Profitability Determinants of Financial Institutions: Evidence from Banks in Pakistan

Abstract

1. Introduction

2. Review of the Pakistani Banking Industry

3. Literature Review

4. Data and Methodology

4.1. Sample and Data

4.2. Variables Selection and Hypothesis Developments

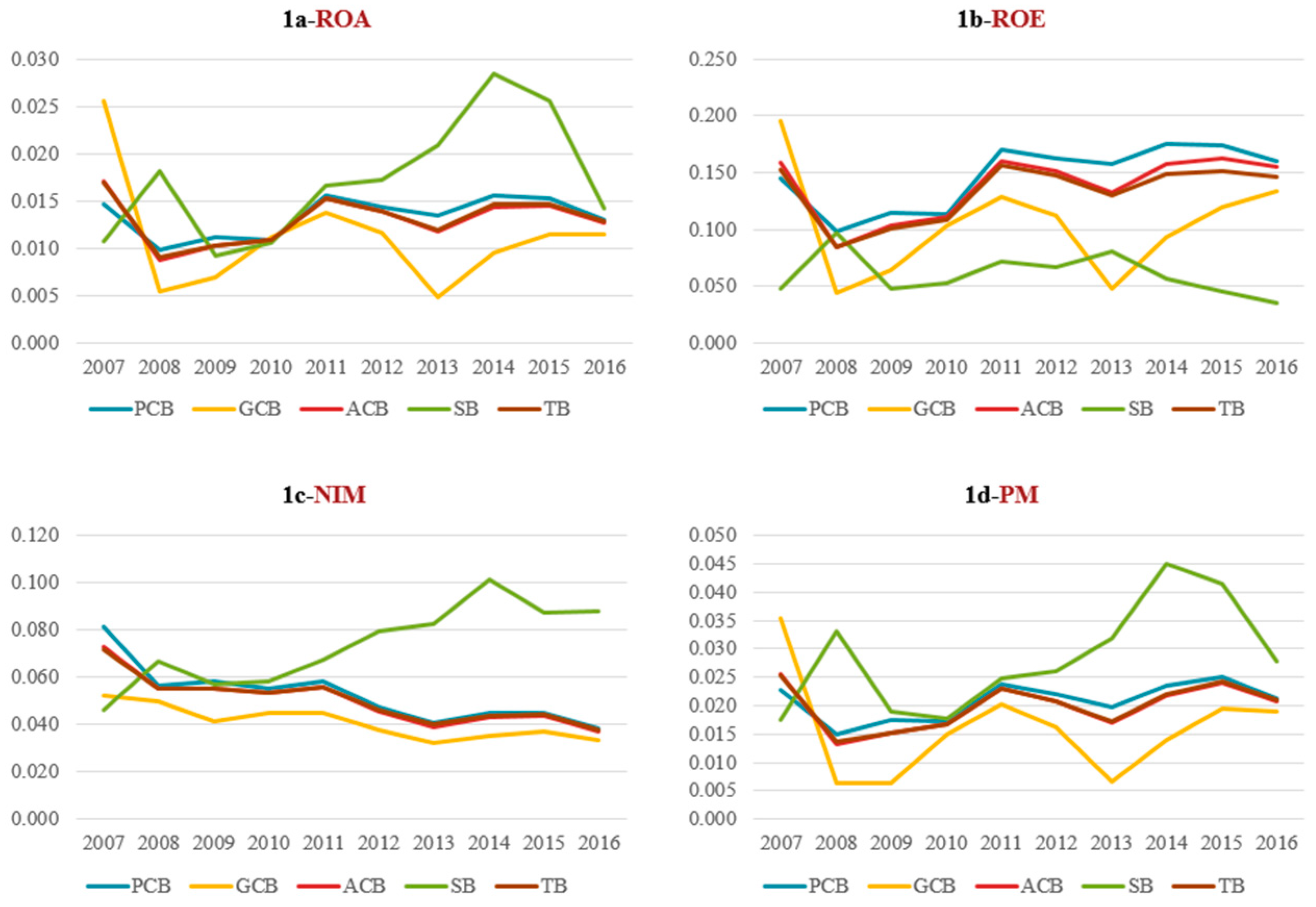

4.2.1. Profitability Indicators

4.2.2. Profitability Determinants

4.3. Econometric Methodology

4.4. Econometric Specification

5. Results and Discussion

5.1. Descriptive Statistics

5.2. Findings

6. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Admati, Anat R., Peter M. DeMarzo, Martin F. Hellwig, and Paul Pfl eiderer. 2010. Fallacies, Irrelevant Facts, and Myths in the Discussion of Capital Regulation: Why Bank Equity Is Not Expensive. Research Paper. Stanford: Stanford University. Available online: http://ssrn.com/abstract=1669704 (accessed on 25 August 2017).

- Ahamed, M. Mostak. 2017. Asset quality, non-interest income, and bank profitability: Evidence from Indian banks. Economic Modelling 63: 1–14. [Google Scholar] [CrossRef]

- Alhassan, Abdul Latif, Michael Lawer Tetteh, and Freeman Owusu Brobbey. 2016. Market power, efficiency and bank profitability: Evidence from Ghana. Economic Change and Restructuring 49: 71–93. [Google Scholar] [CrossRef]

- Angbazo, Lazarus. 1997. Commercial bank net interest margins, default risk, interest-rate risk, and off-balance sheet banking. Journal of Banking & Finance 21: 55–87. [Google Scholar]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Athanasoglou, Panayiotis P., Sophocles N. Brissimisa, and Matthaios D. Delis. 2008. Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of International Financial Markets, Institutions and Money 18: 121–36. [Google Scholar] [CrossRef]

- Athanasoglou, Panayiotis P., Matthaios D. Delis, and Christos K. Staikouras. 2006. Determinants of Bank Profitability in the Southern Eastern European Region. Working Paper No. 47. Athens: Bank of Greece. [Google Scholar]

- Baltagi, Badi H. 2001. Econometric Analysis of Panel Data, 2nd ed.Chichester: John Wiley & Sons. [Google Scholar]

- Banya, Roland, and Nicholas Biekpe. 2018. Banking efficiency and its determinants in selected frontier african markets. Economic Change and Restructuring 51: 69–95. [Google Scholar] [CrossRef]

- Baum, Christopher F., Mark E. Schaffer, and Steven Stillman. 2003. Instrumental variables and GMM: Estimation and testing. The Stata Journal 3: 1–31. [Google Scholar]

- Berger, Allen, and David Humphrey. 1994. Bank Scale Economies, Mergers, Concentration, and Efficiency: The U.S. Experience. Working Paper No. 94. Philadelphia: Financial Institution Centre, University of Pennsylvania. Available online: http://fic.wharton.upenn.edu/fic/papers/94/9425.pdf (accessed on 24 August 2017).

- Berger, Allen N. 1995a. The Profit-Structure Relationship in Banking--Tests of Market-Power and Efficient Structure Hypotheses. Journal of Money, Credit and Banking 27: 404–31. [Google Scholar] [CrossRef]

- Berger, Allen N. 1995b. The Relationship between Capital and Earnings in Banking. Journal of Money, Credit and Banking 27: 432–56. [Google Scholar] [CrossRef]

- Berger, Allen N., Seth D. Bonime, Daniel M. Covitz, and Diana Hancock. 2000. Why are bank profits so persistent? The roles of product market competition, informational opacity, and regional/macroeconomic shocks. Journal of Banking & Finance 24: 1203–35. [Google Scholar]

- Berger, Allen N., Gerald A. Hanweck, and David B. Humphrey. 1987. Competitive viability in banking: Scale scope and product mix economies. Journal of Monetary Economics 20: 501–20. [Google Scholar] [CrossRef]

- Bishnoi, T. R., and Sofia Devi. 2017. Banking Reforms in India: Consolidation, Restructuring and Performance. Cham: Springer. [Google Scholar]

- Black, Dirk, and John Gallemore. 2013. Bank Executive Overconfidence and Delayed Expected Loss Recognition. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2144293 (accessed on 22 February 2018).

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Bougatef, Khemaies. 2017. Determinants of bank profitability in Tunisia: Does corruption matter? Journal of Money Laundering Control 20: 70–78. [Google Scholar] [CrossRef]

- Bourke, Philip. 1989. Concentration and other determinants of bank profitability in Europe, North America and Australia. Journal of Banking & Finance 13: 65–79. [Google Scholar] [CrossRef]

- Bouzgarrou, Houssam, Sameh Jouida, and Waël Louhichi. 2018. Bank profitability during and before the financial crisis: Domestic vs. foreign banks. Research in International Business and Finance 44: 26–39. [Google Scholar] [CrossRef]

- Căpraru, Bogdan, and Iulian Ihnatov. 2014. Banks’ Profitability in Selected Central and Eastern European Countries. Procedia Economics and Finance 16: 587–91. [Google Scholar] [CrossRef]

- Chiorazzo, Vincenzo, Carlo Milani, and Francesca Salvini. 2008. Income Diversification and Bank Performance: Evidence from Italian Banks. Journal of Financial Services Research 33: 181–203. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Ash, and Harry Huizinga. 1999. Determinants of commercial bank interest margins and profitability: Some international evidence. The World Bank Economic Review 13: 379–408. [Google Scholar] [CrossRef]

- Dietrich, Andreas, and Gabrielle Wanzenried. 2011. Determinants of bank profitability before and during the crisis: Evidence from Switzerland. Journal of International Financial Markets, Institutions & Money 21: 307–27. [Google Scholar]

- Dinç, I. Serdar. 2005. Politicians and banks: Political influences on government-owned banks in emerging markets. Journal of Financial Economics 77: 453–79. [Google Scholar] [CrossRef]

- Djalilov, Khurhsid, and Jenifer Piesse. 2016. Determinants of banks profitability in transition countries: What matters most? Research in International Business and Finance 38: 69–82. [Google Scholar] [CrossRef]

- Eichengreen, Barry, and Heather D. Gibson. 2001. Greek Banking at the Dawn of the New Millennium. CEPR Discussion Papers No. 2791. Available online: http://www.cepr.org/active/publications/discussion_papers/dp.php?dpno=2791 (accessed on 22 February 2018).

- Elisa, Menicucci, and Paolucci Guido. 2016. The determinants of bank profitability: Empirical evidence from European banking sector. Journal of Financial Reporting and Accounting 14: 86–115. [Google Scholar] [CrossRef]

- Esther, Laryea, Ntow-Gyamfi Matthew, and Alu Angela Azumah. 2016. Nonperforming loans and bank profitability: Evidence from an emerging market. African Journal of Economic and Management Studies 7: 462–81. [Google Scholar] [CrossRef]

- García-Herrero, Alicia, Sergio Gavilá, and Daniel Santabárbara. 2009. What explains the low profitability of Chinese banks? Journal of Banking & Finance 33: 2080–92. [Google Scholar] [CrossRef]

- Garcia, Maria Teresa Medeiros, and João Pedro Silva Martins Guerreiro. 2016. Internal and external determinants of banks’ profitability: The Portuguese case. Journal of Economic Studies 43: 90–107. [Google Scholar] [CrossRef]

- Gilbert, R. Alton. 1984. Bank Market Structure and Competition: A Survey. Journal of Money, Credit and Banking 16: 617–45. [Google Scholar] [CrossRef]

- Goddard, John, Hong Liu, Philip Molyneux, and John O. S. Wilson. 2011. The persistence of bank profit. Journal of Banking & Finance 35: 2881–90. [Google Scholar] [CrossRef]

- Goddard, John, Phil Molyneux, and John O. S. Wilson. 2004a. The profitability of european banks: A cross-sectional and dynamic panel analysis. The Manchester School 72: 363–81. [Google Scholar] [CrossRef]

- Goddard, John, Phil Molyneux, and John O. S. Wilson. 2004b. Dynamics of Growth and Profitability in Banking. Journal of Money, Credit and Banking 36: 1069–90. [Google Scholar] [CrossRef]

- Haris, Muhammad, Yao HongXing, Gulzara Tariq, and Ali Malik. Forthcoming. An Evaluation of Performance of Public Sector Financial Institutions: Evidence from Pakistan. International Journal of Business Performance Management.

- Hassan, M. Kabir, and Abdel-Hameed Bashir. 2005. Determinants of Islamic Banking Profitability. In Islamic Perspectives on Wealth Creation, 118-141. Edinburgh: Edinburgh University Press. Available online: http://www.jstor.org/stable/10.3366/j.ctt1r2b98 (accessed on 22 February 2018).

- Heffernan, Shelagh A., and Xiaoqing Fu. 2008. The Determinants of Bank Performance in China. London: Sir John Cass Business School. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1247713# (accessed on 22 February 2018).

- Ho, Thomas S. Y., and Anthony Saunders. 1981. The Determinants of Bank Interest Margins: Theory and Empricical Evidence. Jouranl of Financial and Quantitative Analysis 16: 581–600. [Google Scholar] [CrossRef]

- Iannotta, Giuliano, Giacomo Nocera, and Andrea Sironi. 2007. Ownership structure, risk and performance in the European banking industry. Journal of Banking & Finance 31: 2127–49. [Google Scholar] [CrossRef]

- Islam, Md Shahidul, and Shin-Ichi Nishiyama. 2016. The Determinants of Bank Profitability: Dynamic Panel Evidence from South Asian Countries. Journal of Applied Finance & Banking 6: 77–97. [Google Scholar]

- Jiang, Guorong, Nancy Tang, Eve Law, and Angela Sze. 2003. Determinants of Bank Profitbaility in Hong Kong. Research Department, Hong Kong Monetary Authority. Available online: www.hkma.gov.hk/...research/research/.../RM_on_Banz_Profitability.pdf (accessed on 25 August 2017).

- Joarder, Mohammad Abdul Munim, A. K. M. Nurul Hossain, and Monir Uddin Ahmed. 2016. Does the central bank contribute to the political monetary cycles in Bangladesh? Economic Change and Restructuring 49: 365–94. [Google Scholar] [CrossRef]

- Kennedy, Peter. 2008. A Guide to Econometrics. Malden: Blackwell. [Google Scholar]

- Khwaja, Asim Ijaz, and Atif Mian. 2005. Do Lenders Favor Politically Connected Firms? Rent Provision in an Emerging Financial Market. The Quarterly Journal of Economics 120: 1371–411. [Google Scholar] [CrossRef]

- King, Robert G., and Ross Levine. 1993. Finance and Growth: Schumpeter Might be Right. The Quarterly Journal of Economics 108: 717–37. [Google Scholar] [CrossRef]

- Kočenda, Evžen, and Jan Hanousek. 2012. State ownership and control in the Czech Republic. Economic Change and Restructuring 45: 157–91. [Google Scholar] [CrossRef]

- Kosmidou, Kyriaki, Fotios Pasiouras, Constantin Zopounidis, and Michael Doumpos. 2006. A multivariate analysis of the financial characteristics of foreign and domestic banks in the UK. Omega 34: 189–95. [Google Scholar] [CrossRef]

- Kosmidou, Kyriaki, Fotios Pasiouras, and Jordan Floropoulos. 2004. Linking profits to asset-liability management of domestic and foreign banks in the UK. Applied Financial Economics 14: 1319–24. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-De-Silanes, and Andrei Shleifer. 2002. Government Ownership of Banks. The Journal of Finance 57: 265–301. [Google Scholar] [CrossRef]

- Lee, John Y., Glenn Growe, Marinus DeBruine, and Inkyung Cha. 2015. Measuring the Impact of the 2007–2009 Financial Crisis on the Performance and Profitability of U.S. Regional Banks. Advances in Management Accounting. Bingley: Emerald Group Publishing Limited, vol. 25, pp. 181–206. [Google Scholar]

- Levine, Ross, and Sara Zervos. 1998. Stock Markets, Banks, and Economic Growth. The American Economic Review 88: 537–58. Available online: https://ideas.repec.org/a/aea/aecrev/v88y1998i3p537-58.html (accessed on 7 August 2017).

- Malik, Ahmad Rashid. 2017. Pakistan: The Next Asian Tiger? The Diplomate. Available online: https://thediplomat.com/2017/06/pakistan-the-next-asian-tiger/ (accessed on 30 October 2017).

- Maudos, Joaquín. 2017. Income structure, profitability and risk in the European banking sector: The impact of the crisis. Research in International Business and Finance 39: 85–101. [Google Scholar] [CrossRef]

- Micco, Alejandro, Ugo Panizza, and Monica Yañez. 2007. Bank ownership and performance. Does politics matter? Journal of Banking & Finance 31: 219–41. [Google Scholar] [CrossRef]

- Miller, Stephen M., and Athanasios G. Noulas. 1997. Portfolio mix and large-bank profitability in the USA. Applied Economics 29: 505–12. [Google Scholar] [CrossRef]

- Molyneux, Philip. 1993. Structure and Performance in European Banking. Bangor: University of Wales Bangor. Available online: http://e.bangor.ac.uk/id/eprint/4203 (accessed on 22 February 2018).

- Molyneux, Philip, and John Thornton. 1992. Determinants of European bank profitability: A note. Journal of Banking and Finance 16: 1173–78. [Google Scholar] [CrossRef]

- Moualhi, Mouna, Hajer Zarrouk, and Khoutem Ben Jedidia. 2016. Is Islamic bank profitability driven by same forces conventional banks? International Journal of Islamic and Middle Eastern Finance and Management 9: 46–66. [Google Scholar]

- Naceur, Samy Ben. 2003. The Determinants of the Tunisian Banking Industry Profitability: Panel Evidence. Paper presented at the Economic Research Forum (ERF) 10th Annual Conference, Marrakesh, Morocco, December 16–18; Available online: www.mafhoum.com/press6/174E11.pdf (accessed on 22 August 2017).

- Naceur, Samy Ben, and Mohamed Goaied. 2001. The determinants of the Tunisian deposit banks’ performance. Applied Financial Economics 11: 317–19. [Google Scholar] [CrossRef]

- Neely, Michelle Clark, and David C. Wheelock. 1997. Why Does Bank Performance Vary Across States? St. Louis: Federal Reserve Bank of St. Louis Reviews, pp. 27–38. [Google Scholar]

- Pasiouras, Fotios, and Kyriaki Kosmidou. 2007. Factors influencing the profitability of domestic and foreign commercial banks in the European Union. Research in International Business and Finance 21: 222–37. [Google Scholar] [CrossRef]

- Perry, Philip. 1992. Do banks gain or lose from inflation? Journal of Retail Banking 14: 25–31. [Google Scholar]

- Raza, Syed Ali, Syed Tehseen Jawaid, and Junaid Shafqat. 2013. Profitability of the Banking Sector of Pakistan: Panel Evidence from Bank-Specific, Industry-Specific and Macroeconomic Determinants. Available online: http://mpra.ub.uni-muenchen.de/48485/ (accessed on 22 August 2017).

- Rhoades, Stephen A. 1985. Market share as a source of market power: Implications and some evidence. Journal of Economics and Business 37: 343–63. [Google Scholar] [CrossRef]

- Roodman, David. 2009. How to do xtabond2: An introduction to difference and system GMM in Stata. Stata Journal 9: 86–136. [Google Scholar] [CrossRef]

- Saeed, Muhammad Sajid. 2014. Bank-related, Industry-related and Macroeconomic Factors Affecting Bank Profitability: A Case of the United Kingdom. Research Journal of Finance and Accounting 5: 42–50. [Google Scholar]

- Saona, Paolo. 2016. Intra- and extra-bank determinants of Latin American Banks’ profitability. International Review of Economics & Finance 45: 197–214. [Google Scholar] [CrossRef]

- Short, Brock K. 1979. The relation between commercial bank rates and banking concentration in Canada, Western Europe, and Japan. Journal of Banking and Finance 3: 209–19. [Google Scholar] [CrossRef]

- Siew Peng, Lee, and Isa Mansor. 2017. Determinants of bank margins in a dual banking system. Managerial Finance 43: 630–45. [Google Scholar] [CrossRef]

- Sinha, Pankaj, and Sakshi Sharma. 2016. Determinants of bank profits and its persistence in Indian Banks: A study in a dynamic panel data framework. International Journal of System Assurance Engineering and Management 7: 35–46. [Google Scholar] [CrossRef]

- Smirlock, Michael. 1985. Evidence on the (Non) Relationship between Concentration and Profitability in Banking. Journal of Money, Credit and Banking 17: 69–83. [Google Scholar] [CrossRef]

- Staikouras, Christos K., and Geoffrey E. Wood. 2004. The determinants of European bank profitability. International Business and Economics Research Journal 3: 57–68. [Google Scholar] [CrossRef]

- Staikouras, Christos K., and Geoffrey E. Wood. 2003. The determinants of bank profitability in Europe. Paper presented at the European Applied Business Research Conference, Venice, Italy, June 9–13. [Google Scholar]

- Sufian, Fadzlan, and Royfaizal Razali Chong. 2008. Determinants of bank profitability in a developing economy: Empirical evidence from the Philippines. Asian Academy of Management Journal of Accounting and Finance 4: 91–112. [Google Scholar]

- Sufian, Fadzlan, and Muzafar Shah Habibullah. 2009. Bank specific and macroeconomic determinants of bank profitability: Empirical evidence from the China banking sector. Frontiers of Economics in China 4: 274–91. [Google Scholar] [CrossRef]

- Sun, Poi Hun, Shamsher Mohamad, and M. Ariff. 2017. Determinants driving bank performance: A comparison of two types of banks in the OIC. Pacific-Basin Finance Journal 42: 193–203. [Google Scholar] [CrossRef]

- Tan, Yong. 2016. The impacts of risk and competition on bank profitability in China. Journal of International Financial Markets, Institutions and Money 40: 85–110. [Google Scholar] [CrossRef]

- Tan, Yong, Floros Christos, and Anchor John. 2017. The profitability of Chinese banks: Impacts of risk, competition and efficiency. Review of Accounting and Finance 16: 86–105. [Google Scholar] [CrossRef]

- Tan, Yong, and Christos Floros. 2012a. Bank profitability and inflation: The case of China. Journal of Economic Studies 39: 675–96. [Google Scholar] [CrossRef]

- Tan, Yong, and Christos Floros. 2012b. Bank profitability and GDP growth in China: A note. Journal of Chinese Economic and Business Studies 10: 267–73. [Google Scholar] [CrossRef]

- Tan, Yong, and Christos Floros. 2012c. Stock market volatility and bank performance in China. Studies in Economics and Finance 29: 211–28. [Google Scholar] [CrossRef]

- Tarusa, Daniel K., B. Chekol Yonas, and Milcah Mutwol. 2012. Determinants of Net Interest Margins of Commercial Banks in Kenya: A Panel Study. Procedia Economics and Finance 2: 199–208. [Google Scholar] [CrossRef]

- Trujillo-Ponce, Antonio. 2013. What determines the profitability of banks? Evidence from Spain. Accounting and Finance 53: 561–586. [Google Scholar] [CrossRef]

- Williams, Barry. 2003. Domestic and international determinants of bank profits: Foreign banks in Australia. Journal of Banking & Finance 27: 1185–210. [Google Scholar]

- Windmeijer, Frank. 2005. A finite sample correction for the variance of linear efficient two-step GMM estimators. Journal of Econometrics 126: 25–51. [Google Scholar] [CrossRef]

- Wu, Hsiu-Ling, Chien-Hsun Chen, and Fang-Ying Shiu. 2007. The impact of financial development and bank characteristics on the operational performance of commercial banks in the Chinese transitional economy. Journal of Economic Studies 43: 401–14. [Google Scholar] [CrossRef]

- Ye, Qichang, Zongling Xu, and Dan Fang. 2012. Market structure, performance, and efficiency of the Chinese banking sector. Economic Change and Restructuring 45: 337–58. [Google Scholar] [CrossRef]

| 1 | As per MSCI Emerging Market Index created by Morgan Stanley Capital International, which measures equity performance in emerging markets around the world. |

| 2 | Karachi Stock Exchange (KSE) 100 Index compares the stock prices on Pakistan Stock Exchange. |

| 3 | Data accessed from SBP (State Bank of Pakistan, which is the central bank of the country), available at (http://sbp.org.pk/publications/q_reviews/qpr.htm). |

| 4 | Author’s estimations based on available Audited Financial Reports. |

| 5 | Years 2008 and 2013 refer to government transition periods because of elections in the country. |

| 6 | We use the square of the natural logarithm of total assets to check the non-linear relationship between size and profitability. The significant positive coefficients of assets and significant negative coefficients of assets-square affirm the inverted U-shape relationship between size and profitability. It indicates that an increase in the assets up to a certain level has a positive impact on the profitability, but after, hitting a certain level, a further increase in the assets adversely affects the bank’s performance (see Tables 7 and 8). |

| 7 | Government elections took place in the country during 2008 and 2013, therefore, value 1 was assigned to 2008–2009 (transition from Pakistan Muslin League-Quaid to Pakistan People’s Party, political parties in the country) and 2013–2014 (transition from Pakistan People’s Party to Pakistan Muslim League-Noon, political parties in the country) and 0 otherwise. This study intends to assess the impact of government change only rather changing in the political parties. |

| 8 | |

| 9 | Both loans to assets and investment to assets ratios of the banking industry were calculated from the available financial reports. |

| 10 | Authors can find the list of emerging and developed markets at https://www.msci.com/market-classification. |

| Sr. No | Name | Abb. | Data of Commencement | Assets (PKR‘000’) | Share (%) |

|---|---|---|---|---|---|

| 1 | Al-Baraka Bank (Pakistan) Ltd. | ABBPL | 06-04-2006 | 126,798,633 | 0.83 |

| 2 | Allied Bank Ltd. | ABL | 01-07-1974 | 1,069,614,408 | 6.97 |

| 3 | Askari Bank Ltd. | ASBL | 23-02-1992 | 619,139,193 | 4.03 |

| 4 | Bank Al-Habib Ltd. | BAHL | 21-12-1991 | 751,395,816 | 4.90 |

| 5 | Bank Al-Falah Ltd. | BAFL | 01-10-1992 | 917,457,053 | 5.98 |

| 6 | Bank Islami Pakistan Ltd. | BIPL | 13-03-2006 | 180,846,170 | 1.18 |

| 7 | Dubai Islamic Bank Pakistan Ltd. | DIBPL | 28-03-2006 | 152,133,399 | 0.99 |

| 8 | Faysal Bank Ltd. | FBL | 04-12-1994 | 444,464,661 | 2.90 |

| 9 | Habib Bank Ltd. | HBL | 25-08-1941 | 2,393,783,379 | 15.60 |

| 10 | Habib Metropolitan Bank Ltd. | HMBL | 26-10-2006 | 526,606,417 | 3.43 |

| 11 | JS Bank Ltd. | JSBL | 25-05-2006 | 264,700,493 | 1.72 |

| 12 | MCB Bank Ltd. | MCBL | 17-08-1948 | 1,051,813,681 | 6.85 |

| 13 | MCB Islamic Bank Ltd. | MBCIL | 15-10-2015 | 28,568,502 | 0.19 |

| 14 | Meezan Bank Ltd. | MBL | 28-03-2002 | 657,767,097 | 4.29 |

| 15 | NIB Bank Ltd. | NIBL | 02-10-2003 | 243,944,868 | 1.59 |

| 16 | SAMBA Bank Ltd. | SAMBL | 20-10-2008 | 101,414,491 | 0.66 |

| 17 | Silk Bank Ltd. | SILBL | 30-04-1995 | 135,033,822 | 0.88 |

| 18 | Soneri Bank Ltd. | SONBL | 17-02-1992 | 278,520,706 | 1.81 |

| 19 | Standard Chartered Bank (Pakistan) Ltd. | SCBPL | 30-12-2006 | 473,331,718 | 3.08 |

| 20 | Summit Bank Ltd. | SUMBL | 01-10-2007 | 215,022,348 | 1.40 |

| 21 | United Bank Ltd. | UBL | 09-11-1959 | 1,577,551,023 | 10.28 |

| 22 | National Bank of Pakistan | NBP | 08-11-1949 | 1,975,705,764 | 12.87 |

| 23 | The Bank of Punjab | BOP | 19-09-1994 | 545,214,131 | 3.55 |

| 24 | First Women Bank Ltd. | FWBL | 02-12-1989 | 18,520,564 | 0.12 |

| 25 | The Bank of Khyber | BOK | 19-09-1994 | 206,400,274 | 1.34 |

| 26 | Sindh Bank Ltd. | SBL | 14-12-2010 | 146,355,373 | 0.95 |

| 27 | Zarai Tarakiati Bank Ltd. | ZTBL | 18-02-1961 | 215,944,177 | 1.41 |

| 28 | Punjab Provincial Co-operative Bank Ltd. | PPCBL | 07-11-1955 | 19,173,591 | 0.12 |

| 29 | SME Bank Ltd. | SMEBL | 16-04-2005 | 9,378,215 | 0.06 |

| Total Assets | 15,346,599,967 |

| Banks Type | Obs. | ROA | ROE | NIM | PM |

|---|---|---|---|---|---|

| Mean of PCB | 200 | 5.3244 × 10−3 | 7.06965 × 10−2 | 4.36819 × 10−2 | 9.29 × 10−3 |

| Mean of GCB | 46 | 6.0281 × 10−3 | −8.533 × 10−4 | 3.77404 × 10−2 | 8.8675 × 10−3 |

| Diff. | −7.037 × 10−4 | 7.15499 × 10−2 ** | 5.9415 × 10−3 ** | 4.225 × 10−4 | |

| p-value | 4.01 × 10−1 | 3.10 × 10−2 | 2.10 × 10−2 | 4.56 × 10−1 | |

| Mean of ACB | 246 | 5.4559 × 10−3 | 5.73173 × 10−2 | 4.25709 × 10−2 | 9.211 × 10−3 |

| Mean of SB | 30 | −4.1319 × 10−3 | −7.35293 × 10−2 | 7.53001 × 10−2 | 1.759 × 10−3 |

| Diff. | 9.5879 × 10−3 *** | 1.308466 × 10−1 *** | −3.27292 ×10−2 *** | 7.452 × 10−3 * | |

| p-value | 6.0 × 10−3 | 2.0 × 10−3 | 0.000 | 6.1 × 10−2 |

| Variables | Notation | Description | Expected Results |

|---|---|---|---|

| DEPENDENT | |||

| Profitability | ROA | Profit after tax to average assets | |

| ROE | Profit after tax to average equity | ||

| NIM | Interest income—interest expense/average earning assets | ||

| Earning assets defined as investment, advances, lending to financial institutions | |||

| PM | Profit before tax to average assets | ||

| INDEPENDENT | |||

| Bank Specific | |||

| Size | SIZE | Logarithm of total assets | +/− |

| Solvency | SOLV | Total shareholder’s equity to total assets | + |

| Credit Quality | CQ | Loan loss provisions to net advances | − |

| Liquidity | LIQ | Total advances to total assets | +/− |

| Operational Efficiency | OE | Total operating expenses to gross income | − |

| Financial Structure | FS | Total deposits to total equity | +/- |

| Diversification | DIV | Non-interest income to gross income | +/− |

| Funding Cost | FC | Interest paid to average total deposits | − |

| Operating Cost | OC | Operating expense to average assets | + |

| Labor Productivity | LP | Gross income to average number of employees | + |

| Bank Type-Dummy | BTYPE | Equals to 1 if a bank is private owned and 0 otherwise. | +/− |

| Industry Specific | |||

| Industry Concentration | IC5 | total assets of largest five banks to total assets of all banks in study | − |

| Banking Sector Development | BSD | Assets of all banks to GDP | +/− |

| Market Power | MP | Herfindahl–Hirschman Index: calculated as the sum of squares of market shares of each bank | + |

| Macroeconomics Specific | |||

| Economic Growth | GDPR | GDP growth rate | + |

| Inflation | INF | Change in consumer price index rate | +/− |

| Government change-Dummy | GOV | Equal to 1 if the government transition (2008–2009 and 2013–2014) and 0 otherwise | − |

| Bank Specific Variables | Industry Specific Variables | Macroeconomics Variables | Dummy Variable | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Coef. | PV | Coef. | PV | Coef. | PV | Coef. | PV | ||||

| ROA | 272.7805 | 0.000 | BSD | 128.5578 | 0.000 | GDPR | 119.1902 | 0.000 | GOV | 105.9626 | 0.000 |

| ROE | 196.7962 | 0.000 | MP | 114.9365 | 0.000 | INF | 270.2735 | 0.000 | BTYPE | 103.8390 | 0.000 |

| NIM | 129.1156 | 0.000 | IC5 | 150.8416 | 0.000 | ||||||

| PM | 184.7018 | 0.000 | |||||||||

| SIZE | 120.3748 | 0.000 | |||||||||

| SIZE-SQ | 126.0141 | 0.000 | |||||||||

| SOLV | 160.0674 | 0.000 | |||||||||

| CQ | 155.5087 | 0.000 | |||||||||

| LIQ | 155.6284 | 0.000 | |||||||||

| FS | 97.1220 | 0.001 | |||||||||

| OE | 120.7618 | 0.000 | |||||||||

| DIV | 166.6954 | 0.000 | |||||||||

| FC | 139.4334 | 0.000 | |||||||||

| OC | 126.0168 | 0.000 | |||||||||

| LP | 119.4617 | 0.000 | |||||||||

| Variables | SIZE | SOLV | CQ | LIQ | FS | OE | DIV | FC | OC | LP | BTYPE | IC5 | BSD | MP | GDPR | INF | GOV |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SIZE | 1.00 | ||||||||||||||||

| SOLV | −0.48 | 1.00 | |||||||||||||||

| CQ | −0.44 | 0.20 | 1.00 | ||||||||||||||

| LIQ | −0.05 | 0.06 | −0.12 | 1.00 | |||||||||||||

| FS | 0.03 | −0.30 | 0.20 | −0.06 | 1.00 | ||||||||||||

| OE | −0.41 | 0.04 | 0.39 | −0.01 | 0.24 | 1.00 | |||||||||||

| DIV | 0.34 | −0.11 | −0.27 | 0.20 | −0.08 | −0.28 | 1.00 | ||||||||||

| FC | −0.29 | 0.20 | 0.21 | 0.27 | −0.10 | −0.04 | 0.17 | 1.00 | |||||||||

| OC | −0.58 | 0.44 | 0.47 | 0.11 | −0.03 | 0.65 | −0.20 | 0.22 | 1.00 | ||||||||

| LP | 0.64 | −0.40 | −0.30 | −0.37 | 0.01 | −0.30 | 0.24 | −0.25 | −0.50 | 1.00 | |||||||

| BTYPE | 0.32 | −0.37 | −0.35 | −0.03 | −0.02 | 0.00 | −0.01 | −0.35 | −0.17 | 0.24 | 1.00 | ||||||

| IC5 | −0.18 | 0.07 | 0.01 | 0.12 | −0.09 | 0.02 | 0.01 | 0.10 | 0.05 | −0.24 | 0.04 | 1.00 | |||||

| BSD | 0.06 | 0.01 | 0.00 | −0.05 | 0.10 | −0.08 | 0.35 | −0.19 | −0.09 | −0.01 | 0.03 | −0.15 | 1.00 | ||||

| MP | −0.25 | 0.09 | 0.01 | 0.34 | −0.09 | 0.02 | 0.03 | 0.13 | 0.08 | −0.34 | 0.06 | 0.67 | 0.06 | 1.00 | |||

| GDPR | 0.20 | −0.03 | −0.01 | −0.30 | 0.11 | −0.12 | 0.24 | −0.24 | −0.17 | 0.20 | 0.01 | −0.17 | 0.59 | −0.49 | 1.00 | ||

| INF | −0.10 | 0.04 | −0.01 | 0.28 | 0.04 | 0.03 | 0.05 | 0.01 | 0.03 | −0.16 | 0.03 | −0.20 | 0.23 | 0.52 | −0.33 | 1.00 | |

| GOV | −0.06 | 0.02 | −0.02 | 0.19 | −0.06 | −0.04 | −0.07 | 0.08 | 0.05 | −0.10 | 0.00 | 0.11 | −0.26 | 0.30 | −0.15 | 0.27 | 1.00 |

| Variables | TB | PCB | GCB | ACB | SB | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Obs. | Mean | SD | Obs. | Mean | SD | Obs. | Mean | SD | Obs. | Mean | SD | Obs. | Mean | SD | |

| ROA | 276 | 0.00 | 0.02 | 200 | 0.01 | 0.02 | 46 | 0.01 | 0.02 | 246 | 0.01 | 0.02 | 30 | −0.00 | 0.03 |

| ROE | 276 | 0.04 | 0.24 | 200 | 0.07 | 0.19 | 46 | −0.00 | 0.37 | 246 | 0.06 | 0.23 | 30 | −0.07 | 0.25 |

| NIM | 276 | 0.05 | 0.03 | 200 | 0.04 | 0.02 | 46 | 0.04 | 0.02 | 246 | 0.04 | 0.02 | 30 | 0.08 | 0.05 |

| PM | 276 | 0.01 | 0.02 | 200 | 0.01 | 0.02 | 46 | 0.01 | 0.02 | 246 | 0.01 | 0.02 | 30 | 0.00 | 0.04 |

| SIZE | 276 | 18.84 | 1.41 | 200 | 19.13 | 1.16 | 46 | 18.72 | 1.61 | 246 | 19.05 | 1.26 | 30 | 17.03 | 1.28 |

| SOLV | 276 | 0.13 | 0.12 | 200 | 0.10 | 0.06 | 46 | 0.11 | 0.05 | 246 | 0.10 | 0.06 | 30 | 0.34 | 0.22 |

| CQ | 270 | 0.17 | 0.37 | 198 | 0.10 | 0.08 | 45 | 0.12 | 0.07 | 243 | 0.10 | 0.08 | 27 | 0.83 | 0.94 |

| LIQ | 276 | 0.44 | 0.11 | 200 | 0.44 | 0.10 | 46 | 0.40 | 0.11 | 246 | 0.43 | 0.10 | 30 | 0.51 | 0.14 |

| FS | 276 | 9.88 | 16.37 | 200 | 9.76 | 6.01 | 46 | 10.53 | 10.52 | 246 | 9.91 | 7.05 | 30 | 9.68 | 46.07 |

| OE | 276 | 0.79 | 0.68 | 200 | 0.79 | 0.60 | 46 | 0.61 | 0.69 | 246 | 0.76 | 0.62 | 30 | 1.04 | 1.04 |

| DIV | 276 | 0.14 | 0.07 | 200 | 0.14 | 0.05 | 46 | 0.14 | 0.07 | 246 | 0.14 | 0.05 | 30 | 0.15 | 0.13 |

| FC | 276 | 0.09 | 0.10 | 200 | 0.07 | 0.02 | 46 | 0.07 | 0.03 | 246 | 0.07 | 0.03 | 30 | 0.26 | 0.23 |

| OC | 276 | 0.04 | 0.02 | 200 | 0.03 | 0.02 | 46 | 0.03 | 0.01 | 246 | 0.03 | 0.02 | 30 | 0.07 | 0.03 |

| LP | 276 | 5018.10 | 2393.09 | 200 | 5415.90 | 2204.37 | 46 | 5444.63 | 2205.80 | 246 | 5421.23 | 2200.16 | 30 | 1712.10 | 852.84 |

| IC5 | 276 | 0.54 | 0.01 | ||||||||||||

| BSD | 276 | 0.47 | 0.03 | ||||||||||||

| MP | 276 | 0.08 | 0.004 | ||||||||||||

| GDPR | 276 | 3.69 | 1.34 | ||||||||||||

| INF | 276 | 0.05 | 0.60 | ||||||||||||

| Variables | ROA | ROE | NIM | PM | ||||

|---|---|---|---|---|---|---|---|---|

| Bank Specific | Coef. | S.E | Coef. | S.E | Coef. | S.E | Coef. | S.E |

| DEPt−1 | 1.64389 × 10−1** | 8.010 × 10−2 | 5.57721 × 10−1 *** | 1.612 × 10−1 | 4.607633 × 10−1 *** | 7.930 × 10−2 | 1.384147 × 10−1 ** | 6.650 × 10−2 |

| SIZE | 1.203318 × 10−1 ** | 5.210 × 10−2 | 1.840871 *** | 4.708 × 10−1 | 8.50462 × 10−2 ** | 3.980 × 10−2 | 1.704171 × 10−1 *** | 5.570 × 10−2 |

| SIZE-SQ | −3.1109 × 10−3 ** | 1.200 × 10−3 | −4.79522 × 10−2 *** | 1.270 × 10−2 | −2.1508 × 10−3 ** | 1.000 × 10−3 | −4.3710 × 10−3 *** | 1.500 × 10−3 |

| SOLV | 3.24038 × 10−2 ** | 1.590 × 10−2 | 8.398323 × 10−1 ** | 3.313 × 10−1 | 4.02585 × 10−2 ** | 1.550 × 10−2 | 2.55279 × 10−2 * | 1.483 × 10−2 |

| CQ | −2.1073 × 10−2 *** | 7.000 × 10−3 | 3.53846 × 10−2 | 1.206 × 10−1 | 4.6932 × 10−3 | 1.130 × 10−2 | −1.8303 × 10−2 ** | 7.400 × 10−3 |

| LIQ | 9.6017 × 10−3 | 2.280 × 10−2 | −4.157695 × 10−1 | 4.829 × 10−1 | 4.31429 × 10−2 *** | 1.510 × 10−2 | −2.42537 × 10−2 | 1.870 × 10−2 |

| FS | 1.431 × 10−4 *** | 1.000 × 10−4 | −1.3521 × 10−3 | 9.000 × 10−4 | 8.5400 × 10−5 *** | 0.0000 | 4.7200 × 10−5 * | 0.0000 |

| OE | −6.9372 × 10−3 * | 3.600 × 10−3 | 4.8803 × 10−3 | 1.247 × 10−1 | −2.22978 × 10−2 *** | 5.700 × 10−3 | −9.2356 × 10−3 * | 5.000 × 10−3 |

| FC | −3.10499 × 10−2 | 4.200 × 10−2 | 1.447203 ** | 5.487 × 10−1 | −6.19842 × 10−2 * | 3.450 × 10−2 | −1.84158 × 10−2 | 5.060 × 10−2 |

| DIV | −2.70873 × 10−2 | 2.690 × 10−2 | −2.122629 ** | 9.574 × 10−1 | −6.68626 × 10−2 *** | 1.490 × 10−2 | −2.77043 × 10−2 | 2.360 × 10−2 |

| OC | 1.789608 × 10−1 ** | 8.440 × 10−2 | 7.984561 × 10−1 | 2.0353 | 9.104626 × 10−1 *** | 1.852 × 10−1 | 2.690379 × 10−1 ** | 1.218 × 10−1 |

| LP | 1.8400 × 10−6 *** | 0.000 | 6.01 × 10−5 ** | 0.000 | 1.4400 × 10−6 ** | 0.000 | 1.7800 × 10−6 * | 0.000 |

| BTYPE | −1.58954 × 10−2 * | 8.700 × 10−3 | 5.19982 × 10−2 | 7.330 × 10−2 | −2.7358 × 10−3 | 6.600 × 10−3 | −2.51173 × 10−2 ** | 1.000 × 10−2 |

| CONST. | −1.150425 ** | 4.828 × 10−1 | −17.63484 *** | 4.414 | −8.4619 × 10−1 | 3.872 × 10−1 | −1.619994 *** | 4.978 × 10−1 |

| Obs. | 232 | 245 | 223 | 229 | ||||

| Banks | 28 | 28 | 28 | 28 | ||||

| Instruments | 26 | 26 | 28 | 28 | ||||

| F-statistic | 32.61 *** | 306.27 *** | 99.89 *** | 18.34 *** | ||||

| AR(1) | −1.96 (0.051) | −2.15 (0.031) | −1.61 (0.108) | −1.93 (0.053) | ||||

| AR(2) | 0.66 (0.508) | −1.34 (0.180) | −1.36 (0.173) | −0.62 (0.537) | ||||

| Hansen-J | 15.29 (0.169) | 8.85 (0.636) | 10.99 (0.611) | 13.99 (0.374) | ||||

| C-statistics | 2.02 (0.569) | 0.69 (0.875) | 1.08 (0.783) | 3.34 (0.342) | ||||

| Variables | ROA | ROE | NIM | PM | ||||

|---|---|---|---|---|---|---|---|---|

| Coef. | S.E | Coef. | S.E | Coef. | S.E | Coef. | S.E | |

| DEPt−1 | −3.795144 × 10−1 | 2.8920 × 10−1 | −2.636452 × 10−1 | 3.5210 × 10−1 | 4.585008 × 10−1 ** | 2.0030 × 10−1 | −4.8449 × 10−1 | 2.8990 × 10−1 |

| SIZE | 1.996912 × 10−1 ** | 8.8600 × 10−2 | 5.245527 ** | 2.4598 | 1.075671 × 10−1 ** | 4.2200 × 10−2 | 2.947789 × 10−1 *** | 8.4000 × 10−2 |

| SIZE-SQ | −5.1308 × 10−3 ** | 2.3000 × 10−3 | −1.345323 × 10−1 ** | 6.3900 × 10−2 | −2.6682 × 10−3 ** | 1.1000 × 10−3 | −7.3953 × 10−3 *** | 2.1000 × 10−3 |

| SOLV | 6.36889 × 10−2 ** | 2.6000 × 10−2 | −5.60643 × 10−1 | 6.0780 × 10−1 | 8.9748 × 10−3 | 3.1100 × 10−2 | 5.17704 × 10−2 | 4.6100 × 10−2 |

| CQ | −1.22358 × 10−2 | 1.2400 × 10−2 | −8.047776 × 10−1 | 7.0390 × 10−1 | −3.1314 × 10−3 | 8.0000 × 10−3 | −3.5100 × 10−3 | 3.6700 × 10−2 |

| LIQ | 3.0923 × 10−2 | 3.0800 × 10−2 | −2.548268 | 2.0544 | 4.0041 × 10−2 | 4.0100 × 10−2 | −1.86794 × 10−2 | 7.3700 × 10−2 |

| FS | 2.6000 × 10−4 *** | 1.0000 × 10−4 | −4.5253 × 10−3 | 3.3000 × 10−3 | −8.4900 × 10−5 | 0.0000 | 1.954 × 10−4 ** | 1.0000 × 10−4 |

| OE | −2.42199 × 10−2 * | 1.4400 × 10−2 | 5.23202 × 10−2 | 3.8040 × 10−1 | −2.1116 × 10−3 | 8.9000 × 10−3 | −3.62225 × 10−2 ** | 1.8100 × 10−2 |

| FC | −9.66549 × 10−2 *** | 3.1900 × 10−2 | −3.994238 × 10−1 | 8.897 × 10−1 | −1.281034 × 10−1 ** | 5.5100 × 10−2 | −1.105473 × 10−1 | 7.3600 × 10−2 |

| DIV | 3.99372 × 10−2 | 7.900 × 10−2 | −4.85191 × 10−2 | 1.4731 | −2.7757 × 10−3 | 4.4800 × 10−2 | 1.068976 × 10−1 | 1.649 × 10−1 |

| OC | 8.553423 × 10−1 | 8.016 × 10−1 | 15.50088 | 13.3738 | 1.426004 ** | 5.2970 × 10−1 | 1.051571 ** | 4.472 × 10−1 |

| LP | 3.08 × 10−6 | 0.0000 | −1.71 × 10−5 | 0.0000 | 3.19 × 10−6 ** | 0.0000 | 6.34 × 10−6 | 0.0000 |

| BTYPE | −1.47927 × 10−2 | 1.1900 × 10−2 | −7.987422 × 10−1 * | 4.3470 × 10−1 | −1.49075 × 10−2 * | 7.9000 × 10−3 | −1.96613 × 10−2 * | 1.1000 × 10−2 |

| IC5 | −3.50603 * | 1.9145 | −139.6825 ** | 50.9736 | −1.747991 * | 9.0180 × 10−1 | −6.031554 ** | 2.3710 |

| BSD | −1.716065 * | 8.637 × 10−1 | −48.98037 *** | 16.3815 | −8.761173 × 10−1 ** | 3.1680 × 10−1 | −1.982288 * | 1.0083 |

| MP | 26.38733 * | 14.5382 | 704.9716 *** | 213.851 | 8.184816 | 5.0902 | 30.77849 *** | 9.4929 |

| GDPR | 4.89697 × 10−2 * | 2.7200 × 10−2 | 1.192715 *** | 3.9380 × 10−1 | 1.80814 × 10−2 ** | 8.4000 × 10−3 | 4.9927 × 10−2 *** | 1.6900 × 10−2 |

| INF | −2.5191 × 10−2 * | 1.3800 × 10−2 | −7.743261 × 10−1 ** | 3.8340 × 10−1 | −4.6112 × 10−3 | 8.700 × 10−3 | −4.27627 × 10−2 ** | 2.0600 × 10−2 |

| GOV | −7.82821 × 10−2 * | 4.3000 × 10−2 | −1.173972 *** | 4.1380 × 10−1 | −1.48819 × 10−2 * | 8.700 × 10−3 | −5.26827 × 10−2 *** | 1.7600 × 10−2 |

| CONST. | −1.521925 | 8.9930 × 10−1 | −11.29181 | 19.7902 | −4.771748 × 10−1 | 3.949 × 10−1 | −1.347636 | 1.4595 |

| Obs. | 236 | 233 | 230 | 223 | ||||

| Banks | 28 | 28 | 28 | 28 | ||||

| Instruments | 28 | 28 | 28 | 28 | ||||

| F-statistic | 14.77 *** | 13.37 *** | 389.71 *** | 15.12 *** | ||||

| AR(1) | −0.94 (0.345) | −1.56 (0.119) | −1.68 (0.092) | −1.16 (0.244) | ||||

| AR(2) | −1.61 (0.108) | −1.05 (0.294) | 0.14 (0.892) | −0.91 (0.363) | ||||

| Hansen-J | 4.76 (0.783) | 4.84 (0.775) | 5.87 (0.661) | 6.36 (0.607) | ||||

| C-statistics | 3.00 (0.392) | 1.30 (0.730) | 1.43 (0.699) | 4.31 (0.230) | ||||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yao, H.; Haris, M.; Tariq, G. Profitability Determinants of Financial Institutions: Evidence from Banks in Pakistan. Int. J. Financial Stud. 2018, 6, 53. https://doi.org/10.3390/ijfs6020053

Yao H, Haris M, Tariq G. Profitability Determinants of Financial Institutions: Evidence from Banks in Pakistan. International Journal of Financial Studies. 2018; 6(2):53. https://doi.org/10.3390/ijfs6020053

Chicago/Turabian StyleYao, Hongxing, Muhammad Haris, and Gulzara Tariq. 2018. "Profitability Determinants of Financial Institutions: Evidence from Banks in Pakistan" International Journal of Financial Studies 6, no. 2: 53. https://doi.org/10.3390/ijfs6020053

APA StyleYao, H., Haris, M., & Tariq, G. (2018). Profitability Determinants of Financial Institutions: Evidence from Banks in Pakistan. International Journal of Financial Studies, 6(2), 53. https://doi.org/10.3390/ijfs6020053