1. Introduction

The accelerating interplay between financial technology (FinTech) and sustainability-oriented sectors is reshaping how risks are created, transmitted, and absorbed in modern economies. China offers a natural laboratory for studying the FinTech–sustainability nexus given the scale of digital finance, rapid ESG uptake, and an active green–finance policy mix. In this paper, we measure how tail risks propagate across FinTech and sustainability sectors in China by applying a factor-purged Quantile VAR model to daily sector indices (2015–2024). We find that FinTech is a major transmitter of extreme downside shocks to clean energy and green innovation sectors, policy-related sectors like environmental governance alternate between transmitting and absorbing shocks depending on the market state, and cross-sector diversification fails in the tails. Our objective is not to establish structural causality but to measure state-contingent risk propagation across FinTech and sustainability-linked sectors using quantile connectedness. By focusing on tail outcomes (e.g., the worst 10% of days), we capture dynamics that mean-based models would miss.

Recently digital financial infrastructure, green bond issuance, carbon governance, and technology-enabled public services have all expanded rapidly in China. These developments connect capital-intensive, policy-sensitive industries (such as clean energy, green finance, and environmental governance) with data and platform-driven verticals (intelligent transportation, digital healthcare). In this paper, “risk creation” refers to shocks originating in financing or policy nodes; “risk transmission” describes how those shocks spread through liquidity, regulation, or demand channels; and “risk absorption” captures sectors that predominantly receive shocks under specific market conditions. Capturing these state-contingent spillovers requires methods beyond mean-based models, which average away extremes. In the quantile FEVD framework, we interpret ‘risk creation’ as own-shock variance, ‘risk transmission’ as directional spillovers to other nodes, and ‘risk absorption’ as net-receiving contributions. This perspective aligns with recent work on tail connectedness (

Ando et al., 2022;

Choi, 2022;

Shang & Hamori, 2024;

Sun et al., 2024;

Tiwari et al., 2022;

M.-C. Wang et al., 2024).

Methodologically, we rely on quantile connectedness because mean-based VARs understate tail co-movements that matter for asset allocation, stress testing, and systemic oversight (

Diebold & Yilmaz, 2012). The recent finance literature documents materially different networks at the extremes and time variation in spillovers that intensify during crises (

Choi, 2022;

M.-C. Wang et al., 2024). Our approach complements those studies by factor-purging common components before computing quantile FEVDs, sharpening inference on idiosyncratic shock propagation (e.g., platform- or policy-specific). While the approach does not deliver structural causality, it provides transparent, quantile-specific evidence on systemic linkages (

Ando et al., 2022;

Diebold & Yilmaz, 2014) (

Ando et al., 2022;

Chatziantoniou et al., 2021;

Koop et al., 1996;

Pesaran & Shin, 1998).

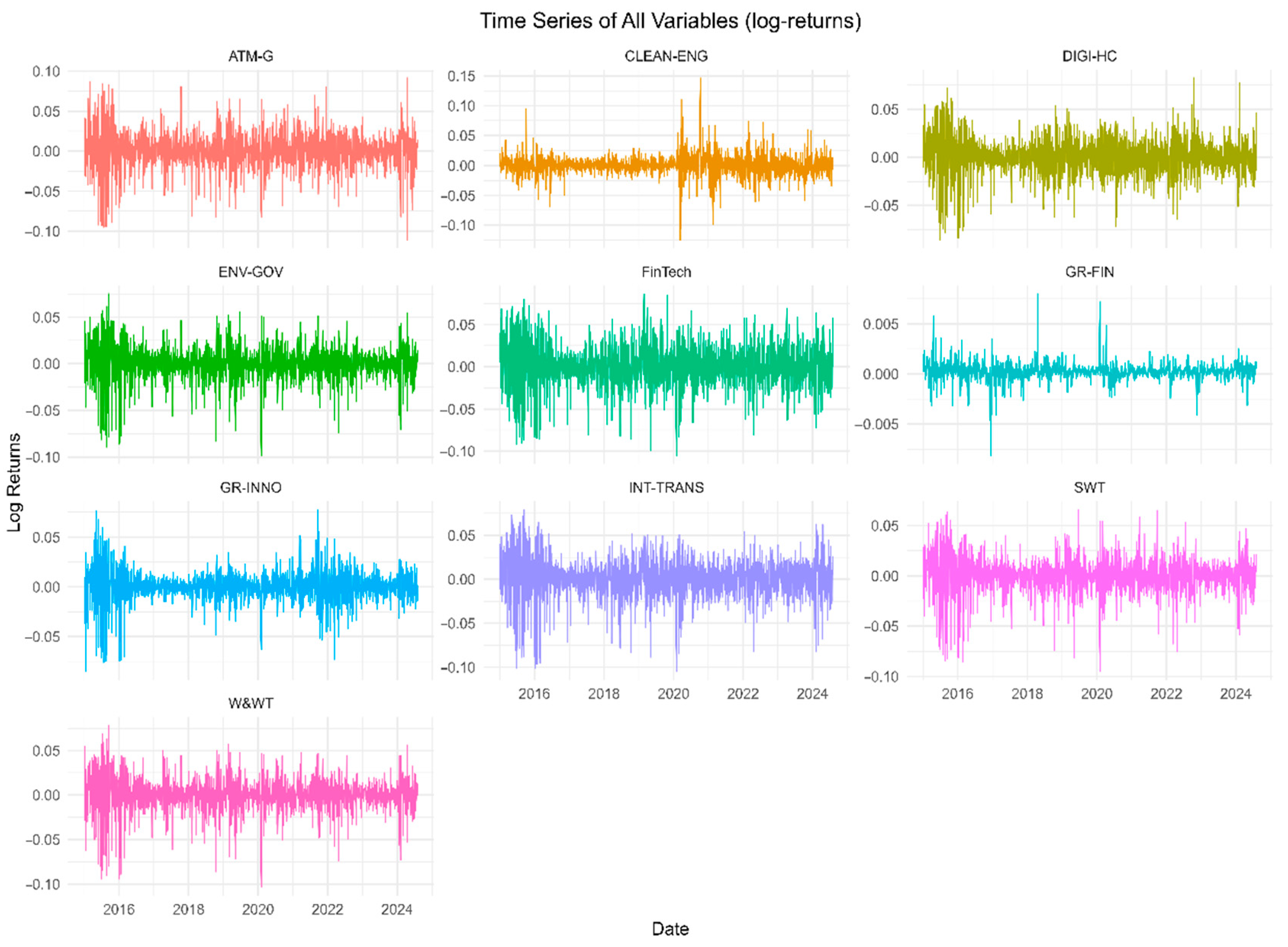

Anchored in this literature, we study daily Chinese stocks and bonds (January 2015–July 2024) spanning ten sustainability-linked sectors: FinTech, green finance, clean energy, green innovations, environmental governance (including atmospheric quality), water and water treatment, solid waste treatment, intelligent transportation, and digital healthcare. This broad yet policy-coherent system is theoretically connected by funding/liquidity channels (FinTech platforms, green credit/bond markets), regulatory spillovers (carbon/ESG rules, environmental governance), and technology/real-economy links (digital healthcare and transport platforms relying on financing and data rails). Modeling these sectors jointly allows us to: (i) assess whether FinTech behaves as a net transmitter of shocks to sustainability verticals in stress states (funding channel), (ii) evaluate policy-intensive nodes (e.g., environmental governance proxies) as state-dependent transmitters/absorbers, and (iii) gauge whether diversification benefits compress in tails when connectedness rises. Recent scholarship has deepened our understanding of green finance and systemic tail-risk transmission.

Bolton and Kacperczyk (

2021) highlight a growing “carbon premium” in asset pricing, underscoring investor sensitivity to climate risk exposures. Their findings support the notion that clean energy and carbon-intensive assets are priced differently under regulatory and investor pressure, aligning with our investigation into spillovers affecting green sectors. Similarly,

Giglio et al. (

2016) identify common systemic risk factors, laying a foundation for analyzing aggregate tail-risk propagation. Our use of factor-purged quantile connectedness builds on this approach by isolating idiosyncratic sectoral dynamics. We also relate our methodology to

Tobias and Brunnermeier’s (

2016) CoVaR framework, which models conditional value-at-risk to quantify systemic vulnerability in distress scenarios. The recent literature has increasingly highlighted the evolving role of FinTech in China’s financial system, particularly its implications for credit allocation, risk transmission, and systemic stability.

Fang et al. (

2023) demonstrate that FinTech-driven liquidity creation can enhance credit supply but also amplify risk exposure through changes in banks’ credit structures. Similarly,

Zhang et al. (

2021) and

Tian et al. (

2024) provide evidence that rapid FinTech expansion contributes to network contagion and tail-risk spillovers, reinforcing concerns about systemic vulnerability. While some studies, such as

R. Wang et al. (

2021) and

Deng et al. (

2021), find that FinTech can reduce bank risk-taking by increasing transparency and competitive discipline (

Deng et al., 2021;

R. Wang et al., 2021), others caution that digital lending platforms, particularly P2P lenders, can exacerbate liquidity shocks during downturns (

Chen et al., 2020;

Li et al., 2020). These findings are underscored by the real-world collapse of China’s P2P lending sector by 2020, which highlighted the sector’s potential to propagate instability. Collectively, these studies motivate a closer examination of FinTech’s role in transmitting tail risks to sustainability-linked sectors within China’s financial landscape. These works collectively situate our analysis within a robust and evolving literature on climate-related financial risk, state-dependent spillovers, and financial technology’s systemic implications. Fresh advances show that spillover structures in sustainable vs. conventional markets are strongly state-dependent and asymmetric. Using quantile connectedness,

Karim (

2025) documents that transmitters/receivers rotate across market states: traditional energy dominates in booms, while eco-indices and strategic minerals are more exposed to stress; robustness is validated with a QVAR check. These patterns imply that portfolio risk and policy transmission differ markedly in the lower vs. upper tails. Complementing this market-side view,

Aharon et al. (

2025) integrate climate policy uncertainty (CUI) with green/dirty assets and show that CUI is a net transmitter during major crises in a dynamic TVP-VAR setting, with influence that weakens later. Together, these studies motivate our China-focused analysis of tail-dependent connectedness across FinTech and sustainability-linked sectors, and they justify our emphasis on descriptive, sensitivity-tested inference and on the policy channel as a potentially state-contingent transmitter.

We make three contributions. First, we provide quantile-specific evidence on how FinTech and sustainability sectors in China exchange risk under different market states, showing that lower-tail conditions compress diversification benefits. Second, we characterize the role of policy-intensive nodes’ environmental governance and climate/air-quality proxies in mediating shocks asymmetrically across quantiles. Third, we translate these patterns into finance-relevant implications for portfolio construction and for regulators concerned with liquidity management and policy-induced spillovers. Unlike prior connectedness studies that focus on average conditions, our analysis highlights tail-risk scenarios that are increasingly relevant (e.g., climate-related financial stress or digital-bubble bursts).

Finally, we emphasize practical implications. For portfolio managers, our results caution that sustainable sector diversification may fail during downturns, implying a need for tail-risk hedging and dynamic risk budgeting. For regulators, the findings suggest incorporating quantile-based stress scenarios, for example simulating a severe FinTech credit crunch and observing its impact on green assets into regulatory stress tests within China’s framework. By doing so, policymakers can better identify hidden vulnerabilities that only manifest under extreme conditions.

We explicitly acknowledge the identification limits of our framework: quantile connectedness provides forecast-variance contributions rather than structural causal effects. We therefore prioritize transparent interpretation, uncertainty assessment, and robustness checks and link each empirical result back to pre-stated hypotheses and an economic mechanism.

4. Methodology

4.1. Quantile VAR Framework

To capture state-dependent risk spillovers, this study employs the Quantile Vector Autoregression (QVAR) framework. Unlike traditional VAR models, which focus only on average relationships, the QVAR allows coefficients to vary across different points of the return distribution. This feature is critical for analyzing dynamics in the tails of the distribution, where crises or periods of exuberance occur and where diversification benefits are most likely to break down. The QVAR therefore enables us to evaluate how shocks propagate under adverse, normal, and optimistic market states, rather than relying on mean effects that may mask extreme behavior (

Ando et al., 2022;

Chatziantoniou et al., 2021).

4.2. Factor-Purging Step

Before estimating the QVAR, we apply a factor-purging procedure to isolate idiosyncratic shocks. Using rolling principal component analysis, we remove common market-wide components that typically dominate financial time series. These common factors often reflect global or macroeconomic conditions and can artificially inflate spillover measures if left unaddressed. Principal Component Analysis is conducted on the matrix of standardized daily log returns (not price levels) for the ten indices. We use the correlation matrix of returns (since we standardize each series) in computing principal components. We remove the first principal component (PC1) in each window. The choice is based on the Kaiser criterion (eigenvalue > 1) and the scree plot of eigenvalues. In our data, PC1 typically has an eigenvalue far above 1 (often > 1), while PC2 is around or below 1. PC1 explains on average approximately 45% of the total variance of the 10 returns, indicating a dominant common factor (essentially a “market” factor influencing all sectors). Therefore, we opted to purge only the first factor. By focusing on idiosyncratic shocks, we sharpen inference about sector-specific channels of transmission, for example FinTech’s role in propagating liquidity shocks or environmental governance indices transmitting policy uncertainty. This adjustment improves the credibility of the connectedness measures and ensures they capture genuine intersector linkages rather than broad market co-movements (

Ando et al., 2022;

Chatziantoniou et al., 2021).

4.3. Forecast Error Variance Decomposition

The QVAR framework is then used to decompose the forecast error variance of each sector into portions attributable to shocks in other sectors. This decomposition shows how much of a sector’s volatility can be explained by innovations in its peers under different quantile states. For example, it allows us to quantify the share of clean energy volatility that arises from FinTech shocks during downturns. Interpreting these decompositions at the lower and upper quantiles highlights whether risk transmission strengthens in adverse states, eases in normal conditions, or becomes more balanced during optimistic periods.

4.4. Connectedness Measures

From these decompositions, we derive the connectedness indices popularized by (

Diebold & Yilmaz, 2009;

Diebold & Yilmaz, 2012;

Diebold & Yilmaz, 2014) and adapt them to the quantile setting. The directional “TO” measure captures how much risk a sector transmits to others, while the “FROM” measure reflects how much risk it absorbs. The difference between the two gives the net connectedness, identifying systemic transmitters with positive values and receivers with negative values. The Total Connectedness Index (TCI) summarizes overall market interconnectedness as the percentage of variance explained by cross-sector shocks. Economically, a high TCI in the lower quantile indicates that shocks spread widely during crises, leaving limited room for diversification.

4.5. Inference and Robustness

We recognize that estimation uncertainty matters for interpreting connectedness measures. In this study, we present connectedness series and networks as descriptive statistics and assess robustness via rolling-window estimation and sensitivity checks over lag length, forecast horizon, and quantile selections. These checks show that our main patterns (e.g., FinTech’s transmitter role in downturns and the reduction in diversification benefits in adverse states) are qualitatively stable for reasonable modeling choices.

4.6. Comparison with Alternative Models

Finally, it is important to clarify why we employ a factor-purged QVAR rather than alternative approaches. The mean-based Diebold–Yilmaz framework (

Diebold & Yilmaz, 2009,

2012,

2014) is well established but cannot capture heterogeneity across tails. Time-varying parameter VAR models allow for gradual temporal changes but still focus on average behavior rather than quantile-specific states (

Antonakakis et al., 2020). Quantile-on-Quantile methods are informative but less suitable for high-dimensional systems (

Chowdhury et al., 2021;

Hung, 2021). Our approach combines the strengths of quantile analysis with factor-purging, enabling a tractable and interpretable framework that highlights state-contingent transmission channels. This design is particularly relevant for studying systemic spillovers, as it identifies how FinTech shocks propagate in stress periods and how policy-sensitive sectors switch roles across different market states. Quantile FEVDs allow us to trace who transmits and who absorbs shocks at specific quantiles, which is essential when risk management focuses on downside states. We employ the quantile connectedness framework of

Chatziantoniou et al. (

2021), we extend our analysis by incorporating a factor-purging step inspired by

Ando et al. (

2022). Specifically, we first extract common factors from the data using principal component analysis (PCA) on a rolling window and remove these components from the original series. This generates idiosyncratic residuals, which are then used as inputs into the quantile VAR connectedness model. In this way, our approach emphasizes the propagation of idiosyncratic shocks rather than common shocks, thereby aligning with the central insight of

Ando et al. (

2022) that systemic risk and spillover intensity are strongly amplified in the tails once common factors are controlled for. While we do not replicate the full quantile factor model of

Ando et al. (

2022), our PCA-based adaptation captures the essence of their methodology and allows us to conduct a tractable large-dimensional empirical application. we approximate their approach by purging common factors using rolling PCA, which preserves the key insight that tail spillovers are amplified once idiosyncratic shocks are isolated.

Below, Equations (2)–(14) present the methodology in one continuous sequence. Symbols: (series vector): is the intercept vector. (QVAR lag matrices at quantile ), it is the lag-ℓ co efficient matrices, ℓ = 1, …, and (innovation vector at quantile), with , (VMA coefficients), (selection vector), and (FEVD horizon). denotes the i-th row (as a column vector) of Fℓ(κ), used in the check-loss minimization. The check loss is . In the equations, the quantile level is denoted by κ (kappa), which is identical to τ used elsewhere; thus, we take κ ≡ τ throughout, i.e., they are identical and both index the conditional quantile state (e.g., 0.10, 0.50, 0.90).

Equation (2)—QVAR (

) at quantile

. Each variable depends on

lags of all variables; coefficients are specific to the evaluation quantile

.

Equation (3)—Estimation by equation-wise quantile regression. For each

, minimize the check loss to obtain

row by row.

Equation (4)—Quantile-specific VMA (∞) representation. Under stability at

, shocks propagate through quantile-specific impulse responses.

Equation (5)—Recursion for

. Compute VMA coefficients from QVAR lags via the standard companion recursion (holding

fixed).

Equation (6)—Generalized FEVD (order-invariant). The

-step share of variable

’s FEV due to a shock in

at quantile

.

Equation (7)—Row-normalization (shares sum to one by row). Normalize generalized shares so each row of the FEVD table is a composition of

’s variance.

Equation (8)—Directional “TO” (outgoing spillovers from

). Sum the off-diagonals in row

(impact of

on all others).

Equation (9)—Directional “FROM” (incoming spillovers to

). Sum the off-diagonals in column

(impact on

from all others).

Equation (10)—Net connectedness of node

. Outgoing minus incoming.

Equation (11)—Total Connectedness Index (percent scale). Off-diagonal mass of the normalized FEVD table, scaled by 100.

Equation (12)—Adjusted Total Connectedness (unit interval). A

index improving comparability across

.

Equation (13)—Ando-style factor decomposition of innovations. Split QVAR innovations into common and idiosyncratic components at

; connectedness focuses on idiosyncratic shocks.

Equation (14)—Idiosyncratic GFEVD (used for spillovers). Compute FEVD with

and shocks

(same formula as (Equation (6), different inputs).

(i) is held fixed throughout each evaluation (QVAR, VMA, FEVD), (ii) the generalized scheme avoids Cholesky ordering and is row-normalized, (iii) when factor-purging is used, all connectedness metrics are built from Equation (14). Typical choices: by BIC at ; ; rolling window for time variation.

5. Results and Discussion

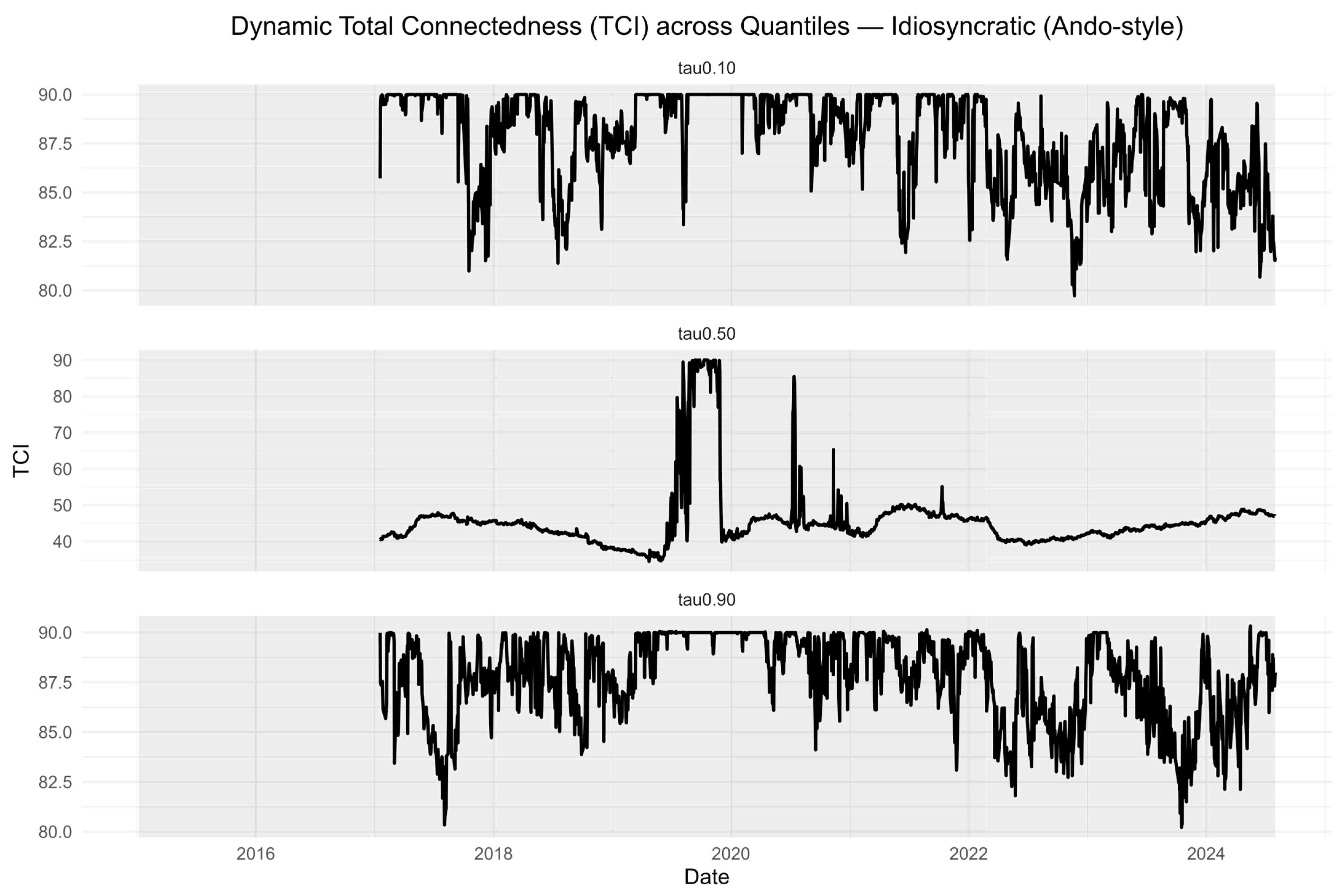

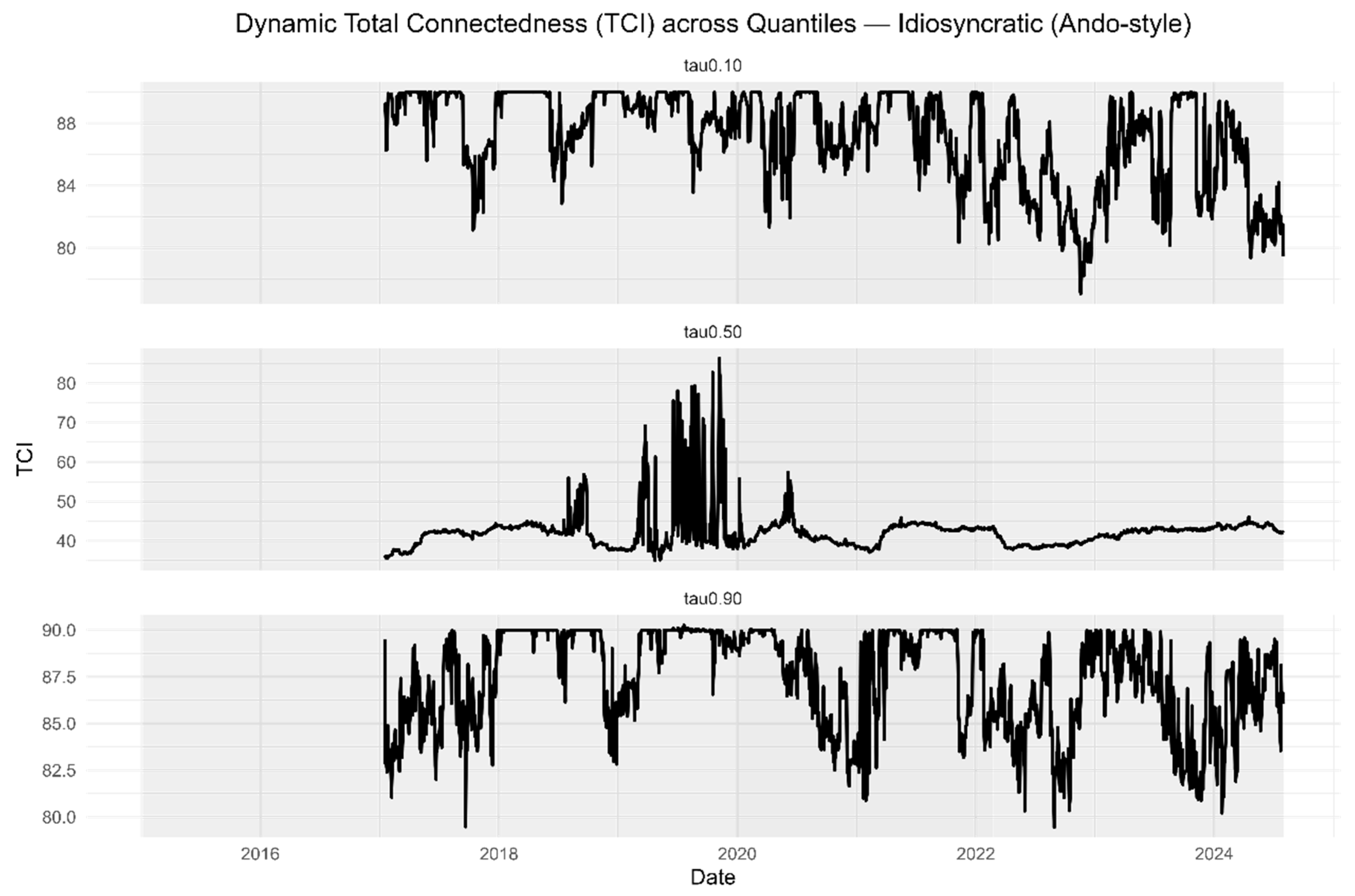

5.1. Dynamic Total Connectedness (TCI) Across Quantiles

Figure 2 plots the dynamic Total Connectedness Index (TCI) obtained from the QVAR–GFEVD at τ ∈ {0.10, 0.50, 0.90}. The first result concerns the overall level of connectedness across sectors. The Total Connectedness Index (TCI) is consistently higher in the lower quantile (τ = 0.10) compared with the median (τ = 0.50) and the upper quantile (τ = 0.90). This pattern indicates that shocks spread more intensively during adverse market conditions, confirming the presence of tail amplification. In practical terms, diversification benefits diminish precisely when investors need them most, as downside states tighten risk linkages across FinTech and sustainability sectors. Episodes such as the COVID-19 outbreak and subsequent policy adjustments are accompanied by pronounced surges in TCI, showing that systemic shocks compress risk buffers across the entire system.

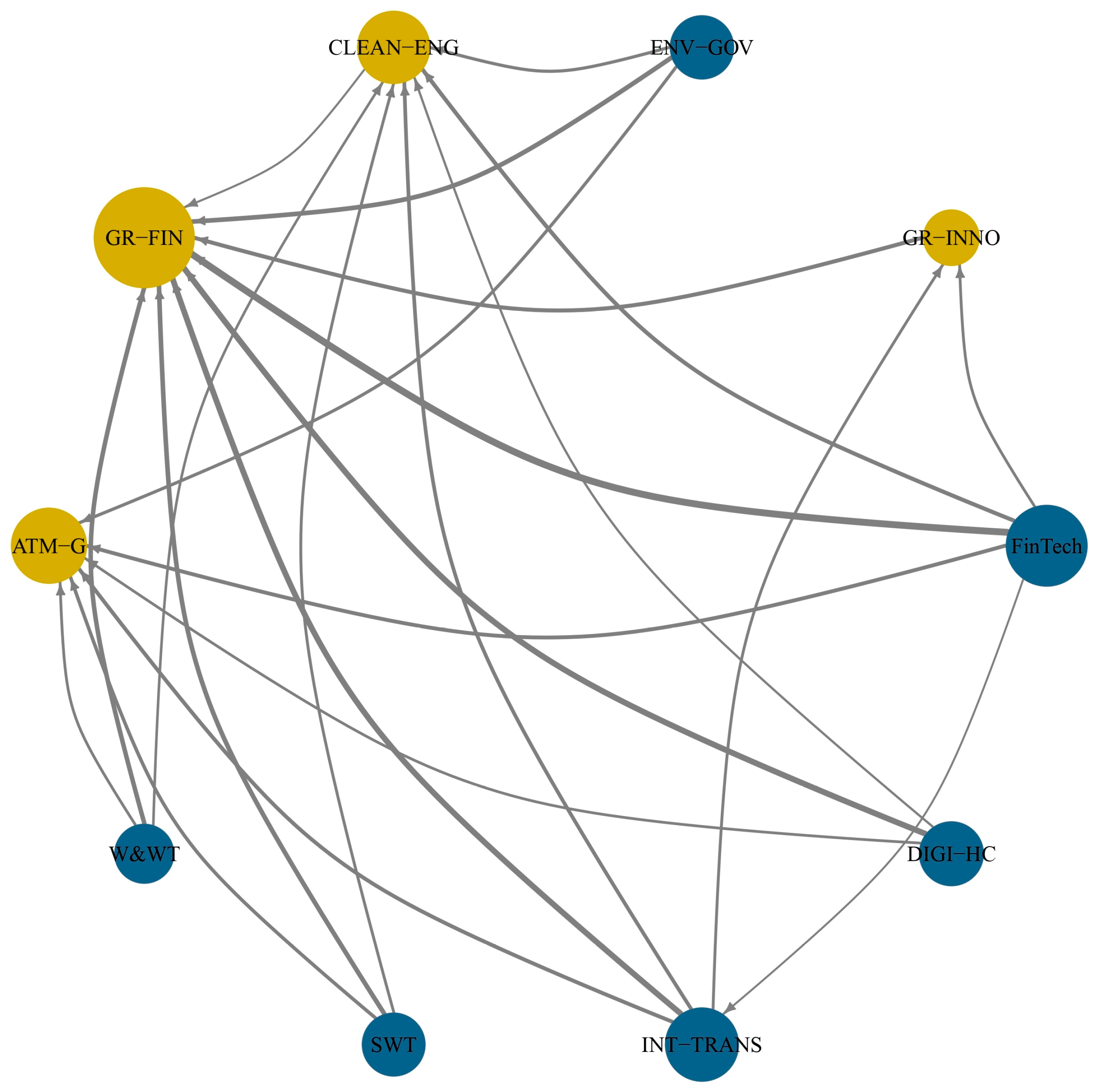

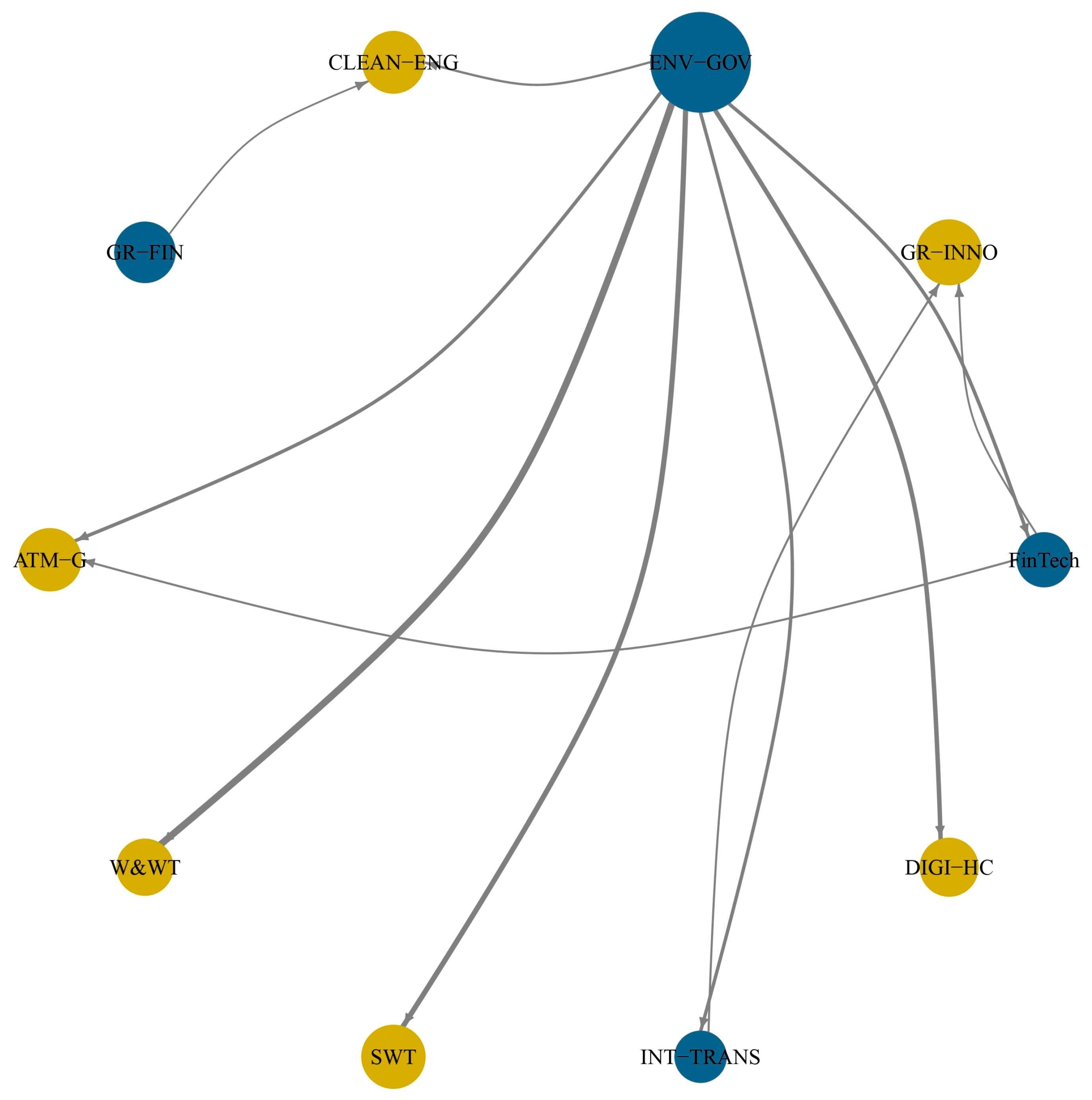

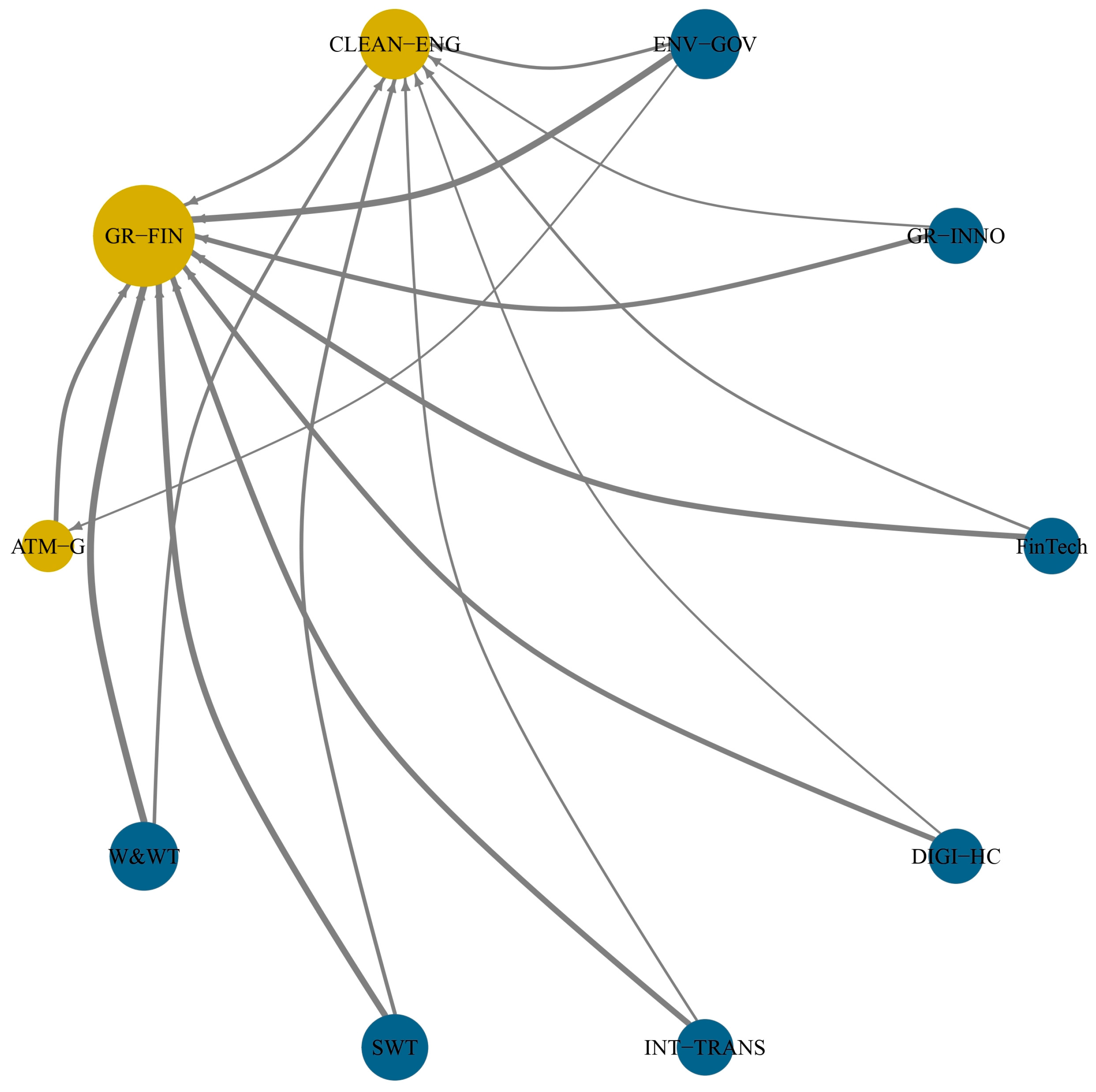

5.2. Full-Sample Spillover Networks at τ = 0.10, 0.50, and 0.90

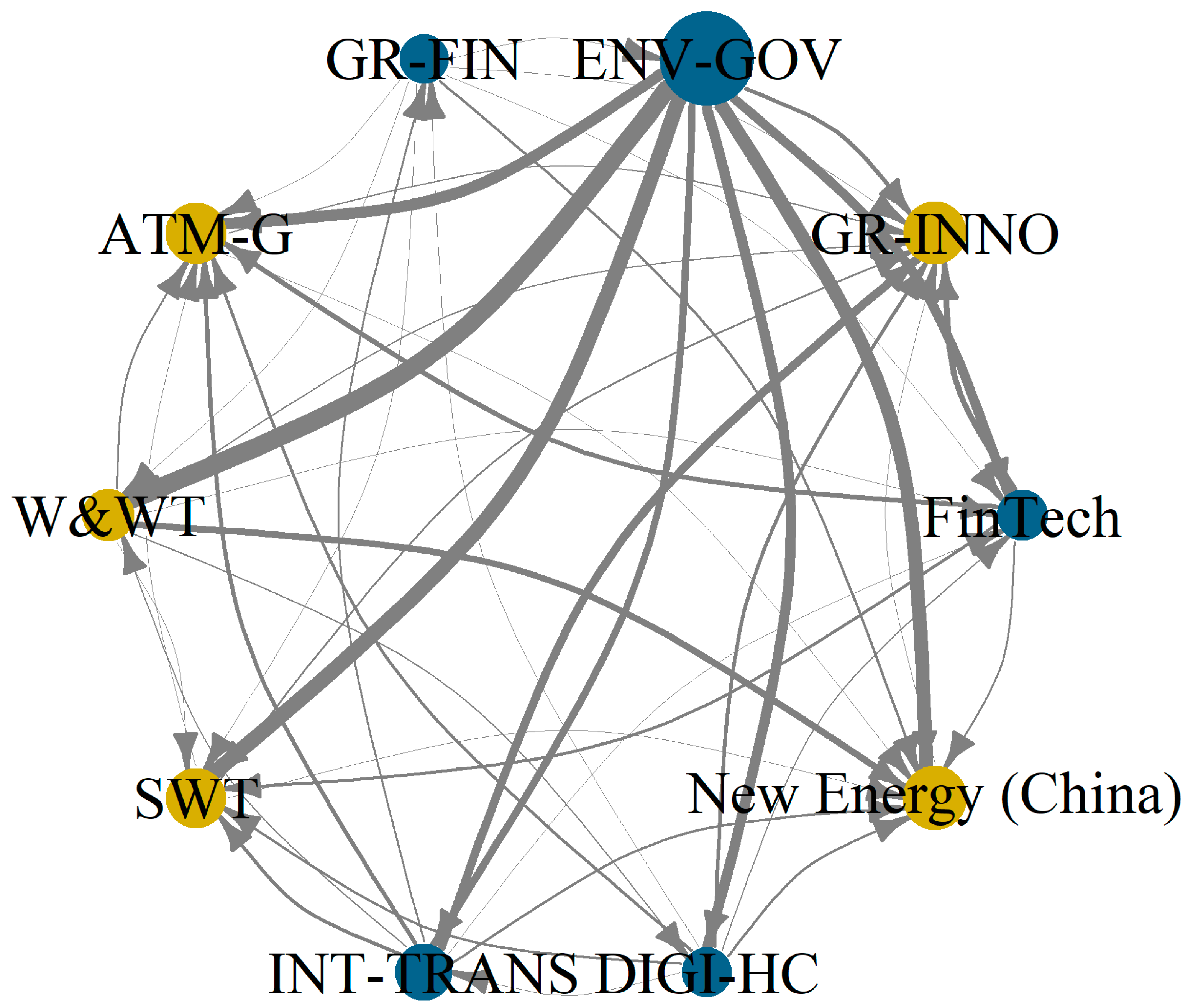

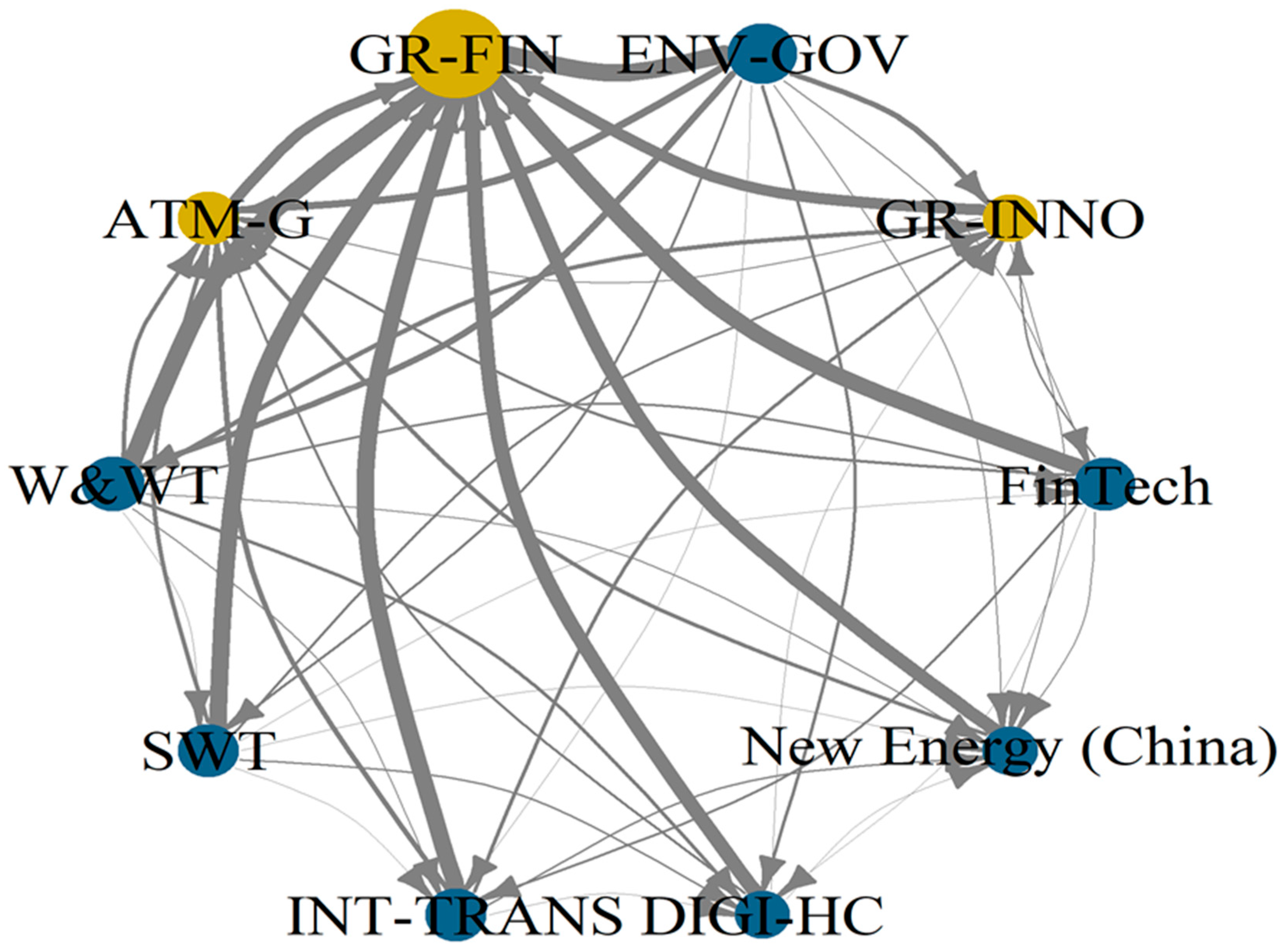

Figure 3,

Figure 4 and

Figure 5 display the directed, weighted spillover networks (full sample) at the lower, median, and upper quantiles. Spillover networks at different quantiles provide further insight into the structure of risk transmission.

At τ = 0.10 (adverse state), FinTech emerges as a central transmitter, sending significant spillovers to clean energy and green innovations. This supports the funding channel (H1), where liquidity and credit shocks originating in FinTech cascade into capital-intensive sustainability sectors.

Policy-related indices, such as environmental and atmospheric governance, also act as transmitters under stress, consistent with the policy asymmetry channel (H2).

Clean energy and green innovations tilt toward receiver roles, absorbing shocks rather than generating them, highlighting their vulnerability to financing conditions.

At τ = 0.50 (median state), spillovers are more balanced, with fewer dominant transmitters. Policy indices absorb more than they transmit, reflecting stabilization during normal conditions.

At τ = 0.90 (optimistic state), the network becomes sparser and two-way interactions dominate. FinTech’s transmitter role weakens, while digital verticals such as healthcare and intelligent transport take on more active positions. This supports H3, where technology-driven sectors partially transmit shocks in positive states, driven by demand rebounds and platform growth.

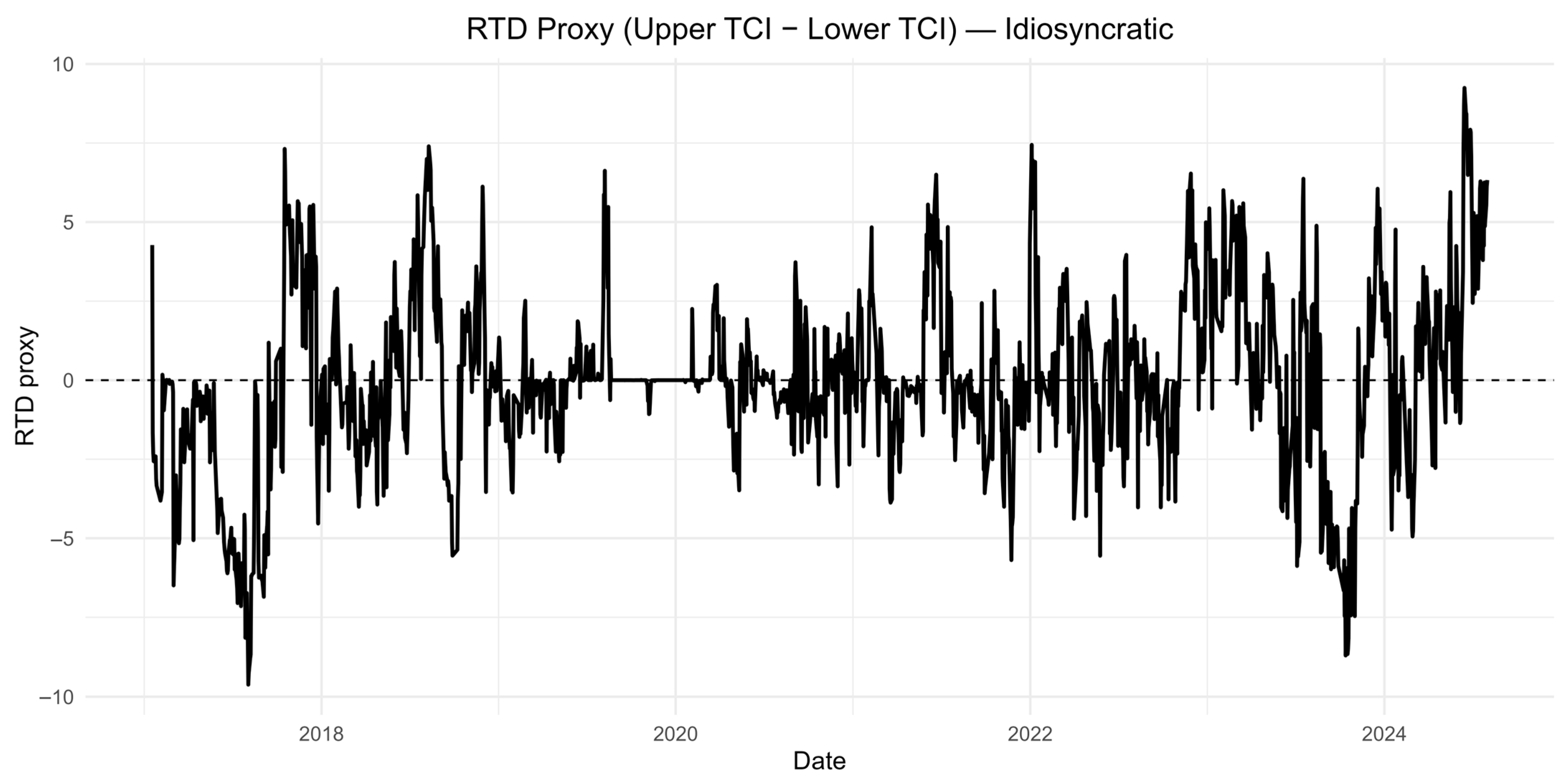

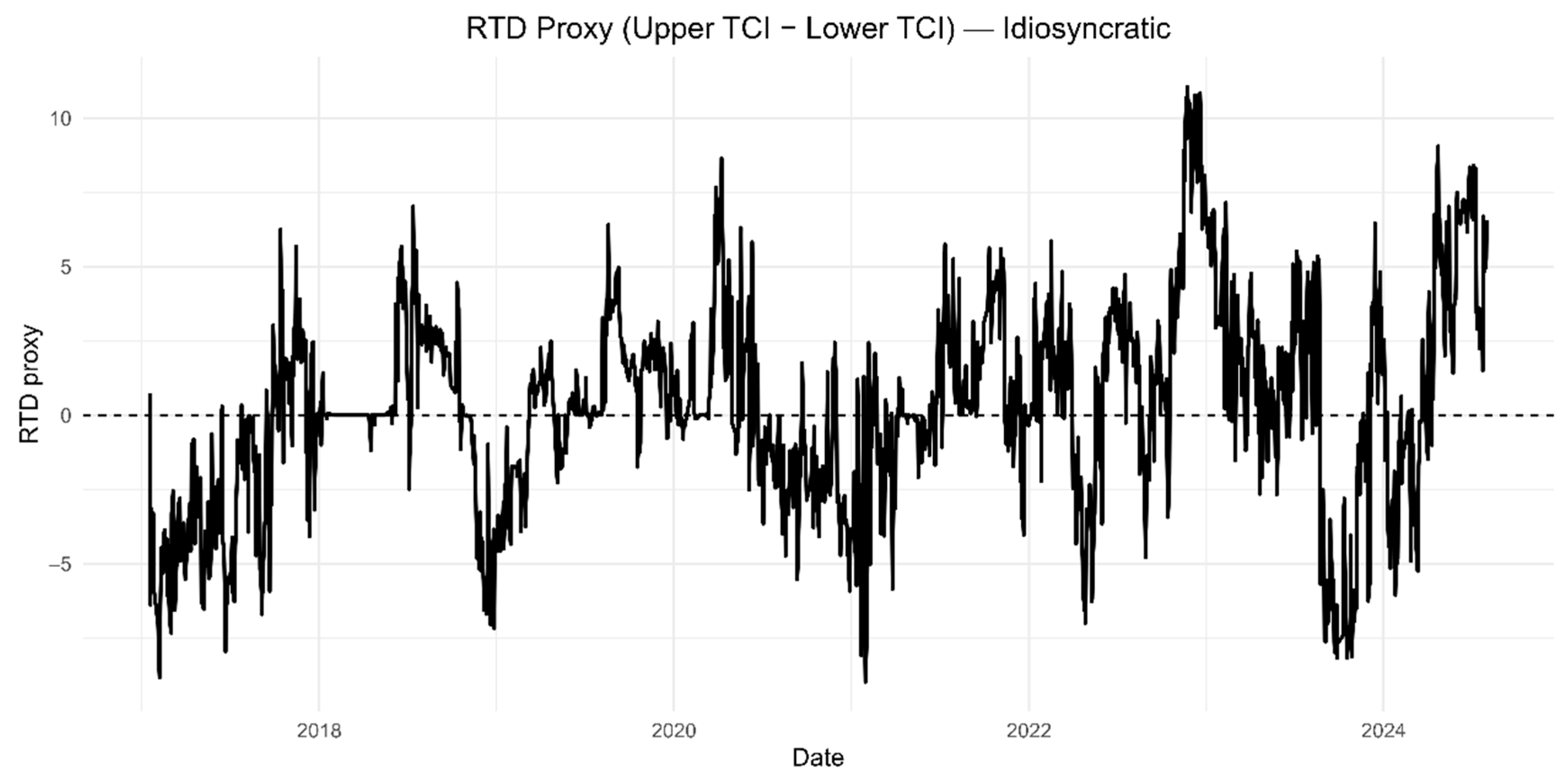

5.3. Quantile Asymmetry (Upper−Lower TCI Proxy)

Figure 6 charts an asymmetry proxy defined as TCI (τ = 0.90) − TCI (τ = 0.10). Comparing TCI between upper and lower quantiles shows that adverse states generally dominate optimistic ones. The difference measure (TCI at τ = 0.90 minus TCI at τ = 0.10) is negative during systemic stress periods, confirming that downside shocks bind sectors more tightly. Occasional positive spikes suggest that optimistic extremes can also generate strong spillovers, but these episodes are less frequent and less persistent. The overall evidence confirms H5, that diversification benefits are compressed in both tails but especially in the left tail.

5.4. Directional Roles and Channels

Synthesizing the results across metrics and hypotheses yields four main observations:

Funding/Liquidity (H1): FinTech and green finance consistently act as transmitters in downturns. Their role as providers of credit and liquidity means that stress in these sectors propagates to clean energy and green innovations.

Policy/Regulation (H2): Environmental and atmospheric governance indices are state-dependent. They transmit shocks during stress but absorb shocks during calmer or optimistic periods. This asymmetry reflects the regulatory environment, where policy tightening amplifies risks but policy relaxation provides relief.

Technology–Real Economy Coupling (H3): Digital healthcare and intelligent transportation absorb more spillovers in downturns but switch to mild transmitters in optimistic conditions. This highlights the pro-cyclical nature of platform-based sectors.

Environmental Services (H4): Water and waste utilities remain net receivers, especially in the lower quantile, underscoring their limited flexibility under financial or policy stress.

5.5. Economic and Policy Implications

The results carry important lessons for both investors and policymakers. For portfolio managers, the evidence demonstrates that diversification across FinTech and sustainability sectors is fragile under stress, and risk budgeting must explicitly account for quantile-specific dynamics. In practical terms, this means investors should monitor tail risk indicators. For instance, if they track a rising TCI at the 10th percentile (perhaps using techniques from this paper), that could warn that their cross-sector diversification is breaking down. Portfolio managers should consider hedging strategies designed for adverse states: e.g., buying protective puts on FinTech index or related ETFs when downside connectedness metrics rise, or reducing exposure to multiple sustainability sectors that tend to crash together. Traditional mean-variance optimization won’t capture these nonlinear correlations; a quantile-based approach (minimizing Conditional Value-at-Risk, for example) might be more appropriate. Our findings specifically suggest that FinTech can be a “risk conduit” so hedging or under-weighting FinTech during times of financial tightening could lower overall portfolio risk. Also, since policy-heavy sectors get hit in crises, investors might demand higher risk premiums for those sectors knowing their asymmetric risk profile. Hedging strategies need to be designed for adverse states, where FinTech shocks in particular compromise capital-intensive sectors.

For regulators, the asymmetric role of policy-intensive nodes calls for careful monitoring of regulatory spillovers during uncertainty, as these can accelerate systemic risk transmission. Stress tests that focus only on average conditions risk underestimating vulnerabilities; instead, regulators should simulate downside-tail scenarios where systemic linkages are strongest. Regulators (such as the People’s Bank of China or the China Banking and Insurance Regulatory Commission) should incorporate downside-tail scenarios in their macroprudential stress testing. For example, they could simulate a scenario where FinTech lending drops by, say, 30% (a severe contraction reflecting a FinTech credit crunch), and examine the impact on clean energy firms’ solvency or on green bond spreads effectively a multi-sector stress scenario. Our results suggest that scenario would show significant knock-on effects, justifying measures to counteract it (like emergency liquidity to sustainable projects or encouraging banks to step in if FinTech pulls back). Secondly, the findings underscore that policy uncertainty can amplify systemic risk in bad times. Thus, regulators might strive for stable and clear communication of environmental policies especially during market stress, to avoid adding fuel to the fire. If possible, major new carbon regulations or green financing rules might be better introduced during stable times, whereas in a crisis, providing reassurance (or even relaxing some requirements temporarily) could avoid exacerbating the financial turmoil in sustainability sectors. Lastly, given FinTech’s systemic role, regulators might consider macroprudential tools targeting FinTech for instance, requiring FinTech platforms to maintain certain loss-absorbing buffers or subjecting them to stress tests alongside banks. This would be analogous to how systemically important banks are regulated, extending some of that mindset to large FinTech firms.

In terms of broader policy, our results align with the agenda of “greening” the financial system but add nuance: a resilient green financial system may need buffers for when multiple green sectors get hit simultaneously (like renewable energy, water, waste all suffering together in a downturn). The network perspective can inform cross-sector policy coordination: e.g., if the Ministry of Finance is designing a green stimulus, they might target it to sectors that are receivers (like water/waste utilities) during downturns to shore them up and prevent cascade, or ensure FinTech credit keeps flowing to clean energy projects in a slump perhaps through guarantees.

6. Conclusions

This paper provides novel evidence on tail-dependent spillovers between Chinese FinTech and sustainability-linked sectors using a factor-purged quantile connectedness framework. Three findings stand out. First, FinTech consistently emerges as a net transmitter in adverse states, underscoring its role in propagating liquidity and credit shocks. When markets turn down, shocks originating in China’s FinTech sector (e.g., tighter online credit, fintech market corrections) spread forcefully to other sectors like clean energy and green finance, amplifying system-wide risk. Second, diversification benefits compress when risks are highest, as stronger connectedness erodes cross-sector hedging opportunities. Investors holding a portfolio of FinTech, renewable energy, and environmental assets will find limited refuge in a crisis as contagion ties their fates together. Third, policy-intensive nodes switch roles asymmetrically across quantiles, reflecting regulatory spillovers that intensify during uncertainty but attenuate in stable conditions. Sectors tied to environmental regulation (environmental governance, atmospheric governance) transmit shocks under stress, reflecting how policy uncertainty or stringent rules bite in bad times, but they become shock absorbers or neutral in stable/optimistic periods. This asymmetry highlights that regulatory impact on financial markets is highly state-dependent.

These results have important implications. For portfolio managers, they caution that diversification strategies relying on sustainable sectors may fail precisely during downturns, requiring quantile-aware risk budgeting and dynamic hedging. In practice, this means incorporating tail-risk measures (like our quantile connectedness metrics or scenario analysis) into portfolio construction. Portfolio hedges should be designed with stress scenarios in mind, for example hedging FinTech exposure or adding uncorrelated assets when our indicators show rising lower-tail connectedness. For regulators, the asymmetric roles of policy sectors call for stress testing at the tails, with a focus on FinTech-linked liquidity channels and climate policy announcement windows. Regulators should simulate worst-case tail scenarios (e.g., a FinTech credit crunch coinciding with a climate policy shock) to see how financial institutions and markets cope. Such quantile-focused stress tests could be integrated into China’s regulatory toolkit, complementing traditional tests. Additionally, our findings suggest that regulators monitor FinTech as a potential amplifier of systemic risk and ensure liquidity support or safeguards for sustainable sectors during extreme events. They also underscore the need for clear policy communication: abrupt environmental policy moves in an already fragile market can accelerate a downturn, so a calibrated approach to policy implementation is advised during stressed conditions.

Finally, while quantile connectedness measures forecast-variance contributions rather than structural causality, our approach enhances transparency and robustness through factor-purging and extensive sensitivity checks. Future research could extend this framework to cross-country comparisons, integrate event-study identification around policy shocks, or apply quantile SVAR methods to strengthen causal interpretation.

In conclusion, the FinTech–sustainability nexus in China exhibits complex, state-dependent risk transmission. By focusing on tail events, we reveal that the very moments when these sectors are needed for stability (e.g., as diversifiers or shock absorbers) are when they instead synchronize and amplify risk. This insight is crucial for designing resilient portfolios and effective regulatory policies in an era where both digital finance and sustainable investments are increasingly central. We hope that our quantile-based network approach provides a useful template for analyzing such systemic interactions under extreme conditions.