3. Applying a Factor Analysis for Justifying the Seven Quality Measures

5.4. Factor Loading, Eigenvalues and Internal Consistency

6. Gap Analysis for the Entire Sample and Discussion of Results

7. Gap Comparison

8. Discussion

Author Contributions

Acknowledgments

Conflicts of Interest

Appendix A

| Age: | Up to 25 years | 26–35 years | 36–50 years | 50+ | ||||

| العمر | تحت 25 سنة | سنة 35–26 | سنة 50–36 | سنة فأكثر 50 |

| Gender: | Male | Female | ||

| الجنس | ذكر | أنثى |

| Nationality: | Saudi | Non-Saudi | ||

| الجنسية | سعودي | غير سعودي |

| Marital Status: | Single | Married | Widow | Divorced | ||||

| الحالة الاجتماعية | أعزب | متزوج | أرملة | مطلق |

| Education: | Under Grade 10 | Grade 12 | Graduation | Master | PhD | |||||

| التعليم | أولى ثانوي فأقل | ثالثة ثانوي فأقل | بكالوريوس | ماجستير | دكتوراة |

| Profession: العمل | Student | Self Employed/Business | Employed Fulltime Non-Executive | |||

| طالب | عمل حر | موظف غير تنفيذي | ||||

| Employed | ||||||

| Fulltime | Unemployed | Housewife | ||||

| Executive | ||||||

| غير موظف | ربة منزل | |||||

| موظف تنفيذي | ||||||

| Your Monthly Income: | >SAR5000 | 5000–9900 | 10,000–14,900 | 15,000–19,900 | 20,000+ | |||||

| الدخل الشهري | أقل من 5000 ريال | –5000 | –10,000 | –15,000 | +20,000 | |||||

| 9900 | 14,900 | 19,900 |

| Your Main Bank: | Saudi National Bank | Multi-National in KSA | Saudi/Foreign JV | Saudi Islamic Bank | ||||

| مصرفك الرئيسي | مصرف سعودي محلي | مصرف متعدد الجنسيات | مصرفي سعودي/ مصرف أجنبي | مصرف سعودي اسلامي |

| S.N التسلسل | Statement البيان Service Reliability/ثقة الخدمة | Strongly Disagree لا أوافق بشدة 1 | Disagree لا أوافق 2 | Neutral محايد 3 | Agree موافق 4 | Strongly agree أوافق بشدة 5 |

| P1 | Bank provides service as promised | |||||

| يقدم المصرف الخدمة كما وعد | ||||||

| P2 | Always active in solving problem | |||||

| المصرف نشيط في حل المشكلة | ||||||

| P3 | Service provided correctly at the first time | |||||

| يقدم المصرف الخدمة بشكل صحيح في أول مرة | ||||||

| P4 | Service provided at the time promised | |||||

| يقدم المصرف الخدمة في الوقت كما وعد | ||||||

| P5 | Bank keeps accurate and updated records | |||||

| المصرف يحافظ على السجلات بطريقة دقيقة ومحدثة | ||||||

| Responsiveness/الاستجابة | ||||||

| P6 | Customers informed when service will be given | |||||

| المصرف يخبر العملاء متى الخدمة ستكون مقدمة | ||||||

| P7 | Gives service promptly | |||||

| المصرف يعطي الخدمة فوراً | ||||||

| P8 | Bank employees willing to help customers | |||||

| موظفي المصرف لديهم الرغبة لمساعدة العملاء | ||||||

| P9 | Responds well to customer requests | |||||

| المصرف يجيب على استفسارات العملاء | ||||||

| Assurance/الضمان | ||||||

| P10 | Bank employees are trustworthy | |||||

| موظفي المصرف موثوقين | ||||||

| P11 | Transactions carried out safely | |||||

| يوجد أمان في العمليات المصرفية | ||||||

| P12 | Employees are always polite | |||||

| موظفي المصرف ذوي خلق عالي | ||||||

| P13 | Employees found with having knowledge answering questions | |||||

| موظفي المصرف لديهم معرفة للاجابة على الأسئلة | ||||||

| Empathy/التعاطف | ||||||

| P14 | Customers are given Individual attention | |||||

| يتم الاهتمام الشخصي بالعميل | ||||||

| P15 | Bank working hours are convenient | |||||

| ساعات عمل المصرف مناسبة | ||||||

| P16 | Bank has customers best interest at heart | |||||

| لدى العملاء ولاء عالي تجاه المصرف | ||||||

| P17 | Bank understands specific need of customers | |||||

| المصرف يفهم احتياجات العملاء | ||||||

| Tangibles/الملموسات | ||||||

| P18 | Bank had modern looking and up-to-date equipment | |||||

| المصرف يمتلك شكل عصري وأدوات محدثة | ||||||

| P19 | Best appearance of physical facilities | |||||

| المصرف يمتلك أفضل تسهيلات ملموسة | ||||||

| P20 | Bank appearance of employees | |||||

| موظفي المصرف يظهروا بأفضل شكل | ||||||

| Technical | ||||||

| P21 | Service is provided with ease | |||||

| يتم توفير الخدمة بسهولة | ||||||

| P22 | Attention to individual need | |||||

| يتم الاهتمام بالحاجات الفردية | ||||||

| P23 | Ease in contacting bank service providers | |||||

| سهولة الاتصال بمزودي الخدمات المصرفية | ||||||

| P24 | Accurate record keeping giving results | |||||

| يتماستخدام سجلات دقيقة لحفظ المعلومات والنتائج | ||||||

| P25 | Providing information correctly | |||||

| يتم تقديم المعلومات بشكل صحيح | ||||||

| Functional | ||||||

| P26 | Employees are trustworthy and keep confidentiality | |||||

| الموظفون جديرون بالثقة ويحافظون على السرية | ||||||

| P27 | Employees available to answer questions | |||||

| الموظفين جاهزون للإجابة على الأسئلة | ||||||

| P28 | Employees are always courteous and friendly | |||||

| الموظفون دائمًا مهذبون وودودون | ||||||

| P29 | Competence in explaining services and policies | |||||

| يتم شرح الخدمات والسياسات من قبل متخصصين | ||||||

| P30 | Understand requests and give good response | |||||

| يتم فهم طلبات العملاء ويتم إعطاء استجابة جيدة | ||||||

References

- Anouze, Abdel Latef M., Ahmed Salameh Alamro, and Abdulkareem Salameh Awwad. 2019. Customer satisfaction and its measurement in Islamic banking sector: A revisit and update. Journal of Islamic Marketing 10: 565–88. [Google Scholar] [CrossRef]

- Aydin, Kenan, and Seda Yildirim. 2012. The measurement of service quality with servqual for different domestic airline firms in Turkey. Serbian Journal of Management 7: 219–30. [Google Scholar] [CrossRef]

- Babakus, Emin, and Gregory W. Boller. 1992. An empirical assessment of the SERVQUAL scale. Journal of Business Research 24: 253–68. [Google Scholar] [CrossRef]

- Baker, Julie, and Charles W. Lamb, Jr. 1994. Measuring architectural design service quality. Journal of Professional Services Marketing 10: 89–106. [Google Scholar] [CrossRef]

- Brysland, Alexandria, and Adrienne Curry. 2001. Service improvements in public services using SERVQUAL. Managing Service Quality 11: 389–401. [Google Scholar] [CrossRef]

- Carman, James M. 1990. Consumer perceptions of service quality: An assessment of T. Journal of Retailing 66: 33. [Google Scholar]

- Creative Research Systems. 1982. Available online: https://www.surveysystem.com/sample-size-formula.htm (accessed on 10 March 2020).

- Cronin, J. Joseph, Jr., and Steven A. Taylor. 1992. Measuring service quality: A reexamination and extension. Journal of Marketing 56: 55–68. [Google Scholar] [CrossRef]

- Dinçer, Hasan, Serhat Yüksel, and Luis Martinez. 2019. Analysis of balanced scorecard-based SERVQUAL criteria based on hesitant decision-making approaches. Computers & Industrial Engineering 131: 1–12. [Google Scholar]

- Gilbert, David, and Robin K. C. Wong. 2003. Passenger expectations and airline services: A Hong Kong based study. Tourism Management 24: 519–32. [Google Scholar] [CrossRef]

- Gronroos, Christian. 1982. Strategic Management and Marketing in the Service Sector. New York: Marketing Science Institute. [Google Scholar]

- Grönroos, C. 1983. Innovative Marketing Strategies and Organization Structures for Services Firms. Emerging Perspectives on Services Marketing 1983: 9–21. [Google Scholar]

- Gržinić, D. 2007. Concepts of service quality measurement in hotel industry. Economic Thought and Practice 110: 81–89. [Google Scholar]

- Hair, J. Fair, William C. Black, Barry J. Babin, and Rolph E. Anderson. 1998. Multivariate Data Analysis. Boston: Upper Saddle River, pp. 207–19. [Google Scholar]

- Higgins, Lexis F., and Jeffery M. Ferguson. 1991. Practical approaches for evaluating the quality dimensions of professional accounting services. Journal of Professional Services Marketing 7: 3–17. [Google Scholar] [CrossRef]

- Ishfaq, Mohammad. 1993. Decentralized Resource Allocation in Primary Health Care: Formal Methods and Their Application in Britain and Pakistan. Ph.D. dissertation, London School of Economics and Political Science, London, UK. [Google Scholar]

- Ishfaq, Mohammad, Faran Ahmad Qadri, Khalil Sulaiman Mohammad Abusaleem, and Mahmood Al-Zyood. 2016. Measuring quality of service from consumers’ perspectives: A case of healthcare insurance in Saudi Arabia. Health Science Journal 10: 1. [Google Scholar]

- Jain, Sanjay K., and Garima Gupta. 2004. Measuring Service Quality: SERVQUAL vs. SERVPERF Scales. Vikalpa 29: 25–38. [Google Scholar] [CrossRef]

- Jensen, John B., and Robert E. Markland. 1996. Improving the application of quality conformance tools in service firms. Journal of Services Marketing 10: 35–55. [Google Scholar] [CrossRef]

- Kingdom of Saudi Arabia. 2019. Available online: https://vision2030.gov.sa/en (accessed on 20 July 2019).

- Kumar, Mukesh, K. Sukumaran Sujit, and Vincent Charles. 2018. Deriving managerial implications through SERVQUAL gap elasticity in UAE banking. International Journal of Quality & Reliability Management 35: 940–64. [Google Scholar]

- Lassar, Walfried M., Chris Manolis, and Robert D. Winsor. 2000. Service quality perspectives and satisfaction in private banking. Journal of Services Marketing 14: 244–71. [Google Scholar] [CrossRef]

- Lehtinen, Uolevi, and Jarmo R. Lehtinen. 1982. Service Quality: A Study of Quality Dimensions. Working paper. Helsinki: Service Management Institute. [Google Scholar]

- Lewis, Barbara R., and Vincent W. Mitchell. 1990. Defining and measuring the quality of customer service. Marketing Intelligence and Planning 8: 11–18. [Google Scholar] [CrossRef]

- Lovelock, Christopher H. 1981. Why marketing mamagement needs to be different for services. In Marketing of Services. Edited by J. H. Donnelley and W. R. George. Chicago: American Marketing Association, pp. 5–9. [Google Scholar]

- Meyer-Reumann, Rolf. 1995. The banking system in Saudi Arabia. Arab Law Quarterly 10: 207–37. [Google Scholar] [CrossRef]

- Nimako, Simon Gyasi, Foresight Kofi Azumah, Francis Donkor, and Veronica Adu-Brobbey. 2012. Confirmatory factor analysis of service quality dimensions within mobile telephony industry in Ghana. Electronic Journal of Information Systems Evaluation 15: 197. [Google Scholar]

- Oliver, Richard L. 1980. Acognitive modelof the antecedents and consequences of satisfaction decisions. Journal of Marketing Research 17: 460–69. [Google Scholar] [CrossRef]

- Oliver, Richard L. 1993. A conceptual model of service quality and service satisfaction: Comparative goals, different concepts. Advances in Service Marketing and Management 2: 65–85. [Google Scholar]

- Pakdil, Fatma, and Özlem Aydın. 2007. Expectations and perceptions in airline services: An analysis using weighted SERVQUAL scores. Journal of Air Transport Management 13: 229–37. [Google Scholar] [CrossRef]

- Palmer, Adrian. 1995. Services Marketing: Principles and Practice. New York: Simon & Schuster. [Google Scholar]

- Parasuraman, Anantharanthan, Valarie A. Zeithaml, and Leonard L. Berry. 1985. A conceptual model of service quality and its implications for future research. Journal of Marketing 49: 41–50. [Google Scholar] [CrossRef]

- Parasuraman, Ananthanarayanan, Valarie A. Zeithaml, and Leonard L. Berry. 1988. Servqual: A multiple-item scale for measuring consumer perc. Journal of Retailing 64: 12. [Google Scholar]

- Parasuraman, Ananthanarayanan, Valarie A. Zeithaml, and Leonard L. Berry. 1994. Reassessment of expectations as a comparison standard in measuring service quality: Implications for future research. Journal of Marketing 58: 111–24. [Google Scholar] [CrossRef]

- Rabbani, Mustafa Raza, Faran Ahmad Qadri, and Mohammed Ishfaq. 2016. Service Quality, Customer Satisfaction and Customer Loyalty: An Empirical Study on Banks in India. VFAST Transactions on Education and Social Sciences 11: 1–9. [Google Scholar] [CrossRef]

- Rezaei, Jafar, Oshan Kothadiya, Lori Tavasszy, and Maarten Kroesen. 2018. Quality assessment of airline baggage handling systems using SERVQUAL and BWM. Tourism Management 66: 85–93. [Google Scholar] [CrossRef]

- Richard, Michael D., and Arthur W. Allaway. 1993. Service quality attributes and choice behaviour. Journal of Services Marketing 7: 59. [Google Scholar] [CrossRef]

- Saudi Arabia Country Commercial Guide. 2018. Saudi Arabia—Banking System. Available online: https://www.export.gov/article?id=Saudi-Arabia-banking-systems (accessed on 30 August 2018).

- Siddique, Md, Mst Akhter, and Abdullah Masum. 2013. Service Quality of Five Star Hotels in Bangladesh: An Empirical Assessment. Asian Business Review 2: 125–30. [Google Scholar] [CrossRef]

- Slack, Nigel, Stuart Chambers, and Robert Johnston. 2010. Operations Management. London: Pearson. [Google Scholar]

- Spreng, Richard A., and Robert D. Mackoy. 1996. An empirical examination of a model of perceived service quality and satisfaction. Journal of Retailing 72: 201–14. [Google Scholar] [CrossRef]

- Teas, R. Kenneth. 1993. Expectations, performance evaluation, and consumers’ perceptions of quality. Journal of Marketing 57: 18–34. [Google Scholar]

- Thangaratinam, Shakila, and Charles WE Redman. 2005. The Delphi technique. The Obstetrician & Gynaecologist 7: 120–25. [Google Scholar]

- TheGlobalEconomy.com. 2016. Saudi Arabia: Bank Account per 1000 Adults. Available online: https://www.theglobaleconomy.com/Saudi-Arabia/bank_accounts/ (accessed on 15 August 2019).

- Vroom, Victor. 1964. Work and Motivation. New York: John Wiley & sons. [Google Scholar]

- Zahorik, Anthony J., and Roland T. Rust. 1992. Modeling the impact of service quality on profitability: A review. Advances in Services Marketing and Management 1: 247–76. [Google Scholar]

- Zeithaml, Valarie A., Leonard L. Berry, and Ananthanarayanan Parasuraman. 1996. The behavioral consequences of service quality. Journal of Marketing 60: 31–46. [Google Scholar] [CrossRef]

- Zhang, Min, Xueping He, Fang Qin, Wenbiao Fu, and Zhen He. 2019. Service quality measurement for omni-channel retail: Scale development and validation. Total Quality Management & Business Excellence 30 Suppl. 1: S210–26. [Google Scholar]

| Demographic Variables | Demographic Characteristics | Frequencies in % | Cumulative % |

|---|---|---|---|

| Age | Up to 25 | 34.5 | 34.5 |

| 26–35 | 34.9 | 69.4 | |

| 36–50 | 25.3 | 94.7 | |

| 50+ | 5.3 | 100 | |

| Gender | M | 73.4 | 73.4 |

| F | 26.6 | 100 | |

| Marital Status | Single | 41.8 | 41.8 |

| Married | 49 | 90.8 | |

| Divorced | 6.2 | 97 | |

| Widow | 3 | 100 | |

| Education | High School | 17.4 | 17.4 |

| Graduate | 52 | 69.4 | |

| Master’s | 22 | 91.4 | |

| PhD | 8.6 | 100 | |

| Profession | Student | 32.6 | 32.6 |

| Un-employed | 3.9 | 36.5 | |

| FT Employed | 47.7 | 84.2 | |

| Executives | 11.5 | 95.7 | |

| Self-employed/business | 4.3 | 100 | |

| Income | <5000 | 36.8 | 36.8 |

| 5000–9900 | 21.4 | 58.2 | |

| 10,000–14,900 | 31.2 | 89.5 | |

| 15,000–19,900 | 2.3 | 91.8 | |

| 20,000+ | 8.2 | 100 | |

| Bank | Saudi National | 68.3 | 68.3 |

| Non-Saudi/Multinational | 31.7 | 100 |

| Reliability Statistics | |

|---|---|

| Cronbach’s Alpha | Number of Items |

| 0.972 | 30 |

| Dimensions | Cronbach’s Alpha for Dimension | Cronbach’s Alpha If Item Is Deleted | Item |

|---|---|---|---|

| Reliability | 0.890 | 0.870 | P1 |

| 0.853 | P2 | ||

| 0.853 | P3 | ||

| 0.854 | P4 | ||

| 0.893 | P5 | ||

| Responsiveness | 0.863 | 0.828 | P6 |

| 0.832 | P7 | ||

| 0.817 | P8 | ||

| 0.826 | P9 | ||

| Assurance | 0.851 | 0.811 | P10 |

| 0.829 | P11 | ||

| 0.810 | P12 | ||

| 0.792 | P13 | ||

| Empathy | 0.839 | 0.803 | P14 |

| 0.837 | P15 | ||

| 0.786 | P16 | ||

| 0.754 | P17 | ||

| Tangibles | 0.851 | 0.784 | P18 |

| 0.742 | P19 | ||

| 0.850 | P20 | ||

| Technical | 0.813 | 0.770 | P21 |

| 0.770 | P22 | ||

| 0.814 | P23 | ||

| 0.773 | P24 | ||

| 0.754 | P25 | ||

| Functional | 0.889 | 0.868 | P26 |

| 0.864 | P27 | ||

| 0.868 | P28 | ||

| 0.867 | P29 | ||

| 0.858 | P30 |

| Component | |||||||

|---|---|---|---|---|---|---|---|

| Factor 1 | Factor 2 | Factor 3 | Factor 4 | Factor 5 | Factor 6 | Factor 7 | |

| ServiceReliabilityE1 | 0.782 | ||||||

| ServiceReliabilityE2 | 0.568 | ||||||

| ServiceReliabilityE3 | 0.818 | ||||||

| ServiceReliabilityE4 | 0.619 | ||||||

| ServiceReliabilityE5 | 0.84 | ||||||

| ResponsivenessE6 | 0.653 | ||||||

| ResponsivenessE7 | 0.672 | ||||||

| ResponsivenessE8 | 0.819 | ||||||

| ResponsivenessE9 | 0.608 | ||||||

| AssuranceE10 | 0.608 | ||||||

| AssuranceE11 | 0.519 | ||||||

| AssuranceE12 | 0.826 | ||||||

| AssuranceE13 | 0.625 | ||||||

| EmpathyE14 | 0.837 | ||||||

| EmpathyE15 | 0.915 | ||||||

| EmpathyE16 | 0.629 | ||||||

| EmpathyE17 | 0.533 | ||||||

| TangiblesE18 | 0.562 | ||||||

| TangiblesE19 | 0.599 | ||||||

| TangiblesE20 | 0.668 | ||||||

| TechnicalE21 | 0.782 | ||||||

| TechnicalE22 | 0.837 | ||||||

| TechnicalE23 | 0.915 | ||||||

| TechnicalE24 | 0.84 | ||||||

| TechnicalE25 | 0.818 | ||||||

| FunctionalE26 | 0.608 | ||||||

| FunctionalE27 | 0.625 | ||||||

| FunctionalE28 | 0.826 | ||||||

| FunctionalE29 | 0.819 | ||||||

| FunctionalE30 | 0.608 | ||||||

| % of Variance | 13.591 | 12.953 | 12.112 | 11.9 | 10.918 | 10.307 | 9.594 |

| Cumulative % | 13.591 | 26.543 | 38.655 | 50.555 | 61.473 | 71.78 | 81.374 |

| S.N | Statement | CP | CE | CP − CE |

|---|---|---|---|---|

| Service Reliability | ||||

| P1 | Bank provides service as promised | 3.953333 | 5 | −1.04667 |

| P2 | Always active in solving problem | 3.883333 | 5 | −1.11667 |

| P3 | Service provided correctly at the first time | 3.856667 | 5 | −1.14333 |

| P4 | Service provided at the time promised | 3.873333 | 5 | −1.12667 |

| P5 | Bank keeps accurate and updated records | 4.163333 | 5 | −0.83667 |

| Total | 19.73 | 25 | −5.27 | |

| Mean Service Reliability Score | 3.946 | 5 | −1.054 | |

| Responsiveness | ||||

| P6 | Customers informed when service will be given | 3.77 | 5 | −1.23 |

| P7 | Gives service promptly | 3.766667 | 5 | −1.23333 |

| P8 | Bank employees are willing to help customers | 3.833333 | 5 | −1.16667 |

| P9 | Responds well to customer requests | 3.883333 | 5 | −1.11667 |

| Total | 15.25333 | 20 | −4.74667 | |

| Mean Responsiveness Score | 3.050667 | 4 | −1.18667 | |

| Assurance | ||||

| P10 | Bank employees are trustworthy | 3.943333 | 5 | −1.05667 |

| P11 | Transactions carried out Safely | 4.23 | 5 | −0.77 |

| P12 | Employees are always polite | 3.983333 | 5 | −1.01667 |

| P13 | Employees found with having knowledge answering questions | 3.926667 | 5 | −1.07333 |

| Total | 16.08333 | 20 | −3.91667 | |

| Mean Assurance Score | 4.020833 | 5 | −0.97917 | |

| Empathy | ||||

| P14 | Customers are given individual attention | 3.793333 | 5 | −1.20667 |

| P15 | Bank working hours are convenient | 3.833333 | 5 | −1.16667 |

| P16 | Bank has customers’ best interests at heart | 3.803333 | 5 | −1.19667 |

| P17 | Bank understands specific need of customers | 3.803333 | 5 | −1.19667 |

| Total | 15.23333 | 20 | −4.76667 | |

| Mean Empathy Score | 3.808333 | 5 | −1.19167 | |

| Tangibles | ||||

| P18 | Bank had modern-looking and up-to-date equipment | 3.97 | 5 | −1.03 |

| P19 | Best appearance of physical facilities | 3.96 | 5 | −1.04 |

| P20 | Best appearance of employees | 3.79 | 5 | −1.21 |

| Total | 11.72 | 15 | −3.28 | |

| Mean Tangibles Score | 3.906667 | 5 | −1.09333 | |

| Technical | ||||

| P21 | Service is provided with ease | 3.916667 | 5 | −1.08333 |

| P22 | Attention to individual needs | 3.81 | 5 | −1.19 |

| P23 | Ease in contacting bank services providers | 3.793333 | 5 | −1.20667 |

| P24 | Accurate record keeping giving results | 4.053333 | 5 | −0.94667 |

| P25 | Providing information correctly | 3.776667 | 5 | −1.22333 |

| Total | 19.35 | 25 | −5.65 | |

| Mean Technical Score | 3.87 | 5 | −1.13 | |

| Functional | ||||

| P26 | Employees are trustworthy and keep confidentiality | 3.943333 | 5 | −1.05667 |

| P27 | Employees available to answer questions | 3.926667 | 5 | −1.07333 |

| P28 | Employees are always courteous and friendly | 3.983333 | 5 | −1.01667 |

| P29 | Competence in explaining services and policies | 3.833333 | 5 | −1.16667 |

| P30 | Understand requests and give good responses | 3.883333 | 5 | −1.11667 |

| Total | 19.57 | 25 | −5.43 | |

| Mean Functional Score | 3.914 | 5 | −1.086 | |

| Dimension | Score |

|---|---|

| Service Reliability | −1.054 |

| Responsiveness | −1.187 |

| Assurance | −0.979 |

| Empathy | −1.192 |

| Tangibles | −1.093 |

| Technical | −1.130 |

| Functional | −1.086 |

| Mean | −1.103 |

| Dimension | Unweighted Score | Importance Weightage | Weighted Score |

|---|---|---|---|

| Service Reliability | −1.054 | 20.62 | −22% |

| Responsiveness | −1.187 | 13.59 | −16% |

| Assurance | −0.979 | 17.94 | −18% |

| Empathy | −1.192 | 5.67 | −7% |

| Tangibles | −1.093 | 4.93 | −5% |

| Technical | −1.130 | 19.67 | −22% |

| Functional | −1.086 | 17.59 | −19% |

| Mean | −1.103 | 100.00 | −16% |

| Non-Saudi | G1 | G2 | G3 | G4 | G5 | G6 | G7 | AV. |

|---|---|---|---|---|---|---|---|---|

| Mean | −1.109 | −1.153 | −0.984 | −1.153 | −1.133 | −1.12 | −1.065 | −1.103 |

| Standard Deviation | 0.891 | 0.949 | 0.893 | 0.967 | 1.016 | 0.854 | 0.877 | 0.921 |

| Variance | 0.793 | 0.9 | 0.797 | 0.936 | 1.033 | 0.73 | 0.768 | 0.851 |

| Skewness | −1.601 | −1.098 | −1.602 | −1.111 | −1.228 | −1.554 | −1.399 | −1.37 |

| Kurtosis | 3.127 | 1.085 | 3.061 | 1.137 | 1.15 | 3.028 | 2.607 | 2.171 |

| One-Sample t-test | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Saudi | ||||||||

| Mean | −1.028 | −1.202 | −0.977 | −1.207 | −1.0748 | −1.135 | −1.096 | −1.1028 |

| Standard Deviation | 0.889 | 1.011 | 0.893 | 0.975 | 0.731 | 0.856 | 0.933 | 0.898 |

| Variance | 0.791 | 1.023 | 0.798 | 0.95 | 0.534 | 0.732 | 0.87 | 0.814 |

| Skewness | −1.024 | −0.795 | −1.294 | −0.847 | −1.095 | −1.041 | −1.045 | −1.02 |

| Kurtosis | 0.613 | −0.096 | 1.574 | 0.169 | 1.277 | 0.945 | 0.75 | 0.747 |

| One-Sample t-test | −0.005 | −0.006 | 0.003 | −0.005 | 0 | 0.006 | 0.006 | 0 |

| Saudi and Non-Saudi | ||||||||

| Mean | −1.054 | −1.187 | −0.979 | −1.19 | −1.093 | −1.13 | −1.086 | −1.103 |

| Standard Deviation | 0.891 | 0.992 | 0.893 | 0.973 | 1.007 | 0.855 | 0.915 | 0.895 |

| Variance | 0.793 | 0.985 | 0.798 | 0.946 | 1.014 | 0.731 | 0.838 | 0.804 |

| Skewness | −1.204 | −0.883 | −1.392 | −0.929 | −1.066 | −1.203 | −1.147 | −1.119 |

| Kurtosis | 1.394 | 0.193 | 1.983 | 0.424 | 0.571 | 1.534 | 1.205 | 1.06 |

| One-Sample t-test | 0 | 0.006 | −0.003 | 0 | −0.006 | 0 | 0 | 0.006 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ishfaq, M.; Al Hajieh, H.; Alharthi, M. Quality Determination of the Saudi Retail Banking System and the Challenges of Vision 2030. Int. J. Financial Stud. 2020, 8, 40. https://doi.org/10.3390/ijfs8030040

Ishfaq M, Al Hajieh H, Alharthi M. Quality Determination of the Saudi Retail Banking System and the Challenges of Vision 2030. International Journal of Financial Studies. 2020; 8(3):40. https://doi.org/10.3390/ijfs8030040

Chicago/Turabian StyleIshfaq, Mohammad, Heitham Al Hajieh, and Majed Alharthi. 2020. "Quality Determination of the Saudi Retail Banking System and the Challenges of Vision 2030" International Journal of Financial Studies 8, no. 3: 40. https://doi.org/10.3390/ijfs8030040

APA StyleIshfaq, M., Al Hajieh, H., & Alharthi, M. (2020). Quality Determination of the Saudi Retail Banking System and the Challenges of Vision 2030. International Journal of Financial Studies, 8(3), 40. https://doi.org/10.3390/ijfs8030040