The Role of Accounting Conservatism in the Decreasing Book Equity of U.S. Firms

Abstract

1. Introduction

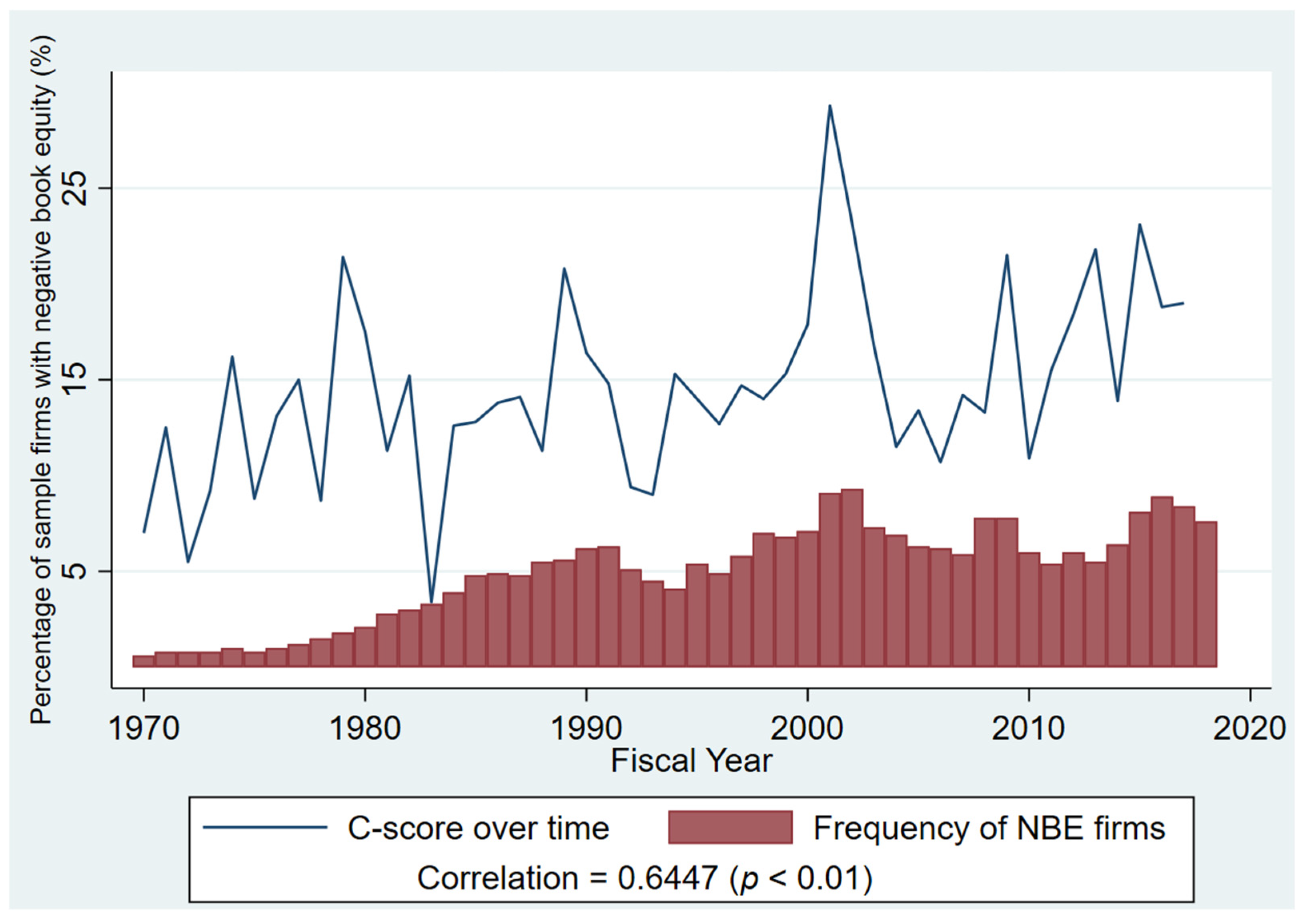

2. Accounting Conservatism’s Role in Decreasing Book Equity

2.1. Earnings Channel

2.2. The Demand for Public Debt Financing Channel

2.3. Beyond Intangibles: Broader GAAP Changes and Enforcement

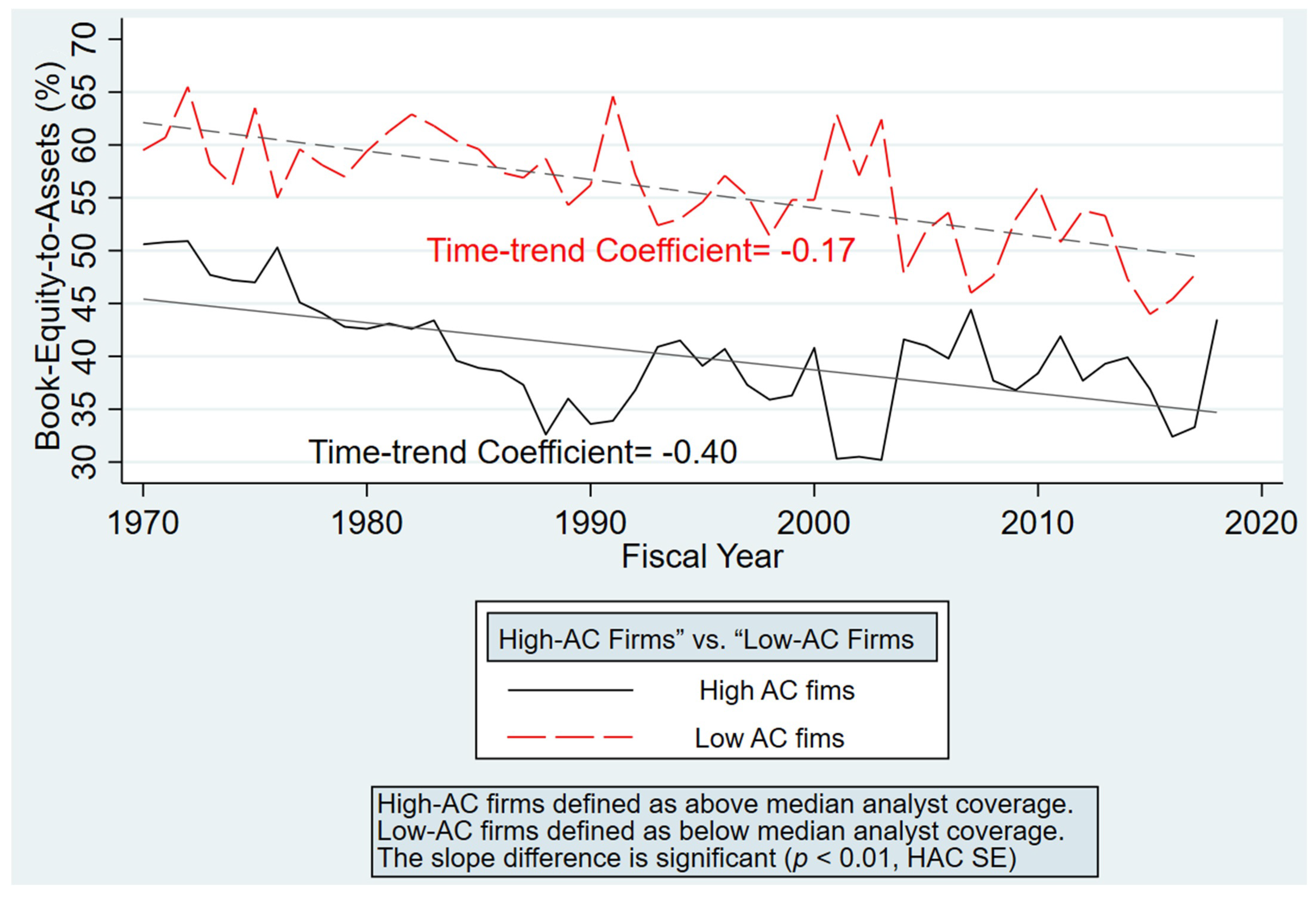

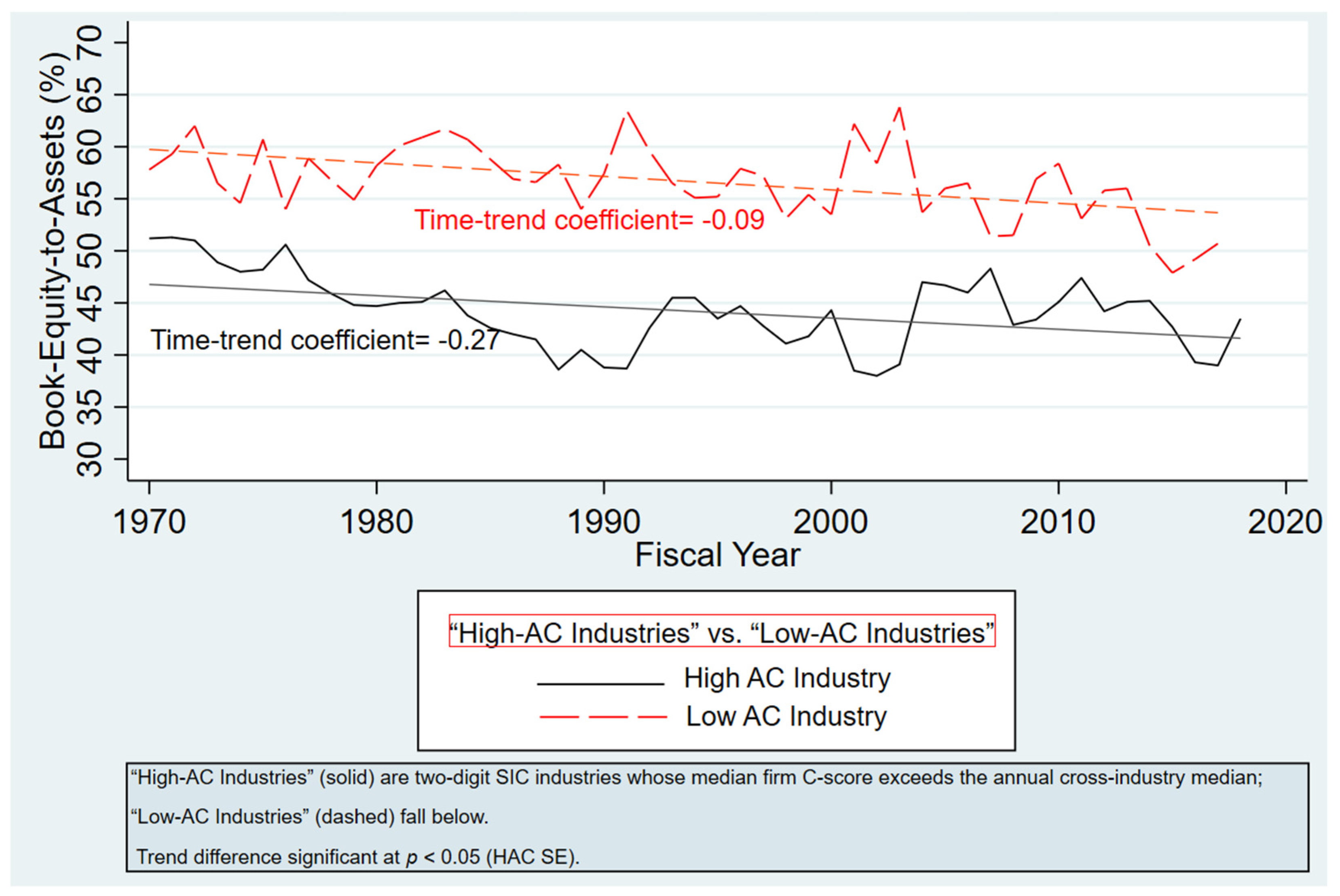

3. Intertemporal Trends of Book Equity and Accounting Conservatism

4. Data and Methodology

4.1. Model Construction

4.2. Sample Construction and Descriptive Statistics

5. Accounting Conservatism and Book Equity: Panel Regression Analysis

5.1. How Accounting Conservatism Affects BE

5.2. The Evolving Effect of Accounting Conservatism and Book Equity over Time

5.3. To What Extent Can Changes in Book Equity Be Explained by Accounting Conservatism?

5.3.1. The Effect of Changing Firm Characteristics

5.3.2. The Effect of Changing Sensitivity

5.4. Alternative Measures of Accounting Conservatism

5.4.1. Earnings Measure

5.4.2. Accrual/Cash Flows Relation Measures

6. Endogeneity Controls

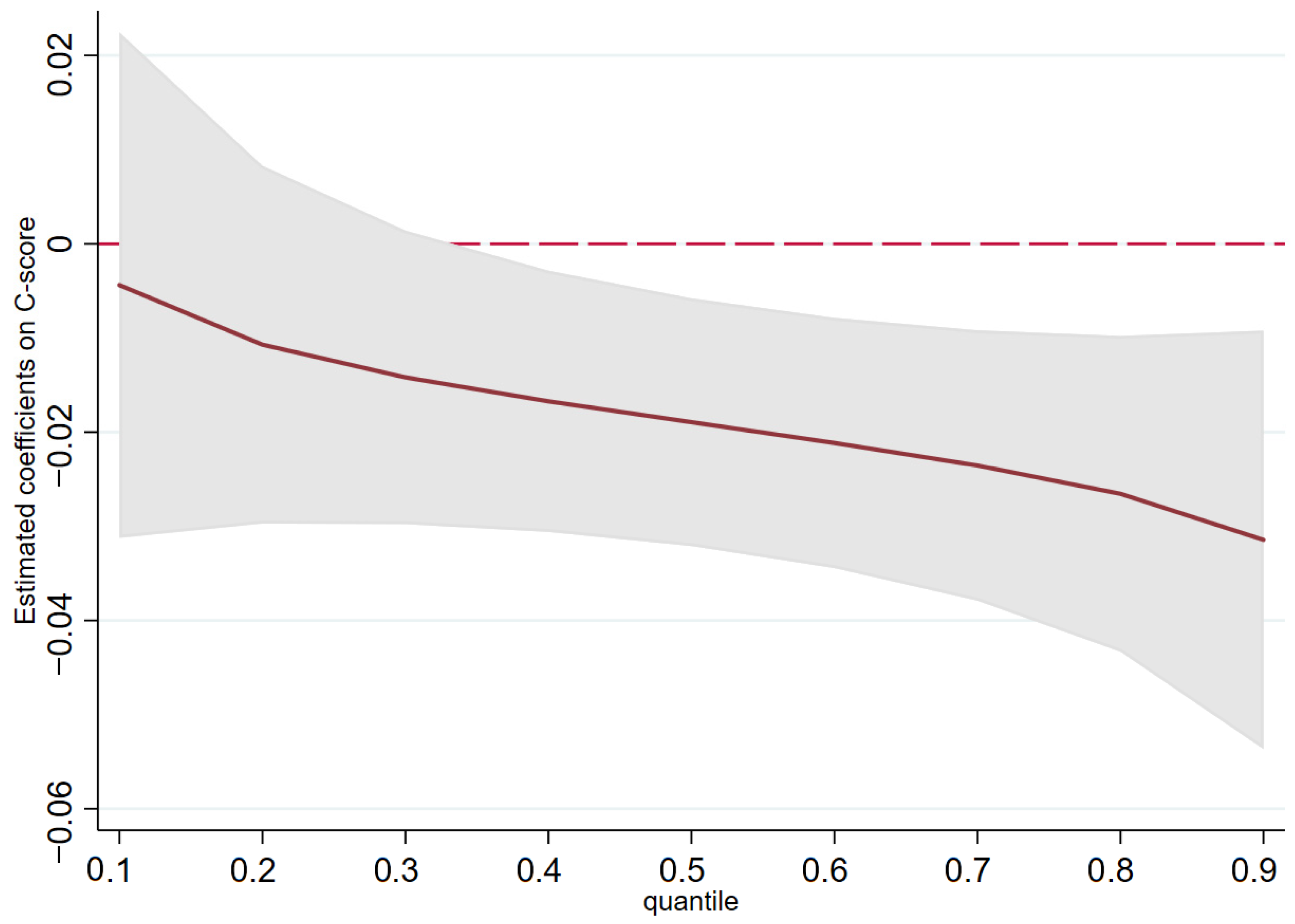

6.1. Accounting Conservatism and Book Equity: A Quantile Regression Approach

6.2. Accounting Conservatism and Book Equity: A Propensity Score Matching Approach

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Variable Definitions

| Variable | Definition and Construction |

| Book Equity (BE) | The sum of shareholders’ book equity, balance sheet deferred taxes, and investment tax credits, minus the book value of preferred stock, all standardized by total assets. |

| Accounting Conservatism (C-score) | A firm-year measure of the asymmetric timeliness of earnings, reflecting the incremental timeliness of reporting bad news over good news. It is estimated annually from the cross-sectional regression model developed by Khan and Watts (2009). |

| Age | The natural logarithm of one plus the number of years since the firm’s incorporation. |

| Asset Utility | Annual sales divided by total assets. |

| Capital Expenditure | The level of capital expenditures divided by total assets. |

| Dividend Dummy | A dummy variable that equals 1 if the firm pays a cash dividend in a given year, and 0 otherwise. |

| Firm Size | The natural logarithm of a firm’s total assets. |

| Leverage | Total debt divided by total assets. |

| Profitability | Operating income before depreciation, scaled by total assets. |

| Retained Earnings | The level of retained earnings divided by total assets. |

| Share Repurchase | The value of common and preferred stock repurchases divided by total assets. |

| Sales Volatility | The standard deviation of sales-to-total-assets ratio over a 5-year rolling window for each 2-digit SIC industry. |

| Tangibility | The ratio of net property, plant, and equipment to total assets. |

| Tobin’s Q | A firm’s current market value divided by its asset replacement cost. |

| Working Capital | The level of working capital scaled by total assets. |

Appendix B. Table 5 Decomposition Formula and Worked Example

- 1st term (“characteristics effect”): how much BE changes because the average level of a driver—e.g., AC—moves, holding base-period coefficients fixed.

- 2nd term (“sensitivity effect”): how much BE changes because the marginal mapping from that driver to BE shifts, holding characteristics fixed at base values. Summing across drivers yields the total decade change; summing across decades yields the period averages quoted below Table 5.

- Base period (1990s) mean C-score = 0.321; coefficient on C-score = −0.108.

- 2000s mean C-score rises to 0.354, so characteristics contribution = (0.354 − 0.321) × (−0.108) = −0.0036 (−0.36 p.p.).

- Coefficient on C-score changes from −0.108 to −0.201, so sensitivity contribution = 0.321 × (–0.201 + 0.108) = −0.0298 (−2.98 p.p.).

- Repeating this for each decade and averaging yields Table 5’s AC totals: −0.769 p.p. (characteristics) and −3.170 p.p. (sensitivity).

| 1 | Because the estimated results in our traditional panel regression models focus only on central tendencies, are sensitive to the skewness of the underlying data that is examined, and assume a constant effect of accounting conservatism on BE for firms across the distribution, we utilize the conditional quantile regression approach to address econometric concerns. |

| 2 | All variables are defined in detail in the Appendix A. |

| 3 | Many other studies, such as Collins et al. (1997), Chan et al. (2001), Darrough and Ye (2007), and Jan and Ou (2012), control for industries that heavily invest in R&D activities. These industries are sometimes referred to as intangible-intensive industries. Conversely, our study controls for the level of firm tangibility. |

| 4 | Our sample period starts in 1971 because Compustat does not report data on share repurchases (PRSTKC) prior to that year. |

| 5 | The minimum BE is −0.77 because we do not exclude firms with negative book equity from our sample. |

| 6 | Refer to Section 4.1: Model Construction for details about the control variables used to match firms. |

| 7 | We choose the same set of variables as in the multivariate regressions because, as suggested by Shipman et al. (2017), the propensity score matching and multivariate regression methods should use similar variables to avoid internally inconsistent and problematic post hoc research design. |

References

- Abadie, A., Drukker, D. M., Herr, J. L., & Imbens, G. W. (2004). Implementing matching estimators for average treatment effects in Stata. The Stata Journal, 4, 290–311. [Google Scholar] [CrossRef]

- Ahmed, A. S., Billings, B. K., Morton, R. M., & Stanford-Harris, M. (2002). The role of accounting conservatism in mitigating bondholder-shareholder conflicts over dividend policy and in reducing debt costs. The Accounting Review, 77, 867–890. [Google Scholar] [CrossRef]

- Ang, J. S., Cole, R. A., & Lin, J. W. (2000). Agency costs and ownership structure. The Journal of Finance, 55, 81–106. [Google Scholar] [CrossRef]

- Asthana, S. C., & Zhang, Y. (2006). Effect of R&D investments on persistence of abnormal earnings. Review of Accounting & Finance, 5, 124. [Google Scholar]

- Ball, R., & Shivakumar, L. (2006). The role of accruals in asymmetrically timely gain and loss recognition. Journal of Accounting Research, 44, 207–242. [Google Scholar] [CrossRef]

- Bandyopadhyay, S. P., Chen, C., Huang, A. G., & Jha, R. (2010). Accounting conservatism and the temporal trends in current earnings’ ability to predict future cash flows versus future earnings: Evidence on the trade-off between relevance and reliability. Contemporary Accounting Research, 27, 413–460. [Google Scholar] [CrossRef]

- Barth, M. E., Beaver, W. H., & Landsman, W. R. (1998). Relative valuation roles of equity book value and net income as a function of financial health. Journal of Accounting and Economics, 25, 1–34. [Google Scholar] [CrossRef]

- Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings. Journal of Accounting and Economics, 24, 3–37. [Google Scholar] [CrossRef]

- Beatty, A., Weber, J., & Yu, J. J. (2008). Conservatism and debt. Journal of Accounting and Economics, 45, 154–174. [Google Scholar] [CrossRef]

- Breusch, T. S., & Pagan, A. R. (1980). The Lagrange multiplier test and its applications to model specification in econometrics. The Review of Economic Studies, 47, 239–253. [Google Scholar] [CrossRef]

- Burgstahler, D., & Dichev, I. (1997). Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics, 24, 99–126. [Google Scholar] [CrossRef]

- Chan, L. K. C., Lakonishok, J., & Sougiannis, T. (2001). The stock market valuation of research and development expenditures. The Journal of Finance, 56, 2431–2456. [Google Scholar] [CrossRef]

- Collins, D. W., Maydew, E. L., & Weiss, I. F. (1997). Changes in the value-relevance of earnings and book values over the past forty years. Journal of Accounting and Economics, 24, 39–67. [Google Scholar] [CrossRef]

- Collins, D. W., Pincus, M., & Xie, H. (1999). Equity valuation and negative earnings: The role of book value of equity. The Accounting Review, 74, 29–61. [Google Scholar] [CrossRef]

- Corrado, C. A., & Hulten, C. R. (2010). How do you measure a “technological revolution”? American Economic Review, 100, 99–104. [Google Scholar] [CrossRef]

- Darrough, M., & Ye, J. (2007). Valuation of loss firms in a knowledge-based economy. Review of Accounting Studies, 12, 61–92. [Google Scholar] [CrossRef]

- DeAngelo, H., & Roll, R. (2015). How stable are corporate capital structures? The Journal of Finance, 70, 373–418. [Google Scholar] [CrossRef]

- Dechow, P. M., & Dichev, I. D. (2002). The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review, 77, 35–59. [Google Scholar] [CrossRef]

- Dechow, P. M., Kothari, S. P., & Watts, R. L. (1998). The relation between earnings and cash flows. Journal of Accounting and Economics, 25, 133–168. [Google Scholar] [CrossRef]

- Diamond, D. W. (1984). Financial intermediation and delegated monitoring. The Review of Economic Studies, 51, 393–414. [Google Scholar] [CrossRef]

- Dichev, I. D., & Skinner, D. J. (2002). Large–sample evidence on the debt covenant hypothesis. Journal of Accounting Research, 40, 1091–1123. [Google Scholar] [CrossRef]

- Dichev, I. D., & Tang, V. W. (2008). Matching and the changing properties of accounting earnings over the last 40 years. The Accounting Review, 83, 1425–1460. [Google Scholar] [CrossRef]

- Fama, E. F. (1985). What’s different about banks? Journal of Monetary Economics, 15, 29–39. [Google Scholar] [CrossRef]

- Fama, E. F., & French, K. R. (2008). Average returns, B/M, and share issues. Journal of Finance, 63, 2971–2995. [Google Scholar] [CrossRef]

- Financial Accounting Standards Board (FASB). (2004). Financial accounting standards board. FASB. [Google Scholar]

- Francis, B., Hasan, I., & Wu, Q. (2013). The benefits of conservative accounting to shareholders: Evidence from the financial crisis. Accounting Horizons, 27, 319–346. [Google Scholar] [CrossRef]

- García Lara, J. M., Osma, B. G., & Penalva, F. (2007). Board of directors’ characteristics and conditional accounting conservatism: Spanish evidence. European Accounting Review, 16(4), 727–755. [Google Scholar] [CrossRef]

- Givoly, D., & Hayn, C. (2000). The changing time-series properties of earnings, cash flows and accruals: Has financial reporting become more conservative? Journal of Accounting and Economics, 29, 287–320. [Google Scholar] [CrossRef]

- Givoly, D., Hayn, C. K., & Natarajan, A. (2007). Measuring reporting conservatism. The Accounting Review, 82, 65–106. [Google Scholar] [CrossRef]

- Goh, B. W., Lim, C. Y., Lobo, G. J., & Tong, Y. H. (2017). Conditional conservatism and debt versus equity financing. Contemporary Accounting Research, 34(1), 216–251. [Google Scholar] [CrossRef]

- Graham, J. R., Leary, M. T., & Roberts, M. R. (2015). A century of capital structure: The leveraging of corporate America. Journal of Financial Economics, 118, 658–683. [Google Scholar] [CrossRef]

- Hao, L., & Naiman, D. (2007). Quantile-regression inference. In Quantile Regression. Sage. [Google Scholar]

- Harford, J., Mansi, S. A., & Maxwell, W. F. (2008). Corporate governance and firm cash holdings in the US. Journal of Financial Economics, 87, 535–555. [Google Scholar] [CrossRef]

- Hausman, J. A. (1978). Specification tests in econometrics. Econometrica, 46, 1251–1271. [Google Scholar] [CrossRef]

- Haw, I. M., Lee, J. J., & Lee, W. J. (2014). Debt financing and accounting conservatism in private firms. Contemporary Accounting Research, 31, 1220–1259. [Google Scholar] [CrossRef]

- Hirshleifer, D., Low, A., & Teoh, S. H. (2012). Are overconfident CEOs better innovators? Journal of Finance, 67, 1457–1498. [Google Scholar] [CrossRef]

- Hulten, C. R., & Hao, X. (2008). What is a company really worth? Intangible capital and the ‘market to book value’ puzzles (Working Paper 14548). National Bureau of Economic Research. [Google Scholar]

- Jackson, S. B., & Liu, X. (2010). The allowance for uncollectible accounts, conservatism, and earnings management. Journal of Accounting Research, 48, 565–601. [Google Scholar] [CrossRef]

- Jan, C.-L., & Ou, J. A. (2012). Negative-book-value firms and their valuation. Accounting Horizons, 26, 91–110. [Google Scholar] [CrossRef]

- Kabir, M. H., & Laswad, F. (2014). The behaviour of earnings, accruals and impairment losses of failed New Zealand finance companies. Australian Accounting Review, 24, 262–275. [Google Scholar] [CrossRef]

- Khan, M., & Watts, R. L. (2009). Estimation and empirical properties of a firm-year measure of accounting conservatism. Journal of Accounting and Economics, 48, 132–150. [Google Scholar] [CrossRef]

- Koenker, R. (2005). Quantile regression: Name index. Cambridge University Press. [Google Scholar]

- Lawrence, A., Minutti-Meza, M., & Zhang, P. (2011). Can Big 4 versus non-Big 4 differences in audit-quality proxies be attributed to client characteristics? The Accounting Review, 86, 259–286. [Google Scholar] [CrossRef]

- Lev, B. (1983). Some economic determinants of time-series properties of earnings. Journal of Accounting and Economics, 5, 31–48. [Google Scholar] [CrossRef]

- Lobo, G. J., & Zhou, J. (2006). Did conservatism in financial reporting increase after the Sarbanes-Oxley Act? Initial evidence. Accounting Horizons, 20(1), 57–73. [Google Scholar] [CrossRef]

- Love, I., Preve, L. A., & Sarria-Allende, V. (2007). Trade credit and bank credit: Evidence from recent financial crises. Journal of Financial Economics, 83, 453–469. [Google Scholar] [CrossRef]

- Luo, H., Liu, I., & Tripathy, N. (2019). A study on firms with negative book value of equity. International Review of Finance, 21, 145–182. [Google Scholar] [CrossRef]

- Park, H. (2019). Intangible assets and the book-to-market effect. European Financial Management, 25, 207–236. [Google Scholar] [CrossRef]

- Peters, R. H., & Taylor, L. A. (2017). Intangible capital and the investment-q relation. Journal of Financial Economics, 123, 251–272. [Google Scholar] [CrossRef]

- Petersen, M. A. (2008). Estimating standard errors in finance panel data sets: Comparing approaches. The Review of Financial Studies, 22, 435–480. [Google Scholar] [CrossRef]

- Petersen, M. A., & Rajan, R. G. (1997). Trade credit: Theories and evidence. The Review of Financial Studies, 10, 661–691. [Google Scholar] [CrossRef]

- Philippon, T. (2009). The bond market’s q. The Quarterly Journal of Economics, 124, 1011–1056. [Google Scholar] [CrossRef]

- Shipman, J. E., Swanquist, Q. T., & Whited, R. L. (2017). Propensity score matching in accounting research. The Accounting Review, 92, 213–244. [Google Scholar] [CrossRef]

- Stuart, E. A., & Rubin, D. B. (2008). Best practices in quasi-experimental designs. In Best Practices in Quantitative Methods (pp. 155–176). Sage. [Google Scholar]

- The Economist. (2019, March 23). Why book value has lost its meaning. The Economist. [Google Scholar]

- Watts, R. L. (2003). Conservatism in accounting part I: Explanations and implications. Accounting Horizons, 17, 207–221. [Google Scholar] [CrossRef]

| Variable | Mean | Median | Std Dev | Min | Q1 | Q3 | Max | N |

|---|---|---|---|---|---|---|---|---|

| BE | 0.53 | 0.54 | 0.21 | −0.77 | 0.40 | 0.69 | 0.94 | 87,382 |

| C-score | 0.15 | 0.14 | 0.10 | −0.13 | 0.08 | 0.21 | 0.50 | 87,382 |

| Asset utility | 1.32 | 1.19 | 0.82 | 0.02 | 0.78 | 1.66 | 4.91 | 87,382 |

| Capital expenditure | 0.07 | 0.05 | 0.07 | 0.00 | 0.03 | 0.09 | 0.41 | 87,382 |

| Dividend | 0.46 | 0.00 | 0.50 | 0.00 | 0.00 | 1.00 | 1.00 | 87,382 |

| Leverage | 0.21 | 0.19 | 0.17 | 0.00 | 0.05 | 0.32 | 1.02 | 87,382 |

| Firm size | 5.35 | 5.16 | 1.91 | 1.27 | 3.90 | 6.63 | 10.22 | 87,382 |

| Profitability | 0.12 | 0.13 | 0.13 | −0.72 | 0.08 | 0.19 | 0.41 | 87,382 |

| Tobin’s q | 2.75 | 2.00 | 2.41 | 0.67 | 1.42 | 3.11 | 22.83 | 87,382 |

| Retained earnings | 0.09 | 0.24 | 0.81 | −7.77 | 0.05 | 0.42 | 0.84 | 87,382 |

| Repurchase | 0.01 | 0.00 | 0.04 | 0.00 | 0.00 | 0.01 | 0.21 | 87,382 |

| Sales volatility | 0.07 | 0.05 | 0.04 | 0.01 | 0.04 | 0.08 | 0.30 | 87,382 |

| Tangibility | 0.30 | 0.25 | 0.21 | 0.02 | 0.14 | 0.41 | 0.91 | 87,382 |

| Working capital | 0.29 | 0.28 | 0.21 | −0.56 | 0.14 | 0.44 | 0.80 | 87,382 |

| Age | 15.51 | 13.00 | 11.34 | 1.00 | 7.00 | 21.00 | 49.00 | 87,382 |

| Panel A: Pearson Correlation Coefficients | ||||||||||||||

| BE | C-score | Asset Utility | Capital Expenditure | Dividend | Leverage | Firm Size | Profitability | Tobin’s Q | Retained Earnings | Repurchase | Sales Volatility | Tangibility | Working Capital | |

| C-score | −0.1170 *** | |||||||||||||

| Asset utility | −0.1871 *** | 0.0623 *** | ||||||||||||

| Capital expenditure | 0.0009 *** | −0.1114 *** | −0.0475 *** | |||||||||||

| Dividend | −0.0204 *** | −0.2708 *** | 0.1391 *** | 0.0097 *** | ||||||||||

| Leverage | −0.7596 *** | 0.1539 *** | −0.0701 *** | 0.1096 *** | 0.0066 * | |||||||||

| Firm size | −0.2005 *** | −0.3539 *** | −0.1574 *** | −0.0585 *** | 0.2747 *** | 0.1330 *** | ||||||||

| Profitability | 0.0630 *** | −0.2300 *** | 0.2496 *** | 0.1606 *** | 0.3000 *** | −0.0307 *** | 0.1499 *** | |||||||

| Tobin’s Q | 0.2615 *** | −0.3627 *** | −0.0629 *** | 0.1142 *** | 0.0039 | −0.2508 *** | −0.1204 *** | 0.1396 *** | ||||||

| Retained earnings | 0.0893 *** | −0.1585 *** | 0.1617 *** | 0.0642 *** | 0.3164 *** | −0.0062 * | 0.1529 *** | 0.5634 *** | −0.0572 *** | |||||

| Repurchase | 0.0322 *** | −0.1394 *** | −0.0041 | −0.0593 *** | 0.0376 *** | −0.0918 *** | 0.1905 *** | 0.1647 *** | 0.0454 *** | 0.0715 *** | ||||

| Sales volatility | −0.0936 *** | 0.0240 *** | 0.2654 *** | 0.0315 *** | 0.0691 *** | 0.0567 *** | 0.0258 *** | 0.0269 *** | −0.0501 *** | 0.0637 *** | −0.0236 *** | |||

| Tangibility | −0.1031 *** | −0.0361 *** | −0.0925 *** | 0.6317 *** | 0.1577 *** | 0.2920 *** | 0.0717 *** | 0.1582 *** | −0.0632 *** | 0.1275 *** | −0.0870 *** | 0.0717 *** | ||

| Working capital | 0.5027 *** | 0.0183 *** | 0.0232 *** | −0.3109 *** | −0.0882 *** | −0.4308 *** | −0.3277 *** | −0.0900 *** | 0.1915 *** | −0.0308 *** | −0.0213 *** | −0.0983 *** | −0.5433 *** | |

| Age | −0.0940 *** | −0.0560 *** | −0.0060 * | −0.1468 *** | 0.3263 *** | −0.0054 * | 0.4629 *** | 0.0920 *** | −0.1856 *** | 0.1566 *** | 0.1316 *** | −0.0161 *** | 0.0012 | −0.1369 *** |

| Panel B: Variance Inflation Factor (VIF) Information for All Variables | ||||||||||||||

| Variable | VIF | 1/VIF | ||||||||||||

| Tangibility | 2.36 | 0.425 | ||||||||||||

| Working capital | 1.88 | 0.533 | ||||||||||||

| Firm size | 1.87 | 0.536 | ||||||||||||

| Capital expenditure | 1.84 | 0.545 | ||||||||||||

| Profitability | 1.76 | 0.569 | ||||||||||||

| Retained earnings | 1.59 | 0.629 | ||||||||||||

| C-score | 1.57 | 0.639 | ||||||||||||

| Age | 1.46 | 0.685 | ||||||||||||

| Tobin’s Q | 1.4 | 0.715 | ||||||||||||

| Dividend | 1.39 | 0.721 | ||||||||||||

| Leverage | 1.34 | 0.745 | ||||||||||||

| Asset utility | 1.3 | 0.769 | ||||||||||||

| Sales volatility | 1.11 | 0.903 | ||||||||||||

| Repurchase | 1.1 | 0.913 | ||||||||||||

| Mean VIF | 1.57 | |||||||||||||

| Model | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Dependent Variable: BE | All Firms | Survivors | Firm FE | FD |

| C-score | −0.0348 *** | −0.2059 * | −0.0225 ** | −0.0117 *** |

| (0.0104) | (0.0808) | (0.0087) | (0.0023) | |

| asset utility | −0.0662 *** | −0.0768 *** | −0.0570 *** | −0.0336 *** |

| (0.0020) | (0.0164) | (0.0027) | (0.0020) | |

| capital expenditure | −0.1253 *** | 0.0543 | −0.0796 *** | −0.0223 *** |

| (0.0143) | (0.1185) | (0.0138) | (0.0066) | |

| dividend | 0.0063 ** | −0.0056 | −0.0011 | 0.0043 *** |

| (0.0024) | (0.0167) | (0.0024) | (0.0011) | |

| leverage | −0.7229 *** | −0.6514 *** | −0.6412 *** | −0.7562 *** |

| (0.0069) | (0.0662) | (0.0081) | (0.0070) | |

| firm size | −0.0136 *** | −0.0136 | 0.0043 * | −0.0058 * |

| (0.0008) | (0.0086) | (0.0019) | (0.0024) | |

| profitability | 0.2538 *** | 0.1119 | 0.1990 *** | 0.0243 *** |

| (0.0096) | (0.0658) | (0.0097) | (0.0062) | |

| Tobin’s Q | 0.0017 *** | −0.0046 | 0.0024 *** | −0.0006 * |

| (0.0004) | (0.0031) | (0.0004) | (0.0003) | |

| retained earnings | 0.0219 *** | 0.1314 ** | 0.0267 *** | 0.0650 *** |

| (0.0019) | (0.0392) | (0.0027) | (0.0036) | |

| repurchase | −0.2185 *** | −0.2728 * | −0.1836 *** | −0.0685 *** |

| (0.0219) | (0.1015) | (0.0165) | (0.0077) | |

| sales volatility | 0.0224 | 0.0759 | −0.0102 | −0.0034 |

| (0.0190) | (0.0897) | (0.0177) | (0.0076) | |

| tangibility | 0.2075 *** | 0.1253 | 0.1419 *** | 0.2125 *** |

| (0.0087) | (0.0659) | (0.0115) | (0.0099) | |

| working capital | 0.3052 *** | 0.2066 *** | 0.2139 *** | 0.2258 *** |

| (0.0078) | (0.0497) | (0.0077) | (0.0056) | |

| age | −0.0008 *** | −0.0111 ** | −0.0030 | −0.0015 |

| (0.0001) | (0.0036) | (0.0022) | (0.0013) | |

| Lag dBE | −0.0095 * | |||

| (0.0039) | ||||

| Lag BE | −0.0266 *** | |||

| (0.0011) | ||||

| Intercept | 0.6843 *** | 1.0703 *** | 0.6435 *** | 0.0144 *** |

| (0.0086) | (0.0996) | (0.0360) | (0.0014) | |

| Firm FE | No | No | Yes | No |

| Industry FE | Yes | Yes | No | No |

| Year FE | Yes | Yes | Yes | No |

| N | 87382 | 1739 | 87382 | 65886 |

| adj. R-sq | 0.6002 | 0.7647 | 0.7360 | 0.6768 |

| Model | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Dependent Variable: BE | 70s | 80s | 90s | 00s | 10s |

| C-score | −0.0588 *** | −0.1477 *** | −0.1313 *** | 0.0659 ** | 0.0061 |

| (0.0112) | (0.0231) | (0.0265) | (0.0223) | (0.0308) | |

| asset utility | −0.0391 *** | −0.0489 *** | −0.0695 *** | −0.0773 *** | −0.0905 *** |

| (0.0031) | (0.0028) | (0.0030) | (0.0034) | (0.0044) | |

| capital expenditure | −0.1637 *** | −0.1598 *** | −0.1497 *** | −0.1042 ** | −0.2273 *** |

| (0.0233) | (0.0232) | (0.0262) | (0.0368) | (0.0571) | |

| dividend | −0.0027 | 0.0119 ** | 0.0053 | −0.0040 | 0.0035 |

| (0.0040) | (0.0038) | (0.0041) | (0.0046) | (0.0053) | |

| leverage | −0.6296 *** | −0.6908 *** | −0.6659 *** | −0.7310 *** | −0.7420 *** |

| (0.0201) | (0.0134) | (0.0115) | (0.0127) | (0.0164) | |

| firm size | −0.0151 *** | −0.0166 *** | −0.0190 *** | −0.0123 *** | −0.0160 *** |

| (0.0013) | (0.0013) | (0.0014) | (0.0016) | (0.0024) | |

| profitability | 0.1898 *** | 0.1474 *** | 0.2149 *** | 0.3178 *** | 0.2943 *** |

| (0.0216) | (0.0191) | (0.0175) | (0.0192) | (0.0233) | |

| Tobin’s Q | 0.0025 *** | 0.0049 *** | 0.0034 *** | −0.0005 | −0.0036* |

| (0.0005) | (0.0009) | (0.0007) | (0.0012) | (0.0017) | |

| retained earnings | 0.1069 *** | 0.0766 *** | 0.0375 *** | 0.0151 *** | 0.0193 *** |

| (0.0217) | (0.0092) | (0.0046) | (0.0026) | (0.0028) | |

| repurchase | −0.1430 * | −0.1067 ** | −0.2006 *** | −0.2115 *** | −0.2632 *** |

| (0.0676) | (0.0408) | (0.0330) | (0.0358) | (0.0454) | |

| sales volatility | −0.0389 | −0.0201 | 0.0526 | 0.0036 | −0.0435 |

| (0.0275) | (0.0284) | (0.0429) | (0.0417) | (0.0451) | |

| tangibility | 0.3323 *** | 0.3279 *** | 0.2218 *** | 0.1081 *** | 0.1269 *** |

| (0.0198) | (0.0156) | (0.0144) | (0.0155) | (0.0182) | |

| working capital | 0.3126 *** | 0.3486 *** | 0.3283 *** | 0.2657 *** | 0.2652 *** |

| (0.0202) | (0.0146) | (0.0119) | (0.0122) | (0.0177) | |

| age | 0.0008 | −0.0011 *** | −0.0008 *** | −0.0009 *** | −0.0004 * |

| (0.0005) | (0.0003) | (0.0002) | (0.0002) | (0.0002) | |

| Intercept | 0.5386 *** | 0.6055 *** | 0.6967 *** | 0.7395 *** | 0.7897 *** |

| (0.0179) | (0.0153) | (0.0145) | (0.0163) | (0.0266) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| N | 14459 | 18201 | 23113 | 20014 | 11594 |

| adj. R-sq | 0.7081 | 0.6423 | 0.5896 | 0.5797 | 0.5970 |

| Model | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Panel A: 1980s Evaluation Period | ||||||

| Potential driving forces | Xi_1980s | Xi,base_1980s | βi,1980s | βi,base_1980s | βi,base_1980s ∗ (Xi_1980s − Xi,base_1980s) | Xi,base_1980s ∗ (βi,1980s − βi,base_1980s) |

| C-score | 0.131 | 0.130 | −0.1477 | −0.0588 | −0.058% | −19.664% |

| Leverage | 0.230 | 0.240 | −0.6908 | −0.6296 | 2.625% | −2.333% |

| Profitability | 0.130 | 0.164 | 0.1474 | 0.1898 | −3.927% | −3.670% |

| Panel B: 1990s Evaluation Period | ||||||

| Potential driving forces | Xi_1990s | Xi,base_1990s | βi,1990s | βi,base_1990s | βi,base_1990s ∗ (Xi_1990s − Xi,base_1990s) | Xi,base_1990s ∗ (βi,1990s − βi,base_1990s) |

| C-score | 0.138 | 0.131 | −0.1313 | −0.1477 | −0.734% | 1.458% |

| Leverage | 0.209 | 0.230 | −0.6659 | −0.6908 | 6.447% | 0.829% |

| Profitability | 0.114 | 0.130 | 0.2149 | 0.1474 | −1.875% | 5.966% |

| Panel C: 2000s Evaluation Period | ||||||

| Potential driving forces | Xi_2000s | Xi,base_2000s | βi,2000s | βi,base_2000s | βi,base_2000s ∗ (Xi_2000s − Xi,base_2000s) | Xi,base_2000s ∗ (βi,2000s − βi,base_2000s) |

| C-score | 0.167 | 0.138 | 0.0659 | −0.1313 | −2.800% | 20.706% |

| Leverage | 0.173 | 0.209 | −0.731 | −0.6659 | 11.417% | −2.039% |

| Profitability | 0.097 | 0.114 | 0.3178 | 0.2149 | −3.089% | 5.445% |

| Panel D: 2010s Evaluation Period | ||||||

| Potential driving forces | Xi_2010s | Xi,base_2010s | βi,2010s | βi,base_2010s | βi,base_2010s ∗ (Xi_2010s − Xi,base_2010s) | Xi,base_2010s ∗ (βi,20010s − βi,base_2010s) |

| C-score | 0.180 | 0.167 | 0.0061 | 0.0659 | 0.514% | −15.179% |

| Leverage | 0.198 | 0.173 | −0.742 | −0.731 | −10.599% | −0.260% |

| Profitability | 0.097 | 0.097 | 0.2943 | 0.3178 | 0.005% | −0.720% |

| Panel E: Average Across All Evaluation Periods | ||||||

| C-score | 0.154 | 0.142 | −0.052 | −0.068 | −0.769% | −3.170% |

| Leverage | 0.202 | 0.213 | −0.707 | −0.679 | 2.472% | −0.951% |

| Profitability | 0.110 | 0.126 | 0.244 | 0.217 | −2.221% | 1.755% |

| Model | (1) | (2) |

|---|---|---|

| Dependent Variable | NI | TA |

| NEG ∗ ET ∗ BE | −0.6509 *** | |

| (−11.1145) | ||

| CFO ∗ DCFO ∗ BE | −0.8807 *** | |

| (−74.5577) | ||

| Intercept | −0.0545 *** | −0.0111 *** |

| (−4.4273) | (−2.9303) | |

| Control Variables | Yes | Yes |

| Industry FE | Yes | Yes |

| Year FE | Yes | Yes |

| N | 123,294 | 123,294 |

| R-sq | 0.2515 | 0.2515 |

| Model | (1) | (2) | (3) |

|---|---|---|---|

| Dependent Variable: BE | Quantile = 0.25 | Quantile = 0.5 | Quantile = 0.75 |

| C-score | −0.01308 | −0.01948 *** | −0.02553 *** |

| (0.009) | (0.007) | (0.007) | |

| asset utility | −0.05714 *** | −0.05702 *** | −0.05689 *** |

| (0.002) | (0.001) | (0.002) | |

| capital expenditure | −0.08873 *** | −0.07870 *** | −0.06920 *** |

| (0.013) | (0.010) | (0.011) | |

| dividend | −0.00034 | −0.00061 | −0.00087 |

| (0.002) | (0.001) | (0.002) | |

| leverage | −0.64381 *** | −0.64133 *** | −0.63898 *** |

| (0.006) | (0.004) | (0.005) | |

| firm size | 0.01101 *** | 0.00349 *** | −0.00363 *** |

| (0.001) | (0.001) | (0.001) | |

| profitability | 0.23778 *** | 0.19421 *** | 0.15294 *** |

| (0.008) | (0.006) | (0.007) | |

| Tobin’s Q | 0.00165 *** | 0.00245 *** | 0.00322 *** |

| (0.000) | (0.000) | (0.000) | |

| retained earnings | 0.03032 *** | 0.02605 *** | 0.02201 *** |

| (0.002) | (0.001) | (0.002) | |

| repurchase | −0.19708 *** | −0.18085 *** | −0.16547 *** |

| (0.018) | (0.013) | (0.015) | |

| sales volatility | −0.01838 | −0.00073 | 0.01599 |

| (0.017) | (0.013) | (0.015) | |

| tangibility | 0.16522 *** | 0.13572 *** | 0.10777 *** |

| (0.008) | (0.006) | (0.007) | |

| working capital | 0.24717 *** | 0.20907 *** | 0.17297 *** |

| (0.006) | (0.004) | (0.005) | |

| age | −0.00205 *** | −0.00169 *** | −0.00135 *** |

| (0.000) | (0.000) | (0.000) | |

| Firm FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 87,382 | 87,382 | 87,382 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | BE | BE | BE | BE |

| D_highACi,t−1 | −0.0056 ** | −0.0067 *** | −0.0063 *** | −0.0055 ** |

| (0.0020) | (0.0015) | (0.0015) | (0.0020) | |

| Controls | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 34,967 | 46,647 | 51,264 | 33,879 |

| adj. R-sq | 0.7216 | 0.7264 | 0.7279 | 0.7216 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, H.; Luo, B.; Peabody, S.D. The Role of Accounting Conservatism in the Decreasing Book Equity of U.S. Firms. Int. J. Financial Stud. 2025, 13, 146. https://doi.org/10.3390/ijfs13030146

Luo H, Luo B, Peabody SD. The Role of Accounting Conservatism in the Decreasing Book Equity of U.S. Firms. International Journal of Financial Studies. 2025; 13(3):146. https://doi.org/10.3390/ijfs13030146

Chicago/Turabian StyleLuo, Haowen, Bing Luo, and S. Drew Peabody. 2025. "The Role of Accounting Conservatism in the Decreasing Book Equity of U.S. Firms" International Journal of Financial Studies 13, no. 3: 146. https://doi.org/10.3390/ijfs13030146

APA StyleLuo, H., Luo, B., & Peabody, S. D. (2025). The Role of Accounting Conservatism in the Decreasing Book Equity of U.S. Firms. International Journal of Financial Studies, 13(3), 146. https://doi.org/10.3390/ijfs13030146