Is the External Audit Report Useful for Bankruptcy Prediction? Evidence Using Artificial Intelligence

Abstract

:1. Introduction

2. Literature Review and Research Question

2.1. Systematic Literature Review: Scope of the Review

2.1.1. Line of Research: Effects of Auditing

2.1.2. Line of Research: Auditor Independence and Audit Quality

2.1.3. Line of Research: Audit Opinion Prediction

2.1.4. Line of Research: Bankruptcy Prediction Using Auditing

2.2. Research Question Development

3. Methodology

3.1. Sample and the Dependent Variable

3.2. Independent Variables: Audit Report Variables

3.3. Artificial Intelligence Methodology: The PART Algorithm

4. Results and Discussion

4.1. Summary Statistics

4.2. The Results of the PART Algorithm

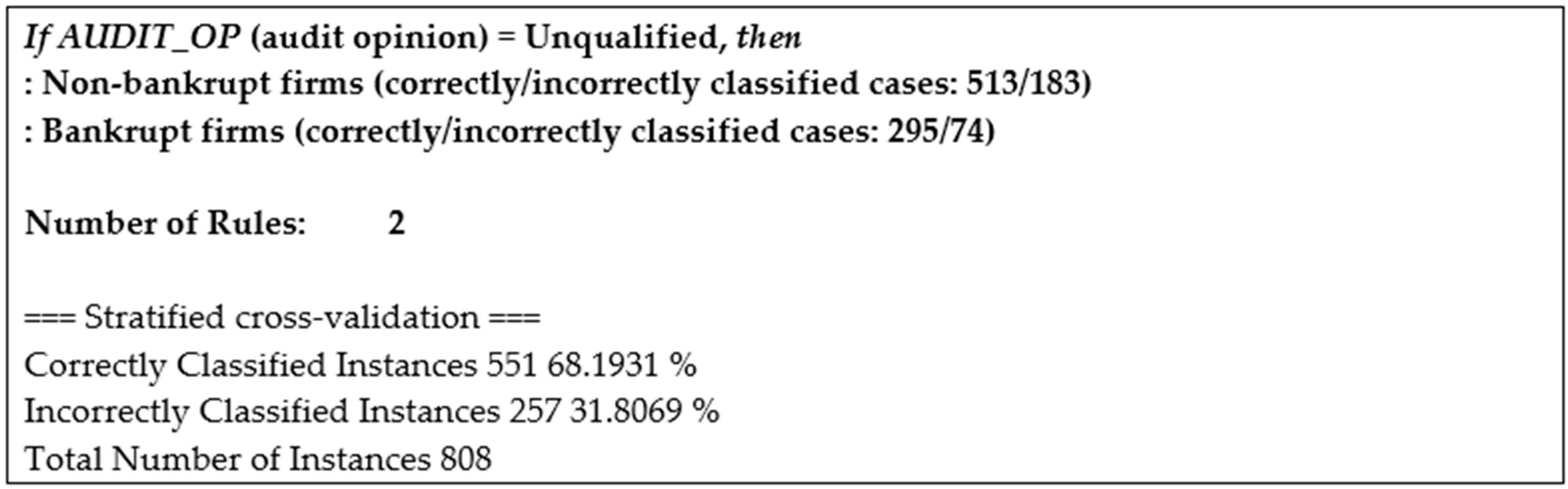

4.2.1. PART Algorithm: Model 1

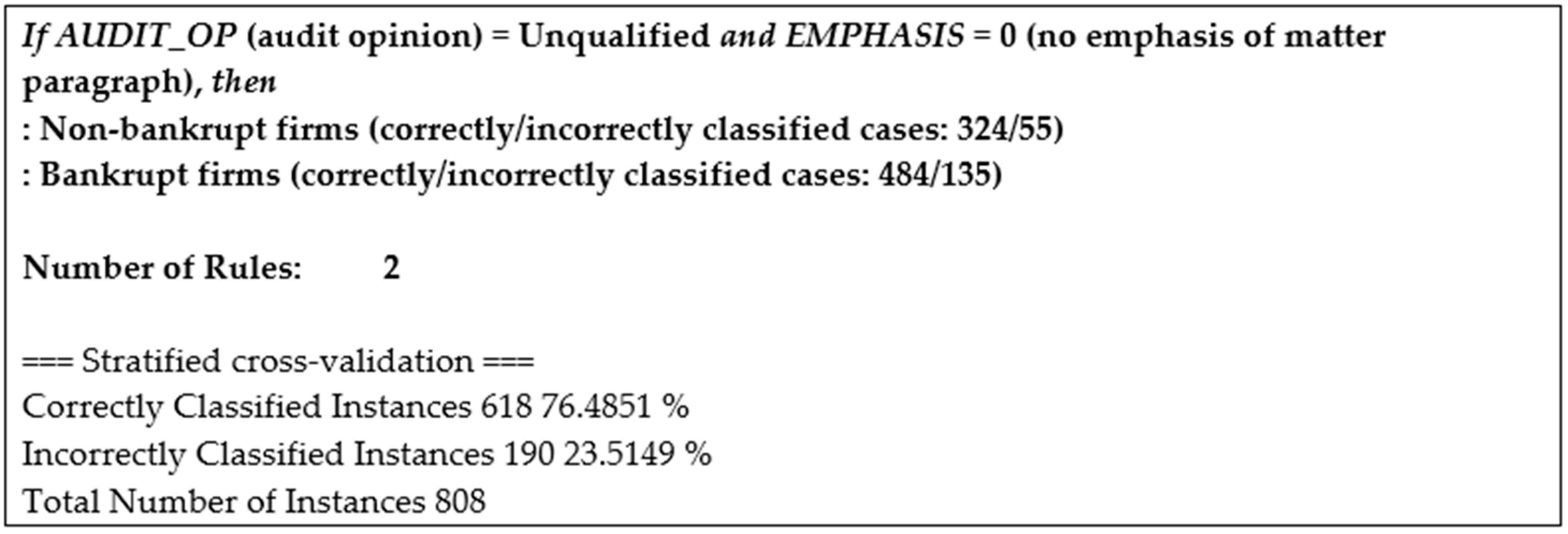

4.2.2. PART Algorithm: Model 2

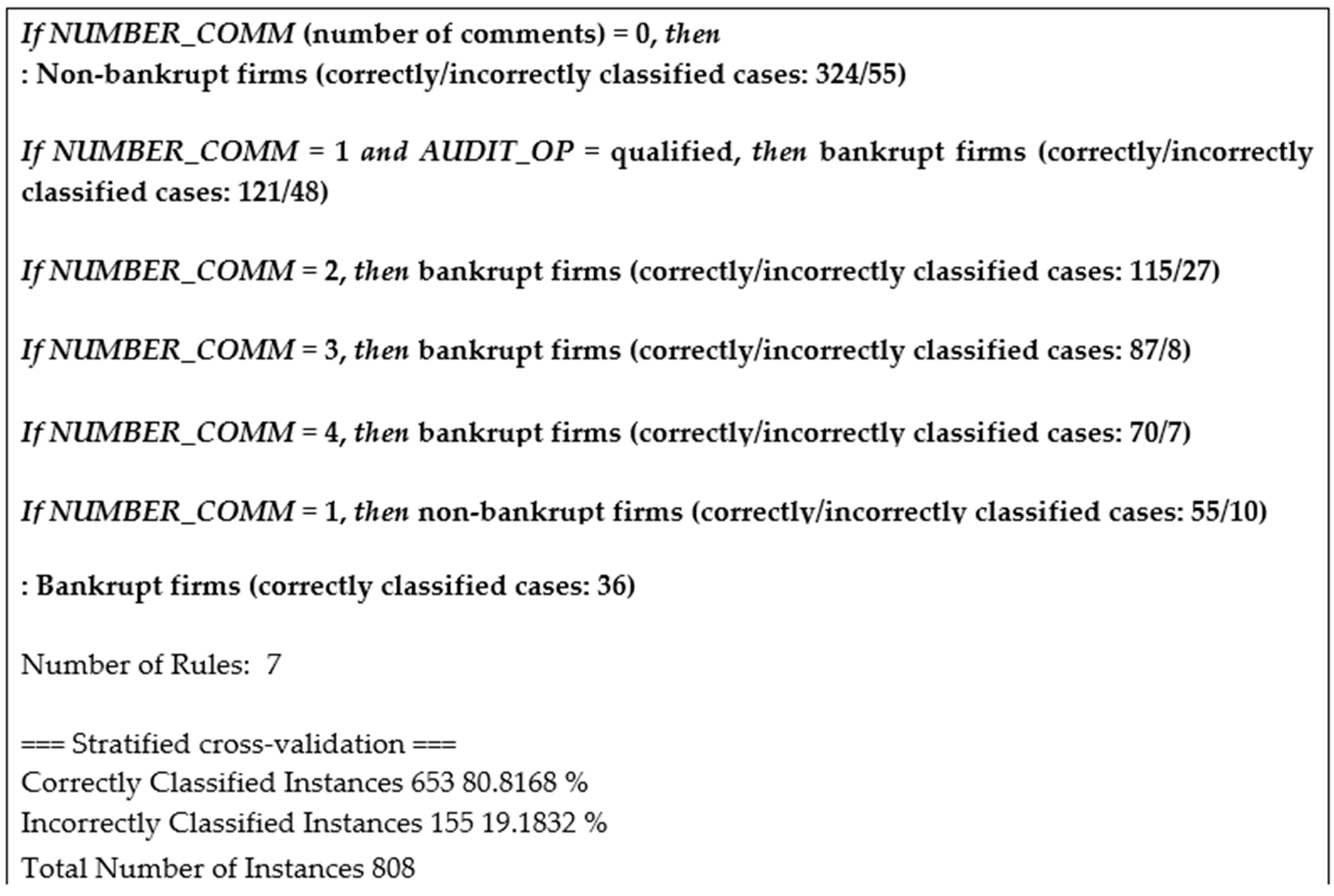

4.2.3. PART Algorithm: Model 3

4.2.4. Robustness: Random Forest and SVM

5. General Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Aguiar-Díaz, Inmaculada, and Nieves L. Díaz-Díaz. 2015. Audit quality, second-tier and size: Effect on the Spanish private distressed firms. Spanish Journal of Finance and Accounting 44: 24–46. [Google Scholar]

- Altman, Edward I. 2018. Applications of distress prediction models: What have we learned after 50 years from the Z-Score models? International Journal of Financial Studies 6: 70. [Google Scholar] [CrossRef]

- Altman, Edward I., and Thomas P. McGough. 1974. Evaluation of a company as a going-concern. Journal of Accountancy 138: 50–57. [Google Scholar]

- Altman, Edward I., Gabriele Sabato, and Nicholas Wilson. 2010. The value of non-financial information in small and medium-sized enterprise risk management. Journal of Credit Risk 2: 95–127. [Google Scholar] [CrossRef]

- Altman, Edward I., Małgorzata Iwanicz-Drozdowska, Erkki K. Laitinen, and Arto Suvas. 2017. Financial distress prediction in an international context: A review and empirical analysis of Altman’s Z-Score model. Journal of International Financial Management and Accounting 28: 131–71. [Google Scholar] [CrossRef]

- Amani, Farzaneh A., and Adam M. Fadlalla. 2017. Data mining applications in accounting: A review of the literature and organizing framework. International Journal of Accounting Information Systems 24: 32–58. [Google Scholar] [CrossRef]

- Amin, Keval, Jagan Krishnan, and Joon Sun Yang. 2014. Going concern opinion and cost of equity. Auditing: A Journal of Practice and Theory 33: 1–39. [Google Scholar] [CrossRef]

- Appiah, Kingsley Opoku, and Chizema Amon. 2017. Board audit committee and corporate insolvency. Journal of Applied Accounting Research 18: 298–316. [Google Scholar] [CrossRef]

- Armeanu, Daniel Ştefan, Georgeta Vintilă, Ştefan Cristian Gherghina, and Dan Cosmin Petrache. 2017. Approaches on correlation between board of directors and risk management in resilient economies. Sustainability 9: 173. [Google Scholar] [CrossRef]

- Arnedo-Ajona, Laura, Fermín Lizarraga-Dallo, Santiago Sánchez-Alegría, and Emiliano Ruiz-Barbadillo. 2012. User’s expectations before audit going concern opinions. Empirical evidence of self-fulfilling prophecy in the Spanish case. Spanish Journal of Finance and Accounting 41: 263–89. [Google Scholar]

- Balcaen, Sofie, and Hubert Ooghe. 2006. 35 years of studies on business failure: An overview of the classic statistical methodologies and their related problems. The British Accounting Review 38: 63–93. [Google Scholar] [CrossRef]

- Barth, Mary E., William H. Beaver, and Wayne R. Landsman. 1998. Relative valuation roles of equity book value and net income as a function of financial health. Journal of Accounting and Economics 25: 1–34. [Google Scholar] [CrossRef]

- Basioudis, Ilias G., Ferdinand A. Gul, and Anthony C. Ng. 2012. Non-Audit fees, Auditor Tenure, and Auditor Independence. Working Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2043311 (accessed on 3 April 2019).

- Bauweraerts, Jonathan. 2016. Predicting bankruptcy in private firms: Towards a stepwise regression procedure. International Journal of Financial Research 7: 147–53. [Google Scholar] [CrossRef]

- Bellovary, Jodi L., Don E. Giacomino, and Michael D. Akers. 2007. A review of bankruptcy prediction studies: 1930 to present. Journal of Financial Education 33: 1–42. [Google Scholar]

- Berglund, Nathan R., John Daniel Eshleman, and Peng Guo. 2018. Auditor size and going concern reporting. Auditing: A Journal of Practice & Theory 37: 1–25. [Google Scholar]

- Blay, Allen D. 2005. Independence threats, litigation risk, and the auditor’s decision process. Contemporary Accounting Research 22: 759–89. [Google Scholar] [CrossRef]

- Blay, Allen D., Marshall A. Geiger, and David S. North. 2011. The auditor’s going-concern opinion as a communication of risk. Auditing: A Journal of Practice and Theory 30: 77–102. [Google Scholar] [CrossRef]

- Buchman, Thomas A., and Denton Collins. 1998. Uncertainty about litigation losses and auditors’ modified audit reports. Journal of Business Research 43: 57–63. [Google Scholar] [CrossRef]

- Calderon, Thomas G., and John J. Cheh. 2002. A roadmap for future neural networks research in auditing and risk assessment. International Journal of Accounting Information Systems 3: 203–36. [Google Scholar] [CrossRef]

- Callaghan, Joseph, Mohinder Parkash, and Rajeev Singhal. 2009. Going-concern audit opinions and the provision of nonaudit services: Implications for auditor independence of bankrupt firms. Auditing: A Journal of Practice and Theory 28: 153–69. [Google Scholar] [CrossRef]

- Camacho-Miñano, Maria-del-Mar, Maria-Jesus Segovia-Vargas, and David Pascual-Ezama. 2015. Which characteristics predict the survival of insolvent firms? An SME reorganization prediction model. Journal of Small Business Management 53: 340–54. [Google Scholar] [CrossRef]

- Cao, Jian, Thomas R. Kubick, and Adi N.S. Masli. 2017. Do corporate payouts signal going-concern risk for auditors? Evidence from audit reports for companies in financial distress. Review of Quantitative Finance and Accounting 49: 599–631. [Google Scholar] [CrossRef]

- Carcello, Joseph V., and Terry L. Neal. 2000. Audit committee composition and auditor reporting. The Accounting Review 75: 453–67. [Google Scholar] [CrossRef]

- Carcello, Joseph V., and Terry L. Neal. 2003. Audit committee characteristics and auditor dismissals following “new” going-concern reports. The Accounting Review 78: 95–117. [Google Scholar] [CrossRef]

- Carcello, Joseph V., Dana R. Hermanson, and H. Fenwick Huss. 1995. Temporal changes in bankruptcy-related reporting. Auditing: A Journal of Practice and Theory 14: 133–43. [Google Scholar]

- Carcello, Joseph V., Dana R. Hermanson, and H. Fenwick Huss. 1997. The effect of SAS No. 59: How treatment of the transition period influences results. Auditing: A Journal of Practice and Theory 16: 114–23. [Google Scholar]

- Carey, Peter, and Roger Simnett. 2006. Audit partner tenure and audit quality. The Accounting Review 81: 653–76. [Google Scholar] [CrossRef]

- Carey, Peter J., Marshall A. Geiger, and Brendan T. O’Connell. 2008. Costs associated with going-concern-modified audit opinions: An analysis of the Australian audit market. Abacus 44: 61–81. [Google Scholar] [CrossRef]

- Carey, Peter, Stuart Kortum, and Robyn Moroney. 2012. Auditors’ going-concern-modified opinions after 2001: Measuring reporting accuracy. Accounting and Finance 52: 1041–59. [Google Scholar] [CrossRef]

- Carson, Elizabeth, Neil Fargher, and Yuyu Zhang. 2016. Trends in auditor reporting in Australia: A synthesis and opportunities for research. Australian Accounting Review 26: 226–42. [Google Scholar] [CrossRef]

- Cassell, Cory A., Lauren M. Dreher, and Linda A. Myers. 2013. Reviewing the SEC’s review process: 10-K comment letters and the cost of remediation. The Accounting Review 88: 1875–908. [Google Scholar] [CrossRef]

- Casterella, Jeffrey R., Barry L. Lewis, and Paul L. Walker. 2000. Modeling the audit opinions issued to bankrupt companies: A two-stage empirical analysis. Decision Sciences 31: 507–30. [Google Scholar] [CrossRef]

- Cenciarelli, Velia Gabriella, Giulio Greco, and Marco Allegrini. 2018. External audit and bankruptcy prediction. Journal of Management and Governance 22: 1–28. [Google Scholar] [CrossRef]

- Charitou, Andreas, Neophytos Lambertides, and Lenos Trigeorgis. 2007. Earnings behaviour of financially distressed firms: The role of institutional ownership. Abacus 43: 271–96. [Google Scholar] [CrossRef]

- Chen, Kevin C. W., and Bryan K. Church. 1996. Going concern opinions and the market’s reaction to bankruptcy filings. The Accounting Review 71: 117–28. [Google Scholar]

- Chen, Chen, Xiumin Martin, and Xin Wang. 2013. Insider trading, litigation concerns, and auditor going-concern opinions. The Accounting Review 88: 365–93. [Google Scholar] [CrossRef]

- Chen, Peter F., Shaohua He, Zhiming Ma, and Derrald Stice. 2016. The information role of audit opinions in debt contracting. Journal of Accounting and Economics 61: 121–44. [Google Scholar] [CrossRef]

- Chen, Yu, John Daniel Eshleman, and Jared S. Soileau. 2017. Business strategy and auditor reporting. Auditing: A Journal of Practice & Theory 36: 63–86. [Google Scholar]

- Citron, David B., and Richard J. Taffler. 2001. Ethical behaviour in the UK audit profession: The case of the self-fulfilling prophecy under going-concern uncertainties. Journal of Business Ethics 29: 353–63. [Google Scholar] [CrossRef]

- Cohen, Sandra, Antonella Costanzo, and Francesca Manes-Rossi. 2017. Auditors and early signals of financial distress in local governments. Managerial Auditing Journal 32: 234–50. [Google Scholar] [CrossRef]

- Conefrey, Thomas, and John Fitz Gerald. 2010. Managing housing bubbles in regional economies under EMU: Ireland and Spain. National Institute Economic Review 211: 91–108. [Google Scholar] [CrossRef]

- Cultrera, Loredana, and Xavier Brédart. 2016. Bankruptcy prediction: The case of Belgian SMEs. Review of Accounting and Finance 15: 1–23. [Google Scholar] [CrossRef]

- Cunnigham, Lawrence A. 2006. Too big to fail: moral hazard in auditing and the need to restructure the industry before it unravels. Columbia Law Review 106: 1–68. [Google Scholar]

- Daily, Catherine M. 1996. Governance patterns in bankruptcy reorganizations. Strategic Management Journal 17: 355–75. [Google Scholar] [CrossRef]

- DeFond, Mark, and Jieying Zhang. 2014. A review of archival auditing research. Journal of Accounting and Economics 58: 275–326. [Google Scholar] [CrossRef]

- DeFond, Mark L., Kannan Raghunandan, and K. R. Subramanyam. 2002. Do non-audit service fees impair auditor independence? Evidence from going concern audit opinions. Journal of Accounting Research 40: 1247–74. [Google Scholar] [CrossRef]

- Desai, Vikram, Joung W. Kim, Rajendra P. Srivastava, and Renu V. Desai. 2017. A study of the relationship between a going concern opinion and its financial distress metrics. Journal of Emerging Technologies in Accounting 14: 17–28. [Google Scholar] [CrossRef]

- Díaz-Martínez, Zuleyka, Alicia Sanchís-Arellano, and María Jesús Segovia-Vargas. 2009. Analysis of Financial Instability by Means of Decision Trees and Lists. In Emerging Topics in Macroeconomics. Edited by Richard O. Bailly. New York: Editorial Nova Publishers, pp. 303–27. [Google Scholar]

- Dopuch, Nicholas, Robert W. Holthausen, and Richard W. Leftwich. 1987. Predicting audit qualifications with financial and market variables. The Accounting Review 62: 431–54. [Google Scholar]

- Du Jardin, Philippe. 2015. Bankruptcy prediction using terminal failure processes. European Journal of Operational Research 242: 286–303. [Google Scholar] [CrossRef]

- Eutsler, Jared, Erin Burrell Nickell, and Sean W. G. Robb. 2016. Fraud Risk Awareness and the Likelihood of Audit Enforcement Action. Accounting Horizons 30: 379–92. [Google Scholar] [CrossRef]

- Feldmann, Dorothy A., and William J. Read. 2010. Auditor conservatism after Enron. Auditing: A Journal of Practice and Theory 29: 267–78. [Google Scholar] [CrossRef]

- Frank, Eibe, and Ian H. Witten. 1998. Generating Accurate Rule Sets without Global Optimization. Working Paper. Hamilton: University of Waikato, Department of Computer Science. [Google Scholar]

- Gaeremynck, Ann, Sofie Van Der Meulen, and Marleen Willekens. 2008. Audit-firm portfolio characteristics and client financial reporting quality. European Accounting Review 17: 243–70. [Google Scholar] [CrossRef]

- García-Blandón, Josep, and Josep Maria Argiles-Bosch. 2013. Audit tenure and audit qualifications in a low litigation risk setting: An analysis of the Spanish market. Estudios de Economía 40: 133–56. [Google Scholar] [CrossRef]

- Geiger, Marshall A., and Kanan Raghunandan. 2001. Bankruptcies, audit reports, and the reform act. Auditing: A Journal of Practice and Theory 20: 187–95. [Google Scholar] [CrossRef]

- Geiger, Marshall A., and Kanan Raghunandan. 2002. Auditor tenure and audit reporting failures. Auditing: A Journal of Practice and Theory 21: 67–78. [Google Scholar] [CrossRef]

- Geiger, Marshall A., Kanan Raghunandan, and Dasaratha V. Rama. 2005. Recent changes in the association between bankruptcies and prior audit opinions. Auditing: A Journal of Practice and Theory 24: 21–35. [Google Scholar] [CrossRef]

- Geiger, Marshall A., Kanan Raghunandan, and William Riccardi. 2014. The Global Financial Crisis: US bankruptcies and going-concern audit opinions. Accounting Horizons 28: 59–75. [Google Scholar] [CrossRef]

- Hope, Ole-Kristian, Danqi Hu, and Wuyang Zhao. 2017. Third-party consequences of short-selling threats: The case of auditor behavior. Journal of Accounting and Economics 63: 479–98. [Google Scholar] [CrossRef]

- Hopwood, William, James McKeown, and Jane Mutchler. 1989. A test of the incremental explanatory power of opinions qualified for consistency and uncertainty. The Accounting Review 64: 28–48. [Google Scholar]

- Ittonen, Kim, Per C. Tronnes, and Leon Wong. 2017. Substantial doubt and the entropy of auditors’ going concern modifications. Journal of Contemporary Accounting & Economics 13: 134–47. [Google Scholar]

- Joe, Jennifer R. 2003. Why press coverage of a client influences the audit opinion. Journal of Accounting Research 41: 109–33. [Google Scholar] [CrossRef]

- Kausar, Asad, and Clive S. Lennox. 2017. Balance sheet conservatism and audit reporting conservatism. Journal of Business Finance & Accounting 44: 897–924. [Google Scholar]

- Kausar, Asad, Richard J. Taffler, and Christine E. L. Tan. 2017. Legal regimes and investor response to the auditor’s going-concern opinion. Journal of Accounting, Auditing & Finance 32: 40–72. [Google Scholar]

- Khurana, Inder K., and Kris K. Raman. 2006. Do investors care about the auditor’s economic dependence on the client? Contemporary Accounting Research 23: 977–1016. [Google Scholar] [CrossRef]

- Kida, Thomas. 1980. An investigation into auditors’ continuity and related qualification judgments. Journal of Accounting Research 18: 506–23. [Google Scholar] [CrossRef]

- Kim, Minchoul, Minho Kim, and Ronald D. McNiel. 2008. Predicting survival prospect of corporate restructuring in Korea. Applied Economics Letters 15: 1187–90. [Google Scholar] [CrossRef]

- Kirkos, Efstathios. 2015. Assessing methodologies for intelligent bankruptcy prediction. Artificial Intelligence Review 43: 83–123. [Google Scholar] [CrossRef]

- Knechel, W. Robert, and Ann Vanstraelen. 2007. The relationship between auditor tenure and audit quality implied by going concern opinions. Auditing: A Journal of Practice and Theory 26: 113–31. [Google Scholar] [CrossRef]

- Koh, Wei-Chem, and Kin-Wai Lee. 2017. Do Auditors Recognize Managerial Risk-Taking Incentives? International Journal of Business 22: 206–29. [Google Scholar]

- Koyuncugil, Ali Serhan, and Nermin Ozgulbas. 2012. Financial early warning system model and data mining application for risk detection. Expert Systems with Applications 39: 6238–53. [Google Scholar] [CrossRef]

- Krishnan, Jagan, and Jayanthi Krishnan. 1997. Litigation risk and auditor resignations. The Accounting Review 72: 539–60. [Google Scholar]

- Kuhn, John R., James F. Courtney, and Bonnie Morris. 2015. A theory of complex adaptive inquiring organizations: Application to continuous assurance of corporate financial information. The Knowledge Engineering Review 30: 265–96. [Google Scholar] [CrossRef]

- Kumar, Krishna, and Lucy Lim. 2015. Was Andersen’s audit quality lower than its peers? A comparative analysis of audit quality. Managerial Auditing Journal 30: 911–62. [Google Scholar] [CrossRef]

- Kumar, P. Ravi, and Vadlamani Ravi. 2007. Bankruptcy prediction in banks and firms via statistical and intelligent techniques: A review. European Journal of Operational Research 180: 1–28. [Google Scholar] [CrossRef]

- Laitinen, Erkki K., and Teija Laitinen. 2009. Effect of accruals on financial, non-financial, and audit information in payment default prediction. International Journal of Accounting, Auditing and Performance Evaluation 5: 353–83. [Google Scholar] [CrossRef]

- Lenard, Mary Jane, Pervaiz Alam, and Gregory R. Madey. 1995. The application of neural networks and a qualitative response model to the auditor’s going concern uncertainty decision. Decision Sciences 26: 209–27. [Google Scholar] [CrossRef]

- Lennox, Clive S. 1999. The accuracy and incremental information content of audit reports in predicting bankruptcy. Journal of Business Finance and Accounting 26: 757–78. [Google Scholar] [CrossRef]

- Lennox, Clive S., and Asad Kausar. 2017. Estimation risk and auditor conservatism. Review of Accounting Studies 22: 185–216. [Google Scholar] [CrossRef]

- Lim, Chee-Yeow, and Hun-Tong Tan. 2010. Does auditor tenure improve audit quality? Moderating effects of industry specialization and fee dependence. Contemporary Accounting Research 27: 923–57. [Google Scholar] [CrossRef]

- Louwers, Timothy J. 1998. The relation between going-concern opinions and the auditor’s loss function. Journal of Accounting Research 36: 143–55. [Google Scholar] [CrossRef]

- Louwers, Timothy J., Frank M. Messina, and Michael D. Richard. 1999. The auditor’s going-concern disclosure as a self-fulfilling prophecy: A discrete-time survival analysis. Decision Sciences 30: 805–24. [Google Scholar] [CrossRef]

- Lowe, D. Jordan, and Philip M. J. Reckers. 1994. The effects of hindsight bias on jurors’ evaluations of auditor decisions. Decision Sciences 25: 401–26. [Google Scholar] [CrossRef]

- Lundberg, C. Gustav, and Brian M. Nagle. 2002. Post-decision inference editing of supportive and counter indicative signals among external auditors in a going concern judgment. European Journal of Operational Research 136: 264–81. [Google Scholar] [CrossRef]

- McKee, Thomas E. 1995. Predicting bankruptcy via induction. Journal of Information Technology 10: 26–36. [Google Scholar] [CrossRef]

- McKee, Thomas E. 2003. Rough sets bankruptcy prediction models versus auditor signalling rates. Journal of Forecasting 22: 569–86. [Google Scholar] [CrossRef]

- McKeown, James C., Jane F. Mutchler, and William Hopwood. 1991. Towards an explanation of auditor failure to modify the audit opinions of bankrupt companies. Auditing: A Journal of Practice and Theory 10: 1–13. [Google Scholar]

- McNichols, Maureen F. 2002. Discussion of the quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review 77: 61–69. [Google Scholar] [CrossRef]

- Menon, Krishnagopal, and David D. Williams. 1994. The insurance hypothesis and market prices. The Accounting Review 69: 327–42. [Google Scholar]

- Min, Jae H., and Young-Chan Lee. 2005. Bankruptcy prediction using support vector machine with optimal choice of kernel function parameters. Expert Systems with Applications 28: 603–14. [Google Scholar] [CrossRef]

- Min, Sung-Hwan, Jumin Lee, and Ingoo Han. 2006. Hybrid genetic algorithms and support vector machines for bankruptcy prediction. Expert Systems with Applications 31: 652–60. [Google Scholar] [CrossRef]

- Muñoz-Izquierdo, Nora, María-del-Mar Camacho-Miñano, and David Pascual-Ezama. 2017. The content of the audit report in the year prior to bankruptcy filing. Empirical evidence from Spain. Spanish Journal of Finance and Accounting 46: 92–126. [Google Scholar]

- Muñoz-Izquierdo, Nora, María Jesús Segovia-Vargas, María-del-Mar Camacho-Miñano, and David Pascual-Ezama. 2019. Explaining the causes of business failure using audit report disclosures. Journal of Business Research 98: 403–14. [Google Scholar] [CrossRef]

- Myers, Linda A., Jonathan E. Shipman, Quinn T. Swanquist, and Robert L. Whited. 2018. Measuring the market response to going concern modifications: The importance of disclosure timing. Review of Accounting Studies 23: 1512–42. [Google Scholar] [CrossRef]

- Ogneva, Maria K., Raghunandan Subramanyam, and Kannan Raghunandan. 2007. Internal control weakness and cost of equity: Evidence from SOX Section 404 disclosures. The Accounting Review 82: 1255–97. [Google Scholar] [CrossRef]

- Pedrosa Rodríguez, M. Áurea, and Francisco López-Corrales. 2018. Autors’ response to the global financial crisis: Evidence from Spanish non-listed companies. Spanish Journal of Finance and Accounting 47: 400–31. [Google Scholar]

- Piñeiro-Sánchez, Carlos, Pablo de Llano-Monelos, and Manuel Rodríguez-López. 2012. Evaluation of the likelihood of financial failure. Empirical contrast of the informational content audit of accounts. Spanish Journal of Finance and Accounting 46: 565–87. [Google Scholar]

- Piñeiro-Sánchez, Carlos, Pablo de Llano-Monelos, and Manuel Rodríguez-López. 2013. A parsimonious model to forecast financial distress, based on audit evidence. Contaduría y Administración 58: 151–73. [Google Scholar] [CrossRef]

- Pratt, Jamie, and James D. Stice. 1994. The effects of client characteristics on auditor litigation risk judgments, required audit evidence, and recommended audit fees. The Accounting Review 69: 639–56. [Google Scholar]

- Raghunandan, Kannan, and Dasaratha V. Rama. 1995. Audit reports for companies in financial distress: Before and after SAS No. 59. Auditing: A Journal of Practice and Theory 14: 50–63. [Google Scholar]

- Ragothaman, Srinivasan, Jon Carpenter, and Thomas Buttars. 1995. Using rule induction for knowledge acquisition: An expert systems approach to evaluating material errors and irregularities. Expert Systems with Applications 9: 483–90. [Google Scholar] [CrossRef]

- Read, William J., and Ari Yezegel. 2016. Auditor tenure and going concern opinions for bankrupt clients: Additional evidence. Auditing: A Journal of Practice and Theory 35: 163–79. [Google Scholar] [CrossRef]

- Read, William J., and Ari Yezegel. 2018. Going-concern opinion decisions on bankrupt clients: Evidence of long-lasting auditor conservatism? Advances in Accounting 40: 20–26. [Google Scholar] [CrossRef]

- Robinson, Dahlia. 2008. Auditor independence and auditor-provided tax service: Evidence from going-concern audit opinions prior to bankruptcy filings. Auditing: A Journal of Practice and Theory 27: 31–54. [Google Scholar] [CrossRef]

- Rodríguez-López, Manuel, Carlos Piñeiro-Sánchez, and Pablo de Llano-Monelos. 2014. Financial risk determination of failure by using parametric model, artificial intelligence and audit information. Estudios de Economía 41: 187–217. [Google Scholar]

- Ruiz-Barbadillo, Emiliano, Nieves Gómez-Aguilar, Cristina De Fuentes-Barberá, and María Antonia García-Benau. 2004. Audit quality and the going-concern decision-making process: Spanish evidence. European Accounting Review 13: 597–620. [Google Scholar] [CrossRef]

- Schwartz, Kenneth B., and Krishnagopal Menon. 1985. Auditor switches by failing firms. The Accounting Review 60: 248–61. [Google Scholar]

- Shu, Pei-Gi, Tsung-Kang Chen, and Wen-Jye Hung. 2015. Audit duration quality and client credit risk. Asia-Pacific Journal of Accounting and Economics 22: 137–62. [Google Scholar] [CrossRef]

- Sikka, Prem. 2009. Financial crisis and the silence of the auditors. Accounting, Organizations and Society 34: 868–73. [Google Scholar] [CrossRef]

- Stanisic, Milovan, Danka Stefanovic, Nada Arezina, and Vule Mizdrakovic. 2013. Analysis of auditors’ reports and bankruptcy risk in banking sector in the Republic of Serbia. The Amfiteatru Economic Journal 15: 431–41. [Google Scholar]

- Stanley, Jonathan D. 2011. Is the audit fee disclosure a leading indicator of clients’ business risk? Auditing: A Journal of Practice and Theory 30: 157–79. [Google Scholar] [CrossRef]

- Sun, Jie, Hui Li, Qing-Hua Huang, and Kai-Yu He. 2014. Predicting financial distress and corporate failure: A review from the state-of-the-art definitions, modelling, sampling, and featuring approaches. Knowledge-Based Systems 57: 41–56. [Google Scholar] [CrossRef]

- Tascón-Fernández, María T., and Francisco J. Castaño-Gutiérrez. 2012. Variables and models for the identification and prediction of business failure: Revision of recent empirical research advances. Spanish Accounting Review 15: 7–58. [Google Scholar]

- Van Caneghem, Tom, and Geert Van Campenhout. 2012. Quantity and quality of information and SME financial structure. Small Business Economics 39: 341–58. [Google Scholar] [CrossRef]

- Van Peursem, Karen, and Yi Chiann Chan. 2014. Forecasting New Zealand corporate failures 2001–10: Opportunity lost? Australian Accounting Review 24: 276–88. [Google Scholar] [CrossRef]

- Vanstraelen, Ann. 2000. Impact of renewable long-term audit mandates on audit quality. European Accounting Review 9: 419–42. [Google Scholar] [CrossRef]

- Vanstraelen, Ann. 2002. Auditor economic incentives and going-concern opinions in a limited litigious continental European business environment: Empirical evidence from Belgium. Accounting and Business Research 32: 171–86. [Google Scholar] [CrossRef]

- Wu, Wei-Wen. 2010. Beyond business failure prediction. Expert Systems with Applications 37: 2371–76. [Google Scholar] [CrossRef]

- Yeh, Ching-Chiang, Der-Jang Chi, and Yi-Rong Lin. 2014. Going-concern prediction using hybrid random forests and rough set approach. Information Sciences 254: 98–110. [Google Scholar] [CrossRef]

- Zdolsek, D., and T. Jagric. 2011. Audit opinion identification using accounting ratios: Experience of United Kingdom and Ireland. Actual Problems of Economics 115: 285–310. [Google Scholar]

- Zięba, Maciej, Sebastian K. Tomczak, and Jakub M. Tomczak. 2016. Ensemble boosted trees with synthetic features generation in application to bankruptcy prediction. Expert Systems with Applications 58: 93–101. [Google Scholar] [CrossRef]

| 1 | The audit data available in the BVD database is a section called the “Auditor’s opinion”. It consists of a maximum of 991 characters of the report representing emphasis paragraphs, qualification paragraphs, or both. From this field, we extracted the audit opinion (unqualified or qualified), the type of paragraphs disclosed, and the number of comments in those paragraphs. We identified the comments manually by reading and labeling the content of each report. |

| 2 | To illustrate the process of identifying the comments in the audit report, here is one example of a firm included in our sample. This firm filed for bankruptcy in 2008 and issued an unqualified audit report with an emphasis on the matter paragraph in the same year. According to the BVD database, this paragraph said: “The company incurred a net loss of 3128 thousand of euros during the year ended 31 December 2008. Also, as of that date, its current liabilities exceeded its total assets so that the company may be unable to convert its assets into funds that can be used to meet its financial obligations. Additionally, as stated in Note 16 in the financial statements, the company holds significant investments in group companies under serious financial distress. These events or conditions indicate that a material uncertainty exists that may cast significant doubt on the company’s ability to continue as a going concern. Although the financial statements were prepared on a going concern basis, the company may be unable to realize its assets, specially the tax credit, and discharge its liabilities in the normal course of business.” Therefore, the comments of the report basically total six in number: accumulated losses, negative working capital, short-term and long-term financial investments, going concern, and deferred tax assets. These are the comments that we took into consideration in our sample, so the independent variable NUMBER_COMM for this firm took the value of six. For this firm, the other three independent dummy variables of the study took the following values: AUDIT_OP value of 0 (unqualified), EMPHASIS takes the value of 1 (matter paragraph disclosed), and SCOPE_VIOLATIONS is 0 (no qualifications). |

| Studies/Year | Sample (Country/Type of Firms/Years/Number) | Key Findings/Methodology |

|---|---|---|

| Line of research: Effects of auditing | ||

| Lowe and Reckers (1994) | US/92 prospective jurors | Outcome knowledge biases jurors’ evaluations of the auditor’s judgement/Experiment |

| Menon and Williams (1994) | US/Public/1990/100 L&H clients and 4523 non-L&H clients | The disclosure of bankruptcy has an adverse effect on market prices and the market does not react to an auditor’s replacement/Multivariate test (OLS) |

| Chen and Church (1996) | US/Public/1980–1988/98 bankrupt | Firms receiving GCOs experience less negative excess returns in the period surrounding bankruptcy filings than those receiving clean opinions/Multivariate test (logit) |

| Buchman and Collins (1998) | US/Public/1977/60 with qualified opinions for litigation uncertainty and 331 with unqualified | Qualified opinions are useful for financial statement users in predicting material litigation losses/Multivariate test (logit) |

| Charitou et al. (2007) | US/Public/1986–2004/859 bankrupt and 859 non-bankrupt | Managers of highly distressed firms shift earnings downward before filing for bankruptcy/Multivariate test (earnings management accrual models) |

| Blay et al. (2011) | US/Public/1989–2006/431 with GCO and 431 without | GCOs represent a risk communication to the equity market and result in a shift of the market’s perception of distressed firms/Multivariate test (models based on Barth et al. 1998) |

| Van Caneghem and Van Campenhout (2012) | Belgium/Private/2007/79,097 SMEs | The amount and quality of financial statement information is positively related to the SMEs’ financial structures (leverage)/Multivariate test (OLS) |

| Stanisic et al. (2013) | Serbia/2007–2011/163 audit reports of 33 banks | Special attention should be paid to banks with explanatory paragraphs or qualifications on their auditors’ reports/Univariate analyses |

| Amin et al. (2014) | US/Public/2000–2010/114 firm-year observations with GCOs and 5343 without | There is a positive relationship between the issuance of a GCO and the firm’s subsequent cost of equity capital/Multivariate test (models based on Khurana and Raman (2006) and Ogneva et al. (2007)) |

| Eutsler et al. (2016) | US/Public/1995–2012/314 fraud | Auditors are penalized for documenting their awareness of fraud risk if subsequent financial statements are fraudulent/Multivariate test (probit) |

| Chen et al. (2016) | US/Public/1992–2009/5377 | Loan contracts incorporate information contained in qualifications/Multivariate test (OLS and probit) |

| Kausar and Lennox (2017) | UK/Public/1994–2008/120 bankrupt | Conservative audit reporting compensates less conservative balance sheets where book values of assets exceed their liquidation values/Multivariate test (logit and OLS) |

| Kausar et al. (2017) | US and UK/Public/1995–2002/823 US and 123 UK first-time GCOs | Investors in a creditor-friendly bankruptcy regime (UK) react more adversely to a first-time GCO than investors in a debtor-friendly regime (US)/Multivariate test (OLS) |

| Myers et al. (2018) | US/Public/2003–2014/897 new GCOs | Market responses to GCOs are statistically weak and smaller in economic magnitude than has been suggested in prior literature/Multivariate test (OLS) |

| Line of research: Auditor independence and audit quality | ||

| Schwartz and Menon (1985) | US/Public/1974–1982/132 failed and 132 non-failed | Greater tendency for failed firms to switch auditors than non-failed firms; neither qualifications nor management changes are associated with auditor displacement in failing firms/Univariate analysis |

| McKeown et al. (1991) | US/Public/1974–1985/134 failed and 160 non-failed | Auditors are less likely to modify opinions of failed firms that are large, have ambiguous probabilities of bankruptcy, or have shorter lags between fiscal year end and audit opinion dates/Multivariate test (logit) |

| Pratt and Stice (1994) | US/243 responses | The financial conditions of poorer firms are associated with higher levels of litigation risk, more audit evidence, and higher audit fees/Questionnaires to Big 6 partners |

| Carcello et al. (1995) | US/Public/1972–1992/446 | Increase in the propensity to modify bankruptcy-related opinions after the issuance of SAS No. 34 but not after SAS No. 59/Multivariate test (logit) |

| Raghunandan and Rama (1995) | US/Public/1987–1991/174 and 188 distressed from pre- and post-SAS No. 59 periods, respectively | After SAS No. 59 became effective, auditors were more likely to issue GCOs for distressed non-bankrupt firms and for bankrupt firms prior to failure/Multivariate test (logit) |

| Ragothaman et al. (1995) | US/Public/1960–1980/34 error and 58 non-error | A prototype expert system that evaluates material errors and potential fraud classifies firms into error and non-error categories correctly/Rule induction |

| Daily (1996) | US/Large/1988–1993/53 bankrupt and 53 non-bankrupt | No association between affiliated director representation on audit committees or institutional holdings and the incidence of bankruptcy/Multivariate test (logit) |

| Carcello et al. (1997) | US/Public/1985–1991/248 bankrupt and 440 non-bankrupt | Any evidence of a significant SAS No. 59 effect is highly dependent on the transition period treatment/Multivariate test (logit) |

| Krishnan and Krishnan (1997) | US/Public/1986–1994/141 auditor resignation firms | Resignation firms differ from dismissal firms along dimensions that capture the likelihood of litigation: distress, the variance of abnormal returns, auditor independence, tenure, and GCOs/Multivariate test (logit) |

| Louwers (1998) | US/Public and private/1984–1991/808 distressed | When issuing GCOs, auditors focus on the client’s financial condition and other indicators of financial distress, and not on factors related to litigation or loss of revenues/Multivariate test (logit) |

| Louwers et al. (1999) | US/Public/1984–1994/210 first-time GCOs | The “self-fulfilling prophecy” effect has little impact on future company prospects/Multivariate test (logit) |

| Carcello and Neal (2000) | US/Public/1994/223 distressed | The greater the percentage of affiliated directors on the audit committee, the lower the likelihood of receiving a GCO/Multivariate test (logit) |

| Vanstraelen (2000) | Belgium/Large/1992–1996/398 distressed and 398 non-distressed | Long-term auditor-client relationships increase the likelihood of an unqualified opinion/Multivariate test (logit) |

| Citron and Taffler (2001) | UK/Public/1986–1993/99 with GCOs and 99 without | No empirical support for the self-fulfilling prophecy in the UK/Multivariate test (logit) |

| Geiger and Raghunandan (2001) | US/Public/1991–1998/383 bankrupt | The likelihood of issuing prior GCOs for bankrupt firms decreased after the Private Securities Litigation Reform Act (1995)/Multivariate test (logit) |

| DeFond et al. (2002) | US/Public/2000/1158 distressed | There is no association between non-audit service fees and impairment of auditor independence/Multivariate test (logit) |

| Vanstraelen (2002) | Belgium/Large/1992–1996/392 bankrupt, 392 distressed non-bankrupt and 392 non-distressed non-bankrupt firms | In a limited litigious environment, the likelihood of issuing GCOs decreases with higher audit fees and higher proportions of client losses/Multivariate test (logit) |

| Geiger and Raghunandan (2002) | US/Public/1996–1998/117 distressed | There is an inverse relationship between audit tenure and audit reporting failures/Multivariate test (logit) |

| Carcello and Neal (2003) | US/Public/1988–1999/124 with GCOs and 250 without | Audit committees with greater independence are more effective in protecting auditors from dismissal after the issuance of first-time GCOs; moreover, the association between committee independence and auditor protection from dismissal has grown stronger over time; finally, the turnover rate for independent committee members increases after auditor dismissals/Multivariate test (logit) |

| Joe (2003) | US/90 in-charge auditors from an international public accounting firm | Negative press coverage increases the auditors’ perceptions of the client’s probability of failure, leading to more qualified opinions/Experiment |

| Ruiz-Barbadillo et al. (2004) | Spain/Public/1991–2000/1199 firm-year observations of distressed firms | For a distressed company, the audit quality affects the likelihood of receiving a GCO/Multivariate test (logit) |

| Geiger et al. (2005) | US/Public/2000–2003/226 distressed | Auditors were more likely to issue GCOs in the period after December 2001, with the number increasing even more in 2002–03 due to the Sarbanes–Oxley Act (2002)/Multivariate test (logit) |

| Carey and Simnett (2006) | Australia/Public/1995/1021 | For long audit partner tenure, there is a deterioration in audit quality, measured by a lower propensity to issue GCOs/Multivariate test (logit) |

| Cunningham (2006) | - | Financial statement insurance could be a way to restructure the auditing industry, so large audit firms can leave without upsetting the financial system/Theoretical study |

| Knechel and Vanstraelen (2007) | Belgium/Large/1992–1996/309 distressed bankrupt and 309 distressed non-bankrupt | Auditors are not less independent over time, nor do they become better at predicting the failures of companies/Multivariate test (logit) |

| Carey et al. (2008) | Australia/Public/1994–1997/68 with first-time GCOs and 68 without | Audit switching is positively associated with the issuance of GCOs; moreover, the issuance of a first-time GCO leads to a loss of clients; however, there is no evidence of the self-fulfilling prophecy/Multivariate test (logit) |

| Gaeremynck et al. (2008) | Belgium/Public and private/1997/200 distressed | While solvency characteristics of an audit-firm portfolio are positively associated with the financial reporting quality amongst firms, there is no association between reporting quality and the portfolio size/Multivariate test (logit) |

| Robinson (2008) | US/Public/2001–2004/209 bankrupt | There is a positive association between the level of tax services fees and the likelihood of correctly issuing a GCO prior to bankruptcy filing/Multivariate test (logit) |

| Callaghan et al. (2009) | US/Public/2001–2005/92 bankrupt | There is no connection between the issuance of GCOs and audit and non-audit fees/Multivariate test (logit) |

| Feldmann and Read (2010) | US/Public/2000–2008/565 bankrupt | While the issuance of GCOs increased sharply in 2002–03 when compared to 2000–01, the number decreased immediately after returning to the pre-Enron level/Multivariate test (logit) |

| Lim and Tan (2010) | US/Public/2000–2005/12,783 firm-year observations | Audit quality is higher for firms audited by industry specialists relative to non-specialists when auditor tenure increases/Multivariate test (qualified discretionary accruals model (McNichols 2002) |

| Stanley (2011) | US/Public/2000–2008/31,057 firm-year observations | There is little evidence of an association between audit fees and changes in the clients’ solvency, including bankruptcy/Multivariate test (audit fee model, adapted from DeFond et al. (2002) and others) |

| Arnedo-Ajona et al. (2012) | Spain/Public and private/1992–2002/236 bankrupt and 236 non-bankrupt | Significant increases in the probability of bankruptcy following a GCO are limited to those cases in which the opinion was considered unexpected/Multivariate test (OLS) |

| Carey et al. (2012) | Australia/Public/1995–1996 and 2004–2005/142 with GCOs | Auditors maintained the reporting accuracy of GCOs before and after corporate collapses in 2001/Multivariate test (logit) |

| Basioudis et al. (2012) | US/Public/2000–2007 10,394 firm-year observations of distressed firms | High non-audit fees affect auditor independence only when audit tenure is long or when auditor quality is poor/Multivariate test (logit) |

| Chen et al. (2013) | US/Public and private/2000–2007/801 firm-year observations with first-time GCOs and 11,528 without | The likelihood of receiving a GCO is negatively associated with the level of insider trading/Multivariate test (logit, probit, and OLS) |

| García-Blandón and Argiles-Bosch (2013) | Spain/Public/2001–2009/881 firm-year observations | The probability of issuing audit qualifications decreases with audit tenure/Multivariate test (logit) |

| Geiger et al. (2014) | US/Public/2004–2010/414 bankrupt | The propensity of issuing a GCO prior to bankruptcy increased after the GFC/Multivariate test (logit) |

| Rodríguez-López et al. (2014) | Galicia (Spain)/Private/1990–1997/60 distressed and 60 non-distressed | Distress prediction models that use financial ratios show higher performance rates than audit-based forecast models/Multivariate test (MDA and logit) and neural networks |

| Aguiar-Díaz and Díaz-Díaz (2015) | Spain/Private/2007–2010/733 distressed | Auditor behaviors change depending on the client size, suggesting that larger auditors provide higher audit quality for larger clients/Multivariate test (probit) and simultaneous equation model |

| Kuhn et al. (2015) | One firm (Frontier Airlines, a low-cost US airline) | The development of a systems design theory for continuous auditing systems/Case study |

| Kumar and Lim (2015) | US/Public/1996–2000/4669 Andersen clients and 17,793 other Big 5 clients | Andersen’s audit quality did not differ materially from its peers prior to its failure/Multivariate tests (earnings response coefficients, magnitudes of abnormal accruals, propensity to issue GCOs, the usefulness of GCOs in predicting bankruptcy) and frequency of AAER |

| Shu et al. (2015) | Taiwan/Public/1999–2010/9876 firm-year observations | The level and volatility of the audit report lag is positively related to the clients’ credit risk/Multivariate test (logit) |

| Carson et al. (2016) | Australia/Public/2005–2013/15,855 | GCOs have increased beyond the GFC in Australian publicly listed companies/Univariate test |

| Read and Yezegel (2016) | US/Public/2002–2008/401 bankrupt | There is no association between audit tenure and the Big 4 firms not issuing prior GCOs to bankrupt firms, and there is a non-linear association for non-Big 4 firms/Multivariate test (logit) |

| Cao et al. (2017) | US/Public/2000–2010/11,056 distressed firms that distributed income | When issuing GCOs, auditors underreact to corporate payout decreases (negative signals) but react appropriately to payout increases/Multivariate test (logit) |

| Chen et al. (2017) | US/Public/2000–2013/4322 firm-year observations of distressed firms | Auditors issue fewer GCOs and more material weakness opinions to firms following innovative prospector strategies than cost-leadership defenders/Multivariate test (probit) |

| Cohen et al. (2017) | Italy/Local governments/2003–2012/44 distressed and 53 non-distressed | Personnel expenses over revenues, short-term liabilities over revenues, and the reliance on subsidies are discriminators of financial distress/Multivariate test (logit) |

| Hope et al. (2017) | US/Public/2000–2013/1610 firms (538 pilot firms and 1072 non-pilot firms) | Audit fees increase when auditors are concerned about bankruptcy risk or when managers are less likely to be disciplined by short sellers/Multivariate test (OLS) |

| Koh and Lee (2017) | US/Public/2000–2009/1157 bankrupt | Greater CEO risk-decreasing incentives are positively related to a lower probability of bankruptcy and a lower tendency to issue GCOs/Multivariate test (logit and OLS) |

| Lennox and Kausar (2017) | US/Public/2000–2013/51,882 firm-year observations | Estimation risk significantly affects auditor behavior/Multivariate test (regressions) |

| Muñoz-Izquierdo et al. (2017) | Spain/Private/2004–2014/404 bankrupt | Audit reports of bankrupt firms vary depending on auditor size, client industry, and financial condition and the stage of insolvency legal proceedings/Univariate test |

| Berglund et al. (2018) | US/Public/2000–2013/933 first-time GCOs and 8334 distressed clients with no GCOs | Controlling for the firms’ financial health, there is a positive relationship between auditor size and the issuance of GCOs/Multivariate test (logit) |

| Pedrosa Rodríguez and López-Corrales (2018) | Spain/Private/pre-GFC period (2006–2007) and GFC period (2008–2010) | The propensity to issue GCOs increased during the GFC for both Big 4 and non-Big 4 auditors/Multivariate test (logit) |

| Read and Yezegel (2018) | US/Public/2006–2015/340 bankrupt | The propensity to issue GCOs significantly increased following the GFC, but decreased to GFC levels after two post-GFC recovery periods/Multivariate test (logit) |

| Line of research: Audit opinion prediction | ||

| McKeown et al. (1991) | US/Public/1974–1985/134 bankrupt and 160 non-bankrupt | Firms that do not receive qualified opinions are more likely to have ambiguous bankruptcy probabilities, to be larger, and to have shorter time periods between their fiscal year ends and audit report dates than those that do receive GCOs. Additionally, hidden fraud does not explain the auditors’ failure to modify opinions of distressed companies that go bankrupt/Multivariate test (logit) |

| Lenard et al. (1995) | US/Public/1982–1987/40 with GCO and 40 without | Neural networks are proposed as a robust alternative for auditors to support their issuance of GCOs/Neural networks and multivariate test (logit) |

| McKee (1995) | US/Public/1986–1989/30 with GCO and 30 without | Induction algorithm predicts bankruptcy using a simple and theoretically consistent model with 97% accuracy/Inductive inferencing algorithm |

| Lundberg and Nagle (2002) | US/55 professional auditors | Professional auditors edit crucial signals, but the extent of the post-decision editing depends on the task and the presence/absence of feedback/Experiment |

| Zdolsek and Jagric (2011) | UK and Ireland/Public/1997–2002/265 with qualified opinion and 265 with non-qualified | Development of a model to identify qualified opinions using accounting ratios/Multivariate test (logit) |

| Cassell et al. (2013) | US/Public/2004–2009/6702 firm-year observations with comment letter | Low profitability, high complexity, engaging a small audit firm, and weaknesses in governance are positively associated with the receipt of SEC comment letters/Multivariate tests (logit and OLS) |

| Ittonen et al. (2017) | US/Public/2003–2015/5146 non-financial firms obtained from Compustat | GCOs should be issued when there is an 8% chance (or higher) that the client is bankrupt/Shannon entropy from information theory |

| Line of research: Bankruptcy prediction using auditing | ||

| Casterella et al. (2000) | US/Public/1982–1992/100 bankrupt | Auditors do not appear to be able to predict either bankruptcy filings or resolutions/Multivariate analysis (logit) |

| McKee (2003) | US/Public/1991–1997/146 bankrupt and 145 non-bankrupt | Rough set models do not provide a significant comparative advantage regarding prediction accuracy over auditors’ methodologies/Artificial intelligence (rough sets) |

| Kim et al. (2008) | Republic of Korea/1991–2003/35 firms that recovered from financial distress and 24 non-recovered | Audit opinion, client risk, and client size are accurate predictors of the survival prospects of distressed firms/Multivariate test (logit) |

| Altman et al. (2010) | UK/Private/2000–2007/5.8 million SMEs, of which 66,000 failed | Creditors’ legal actions, company filing histories, comprehensive audit reports, and audit opinions contribute to increasing the default prediction power of risk models for SMEs/Multivariate test (logit) |

| Piñeiro-Sánchez et al. (2012) | Galicia (Spain)/Private/1998–2008/101 distressed and 101 non-distressed | The accumulation of qualified opinions and high auditor rotation rates are reliable measures of credit risk and predictors of bankruptcy/Multivariate test (logit) |

| Piñeiro-Sánchez et al. (2013) | Galicia (Spain)/Private/1998–2008/98 distressed | High auditor rotation, qualified reports, and non-compliance with the publication deadlines of financial statements are accurate indicators of financial distress/Multivariate test (logit) |

| Van Peursem and Chan (2014) | New Zealand/Public/2001–2010/25 failed and 25 non-failed | There are significant differences between failing and non-failing firms that can be detected using financial ratios and audit data/Univariate analysis |

| Appiah and Amon (2017) | UK/Public/1994–2011/98 insolvent and 269 solvent | There is a negative association between meetings and the independence of the audit committee/Multivariate test (logit) |

| Armeanu et al. (2017) | Romania/Public/2013/69 | Business failure is negatively influenced by CEO gender, board size, and audit committee/Multivariate test (principal components) |

| Desai et al. (2017) | US/Public/1995–2015/All distressed firms in the SEC’s EDGAR database | The survival rate of first-time GCOs is much lower using delisting as a measure of financial viability than bankruptcy/Search engine technology (textual analysis) |

| AUDIT OPINION | AUDIT_OP | Dummy variable with a value of 1 if the auditor’s report is qualified, and 0 if it is unqualified. |

| TYPE OF PARAGRAPH | EMPHASIS | Dummy variable with a value of 1 if the auditor’s report has an Emphasis of Matter paragraph, 0 otherwise. |

| SCOPE_VIOLATIONS | Categorical variable with a value of 0 if no qualifications appear in the report, 1 if the audit report has a qualification due to a scope limitation or due a GAAP violation, and 2 if the report shows both. | |

| NUMBER OF COMMENTS | NUMBER_COMM | Categorical variable with a value of 0 if no comments are disclosed in the report, and 1 to 6 according to the number of comments shown. |

| Frequency of Industries by Bankruptcy Classification | ||||

| Bankrupt firms | Non-bankrupt firms | Total | Total (%) | |

| Construction and real-estate | 141 | 141 | 282 | 35% |

| Manufacturing | 110 | 110 | 220 | 27% |

| Commercial | 79 | 79 | 158 | 20% |

| Services | 70 | 70 | 140 | 17% |

| Primary | 4 | 4 | 8 | 1% |

| Total | 404 | 404 | 808 | 100% |

| Means and Standard Deviations by Bankruptcy Classification | ||||

| Bankrupt firms | Non-bankrupt firms | |||

| Mean | S.D. | Mean | S.D. | |

| Age (years) | 22 | 13 | 23 | 14 |

| Size (total assets) | 84,352 | 276,969 | 84,431 | 293,514 |

| WCTA | −0.090 | 0.401 | 0.239 | 0.307 |

| EBITTA | −0.169 | 0.329 | 0.026 | 0.104 |

| BVETL | 0.278 | 1.098 | 1.728 | 3.015 |

| # of obs. | 404 | 404 | ||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Muñoz-Izquierdo, N.; Camacho-Miñano, M.-d.-M.; Segovia-Vargas, M.-J.; Pascual-Ezama, D. Is the External Audit Report Useful for Bankruptcy Prediction? Evidence Using Artificial Intelligence. Int. J. Financial Stud. 2019, 7, 20. https://doi.org/10.3390/ijfs7020020

Muñoz-Izquierdo N, Camacho-Miñano M-d-M, Segovia-Vargas M-J, Pascual-Ezama D. Is the External Audit Report Useful for Bankruptcy Prediction? Evidence Using Artificial Intelligence. International Journal of Financial Studies. 2019; 7(2):20. https://doi.org/10.3390/ijfs7020020

Chicago/Turabian StyleMuñoz-Izquierdo, Nora, María-del-Mar Camacho-Miñano, María-Jesús Segovia-Vargas, and David Pascual-Ezama. 2019. "Is the External Audit Report Useful for Bankruptcy Prediction? Evidence Using Artificial Intelligence" International Journal of Financial Studies 7, no. 2: 20. https://doi.org/10.3390/ijfs7020020

APA StyleMuñoz-Izquierdo, N., Camacho-Miñano, M.-d.-M., Segovia-Vargas, M.-J., & Pascual-Ezama, D. (2019). Is the External Audit Report Useful for Bankruptcy Prediction? Evidence Using Artificial Intelligence. International Journal of Financial Studies, 7(2), 20. https://doi.org/10.3390/ijfs7020020