Digital Regulatory Governance: The Role of RegTech and SupTech in Transforming Financial Oversight and Administrative Capacity

Abstract

1. Introduction

1.1. Conceptual Evolution of RegTech and SupTech

1.2. Technological Foundations of RegTech and SupTech

1.3. Institutional and Governance Perspectives

1.4. Gaps and Contributions of the Current Study

2. Research Methodology

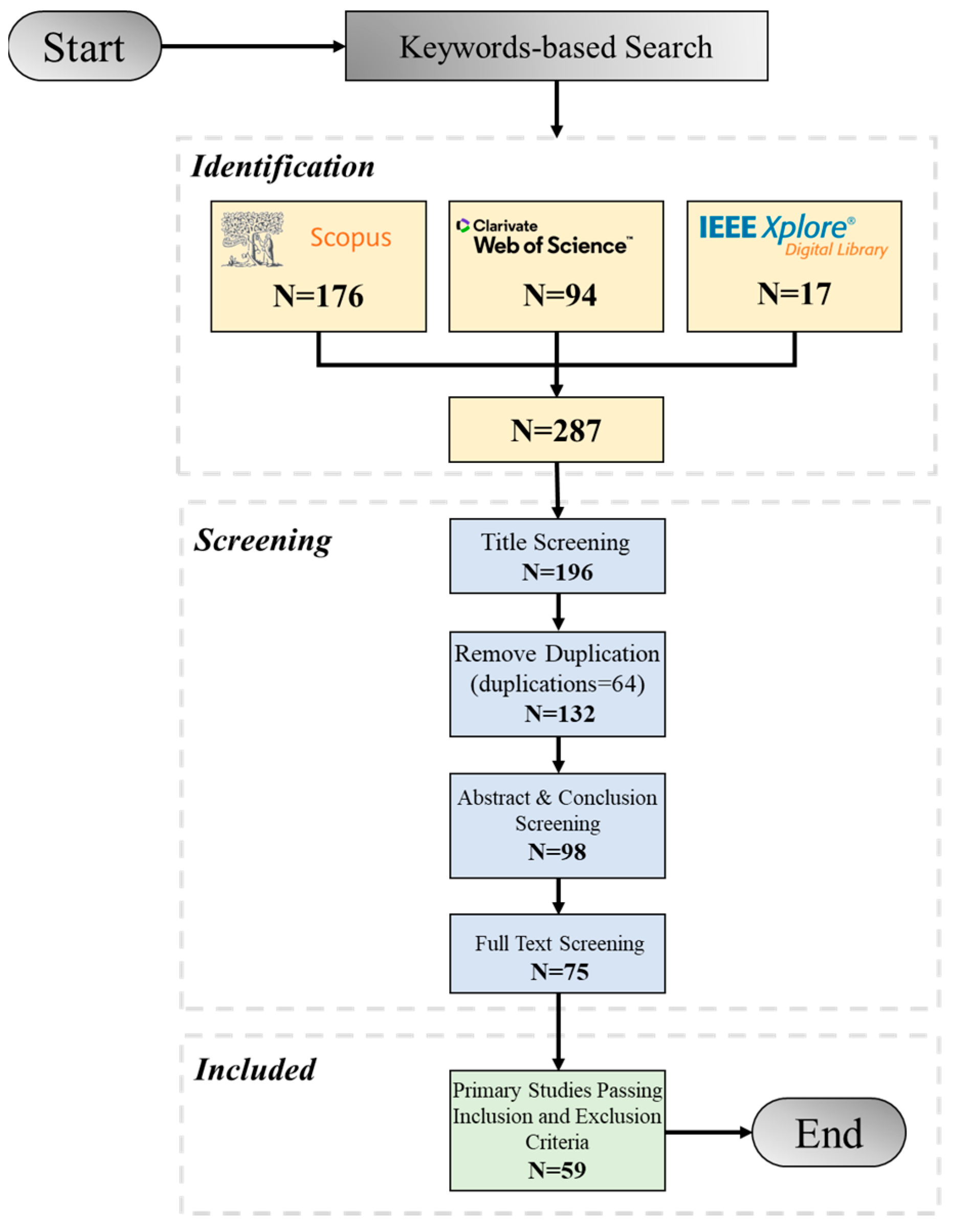

2.1. Systematic Literature Review (SLR)

2.1.1. Research Questions

- What are the key publication trends, intellectual structures, and thematic clusters shaping the development of RegTech and SupTech research?

- What are the primary opportunities presented by RegTech and SupTech in enhancing regulatory compliance and risk management within financial institutions?

- What challenges do financial institutions face when implementing RegTech and SupTech solutions, particularly regarding technological maturity and cybersecurity?

- How do RegTech and SupTech technologies transform the processes of data reporting and institutional supervision in the financial sector?

2.1.2. Search Strategy

2.1.3. Inclusion and Exclusion Criteria

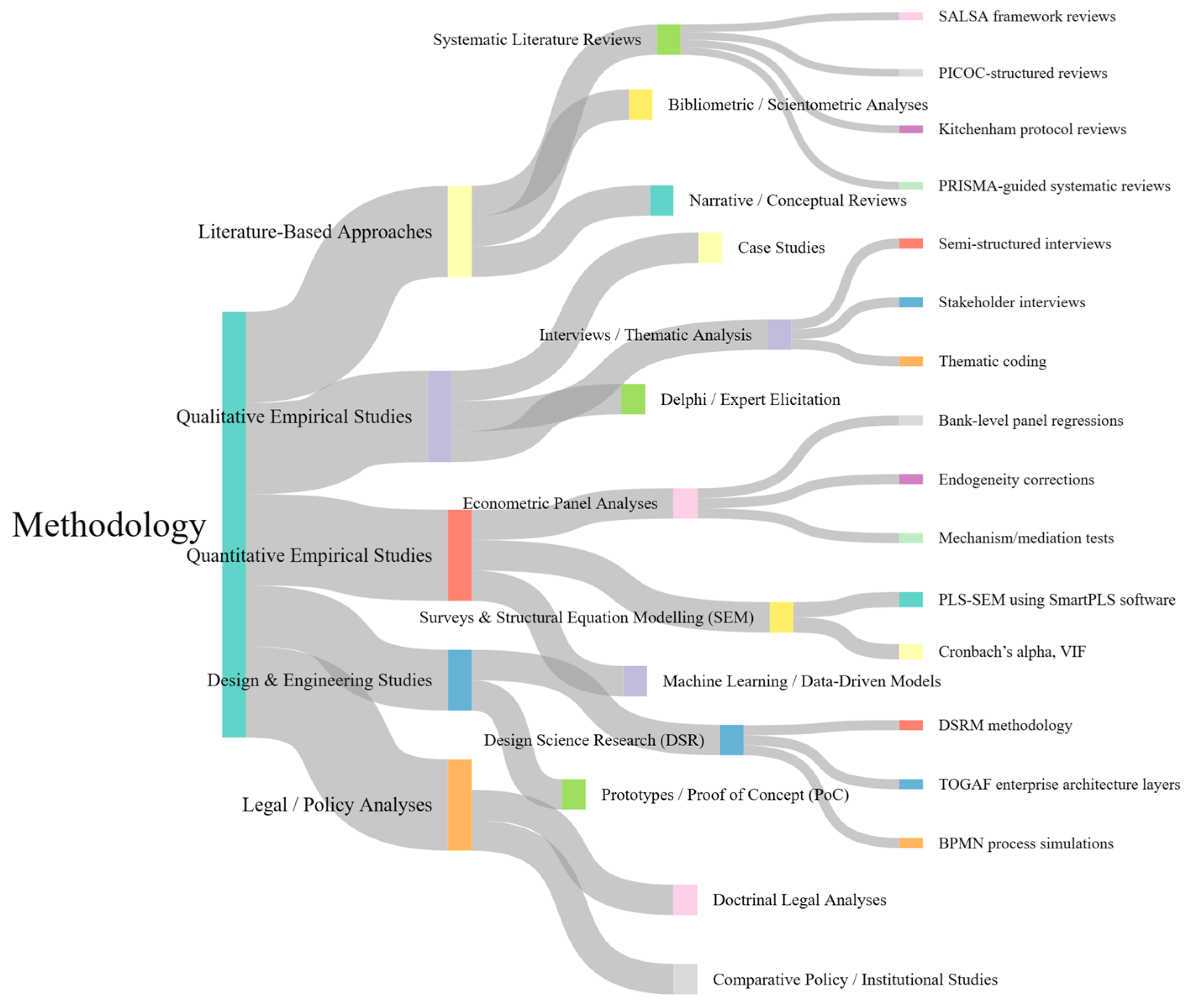

2.2. Bibliometric Methodology

3. Results and Discussions

3.1. Publications Trend

3.2. Bibliometric Analysis

3.2.1. Contributions of Authors

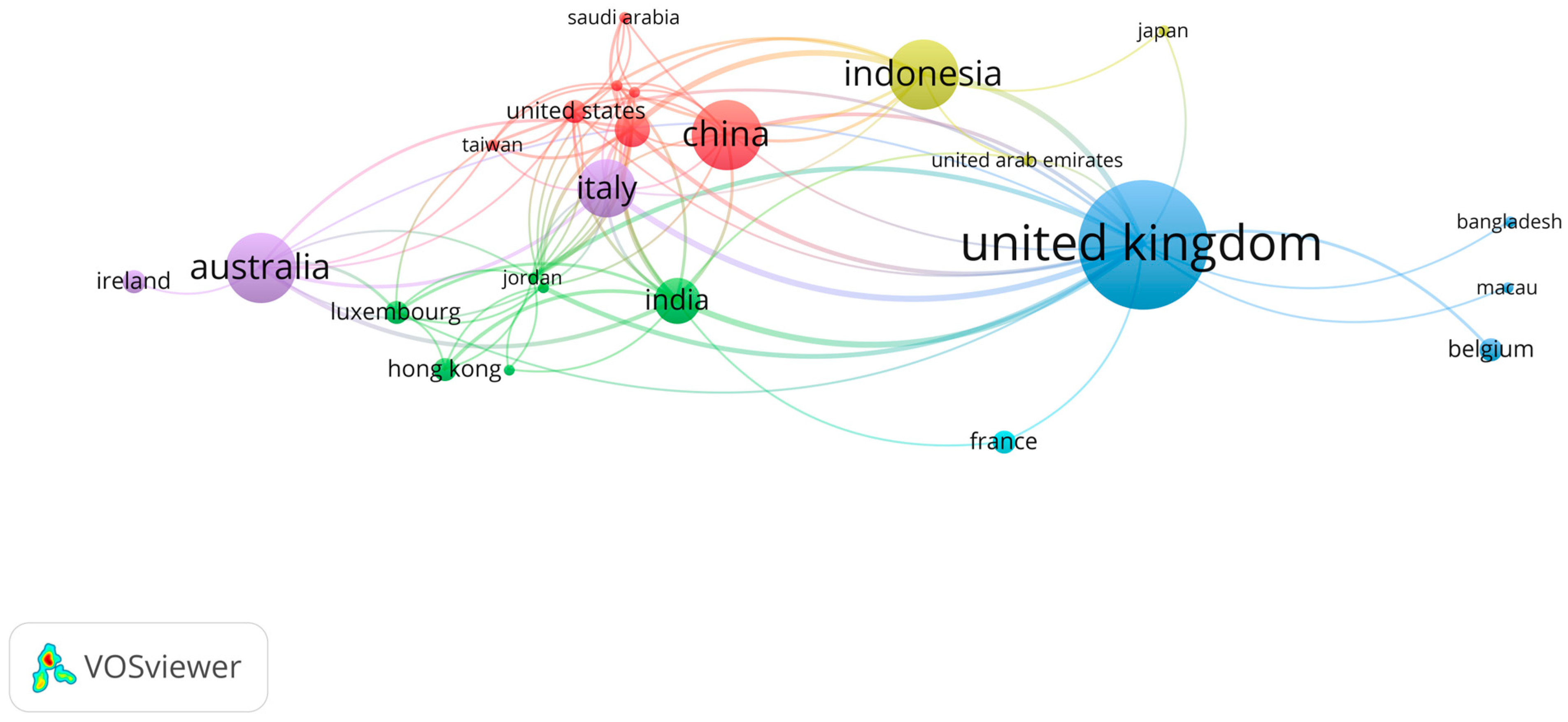

3.2.2. Contributions of Country

3.3. Synthesis of Findings

3.3.1. Evolution of RegTech and SupTech Definitions in Organizations (2017–2025)

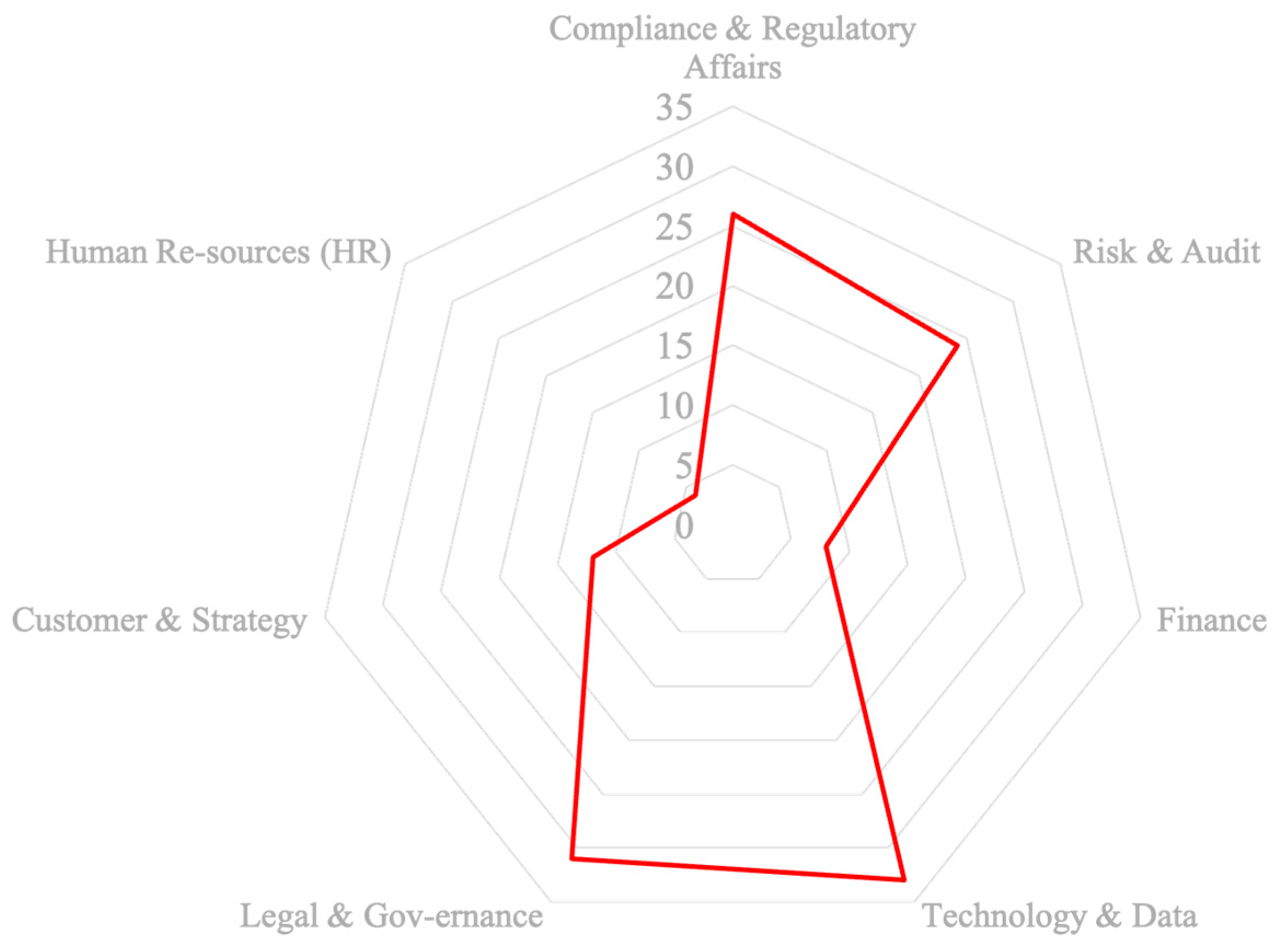

3.3.2. Systematic Opportunities of RegTech and SupTech in Financial Institutions

3.3.3. Implementation Challenges in RegTech and SupTech Adoption

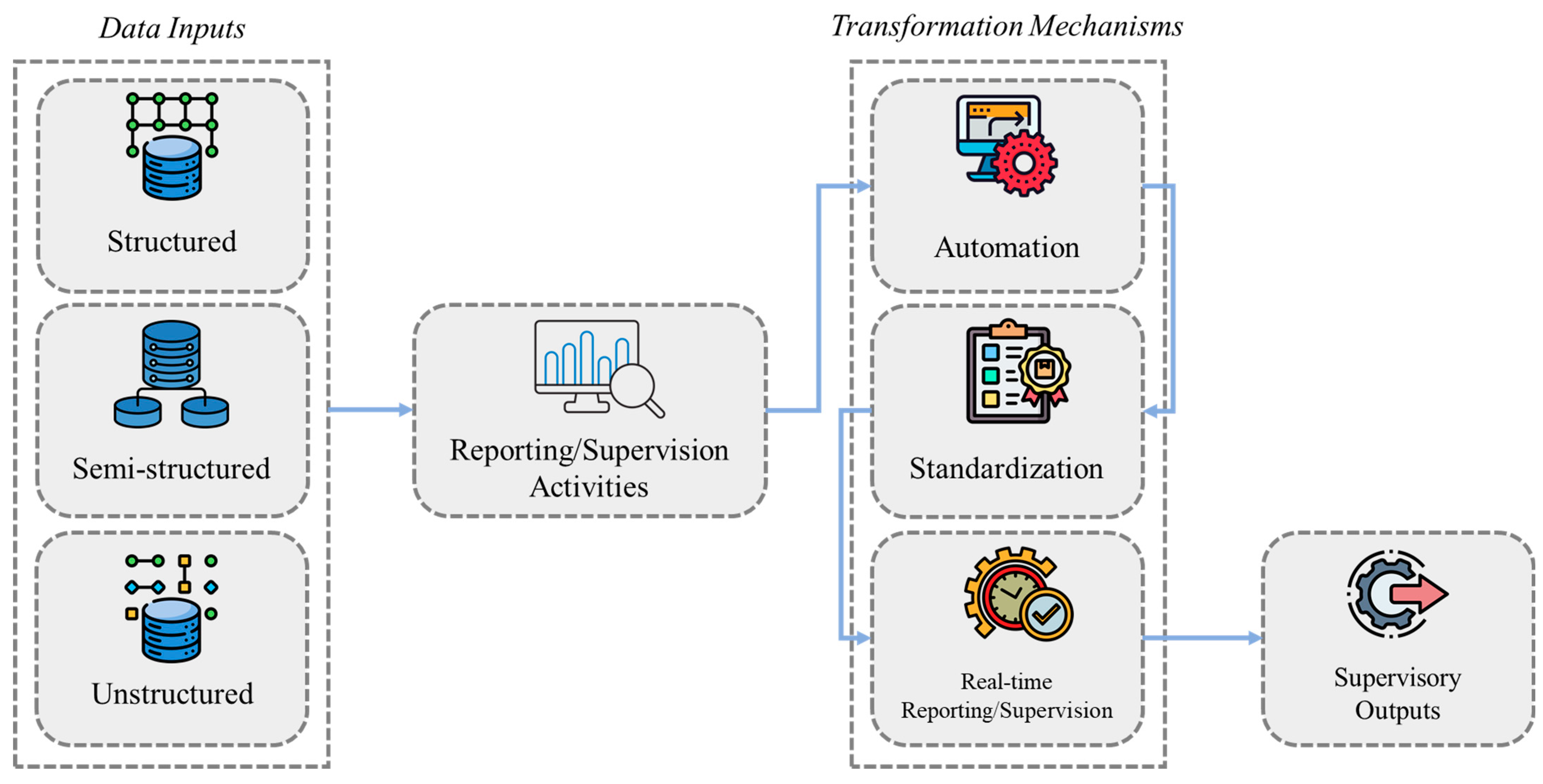

3.3.4. Transformation of Data Reporting and Supervision Through RegTech and SupTech

3.4. Transformation of Data Reporting Through RegTech

3.4.1. Data Inputs

3.4.2. Reporting Activities and Automation

3.4.3. Standardization

3.4.4. Real-Time Reporting

3.5. Transformation of Data Supervision Through SupTech

3.5.1. Data Inputs

3.5.2. Supervision Activities and Automation

3.5.3. Standardization

3.5.4. Real-Time Supervision

4. Future Research Opportunities and Identified Gaps

4.1. Foundations, Methods, and Architectures

4.2. Evidence on Effectiveness and Outcomes

4.3. Standardization, Interoperability, and Data Governance

- Test schema/taxonomy alignment across jurisdictions through live pilots;

- Design governance for shared utilities and data-pull architectures; and

- Evaluate how standards choices affect model drift, auditability, and portability across vendors and agencies (Jung, 2021; Miglionico, 2020). Work on ESG and sustainability reporting is a special case where sustained, taxonomy-based evidence will only emerge after several cycles of consistent use (Zetzsche & Anker-Sørensen, 2022).

4.4. Legal, Ethical, and Accountability Safeguards

4.5. Scope, Technologies, and Contexts Still Under-Studied

- Benchmark algorithm families for defined tasks (e.g., AML triage, obligation extraction, conduct sentiment) with shared datasets;

- Extend evaluations to insurance/insurtech and non-profit compliance; and

- Study organizational change—skills, incentives, human-in-the-loop design—needed to integrate these tools sustainably. Cross-disciplinary teams linking computer science, law, and public administration are especially important where political mandates and institutional resistance shape adoption.

4.6. Cross-Border and Consumer Challenges

5. Conclusions and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| RegTech | Regulatory Technology |

| SupTech | Supervisory Technology |

| FinTech | Financial Technology |

| FSB | Financial Stability Board |

| IMF | International Monetary Fund |

| FCA | Financial Conduct Authority |

| MAS | Monetary Authority of Singapore |

| NFRC | National Financial Regulatory Commission |

| AML | Anti-Money Laundering |

| KYC | Know Your Customer |

| e-KYC | Electronic Know Your Customer |

| CFT | Countering the Financing of Terrorism |

| SA | Sentiment Analysis |

| ROI | Return on Investment |

| CRR | Capital Requirements Regulation |

| CRD | Capital Requirements Directive |

| AI | Artificial Intelligence |

| ML | Machine Learning |

| NLP | Natural Language Processing |

| DLT | Distributed Ledger Technology |

| IT | Information Technology |

| API | Application Programming Interface |

| UX | User Experience |

| SVM | Support Vector Machine |

| RNN | Recurrent Neural Network |

| CNNs | Convolutional Neural Networks |

| XBRL | eXtensible Business Reporting Language |

| DBSCAN | Density-Based Spatial Clustering of Applications with Noise |

| LSTM | Long Short-Term Memory |

| DNN | Deep Neural Networks |

| SLR | Systematic Literature Review |

| PRISMA | Preferred Reporting Items for Systematic Reviews and Meta-Analyses |

| LEI | Legal Entity Identifier |

| CRU | Common Reporting Utilities |

| RACI | Responsible, Accountable, Consulted, Informed |

| IMD | International Institute for Management Development |

| CSMAR | China Stock Market & Accounting Research Database |

| CNRDS | China Research Data Services |

| GDPR | General Data Protection Regulation |

| CCPA | California Consumer Privacy Act |

| GFC | Global Financial Crisis |

| CBDS | Central Bank Digital Currencies (sometimes written as CBDCs) |

| SEM | Structural Equation Modelling |

| ESG | Environmental, Social, and Governance |

References

- Abubakar, Y. I., Othmani, A., Siarry, P., & Sabri, A. Q. M. (2024). A systematic review of rare events detection across modalities using machine learning and deep learning. IEEE Access, 12, 47091–47109. [Google Scholar] [CrossRef]

- Adeosun, O. A., Bello, A. D., Serifat, O. A., & Amomo, C. G. (2025). Enhancing financial cybersecurity in cloud engineering: A systematic review of threats, mitigation strategies and regulatory compliance. Asian Journal of Research in Computer Science, 18(5), 244–256. [Google Scholar] [CrossRef]

- Al-Harbi, A. (2025). Impact of AI on market efficiency and stability. International Journal of Science and Research Archive, 14(01), 552–560. [Google Scholar] [CrossRef]

- Alka, M., Bancong, H., & Muzaini, M. (2023). Bibliometric analysis of Pedagogical Content Knowledge (PCK) publication trends in Scopus database from 2018 to 2022. Studies in Learning and Teaching, 4(2), 306–318. [Google Scholar] [CrossRef]

- Alonso-Robisco, A., Azqueta-Gavaldón, A., Carbó, J. M., González, J. L., Hernáez, A. I., Herrera, J. L., Quintana, J., & Tarancón, J. (2025). Empowering financial supervision: A SupTech experiment using machine learning in an early warning system. Banco de España. [Google Scholar]

- Anagnostopoulos, I. (2018). Fintech and regtech: Impact on regulators and banks. Journal of Economics and Business, 100, 7–25. [Google Scholar] [CrossRef]

- Antunes, J. A. P. (2021). To supervise or to self-supervise: A machine learning based comparison on credit supervision. Financial innovation, 7(1), 26. [Google Scholar] [CrossRef]

- Armstrong, B., Barnes, T. D., Chiba, D., & O’brien, D. Z. (2024). Financial crises and the selection and survival of women finance ministers. American Political Science Review, 118(3), 1305–1323. [Google Scholar] [CrossRef]

- Armstrong, P. (2018). Developments in RegTech and SupTech. Paris Dauphine University. Available online: https://www.esma.europa.eu/sites/default/files/library/esma71-99-1070_speech_on_regtech.pdf (accessed on 10 September 2025).

- Arner, D. W., Barberis, J., & Buckey, R. P. (2016). FinTech, RegTech, and the reconceptualization of financial regulation. Northwestern Journal of International Law and Business, 37, 371. [Google Scholar]

- Arner, D. W., Barberis, J., & Buckley, R. P. (2018). RegTech: Building a better financial system. In Handbook of blockchain, digital finance, and inclusion (Vol. 1, pp. 359–373). Elsevier. [Google Scholar]

- Avramović, P. (2023). Digital transformation of financial regulators and the emergence of supervisory technologies (SupTech): A case study of the UK Financial conduct authority. Harvard Data Science Review, 5(2). [Google Scholar] [CrossRef]

- Aziz, A., Syafii, M., & Jayanti, F. D. (2025). Analysis of the implementation of cloud accounting technology in increasing the efficiency and accuracy of financial reporting. The Journal of Academic Science, 2(4), 1239–1246. [Google Scholar] [CrossRef]

- Baghalzadeh Shishehgarkhaneh, M., Keivani, A., Moehler, R. C., Jelodari, N., & Roshdi Laleh, S. (2022). Internet of Things (IoT), Building Information Modeling (BIM), and Digital Twin (DT) in construction industry: A review, bibliometric, and network analysis. Buildings, 12(10), 1503. [Google Scholar] [CrossRef]

- Baghalzadeh Shishehgarkhaneh, M., Moehler, R. C., Fang, Y., Hijazi, A. A., & Aboutorab, H. (2025). A comprehensive taxonomy of supply chain risks in construction project management: A systematic literature review. Journal of Legal Affairs and Dispute Resolution in Engineering and Construction, 17(4), 03125002. [Google Scholar] [CrossRef]

- Bakhos Douaihy, H., & Rowe, F. (2023). Institutional pressures and RegTech challenges for banking: The case of money laundering and terrorist financing in Lebanon. Journal of Information Technology, 38(3), 304–318. [Google Scholar] [CrossRef]

- Bamberger, K. A. (2009). Technologies of compliance: Risk and regulation in a digital age. Texas Law Review, 88, 669. [Google Scholar]

- Bancong, H. (2024). The past and present of thought experiments’ research at Glancy: Bibliometric review and analysis. Discover Education, 3(1), 142. [Google Scholar] [CrossRef]

- Bansal, N., & Taneja, S. (2025). RegTech: The new regulatory technology. In Financial landscape transformation: Technological disruptions (pp. 235–251). Emerald Publishing Limited. [Google Scholar]

- Battanta, L., Giorgino, M., Grassi, L., & Lanfranchi, D. (2020, September 17–18). Regtech: Case studies of cooperation with banks in italy. European Conference on Innovation and Entrepreneurship, Rome, Italy. [Google Scholar]

- Becker, M., Merz, K., & Buchkremer, R. (2020). RegTech—The application of modern information technology in regulatory affairs: Areas of interest in research and practice. Intelligent Systems in Accounting, Finance and Management, 27(4), 161–167. [Google Scholar] [CrossRef]

- Biondi, Y., & Del Barrio, C. (2018, November 1). The single market’s catch-22: Supervisory centralisation in a fragmented banking landscape. Financial Stability Conference—FSC Research Workshop 2018, Financial Risk and Stability Network, Berlin, Germany. [Google Scholar] [CrossRef]

- Boeddu, G., Brix, L., Kachingwe, N., Lopes, L., & Randall, D. (2018). From spreadsheets to suptech; technology solutions for market conduct supervision (Vol. 1, p. 127577). World Bank Group. [Google Scholar]

- Boeddu, G. L., Newbury, L. B., Kachingwe, N. L., De Souza Neves Lopes, L., & Randall, D. (2018). From spreadsheets to suptech: Technology solutions for market conduct supervision. World Bank. Available online: https://documents1.worldbank.org/curated/en/612021529953613035/pdf/127577-REVISED-Suptech-Technology-Solutions-for-Market-Conduct-Supervision.pdf (accessed on 15 September 2025).

- Bolton, M., & Mintrom, M. (2023). RegTech and creating public value: Opportunities and challenges. Policy Design and Practice, 6(3), 266–282. [Google Scholar] [CrossRef]

- Borio, C. E., Farag, M., & Tarashev, N. A. (2020). Post-crisis international financial regulatory reforms: A primer (BIS Working Papers). Available online: https://www.bis.org/publ/work859.htm (accessed on 15 September 2025).

- Broeders, D., & Prenio, J. (2018). FSI Insights Innovative technology in financial supervision. FSI Insights on Policy Implementation, 2, 018. [Google Scholar]

- Butler, T. (2017). Towards a standards-based technology architecture for RegTech. Journal of Financial Transformation, 45, 49–59. [Google Scholar]

- Butler, T., & O’Brien, L. (2019). Understanding RegTech for digital regulatory compliance. Disrupting Finance, 85–102. [Google Scholar] [CrossRef]

- Campbell-Verduyn, M., & Lenglet, M. (2023). Imaginary failure: RegTech in finance. New Political Economy, 28(3), 468–482. [Google Scholar] [CrossRef]

- Cave, J. (2017). Get with the program: Fintech meets Regtech in the light-touch sandbox. Available at SSRN 2944249. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2944249 (accessed on 9 September 2025).

- Cerqueti, R., Clemente, G. P., & Grassi, R. (2021). Systemic risk assessment through high order clustering coefficient. Annals of Operations Research, 299(1), 1165–1187. [Google Scholar] [CrossRef]

- Cevik, E. I., Kenc, T., Goodell, J. W., & Gunay, S. (2025). Enhancing banking systemic risk indicators by incorporating volatility clustering, variance risk premiums, and considering distance-to-capital. International Review of Economics & Finance, 97, 103779. [Google Scholar]

- Chakraborty, C., & Joseph, A. (2017). Machine learning at central banks (Bank of England Working Paper No. 674). Available online: https://ssrn.com/abstract=3031796 (accessed on 20 September 2025).

- Chirulli, P. (2021). FinTech, RegTech and SupTech: Institutional challenges to the supervisory architecture of the financial markets. In Routledge handbook of financial technology and law (pp. 447–464). Routledge. [Google Scholar]

- Chishti, B. S. (2019). The power of regtech to drive cultural change and enhance conduct risk management across banking. The RegTech Book. [Google Scholar]

- Clarke, R. (2020). RegTech opportunities in the platform-based business sector. Available online: https://aisel.aisnet.org/bled2020/37/ (accessed on 20 September 2025).

- Climent, F., Momparler, A., & Carmona, P. (2019). Anticipating bank distress in the Eurozone: An Extreme Gradient Boosting approach. Journal of Business Research, 101, 885–896. [Google Scholar] [CrossRef]

- Colaert, V. (2021). ‘Computer says no’–benefits and challenges of RegTech. In Routledge handbook of financial technology and law (pp. 431–446). Routledge. [Google Scholar]

- Currie, W. L., Gozman, D. P., & Seddon, J. J. M. (2018). Dialectic tensions in the financial markets: A longitudinal study of pre- and post-crisis regulatory technology. Journal of Information Technology, 33(4), 304–325. [Google Scholar] [CrossRef]

- Das, S. R., Kim, S., & Kothari, B. (2017). Zero-revelation RegTech: Detecting risk through linguistic analysis of corporate emails and news. Available at SSRN 2960350. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2960350 (accessed on 12 September 2025).

- Deng, J., Liu, L., Lv, C., Yang, Z., & Han, G. (2024, August 9–10). Application of smart contracts in blockchain in financial risk control. 2024 Second International Conference on Networks, Multimedia and Information Technology (NMITCON), Bengaluru, India. [Google Scholar]

- di Castri, S., Grasser, M., & Kulenkampff, A. (2018). An AML SupTech solution for the Mexican national banking and securities commission (CNBV)-R2A project retrospective and lessons learned. Available at SSRN 3592564. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3592564 (accessed on 10 September 2025).

- Dinçkol, D., Ozcan, P., & Zachariadis, M. (2023). Regulatory standards and consequences for industry architecture: The case of UK Open Banking. Research Policy, 52(6), 104760. [Google Scholar] [CrossRef]

- Dongxing, J., & Tao, Z. (2020). Approach to SupTech development. China Economic Transition (CET), 3(2). [Google Scholar] [CrossRef]

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. [Google Scholar] [CrossRef]

- Du, J., & Wei, L. (2020, November 20–22). An analysis of regulatory technology in the Internet financial sector in conjunction with the logit model. 2020 2nd International Conference on Economic Management and Model Engineering (ICEMME), Chongqing, China. [Google Scholar]

- El Khoury, R., Alshater, M. M., & Joshipura, M. (2025). RegTech advancements-a comprehensive review of its evolution, challenges, and implications for financial regulation and compliance. Journal of Financial Reporting and Accounting, 23(4), 1450–1485. [Google Scholar] [CrossRef]

- Ellegaard, O., & Wallin, J. A. (2015). The bibliometric analysis of scholarly production: How great is the impact? Scientometrics, 105(3), 1809–1831. [Google Scholar] [CrossRef]

- Fachsandy, F. (2025). Regulatory and supervisory technology research: A bibliometric analysis. Journal of Central Banking Law and Institutions, 4(1), 181–202. [Google Scholar] [CrossRef]

- Finance, I. o. I. (2015). Regtech: Exploring solutions for regulatory challenges. Institute of International Finance. Available online: https://www.iif.com/Publications/ID/4229/Regtech-Exploring-Solutions-for-Regulatory-Challenges (accessed on 18 September 2025).

- Firiza, M. D., Lutfiani, N., Zahra, A. R. A., & Rahardja, U. (2024, October 3–4). The role of regtech in automating compliance and risk management. 2024 12th International Conference on Cyber and IT Service Management (CITSM), Batam, Indonesia. [Google Scholar]

- Firmansyah, B., & Arman, A. A. (2022, November 8–9). A systematic literature review of RegTech: Technologies, characteristics, and architectures. 2022 International Conference on Information Technology Systems and Innovation (ICITSI), Bandung, Indonesia. [Google Scholar]

- Firmansyah, B., & Arman, A. A. (2023). Generic solution architecture design of regulatory technology (RegTech). Indonesian Journal of Electrical Engineering and Informatics (IJEEI), 11(2), 453–468. [Google Scholar] [CrossRef]

- Gasparri, G. (2019). Risks and opportunities of RegTech and SupTech developments. Frontiers in Artificial Intelligence, 2, 14. [Google Scholar] [CrossRef]

- Ghosh, K. (2021). RegTech: Bits and bytes of financial regulation. Journal of Business Strategy Finance and Management, 3(1–2), 103. [Google Scholar] [CrossRef]

- Grant, S., Armstrong, C., & Khodyakov, D. (2021). Online modified-Delphi: A potential method for continuous patient engagement across stages of clinical practice guideline development. Journal of General Internal Medicine, 36(6), 1746–1750. [Google Scholar] [CrossRef]

- Grassi, L., & Lanfranchi, D. (2022). RegTech in public and private sectors: The nexus between data, technology and regulation. Journal of Industrial and Business Economics, 49(3), 441–479. [Google Scholar] [CrossRef]

- Guerra, P., Castelli, M., & Côrte-Real, N. (2022). Approaching european supervisory risk assessment with SupTech: A proposal of an early warning system. Risks, 10(4), 71. [Google Scholar] [CrossRef]

- Işgın, E., & Sopher, B. (2015). Information transparency, fairness and labor market efficiency. Journal of Behavioral and Experimental Economics, 58, 33–39. [Google Scholar] [CrossRef]

- Jagrič, T., Zdolšek, D., Horvat, R., Kolar, I., Erker, N., Merhar, J., & Jagrič, V. (2023). New suptech tool of the predictive generation for insurance companies—The case of the european market. Information, 14(10), 565. [Google Scholar] [CrossRef]

- Jagtiani, J., Vermilyea, T., & Wall, L. D. (2018). The roles of big data and machine learning in bank supervision. Forthcoming, Banking Perspectives. Available online: https://ssrn.com/abstract=3221309 (accessed on 10 September 2025).

- Jović, Ž., & Nikolić, I. (2022). The darker side of FinTech: The emergence of new risks. Zagreb International Review of Economics & Business, 25(SCI), 46–63. [Google Scholar]

- Jung, J. H. H. (2021). RegTech and SupTech: The future of compliance. In FinTech (pp. 291–316). Edward Elgar Publishing. [Google Scholar]

- Kanojia, S., Kaur, S., & Bhavya. (2024). Business sustainability in the era of Fintech and Regtech: A systematic literature review. Discover Sustainability, 5(1), 525. [Google Scholar] [CrossRef]

- Kavassalis, P., Stieber, H., Breymann, W., Saxton, K., & Gross, F. J. (2018). An innovative RegTech approach to financial risk monitoring and supervisory reporting. The Journal of Risk Finance, 19(1), 39–55. [Google Scholar] [CrossRef]

- Ketcham, M., Boonyopakorn, P., & Ganokratanaa, T. (2025). Resolution-aware deep learning with feature space optimization for reliable identity verification in electronic know your customer processes. Mathematics, 13(11), 1726. [Google Scholar] [CrossRef]

- Khalatur, S., Pavlova, H., Vasilieva, L., Karamushka, D., & Danileviča, A. (2022). Innovation management as basis of digitalization trends and security of financial sector. Entrepreneurship and Sustainability Issues, 9(4), 56–76. [Google Scholar] [CrossRef]

- Khan, F. S., Mazhar, S. S., Mazhar, K., A. AlSaleh, D., & Mazhar, A. (2025). Model-agnostic explainable artificial intelligence methods in finance: A systematic review, recent developments, limitations, challenges and future directions. Artificial Intelligence Review, 58(8), 232. [Google Scholar] [CrossRef]

- Kholkar, D., Sunkle, S., & Kulkarni, V. (2017, June 16). Semi-automated creation of regulation rule bases using generic template-driven rule extraction. Second Workshop on Automated Semantic Analysis of Information in Legal Text (ASAIL@ ICAIL), London, UK. [Google Scholar]

- Kolari, J. W., López-Iturriaga, F. J., & Sanz, I. P. (2019). Predicting European bank stress tests: Survival of the fittest. Global Finance Journal, 39, 44–57. [Google Scholar] [CrossRef]

- Konina, A. (2021). Banks as delegated regulators of technology. Alberta Law Review, 59, 753. [Google Scholar]

- Koo, K., Park, M., & Yoon, B. (2024). A suspicious financial transaction detection model using autoencoder and risk-based approach. IEEE Access, 12, 68926–68939. [Google Scholar] [CrossRef]

- Kristanto, A. D., & Arman, A. A. (2022, November 8–9). Towards a smart regulatory compliance, the capabilities of RegTech and SupTech. 2022 International Conference on Information Technology Systems and Innovation (ICITSI), Bandung, Indonesia. [Google Scholar]

- Kumar, A., Kumar, A., Raja, R., Dewangan, A. K., Kumar, M., Soni, A., Agarwal, D., & Saudagar, A. K. J. (2025). Revolutionising anomaly detection: A hybrid framework for anomaly detection integrating isolation forest, autoencoder, and Conv. LSTM. Knowledge and Information Systems, 1–51. [Google Scholar] [CrossRef]

- Kurum, E. (2023). RegTech solutions and AML compliance: What future for financial crime? Journal of Financial Crime, 30(3), 776–794. [Google Scholar] [CrossRef]

- Laguna de Paz, J. C. (2023). Some implications of the new global digital economy for financial regulation and supervision. Journal of Banking Regulation, 24(2), 146–155. [Google Scholar] [CrossRef]

- Li, J., Maiti, A., & Fei, J. (2023). Features and scope of regulatory technologies: Challenges and opportunities with industrial internet of things. Future Internet, 15(8), 256. [Google Scholar] [CrossRef]

- Li, W. (2024). Application of financial regulatory technology (RegTech) and its impact on financial stability. Journal of Economics and Public Finance, 10, 65. [Google Scholar] [CrossRef]

- Li, Y., Xia, Y., Shi, H., Li, N., & Shi, Z. (2025). Can bank regulatory technology (RegTech) boost corporate investment efficiency? Evidence from matched bank–firm loan data. Managerial and Decision Economics, 46(6), 3683–3710. [Google Scholar] [CrossRef]

- Loiacono, G., & Rulli, E. (2022). ResTech: Innovative technologies for crisis resolution. Journal of Banking Regulation, 23(3), 227–243. [Google Scholar] [CrossRef]

- Lukicheva, E. (2022). Features of supervisory reporting of professional securities market participants. Accounting Analysis Auditing, 8(5), 83–91. [Google Scholar] [CrossRef]

- Marrazzo, R. (2018). Effective reporting can support improved decision-making by directors and executives. Journal of Financial Compliance, 2(1), 13–21. [Google Scholar] [CrossRef]

- McCarthy, J. (2023). The regulation of RegTech and SupTech in finance: Ensuring consistency in principle and in practice. Journal of Financial Regulation and Compliance, 31(2), 186–199. [Google Scholar] [CrossRef]

- McNulty, L. (2017). Top regulator: City firms must bear responsibility for RegTech risks. Financial News. Available online: https://www.fnlondon.com/amp/articles/city-firms-must-bear-responsibility-for-regtech-risk-20170516 (accessed on 10 September 2025).

- Memminger, M., Baxter, M., & Lin, E. (2016). Banking regtechs to the rescue? Available online: https://www.bain.com/insights/banking-regtechs-to-the-rescue/ (accessed on 15 September 2025).

- Michaels, L., & Homer, M. (2018). Regulation and supervision in a digital and inclusive world. In Handbook of blockchain, digital finance, and inclusion (Vol. 1, pp. 329–346). Elsevier. [Google Scholar]

- Michailidou, F. (2020). RegTech and SupTech: Opportunities and challenges in the financial sector. Available online: https://unitesi.unive.it/handle/20.500.14247/15734 (accessed on 10 September 2025).

- Micheler, E., & Whaley, A. (2020). Regulatory technology: Replacing law with computer code. European Business Organization Law Review, 21(2), 349–377. [Google Scholar] [CrossRef]

- Miglionico, A. (2020). Automated regulation and supervision: The impact of RegTech on banking compliance. European Business Law Review, 31(4), 641–662. [Google Scholar] [CrossRef]

- Muganyi, T., Yan, L., Yin, Y., Sun, H., Gong, X., & Taghizadeh-Hesary, F. (2022). Fintech, regtech, and financial development: Evidence from China. Financial Innovation, 8(1), 29. [Google Scholar] [CrossRef]

- Muzammil, M., & Vihari, N. S. (2020). Determinants for the adoption of regulatory technology (RegTech) services by the companies in United Arab Emirates: An MCDM approach. CERC. [Google Scholar]

- Neuwirth, R. J., & Tan, Y. (2024). Regulating fintech in the Greater Bay area: Regtech and the role of regulatory sandboxes. The Chinese Journal of Comparative Law, 12, cxae014. [Google Scholar] [CrossRef]

- Ojo, I. P., & Tomy, A. (2025). Explainable AI for credit card fraud detection: Bridging the gap between accuracy and interpretability. Volume, 25, 1246–1256. [Google Scholar]

- Olaiya, O. P., Adesoga, T. O., Pieterson, K., & Qazeem, O. (2024). RegTech Solutions: Enhancing compliance and risk management in the financial industry. GSC Advanced Research and Reviews, 20(2), 8–15. [Google Scholar] [CrossRef]

- O’Sullivan, K., & Kennedy, T. (2008). Supervision of the Irish banking system: A critical perspective. CESifo DICE Report, 6(3), 20–26. [Google Scholar]

- Packin, N. G. (2018). RegTech, compliance and technology judgment rule. Chicago-Kent Law Review, 93, 193. [Google Scholar]

- Pan, M., Li, D., Wu, H., & Lei, P. (2024). Technological revolution and regulatory innovation: How governmental artificial intelligence adoption matters for financial regulation intensity. International Review of Financial Analysis, 96, 103535. [Google Scholar] [CrossRef]

- Papantoniou, A. A. (2022). Regtech: Steering the regulatory spaceship in the right direction? Journal of Banking and Financial Technology, 6(1), 1–16. [Google Scholar] [CrossRef]

- Prakash, A., & Santhi, M. (2025). AI in the enterprise: Overcoming adoption barriers and maximizing business value. Journal of Information Systems Engineering and Management, 10, 603–613. [Google Scholar] [CrossRef]

- Press release. (2020). FSB report highlights increased use of RegTech and SupTech. Available online: https://www.fsb.org/uploads/R091020-1.pdf (accessed on 15 September 2025).

- Rawat, R., Kassem, A.-A., Dixit, K. K., Deepak, A., Pushkarna, G., & Harikrishna, M. (2024, May 9–11). Real-time anomaly detection in large-scale sensor networks using isolation forests. 2024 International Conference on Communication, Computer Sciences and Engineering (IC3SE), Gautam Buddha Nagar, India. [Google Scholar]

- Ryan, P., Crane, M., & Brennan, R. (2020). Design challenges for GDPR RegTech. arXiv, arXiv:2005.12138. [Google Scholar] [CrossRef]

- Saifullah, S., Supriyadi, A. P., Bahagiati, K., & Al Munawar, F. A. (2023). The evaluation of the Indonesian fintech law from the perspective of regulatory technology paradigms to mitigate illegal fintech. Jurisdictie: Jurnal Hukum dan Syariah, 14(2), 233–264. [Google Scholar] [CrossRef]

- Salampasis, D., & Samakovitis, G. (2024). Regtech frontiers: Innovations, trends, and insights redefining compliance. In The emerald handbook of fintech (pp. 65–87). Emerald Publishing Limited. [Google Scholar]

- Sarkis-Onofre, R., Catalá-López, F., Aromataris, E., & Lockwood, C. (2021). How to properly use the PRISMA Statement. Systematic Reviews, 10(1), 117. [Google Scholar] [CrossRef]

- Sharma, M., Vaish, K., Kathuria, S., Singh, R., Chythanya, K. R., & Awasthi, S. (2023, September 14–16). Artificial intelligence in RegTech to predict financial market trends. 2023 6th International Conference on Contemporary Computing and Informatics (IC3I), Gautam Buddha Nagar, India. [Google Scholar]

- Shi, Z., Xia, Y., He, L., Sun, N., & Zheng, Q. (2025). Can internal regulatory technology (RegTech) mitigate bank credit risk? Evidence from the banking sector in China. Research in International Business and Finance, 75, 102780. [Google Scholar] [CrossRef]

- Shishehgarkhaneh, M. B., Moehler, R. C., & Moradinia, S. F. (2023). Blockchain in the Construction Industry between 2016 and 2022: A Review, Bibliometric, and Network Analysis. Smart Cities, 6(2), 819–845. [Google Scholar] [CrossRef]

- Singh, C. (2024). Artificial intelligence and deep learning: Considerations for financial institutions for compliance with the regulatory burden in the United Kingdom. Journal of Financial Crime, 31(2), 259–266. [Google Scholar] [CrossRef]

- Singh, C., & Lin, W. (2021). Can artificial intelligence, RegTech and CharityTech provide effective solutions for anti-money laundering and counter-terror financing initiatives in charitable fundraising. Journal of Money Laundering Control, 24(3), 464–482. [Google Scholar] [CrossRef]

- Singh, C., Zhao, L., Lin, W., & Ye, Z. (2022). Can machine learning, as a RegTech compliance tool, lighten the regulatory burden for charitable organisations in the United Kingdom? Journal of Financial Crime, 29(1), 45–61. [Google Scholar] [CrossRef]

- Singhania, M., & Saini, N. (2023). Institutional framework of ESG disclosures: Comparative analysis of developed and developing countries. Journal of Sustainable Finance & Investment, 13(1), 516–559. [Google Scholar]

- Ssetimba, I. D., Kato, J., Pinyi, E. O., Twineamatsiko, E., Nakayenga, H. N., & Muhangi, E. (2024). Advancing electronic communication compliance and fraud detection through machine learning, NLP and generative AI: A pathway to enhanced cybersecurity and regulatory adherence. World Journal of Advanced Research and Reviews, 23(2), 697–707. [Google Scholar] [CrossRef]

- Takeda, A., & Ito, Y. (2021). A review of FinTech research. International Journal of Technology Management, 86(1), 67–88. [Google Scholar] [CrossRef]

- Teichmann, F., Boticiu, S., & Sergi, B. S. (2023). RegTech–Potential benefits and challenges for businesses. Technology in Society, 72, 102150. [Google Scholar] [CrossRef]

- Tsai, C.-h., & Peng, K.-J. (2017). The FinTech revolution and financial regulation: The case of online supply-chain financing. Asian Journal of Law and Society, 4(1), 109–132. [Google Scholar] [CrossRef]

- Uddin, S. M. S., Goni, M. O., & Hossen, T. A. (2025). Regulatory technology (RegTech) landscape of Bangladesh: Policies and practices. In M. Kour, S. Taneja, E. Özen, K. Sood, & S. Grima (Eds.), Financial Landscape Transformation: Technological Disruptions (pp. 269–285). Emerald Publishing Limited. [Google Scholar] [CrossRef]

- Vats, R., Agrawal, S., & Chippada, S. S. (2025). Bias detection and fairness in large language models for financial services. International Journal of Scientific Research in Computer Science, Engineering and Information Technology, 11(2), 1329–1345. [Google Scholar] [CrossRef]

- Visser, M., Van Eck, N. J., & Waltman, L. (2021). Large-scale comparison of bibliographic data sources: Scopus, Web of Science, Dimensions, Crossref, and Microsoft Academic. Quantitative Science Studies, 2(1), 20–41. [Google Scholar] [CrossRef]

- Voigt, P., & Von Dem Bussche, A. (2024). Enforcement and fines under the GDPR. In The EU general data protection regulation (GDPR) a practical guide (pp. 275–299). Springer. [Google Scholar]

- Von Solms, J. (2021). Integrating regulatory technology (RegTech) into the digital transformation of a bank Treasury. Journal of Banking Regulation, 22(2), 152–168. [Google Scholar] [CrossRef]

- Walker, O. (2018). M&A in asset management sector climbs to 8-year high. The Financial Times. Available online: https://www.ft.com/content/2f1e77f2-f80c-11e7-88f7-5465a6ce1a00 (accessed on 15 September 2025).

- Wang, J.-S., & Chen, Y.-T. (2024). Configuring the RegTech business model to explore implications of FinTech. Egyptian Informatics Journal, 26, 100483. [Google Scholar] [CrossRef]

- White, E. (2023). What does finance democracy look like?: Thinking beyond fintech and regtech. Transnational Legal Theory, 14(3), 245–269. [Google Scholar] [CrossRef]

- Xia, C., Ye, Y., & Yu, H. (2025). RegTech and regulators’ error detection activities: Evidence from China. Finance Research Letters, 78, 107198. [Google Scholar] [CrossRef]

- Xia, Y., Lu, X., Hao, Z., & Shi, H. (2024). Internal regulatory technology (RegTech) and bank liquidity risk: Evidence from Chinese listed banks. Applied Economics Letters, 1–6. [Google Scholar] [CrossRef]

- Xu, B., Wang, Y., Liao, X., & Wang, K. (2023). Efficient fraud detection using deep boosting decision trees. Decision Support Systems, 175, 114037. [Google Scholar] [CrossRef]

- Yang, Y.-P., & Tsang, C.-Y. (2018). Regtech and the new era of financial regulators: Envisaging more public-private-partnership models of financial regulators. University of Pennsylvania Journal of Business Law, 21, 354. [Google Scholar]

- Zabat, L., Sadaoui, N., Benlaria, H., Ahmed, S. A. K., Hussien, B. S. A., & Abdulrahman, B. M. A. (2024). The impact of RegTech on compliance costs and risk management from the perspective of Saudi Banks’ employees. WSEAS Transactions on Business and Economics, 21, 1200–1216. [Google Scholar] [CrossRef]

- Zeranski, S., & Sancak, I. E. (2021). Prudential supervisory disclosure (PSD) with supervisory technology (SupTech): Lessons from a FinTech crisis. International Journal of Disclosure and Governance, 18(4), 315–335. [Google Scholar] [CrossRef]

- Zetzsche, D. A., & Anker-Sørensen, L. (2022). Regulating sustainable finance in the dark. European Business Organization Law Review, 23(1), 47–85. [Google Scholar] [CrossRef]

- Zetzsche, D. A., Arner, D. W., Buckley, R. P., & Weber, R. H. (2019). The future of data-driven finance and RegTech: Lessons from EU big bang II. European Banking Institute. [Google Scholar]

- Zhang, X., & Luo, X. (2022). A machine-reading-comprehension method for named entity recognition in legal documents. In International conference on neural information processing (pp. 224–236). Springer Nature Singapore. [Google Scholar] [CrossRef]

- Zhu, Y., Hu, Y., Liu, Q., Liu, H., Ma, C., & Yin, J. (2023). A hybrid approach for predicting corporate financial risk: Integrating SMOTE-ENN and NGBoost. IEEE Access, 11, 111106–111125. [Google Scholar] [CrossRef]

| Dimension | RegTech | SupTech | Source |

|---|---|---|---|

| Time Period | Coined in 2015, following the post-GFC regulatory surge, and rapidly expanded since | Introduced around 2017, gaining momentum in supervisory authorities worldwide | (Arner et al., 2016; Broeders & Prenio, 2018; Jović & Nikolić, 2022) |

| Primary Focus | Helps firms address regulatory compliance obligations more efficiently, accurately, and cost-effectively | Supports supervisory authorities in monitoring, assessing, and enforcing compliance across institutions | (G. L. Boeddu et al., 2018; Cave, 2017; Finance, 2015; Press release, 2020) |

| Aim/Purpose | Streamline regulatory reporting, risk monitoring, AML/KYC checks, and adapt to regulatory changes | Enhance prudential supervision, enable proactive oversight, and strengthen market integrity | (Currie et al., 2018; Das et al., 2017; Kolari et al., 2019) |

| Institutional Scope | Applied by financial institutions, banks, insurers, and other regulated entities | Adopted by supervisory authorities, central banks, and regulators to evaluate compliance | (Kristanto & Arman, 2022; McNulty, 2017) |

| Key Technologies | AI, ML, NLP, blockchain, big data analytics, cloud computing, RegData tagging, smart contracts | Similar toolset (AI/ML, DLT, cloud, NLP), but applied for supervisory use cases such as stress testing and real-time monitoring | (Broeders & Prenio, 2018; Climent et al., 2019; Kavassalis et al., 2018) |

| Core Examples | Automated regulatory reporting systems, AML transaction monitoring, e-KYC platforms | Digital complaint management, continuous prudential reporting, systemic risk analytics | (G. L. Boeddu et al., 2018; Takeda & Ito, 2021) |

| Relationship | RegTech focuses on compliance within regulated firms and produces the data required for supervisory functions. | SupTech represents the supervisor-side application that consumes and validates the data produced through RegTech. | (Butler & O’Brien, 2019; Currie et al., 2018; Zetzsche et al., 2019) |

| Category | Criteria |

|---|---|

| Inclusion | Journal articles, conference proceedings, and book chapters (peer-reviewed) Written in English Full-text accessible Explicit focus on RegTech and/or SupTech in financial regulation or supervision Addresses at least one research theme: opportunities, challenges, benefits, risks, barriers, implications, or applications in financial institutions, regulators, or supervisory bodies |

| Exclusion | No direct focus on RegTech or SupTech (e.g., studies mention only FinTech or general digitalization without regulatory/supervisory link) Lack of alignment with research aims (did not address opportunities, challenges, benefits, risks, or implications in regulatory/supervisory context) Technologies discussed in isolation (e.g., only AI, blockchain, or big data without regulatory/supervisory application) Application outside financial regulation/supervision (e.g., healthcare, agriculture, manufacturing) Too generic or conceptual (discusses digital transformation broadly without technical, institutional, or practical details relevant to RegTech/SupTech adoption) |

| Author | Documents | Citations | Total Link Strength | h-Index |

|---|---|---|---|---|

| Singh, C. | 3 | 56 | 4 | 4 |

| Arman, A.A. | 3 | 12 | 3 | 19 |

| Arner, D.W. | 2 | 341 | 4 | 46 |

| Barberis, J. | 2 | 341 | 4 | 7 |

| Buckley, R.P. | 2 | 341 | 4 | 47 |

| Grassl, I. | 2 | 31 | 4 | 10 |

| Lanfranchi, D. | 2 | 31 | 4 | 5 |

| Lin, W. | 2 | 42 | 4 | 4 |

| Firmansyah, B. | 1 | 7 | 2 | 2 |

| Erker, N. | 1 | 1 | 6 | 1 |

| Horvat, R. | 1 | 1 | 6 | 1 |

| Jagrić, T. | 1 | 1 | 6 | 12 |

| Rank | Country | Documents | Citations | Total Link Strength |

|---|---|---|---|---|

| 1 | United Kingdom | 11 | 531 | 53 |

| 2 | Indonesia | 6 | 18 | 25 |

| 3 | Australia | 6 | 369 | 17 |

| 4 | China | 6 | 159 | 17 |

| 5 | Italy | 5 | 47 | 24 |

| 6 | India | 4 | 8 | 35 |

| 7 | Germany | 3 | 72 | 35 |

| 8 | United States | 2 | 56 | 13 |

| 9 | Luxembourg | 2 | 82 | 9 |

| 10 | Hong Kong | 2 | 341 | 6 |

| Year | RegTech | SupTech |

|---|---|---|

| 2017 | RegTech is IT for monitoring, reporting, and compliance, automating processes for efficiency and real-time use (Arner et al., 2016). | - |

| RegTech is framed as the next stage of regulation beyond FinTech, enabling continuous, data-driven supervision (Arner et al., 2018). | ||

| 2018 | RegTech is a subset of FinTech applying new technologies to compliance and supervision for efficiency and monitoring (Anagnostopoulos, 2018). | |

| RegTech is a market segment offering tools like real-time fraud detection, also relevant for regulators (Michaels & Homer, 2018). | ||

| 2019 | RegTech embeds technology into institutions’ core operations, integrating compliance, analytics, and reporting (Jung, 2021). | SupTech is technology used by supervisory agencies to digitize reporting and regulatory processes, enabling more efficient and proactive monitoring (Jung, 2021). |

| 2020 | RegTech digitizes monitoring and reporting to cut costs and improve accuracy (Miglionico, 2020). | SupTech is supervisors’ data infrastructures, analytics, and automation for standardized submissions and continuous oversight (Miglionico, 2020). |

| RegTech applies broadly to regulators, firms, and regulated entities beyond finance (Clarke, 2020). | ||

| RegTech integrates AI, big data, blockchain, and cloud for adaptive, real-time supervision (Du & Wei, 2020). | ||

| 2021 | RegTech includes compliance (firms), supervisory (supervisors), and regulatory (digital rules) (Colaert, 2021). | SupTech is supervisory technology covering licencing, reporting, enforcement, and experimental tools like blockchain (Chirulli, 2021). |

| SupTech enables real-time market monitoring with automated data collection and big-data analytics, closing the gap with digital markets (Zeranski & Sancak, 2021). | ||

| SupTech applies big data, AI, ML, and NLP for predictive, real-time, partially automated supervision (Chirulli, 2021). | ||

| 2022 | RegTech is the deployment of FinTech in regulation using AI and big data to boost effectiveness and stability (Muganyi et al., 2022). | SupTech is supervisors’ use of technology to ensure compliance of regulated entities (Kristanto & Arman, 2022). |

| SupTech is digital tools for regulators to enhance monitoring, data gathering, and fraud detection, accelerated post-COVID (Khalatur et al., 2022) | ||

| SupTech uses advanced analytics to enable real-time supervision and reshape regulatory drafting and enforcement (Loiacono & Rulli, 2022). | ||

| SupTech is regulators’ adoption of RegTech solutions for authorization, monitoring, fraud prevention, and risk analysis (Grassi & Lanfranchi, 2022). | ||

| SupTech is machine learning and data-driven systems for predictive indicators, early warnings, and automated supervision (Guerra et al., 2022). | ||

| 2023 | RegTech fuses law and digital technology to ensure accountability, transparency, and consumer protection (Saifullah et al., 2023). | SupTech is technology enhancing supervisors’ efficiency, insight, and agility in overseeing complex markets (Avramović, 2023). |

| RegTech evolves from 1.0 (basic tools) to 3.0 (data-driven compliance strategies like “know your data”) (Kurum, 2023). | SupTech enables proactive, data-driven supervision, verifying firms’ RegTech outputs through analytics (J. Li et al., 2023). | |

| 2024 | RegTech is AI/ML-driven, automating compliance tasks, monitoring rules, and enabling digital processing (Singh, 2024). | SupTech is technology enabling data-driven oversight and proactive risk identification (Firiza et al., 2024). |

| RegTech fuses AI, cloud, big data, and blockchain to automate reporting and support supervision. 36 | ||

| RegTech is the fusion of data, technology, and regulation, shifting from manual to smart digital compliance (Salampasis & Samakovitis, 2024). | ||

| 2025 | RegTech is defined narrowly as compliance tech in banks and broadly as technology for regulators’ risk monitoring (Shi et al., 2025). | SupTech is big-data and machine learning tools for supervisors, including API-based reporting, chatbots, and AML analytics (Fachsandy, 2025). |

| RegTech is an umbrella for evolving technologies improving outcomes and public value, including government use (Bansal & Taneja, 2025). |

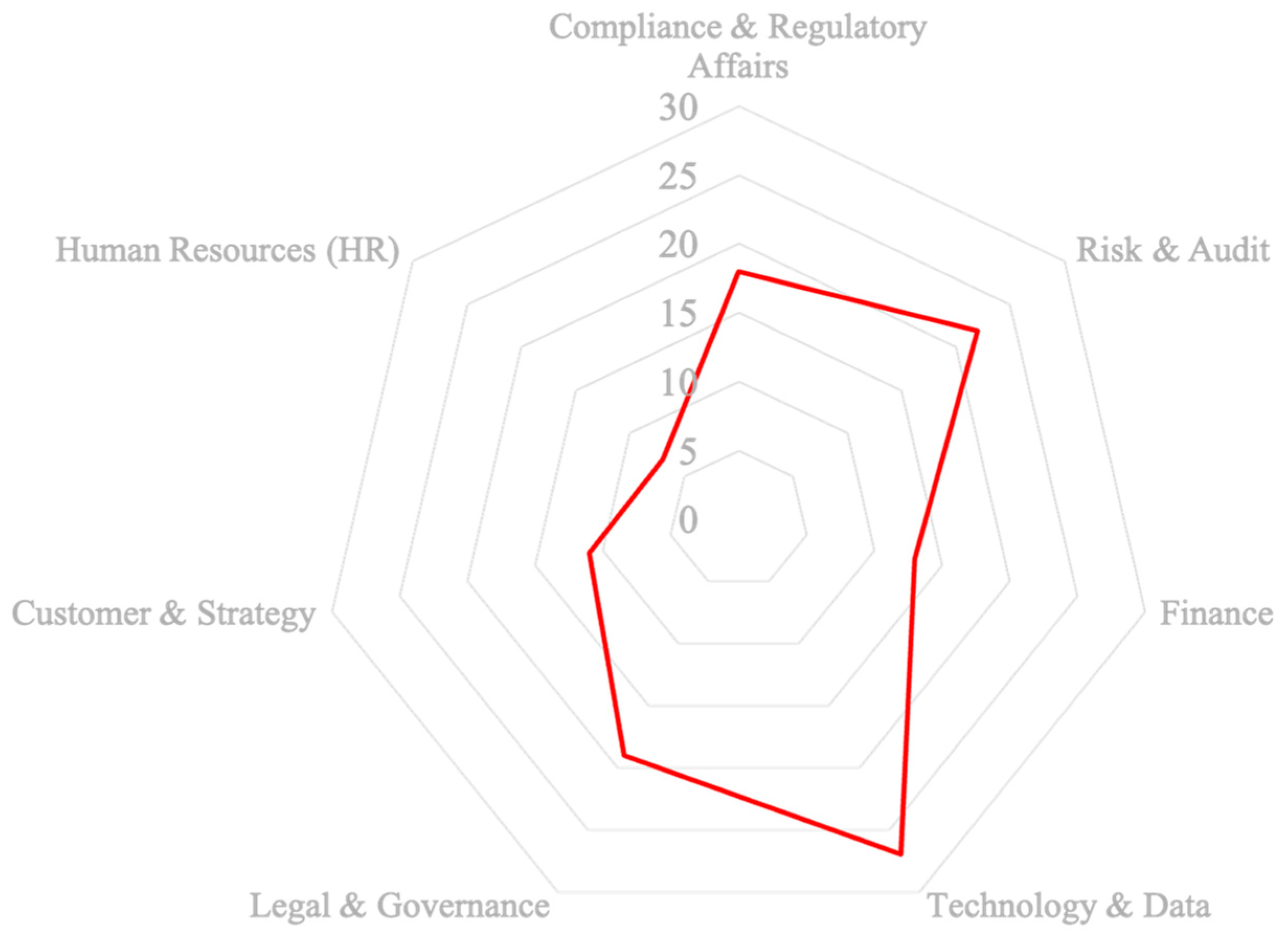

| Opportunity Type | Opportunity Name | Compliance & Regulatory Affairs | Risk & Audit | Finance | Technology & Data | Legal & Governance | Customer & Strategy | Human Resources (HR) | Source |

|---|---|---|---|---|---|---|---|---|---|

| Compliance efficiency & cost reduction | Automate evidence collection and testing | ✓ | (Colaert, 2021; Firmansyah & Arman, 2023; Jung, 2021; Khalatur et al., 2022; Kristanto & Arman, 2022; J. Li et al., 2023) | ||||||

| Consolidate duplicate controls/processes | ✓ | ✓ | (Becker et al., 2020; El Khoury et al., 2025; Jung, 2021; Khalatur et al., 2022; Uddin et al., 2025; Zabat et al., 2024) | ||||||

| Optimize headcount via “shift-left” compliance | ✓ | (Chishti, 2019; Firmansyah & Arman, 2023; Singh, 2024; Singh & Lin, 2021) | |||||||

| Reduce penalties through better control design | ✓ | (Battanta et al., 2020; Chirulli, 2021; Colaert, 2021; Uddin et al., 2025) | |||||||

| Benchmark unit cost of compliance across units | ✓ | (Becker et al., 2020; Gasparri, 2019; Jung, 2021; Khalatur et al., 2022; Zabat et al., 2024) | |||||||

| Automation of reporting & monitoring (real-time) | T+0 regulatory submissions | ✓ | (Du & Wei, 2020; Firmansyah & Arman, 2023; Jung, 2021; Kavassalis et al., 2018; Miglionico, 2020) | ||||||

| Streaming control dashboards | ✓ | ✓ | (Chirulli, 2021; Chishti, 2019; Jung, 2021; Khalatur et al., 2022) | ||||||

| Improved data quality, accuracy & standardization | Golden sources and data lineage | ✓ | (Du & Wei, 2020; El Khoury et al., 2025; Firmansyah & Arman, 2022; J. Li et al., 2023) | ||||||

| Standard taxonomies/ontologies (LEI, product) | ✓ | ✓ | (Du & Wei, 2020; Fachsandy, 2025; Miglionico, 2020) | ||||||

| Data quality SLAs and scorecards | ✓ | ✓ | (Firiza et al., 2024; Laguna de Paz, 2023; J. Li et al., 2023) | ||||||

| Enhanced risk management, early-warning & fraud/AML detection | ML-driven anomaly detection & alert tuning | ✓ | ✓ | (Colaert, 2021; Gasparri, 2019; Kurum, 2023; Sharma et al., 2023) | |||||

| Network analytics for AML/KYC | ✓ | ✓ | (Colaert, 2021; Kurum, 2023; Uddin et al., 2025) | ||||||

| Model-based capital/risk estimation | ✓ | ✓ | ✓ | (Guerra et al., 2022; Shi et al., 2025; Y. Xia et al., 2024) | |||||

| Conduct/market-abuse surveillance | ✓ | ✓ | (Anagnostopoulos, 2018; Avramović, 2023; Gasparri, 2019) | ||||||

| Proportionate, risk-based & continuous supervision | Risk-tiering to focus exams | ✓ | ✓ | (Arner et al., 2018; Chirulli, 2021) | |||||

| Continuous controls testing | ✓ | ✓ | (Chirulli, 2021; Colaert, 2021; Jung, 2021) | ||||||

| Machine-assisted case triage | ✓ | ✓ | (Du & Wei, 2020; Guerra et al., 2022; Jung, 2021) | ||||||

| Automated rule checks | ✓ | ✓ | (Colaert, 2021; Miglionico, 2020; Ryan et al., 2020) | ||||||

| Better analytics & decision-making | Portfolio-level stress testing | ✓ | ✓ | ✓ | (El Khoury et al., 2025; Gasparri, 2019; Guerra et al., 2022) | ||||

| Text/NLP for rule interpretation | ✓ | ✓ | (Miglionico, 2020; Ryan et al., 2020) | ||||||

| Scenario and “what-if” policy analysis | ✓ | ✓ | (Du & Wei, 2020; Guerra et al., 2022; Zeranski & Sancak, 2021) | ||||||

| Transparency, auditability, market integrity & trust | Immutable audit trails | ✓ | ✓ | (J. Li et al., 2023; Miglionico, 2020; Sharma et al., 2023) | |||||

| Evidence repositories for regulators | ✓ | ✓ | (Khalatur et al., 2022; J. Li et al., 2023; Ryan et al., 2020) | ||||||

| Complaint/whistleblowing analytics | ✓ | ✓ | (Clarke, 2020; Michaels & Homer, 2018; Singh & Lin, 2021) | ||||||

| Explainability for AI decisions | ✓ | ✓ | (Gasparri, 2019; Sharma et al., 2023; Singh, 2024) | ||||||

| Public transparency reports | ✓ | ✓ | (Grassi & Lanfranchi, 2022; Michaels & Homer, 2018) | ||||||

| Faster regulatory change management & adaptability | Machine-readable rulebooks | ✓ | ✓ | (Colaert, 2021; Miglionico, 2020; Ryan et al., 2020) | |||||

| Impact analysis and playbooks | ✓ | ✓ | (Chishti, 2019; Jung, 2021; Zabat et al., 2024) | ||||||

| Automated control updates | ✓ | ✓ | (Colaert, 2021; Firmansyah & Arman, 2023; Zabat et al., 2024) | ||||||

| Interoperability & data- infrastructure | API gateways with regulator utilities | ✓ | (Chirulli, 2021; Du & Wei, 2020; Fachsandy, 2025) | ||||||

| Common reporting utilities (CRUs) | ✓ | ✓ | (Arner et al., 2018; Jung, 2021; Miglionico, 2020) | ||||||

| Schema registries and contracts | ✓ | ✓ | (Du & Wei, 2020; Firmansyah & Arman, 2022; Miglionico, 2020) | ||||||

| Governance, accountability & stronger internal controls | Control libraries with ownership/RACI | ✓ | ✓ | (Chishti, 2019; Konina, 2021) | |||||

| Board-level risk dashboards | ✓ | ✓ | ✓ | (Guerra et al., 2022; Y. Xia et al., 2024) | |||||

| Consumer protection & customer-centric improvements | Real-time vulnerability/complaint signals | ✓ | (Clarke, 2020; Grassi & Lanfranchi, 2022; Michaels & Homer, 2018) | ||||||

| Fairness/bias testing in decisions | ✓ | ✓ | ✓ | (Grassi & Lanfranchi, 2022; Sharma et al., 2023; Singh, 2024) | |||||

| Fee/terms transparency tools | ✓ | ✓ | (Grassi & Lanfranchi, 2022; Michaels & Homer, 2018; Muzammil & Vihari, 2020) | ||||||

| Dispute resolution automation | ✓ | ✓ | (Grassi & Lanfranchi, 2022; Muzammil & Vihari, 2020) | ||||||

| Financial inclusion, access expansion & growth | e-KYC for remote onboarding | ✓ | ✓ | ✓ | (Michaels & Homer, 2018; Uddin et al., 2025) | ||||

| Proportional KYC for low-risk users | ✓ | ✓ | (Chirulli, 2021; Michaels & Homer, 2018; Uddin et al., 2025) | ||||||

| Alternative-data credit pathways | ✓ | ✓ | ✓ | (El Khoury et al., 2025; Muganyi et al., 2022; Sharma et al., 2023) | |||||

| Cross-border cooperation, harmonization & legal predictability | Passportable reporting packs | ✓ | ✓ | (Arner et al., 2016; Grassi & Lanfranchi, 2022; Neuwirth & Tan, 2024) | |||||

| Shared sanctions/KYC utilities | ✓ | ✓ | ✓ | (Colaert, 2021; Grassi & Lanfranchi, 2022) | |||||

| Mutual recognition of supervisory data | ✓ | ✓ | (Fachsandy, 2025; Grassi & Lanfranchi, 2022; Neuwirth & Tan, 2024) | ||||||

| Operational resilience & systemic stability | Real-time incident/regulatory notification | ✓ | ✓ | (Chirulli, 2021; Du & Wei, 2020; Khalatur et al., 2022) | |||||

| Resilience metrics for critical services | ✓ | ✓ | (Chirulli, 2021; Grassi & Lanfranchi, 2022) | ||||||

| Liquidity/treasury early-warning indicators | ✓ | ✓ | (Y. Li et al., 2025; Shi et al., 2025; Y. Xia et al., 2024) | ||||||

| Sector-wide stress telemetry | ✓ | ✓ | (Gasparri, 2019; Guerra et al., 2022; Jung, 2021) | ||||||

| Reduced human error & fewer false positives/negatives | Human-in-the-loop alert retraining | ✓ | ✓ | (Bakhos Douaihy & Rowe, 2023; Kurum, 2023) | |||||

| UX to prevent rule-entry mistakes | ✓ | ✓ | (Firmansyah & Arman, 2022; Firmansyah & Arman, 2023) | ||||||

| Active learning on mislabeled alerts | ✓ | ✓ | (Colaert, 2021; Gasparri, 2019; Sharma et al., 2023) | ||||||

| Faster onboarding/KYC & identity management | Orchestrated e-KYC with biometrics | ✓ | ✓ | ✓ | (Kurum, 2023; Michaels & Homer, 2018; Uddin et al., 2025) | ||||

| Portable digital identity wallets | ✓ | ✓ | (Micheler & Whaley, 2020; Miglionico, 2020; Muzammil & Vihari, 2020) | ||||||

| Cybersecurity, data privacy & secure data handling | Differential privacy/pseudonymization | ✓ | ✓ | (J. Li et al., 2023; Ryan et al., 2020) | |||||

| Confidential computing for shared analytics | ✓ | (Du & Wei, 2020; Fachsandy, 2025) | |||||||

| Zero-trust access for reg data | ✓ | ✓ | (Du & Wei, 2020; Grassi & Lanfranchi, 2022; J. Li et al., 2023) | ||||||

| Automated GDPR/CCPA evidence packs | ✓ | ✓ | (Firmansyah & Arman, 2023; J. Li et al., 2023; Ryan et al., 2020) | ||||||

| Data retention/minimization policies | ✓ | (Ryan et al., 2020; Sharma et al., 2023) | |||||||

| Innovation enablement, competitiveness & collaboration | Sandboxes/TechSprints with regulators | ✓ | ✓ | ✓ | (Arner et al., 2018; Grassi & Lanfranchi, 2022; Jung, 2021) | ||||

| Vendor co-builds and shared utilities | ✓ | ✓ | (Arner et al., 2018; Miglionico, 2020) | ||||||

| Metrics for compliance ROI | ✓ | ✓ | (Gasparri, 2019; Khalatur et al., 2022; Zabat et al., 2024) | ||||||

| Public-sector value creation & policy execution | Telemetry for transport/environment enforcement | ✓ | ✓ | (Bansal & Taneja, 2025) | |||||

| Outcome-based funding tied to reg data | ✓ | ✓ | (Bansal & Taneja, 2025; Grassi & Lanfranchi, 2022; Michaels & Homer, 2018) | ||||||

| Cross-agency risk registers | ✓ | ✓ | ✓ | (Chirulli, 2021; Fachsandy, 2025; Grassi & Lanfranchi, 2022) | |||||

| Market confidence via timely supervisory disclosure & oversight | Crisis-time dashboards and disclosures | ✓ | ✓ | ✓ | (Avramović, 2023; Grassi & Lanfranchi, 2022; Zeranski & Sancak, 2021) | ||||

| Cross-market data consolidation for signals | ✓ | ✓ | ✓ | (Avramović, 2023; Fachsandy, 2025; Zeranski & Sancak, 2021) |

| Challenge | Challenge Type | Challenge Name | Compliance & Regulatory Affairs | Risk & Audit | Finance | Technology & Data | Legal & Governance | Customer & Strategy | Human Resources (HR) | Source |

|---|---|---|---|---|---|---|---|---|---|---|

| Technological Challenges | Cybersecurity and Privacy Risks | Data breaches, hacking incidents, and vulnerabilities in cloud and outsourced infrastructures | ✓ | ✓ | ✓ | (Arner et al., 2018; Chirulli, 2021; Colaert, 2021; El Khoury et al., 2025; Grassi & Lanfranchi, 2022; Jung, 2021; Khalatur et al., 2022; Laguna de Paz, 2023; J. Li et al., 2023; Sharma et al., 2023) | ||||

| Privacy risks in data mining, data retention, and GDPR/CCPA compliance | ✓ | ✓ | ✓ | (Colaert, 2021; J. Li et al., 2023; Ryan et al., 2020; Singh, 2024) | ||||||

| Increased exposure due to cross-border data flows and lack of unified international standards | ✓ | ✓ | ✓ | (Du & Wei, 2020; Kanojia et al., 2024) | ||||||

| Algorithmic Complexity and Opacity | Bias and unfair outcomes due to poor training data or design | ✓ | ✓ | ✓ | (Bakhos Douaihy & Rowe, 2023; Chirulli, 2021; Gasparri, 2019; Konina, 2021; Loiacono & Rulli, 2022; Sharma et al., 2023; Singh, 2024; Singh & Lin, 2021) | |||||

| Trade-secret protections limiting supervisory validation of algorithms | ✓ | ✓ | (Avramović, 2023; Chirulli, 2021; Gasparri, 2019; Konina, 2021; Loiacono & Rulli, 2022; Singh & Lin, 2021) | |||||||

| Explainability and transparency gaps creating accountability risks | ✓ | ✓ | ✓ | ✓ | (Konina, 2021; Loiacono & Rulli, 2022) | |||||

| Legacy and Immature Technology Issues | Difficulty integrating with outdated IT systems | ✓ | ✓ | ✓ | (Butler & O’Brien, 2019; Khalatur et al., 2022; Laguna de Paz, 2023; J. Li et al., 2023; Micheler & Whaley, 2020; Salampasis & Samakovitis, 2024; Y. Xia et al., 2024) | |||||

| Low maturity or robustness of AI, NLP, RPA, and distributed ledgers | ✓ | ✓ | (Becker et al., 2020; Fachsandy, 2025; Firiza et al., 2024; Jagrič et al., 2023; Laguna de Paz, 2023; Shi et al., 2025) | |||||||

| Heavy computational demands and storage requirements limiting scalability | ✓ | ✓ | ✓ | (Guerra et al., 2022; J. Li et al., 2023; Sharma et al., 2023) | ||||||

| Organizational Challenges | Cultural and Institutional Resistance | Traditional institutions resisting transformation due to legacy processes and risk aversion | ✓ | ✓ | ✓ | (Anagnostopoulos, 2018; Avramović, 2023; Bansal & Taneja, 2025; Khalatur et al., 2022; Sharma et al., 2023) | ||||

| Supervisory cultures privileging stability over innovation | ✓ | ✓ | (Michaels & Homer, 2018) | |||||||

| Skills and Workforce Gaps | Shortage of qualified IT and data science professionals | ✓ | ✓ | (Bakhos Douaihy & Rowe, 2023; Chirulli, 2021; Chishti, 2019; Du & Wei, 2020; Khalatur et al., 2022; Loiacono & Rulli, 2022) | ||||||

| Training needs for regulators and compliance staff to adapt to digital tools | ✓ | ✓ | ✓ | (Bakhos Douaihy & Rowe, 2023; Chishti, 2019; Colaert, 2021; Loiacono & Rulli, 2022) | ||||||

| Cost and Vendor-Dependence | High upfront and maintenance costs, especially for smaller firms | ✓ | ✓ | ✓ | (Bakhos Douaihy & Rowe, 2023; Colaert, 2021; Jung, 2021; Kanojia et al., 2024; Khalatur et al., 2022; Singh et al., 2022; Wang & Chen, 2024) | |||||

| Reliance on third-party vendors leading to vendor lock-in and systemic dependency | ✓ | ✓ | (Bakhos Douaihy & Rowe, 2023; Jung, 2021; Salampasis & Samakovitis, 2024) | |||||||

| Operational Barriers | Complex procurement processes slowing adoption | ✓ | ✓ | (Jung, 2021) | ||||||

| Inefficient reporting discipline and uneven adoption across institutions | ✓ | ✓ | (Uddin et al., 2025) | |||||||

| Poor governance structures and lack of cross-agency collaboration | ✓ | ✓ | (Saifullah et al., 2023; Zeranski & Sancak, 2021) | |||||||

| Regulatory & Legal Challenges | Regulatory & Legal Challenges | Overlapping or contradictory regulations across jurisdictions | ✓ | ✓ | (Arner et al., 2016; Arner et al., 2018; Khalatur et al., 2022; Neuwirth & Tan, 2024; Saifullah et al., 2023) | |||||

| Fragmented supervisory structures limiting oversight coordination | ✓ | ✓ | (Zeranski & Sancak, 2021) | |||||||

| Outdated frameworks unable to accommodate digital compliance solutions | ✓ | ✓ | (Du & Wei, 2020; Khalatur et al., 2022; Zabat et al., 2024) | |||||||

| Harmonization and Cross-Border Issues | Inadequate cross-border cooperation and recognition of standards | ✓ | ✓ | (Arner et al., 2018; Chirulli, 2021; Khalatur et al., 2022; Kurum, 2023; Neuwirth & Tan, 2024) | ||||||

| Regulatory arbitrage risks where inconsistent rules are exploited | ✓ | ✓ | ✓ | (Arner et al., 2018; Kanojia et al., 2024; Muganyi et al., 2022) | ||||||

| Accountability and Due Process Risks | Concerns over fairness, rule of law, and democratic legitimacy when law is “coded” | ✓ | ✓ | ✓ | ✓ | (Chirulli, 2021; Colaert, 2021; Gasparri, 2019; Loiacono & Rulli, 2022; Micheler & Whaley, 2020; Singh & Lin, 2021) | ||||

| Liability issues for errors in automated decision-making or third-party code | ✓ | ✓ | (Battanta et al., 2020; Jung, 2021; Loiacono & Rulli, 2022) | |||||||

| Transparency dilemmas where excessive disclosure undermines enforcement effectiveness | ✓ | ✓ | (Pan et al., 2024) | |||||||

| Premature or Inconsistent Regulation | Regulatory lag compared to rapid innovation | ✓ | ✓ | (Muganyi et al., 2022; Pan et al., 2024; Zabat et al., 2024) | ||||||

| Premature mandates (e.g., in sustainability) creating unintended consequences | ✓ | ✓ | ✓ | (Zetzsche & Anker-Sørensen, 2022) | ||||||

| Lack of methodological standards in GDPR, DLT, and other areas | ✓ | ✓ | ✓ | (Kavassalis et al., 2018; Ryan et al., 2020) | ||||||

| Strategic & Market Challenges | Systemic and Market Risks | Risk of systematic errors scaling across institutions | ✓ | ✓ | ✓ | (Anagnostopoulos, 2018; Chirulli, 2021; Colaert, 2021; Gasparri, 2019) | ||||

| Excessive standardization reducing innovation and competitiveness | ✓ | ✓ | (Chirulli, 2021; Colaert, 2021; Micheler & Whaley, 2020) | |||||||

| Operational concentration risks from reliance on few cloud providers | ✓ | ✓ | (Jung, 2021) | |||||||

| Adoption and Innovation Tensions | Slow, uneven, or partial adoption across banks and jurisdictions | ✓ | ✓ | ✓ | (Anagnostopoulos, 2018; Becker et al., 2020; Uddin et al., 2025) | |||||

| Trade-offs between innovation and formal governance structures | ✓ | ✓ | ✓ | (Avramović, 2023; Pan et al., 2024; Zabat et al., 2024) | ||||||

| Political and geopolitical pressures affecting technology adoption | ✓ | ✓ | (Bakhos Douaihy & Rowe, 2023; Saifullah et al., 2023) | |||||||

| Research and Knowledge Gaps | Limited academic coverage of critical technologies (NLP, RPA) | ✓ | ✓ | (Becker et al., 2020) | ||||||

| Misperceptions and hype cycles leading to over-promising | ✓ | ✓ | (Bansal & Taneja, 2025) | |||||||

| Lack of shared standards for SupTech across jurisdictions | ✓ | ✓ | (Avramović, 2023) | |||||||

| Data & Infrastructure Challenges | Data Quality and Reliability | Poor-quality, incomplete, or biased data undermining reliability | ✓ | ✓ | (Bakhos Douaihy & Rowe, 2023; Chishti, 2019; Guerra et al., 2022; Y. Li et al., 2025; Singh, 2024; Singh & Lin, 2021) | |||||

| Over-reliance on outdated or manual data entry | ✓ | ✓ | (Du & Wei, 2020; Shi et al., 2025) | |||||||

| Fragmented data sources limiting oversight capacity | ✓ | ✓ | ✓ | (Butler & O’Brien, 2019; Ryan et al., 2020; Singh & Lin, 2021) | ||||||

| Data Standardization and Interoperability | Lack of standardized data formats across jurisdictions and systems | ✓ | ✓ | ✓ | (Butler & O’Brien, 2019; Firiza et al., 2024; Ryan et al., 2020) | |||||

| Semantic interoperability challenges in GDPR and supervisory reporting | ✓ | ✓ | ✓ | (Ryan et al., 2020) | ||||||

| Infrastructure and Capacity Constraints | High computational intensity for advanced ML tools | ✓ | ✓ | ✓ | (Guerra et al., 2022; J. Li et al., 2023; Sharma et al., 2023) | |||||

| Insufficient digital infrastructure in developing markets | ✓ | ✓ | ✓ | (Guerra et al., 2022; J. Li et al., 2023; Sharma et al., 2023) | ||||||

| Insufficient digital infrastructure in developing markets | ✓ | ✓ | (Shi et al., 2025) |

| Reporting Activity | AI Methods (Automation Stage) | Source |

|---|---|---|

| Regulatory report compilation and submission | NLP (rule extraction, text parsing), Text mining, Decision-tree classifiers | (Avramović, 2023; Chirulli, 2021; El Khoury et al., 2025) |

| Data collection and integration | Process mining, Clustering (K-means, hierarchical), Regression models | (Becker et al., 2020; Konina, 2021; Y. Li et al., 2025) |

| Data standardization and validation | NLP rule interpretation, SVM, Ontology-based classification | (Chirulli, 2021; Colaert, 2021; Kavassalis et al., 2018) |

| Fraud detection and anomaly monitoring | Random Forest, Gradient Boosting (XGBoost, LightGBM), ANN, DNN, Bayesian models, Network analysis | (Becker et al., 2020; Butler & O’Brien, 2019; Kanojia et al., 2024; Y. Li et al., 2025) |

| Transaction reporting | Recurrent Neural Networks (RNN), Autoencoders, Time-series prediction | (Arner et al., 2018; Gasparri, 2019; Jung, 2021; Kavassalis et al., 2018; Uddin et al., 2025) |

| Identity verification (e-KYC) | CNN for facial recognition, Fingerprint models, SVM pattern recognition | (Grassi & Lanfranchi, 2022; Kanojia et al., 2024; Konina, 2021; Zabat et al., 2024) |

| Obligation extraction from regulations | NLP (NER, dependency parsing), NLG, Transformer models (BERT) | (Avramović, 2023; El Khoury et al., 2025; Jović & Nikolić, 2022; Khalatur et al., 2022; Kristanto & Arman, 2022) |

| Risk assessment and profiling | Logistic regression, Random Forest, Gradient Boosting, Credit scoring models | (Avramović, 2023; Becker et al., 2020; Chirulli, 2021; Khalatur et al., 2022; Konina, 2021) |

| Complaint handling and consumer reporting | NLP sentiment analysis, Chatbot dialogue, Speech-to-text, Topic modelling (LDA) | (Chirulli, 2021; Pan et al., 2024; Singh et al., 2022; Y. Xia et al., 2024) |

| AML/PSD2 compliance checks | Decision trees, Random Forest, DNN, Autoencoders | (Becker et al., 2020; Chirulli, 2021; El Khoury et al., 2025; Khalatur et al., 2022; Konina, 2021) |

| ESG and disclosure reporting | Text mining, Transformer NLP sentiment analysis, SVM, Logistic regression | (Grassi & Lanfranchi, 2022; Kanojia et al., 2024; Loiacono & Rulli, 2022; Shi et al., 2025; Y. Xia et al., 2024; Zetzsche & Anker-Sørensen, 2022) |

| Audit trails and supervisory dashboards | Isolation Forest, One-Class SVM, Time-series prediction, Network analysis | (Avramović, 2023; El Khoury et al., 2025; Jović & Nikolić, 2022; Khalatur et al., 2022; Konina, 2021) |

| Category | Tools/Technologies | Purpose/Role | Sources |

|---|---|---|---|

| Streaming and Continuous Data Flows | APIs, data streaming platforms, event-driven pipelines | Enable continuous rather than periodic reporting; reduce lag between transaction and supervisory visibility | (Anagnostopoulos, 2018; Grassi & Lanfranchi, 2022; Jung, 2021; Kanojia et al., 2024; Shi et al., 2025) |

| Supervisory Dashboards and Portals | Interactive dashboards, real-time monitoring portals, conduct dashboards | Provide supervisors with live oversight of firm-level risks, consumer complaints, and compliance metrics | (Chirulli, 2021; Pan et al., 2024; Singh et al., 2022; Y. Xia et al., 2024) |

| Real-time Anomaly Detection | Isolation Forest, One-Class SVM, Autoencoders, time-series models | Continuous monitoring of fraud, AML alerts, transaction anomalies, reducing false positives and detection delays | (Becker et al., 2020; Butler & O’Brien, 2019; Kanojia et al., 2024; Y. Li et al., 2025) |

| Trigger-based/Event-driven Reporting | Smart contracts, automated triggers for risk thresholds, e-notifications | Automatically generate reports when pre-defined risk events occur, ensuring immediate supervisory awareness | (Becker et al., 2020; Butler & O’Brien, 2019; Chirulli, 2021; El Khoury et al., 2025; Khalatur et al., 2022; Konina, 2021) |

| Continuous Risk and Conduct Monitoring | Sentiment analysis, NLP-based consumer monitoring, conduct risk dashboards | Stream unstructured data (complaints, narratives) into structured real-time oversight signals | (Chirulli, 2021; Grassi & Lanfranchi, 2022; Pan et al., 2024; Saifullah et al., 2023; Singh et al., 2022; Y. Xia et al., 2024; Zabat et al., 2024) |

| Regulatory Data Integration in Real-Time | API-based submissions into central data lakes, cloud platforms | Consolidate firm-level submissions into supervisory databases in near real-time for benchmarking and peer comparisons | (Anagnostopoulos, 2018; Grassi & Lanfranchi, 2022; Jung, 2021; Kanojia et al., 2024; Loiacono & Rulli, 2022; Shi et al., 2025) |

| Supervision Activities | AI Methods (Automation Stage) | Sources |

|---|---|---|

| Anomaly detection and fraud monitoring | Random Forest, Gradient Boosting (XGBoost, LightGBM), Autoencoders, DNN, Bayesian anomaly models, Graph/network analysis | (Becker et al., 2020; Butler & O’Brien, 2019; Kanojia et al., 2024; Y. Li et al., 2025) |

| AML/CTF supervision | Decision trees, Random Forest, Autoencoders, Deep Neural Networks, Clustering (K-means, DBSCAN) | (Becker et al., 2020; Butler & O’Brien, 2019; Chirulli, 2021; El Khoury et al., 2025; Khalatur et al., 2022; Konina, 2021) |

| Prudential supervision/risk monitoring | Logistic regression, Random Forest, Gradient Boosting, Time-series forecasting (ARIMA, LSTM), Credit scoring models | (Avramović, 2023; Becker et al., 2020; Chirulli, 2021; Kanojia et al., 2024; Khalatur et al., 2022; Konina, 2021; Y. Li et al., 2025) |

| Conduct supervision/consumer protection | NLP sentiment analysis, Topic modelling (LDA), Text categorization, Speech-to-text (ASR), Anomaly detection (Isolation Forest) | (Chirulli, 2021; Grassi & Lanfranchi, 2022; Pan et al., 2024; Saifullah et al., 2023; Singh et al., 2022; Y. Xia et al., 2024; Zabat et al., 2024) |

| Identity verification and e-KYC oversight | CNN for facial recognition, Fingerprint recognition models, SVM for artefact detection | (Grassi & Lanfranchi, 2022; Kanojia et al., 2024; Konina, 2021; Saifullah et al., 2023; Zabat et al., 2024) |

| Obligation extraction from regulatory texts | NLP (Named Entity Recognition, dependency parsing), Transformer models (BERT, RoBERTa), Ontology-based classification, Rule induction | (Avramović, 2023; Becker et al., 2020; El Khoury et al., 2025; Jović & Nikolić, 2022; Khalatur et al., 2022; Konina, 2021; Kristanto & Arman, 2022) |

| Transaction surveillance in real-time | RNN, LSTM, Autoencoders, Time-series anomaly detection models | (Arner et al., 2018; Gasparri, 2019; Jung, 2021; Kavassalis et al., 2018; Uddin et al., 2025) |

| Market surveillance/systemic risk oversight | Clustering (K-means, DBSCAN), Neural networks (ANN, DNN), Graph/network analytics, Anomaly detection (Isolation Forest, One-Class SVM) | (Becker et al., 2020; Butler & O’Brien, 2019; Kanojia et al., 2024; Y. Li et al., 2025) |

| ESG and disclosure supervision | Text mining, Transformer NLP models (BERT, RoBERTa), Sentiment analysis, SVM, Logistic regression | (Grassi & Lanfranchi, 2022; Kanojia et al., 2024; Loiacono & Rulli, 2022; Shi et al., 2025; Y. Xia et al., 2024; Zetzsche & Anker-Sørensen, 2022) |

| Audit trails and supervisory dashboards | Isolation Forest, One-Class SVM, Time-series forecasting models, Network analysis, Anomaly detection pipelines | (Avramović, 2023; El Khoury et al., 2025; Jović & Nikolić, 2022; Khalatur et al., 2022; Konina, 2021; Kristanto & Arman, 2022) |

| Category | Names | Sources |

|---|---|---|

| Schemas | Supervisory data schemas, reporting frameworks (prudential, conduct, AML datasets) | (Becker et al., 2020; Kanojia et al., 2024; Y. Li et al., 2025; Loiacono & Rulli, 2022) |

| Taxonomies | Supervisory taxonomies, conduct risk taxonomies, ESG classification frameworks | (Grassi & Lanfranchi, 2022; Kanojia et al., 2024; Loiacono & Rulli, 2022; Zetzsche & Anker-Sørensen, 2022) |

| Ontologies and Dictionaries | Supervisory dictionaries for obligations and risks, ontology-based classification of rules | (Chirulli, 2021; Colaert, 2021; Konina, 2021; Pan et al., 2024) |

| Templates and Machine-Readable Formats | Structured supervisory forms, XML/XBRL-based submissions, API-enabled supervisory data flows | (Chirulli, 2021; El Khoury et al., 2025; Kanojia et al., 2024; Kavassalis et al., 2018; Khalatur et al., 2022; Y. Li et al., 2025; Loiacono & Rulli, 2022; Shi et al., 2025; Zetzsche & Anker-Sørensen, 2022) |

| Dashboards/Portals (extended for SubTech) | Interactive supervisory dashboards, machine-readable alerts, conduct monitoring dashboards | (Chirulli, 2021; Pan et al., 2024; Saifullah et al., 2023; Singh et al., 2022; Y. Xia et al., 2024; Zabat et al., 2024) |

| Category | Tools/Technologies | Purpose/Role | Sources |

|---|---|---|---|

| Streaming and Continuous Data Flows | APIs, real-time data pipelines, event-driven platforms | Enable supervisors to access data streams continuously rather than waiting for periodic submissions, reducing supervisory lag | (Grassi & Lanfranchi, 2022; Kanojia et al., 2024; Loiacono & Rulli, 2022; Shi et al., 2025) |

| Supervisory Dashboards and Portals | Interactive dashboards, early warning systems, conduct monitoring portals | Provide supervisors with live views of prudential ratios, conduct risks, and consumer complaints | (Chirulli, 2021; Pan et al., 2024; Saifullah et al., 2023; Singh et al., 2022; Zabat et al., 2024) |

| Real-time Anomaly Detection | Isolation Forest, One-Class SVM, Autoencoders, RNN, time-series anomaly detection | Support continuous detection of suspicious transactions, AML alerts, and systemic market anomalies, reducing false positives | (Arner et al., 2018; Becker et al., 2020; Butler & O’Brien, 2019; Gasparri, 2019; Jung, 2021; Kanojia et al., 2024; Y. Li et al., 2025; Uddin et al., 2025) |

| Trigger-based/Event-driven Supervision | Smart contracts, automated thresholds, e-notifications | Generate alerts or supervisory interventions when predefined risk thresholds are breached | (Becker et al., 2020; Butler & O’Brien, 2019; Chirulli, 2021; El Khoury et al., 2025; Konina, 2021; Y. Li et al., 2025) |

| Continuous Risk and Conduct Monitoring | Sentiment analysis, NLP-based complaint analysis, consumer protection dashboards | Transform unstructured consumer data into structured real-time oversight signals | (Chirulli, 2021; Grassi & Lanfranchi, 2022; Pan et al., 2024; Saifullah et al., 2023; Singh et al., 2022; Y. Xia et al., 2024; Zabat et al., 2024) |

| Supervisory Data Integration | Cloud-based data lakes, API submissions, cross-market data pooling | Aggregate firm-level and market-level submissions into supervisory databases in near real-time for benchmarking | (Anagnostopoulos, 2018; Grassi & Lanfranchi, 2022; Jung, 2021; Kanojia et al., 2024; Loiacono & Rulli, 2022; Shi et al., 2025) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bagherifam, N.; Naghdi, S.; Ahmadian, V.; Fazlzadeh, A.; Baghalzadeh Shishehgarkhaneh, M. Digital Regulatory Governance: The Role of RegTech and SupTech in Transforming Financial Oversight and Administrative Capacity. Int. J. Financial Stud. 2025, 13, 217. https://doi.org/10.3390/ijfs13040217

Bagherifam N, Naghdi S, Ahmadian V, Fazlzadeh A, Baghalzadeh Shishehgarkhaneh M. Digital Regulatory Governance: The Role of RegTech and SupTech in Transforming Financial Oversight and Administrative Capacity. International Journal of Financial Studies. 2025; 13(4):217. https://doi.org/10.3390/ijfs13040217

Chicago/Turabian StyleBagherifam, Niloufar, Sajjad Naghdi, Vahid Ahmadian, Alireza Fazlzadeh, and Milad Baghalzadeh Shishehgarkhaneh. 2025. "Digital Regulatory Governance: The Role of RegTech and SupTech in Transforming Financial Oversight and Administrative Capacity" International Journal of Financial Studies 13, no. 4: 217. https://doi.org/10.3390/ijfs13040217

APA StyleBagherifam, N., Naghdi, S., Ahmadian, V., Fazlzadeh, A., & Baghalzadeh Shishehgarkhaneh, M. (2025). Digital Regulatory Governance: The Role of RegTech and SupTech in Transforming Financial Oversight and Administrative Capacity. International Journal of Financial Studies, 13(4), 217. https://doi.org/10.3390/ijfs13040217