Abstract

Cryptocurrency investment in India has quickly become a mainstream financial activity, but it is still highly prone to psychological factors that impact the decision-making of retail investors. This study examines the effect of personality traits on cryptocurrency investment behavior using the mediating variable of behavioral biases. Based on the Big Five Personality Model and the theory of Behavioral Finance, data were gathered from 716 Indian retail investors using a structured questionnaire. Partial Least Squares Structural Equation Modeling (PLS-SEM) was conducted to analyze the relationships among the variables. Results show that Openness to experience and Agreeableness significantly predict Availability Bias, whereas Extraversion and Agreeableness affect the Disposition Effect. The theoretical framework shows how bias-driven investment behavior in volatile markets such as cryptocurrency is triggered by personality-based predispositions. The study adds to the behavioral finance literature by taking psychological profiling outside the realms of traditional investment contexts into digital asset investing and provides practical insights for regulators, fintech platforms, and investment advisors to design interventions to mitigate bias and enhance investor education.

1. Introduction

The emergence of cryptocurrencies has changed the financial landscape worldwide by introducing decentralized, technology-driven systems of value exchange. Assets such as Bitcoin and Ethereum have moved from being experimental innovations to mainstream investment instruments that attract individuals across age groups and professions. The global cryptocurrency market now represents billions of dollars in capitalization, driven largely by digital-native investors seeking independence from traditional banking channels. This transformation has been accelerated by improvements in internet access, digital payment infrastructure, and fintech applications. In emerging economies such as India, the appeal of cryptocurrency is particularly strong because it combines financial inclusion, rapid technological diffusion, and aspirations for high returns within a relatively short time frame.

The technological foundation of cryptocurrencies lies in blockchain—a distributed ledger system that ensures transparency, immutability, and decentralized verification of transactions. This innovation not only challenges the dominance of centralized financial intermediaries but also inspires the emergence of decentralized finance (DeFi), tokenized assets, and non-fungible tokens (NFTs). Globally, blockchain-based systems have extended into various sectors, including cross-border payments, remittances, and digital identity verification, thereby redefining the meaning of trust and security in finance. Artificial intelligence (AI) and big data analytics further enhance these systems by enabling algorithmic trading, sentiment analysis, and predictive models for market behavior. In the context of India, the convergence of blockchain technology with fintech platforms such as Paytm, CoinSwitch, and WazirX has democratized access to digital assets, empowering millions of young investors. Yet, this democratization also exposes retail investors to behavioral vulnerabilities—where decisions are guided more by online trends, peer influence, and speculative optimism than by fundamental analysis. Hence, technological advancement, while fostering inclusion, simultaneously intensifies behavioral biases that affect investor rationality.

Cryptocurrency in India has seen a tremendous growth since 2020 because of access to technology, social media influence, and the emergence of fintech exchanges. Despite regulatory uncertainty, India is among the top crypto holders and traders in the world. However, this rapid adoption has also brought behavioral and psychological challenges in the form of retail investors who tend to make decisions based on emotional or heuristic biases instead of rational analysis (Kala et al., 2025).

The literature on behavioral finance illustrates that the behavior of investors does not necessarily comply with rational utility models because of their cognitive and emotional biases. In this respect, personality characteristics (especially those that are described by the Big Five model) are instrumental in determining vulnerability to biases like Availability Bias and the Disposition Effect. The nature of these psychological factors is crucial to making sense of the irrational investment patterns observed in highly volatile crypto markets (Koziuk et al., 2024).

In emerging markets such as India, where the financial ecosystem is rapidly evolving, behavioral finance offers a compelling framework to understand crypto investing patterns. The intersection of youth demographics, digital connectivity, and aspirational consumption has created an investor class that is highly receptive to social media narratives and influencer marketing. Unlike traditional stock or mutual fund investors, crypto participants are often motivated by emotional and social incentives—such as fear of missing out (FOMO), perceived community belonging, and the excitement of high-risk, high-reward ventures. Cognitive shortcuts, or heuristics, become dominant when individuals face complex information or lack adequate financial literacy. This leads to impulsive decision-making, overconfidence, and confirmation bias—where investors seek information that validates their expectations rather than challenges them. Studies in behavioral economics suggest that such tendencies are intensified in volatile markets, where emotional contagion and herd behavior amplify price movements. Consequently, the crypto market in India serves as an ideal environment to study the interplay between technology, emotion, and cognitive bias, revealing how psychological and socio-cultural factors jointly shape investment intentions.

This research paper addresses a strong gap in the literature by incorporating the theory of personality traits and behavioral bias to understand the tendency to invest in cryptocurrencies in emerging markets. Whereas some previous studies have analyzed either or both biases or traits, this study forms a composite predictive model based on PLS-SEM and tests it on a large sample of Indian retailers (Damayanti et al., 2023). The research contributes to theory by showing a psychological mechanism linking trait predisposition to bias formation and investment decision-making, a new behavioral prism through which the psychology of retail investors in digital assets can be examined (James & Seranmadevi, 2024).

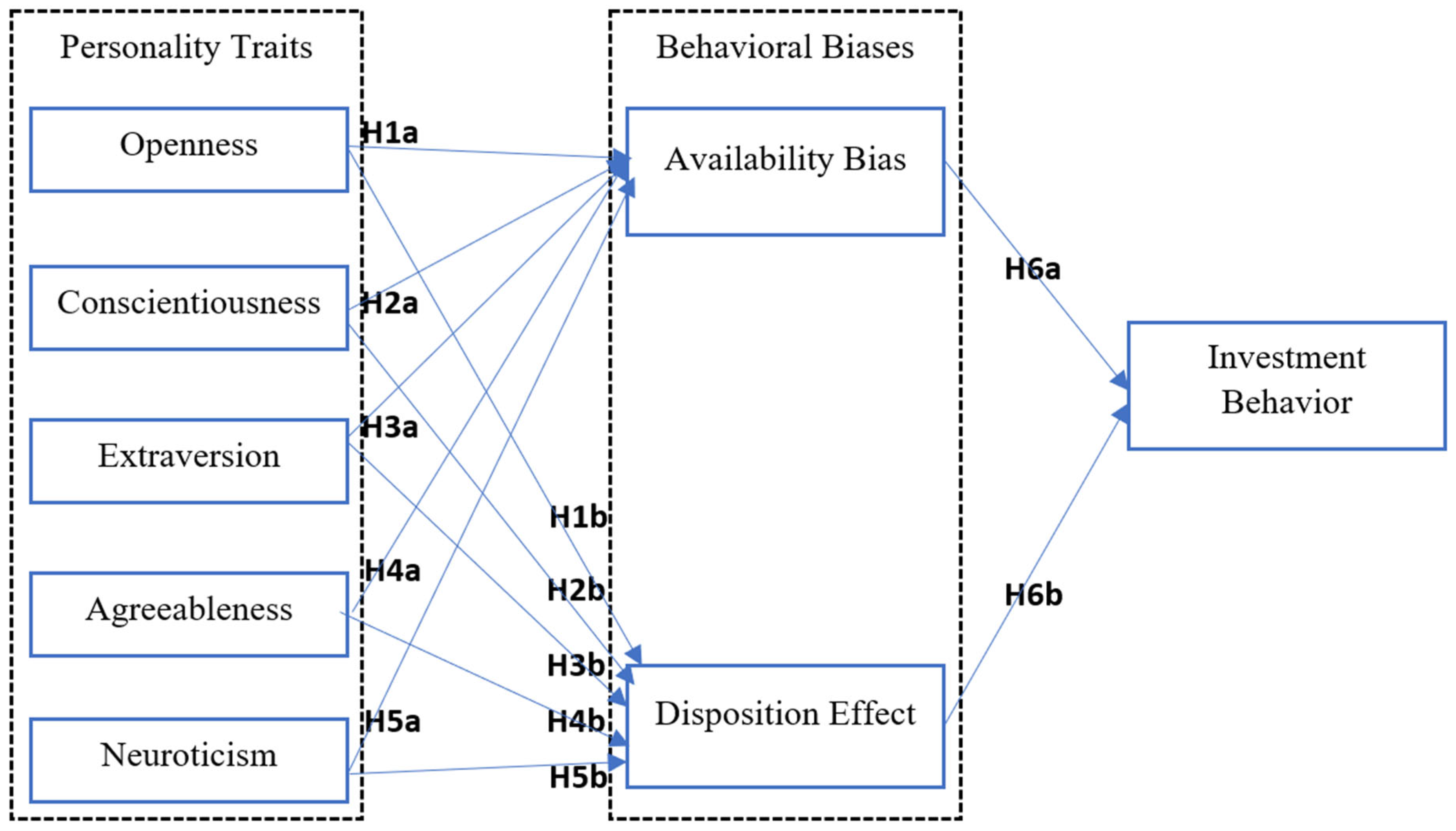

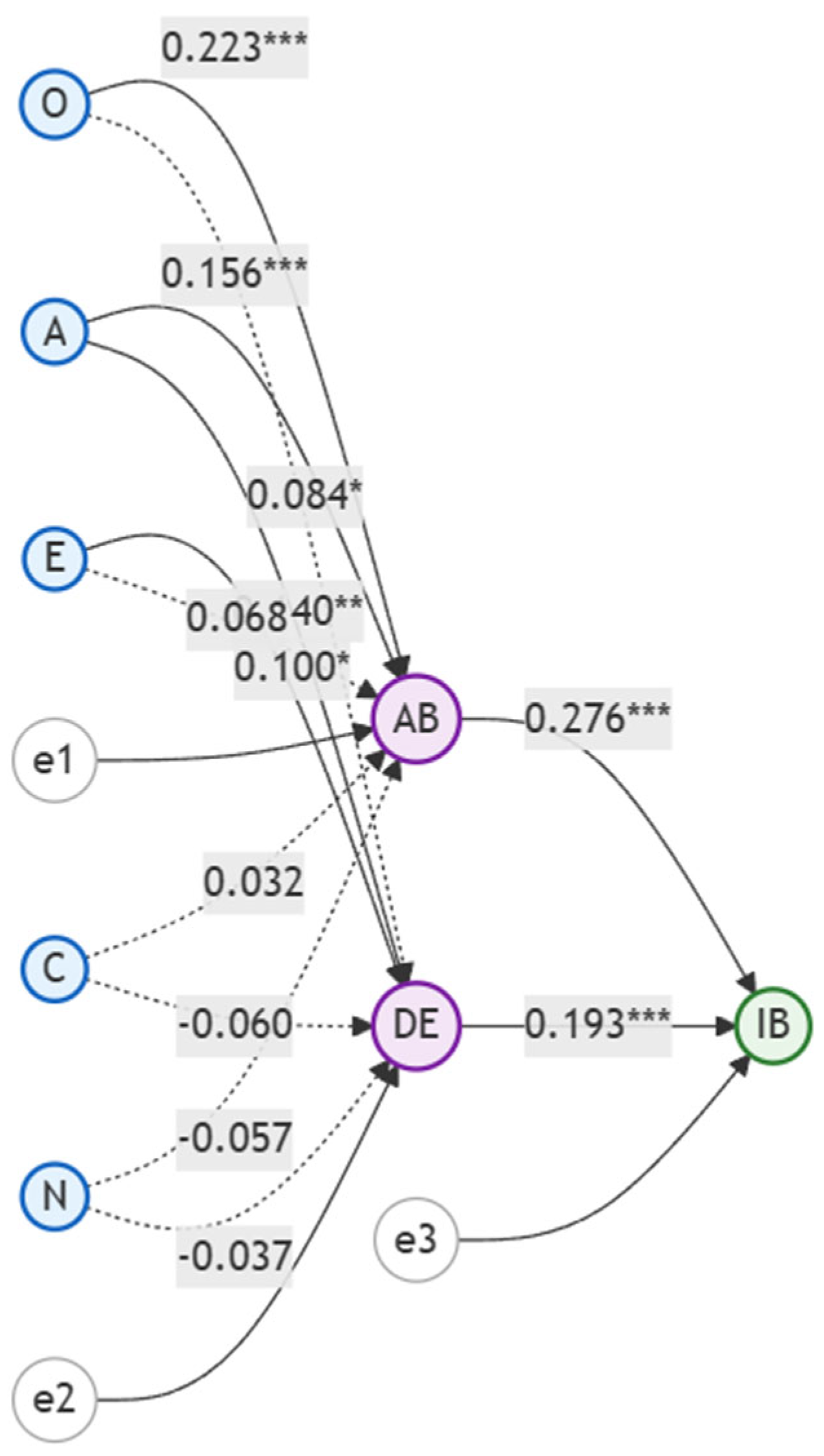

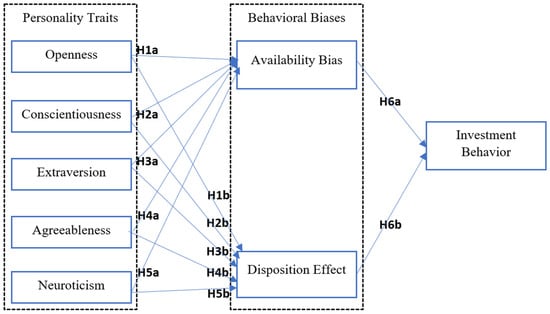

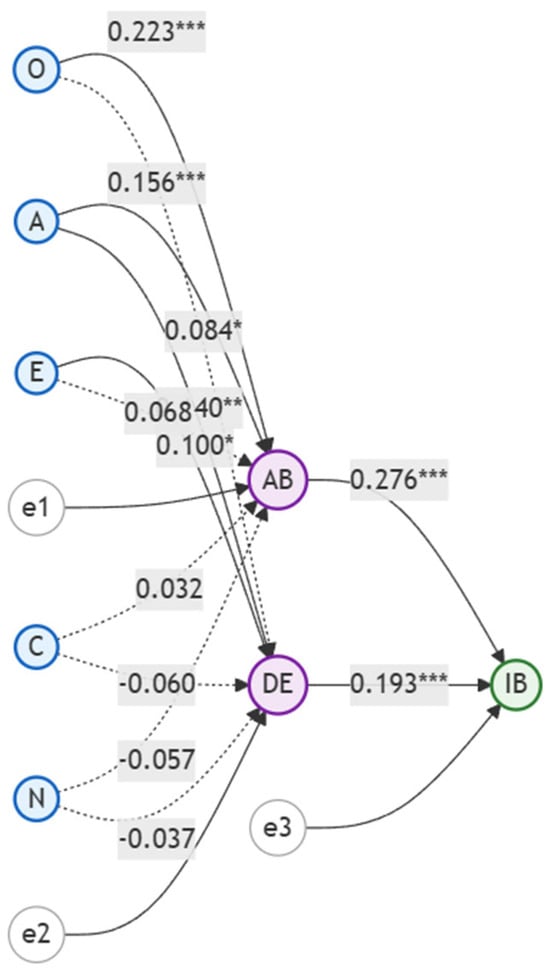

To explain this mechanism visually, the study develops two figures that represent the proposed psychological pathways. Figure 1 presents the conceptual framework linking the Big Five personality traits to behavioral biases—Availability Bias and Disposition Effect—which in turn shape cryptocurrency investment behavior. Figure 2 displays the structural equation model with standardized path coefficients derived from PLS-SEM, highlighting the relative strength and significance of each relationship. These figures collectively clarify how personality traits predispose investors to specific biases and how those biases influence their trading choices in a volatile and technology-mediated environment. This visual explanation strengthens the theoretical alignment of the study and ensures transparency in the causal logic underlying the hypotheses.

Figure 1.

Conceptual research framework. Conceptual framework linking Big Five personality traits (OCEAN) to cryptocurrency investment behavior via mediating biases (Availability Bias and Disposition Effect).

Figure 2.

Path analysis of the structural model. Structural model results: standardized path coefficients (β) and statistical significance. R2 values are shown for mediator constructs. Solid lines = p < 0.05; dashed lines = non-significant. Statistical significance: * p < 0.05, ** p < 0.01, *** p < 0.001. Key insights: Agreeableness and Openness are the strongest personality predictors, Availability Bias has a stronger impact on investment than the Disposition Effect, and Conscientiousness and Neuroticism show no significant effects.

From a theoretical standpoint, this study bridges personality psychology and behavioral finance through an integrative empirical model. The Big Five personality dimensions—Openness, Conscientiousness, Extraversion, Agreeableness, and Neuroticism—are treated not merely as static personality descriptors but as dynamic predictors of behavioral bias susceptibility. For example, investors high in Openness may exhibit stronger Availability Bias due to curiosity and exposure to new information, while those high in Neuroticism may demonstrate a greater Disposition Effect, being more loss-averse and emotionally reactive to market fluctuations. By applying Partial Least Squares Structural Equation Modeling (PLS-SEM), the study statistically estimates how these traits influence bias formation and, consequently, crypto investment behavior. This approach allows for the analysis of latent constructs and indirect pathways, offering a nuanced psychological map of decision-making under uncertainty. Such an integrative framework contributes both methodologically and theoretically—moving beyond isolated trait–bias relationships to a systemic understanding of how psychological dispositions, cognitive heuristics, and technological stimuli coalesce in shaping modern investment behavior

The rest of the paper will follow the following structure: Section 2 includes the literature review; Section 3 discusses the theoretical framework, hypotheses development, and model development; Section 4 outlines the methodology; Section 5 involves the discussion of the results and robustness checks; Section 6 provides the implications and policy recommendations; and Section 7 includes the limitations and future research directions.

2. Literature Review

The emergence of cryptocurrency as a trendy investment option has transformed the way money and investing are perceived. It has also introduced another psychological dimension to the decisions made by investors. This is because, unlike traditional markets such as stocks or bonds, cryptocurrency markets are very erratic, lack complete information, and are prone to speculation (Y. Li et al., 2025). All these factors contribute to the fact that investors are more inclined to make emotional decisions instead of rational ones. Behavioral finance has revealed, ever since the writings of Kahneman and Tversky (1979), that mental shortcuts and biases tend to affect people’s financial choices (Almansour et al., 2025). Elaborating on this concept, recent research has begun to investigate the role of personality traits and psychological tendencies in how individuals assess risk, interpret information, and make decisions in digital assets (Baker et al., 2021).

2.1. Personality Traits and Investment Behavior

Personality psychology can be used to explain why individuals are likely to act in a similar manner when making decisions. Openness, Conscientiousness, Extraversion, Agreeableness, and Neuroticism—the well-known Big Five personality traits—are frequently employed to interpret differences in financial behavior (Matha et al., 2022). As an illustration, individuals who are open to experience or who are more outgoing are more likely to take risks where faced with uncertainty in financial situations (Kurnaz, 2022).

In cryptocurrency investing, these personality traits may combine with the specifics of digital market consumers. Extroverted people tend to prefer more speculative investments such as Bitcoin due to curiosity and the adventure of social interaction, while people who are high in Neuroticism tend to trade more and respond harshly to financial losses (He & Lei, 2025). In the meantime, Conscientious individuals are likely to make careful, premeditated choices in most cases, although in rapidly changing and information-saturated markets, their analytical character may also be questioned (Gniewosz et al., 2020). In general, personality has a vast effect on the way investors think, feel, and behave in the complicated realm of cryptocurrency.

2.2. Behavioral Biases in Cryptocurrency Investment

Behavioral biases are systematic ways of thinking that result in irrational financial decisions in individuals. Availability Bias and the Disposition Effect are two that are especially prevalent in the case of cryptocurrency (Sumantri et al., 2024).

Availability Bias occurs when investors become overconfident with information that is readily recollected or remembered, such as recent market news or social media hype, instead of critically evaluating the facts. The Disposition Effect takes place when investors immediately sell performing assets but keep losing ones for too long, this is mostly due to emotional ties or fear of losing money (An et al., 2024).

These biases particularly affect cryptocurrency investors due to their constant interaction over the Internet and the 24-h trading environment. Many people use trending opinions or even discussions in online communities rather than proper research, leading to speculative behavior and herd-like trading patterns. This combination of emotional decision-making and overconfidence tends to cause extreme market volatility and unsteady investment decisions (Sumantri et al., 2024).

2.3. Linking Personality Traits to Behavioral Biases

The combination of personality trait theory and behavioral bias theory will be able to explain why individuals make various financial decisions. Research indicates that some personality attributes predispose individuals to be more or less susceptible to certain decision-making biasness. In this scenario, extroverted people tend to base their decisions on readily accessible or information considered popular, thereby demonstrating Availability Bias (Aidil Fadli et al., 2024). Conscientious people, on the contrary, are less likely to make such errors due to their high level of organization and caution, but in unpredictable markets such as cryptocurrency, this effect may be weakened since emotions tend to dominate in those situations (Gniewosz et al., 2020).

Similarly, agreeable individuals might be reluctant to sell investments that are depreciating, which is characteristic of avoiding actualization of losses (Shum et al., 2025). According to newer models of financial behavior, personality traits may have a role in influencing whether individuals tend to use quick, intuitive thinking or slow, analytical thinking in investment decisions. The engagement of these characteristics and thinking patterns can be of great help in understanding why investors behave irrationally at times, particularly amid rapid and decentralized financial settings (Khan et al., 2024).

2.4. Emerging Perspectives

Although there is increasing interest regarding the influence of personality and behavior with respect to financial decisions, several critical gaps remain. Most previous studies have focused on developed countries, and very little research reflects emerging economies such as India, where social, cultural, and technological aspects influence the way people think and invest (Junejo et al., 2024; Baker et al., 2023). Also, while conventional financial markets are thoroughly researched, the specific behavioral motivations behind investing in cryptocurrencies remain poorly comprehended, particularly the relationship between personal biases, investment performance, and personality traits (Sumantri et al., 2024).

This research contributes to the body of knowledge by synthesizing concepts from personality psychology, financial behavior, and digital investing. It examines the influence of personal personality attributes on cryptocurrency investment choices, particularly through the potential impact of the most frequent decision-making biases, such as the desire to use information that is easy to access or the tendency to hold on to assets that are not profitable. Based on results from a large sample of Indian retail investors, we learn more about the ways investors act in the online financial environment, with results being useful for both theorists and practitioners.

2.5. Research Gap and Research Objectives

While several studies (Anaza et al., 2024; Ballis & Verousis, 2022; Xiong et al., 2024) have examined behavioral biases in traditional finance, very few have explored how enduring psychological traits interact with cognitive biases in crypto asset decisions—particularly in emerging economies such as India. This absence of context-specific behavioral evidence creates a significant research void concerning how personality-driven biases manifest in volatile and technology-mediated markets (Kolte et al., 2022).

Hence, the objective of this research is to investigate the following topics.

To examine the influence of the Big Five personality traits—Openness, Conscientiousness, Extraversion, Agreeableness, and Neuroticism—on two prominent behavioral biases, namely Availability Bias and Disposition Effect, among Indian retail cryptocurrency investors.

To analyze how these behavioral biases (Availability Bias and Disposition Effect) mediate the relationship between personality traits and cryptocurrency investment behavior.

To assess the extent to which Availability Bias and Disposition Effect directly influence investment decision-making and behavioral outcomes in the cryptocurrency market.

To provide theoretical and practical insights into how individual psychological differences shape biased investment behavior in volatile and technology-driven financial markets, particularly in the context of emerging economies like India.

3. Theoretical Framework, Hypotheses Development, and Model Development

Theoretical analysis is key to empirical research, helping explain why interactions happen between different variables. When it comes to behavioral finance, we are learning that decisions are not just rational; they are swayed by emotions, behavioral biases, and even personality. This section will look at the theories that link personality, biases, and how people invest in cryptocurrency, which will lead the plan for this work.

3.1. The Rise in Cryptocurrency Investing in Emerging Markets

Investing in cryptocurrency has become a major trend in India and many other developing countries, owing to the democratization of fintech and the soaring allure of decentralized digital assets (Roy & Vasa, 2024). Compared with traditional financial markets, the crypto markets are highly volatile, poorly regulated, and inordinately influenced by social media and the online narratives created by both public and private actors (Putri et al., 2025). In this context, a dramatic growth in retail participation has been witnessed in India, with millions of young and technology-driven investors entering the cryptocurrency market.

3.2. Bounded Rationality and Behavioral Finance

The conventional view that investors in financial markets are rational beings has been challenged by the idea of bounded rationality. Bounded rationality, proposed by Herbert Simon, implies that human beings have cognitive and psychological constraints that limit their ability to make sound judgments (de Lima Amorim, 2025). This has resulted in the formation of behavioral finance as an interdisciplinary field blending psychology with economic and financial theory. Behavioral finance explains why investor behavior so often contradicts rational expectations and creates market anomalies (Kireyeva et al., 2021).

Undoubtedly, bounded rationality has stronger effects in the context of cryptocurrency markets, which are extremely volatile, fast-changing, and impervious. In these circumstances, they must rely on either rational heuristics or, more often, instincts. The theory of bounded rationality assures that in their forecasting and investor behavior, there might be some kind of underlying logic that is not immediately apparent (Upravitelev, 2022).

3.3. The Dual-Process Model and Behavioral Biases

The dual-process theory of cognition provides a useful conceptual framework for explaining how behavioral biases emerge in financial decision-making.

This theory states that human thinking operates through two distinct but interacting systems of cognition: System 1 (Intuitive/Automatic) and System 2 (Analytical/Controlled) (Tinghög et al., 2023).

System 1 is automatic, fast, intuitive, and emotional. Heuristics, experience, and gut feelings allow people to make quick judgments, but they are not the most reliable bases for decision-making. When we rely on them, we are using System 1. Although effective in circumstances demanding rapid responses, System 1 is vulnerable to cognitive errors and biases, especially in complicated or unfamiliar situations (Frankish, 2023).

System 2, on the other hand, is slow, reflective, analytical, and rational. System 2 processes information in a more reflective and systematic way, allowing for more accurate and thoughtful decision-making. However, it is not easy to use, and most people avoid engaging it unless necessary, especially when we are stressed, pressed for time, or cognitively loaded (Greene, 2023).

In the cryptocurrency market, which is so volatile and uncertain, intuitive and emotional decision-making processes, that form the core of System 1 processing, often take center stage. Intuitive decisions made in a market, where investors display a range of behavioral biases, are not regarded as rational in the field of ordinary cognitive psychology. These markets can turn a price bubble into a price crash, and vice versa, as investors in these markets continue speculating with their chances (Frankish, 2023).

Therefore, emphasis is placed on education of investors about cognitive biases. The more investors understand how cognitive biases influence their behavior, the better they can make rational decisions that are not influenced by biases (Sumantri et al., 2024).

3.4. Personality Traits as Deep Psychological Drivers

The Five-Factor Model of Personality proposes that people tend to act in predictable ways based on the following five main personality traits: Openness, Conscientiousness, Extraversion, Agreeableness, and Neuroticism. These traits influence how investors see risk, deal with unknown, and make investment choices.

Being open to new experiences means that you are curious, creative, and like trying new things. In investing, such people often take risky decisions in using new technologies or investing in new financial models like cryptocurrencies. However, because they like novelty, they might depend too much on the latest buzz when making fast choices (Z. Li et al., 2024).

Being conscientious means that one is disciplined, organized, and likes to plan. These investors usually act logically and avoid risks. But in quick markets like cryptocurrency, even careful people can feel stressed and use simple ways out instead of looking at the details (Gniewosz et al., 2020).

Extraversion includes traits like being social, outgoing, and positive. Extraverted investors often discuss their choices with others and follow trends, which make them more susceptible to herd behavior—that is, being influenced by what is most visible or popular (He & Lei, 2025).

Agreeableness reflects kindness, empathy, and trust in others. While this trait facilitates cooperation, agreeable investors may be hesitant to sell underperforming assets because of emotional attachment or not wanting to go against group opinions (Kajonius et al., 2025).

Neuroticism indicates emotional sensitivity and anxiety. Investors with this trait are quite sensitive to losses and may react impulsively in volatile markets. Taken altogether, these traits create different psychological paths that influence how people interpret market signals and form their investment decisions (Gautam et al., 2024).

3.5. Behavioral Biases as Mediating Mechanisms

How personality affects investment results often comes down to how we make decisions. For example, if something is easy to remember or happened recently, we might think that it is more important than it really is, and this is a phenomenon called Availability Bias (Aidil Fadli et al., 2024). In cryptocurrency market, this can cause overexcitement about social media trends or a sudden increase in price.

There is also something called the Disposition Effect, where people tend to sell investments that have made money but hold on to the ones that have lost money. This is often because they want to feel good and avoid regret (Oreng et al., 2021).

3.6. Formulation of Research Hypotheses

Personality traits help anticipate the psychological mechanisms that can be used to interpret behaviors in decision-making (Singh et al., 2024). The most effective taxonomy of personality is the Big Five Personality Model, which includes the following characteristics: Openness to Experience, Conscientiousness, Extraversion, Agreeableness, and Neuroticism (Nekljudova, 2019).

Being open is a crucial trait of investor behavior, as it enhances investment performance, especially in cryptocurrency, because Openness, whether in decision-making styles or personality traits, often increases availability to sources of information and investment opportunities (Niszczota, 2019). However, Availability Bias may result in these sources being overvalued, leading investors to hold cryptocurrencies longer than is rational (Ahmed et al., 2022).

Derived from the above theories, the following hypotheses are proposed for this study.

H1a.

Openness positively affects Availability Bias in cryptocurrency investment decisions.

H1b.

Openness positively affects the Disposition Effect in cryptocurrency investment decisions.

Being careful and thorough in making decisions is part of the definition of being Conscientious. Conscientious people tend to be organized, plan, and follow through in a performance-oriented way. They exhibit a kind of reliability that is often associated with responsible investing (Lauter et al., 2023). This is because forward-looking attributes such as planned long investment spans, risk aversion, and even portfolio diversification make them less prone to the behavioral biases that have been identified as impacting decision-making in crypto market (Conger et al., 2021).

Derived from the above theories, the following hypotheses are proposed for this study.

H2a.

Conscientiousness negatively influences Availability Bias in cryptocurrency investment decisions.

H2b.

Conscientiousness negatively influences the Disposition Effect in cryptocurrency investment decisions.

Extraversion is characterized by outgoingness, a warm nature, and positive emotionality. Extraverted investors are also more willing to take risks of losing money in pursuit of market rewards. However, in the social media-driven environment of peer pressure that characterizes the current cryptocurrency market, such a personality may not be the best for making sound investment decisions (Oehler et al., 2018). Extraverts often act without fully considering the consequences of their actions. While this can sometimes help them to act more decisively in the market, it can also lead to some behavioral biases that are particularly prevalent in online communities.

Derived from the above theories, the following hypotheses are proposed for this study.

H3a.

Extraversion has a positive impact on Availability Bias in cryptocurrency investment decisions.

H3b.

The Disposition Effect is positively affected by Extraversion in cryptocurrency investment decisions.

Being agreeable involves being confident, being cooperative, and avoiding trouble, and this Agreeableness will influence some investors in the crypto space. Cryptocurrency buyers are already primed to believe in the valuations of certain crypto assets, because of social construction; they are influenced by the idea of these new forms of investment in the digital currency market (Hudson & Roberts, 2016).

Derived from the above theories, the following hypotheses are proposed for this study.

H4a.

There is a positive effect of Agreeableness on Availability Bias in cryptocurrency investment decisions.

H4b.

Agreeableness has a positive influence on the Disposition Effect in cryptocurrency investment decisions.

Neuroticism is the inflexibility of emotions, anxiety, and susceptibility to negative affectivity. High-Neuroticism investors tend to fear losses more and are more affected by the changes in the market (Oehler et al., 2018). These trends in the cryptocurrency market can be used to worsen the creation of an Availability Bias, whereby distinctly notable news or actions will have a better likelihood of being utilized in decision-making (Fachrudin, 2021). Likewise, it may also trigger the fear of admitting losses, which perpetuates the Disposition Effect, as neurotic investors may hold losing stocks in the hope of avoiding regret (Oehler et al., 2018).

Derived from the above theories, the following hypotheses are proposed for this study.

H5a.

Neuroticism positively influences Availability Bias in cryptocurrency investment decisions.

H5b.

Neuroticism positively influences the Disposition Effect in cryptocurrency investment decisions.

Current research substantially confirms the role of personality factors in creating behavioral biases in traditional investment settings. However, cryptocurrency markets are entirely unlike them due to their extreme volatility, social media-driven narratives, and prevalence of retail investor activity (Sudani & Pertiwi, 2022). As far as we are aware, almost no study has methodically examined the convergence of personality with behavioral biases in crypto investing in India and other developing economies (Yuwono & Altiyane, 2023). This gap will be filled by this paper, which proposes a model that links the Big Five personality traits with two of the most applicable biases in crypto markets: Availability Bias and the Disposition Effect.

Derived from the above theories, the following hypotheses are proposed for this study.

H6a.

Availability Bias positively influences sub-optimal cryptocurrency investment behavior.

H6b.

The Disposition Effect positively influences sub-optimal cryptocurrency investment behavior.

3.7. Conceptual Research Framework

Based on the theoretical ideas above, this work puts forward a conceptual model. It links personality traits to how people invest in cryptocurrency through behavioral biases. The model has the following three ideas:

- Personality traits are stable and make investors likely to have certain thinking and emotional habits.

- Behavioral biases affect how personality traits relate to investment results. They do this by changing how people process info and react emotionally.

- Investment choices show the pattern of bias-influenced decisions in the changing cryptocurrency market.

So, the mechanism flow is as follows:

Personality Traits → Behavioral Biases (Availability, Disposition) → Cryptocurrency Investment Behavior.

This method combines personal and situational factors. It agrees with interactionist views in behavioral finance, which say that actions come from the interaction between individual psychology and environmental factors. The model also fits with recent additions to the Theory of Planned Behavior (TPB), where personality traits have an indirect impact on plans through attitudes and cognitive mediators (Bosnjak et al., 2020).

This model shows how personality can shape investment moves because of how we think and act. See Figure 1 for a simple layout. It shows how things like jumping to conclusions or selling too early can change how someone invests, turning personality into an investment choice. It gives a better look at why some regular consumers invest the way they do in digital coins.

4. Research Design and Sampling Method

The research used a quantitative, cross-sectional, survey-based design to explore the effect of personality traits on behavioral biases, namely Availability Bias (Sumantri et al., 2024) and the Disposition Effect (Kiky et al., 2024), and their relevance to cryptocurrency investment decisions among Indian retail investors. The target population included Indian retail investors trading or investing in digital currencies.

Non-probability sampling techniques (purposive and snowball sampling) were employed to contact respondents online through social media, cryptocurrency investment communities, and investor groups. Data collection was conducted over one month (June 2025 to July 2025) via an automated questionnaire created with the help of Google Forms and distributed via referral links. The initial sample consisted of 1000 respondents. After deleting partially completed, duplicate, and inconsistent responses, i.e., respondents without active crypto investments or exhibiting straight-lining, 716 valid responses were retained for analysis. The final sample size is considerably greater than that of the PLS-SEM analysis based on inverse square root and gamma-exponential path coefficient calculations of 0.05 to 0.10 at 95 percent confidence level, which will require at least 600 observations.

4.1. Measurement Instrument

The survey was divided into three categories, namely demographic information, items on personality traits, and behavioral bias measures. All constructs were evaluated with the help of a well-established 7-point Likert scale (ranging between 1: strongly disagree and 7: strongly agree) from previous studies.

4.1.1. Personality Traits as Independent Variables

The Big Five personality traits, namely Openness, Conscientiousness, Extraversion, Agreeableness, and Neuroticism, were measured using a series of 25 questions (Matha et al., 2022). Openness includes five items consisting of curiosity, intellectual interest, and preference for innovation. Conscientiousness includes five items measuring orderliness, diligence, and goal orientation. Extraversion includes five items measuring sociability, energy, and optimism. Agreeableness includes four items that are indicators of social relationships in aspects of cooperativeness and trust. Neuroticism includes five items measuring emotional instability, anxiety, and stress-sensitive personality traits (Matha et al., 2022).

4.1.2. Behavioral Biases as Mediating Constructs

Two prominent behavioral biases known to influence cryptocurrency investors were assessed as follows: Availability Bias includes five items to capture the tendency to use easily available or recent information in making crypto investment choices (e.g., following news trends, price fluctuations, or recommendations from influencers) (Aidil Fadli et al., 2024). Disposition Effect includes five items assessing the tendency to sell profitable coins ahead of schedule and retain losing assets because of emotional attachment or regret aversion (Danbolt et al., 2022). All the items were reworded contextually to fit the cryptocurrency investment context and pilot-tested for understanding prior to large-scale dissemination.

4.2. Common Method Bias (CMB) Control

Since all variables were self-reported and measured by the same instrument, common method bias (CMB) was examined using Harman’s single-factor test. The test revealed that the largest factor accounted for 18.88% of the total variance, well below the 50% threshold (Podsakoff et al., 2003).

4.3. Data Analysis Technique

The final dataset of 716 observations was estimated using Smart PLS 4.0, a highly capable Partial Least Squares Structural Equation Modeling (PLS-SEM) instrument well-suited for predictive modeling and theory development involving complex constructs.

PLS-SEM was preferred because the study focuses on prediction and theory development rather than theory confirmation. It also accommodates complex models with multiple constructs and indicators and is more suitable for non-normal data and medium sample sizes (Hair et al., 2011).

4.4. Measurement Model Evaluation

Here, the convergent validity, construct reliability, and discriminant validity were tested as follows: factor loadings for all the items retained loads of >0.70 (cut-off threshold: 0.50); Composite Reliability (CR) varied from 0.837 to 0.930, higher than the 0.70 threshold; and all constructs had Average Variance Extracted (AVE) > 0.50, showing adequate convergent validity. Discriminant validity was checked by using the Heterotrait–Monotrait Ratio of Correlations (HTMT) ratios, with all ratios < the threshold of 0.85.

4.5. Structural Model Evaluation

Path analysis was performed to examine the hypothesized associations among personality traits and behavioral biases. The R2 values were as follows: Availability Bias, R2 = 0.126 (12.6% explained variance); Disposition Effect, R2 = 0.149 (14.9% explained variance). Bootstrapping with 5000 resamples was utilized to examine the significance of the path coefficients.

Outlier diagnostics using Mahalanobis distance and leverage statistics were conducted, and extreme cases (>3 SD) were removed prior to final estimation. Adjusted R2 values were also computed (Availability Bias: 0.121; Disposition Effect: 0.142), which, although modest, remain within acceptable behavioral research standards. Such explanatory power aligns with previous psychological modeling studies, where human decision variance is inherently complex and multifactorial.

5. Hypothesis Testing and Discussion of the Results

5.1. Sample Profile

The demographic profiles of the 716 participants are presented in Table 1. Of the total sample, 52.7% were male and 47.3% were female, showing that the gender distribution of Indian cryptocurrency investors was relatively even. This indicates that increased access to digital platforms is drawing in gender participation, reducing the conventional gender gap hitherto observed in financial investment.

Table 1.

Demographic profile of the respondents.

Regarding age, most respondents were in the 26–35 age group (48.9%), followed by the 18–25 group (42.7%). The 36–45 age group was 6% and the group of 46 years and older was 2.4% of the sample. This is in conjunction with reports in the industry showing that young, technologically savvy Indians are taking the lead in cryptocurrency investment.

Regarding education level, the sample was well educated, with 80.7 percent having graduate-level qualifications, 10.1 percent having post-graduate qualifications, and 0.6 percent having doctoral degrees. This substantiates the present fact that informed and technology-wise individuals are early adopters of crypto assets. The marital status results were broken down to show that 64 percent were married, 35 percent were single, and 1 percent were widowed. This demographic dynamic shows that both singles and married individuals prefer to invest in cryptocurrency, possibly due to its perceived potential for wealth accumulation and stock diversification. Regarding profession, respondents were from a variety of occupational groups: 50.3% were professionals (including IT, finance, and consulting professionals), 30.4% were academicians, and 19.3% were entrepreneurs. This result concurs with larger trends showing that cryptocurrency markets attract individuals with different risk appetites and professional flexibility.

Lastly, the distribution of crypto investing experience revealed that 60.9% of respondents had been investing for a period of less than one year, affirming the recent increased in cryptocurrency popularity in India. An additional 30% had invested for between one and three years, 5% for between three and five years, and 4.1% for over five years. This emphasizes that India’s investor base in cryptocurrency is still developing and mainly composed of newer players, which can also impact behavioral biases like Availability Bias and the Disposition Effect.

Generally, the population profile captures a young, highly educated, tech-savvy group of Indian cryptocurrency investors—representing an appropriate backdrop to analyze the interaction between personality traits and behavioral biases among this new investment class.

5.2. Measurement Model: Reliability and Validity

The validity and reliability of the constructs were examined using Cronbach’s alpha, Composite Reliability (CR), rho_A, and Average Variance Extracted (AVE), as presented in Table 2.

Table 2.

Convergent validity and construct reliability.

All constructs had good internal consistency. Cronbach’s alpha values ranged from 0.738 to 0.905, exceeding the suggested minimum of 0.70 (Hair et al., 2011; Razi-ur-Rahim et al., 2024a, 2024b). It shows that the items of measurement for each construct were highly reliable and consistent. Likewise, Composite Reliability (CR) values across all constructs varied between 0.837 and 0.930, which is also higher than the recommended minimum of 0.70, further supporting internal consistency reliability. Values of rho_A were higher than 0.70 for each construct, further establishing the measures as reliable. Regarding convergent validity, the Average Variance Extracted (AVE) for all constructs was higher than the threshold value of 0.50. AVE values were between 0.572 (Agreeableness) and 0.726 (Extraversion), which shows that over 50% of variance in the observed items was accounted for by the latent constructs.

Furthermore, all the factor loadings for individual items were above 0.70, except for a few acceptable instances near 0.70 (as presented in Table 2), further supporting item reliability.

Overall, these findings reveal that the measurement model had high internal consistency, convergent validity, and reliability, supporting that the constructs are valid for testing the hypothesized structural relationships in the model.

5.3. Discriminant Validity

Discriminant validity was evaluated via the HTMT criterion (Yusoff et al., 2020). HTMT coefficients for all constructs pairs are reported in Table 3.

Table 3.

Discriminant validity—Heterotrait–Monotrait (HTMT).

The findings show that all HTMT values were lower than the conservative cut-off value of 0.85, implying that every construct is empirically unique from the others. Particularly, HTMT values varied from 0.034 (Neuroticism and Disposition Effect) to 0.558 (Availability Bias and Disposition Effect). These results are strong evidence of discriminant validity, supporting the fact that the latent constructs—personality traits (Openness, Conscientiousness, Extraversion, Agreeableness, Neuroticism) and behavioral biases (Availability Bias, Disposition Effect)—are statistically and conceptually different under the scenario of cryptocurrency investment choices (Sharma et al., 2022).

Therefore, the measurement model meets both convergent and discriminant validity standards, proving its efficacy in testing the structural relations hypothesized in the study.

5.4. Structural Model Results and Hypothesis Testing

The structural model within this research was assessed with Partial Least Squares Structural Equation Modeling (PLS-SEM), which is a powerful analytical tool best suited for theory testing and predictive modeling in behavioral research (Razi-ur-Rahim et al., 2025; Raza et al., 2025). Bootstrapping with 5000 resamples was employed in the analysis to estimate path coefficients and assess the significance of hypothesized relationships.

This section reports the hypothesis testing results and interprets the direction, strength, and significance of relationships between the Big Five personality traits (independent variables) and two of the most important behavioral biases: Availability Bias and the Disposition Effect (dependent variables). The model’s explanatory power is also investigated, and empirical support (or not) for the suggested hypotheses is discussed.

5.4.1. Robustness and Sensitivity Analysis

To ensure the robustness of the findings, several diagnostic procedures were implemented.

Bootstrapping with 5000 resamples was employed in the analysis to allow for consistent estimation of path coefficients and significance levels for the hypothesized relationships.

5.4.2. Model Fit and Variance Explained

The R2 measures, which are the percentages of variance accounted for by the independent variables in each dependent construct, give a first insight into the explanatory ability of the model:

Availability Bias: R2 = 0.126, meaning that about 12.6% of the variance in Availability Bias is explained by the personality variables incorporated into the model.

Disposition Effect: R2 = 0.149, indicating that 14.9% of variance in the Disposition Effect is explained by personality traits.

These are moderate values, typical for behavioral models where psychological constructs and environmental noise restrict explanatory power. However, the model does provide useful insights into how personality traits determine investor behavior in cryptocurrency markets.

5.5. Summary of Hypotheses Testing Results

The model consisted of ten direct hypotheses connecting each of the five personality traits to the two behavioral biases (Table 4). The path coefficients (β), t-statistics, and p-values for each hypothesis are listed in Table 4 (see original document). The next paragraphs describe each set of hypotheses, classified by personality trait, and interpret whether they were supported or rejected.

Table 4.

Path analysis of the structural model.

5.5.1. Openness to Experience and Behavioral Biases

The findings indicate that Openness to Experience strongly explains both Availability Bias and the Disposition Effect, confirming hypotheses H1a and H1b.

H1a.

Openness → Availability Bias: β = 0.223, p < 0.001.

H1b.

Openness → Disposition Effect: β = 0.084, p < 0.05.

These results align with theoretical predictions. Open people are intellectually curious, value novelty, and are attracted to innovative behavior that is typically related to higher participation in cryptocurrency markets (Niszczota, 2019). Their receptivity to new information can possibly render them more vulnerable to Availability Bias, particularly when they are exposed to widespread and emotionally evocative information on social media sites (Kazakov et al., 2024; Liu et al., 2023). At the same time, their test-and-hold and negative risk tolerance may enhance the risk of retaining losing holdings for future possible recovery, thereby making them more susceptible to the Disposition Effect.

5.5.2. Conscientiousness and Behavioral Biases

Unexpectedly, Conscientiousness was not found to have a significant effect on either Availability Bias or the Disposition Effect. Thus, H2a and H2b are rejected.

H2a.

Conscientiousness → Availability Bias: β = 0.032, p = 0.229.

H2b.

Conscientiousness → Disposition Effect: β = –0.060, p = 0.099.

These insignificant findings imply that characteristics such as orderliness, discipline, and goal orientation do not meaningfully affect the way investors handle uncertain and emotional information in crypto markets. One possible reason is that the intrinsic uncertainty and speculative nature of cryptocurrency dominate the systematic, rule-based behavior that conscientious individuals generally tend to prefer, or that conscientious individuals might be less likely to engage actively in crypto trading, yielding dampened behavioral impacts (Lauter et al., 2023).

5.5.3. Extraversion and Behavioral Biases

Extraversion was shown to have a significant impact on only the Disposition Effect, confirming H3b but not H3a.

H3a.

Extraversion → Availability Bias: β = 0.068, p = 0.055 (not significant).

H3b.

Extraversion → Disposition Effect: β = 0.100, p = 0.020.

The constructive and substantial route to the Disposition Effect shows that extraverted individuals, characteristically active, eager, and positive, are likely to hold onto performing assets in hopes of a price turnaround. Their social and emotional focus might lead them to perceive transitory losses in a positive light and to avoid realizing losses, a defining feature of the Disposition Effect (Kiky et al., 2024).

Yet, the non-significant effect on Availability Bias can be interpreted as meaning that extraverts, although socially engaged, are also proactive in seeking information instead of being reactive to popular content. The partial support thus indicates the sophisticated role of social behavior in influencing various types of investment bias (Oehler et al., 2018).

5.5.4. Agreeableness and Behavioral Biases

Agreeableness had strong and statistically significant influences on both Availability Bias and the Disposition Effect, strongly supporting hypotheses H4a and H4b.

H4a.

Agreeableness → Availability Bias: β = 0.156, p < 0.001.

H4b.

Agreeableness → Disposition Effect: β = 0.140, p = 0.001.

These findings suggest that agreeable people who are cooperative, trusting, and prone to conforming to social norms are more likely to engage in emotionally driven investment decisions (Hudson & Roberts, 2016). In the socially constructed cryptocurrency world, where peer views, influencer stories, and online forum pressures guide decision-making, agreeable investors could be particularly susceptible to herding and social approval, resulting in increased Availability Bias (Sumantri et al., 2024). Their tendency to avoid conflict could also prevent them from admitting investment errors, lending further evidence to the Disposition Effect.

5.5.5. Neuroticism and Behavioral Biases

Neuroticism did not significantly predict behavioral bias in either case, making H5a and H5b unsupported.

H5a.

Neuroticism → Availability Bias: β = –0.057, p = 0.100.

H5b.

Neuroticism → Disposition Effect: β = –0.037, p = 0.223.

These results were surprising, based on previous literature indicating that neurotics are likely to experience anxiety, emotional instability, and fear-based behaviors. One theory is that the sample, made up largely of younger, technologically adept investors, might self-select for individuals with greater emotional strength or a higher capacity for risk tolerance in finance (Oehler et al., 2018). Alternatively, the brief investment horizon cited by most respondents (<1 year for 60.9% of the sample) could imply they have not yet witnessed enough loss cycles to trigger strong neurotic responses.

5.5.6. Behavioral Biases and Investment Behavior

Apart from testing the impact of personality traits on behavioral biases, the model also tested how these biases impact cryptocurrency investment behavior, particularly testing H6a and H6b.

H6a.

Availability Bias → Cryptocurrency Investment Behavior.

H6b.

Disposition Effect → Cryptocurrency Investment Behavior.

Results suggested that both biases have a significant positive impact on non-optimal or emotionally motivated investment decisions:

H6a.

Availability Bias → Investment Behavior: β = 0.276, p < 0.001.

H6b.

Disposition Effect → Investment Behavior: β = 0.193, p < 0.01.

These results give strong support to the proposed model in which cognitive biases are the proximal predictors of real investor behavior. Individuals exhibiting Availability Bias tend to make their crypto choices on recent news, social media, or salient emotional information, resulting in reactionary or ill-timed trades (Rahmawati & Santi, 2023). Those subjects to the Disposition Effect also tend to hold underperforming coins and sell winning coins too early, resulting in below-optimal portfolio performance.

The results highlight (Figure 2) the central role of behavioral biases as mediators between personality traits and actual investment decisions, reinforcing the need to target these biases in educational and platform design interventions aimed at improving investor outcomes.

5.5.7. Mechanism Validation

We performed mediation analyses using the bootstrapping approach to estimate indirect effects and to test the suggested theoretical mechanism with actual data. The findings demonstrated that both the Disposition Effect and Availability Bias significantly mediate the relationship between personality factors and actual investment behavior (p < 0.05). In other words, people’s investment decisions are heavily influenced by these psychological biases rather than being directly influenced by their personalities. This pattern of findings supports the causal relationship we previously outlined: investors’ financial decisions are influenced by their biased cognitive processes, which are shaped by their personality traits. These results provide substantial empirical backing for the theoretical framework presented in Section 3

5.6. Discussion of Overall Results

The results of the structural model are significant in revealing the relationship between personality traits, behavioral biases, and investment activities in the setting of cryptocurrency markets. The analysis presented twelve experimental hypotheses (H1a–H6b), eight of which were confirmed, proving the validity of the theoretical framework and predictive power of the proposed conceptual model. By having behavioral biases as mediators, the model captured a portion of 12.6 and 14.9 percent of the variance in Availability Bias and the Disposition Effect, respectively, and provided another percentage of variation in the behavior of cryptocurrency investment (Sumantri et al., 2024). Even though these R2 values are low, they are expected in behavior finance research, where a broad range of implicit emotional, situational, and environmental factors make it hard to describe outcomes using underlying stable personality traits (Sudani & Pertiwi, 2022).

These findings are consistent with prior research showing that Openness and Agreeableness enhance susceptibility to cognitive biases in financial decisions (George & Tittler, 1984; McCrae, 1994; Niszczota, 2019). Similarly, the positive influence of Extraversion on the Disposition Effect aligns with the results of previous research (Côté & Moskowitz, 1998; Oehler et al., 2018). This further confirms that social and optimistic investors are prone to emotionally anchored investment behavior.

5.6.1. Key Personality Predictors of Behavioral Biases

Open investors are drawn to new and unconventional investments, i.e., cryptocurrencies. Being risk-taking and experimental, they are also more prone to react to information that is easily available and emotionally provocative (Availability Bias) (Sumantri et al., 2024) and to hold unstable assets that have not been redeemed yet (Disposition Effect) (Chan & Park, 2013).

It was also identified that Extraversion has only a positive correlation with the Disposition Effect (confirms H3b). The above association corresponds to earlier findings which associate Extraversion with expressions of emotions and risk tolerance. Optimism also characterizes extraverted investors, who may believe that losing investments will recover and thus hold on to them (Oehler et al., 2018). The lack of a significant correlation between Extraversion and Availability Bias (H3a not supported) can nevertheless be used to conjecture that extraverts may be able to conduct more proactive information searches than the rest of us rather than relying solely on the most recent and vivid information, making this bias less harmful. In contrast, there was no significant relationship between Conscientiousness and/or Neuroticism and either biases, so hypotheses H2a, H2b, H5a, and H5b were rejected. While Conscientiousness is commonly connected with astute judgment and aversion to rash actions, it may be less important in swift and unpredictable markets like cryptocurrency, where even the most structured investors cannot help but interfere (Lauter et al., 2023).

On the same note, Neuroticism, which is often linked to anxiety and fear of instability, is not always indicative of bias in a comparatively young, tech-savvy investment demographic that possesses a high emotional tolerance threshold for risk (Oehler et al., 2018).

Contrary to conventional behavioral finance findings, Conscientiousness and Extraversion did not significantly predict Availability Bias. This anomaly can be attributed to the unique nature of cryptocurrency markets—characterized by limited reliable data, speculative volatility, and socially amplified narratives that diminish the efficacy of deliberate information processing. As a result, even analytical investors are constrained by bounded rationality, reducing the protective role of Conscientious behavior.

5.6.2. Behavioral Biases as Predictors of Investment Behavior

The last set of hypotheses, H6a and H6b, showed that both Availability Bias and the Disposition Effect are important and positive indicators of actual cryptocurrency investment behavior. These results support the assumption of the conceptual model that biases in behaviors are a proximal mechanism through which stable individual characteristics tack on financial decisions (Sudani & Pertiwi, 2022).

H6a was determined as true, stating that investors who are likely to experience Availability Bias tend to make emotionally charged boundary responses based on information that is easily accessible or highly salient (Wang, 2023). This includes overreacting to media coverage, celebrity opinions, or unjustified market movements; however, it frequently leads to impulsive purchases or sales.

H6b established that individuals subject to the Disposition Effect tend to make inferior trading decisions, i.e., holding on to their declining assets and liquidating profitable assets too early, which is regrettably a result of discrepancy in very voluptuous markets, such as cryptocurrency (Braga & Fávero, 2017).

Combined, the nature of these findings suggests that a person ought to consider behavioral biases more than confidence-interfering decision errors; they serve as precursors for forecasting broader investment behavior in developing markets where official financial training might not be present (Basana & Tarigan, 2022).

6. Implications of the Study

6.1. Theoretical Implications

Overall, the model agrees that personality traits influence investment behavior indirectly through their influences on behavioral biases, with Openness and Agreeableness as the two strongest variables. The partial impact of Extraversion and the insignificant findings of Conscientiousness and Neuroticism show that not all personality orientations have equal psychological influence on investors (Anaza et al., 2024).

The concepts of bounded rationality and dual-process theory may be utilized to describe cryptocurrency investment behaviors within the Big Five framework. The figures can prove the fact that most investors tend to act and think in ways predetermined by System 1 processing, that is, fast, emotional, and intuitive thought, when face the high uncertainty of the crypto market, rapid information flows, and social media narratives (Rafay & Mustafa, 2023).

These findings are immensely significant in India, where many of the investors are young people, with minimal experience, and trends in computer technology. The model provides an empirically justified explanation for why behavioral aberrations are rampant in this field and what differences among individuals puts them at higher risk to vulnerability (Killins, 2023).

6.2. Practical Implications

6.2.1. Practical Implications for India and Other Emerging Economies

The present study has several practical implications for cryptocurrency markets in India and other developing economies where digital asset adoption is snowballing in the dynamic regulatory and market frameworks (Putri et al., 2025). The knowledge on how individual characters influence behavioral bias, like Availability Bias and the Disposition Effect can guide more concrete approaches for crypto exchanges, financial advisors, regulators, and policymakers in Asia, and other similar emerging markets (Sachitra & Rajapaksha, 2023).

6.2.2. Facilitating More Sound Investment Decision-Making

The results emphasize that Indian cryptocurrency investors, especially those with high Openness and Agreeableness scores, are vulnerable to Availability Bias, being strongly influenced by relevant and vivid information that is also emotional and may include social media trends, news headlines, and opinions of influencers (Kanojia & Malhotra, 2023). This generates an even bigger threat of herding, investment bubble formation, and panic selling as an effect of market volatility in emerging markets with varying levels of digital literacy and financial education (India Cryptocurrency Market Size, Share, Price Trends, n.d.).

To contain this, crypto exchanges and digital exchanges functioning in India, as well as in other such markets, must come up with improved investor education programs that encourage users to question their sources of information (Vaarmets et al., 2019). This may comprise the following:

In-app reminders to make users conscious of making investment decisions with minimal information. Develop information materials to inform the users of common behavioral biases. Educational campaigns on evidence-based investing and risk management. The following are the interventions that can be employed to overcome the consequences of Availability Bias and promote a higher degree of prudent and steady investing behavior (Wang, 2023).

6.2.3. Customization of Risk Disclosure and Platform Design

Personality characteristics are an influential factor in the process of how investors receive information and react to market activity, so exchanges can further develop risk disclosure and interface design by pursuing a more behaviorally feasible format. For example, risk warnings and decision nudges can be supplied to investors who are identified as high in either Openness or Agreeableness based on onboarding surveys or behavioral patterns associated with tokens that offer more significant currency payments upon successful completion, low liquidity, or highly speculative features (Ahmed et al., 2022).

Another visual clue that could be used as a silver bullet against the problem would be dynamic risk labeling, indicating to investors whether there has been a recent flurry of interest by social media sources, thus reducing the likelihood of availability-led decisions (Rijanto & Utami, 2024).

This would not contradict globally accepted best practiced in investor protection and would help regulatory goals in emerging economies where many naive investors want to join crypto platforms.

6.2.4. Developing Investor Resilience Against the Disposition Effect

The positive correlation between the Disposition Effect and the traits of Openness and Extraversion indicate that most retail investors are likely to hold declining crypto holdings or sell winners prematurely. This results in inferior portfolio performance and could discourage long-term market involvement (Kiky et al., 2024).

To Indian regulators (e.g., SEBI or RBI, as they prepare to regulate crypto formally) and to Asian policymakers, these findings reemphasize the value of financial resilience programs. In particular, financial literacy programs need to have specific modules on behavioral biases applied to crypto markets (Vaarmets et al., 2019). Guidelines for advisory firms and new exchanges should suggest that investors regularly rebalance their portfolios using objective performance measures to help them overcome emotional biases such as the Disposition Effect (Hur et al., 2010). Gamification features ubiquitous in crypto apps must be scrutinized so that they do not reinforce sentiment attachment to underperforming tokens. These would assist in constructing long-term investor resistance and mitigate overexposure, emotional investing, and financial stress, risks issues that are especially pronounced in emerging markets with weakly developed social safety nets (Ali et al., 2024).

6.2.5. Applications for Regional Markets Beyond India

The implications of this research are practical and extend beyond India to other rapidly growing crypto markets in emerging Asia and Africa. In most of these settings, retail investors are flowing into the crypto market influenced by peer pressure, FOMO (fear of missing out), and hopes for rapid returns (Nizar & Daljono, 2024). The psychological profiles revealed here, especially the impact of Openness and Agreeableness on biases, are likely to be even stronger in nations with similarly young, mobile-first investor bases (Anaza et al., 2024).

Regulators, exchanges, and financial education institutions in Vietnam, Indonesia, Philippines, Thailand, Nigeria, and Brazil can leverage these findings to achieve the following: Tailor educational content on behavioral bias in crypto investing. Implement pre-trade nudges that assist investors in stopping and reflecting on motivations (Hassan et al., 2024). Build regional knowledge transfer platforms for emerging markets to exchange best practices in managing behavioral risks (Vaarmets et al., 2019).

In performing this, these markets will be able to better protect investors while continuing to facilitate innovation, a critical objective for developing economies where cryptocurrency is increasingly seen as an agent of economic opportunity and financial empowerment.

6.2.6. Implications for Platform Governance

Finally, this research provides significant guidance regarding how crypto exchanges themselves can regulate themselves to establish trust and legitimacy in emerging markets. Exchanges ought to disclose social media-facilitated Availability Bias risks openly and inform investors when their actions are likely to be emotion-based (Sundarasen & Saleem, 2025). Platforms may provide in-app tracking capabilities that enable users to monitor when they are displaying patterns in line with the Disposition Effect leading to reflection and more thoughtful decision-making (Rafay & Mustafa, 2023).

6.3. Policy Recommendations for Consumer Protection in Emerging Economies

Regulators must strike a tricky balance between stimulating innovation and financial inclusion through digital assets while protecting retail investors from market abuse and self-destructive behavior (Aidil Fadli et al., 2024). The results of this research can be used to inform more behaviorally based regulatory policy in India and throughout Asia. In particular, the regulators should embrace disclosure regimes that extend beyond technical risk to cover behavioral risk, directly teaching investors about Availability Bias, the Disposition Effect, and how personality can lead to irrational choices (Bhutto et al., 2025). Public–private partnerships can create national campaigns (such as anti-fraud or cyber-safety campaigns) to educate new investors on how to identify when they are at risk of succumbing to such biases, particularly because India’s crypto investor base is disproportionately composed of young, first-time investors (18–35 years), who have high usage of social media (Trevina & Kohardinata, 2024).

Asian regulators must also consider harm-reduction strategies which permit exchanges to pass on anonymized behavioral data to regulators, enabling more active regulation of nascent risks pertaining to herding, panic selling, or market manipulation through influencer-fueled hype cycles.

7. Limitations and Future Research

Based on the previous studies and the present analyses, this research identifies the following areas for further research.

First, this study has probed little into the prospect of behavioral biases having mediating effects. In future work, if the mediating effects of any biases are to be gauged even more indirectly than presently attempted, a model incorporating these biases as mediators should be tested.

Second, future research could test moderating factors which could condition or influence the strength of the relationship between personality traits and some areas of behavior biases, such as the impact of financial literacy, risk tolerance, or the strength of social media usage. For example, a highly open person who financially literate might be less prone to Availability Bias as compared to someone with less knowledge.

Third, researchers are advised to choose longitudinal or experimental designs, especially when there is a time-sensitive restriction (and the dynamic nature of the problem itself), to eliminate the limitations of cross-sectional data. Self-reports of behavior could be matched with real-time behavioral data via trading apps or blockchain analytics platform.

Finally, cross-national studies in both emerging and developed markets would allow cross-cultural validation of the model and investigation of whether the same psychological processes are workable in more controlled or more developed financial conditions.

8. Conclusions

The study investigated the impact of the five dimensions of the Big Five personalities on two behavioral biases—Availability Bias and the Disposition Effect—among Indian cryptocurrency investors. It contributes to a better understanding of how personal mental variance influence decision-making in the unsteady and shifting environment of the digital asset climate. The research shows that personality greatly affects how people invest in cryptocurrency because of their biases. It found that Openness and Agreeable makes people prone to Availability Bias, while Extraversion leads to the Disposition Effect. These findings expand upon the theory of behavioral finance by showing how biases affect investment in digital assets.

For policymakers, regulators, and crypto exchanges, they should create behavioral monitoring tools and programs to educate investors in reduce bias-driven trading. Putting behavioral analytics into exchange dashboards can assist investors in spotting emotional triggers and make more rational decisions. Financial advisors can also use personality profiles to customize advice for new investors.

Even though this study contributes valuable information, its design limits the ability to determine cause-and-effect relationships. Future studies could use longitudinal or experimental design to further validate the psychological mechanisms of cryptocurrency investment.

Author Contributions

Conceptualization, M.S. and M.B.H.; methodology, M.S., F.U. and M.B.H.; software, M.S. and F.U.; validation, M.B.H.; formal analysis, M.S. and F.U.; investigation, F.U. and M.B.H.; resources, M.B.H.; data curation, M.S. and M.B.H.; writing—original draft, M.S. and F.U.; writing—review and editing, M.S. and M.B.H.; visualization, M.B.H.; project administration, M.S.; supervision, M.B.H.; funding acquisition, M.B.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research work did not receive any specific funding from any specific body or organization.

Institutional Review Board Statement

The study did not involve any sensitive personal data and/or invasive procedures. According to the Institutional Ethics Committee (IEC) of SVKM’s Narsee Monjee Institute of Management Studies (NMIMS), Hyderabad Campus, India, ethical review and approval were waived for non-interventional, fully anonymous surveys that do not collect identifiable or sensitive information. This research was conducted in accordance with the regulations of the Institutional Ethics Committee (IEC) of SVKM’s Narsee Monjee Institute of Management Studies (NMIMS), Hyderabad Campus, India. The specific approval details are maintained by the department. As the study fully complies with these principles and involves no identifiable data, no prior ethics approval was required by the department.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed at the corresponding author.

Acknowledgments

We sincerely thank the anonymous reviewers of this paper for their insightful and helpful recommendations.

Conflicts of Interest

The authors hereby declare no conflicts of interest.

References

- Ahmed, Z., Rasool, S., Saleem, Q., Khan, M. A., & Kanwal, S. (2022). Mediating role of risk perception between behavioral biases and investor’s investment decisions. SAGE Open, 12(2), 1–18. [Google Scholar] [CrossRef]

- Aidil Fadli, J., Rusmanto, T., Kurniawan, Y., & Hutagaol-Martowidjojo, Y. (2024). The interplay of financial availability, herding behavior, and cryptocurrency investment experience moderated by government policy: A study from Indonesia. Qubahan Academic Journal, 4(4), 509–527. [Google Scholar] [CrossRef]

- Ali, M. H., Bakar, A., Tufail, M. S., & Mazhar, F. (2024). Behavioral biases in investment: Overconfidence, disposition effect, and herding behavior. IRASD Journal of Economics, 6(2), 555–566. [Google Scholar] [CrossRef]

- Almansour, B. Y., Almansour, A. Y., Elkrghli, S., & Shojaei, S. A. (2025). The investment puzzle: Unveiling behavioral finance, risk perception, and financial literacy. Economics—Innovative and Economics Research Journal, 13(1), 131–151. [Google Scholar] [CrossRef]

- An, L., Engelberg, J., Henriksson, M., Wang, B., & Williams, J. (2024). The portfolio-driven disposition effect. Journal of Finance, 79(5), 3459–3495. [Google Scholar] [CrossRef]

- Anaza, N. A., Upadhyaya, B., Bennett, D., & Ruvalcaba, C. (2024). Is it FOMO or is it ME? The influence of personality traits on cryptocurrency consumption. Psychology and Marketing, 41(1), 184–202. [Google Scholar] [CrossRef]

- Baker, H. K., Kapoor, S., & Khare, T. (2023). Personality traits and behavioral biases of Indian financial professionals. Review of Behavioral Finance, 15(6), 846–864. [Google Scholar] [CrossRef]

- Baker, H. K., Kumar, S., & Goyal, N. (2021). Personality traits and investor sentiment. Review of Behavioral Finance, 13(4), 354–369. [Google Scholar] [CrossRef]

- Ballis, A., & Verousis, T. (2022). Behavioural finance and cryptocurrencies. Review of Behavioral Finance, 14(4), 545–562. [Google Scholar] [CrossRef]

- Basana, S. R., & Tarigan, Z. J. H. (2022). The effect of essential information and disposition effect on shifting decision investment. Accounting, 8(2), 227–234. [Google Scholar] [CrossRef]

- Bhutto, S. A., Nazeer, N., Saad, M., & Talreja, K. (2025). Herding behavior, disposition effect, and investment decisions: A multi-mediation analysis of risk perception and dividend policy. Acta Psychologica, 255, 104964. [Google Scholar] [CrossRef] [PubMed]

- Bosnjak, M., Ajzen, I., & Schmidt, P. (2020). The theory of planned behavior: Selected recent advances and applications. Europe’s Journal of Psychology, 16(3), 352–356. [Google Scholar] [CrossRef]

- Braga, R., & Fávero, L. P. L. (2017). Disposition effect and tolerance to losses in stock investment decisions: An experimental study. Journal of Behavioral Finance, 18(3), 271–280. [Google Scholar] [CrossRef]

- Chan, C. S. R., & Park, H. D. (2013). The influence of dispositional affect and cognition on venture investment portfolio concentration. Journal of Business Venturing, 28(3), 397–412. [Google Scholar] [CrossRef]

- Conger, R. D., Martin, M. J., & Masarik, A. S. (2021). Dynamic associations among socioeconomic status (SES), parenting investments, and conscientiousness across time and generations. Developmental Psychology, 57(2), 147–163. [Google Scholar] [CrossRef]

- Côté, S., & Moskowitz, D. S. (1998). On the dynamic covariation between interpersonal behavior and affect: Prediction from neuroticism, extraversion, and agreeableness. Journal of Personality and Social Psychology, 75(4), 1032–1046. [Google Scholar] [CrossRef]

- Damayanti, F., Djakfar, L., Wisnumurti, & Nugroho, A. M. (2023). Analysis of the role of big five personality throuch worker’s safety culture and personal value as intervening variable on construction workers’ safety behavior using sem-pls. Eastern-European Journal of Enterprise Technologies, 123(10), 15–22. [Google Scholar] [CrossRef]

- Danbolt, J., Eshraghi, A., & Lukas, M. (2022). Investment transparency and the disposition effect. European Financial Management, 28(3), 834–865. [Google Scholar] [CrossRef]

- de Lima Amorim, D. P. (2025). Positioning herbert simon within behavioral finance. Qeios. [Google Scholar] [CrossRef]

- Fachrudin, K. A. (2021). The role of financial behavior in mediating the influence of socioeconomic characteristic and neuroticism personality traits on financial satisfaction. Global Conference on Business and Social Sciences Proceeding, 12(1), 1–15. [Google Scholar] [CrossRef]

- Frankish, K. (2023). Toward dual-process theory 3.0. Behavioral and Brain Sciences, 46, e122. [Google Scholar] [CrossRef]

- Gautam, S., Kumar, P., & Dahiya, P. (2024). The Influence of neurotransmitters on cryptocurrency investment decision-making: The mediating role of risk tolerance and moderating role of investment experience. Indian Journal of Finance, 18(10), 40–55. [Google Scholar] [CrossRef]

- George, J. C., & Tittler, B. I. (1984). Openness-to-experience and mental health. Psychological Reports, 54(2), 651–654. [Google Scholar] [CrossRef] [PubMed]

- Gniewosz, G., Ortner, T. M., & Scherndl, T. (2020). Personality in action: Assessing personality to identify an ‘ideal’ conscientious response type with two different behavioural tasks. European Journal of Personality, 34(5), 808–825. [Google Scholar] [CrossRef]

- Greene, J. D. (2023). Dual-process moral judgment beyond fast and slow. Behavioral and Brain Sciences, 46, p1. [Google Scholar] [CrossRef]

- Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice, 19(2), 139–152. [Google Scholar] [CrossRef]

- Hassan, R. H., Hassan, M. T., Sameem, M. S. I., & Rafique, M. A. (2024). Personality-Aware course recommender system using deep learning for technical and vocational education and training. Information, 15(12), 803. [Google Scholar] [CrossRef]

- He, Y., & Lei, P. (2025). Differential pathways from personality to risk-taking: How extraversion and negative emotionality shape decision-making through overconfidence. Frontiers in Psychology, 16, 1537658. [Google Scholar] [CrossRef]