Capital Asset Pricing Model Testing at Warsaw Stock Exchange: Are Family Businesses the Remedy for Economic Recessions?

Abstract

:1. Introduction

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EU-27 | Total construction | 4.0 | 0.5 | 1.1 | 1.8 | 0.8 | 1.9 | 3.6 | 2.0 | −3.8 | −8.5 | −4.1 |

| Building | 5.2 | 0.4 | 0.7 | 2.7 | 1.8 | 2.2 | 4.3 | 1.9 | −4.3 | −10.9 | −3.4 | |

| Civil engineering | 0.2 | 1.1 | 1.7 | −1.5 | −3.2 | 1.9 | −1.2 | 2.9 | −1.4 | 2.3 | −7.1 | |

| EA-17 | Total construction | 4.1 | 0.6 | 0.4 | 0.9 | 0.0 | 2.2 | 3.7 | 1.3 | −5.5 | −7.9 | −7.7 |

| Building | 5.3 | 0.4 | −0.1 | 1.6 | 0.8 | 2.6 | 4.7 | 1.2 | −6.1 | −10.1 | −6.7 | |

| Civil engineering | 1.4 | 0.8 | 0.5 | −0.8 | −2.1 | 2.7 | −1.8 | 2.1 | −4.2 | 0.6 | −12.0 | |

| Weight in 2005 (% of EU-27) | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EU-27 | 100.0 | 4.0 | 0.5 | 1.1 | 1.8 | 0.8 | 1.9 | 3.6 | 2.0 | −3.8 | −8.5 | −4.1 |

| EA-17 | 71.3 | 4.1 | 0.6 | 0.4 | 0.9 | 0.0 | 2.2 | 3.7 | 1.3 | −5.5 | −7.9 | −7.7 |

| Belgium | 2.0 | : | −2.4 | −2.6 | −0.2 | 2.9 | 0.6 | 3.3 | 1.5 | −0.4 | −3.3 | −2.1 |

| Bulgaria | 0.1 | : | 13.4 | 3.8 | 4.6 | 35.3 | 31.7 | 24.8 | 26.8 | 12.6 | −14.2 | −17.9 |

| Czech Republic | 0.8 | 0.8 | 10.3 | 2.9 | 9.5 | 8.6 | 5.2 | 6.4 | 6.8 | −0.3 | −0.6 | −7.3 |

| Denmark | 1.7 | 1.7 | −6.7 | −1.2 | 2.1 | −0.2 | 3.1 | 3.8 | −4.2 | −5.7 | −10.8 | −8.4 |

| Germany | 11.1 | −3.5 | −7.6 | −4.3 | −4.2 | −5.3 | −5.3 | 6.3 | 2.9 | −0.7 | 0.1 | 0.2 |

| Estonia | 0.1 | 18.6 | 4.2 | 22.6 | 6.1 | 12.5 | 22.4 | 26.9 | 13.5 | −13.3 | −29.8 | −12.4 |

| Ireland | 2.8 | : | 3.4 | 2.0 | 5.7 | 25.3 | 10.0 | 3.8 | −13.5 | −29.2 | −36.9 | −30.1 |

| Greece | 1.1 | : | 6.6 | 39.1 | −5.7 | −15.9 | −38.7 | 3.6 | 14.3 | 7.7 | −17.5 | −31.6 |

| Spain | 18.8 | 10.7 | 3.0 | 0.6 | 7.2 | 2.3 | 10.9 | 2.2 | −4.3 | −16.3 | −11.3 | −20.2 |

| France | 12.5 | 6.0 | 1.2 | −2.3 | −0.8 | −1.2 | 2.7 | 4.2 | 2.3 | −3.7 | −5.9 | −3.4 |

| Italy | 11.5 | 6.2 | 6.2 | 5.1 | 2.8 | 1.6 | 1.3 | 3.9 | 6.4 | −1.1 | −11.5 | −3.4 |

| Cyprus | 0.3 | : | 3.7 | 3.2 | 6.5 | 4.4 | 2.9 | 4.1 | 6.8 | 2.3 | −10.6 | −8.0 |

| Latvia | 0.1 | 7.2 | 6.2 | 12.1 | 13.1 | 13.1 | 15.5 | 13.3 | 13.6 | −3.1 | −34.9 | −23.4 |

| Lithuania | 0.2 | −18.1 | 7.4 | 21.7 | 27.8 | 6.8 | 9.9 | 21.7 | 22.2 | 4.0 | −48.5 | −7.7 |

| Luxembourg | 0.3 | : | 4.2 | 1.9 | 0.9 | −1.1 | −0.9 | 2.6 | 2.6 | −1.8 | 0.8 | 0.1 |

| Hungary | 0.5 | 7.7 | 9.3 | 18.0 | 2.7 | 4.3 | 15.7 | −0.7 | −14.0 | −5.2 | −4.4 | −10.4 |

| Malta | 0.0 | : | −4.0 | 23.4 | −5.7 | 8.0 | 18.5 | 4.4 | 7.2 | 6.6 | −7.9 | 0.2 |

| Netherlands | 4.9 | : | 1.9 | −3.1 | −4.9 | −2.6 | 3.2 | 2.3 | 5.6 | 3.2 | −3.0 | −11.0 |

| Austria | 2.2 | −0.6 | −0.6 | 0.5 | 12.3 | 5.0 | 4.9 | 5.9 | 3.9 | −0.9 | −1.6 | −4.3 |

| Poland | 1.7 | 1.2 | −10.9 | −10.1 | −7.2 | −1.9 | 9.2 | 15.6 | 16.3 | 10.2 | 4.5 | 3.7 |

| Portugal | 1.8 | : | 4.7 | −1.1 | −8.6 | −4.4 | −4.5 | −6.3 | −4.0 | −1.2 | −6.6 | −8.5 |

| Romania | 0.4 | : | 11.5 | 4.5 | 3.2 | 1.4 | 6.6 | 15.6 | 33.1 | 26.7 | −15.2 | −13.4 |

| Slovenia | 0.2 | 2.9 | −10.5 | 7.5 | 9.6 | 0.7 | 2.0 | 15.7 | 18.5 | 15.5 | −20.9 | −16.9 |

| Slovakia | 0.2 | 0.2 | 0.7 | 4.1 | 5.7 | 5.9 | 14.5 | 15.4 | 5.5 | 11.5 | −11.2 | −4.3 |

| Finland | 1.3 | 8.0 | −0.1 | 1.4 | 4.2 | 4.4 | 5.2 | 7.8 | 10.2 | 4.1 | −13.2 | 11.9 |

| Sweden | 2.1 | 4.4 | 5.4 | 0.3 | 0.0 | 0.1 | 3.0 | 8.0 | 6.2 | 4.2 | −3.5 | 5.9 |

| United Kingdom | 21.2 | 4.2 | 1.1 | 4.6 | 5.6 | 3.5 | −0.5 | 1.4 | 2.3 | −1.3 | −11.6 | 7.3 |

| Norway | - | −2.1 | 1.2 | −0.1 | 2.1 | 7.4 | 8.9 | 6.0 | 5.8 | 1.1 | −8.3 | −0.1 |

| Switzerland | - | 2.7 | −2.7 | 0.9 | 0.1 | 3.1 | 2.6 | 2.0 | 1.2 | 2.4 | 1.4 | 1.9 |

| Montenegro | - | : | 5.3 | 0.3 | −8.5 | −5.8 | 7.6 | 46.1 | −1.7 | 20.7 | −19.3 | −0.6 |

| Croatia | - | −8.9 | 3.7 | 13.0 | 22.3 | 1.6 | −0.2 | 9.3 | 2.6 | 11.8 | −6.9 | −15.9 |

| FYR of Macedonia | - | : | : | : | : | : | : | −12.3 | 7.5 | 25.5 | 13.7 | 15.2 |

| Turkey | - | : | : | : | : | : | : | 18.4 | 5.5 | −7.6 | −16.3 | 17.5 |

2. Theoretical Background

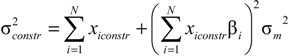

3. Methodology

3.1. Definition

3.2. Data Description

| Company | Market Cap | Family | ||

|---|---|---|---|---|

| Market Cap | % | Shares % | Votes % | |

| Elektrobudowa | 498,435,000 | 14.00% | - | - |

| Trakcja PRKII | 322,712,640 | 9.06% | - | - |

| Mostostal Zabrze | 190,973,650 | 5.36% | - | - |

| Erbud | 163,726,800 | 4.60% | - | - |

| Polimex-Mostostal | 134,416,620 | 3.78% | - | - |

| Ulma-Construccion Polska | 121,458,400 | 3.41% | - | - |

| Instal Kraków | 117,900,450 | 3.31% | - | - |

| Unibep | 101,347,200 | 2.85% | 26.98% *17.83% | 26.98% 17.83% |

| P.A. Nova | 94,367,000 | 2.65% | 18.19% 9.13% | 20.80% 10.88% |

| Prochem | 66,588,900 | 1.87% | - | - |

| Mirbud | 63,918,020 | 1.80% | 43.19% | 43.19%; |

| Herkules | 62,118,000 | 1.74% | 18.99% | 18.99%; 93.31% ** |

| Elektrotim | 61,625,740 | 1.73% | - | - |

| ZUE | 58,560,000 | 1.64% | 72.75% 0.01% | 72.75% 0.01% |

| Projprzem | 50,534,820 | 1.42% | - | - |

| Mostostal Warszawa | 39,325,140 | 1.10% | - | - |

| Centrum Nowoczesnych Technologii | 34,203,650 | 0.96% | - | - |

| Tesgas | 20,029,750 | 0.56% | 40.58% | 55.66% |

| Mostostal Płock | 14,261,400 | 0.40% | - | - |

| Energoaparatura | 13,069,400 | 0.37% | - | - |

| Bipromet | 12,009,900 | 0.34% | - | - |

| Mostostal Export | 7,941,450 | 0.22% | - | - |

| Awbud | 7,413,450 | 0.21% | - | - |

| Non-family cap | 3,160,359,660 | 88.76% | - | - |

| Family-controlled cap | 400,339,970 | 11.24% | - | - |

| TOTAL CAP | 3,560,699,630 | 100.00% | - | - |

| Company | 2006–2007 | 2008–2009 | 2010–2011 | |||

|---|---|---|---|---|---|---|

| Expected Return | Beta | Expected Return | Beta | Expected Return | Beta | |

| Elektrobudowa | 0.08 | 1.23 | −0.01 | 0.38 | −0.02 | 0.88 |

| Trakcja PRKII | - | - | −0.01 | 0.59 | −0.06 | 2.12 |

| Mostostal Zabrze | 0.11 | 2.11 | −0.01 | 1.31 | −0.04 | 2.16 |

| Erbud | 0.03 | 0.51 | 0.00 | 1.16 | −0.04 | 0.82 |

| Polimex-Mostostal | 0.02 | 1.45 | −0.03 | 1.17 | −0.03 | 1.50 |

| Ulma-Construccion Polska | 0.11 | 0.70 | −0.02 | 1.40 | −0.01 | 0.31 |

| Instal Kraków | 0.07 | 0.98 | 0.00 | 1.00 | −0.01 | 0.85 |

| Unibep | - | - | 0.30 | 1.19 | 0.01 | 0.48 |

| P.A. Nova | 0.01 | 0.31 | 0.28 | 0.71 | 0.01 | 1.04 |

| Prochem | 0.02 | 1.17 | −0.01 | 1.36 | −0.01 | 1.64 |

| Mirbud | - | - | 0.19 | 0.61 | −0.01 | 0.59 |

| Herkules | 0.09 | 3.04 | 0.18 | 1.40 | −0.06 | 1.40 |

| Elektrotim | −0.07 | 1.20 | 0.00 | 0.38 | −0.02 | 1.39 |

| ZUE | - | - | - | - | −0.07 | −0.05 |

| Projprzem | 0.05 | 2.09 | −0.03 | 0.69 | −0.02 | 1.18 |

| Mostostal Warszawa | 0.09 | 0.73 | 0.01 | 0.52 | −0.04 | 1.31 |

| Centrum Nowoczesnych Technologii | 0.18 | 3.30 | 0.00 | 1.40 | 0.02 | 0.18 |

| Tesgas | - | - | 0.06 | 0.02 | −0.03 | 0.78 |

| Mostostal Płock | 0.08 | 1.69 | −0.01 | 0.99 | −0.04 | 1.81 |

| Energoaparatura | 0.05 | 1.90 | −0.01 | 0.65 | −0.03 | 1.21 |

| Bipromet | - | - | −0.02 | 0.39 | 0.01 | −0.09 |

| Mostostal Export | 0.08 | 3.59 | −0.02 | 0.53 | −0.01 | 1.36 |

| Awbud | 0.10 | 2.76 | −0.04 | 0.58 | 0.01 | 0.74 |

| Before The Crisis | In Crisis | After The Crisis | |

|---|---|---|---|

| Portfolio formation period | 2006–2007 | 2008–2009 | 2010–2012 |

| No. of family firms | 2 | 5 | 6 |

| No. of nonfamily firms | 16 | 18 | 18 |

3.3. Methodology and Results

| 2006–2007 | 2008–2009 | 2010–2012 | ||||

|---|---|---|---|---|---|---|

| NFF | FF | NFF | FF | NFF | FF | |

| Expected Return | 5.35% | 4.13% | −0.76% | 23.56% | −1.56% | −1.72% |

| Variance | 0.093 | 0.071 | 0.022 | 0.031 | 0.011 | 0.010 |

| Standard Deviation | 0.306 | 0.267 | 0.150 | 0.175 | 0.107 | 0.103 |

| Coefficient of variation | 5.719 | 6.467 | −19.816 | 0.742 | −6.816 | −5.963 |

| Beta | 1.223 | 1.392 | 0.680 | 0.921 | 1.305 | 0.711 |

| Systematic Risk | 0.005 | 0.006 | 0.004 | 0.007 | 0.004 | 0.001 |

| Specific Risk | 0.089 | 0.065 | 0.018 | 0.023 | 0.008 | 0.009 |

| Specific Risk/Variance | 0.948 | 0.912 | 0.819 | 0.757 | 0.661 | 0.892 |

| Jensen’s alpha | 0.032 | 0.018 | −0.008 | 0.237 | −0.018 | −0.020 |

| Skewness | 6.142 | 1.231 | 0.438 | −0.623 | 0.175 | 0.212 |

| Kurtosis | 72.109 | 0.471 | 2.210 | 5.022 | 2.206 | 1.722 |

| Jarque–Bera | 3284.634 | 1.039 | 1.043 | 1.175 | 0.564 | 0.453 |

4. Conclusions

Conflicts of Interest

References

- International Labour Office, Governing Body. The Current Global Economic Crisis: Sectoral Aspects. Geneva, Switzerland: International Labour Office, Governing Body, 2009, pp. 1–13. [Google Scholar]

- Organisation for Economic Co-operation and Development (OECD). “Responding to the Economic Crisis. Fostering Industrial Restructuring and Renewal.” Available online: http://www.oecd.org/industry/ind/43387209.pdf (accessed on 30 January 2014).

- Current Population Survey (CPS). “United States Census Bureau.” Available online: https://www.census.gov/cps/ (accessed on 30 January 2014).

- J. Lee. “Family firm performance: Further evidence.” Fam. Bus. Rev. 19 (2006): 103–114. [Google Scholar]

- A. Van Gils, W. Voordeckers, and J. van den Heuvel. “Environmental uncertainty and strategic behavior in Belgian family firms.” Eur. Manag. J. 22 (2004): 588–595. [Google Scholar] [CrossRef]

- P.C. Rosenblatt. “The interplay of family system and business system in family farms during economic recession.” Fam. Bus. Rev. 4 (1991): 45–57. [Google Scholar]

- D. Sirmon, J. Arregle, M. Hitt, and J. Webb. “The role of family influence in firms’ strategic responses to threat of imitation.” Entrep. Theory Pract. 32 (2008): 979–998. [Google Scholar] [CrossRef]

- G. Corbetta, and C. Salvato. “Self-serving or self-actualizing? Models of man and agency costs in different types of family firms: A commentary on comparing the agency costs of family and non-family firms: Conceptual issues and exploratory evidence.” Entrep. Theory Pract. 28 (2004): 355–362. [Google Scholar] [CrossRef]

- R. Anderson, and D.M. Reeb. “Founding-Family Ownership and Firm Performance: Evidence from the S&P 500.” J. Financ. 58 (2003): 1301–1327. [Google Scholar] [CrossRef]

- W.F. Sharpe. “Capital Asset Prices: A Theory of Market Equilibrium under conditions of risk.” J. Financ. 19 (1964): 425–442. [Google Scholar]

- J. Lintner. “The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets.” Rev. Econ. Stat. 47 (1965): 13–25. [Google Scholar] [CrossRef]

- J. Mossin. “Equilibrium in a capital Asset Market.” Econometrica 34 (1966): 768–783. [Google Scholar] [CrossRef]

- E.O. Lyn, and E.J. Zychowicz. “Predicting Stock Returns in the Developing Markets of Eastern Europe.” J. Invest. 13 (2004): 63–71. [Google Scholar] [CrossRef]

- K. Kompa, and A.M. Matuszewska. “Rates of Return Analysis: Examples from the Warsaw Stock Exchange.” Int. Adv. Econ. Res. 13 (2007): 111–112. [Google Scholar] [CrossRef]

- D.M. Witkowska. “Portfolio Analysis: Example for the Warsaw Stock Exchange.” Int. Adv. Econ. Res. 13 (2007): 247–248. [Google Scholar]

- B. Gębka. “Volume- and size-related lead–lag effects in stock returns and volatility: An empirical investigation of the Warsaw Stock Exchange.” Int. Rev. Financ. Anal. 17 (2008): 134–155. [Google Scholar] [CrossRef]

- O. Kowalewski, O. Talavera, and I. Stetsyuk. “Influence of Family Involvement in Management and Ownership on Firm Performance: Evidence from Poland.” Fam. Bus. Rev. 23 (2010): 23–45. [Google Scholar]

- A. Waszczuk. “Do Local or Global Risk Factors Explain the Size, Value and Momentum Trading Payoffs on the Warsaw Stock Exchange? ” Appl. Financ. Econ. 23 (2013): 1497–1508. [Google Scholar] [CrossRef]

- H.M. Markowitz. “Portfolio Selection.” J. Financ. 7 (1952): 77–91. [Google Scholar]

- M.C. Jensen. “The performance of mutual funds in the period 1945–1964.” J. Financ. 23 (1968): 389–416. [Google Scholar]

- E.F. Fama, and J.D. MacBeth. “Risk, Return, and Equilibrium: Empirical Tests.” J. Polit. Econ. 81 (1973): 607–636. [Google Scholar]

- D. Isakov. “Is beta still alive? Conclusive evidence from the Swiss stock market.” Eur. J. Financ. 5 (1999): 202–212. [Google Scholar] [CrossRef]

- J. Zhang, and C. Wihlborg. “Unconditional and conditional CAPM: Evidence from European emerging markets.” Available online: http://snee.org/filer/papers/266.pdf (accessed on 30 January 2014).

- R.H. Litzenberger, and K. Ramaswamy. “The Effects of Dividends on Common Stock Prices Tax Effects or Information Effects? ” J. Financ. 37 (1982): 429–443. [Google Scholar]

- N. Durack, R.B. Durand, and R.A. Maller. “A best choice among asset pricing models? The Conditional Capital Asset Pricing Model in Australia.” Account. Financ. 44 (2004): 139–162. [Google Scholar]

- S.D. Köseoğlu, and B.A. Mercangöz. “Testing the Validity of Standard and Zero Beta Capital Asset Pricing Model in Istanbul Stock Exchange.” Int. J. Bus. Humanit. Technol. 3 (2013): 58–67. [Google Scholar]

- R. Ibbotson, and R. Sinquefield. “Stocks, Bonds, Bills and Inflation: Year-by-Year Historical Returns (1926–1974).” J. Bus. 49 (1976): 11–47. [Google Scholar]

- R. Roll. “A Critique of the Asset Pricing Theory’s Tests.” J. Financ. Econ. 4 (1977): 129–176. [Google Scholar] [CrossRef]

- R.W. Banz. “The relationship between return and market value of common stocks.” J. Financ. Econ. 9 (1981): 3–18. [Google Scholar] [CrossRef]

- E.F. Fama, and K.R. French. “The Cross-Section of Expected Stock Returns.” J. Financ. 47 (1992): 427–465. [Google Scholar]

- G. Michailidis, S. Tsopoglou, D. Papanastasiou, and E. Mariola. “Testing the Capital Asset Pricing Model (CAPM): The Case of the Emerging Greek Securities Market.” Int. Res. J. Financ. Econ. 4 (2006): 78–91. [Google Scholar]

- A.J. Adedokun, and S.A. Olakojo. “Test of Capital Asset Pricing Model: Evidence from Nigerian Stock Exchange.” J. Econ. Theory 6 (2012): 121–127. [Google Scholar]

- Z. Hasan, A.A. Kamil, and A. Baten. “Analyzing and estimating portfolio performance of Bangladesh stock market.” Am. J. Appl. Sci. 10 (2013): 139–146. [Google Scholar] [CrossRef] [Green Version]

- R.C. Merton. “An intertemporal capital asset pricing model.” Econometrica 41 (1973): 867–887. [Google Scholar] [CrossRef]

- D.T. Breeden. “An intertemporal asset pricing model with stochastic consumption and investment opportunities.” J. Financ. Econ. 7 (1979): 265–296. [Google Scholar] [CrossRef]

- S. Basu. “Investment Performance of Common Stocks in Relation to Their Price-Earnings Ratios: A Test of the Efficient Market Hypothesis.” J. Financ. 32 (1977): 663–682. [Google Scholar] [CrossRef]

- L. Bhandari. “Debt/Equity Ratio and Expected Common Stock Returns: Empirical Evidence.” J. Financ. 2 (1988): 507–528. [Google Scholar] [CrossRef]

- B. Rosenberg, K. Reid, and R. Lanstein. “Persuasive evidence of market inefficiency.” J. Portf. Manag. 11 (1985): 9–16. [Google Scholar] [CrossRef]

- L. Chan, Y. Hamao, and J. Lakonishok. “Fundamentals and Stock Returns in Japan.” J. Financ. 46 (1991): 1739–1764. [Google Scholar]

- E.F. Fama, and K.R. French. “Common Risk Factors in the Returns on Stocks and Bonds.” J. Financ. Econ. 33 (1993): 3–56. [Google Scholar] [CrossRef]

- A.Y. Javid, and E. Ahmad. Test of Multi-moment Capital Asset Pricing Model: Evidence from Karachi Stock Exchange. Pakistan Institute of Development Economics Working Paper 2008:49; Islamabad, Pakistan: Pakistan Institute of Development Economics, 2008. [Google Scholar]

- P. Akbari, and E. Mohammadi. “A Study of the Effects of Leverages Ratio on Systematic Risk based on the Capital Asset Pricing Model Among Accepted Companies in Tehran Stock Market.” J. Educ. Manag. Stud. 3 (2013): 271–277. [Google Scholar]

- T. Zellweger. “Time Horizon, Costs of Equity Capital, and Generic Investment Strategies of Firms.” Fam. Bus. Rev. 20 (2007): 1–15. [Google Scholar] [CrossRef]

- J.H. Chua, J.J. Chrisman, and P. Sharma. “Defining the Family Business by Behavior.” Entrep. Theory Pract. 23 (1999): 19–39. [Google Scholar]

- H. Lindgren, and S. Fritz. “Aktivt Ägande. Investor under Växlande Konjunkturer.” In Scandinavian Economic History Review. Abingdon, UK: Routledge, 1996. (in Swedish) [Google Scholar]

- P. Jaskiewicz, V.M. Gonzalez, S. Menendez, and D. Schiereck. “Long-run IPO Performance Analysis of German and Spanish Family-owned businesses.” Fam. Bus. Rev. 18 (2005): 179–202. [Google Scholar] [CrossRef]

- C. Blondel, N. Rowell, and L. van der Heyden. “Prevalence of Patrimonial Firms on Paris Stock Exchange: Analysis of the Top 250 Companies in 1993 and 1998.” Available online: http://www.insead.edu/facultyresearch/research/doc.cfm?did=990 (accessed on 30 January 2014).

- P. Leach, and T. Bogod. The BDO-Stoy Hayward Guide to the Family Business. London, UK: Kogan Page, 1999. [Google Scholar]

- B. Villalonga, and R. Amit. “How do family ownership, control and management affect firm value? ” J. Financ. Econ. 80 (2006): 385–417. [Google Scholar] [CrossRef]

- D. Sraer, and D. Thesmar. “Performance and Behavior of Family Firms: Evidence from the French Stock Market.” Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=925415 (accessed on 20 December 2013).

- D. Miller, I. Le Breton-Miller, R.H. Lester, and A.A. Cannella Jr. “Are Family Firms Really Superior Performers.” J. Corp. Financ. 5 (2007): 829–858. [Google Scholar]

- “Warsaw Stock Exchange.” Available online: http://www.gpw.pl (accessed on 20 December 2013).

- M.E. Blume. “Portfolio Theory: A Step Toward Its Practical Application.” J. Bus. 43 (1970): 152–173. [Google Scholar]

- I. Friend, and M. Blume. “Measurement of Portfolio Performance under Uncertainty.” Am. Econ. Rev. 60 (1970): 607–636. [Google Scholar]

- F. Black, M.C. Jensen, and M. Scholes. “The Capital Asset Pricing Model: Some Empirical Tests.” In Studies in the Theory of Capital Markets. Edited by M.C. Jensen. New York, NY, USA: Praeger, 1972, pp. 79–121. [Google Scholar]

- R. Jagannathan, and E.R. McGrattan. “The CAPM debate.” Fed. Reserv. Bank Minneap. Q. Rev. 19 (1995): 2–17. [Google Scholar]

© 2014 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Lipiec, J. Capital Asset Pricing Model Testing at Warsaw Stock Exchange: Are Family Businesses the Remedy for Economic Recessions? Int. J. Financial Stud. 2014, 2, 266-279. https://doi.org/10.3390/ijfs2030266

Lipiec J. Capital Asset Pricing Model Testing at Warsaw Stock Exchange: Are Family Businesses the Remedy for Economic Recessions? International Journal of Financial Studies. 2014; 2(3):266-279. https://doi.org/10.3390/ijfs2030266

Chicago/Turabian StyleLipiec, Jacek. 2014. "Capital Asset Pricing Model Testing at Warsaw Stock Exchange: Are Family Businesses the Remedy for Economic Recessions?" International Journal of Financial Studies 2, no. 3: 266-279. https://doi.org/10.3390/ijfs2030266

APA StyleLipiec, J. (2014). Capital Asset Pricing Model Testing at Warsaw Stock Exchange: Are Family Businesses the Remedy for Economic Recessions? International Journal of Financial Studies, 2(3), 266-279. https://doi.org/10.3390/ijfs2030266