1. Not Clockwork: A Short History of the Short-Lived Swiss Franc Peg

The objective of this paper is three-fold. We describe the events surrounding the decision by the Swiss National Bank to remove the peg between the Swiss franc and the euro. Next, we analyse the reasons behind the creation of the peg. Then, we discuss the short- and long-term consequences of the peg’s elimination.

The Swiss National Bank (SNB) pegged the Swiss franc (CHF) to the euro at 1.20 in 2011, thereby tracking the euro in its moves against all other currencies. The peg was adopted in the midst of the European debt crisis as the Swiss currency experienced massive safe haven inflows. These flows of funds were both threatening the competitiveness of the Swiss economy and creating significant asset bubbles within Switzerland, notably property. In pegging, the Swiss moved away from merely intervening in the exchange the rate to a formal target. However, in either case, it significantly expanded their balance sheet.

This was a pledge to buy Swiss francs at that rate even in the face of a growing desire to sell euros, which, unpegged, would have driven the euro rate down. In essence, this meant that the SNB was pledging to printing Swiss francs on demand. This policy led to the SNB holding large balances of other currencies. According to

Table 1, the SNB “lost” about CHF 78 billion, which is about 12% of the Swiss GDP. They made some CHF 38 billion during 2014.

Table 1.

Approximate loss of the Swiss National Bank (SNB) in two days following the lifting of the peg.

Table 1.

Approximate loss of the Swiss National Bank (SNB) in two days following the lifting of the peg.

| Currency | USD | EUR | JPY | GBP | CAD | Other | Total |

|---|

| Amount at 31 December | 148,356 | 196,574 | 4,736,156 | 22,138 | 24,482 | 32,006 | |

| (in millions of foreign currency) |

| CHF Equivalent at 31 December | 147,214 | 236,360 | 39,310 | 34,223 | 20,950 | 32,006 | 510,063 |

| (in millions of CHF) |

| % of Currency Reserves | 28.86% | 46.34% | 7.71% | 6.71% | 4.11% | 6.27% | 100.00% |

| FX Rate 14 January | 1.0187 | 1.2010 | 0.0087 | 1.5519 | 0.8524 | 1.0000 | |

| FX Rate 16 January | 0.8587 | 0.9941 | 0.0073 | 1.3016 | 0.7168 | 0.8500 | |

| FX Return | −15.71% | −17.22% | −15.92% | −16.13% | −15.91% | −15.00% | |

| MTM Gain/Loss (in CHF millions) | | | | | | | |

Article 5 of the

Federal Act on the Swiss National Bank [

2] sets the mandate of the SNB. Its essential task is to pursue a monetary policy serving the interests of the country as a whole and to ensure price stability, with a view to contributing to the economic development of the federation.

The SNB also has a unique ownership structure compared to most other central banks: about 55% of the SNB’s shares are held by public institutions, such as cantons, while the remaining 45% are openly traded on the stock market. The shareholders have very limited rights and the dividends they receive are effectively capped by law. Effectively, the shares are closer to preferred shares than to common stocks.

Central bank reserve accumulation tends to be negative for its returns, since it has to effectively take on a negative carry or accept the risk of future losses. If the accumulation were the main reason why CHF was staying weak at some point, it would have to take losses.

Moreover, the recent gold referendum (even though it failed) was a sign that the political costs of expanding the balance sheet had increased and that the Swiss public might not have been happy about an increase in the fiscal cost of keeping the floor. A sharper move of the European Central Bank (ECB) toward quantitative easing (QE), a return of the Eurozone (EZ) crisis in the name of Greece-or Russia-related uncertainties, effectively could put pressure on the exchange rate and, thus, require it to expand its balance sheet even more by buying a lot of euros.

The initial aim of the EUR/CHF floor/peg was to stem a further appreciation of the CHF, which was being buffeted by capital inflows during the euro crisis and more recently. However, the fact that the Swiss were questioning the effectiveness of the peg made the political costs of maintaining the peg too high to bear.

Arguably, Switzerland is not the only country directly exposed to the variation of the euro and to fundamental changes in the ECB’s policies. Denmark, whose krone is pegged to the euro

1, was forced to cut interest four times in just 18 days to defend the fixed exchange rate. The last move, on 5 February 2015, made the headline by slashing the Danmarks Nationalbank’s interest rate on certificates of deposit by 0.25% points to a negative interest rate of −0.75%. In an effort to defend the peg, the central bank’s currency reserves have soared between two-thirds and more than 100% in recent months. They now amount to more than USD 110 billion, which is about one third of Denmark’s 2014 GDP

2.

The Swiss policy is a form of QE. Instead of printing money directly, the central bank committed to buying euros in order to weaken the CHF. This type of policy may be tempting for small countries with an open economy, such as Switzerland. Ultimately, the costs of such a strategy were deemed too great. Now, the SNB is relying on negative interest rates (−0.75%) to try to weaken CHF vs. EUR. It is not clear if this will be effective. Moreover, there could be much collateral damage if investors avoid putting on any hedges since they trusted the floor and policy.

To be fair, the SNB did a poor job of managing expectations, and the risk is that they will end up having made a policy mistake since they are even more mired in deflation, but we should not undercount the political pressures.

If the SNB were just focused on reflationary policies, they would have implemented policies that yield a weaker exchange rate. What surprised market actors was the fact that if anything with US$/EUR moving so much in anticipation of ECB QE and the weaker oil price adding to global/European deflationary trends, the EUR/CHF should have weakened.

In early February, the SNB unofficially began targeting an exchange rate corridor of 1.05–1.10 CHF/euro. The bank was willing to incur losses of a further CHF 10 billion over a period of time that they did not specify. This was another non-transparent action by the SNB. However, it amounts to a revaluation of the Swiss franc by 10%–15%.

2. Why Did the SNB Start the Peg, and Why Did They Eliminate It?

Why they did it: The peg was installed on 6 September 2011 (Swiss National Bank, 2011) . The trigger for the SNB’s decision to end the peg so precipitously, following an earlier announcement in the same week that they were maintaining it, was probably the ECB’s hints that it was ready to announce a large-scale program of quantitative easing to attempt to move the Eurozone out of deflation. Indeed, the ECB officially announced the details of its QE programme on 22 January 2015, one week exactly after Switzerland removed its peg. The programme calls for a € 60 billion monthly bond purchase, totalling about € 1 trillion to start in March 2015 until September 2016.

Could the SNB have eliminated the peg gradually? We do not think so. They could have announced it over a weekend to soften the blow, but the final effect would have been similar.

The peg was effectively fixed at 1.20. Hong Kong is in a similar situation, as its currency is pegged to the US$.

During the Asian financial crisis, the Hong Kong Monetary Authority (HKMA) was among the first central banks to engage in quantitative easing. The HKMA was willing to expand its balance sheet massively, including by purchasing local equity.

Both Hong Kong and Switzerland have small economies with the peg against a much larger economy. Both have been affected by the larger economy’s monetary policy. Both are financial centres. This situation can result in shocks. In the case of Hong Kong, the attempt to balance between the U.S. and China will complicate the maintenance of the peg over the longer term. For Switzerland, the shock was the prospect of the ECB’s QE. Krugman [

3] argues that the situations of Switzerland and Hong Kong are different: “the institutional setup and history of Hong Kong plays very differently with the hard-money ideology than the Swiss peg did ….” Hong Kong has a currency board to maintain the peg, and the HKMA does not have the mixed ownership structure of the SNB. The Swiss could have maintained the peg forever, but it was nagging from hard money types that led to the change in priority. The Swiss currency intervention was the result of a huge expansion of the central bank’s balance sheet and printing money, even if the goal was to keep it from getting stronger.

3. How Does Quantitative Easing Work, and What Are Its Costs and Benefits?

To see why talks about an ECB-led quantitative easing programme most probably delivered the final blow to the Swiss peg, we need to understand how quantitative easing works and what its effects have been so far.

Although quantitative easing is new in the Eurozone, it has been used for more than six years in the U.S. The track record of QE in the U.S. is chequered at best. QE managed to reflate asset markets while failing to support final demand and pushing investors into higher yielding assets. According to Sandra Schwartz [

4]:

We have been sold a bill of goods on quantitative easing. It is not a new monetary policy, but a variant, only the Instruments are different—buying up the debt of banks and others rather than buying up government debt.

With quantitative easing, all economic policy has been placed on the shoulders of monetary policy and this has been very indirect and has led primarily to an asset bubble.

With fiscal policy, that is running a government deficit, goods and services are are bought directly and the quantitative easing happens when the bank buys the debt that the government has created to facilitate it. When there is unemployment this does not crowd out private investment but gets the economy moving. It could build infrastructure that directly will later help private investment. As it is directly spent on goods and services, it does not create an asset bubble but it creates jobs, employment and income.

The U.S. took an approach to stimulate the economy and not have austerity measures imposed on the companies and people. This has led to a robust economy and a stock market up three times since the 6 March low.

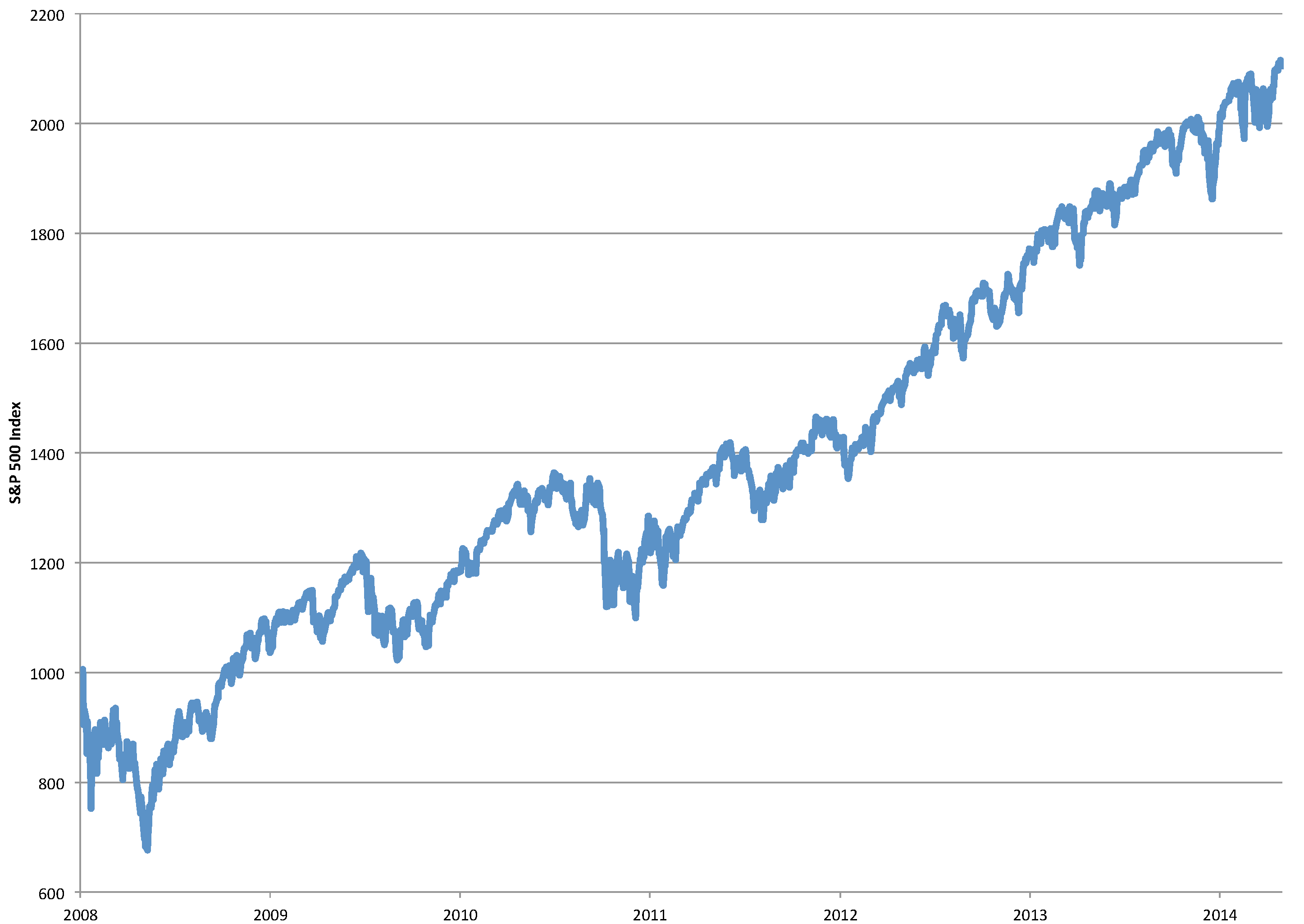

Figure 1 displays the evolution of the S&P 500 since the start of QE 1 in late November 2008. The level of the S&P 500 has increased by 140% between 15 November 2008 and 28 February 2015. At the time of writing, the Federal Reserve has stopped purchasing assets. The Federal Reserve now faces the decision of how to deal with a balance sheet worth US$4 trillion: should it start unwinding its positions or simply wait until the bonds it has purchased mature? Neither exit strategy is expected to cause much trouble on the financial markets.

Figure 1.

Effect of quantitative easing on the U.S. equity market: evolution of the S&P 500 between 15 November 2008 and 28 February 2015.

Figure 1.

Effect of quantitative easing on the U.S. equity market: evolution of the S&P 500 between 15 November 2008 and 28 February 2015.

On the other hand, Europe faces a complex situation with more players. Europe took a different route: austerity. This has caused trouble in many places, pushing unemployment among the youths to between 25% and 50%. The worst case is Greece, and in 2015, we had trouble. The 60 billion per month of some 1.2 trillion bond buying will have to delicately balance inflation and deflation. A serious negotiation is set to take place between Germany, who, as a major exporter, benefits from a situation where the Eurozone does not implode, and Greece, who cannot continue with the heavy austerity. While both countries have vastly different political and economic structures, they both benefit from a weaker euro. Therefore, a political compromise was ironed out, but the states and a quantitative easing sponsored by the European Central Bank are coming at the same time to the Eurozone. With the euro weakening, the anticipation of a sharp increase of foreign capital flowing into Switzerland triggered the Swiss currency move.

The real problem with quantitative easing in the U.S. and Europe is where the money goes: to banks, whereas channelling it to people would be more effective. The expectation has been that banks would reorientate toward their historical financial intermediation role after the credit crisis of 2007–2009. Chuptka [

5], following Peter Schiff of euro Capital, argues, as we to do, that unemployment is the key problem.

4. The Currency Moves

Currencies tend to trend and reverse sharply. A typical example is the US$/EUR from 2002–2007 when the euro gradually fell until it sharply reversed. The trade to sell puts out of the money on the US$/EUR exchange rate was very successful, but it ended badly when the currency turned. For example, puts that were two cents one day, four cents the next day and then 28 cents the next, ended up at $4.

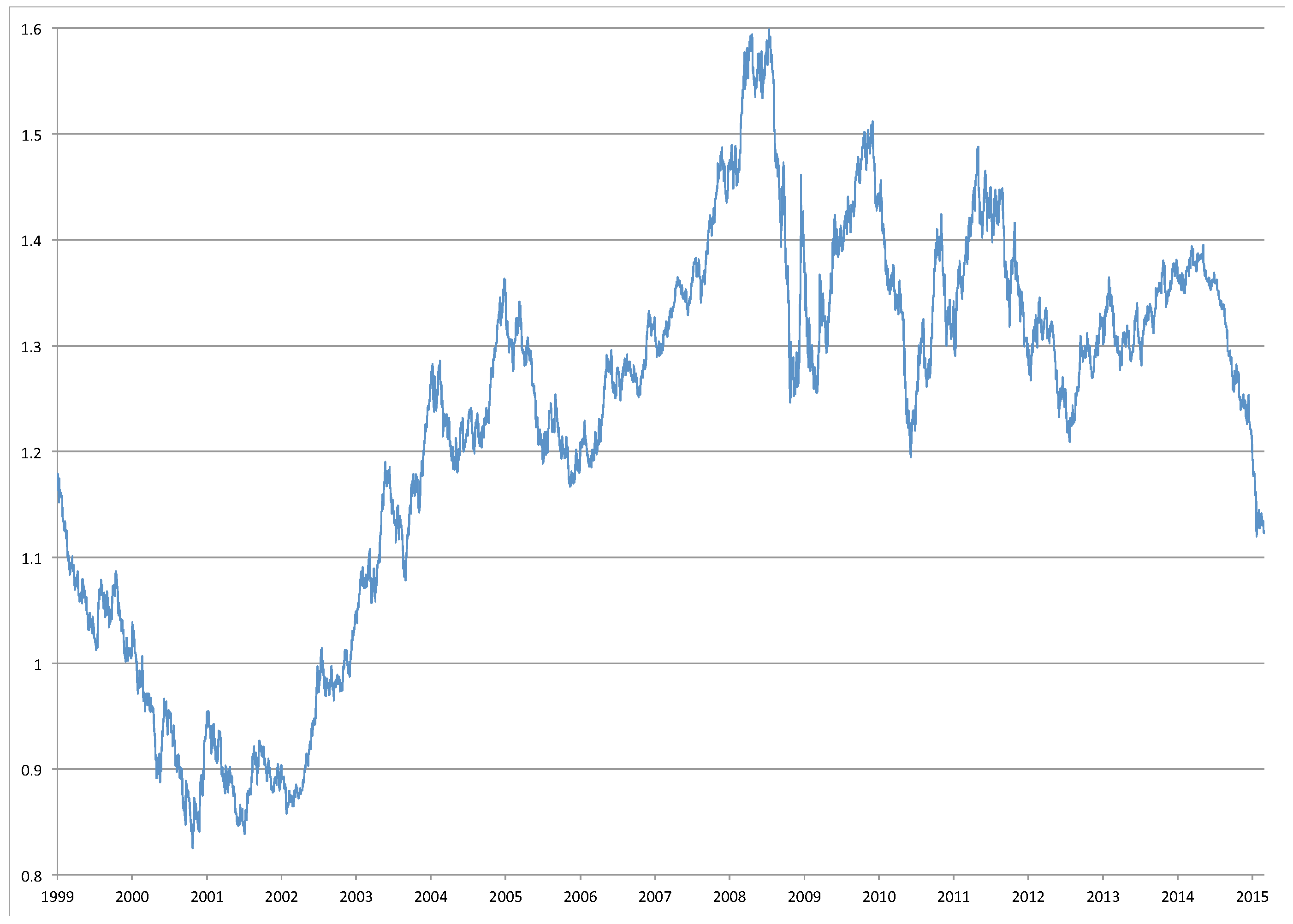

Figure 2 shows the euro exchange rate from its start on 1 January 1999 to the end of February 2015. Physical euro coins and banknotes came in use across the Eurozone on 1 January 2002. Currently, the Eurozone includes the following 19 of the 28 member states of the European Union: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

Figure 2.

The US$/EUR exchange rate from 1 January 1999–2 March 2015. The euro became an effective currency on 1 January 2002 when the first coins and banknotes started circulating (closing EUR/USD rate on 31 December 2001 = 0.9038; source: European Central Bank (ECB) [

6]).

Figure 2.

The US$/EUR exchange rate from 1 January 1999–2 March 2015. The euro became an effective currency on 1 January 2002 when the first coins and banknotes started circulating (closing EUR/USD rate on 31 December 2001 = 0.9038; source: European Central Bank (ECB) [

6]).

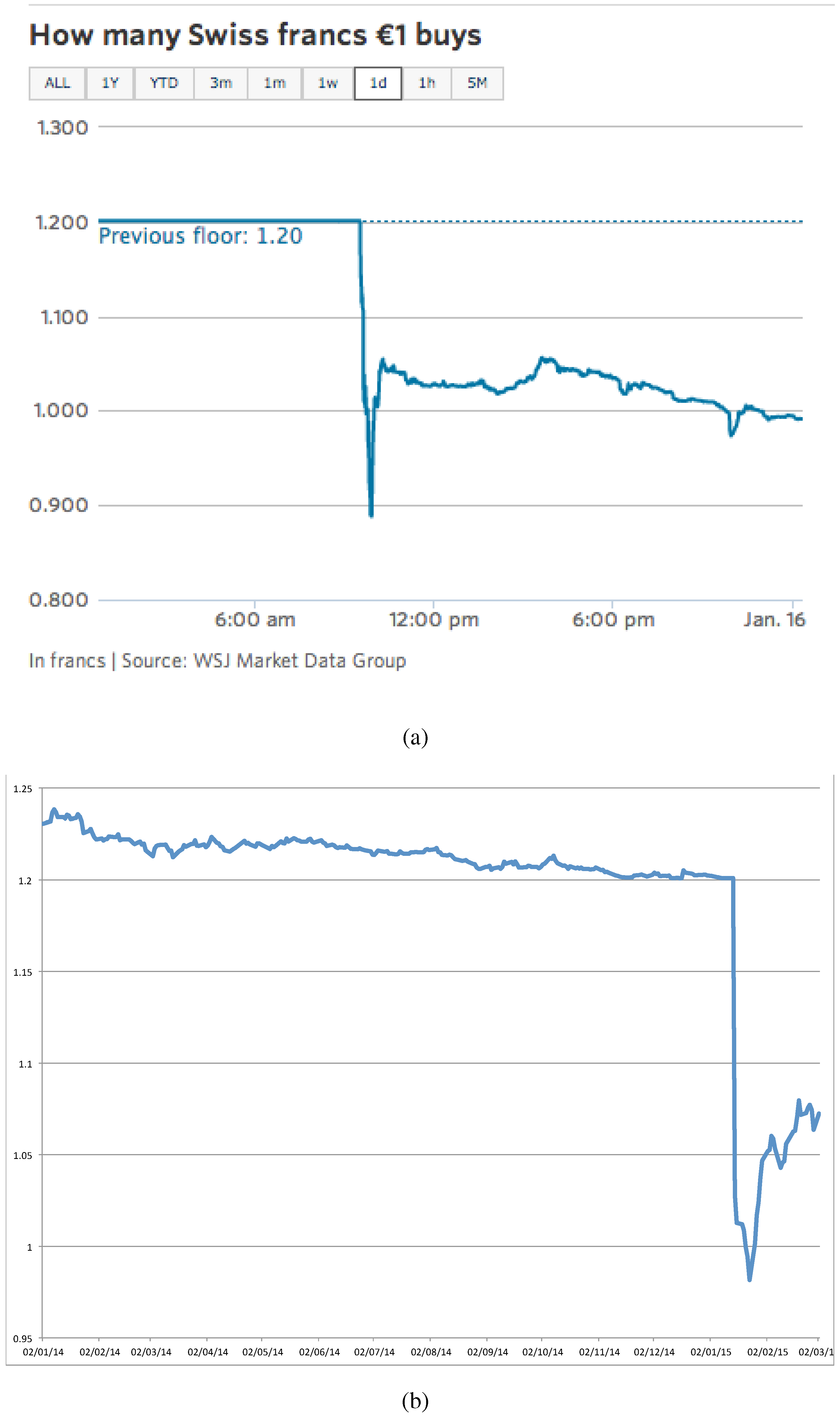

Usually, currencies move 0.5%–1% or even 2% per day on a large move. The SNB’s drop of the peg caused an immediate 39% increase in the CHF

vs. the EUR. See the 15 January 2015 move in

Figure 3.

Figure 3.

Swiss franc U-turn. (

a) One-day move in the CHF/EUR exchange rate on 15 January 2015. (

b) Evolution of the CHF/EUR from 1 January 2014, to 2 March 2015 (source: ECB [

6]).

Figure 3.

Swiss franc U-turn. (

a) One-day move in the CHF/EUR exchange rate on 15 January 2015. (

b) Evolution of the CHF/EUR from 1 January 2014, to 2 March 2015 (source: ECB [

6]).

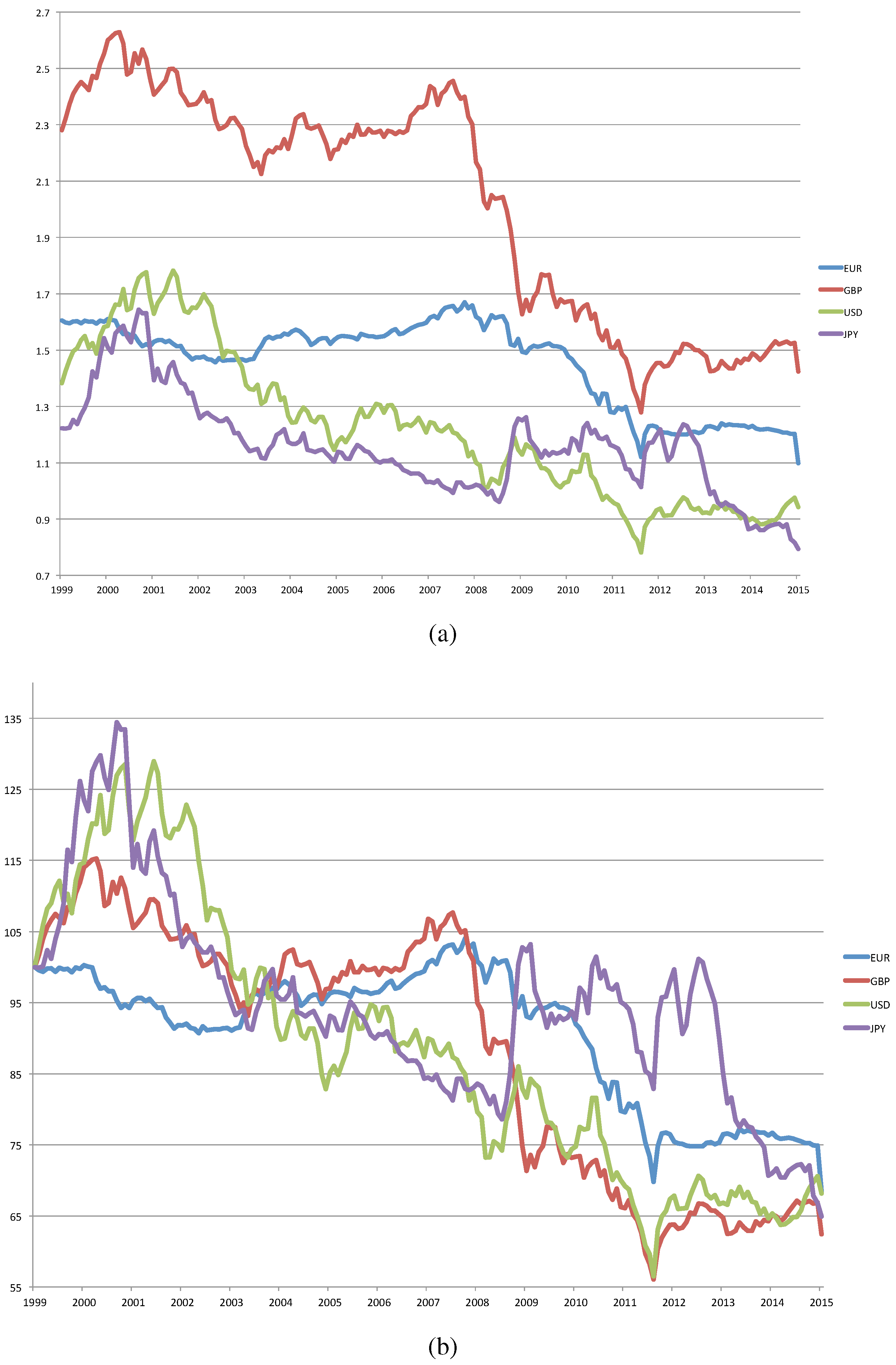

Figure 4 displays the evolution of the Swiss franc against the four major currencies: euro (EUR), British pound (GBP), U.S. dollar (US$) and Japanese yen (JPY).

Figure 4.

Swiss franc U-turn: evolution of the Swiss franc against major international currencies. (

a) Evolution of the CHF against major international currencies from 1 January 1999–28 February 2015 (exchange rate; source: SNB [

7]); (

b) Evolution of the CHF against major international currencies from 1 January 1999–8 February 2015 (index value = 100 on 1 January 1999).

Figure 4.

Swiss franc U-turn: evolution of the Swiss franc against major international currencies. (

a) Evolution of the CHF against major international currencies from 1 January 1999–28 February 2015 (exchange rate; source: SNB [

7]); (

b) Evolution of the CHF against major international currencies from 1 January 1999–8 February 2015 (index value = 100 on 1 January 1999).

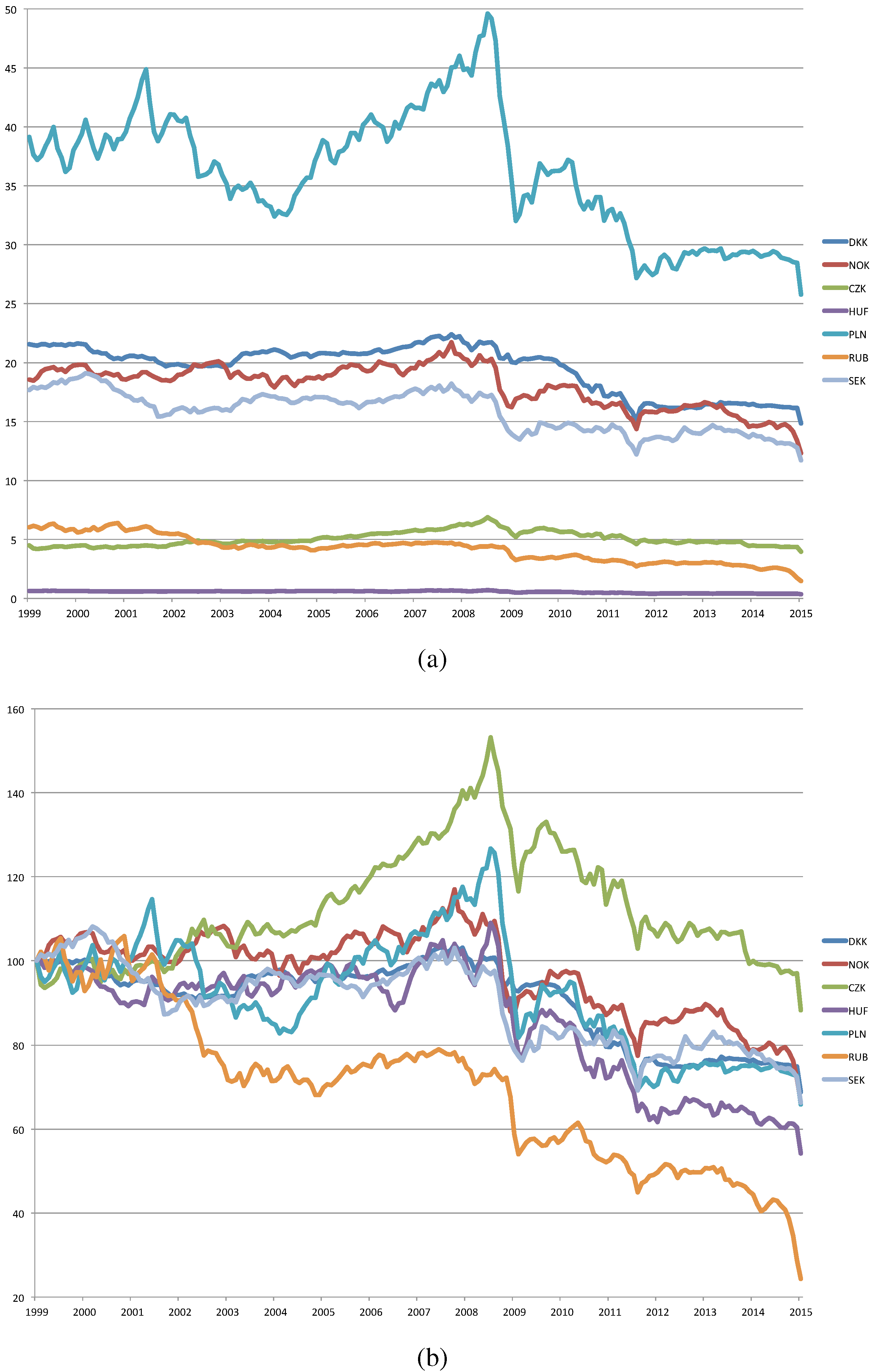

Figure 5 shows the evolution of the Swiss franc against the other European currencies: Danish krone (DKK), Norwegian krone (NOK), Czech koruna (CZK), Hungarian forint (HUF), Polish zloty (PLN), Russian ruble (RUB) and Swedish krona (SEK).

Figure 5.

Swiss franc U-turn: evolution of the Swiss franc against other European currencies. (

a) Evolution of the CHF against other European currencies from 1 January 1999–28 February 2015 (exchange rate; source: SNB [

7]); (

b) Evolution of the CHF against other European currencies from 1 January 1999–28 February 2015 (index value = 100 on 1 January 1999).

Figure 5.

Swiss franc U-turn: evolution of the Swiss franc against other European currencies. (

a) Evolution of the CHF against other European currencies from 1 January 1999–28 February 2015 (exchange rate; source: SNB [

7]); (

b) Evolution of the CHF against other European currencies from 1 January 1999–28 February 2015 (index value = 100 on 1 January 1999).

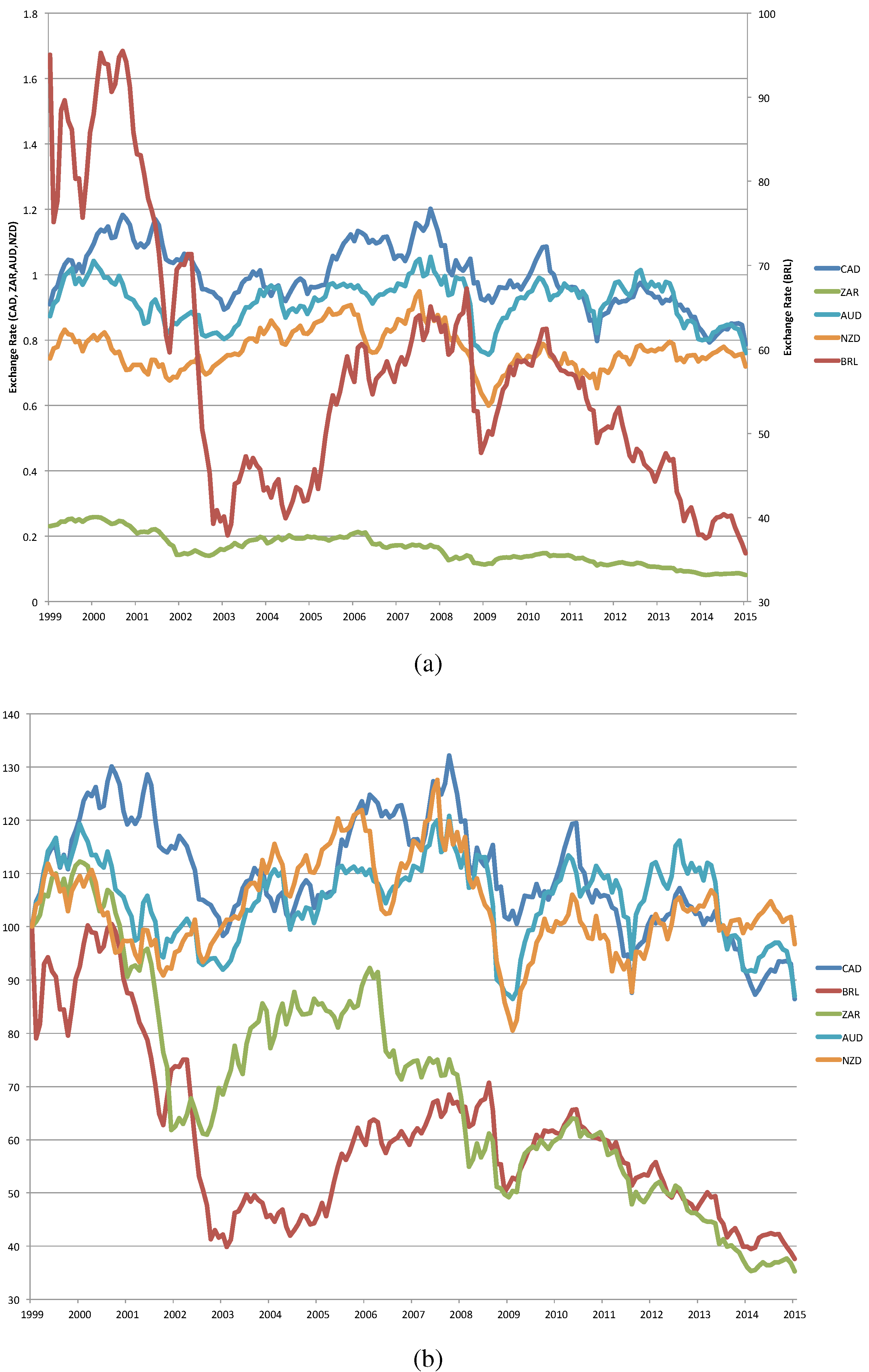

Figure 6 shows the evolution of the Swiss franc against the currencies of commodity-producing countries: Canadian dollar (CAD), Brazilian real (BRL), South African rand (ZAR), Australian dollar (AUD) and New Zealand dollar (NZD).

Figure 6.

Swiss franc U-turn: evolution of the Swiss franc against other European currencies. (

a) Evolution of the CHF against the currencies of commodity-producing countries from 1 January 1999–28 February 2015 (exchange rate; source: SNB [

7]); (

b) Evolution of the CHF against the currencies of commodity-producing countries from 1 January 1999–28 February 2015 (index value = 100 on 1 January 1999).

Figure 6.

Swiss franc U-turn: evolution of the Swiss franc against other European currencies. (

a) Evolution of the CHF against the currencies of commodity-producing countries from 1 January 1999–28 February 2015 (exchange rate; source: SNB [

7]); (

b) Evolution of the CHF against the currencies of commodity-producing countries from 1 January 1999–28 February 2015 (index value = 100 on 1 January 1999).

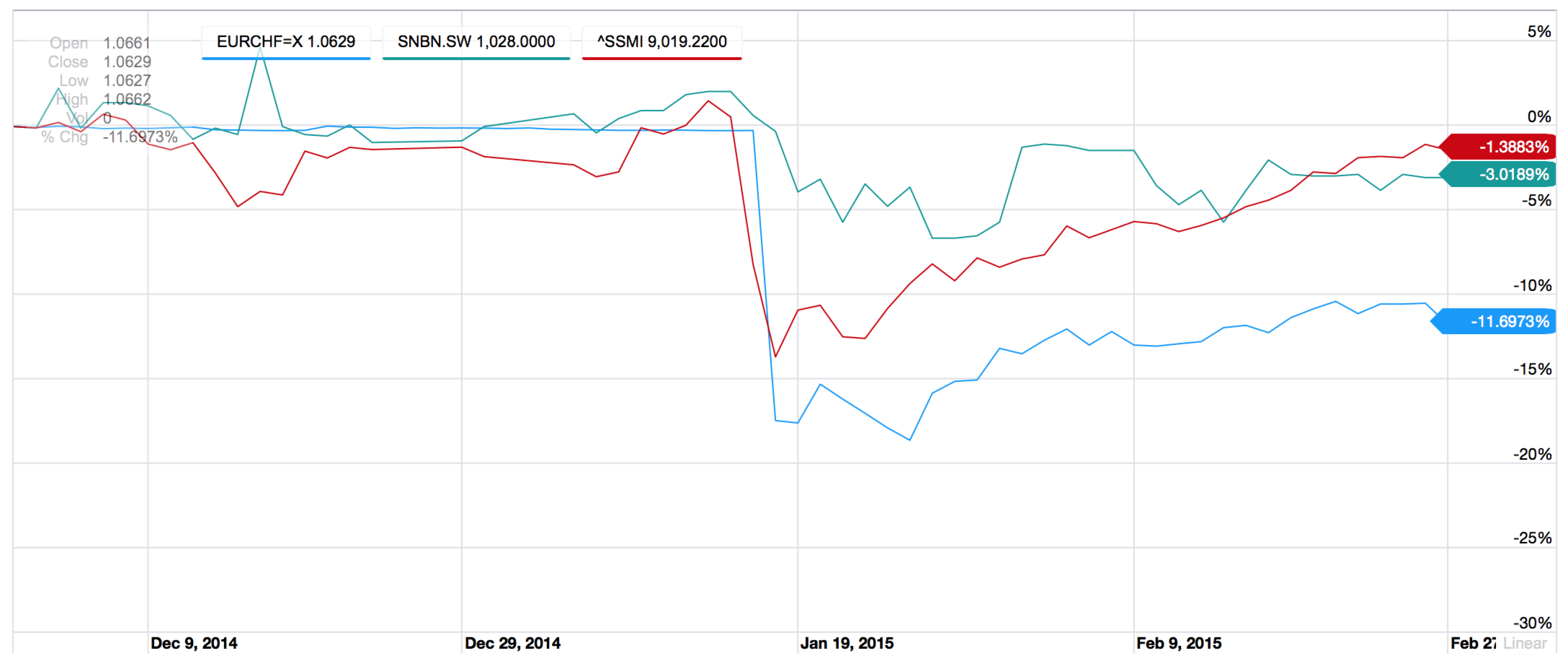

Figure 7 displays the relative performance of the CHF/EUR exchange rate against the Swiss equity market index, the Swiss Market Index (SMI) and the SNB’s stock price from 1 December 2014–27 February 2015. In the aftermath of the 15 January decision to remove the peg, the SNB’s stock price fared far better than the Swiss market and the exchange rate. The Swiss stock market has recovered: it closed February with only a 1.4% loss with respect to its level on 1 December. We can contrast this with the performance of the SNB stock price, down 3%, and of the currency, with an 11.7% loss.

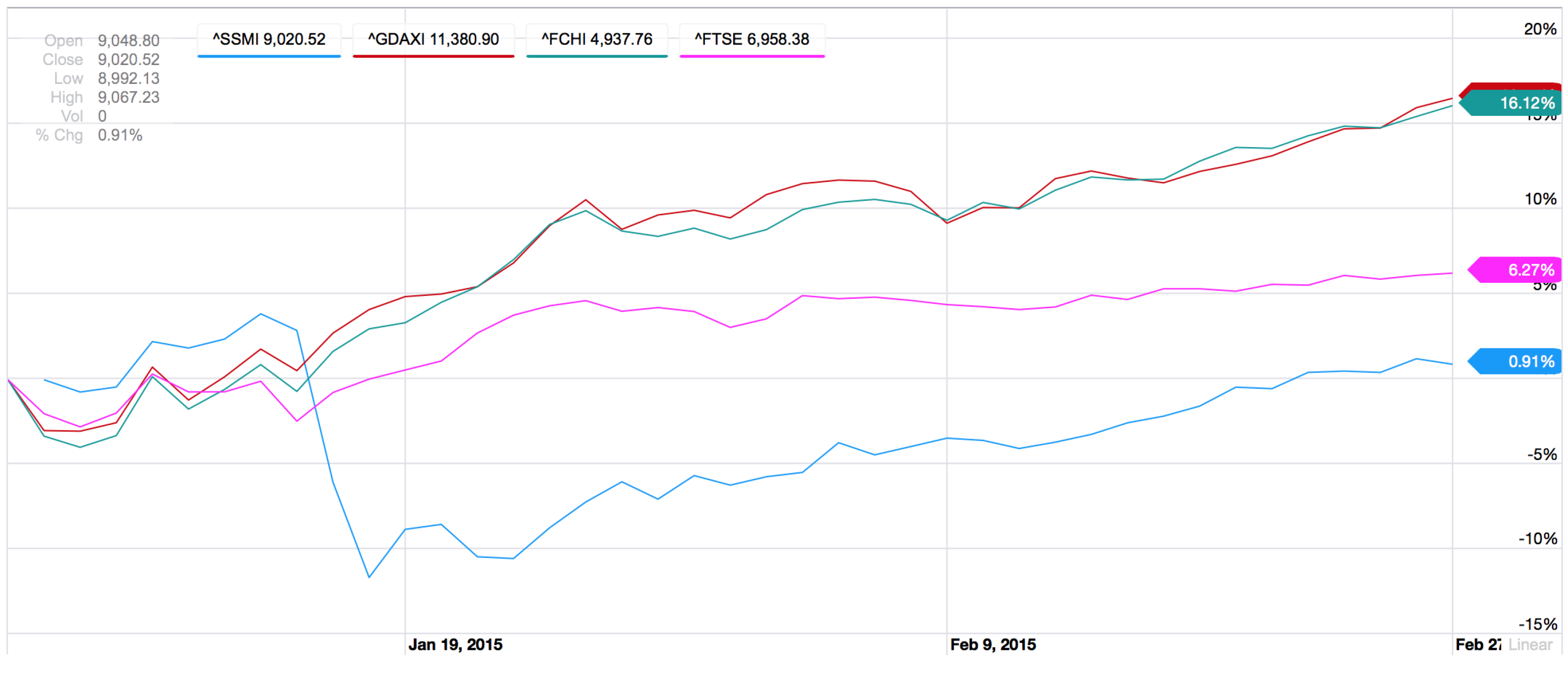

Figure 8 shows the performance of the SMI

versus the DAX 30, CAC 40 and FTSE in their local currencies between 1 January 2014 and 27 February 2015. While the Swiss stock market was leading the DAX 30, CAC 40 and FTSE 100 through December 2014 and the first half of January, the decision to remove the peg has had a noticeable impact on the performance of the SMI. Over the period 1 December 2014–27 February 2015, the SMI is trailing the DAX 30 and CAC 40 by around 15% and the FTSE by more than 3%.

Figure 7.

Relative performance of the CHF/EUR exchange rate (blue), the SNB’s stock price (SNBN, green) and of the Swiss Market Index (SMI, red) from 1 December 2014–27 February 2015 (source: Yahoo! Finance [

8]).

Figure 7.

Relative performance of the CHF/EUR exchange rate (blue), the SNB’s stock price (SNBN, green) and of the Swiss Market Index (SMI, red) from 1 December 2014–27 February 2015 (source: Yahoo! Finance [

8]).

Figure 8.

Relative performance of the Swiss Market Index (SMI, blue) against the DAX 30 (red), CAC 40 (green) and FTSE 100 from 1 January 2014–27 February 2015 in their local currencies (source: Yahoo! Finance [

8]).

Figure 8.

Relative performance of the Swiss Market Index (SMI, blue) against the DAX 30 (red), CAC 40 (green) and FTSE 100 from 1 January 2014–27 February 2015 in their local currencies (source: Yahoo! Finance [

8]).

5. Review of How to Lose Money Trading Derivatives

The SNB’s decision to remove the peg caused significant, and in some cases disastrous, losses at banks, hedge funds, brokerage firms and individual traders, both in and outside of Switzerland.

In this section, we discuss typical ways to lose money while trading derivatives. The underlying theme is that most disasters occur when one is not diversified in all scenarios, is overbet and a bad scenario occurs. We can then categorize losers in the CHF black swan. Understanding how to lose helps one avoid losses!

The derivative futures industry deals with products in which one party gains what the other party loses. These are zero sum games situations. Hence, there will be large winners and large losers. The size of the gains and losses are magnified by the leverage and overbetting, leading invariably to large losses when a bad scenario occurs. This industry now totals over $700 trillion, of which the majority is in interest and bond derivatives with a smaller, but substantial, amount in equity derivatives. Figlewski [

9] attempted to categorize derivative disasters, and this chapter discusses and expands on that (see also Lleo and Ziemba [

10,

11] for a discussion of banking, hedge funds and trading disasters).

- 1.

Hedge:

In an ordinary hedge, one loses money on one side of the transaction in an effort to reduce risk. To evaluate the performance of a hedge, one must consider all aspects of the transaction. In hedges where one delta hedges, but is a net seller of options, there is volatility (gamma) risk, which could lead to losses if there is a large price move up or down and the volatility rises. Furthermore, accounting problems can lead to losses if gains and losses on both sides of a derivatives hedge are recorded in the firm’s financial statements at the same time.

- 2.

Counterparty default:

Credit risk is the fastest growing area of derivatives, and a common hedge fund strategy is to be short overpriced credit default derivatives. There are many ways to lose money on these shorts if they are not hedged correctly, even if they have a mathematical advantage. In addition, one may lose more if the counterparty defaults because of fraud or following the theft of funds, as was the case with MF Global.

- 3.

Speculation:

Derivatives have many purposes, including transferring risk from those who do not wish it (hedgers) to those who do (speculators). Speculators who take naked unhedged positions take the purest bet and win or lose monies related to the size of the move of the underlying security. Bets on currencies, interest rates, bonds and stock market index moves are common futures and futures options trades.

Human agency problems frequently lead to larger losses for traders who are holding losing positions that, if cashed out, would lead to lost jobs or bonuses. Some traders increase exposure exactly when they should reduce it in the hopes that a market turnaround will allow them to cash out with a small gain before their superiors find out about the true situation and force them to liquidate. Since the job or bonus may have already been lost, the trader’s interests are in conflict with the objectives of the firm, and huge losses may occur. Writing options and, more generally, selling volatility or insurance, which typically gains small profits most of the time, but can lead to large losses, are common vehicles for this problem, because the size of the position accelerates quickly when the underlying security moves in the wrong direction, as in the Victor Niederhoffer hedge fund disaster caused by the the Asian currency crisis of 1997. Since trades between large institutions frequently are not collateralized mark-to-market, large paper losses can accumulate without visible signs, such as a margin call. Nick Leeson’s loss betting on short puts and calls on the Nikkei is one of many such examples. The Kobe earthquake was the bad scenario that bankrupted Barings.

A proper accounting of trading success evaluates all gains and losses, so that the extent of some current loss is weighed against previous gains. Derivative losses should also be compared to losses on underlying securities. For example, from 3 January–30 June 1994, 30-year T-bonds fell 13.6%. Hence, holders of bonds lost considerable sums, as well, since interest rates rose quickly and significantly.

- 4.

Forced liquidation at unfavourable prices:

Gap moves through stops are one example of forced liquidation. Portfolio insurance strategies based on selling futures during the 18 October 1987 stock market crash were unable to keep up with the rapidly declining market. The futures fell 29% that day compared to −22% for the S&P 500 cash market. Forced liquidation due to margin problems is made more difficult when others have similar positions and predicaments, and this leads to contagion. The August 1998 problems of long-term capital management in bond and other markets were more difficult because others had followed their lead with similar positions. When trouble arose, buyers were scarce, and sellers were everywhere. Another example is Metallgellschaft’s crude oil futures hedging losses of over $1.3 billion. They had long-term contracts to supply oil at fixed prices for several years. These commitments were hedged with long oil futures. However, when spot oil prices fell rapidly, the contracts to sell oil at high prices rose in value, but did not provide current cash to cover the mark to the market futures losses. A management error led to the unwinding of the hedge near the bottom of the oil market and the disaster.

Potential problems are greater in illiquid markets. Such positions are typically long term, and liquidation must be done matching sales with available buyers. Hence, forced liquidation can lead to large bid-ask spreads. Askin Capital’s failure in the bond market in 1994 was exacerbated because they held very sophisticated securities, which were only traded by very few counterparties, so contagion occurred. Once they learned of Askin’s liquidity problems and weak bargaining position, they lowered their bids even more and were then able to gain large liquidity premiums.

- 5.

Misunderstanding the risk exposure:

As derivative securities have become more complex, so has their full understanding. The Shaw, Thorp and Ziemba [

12] Nikkei put warrant trade (discussed in Ziemba and Ziemba [

13], Chapter 12) was successful because we did a careful analysis to fairly price the securities. In many cases, losses are the result of trading in high-risk financial instruments by unsophisticated investors. Lawsuits have arisen by such investors attempting to recover some of their losses with claims that they were misled or not properly briefed on the risks of the positions taken. Since the general public and, thus, judges and juries find derivatives confusing and risky, even when they are used to reduce risk, such cases or their threat may be successful.

A great risk exposure is the extreme scenario that often investors assume has zero probability when, in fact, they have low, but positive probability. Investors are frequently unprepared for interest rate, currency or stock price changes so large and so fast that they are considered to be impossible to occur. The move of some bond interest rate spreads from 3% a year earlier to 17% in August/September 1998 led even savvy investors and very sophisticated long-term capital management researchers and traders down this road. They had done extensive stress testing with a VaR risk model, which failed as the extreme events, such as the August 1998 Russian default, were both extremely low probability events plus changing correlations.

There was a similar failure of VaR and CVaR models because of the Swiss currency unpegging; see Daníelson [

14] for a discussion and some calculations. For current regulations, see the Basel Committee on Banking Supervision [

15]. What is needed as we argue below are convex penalty risk measures that penalize drawdowns enough to avoid the disasters. Unfortunately, these types of risk functions are not yet in regulations of risk models, although some applications have shown their superiority to the VaR and CVaR models; see Geyer and Ziemba [

16] and Ziemba [

17,

18].

Several scenario-dependent correlation matrices, rather than simulations around the past correlations from one correlation matrix, are suggested. This is implemented, for example, in the Innovest pension plan model, which does not involve levered derivative positions (see Ziemba and Ziemba [

19], Chapter 14). The key for staying out of trouble, especially with highly-levered positions, is to fully consider the possible futures and have enough capital or access to capital to weather bad scenario storms, so that any required liquidation can be done in an orderly manner.

Figlewski [

9] observes that the risk in mortgage-backed securities is especially difficult to understand. Interest-only (IO) securities, which provide only the interest part of the underlying mortgage pool’s payment stream, are a good example. When interest rates rise, IOs rise, since payments are reduced and the stream of interest payments is larger. However, when rates rise sharply, the IO falls in value like other fixed-income instruments, because the future interest payments are more heavily discounted. This signal of changing interest rate exposure was one of the difficulties in Askin’s losses in 1994. Similarly, the sign change between stocks and bonds during stock market crashes, as in 2000–2003, has caused other similar losses. Scenario-dependent matrices are especially useful and needed in such situations.

- 6.

Forgetting that high returns involve high risk:

If investors seek high returns, then they will usually have some large losses. The Kelly criterion strategy and its variants provide a theory to achieve very high long-term returns, but large losses will also occur. These losses are magnified with derivative securities and especially with large derivative positions relative to the investor’s available capital.

- 7.

How overbetting occurs:

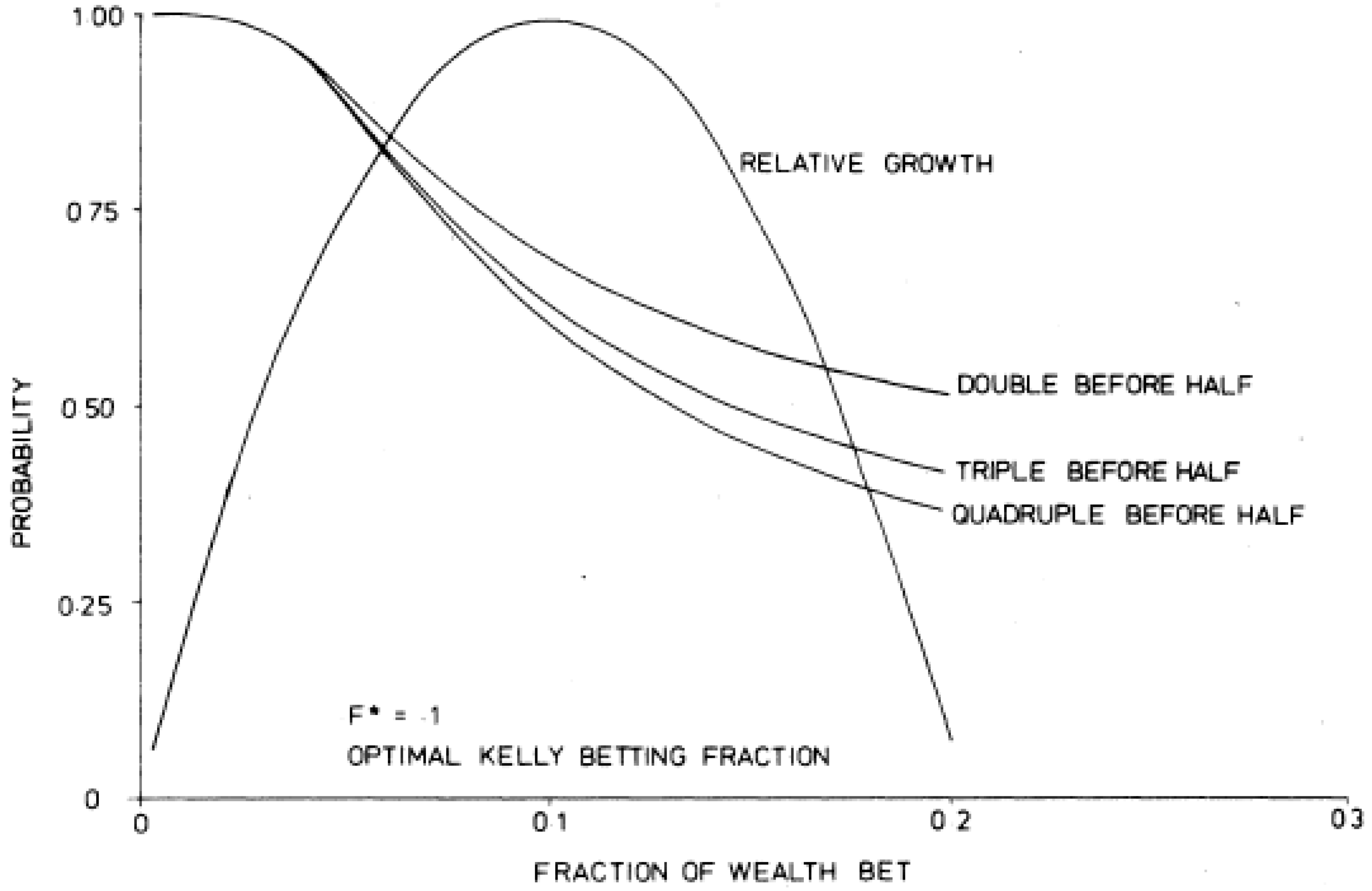

Figure 9 shows how the typical overbetting situation occurs assuming a Kelly strategy is being used. The top of the growth rate curve is at the full Kelly bet level, that is the asset allocation maximizing the expected value of the log of the final wealth subject to the constraints of the model. To the left of this point are the fractional Kelly strategies, which, under a lognormal asset distribution assumption, use a negative power utility function rather than the log. Therefore,

, for

, gives the fractional Kelly weight

. Therefore,

corresponds to

Kelly with

. Overbetting is to the right of the full Kelly strategy, and it is clear that betting more than full Kelly gives more risk measured by the probability of reaching a high goal before a lower level curve on the figure. It is this area, way to the right, where overbetting occurs. Additionally, virtually all of the disasters occur because of the overbetting.

It is easy to overbet with derivative positions, as the size depends on the volatility and other parameters and is always changing. Therefore, a position safe one day can become very risky very quickly. A full treatment of the pros and cons of Kelly betting is in MacLean

et al. [

20].

Figure 9.

Relative growth and probabilities of doubling, tripling and quadrupling initial wealth for various fractions of wealth bet for the gamble win $2 with probability 0.4 and lose $1 with probability 0.6.

Figure 9.

Relative growth and probabilities of doubling, tripling and quadrupling initial wealth for various fractions of wealth bet for the gamble win $2 with probability 0.4 and lose $1 with probability 0.6.

Stochastic programming models provide a good way to try to avoid Problems 1–6 by carefully modelling the situation at hand and considering the possible economic futures in an organized way.

Hedge fund and bank trading disasters usually occur because traders overbet, the portfolio is not truly diversified and then trouble arises when a bad scenario occurs. Lleo and Ziemba [

11] discuss a number of sensational failures, including Metalgesllshart (1993), LTCM (1998), Niederhoffer (1997), Amaranth Advisors (2006), Merrill Lynch (2007), Société Généralé (2008), Lehman (2008), AIG (2008), Citigroup (2008), MF Global (2012) and Monte Paschi (2013). Stochastic programming models provide a way to deal with the risk control of such portfolios using an overall approach to position size, taking into account various possible scenarios that may be beyond the range of previous historical data. Since correlations are scenario dependent, this approach is useful to model the overall position size. The model will not allow the hedge fund to maintain positions so large and so under-diversified that a major disaster can occur. Furthermore, the model will force the consideration of how the fund will attempt to deal with the bad scenario, because once there is a derivative disaster, it is very difficult to resolve the problem. More cash is immediately needed, and there are liquidity and other considerations; see Ziemba and Ziemba [

19]. Chapter 14 explores more deeply such models in the context of pension fund, as well as hedge fund management.

Litzenberger and Modest [

21], who were on the firing line for the LTCM failure, propose a modification of standard finance CAPM-type theory modified for fat tails and CVaR or expected tail losses for the losses. Ziemba [

17,

18,

19] presents his approach using convex risk measures and three scenario-dependent correlation matrices depending on volatility using stochastic programming scenario optimization. Both of these approaches would mitigate such losses. The key is not to overbet, to have access to capital once a crisis occurs and to plan in advance for such events.

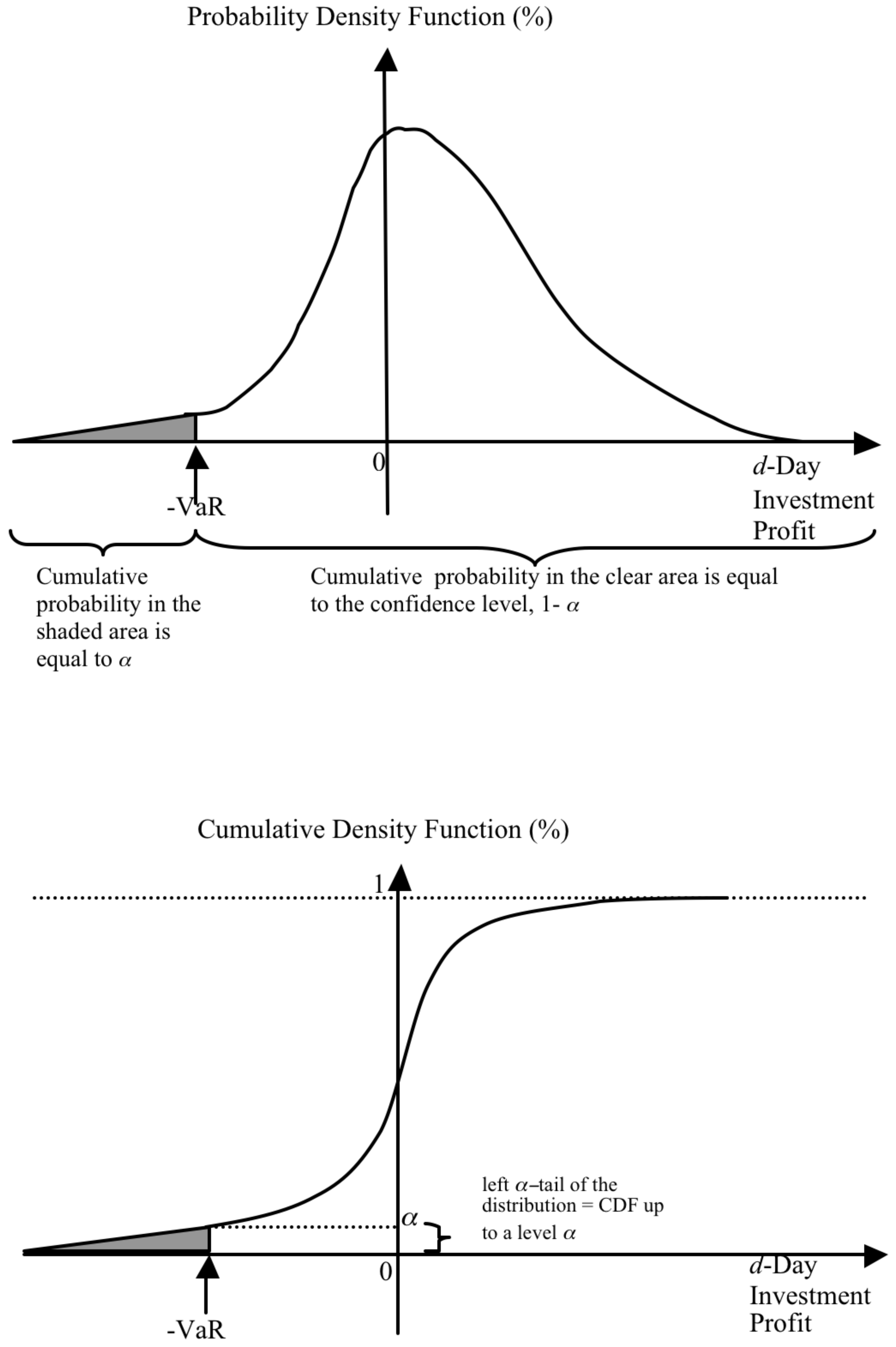

6. The Folly of the Misleading Value at Risk Measure

Value at risk (VaR) is the most widely-used risk measure and has held a central place in the development of international banking regulations in general and of the Basel Accord in particular. The VaR of a portfolio represents the maximum loss within a confidence level of

(between zero and one) that the portfolio could incur over a specified time period, for instance a

d-days horizon (see

Figure 10). For example, if the 10-day 95 percent VaR of a portfolio is $10 million, then the expectation with 95 percent confidence is that the portfolio will not lose more than $10 million during any 10-day period. Formally, the (

) VaR of a portfolio with (random) P&L

X is defined as:

which reads “minus the loss

X (so the VaR is a positive number) chosen such that a greater loss than

X occurs in no more than a percent of cases.”

It is widely acknowledged that J.P. Morgan was the first institution to define and widely use VaR (see for example Brown [

22]). This was quickly followed by keynote presentation by Till Guldimann at J.P. Morgan’s Annual Research Conference, and by a recommendation by the Group of Thirty (see [

23]). Embrechts

et al. [

24] cover risk management from a mathematical and technical perspective. Jorion [

25] presents a comprehensive and highly-readable reference on VaR and its use in the banking industry. O’Brien and Szerszen [

26] discuss VaR with reference to the 2007–2009 financial crisis. Value at risk has the advantage of being a particularly simple risk measure, because it corresponds to minus the

α-quantile of the P&L distribution:

VaR is also elicitable (see Ziegel [

27]), a property shared by all of the quantiles.

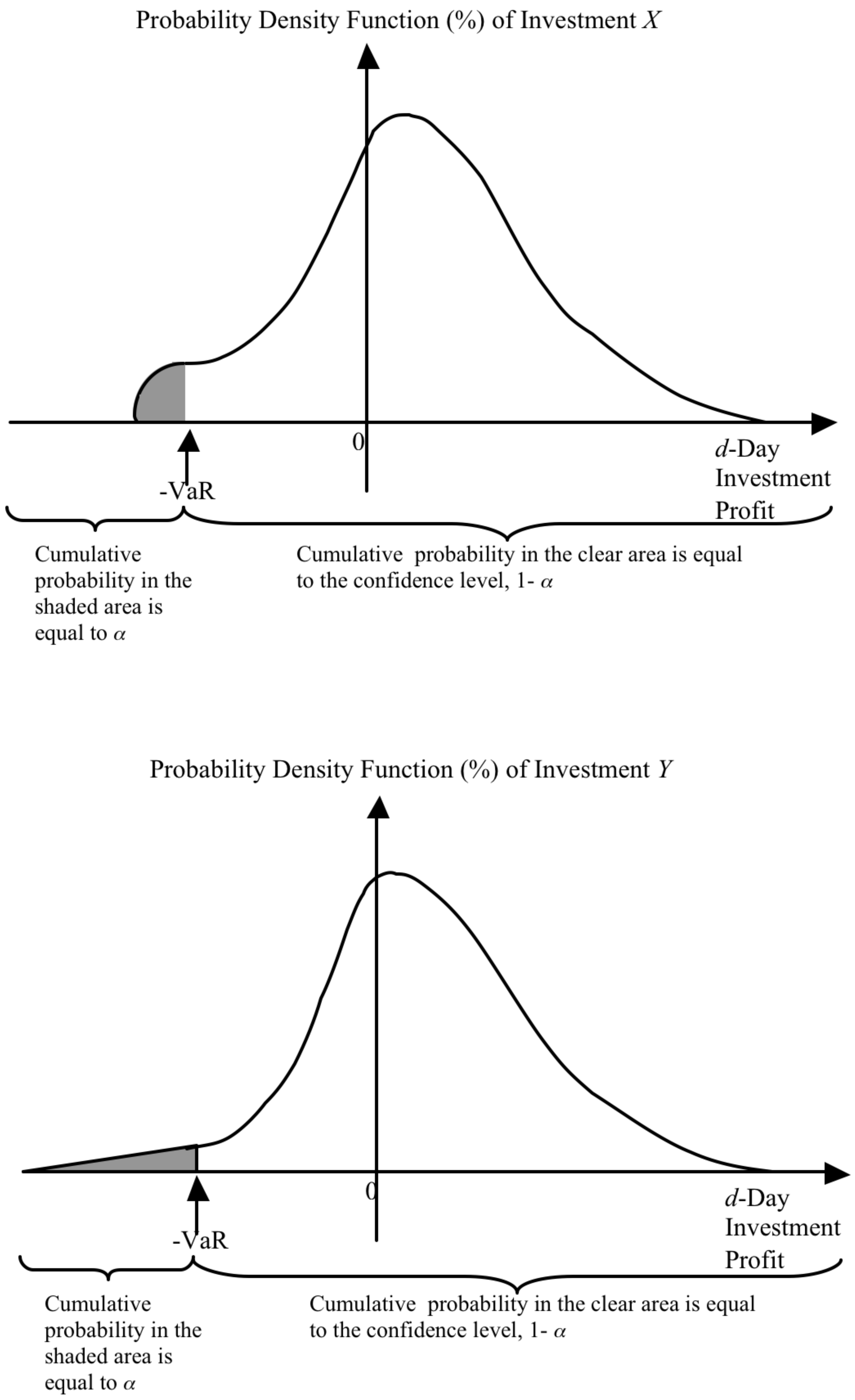

An alternative definition for the VaR of a portfolio as the minimum amount that a portfolio is expected to lose within a specified time period and at a given confidence level reveals a crucial weakness. The VaR has a well-documented “blind spot” in the

α-tail of the distribution, which means that it is impossible to evaluate the probability and severity of truly extreme events. The P&L distributions for investments

X and

Y in

Figure 11 have the same VaR, but the P&L distribution of

Y is riskier, because it harbours larger potential losses.

Figure 10.

Value at risk in terms of both PDF and CDF.

Figure 10.

Value at risk in terms of both PDF and CDF.

Figure 11.

Two investments with the same value at risk, but different degrees of desirability.

Figure 11.

Two investments with the same value at risk, but different degrees of desirability.

Furthermore, VaR is not a coherent risk measure. Artzner, Delbaen, Eber and Heath [

28] defined coherent risk measures as the class of monetary risk measures satisfying four “coherence” axioms.

Monetary risk measures, first introduced by Artzner, Delbaen, Eber and Heath [

28], are a class of risk measures that equate the risk of an investment with the minimum amount of cash, or capital, that one needs to add to a specific risky investment to make its risk acceptable to the investor or regulator. In short, a monetary measure of risk r is defined as:

where

k represents an amount of cash or capital and

X is the monetary profit and loss (P&L) of some investment or portfolio during a given time horizon, discounted back to the initial time.

The coherence axioms are:

1. Monotonicity: If the return of asset

X is always less than that of asset

Y, then the risk of asset

X must be greater. This translates into:

2. Subadditivity: The risk of a portfolio of assets cannot be more than the sum of the risks of the individual positions. Formally, if an investor has two positions in investments

X and

Y, then:

This property guarantees that the risk of a portfolio cannot be more (and should generally be less) than the sum of the risks of its positions, and hence, it can be viewed as an extension of the concept of diversification introduced by Markowitz [

29]. This property is particularly important for portfolio managers and banks trying to aggregate their risks among several trading desks. VaR is not subadditive, meaning that VaR may not reward diversification, potentially resulting in increased concentration risk.

3. Homogeneity: If a position in asset X is increased by some proportion k, then the risk of the position increases by the same proportion k. Mathematically,

This property guarantees that risk scales according to the size of the positions taken. This property, however, does not reflect the increased liquidity risk that may arise when a position increases. For example, owning 500,000 shares of company XYZ might be riskier than owning 100 shares, because in the event of a crisis, selling 500,000 shares will be more difficult, costly and require more time. As a remedy, Artzner, Delbaen, Eber and Heath [

28] proposed to adjust

X directly to reflect the increased liquidity risk of a larger position.

4. Translation invariance or risk-free condition: Adding cash to an existing position reduces the risk of the position by an equivalent amount. For an investment with value X and an amount of cash r,

Stress testing complements VaR by helping address the blind spot in the

α-tail of the distribution. In stress testing, the risk manager analyses the behaviour of the portfolio under a number of extreme market scenarios that may include historical scenarios, as well as scenarios designed by the risk manager. The choice of scenarios and the ability to fully price the portfolio in each situation are critical to the success of stress testing. Jorion [

25] discussed stress testing and how it complements VaR.

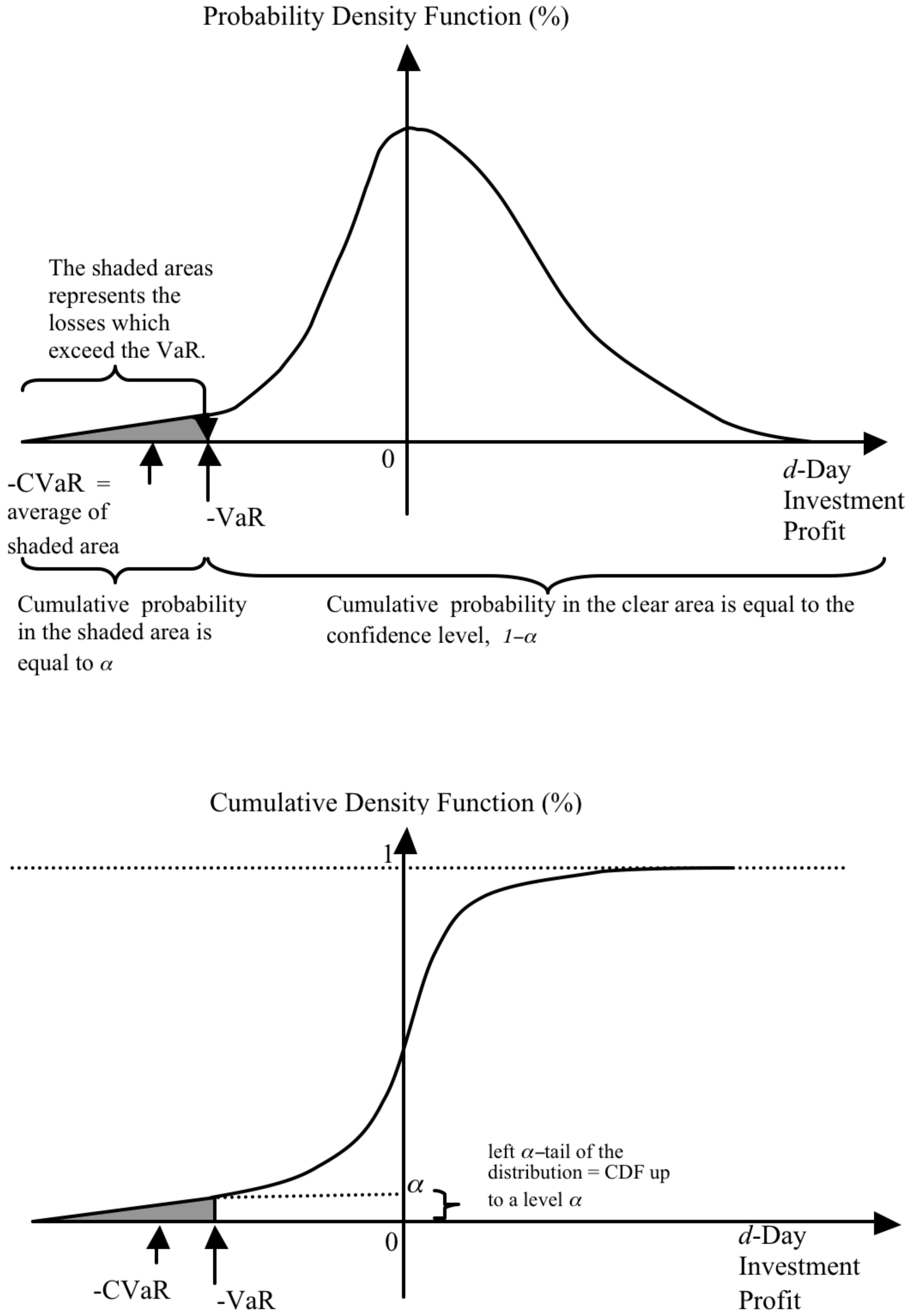

Conditional VaR (CVaR) is an improvement over VaR. Conditional VaR is the average of all of the

d-day losses exceeding the

d-day (

) VaR (see

Figure 12). Thus, the CVaR cannot be less than the VaR, and the computation of the

d-day

VaR is embedded in the calculation of the

d-day

CVaR.

Formally, the

d-day (

) CVaR of an asset or portfolio

X is defined as:

This formula takes the inverse CDF of the confidence level, a, to give a monetary loss threshold (equal to the VaR). The CVaR is then obtained by taking the expectation, or mean value of all of the possible losses in the left tail of the distribution, beyond the threshold. CVaR is a coherent risk measure, implying that it accounts for diversification, and it can be used efficiently to optimise portfolios (see Rockafellar and Uryasev [

30,

31]). Yamai and Yoshiba [

32] compare VaR and CVaR.

However, CVaR is not elicitable, depends heavily on the quality of tail data and only introduces a linear penalisation for the loss. This last point comes from the definition CVaR as the mean tail loss operator, implying that CVaR computes risk as a linear function of tail loss.

As an alternative, Ziemba [

19] has argued for convex risk measures that penalize losses more and more as the losses mount. Rockafellar and Ziemba [

33,

34] define convex risk measures as monetary risk measures satisfying the five following axioms:

In Rockafellar and Ziemba’s definition, Axioms (

R2) and (

R5) replace the more restrictive coherence Axioms (

A2) and (

A3). Separately, Föllmer and Schied [

35] proposed an alternate definition of convex risk measure simply replacing coherence Axioms (

A2) and (

A3) by the convexity Property (

R2).

Figure 12.

Conditional value at risk in terms of both PDF and CDF.

Figure 12.

Conditional value at risk in terms of both PDF and CDF.

However, the industry still uses the flawed value at risk, which penalizes a loss of one billion the same as one million if one million is the VaR number to be exceeded only 5% of the time. Shorting the CHF was a popular trade, and most firms would lever their position some 20-times or more. With such leverage, a 5% move against the position wipes out all of the value. Yet, the trades were seen as relatively low risk using VaR models at financial institutions, because the volatility of the CHF was reduced by the SNB’s cap. See Daníelson [

14] for an analysis of the failure of VaR and CVaR risk models around the time of the Swiss currency unpegging. An important point here is that the regulations do not include the better convex risk measures.

Regardless of the risk measure, the design of scenarios and stress tests is crucial. Ziemba [

17,

18] makes the following remark and establishes a list of factors that should be considered when designing scenarios:

The generation of good scenarios that well represent the future evolution of the key parameters is crucial to the success of the modelling effort. Scenario generation, sampling, and aggregation are complex subjects, and I will discuss them by describing key elements and providing various developed and implemented models.

Scenarios should consider the following, among other things:

mean reversion of asset prices;

volatility clumping, in which a period of high volatility is followed by another period of high volatility;

volatility increases when prices fall and decreases when they rise; trending of currency, interest rates and bond prices;

ways to estimate mean returns;

ways to estimate fat tails; and

ways to eliminate arbitrage opportunities or to minimize their effects.

Depending on the specificities of the problem, we could use either of five methods to generate scenarios:

- 1.

full knowledge of the exact probability distribution, P;

- 2.

use a known parametric family of statistical or probabilistic models;

- 3.

moment matching;

- 4.

historical simulation;

- 5.

expert opinion

We could also combine several methods. For example, the Black-Litterman model (see Black and Litterman [

36]) and its descendants combine a parametric approach with expert opinions.

7. Losers and How It Affected Them

The major activity in Switzerland is money storage and management. The Swiss produce watches, chocolate, pharmaceuticals and many tourists activities, such skiing, hiking and visiting the beautiful countryside. Half of the GDP comes from exports. Dhubat [

37] discusses the Canadian-Swiss chocolate market. The CAD went from 0.85 to 0.74 CHF with the unpegging, some 13.75% more expensive. When Ziemba sold a VW camper bus in Zurich in 1973, each CAD was worth 4 CHF. Ziemba got CHF 12,000 for a six-month-old camper that cost C $3000 six month when purchased. These CHF 12,000 are now worth C $15,751.60 after the revaluation. This reminds us that the CHF has changed dramatically overtime. Canada has about US$2.7 billion in chocolate sales

versus total North American sales of about US$20.2. Toronto-based Swiss national chocolatier Ingrid Laderach who sells mostly Swiss-made chocolate said: “it was a huge shock, and being Swiss myself, I was kind of disappointed at my countrymen to be honest with you” (source: Dhubat [

37]). She expects that the SNB’s move would impact Valentine’s day and Easter when chocolate demand is high. This of course is a plus for local Canadian producers.

Ski resorts in Switzerland have been hit hard as their prices are about double those in France and Austria. Therefore, Swiss resorts have needed to lower their prices, especially for foreigners.

Swiss research institutes have lowered growth forecasts by 75%. Companies are squeezing employees with lower pay and more hours of work. Retailers are cutting prices and have the added problem of cross-border shopping into France, Germany and Italy. High-end products, such as the top watches made by TAG Heuer and others, are less hit, as their very high profit margins act as a buffer against currency shocks. Private wealth management banks face significant difficulties, because they are forced to be more transparent. In addition their traditional competitive advantages, such as secrecy and a perception of safety, are declining.

8. Banks and Hedge Funds

The losses are in the billions: Citigroup Inc., Deutsche Bank AG and Barclays PLC together lost US$400 million. Marco Dimitrojevic’s US$830 million hedge fund was hit so bad, that it had to be closed.

Interactive Brokers (IB) is a web-based brokerage firm that is growing rapidly, offering attractive terms to traders. IB has been rated No. 1 by

Barron’s three years in a row, is a stock pick of Motley Fool and is highly regarded. They have low fees for electronic trading. They are aware of possible losses and do certain things to prevent them. They reported that several customers suffered losses in excess of their account capital, amounting to about $120 million, which is about 2.5% of the net worth of the company. Ziemba has accounts with them: what they do is charge an insurance fee if you have positions such that a 30% move would wipe out all your capital. It is not clear whether they buy the puts for this or simply pocket the money as part of their business (a form of self-insurance). Possibly because of the 120 million loss, they are doubling the exposure fee; see

Figure 13.

Very big losers were small-time individual retail FOREX traders and the firms with which they traded. These individuals expect to win, but in fact, most lost because of the volatility of the market and the fact that they are undercapitalized (or in other words, over-levered). The Aite Group LLC found that 11% of such traders expect to lose, while the other 89% expect to win; fully, 41% expect to gain 10% per month. Citi estimated worldwide that there are some four million such traders with about 150,000 in the U.S. The NFA estimated that 72% lose money. Alpari, which folded on the Friday after the 15 January 2015 unpegging, had about 70,000 such clients. Gain Capital was growing customer trading volume at 90% per year, and their income was growing even faster from US$7 million in 2004 to US$230 million in 2008. The firm was allowing huge leverage, for example, a cash account with $5000 could control $1 million in currency positions, which is a 200:1 leverage. Some firms, like Gain, take the other side of the trades, so these small traders were not client customers, but simply counterparties. Gain, of course, and others like them, won. With such leverage and high volatility, most clients are losers. In the U.S., the NFA required large capital and permitted a 50:1 leverage, so much of the business moved to London, where leverage up to 500:1 was allowed; and in Cyprus, a 1000:1 leverage was possible. To get more customers, such firms have extensive marketing, because old customers are blowing up and leaving, but there is always another sucker out there for them. Spot FOREX trading is not regulated in London or Europe. In London, the financial conduct authority (FCA) only takes action if there is fraud or boiler rooms in action (of course, one could suggest that this entire segment of the industry is fraudulent).

Figure 13.

Interactive Brokers’ portfolio insurance charges for risky positions in the U.S.

Figure 13.

Interactive Brokers’ portfolio insurance charges for risky positions in the U.S.

A prime example with a different type of operating procedure was Drew Nir’s firm FXGM, as reported by Evans [

38] and Lex team [

39]. FXGM has a 157-page prospectus, which has one dangerous provision for themselves: they do not try to obtain more funds or sue clients who lose money or go into negative equity. They allowed 29% of their clients to use credit cards, even though that is not allowed; and they are not on the other side, but they are supposed to hedge. Their clients lost about $225 million. FXGM is allowed the forced sale of customer positions in deficit, but in this case, the currency move was way too fast to do much of this. Before 15 January, they had a market cap of $1.4 billion and $300 million capital, which was $200 million above the $100 million required by the regulators. Its shares had been listed in 2010 at $14. They handled $1.4 trillion of trades in Q4:2014. Post peg, the stock in FXGM fell 87.33% down to $1.60 and as low as 98 cents from a pre-15 January price of about $12.63. They needed a bailout, and after the market closed on Friday, Jeffries arranged a $300 million loan at 10% interest from Leucadia National Corp. The shares rebounded and were worth $2.43 on 23 January.

Another problem is co-mingled funds, which are always a big danger. Stock and future funds do not legally allow co-mingling of client and firm funds. MF Global (see Lleo and Ziemba [

10,

11]) is one example where this policy was violated. In FXGM’s case, this inadvertent co-mingling led to their large losses.

9. What Types of Traders Lost Money

Actually, one did not have to be doing trades to lose money. Anyone in Switzerland holding foreign currencies took losses if they wanted to spend their money at home.

One Swiss colleague who is a professor and trader had the trading firm’s capital in US$, since many of their trades are in US$. Another professor colleague who is German, but at a university in Switzerland, plans a retirement in Germany, so his CHF holdings, including his university pension, gained in EUR terms, but his other assets in other currencies lost in CHF terms; he writes that he gained 10% in EUR and lost 10% in CHF in his overall situation.

Some traders that lost money are as follows:

- 1.

Short puts on the EUR/CHF cross: One bets that the EUR will not fall and collects a small premium. The tails here follow typical deep out of the money favourite long shot bias characteristics. Ziegler and Ziemba [

40] study returns from buying and selling hedged and unhedged puts and calls from 1985 to 2010 on the S&P 500 futures. These types of trades usually win, but if there is a big move in the wrong direction, the losses can be very large. The Niederhoffer bankruptcy from the Asian currency crisis in 1997 is a typical example [

13]. One hundred twenty million dollars in his hedge fund were turned into $70 million by buying inexpensive Thai stocks, which continued to drop. Then, the $70 million was turned into −$20 million by shorting out of the money S&P puts. It turned out that the puts expired as worthless the next month, and Nieferhoffer would have survived if he had more capital. This is another reminder that one needs to be sufficiently capitalized for the type of trading one is doing. Usually, one must have large capital for each short position to try to weather storms. In the CHF case, a 15% move yielded large losses. All of this depends on how fast the brokerage firm is checking the positions. Minutes after the announcement, the CHF was up 38% and then settled at 15% ahead. Of course, those who were long CHF with short calls on the EUR/CHF would gain, but only the premium. Therefore, the losses are much greater than the gains in this case.

- 2.

Short strangles and straddles: These involve selling both sides of the market, that is short puts and short calls, collecting two premiums. One has a strike at the money, and the other is out of the money. Those as in (1) would have large losses less the two premiums, which would not lower the loss much. The opposite position, buying the puts and calls, paying two premiums, which is usually a losing strategy, in this case, would have had had huge gains on the long CHF side.

10. Mortgage Losses

Swiss fixed interest rates on mortgages are as low as 1.5%. With the exchange rate fixed, borrowing in Swiss for homeowners in Austria, Hungary, Poland and other countries in central and eastern Europe seemed like a good decision.

3 During the real estate bubble of 2005–2007, mortgage rates in theses countries were over 10%. In addition, the local currencies were rising in value as investors anticipated Poland and Hungary joining the Eurozone. However, in 2008, these currencies fell relative to the strong Swiss franc, so the payments increased. Poland banned new CHF lending, and Hungary added the increased payments to the principle owing.

There was a disconnect between western Europe and eastern Europe Swiss franc borrowers. Those in the west are concentred in the business and financial sectors, and more care was taken to hedge the currency risk. However, in eastern Europe, it was mortgages, some 566,000 Polish, 150,000 Romanian and 60,000 Croatian. Additionally, in Hungary, half of all households in the whole country had foreign currency debt, with most in Swiss francs. The mortgages are not transparent, as mostly the interest is paid in local currency, although it is computed in Swiss francs at a non-Swiss bank.

In 2011, the same flight to safety that devalued the Polish zloty and Hungarian forint in 2008 devalued the euro against the Swiss franc, so all costs in francs increased, such as these loans.

Croatia pegged its currency, the kuna, to the franc for one year. This had a large cost of at least 30% of its currency reserves. Additionally, if the franc continues to rise against the euro, Croatian goods will be more expensive for French, German, Italian and other customers. Other countries, such as Romania, are considering similar moves. In contrast, Hungary reacted by forcing all mortgages such as these to convert their Swiss franc loans to Hungarian forints. Foreign banks, and in particular, Austrian banks, had to bear the adjustment cost.

11. From Quantitative Easing to Financial Unease?

The quantitative easing programme implemented by the U.S. Federal Reserve as a remedy for the 2007–2009 financial crisis has led to a massive increase in U.S. stock prices, tripling the S&P 500 index since the March 2009 low. Unemployment is now much lower, even though wages have not increased. This sets the stage for a gradual interest rate hike, limited in scope by the huge debt loads of the U.S. government. With its USD 4 trillion balance sheet, the Federal Reserve Bank has a tricky policy road ahead, and there likely will be some bumps along the way. We see this already with daily up and down moves in the U.S. stock market as the probability of when the first rate rise will occur is reassessed daily.

Now, the European Central Bank is embarking on the same path. The monies they spend to buy bonds do not directly go to the real problem, namely unemployment. However, rather, it will basically go to the banks and lower interest rates. The divergence between U.S. rates heading up and European rates going down has helped fuel a massive shift to the U.S. dollar, with most countries’ currencies dropping. The Swiss franc has historically been a safe haven, and it has been for many years on a monotone increase in value. Jim Rogers noted this, as did Ziemba’s car sale in the 1970s.

Since then, the franc has increased five-fold and is continuing to strengthen. Although many aspects of the Swiss banking advantage are declining, there is still much demand for the currency, even with negative interest rates. This paper concerns the 15 January 2015 unpegging on the euro franc exchange rate at 1.20. Since 2001, the Swiss central bank, partially owned by the cantons, had been buying various currencies to keep the euro exchange rate at this level. This caused them considerable losses. These losses were a factor in their decision to exit the peg. We discussed this abrupt action that caused a large, fast move in currency prices and triggered large losses for many individuals and institutions.

After the markets calmed down, the currencies were roughly 15% lower. The Swiss National Bank subsequently announced a loose target zone of 1.05–1.10 for the euro. They were prepared to spend considerable funds to keep this range. Meanwhile, the euro has declined steeply against the U.S. dollar. Even short covering rallies are met with more selling. The euro, which once fetched 1.60 US dollars and was 1.40 in May 2014, was down to 1.05 when we went to press.

12. Final Remarks: The Aftermath of the Unpegging

The impact on growth of the unpegging is likely to be minor. GDP growth forecasts for 2015 stand at about 1%. The historic strength of the currency as a safe haven has pushed the economy to focus on high value goods with low price elasticity, such as pharmaceuticals, private bankers, high technology engineering and luxury consumer goods, including watches. Inflation will continue to be pushed down by currency appreciation, while the current account surplus should fall significantly (Economist Intelligence Unit [

42]).

There are conflicting views of the situation. Some forecasters, such as Deutsche Bank, predicted a move to 1.00 by the end of 2015 and a new cycle low of 85 cents by 2017. Their reasoning articulates around the concept of a “euro glut.” Deutsche Bank explains: “simply put, it argues that the euro-area’s gigantic current account surplus, combined with the European Central Bank’s Quantitative Easing program, and with negative interest rates will continue to cause the euro to tumble? Robin Winkler and George Saravelos of the Deutsche Bank say that the region, which is currently a debtor to the world, must become a net creditor to the world. To that end, its investment position needs to reach 30% of GDP versus its current −10% before the current account surplus is sustainable. This can only happen with net capital outflows of at least 4 trillion euros. In fact, European outflows in the last six months have been high, putting downward pressure on the euro/US dollar exchange rate.

According to economist Rachel Ziemba [

43], this argument lacks validity. The Eurozone has net foreign assets (stock) and net surplus (flow). Until the euro crisis, Europe’s balance of payments was roughly balanced, since the net surplus from the core countries, especially Germany offsets, deficits in the periphery countries. Currently, these latter countries are doing: (1) fiscal adjustment; (2) structural reforms; and (3) deleveraging, to some extent. Hence, the deficits have shrunk, even though the stock of debt is high. She argues that Deutsche Bank conflates two drivers of euro weakness, namely the quantitative easing and lower rate differential

versus the U.S. with one (current account surplus) that is supportive of euro strength. Should the trade and capital flows reverse because of these ECB actions, the euro weakness could extend, but the weaker euro lowers imports and increases exports.

Therefore, what does this mean for the Swiss franc? For Switzerland, as for the United States, it certainly seems that a continued increase in the respective values is likely until the exchange rate greatly affects the economy of Switzerland and the United States. As we go to press, the euro/franc exchange rare is at the bottom of its target range of about 1.05, and the U.S. dollar is on par with the Swiss franc with a 1.00 exchange rate.