Predictive Power of ESG Factors for DAX ESG 50 Index Forecasting Using Multivariate LSTM

Abstract

1. Introduction

- (RQ1): Does the inclusion of a comprehensive set of ESG scores lead to a statistically significant improvement in the forecast accuracy of monthly stock returns compared to a baseline model?

- (RQ2): Does the predictive value of a single ESG factor (the Disclosure Score) persist over a longer, 16-year time horizon?

- (RQ3): Which specific ESG factors (e.g., Environmental, Social, and Governance), if any, have the most significant impact on the model’s predictions?

- Methodological Contribution: We provide a pragmatic and direct application of a multivariate LSTM network to systematically test the predictive value of annual ESG data on monthly returns. Our contribution is not the development of a new hybrid model, but rather the design of a clean, transparent, and easily replicable out-of-sample experiment that directly simulates a real-world investment process.

- Empirical Finding: We provide robust evidence of a null result, demonstrating that the inclusion of different annual ESG scores does not lead to a statistically significant improvement in forecast accuracy for the DAX ESG 50 index. In our 8-year analysis, adding ESG data significantly increased forecast error, suggesting it acted as noise rather than a valuable signal.

- Practical Implications: Our findings have a direct impact on quantitative investors and portfolio managers. The findings show that typical ESG data cannot easily be leveraged to generate alpha since its informational content appears to have been either priced in by the market or exceeded by the forecasting potential of past returns. This emphasizes the importance of more immediate, forward-looking ESG signals for accurate financial forecasts.

2. Literature Review

From Univariate to Multivariate Forecasting

- Process: Unlike a univariate model that processes one data point at each time step (e.g., last month’s return), our multivariate model processes a vector of features simultaneously. At each step, it takes into account not only the historical return but also the associated ESG scores (e.g., esg_governance_score, esg_social_score, etc.). The LSTM’s internal gates then learn the (potential) complex, non-linear relationships between these different input variables over time.

- Advantages: The primary advantage of this multivariate approach is its ability to create a better-informed forecasting model. It allows us to test the central hypothesis of this paper: whether ESG factors contain predictive information that is not already captured in the historical return series. By combining multiple variables, the model can identify potential cross-correlations and lead-lag effects that a univariate model is structurally blind to, making it the ideal method for this research question.

3. Materials and Methods

3.1. Data

3.2. Model Architecture

- Forget gate Decides what information is discarded from the memory/previous cell state (using a sigmoid activation function ).

- Input gate Decides which new information from the input is considered in the memory (using a sigmoid activation function and a tanh layer that creates a vector of new candidate values , which could be added to the state).The old cell state is then updated to the new cell state by multiplying the old state by the forget gate’s output and adding the product of the input gate and the candidate values.

- Output gate Determines the next hidden state , which is a filtered version of the cell state. First, a sigmoid layer decides which parts of the cell state will be output. Then, the cell state is passed through a function (to push the values to be between −1 and 1) and multiplied by the output of the sigmoid gate.

3.3. Feature Importance

- Grounded in game theory: We chose SHAP because it is not just another ad hoc method; it’s built on the Nobel Memorial Prize-winning Shapley value concept from game theory. This provides a solid theoretical basis for fairly distributing a single prediction’s outcome among the features that contributed to it.

- Trustworthy and consistent results: A key advantage of SHAP is its guarantee of consistency. If a feature’s actual contribution to the model increases, its measured importance will not decrease. This prevents illogical outcomes found in some other methods and makes the feature importance rankings more intuitive and reliable.

- Versatility for different questions: SHAP is a versatile tool that can answer two different questions. It can provide a high-level, global view of which features matter most across the entire dataset, which is our focus. It can also zoom in to explain the specific drivers of a single, individual forecast, making it a powerful instrument for any diagnostic work.

3.4. Experimental Design

- Main Analysis (RQ1):January 2016 to December 2023 comparison of a baseline model (using only historical returns) against an ESG model (historical returns and all five ESG scores).

- Additional Analysis (RQ2):January 2008 to December 2023, comparing a baseline model against an ESG model using only the esg_disclosure_score.

- Feature Importance in Both Analyses (RQ3):The SHAP values are calculated for the features used in each analysis of RQ1 and RQ2.

3.5. Evaluation Metrics

4. Results

4.1. Main Analysis: 8-Year Period with All ESG Scores

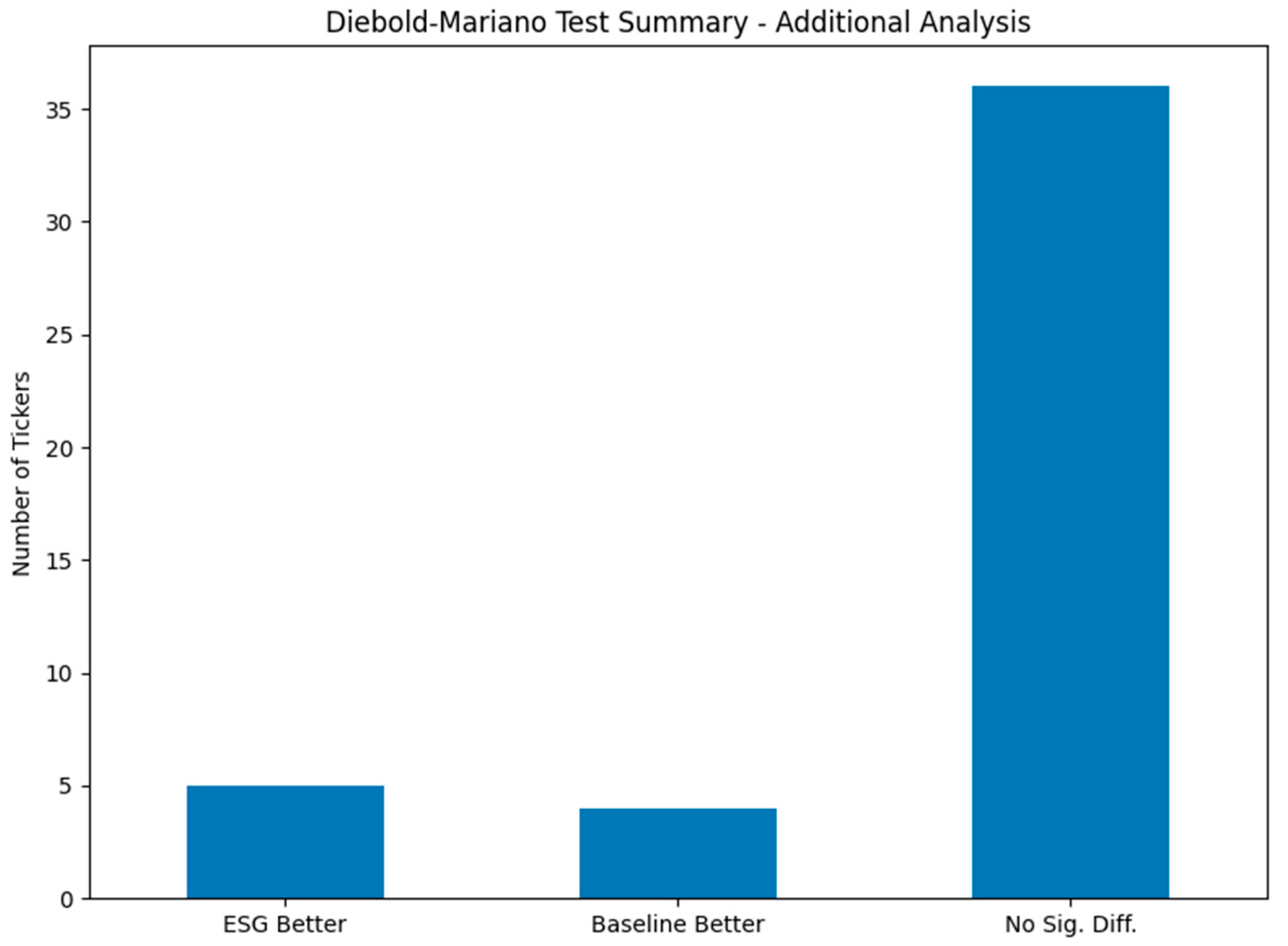

4.2. Additional Analysis: 16-Year Period with All ESG Scores

4.3. Feature Importance (SHAP Analysis)

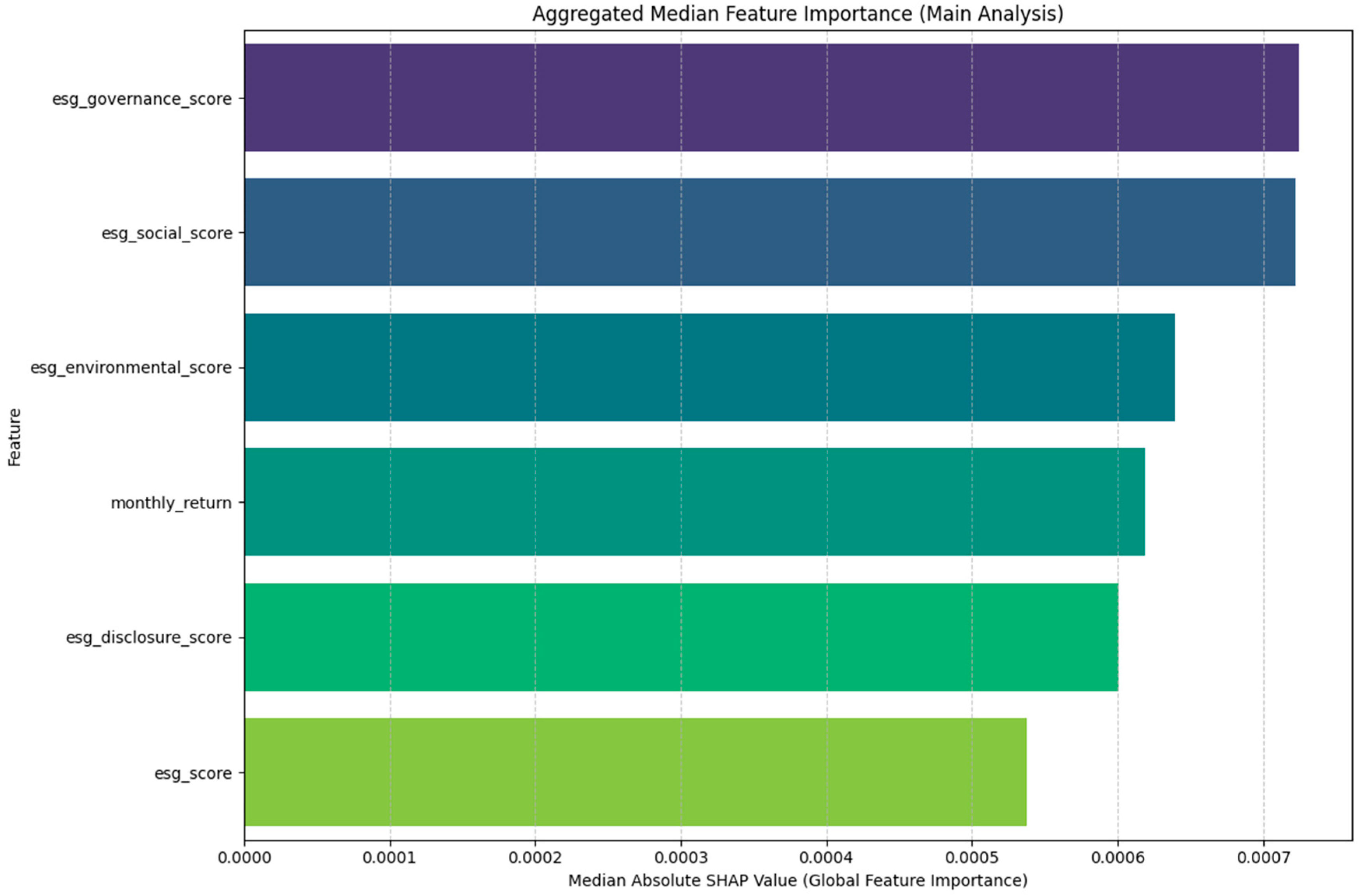

4.3.1. Feature Importance in the Main Analysis

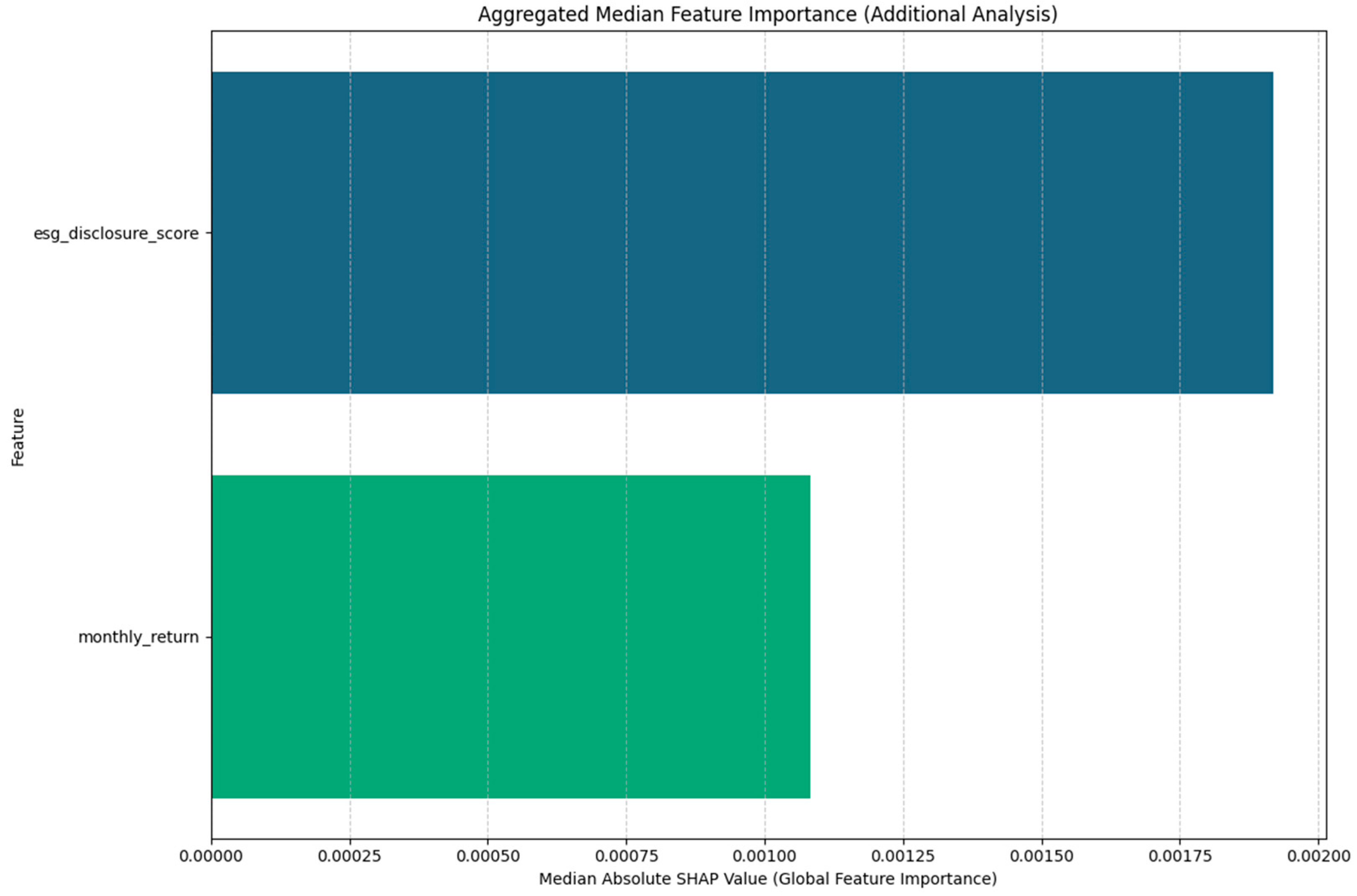

4.3.2. Feature Importance in the Additional Analysis

5. Discussion

5.1. Context Within Existing Research

- Reconciling Feature Importance with Predictive Performance: The “Loud But Unhelpful” Signal

- SHAP Measures Influence, Not Correctness: SHAP values quantify the magnitude of a feature’s impact on a model’s output. A high SHAP value for esg_governance_score means the model learned a relationship and is actively using that score to adjust its forecasts up or down. It tells us the model is listening to that feature.

- Performance Metrics Measure Correctness: Metrics like RMSE and MAE, however, measure whether those adjustments were correct.

5.2. The Challenge of a Low-Variability Signal

5.3. Limitations

5.4. Future Work

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| API | Application Programming Interface |

| ARIMA | Autoregressive Integrated Moving Average |

| CSRD | Corporate Sustainability Reporting Directive |

| CSR-RUG | CSR-Richtlinie-Umsetzungsgesetz (German national law implementing the EU Non-Financial Reporting Directive) |

| DAX | Deutscher Aktienindex (German Stock Index) |

| ESG | Environmental, Social, and Governance |

| ESRS | European Sustainability Reporting Standards |

| EU | European Union |

| FY | Fiscal Year |

| GRI | Global Reporting Initiative |

| LkSG | Lieferkettensorgfaltspflichtengesetz |

| LSTM | Long Short-Term Memory |

| MAE | Mean Absolute Error |

| MAPE | Mean Absolute Percentage Error |

| MDA | Mean Directional Accuracy |

| MIDAS | Mixed Data Sampling |

| NFRD | Non-Financial Reporting Directive |

| QLRA | Quantized Low-Rank Adaptation |

| Qlora | Quantized Low-Rank Adapter (context: Llama 2-Qlora models) |

| RNN | Recurrent Neural Network |

| RMSE | Root Mean Squared Error |

| RQ | Research Question |

| SASB | Sustainability Accounting Standards Board |

| SDGs | Sustainable Development Goals |

| SFDR | Sustainable Finance Disclosure Regulation |

| SHAP | SHapley Additive exPlanations |

| std dev | Standard Deviation |

| UNPRI | United Nations Principles for Responsible Investment |

| UNSDGs | United Nations Sustainable Development Goals |

Appendix A

| Regulation/Law | Legal Level | Applies To | Effective Since | Applicability to DAX ESG 50 Companies? |

|---|---|---|---|---|

| Non-Financial Reporting Directive (NFRD) | EU Directive | Large public-interest entities with >500 employees | 1 January 2017 | Yes; implemented in Germany via the CSR-Richtlinie-Umsetzungsgesetz |

| Corporate Sustainability Reporting Directive (CSRD) | EU Directive | Expands scope to large companies and listed SMEs | 5 January 2023 (reporting from FY 2024) | Yes; mandatory reporting from FY 2024 onwards |

| European Sustainability Reporting Standards (ESRS) | EU Standards | Companies subject to CSRD | Adopted 31 July 2023 | Yes; binding with CSRD compliance from FY 2024 |

| CSR-Richtlinie-Umsetzungsgesetz (CSR-RUG) | German National Law | German transposition of NFRD | 11 April 2017 | Yes; requires non-financial statements |

| Lieferkettensorgfaltspflichtengesetz (LkSG) | German National Law | Companies with >3000 employees (from 2023); >1000 employees (from 2024) | 1 January 2023 | Yes; many DAX ESG 50 companies meet the employee threshold |

| EU Taxonomy Regulation | EU Regulation | Financial market participants and large companies | 1 July 2021 | Yes; alignment disclosures mandatory |

| Sustainable Finance Disclosure Regulation (SFDR) | EU Regulation | Financial market participants | 10 March 2021 | Yes; applicable to DAX ESG 50 companies in the financial sector |

| Global Reporting Initiative (GRI) Standards | International Standard | Voluntary, but widely adopted | First released in 2000; GRI Standards since 2016 | Yes; many DAX ESG 50 companies use GRI for sustainability reporting |

| Company Name | Bloomberg Ticker | Yahoo Ticker | Main Analysis | Additional Analysis |

|---|---|---|---|---|

| Adidas | ADS GY Equity | ads.de | X | |

| Allianz | ALV GY Equity | alv.de | X | |

| Aroundtown | AT1 GY Equity | at1.de | X | |

| BASF | BAS GY Equity | bas.de | X | X |

| BMW | BMW GY Equity | bmw.de | X | X |

| Bayer | BAYN GY Equity | bayn.de | X | X |

| Bechtle AG | BC8 GY Equity | bc8.de | X | |

| Beiersdorf | BEI GY Equity | bei.de | X | X |

| Brenntag | BNR GY Equity | bnr.de | X | |

| Carl Zeiss Meditec | AFX GY Equity | afx.de | X | |

| Commerzbank | CBK GY Equity | cbk.de | X | X |

| Continental | CON GY Equity | con.de | X | X |

| Covestro | 1COV GY Equity | 1cov.de | X | |

| Daimler (jetzt Mercedes-Benz) | MBG GY Equity | mbg.de | X | X |

| Deutsche Bank | DBK GY Equity | dbk.de | X | X |

| Deutsche Börse | DB1 GY Equity | db1.de | X | X |

| Deutsche Post (now DHL Group) | DHL GY Equity | dhl.de | X | X |

| Deutsche Telekom | DTE GY Equity | dte.de | X | X |

| Deutsche Wohnen | DWNI GY Equity | dwni.de | X | |

| E.ON SE | EOAN GY Equity | eoan.de | X | X |

| Evonik | EVK GY Equity | evk.de | X | X |

| Fraport | FRA GY Equity | fra.de | X | X |

| Freenet AG | FNTN GY Equity | fntn.de | X | |

| Fresenius | FRE GY Equity | fre.de | X | X |

| Fresenius Medical Care AG | FME GY Equity | fme.de | X | |

| Fuchs Petrolub SE | FPE3 GY Equity | fpe3.de | X | |

| GEA Group | G1A GY Equity | g1a.de | X | X |

| Hannover Rück | HNR1 GY Equity | hnr1.de | X | X |

| Heidelberg Materials (previously HeidelbergCement) | HEI GY Equity | hei.de | X | X |

| Henkel | HEN3 GY Equity | hen3.de | X | X |

| Hochtief | HOT GY Equity | hot.de | X | X |

| Hugo Boss | BOSS GY Equity | boss.de | X | |

| Infineon Technologies | IFX GY Equity | ifx.de | X | X |

| K+S | SDF GY Equity | sdf.de | X | X |

| KION Group | KGX GY Equity | kgx.de | X | X |

| Knorr-Bremse | KBX GY Equity | kbx.de | X | X |

| LEG Immobilien | LEG GY Equity | leg.de | X | X |

| Lanxess | LXS GY Equity | lxs.de | X | |

| Lufthansa | LHA GY Equity | lha.de | X | X |

| Merck | MRK GY Equity | mrk.de | X | X |

| Münchener Rück | MUV2 GY Equity | muv2.de | X | X |

| Porsche Automobil Holding SE | PAH3 GY Equity | pah3.de | X | X |

| ProSiebenSat.1 Media | PSM GY Equity | psm.de | X | |

| Puma | PUM GY Equity | pum.de | X | X |

| Qiagen N.V. | QIA GY Equity | qia.de | X | X |

| Rational AG | RAA GY Equity | raa.de | X | |

| SAP | SAP GY Equity | sap.de | X | X |

| Sartorius | SRT3 GY Equity | srt3.de | X | X |

| Sartorius AG | SRT GY Equity | srt.de | X | X |

| Scout24 | G24 GY Equity | g24.de | X | |

| Siemens | SIE GY Equity | sie.de | X | X |

| Symrise | SY1 GY Equity | sy1.de | X | |

| TAG Immobilien AG | TEG GY Equity | teg.de | X | |

| Talanx AG | TLX GY Equity | tlx.de | X | X |

| Thyssenkrupp | TKA GY Equity | tka.de | X | X |

| United Internet AG | UTDI GY Equity | utdi.de | X | X |

| Volkswagen AG | VOW3 GY Equity | vow3.de | X | X |

| Vonovia SE | VNA GY Equity | vna.de | X | X |

| Wacker Chemie AG | WCH GY Equity | wch.de | X | X |

| Zalando | ZAL GY Equity | zal.de | X |

| Ticker | Main Analysis DM-Stat | Main Analysis p-Value | Additional Analysis DM-Stat | Additional Analysis p-Value |

|---|---|---|---|---|

| 1cov.de | 0.231 | 0.8199 | N/A | N/A |

| ads.de | N/A | N/A | −0.908 | 0.3688 |

| afx.de | −2.675 | 0.0166 * | N/A | N/A |

| alv.de | N/A | N/A | 1.539 | 0.1308 |

| at1.de | N/A | N/A | −0.060 | 0.9532 |

| bas.de | −0.718 | 0.4830 | 2.285 | 0.0271 * |

| bayn.de | 0.889 | 0.3871 | 0.589 | 0.5589 |

| bc8.de | −0.236 | 0.8164 | N/A | N/A |

| bei.de | −1.130 | 0.2750 | 2.129 | 0.0388 * |

| bmw.de | −1.047 | 0.3107 | −1.706 | 0.0949 |

| bnr.de | N/A | N/A | 1.493 | 0.1439 |

| boss.de | −2.886 | 0.0107 * | N/A | N/A |

| cbk.de | −2.594 | 0.0196 * | 2.288 | 0.0269 * |

| con.de | 1.704 | 0.1077 | −1.105 | 0.2750 |

| db1.de | 0.228 | 0.8229 | −0.629 | 0.5325 |

| dbk.de | 0.486 | 0.6335 | −0.225 | 0.8230 |

| dhl.de | −1.265 | 0.2240 | −2.256 | 0.0290 * |

| dte.de | −1.931 | 0.0715 | −1.523 | 0.1347 |

| dwni.de | −1.468 | 0.1616 | N/A | N/A |

| eoan.de | 1.458 | 0.1641 | 1.082 | 0.2849 |

| evk.de | 0.802 | 0.4340 | 0.339 | 0.7376 |

| fme.de | 0.824 | 0.4223 | N/A | N/A |

| fntn.de | 1.305 | 0.2104 | N/A | N/A |

| fpe3.de | 0.400 | 0.6948 | N/A | N/A |

| fra.de | −0.896 | 0.3838 | 0.946 | 0.3491 |

| fre.de | 0.701 | 0.4937 | 0.124 | 0.9020 |

| g1a.de | −2.571 | 0.0205 * | 3.200 | 0.0025 * |

| g24.de | 0.297 | 0.7700 | N/A | N/A |

| hei.de | 0.666 | 0.5148 | 1.671 | 0.1018 |

| hen3.de | −0.785 | 0.4437 | −1.791 | 0.0800 |

| hnr1.de | −0.407 | 0.6891 | −1.443 | 0.1560 |

| hot.de | −3.733 | 0.0018 * | −0.856 | 0.3966 |

| ifx.de | 0.547 | 0.5918 | −1.308 | 0.1975 |

| kbx.de | −0.462 | 0.6605 | −1.257 | 0.2556 |

| kgx.de | 0.088 | 0.9309 | 1.417 | 0.1687 |

| leg.de | −0.121 | 0.9050 | 0.439 | 0.6644 |

| lha.de | 0.651 | 0.5245 | −0.642 | 0.5242 |

| lxs.de | −1.170 | 0.2590 | N/A | N/A |

| mbg.de | −0.612 | 0.5493 | 0.482 | 0.6324 |

| mrk.de | −0.654 | 0.5226 | 0.565 | 0.5746 |

| muv2.de | 0.960 | 0.3515 | 0.578 | 0.5664 |

| pah3.de | −4.413 | 0.0004 * | 0.604 | 0.5491 |

| psm.de | 0.424 | 0.6775 | N/A | N/A |

| pum.de | −1.804 | 0.0901 | −2.092 | 0.0421 * |

| qia.de | −3.778 | 0.0016 * | −5.376 | 0.0000 * |

| raa.de | 0.378 | 0.7105 | N/A | N/A |

| sap.de | −0.722 | 0.4806 | −0.046 | 0.9639 |

| sdf.de | 1.613 | 0.1263 | −1.815 | 0.0763 |

| sie.de | 0.641 | 0.5305 | −0.871 | 0.3884 |

| srt.de | −1.970 | 0.0664 | 0.552 | 0.5838 |

| srt3.de | −1.022 | 0.3218 | −0.130 | 0.8972 |

| sy1.de | −1.724 | 0.1039 | N/A | N/A |

| teg.de | −0.177 | 0.8615 | N/A | N/A |

| tka.de | 1.337 | 0.1998 | −1.302 | 0.1997 |

| tlx.de | −1.053 | 0.3079 | −4.126 | 0.0003 * |

| utdi.de | −0.620 | 0.5437 | 0.477 | 0.6356 |

| vna.de | 0.048 | 0.9620 | 0.848 | 0.4046 |

| vow3.de | −0.431 | 0.6725 | 1.530 | 0.1329 |

| wch.de | −0.461 | 0.6510 | 2.468 | 0.0175 * |

| zal.de | −0.373 | 0.7139 | N/A | N/A |

| 1 | https://stoxx.com/index/DAXESGK/ (accessed on 1 May 2025). |

| 2 | https://www.bloomberg.com/professional/solutions/sustainable-finance/#overview (accessed on 1 May 2025). |

References

- 1-DAX 50 ESG (DAXESGK) (DE000A0S3E04). (n.d.). DAX® 50 ESG a new benchmark for German ESG investing. Available online: https://stoxx.com/index/daxesgk/ (accessed on 30 April 2025).

- ArunKumar, K. E., Kalaga, D. V., Kumar, C. M. S., Kawaji, M., & Brenza, T. M. (2022). Comparative analysis of gated recurrent units (GRU), long short-term memory (LSTM) cells, autoregressive integrated moving average (ARIMA), seasonal autoregressive integrated moving average (SARIMA) for forecasting COVID-19 trends. Alexandria Engineering Journal, 61(10), 7585–7603. [Google Scholar] [CrossRef]

- Bruno, G., Goltz, F., & Naly, A. (2025). Does ESG information deliver investment value? A high-dimensional portfolio perspective. SSRN. [Google Scholar] [CrossRef]

- Chung, T. Y., & Latifi, M. (2024). Evaluating the performance of state-of-the-art esg Domain-specific pre-trained large language models in text classification against existing models and traditional machine learning techniques. arXiv, arXiv:2410.00207. [Google Scholar]

- Dahbi, F., Carrasco, I., & Petracci, B. (2024). A systematic literature review on social impact bonds. Finance Research Letters, 62, 105063. [Google Scholar] [CrossRef]

- Elsaraiti, M., & Merabet, A. (2021). A comparative analysis of the ARIMA and LSTM predictive models and their effectiveness for predicting wind speed. Energies, 14(20), 6782. [Google Scholar] [CrossRef]

- European Commission, Directorate-General for Financial Stability, Financial Services and Capital Markets Union. (2025). Commission simplifies rules on sustainability and EU investments, delivering over €6 billion in administrative relief. European Commission, Directorate-General for Financial Stability, Financial Services and Capital Markets Union. [Google Scholar]

- Feng, J., Goodell, J. W., & Shen, D. (2022). ESG rating and stock price crash risk: Evidence from China. Finance Research Letters, 46, 102476. [Google Scholar] [CrossRef]

- Ferjančič, U., Ichev, R., Lončarski, I., Montariol, S., Pelicon, A., Pollak, S., Šuštar, K. S., Toman, A., Valentinčič, A., & Žnidaršič, M. (2024). Textual analysis of corporate sustainability reporting and corporate ESG scores. International Review of Financial Analysis, 96, 103669. [Google Scholar] [CrossRef]

- Fischer, T., & Krauss, C. (2018). Deep learning with long short-term memory networks for financial market predictions. European Journal of Operational Research, 270(2), 654–669. [Google Scholar] [CrossRef]

- Gao, Z., Chen, J., Wang, G., Ren, S., Fang, L., Yinglan, A., & Wang, Q. (2023). A novel multivariate time series prediction of crucial water quality parameters with long short-term memory (LSTM) networks. Journal of Contaminant Hydrology, 259, 104262. [Google Scholar] [CrossRef] [PubMed]

- Ghysels, E., Sinko, A., & Valkanov, R. (2007). MIDAS regressions: Further results and new directions. Econometric Reviews, 26(1), 53–90. [Google Scholar] [CrossRef]

- Gibson Brandon, R., Krueger, P., & Schmidt, P. S. (2021). ESG rating disagreement and stock returns. Financial Analysts Journal, 77(4), 104–127. [Google Scholar] [CrossRef]

- Gu, S., Kelly, B. T., & Xiu, D. (2019). Empirical asset pricing via machine learning. The Review of Financial Studies, 33(5), 2223–2273. [Google Scholar] [CrossRef]

- Hartzmark, S. M., & Sussman, A. B. (2019). Do investors value sustainability? A natural experiment examining ranking and fund flows. The Journal of Finance, 74(6), 2789–2837. [Google Scholar] [CrossRef]

- Hochreiter, S., & Schmidhuber, J. (1997). Long short-term memory. Neural Computation, 9, 1735–1780. [Google Scholar] [CrossRef] [PubMed]

- Hong, H., & Kacperczyk, M. (2009). The price of sin: The effects of social norms on markets. Journal of Financial Economics, 93(1), 15–36. [Google Scholar] [CrossRef]

- Hyndman, R. J., & Athanasopoulos, G. (2018). Forecasting: Principles and practice. OTexts. [Google Scholar]

- Kobiela, D., Krefta, D., Król, W., & Weichbroth, P. (2022). ARIMA vs LSTM on NASDAQ stock exchange data. Procedia Computer Science, 207, 3836–3845. [Google Scholar] [CrossRef]

- Kulal, A., Abhishek, N., Dinesh, S., & Divyashree, M. S. (2023). Impact of environmental, social, and governance (ESG) factors on stock prices and investment performance. Macro Management & Public Policies, 5(2), 14–26. [Google Scholar] [CrossRef]

- Latif, N., Selvam, J. D., Kapse, M., Sharma, V., & Mahajan, V. (2023). Comparative performance of LSTM and ARIMA for the short-term prediction of bitcoin prices. Australasian Accounting, Business and Finance Journal, 17(1), 256–276. [Google Scholar] [CrossRef]

- La Torre, M., Mango, F., Cafaro, A., & Leo, S. (2020). Does the ESG index affect stock return? Evidence from the Eurostoxx50. Sustainability, 12(16), 6387. [Google Scholar] [CrossRef]

- Lundberg, S. M., & Lee, S.-I. (2017). A unified approach to interpreting model predictions. In Proceedings of the 31st International Conference on Neural Information Processing Systems, NIPS’17 (pp. 4768–4777). Curran Associates Inc. [Google Scholar]

- Luo, W., Tian, Z., Fang, X., & Deng, M. (2024). Can good ESG performance reduce stock price crash risk? Evidence from Chinese listed companies. Corporate Social Responsibility and Environmental Management, 31(3), 1469–1492. [Google Scholar] [CrossRef]

- Maltais, A., & Nykvist, B. (n.d.). Understanding the role of green bonds in advancing sustainability. Journal of Sustainable Finance & Investment, 1–20. [Google Scholar] [CrossRef]

- Mechrgui, S., & Theiri, S. (2024). The effect of environmental, social, and governance (ESG) performance on the volatility of stock price returns: The moderating role of tax payment. Journal of Financial Reporting and Accounting. ahead-of-print. [Google Scholar] [CrossRef]

- Morea, D., Mango, F., Cardi, M., Paccione, C., & Bittucci, L. (2022). Circular economy impact analysis on stock performances: An empirical comparison with the Euro Stoxx 50® ESG index. Sustainability, 14(2), 843. [Google Scholar] [CrossRef]

- Ning, Y., Kazemi, H., & Tahmasebi, P. (2022). A comparative machine learning study for time series oil production forecasting: ARIMA, LSTM, and Prophet. Computers & Geosciences, 164, 105126. [Google Scholar] [CrossRef]

- Rosinus, M. (2025). Comparison of classical ARIMA forecasting methods to the machine learning LSTM method: A case study on DAX 50 ESG index. ACTA VŠFS, 19(1). [Google Scholar] [CrossRef]

- Serafeim, G., & Yoon, A. (2023). Stock price reactions to ESG news: The role of ESG ratings and disagreement. Review of Accounting Studies, 28(3), 1500–1530. [Google Scholar] [CrossRef]

- Siami-Namini, S., & Namin, A. S. (2018). Forecasting economics and financial time series: ARIMA vs. LSTM. arXiv, arXiv:1803.06386. [Google Scholar] [CrossRef]

- Teja, K. R., & Liu, C.-M. (2024). ESG investing: A statistically valid approach to data-driven decision making and the impact of ESG factors on stock returns and risk. IEEE Access, 12, 69434–69444. [Google Scholar] [CrossRef]

- Verma, S. (2021). Forecasting volatility of crude oil futures using a GARCH–RNN hybrid approach. Intelligent Systems in Accounting, Finance and Management, 28(2), 130–142. [Google Scholar] [CrossRef]

- Zhang, R., Song, H., Chen, Q., Wang, Y., Wang, S., & Li, Y. (2022). Comparison of ARIMA and LSTM for prediction of hemorrhagic fever at different time scales in China. PLoS ONE, 17(1), e0262009. [Google Scholar] [CrossRef] [PubMed]

| Mean | Median | Std. Dev. | Skewness | Kurtosis | Min | Max | |

|---|---|---|---|---|---|---|---|

| monthly_return | 0.0069 | 0.0073 | 0.0875 | 0.0154 | 2.2330 | −0.5025 | 0.5338 |

| esg_score | 3.7955 | 3.8700 | 1.2457 | −0.0546 | −0.2165 | 0.7700 | 7.0600 |

| esg_environmental_score | 3.3577 | 3.3800 | 2.1724 | 0.1912 | −0.5480 | 0.0000 | 9.1000 |

| esg_social_score | 3.4126 | 3.0300 | 1.9890 | 0.8769 | 0.3297 | 0.1800 | 9.7500 |

| esg_governance_score | 5.5343 | 5.6800 | 1.1658 | −0.3083 | −0.6242 | 2.0400 | 8.1200 |

| esg_disclosure_score | 51.4454 | 52.7311 | 13.6460 | −0.3311 | −0.1590 | 14.5559 | 86.6311 |

| Mean | Median | Std. Dev. | Skewness | Kurtosis | Min | Max | |

|---|---|---|---|---|---|---|---|

| monthly_return | 0.0086 | 0.0083 | 0.0932 | 0.3007 | 8.5424 | −0.5187 | 1.3161 |

| esg_disclosure_score | 43.5219 | 44.6333 | 16.5364 | −0.1769 | −0.6415 | 5.7037 | 86.6311 |

| Parameter | Value/Choice | Justification |

|---|---|---|

| LSTM Layers | 2 | Provides sufficient capacity to learn complex patterns without excessive risk of overfitting. |

| Units per Layer | 50 | A standard choice offering a good balance between representational power and computational cost. |

| Activation Function | ReLU | Widely used for its efficiency and effectiveness in preventing vanishing gradients in hidden layers. |

| Dropout Rate | 0.2 | A regularization technique to prevent overfitting by randomly dropping 20% of units during training. |

| Output Layer | Dense (1 unit) | A single output neuron to produce the continuous value forecast for the next month’s return. |

| Optimizer | Adam | An efficient and widely adopted optimization algorithm that adapts the learning rate during training. |

| Loss Function | Mean Squared Error | Standard loss function for regression tasks, penalizing larger errors more heavily. |

| Batch Size | 32 | A common batch size that provides a stable gradient estimate during training. |

| Epochs | 100 | An initial upper limit for training, used in conjunction with early stopping to prevent overfitting. |

| Metric | Model | Mean | Median | Std. Dev. | Paired Statistical Tests Wilcoxon (p-Values) |

|---|---|---|---|---|---|

| RMSE | BASELINE | 0.093267 | 0.08972 | 0.03307 | 0.0073 |

| RMSE | ESG | 0.097681 | 0.09788 | 0.03327 | |

| MAE | BASELINE | 0.075014 | 0.07026 | 0.02581 | 0.0008 |

| MAE | ESG | 0.079447 | 0.07949 | 0.02688 | |

| MDA | BASELINE | 52.91116 | 52.9412 | 11.4258 | 0.2921 |

| MDA | ESG | 51.86074 | 52.9412 | 10.8065 |

| Metric | Model | Mean | Median | Std. Dev. | Paired Statistical Tests Wilcoxon (p-Values) |

|---|---|---|---|---|---|

| RMSE | BASELINE | 0.10144 | 0.09867 | 0.03332 | 0.9911 |

| RMSE | ESG | 0.10283 | 0.10057 | 0.03204 | |

| MAE | BASELINE | 0.07861 | 0.07409 | 0.02461 | 0.9022 |

| MAE | ESG | 0.07994 | 0.07812 | 0.02428 | |

| MDA | BASELINE | 48.9497 | 50.0000 | 6.37896 | 0.5969 |

| MDA | ESG | 49.9417 | 50.0000 | 6.31231 |

| Feature | Median SHAP Value |

|---|---|

| esg_governance_score | 0.000725 |

| esg_social_score | 0.000722 |

| esg_environmental_score | 0.000640 |

| monthly_return | 0.000619 |

| esg_disclosure_score | 0.000601 |

| esg_score | 0.000537 |

| Feature | Median SHAP Value |

|---|---|

| esg_disclosure_score | 0.001919 |

| monthly_return | 0.001082 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rosinus, M.; Lansky, J. Predictive Power of ESG Factors for DAX ESG 50 Index Forecasting Using Multivariate LSTM. Int. J. Financial Stud. 2025, 13, 167. https://doi.org/10.3390/ijfs13030167

Rosinus M, Lansky J. Predictive Power of ESG Factors for DAX ESG 50 Index Forecasting Using Multivariate LSTM. International Journal of Financial Studies. 2025; 13(3):167. https://doi.org/10.3390/ijfs13030167

Chicago/Turabian StyleRosinus, Manuel, and Jan Lansky. 2025. "Predictive Power of ESG Factors for DAX ESG 50 Index Forecasting Using Multivariate LSTM" International Journal of Financial Studies 13, no. 3: 167. https://doi.org/10.3390/ijfs13030167

APA StyleRosinus, M., & Lansky, J. (2025). Predictive Power of ESG Factors for DAX ESG 50 Index Forecasting Using Multivariate LSTM. International Journal of Financial Studies, 13(3), 167. https://doi.org/10.3390/ijfs13030167