Investor Attention and Stock Market Activities: New Evidence from Panel Data

Abstract

1. Introduction

2. Relevant Literature

3. Data

3.1. Google Search Intensity

3.2. Stock Market Return, Volatility, and Abnormal Trading Volume

4. Panel Vector Autoregression

5. Empirical Results

5.1. Panel Granger Causality

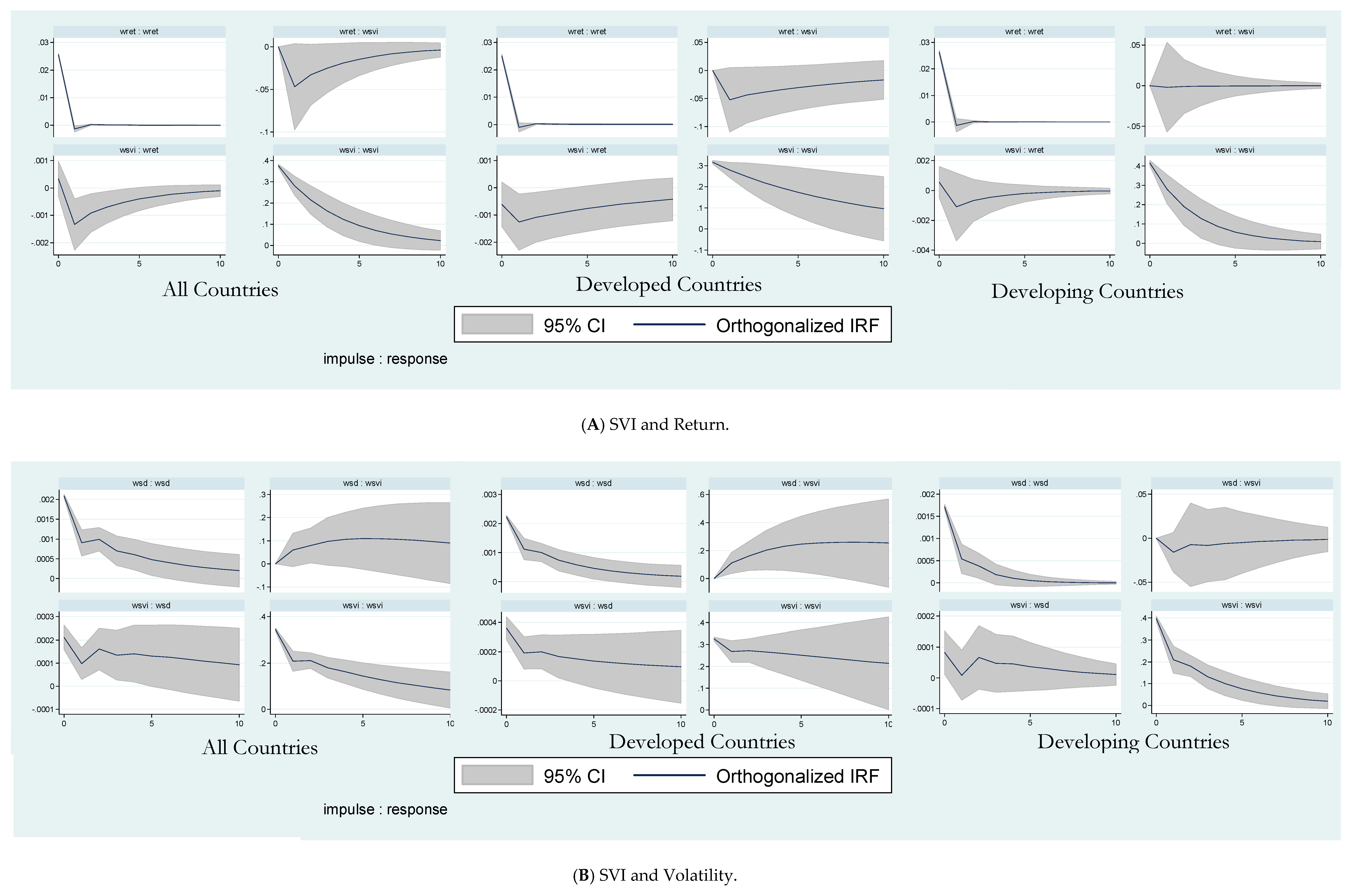

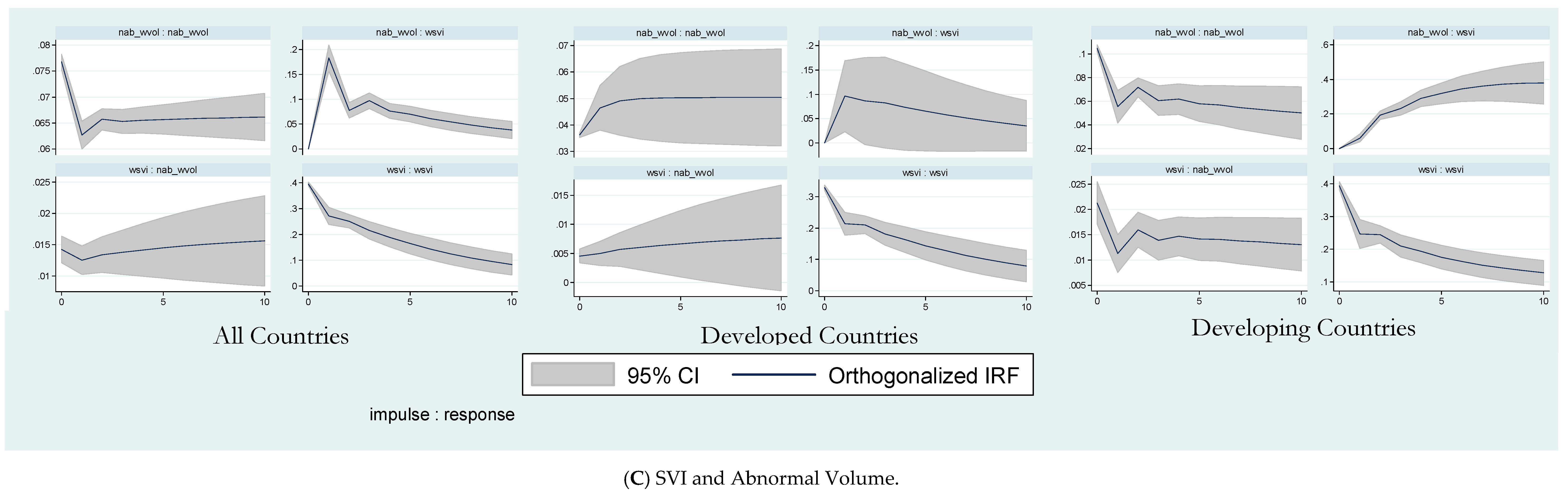

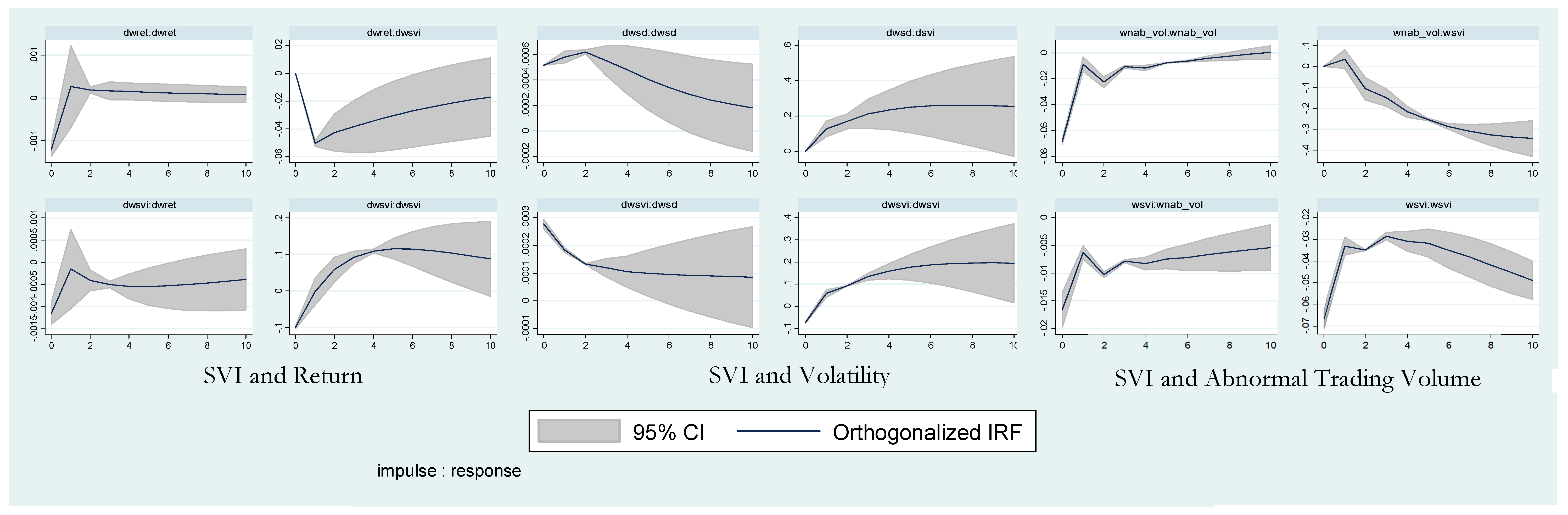

5.2. Panel Vector Autoregression

5.3. Variance Decomposition

5.4. Developing and Developed Countries

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Country | Google Search Keyword |

|---|---|

| Developing countries | |

| China | shanghai_stock_exchange |

| India | bse |

| Malaysia | klse |

| Thailand | set_50 |

| Developed countries | |

| Australia | asx_200 |

| Hong Kong | hsi |

| Japan | nikkei |

| Korea | kospi |

| New Zealand | nzx |

| Singapore | straits_times |

References

- Al-Eroud, Ahmed F., Mohammad A. Al-Ramahi, Mohammad N. Al-Kabi, Izzat M. Alsmadi, and Emad M. Al-Shawakfa. 2011. Evaluating Google queries based on language preferences. Journal of Information Science 37: 282–92. [Google Scholar] [CrossRef]

- Andrei, Daniel, and Michael Hasler. 2015. Investor attention and stock market volatility. The Review of Financial Studies 28: 33–72. [Google Scholar] [CrossRef]

- Andrews, Donald W. K., and Biao Lu. 2001. Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. Journal of Econometrics 101: 123–64. [Google Scholar] [CrossRef]

- Ang, Andrew, Joseph Chen, and Yuhang Xing. 2006. Downside risk. The Review of Financial Studies 19: 1191–239. [Google Scholar] [CrossRef]

- Aouadi, Amal, Mohamed Arouri, and Frédéric Teulon. 2013. Investor attention and stock market activity: Evidence from France. Economic Modelling 35: 674–81. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Bank, Matthias, Martin Larch, and Georg Perter. 2011. Google search volume and its influence on liquidity and returns of German stocks. Financial Market Portfolio Management 25: 239–64. [Google Scholar] [CrossRef]

- Barber, Brad M., and Terrance Odean. 2008. All that glitters: the effect of attention of attention and news on the buying behavior of individual and institutional investors. The Review of Financial Studies 21: 785–818. [Google Scholar] [CrossRef]

- Benson, Karen, Robert Faff, and Tom Smith. 2014. Fifty years of finance research in the Asia Pacific Basin. Accounting & Finance 54: 335–63. [Google Scholar]

- Bijl, Laurens, Glenn Kringhaug, Polar Molnár, and Eirik Sandvik. 2016. Google searches and stock returns. International Review of Financial Analysis 45: 150–56. [Google Scholar] [CrossRef]

- Boduroglu, Aysecan, Priti Shah, and Richard E. Nisbett. 2009. Cultural differences in allocation of attention in visual information processing. Journal of Cross Cultural Psychology 40: 349–60. [Google Scholar] [CrossRef] [PubMed]

- Braun, Nicole. 2016. Google search volume sentiment and its impact on REIT market movements. Journal of Property Investment & Finance 34: 249–62. [Google Scholar]

- Chang, Eric C., Joseph W. Cheng, and Ajay Khorana. 2000. An examination of herd behavior in equity markets: An international perspective. Journal of Banking and Finance 24: 1651–79. [Google Scholar] [CrossRef]

- Chiang, Thomas C., and Dazhi Zheng. 2010. An empirical analysis of herd behavior in global stock markets. Journal of Banking & Finance 34: 1911–21. [Google Scholar]

- Choi, In. 2001. Unit root tests for panel data. Journal of International Money and Finance 20: 249–72. [Google Scholar] [CrossRef]

- Da, Zhi, Joseph Engelberg, and Pengjie Gao. 2011. In search of attention. The Journal of Finance 66: 1461–99. [Google Scholar] [CrossRef]

- Da, Zhi, Umit G. Gurun, and Mitch Warachka. 2014. Frog in the pan: continuous information and momentum. The Review of Financial Studies 27: 2171–218. [Google Scholar] [CrossRef]

- DellaVigna, Stefano, and Joshua M. Pollet. 2009. Investor inattention and Friday earnings announcements. The Journal of Finance 64: 709–49. [Google Scholar] [CrossRef]

- Dimpfl, Thomas, and Stephan Jank. 2016. Can Internet Search Queries Help to Predict Stock Market Volatility? European Financial Management 22: 171–92. [Google Scholar] [CrossRef]

- Ding, Rong, and Wenxuan Hou. 2015. Retail investor attention and stock liquidity. Journal of International Financial Markets, Institutions & Money 37: 12–26. [Google Scholar]

- Do, Hung Xuan, Robert Brooks, Sirimon Treepongkaruna, and Eliza Wu. 2014. How does trading volume affect financial return distributions? International Review of Financial Analysis 35: 190–206. [Google Scholar] [CrossRef]

- Gao, Zhenyu, Haohan Ren, and Bohui Zhang. 2016. Googling Investor Sentiment around the World. Journal of Financial and Quantitative Analysis, 1–66. [Google Scholar] [CrossRef]

- Gervais, Simon, Ron Kaniel, and Dan H. Mingelgrin. 2001. The high-volume return premium. The Journal of Finance 61: 877–919. [Google Scholar] [CrossRef]

- Goddard, John, Arben Kita, and Qingwei Wang. 2015. Investor attention and FX market volatility. Journal of International Financial Markets & Institutions & Money 38: 79–96. [Google Scholar]

- Grossmann, Axel, Inessa Love, and Alexei G. Orlov. 2014. The dynamics of exchange rate volatility: A panel VAR approach. Journal of International Financial Markets, Institutions & Money 33: 1–27. [Google Scholar]

- Hamid, Alain, and Moritz Heiden. 2015. Forecasting volatility with empirical similarity and Google trends. Journal of Economic Behavior & Organization 117: 62–81. [Google Scholar]

- Harding, Noel, and Wen He. 2016. Investor mood and the determinants of stock prices: An experimental analysis. Accounting & Finance 56: 445–78. [Google Scholar]

- Hayakawa, Kazuhiko. 2009. First difference or forward orthogonal deviation-which transformation should be used in dynamic panel data models? A simulation study. Economics Bulletin 29: 2008–17. [Google Scholar]

- Holtz-Eakin, Douglas, Whitney Newey, and Harvey S. Rosen. 1988. Estimated vector autoregressions with panel data. Econometrica 56: 1371–95. [Google Scholar] [CrossRef]

- Hou, Kewei, Wei Xiong, and Lin Peng. 2009. A Tale of Two Anomalies: The Implications of Investor Attention for Price and Earnings Momentum. SSRN Working Paper. Amsterdam: Elsevier. [Google Scholar]

- Huberman, Gur, and Tomer Regev. 2001. Contagious speculation and a cure for cancer: A nonevent that made stock prices soar. The Journal of Finance 56: 387–96. [Google Scholar] [CrossRef]

- Jacobs, Heiko. 2015. The role of attention constraints for investor behavior and economic aggregates: What have we learnt so far? Management Review Quarterly 65: 217–37. [Google Scholar] [CrossRef]

- Johnman, Mark, Bruce James Vanstone, and Adrian Gepp. 2018. Predicting FTSE 100 returns and volatility using sentimental analysis. Accounting & Finance 58: 253–74. [Google Scholar]

- Joseph, Kissan, M. Babajide Wintoki, and Zelin Zhang. 2011. Forecasting abnormal stock returns and trading volume using investor sentiment: Evidence from online search. International Journal of Forecasting 27: 1116–27. [Google Scholar] [CrossRef]

- Kahneman, Daniel. 1973. Attention and Effort. Englewood Cliffs: Princeton Hall. [Google Scholar]

- Kumar, Alok. 2009. Who Gambles in the Stock Market? The Journal of Finance 64: 1889–933. [Google Scholar] [CrossRef]

- Kumar, Alok, and Charles M. C. Lee. 2006. Retail Investor Sentiment and Return Comovements. The Journal of Finance 61: 2451–86. [Google Scholar] [CrossRef]

- Laksomya, Nattapong, John G. Powell, Suparatana Tanthanongsakkun, and Sirimon Treepongkaruna. 2018. Are Internet message boards used to facilitate stock price manipulation? evidence from an emerging market, Thailand. Accounting & Finance 58: 275–309. [Google Scholar]

- Li, Xin, Jian Ma, Shouyang Wang, and Xun Zhang. 2015. How does Google search affect trader positions and crude oil prices? Economic Modelling 49: 162–71. [Google Scholar] [CrossRef]

- Love, Inessa, and Lea Zicchino. 2006. Financial development and dynamic investment behavior: Evidence from panel VAR. The Quarterly Review of Economics and Finance 46: 190–210. [Google Scholar] [CrossRef]

- Madhavan, Ananth. 2000. Market microstructure: A survey. Journal of Financial Markets 3: 205–58. [Google Scholar] [CrossRef]

- Merton, Robert C. 1987. A simple model of capital market equilibrium with incomplete information. The Journal of Finance 42: 483–510. [Google Scholar] [CrossRef]

- Miller, Edward M. 1977. Risk, uncertainty, and divergence of opinion. The Journal of Finance 32: 1151–68. [Google Scholar] [CrossRef]

- Nisbett, Richard E., Kaiping Peng, Incheol Choi, and Ara Norenzayan. 2001. Culture and systems of thought: holistic versus analytic cognition. Psychological Review 108: 291–310. [Google Scholar] [CrossRef] [PubMed]

- Peng, Lin, Wei Xiong, and Tim Bollerslev. 2007. Investor attention and time-varying comovements. European Financial Management 13: 394–422. [Google Scholar] [CrossRef]

- Piccoli, Pedro, Newton C. A. da Costa, Jr., Wesley Vieira da Silva, and June A. W. Cruz. 2018. Investor sentiment and the risk-return tradeoff in the Brazilian market. Accounting & Finance 58: 599–618. [Google Scholar]

- Rochdi, Karim, and Marian Dietzel. 2015. Outperforming the benchmark: Online information demand and REIT market performance. Journal of Property Investment & Finance 33: 169–95. [Google Scholar]

- Rousseau, P. L., and P. Wachtel. 2000. Equity markets and growth: Cross-country evidence on timing and outcomes, 1980–1995. Journal of Banking and Finance 24: 1933–57. [Google Scholar] [CrossRef]

- Sim, Christopher A. 1980. Macroeconomics and reality. Econometrica 48: 1–48. [Google Scholar]

- Storms, Konstantin, Julia Kapraun, and Markus Rudolf. 2015. Can Retail Investor Attention Enhance Market Efficiency? Insights from Search Engine Data. SSRN Working Paper. Amsterdam: Elsevier. [Google Scholar]

- Takeda, Fumiko, and Takumi Wakao. 2014. Google search intensity and its relationship with returns and trading volume of Japanese stocks. Pacific-Basin Finance Journal 27: 1–18. [Google Scholar] [CrossRef]

- Tantaopas, Parkpoom, Chaiyuth Padungsaksawasdi, and Sirimon Treepongkaruna. 2016. Attention effect via internet search intensity in Asia-Pacific stock markets. Pacific-Basin Finance Journal 38: 107–24. [Google Scholar] [CrossRef]

- Tourani-Rad, Alireza, and Stephen Kirkby. 2005. Investigation of investors’ overconfidence, familiarity and socialization. Accounting & Finance 45: 283–300. [Google Scholar]

- Treepongkaruna, Sirimon, and Stephen Gray. 2009. Information and volatility links in the foreign exchange market. Accounting & Finance 49: 385–405. [Google Scholar]

- Treepongkaruna, Sirimon, Robert Brooks, and Stephen Gray. 2012. Do trading hours affect volatility links in the foreign exchange market? Australian Journal of Management 37: 7–27. [Google Scholar] [CrossRef]

- Tsai, I.-Chun. 2017. Diffusion of optimistic and pessimistic investor sentiment: An empirical study of an emerging market. International Review of Economics and Finance 47: 22–34. [Google Scholar] [CrossRef]

- Tsukioka, Yasutomo, Junya Yanagi, and Teruko Takada. 2017. Investor sentiment extracted from internet stock message boards and IPO puzzles. International Review of Economics and Finance 56: 205–17. [Google Scholar] [CrossRef]

- Vozlyublennaia, Nadia. 2014. Investor attention, index performance, and return predictability. Journal of Banking and Finance 41: 17–35. [Google Scholar] [CrossRef]

- Wang, Kemin, Xiaoyun Yu, and Bohui Zhang. 2017. The Power of the Passive Information Intermediary: Evidence from Google’s China Exit. Working Paper. Available online: http://english.ckgsb.edu.cn/sites/default/files/files/GoogleChina%202017%209%204%20cleaned_Xiaoyun%20Yu.pdf (accessed on 4 September 2017).

- Ying, Qianwei, Dongmin Kong, and Danglun Luo. 2015. Investor attention, institutional ownership, and stock return: empirical evidence from China. Emerging Markets Finance and Trade 51: 672–85. [Google Scholar] [CrossRef]

- Yung, Kenneth, and Nadia Nafar. 2017. Investor attention and the expected returns of reits. International Review of Economics and Finance 48: 423–39. [Google Scholar] [CrossRef]

| 1 | The survey study in New Zealand of Tourani-Rad and Kirkby (2005) shows that almost half of the respondents actively uses the internet as a source of information for making decision in the investment, which is subject to the psychological bias (investor socialization). Recently, Laksomya et al. (2018) show an impact of message board posted on internet on price manipulation in the stock exchange of Thailand. |

| 2 | It should also be noted that the Google SVI has also been used to capture retail investor attention in other markets such as foreign exchange and real estate markets. For example, Yung and Nafar (2017) document high search-intensity REITs possess high expected returns and the search query is important, especially for small stocks, high book-to-market stocks, and less informative stocks. In foreign exchange markets, Goddard et al. (2015), show the co-movement between the Google search intensity and volatilities in major currencies, and conjecture that investor attention is a risk factor in the FOREX markets. |

| 3 | For example, see Aouadi et al. (2013) for France, Bank et al. (2011) for Germany, Ying et al. (2015) for China, Takeda and Wakao (2014) for Japan, Tantaopas et al. (2016) for the Asia-Pacific countries, and Da et al. (2011) for the U.S. |

| 4 | Barber and Odean (2008) argue that without investor attention, trading volume cannot happen. Thus, trading volume is a consequence of actual attention. |

| 5 | Two other popular behavioral factors influencing stock market activities include investor mood (Harding and He 2016) and investor sentiment (Piccoli et al. 2018 and Johnman et al. 2018). |

| 6 | The study of the attention effect is not limited only in stock markets and the results in other markets largely confirm the findings in stock markets. See, for example, Goddard et al. (2015) for foreign exchange markets, Li et al. (2015) for energy markets, and Rochdi and Dietzel (2015) and Braun (2016) for real estate markets. |

| 7 | |

| 8 | Storms et al. (2015) also document the efficiency-improving role of investor attention in individual stocks in the European and the U.S. markets. The efficiency improvement is more pronounced during bullish markets. Aouadi et al. (2013) find the same evidence in the French stock market. |

| 9 | From the Google Trends’ website, we select the “global region” in order to capture the “true” investor attention around the globe. |

| 10 | Even though some employ the Baidu search engine rather than Google search engine in the mainland Chinese stock market due to the exit of the Google on March 23, 2010, we prefer using the Google SVI for a few reasons. First, uses of the same international search engine for all countries make the data consistent and comparable. Our approach is similar to Gao et al. (2016), who study the Google sentiment on stock markets in a cross country analysis around the globe, including mainland China. Second, though Google search is prohibited in the mainland China, foreign retail investors are still able to use Google to search information and decide to trade in the Chinese stock markets or local investor can use the virtual private networks (VPNs) to access the Google website (Wang et al. 2017). Thus, Google search intensity for the Chinese stock market is valid. |

| 11 | The search keywords are in the English language. There are some working papers that use the local language for the search queries. For example, Storms et al. (2015) rely on the search keywords in local languages for stocks in European countries. However, they show that the local search keywords are highly correlated with the English search keywords. Thus, the search keyword is not biased from the choice of the languages. The results are similar to the findings of Al-Eroud et al. (2011), who study the language preferences for searching Google queries for Arab countries. The internet users in these countries favor to use English language rather than their own local languages to Google search. Thus, our use of English search keywords in the study is in line with other literature. |

| 12 | The null hypothesis is that panels are unit roots. The Z statistic is presented as , where pi is the ith panel and Φ−1 is the inverse of the standard normal cumulative distribution function. Z is normally distributed with zero mean and unity variance. The results are available upon request. |

| 13 | It is interesting to note that one-way relationships are detected in the SVI–volatility relationship of the developed markets and the SVI–volume relationship of the full sample. SVI Granger causes stock market volatility and abnormal trading volume, but not the other way around. When people search more they are making the market more volatile or executing more trade orders. Thus, Google search intensity is a good proxy of retail investor attention. |

| 14 | |

| 15 | Examples of a linkage between information and volatility in FX markets include Treepongkaruna and Gray (2009) and Treepongkaruna et al. (2012). |

| Chi-Square | p-Value | |

|---|---|---|

| Panel A: SVI and Return | ||

| Full Sample | ||

| SVI does not Granger cause return | 3.847 ** | 0.050 |

| Return does not Granger cause SVI | 6.312 ** | 0.012 |

| Developed markets | ||

| SVI does not Granger cause return | 3.092 * | 0.079 |

| Return does not Granger cause SVI | 5.35 ** | 0.021 |

| Developing markets | ||

| SVI does not Granger cause return | 0.004 | 0.947 |

| Return does not Granger cause SVI | 0.992 | 0.319 |

| Panel B: SVI and Volatility | ||

| Full Sample | ||

| SVI does not Granger cause volatility | 7.674 ** | 0.022 |

| Volatility does not Granger cause SVI | 4.901 * | 0.086 |

| Developed markets | ||

| SVI does not Granger cause volatility | 15.695 *** | 0.000 |

| Volatility does not Granger cause SVI | 1.249 | 0.536 |

| Developing markets | ||

| SVI does not Granger cause volatility | 2.201 | 0.333 |

| Volatility does not Granger cause SVI | 2.954 | 0.228 |

| Panel C: SVI and Abnormal Trading Volume | ||

| Full Sample | ||

| SVI does not Granger cause volume | 414.089 *** | 0.000 |

| Volume does not Granger cause SVI | 1.362 | 0.506 |

| Developed markets | ||

| SVI does not Granger cause volume | 28.301 *** | 0.000 |

| Volume does not Granger cause SVI | 5.222 * | 0.073 |

| Developing markets | ||

| SVI does not Granger cause volume | 268.509 *** | 0.000 |

| Volume does not Granger cause SVI | 4.648 * | 0.098 |

| Panel A: SVI and Return. | ||||||

| Full Sample | Developed Markets | Developing Markets | ||||

| 0.7512 *** | −0.0035 *** | 0.8790 *** | −0.0041 | 0.6753 *** | −0.0026 | |

| (0.0588) | (0.0014) | (0.0583) | (0.0018) | (0.0872) | (0.0026) | |

| −1.8397 *** | −0.0534 ** | −2.0877 * | −0.0411 | −0.0701 | −0.0493 | |

| (0.9379) | (0.0224) | (1.1872) | (0.0352) | (1.0598) | (0.0496) | |

| Hansen J Test | 0.168 | 0.127 | 0.990 | |||

| Panel B: SVI and Volatility. | ||||||

| Full Sample | Developed Markets | Developing Markets | ||||

| 0.5861 *** | 0.0000 | 0.7683 *** | 0.0000 | 0.5299 *** | −0.0000 | |

| (0.0624) | (0.0001) | (0.0769) | (0.0001) | (0.0817) | (0.0001) | |

| 0.2436 *** | 0.0002 ** | 0.1643 ** | 0.0001 | 0.1726 ** | 0.0002* | |

| (0.0610) | (0.0001) | (0.0693) | (0.0001) | (0.0797) | (0.0001) | |

| 28.6188 * | 0.4334 *** | 49.8386 *** | 0.5011 *** | −9.2805 | 0.3144 *** | |

| (17.0147) | (0.0817) | (17.1577) | (0.0852) | (6.6255) | (0.1016) | |

| 8.7659 | 0.2885 *** | 9.4705 | 0.1961 *** | 3.5395 | 0.1244 ** | |

| (9.3922) | (0.0548) | (9.2032) | (0.0535) | (16.8600) | (0.0494) | |

| Hansen J Test | 0.888 | 0.584 | 0.998 | |||

| Panel C: SVI and Abnormal Trading Volume. | ||||||

| Full Sample | Developed Markets | Developing Markets | ||||

| 0.5687 *** | 0.0022 | 0.5632 *** | −0.0023 | 0.5938 *** | 0.0001 | |

| (0.0419) | (0.0021) | (0.0580) | (0.0019) | (0.0529) | (0.0020) | |

| 0.2178 *** | 0.0001 | 0.2887 *** | 0.0037 ** | 0.1695 *** | 0.0034 ** | |

| (0.0392) | (0.0017) | (0.0558) | (0.0016) | (0.0503) | (0.0016) | |

| 2.5403 *** | 0.7262 *** | 4.4586 *** | 1.2674 *** | 0.5779 *** | 0.5282 *** | |

| (0.2191) | (0.0514) | (0.8500) | (0.0784) | (0.1134) | (0.0660) | |

| −0.5859 *** | 0.2207 *** | −3.9262 *** | −0.2962 *** | 1.1878 *** | 0.4054 *** | |

| (0.0845) | (0.0449) | (0.7693) | (0.0694) | (0.1898) | (0.0636) | |

| Hansen J Test | 0.631 | 0.931 | 0.637 | |||

| Panel A: SVI and Return. | |||||||

| Response | Forecast | Impulse Variable | |||||

| Variable | Horizon | Full Sample | Developed Countries | Developing Countries | |||

| SVI | Return | SVI | Return | SVI | Return | ||

| SVI | 1 | 1.0000 | 0.0000 | 1.0000 | 0.0000 | 1.0000 | 0.0000 |

| 2 | 0.9901 | 0.0099 | 0.9848 | 0.0152 | 1.0000 | 0.0000 | |

| 3 | 0.9878 | 0.0122 | 0.9809 | 0.0191 | 1.0000 | 0.0000 | |

| 4 | 0.9868 | 0.0132 | 0.9789 | 0.0211 | 1.0000 | 0.0000 | |

| 5 | 0.9863 | 0.0137 | 0.9778 | 0.0222 | 1.0000 | 0.0000 | |

| 6 | 0.9860 | 0.0140 | 0.9771 | 0.0229 | 1.0000 | 0.0000 | |

| 7 | 0.9859 | 0.0141 | 0.9766 | 0.0234 | 1.0000 | 0.0000 | |

| 8 | 0.9858 | 0.0142 | 0.9762 | 0.0238 | 1.0000 | 0.0000 | |

| 9 | 0.9857 | 0.0143 | 0.9760 | 0.0240 | 1.0000 | 0.0000 | |

| 10 | 0.9857 | 0.0143 | 0.9758 | 0.0242 | 1.0000 | 0.0000 | |

| Return | 1 | 0.0002 | 0.9998 | 0.0006 | 0.9994 | 0.0004 | 0.9996 |

| 2 | 0.0029 | 0.9971 | 0.0031 | 0.9969 | 0.0022 | 0.9978 | |

| 3 | 0.0041 | 0.9959 | 0.0049 | 0.9951 | 0.0028 | 0.9972 | |

| 4 | 0.0049 | 0.9951 | 0.0064 | 0.9936 | 0.0031 | 0.9969 | |

| 5 | 0.0053 | 0.9947 | 0.0075 | 0.9925 | 0.0033 | 0.9967 | |

| 6 | 0.0056 | 0.9944 | 0.0084 | 0.9916 | 0.0033 | 0.9967 | |

| 7 | 0.0057 | 0.9943 | 0.0091 | 0.9909 | 0.0034 | 0.9966 | |

| 8 | 0.0058 | 0.9942 | 0.0097 | 0.9903 | 0.0034 | 0.9966 | |

| 9 | 0.0058 | 0.9942 | 0.0101 | 0.9899 | 0.0034 | 0.9966 | |

| 10 | 0.0059 | 0.9941 | 0.0105 | 0.9895 | 0.0034 | 0.9966 | |

| Panel B: SVI and Volatility. | |||||||

| Response | Forecast | Impulse Variable | |||||

| Variable | Horizon | Full Sample | Developed Countries | Developing Countries | |||

| SVI | Volatility | SVI | Volatility | SVI | Volatility | ||

| SVI | 1 | 1.0000 | 0.0000 | 1.0000 | 0.0000 | 1.0000 | 0.0000 |

| 2 | 0.9785 | 0.0215 | 0.9350 | 0.0650 | 0.9987 | 0.0013 | |

| 3 | 0.9546 | 0.0454 | 0.8669 | 0.1331 | 0.9987 | 0.0013 | |

| 4 | 0.9252 | 0.0748 | 0.8009 | 0.1991 | 0.9985 | 0.0015 | |

| 5 | 0.8972 | 0.1028 | 0.7458 | 0.2542 | 0.9984 | 0.0016 | |

| 6 | 0.8713 | 0.1287 | 0.7010 | 0.2990 | 0.9984 | 0.0016 | |

| 7 | 0.8485 | 0.1516 | 0.6650 | 0.3350 | 0.9983 | 0.0017 | |

| 8 | 0.8288 | 0.1712 | 0.6360 | 0.3640 | 0.9983 | 0.0017 | |

| 9 | 0.8120 | 0.1880 | 0.6125 | 0.3875 | 0.9983 | 0.0017 | |

| 10 | 0.7980 | 0.2020 | 0.5934 | 0.4066 | 0.9983 | 0.0017 | |

| Volatility | 1 | 0.0101 | 0.9899 | 0.0252 | 0.9748 | 0.0023 | 0.9977 |

| 2 | 0.0103 | 0.9897 | 0.0259 | 0.9741 | 0.0021 | 0.9979 | |

| 3 | 0.0128 | 0.9872 | 0.0275 | 0.9725 | 0.0033 | 0.9967 | |

| 4 | 0.0145 | 0.9855 | 0.0290 | 0.9710 | 0.0039 | 0.9961 | |

| 5 | 0.0165 | 0.9835 | 0.0305 | 0.9695 | 0.0045 | 0.9955 | |

| 6 | 0.0182 | 0.9818 | 0.0318 | 0.9682 | 0.0048 | 0.9952 | |

| 7 | 0.0199 | 0.9801 | 0.0330 | 0.9670 | 0.0051 | 0.9949 | |

| 8 | 0.0213 | 0.9787 | 0.0341 | 0.9659 | 0.0052 | 0.9948 | |

| 9 | 0.0226 | 0.9774 | 0.0352 | 0.9649 | 0.0053 | 0.9947 | |

| 10 | 0.0237 | 0.9763 | 0.0361 | 0.9639 | 0.0054 | 0.9946 | |

| Panel C: SVI and Abnormal Trading Volume. | |||||||

| Response | Forecast | Impulse Variable | |||||

| Variable | Horizon | Full Sample | Developed Countries | Developing Countries | |||

| SVI | Volume | SVI | Volume | SVI | Volume | ||

| SVI | 1 | 1.0000 | 0.0000 | 1.0000 | 0.0000 | 1.0000 | 0.0000 |

| 2 | 0.8716 | 0.1284 | 0.9288 | 0.0712 | 0.9834 | 0.0166 | |

| 3 | 0.8054 | 0.1946 | 0.8994 | 0.1006 | 0.8719 | 0.1281 | |

| 4 | 0.7175 | 0.2825 | 0.8726 | 0.1274 | 0.7728 | 0.2272 | |

| 5 | 0.6427 | 0.3573 | 0.8532 | 0.1468 | 0.6672 | 0.3328 | |

| 6 | 0.5766 | 0.4234 | 0.8368 | 0.1632 | 0.5809 | 0.4191 | |

| 7 | 0.5210 | 0.4790 | 0.8228 | 0.1772 | 0.5094 | 0.4906 | |

| 8 | 0.4744 | 0.5256 | 0.8104 | 0.1896 | 0.4524 | 0.5476 | |

| 9 | 0.4355 | 0.5645 | 0.7992 | 0.2008 | 0.4067 | 0.5933 | |

| 10 | 0.4029 | 0.5971 | 0.7890 | 0.2110 | 0.3700 | 0.6300 | |

| Volume | 1 | 0.0515 | 0.9485 | 0.0298 | 0.9702 | 0.0396 | 0.9604 |

| 2 | 0.0539 | 0.9461 | 0.0252 | 0.9748 | 0.0397 | 0.9604 | |

| 3 | 0.0558 | 0.9442 | 0.0264 | 0.9736 | 0.0417 | 0.9583 | |

| 4 | 0.0575 | 0.9425 | 0.0282 | 0.9718 | 0.0430 | 0.9570 | |

| 5 | 0.0589 | 0.9411 | 0.0304 | 0.9696 | 0.0446 | 0.9554 | |

| 6 | 0.0603 | 0.9397 | 0.0326 | 0.9674 | 0.0459 | 0.9541 | |

| 7 | 0.0615 | 0.9385 | 0.0349 | 0.9651 | 0.0471 | 0.9529 | |

| 8 | 0.0626 | 0.9374 | 0.0371 | 0.9629 | 0.0482 | 0.9518 | |

| 9 | 0.0636 | 0.9364 | 0.0392 | 0.9608 | 0.0491 | 0.9509 | |

| 10 | 0.0644 | 0.9356 | 0.0412 | 0.9588 | 0.0500 | 0.9500 | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Padungsaksawasdi, C.; Treepongkaruna, S.; Brooks, R. Investor Attention and Stock Market Activities: New Evidence from Panel Data. Int. J. Financial Stud. 2019, 7, 30. https://doi.org/10.3390/ijfs7020030

Padungsaksawasdi C, Treepongkaruna S, Brooks R. Investor Attention and Stock Market Activities: New Evidence from Panel Data. International Journal of Financial Studies. 2019; 7(2):30. https://doi.org/10.3390/ijfs7020030

Chicago/Turabian StylePadungsaksawasdi, Chaiyuth, Sirimon Treepongkaruna, and Robert Brooks. 2019. "Investor Attention and Stock Market Activities: New Evidence from Panel Data" International Journal of Financial Studies 7, no. 2: 30. https://doi.org/10.3390/ijfs7020030

APA StylePadungsaksawasdi, C., Treepongkaruna, S., & Brooks, R. (2019). Investor Attention and Stock Market Activities: New Evidence from Panel Data. International Journal of Financial Studies, 7(2), 30. https://doi.org/10.3390/ijfs7020030