From Fields to Finance: Dynamic Connectedness and Optimal Portfolio Strategies Among Agricultural Commodities, Oil, and Stock Markets

Abstract

1. Introduction

- Question 1:

- Do the patterns of return connectedness behavior among agricultural commodities, crude oil, and the overall stock market vary across major global crises?

- Question 2:

- Do and how agricultural commodities enhance stock portfolio performance during turbulent periods?

2. Methodology

2.1. Connectedness Analysis

2.1.1. TVP-VAR Model

2.1.2. Dynamic Connectedness Indices

2.2. Portfolio Analysis

2.2.1. Portfolio Optimization

2.2.2. Portfolio Evaluation

3. Data

4. Results and Discussion

4.1. Connectedness Analysis

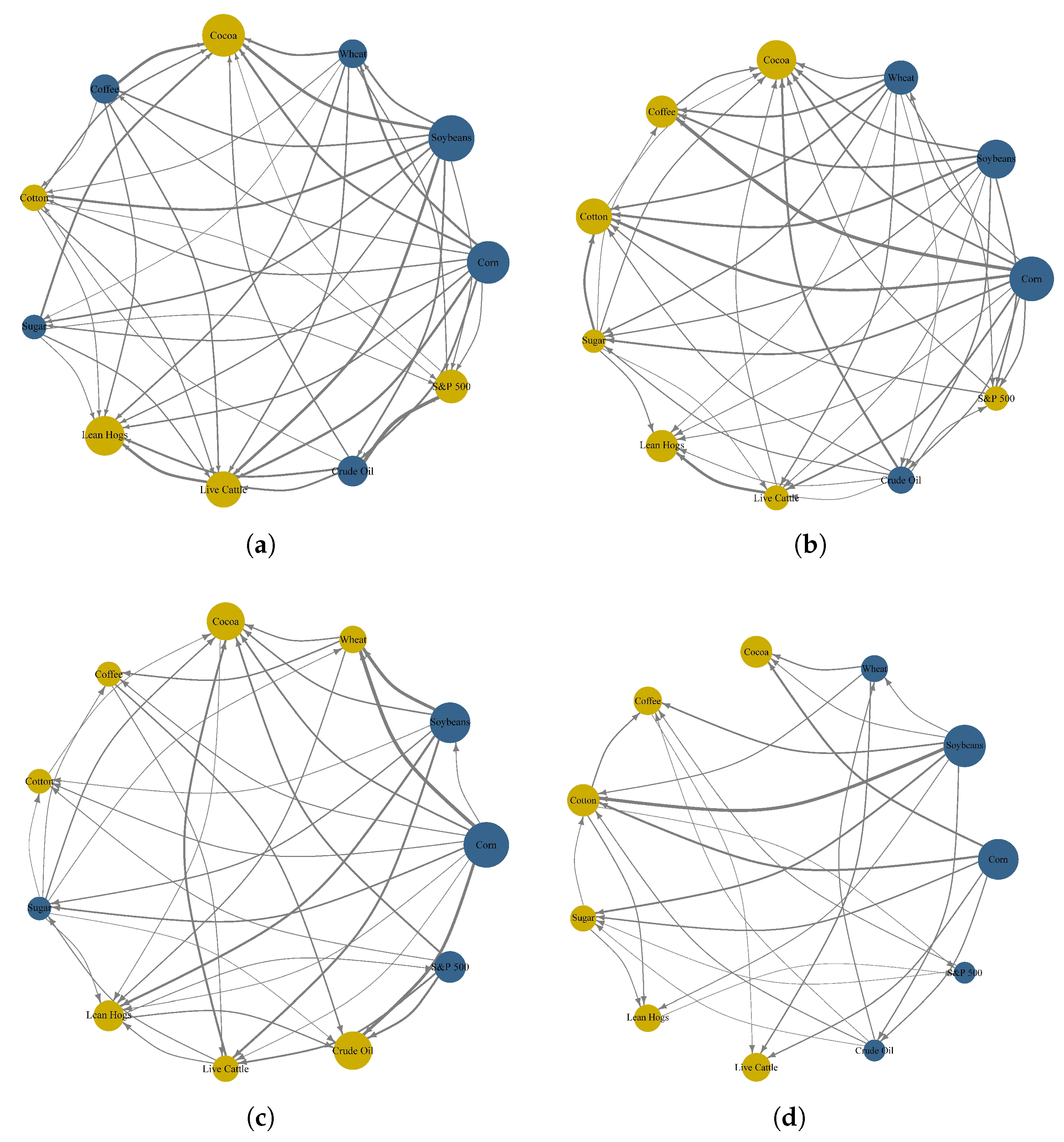

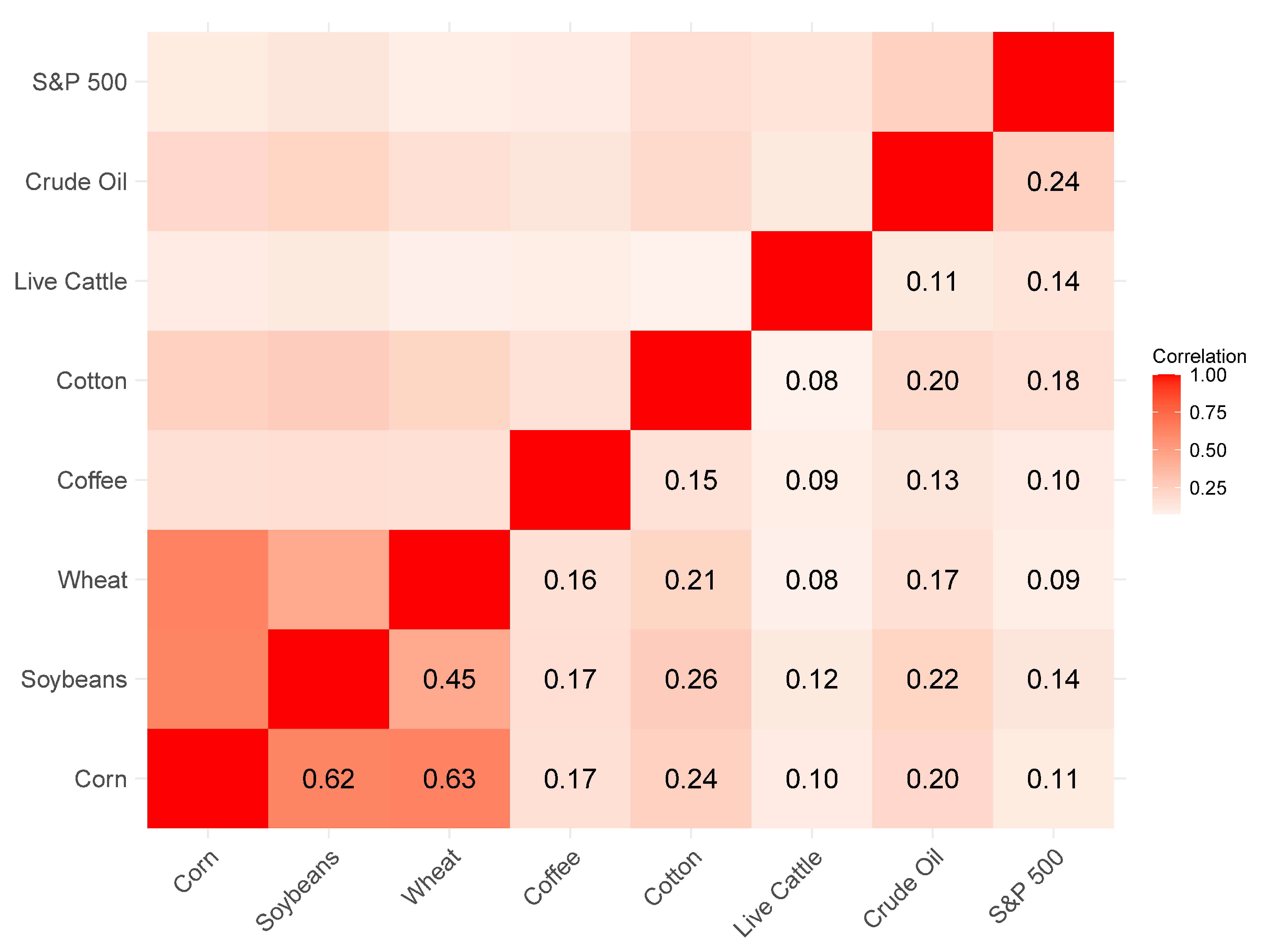

4.1.1. Static Connectedness

4.1.2. Dynamic Total Connectedness

4.1.3. Sub-Sample Connectedness Network

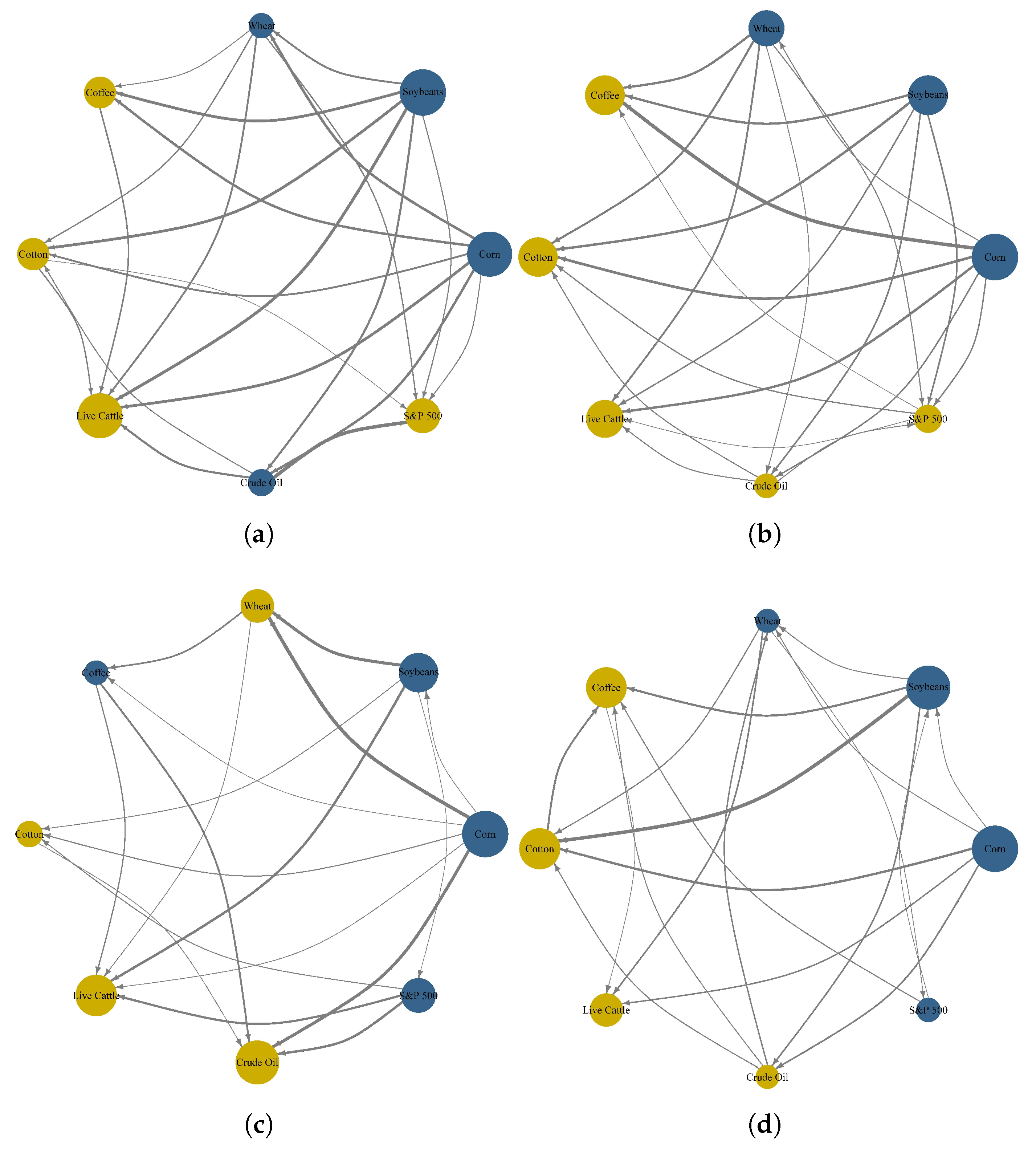

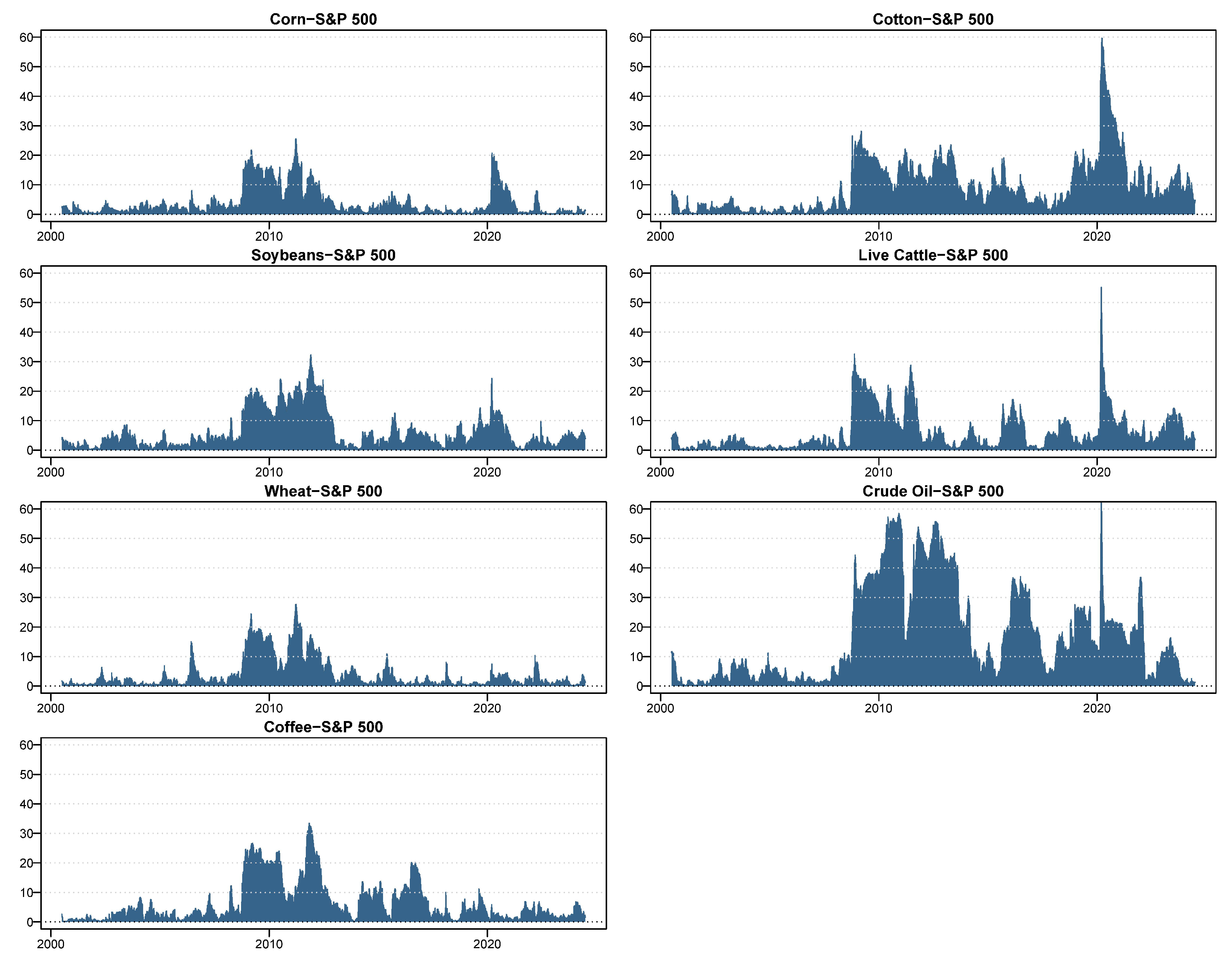

4.1.4. Dynamic Pairwise Connectedness

4.2. Dynamic Portfolios

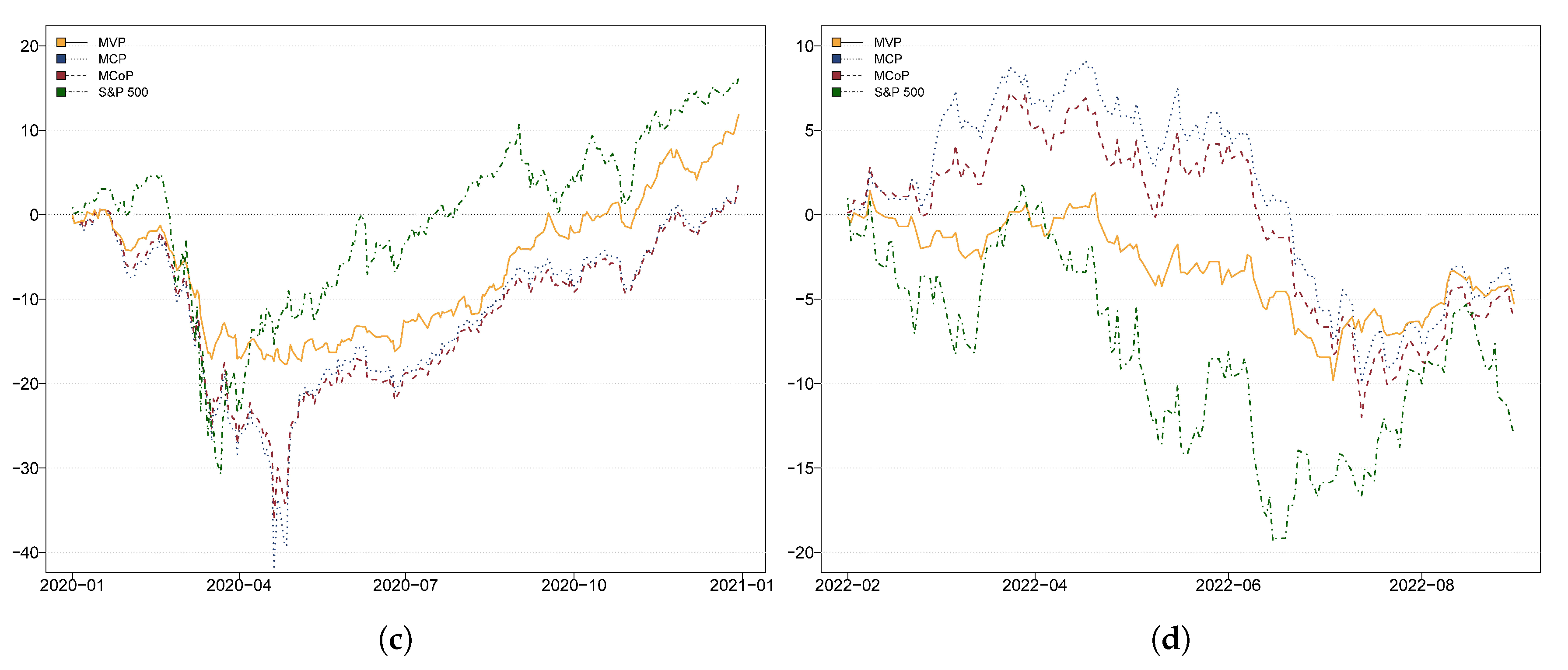

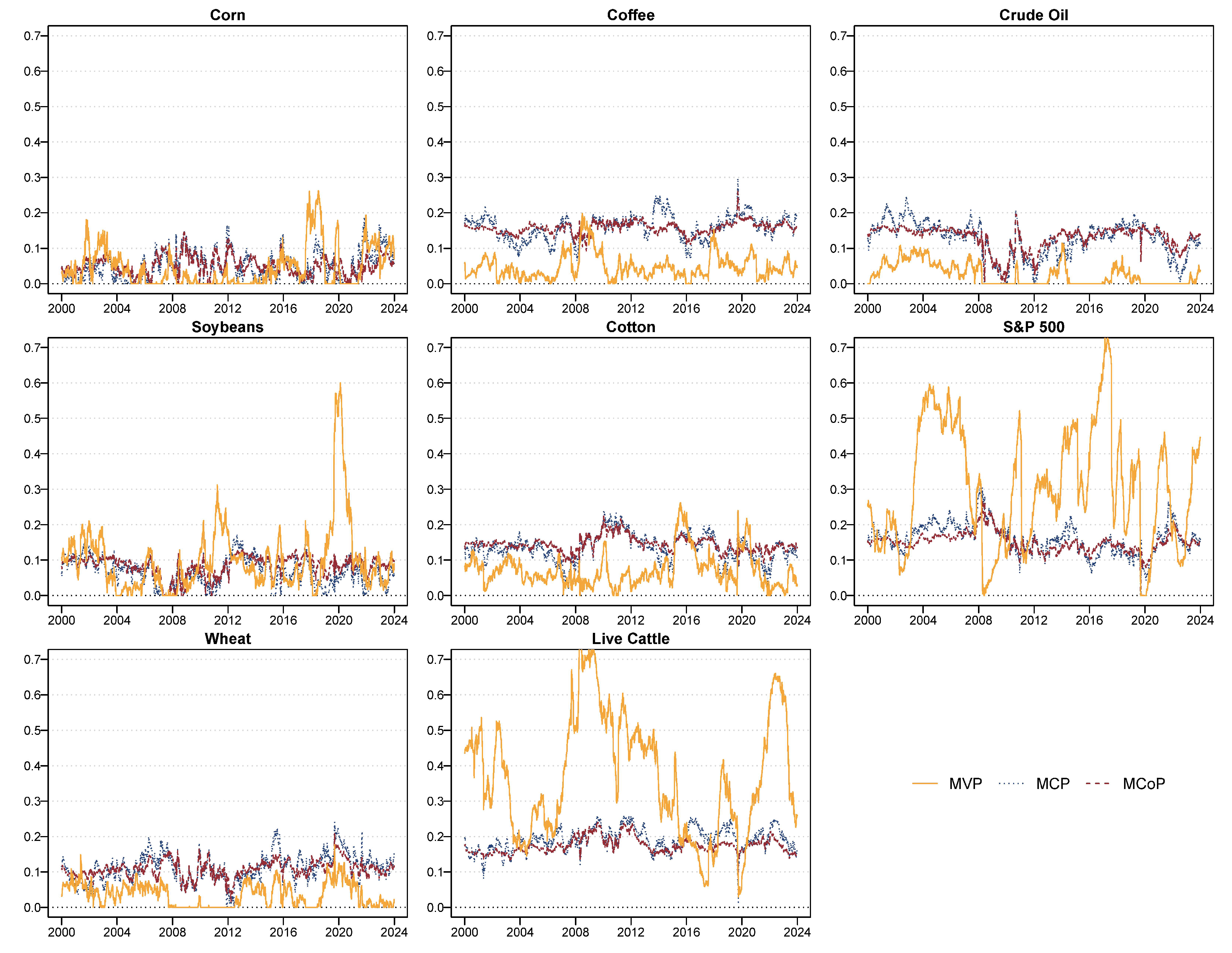

4.2.1. Cumulative Returns

4.2.2. Dynamic Allocation Weights and Hedging Effectiveness

4.2.3. Risk-Adjusted Portfolio Performance

4.2.4. Robustness

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Panel A: Global Financial Crisis | |||||||

| Variables | Mean | Std. Dev. | 5% | 95% | HE | p-Value | |

| MVP | Corn | 0.02 | 0.03 | 0.00 | 0.07 | 0.84 | 0.00 |

| Soybeans | 0.03 | 0.03 | 0.00 | 0.10 | 0.82 | 0.00 | |

| Wheat | 0.00 | 0.00 | 0.00 | 0.01 | 0.88 | 0.00 | |

| Coffee | 0.11 | 0.05 | 0.03 | 0.19 | 0.74 | 0.00 | |

| Cotton | 0.04 | 0.02 | 0.02 | 0.07 | 0.82 | 0.00 | |

| Live Cattle | 0.70 | 0.05 | 0.63 | 0.81 | 0.13 | 0.14 | |

| Crude Oil | 0.00 | 0.00 | 0.00 | 0.01 | 0.92 | 0.00 | |

| S&P 500 | 0.09 | 0.08 | 0.01 | 0.24 | 0.83 | 0.00 | |

| MCP | Corn | 0.07 | 0.04 | 0.01 | 0.14 | 0.64 | 0.00 |

| Soybeans | 0.04 | 0.03 | 0.00 | 0.09 | 0.59 | 0.00 | |

| Wheat | 0.12 | 0.04 | 0.05 | 0.17 | 0.73 | 0.00 | |

| Coffee | 0.12 | 0.02 | 0.09 | 0.14 | 0.41 | 0.00 | |

| Cotton | 0.13 | 0.02 | 0.10 | 0.17 | 0.58 | 0.00 | |

| Live Cattle | 0.20 | 0.02 | 0.16 | 0.22 | −0.95 | 0.00 | |

| Crude Oil | 0.08 | 0.03 | 0.03 | 0.13 | 0.82 | 0.00 | |

| S&P 500 | 0.25 | 0.03 | 0.20 | 0.30 | 0.61 | 0.00 | |

| MCoP | Corn | 0.05 | 0.04 | 0.00 | 0.13 | 0.64 | 0.00 |

| Soybeans | 0.04 | 0.03 | 0.00 | 0.10 | 0.59 | 0.00 | |

| Wheat | 0.12 | 0.04 | 0.05 | 0.16 | 0.73 | 0.00 | |

| Coffee | 0.13 | 0.01 | 0.10 | 0.14 | 0.41 | 0.00 | |

| Cotton | 0.14 | 0.02 | 0.12 | 0.18 | 0.58 | 0.00 | |

| Live Cattle | 0.20 | 0.02 | 0.16 | 0.22 | −0.96 | 0.00 | |

| Crude Oil | 0.09 | 0.03 | 0.05 | 0.13 | 0.82 | 0.00 | |

| S&P 500 | 0.23 | 0.02 | 0.19 | 0.25 | 0.61 | 0.00 | |

| Panel B: European Debt Crisis | |||||||

| Variables | Mean | Std. Dev. | 5% | 95% | HE | p-Value | |

| MVP | Corn | 0.01 | 0.01 | 0.00 | 0.04 | 0.87 | 0.00 |

| Soybeans | 0.18 | 0.06 | 0.07 | 0.26 | 0.72 | 0.00 | |

| Wheat | 0.00 | 0.00 | 0.00 | 0.00 | 0.90 | 0.00 | |

| Coffee | 0.03 | 0.02 | 0.00 | 0.06 | 0.86 | 0.00 | |

| Cotton | 0.05 | 0.03 | 0.00 | 0.10 | 0.89 | 0.00 | |

| Live Cattle | 0.50 | 0.08 | 0.31 | 0.58 | 0.38 | 0.00 | |

| Crude Oil | 0.01 | 0.02 | 0.00 | 0.06 | 0.85 | 0.00 | |

| S&P 500 | 0.24 | 0.13 | 0.11 | 0.49 | 0.67 | 0.00 | |

| MCP | Corn | 0.05 | 0.03 | 0.00 | 0.10 | 0.74 | 0.00 |

| Soybeans | 0.04 | 0.03 | 0.00 | 0.10 | 0.44 | 0.00 | |

| Wheat | 0.10 | 0.02 | 0.07 | 0.14 | 0.81 | 0.00 | |

| Coffee | 0.17 | 0.01 | 0.15 | 0.18 | 0.72 | 0.00 | |

| Cotton | 0.20 | 0.01 | 0.18 | 0.23 | 0.78 | 0.00 | |

| Live Cattle | 0.21 | 0.03 | 0.16 | 0.25 | −0.24 | 0.01 | |

| Crude Oil | 0.09 | 0.04 | 0.05 | 0.19 | 0.70 | 0.00 | |

| S&P 500 | 0.13 | 0.02 | 0.10 | 0.16 | 0.34 | 0.00 | |

| MCoP | Corn | 0.05 | 0.03 | 0.00 | 0.09 | 0.74 | 0.00 |

| Soybeans | 0.06 | 0.02 | 0.02 | 0.09 | 0.44 | 0.00 | |

| Wheat | 0.10 | 0.02 | 0.07 | 0.14 | 0.81 | 0.00 | |

| Coffee | 0.17 | 0.01 | 0.15 | 0.18 | 0.72 | 0.00 | |

| Cotton | 0.19 | 0.01 | 0.18 | 0.21 | 0.78 | 0.00 | |

| Live Cattle | 0.19 | 0.02 | 0.16 | 0.23 | −0.24 | 0.01 | |

| Crude Oil | 0.11 | 0.03 | 0.07 | 0.19 | 0.70 | 0.00 | |

| S&P 500 | 0.13 | 0.01 | 0.11 | 0.15 | 0.34 | 0.00 | |

| Panel C: COVID-19 Pandemic | |||||||

| Variables | Mean | Std. Dev. | 5% | 95% | HE | p-Value | |

| MVP | Corn | 0.05 | 0.08 | 0.00 | 0.20 | 0.63 | 0.00 |

| Soybeans | 0.48 | 0.07 | 0.37 | 0.58 | 0.37 | 0.00 | |

| Wheat | 0.12 | 0.02 | 0.08 | 0.15 | 0.74 | 0.00 | |

| Coffee | 0.05 | 0.02 | 0.02 | 0.07 | 0.88 | 0.00 | |

| Cotton | 0.17 | 0.03 | 0.13 | 0.22 | 0.71 | 0.00 | |

| Live Cattle | 0.11 | 0.05 | 0.04 | 0.19 | 0.78 | 0.00 | |

| Crude Oil | 0.00 | 0.00 | 0.00 | 0.00 | 0.99 | 0.00 | |

| S&P 500 | 0.02 | 0.03 | 0.00 | 0.08 | 0.87 | 0.00 | |

| MCP | Corn | 0.01 | 0.01 | 0.00 | 0.03 | −0.50 | 0.00 |

| Soybeans | 0.06 | 0.01 | 0.04 | 0.08 | −1.58 | 0.00 | |

| Wheat | 0.20 | 0.01 | 0.17 | 0.22 | −0.07 | 0.61 | |

| Coffee | 0.21 | 0.02 | 0.18 | 0.24 | 0.52 | 0.00 | |

| Cotton | 0.13 | 0.02 | 0.11 | 0.16 | −0.19 | 0.17 | |

| Live Cattle | 0.16 | 0.02 | 0.12 | 0.19 | 0.09 | 0.46 | |

| Crude Oil | 0.16 | 0.02 | 0.13 | 0.19 | 0.95 | 0.00 | |

| S&P 500 | 0.08 | 0.02 | 0.05 | 0.11 | 0.47 | 0.00 | |

| MCoP | Corn | 0.04 | 0.02 | 0.01 | 0.07 | −0.39 | 0.01 |

| Soybeans | 0.08 | 0.01 | 0.06 | 0.09 | −1.38 | 0.00 | |

| Wheat | 0.17 | 0.01 | 0.15 | 0.19 | 0.01 | 0.91 | |

| Coffee | 0.18 | 0.01 | 0.17 | 0.21 | 0.56 | 0.00 | |

| Cotton | 0.12 | 0.01 | 0.11 | 0.14 | −0.10 | 0.46 | |

| Live Cattle | 0.16 | 0.01 | 0.14 | 0.18 | 0.16 | 0.17 | |

| Crude Oil | 0.15 | 0.01 | 0.14 | 0.17 | 0.95 | 0.00 | |

| S&P 500 | 0.10 | 0.01 | 0.09 | 0.12 | 0.51 | 0.00 | |

| Panel D: Russia-Ukraine Conflict | |||||||

| Variables | Mean | Std. Dev. | 5% | 95% | HE | p-Value | |

| MVP | Corn | 0.16 | 0.03 | 0.12 | 0.20 | 0.89 | 0.00 |

| Soybeans | 0.03 | 0.02 | 0.01 | 0.09 | 0.86 | 0.00 | |

| Wheat | 0.00 | 0.00 | 0.00 | 0.00 | 0.96 | 0.00 | |

| Coffee | 0.04 | 0.01 | 0.02 | 0.07 | 0.91 | 0.00 | |

| Cotton | 0.02 | 0.01 | 0.00 | 0.03 | 0.92 | 0.00 | |

| Live Cattle | 0.59 | 0.03 | 0.53 | 0.63 | 0.39 | 0.00 | |

| Crude Oil | 0.00 | 0.00 | 0.00 | 0.00 | 0.96 | 0.00 | |

| S&P 500 | 0.17 | 0.02 | 0.14 | 0.19 | 0.81 | 0.00 | |

| MCP | Corn | 0.16 | 0.03 | 0.13 | 0.21 | 0.75 | 0.00 |

| Soybeans | 0.00 | 0.01 | 0.00 | 0.03 | 0.67 | 0.00 | |

| Wheat | 0.10 | 0.02 | 0.07 | 0.13 | 0.90 | 0.00 | |

| Coffee | 0.14 | 0.01 | 0.12 | 0.17 | 0.80 | 0.00 | |

| Cotton | 0.08 | 0.01 | 0.05 | 0.10 | 0.82 | 0.00 | |

| Live Cattle | 0.21 | 0.01 | 0.19 | 0.24 | −0.41 | 0.03 | |

| Crude Oil | 0.06 | 0.02 | 0.04 | 0.09 | 0.91 | 0.00 | |

| S&P 500 | 0.23 | 0.01 | 0.22 | 0.25 | 0.56 | 0.00 | |

| MCoP | Corn | 0.06 | 0.02 | 0.03 | 0.09 | 0.71 | 0.00 |

| Soybeans | 0.05 | 0.02 | 0.03 | 0.08 | 0.62 | 0.00 | |

| Wheat | 0.08 | 0.01 | 0.06 | 0.10 | 0.89 | 0.00 | |

| Coffee | 0.16 | 0.01 | 0.16 | 0.17 | 0.77 | 0.00 | |

| Cotton | 0.14 | 0.01 | 0.12 | 0.16 | 0.80 | 0.00 | |

| Live Cattle | 0.20 | 0.01 | 0.19 | 0.22 | −0.62 | 0.00 | |

| Crude Oil | 0.10 | 0.01 | 0.08 | 0.12 | 0.90 | 0.00 | |

| S&P 500 | 0.20 | 0.01 | 0.19 | 0.21 | 0.50 | 0.00 | |

| 1 | Diebold and Yilmaz used a generalized variance decompositions scheme according to Koop et al. (1996); Parkinson (1980); Pesaran and Shin (1998). |

References

- Abakah, E. J. A., Tiwari, A. K., Oliyide, J. A., & Appiah, K. O. (2025). Analyzing the static and dynamic dependence among green investments, carbon markets, financial markets and commodity markets. International Journal of Managerial Finance, 21(1), 286–327. [Google Scholar] [CrossRef]

- Ali, S., Bouri, E., Czudaj, R. L., & Shahzad, S. J. H. (2020). Revisiting the valuable roles of commodities for international stock markets. Resources Policy, 66, 101603. [Google Scholar] [CrossRef]

- Antonakakis, N., Chatziantoniou, I., & Gabauer, D. (2020). Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. Journal of Risk and Financial Management, 13(4), 84. [Google Scholar] [CrossRef]

- Antonakakis, N., & Gabauer, D. (2017). Refined measures of dynamic connectedness based on TVP-VAR (Tech. Rep.). University Library of Munich. [Google Scholar]

- Babar, M., Ahmad, H., & Yousaf, I. (2023). Returns and volatility spillover between agricultural commodities and emerging stock markets: New evidence from COVID-19 and Russian-Ukrainian war. International Journal of Emerging Markets, 19(11), 4049–4072. [Google Scholar] [CrossRef]

- Baldi, L., Peri, M., & Vandone, D. (2016). Stock markets’ bubbles burst and volatility spillovers in agricultural commodity markets. Research in International Business and Finance, 38, 277–285. [Google Scholar] [CrossRef]

- Banerjee, A. K., Akhtaruzzaman, M., Sensoy, A., & Goodell, J. W. (2024). Volatility spillovers and hedging strategies between impact investing and agricultural commodities. International Review of Financial Analysis, 94, 103237. [Google Scholar] [CrossRef]

- Biglova, A., Ortobelli, S., Rachev, S., & Stoyanov, S. (2004). Different approaches to risk estimation in portfolio theory. Journal of Portfolio Management, 31(1), 103. [Google Scholar] [CrossRef]

- Broadstock, D. C., Chatziantoniou, I., & Gabauer, D. (2022). Minimum connectedness portfolios and the market for green bonds: Advocating socially responsible investment (SRI) activity. In Applications in energy finance: The energy sector, economic activity, financial markets and the environment (pp. 217–253). Springer. [Google Scholar]

- Brown, M. B., & Forsythe, A. B. (1974). Robust tests for the equality of variances. Journal of the American Statistical Association, 69(346), 364–367. [Google Scholar] [CrossRef]

- Bunditsakulporn, K. (2022). The relationship between agricultural commodities and stock market in case of Thailand: Safe-haven, hedge, or diversifier?–Cross quantilogram analysis. International Journal of Business & Administrative Studies, 8(3), 127–152. [Google Scholar]

- Cagli, E. C., Mandaci, P. E., & Taskin, D. (2023). The volatility connectedness between agricultural commodity and agri businesses: Evidence from time-varying extended joint approach. Finance Research Letters, 52, 103555. [Google Scholar] [CrossRef]

- Cagli, E. C. C., Mandaci, P. E., & Taşkın, D. (2023). Environmental, social, and governance (ESG) investing and commodities: Dynamic connectedness and risk management strategies. Sustainability Accounting, Management and Policy Journal, 14(5), 1052–1074. [Google Scholar] [CrossRef]

- Campiche, J. L., Bryant, H. L., Richardson, J. W., & Outlaw, J. L. (2007, July 29–August 1). Examining the evolving correspondence between petroleum prices and agricultural commodity prices. The American Agricultural Economics Association Annual Meeting, Portland, OR, USA. [Google Scholar]

- Chen, Z., Yan, B., & Kang, H. (2022). Dynamic correlation between crude oil and agricultural futures markets. Review of Development Economics, 1798–1849. [Google Scholar] [CrossRef]

- Cheng, I.-H., & Xiong, W. (2014). Financialization of commodity markets. Annual Review of Financial Economics, 6(1), 419–441. [Google Scholar] [CrossRef]

- Chien, F., Sadiq, M., Kamran, H. W., Nawaz, M. A., Hussain, M. S., & Raza, M. (2021). Co-movement of energy prices and stock market return: Environmental wavelet nexus of COVID-19 pandemic from the USA, Europe, and China. Environmental Science and Pollution Research, 28(25), 32359–32373. [Google Scholar] [CrossRef] [PubMed]

- Christoffersen, P., Errunza, V., Jacobs, K., & Jin, X. (2014). Correlation dynamics and international diversification benefits. International Journal of Forecasting, 30(3), 807–824. [Google Scholar] [CrossRef]

- Claessens, S., & Schmukler, S. L. (2007). International financial integration through equity markets: Which firms from which countries go global? Journal of International Money and Finance, 26(5), 788–813. [Google Scholar] [CrossRef]

- Del Negro, M., & Primiceri, G. E. (2015). Time varying structural vector autoregressions and monetary policy: A corrigendum. The Review of Economic Studies, 82(4), 1342–1345. [Google Scholar] [CrossRef]

- Demirer, M., Diebold, F. X., Liu, L., & Yilmaz, K. (2018). Estimating global bank network connectedness. Journal of Applied Econometrics, 33(1), 1–15. [Google Scholar] [CrossRef]

- Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366a), 427–431. [Google Scholar]

- Diebold, F. X., & Yilmaz, K. (2009). Measuring financial asset return and volatility spillovers, with application to global equity markets. The Economic Journal, 119(534), 158–171. [Google Scholar] [CrossRef]

- Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66. [Google Scholar] [CrossRef]

- Diebold, F. X., & Yilmaz, K. (2014). On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics, 182(1), 119–134. [Google Scholar] [CrossRef]

- Du, L., & He, Y. (2015). Extreme risk spillovers between crude oil and stock markets. Energy Economics, 51, 455–465. [Google Scholar] [CrossRef]

- Duménil, G., & Lévy, D. (2004). Capital resurgent: Roots of the neoliberal revolution. Harvard University Press. [Google Scholar]

- Ederington, L. H. (1979). The hedging performance of the new futures markets. The Journal of Finance, 34(1), 157–170. [Google Scholar] [CrossRef]

- Fisher, T. J., & Gallagher, C. M. (2012). New weighted portmanteau statistics for time series goodness of fit testing. Journal of the American Statistical Association, 107(498), 777–787. [Google Scholar] [CrossRef]

- Gabauer, D. (2021). Dynamic measures of asymmetric & pairwise connectedness within an optimal currency area: Evidence from the ERM I system. Journal of Multinational Financial Management, 60, 100680. [Google Scholar] [CrossRef]

- Garcia-Jorcano, L., & Sanchis-Marco, L. (2022). Spillover effects between commodity and stock markets: A SDSES approach. Resources Policy, 79, 102926. [Google Scholar] [CrossRef]

- Gatfaoui, H. (2016). Linking the gas and oil markets with the stock market: Investigating the US relationship. Energy Economics, 53, 5–16. [Google Scholar] [CrossRef]

- Giunta, N., Orlando, G., Carleo, A., & Ricci, J. M. (2024). Exploring entropy-based portfolio strategies: Empirical analysis and cryptocurrency impact. Risks, 12(5), 78. [Google Scholar] [CrossRef]

- Goodwin, T. H. (1998). The information ratio. Financial Analysts Journal, 54(4), 34–43. [Google Scholar] [CrossRef]

- Hadad, E., Malhotra, D., & Vasileiou, E. (2024). Risk spillovers and optimal hedging in commodity ETFs: A TVP-VAR Approach. Finance Research Letters, 70, 106372. [Google Scholar] [CrossRef]

- Han, S. (2025). Evaluating the hedging potential of energy, metals, and agricultural commodities for US stocks post-COVID-19. The North American Journal of Economics and Finance, 77, 102380. [Google Scholar] [CrossRef]

- Hernandez, J. A., Kang, S. H., & Yoon, S.-M. (2021). Spillovers and portfolio optimization of agricultural commodity and global equity markets. Applied Economics, 53(12), 1326–1341. [Google Scholar] [CrossRef]

- Hung, N. T. (2021). Oil prices and agricultural commodity markets: Evidence from pre and during COVID-19 outbreak. Resources Policy, 73, 102236. [Google Scholar] [CrossRef] [PubMed]

- Jarque, C. M., & Bera, A. K. (1980). Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Economics Letters, 6(3), 255–259. [Google Scholar] [CrossRef]

- Jebabli, I., Kouaissah, N., & Arouri, M. (2022). Volatility spillovers between stock and energy markets during crises: A comparative assessment between the 2008 global financial crisis and the COVID-19 pandemic crisis. Finance Research Letters, 46, 102363. [Google Scholar] [CrossRef]

- Kang, J.-S., Hu, J.-L., Chen, C.-W., & Hu, J.-L. (2013). Linkage between international food commodity prices and the Chinese stock markets. International Journal of Economics and Finance, 5(10), 147. [Google Scholar] [CrossRef]

- Kang, S. H., McIver, R., & Yoon, S.-M. (2017). Dynamic spillover effects among crude oil, precious metal, and agricultural commodity futures markets. Energy Economics, 62, 19–32. [Google Scholar] [CrossRef]

- Kang, W., Tang, K., & Wang, N. (2023). Financialization of commodity markets ten years later. Journal of Commodity Markets, 30, 100313. [Google Scholar] [CrossRef]

- Koop, G., & Korobilis, D. (2014). A new index of financial conditions. European Economic Review, 71, 101–116. [Google Scholar] [CrossRef]

- Koop, G., Pesaran, M. H., & Potter, S. M. (1996). Impulse response analysis in nonlinear multivariate models. Journal of Econometrics, 74(1), 119–147. [Google Scholar] [CrossRef]

- Korobilis, D., & Yilmaz, K. (2018). Measuring dynamic connectedness with large bayesian var models [Working Paper]. Available online: https://ssrn.com/abstract=3099725 (accessed on 30 August 2023).

- Li, B., Haneklaus, N., & Rahman, M. M. (2024). Dynamic connectedness and hedging opportunities of the commodity and stock markets in China: Evidence from the TVP-VAR and cDCC-FIAPARCH. Financial Innovation, 10(1), 52. [Google Scholar] [CrossRef]

- Liu, Z., Tseng, H.-K., Wu, J. S., & Ding, Z. (2020). Implied volatility relationships between crude oil and the US stock markets: Dynamic correlation and spillover effects. Resources Policy, 66, 101637. [Google Scholar] [CrossRef]

- Ljung, G. M., & Box, G. E. (1978). On a measure of lack of fit in time series models. Biometrika, 65(2), 297–303. [Google Scholar] [CrossRef]

- Markovitz, H. (1959). Portfolio selection: Efficient diversification of investments. John Wiley. [Google Scholar]

- Martin, P. G., & McCann, B. B. (1989). The investor’s guide to fidelity funds: Winning strategies for mutual fund investors. John Wiley & Sons, Inc. [Google Scholar]

- Mujtaba, G., Siddique, A., Naifar, N., & Shahzad, S. J. H. (2024). Hedge and safe haven role of commodities for the US and Chinese equity markets. International Journal of Finance & Economics, 29(2), 2381–2414. [Google Scholar]

- Parkinson, M. (1980). The extreme value method for estimating the variance of the rate of return. Journal of Business, 53(1), 61–65. [Google Scholar] [CrossRef]

- Pesaran, H. H., & Shin, Y. (1998). Generalized impulse response analysis in linear multivariate models. Economics Letters, 58(1), 17–29. [Google Scholar] [CrossRef]

- Pinho, C., & Maldonado, I. (2022). Commodity and equity markets: Volatility and return spillovers. Commodities, 1(1), 18–33. [Google Scholar] [CrossRef]

- Primiceri, G. E. (2005). Time varying structural vector autoregressions and monetary policy. The Review of Economic Studies, 72(3), 821–852. [Google Scholar] [CrossRef]

- Reboredo, J. C., Ugolini, A., & Hernandez, J. A. (2021). Dynamic spillovers and network structure among commodity, currency, and stock markets. Resources Policy, 74, 102266. [Google Scholar] [CrossRef]

- Roll, R. (1992). A mean/variance analysis of tracking error. Journal of Portfolio Management, 18(4), 13–22. [Google Scholar] [CrossRef]

- Rubbaniy, G., Khalid, A. A., Syriopoulos, K., & Samitas, A. (2022). Safe-haven properties of soft commodities during times of COVID-19. Journal of Commodity Markets, 27, 100223. [Google Scholar] [CrossRef]

- Rubbaniy, G., Maghyereh, A., Cheffi, W., & Khalid, A. A. (2024). Dynamic connectedness, portfolio performance, and hedging effectiveness of the hydrogen economy, renewable energy, equity, and commodity markets: Insights from the COVID-19 pandemic and the Russia-Ukraine war. Journal of Cleaner Production, 452, 142217. [Google Scholar] [CrossRef]

- Sevillano, M. C., Jareño, F., López, R., & Esparcia, C. (2024). Connectedness between oil price shocks and US sector returns: Evidence from TVP-VAR and wavelet decomposition. Energy Economics, 131, 107398. [Google Scholar] [CrossRef]

- Sharpe, W. F. (1966). Mutual fund performance. The Journal of Business, 39(1), 119–138. [Google Scholar] [CrossRef]

- Sortino, F. A., & Van Der Meer, R. (1991). Downside risk. Journal of Portfolio Management, 17(4), 27. [Google Scholar] [CrossRef]

- Tobler, A., Haase, M., & Sigg, P. (2017). Integrating Sustainability into Commodity Investing. In Handbook on sustainable investments: Background information and practical examples for institutional asset owners (pp. 129–133). CFA Institute Research Foundation. [Google Scholar]

- Wen, X., Wei, Y., & Huang, D. (2012). Measuring contagion between energy market and stock market during financial crisis: A copula approach. Energy Economics, 34(5), 1435–1446. [Google Scholar] [CrossRef]

- Wu, F., Guan, Z., & Myers, R. J. (2011). Volatility spillover effects and cross hedging in corn and crude oil futures. Journal of Futures Markets, 31(11), 1052–1075. [Google Scholar] [CrossRef]

- Xu, W., Ma, F., Chen, W., & Zhang, B. (2019). Asymmetric volatility spillovers between oil and stock markets: Evidence from China and the United States. Energy Economics, 80, 310–320. [Google Scholar] [CrossRef]

- Zhang, H., Chen, J., & Shao, L. (2021). Dynamic spillovers between energy and stock markets and their implications in the context of COVID-19. International Review of Financial Analysis, 77, 101828. [Google Scholar] [CrossRef]

- Zhu, B., Lin, R., Deng, Y., Chen, P., & Chevallier, J. (2021). Intersectoral systemic risk spillovers between energy and agriculture under the financial and COVID-19 crises. Economic Modelling, 105, 105651. [Google Scholar] [CrossRef]

| Variables | Mean (%) | Max. (%) | Min. (%) | Std. Dev. | Skewness | Kurtosis | Jarque-Bera | L-B Q(20) | L-B Q2(20) | ADF |

|---|---|---|---|---|---|---|---|---|---|---|

| Corn | 0.01 | 8.66 | −8.12 | 1.65 | −0.01 | 2.46 | 1574.44 *** | 30.97 *** | 1092.80 *** | −17.25 *** |

| Soybeans | 0.01 | 6.43 | −7.34 | 1.44 | −0.22 | 2.52 | 1707.56 *** | 16.05 * | 1246.35 *** | −16.89 *** |

| Wheat | 0.01 | 8.79 | −10.02 | 1.91 | 0.12 | 1.96 | 1021.30 *** | 9.02 | 1187.46 *** | −19.30 *** |

| Coffee | 0.02 | 16.39 | −13.38 | 2.04 | 0.17 | 3.01 | 2398.67 *** | 22.27 *** | 1051.19 *** | −19.50 *** |

| Cotton | 0.00 | 8.53 | −7.13 | 1.68 | −0.06 | 1.41 | 522.15 *** | 31.45 *** | 1307.32 *** | −17.71 *** |

| Live Cattle | 0.02 | 5.45 | −6.36 | 0.99 | −0.16 | 2.46 | 1604.98 *** | 75.79 *** | 2690.00 *** | −16.86 *** |

| Crude Oil | 0.02 | 43.79 | −56.86 | 2.59 | −1.44 | 61.15 | 977,190.43 *** | 107.21 *** | 1615.66 *** | −17.93 *** |

| S&P 500 | 0.02 | 10.96 | −12.77 | 1.20 | −0.39 | 11.29 | 33,389.67 *** | 98.94 *** | 5765.25 *** | −18.58 *** |

| Panel A: Full Sample | |||||||||

| Variables | Corn | Soybeans | Wheat | Coffee | Cotton | Live Cattle | Crude Oil | S&P 500 | From |

| Corn | 50.87 | 19.39 | 20.20 | 1.88 | 3.08 | 1.18 | 2.53 | 0.88 | 49.13 |

| Soybeans | 21.04 | 55.40 | 10.84 | 2.44 | 3.87 | 1.34 | 3.43 | 1.63 | 44.60 |

| Wheat | 22.54 | 11.17 | 57.34 | 2.07 | 2.45 | 1.14 | 2.38 | 0.91 | 42.66 |

| Coffee | 3.00 | 3.52 | 2.92 | 81.11 | 2.65 | 1.56 | 2.95 | 2.29 | 18.89 |

| Cotton | 4.26 | 5.00 | 3.16 | 2.58 | 76.42 | 1.36 | 3.76 | 3.45 | 23.58 |

| Live Cattle | 1.89 | 2.16 | 1.68 | 1.55 | 1.59 | 86.76 | 1.95 | 2.41 | 13.24 |

| Crude Oil | 3.28 | 4.30 | 2.57 | 2.57 | 3.47 | 1.69 | 75.89 | 6.24 | 24.11 |

| S&P 500 | 1.32 | 2.06 | 1.28 | 2.14 | 3.44 | 2.03 | 6.69 | 81.04 | 18.96 |

| TO | 57.32 | 47.60 | 42.65 | 15.23 | 20.56 | 10.31 | 23.70 | 17.80 | cTCI/TCI |

| NET | 8.19 | 3.01 | −0.01 | −3.65 | −3.02 | −2.94 | −0.42 | −1.16 | 33.60/29.40 |

| Panel B: Global Financial Crisis | |||||||||

| Variables | Corn | Soybeans | Wheat | Coffee | Cotton | Live Cattle | Crude Oil | S&P 500 | From |

| Corn | 36.20 | 18.64 | 14.44 | 7.82 | 8.05 | 3.78 | 8.74 | 2.33 | 63.80 |

| Soybeans | 18.52 | 36.24 | 11.77 | 8.24 | 8.85 | 4.12 | 9.99 | 2.27 | 63.76 |

| Wheat | 16.67 | 13.37 | 41.46 | 7.63 | 7.07 | 3.42 | 8.24 | 2.14 | 58.54 |

| Coffee | 9.93 | 10.68 | 8.36 | 45.78 | 9.12 | 4.15 | 7.61 | 4.37 | 54.22 |

| Cotton | 9.63 | 11.25 | 8.12 | 9.26 | 46.80 | 3.99 | 7.26 | 3.69 | 53.20 |

| Live Cattle | 6.17 | 6.67 | 4.96 | 5.41 | 5.07 | 59.81 | 6.74 | 5.15 | 40.19 |

| Crude Oil | 10.85 | 11.78 | 8.60 | 7.21 | 6.43 | 4.95 | 44.45 | 5.73 | 55.55 |

| S&P 500 | 3.14 | 3.17 | 3.18 | 4.40 | 4.15 | 4.71 | 8.77 | 68.48 | 31.52 |

| TO | 74.92 | 75.56 | 59.42 | 49.97 | 48.75 | 29.12 | 57.35 | 25.69 | cTCI/TCI |

| NET | 11.12 | 11.81 | 0.88 | −4.24 | −4.45 | −11.07 | 1.80 | −5.84 | 60.11/52.60 |

| Panel C: European Debt Crisis | |||||||||

| Variables | Corn | Soybeans | Wheat | Coffee | Cotton | Live Cattle | Crude Oil | S&P 500 | From |

| Corn | 43.77 | 16.92 | 22.08 | 3.56 | 3.95 | 3.58 | 3.96 | 2.19 | 56.23 |

| Soybeans | 17.35 | 45.17 | 14.78 | 3.90 | 4.83 | 2.63 | 6.38 | 4.95 | 54.83 |

| Wheat | 22.92 | 14.92 | 45.92 | 2.94 | 3.53 | 3.02 | 3.76 | 3.00 | 54.08 |

| Coffee | 6.85 | 6.03 | 5.04 | 64.39 | 2.81 | 4.09 | 5.29 | 5.50 | 35.61 |

| Cotton | 6.43 | 7.10 | 5.41 | 2.69 | 68.79 | 0.86 | 4.37 | 4.34 | 31.21 |

| Live Cattle | 5.82 | 3.94 | 4.69 | 4.29 | 1.28 | 71.89 | 4.05 | 4.04 | 28.11 |

| Crude Oil | 5.23 | 7.83 | 4.52 | 4.94 | 3.46 | 3.13 | 55.79 | 15.10 | 44.21 |

| S&P 500 | 3.39 | 6.41 | 3.97 | 4.99 | 3.27 | 3.50 | 15.87 | 58.60 | 41.40 |

| TO | 67.99 | 63.15 | 60.49 | 27.30 | 23.13 | 20.81 | 43.68 | 39.12 | cTCI/TCI |

| NET | 11.76 | 8.32 | 6.41 | −8.31 | −8.07 | −7.30 | −0.53 | −2.28 | 49.38/43.21 |

| Panel D: COVID-19 Pandemic | |||||||||

| Variables | Corn | Soybeans | Wheat | Coffee | Cotton | Live Cattle | Crude Oil | S&P 500 | From |

| Corn | 51.91 | 20.59 | 7.32 | 3.53 | 5.69 | 1.90 | 5.01 | 4.05 | 48.09 |

| Soybeans | 21.07 | 54.13 | 8.51 | 5.06 | 3.39 | 3.49 | 1.52 | 2.84 | 45.87 |

| Wheat | 10.23 | 11.07 | 73.85 | 1.13 | 0.48 | 1.22 | 0.84 | 1.20 | 26.15 |

| Coffee | 3.99 | 5.12 | 2.45 | 83.90 | 0.73 | 1.90 | 1.24 | 0.66 | 16.10 |

| Cotton | 6.52 | 4.03 | 0.53 | 0.44 | 65.08 | 2.81 | 5.62 | 14.97 | 34.92 |

| Live Cattle | 2.45 | 5.49 | 1.74 | 2.87 | 3.24 | 76.32 | 1.58 | 6.31 | 23.68 |

| Crude Oil | 7.54 | 1.94 | 1.09 | 2.74 | 6.18 | 1.49 | 71.08 | 7.95 | 28.92 |

| S&P 500 | 4.36 | 3.28 | 0.97 | 0.66 | 14.23 | 4.55 | 5.98 | 65.99 | 34.01 |

| TO | 56.16 | 51.51 | 22.62 | 16.43 | 33.93 | 17.35 | 21.78 | 37.97 | cTCI/TCI |

| NET | 8.07 | 5.64 | −3.53 | 0.33 | −0.99 | −6.33 | −7.14 | 3.95 | 36.82/32.22 |

| Panel E: Russia-Ukraine Conflict | |||||||||

| Variables | Corn | Soybeans | Wheat | Coffee | Cotton | Live Cattle | Crude Oil | S&P 500 | From |

| Corn | 44.12 | 19.95 | 21.04 | 0.50 | 4.24 | 0.67 | 8.48 | 1.02 | 55.88 |

| Soybeans | 20.79 | 47.39 | 9.87 | 3.97 | 5.05 | 0.66 | 10.92 | 1.35 | 52.61 |

| Wheat | 22.02 | 10.99 | 45.95 | 1.64 | 3.14 | 0.15 | 15.15 | 0.97 | 54.05 |

| Coffee | 0.97 | 6.61 | 1.49 | 76.76 | 6.42 | 1.36 | 4.45 | 1.95 | 23.24 |

| Cotton | 7.17 | 9.48 | 4.54 | 4.03 | 67.74 | 0.54 | 5.14 | 1.36 | 32.26 |

| Live Cattle | 2.39 | 0.62 | 2.08 | 2.04 | 0.48 | 90.97 | 0.54 | 0.88 | 9.03 |

| Crude Oil | 10.49 | 12.78 | 13.45 | 3.34 | 3.85 | 0.72 | 54.68 | 0.68 | 45.32 |

| S&P 500 | 1.45 | 0.65 | 1.78 | 0.67 | 1.88 | 0.90 | 0.54 | 92.13 | 7.87 |

| TO | 65.28 | 61.08 | 54.24 | 16.19 | 25.06 | 4.99 | 45.22 | 8.21 | cTCI/TCI |

| NET | 9.40 | 8.47 | 0.18 | −7.05 | −7.21 | −4.05 | −0.10 | 0.35 | 40.04/35.03 |

| Panel A: Global Financial Crisis | |||||||

| Measures | Phases | Std. Dev. | Sortino Ratio | Ulcer Index | Rachev Ratio | Tracking Error | Information Ratio |

| early | 0.7370 | 0.0848 | 0.0313 | 1.0152 | 1.2926 | 0.0671 | |

| MVP | middle | 1.0735 | −0.0753 | 0.1829 | 0.8049 | 2.3643 | 0.0343 |

| late | 0.9852 | 0.0273 | 0.0460 | 0.8915 | 1.8990 | 0.0057 | |

| early | 1.0141 | 0.0389 | 0.0556 | 0.7916 | 1.2995 | 0.0569 | |

| MCP | middle | 1.6422 | −0.0730 | 0.2901 | 0.7689 | 1.8932 | 0.0263 |

| late | 1.4648 | 0.0491 | 0.0486 | 0.8339 | 1.4360 | 0.0307 | |

| early | 1.0250 | 0.0441 | 0.0545 | 0.7783 | 1.3225 | 0.0593 | |

| MCoP | middle | 1.6439 | −0.0737 | 0.2926 | 0.7704 | 1.9365 | 0.0253 |

| late | 1.4666 | 0.0507 | 0.0482 | 0.8325 | 1.4560 | 0.0315 | |

| early | 1.3097 | −0.0472 | 0.0999 | 0.9428 | |||

| S&P 500 | middle | 2.6970 | −0.0715 | 0.3579 | 0.8847 | ||

| late | 2.1719 | 0.0056 | 0.1074 | 0.9584 | |||

| Panel B: European Debt Crisis | |||||||

| Measures | Phases | Std. Dev. | Sortino Ratio | Ulcer Index | Rachev Ratio | Tracking Error | Information Ratio |

| early | 0.7257 | 0.1945 | 0.0358 | 0.9654 | 1.0138 | 0.0766 | |

| MVP | middle | 0.7207 | 0.0000 | 0.0668 | 0.9081 | 1.0016 | −0.0141 |

| late | 0.6325 | −0.0664 | 0.0374 | 0.9979 | 0.9912 | −0.0722 | |

| early | 1.0567 | 0.2764 | 0.0355 | 1.1487 | 1.1115 | 0.1494 | |

| MCP | middle | 0.9992 | −0.0611 | 0.1916 | 0.8145 | 1.1134 | −0.0546 |

| late | 0.7885 | −0.1250 | 0.0557 | 0.8170 | 0.9623 | −0.1226 | |

| early | 1.0613 | 0.2668 | 0.0357 | 1.1413 | 1.1067 | 0.1452 | |

| MCoP | middle | 0.9995 | −0.0589 | 0.1833 | 0.8144 | 1.1021 | −0.0537 |

| late | 0.8060 | −0.1229 | 0.0550 | 0.8104 | 0.9621 | −0.1232 | |

| early | 1.2570 | 0.0191 | 0.0817 | 1.0214 | |||

| S&P 500 | middle | 1.2548 | 0.0152 | 0.0784 | 0.8738 | ||

| late | 1.0835 | 0.0566 | 0.0359 | 1.0323 | |||

| Panel C: COVID-19 Pandemic | |||||||

| Measures | Phases | Std. Dev. | Sortino Ratio | Ulcer Index | Rachev Ratio | Tracking Error | Information Ratio |

| early | 0.8732 | −0.2852 | 0.0990 | 0.5319 | 3.0635 | −0.0177 | |

| MVP | middle | 0.6968 | 0.4289 | 0.0110 | 1.2687 | 1.2721 | 0.0221 |

| late | 0.7166 | 0.5122 | 0.0121 | 1.2030 | 1.1213 | 0.0700 | |

| early | 1.7434 | −0.2610 | 0.1595 | 0.7160 | 2.8256 | −0.0722 | |

| MCP | middle | 1.4875 | 0.1627 | 0.0295 | 1.0357 | 1.4780 | 0.0198 |

| late | 0.8485 | 0.3039 | 0.0161 | 1.1362 | 1.0851 | 0.0240 | |

| early | 1.7368 | −0.2580 | 0.1571 | 0.7008 | 2.7757 | −0.0717 | |

| MCoP | middle | 1.3972 | 0.1712 | 0.0269 | 1.0295 | 1.3923 | 0.0211 |

| late | 0.8256 | 0.3433 | 0.0149 | 1.1624 | 1.0397 | 0.0387 | |

| early | 3.4539 | −0.0665 | 0.1673 | 0.8705 | |||

| S&P 500 | middle | 1.2426 | 0.1598 | 0.0352 | 0.7982 | ||

| late | 1.0427 | 0.1902 | 0.0230 | 0.9701 | |||

| Panel D: Russia-Ukraine Conflict | |||||||

| Measures | Phases | Std. Dev. | Sortino Ratio | Ulcer Index | Rachev Ratio | Tracking Error | Information Ratio |

| early | 0.5507 | −0.1134 | 0.0306 | 0.9070 | 1.3748 | −0.0262 | |

| MVP | middle | 0.7074 | −0.0445 | 0.0577 | 0.7364 | 1.3714 | 0.0826 |

| late | 0.5952 | 0.2804 | 0.0055 | 1.0249 | 1.1389 | 0.0271 | |

| early | 0.8857 | 0.2755 | 0.0160 | 1.1255 | 1.7187 | 0.0939 | |

| MCP | middle | 1.0476 | −0.1051 | 0.0933 | 0.7496 | 1.4637 | 0.0355 |

| late | 1.1343 | 0.0340 | 0.0293 | 0.7900 | 1.3838 | −0.0359 | |

| early | 0.9412 | 0.1631 | 0.0196 | 0.9716 | 1.7313 | 0.0643 | |

| MCoP | middle | 1.1287 | −0.0995 | 0.0929 | 0.7938 | 1.5026 | 0.0338 |

| late | 1.1893 | 0.0298 | 0.0297 | 0.7916 | 1.4087 | −0.0369 | |

| early | 1.3997 | −0.0106 | 0.0484 | 0.9149 | |||

| S&P 500 | middle | 1.5779 | −0.1117 | 0.1280 | 0.7274 | ||

| late | 1.2220 | 0.0988 | 0.0255 | 1.1389 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tu, X.; Leatham, D. From Fields to Finance: Dynamic Connectedness and Optimal Portfolio Strategies Among Agricultural Commodities, Oil, and Stock Markets. Int. J. Financial Stud. 2025, 13, 143. https://doi.org/10.3390/ijfs13030143

Tu X, Leatham D. From Fields to Finance: Dynamic Connectedness and Optimal Portfolio Strategies Among Agricultural Commodities, Oil, and Stock Markets. International Journal of Financial Studies. 2025; 13(3):143. https://doi.org/10.3390/ijfs13030143

Chicago/Turabian StyleTu, Xuan, and David Leatham. 2025. "From Fields to Finance: Dynamic Connectedness and Optimal Portfolio Strategies Among Agricultural Commodities, Oil, and Stock Markets" International Journal of Financial Studies 13, no. 3: 143. https://doi.org/10.3390/ijfs13030143

APA StyleTu, X., & Leatham, D. (2025). From Fields to Finance: Dynamic Connectedness and Optimal Portfolio Strategies Among Agricultural Commodities, Oil, and Stock Markets. International Journal of Financial Studies, 13(3), 143. https://doi.org/10.3390/ijfs13030143