1. Introduction

Earnings management has been a central concern in accounting and corporate governance research because it distorts financial reporting quality and undermines market efficiency (

Healy & Wahlen, 1999;

Cohen et al., 2008). Prior studies have examined managerial incentives, ownership structures, and board governance as key determinants of financial reporting quality (

Dechow et al., 1995;

Kothari et al., 2005). However, less attention has been devoted to workforce-related governance factors, despite their potential to influence managerial discretion and reporting practices in meaningful ways.

Drawing on agency theory, employee tenure can be conceptualized as a governance-related factor that may exacerbate agency problems. Longer tenure provides employees with firm-specific knowledge and stability, but these same features may entrench organizational routines, reduce adaptability, and enable opportunistic behavior. Entrenchment perspectives suggest that long-tenured employees may be more likely to align with managers, tacitly supporting discretionary practices that reduce transparency. In this way, workforce stability has a dual nature: it can serve as a resource that enhances efficiency or as a constraint that weakens monitoring and fosters managerial discretion.

At the same time, resource dependence theory and the corporate governance literature emphasize the importance of external monitoring in reducing agency costs. Foreign institutional investors, in particular, are recognized as sophisticated governance agents with the expertise and incentives to discipline management (

Shleifer & Vishny, 1986;

La Porta et al., 1998;

Lel, 2019). In emerging markets such as South Korea, where local governance institutions are comparatively weaker, the monitoring role of foreign investors becomes especially salient. By importing higher disclosure standards and exercising independent oversight, foreign investors may counteract the governance risks associated with entrenched labor structures.

This theoretical intersection of internal governance mechanisms (employee tenure) and external governance mechanisms (foreign investors) provides the foundation for our research. While entrenched employees may tacitly support opportunistic reporting, foreign investors can act as countervailing forces that constrain such behavior. Despite this intuitive complementarity, little empirical work has explicitly integrated workforce characteristics into corporate governance frameworks of earnings management.

Accordingly, this study investigates whether average employee tenure influences the extent of accrual-based earnings management and whether foreign investor ownership moderates this relationship. Using a comprehensive panel dataset of 11,381 firm-year observations from companies listed on the Korean Stock Exchange between 2011 and 2019, we test two key hypotheses: (1) that longer average employee tenure is positively associated with discretionary accruals, and (2) that foreign investor ownership mitigates this effect, consistent with the notion that external monitoring constrains opportunistic reporting.

Our research design employs two widely accepted models of accrual-based earnings management: the modified Jones model (

Dechow et al., 1995) and the performance-matched model (

Kothari et al., 2005). Regression specifications include firm-level controls (size, leverage, profitability), board governance characteristics, and industry and year fixed effects. To address endogeneity concerns, we implement two-stage least squares (2SLS) estimation using wage volatility as an instrumental variable for employee tenure.

The empirical findings show that longer employee tenure is significantly and positively related to discretionary accruals, consistent across both accrual estimation models. However, this relationship weakens considerably in firms with higher foreign investor ownership, confirming the role of foreign investors as effective external monitors. Robustness tests—including alternative model specifications, subsample analyses, and instrumental variable estimation—reinforce the validity of these results.

Taken together, these findings provide novel evidence that workforce characteristics, particularly employee tenure, are important determinants of financial reporting quality. By documenting the moderating role of foreign investor monitoring, the study highlights the interplay between internal organizational structures and external governance mechanisms in shaping earnings management behavior.

From a theoretical perspective, the study positions employee tenure as an underexplored but critical governance dimension and integrates it with external monitoring theory to provide a comprehensive conceptual framework. From a policy perspective, the findings underscore the importance of incorporating human capital metrics, such as average tenure, into governance frameworks and supporting policies that encourage foreign participation in emerging equity markets. From a practical perspective, the evidence demonstrates that foreign investors can substitute for weak domestic monitoring, offering actionable insights for boards, regulators, and market participants. Finally, while the analysis focuses on Korean firms, future research could extend this framework to other institutional settings, explore heterogeneity across different types of foreign investors, and incorporate qualitative approaches (e.g., case studies or interviews) to uncover the mechanisms linking employee entrenchment and reporting practices.

2. Literature Review

2.1. Employee Tenure and Corporate Governance

Employee tenure, the average length of time employees remain with a firm, represents an important but underexplored dimension of corporate governance. Longer tenure implies the accumulation of firm-specific human capital, operational knowledge, and organizational stability. From a governance standpoint, however, entrenched workforces can also reduce adaptability, reinforce managerial discretion, and complicate external monitoring.

Early research in labor economics suggests that governance structures influence employment relationships.

B. Black et al. (

2007) find that active equity markets and strong shareholder-value orientations are associated with shorter job tenures, weaker employee protections, and higher pay dispersion. In such environments, managers prioritize shareholder interests and adopt short time horizons, limiting their willingness to commit to long-term employee contracts. This aligns with

Hall and Soskice’s (

2001) “varieties of capitalism” framework, which distinguishes between coordinated and liberal market economies in shaping labor–governance dynamics.

Within the accounting literature, employee tenure has been linked to both the detection and facilitation of earnings management.

Cho et al. (

2021) show that longer-tenured employees possess deeper firm-specific knowledge and operational control, which can either constrain or support managerial opportunism. Their evidence from Korean firms suggests a positive association between employee tenure and real earnings management, particularly through abnormal production and discretionary expense reductions. This is consistent with theories of rent-seeking, where employees collaborate with managers if such actions are perceived to safeguard the firm’s survival or enhance credibility with capital markets (

Graham et al., 2005;

Gunny, 2010).

At the same time, longer-tenured employees may also serve as informal monitors of management. Prior work notes that employees often act as whistleblowers or informal enforcers of ethical conduct, particularly when their long-term wealth is tied to the firm’s reputation (

Bowen et al., 2010;

Wilde, 2017). However, the effectiveness of this internal monitoring depends on the quality of the governance system. In contexts with weak governance, entrenched employees may align with managerial interests at the expense of shareholders (

Faleye et al., 2006), whereas stronger governance systems can discipline both managers and long-tenured employees.

Lee and Tulcanaza-Prieto (

2022) document that corporate governance mechanisms—such as independent boards, disclosure standards, and strong audit committees—attenuate the negative consequences of real earnings management. Their study of Korean firms shows that effective governance prevents entrenched workforces from collaborating with managers in opportunistic reporting strategies. Similarly,

García-Osma and Noguer (

2007) and

Enomoto et al. (

2018) provide evidence that stronger board oversight and ownership concentration reduce the scope for managerial manipulation of earnings, even when internal labor structures might otherwise enable it.

Collectively, the literature suggests that employee tenure operates as a double-edged sword in the governance framework. On one hand, longer tenure enhances firm-specific expertise, loyalty, and operational efficiency (e.g.,

Shaw et al., 2005). On the other hand, it can entrench networks that facilitate opportunism and earnings management when external monitoring is weak. The balance between these outcomes depends critically on the broader governance environment. In strong governance contexts, long-tenured employees may contribute to stability without undermining reporting quality, whereas in weakly governed firms, tenure may amplify managerial discretion and reduce transparency. Relatedly, recent work suggests that employee welfare and internal labor conditions shape managers’ choice between accrual-based and real activities manipulation, highlighting another workforce channel consistent with our tenure mechanism (

Zhai & Xu, 2025).

2.2. Accrual-Based Earnings Management

Accrual-based earnings management refers to the use of accounting judgment and discretion to alter reported earnings without changing underlying cash flows.

Healy and Wahlen (

1999) define earnings management broadly as occurring when managers exercise judgment in financial reporting and structuring transactions either to mislead stakeholders or to influence contractual outcomes. Unlike real earnings management, which involves altering actual business activities, accrual-based earnings management typically operates through the accrual process, such as adjusting provisions, estimates, and revenue recognition.

The regulatory environment has a direct effect on firms’ reliance on accrual-based earnings management. For instance,

Cohen et al. (

2008) document that accrual manipulation increased during the late 1990s but declined significantly following the passage of the Sarbanes–Oxley Act (SOX). At the same time, managers substituted away from accruals toward real earnings management, which is more difficult for auditors and regulators to detect ex ante.

Zang (

2012) formalizes this substitution mechanism, showing that managers typically make real earnings management decisions during the fiscal year and then use accrual-based earnings management at year-end to fine-tune reported earnings toward targets. Extending the substitution view beyond accruals, blockholder voting power has been shown to constrain real earnings management across East Asian markets, including Korea (

Amin & Cumming, 2021), while pandemic-era studies in Korea document shifts in earnings management behavior during COVID-19 (

W. Kim et al., 2024).

Firm- and manager-specific factors also shape the extent of accrual-based earnings management.

Kuang et al. (

2014) find that CEO origin matters: firms led by externally hired CEOs are more likely to engage in income-increasing accrual manipulation, especially early in their tenure. Financial structure exerts another important influence.

Anagnostopoulou and Tsekrekos (

2017) show that higher financial leverage constrains accrual-based earnings management, as creditors and outside monitors reduce the scope for discretionary accruals, leading firms to rely more on real activities manipulation. Ownership structure also plays a role:

Achleitner et al. (

2014) report that family-controlled firms use fewer upward accruals and tend instead to adopt more conservative, earnings-decreasing accruals, reflecting their long-term orientation and concern for intergenerational wealth preservation.

At the international level, institutional quality has been shown to condition the use of accrual-based earnings management.

Enomoto et al. (

2018) find that firms in countries with stronger investor protection are less likely to rely on accrual manipulation and more likely to substitute into real earnings management. The moderating effect of analyst following further constrains opportunistic use of either channel. These findings are echoed by comparative studies showing that differences in legal enforcement, governance practices, and market monitoring shape firms’ relative reliance on accruals versus real actions (

Habib et al., 2022).

In summary, prior studies have established three consistent themes. First, accrual-based earnings management is detectable through established discretionary accrual models and remains a widely used measure of financial reporting quality. Second, regulatory shifts, governance mechanisms, and financing constraints alter the cost–benefit trade-off of accrual manipulation relative to real activities. Third, institutional settings shape the degree to which accrual-based earnings management is constrained, with stronger governance and investor protection reducing its prevalence. Guided by this evidence, our study employs both the modified Jones and performance-matched models to capture discretionary accruals and explicitly considers their interaction with other governance factors in shaping reporting quality.

2.3. Foreign Investor Monitoring

Foreign investors are often considered sophisticated monitors due to their analytical resources and commitment to shareholder value (see

Ferreira & Matos, 2008;

Gu et al., 2022;

Wang et al., 2022). In emerging markets like Korea, foreign ownership has been shown to improve transparency and reduce earnings manipulation. By exerting pressure on management, foreign investors may counteract internal dynamics—such as those arising from long employee tenure—that otherwise promote earnings management. Recent evidence also shows that monitoring operates through investor networks and ownership structure: foreign institutional investor networks mitigate earnings management (

Li et al., 2024), and institutional ownership improves earnings quality by constraining both accrual-based and real manipulation (

Ali et al., 2024). Moreover, in China, qualified foreign investor participation is associated with stronger governance and disclosure quality, reinforcing the role of foreign institutions as external monitors (

Wang et al., 2022).

The globalization of capital markets has expanded the role of foreign investors as external monitors of corporate behavior (

Gu et al., 2022). Unlike domestic investors, foreign investors are typically independent of local managerial networks and often carry with them higher expectations for disclosure and governance, derived from their experiences in more developed markets. As such, foreign investor ownership can reduce agency costs by promoting transparent reporting, constraining opportunistic managerial behavior, and importing international best practices into emerging markets.

Classic corporate governance theory emphasizes that large, sophisticated investors are well-positioned to mitigate agency conflicts.

Shleifer and Vishny (

1986) argue that concentrated ownership gives investors both the incentives and the ability to monitor management effectively. Similarly,

La Porta et al. (

1998) highlight that investor protection varies significantly across countries, and where local governance is weak, external monitoring by sophisticated shareholders becomes particularly important. Building on these foundations,

B. S. Black (

1992) underscores the value of institutional monitoring, suggesting that financial institutions can correct systemic governance failures such as managerial entrenchment, inefficient diversification, and wasteful acquisitions.

Barnhart and Rosenstein (

1998) further note that ownership structure, board composition, and firm performance are jointly determined, with institutional ownership often associated with stronger firm value. Together, these studies establish the conceptual basis for understanding foreign investor ownership as a key factor in corporate governance monitoring mechanisms.

Foreign investors have been shown to discipline earnings management across a variety of institutional contexts.

Lel (

2019) provides cross-country evidence that the presence of independent foreign investors is associated with significantly lower earnings management, especially in countries with weak investor protection. This finding highlights the substitutive role of foreign investors when traditional governance mechanisms are less effective. Foreign investors are also associated with stronger board oversight, including the presence of foreign directors and more independent audit committees, further reinforcing their monitoring influence.

Foreign investor ownership improves the broader financial reporting environment as well.

J. Kim et al. (

2020) show that foreign ownership reduces stock price crash risk by curbing bad news hoarding and enhancing accrual quality, conservatism, and tone in corporate disclosures. Their results suggest that foreign institutional investors not only limit opportunistic reporting practices but also promote transparency and reduce extreme downside risk for investors.

Not all foreign investors are equally effective.

Gu et al. (

2022) find that foreign institutional investors are particularly effective in curbing real earnings management, while their impact on accrual-based earnings management is weaker. This pattern reflects foreign investors’ comparative advantage in monitoring management operating activities across industries and countries, where their global expertise allows them to detect abnormal business practices more easily than subtle accounting choices. In addition, the effectiveness of foreign investors depends on investment horizon and ownership type. Long-term foreign investors and those with strategic stakes tend to exercise more intensive monitoring, whereas short-term or “gray” investors may have limited incentives to intervene (

Ferreira & Matos, 2008;

Aggarwal et al., 2011).

Foreign investors’ monitoring role also depends on the governance context of host countries.

Tran et al. (

2023) find that foreign ownership and strong domestic governance jointly reduce earnings management in Vietnamese firms, illustrating the complementary relationship between internal and external monitoring. These findings align with the broader governance literature, which emphasizes that effective monitoring results from the interplay of ownership structures, board oversight, and legal institutions (

La Porta et al., 1998).

Taken together, the existing literature indicates that foreign investors act as valuable external monitors by constraining opportunistic earnings management, enhancing financial reporting quality, and reducing information risk. Their influence is particularly pronounced in environments with weak investor protection, entrenched managerial power, or limited alternative governance mechanisms. At the same time, their effectiveness varies with investor type, home-country institutions, and the quality of local governance structures.

For the purposes of this paper, these findings suggest that foreign investors may counterbalance the governance risks posed by entrenched internal structures such as long employee tenure. While long tenure may increase the likelihood of employee collusion in earnings management, foreign investors can serve as external monitors that mitigate such opportunistic behavior. Accordingly, we test whether foreign investor ownership moderates the relationship between employee tenure and accrual-based earnings management, extending the current literature by linking workforce entrenchment with external monitoring in an emerging-market setting.

3. Hypotheses Development

3.1. Employee Tenure and Earnings Management

Employee tenure reflects the average length of time employees remain with a firm and captures the degree of workforce stability and embeddedness. While longer tenure may lead to greater firm-specific knowledge and operational efficiency, it can also result in entrenchment and organizational inertia (

B. Black et al., 2007). From a governance perspective, entrenched employees may tacitly support managerial discretion, thereby amplifying the likelihood of opportunistic reporting practices.

Empirical studies provide evidence that longer employee tenure is associated with earnings management.

Cho et al. (

2021) document that firms with long-tenured employees are more likely to engage in income-increasing real earnings management, particularly by reducing discretionary expenses and increasing production. This suggests that stable workforces may collaborate with managers to present favorable performance outcomes. Similarly,

Lee and Tulcanaza-Prieto (

2022) emphasize that stronger governance mechanisms can mitigate the risks posed by entrenched employees, reducing the likelihood of manipulation.

Building on these insights, we hypothesize that longer employee tenure increases the use of accrual-based earnings management.

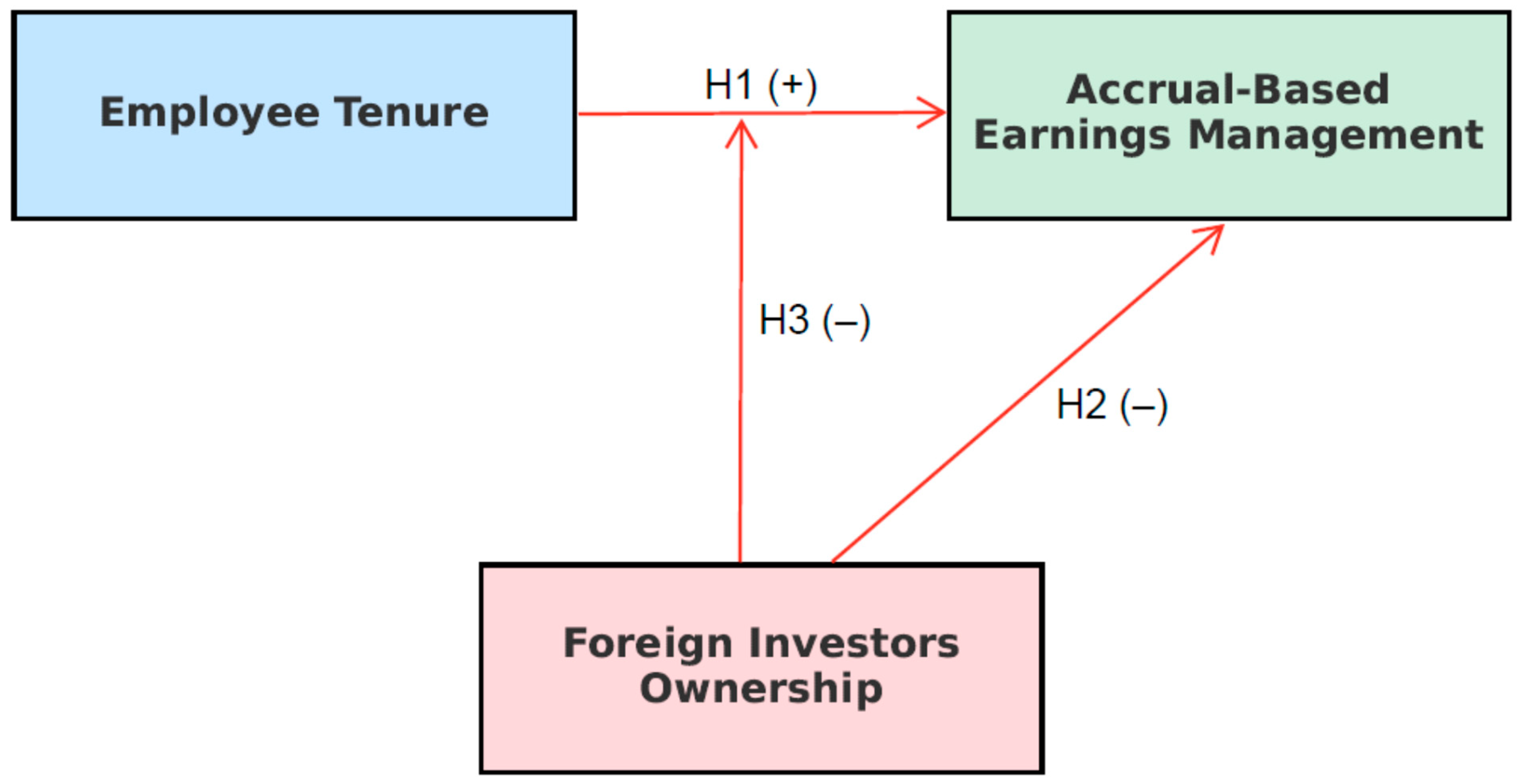

H1. Employee tenure is positively associated with accrual-based earnings management.

3.2. Foreign Investors and Earnings Management

Certain types of investors are more actively engaged in monitoring and mitigating agency conflicts (refer to

Shleifer & Vishny, 1986). Foreign investors are particularly effective monitors because they are independent of domestic managerial networks and often bring higher standards of disclosure and governance from their home countries (e.g.,

La Porta et al., 1998).

B. S. Black (

1992) further argues that institutional monitoring is essential for correcting systemic governance failures, while

Barnhart and Rosenstein (

1998) show that institutional ownership is positively related to firm performance through improved oversight.

More recent studies demonstrate that foreign institutional investors can constrain earnings management and enhance financial reporting quality.

Lel (

2019) finds that foreign institutional investors reduce earnings management across countries, especially in weak governance environments.

J. Kim et al. (

2020) show that foreign ownership curbs managerial bad news hoarding, reducing stock price crash risk.

Gu et al. (

2022) document that foreign institutional investors are particularly effective in limiting real earnings management, while

Tran et al. (

2023) find that foreign institutional investors interact positively with domestic governance mechanisms to constrain opportunistic reporting.

Drawing on this literature, we hypothesize that the presence of foreign investors reduces accrual-based earnings management and moderates the relationship between employee tenure and earnings manipulation.

H2. Foreign investor ownership is negatively associated with accrual-based earnings management.

H3. The positive association between employee tenure and accrual-based earnings management is attenuated when foreign investor ownership is higher.

3.3. Conceptual Model

Figure 1 summarizes our hypotheses. Longer employee tenure is expected to increase accrual-based earnings management (H1). However, foreign investor ownership directly reduces accrual-based earnings management (H2) and weakens the positive relationship between tenure and accrual-based earnings management (H3).

4. Research Design

4.1. Sampled Dataset

Our empirical analyses are based on an unbalanced panel of publicly listed firms in Korea. The sample period extends from 2011 to 2019, a timeframe that allows us to capture post-global financial crisis dynamics, as well as changes in corporate governance and foreign investment activity in the Korean market. We begin with the firms listed on the Korea Composite Stock Price Index (KOSPI) and the Korea Securities Dealers Automated Quotations (KOSDAQ).

Annual accounting and financial statement data were obtained from the TS-2000 and KIS-VALUE databases, which provide comprehensive coverage of Korean firms’ financial reports. Stock market information, including prices, returns, and market capitalization, was collected from FnGuide. Data on foreign investor ownership were obtained from the Korea Exchange (KRX), which requires firms to report foreign investor holdings. Following prior studies (e.g.,

Lel, 2019;

J. Kim et al., 2020), we measure foreign ownership as the ratio of shares held by foreign institutional investors to total outstanding shares at the fiscal year-end.

Consistent with earnings management research (e.g.,

Kothari et al., 2005), we exclude firms in the financial sector (SIC codes 6000–6999) and regulated utilities (SIC codes 4900–4999), as these industries are subject to unique reporting rules and earnings management incentives that may bias discretionary accrual estimates. The final sample is obtained after the following systematic cleaning process. From an initial 18,440 firm-year observations of Korean listed firms, excluding those stated above, we restrict the sample to December fiscal year firms (18,181), exclude cases with missing employee tenure (14,653), remove observations where discretionary accruals could not be estimated due to missing variables, and further exclude firm-years with missing data on key variables necessary to compute foreign investor ownership, resulting in a final sample of 11,381 firm-years. Following established practice, all continuous variables are Winsorized at the top and bottom 1% levels to mitigate the influence of outliers.

Our measure of employee tenure is constructed using firm-level disclosures of workforce composition in annual reports, supplemented by survey data from the Korean Statistical Information Service (KOSIS). Specifically, we compute the average tenure of employees by dividing the total cumulative years of service by the number of employees. This measure captures the overall degree of workforce stability, in line with

B. Black et al. (

2007) and

Cho et al. (

2021).

To measure accrual-based earnings management, we estimate discretionary accruals using both the modified Jones model (

Dechow et al., 1995) and the performance-matched model of

Kothari et al. (

2005). This dual approach enhances the robustness of our results by ensuring that our findings are not sensitive to a particular model specification.

The final sample consists of 11,381 firm-year observations after applying all filters. This sample size is comparable to those used in prior studies investigating earnings management and corporate governance in Korea (e.g.,

Lee & Tulcanaza-Prieto, 2022;

Gu et al., 2022).

4.2. Model Specification and Variables

This study employs an archival research design to test the association between employee tenure and accrual-based earnings management, as well as the moderating role of foreign investor ownership. Discretionary accruals are estimated using the modified Jones model (

Dechow et al., 1995) and the performance-matched model (

Kothari et al., 2005). Employee tenure and foreign investor ownership are the key independent variables, with firm characteristics and governance measures included as controls. As stated in the previous section, we collected unbalanced panel data for this study and employed panel regressions with firm and year fixed effects and clustered standard errors, which provide the basis for our empirical test.

To test the hypotheses developed in

Section 3, we estimate panel regression models of the following general form:

where AEM

it is the measure of accrual-based earnings management for firm

i in year

t; Tenure

it captures average employee tenure; Foreign

it represents foreign investor ownership; and the interaction term Tenure

it × Foreign

it tests the moderating effect of foreign investors. Firm fixed effects (

μi) and year fixed effects (

λt) are included to account for unobservable heterogeneity across firms and macroeconomic shocks. Standard errors are clustered at the firm level.

The dependent variable is discretionary accruals, estimated using two widely accepted approaches: the modified Jones model (

Dechow et al., 1995) and the performance-matched model (

Kothari et al., 2005). Consistent with previous studies (

Cohen et al., 2008;

Zang, 2012), the use of both models ensures robustness and comparability. Accrual-based earnings management is measured as the residuals from these models, where positive values indicate income-increasing manipulation and negative values suggest income-decreasing behavior.

The key independent variable is average employee tenure, defined as the total cumulative years of employee service divided by the number of employees. This measure captures the extent of workforce stability, following prior studies (

B. Black et al., 2007;

Cho et al., 2021). Longer tenure is expected to increase accrual-based earnings management (H1).

The other key independent variable, foreign investor ownership (FI), is measured as the ratio of shares held by foreign institutional investors to total outstanding shares at fiscal year-end, following

Lel (

2019) and

J. Kim et al. (

2020). Higher levels of foreign ownership are expected to constrain earnings management directly (H2) and weaken the positive effect of tenure on accrual-based earnings management (H3).

We include the following firm-level controls that prior studies have identified as determinants of earnings management:

Firm Size, the natural logarithm of total assets, controlling for scale effects (

Dechow & Dichev, 2002).

Leverage, the ratio of total debt to total assets, capturing financial risk and creditor monitoring (

Anagnostopoulou & Tsekrekos, 2017).

Profitability, the return on assets, defined as net income divided by total assets, controlling for performance incentives.

Growth Opportunities, the market-to-book ratio, reflecting managers’ incentives to meet growth expectations (

Roychowdhury, 2006).

Cash Flows from Operations, the operating cash flows scaled by total assets, included to control for firm fundamentals (

Kothari et al., 2005).

Board Independence, the proportion of independent directors on the board, to control for governance mechanisms (

Lee & Tulcanaza-Prieto, 2022).

Industry and

year fixed effects, accounting for industry-wide practices and macroeconomic conditions.

This specification allows us to test whether longer employee tenure increases accrual-based earnings management (H1), whether foreign investor ownership constrains such manipulation (H2), and whether foreign investors moderate the tenure–earnings management relationship (H3). The inclusion of firm characteristics and governance variables ensures that the estimated relationships are not confounded by other determinants of reporting quality.

5. Empirical Findings

5.1. Descriptive Statistics

Panel A in

Table 1 shows the number of observations per year, and Panel B in

Table 1 presents descriptive statistics for the key variables. As shown in Panel A, the number of observations per year has increased over time. The average discretionary accruals, measured using the modified Jones model (MJDA) and the performance-matched model (PMDA), are close to zero, which is consistent with prior research documenting no systematic bias in accruals at the aggregate level (

Cohen et al., 2008;

Kothari et al., 2005). The relatively small standard deviations (0.076 and 0.075, respectively) also suggest that most firms cluster around zero, though the range of values (−0.25 to +0.24) shows the presence of firms with substantial income-increasing or income-decreasing accruals. This result indicates that the estimation models are well-specified for our sample of Korean firms.

Panel B of

Table 1 presents additional descriptive statistics and distributional properties of the variables. The statistics in Panel B indicate several important features of the sample. Employee tenure (ETenure) averages 1.85 on the log-transformed scale, which translates to about seven years in raw terms, though the range is wide (1.65 to 15.5 years). This dispersion indicates significant variation in human capital stability across Korean firms, which is consistent with institutional differences in labor practices. Foreign investor ownership (FI) averages 7.1%, but the high standard deviation (10.5%) and maximum value above 50% reflect stark contrasts between firms that are internationally integrated and those that remain primarily domestically owned. This variability is particularly useful for testing how external monitoring by foreign investors might influence reporting behavior. Other governance variables, such as the proportion of outside board members (OutBOD, mean = 34%) and the largest shareholder’s stake (LargestSH, mean = 40%), suggest an ownership structure typical of Korean firms, where controlling shareholders exert strong influence but outside directors provide partial checks.

Finally, firm characteristics, including mean size (log of assets = 19.3), market-to-book ratio (0.86), leverage (43%), and cash flows from operations (CFO = 4.5%), are consistent with prior evidence on Korean listed companies. The distribution of sales growth shows considerable heterogeneity, with both negative values and firms experiencing rapid expansion (up to +165%). These patterns underscore the representativeness of the sample and provide confidence in the generalizability of subsequent analyses in this study.

5.2. Correlation Analysis

Table 2 reports correlation coefficients among the main variables. Both discretionary accrual measures (MJDA and PMDA) are highly correlated with one another (0.937 ***), which is expected since they capture similar constructs of accrual-based earnings management. MJDA and PMDA show a positive and significant correlation with employee tenure (0.061 *** and 0.047 ***, respectively), supporting the notion that firms with longer average tenure may engage more actively in accrual-based earnings management. Employee tenure itself provides early support for H1 that longer tenure is associated with higher earnings manipulation. Beyond its link to discretionary accruals, ETenure shows strong and positive correlations with leverage (LEV, 0.108 ***) and firm age (FAge, 0.440 ***). This suggests that firms with longer-tenured employees also tend to be older and more levered, potentially reflecting institutional labor practices in more established firms. LEV is negatively correlated with MJDA (−0.137 ***) and PMDA (−0.068 ***), implying that highly levered firms are less likely to engage in accrual-based earnings manipulation. This pattern aligns with the idea that creditors exert monitoring pressure, constraining managerial discretion over accruals. Interestingly, LEV is positively related to ETenure (0.108 ***), suggesting that firms with more stable and longer-tenured workforces also carry higher financial leverage, potentially due to their size and maturity.

In sum,

Table 2 reveals that employee tenure is positively related to accrual-based earnings management, consistent across MJDA and PMDA measures. Leverage serves as a disciplinary factor, reducing the likelihood of discretionary accruals, while firm age contributes to longer tenure and is modestly linked to accrual manipulation. These relationships highlight the interconnected dynamics of workforce stability, firm maturity, and financial structure in shaping firms’ earnings management behavior. Note that the correlations between independent variables are modest in magnitude (<0.3), reducing concerns of multicollinearity. Variance inflation factors (VIFs) computed in untabulated tests are below the conventional threshold of 10, further confirming the absence of multicollinearity issues.

5.3. Univariate Tests

Table 3 presents the

t-tests comparing differences in means between high and low accrual manipulation groups. When firms are ranked by employee tenure, the mean modified Jones discretionary accruals (MJDA) differ significantly across groups. Firms in the low-tenure group report an average MJDA of −0.0110, whereas those in the high-tenure group show a higher value of −0.0004. The difference between the high- and low-tenure groups is statistically significant at the 1% level (

t = −6.52). This finding suggests that firms with longer employee tenure exhibit significantly higher discretionary accruals compared to those with shorter tenure, consistent with the hypothesis that tenure is positively associated with accrual-based earnings management. The results are robust when using the performance-matched discretionary accruals (PMDA) measure. The low-tenure firms report an average PMDA of −0.0090, while high-tenure firms show −0.0003. The high–low difference (0.0087) is also significant at the 1% level (

t = −5.54). This reinforces the evidence that longer employee tenure is associated with higher levels of accrual-based earnings manipulation, regardless of which discretionary accrual model is used. The consistent patterns across both proxies (MJDA and PMDA) indicate that the relationship between employee tenure and accrual-based earnings management is not sensitive to measurement choice. The fact that high-tenure firms are systematically associated with less negative (i.e., higher) discretionary accruals suggests that managerial discretion increases as the workforce becomes more stable and long-tenured. These univariate findings provide preliminary evidence in support of H1, highlighting the potential for entrenched labor structures to facilitate opportunistic reporting behavior.

5.4. Regression Analysis: Baseline Model

Table 4 incorporates foreign investor ownership into the model. The coefficient of foreign ownership is negative and significant, consistent with H2, suggesting that foreign institutional investors reduce firms’ reliance on discretionary accruals. This result is consistent with the view that foreign investors act as sophisticated monitors who demand higher reporting quality (

Lel, 2019;

J. Kim et al., 2020).

Table 4 documents the empirical findings of our baseline model using two different measures of accrual-based earnings management. The coefficient on ETenure is positive and statistically significant in both specifications (0.004,

t = 2.54 for MJDA; 0.004,

t = 2.56 for PMDA). This indicates that firms with longer employee tenure are more likely to engage in accrual-based earnings management, regardless of whether MJDA or PMDA is used as the proxy. These results reinforce the univariate findings and support the hypothesis that longer tenure is associated with greater managerial discretion over accruals.

FI is negatively and significantly associated with both MJDA (−0.019, t = −2.42) and PMDA (−0.023, t = −2.90). This suggests that higher levels of foreign investor ownership reduce firms’ reliance on discretionary accruals. The consistency across both proxies supports the idea that foreign investors serve as sophisticated external monitors who demand greater transparency and reporting quality.

In addition, LEV shows a strong and negative relationship with accrual-based earnings management (−0.056, t = −14.66 for MJDA; −0.034, t = −9.22 for PMDA). These highly significant coefficients indicate that firms with higher leverage are less likely to manipulate earnings through discretionary accruals, consistent with the disciplining role of creditors in monitoring financial reporting practices. Firm size is positively and significantly related to accrual-based earnings management (0.005, t = 6.98 for MJDA; 0.004, t = 5.33 for PMDA). Larger firms therefore appear to use more discretionary accruals, which may reflect both greater opportunities for manipulation and higher incentives to manage earnings in the context of capital markets scrutiny. Firm age, FAge, has small, statistically insignificant coefficients (0.001, t = 0.57 for MJDA; 0.001, t = 1.08 for PMDA). This implies that firm age does not play a meaningful role in explaining variation in accrual-based earnings management once other controls are included. The coefficients on Big4 are negative and statistically significant (−0.007, t = −4.49 for MJDA; −0.005, t = −3.27 for PMDA). This suggests that firms audited by Big 4 accounting firms are less likely to engage in discretionary accruals, highlighting the role of audit quality as a constraint on earnings management.

The regression evidence in

Table 4 provides strong support for our hypotheses. Consistent with H1, employee tenure is positively and significantly associated with both MJDA and PMDA, indicating that longer-tenured workforces are linked to greater use of discretionary accruals. In line with H2, foreign investor ownership is negatively related to accrual-based earnings management across both measures, underscoring the monitoring role of foreign investors in constraining opportunistic reporting. These results, taken together, reinforce the argument that workforce stability interacts with governance and monitoring structures to shape financial reporting behavior.

5.5. Moderating Effect of Foreign Investor Ownership

The coefficient on the interaction term between employee tenure and foreign investor ownership (Inter_ET_FI) is negative and statistically significant in both models (−0.068, t = −4.90 for MJDA; −0.049, t = −3.62 for PMDA). This indicates that foreign investor ownership significantly weakens the positive relationship between employee tenure and accrual-based earnings management. In other words, while firms with longer employee tenure tend to engage more in discretionary accruals, this effect is substantially reduced in firms with higher foreign investor participation. These findings directly support H3, which posits that foreign investors moderate the relationship between employee tenure and earnings manipulation. The results show that foreign investors act as an external monitoring mechanism that offsets the entrenching effects of a long-tenured workforce. In practical terms, this suggests that the governance role of foreign investors is particularly important in contexts where employee tenure might otherwise facilitate opportunistic reporting behavior.

Table 5 introduces the interaction term between employee tenure and foreign investor ownership. The coefficient on the interaction term is negative and significant, supporting H3. This result suggests that foreign institutional investors moderate the positive relationship between employee tenure and accrual-based earnings management: in firms with high foreign ownership, the entrenching effect of long tenure is significantly weakened.

5.6. Robustness Tests

To further validate our findings, we conduct several robustness checks. First, we employ alternative measures of accrual-based earnings management, estimating discretionary accruals under different model specifications (e.g., industry-year regressions with alternative scaling approaches). The results remain qualitatively unchanged, suggesting that our inferences are not sensitive to the choice of estimation method. Second, we perform subsample analyses by partitioning the data based on industry concentration and firm size. These tests reveal that the moderating effect of foreign investors is stronger among smaller firms and in industries with weaker governance environments, consistent with the view that external monitoring is especially valuable where other governance mechanisms are limited. Third, we consider alternative proxies for workforce stability by substituting the employee turnover rate for average tenure. The results remain consistent, indicating that the observed effects reflect workforce entrenchment rather than dependence on a specific proxy. Finally, to mitigate concerns about endogeneity and reverse causality, we re-estimate the models using lagged measures of foreign ownership and an instrumental variable approach. Beyond baseline and moderating results, we perform robustness tests and instrumental variable analysis to ensure our findings are not driven by model specification or endogeneity concerns.

Table 6 presents the results of the two-stage least squares (2SLS) estimation, where wage volatility is employed as an instrument for employee tenure. We choose wage volatility (WVol) as our instrument, as it reflects fluctuations in labor costs that influence employee retention but are not directly related to firms’ accrual-based earnings management. This makes WVol a theoretically valid and econometrically strong instrument, consistent with prior research employing labor-market shocks to address endogeneity concerns. In the first stage, wage volatility is strongly negatively related to tenure, confirming its relevance as an instrument (

F-statistic = 471.38). In the second stage, the predicted values of tenure remain positively and significantly associated with both MJDA (0.031,

t = 3.73) and PMDA (0.024,

t = 2.93). These findings demonstrate that the positive relationship between tenure and accrual-based earnings management persists even after addressing endogeneity concerns. Taken together, the robustness checks and 2SLS results reinforce the credibility of our main conclusions, showing that workforce entrenchment is systematically linked to accrual manipulation, and that foreign investors play an important moderating role.

In sum, the documented empirical results strongly support our hypotheses. Employee tenure is positively associated with accrual-based earnings management (H1). Foreign institutional ownership reduces accrual manipulation directly (H2) and significantly weakens the positive relationship between tenure and accrual-based earnings management (H3). The robustness checks confirm that these results are not driven by model specification, sample selection, or endogeneity concerns. Taken together, our empirical findings highlight the dual role of internal workforce stability and external investor monitoring in shaping firms’ financial reporting quality.

6. Conclusions

This study investigates the interplay between employee tenure, foreign investor ownership, and accrual-based earnings management in Korean listed firms from 2011 to 2019. Using a large panel of firm-year observations, we estimate discretionary accruals via both the modified Jones model and the performance-matched Kothari model, ensuring robustness to model specification. Our findings reveal that average employee tenure is positively associated with discretionary accruals, suggesting that entrenched workforces may tacitly enable opportunistic reporting. In contrast, foreign institutional investors serve as effective external monitors: their ownership is directly associated with lower levels of accrual-based earnings management, and they moderate the positive association between tenure and earnings manipulation.

This study extends prior work on corporate governance and financial reporting in several meaningful ways. First, while existing research has primarily focused on board structures, ownership concentration, and managerial incentives as determinants of earnings management (

Healy & Wahlen, 1999;

Cohen et al., 2008;

Zang, 2012), we highlight the role of workforce characteristics. Our evidence shows that employee tenure—an underexplored but measurable firm attribute—matters for financial reporting quality. Second, we contribute to the growing literature on the role of foreign institutional investors as governance agents (

Lel, 2019;

J. Kim et al., 2020;

Gu et al., 2022). Specifically, we demonstrate that foreign institutional investors do not merely reduce opportunism in general but actively counterbalance the risks associated with entrenched labor structures. This dual perspective—internal workforce dynamics and external investor oversight—provides a richer understanding of how governance mechanisms interact in shaping firms’ reporting outcomes.

From a methodological perspective, the study’s findings are robust across multiple accrual estimation methods, alternative measures of workforce stability, and instrumental variable approaches to address potential endogeneity. These robustness checks reinforce the credibility of our conclusions and underscore the importance of considering both labor-market variables and foreign ownership structures when examining earnings management.

Theoretically, our findings highlight that internal and external governance mechanisms can either complement or counteract one another. Long-tenured employees may reduce transparency by supporting managerial discretion, but this effect can be attenuated or reversed when strong external monitors such as foreign institutional investors are present. Thus, the balance between internal labor structures and external monitoring helps explain heterogeneity in reporting quality across firms.

Beyond academic contributions, the findings offer practical guidance for multiple stakeholders. External investors, particularly international portfolio managers, can use information about employee tenure and workforce stability as an additional signal when assessing financial reporting risk. Firms with entrenched workforces may warrant closer scrutiny, but the presence of significant foreign investor ownership can signal improved reporting quality. In practice, this implies that investors should integrate both governance and workforce-related metrics into their risk assessment frameworks. For corporate management, the findings suggest a need to recognize the trade-offs associated with long employee tenure. While workforce stability provides operational benefits and firm-specific expertise, it also creates the potential for entrenchment and collusion in financial reporting. Managers should therefore adopt complementary governance mechanisms—such as independent boards, strong audit committees, and transparent disclosure policies—to counterbalance these risks and maintain investor confidence. For policymakers and regulators, the evidence underscores the importance of encouraging foreign institutional participation in emerging markets. Foreign institutional investors bring external governance expertise and help reduce opportunistic reporting practices, particularly in countries with weaker investor protections. Policies that reduce barriers to foreign ownership and improve disclosure of workforce metrics could strengthen overall market transparency. Additionally, requiring firms to disclose average employee tenure in annual reports would enhance the ability of stakeholders to evaluate reporting risk.

The implications of this study are relevant across multiple audiences. For scholars, the study highlights employee tenure as an underexplored but theoretically important governance dimension, enriching the literature on corporate governance and earnings management. For managers, the results emphasize the trade-offs of workforce stability, underscoring the need to complement long-tenured workforces with effective governance mechanisms such as strong boards and audit committees. For investors, particularly international portfolio managers, employee tenure serves as an additional signal of reporting risk, while foreign ownership demonstrates a monitoring effect that enhances transparency. For policymakers, the findings support initiatives to improve disclosure of workforce-related metrics and promote foreign investor participation in emerging markets as mechanisms to strengthen financial reporting quality.

In sum, this study provides novel evidence on the governance role of employee tenure and foreign investor ownership in shaping earnings management. From a policy perspective, our results support initiatives to improve disclosure of workforce-related metrics, particularly average tenure, to strengthen reporting transparency. From a theoretical standpoint, the study positions employee tenure as an underexplored but important determinant of earnings management, extending governance research beyond boards and ownership. From a practical and actionable perspective, the monitoring role of foreign institutional investors underscores the value of encouraging foreign capital participation in markets where local oversight remains weak. While our study provides robust evidence on the relationship between employee tenure, foreign investors, and earnings management, we acknowledge that our tenure variable is measured at the aggregate level. As noted in the limitations section, distinguishing managerial from non-managerial tenure would offer deeper insights into the mechanisms of entrenchment and remains a valuable direction for future research.

7. Shortcomings and Future Research

While this study provides new insights into the role of employee tenure and foreign institutional monitoring in shaping accrual-based earnings management, several limitations should be acknowledged. First, our analysis is restricted to publicly listed firms in Korea. It is important to note that the Korean context—characterized by concentrated ownership and comparatively weaker governance institutions—may amplify both the entrenchment effects of employee tenure and the monitoring role of foreign investors, which could differ in other markets. Although Korea offers a compelling institutional setting, characterized by concentrated ownership and increasing foreign investor participation, the generalizability of the findings to other contexts may be limited. Future research could extend this framework to other institutional contexts (e.g., Japan, China, or EU member states) to assess the generalizability of our findings across different labor practices and governance environments.

Second, our measure of employee tenure is constructed from firm-level disclosures and statistical surveys, which capture average tenure but do not distinguish between managerial, professional, and non-professional employees. This limitation constrains interpretation, as entrenchment effects may vary across employee groups: for example, managerial tenure (e.g., CEO or executive team tenure) may exert a stronger influence on financial reporting practices, while non-managerial employees may play different governance roles. Future research could address this by developing proxies for managerial tenure, moderating workforce mix (e.g., relative shares of professional versus production staff), or leveraging matched employer–employee datasets to provide a more granular analysis of workforce structures and their governance implications.

Third, although we employ multiple discretionary accrual models and robustness checks, earnings management is inherently difficult to measure. Discretionary accruals capture estimation choices but may not fully disentangle opportunistic manipulation from legitimate managerial discretion. Combining accrual-based proxies with real earnings management measures could provide a more comprehensive picture of reporting quality.

Fourth, while foreign investor ownership is treated as a key external monitoring mechanism, we do not explicitly distinguish between different types of foreign investors (e.g., active vs. passive investors, long-term vs. short-term funds, or those from developed vs. emerging markets). Our foreign investor ownership measure is available only in aggregate form and therefore cannot distinguish investor types (e.g., hedge funds, pension funds, and ETFs) or investment horizons. We accordingly temper our interpretation of the “monitoring effect” and highlight the use of type-level classifications and more granular ownership data to isolate heterogeneous monitoring channels as a priority for future research. Future studies could explore whether the monitoring role varies systematically across investor types, as suggested by

Ferreira and Matos (

2008) and

Aggarwal et al. (

2011).

Fifth, although our study adopts an empirical archival approach, future research could enrich this line of inquiry by incorporating qualitative methods such as interviews or case studies. Such approaches may provide deeper insights into the behavioral mechanisms through which employee entrenchment influences earnings management.

Sixth, our sample period ends in 2019, as the COVID-19 pandemic introduced substantial distortions in both employee tenure data and firms’ financial reporting behavior. Future research could extend the analysis into the post-pandemic period, once the labor market and reporting practices stabilize, to assess whether our findings hold under these new conditions.

Finally, our study focuses primarily on the interaction between employee tenure and foreign institutional investors. However, other stakeholders—such as auditors, domestic institutional investors, labor unions, and regulatory bodies—also play important roles in influencing reporting quality. Future research could integrate these additional governance actors to build a more holistic understanding of how internal and external forces jointly shape financial reporting outcomes.

By acknowledging these limitations, we encourage further work that expands the scope of analysis beyond a single country, integrates richer data on workforce structures, incorporates both accrual-based and real earnings management, and examines heterogeneity across foreign and domestic monitors. Addressing these avenues will advance our understanding of how governance mechanisms interact with labor-market dynamics to influence firms’ financial reporting practices.