Cross-Border Lending, Government Capital Injection, and Bank Performance

Abstract

1. Introduction

2. Related Literature

3. The Model Basics

3.1. The Framework and Assumptions

3.2. Model Specifications

4. Solution and Results

4.1. Optimum and Comparative Static Analysis

4.2. Parameter Basics

- (i)

- The conditions of and indicate the scope of earning-asset portfolio substitution (Kashyap et al. 2002). captures the binding condition of the capital constraint (Wong 1997). demonstrates the bank interest margin as an element of after-tax earnings (Saunders and Schumacher 2000).

- (ii)

- The specification of capital adequacy requirement is set by the capital-to-deposits ratio (VanHoose 2007). In the case, without government capital injection where , the capital-to-asset ratio at is = 7.18%, where , , and , which does not meet the capital adequacy requirement of 8.00%. This indicates a situation of the bank’s depleted capital. This possible case is supportive to an argument of Bayazitova and Shivdasani (2012): the government capital injection is anticipated by the distressed bank when raising new capital in public markets by the bank is difficult.

- (iii)

- The condition of indicates that the standard deviation of domestic loan repayments is less than the standard deviation of foreign loan repayments. This can be understood that international portfolio investment involves, at the very least, two additional sources of risk, exchange rate volatility and country risk (Rajan and Friedman 1997). Accordingly, we further assume the condition of , implying that the bank with high asset volatility are more likely to exhibit a higher probability of hitting the barrier before the expiration date than the bank without such the characteristic.

4.3. International Loan Portfolio Diversification Effect

4.4. Government Capital Injection Effect

4.5. Capital Regulation Effect

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Acharya, Viral V., Hamid Mehran, Til Schuermann, and Anjan V. Thakor. 2011. Robust capital regulation. Staff Report no. 490, Federal Reserve Bank of New York, New York, NY. Available online: https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr490.pdf (accessed on 31 January 2019).

- Allen, Franklin, Elena Carletti, and Robert Marquez. 2011. Credit market competition and capital regulation. Review of Financial Studies 24: 983–1018. [Google Scholar] [CrossRef]

- Barrell, Ray, and Abdulkader Nahhas. 2019. The role of lender country factors in cross border bank lending. International Review of Financial Analysis. in press. [Google Scholar] [CrossRef]

- Bayazitova, Dinara, and Anil Shivdasani. 2011. Assessing TARP. Review of Financial Studies 25: 377–407. [Google Scholar] [CrossRef]

- Berger, Allen N., and Christa H. S. Bouwman. 2013. How does capital affect bank performance during financial crises? Journal of Financial Economics 109: 146–76. [Google Scholar] [CrossRef]

- Berger, Philip G., and Eli Ofek. 1996. Bustup takeovers of value-destroying diversified firms. Journal of Finance 51: 1175–200. [Google Scholar] [CrossRef]

- Besanko, David, and George Kanatas. 1996. The regulation of bank capital: Do capital standards promote bank safety? Journal of Financial Intermediation 5: 160–83. [Google Scholar] [CrossRef]

- Boot, Arnoud W. A., and Anjolein Schmeits. 2000. Market discipline and incentive problems in conglomerate firms with applications to banking. Journal of Financial Intermediation 9: 240–73. [Google Scholar] [CrossRef]

- Breitenfellner, Bastian, and Niklas Wagner. 2010. Government intervention in response to the subprime financial crisis: The good into the pot, the bad into the crop. International Review of Financial Analysis 19: 289–97. [Google Scholar] [CrossRef]

- Bremus, Franziska M. 2015. Cross-border banking, bank market structures and market power: Theory and cross-country evidence. Journal of Banking & Finance 50: 242–59. [Google Scholar] [CrossRef][Green Version]

- Bremus, Franziska, and Marcel Fratzscher. 2014. Drivers of Structural Change in Cross-Border Banking Since the Global Financial Crisis. DIW Berlin Discussion Paper No. 1411. Berlin: German Institute for Economic Research. [Google Scholar] [CrossRef]

- Calomiris, Charles W., and Berry Wilson. 2004. Bank capital and portfolio management: The 1930s “capital crunch” and the scramble to shed risk. Journal of Business 77: 421–55. [Google Scholar] [CrossRef]

- Cetorelli, Nicola, and Linda S. Goldberg. 2012a. Banking globalization and monetary transmission. Journal of Finance 67: 1811–43. [Google Scholar] [CrossRef]

- Cetorelli, Nicola, and Linda S. Goldberg. 2012b. Follow the money: Quantifying domestic effects of foreign bank shocks in the great recession. American Economic Review 102: 213–18. [Google Scholar] [CrossRef]

- Chakraborty, Indraneel, Rong Hai, Hans A. Holter, and Serhiy Stepanchuk. 2017. The real effects of financial (dis)integration: A multi-country equilibrium analysis of Europe. Journal of Monetary Economics 85: 28–45. [Google Scholar] [CrossRef]

- Claessens, Stijn. 2006. Competitive Implications of Cross-Border Banking. Policy Research Working Paper 3854. Washington: World Bank. [Google Scholar] [CrossRef]

- Cole, Harold L., and Maurice Obstfeld. 1991. Commodity trade and international risk sharing: How much do financial markets matter? Journal of Monetary Economics 28: 3–24. [Google Scholar] [CrossRef]

- Committee on the Global Financial System. 2018. Structural Changes in Banking after the Crisis. CGFS Papers No 60, Bank for International Settlements. Available online: https://www.bis.org/publ/cgfs60.pdf (accessed on 3 April 2019).

- Crouhy, Michel, and Dan Galai. 1991. A contingent claim analysis of a regulated depository institution. Journal of Banking & Finance 15: 73–90. [Google Scholar] [CrossRef]

- Damanpour, Faramarz. 1986. A survey of market structure and activities of foreign banking in the US. Columbia Journal of World Business 21: 35–46. [Google Scholar]

- de Blas, Beatriz, and Katheryn Niles Russ. 2010. FDI in the Banking Sector. Working Paper No. 10–8, University of California, Davis, Department of Economics, Davis, CA. Available online: https://ssrn.com/abstract=1647347 (accessed on 31 January 2019).

- de Blas, Beatriz, and Katheryn Niles Russ. 2013. All Banks Great, Small, and Global: Loan Pricing and Foreign Competition. International Review of Economics & Finance 26: 4–24. [Google Scholar] [CrossRef]

- Deng, Saiying, and Elyas Elyasiani. 2008. Geographic diversification, bank holding company value, and risk. Journal of Money, Credit and Banking 40: 1217–38. [Google Scholar] [CrossRef]

- Denis, David J., Diane K. Denis, and Atulya Sarin. 1997. Agency problems, equity ownership, and corporate diversification. Journal of Finance 52: 135–60. [Google Scholar] [CrossRef]

- Diamond, Douglas W. 1984. Financial intermediation and delegated monitoring. Review of Economic Studies 51: 393–414. [Google Scholar] [CrossRef]

- Drucker, Steven, and Manju Puri. 2009. On loan sales, loan contracting, and lending relationships. Review of Financial Studies 22: 2835–72. [Google Scholar] [CrossRef]

- Elsas, Ralf, Andreas Hackethal, and Markus Holzhäuser. 2010. The anatomy of bank diversification. Journal of Banking & Finance 34: 1274–87. [Google Scholar] [CrossRef]

- Episcopos, Athanasios. 2008. Bank capital regulation in a barrier option framework. Journal of Banking & Finance 32: 1677–86. [Google Scholar] [CrossRef]

- García-Herrero, Alicia, and Francisco Vázquez. 2013. International diversification gains and home bias in banking. Journal of Banking & Finance 37: 2560–71. [Google Scholar] [CrossRef]

- Harris, Oneil, Daniel Huerta, and Thanh Ngo. 2013. The impact of TARP on bank efficiency. Journal of International Financial Markets, Institutions & Money 24: 85–104. [Google Scholar] [CrossRef]

- Holmstrom, Bengt, and Jean Tirole. 1997. Financial intermediation, loanable funds, and the real sector. Quarterly Journal of Economics 112: 663–91. [Google Scholar] [CrossRef]

- Iskandar-Datta, Mai, and Robyn McLaughlin. 2007. Global diversification: New evidence from corporate operating performance. Corporate Ownership and Control 4: 228–50. Available online: http://www.virtusinterpress.org/IMG/pdf/COC__Volume_4_Issue_4_Summer_2007_Continued_.pdf#page=68 (accessed on 31 January 2019). [CrossRef]

- Kashyap, Anil K., Raghuram G. Rajan, and Jeremy C. Stein. 2002. Banks as liquidity providers: An explanation for the coexistence of lending and deposit-taking. Journal of Finance 57: 33–73. [Google Scholar] [CrossRef]

- Kashyap, Anil K., Raghuram G. Rajan, and Jeremy C. Stein. 2008. Rethinking capital regulation. In Maintaining Stability in a Changing Financial System. Kansas City: Federal Reserve Bank of Kansas City, pp. 431–71. [Google Scholar]

- Kasman, Adnan, Gokce Tunc, Gulin Vardar, and Berna Okan. 2010. Consolidation and commercial bank net interest margins: Evidence from the old and new European Union members and candidate countries. Economic Modelling 27: 648–55. [Google Scholar] [CrossRef]

- Klein, Peter G., and Marc R. Saidenberg. 1998. Diversification, Organization, and Efficiency: Evidence from Bank Holding Companies. Working Paper, Federal Reserve Bank of New York, New York, NY. Available online: https://ssrn.com/abstract=98653 (accessed on 31 January 2019).

- Koehn, Michael, and Anthony M. Santomero. 1980. Regulation of bank capital and portfolio risk. Journal of Finance 35: 1235–44. [Google Scholar] [CrossRef]

- Laeven, Luc, and Ross Levine. 2007. Is there a diversification discount in financial conglomerates? Journal of Financial Economics 85: 331–67. [Google Scholar] [CrossRef]

- Lin, Jyh-Horng, and Xuelian Li. 2017. Regulatory policies on Gramm-Leach-Bliley consolidation of commercial banking, shadow banking, and life insurance. Journal of International Financial Markets, Institutions & Money 50: 69–84. [Google Scholar] [CrossRef]

- Merton, Robert C. 1974. On the pricing of corporate debt: The risk structure of interest rates. Journal of Finance 29: 449–70. [Google Scholar] [CrossRef]

- Rajan, Murli, and Joseph Friedman. 1997. An examination of the impact of country risk on the international portfolio selection decision. Global Finance Journal 8: 55–70. [Google Scholar] [CrossRef]

- Ronn, Ehud I., and Avinash K. Verma. 1986. Pricing risk-adjusted deposit insurance: An option-based model. Journal of Finance 41: 871–95. [Google Scholar] [CrossRef]

- Rose, Andrew K., and Tomasz Wieladek. 2011. Financial Protectionism: The First Tests. NBER Working Paper No. 17073, National Bureau of Economic Research, Cambridge, MA. Available online: https://www.nber.org/papers/w17073.pdf (accessed on 31 January 2019).

- Rossi, Stefania P.S., Markus S. Schwaiger, and Gerhard Winkler. 2009. How loan portfolio diversification affects risk, efficiency and capitalization: A managerial behavior model for Austrian banks. Journal of Banking & Finance 33: 2218–26. [Google Scholar] [CrossRef]

- Saunders, Anthony, and Liliana Schumacher. 2000. The determinants of bank interest rate margins: An international study. Journal of International Money and Finance 19: 813–32. [Google Scholar] [CrossRef]

- Tabak, Benjamin M., Dimas M. Fazio, and Daniel O. Cajueiro. 2011. The effects of loan portfolio concentration on Brazilian banks’ return and risk. Journal of Banking & Finance 35: 3065–76. [Google Scholar] [CrossRef]

- VanHoose, David. 2007. Theories of bank behavior under capital regulation. Journal of Banking & Finance 31: 3680–97. [Google Scholar] [CrossRef]

- Winton, Andrew. 1999. Don’t Put All Your Eggs in One Basket? Diversification and Specialization in Lending. Working Paper, University of Minnesota, Minneapolis, MN. Available online: https://ssrn.com/abstract=173615 (accessed on 31 January 2019).

- Wong, Kit Pong. 1997. On the determinants of bank interest margins under credit and interest rate risks. Journal of Banking & Finance 21: 251–71. [Google Scholar] [CrossRef]

| 1 | We are a bit informal here and use “international” and “cross-border” synonymously. The terms “efficiency” or “diversification efficiency” refer to “efficiency from international loan portfolio diversification”. |

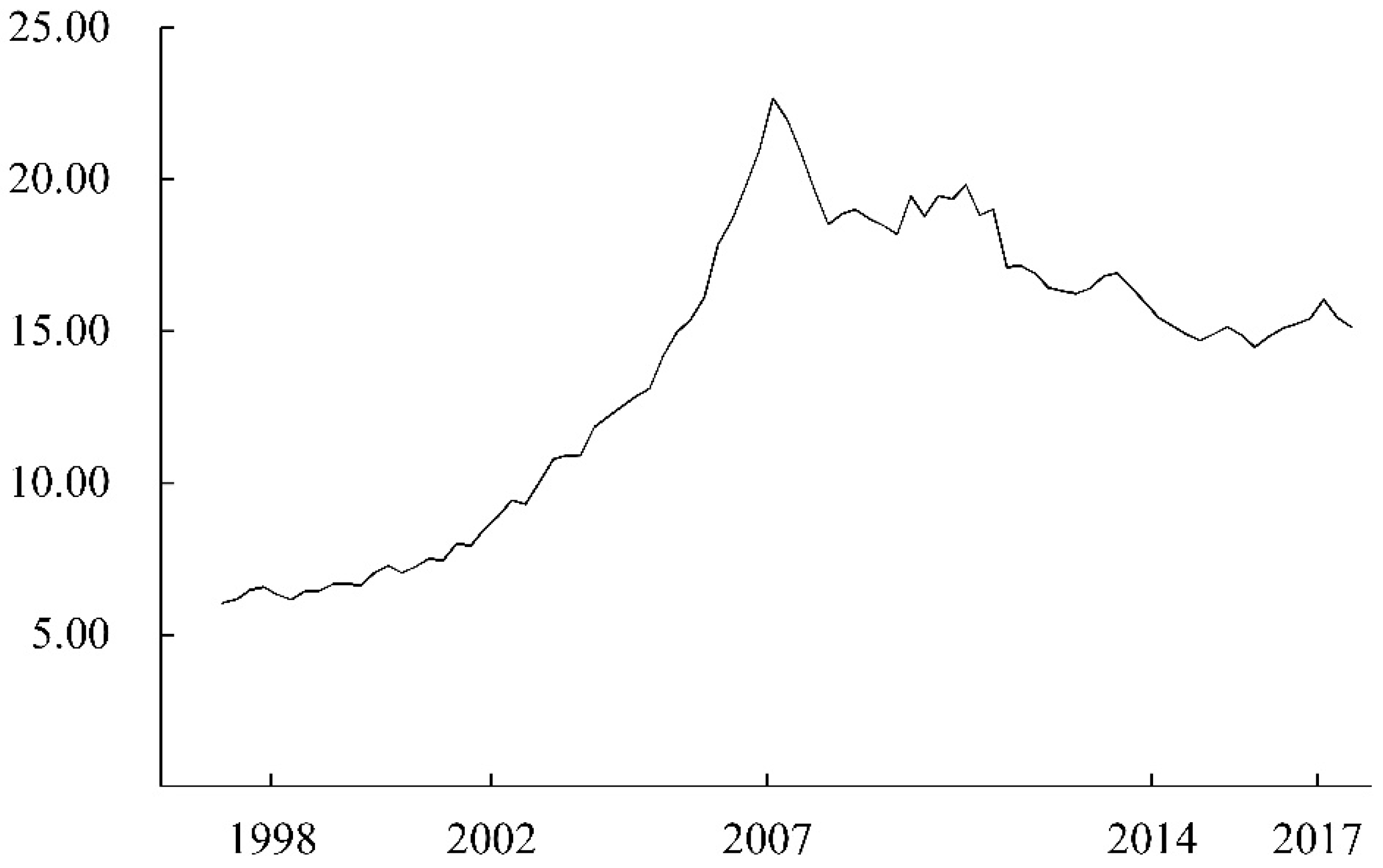

| 2 | The decade since the onset of the global financial crisis has brought about significant structural changes in the banking sector. The Committee on the Global Financial System (2018) pointed out that, while many large advanced economy banks have moved away from trading and cross-border activities, there does not appear to be clear evidence of a systemic retrenchment from core credit provision. Bremus and Fratzscher (2014) found that total cross-border bank claims have significantly decreased in response to the global financial crisis and did not resume the pre-crisis upward trend since then. The authors analyzed the effects of changes to regulatory policy and to monetary policy on cross-border bank lending since the global financial crisis. We would like to thank an anonymous reviewer for pointing these effects out to us. |

| 3 | Incentives, for example, include nationalizations, guarantees, or regulatory rules (see Rose and Wieladek 2011). |

| 4 | A cornerstone of the Troubled Asset Relief Program (TARP) is the government’s purchase of equity capital in financial institutions. |

| 5 | Note that, in the standard context of the aggregated approach (e.g., Episcopos 2008), shareholders are indifferent among various asset compositions so long as the portfolio attains a specific level of overall portfolio risk instead of the used disaggregated approach and in our model. |

| Assets | Liabilities and Equity | ||

|---|---|---|---|

| domestic loan | deposit | ||

| foreign loan | equity | ||

| liquid asset | |||

| Total | Total | ||

| (4.5, 350) | (4.6, 349) | (4.7, 347) | (4.8, 344) | (4.9, 340) | (5.0, 335) | (5.1, 329) | |

| 0.20 | 93.2192 | 93.2374 | 93.0793 | 92.7432 | 92.2279 | 91.5320 | 90.6542 |

| 0.25 | 93.8960 | 93.9113 | 93.7594 | 93.4391 | 92.9490 | 92.2877 | 91.4542 |

| 0.30 | 94.5521 | 94.5648 | 94.4200 | 94.1164 | 93.6527 | 93.0278 | 92.2405 |

| 0.35 | 95.1957 | 95.2062 | 95.0690 | 94.7829 | 94.3469 | 93.7597 | 93.0202 |

| 0.40 | 95.8309 | 95.8394 | 95.7103 | 95.4426 | 95.0352 | 94.4870 | 93.7969 |

| (%) | |||||||

| 0.20→0.25 | - | −3.3956 | 7.1035 | 17.5259 | 27.8752 | 38.1549 | - |

| 0.25→0.30 | - | −3.0997 | 8.3386 | 19.6909 | 30.9609 | 42.1522 | - |

| 0.30→0.35 | - | −2.8738 | 9.5909 | 21.9600 | 34.2373 | 46.4267 | - |

| 0.35→0.40 | - | −2.6778 | 10.9402 | 24.4524 | 37.8628 | 51.1755 | - |

| (%) | |||||||

| 0.20→0.25 | - | 26.9056 | 26.9813 | 27.0038 | 26.9757 | 26.8981 | - |

| 0.25→0.30 | - | 24.5969 | 24.6820 | 24.7147 | 24.6976 | 24.6317 | - |

| 0.30→0.35 | - | 23.0997 | 23.1893 | 23.2266 | 23.2144 | 23.1539 | - |

| 0.35→0.40 | - | 22.0011 | 22.0925 | 22.1315 | 22.1206 | 22.0613 | - |

| : total effect (10−4) | |||||||

| 0.20→0.25 | - | 0.0186 | 0.0178 | 0.0169 | 0.0158 | 0.0147 | - |

| 0.25→0.30 | - | 3.1350 | 3.0477 | 2.9435 | 2.8237 | 2.6897 | - |

| 0.30→0.35 | - | 74.9129 | 73.5032 | 71.7871 | 69.7776 | 67.4876 | - |

| 0.35→0.40 | - | 603.8547 | 596.0278 | 586.3013 | 574.7190 | 561.3216 | - |

| 0.20 | 0.25 | 0.30 | 0.35 | 0.40 | |

| 0.20 | 93.2374 | 93.9430 | 94.6534 | 95.3686 | 96.0887 |

| 0.25 | 93.9113 | 94.6128 | 95.3191 | 96.0302 | 96.7462 |

| 0.30 | 94.5648 | 95.2629 | 95.9657 | 96.6734 | 97.3859 |

| 0.35 | 95.2062 | 95.9013 | 96.6011 | 97.3057 | 98.0151 |

| 0.40 | 95.8394 | 96.5319 | 97.2291 | 97.9311 | 98.6377 |

| (%) | |||||

| 0.20→0.25 | −3.3956 | −3.4785 | −3.5631 | −3.6494 | −3.7374 |

| 0.25→0.30 | −3.0997 | −3.1896 | −3.2812 | −3.3744 | −3.4694 |

| 0.30→0.35 | −2.8738 | −2.9709 | −3.0697 | −3.1702 | −3.2724 |

| 0.35→0.40 | −2.6778 | −2.7833 | −2.8904 | −2.9991 | −3.1095 |

| (%) | |||||

| 0.20→0.25 | 26.9056 | 26.8632 | 26.8252 | 26.8252 | 26.7614 |

| 0.25→0.30 | 24.5969 | 24.6292 | 24.6638 | 24.6638 | 24.7400 |

| 0.30→0.35 | 23.0997 | 23.1883 | 23.2773 | 23.2773 | 23.4568 |

| 0.35→0.40 | 22.0011 | 22.1420 | 22.2811 | 22.2811 | 22.5538 |

| : total effect (10−4) | |||||

| 0.20→0.25 | 0.0186 | 0.0155 | 0.0129 | 0.0107 | 0.0089 |

| 0.25→0.30 | 3.1350 | 2.7478 | 2.4057 | 2.1037 | 1.8375 |

| 0.30→0.35 | 74.9129 | 67.7320 | 61.1863 | 55.2250 | 49.8004 |

| 0.35→0.40 | 603.8547 | 557.3680 | 514.1072 | 473.8757 | 436.4872 |

| (%) | |||||

| 8.3 | 8.5 | 8.7 | 8.9 | 9.1 | |

| 0.20 | 93.2374 | 93.1960 | 93.1566 | 93.1189 | 93.0828 |

| 0.25 | 93.9113 | 93.8701 | 93.8309 | 93.7934 | 93.7576 |

| 0.30 | 94.5648 | 94.5238 | 94.4848 | 94.4475 | 94.4118 |

| 0.35 | 95.2062 | 95.1654 | 95.1265 | 95.0894 | 95.0539 |

| 0.40 | 95.8394 | 95.7987 | 95.7600 | 95.7230 | 95.6876 |

| (%) | |||||

| 0.20→0.25 | −3.3956 | −3.3907 | −3.3861 | −3.3817 | −3.3775 |

| 0.25→0.30 | −3.0997 | −3.0944 | −3.0894 | −3.0847 | −3.0801 |

| 0.30→0.35 | −2.8738 | −2.8681 | −2.8627 | −2.8576 | −2.8526 |

| 0.35→0.40 | −2.6778 | −2.6717 | −2.6658 | −2.6602 | −2.6548 |

| (%) | |||||

| 0.20→0.25 | 26.9056 | 26.9082 | 26.9107 | 26.9131 | 26.9155 |

| 0.25→0.30 | 24.5969 | 24.5951 | 24.5934 | 24.5917 | 24.5902 |

| 0.30→0.35 | 23.0997 | 23.0945 | 23.0896 | 23.0848 | 23.0803 |

| 0.35→0.40 | 22.0011 | 21.9927 | 21.9847 | 21.9771 | 21.9698 |

| : total effect (10−4) | |||||

| 0.20→0.25 | 0.0186 | 0.0188 | 0.0189 | 0.0191 | 0.0192 |

| 0.25→0.30 | 3.1350 | 3.1546 | 3.1733 | 3.1913 | 3.2086 |

| 0.30→0.35 | 74.9129 | 75.2395 | 75.5521 | 75.8517 | 76.1390 |

| 0.35→0.40 | 603.8547 | 605.7287 | 607.5206 | 609.2355 | 610.8784 |

| (4.5, 350) | (4.6, 349) | (4.7, 347) | (4.8, 344) | (4.9, 340) | (5.0, 335) | (5.1, 329) | |

| 0.10 | 91.8244 | 91.8405 | 91.6797 | 91.3405 | 90.8215 | 90.1213 | 89.2386 |

| 0.15 | 92.5194 | 92.5366 | 92.3771 | 92.0395 | 91.5223 | 90.8242 | 89.9439 |

| 0.20 | 93.2192 | 93.2374 | 93.0793 | 92.7432 | 92.2279 | 91.5320 | 90.6542 |

| 0.25 | 93.9237 | 93.9430 | 93.7862 | 93.4518 | 92.9385 | 92.2448 | 91.3695 |

| 0.30 | 94.6330 | 94.6534 | 94.4980 | 94.1653 | 93.6539 | 92.9625 | 92.0898 |

| 0.35 | 95.3471 | 95.3686 | 95.2146 | 94.8836 | 94.3742 | 93.6852 | 92.8152 |

| 0.40 | 96.0660 | 96.0887 | 95.9361 | 95.6068 | 95.0995 | 94.4129 | 93.5457 |

| (%) | |||||||

| 0.10→0.15 | - | 1.2036 | 1.4671 | 1.7333 | 2.0066 | 2.2918 | - |

| 0.15→0.20 | - | 1.2200 | 1.4976 | 1.7782 | 2.0665 | 2.3675 | - |

| 0.20→0.25 | - | 1.2365 | 1.5285 | 1.8237 | 2.1272 | 2.4441 | - |

| 0.25→0.30 | - | 1.2532 | 1.5597 | 1.8698 | 2.1886 | 2.5218 | - |

| 0.30→0.35 | - | 1.2700 | 1.5913 | 1.9164 | 2.2507 | 2.6004 | - |

| 0.35→0.40 | - | 1.2870 | 1.6233 | 1.9635 | 2.3137 | 2.6800 | - |

| (%) | |||||||

| 0.10→0.15 | - | −24.3328 | −24.4345 | −24.5960 | −24.8199 | −25.1100 | - |

| 0.15→0.20 | - | −24.3034 | −24.4056 | −24.5678 | −24.7925 | −25.0837 | - |

| 0.20→0.25 | - | −24.2731 | −24.3759 | −24.5387 | −24.7643 | −25.0566 | - |

| 0.25→0.30 | - | −24.2419 | −24.3452 | −24.5087 | −24.7353 | −25.0287 | - |

| 0.30→0.35 | - | −24.2097 | −24.3136 | −24.4779 | −24.7054 | −25.0001 | - |

| 0.35→0.40 | - | −24.1766 | −24.2810 | −24.4461 | −24.6746 | −24.9706 | - |

| (10−11) | |||||||

| 0.10→0.15 | - | −8.0267 | −7.5342 | −6.9854 | −6.4009 | −5.7878 | - |

| 0.15→0.20 | - | −6.1554 | −5.7757 | −5.3326 | −4.8821 | −4.4244 | - |

| 0.20→0.25 | - | −4.7536 | −4.4444 | −4.1140 | −3.7269 | −3.3325 | - |

| 0.25→0.30 | - | −3.6153 | −3.3763 | −3.1093 | −2.8562 | −2.5679 | - |

| 0.30→0.35 | - | −2.7754 | −2.5717 | −2.3823 | −2.1077 | −1.8754 | - |

| 0.35→0.40 | - | −2.1137 | −1.9946 | −1.7980 | −1.6359 | −1.4463 | - |

| 0.20 | 0.25 | 0.30 | 0.35 | 0.40 | |

| 0.10 | 91.8405 | 92.5224 | 93.1828 | 93.8300 | 94.4683 |

| 0.15 | 92.5366 | 93.2145 | 93.8714 | 94.5157 | 95.1515 |

| 0.20 | 93.2374 | 93.9113 | 94.5648 | 95.2062 | 95.8394 |

| 0.25 | 93.9430 | 94.6128 | 95.2629 | 95.9013 | 96.5319 |

| 0.30 | 94.6534 | 95.3191 | 95.9657 | 96.6011 | 97.2291 |

| 0.35 | 95.3686 | 96.0302 | 96.6734 | 97.3057 | 97.9311 |

| 0.40 | 96.0887 | 96.7462 | 97.3859 | 98.0151 | 98.6377 |

| (%) | |||||

| 0.10→0.15 | 1.2036 | 1.1914 | 1.1765 | 1.1591 | 1.1382 |

| 0.15→0.20 | 1.2200 | 1.2073 | 1.1921 | 1.1743 | 1.1532 |

| 0.20→0.25 | 1.2365 | 1.2234 | 1.2078 | 1.1896 | 1.1683 |

| 0.25→0.30 | 1.2532 | 1.2397 | 1.2236 | 1.2052 | 1.1836 |

| 0.30→0.35 | 1.2700 | 1.2561 | 1.2397 | 1.2209 | 1.1991 |

| 0.35→0.40 | 1.2870 | 1.2727 | 1.2559 | 1.2368 | 1.2147 |

| (%) | |||||

| 0.10→0.15 | −24.3328 | −24.3846 | −24.3579 | −24.2708 | −24.1261 |

| 0.15→0.20 | −24.3034 | −24.3507 | −24.3212 | −24.2334 | −24.0907 |

| 0.20→0.25 | −24.2731 | −24.3159 | −24.2839 | −24.1955 | −24.0546 |

| 0.25→0.30 | −24.2419 | −24.2803 | −24.2459 | −24.1570 | −24.0180 |

| 0.30→0.35 | −24.2097 | −24.2440 | −24.2073 | −24.1179 | −23.9807 |

| 0.35→0.40 | −24.1766 | −24.2069 | −24.1680 | −24.0782 | −23.9429 |

| : total effect | |||||

| (10−1155) | (10−755) | (10−555) | (10−455) | (10−355) | |

| 0.10→0.15 | −8.0267 | −4.3761 | −4.9923 | −9.1272 | −6.2734 |

| 0.15→0.20 | −6.1554 | −3.6880 | −4.4191 | −8.3200 | −5.8274 |

| 0.20→0.25 | −4.7536 | −3.1032 | −3.9074 | −7.5781 | −5.4098 |

| 0.25→0.30 | −3.6153 | −2.6070 | −3.4512 | −6.8967 | −5.0189 |

| 0.30→0.35 | −2.7754 | −2.1867 | −3.0448 | −6.2714 | −4.6533 |

| 0.35→0.40 | −2.1137 | −1.8311 | −2.6833 | −5.6980 | −4.3115 |

| (%) | (4.5, 350) | (4.6, 349) | (4.7, 347) | (4.8, 344) | (4.9, 340) | (5.0, 335) | (5.1, 329) |

| 8.1 | 93.2626 | 93.2809 | 93.1228 | 92.7869 | 92.2717 | 91.5759 | 90.6982 |

| 8.3 | 93.2192 | 93.2374 | 93.0793 | 92.7432 | 92.2279 | 91.5320 | 90.6542 |

| 8.5 | 93.1778 | 93.1960 | 93.0378 | 92.7017 | 92.1863 | 91.4902 | 90.6122 |

| 8.7 | 93.1384 | 93.1566 | 92.9982 | 92.6620 | 92.1465 | 91.4503 | 90.5722 |

| 8.9 | 93.1008 | 93.1189 | 92.9605 | 92.6242 | 92.1085 | 91.4123 | 90.5340 |

| 9.1 | 93.0648 | 93.0828 | 92.9244 | 92.5880 | 92.0723 | 91.3759 | 90.4975 |

| 9.3 | 93.0304 | 93.0484 | 92.8899 | 92.5534 | 92.0376 | 91.3411 | 90.4626 |

| (10−4) | |||||||

| 8.1→8.3 | - | −1.8995 | −2.3405 | −2.7864 | −3.2446 | −3.7232 | - |

| 8.3→8.5 | - | −1.8087 | −2.2276 | −2.6512 | −3.0865 | −3.5411 | - |

| 8.5→8.7 | - | −1.7242 | −2.1227 | −2.5256 | −2.9396 | −3.3721 | - |

| 8.7→8.9 | - | −1.6454 | −2.0250 | −2.4087 | −2.8030 | −3.2149 | - |

| 8.9→9.1 | - | −1.5720 | −1.9339 | −2.2998 | −2.6758 | −3.0684 | - |

| 9.1→9.3 | - | −1.5034 | −1.8488 | −2.1981 | −2.5569 | −2.9317 | - |

| (‰) | |||||||

| 8.1→8.3 | - | 3.7518 | 3.7677 | 3.7928 | 3.8277 | 3.8729 | - |

| 8.3→8.5 | - | 3.5755 | 3.5906 | 3.6146 | 3.6478 | 3.6908 | - |

| 8.5→8.7 | - | 3.4114 | 3.4258 | 3.4486 | 3.4803 | 3.5214 | - |

| 8.7→8.9 | - | 3.2583 | 3.2720 | 3.2939 | 3.3241 | 3.3633 | - |

| 8.9→9.1 | - | 3.1153 | 3.1284 | 3.1493 | 3.1782 | 3.2156 | - |

| 9.1→9.3 | - | 2.9814 | 2.9940 | 3.0140 | 3.0417 | 3.0775 | - |

| (10−13) | |||||||

| 8.1→8.3 | - | 7.8270 | 7.2990 | 6.9492 | 5.5330 | 5.3615 | - |

| 8.3→8.5 | - | 6.9383 | 6.5880 | 5.7049 | 5.3549 | 5.3600 | - |

| 8.5→8.7 | - | 7.2932 | 6.2321 | 6.0596 | 6.2421 | 5.0033 | - |

| 8.7→8.9 | - | 6.9376 | 7.1200 | 6.2364 | 4.6421 | 5.1803 | - |

| 8.9→9.1 | - | 6.4044 | 5.6982 | 6.0583 | 5.3525 | 4.6458 | - |

| 9.1→9.3 | - | 6.0489 | 6.4084 | 5.1692 | 5.3518 | 4.6450 | - |

| (%) | 0.20 | 0.25 | 0.30 | 0.35 | 0.40 |

| 8.1 | 93.2809 | 93.9886 | 94.7012 | 95.4185 | 96.1408 |

| 8.3 | 93.2374 | 93.9430 | 94.6534 | 95.3686 | 96.0887 |

| 8.5 | 93.1960 | 93.8996 | 94.6080 | 95.3211 | 96.0390 |

| 8.7 | 93.1566 | 93.8582 | 94.5646 | 95.2758 | 95.9917 |

| 8.9 | 93.1189 | 93.8187 | 94.5232 | 95.2325 | 95.9466 |

| 9.1 | 93.0828 | 93.7809 | 94.4837 | 95.1912 | 95.9034 |

| 9.3 | 93.0484 | 93.7448 | 94.4459 | 95.1516 | 95.8621 |

| (10−4) | |||||

| 8.1→8.3 | −1.8995 | −2.0055 | −2.1140 | −2.2249 | −2.3383 |

| 8.3→8.5 | −1.8087 | −1.9095 | −2.0127 | −2.1182 | −2.2262 |

| 8.5→8.7 | −1.7242 | −1.8203 | −1.9186 | −2.0191 | −2.1219 |

| 8.7→8.9 | −1.6454 | −1.7371 | −1.8309 | −1.9268 | −2.0248 |

| 8.9→9.1 | −1.5720 | −1.6595 | −1.7491 | −1.8406 | −1.9342 |

| 9.1→9.3 | −1.5034 | −1.5870 | −1.6726 | −1.7601 | −1.8496 |

| (‰) | |||||

| 8.1→8.3 | 3.7518 | 3.9032 | 4.0540 | 4.2042 | 4.3539 |

| 8.3→8.5 | 3.5755 | 3.7198 | 3.8635 | 4.0067 | 4.1494 |

| 8.5→8.7 | 3.4114 | 3.5490 | 3.6862 | 3.8229 | 3.9590 |

| 8.7→8.9 | 3.2583 | 3.3898 | 3.5208 | 3.6514 | 3.7814 |

| 8.9→9.1 | 3.1153 | 3.2410 | 3.3663 | 3.4911 | 3.6155 |

| 9.1→9.3 | 2.9814 | 3.1018 | 3.2217 | 3.3412 | 3.4603 |

| : total effect (10−13) | |||||

| 8.1→8.3 | 7.8270 | 6.0484 | 4.4478 | 3.9137 | 3.0249 |

| 8.3→8.5 | 6.9383 | 6.5812 | 4.2701 | 3.3807 | 2.6693 |

| 8.5→8.7 | 7.2932 | 4.6264 | 4.8030 | 4.0913 | 3.0243 |

| 8.7→8.9 | 6.9376 | 6.0479 | 4.2698 | 3.0251 | 2.4911 |

| 8.9→9.1 | 6.4044 | 4.9818 | 4.2695 | 3.7356 | 2.8464 |

| 9.1→9.3 | 6.0489 | 4.9813 | 3.3811 | 3.3799 | 2.6687 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, J.-H.; Lii, P.-C.; Huang, F.-W.; Chen, S. Cross-Border Lending, Government Capital Injection, and Bank Performance. Int. J. Financial Stud. 2019, 7, 21. https://doi.org/10.3390/ijfs7020021

Lin J-H, Lii P-C, Huang F-W, Chen S. Cross-Border Lending, Government Capital Injection, and Bank Performance. International Journal of Financial Studies. 2019; 7(2):21. https://doi.org/10.3390/ijfs7020021

Chicago/Turabian StyleLin, Jyh-Horng, Pei-Chi Lii, Fu-Wei Huang, and Shi Chen. 2019. "Cross-Border Lending, Government Capital Injection, and Bank Performance" International Journal of Financial Studies 7, no. 2: 21. https://doi.org/10.3390/ijfs7020021

APA StyleLin, J.-H., Lii, P.-C., Huang, F.-W., & Chen, S. (2019). Cross-Border Lending, Government Capital Injection, and Bank Performance. International Journal of Financial Studies, 7(2), 21. https://doi.org/10.3390/ijfs7020021