Implication of Digital Marketing in the Supply Chain Finance of the Beverage Industry

Abstract

1. Introduction

- (a)

- RQ1: “To what extent do digital marketing signals—such as paid search traffic, organic search traffic, social referrals, and display advertising—function as leading indicators of short-term revenue growth in beverage supply chain firms?”.

- (b)

- RQ2: “How does brand heterogeneity influence the relationship between digital visibility and financial outcomes, and why do fixed brand effects outweigh within-month variations in digital acquisition channels?”.

- (c)

- RQ3: “What role do user engagement metrics (pages per visit and bounce rates) play in predicting financial performance, compared to overall traffic volume and acquisition channel shares?”.

2. Results

2.1. Descriptive Statistics

2.2. Correlation Analysis

2.3. Group Differences (ANOVA)

2.4. Fixed-Effects Regression Results

2.5. FCM Modeling

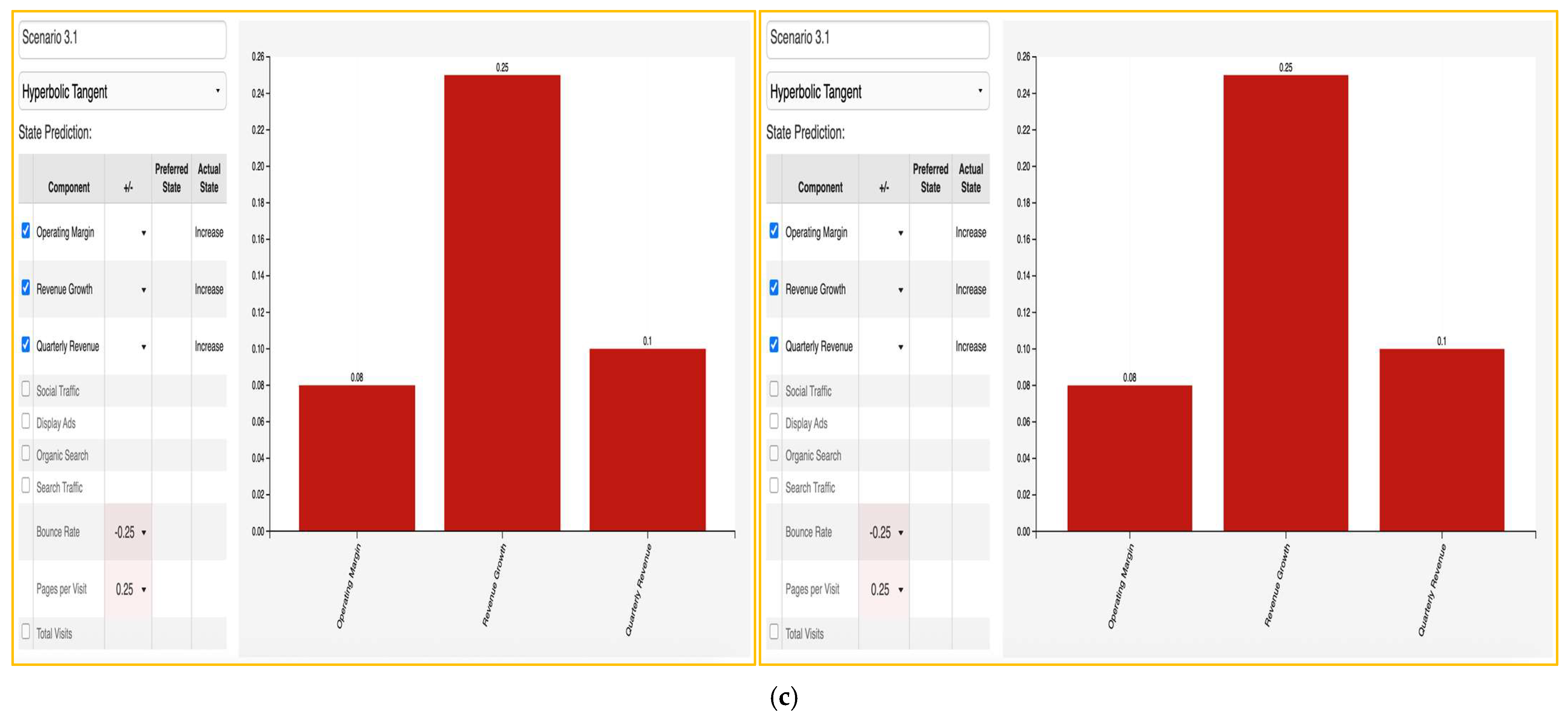

Scenarios’ Development

3. Discussion

- Digital marketing signals—especially paid search share and engagement depth—are credible short-term growth indicators (RQ1).

- Brand heterogeneity remains the most potent structural driver, overshadowing tactical shifts (RQ2).

- Engagement quality, more than traffic volume, is a key lever of performance (RQ3).

4. Materials and Methods

4.1. Data Collection and Sources

4.2. Methodological Approach

4.3. Justification of Methods

5. Conclusions

5.1. Theoretical Implications

5.2. Practical and Managerial Implications

5.3. Limitations

5.4. Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ackermann, T. (2012). IT Security risk management: Perceived it security risks in the context of cloud computing. Springer Science & Business Media. [Google Scholar]

- Akkas, A., Gaur, V., & Simchi-Levi, D. (2019). Drivers of product expiration in consumer packaged goods retailing. Management Science, 65(5), 2179–2195. [Google Scholar] [CrossRef]

- Al-Hadi, A., & Al-Abri, A. (2022). Firm-level trade credit responses to COVID-19-induced monetary and fiscal policies: International evidence. Research in International Business and Finance, 60, 101568. [Google Scholar] [CrossRef]

- Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277–297. [Google Scholar] [CrossRef]

- Ayala, M. J., Gonzálvez-Gallego, N., & Arteaga-Sánchez, R. (2024). Google search volume index and investor attention in stock market: A systematic review. Financial Innovation, 10(1), 70. [Google Scholar] [CrossRef]

- Backaler, J. (2018). Digital influence. Unleash the power of influencer marketing to accelerate your global business e-book. Palgrave. [Google Scholar]

- Baltagi, B. H. (2008). Econometric analysis of panel data. John Wiley & Sons Inc. [Google Scholar]

- Bei, Z., & Gielens, K. (2023). The one-party versus third-party platform conundrum: How can brands thrive? Journal of Marketing, 87(2), 253–274. [Google Scholar] [CrossRef]

- Bowersox, D. J., Closs, D. J., Cooper, M. B., & Bowersox, J. C. (2020). Supply chain logistics management. McGraw-Hill Education. [Google Scholar]

- Bueno, S., & Salmeron, J. L. (2008). Fuzzy modeling enterprise resource planning tool selection. Computer Standards & Interfaces, 30(3), 137–147. [Google Scholar] [CrossRef]

- Carvalho, J. V., Rocha, Á., & Abreu, A. (2016). Maturity models of healthcare information systems and technologies: A literature review. Journal of Medical Systems, 40(6), 131. [Google Scholar] [CrossRef]

- Chaffey, D., Hemphill, T., & Edmundson-Bird, D. (2019). Digital business and e-commerce management. Pearson. [Google Scholar]

- Cheng, B., & Hou, S. (2024). Brand equity and financial performance: An institutional view. Marketing Intelligence & Planning, 42(8), 1433–1463. [Google Scholar] [CrossRef]

- Chi, F., Hwang, B. H., & Zheng, Y. (2025). The use and usefulness of big data in finance: Evidence from financial analysts. Management Science, 71(6), 4599–4621. [Google Scholar] [CrossRef]

- Christopher, M. (2016). Logistics and supply chain management: Logistics & supply chain management. Pearson. [Google Scholar]

- Conductor. (2025). Page speed matters: 10 case studies show why. Available online: https://www.conductor.com/academy/page-speed-resources/ (accessed on 28 August 2025).

- Coroneo, L., & Iacone, F. (2025). Testing for equal predictive accuracy with strong dependence. International Journal of Forecasting, 41(3), 1073–1092. [Google Scholar] [CrossRef]

- Costola, M., Hinz, O., Nofer, M., & Pelizzon, L. (2023). Machine learning sentiment analysis, COVID-19 news and stock market reactions. Research in International Business and Finance, 64, 101881. [Google Scholar] [CrossRef] [PubMed]

- Dataiku. (2023). Predicting GDP with Google trends: The OECD weekly tracker. Available online: https://blog.dataiku.com/predicting-gdp-google-trends (accessed on 28 August 2025).

- Dessaint, O., Foucault, T., & Frésard, L. (2024). Does alternative data improve financial forecasting? the horizon effect. The Journal of Finance, 79(3), 2237–2287. [Google Scholar] [CrossRef]

- Diebold, F. X., & Mariano, R. S. (2002). Comparing predictive accuracy. Journal of Business & Economic Statistics, 20(1), 134–144. [Google Scholar] [CrossRef]

- Driscoll, J. C., & Kraay, A. C. (1998). Consistent covariance matrix estimation with spatially dependent panel data. Review of Economics and Statistics, 80(4), 549–560. [Google Scholar] [CrossRef]

- France, S. L., Shi, Y., & Kazandjian, B. (2021). Web trends: A valuable tool for business research. Journal of Business Research, 132, 666–679. [Google Scholar] [CrossRef]

- Giannakis, M., & Papadopoulos, T. (2016). Supply chain sustainability: A risk management approach. International Journal of Production Economics, 171, 455–470. [Google Scholar] [CrossRef]

- Giannakopoulos, N. T. (2025). Beverage industry supply chain finance and digital marketing. Available online: https://files.fm/u/5emnd45t7q (accessed on 6 September 2025).

- Glykas, M. (2013). Fuzzy cognitive strategic maps in business process performance measurement. Expert Systems with Applications, 40(1), 1–14. [Google Scholar] [CrossRef]

- Golovanova, E., & Zubarev, A. (2021). Forecasting aggregate retail sales with Google trends. Russian Journal of Money and Finance, 80(4), 50–73. [Google Scholar] [CrossRef]

- Google Analytics. (2025). Engagement rate and bounce rate (GA4). Available online: https://support.google.com/analytics/answer/12195621?hl=en (accessed on 28 August 2025).

- Gric, Z., Bajzík, J., & Badura, O. (2023). Does sentiment affect stock returns? A meta-analysis across survey-based measures. International Review of Financial Analysis, 89, 102773. [Google Scholar] [CrossRef]

- Guhl, D. (2024). Tracking time-varying brand equity using household panel data. Journal of Business Research, 182, 114799. [Google Scholar] [CrossRef]

- Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2019). Multivariate data analysis. Cengage Learning. [Google Scholar]

- Heredia, J., Castillo-Vergara, M., Geldes, C., Gamarra, F. M. C., Flores, A., & Heredia, W. (2022). How do digital capabilities affect firm performance? The mediating role of technological capabilities in the “new normal”. Journal of Innovation & Knowledge, 7(2), 100171. [Google Scholar] [CrossRef]

- Hoechle, D. (2007). Robust standard errors for panel regressions with cross-sectional dependence. Stata Journal, 7(3), 281–312. [Google Scholar] [CrossRef]

- Hollebeek, L. D., & Macky, K. (2019). Digital content marketing’s role in fostering consumer engagement, trust, and value: Framework, fundamental propositions, and implications. Journal of Interactive Marketing, 45(1), 27–41. [Google Scholar] [CrossRef]

- Homburg, C., & Wielgos, D. M. (2022). The value relevance of digital marketing capabilities to firm performance. Journal of the Academy of Marketing Science, 50(4), 666–688. [Google Scholar] [CrossRef] [PubMed]

- Jansen, B. J., Jung, S. G., & Salminen, J. (2022). Measuring user interactions with websites: A comparison of two industry standard analytics approaches using data of 86 websites. PLoS ONE, 17(5), e0268212. [Google Scholar] [CrossRef] [PubMed]

- Jing, H., & Fan, Y. (2024). Digital transformation, supply chain integration and supply chain performance: Evidence from Chinese manufacturing listed firms. Sage Open, 14(3), 21582440241281616. [Google Scholar] [CrossRef]

- Johan, S., Kayani, U. N., Naeem, M. A., & Karim, S. (2024). How effective is the cash conversion cycle in improving firm performance? Evidence from BRICS. Emerging Markets Review, 59, 101114. [Google Scholar] [CrossRef]

- Jung, S.-U., & Shegai, V. (2023). The impact of digital marketing innovation on firm performance: Mediation by marketing capability and moderation by firm size. Sustainability, 15(7), 5711. [Google Scholar] [CrossRef]

- Krowinska, A., & Dineva, D. (2025). The role and forms of social media branded content driving active customer engagement behaviours. Journal of Marketing Management, 41(9–10), 1–31. [Google Scholar] [CrossRef]

- Kumar, V., & Gupta, S. (2016). Conceptualizing the evolution and future of advertising. Journal of Advertising, 45(3), 302–317. [Google Scholar] [CrossRef]

- Li, H., Fang, Y., Lim, K. H., & Wang, Y. (2019). Platform-based function repertoire, reputation, and sales performance of e-marketplace sellers. MIS Quarterly, 43(1), 207–236. Available online: https://www.jstor.org/stable/26847858 (accessed on 25 August 2025). [CrossRef]

- Li, X., Yan, J., Cheng, J., & Li, J. (2023). Supply-chain finance and investment efficiency: The perspective of sustainable development. Sustainability, 15(10), 7857. [Google Scholar] [CrossRef]

- Liadeli, G., Sotgiu, F., & Verlegh, P. W. (2023). A meta-analysis of the effects of brands’ owned social media on social media engagement and sales. Journal of Marketing, 87(3), 406–427. [Google Scholar] [CrossRef]

- Lim, W. M., & Rasul, T. (2022). Customer engagement and social media: Revisiting the past to inform the future. Journal of Business Research, 148, 325–342. [Google Scholar] [CrossRef]

- Mangan, J., & Lalwani, C. (2016). Global logistics and supply chain management. John Wiley & Sons. [Google Scholar]

- Mitra, G., Hoang, K. T., Gladilin, A., Chu, Y., Black, K., & Mani, G. (2023). Alternative data: Overview. In Handbook of alternative data in finance (Vol. I, pp. 1–28). Chapman and Hall/CRC. [Google Scholar]

- Newey, W. K., & West, K. D. (1987). Hypothesis testing with efficient method of moments estimation. International Economic Review, 28(3), 777–787. [Google Scholar] [CrossRef]

- Nyakurukwa, K., & Seetharam, Y. (2024). Sentimental showdown: News media vs. social media in stock markets. Heliyon, 10(9), e30211. [Google Scholar] [CrossRef] [PubMed]

- OWOX. (2021). Comparing accuracy: SEMrush vs. SimilarWeb. Available online: https://www.owox.com/blog/articles/semrush-vs-similarweb (accessed on 28 August 2025).

- Ozlem, B. (2018). E-business and supply chain integration: Strategies and case studies from industry. Kogan Page Publishers. [Google Scholar]

- Petersen, M. A. (2009). Estimating standard errors in finance panel data sets: Comparing approaches. The Review of Financial Studies, Society for Financial Studies, 22(1), 435–480. [Google Scholar] [CrossRef]

- Sanders, N. R. (2025). Supply Chain Management, with eBook access code: A global perspective. John Wiley & Sons. [Google Scholar]

- SimilarWeb. (2025). Data accuracy. Available online: https://support.similarweb.com/hc/en-us/articles/360002219177-Similarweb-s-Data-Accuracy#h_01HFKSA3MCE9MJVGB1ZEVVWTQB (accessed on 28 August 2025).

- Srivastava, R., Gupta, P., Kumar, H., & Tuli, N. (2025). Digital customer engagement: A systematic literature review and research agenda. Australian Journal of Management, 50(1), 220–245. [Google Scholar] [CrossRef]

- Strategy, &. (2025). Measuring brand equity with public and social media data. Available online: https://www.strategyand.pwc.com/lu/en/insights/brand-equity-with-public-and-social-media-data.html (accessed on 28 August 2025).

- Stylios, C. D., Bourgani, E., & Georgopoulos, V. C. (2020). Impact and applications of fuzzy cognitive map methodologies. In Beyond traditional probabilistic data processing techniques: Interval, fuzzy etc. methods and their applications (pp. 229–246). Springer International Publishing. [Google Scholar]

- Sun, Y., Liu, L., Xu, Y., Zeng, X., Shi, Y., Hu, H., Jiang, J., & Abraham, A. (2024). Alternative data in finance and business: Emerging applications and theory analysis. Financial Innovation, 10(1), 127. [Google Scholar] [CrossRef]

- Szczygielski, J. J., Charteris, A., Bwanya, P. R., & Brzeszczyński, J. (2024). Google search trends and stock markets: Sentiment, attention or uncertainty? International Review of Financial Analysis, 91, 102549. [Google Scholar] [CrossRef]

- Techradar. (2025). Affiliate marketing in 2025: Practical insights into the rise of alternative channels and the video-first revolution. Available online: https://www.techradar.com/pro/affiliate-marketing-in-2025-practical-insights-into-the-rise-of-alternative-channels-and-the-video-first-revolution?utm_source=chatgpt.com (accessed on 31 August 2025).

- Thinkbox. (2024). Profit ability 2: The new business case for advertising. Available online: https://www.thinkbox.tv/research/thinkbox-research/profit-ability-2-the-new-business-case-for-advertising (accessed on 28 August 2025).

- Trunfio, M., & Rossi, S. (2021). Conceptualising and measuring social media engagement: A systematic literature review. Italian Journal of Marketing, 2021(3), 267–292. [Google Scholar] [CrossRef]

- Tukey, J. W. (1949). Comparing individual means in the analysis of variance. Biometrics, 5(2), 99–114. [Google Scholar] [CrossRef] [PubMed]

- van Berlo, Z. M., Meijers, M. H., Eelen, J., Voorveld, H. A. M., & Eisend, M. (2024). When the medium is the message: A meta-analysis of creative media advertising effects. Journal of Advertising, 53(2), 278–295. [Google Scholar] [CrossRef]

- van Ewijk, B. J., Stubbe, A., Gijsbrechts, E., & Dekimpe, M. G. (2021). Online display advertising for CPG brands: (When) does it work? International Journal of Research in Marketing, 38(2), 271–289. [Google Scholar] [CrossRef]

- Wang, X., & Yu, J. (2023). COVID-19 pandemic and corporate liquidity: The role of SOEs’ trade credit response. Journal of International Money and Finance, 137, 102901. [Google Scholar] [CrossRef]

- Wedel, M., & Kannan, P. K. (2016). Marketing analytics for data-rich environments. Journal of Marketing, 80(6), 97–121. [Google Scholar] [CrossRef]

- Woloszko, N. (2020). Tracking activity in real time with Google trends. OECD Policy Paper, No. 29. Available online: https://www.oecd.org/en/publications/tracking-activity-in-real-time-with-google-trends_6b9c7518-en.html (accessed on 28 August 2025).

- Woloszko, N. (2024). Nowcasting with panels and alternative data: The OECD weekly tracker. International Journal of Forecasting, 40(4), 1302–1335. [Google Scholar] [CrossRef]

- Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data. MIT Press. [Google Scholar]

- Zhou, L., Chen, M., & Lee, H. (2022). Supply chain finance: A research review and prospects based on a systematic literature analysis from a financial ecology perspective. Sustainability, 14(21), 14452. [Google Scholar] [CrossRef]

| Variable | Mean | SD | Min | Max |

|---|---|---|---|---|

| Quarterly Revenue (USD bn) | 10.96 | 8.24 | 1.73 | 23.45 |

| Revenue Growth % YoY | 6.5% | 5.2% | −0.5% | 14.4% |

| Operating Margin % | 15.2% | 4.3% | 11.0% | 21.0% |

| Total Visits | 5,313,240.00 | 8,175,383.82 | 3200.00 | 23,000,000.00 |

| Visitors | 3,240,952.00 | 4,959,969.58 | 1800.00 | 14,200,000.00 |

| Unique Visitors | 2,720,300.00 | 4,541,101.77 | 1400.00 | 18,000,000.00 |

| Pages per Visit | 3.10 | 1.28 | 2.08 | 5.81 |

| Bounce Rate | 65.64 | 18.02 | 13.05 | 97.31 |

| Paid Search Traffic | 32.67 | 8.71 | 16.67 | 46.07 |

| Organic Search Traffic | 52.87 | 12.31 | 33.02 | 70.53 |

| Social Traffic | 4.96 | 3.96 | 0.02 | 16.16 |

| Display Ads | 0.75 | 0.94 | 0.01 | 3.13 |

| Variable | Total Visits | Pages per Visit | Bounce Rate | Search Traffic | Organic Search | Social Traffic | Display Ads |

|---|---|---|---|---|---|---|---|

| Total Visits | 1.00 | −0.37 | 0.38 | 0.01 | 0.07 | 0.28 | 0.08 |

| Pages per Visit | −0.37 | 1.00 | −0.09 | 0.51 * | −0.52 * | −0.11 | 0.65 * |

| Bounce Rate | 0.38 | −0.09 | 1.00 | −0.15 | 0.20 | 0.28 | −0.06 |

| Paid Search Traffic | 0.01 | 0.51 * | −0.15 | 1.00 | −0.88 ** | −0.57 * | 0.41 |

| Organic Search Traffic | 0.07 | −0.52 * | 0.20 | −0.88 ** | 1.00 | 0.27 | −0.37 |

| Social Traffic | 0.28 | −0.11 | 0.28 | −0.57 * | 0.27 | 1.00 | −0.17 |

| Display Ads | 0.08 | 0.65 * | −0.06 | 0.41 | −0.37 | −0.17 | 1.00 |

| Variable | Revenue Growth | Operating Margin | Quarterly Revenue |

|---|---|---|---|

| Total Visits | 0.29 | 0.21 | 0.44 * |

| Pages per Visit | 0.55 * | 0.23 | 0.27 |

| Bounce Rate % | −0.48 * | −0.11 | −0.13 |

| Paid Search Traffic % | 0.62 * | 0.28 | 0.31 |

| Organic Search Traffic % | −0.59 * | −0.22 | −0.19 |

| Social Traffic % | 0.34 | 0.17 | 0.21 |

| Display Ads % | 0.18 | −0.05 | 0.09 |

| Source | df | F | p-Value | η2 |

|---|---|---|---|---|

| Between brands | 4 | 78.19 | <0.001 | 0.94 |

| Within (error) | 20 | – | – | – |

| Group1 | Group2 | Mean_Diff | p-Adj | Lower | Upper | Reject |

|---|---|---|---|---|---|---|

| Coca-Cola | DrPepper | 23.456 | 0.0 | 19.0304 | 27.8816 | True |

| Coca-Cola | Monster | 10.534 | 0.0 | 6.1084 | 14.9596 | True |

| Coca-Cola | PepsiCo | 20.708 | 0.0 | 16.2824 | 25.1336 | True |

| Coca-Cola | RedBull | 13.874 | 0.0 | 9.4484 | 18.2996 | True |

| DrPepper | Monster | −12.922 | 0.0 | −17.3476 | −8.4964 | True |

| DrPepper | PepsiCo | −2.748 | 0.3703 | −7.1736 | 1.6776 | False |

| DrPepper | RedBull | −9.582 | 0.0 | −14.0076 | −5.1564 | True |

| Monster | PepsiCo | 10.174 | 0.0 | 5.7484 | 14.5996 | True |

| Monster | RedBull | 3.34 | 0.1996 | −1.0856 | 7.7656 | False |

| PepsiCo | RedBull | −6.834 | 0.0014 | −11.2596 | −2.4084 | True |

| Index | Coef. | Std.Err. | z | p > |z| | [0.025 | 0.975] |

|---|---|---|---|---|---|---|

| Intercept | 17.287 | 3.242 | 5.330 | 9.770 × 10−8 | 10.931 | 23.642 |

| C(brand) [T.DrPepper] | 3.546 | 4.872 | 0.727 | 0.466 | −6.003 | 13.096 |

| C(brand) [T.Monster] | −1.540 | 2.316 | −0.665 | 0.506 | −6.079 | 2.999 |

| C(brand) [T.PepsiCo] | 4.349 | 3.571 | 1.217 | 0.223 | −2.651 | 11.349 |

| C(brand) [T.RedBull] | 5.067 | 2.149 | 2.357 | 0.018 * | 0.853 | 9.280 |

| C(month_str) [T.2023-06] | −0.280 | 0.466 | −0.601 | 0.547 | −1.194 | 0.633 |

| C(month_str) [T.2023-07] | −0.083 | 0.522 | −0.159 | 0.872 | −1.107 | 0.939 |

| C(month_str) [T.2023-08] | −0.852 | 0.682 | −1.250 | 0.211 | −2.18 | 0.484 |

| C(month_str) [T.2023-09] | −0.384 | 0.706 | −0.545 | 0.585 | −1.7694 | 0.999 |

| Paid_Search Traffic_p | −13.664 | 11.276 | −1.211 | 0.225 | −35.7651 | 8.436 |

| Organic Search_ Traffic_p | 0.793 | 4.222 | 0.188 | 0.850 | −7.481 | 9.069 |

| Social Traffic_p | 11.827 | 12.864 | 0.919 | 0.357 | −13.385 | 37.040 |

| Display Ads_p | −15.089 | 19.129 | −0.788 | 0.430 | −52.583 | 22.403 |

| Pages per Visit | −0.279 | 0.487 | −0.574 | 0.565 | −1.234 | 0.674 |

| Bounce Rate_p | −1.450 | 1.619 | −0.896 | 0.370 | −4.624 | 1.722 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Giannakopoulos, N.T.; Sakas, D.P.; Toudas, K.; Karountzos, P. Implication of Digital Marketing in the Supply Chain Finance of the Beverage Industry. Int. J. Financial Stud. 2025, 13, 189. https://doi.org/10.3390/ijfs13040189

Giannakopoulos NT, Sakas DP, Toudas K, Karountzos P. Implication of Digital Marketing in the Supply Chain Finance of the Beverage Industry. International Journal of Financial Studies. 2025; 13(4):189. https://doi.org/10.3390/ijfs13040189

Chicago/Turabian StyleGiannakopoulos, Nikolaos T., Damianos P. Sakas, Kanellos Toudas, and Panagiotis Karountzos. 2025. "Implication of Digital Marketing in the Supply Chain Finance of the Beverage Industry" International Journal of Financial Studies 13, no. 4: 189. https://doi.org/10.3390/ijfs13040189

APA StyleGiannakopoulos, N. T., Sakas, D. P., Toudas, K., & Karountzos, P. (2025). Implication of Digital Marketing in the Supply Chain Finance of the Beverage Industry. International Journal of Financial Studies, 13(4), 189. https://doi.org/10.3390/ijfs13040189