Effect of Speculators’ Position Changes on the LME Futures Market

Abstract

1. Introduction

2. Literature Review

3. Methodology

4. Empirical Results

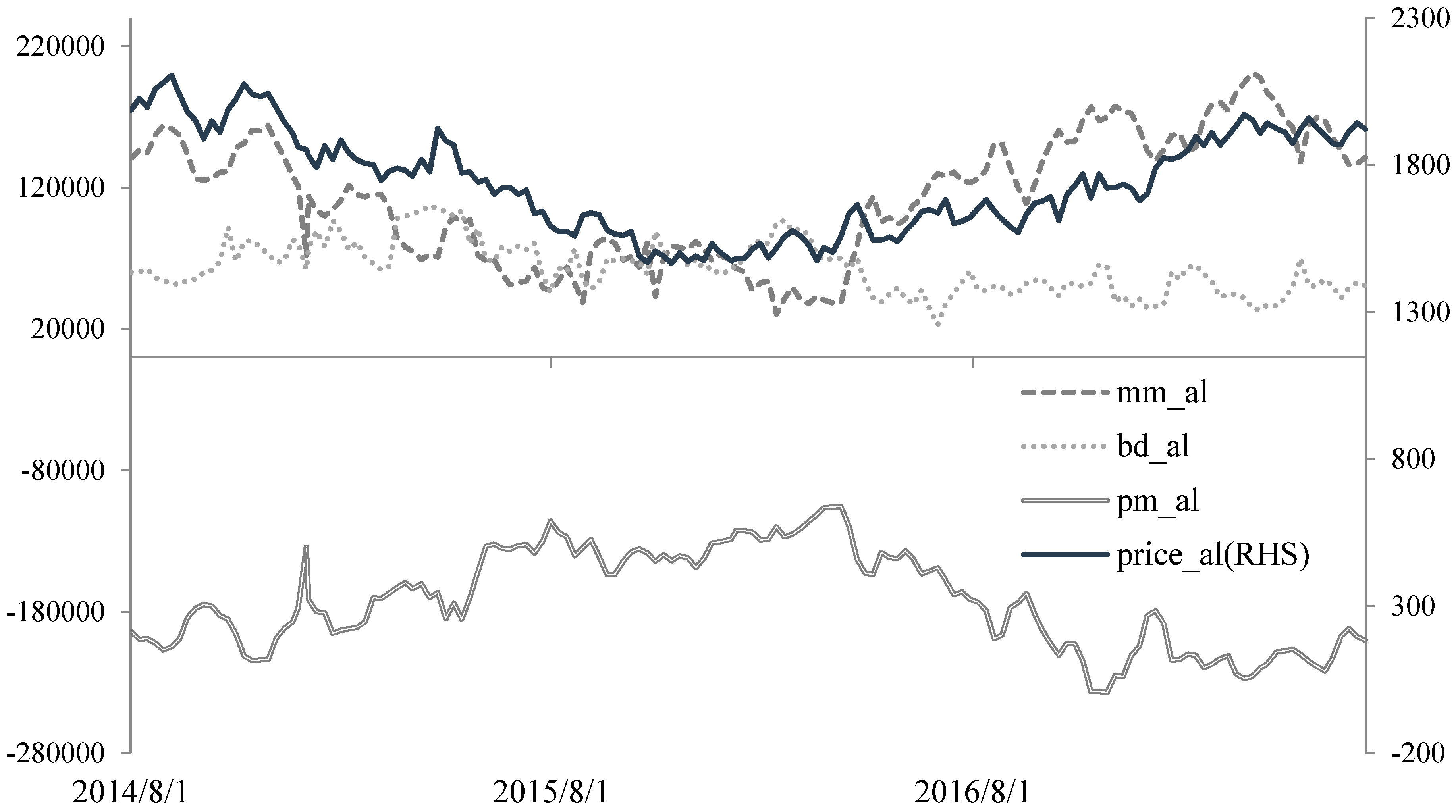

4.1. Data

4.2. Empirical Results

5. Summary and Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Arouri, Mohamed El Hedi, Fredj Jawadi, and Prosper Mouak. 2011. The Speculative Efficiency of the Aluminum Market: A Nonlinear Investigation. International Economics 126–27: 73–89. [Google Scholar] [CrossRef]

- Brunetti, Celso, Bahattin Buyuksahin, and Jeffrey H. Harris. 2015. Speculators, Prices and Market Volatility. Journal of Financial and Quantitative Analysis 51: 1545–74. [Google Scholar] [CrossRef]

- Brunetti, Celso, and Bahattin Buyuksahin. 2009. Is Speculation Destabilizing? Working Paper. US CFTC. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1393524 (accessed on 12 June 2019).

- Buyuksahin, Bahattin, and Jeffrey H. Harris. 2011. Do Speculators Drive Crude Oil Futures Prices? Energy Journal 32: 167–202. [Google Scholar] [CrossRef]

- Buyuksahin, Bahattin, Michael S. Haigh, Jeffrey H. Harris, James A. Overdahl, and Michel A. Robe. 2009. Fundamentals, Trader Activity and Derivative Pricing. Working Paper. US CFTC. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=966692 (accessed on 12 June 2019).

- Buyuksahin, Bahattin, and Michel A. Robe. 2009. Commodity Traders’ Positions and Energy Prices: Evidence from the Recent Boom-Bust Cycle. Working Paper. US CFTC. Available online: https://www.aeaweb.org/conference/2010/retrieve.php?pdfid=355 (accessed on 12 June 2019).

- Cheng, Ing-Haw, and Wei Xiong. 2014. Financialization of commodity markets. Annual Review of Financial Economics 6: 419–41. [Google Scholar] [CrossRef]

- Figuerola-Ferretti, Isabel, and Christopher L. Gilbert. 2008. Commonality in the LME aluminum and copper volatility processes through a FIGARCH lens. Journal of Futures Markets 28: 935–62. [Google Scholar] [CrossRef]

- Gilbert, C. 2010. How to understand high food prices. Journal of Agricultural Economics 61: 398–425. [Google Scholar] [CrossRef]

- Irwin, S., and B. Holt. 2004. The impact of large hedge find and CTA trading on futures market volatility. In Commodity Trading Advisors: Risk, Performance Analysis and Selection. Hoboken: John Wiley and Sons, Inc., pp. 151–82. [Google Scholar]

- Irwin, Scott H., and Dwight R. Sanders. 2012. Testing the Masters Hypothesis in commodity futures markets. Energy Economics 34: 256–69. [Google Scholar] [CrossRef]

- Otto, S. 2011. A Speculative Efficiency Analysis of the London Metal Exchange in a Multi-Contract Framework. International Journal of Economics and Finance 3: 3–16. [Google Scholar] [CrossRef]

- Park, J. 2018. Volatility Transmission between Oil and LME Futures. Applied Economics and Finance 5: 65–72. [Google Scholar] [CrossRef]

- Park, J. 2019. The Role of Cancelled Warrants in the LME Market. International Journal of Financial Studies 7: 10. [Google Scholar] [CrossRef]

- Park, Jaehwan, and Byungkwon Lim. 2018. Testing Efficiency of the London Metal Exchange: New Evidence. International Journal of Financial Studies 6: 32. [Google Scholar] [CrossRef]

- Sanders, Dwight R., Scott H. Irwin, and Robert P. Merrin. 2010. The adequacy of speculation in agricultural futures markets: Too much of a good thing? Applied Economic Perspectives and Policy 32: 77–94. [Google Scholar] [CrossRef]

- Singleton, Kenneth J. 2014. Investor Flows and the 2008 Boom/Bust in Oil Prices. Management Science 60: 300–18. [Google Scholar] [CrossRef]

- Tang, Ke, and Wei Xiong. 2012. Index Investment and the Financialization of Commodities. Financial Analysts Journal 68: 54–74. [Google Scholar] [CrossRef]

- US Senate Permanent Subcommittee on Investigations (USPSI). 2009. Excessive Speculation in the Wheat Market; Washington: USPSI, June 24.

| 1 | This is called the “Masters Hypothesis” by Irwin and Sanders (2012), in which long-only index investment was a major driver of the 2007–2008 spikes in commodities futures. Masters, a hedge fund manager, argued that massive buy-side ‘demand’ from index funds created a bubble in commodities prices in U.S. congressional hearings. He insisted that the recent speculators’ behavior differed from that of traditional speculators. First, new investors took positions across the entire range of commodity futures, not in specific futures as traditional speculators did. Second, new investors were almost only long, whereas traditional speculators might equally be long or short. |

| 2 | The USPSI (USPSI 2009) concluded that there was significant evidence from the wheat futures market that one of the major reasons for unusual market price spikes is the high level of speculation by commodity index traders. |

| 3 | The LME is the world’s largest futures exchange in the metal industry, including base metals and spot (cash), futures (3M), and various option contracts. Park and Lim (2018) provided a good discussion of the LME. They found that the LME was an inefficient market. |

| 4 | Six major base metals reports are published each Tuesday, one for each business day of the previous week. This data is obtained through the Bloomberg. |

| 5 | Thursday is the day the LME’s COTR is announced. |

| 6 | Other unit root tests such as the Phillips–Perron (PP) test and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) test have similar results. |

| Metals | Variables | Statistics | Metals | Variables | Statistics |

|---|---|---|---|---|---|

| Aluminum | r_al | −14.09 | Copper | r_cu | −12.60 |

| mm_al | −13.18 | mm_cu | −12.86 | ||

| bd_al | −14.23 | bd_cu | −12.57 | ||

| pm_al | −9.935 | pm_cu | −12.15 | ||

| Zinc | r_zn | −13.32 | Lead | r_pb | −11.61 |

| mm_zn | −9.293 | mm_pb | −11.92 | ||

| bd_zn | −12.24 | bd_pb | −9.940 | ||

| pm_zn | −12.07 | pm_pb | −11.74 | ||

| Tin | r_sn | −13.55 | Nickel | r_ni | −14.28 |

| mm_sn | −12.69 | mm_ni | −13.10 | ||

| bd_sn | −12.33 | bd_ni | −13.13 | ||

| pm_sn | −13.02 | pm_ni | −12.41 |

| Aluminum | Lead | ||||

| Causality Direction | Lags | p-Value | Causality Direction | Lags | p-Value |

| mm_al → r_al | 3 | 0.045 ** | mm_pb → r_pb | 2 | 0.392 |

| r_al → mm_al | 3 | 0.000 *** | r_pb → mm_pb | 2 | 0.000 *** |

| bd_al → r_al | 3 | 0.074 * | bd_pb → r_pb | 3 | 0.826 |

| r_al → bd_al | 3 | 0.697 | r_pb → bd_pb | 3 | 0.665 |

| pm_al → r_al | 3 | 0.700 | pm_pb → r_pb | 3 | 0.167 |

| r_al → pm_al | 3 | 0.000 *** | r_pb → pm_pb | 3 | 0.245 |

| Copper | Tin | ||||

| Causality Direction | Lags | p-Value | Causality Direction | Lags | p-Value |

| mm_cu → r_cu | 3 | 0.003 *** | mm_sn → r_sn | 2 | 0.321 |

| r_cu → mm_cu | 3 | 0.006 *** | r_sn → mm_sn | 2 | 0.000 *** |

| bd_cu → r_cu | 2 | 0.669 | bd_sn → r_sn | 2 | 0.032 ** |

| r_cu → bd_cu | 2 | 0.202 | r_sn → bd_sn | 2 | 0.467 |

| pm_cu → r_cu | 2 | 0.086 * | pm_sn → r_sn | 2 | 0.315 |

| r_cu → pm_cu | 2 | 0.450 | r_sn → pm_sn | 2 | 0.416 |

| Zinc | Nickel | ||||

| Causality Direction | Lags | p-Value | Causality Direction | Lags | p-Value |

| mm_zn → r_zn | 2 | 0.048 ** | mm_ni → r_ni | 2 | 0.103 |

| r_zn → mm_zn | 2 | 0.042 ** | r_ni → mm_ni | 2 | 0.007 *** |

| bd_zn → r_zn | 2 | 0.803 | bd_ni → r_ni | 2 | 0.404 |

| r_zn → bd_zn | 2 | 0.102 | r_ni → bd_ni | 2 | 0.411 |

| pm_zn → r_zn | 2 | 0.677 | pm_ni → r_ni | 2 | 0.444 |

| r_zn → pm_zn | 2 | 0.476 | r_ni → pm_ni | 2 | 0.579 |

| Causality Direction | Lags | p-Value |

|---|---|---|

| Aluminum | ||

| mm_al → iv_al | 2 | 0.166 |

| iv_al → mm_al | 2 | 0.379 |

| Copper | ||

| mm_cu → iv_cu | 2 | 0.084 * |

| iv_cu → mm_cu | 2 | 0.161 |

| Zinc | ||

| mm_zn → iv_zn | 3 | 0.048 ** |

| iv_zn → mm_zn | 3 | 0.521 |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, J. Effect of Speculators’ Position Changes on the LME Futures Market. Int. J. Financial Stud. 2019, 7, 32. https://doi.org/10.3390/ijfs7020032

Park J. Effect of Speculators’ Position Changes on the LME Futures Market. International Journal of Financial Studies. 2019; 7(2):32. https://doi.org/10.3390/ijfs7020032

Chicago/Turabian StylePark, Jaehwan. 2019. "Effect of Speculators’ Position Changes on the LME Futures Market" International Journal of Financial Studies 7, no. 2: 32. https://doi.org/10.3390/ijfs7020032

APA StylePark, J. (2019). Effect of Speculators’ Position Changes on the LME Futures Market. International Journal of Financial Studies, 7(2), 32. https://doi.org/10.3390/ijfs7020032