Abstract

This study identifies a nonlinear relationship among liquidity, tracking error, and risk-adjusted performance in JETFs. Collecting daily data for 1077 JETFs from January 2008 to April 2022, we find a concave association, whereby both highly liquid and highly illiquid JETFs exhibit lower risk-adjusted returns and higher tracking errors. Employing quantile regression, we further show that smaller, less liquid JETFs tend to deliver superior risk-adjusted performance. When comparing across listing venues—Japan, the U.S., Ireland, and Luxembourg—we find that the impact of liquidity on performance is most pronounced in the Japanese market, which also shows the highest average tracking error. In contrast, U.S.-listed JETFs offer the lowest tracking error. These results suggest that investors may benefit from choosing smaller JETFs listed in Japan.

1. Introduction

The origin of Japanese Exchange-Traded Funds (JETFs) can be traced back to the early 2000s, coinciding with the global rise in popularity of ETFs. While the concept of JETFs can be linked to developments as early as the mid-1990s, their widespread adoption in Japan gained momentum in the subsequent decade. A growing number of economists have directed their attention to ETFs, recognizing them as one of the most significant financial innovations in recent decades (Lettau & Madhavan, 2018). Many existing studies have examined ETFs in the context of U.S., European, and selected emerging markets. However, relatively fewer studies focus on Asian markets—particularly Japan, which hosts one of the most influential financial centers in the world. Unlike other markets, Japan’s financial system plays a vital role in the global economy. This is not only because Japan is a highly developed country, but also due to the distinctive characteristics of its financial markets, particularly in the ETF sector. One notable feature of JETFs is their heavy concentration in large-cap stocks. Many JETFs are predominantly weighted toward large-cap stocks, well-established companies, which tend to offer greater stability compared to smaller firms. In addition, JETFs are typically characterized by high liquidity, allowing investors to buy and sell them easily and efficiently. This feature is particularly important for investors aiming to capitalize on short-term market movements. It is also highly relevant to this study, which focuses on the size, liquidity, and arbitrage mechanisms of JETFs. According to Zawadzki (2020), discrepancies in trading hours across countries contribute to higher tracking errors in the ETF market. Specifically, there is nearly a 12 h time difference between the trading sessions of the Japanese and U.S. ETF markets. Given that the U.S. often plays a leading role in global financial markets and that many U.S.-listed ETFs track Japanese assets, fluctuations in the U.S. equity market can spill over into the Japanese market. This interdependence may result in greater tracking errors for JETFs. According to the study of Bloch et al. (1993), which found significant differences in the average return and standard deviation of stocks between Japan and U.S., it is reasonable to conjecture that ETF tracking error might be higher in the Japanese markets. This conjecture is supported by data and empirical works later, and a focused investigation into JETFs is a valuable and noteworthy contribution to the economics and finance areas.

Our main objective in this study is to investigate the existence of an optimal liquidity structure that simultaneously maximizes Jensen’s alpha and minimizes tracking error. Prior research has primarily focused on three main areas. First, Charupat and Miu (2013) examine the effectiveness of ETFs by analyzing the deviation between market prices and net asset values (NAV). Numerous studies construct tracking error measures to assess the effectiveness of ETFs and to determine how well an ETF replicates the performance of its underlying index. Furthermore, the capital asset pricing model (CAPM) offers beta to measure whether an ETF is well-suited for simulating the movement of indexes. Second, the impact of ETFs on the broader financial market has been a growing area of interest. There is empirical evidence (e.g., Ben-David, Franzoni, & Moussawi) indicating a positive correlation between ETF arbitrage activity and ETF price volatility. These arbitrage activities, in turn, influence the volatility of the underlying stocks, suggesting that ETFs may serve as a new source of systemic risk in financial markets. Bhattacharya and O’Hara (2018) finds that market makers may incorporate not only value-relevant information but also noise or unrelated signals when engaging in ETF-related trading. This leads to propagation of shocks unrelated to fundamentals and causes market instability. In addition, if market makers are unable to synchronize prices instantaneously, inter-market learning may induce herding behavior. Ben-David et al. (2018) and Krause et al. (2014) provide evidence that ETFs increase the volatility of their underlying assets. Third, a growing body of research investigates the relationship between ETFs and the financial instruments included in their benchmark indices—such as constituent shares and futures contracts. These studies often examine whether the introduction of an ETF alters the trading characteristics of the underlying assets, including changes in trading volume, bid–ask spreads, and liquidity (Charupat & Miu, 2013). A number of studies concentrate on determining the effect of ETFs on trading volume and exchange rate spreads of related financial instruments (Qadan & Yagil, 2012).

Our motivation stems from several key findings in the existing literature. Bae and Kim (2020) document a negative relationship between ETF liquidity and tracking error using a two-stage OLS regression model with a threshold dummy variable. More importantly, their analysis suggests a nonlinear relationship between liquidity and tracking error in U.S. ETF markets. Motivated by this, we aim to investigate if there is a similar nonlinear relationship in the Japanese ETF market. Shin and Soydemir (2010) states that arbitrageurs intervene with either long or short transactions when an asset departs from its equilibrium price until the premium or discount is eliminated. Based on this study, we expect a positive relationship between the bid–ask spread and the size of ETF premiums or discounts. That is, lower liquidity may reduce the frequency of arbitrage activities, allowing larger deviations from net asset value (NAV) to persist. Ben-David et al. (2018) also emphasizes that ETF mispricing may serve as a proxy for insufficient arbitrage activity. In other words, higher tracking errors could result from infrequent arbitrage, which may stem from high transaction costs, limited liquidity, or the absence of profitable arbitrage opportunities. The study of Amihud (2018) finds that the relationship between illiquidity and stock returns is nonlinear. Specifically, higher levels of illiquidity are associated with lower expected returns, while the illiquidity premium is time-varying and increases during periods of heightened illiquidity. Moreover, Amihud (2018) explores the benefits of incorporating illiquidity into investment strategies and finds that liquidity-based strategies can generate significant risk-adjusted returns—particularly for small-cap and value stocks. Since our study focuses on equity-based JETFs, whose underlying assets are predominantly stocks, we hypothesize that a similar nonlinear relationship may also exist between liquidity, tracking error, and performance in the Japanese ETF market. To further explore these three proxies, we first construct cross sections and panels with time-series regression models to check the quadratic relationships between them. Next, we consider the effect of size of JETFs on risk-adjusted performance and tracking error. We then construct the optimal JETF strategy, which maximizes risk-adjusted performance and minimizes tracking errors. Lastly, we check whether international markets provide similar results.

Previously, there have been some studies that demonstrate the quadratic regression model. For example, Amihud and Goyenko (2013) regress-investigate the relation between manager’s selectivity and fund performance. de Andres and Vallelado (2008) state that there is an optimal structure (inverted-U-shape relationship) between bank performance and board size. The regression model can be utilized to find optimal choices or improve investment strategies. Following this notion, we intend to find optimal JETFs that can maximize risk-adjusted performance. To achieve this, we first find optimal JETFs that maximize risk-adjusted performance or minimize tracking error by regressing the quadratic regression model and then minimize the “optimal” portfolio risk to determine the weights of each JETF in the portfolio, then compare our strategy to other strategies (e.g., equally and value-weighted portfolios). Next, our study is also inspired by small stock anomalies. Our empirical findings show that small JETFs have higher tracking error and risk-adjusted performance than medium and large JETFs. To answer how the size of JETFs affects risk-adjusted performance and tracking error is our second objective; we are interested to know whether a similar phenomenon occurs in JETFs. The research direction focuses on how to explain the small firm stocks outperforming large firm stocks.

Finally, we divide 1077 JETF funds into four main markets, Ireland (322), Japan (308), Luxembourg (249), and U.S. (108), to check whether the relation has changed or not and how the closeness of the relation changes in different markets.

2. Literature Review

There are some studies that involve the research of JETFs. Maeda et al. (2022) state that ETF purchase programs increase the supply of stocks. According to Katagiri et al. (2025), the purchase of JETFs by the Bank of Japan (BOJ) has a positive effect on stock prices and reduces the market beta and coskewness of Japanese stocks, while also decreasing risk premia. They also show that the announcement of a future decrease (increase) in the amount of BOJ purchases can be promoted to decrease (increase) stock price, and the effect is evident once BOJ stops the program. This connects JETFs to the equity market in the U.S., since Japan’s stock market has been dominated by foreign investors, and their presence has increased over the past 5 years. Based on this point, constructing bridges between JETFs and equity market in the U.S. is considerable. We estimate the risk-adjusted performance of JETFs by regressing the excess return of JETFs on Japanese Fama–French five factors.

Gastineau (2001) discusses the low expense ratios of ETFs and how ETFs manage to avoid significant capital gains contributions. Agapova (2011) states conventional index funds and ETFs are possible substitutes. Clientele effects and tax clientele may explain the coexistence of conventional index funds and ETFs. Gastineau (2004) examines the performance of index ETFs relative to their respective benchmarks and conventional index funds by analyzing the operating efficiency of the funds and then showing that conventional index funds outperform their benchmarks. According to Huang and Guedj (2009), conventional funds are beneficial to risk-averse investors due to the partial insurance against future liquidity shocks embedded in the conventional index fund structure. Shin and Soydemir (2010) find that, based on Jensen’s alpha, risk-adjusted returns are significantly inferior to benchmark returns for all ETFs with two exceptions at conventional significance levels, revealing that passive investment strategy does not outperform market returns. Transaction costs such as fees are found to be the main cause of this poor performance. Thus, replicating a market portfolio yields better returns than solely investing in mutual funds.

Based on different periods, Alexander and Barbosa (2008) analyzed the hedging problem, which arises in ETF creation/redemption when the underlying base of the ETF shares involves illiquid stocks with relatively high transaction costs. They found that efficient hedging is important to offset long and short positions on a market maker’s accounts, especially imbalances in net creation or redemption demands around the time of dividend payments.

Combining the features of closed-end funds and open-end funds, ETFs not only allow the creation and redemption of shares in the fund but also create a much greater opportunity for effective arbitrage. As a result, this gives price discovery to ETFs. In addition, the advantage of low transactions gives more liquidity to ETFs, which provide conditions for ETFs’ arbitrage.

From volatility and diversification perspectives, the massive scale of ETFs accounts for about 35% of the volume in U.S. equity markets. Ben-David et al. (2018) find a long–short portfolio of the top minus the bottom quintile of stocks by ETF ownership earns a return premium of up to 56 bps per month by regressing Fama–French seven-factor model. In addition, they describe the effect of ETFs on volatility; it is weaker for stocks with higher limits of arbitrage and is stronger during times of more intense arbitrageur trading activity, which provides important indirect evidence for positive correlation between the arbitrage of ETFs and stock volatility. Ben-David et al. (2018) and Naka and Noman (2017) conclude that ETFs are not suitable for international diversification. Also, the magnitude of time-series variation in estimated betas is substantial for both U.S. and foreign betas, indicating that the magnitude of diversification benefits does not remain the same over time. Agarwal et al. (2018) indicate that ETFs reduce investors’ ability to diversify liquidity risk. Malamud (2015) shows that listing new ETFs may lead to a reduction in volatility and co-movement for some assets and an increase in liquidity in the underlying securities. These results imply that ETFs can help investors diversify risks. Adjei (2009) show that the performance of ETFs and the S&P index have no significant differences, which is weak evidence of performance persistence for the 6- and 12-month horizons.

Research Motivation

Bae and Kim (2020) find the estimates of the second-stage regressions are larger than those of the OLS estimates. These results may occur because the relations between ETF liquidity and tracking error are nonlinear. In this study, we validate the results using cross-sectional and panel-regression analysis. According to the arbitrage pricing model, arbitragers will enter into short or long transactions until premiums or discounts disappear if an asset deviates from its equilibrium price. Higher transaction costs may interrupt arbitrage procedures by reducing incentives to arbitrage. Following this notion, we expect a positive relationship between bid–ask spread and the size of ETF premiums or discounts (Shin & Soydemir, 2010). Furthermore, higher liquidity may cause arbitrage to disappear later because of high frequent trading. Brown and Yang (2011) examine the relationship between liquidity, arbitrage activities, and short sales using data from the London Stock Exchange (LSE). They conclude that more liquid stocks are more likely to experience arbitrage activities, and that short sales play an important role in arbitrage activities. Furthermore, more liquid assets are generally more widely traded, which can lead to greater efficiency in pricing and a lower bid–ask spread. This could make it easier for investors to buy and sell these assets without significant transaction costs and can result in more accurate pricing and better returns. Therefore, the relation between liquidity and risk-adjusted performance would be positive (Khanniche et al., 2014; Doukas & McKnight, 2005; Lettau & Ludvigson, 2019).

A distinctive feature of ETFs is the creation and redemption mechanism, which is executed exclusively by Authorized Participants (APs). APs are typically large institutional investors or broker–dealers who possess the right to exchange baskets of underlying securities for ETF shares (creation) or to return ETF shares in exchange for the underlying basket (redemption). This mechanism is central to maintaining the alignment between ETF prices and their net asset values (NAVs). When ETF trades at a premium to NAV, APs can create new shares by delivering the underlying securities and sell them in the market, thereby exerting downward pressure on the ETF price. Conversely, when an ETF trades at a discount, APs can redeem shares in exchange for the underlying assets, reducing supply and pushing the ETF price upward toward NAV.

The effectiveness of this arbitrage process depends critically on market liquidity and transaction costs. When liquidity is low—characterized by wide bid–ask spreads or low turnover—APs face high costs in assembling or liquidating baskets of securities, which discourages arbitrage and allows deviations between ETF prices and NAV to persist. In contrast, in highly liquid markets, AP activity is frequent, but the abundance of speculative trading may introduce noise, which can also impair price discovery and lead to larger tracking errors. Thus, the incentives of APs generate a nonlinear relation between liquidity and tracking error: both insufficient and excessive liquidity can undermine the arbitrage mechanism, while an intermediate level of liquidity promotes the closest alignment between ETF prices and NAV.

Based on the studies above, we conjecture that there is a quadratic nonlinear relation between liquidity and Jensen’s alpha, and, in a certain liquidity point, it can maximize Jensen’s alpha. In this study, we discuss four liquidity measures to strengthen our conclusion.

3. Data Description and Variables Constructed

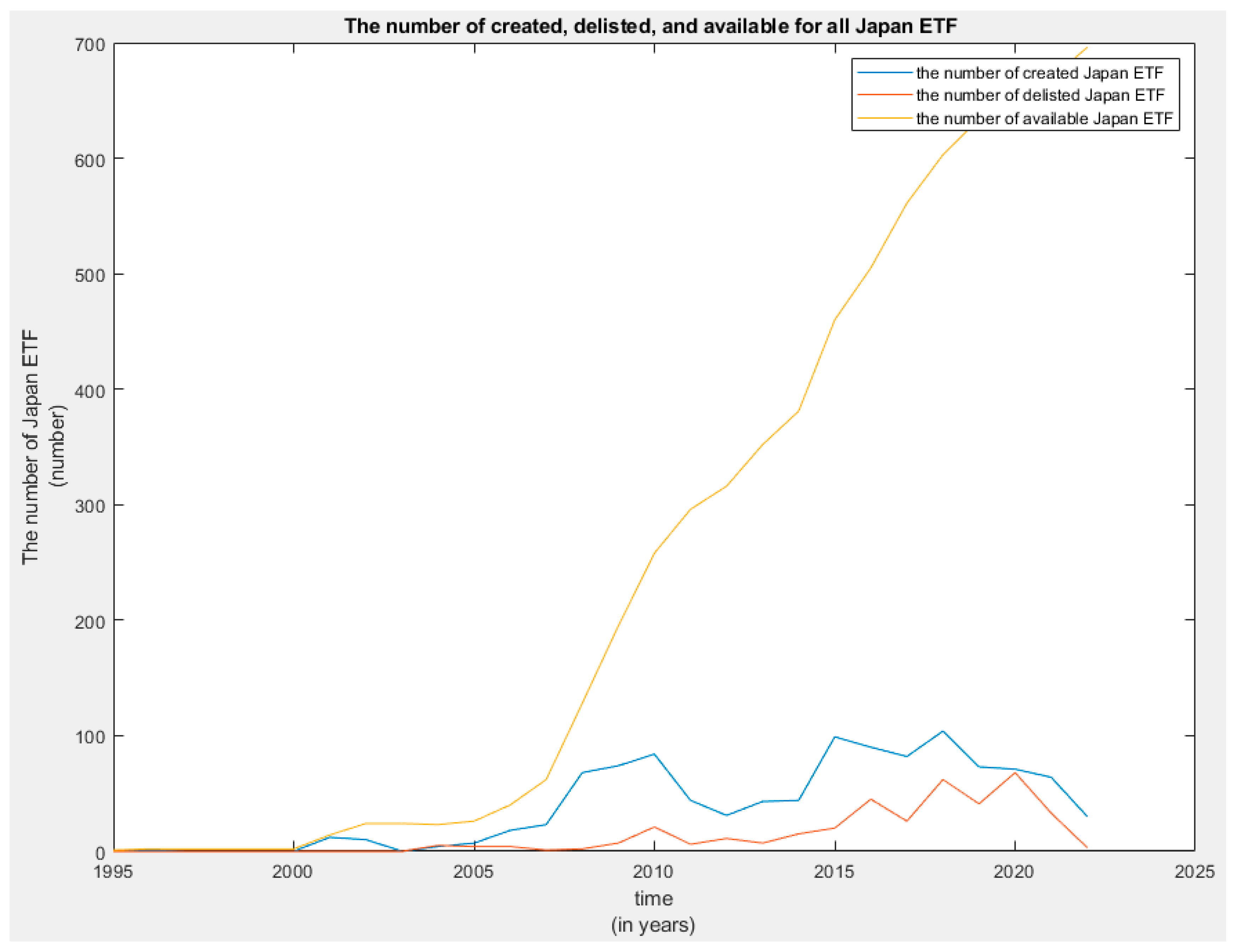

Our dataset consists of 1077 JETFs obtained from Datastream, spanning the period from 1995 to 2022 at a daily frequency. It includes all Japan-related ETFs ever listed and traded globally—both active and delisted—thereby substantially mitigating survivorship bias. Table 1 presents the annual number of JETFs created, delisted, and outstanding. By tracking all fund issuances and terminations, the dataset offers a comprehensive view of the market and avoids upward biases associated with survivor-only samples.

Table 1.

The number of created, delisted, and available JETFs.

For empirical analysis, we restrict the sample period to January 2008 through April 2022. This decision is driven by the substantial number of missing observations prior to 2008 and a notable expansion of the ETF universe during this period, with the number of funds increasing from 62 to 128. Beginning in 2008, the sample size becomes sufficiently large to support robust statistical inference, thereby justifying our focus on this interval.

We further refine the sample by excluding ETFs with insufficient trading data (e.g., missing daily price series) over the analysis window. To mitigate the influence of extreme values, all continuous variables are winsorized at the 5th and 95th percentiles.

Finally, we classify the ETFs by their primary listing venue into four major jurisdictions: Ireland (322), Japan (308), Luxembourg (249), and the United States (108). Markets with fewer than ten listings are omitted from our analysis.

Figure 1 shows the annual number of JETFs created, delisted, and available globally. Notably, the number of tradable JETFs increased substantially after 2007, reflecting the rapid expansion of the ETF market. However, both the creation and delisting of JETFs appear to decline after 2020, possibly indicating a market saturation effect or a shift in investor preferences. To better visualize these developments, Figure 1 presents the annual time series for each category.

Figure 1.

The number of JETFs created, delisted, and available around the world. Obviously, it experienced a very significant increase for tradable JETFs after 2007. The number of both created and delisted seemly decrease after 2020.

Table 1 reports the annual number of JETFs initiated, delisted, and tradable at year-end from 2008 to 2022, based on daily-frequency data. The universe of tradable ETFs displays a notable upward trend beginning in 2008, coinciding with the broader expansion of the global ETF market. ETF launches (first column) exhibit steady growth from 2005 onward, while delisting forms a distinct hump between 2016 and 2021, suggesting a period of increased market turnover or restructuring.

Following Bae and Kim (2020), we compute both ETF returns and NAV returns as the first differences of the natural logarithms of the ETF’s closing price and its net asset value (NAV) per share. All data are obtained from Datastream. ETF turnover—defined as the average daily trading volume divided by the number of shares outstanding—serves as our primary proxy for liquidity and is also sourced from Datastream.

Market value is calculated as the product of the ETF’s closing price and the number of ordinary shares outstanding, providing a straightforward measure of fund size. Additionally, bid and ask prices are used to construct the bid–ask spread, which serves as an alternative liquidity indicator.

Table 2 reports cross-sectional descriptive statistics for the sample. We begin with a panel of 3738 daily observations across 1077 Japan-focused ETFs. For each ETF, we compute time-series averages over the period from January 2008 to April 2022, resulting in 1077 fund-level means. The summary statistics presented in Table 2 are derived from these cross-sectional averages. All monetary variables are denominated in local currency. Market value and assets under management (AUM) are reported in millions, while turnover (trading volume) and shares outstanding are expressed in thousands. Natural logarithmic transformations are applied to ETF returns, NAV returns, and the growth rate of shares outstanding; all other variables are presented in their original scales. ETF excess return is defined as the log return net of the risk-free rate. Finally, one-sample t-tests are conducted to evaluate whether the sample means differ significantly from zero at the 5% significance level.

Table 2.

Descriptive statistics.

3.1. Bid–Ask Spread—The Proxy of Transaction Costs

Following Lesmond (2005), who identifies the bid–ask spread as the most effective liquidity metric in equity markets, and given the analogous trading mechanisms of ETFs and stocks, we adopt the bid–ask spread to proxy JETF liquidity. Daily bid and ask prices were retrieved from Datastream, and all series—including the bid–ask spread—were winsorized at the 5% level. The specification of our bid–ask spread model is presented below:

where bid price refers to the highest price a buyer will pay to buy a specified number of shares of a stock at any given time, ask price refers to the lowest price at which a seller will sell the stock, the data period involved is from January 2008 to April 2022 on a daily basis.

3.2. Amihud Illliquidity

Lou and Shu (2017) find that the Amihud illiquidity measure is a significant predictor of future returns, even after controlling for other well-known measures of liquidity. Amihud (2018) shows that the relationship between illiquidity and stock returns is nonlinear, with higher levels of illiquidity leading to lower expected returns, and also find that the illiquidity premium is time-varying. These results make us believe Amihud illiquidity is an appropriate choice for our analysis.

Amihud (2002) introduces a price-impact measure, defined as the absolute value of stock returns scaled by dollar volume in assessing the relation between liquidity and ex ante returns. The Amihud illiquidity measure is defined by the following:

where T is number of days (up to 3738 days), is the dollar trading volume in day t for Japan ETF firm, i, and is the return on day t for ETF firm i. is Amihud illiquidity mearue. All data are daily frequency and winsorized at the five-percent level. The dollar trading volume is from Datastream, and the ETF return is based on the log difference of the ETF closing price.

3.3. Turnover Liquidity Measure

One advantage of turnover as a liquidity measure is that it provides a clear and easily understandable indication of how quickly JETFs are bought or sold, although the measure is relatively weaker than other measures.

This measure can be expressed as the following:

The volume and shares outstanding can be obtained from Datastream. The N refers to observations from 1 January 2008 to 30 April 2022. We also winsorize our turnover data.

3.4. New Revised Roll Liquidity Measure

We introduce a new Roll liquidity measure created by Christopoulos (2021). The basic idea is taking the absolute value of Roll’s measure. Christopoulos (2021) shows that the Absolute Roll Measure resolves an issue in the literature and provides a measure applicable to all traded securities that are limited to closing price information. He explains that the existing adaptations in the literature to Roll (1984) that are restricted to closing prices (and no other data) result in either negative bid–ask spreads or the omission of large amounts of observations, as observed in several studies. His formula is shown by the following:

Table 3 reports the descriptive statistics of four liquidity measures we mentioned above. Except for the absolute value of the Roll liquidity measure, the other three liquidity measures display positive (right) skewness. In addition, the absolute value of the Roll liquidity measure is closer to the normal distribution. Overall, the JETF liquidity seems to have upward risk.

Table 3.

The descriptive statistic of 4 liquidity measures.

4. Empirical Analysis

4.1. The Relation Between Tracking Error and Liquidity

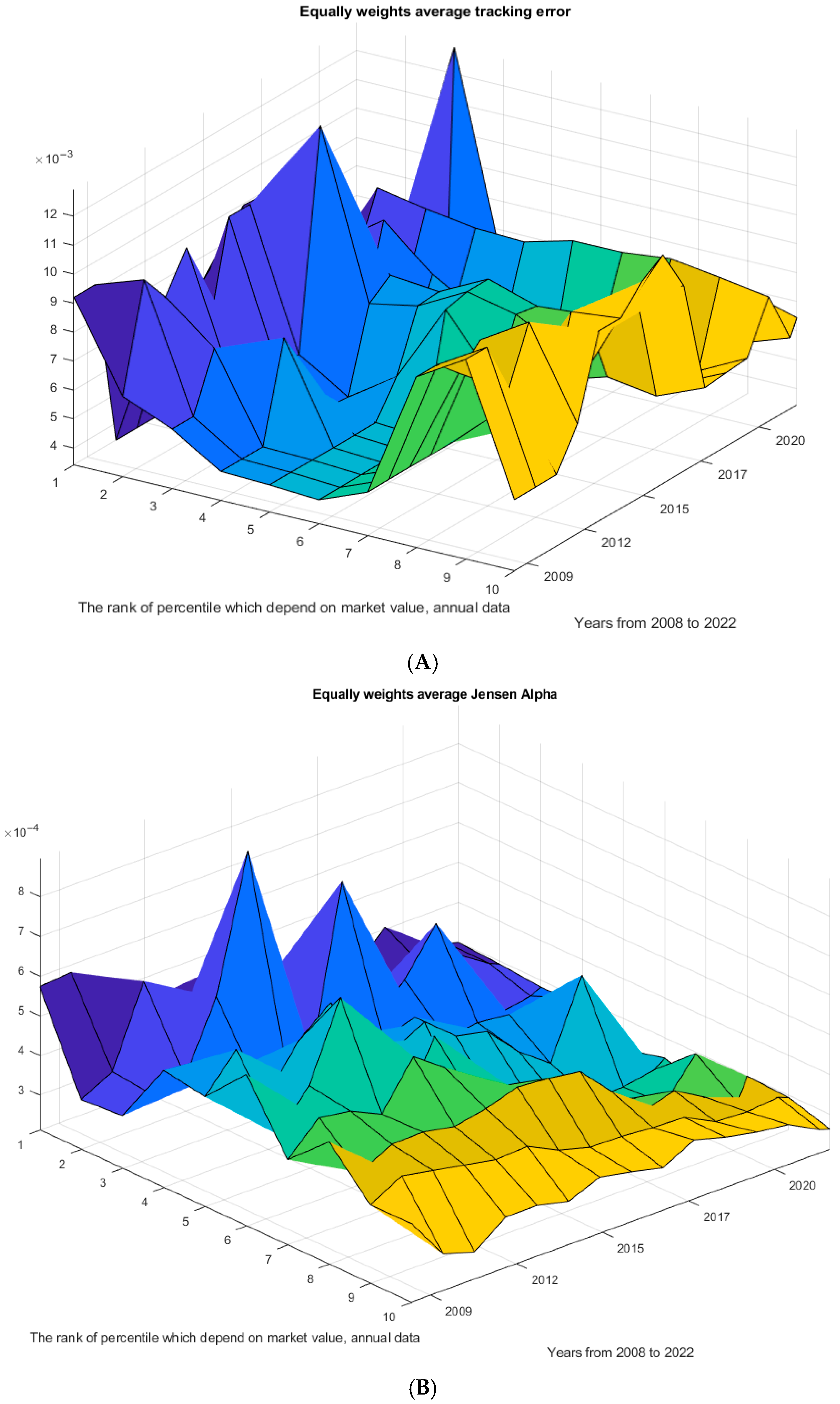

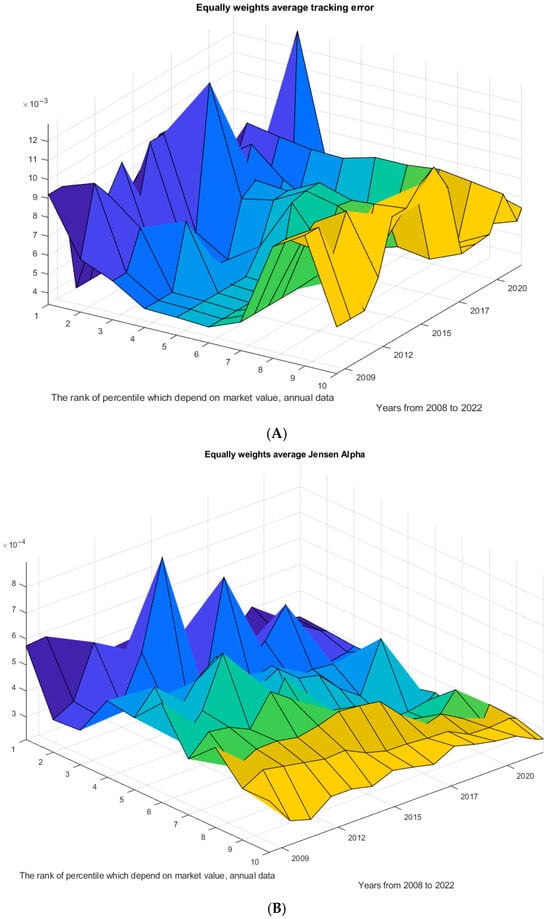

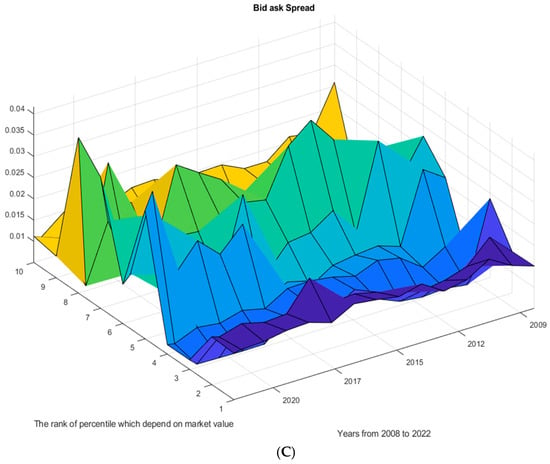

Figure 2A shows equally weighted tracking errors (TE(1)) based on firm level from the 10th percentile to the 90th percentile based on JETF market value. We firstly calculate average daily tracking error for each JETF from 1 January 2008 to 30 April 2022. Then, we divide our 1077 JETF samples into the 10th, 20th, 30th, 40th, 50th, 60th, 70th, 80th, and 90th percentile based on their market value. For example, 10th percentile means the JETFs whose market values are the lowest 10 percentage and the rank is 1. This figure describes equally weighted tracking errors from different percentile ranks; all data is winsorized at the 5-percent level. Figure 2A suggests that among the 1077 JETFs, those with the largest and smallest sizes exhibit significantly higher tracking errors, whereas mid-sized JETFs display the lowest tracking errors.

Figure 2.

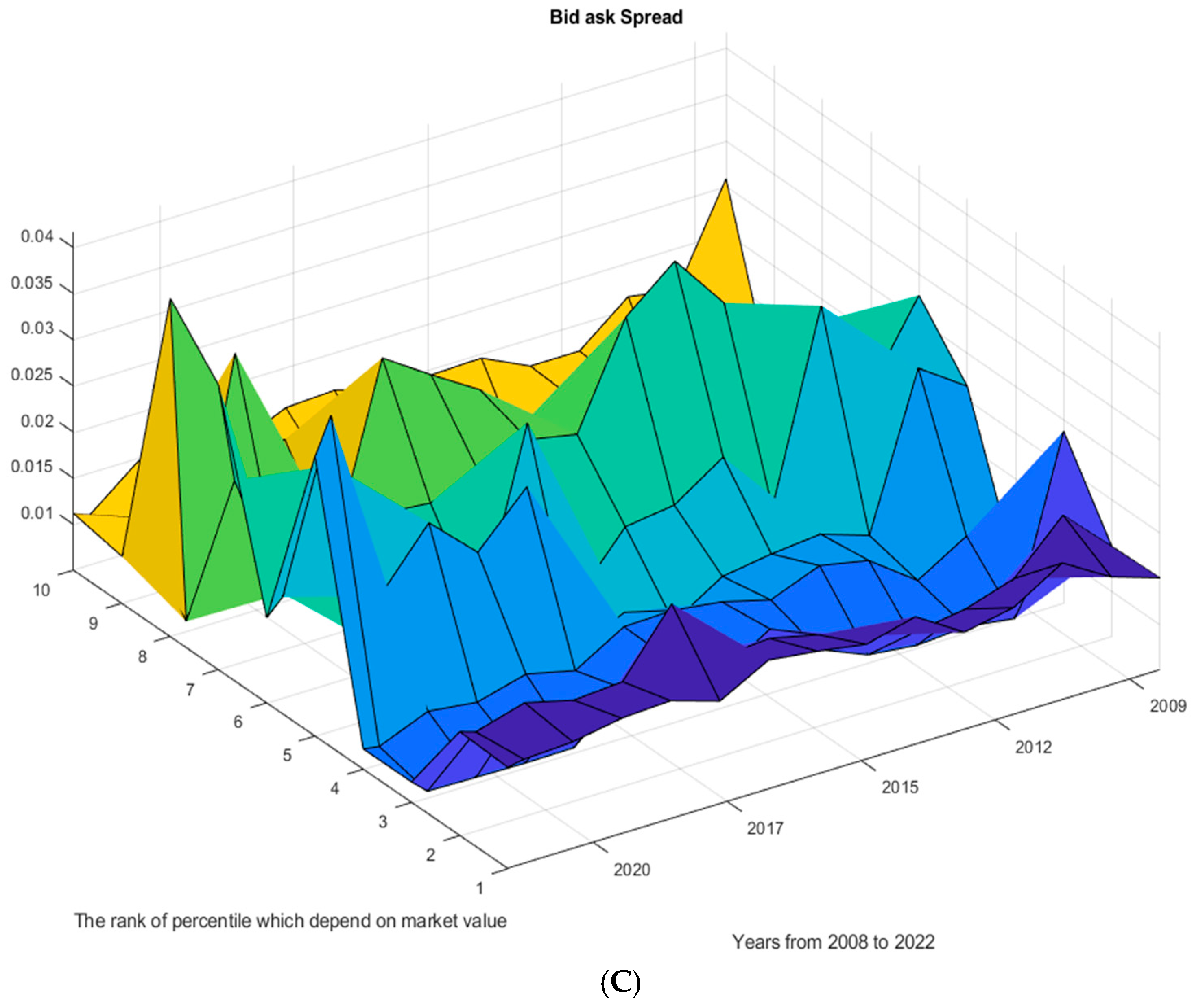

(A) shows equally weighted tracking errors (TE(1)) based on firm level from the 10 percentile to the 90 percentile based on JETFs market value. We firstly calculate average daily tracking error for each JETF from 1 January 2008 to 30 April 2022. Then, we divide our 1077 JETFs samples into the 10th, 20th, 30th, 40th, 50th, 60th, 70th, 80th, and 90th percentile based on their market value. For example, 10th percentile means the JETFs whose market values are the lowest 10 percentage and the rank is 1. This figure describes equally weighted tracking errors from different percentile ranks. All data is winsorized at the 5-percent level. (B) shows value-weighted tracking errors (TE(1)) based on firm level from 10 percentile to 90 percentile based on JETFs market value. We firstly calculate the average daily Jensen’s alpha (risk-adjusted returns) for each JETF from 1 January 2008 to 30 April 2022. Then, we divide our 1077 JETFs samples into the 10th, 20th, 30th, 40th, 50th, 60th, 70th, 80th, and 90th percentile based on their market value. For example, 10th percentile means the JETFs whose market values are the lowest 10 percentage and the rank is 1. This figure describes equally weighted tracking errors from different percentile ranks. All data is winsorized at the 5-percent level. (C) Annual time series for cross-sectional average bid–ask spread according to different ranks of market value. This figure illustrates historical time series of cross-sectional average bid–ask spread and the rank of market value from 2008 to 2022.

Figure 2B shows value-weighted tracking errors (TE(1)) based on firm levels from the 10th percentile to the 90th percentile based on JETF market value. We firstly calculate the average daily Jensen’s alpha (risk-adjusted returns) for each JETF from 1 January 2008 to 30 April 2022. Then, we divide our 1077 JETF samples into the 10th, 20th, 30th, 40th, 50th, 60th, 70th, 80th, and 90th percentile based on their market value. For example, 10th percentile means the JETFs whose market values are the lowest 10 percentage and the rank is 1. This figure describes equally weighted tracking errors from different percentile ranks. All data is winsorized at the 5-percent level. Figure 2B indicates that as the size of JETFs increases, the risk-adjusted return (measured by Jensen’s alpha) generally declines, suggesting that larger JETFs tend to offer lower returns to investors. This pattern is consistent with the characteristics of derivative investment products that are linked to equity-based, risky assets.

Figure 2C explores the relationship between liquidity and the size of JETFs. The figure shows that ETFs falling between the 40th and 90th percentiles in size exhibit lower liquidity—as proxied by bid–ask spreads—suggesting that mid-to-upper-sized JETFs tend to have the worst liquidity. In contrast, the largest and below-median-sized JETFs demonstrate relatively higher liquidity. Taken together, the findings from Figure 2A–C suggest the presence of a nonlinear relationship among tracking error, risk-adjusted return, and liquidity.

Tracking error is a fundamental indicator for ETFs, commonly employed to evaluate how accurately an ETF mirrors its underlying assets (Johnson, 2009). Defined as the deviation between an ETF’s return and that of its benchmark index, tracking error has been studied across both domestic and international contexts. Shin and Soydemir (2010), for instance, find that exchange-rate movements are significantly linked to tracking error, with Asian markets exhibiting greater persistence in tracking deviations—and thus lower efficiency—than the U.S. market. Their analysis uses daily data from July 2004 to June 2007 on twenty iShares MSCI Country Funds and six iShares Broad U.S. Equity Market Funds. They further employ Jensen’s alpha to assess performance: a significantly positive alpha indicates ETF outperformance relative to its benchmark, while a negative alpha signifies underperformance. When ETF premium/discount is treated as the dependent variable, their results again highlight exchange-rate risk as a key determinant of tracking error.

Elton et al. (1996), Gastineau (2004), Avellaneda and Dobi (2012), and Tang and Xu (2013) report relatively high levels of ETF tracking error, which they attribute primarily to higher expense ratios and to discrepancies in trading hours across time zones. Zawadzki (2020) finds that tracking errors are both statistically significant and negatively related to ETF returns, indicating that ETFs do not substantially outperform their benchmarks regardless of market maturity or geography. In contrast, Kalfa Baş and Eren Sarıoğlu (2015) documents relatively low tracking errors in the Turkish ETF market, suggesting limited arbitrage opportunities. However, these studies often suffer from small, potentially biased samples and overlook cross-market variations in investor benefits. Chu (2013) demonstrates that larger fund size reduces tracking error, while higher expense ratios increase it, and further observes that ETFs in Hong Kong exhibit greater tracking deviations than those in Australia or the United States. Since a perfectly replicative ETF would have a tracking error of one, we extend this literature by examining Japan-focused ETFs across multiple listing jurisdictions.

4.1.1. Measuring Tracking Error

There are three widely used approaches to measuring tracking errors. Following Roll (1992) and Pope and Yadav (1994), we first compute each ETF’s tracking error as the difference between its return and its NAV return. We then apply each of the three methodologies to the 1077 JETFs to obtain average cross-sectional tracking errors, yielding 1077 observations per method.

where refers to individual ETF firm i’s log return at time t, frequency is daily basis, refers to individual ETF firm i’s NAV log return at time t, and refers to individual ETF firm i’s tracking differences at time t.

TE(1), TE(2), and TE(3) are three methods to calculate cross-sectional average tracking errors for 1077 ETF firms from 1 January 2008 to 30 April 2022. The TE is used for panel regression in the following section, and the TE(2) is used for cross-sectional regression.

We also calculate corresponding time-series tracking error:

Table 4A–D report descriptive statistics of all variables for the four markets, Ireland, Japan, Luxembourg, and U.S. JETFs in Japan markets have relatively higher and lower return and volatility than those of other markets. A possible explanation is that the tracking error of JETFs in Japan markets is higher other markets.

Table 4.

Descriptive statistics. (A) JETF in Ireland market. (B) JETFs in Japan market. (C) JETFs in Luxembourg. (D) JETFs in U.S. (E) Tracking error (TE(1)) by Equation (2) descriptive statistics.

Table 4E reports descriptive statistics of tracking errors in four different markets. The tracking error of JETFs in the Japan market is higher than other markets, and the tracking error in the U.S. is lower than the other markets, which is consistent with our expectation above.

4.1.2. Beta Measure of TE

Furthermore, we use methods from Bae and Kim (2020) to measure tracking error. They regress ETF log return on ETF NAV return to collect beta; 1 − beta is their tracking error. The basic methodology is shown by the following.

where refers to individual ETF firm i’s log return at time t, frequency is daily basis, refers to individual ETF firm i’s NAV log return at time t, rolling beta and rolling window is 60 days, and is residual term.

Firstly, we set up 60-day rolling windows in our data. We get the first beta by regressing data from t to t + 59, the second beta from t + 1 to t + 60…. For each JETF firm, we let 1 − beta be our tracking error, following Bae and Kim (2020), to obtain the daily tracking error for each firm. Secondly, we calculate the average cross-sectional tracking error for 1077 JETFs from 1 January 2008 to 30 April 2022.

We selected a 60-day rolling window because it provides a balance between capturing short-term price dynamics and maintaining sufficient observations for stable estimation of beta, consistent with prior ETF studies. For example, Evans et al. (in press) construct a 60-day rolling correlation between individual stocks and ETFs; Ranaldo and Somogyi (2021) compute key variables using a 60-day rolling window; and Tetlock (2010) uses a rolling 60-day average of log turnover. Consistent with this literature, we use 60 days as our baseline.

4.1.3. The Relation Between Tracking Error and Liquidity—Cross Section Regression

Bae and Kim (2020) prove there is a negative relation between ETF liquidity and tracing error by checking a two-stage OLS regression model with a threshold flag dummy variable. More importantly, they perceive there is a nonlinear relation between ETF liquidity and tracking error in U.S. markets from the two-stage model. We are interested in investigating whether the nonlinear relation exists in the Japanese ETF market. If an asset deviates from its equilibrium price, arbitragers will step in in a short or long transaction until the premiums/discounts disappear (Shin & Soydemir, 2010). Ben-David et al. (2018) states that ETF mispricing could instead proxy for a lack of arbitrage activity. In other words, higher tracking error may be caused by less frequent arbitrage activities. There are many reasons that can explain less frequent arbitrage activities, for example, less liquidity (e.g., higher transaction costs) and zero or negative arbitrage profits.

where is the cross section tracking error for JETF firm , is the liquidity measure for JETF firm , is the square of the liquidity measure, is the Japan ETF log return for firm i at time t, and is the Japan ETF underlying asset log return. Following Bae and Kim (2020), is the matrix of control variables, and is the vector of coefficients corresponding to . Following Bae and Kim (2020), the control variables include JETF volatility, dollar trading volume, log shares outstanding, and log asset under management. and are intercept and residual, respectively.

Table 5A reports the regression results of TE(1) as dependent variables, noting the coefficients of quadratic terms are negative value for illiquidity measure and positive value for liquidity measure. Furthermore, the results of the high significance level from bid–ask spread illiquidity and the absolute value of Roll liquidity seemingly imply that a quadratic nonlinear relation exists between tracking error and liquidity.

Table 5.

(A) Liquidity proxies on tracking error: cross-sectional regression. (B) Beta measure of tracking error with cross-sectional. (C) The residual difference measure of tracking error with cross-sectional.

Table 5B reports the regression results of 1 − beta as tracking error measure. Revised Roll liquidity and Amihud also imply that there is a quadratic nonlinear relation between liquidity and tracking error. Except for the Revised Roll liquidity proxy, all quadratic terms in the regression specifications are negative, indicating an inverted-U-shaped, nonlinear association between tracking error and liquidity.

Table 5C reports coefficient estimates of regressions of tracking error (the residual difference) on different ETF liquidity proxies. The empirical results in this table further corroborate the patterns observed in Table 5A,B, suggesting robustness across different model specifications.

All of our results support the quadratic relation except under the 1 − β specification. We consider this discrepancy to stem from the 60-day overlapping rolling estimation of β, which yields a very smooth 1 − β series with limited variation, making it statistically difficult to detect curvature; the coefficient signs remain consistent with our hypothesis, so the lack of significance reflects reduced variation rather than an opposite economic effect. Therefore, this reduces statistical power in panel regressions and leads to weaker significance, even though the coefficient signs remain directionally consistent with the hypothesized nonlinearity. For this reason, we report cross-sectional regressions for TE(2), while the nonlinear relation is strong and significant for TE(1) and TE(3) in both cross-sectional and panel settings.

4.1.4. The Relation Between Tracking Error and Liquidity—Panel Regression

We use the following panel regression model to estimate coefficients:

where is the difference between log JETF return and log JETF NAV return for JETF firm at time t, is liquidity measure for JETF firm at time t, is the square of the liquidity measure. Following Bae and Kim (2020), is their matrix of control variables, and and b are vectors of coefficients corresponding to . Following Bae and Kim (2020), the control variables include JETF volatility, dollar trading volume, log share outstanding growth, log share outstanding, and log asset under management. , and , are intercept and residual, respectively. is rolling window beta for 60-day rolling window. is residuals from the rolling window regression model.

Table 6A reports the results of panel regression with pool and fixed effect. The significance level of coefficients of liquidity implies that there is a quadratic nonlinear relation between tracking error and liquidity, which is consistent with our assumption. Since a higher bid–ask spread indicates lower liquidity, the estimated quadratic in spread translates into a U-shaped pattern in the relationship between liquidity and tracking error. Furthermore, the positive coefficients of the quadratic term show a U-shaped curve between liquidity and tracking. The results from Table 5 and Table 6A imply that an optimal structure of JETFs may exist to minimize tracking error.

Table 6.

(A) Panel regression with TE(1) dependent. (B) Panel regression with 1 − beta dependent. (C) Panel regression. (D) The residuals difference measure of tracking error with panel regression.

Table 6B reports the results of panel regression with pool and fixed effect. Alternatively, we use Bae and Kim’s tracking error measure, that is, 1 − beta as dependent variable. Similarly, the significance level of coefficients of liquidity also implies that there is a quadratic nonlinear relation between 1 − beta and liquidity. As a result, it provides more evidence to support our assumption, and the results also imply that an optimal structure of JETFs may exist to minimize tracking error.

Based on the results above, more importantly, the table shows that both higher (lower spread) and lower (higher spread) liquidity give investors higher tracking error. These results are also seemly supported by Figure 2A and Bae and Kim’s (2020) conjecture.

4.1.5. International Markets

Since Japan’s trading hours differ from those of other markets (for example, the United States) due to time-zone disparities, JETFs listed outside Japan may incur larger tracking errors than those traded on Japanese exchanges. Market participants in Japan can access and incorporate information about underlying assets more rapidly, enabling Japan-listed JETFs to adjust their prices more quickly. In contrast, JETF trading in foreign venues may lag in price discovery, leading to higher tracking errors. Panels 4A–D present descriptive statistics for JETFs domiciled in Ireland, Japan, Luxembourg, and the United States. Both Japanese and U.S. listings exhibit negative mean ETF returns, whereas Luxembourg-listed JETFs show a positive mean. Additionally, return volatility is highest for Japan-listed ETFs (0.1953) and lowest for U.S.-listed ETFs (0.1699) compared with the other jurisdictions. We still use panel regression above to regress TE(1) on bid–ask spread illiquidity measure:

where is the difference between log JETF return and log JETF NAV return for JETF firm at time t, is the liquidity measure for JETF firm at time t, is the square of liquidity measure. Following Bae and Kim (2020), is their matrix of control variables, and and b are vectors of coefficients corresponding to . Following Bae and Kim (2020), the control variables include JETF volatility, dollar trading volume, log shares outstanding growth, log shares outstanding, and log asset under management.

Table 6C reports the panel regression for the four markets. The liquidity plays a very important role in affecting tracking error in the Japan market (highest coefficients among the four markets). Tracking error is most sensitive to illiquidity measure in Japan and weakest in US. That is, liquidity’s risk of tracking error in Japan is higher than in other markets.

Furthermore, we summarize tracking error descriptive statistics for the four markets in Table 4E. Overall, the absolute value of tracking error is seemly higher in Japan and lower in U.S. As a result, it is consistent with our expectation, since the U.S market plays a leading role in the global market (Eun et al., 2008), The Japan market is then affected by the U.S. market due to the trading time difference. As a result, it may explain why the tracking error in the Japan market is higher than other markets.

4.2. The Relationship Between Liquidity and Risk-Adjusted Return

4.2.1. Why Use Risk-Adjusted Performance and Fama–French Five-Factor Model?

Jensen (1967, 1969) proposed the Jensen’s alpha to capture the risk-adjusted performance of financial assets or derivatives relative to the CAPM’s expected market return; this abnormal return may also reflect gains from arbitrage. MacGregor et al. (2021) estimate rolling five-year alphas for different fund types, arguing that economic fundamentals, the business cycle, and sector-specific factors affect fund categories heterogeneously. Paliienko et al. (2020) report an average monthly excess yield of 11.56%, with model significance at 94.4% per ANOVA analysis, and they find that the five-factor model effectively explains returns for portfolios characterized by negative VaR and CVaR, particularly those holding a limited number of blue-chip stocks. Glosten et al. (2021) further employ the Fama–French five-factor framework to examine the impact of ETF activity on post-earnings-announcement drift, demonstrating that ETF trading rapidly incorporates new information into stock prices.

4.2.2. Cross-Sectional Regression

Building on the existing literature, we assess the performance of JETFs using risk-adjusted returns, measured by Jensen’s alpha. This measure is obtained by regressing each JETF’s excess return on the Fama–French five-factor model. To construct the cross-sectional dataset, we conduct time-series regressions for each individual JETF, using its excess returns and the five-factor exposures. This process yields 1077 alpha estimates, each representing the risk-adjusted performance of a specific JETF. The corresponding time-series regression model shows by the following:

where refers to JETF excess return for JETF firm i in day t; it is calculated by subtracting risk-free rate from JETF return. is Jensen’s alpha for JETF firm i in day t, denotes the market risk premium for day t, and is size effect for day t and denotes the return difference between small stock and big stock. denotes the return difference for day t between high book-to-market and low book-to-market firms, and denotes the return difference between day t robust and weak probability firms. denotes the return difference for day t between low investment and high investment firms. are residuals for JETF firm i in day t.

For Fama–French five factors, we obtain data from Kenneth French Library based on daily frequency. In addition, our model first is cross-sectional regression, and then we use panel regression to test our hypothesis.

Jensen’s alpha estimates derived from the Fama–French three-, five-, and six-factor models for the period from 1 January 2008 to 30 April 2022. These alphas are calculated using OLS regressions for each of the 1077 JETFs over the same period. For ETF log returns, ETF NAV log returns, volatility, market value, and turnover, we first compute the average values for each ETF individually across the sample period, resulting in a total of 1077 cross-sectional observations. The distribution of Jensen’s alpha appears approximately normal, although it exhibits slight right-skewness.

Bae and Kim (2020) demonstrate that the coefficients obtained from the second-stage regressions exceed those from the OLS estimates, potentially due to nonlinear relationships between ETF liquidity and tracking error. Additionally, there is evidence of a significant relationship between tracking error and Jensen’s alpha. For instance, Amihud and Goyenko (2013) report that stock funds with the lowest and highest values yield significantly higher subsequent-period alphas—up to 3.804%. Moreover, funds in the lowest and highest quintiles of lagged alpha produce an annual alpha of approximately 3.8%. This result is particularly noteworthy, as it suggests that 1 − may effectively serve as a proxy for tracking error, implying a meaningful connection between tracking error and alpha.

According to Box et al. (2015), cross-sectional linear regression models remain unaffected by autocorrelation since each entity contributes only one observation, thereby excluding time-series dependence. Shin and Soydemir (2010), based on the arbitrage pricing model, argue that when an asset deviates from its equilibrium price, arbitrageurs initiate long or short positions until any premiums or discounts are eliminated. Furthermore, they highlight that persistent premiums or discounts indicate arbitrage opportunities, suggesting a positive relationship between tracking error and risk-adjusted performance.

However, high transaction costs can impede arbitrage by reducing incentives for arbitrage activities. Delcoure and Zhong (2007) employ bid–ask spreads as proxies for transaction costs; hence, we similarly use bid–ask spreads as our liquidity measure in subsequent panel regressions, as they effectively capture trading costs. This approach implicitly links liquidity to risk-adjusted performance. Additionally, greater liquidity may quickly eliminate arbitrage through high-frequency trading. Consequently, Shin and Soydemir (2010) anticipate a positive relationship between bid–ask spread and ETF premiums or discounts.

In summary, high liquidity (low transaction costs) might swiftly eliminate arbitrage opportunities, while low liquidity (high transaction costs) may deter arbitrage due to associated costs. Coupled with Bae and Kim’s (2020) findings, which indicate a nonlinear relationship between ETF liquidity and tracking error, we hypothesize a quadratic nonlinear relationship among liquidity, risk-adjusted performance, and tracking error. Specifically, we posit that there is an optimal liquidity level at which Jensen’s alpha is maximized.

Therefore, we mention this important hypothesis:

Hypothesis 1.

There is a nonlinear relationship between liquidity and risk-adjusted performance.

Thus, in the first place, we design the following cross sectional regression model for 1077 JETF firms. The frequency of data are daily. We firstly collect risk-adjusted performance by regressing each JETF excess return on Fama–French five factors. Second, we take equally average for each variable and each JETF for 3679 data (rolling data), then we get 1077 cross section data for each independent variable. Third, we regress the following cross section model:

where is Jensen’s alpha for JETF firm obtained from is liquidity measure for JETF firm , is square of liquidity measure, controls means control variables, Following Bae and Kim (2020), is the matrix of control variables and the is vector of coefficients corresponding , Following Bae and Kim (2020), the control variables include JETF volatility, dollar trading volume, log shares outstanding growth, log shares outstanding, log asset under management, and tracking error (TE2). and are intercept and residual, respectively.

We get the following regression results:

The results above show that there is significant quadratic nonlinear relationship between liquidity and Jensen’s alpha, since the coefficients for one term and quadratic term are significant at 5%, which is consistent with the conjecture of Bae and Kim. The nonlinear relationship seemly displays a U-shape curve.

Table 7 reports the results of cross section regression model with dependent of risk-adjusted return, the coefficients of quadratic term are significant at 5% for each illiquidity measure (bid–ask spread), supporting nonlinear relation between liquidity and risk-adjusted return and the assumption of optimal liquidity structure. Furthermore, the signs of all coefficients are consistent with each other.

Table 7.

Cross section regression, dependent: risk-adjusted return (Jensen’s alpha).

4.2.3. Panel Regression

MacGregor et al. (2021) estimate the alphas for each fund type in rolling windows of five years in their regression model, since they consider that different fund types will be affected differently by different aspects of economic fundamentals and the business cycle. Similarly to their method, we regress Japan ETF excess return (Japan ETF return minus Fama–French risk-free rate) on Fama–French five factors by 60-day rolling window to estimate Jensen’s alpha for 1077 Japan ETF firms from 1 January 2008 to 30 April 2022; that is, the is the sample period from day 1 to day 60, is the sample period from day 2 to day 61… is the sample period from day t to day 59 + t. Therefore, we get 3679 rolling window alphas:

where refers to the difference between Japan ETF return and Fama–French risk-free rate for individual Japan ETF firm i at time t, is the 60-day rolling window Jensen’s alpha for Japan ETF firm i and can be used to measure risk-adjusted performance, are estimated 60-day rolling window coefficients for market premium, are estimated 60-day rolling window coefficients for the difference of return between small and big JETF firms, are estimated 60-day rolling window coefficients for the difference of return between high and low book-to-market ratio, are estimated 60-day rolling window coefficients for the difference of return between profitable and unprofitable JETF firms, are estimated 60-day rolling window coefficients for the difference of return between JETF firms that invest conservatively and JETF firms that invest aggressively, and are error terms for Japan ETF firm i at time t.

We construct panel regression model for 1077 JETFs from 2008 to 2022 (3679 time-series data, since rolling alpha decreases samples from 3738 to 3679) to observe a quadratic linear relationship between liquidity and risk-adjusted return, where we use bid–ask spread as our liquidity proxy, and all data are daily frequency, since the bid–ask quote is by far the most demonstrable indicator of overall liquidity (Lesmond, 2005). Furthermore, we estimate bid–ask spread, TE(1), risk-adjusted return, and the rest of the control variables at the daily frequency to observe the quadratic nonlinear relationship. We use 60-day rolling window to estimate risk-adjusted return by regressing Fama–French five-factor model and collecting alpha. The number of alphas is equal to 3679 × 1077 from 60-day rolling window regression. Therefore, the number of each variable is 3679 × 1077 since rolling window alpha decreases the number of data.

where is Jensen’s alpha in day t for firm , is liquidity measure in day t for firm , is the square of liquidity measure, is the matrix of control variables, is the vector of coefficients corresponding to , and and are fixed effect for year and firms, respectively. Following Bae and Kim (2020), the control variables include JETF volatility, dollar trading volume, log shares outstanding growth, log shares outstanding, log asset under management, and tracking error (TE). and are intercept and residual, respectively. Some studies introduce quadratic term in the regression model with OLS. Bunnenberg et al. (2019) find a nonlinear relation between the contemporaneous excess return on market portfolio and the population of fund returns in excess of the risk-free rate or excess return of mutual fund. They regress excess return of mutual funds on excess return of market portfolio and its square to evaluate managers’ market timing abilities. The model is also called the TM model, which was developed by Treynor and Mazuy (1966).

Table 8 presents the coefficient estimates from panel regressions of risk-adjusted returns on the bid–ask spread, its quadratic form, and various control variables, using panel data regression methods. The findings indicate a quadratic nonlinear relationship between illiquidity and risk-adjusted performance. Specifically, the coefficients for the bid–ask spread and its quadratic term are statistically significant at the 1% and 5% levels, respectively, forming a U-shaped curve. Importantly, the results suggest that both extremely high liquidity (narrow spreads) and extremely low liquidity (wide spreads) result in lower risk-adjusted returns for investors.

Table 8.

Panel regression, dependent: risk-adjusted return (Jensen’s alpha).

Columns 1 and 3 of Table 8 also confirm a negative relationship between tracking error and risk-adjusted performance, aligning with prior research. According to the arbitrage pricing model (Shin & Soydemir, 2010), when an asset deviates from its equilibrium price, arbitrageurs engage in long or short positions until any premiums or discounts vanish. Moreover, higher transaction costs can impede arbitrage by diminishing arbitrage incentives and potential profits. Conversely, higher liquidity levels may rapidly eliminate arbitrage opportunities due to frequent trading activities.

4.3. How the Size of JETF Affects Tracking Error and Risk-Adjusted Return

This section explores how the size of JETF affects its risk-adjusted performance since we find the size of JETF firms seemly affects their tracking error and risk-adjusted return in Figure 2A,B. We find that smaller JETF firms seem to create more tracking errors than their counterparts, medium and big ones. The results are easy to accept. For instance, a small JETF tracks a certain index, the index issue three new stocks, but the small JETF cannot buy these three stocks in time because of absence of funds or limited funds. As a result, it is easy to create more tracking errors in small JETF firms. The market value of JETF is used to measure the size of JETFs. We divide JETFs into small, middle, and big sizes and then set up three dummy variables for these three types of size. Since we consider that different sizes of ETF have different volatilities of return, we use panel regression with fixed effect to estimate the coefficients of size dummies. In addition, some of the literature also considers fund size as an important indicator to reflect fund size. Berk and Green (2004) predict a strong relationship between fund size and active management. Their model shows that active managers can create positive risk-adjusted performance, but they also faces a linear price impact (in turn generating a quadratic dollar cost), which reduces their initial alpha (Cremers & Petajisto, 2009). The quantile regression helps us minimize the weighted sum of absolute deviations, which is different from OLS with only minimizing sum of deviations. As a result, it can offer more accurate relation between illiquidity and risk-adjusted return (Paudel & Naka, 2023). We construct panel quantile regression by 25th, median, and 75th percentile and regress the following model:

where is Jensen’s alpha in day t for firm , is the liquidity measure in day t for firm , is the square of the liquidity measure. The controls mean control variables, following Bae and Kim (2020), including JETF volatility, dollar trading volume, log share outstanding growth, log shares outstanding, log asset under management, and tracking error (TE2). and are intercept and residual, respectively.

Table 9 presents the impacts of ETF size, illiquidity, and the quadratic form of illiquidity on risk-adjusted performance. The results indicate that as ETF size grows, increased liquidity appears to diminish ETF performance in terms of risk-adjusted returns. Additionally, the influence of tracking error on ETF performance weakens with larger ETF sizes. In summary, smaller ETFs characterized by lower liquidity (higher illiquidity) tend to deliver higher risk-adjusted returns to investors.

Table 9.

Quantile regression.

Table 10 reports coefficient estimates of regressions of risk-adjusted return proxy (bid–ask spread) and control variables for the four different markets. In Table 10, the coefficients on the squared bid–ask spread for the four markets are −0.381, −0.901, −0.333, and −0.028, respectively. All four estimates are negative and statistically significant at the 1% level—except in Ireland (−0.381), where significance is achieved only at the 10% level. This pattern implies a nonlinear, inverted-U-shaped relationship between liquidity and risk-adjusted returns, confirming our hypothesis that there exists an optimal liquidity level which maximizes risk-adjusted returns.

Table 10.

The nonlinear relationship between tracking error and liquidity in four countries.

5. Robustness Checks

To address contemporaneous endogeneity between liquidity conditions and ETF tracking error/risk-adjusted return, we re-estimate the quadratic specification using one-period-lagged bid–ask spread and its square as the key regressors, with all controls lagged by one period and firm and time fixed effects included. Results are reported in Table 11.

Table 11.

Robustness checks of panel regression.

In columns (1)–(3), using three alternative dependent variables—TE(1) (price–NAV differences), TE(2) (1 − β), and TE(3) (residual difference)—we find that the lagged bid–ask spread and its squared term enter with joint statistical significance in each specification, and the coefficients preserve the nonlinear pattern documented in the baseline analysis. The linear term is positive, and the squared term is negative, for TE(1) and TE(2), while TE(3) shows a weaker linear effect but a significant negative quadratic term. Economically, these estimates indicate a pronounced curvature in the relation between lagged illiquidity and tracking error, which imply the relationship display convex curve and U-shaped pattern. It is consistent with limits to AP arbitrage when trading frictions are either very low (noise-trading dominated) or very high (cost-dominated). The nonlinearity remains robust and consistent with our previous results.

In column (4), when the 60-day rolling Jensen’s alpha serves as the dependent variable, the lagged bid–ask spread loads negatively while the squared term loads positively, yielding a statistically strong concave (inverted-U-shaped) relation between risk-adjusted return and liquidity. This pattern is consistent with the mechanism that higher trading frictions depress risk-adjusted performance at low-to-moderate spread levels, while the marginal impact attenuates at extremely high spreads, where trading activity and arbitrage attempts are sparse. Overall, the signs and economic magnitudes are fully aligned with our main results and theoretical narrative tying AP incentives to liquidity-dependent arbitrage costs.

Using the Table 11 coefficients, we compute turning points and convert effects into basis points. For example, under TE(1), a 0.10 increase in the bid–ask spread raises tracking error by ≈30 bps at low spread levels before attenuating, with the minimum TE occurring around S* ≈ 0.675; for 60-day Jensen’s alpha, a 0.10 spread increase reduces alpha by ≈4.8 bps per 60 days (≈29 bps/year), with a turning point at S* ≈ 0.649. These magnitudes show the effects are economically meaningful, not merely statistically significant. See Table 11 and the new paragraph in the text.

6. Conclusions

This study centers on Japanese ETFs (JETFs), which are particularly subject to tracking error due to significant time zone differences with other developed markets. Because of the differences in trading hours across countries, the prices of underlying assets cannot be immediately reflected in the prices of ETFs. This discrepancy creates an ideal environment for arbitrageurs. AI-driven quantitative trading has become a common practice for exploiting arbitrage opportunities. In these cases, the decisive factor determining the success of arbitrage is the liquidity of JETFs. Therefore, examining the relationship between tracking error, risk-adjusted performance, and liquidity is both more relevant and insightful in this context. Our findings reveal a quadratic relationship between liquidity and tracking error, as well as between liquidity and risk-adjusted returns. We find a quadratic relation between liquidity and tracking error, liquidity and risk-adjusted return. On the one hand, there exists an optimal liquidity that can minimize tracking error. On the other hand, there also exists optimal liquidity that can maximize risk-adjusted return. We employ four liquidity measures to test our hypothesis, and the results are both consistent and statistically significant. This finding contributes to a better understanding of how to balance the trade-offs between liquidity, tracking error, and risk-adjusted returns.

Our findings refined the growing literature on ETF market quality in three ways. First, we reconcile apparently conflicting evidence by demonstrating that the liquidity–performance relation is fundamentally nonlinear. Second, we bridge ETF-specific arbitrage with classic asset-pricing anomalies such as Amihud illiquidity and fund-size effects. Third, we highlight cross-market linkages: U.S. price leadership and Japan’s time-zone segmentation jointly shape JETF efficiency.

Our nonlinear results imply that both very low and very high liquidity can impede price–NAV alignment, with the tightest alignment at intermediate liquidity. Exchanges and regulators could improve ETF pricing efficiency by (i) enhancing the transparency of AP creation/redemption activity and basket composition, (ii) supporting high-quality intraday iNAV/IOPV dissemination and closing auctions, and (iii) reducing frictions (e.g., tick-size calibration, maker-taker incentives, and cross-venue coordination during overlapping hours) that influence AP arbitrage economics. Issuers may help by clearly disclosing replication methods, expense ratios, and basket substitution rules, while investors should recognize that “more liquidity” is not always better—intermediate liquidity is often associated with lower tracking error—once costs and noise trading are accounted for.

There exist some limitations of our results. Our evidence is correlated rather than strictly causal. Liquidity is proxied primarily by the bid–ask spread (and related measures), which can embed microstructure noise and venue-specific conventions. Also, AP activity is inferred indirectly (e.g., via share-count changes) rather than observed at the trade-level and the 60-day rolling estimation of betas/alphas, while stabilizing estimates on daily data; this mechanically smooths series and can reduce statistical power in some specifications.

These limitations show directions for future research. Three avenues are particularly promising. First, micro-data on APs (creation/redemption orders, borrow costs, collateral terms) would allow direct tests of the mechanism we propose. Second, high-frequency designs (intraday TE, realized spreads/volatility) and causal identification around exogenous frictions (tick-size changes, fee/rebate reforms, tax or stamp-duty adjustments, or exchange rule changes) could sharpen inference. Third, extending the analysis across additional venues and instruments (leveraged/inverse ETFs, futures/options liquidity, flow shocks) and exploring alternative nonlinear forms (threshold, spline, TVP) would test robustness and heterogeneity—e.g., whether the optimal liquidity point varies with fund size, replication method, or market regime (including BOJ purchase/exit phases).

Author Contributions

Conceptualization, A.N. and J.T.; methodology, A.N. and J.T.; software, J.T.; validation, A.N., J.T. and S.S.; formal analysis, J.T.; investigation, J.T. and S.S.; resources, S.S.; data curation, J.T.; writing—original draft preparation, A.N. and J.T.; writing—review and editing, A.N. and S.S.; visualization, J.T.; supervision, A.N. and S.S.; project administration, S.S.; funding acquisition, S.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Adjei, F. (2009). Diversification, performance, and performance persistence in exchange traded funds. International Review of Applied Financial Issues and Economics, 1(1), 4–19. [Google Scholar]

- Agapova, A. (2011). Conventional mutual index funds versus exchange-traded funds. Journal of Financial Markets, 14(2), 323–343. [Google Scholar] [CrossRef]

- Agarwal, V., Hanouna, P. E., Moussawi, R., & Stahel, C. W. (2018, November 20). Do ETFs increase the commonality in liquidity of underlying stocks? 28th Annual Conference on Financial Economics and Accounting and the Fifth Annual Conference on Financial Market Regulation. Available online: https://ssrn.com/abstract=3001524 (accessed on 23 May 2023).

- Alexander, C., & Barbosa, A. (2008). Hedging index exchange traded funds. Journal of Banking & Finance, 32(2), 326–337. [Google Scholar] [CrossRef]

- Amihud, Y. (2002). Illiquidity and stock returns: Cross-section and time-series effects. Journal of Financial Markets, 5(1), 31–56. [Google Scholar] [CrossRef]

- Amihud, Y. (2018). Illiquidity and stock returns: A revisit. Critical Finance Review. Available online: https://ssrn.com/abstract=3257038 (accessed on 23 May 2023).

- Amihud, Y., & Goyenko, R. (2013). Mutual fund’s R2 as predictor of performance. The Review of Financial Studies, 26(3), 667–694. [Google Scholar] [CrossRef]

- Avellaneda, M., & Dobi, D. (2012). Structural slippage of leveraged ETFs [Working Paper]. SSRN. [Google Scholar] [CrossRef][Green Version]

- Bae, K., & Kim, D. (2020). Liquidity risk and exchange-traded fund returns, variances, and tracking errors. Journal of Financial Economics, 138, 222–253. [Google Scholar] [CrossRef]

- Ben-David, I., Franzoni, F., & Moussawi, R. (2018). Do ETFs increase volatility? Journal of Finance, 73(6), 2471–2535. [Google Scholar] [CrossRef]

- Berk, J. B., & Green, R. C. (2004). Mutual fund flows and performance in rational markets. Journal of Political Economy, 112(6), 1269–1295. [Google Scholar] [CrossRef]

- Bhattacharya, A., & O’Hara, M. (2018). Can ETFs increase market fragility? Effect of information linkages in ETF markets. SSRN. [Google Scholar] [CrossRef]

- Bloch, M., Guerard, J., Markowitz, H., Todd, P., & Xu, G. (1993). A comparison of some aspects of the U.S. and Japanese equity markets. Japan and the World Economy, 5(1), 3–26. [Google Scholar] [CrossRef]

- Box, G. E., Jenkins, G. M., Reinsel, G. C., & Ljung, G. M. (2015). Time series analysis: Forecasting and control. John Wiley & Sons. [Google Scholar]

- Brown, A., & Yang, F. (2011). Liquidity, arbitrage, and short sales: Evidence from the London stock exchange. Journal of Financial Economics, 101(2), 583–604. [Google Scholar]

- Bunnenberg, S., Rohleder, M., Scholz, H., & Wilkens, M. (2019). Jensen’s alpha and the market-timing puzzle. Review of Financial Economics, 37, 234–255. [Google Scholar] [CrossRef]

- Charupat, N., & Miu, P. (2013). Recent developments in exchange-traded funds literature: Pricing efficiency, tracking ability and effects on underlying assets. Managerial Finance, 39(5), 427–443. [Google Scholar] [CrossRef]

- Christopoulos, A. (2021). The absolute Roll measure. SSRN. Available online: https://ssrn.com/abstract=3958079 (accessed on 1 September 2025). [CrossRef]

- Chu, P. K.-K. (2013). Tracking errors and their determinants: Evidence from Hong Kong exchange traded funds. SSRN. [Google Scholar] [CrossRef]

- Cremers, K. J. M., & Petajisto, A. (2009). How active is your fund manager? A new measure that predicts performance [Working paper]. SSRN. [Google Scholar]

- de Andres, P., & Vallelado, E. (2008). Corporate governance in banking: The role of the board of directors. Journal of Banking & Finance, 32(12), 2570–2580. [Google Scholar] [CrossRef]

- Delcoure, N., & Zhong, M. (2007). On the premiums of iShares. Journal of Empirical Finance, 14(2), 168–195. [Google Scholar] [CrossRef]

- Doukas, J. A., & McKnight, P. J. (2005). Liquidity and the Jensen index of mutual funds. Journal of Financial Research, 28(4), 559–569. [Google Scholar] [CrossRef]

- Elton, E. J., Gruber, M. J., & Blake, C. R. (1996). Survivorship bias and mutual fund performance. The Review of Financial Studies, 9(4), 1097–1120. [Google Scholar] [CrossRef]

- Eun, C. S., Huang, W., & Lai, S. (2008). International diversification with large- and small-cap stocks. The Journal of Financial and Quantitative Analysis, 43(2), 489–523. [Google Scholar] [CrossRef]

- Evans, R. B., Karakaş, O., Moussawi, R., & Young, M. J. (in press). Phantom of the Opera: ETF shorting and shareholder voting. Management Science. [CrossRef]

- Gastineau, G. L. (2001). Exchange-traded funds: An introduction. The Journal of Portfolio Management, 27(3), 88–96. [Google Scholar] [CrossRef]

- Gastineau, G. L. (2004). The benchmark index ETF performance problem. The Journal of Portfolio Management, 30(2), 96–103. [Google Scholar] [CrossRef]

- Glosten, L. R., Nallareddy, S., & Zou, Y. (2021). ETF activity and informational efficiency of underlying securities. Management Science, 67(1), 22–47. [Google Scholar] [CrossRef]

- Huang, J. C., & Guedj, I. (2009, March 15). Are ETFs replacing index mutual funds? The American Finance Association 2009, San Francisco, CA, USA. [Google Scholar] [CrossRef]

- Jensen, M. C. (1967). The Performance of Mutual Funds in the Period 1945–1964. Journal of Finance, 23, 389–416. [Google Scholar]

- Jensen, M. C. (1969). Risk, the pricing of capital assets, and the evaluation of investment portfolios. Journal of Business, 42(2), 167–247. [Google Scholar] [CrossRef]

- Johnson, W. (2009). Tracking errors of exchange traded funds. Journal of Asset Management, 10(3), 253–262. [Google Scholar] [CrossRef]

- Kalfa Baş, N., & Eren Sarıoğlu, S. (2015). Tracking ability and pricing efficiency of exchange traded funds: Evidence from Borsa Istanbul. Business and Economics Research Journal, 6(1), 19–33. [Google Scholar]

- Katagiri, M., Shino, J., & Takahashi, K. (2025). Bank of Japan’s ETF purchase program and equity risk premium: A CAPM interpretation. Journal of Financial Markets, 73, 100961. [Google Scholar] [CrossRef]

- Khanniche, S., Van Oppens, H., & Zekri, D. (2014). Liquidity and alpha: Do they coexist? Journal of Asset Management, 15(2), 71–82. [Google Scholar] [CrossRef]

- Krause, T., Ehsani, S., & Lien, D. (2014). Exchange-traded funds, liquidity and volatility. Applied Financial Economics, 24(24), 1617–1630. [Google Scholar] [CrossRef]

- Lesmond, D. A. (2005). Liquidity of emerging markets. Journal of Financial Economics, 77(2), 411–452. [Google Scholar] [CrossRef]

- Lettau, M., & Ludvigson, S. C. (2019). The Importance of liquidity in fund performance. Journal of Finance, 74(1), 423–456. [Google Scholar] [CrossRef]

- Lettau, M., & Madhavan, A. (2018). Exchange-traded funds 101 for economists. Journal of Economic Perspectives, 32(1), 135–154. [Google Scholar] [CrossRef]

- Lou, X., & Shu, T. (2017). Price impact or trading volume: Why is the amihud (2002) measure priced? The Review of Financial Studies, 30(12), 4481–4520. [Google Scholar] [CrossRef]

- MacGregor, B. D., Schulz, R., & Zhao, Y. (2021). Performance and market maturity in mutual funds: Is real estate different? The Journal of Real Estate Finance and Economics, 63(3), 437–492. [Google Scholar] [CrossRef]

- Maeda, K., Shino, J., & Takahashi, K. (2022). Counteracting large-scale asset purchase program: The Bank of Japan’s ETF purchases and securities lending. Economic Analysis and Policy, 75, 563–576. [Google Scholar] [CrossRef]

- Malamud, S. (2015). A dynamic equilibrium model of ETFs (Swiss Finance Institute Research Paper No. 15–37). SSRN. [Google Scholar] [CrossRef]

- Naka, A., & Noman, A. (2017). Diversification of risk exposure through country mutual funds under alternative investment opportunities. The Quarterly Review of Economics and Finance, 64, 215–227. [Google Scholar] [CrossRef]

- Paliienko, O., Naumenkova, S., & Mishchenko, S. (2020). An empirical investigation of the Fama-French five-factor model. Investment Management and Financial Innovations, 17(1), 143–155. [Google Scholar] [CrossRef]

- Paudel, K., & Naka, A. (2023). Effects of size on the exchange-traded funds performance. Journal of Asset Management, 24(6), 474–484. [Google Scholar] [CrossRef]

- Pope, P. F., & Yadav, P. K. (1994). Discovering errors in tracking error. The Journal of Portfolio Management, 20(2), 27–32. [Google Scholar] [CrossRef]

- Qadan, M., & Yagil, J. (2012). On the dynamics of tracking indices by exchange traded funds in the presence of high volatility. Managerial Finance, 38(9), 804–832. [Google Scholar] [CrossRef]

- Ranaldo, A., & Somogyi, F. (2021). Asymmetric information risk in FX markets. Journal of Financial Economics, 140(2), 391–411. [Google Scholar] [CrossRef]

- Roll, R. (1984). A simple implicit measure of the effective bid-ask spread in an efficient market. The Journal of Finance, 39(4), 1127–1139. [Google Scholar] [CrossRef]

- Roll, R. (1992). A mean/variance analysis of tracking error. The Journal of Portfolio Management, 18, 13–22. [Google Scholar] [CrossRef]

- Shin, S., & Soydemir, G. (2010). Exchange-traded funds, persistence in tracking errors and information dissemination. Journal of Multinational Financial Management, 20(4–5), 214–234. [Google Scholar] [CrossRef]

- Tang, H., & Xu, X. E. (2013). Solving the Return Deviation Conundrum of Leveraged Exchange-Traded Funds. The Journal of Financial and Quantitative Analysis, 48(1), 309–342. Available online: http://www.jstor.org/stable/43303801 (accessed on 1 September 2025). [CrossRef]

- Tetlock, P. C. (2010). Does public financial news resolve asymmetric information? The Review of Financial Studies, 23(9), 3520–3557. [Google Scholar] [CrossRef]

- Treynor, J. L., & Mazuy, K. K. (1966). Can mutual funds outguess the market? Harvard Business Review, 44(4), 131–136. [Google Scholar]

- Zawadzki, K. (2020). The performance of ETFs on developed and emerging markets with consideration of regional diversity. Quantitative Finance and Economics, 4(3), 515–525. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).