Abstract

In this study, we attempt to identify the asset which has the best hedging characteristics against inflation. We study stock, bond, commodity, real estate and oil indexes. We also study these indexes tracking exchange traded funds (ETFs) to determine the most beneficial tradable asset in addition to the more theoretical index for inflation hedging. We find that, in our sample, oil is the best hedge against inflation, even though three in total are a good hedge—oil, gold and corn—with corn and oil being complete hedges, while gold is a partial hedge. Two assets have conflicting results depending on whether we examine the index or the ETF: the real estate index is a hedge, whereas real estate ETF is the opposite of a hedge. Similarly, the bond index is not related to inflation, whereas bond ETF is the opposite of a hedge. We find that stocks, soy and beef are not hedges against inflation.

JEL Classification:

G10; G11

1. Introduction

In this study, we attempt to identify the asset which has the best hedging characteristics against inflation. We study stocks, bonds, gold, corn, soy, beef, real estate and oil as candidates for a perfect hedge against inflation. Considering that indexes now have tracking exchange traded funds (ETFs), we also study tracking ETFs to determine the most beneficial tradable asset in addition to the more theoretical index for inflation hedging.

Numerous studies have examined a variety of assets as a potential hedge against inflation and against movements of other assets. Baur and Lucey (2010) examine the hedging characteristics of gold relative to stocks and bonds in the US, UK and Germany. They find that, on average, gold is a good hedge and a safe haven for stocks. They define a hedge as “an asset that is uncorrelated or negatively correlated with another asset or portfolio on average. A strict hedge is (strictly) negatively correlated with another asset or a portfolio on average” They define a diversifier as “an asset that is positively (but not perfectly correlated) with another asset or portfolio on average” In addition, they define a safe haven as “an asset that is uncorrelated or negatively correlated with another asset or portfolio in times of market stress or turmoil”.

Bodie (1983) study commodities as a hedge against inflation. Ghosh et al. (2004) study the characteristics of gold hedging against inflation and find that gold is indeed a good inflation hedge over the long-term. A similar conclusion is reached by Worthington and Pahlavani (2007). Dempster and Artigas (2010) also study the hedging against inflation characteristics of gold and find that, in a portfolio optimization framework, adding gold is beneficial for hedging against inflation. Recently, Bampinas and Panagiotidis (2015a) study the hedging abilities of gold and silver and find that gold is a better hedge to inflation than silver in both the US and UK.

Reboredo (2013) examines the hedging characteristics of gold against oil. He finds that gold is not a good hedge against oil price movements but that it can be a safe haven against extreme oil price movements. Froot (1995) uses real assets in his study of portfolio hedging. A separate strand of the literature focuses on stocks as a hedge against inflation, such as studies by Alagidede and Panagiotidis (2010, 2012), who find that stocks are a good hedge against inflation in Africa and G7 countries. Bampinas and Panagiotidis (2016) find that individual stocks in the energy and industrial sectors tend to be a good hedge for inflation and also document that the hedging ability of stocks against after the Great Recession has diminished.

To the best of our knowledge, no comprehensive integrative study of stocks, bonds, gold, corn, soy, beef, real estate and oil as a hedge against inflation has been performed so far. We attempt to fill this void in the literature. We find that, in our sample, oil is the best hedge against inflation, even though three out of the eight assets in total are a good hedge: oil, gold and corn, with corn and oil being complete hedges, and gold being a partial hedge. This is consistent with the findings of Chua and Woodward (1982) that gold is a good hedge against inflation, even though they study a different time period—January 1975 to January 1980. Two assets have conflicting results depending on whether we examine the index or the ETF—real estate index is a hedge, whereas real estate ETF is the opposite of a hedge. Similarly, the bond index is not related to inflation, whereas bond ETF is the opposite of a hedge. We find that stocks, soy and beef are not hedges against inflation.

2. Methodology

Chua and Woodward (1982) study the hedging benefits of gold by using monthly and semiannual data in the period January 1975 to January 1980. They use the following regression model to determine if gold has hedging abilities:

where is the return on gold, is the inflation rate and is the error term. Thus, if gold is a hedge against inflation, the regression coefficient would be positive and statistically significant; otherwise it will not be a good hedge. If the coefficient is between zero and one that would indicate a partial hedge, if equal or above one gold would be a complete hedge. In addition to this single factor model Chua and Woodward (1982) decompose inflation into its expected and unexpected components. Therefore, they use the following additional model in their study:

where is the return on gold, is the expected inflation rate, is the unexpected inflation rate and is the error term.

3. Data

The analysis that we perform is on monthly data which comes from different sources. The S&P 500 data are from the Center for Research in Security Prices (CRSP) at the University of Chicago. The inflation and indexes data are from the St. Louis Fed Federal Reserve Economic Data (FRED), and the expected inflation data are from the Cleveland Fed. The indexes data span the period February 1989 to December 2016 whereas the ETF data span the period September 2011 to December 2016. Naturally, different indexes and ETFs have different starting points, but the samples that we study are equal and constrained by the length of the shortest index or ETF data availability period. This way we ensure the consistency of the results and hence comparability.

Table 1 provides descriptions of the studied indexes in Panel A and of studied ETFs in Panel B. The Spider ETF (with ticker SPY) tracks the same index as the one that we examine. The rest of the ETFs do not track the same index as the one that we examine due to lack of data because of the proprietary nature of the underlying indexes; however, the underlying index of the ETF and the examined index should be highly correlated. Keep in mind that the indexes that we study are theoretical constructs, which might not have a practical, tradable asset associated with them. The ETFs that we study are close substitutes. We use the following indexes in this study: S&P 500, BofA Merrill Lynch US Corp A Total Return Index Value, London Bullion Market (U.S. Dollars), global price of corn, global price of soybean meal, global price of beef, S&P/Case-Shiller U.S. National Home Price Index and crude oil prices from the West Texas Intermediate (WTI-Cushing, Oklahoma) index. The sources of data are listed in the same table. Most of the indexes data we obtain from the Federal Reserve.

Table 1.

Descriptions.

Table 2.

Summary statistics table.

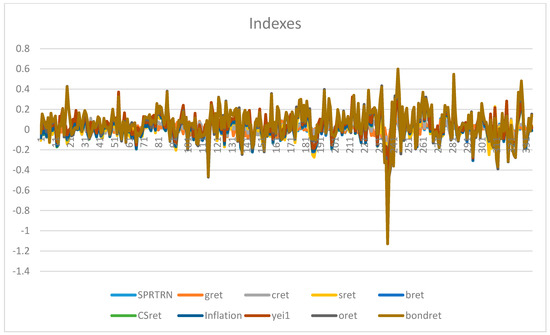

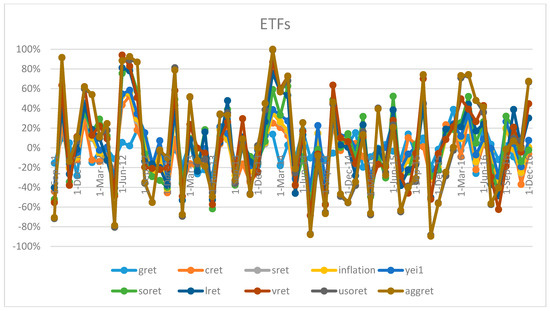

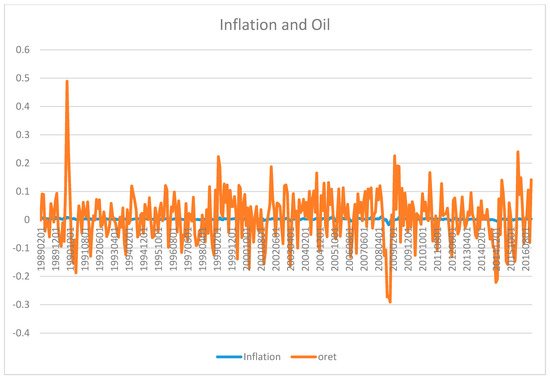

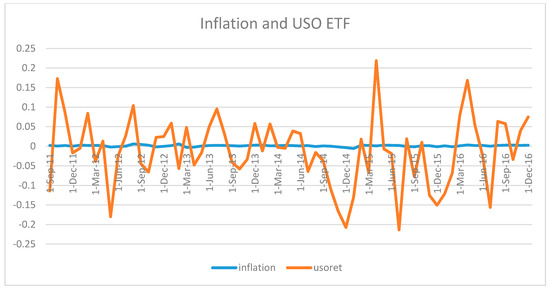

In addition to examining indexes, which is typical in the literature, we also examine ETFs, which track indexes. The reason for this is that indexes are theoretical constructs and as such are not necessarily easily tradable. It is true that index replication and futures contracts can be used, but replication is costly and not precise and futures contracts need to be constantly rolled-over. With ETFs, those issues are now resolved; you just buy the respective ETF in the same way as you would a common stock, and you have instant low-cost exposure to an index. We also use ETFs tracking indexes corresponding to the list of indexes above—SPDR S&P 500 ETF (ticker: SPY), iShares Core U.S. Aggregate Bond ETF (ticker: AGG), The Teucrium Corn Fund (ticker: CORN), The Teucrium Soybean Fund (ticker: SOYB), iPath Bloomberg Livestock Subindex Total ReturnSM ETN (ticker: COW), Vanguard REIT ETF (ticker: VNQ) and United States Oil Fund (ticker: USO). However, of those ETFs, only the SPY tracks the same index as above—the S&P 500 index. The rest track indexes that are different but close proxies to the list of indexes above. The reason that we do not use exactly the same indexes as the ETFs is because these ETFs track proprietary indexes, to which we do not have access as of the time of writing the paper. The indexes that we use are from the Federal Reserve and as such are close proxies for the indexes tracked by the ETFs. Even though not exact substitutes, they are widely used in the financial industry. Indexes and ETFs returns are presented visually in Figure 1, Figure 2, Figure 3 and Figure 4.

Figure 1.

Index returns graph.

Figure 2.

ETF returns graph.

Figure 3.

Inflation and oil index graph.

Figure 4.

Inflation and Oil ETF (with ticker USO) ETF graph.

ETFs can have different organizational structures. This is true for the ETFs that we study as well; some are structured as unit investment trusts (UIT), others as commodity pools, exchange traded notes (ETN) and open-end funds. ETNs are like bonds, commodity pools are based on derivative products and as such are governed by the CFTC rather than the SEC, which oversees UITs and open-end funds.

4. Analysis

Correlation coefficients are presented in Table 3. Panel A presents index correlation coefficients and Panel B presents ETF correlation coefficients. The indexes panel shows that corn and soy returns are 53% positively correlated, and for inflation only oil return is positively correlated with inflation with less than 50%; namely only 46%. The rest of the correlations are of magnitudes less than 10%, with the exception of the gold and soy correlation, which is 18%. The ETFs table shows similarly a slightly higher correlation of 70% between corn and soy, and 48% correlation between the bond ETF and the real estate ETF, but only 36% correlation between oil and inflation and 32% correlation between bond and gold ETFs. The rest of the correlations are of magnitudes less than 20%.

Table 3.

Correlation table.

Regression results are presented in Table 4 and Table 5. Table 4 presents regression results based on Equation (1) whereas Table 5 presents results based on Equation (2).

Table 4.

Regression results table.

Table 5.

Regression results, expected and unexpected inflation.

The results based on Equation (1) and indexes suggest that only corn and oil indexes seem to provide a complete hedge against inflation with a regression coefficient of more than one that is statistically significant. The regression coefficient of gold and real estate are also statistically significant but less than one, which signals partial hedge of inflation of real estate. The regression coefficients of the S&P 500 index, bond, soy and beef are not statistically significant. To put things in perspective, these coefficients could have been statistically significant and negative, which would have indicated an opposite to a hedge to inflation characteristic. At least they are not different from zero, which signals the independence of these indexes from inflation, which could be used in investments for hedging as well.

The results also based on Equation (1) but, for ETFs, suggest that only oil is a hedge against inflation, because of the statistically significant and positive regression coefficient. Real estate and bonds also have a statistically significant coefficient, but it is negative, which suggests that these ETFs are the opposite of a hedge against inflation. The rest of the coefficients are not statistically different from zero.

The reason for the difference in results for indexes and ETFs could be due to the fact that the time periods of the examined samples are different. We have less available data for ETFs since they were introduced recently, whereas indexes have much longer time periods. Another reason for the differing results could be due to the slight difference in the underlying indexes of ETFs relative to the examined indexes. The reason we did not use the exact same indexes is lack of data on the ETFs underlying indexes because of their proprietary nature.

The regression results based on Equation (2) yield results which indicate that only the regression coefficients for beef indexes and ETF are statistically different from zero only for unexpected inflation, thus suggesting a good hedge against unexpected inflation. The S&P 500 and bond indexes have a statistically significant coefficient for unexpected inflation but it is negative, which indicates that the S&P 500 and bond indexes are a poor hedge against unexpected inflation.

Overall, oil seems to be the best hedge against inflation, even though three in total are a good hedge: oil, gold and corn, with corn and oil being complete hedges, and gold being a partial hedge. This is consistent with the findings of Bampinas and Panagiotidis (2016) that energy stocks are a good hedge against inflation. This is also not surprising, as pointed out by Bampinas and Panagiotidis (2015b) who show that, before the recent financial crisis period, oil spot price changes cause gold spot price changes, whereas after the crisis period this effect seems to have weakened.

5. Robustness Tests

Considering that the data in this study span the period February 1989 to December 2016 for indexes and the period September 2011 to December 2016 for ETFs, it is natural to perform additional tests to ascertain the robustness of the results. The first test that we perform is based on synchronizing the data periods, i.e., we perform the same analysis on index but for the shorter, after Great Recession period, which we study for ETFs. These results are presented in Table 6 and Table 7.

Table 6.

Regression results table: indexes, September 2011 to December 2016.

Table 7.

Regression results: expected and unexpected inflation, indexes, September 2011 to December 2016.

Table 6 shows that, among the indexes, only bonds, soy and oil have statistically significant regression coefficients. The coefficients for the same time period are significant for bonds, real estate and soy and they have the same sign as the index regression coefficients indicating robustness of results.

Table 7 shows regression results based on Equation (2) when the indexes data period is matched with the ETFs data period. These results show that stocks, gold, corn and real estate expected inflation regression coefficients are statistically significant, and beef’s unexpected regression coefficient is significant. In the ETF sample, only stock ETF expected inflation and beef unexpected regression coefficients are statistically significant. A reason for the diffference could be the use of different underlying index for the ETF than what we use for the index analysis, since ETFs underlying index are proprietary. Nevertheless, the signs of the coefficients are the same, which provides proof for the robustness of the results.

6. Conclusions

In this study, we attempt to identify the asset which is the best hedge against inflation. The assets that we study are stocks, bonds, commodities, real estate and oil indexes and their corresponding ETFs to determine the most beneficial tradable asset in addition to the more theoretical index asset for inflation hedging in the period February 1989 to December 2016 for indexes and September 2011 to December 2016 for ETFs.

We find that, out of the eight studied assets, oil is the best hedge against inflation, even though three in total are a good hedge: oil, gold and corn, with corn and oil being complete hedges, and gold being a partial hedge. This is consistent with the findings of Chua and Woodward (1982) and Bampinas and Panagiotidis (2016). Chua and Woodward (1982) find that gold is a good hedge against inflation, even though in a different time period—January 1975 to January 1980. Bampinas and Panagiotidis (2016) document that energy stocks are a good hedge against inflation. Two have conflicting results depending on whether we examine the index or the ETF—the real estate index is a hedge, and real estate ETF is the opposite of a hedge. Similarly, the bond index is not related to inflation, whereas bond ETF is the opposite of a hedge. We find that stocks, soy and beef are not hedges against inflation.

Acknowledgments

The author would like to acknowlege the support of Nancie Fimbel.

Conflicts of Interest

The author declares no conflict of interest.

References

- Alagidede, Paul, and Theodore Panagiotidis. 2010. Can common stocks provide a hedge against inflation? Evidence from African countries. Review of Financial Economics 19: 91–100. [Google Scholar] [CrossRef]

- Alagidede, Paul, and Theodore Panagiotidis. 2012. Stock returns and inflation: Evidence from quantile regressions. Economics Letters 117: 283–86. [Google Scholar] [CrossRef]

- Bampinas, Georgios, and Theodore Panagiotidis. 2015a. Are gold and silver a hedge against inflation? A two century perspective. International Review of Financial Analysis 41: 267–76. [Google Scholar] [CrossRef]

- Bampinas, Georgios, and Theodore Panagiotidis. 2015b. On the relationship between oil and gold before and after financial crisis: Linear, nonlinear and time-varying causality testing. Studies in Nonlinear Dynamics & Econometrics 19: 657–68. [Google Scholar]

- Bampinas, Georgios, and Theodore Panagiotidis. 2016. Hedging inflation with individual US stocks: A long-run portfolio analysis. The North American Journal of Economics and Finance 37: 374–92. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Brian M. Lucey. 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review 45: 217–29. [Google Scholar] [CrossRef]

- Bodie, Zvi. 1983. Commodity futures as a hedge against inflation. The Journal of Portfolio Management 9: 12–17. [Google Scholar] [CrossRef]

- Chua, Jess, and Richard S. Woodward. 1982. Gold as an inflation hedge: A comparative study of six major industrial countries. Journal of Business Finance & Accounting 9: 191–97. [Google Scholar]

- Dempster, Natalie, and Juan Carlos Artigas. 2010. Gold: Inflation hedge and long-term strategic asset. The Journal of Wealth Management 13: 69–75. [Google Scholar] [CrossRef]

- Froot, Kenneth A. 1995. Hedging portfolios with real assets. The Journal of Portfolio Management 21: 60–77. [Google Scholar] [CrossRef]

- Ghosh, Dipak, Eric J. Levin, Peter Macmillan, and Robert E. Wright. 2004. Gold as an inflation hedge? Studies in Economics and Finance 22: 1–25. [Google Scholar] [CrossRef]

- Reboredo, Juan C. 2013. Is gold a hedge or safe haven against oil price movements? Resources Policy 38: 130–37. [Google Scholar] [CrossRef]

- Worthington, Andrew C., and Mosayeb Pahlavani. 2007. Gold investment as an inflationary hedge: Cointegration evidence with allowance for endogenous structural breaks. Applied Financial Economics Letters 3: 259–62. [Google Scholar] [CrossRef]

© 2017 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).