Abstract

This study presents a comprehensive bibliometric and topic modeling analysis of the academic literature on green and sustainable finance. Using 1372 peer-reviewed articles indexed in the Web of Science up to 2024, we identify key publication trends, influential authors, prominent journals, and thematic clusters shaping the field. The analysis reveals an exponential growth in publications since 2017 and highlights the dominance of journals such as Journal of Sustainable Finance & Investment and Sustainability. Text mining techniques, including TF-IDF and Latent Dirichlet Allocation (LDA), are applied to abstracts to extract the most relevant terms and classify articles into four latent topics. The findings suggest a growing focus on the impact of green finance on carbon emissions, energy efficiency, and firm performance, particularly in the context of China. This study offers valuable insights for researchers and policymakers by mapping the intellectual structure and identifying emerging research frontiers in the rapidly evolving field of green finance.

1. Introduction

In recent years, green finance has emerged as a critical pillar for supporting sustainable development, addressing climate change, and promoting low-carbon economic transitions. Defined as the set of financial instruments and mechanisms that incorporate environmental factors into investment decisions, green finance encompasses a wide range of initiatives—from green bonds and sustainability-linked loans to ESG-driven investment strategies (Tung et al., 2025; Surwanti & Mahmoud, 2025). Its rapid expansion has not only reshaped financial markets but has also triggered a growing body of academic research aiming to understand its impacts, drivers, and evolving trends. The rise of green finance is closely linked to the global policy agenda. For example, the transition towards carbon neutrality and the implementation of the UN Sustainable Development Goals have prompted governments and financial institutions to adopt new sustainability-oriented policies and instruments (Alvi et al., 2025; Cojoianu et al., 2025). Empirical studies have further shown that green finance can enhance investment efficiency (X. Li et al., 2025), support enterprise-level innovation and productivity (Fu & Zhao, 2025; Liu & Liu, 2025), and drive synergies between pollution control and carbon reduction (Hou et al., 2025; Wang et al., 2025).

Despite the growing volume of literature, the field remains fragmented and characterized by a variety of methodological approaches, regional focuses, and thematic emphases. For instance, while several studies concentrate on the Chinese experience—emphasizing regional disparities and policy heterogeneity (Lu et al., 2025; Han et al., 2025)—others explore green finance adoption in sectors such as aviation (Kumar et al., 2025), tourism (Gharbi et al., 2025), or digital financial systems (Zaid et al., 2025; Wang et al., 2025). Moreover, emerging intersections with artificial intelligence (Wang et al., 2025), cultural factors (Nguyen et al., 2025), and Islamic finance (Hermala et al., 2025) signal a diversification of the academic discourse and call for a comprehensive synthesis of the knowledge landscape.

We chose to focus on green finance due to its growing prominence at the intersection of financial markets and sustainability agendas. In recent years, green finance has transitioned from a niche concept to a central pillar in global policy debates, especially in light of climate change, net-zero commitments, and the mobilization of private capital for environmental goals. This transformation has triggered a surge in scholarly output, making it an ideal field for bibliometric mapping. By systematically analyzing this body of literature, we aim to capture how academic knowledge is responding to the financial sector’s role in the transition toward a more sustainable economy.

This study contributes to the literature by providing a systematic bibliometric and topic modeling analysis of green and sustainable finance research, based on 1372 peer-reviewed articles indexed in Web of Science up to 2024. Using the bibliometrix R package (version 4.2.0) and Latent Dirichlet Allocation (LDA), we map publication trends, identify key authors and journals, and uncover dominant themes and research clusters. By doing so, we aim to offer an integrated view of the field’s evolution, highlight underexplored areas, and provide a foundation for future research and policy development. This study aims to provide a comprehensive mapping of the academic landscape in green and sustainable finance through bibliometric and topic modeling techniques. While the literature has expanded rapidly, it remains fragmented across methodologies, regional scopes, and thematic emphases. Prior syntheses have often focused on specific regions or lacked integration with text mining tools. Therefore, this study seeks to fill this gap by addressing the following research questions: What are the main publication and citation trends in green and sustainable finance over the last two decades? Which authors, journals, and countries have had the greatest influence in shaping the field? What are the latent thematic structures emerging from the literature, and how have these evolved? By answering these questions, the study contributes to a deeper understanding of how the field has developed and where future research efforts may be directed.

2. Advances and Emerging Themes in Green Finance Research

To improve clarity and thematic coherence, we structure the emerging literature into four key areas that reflect the diversity and evolution of green finance research: (i) green innovation and productivity, (ii) ESG and firm performance, (iii) financial instruments and policy frameworks, and (iv) renewable energy and environmental outcomes. Below, we summarize the key findings in each area based on recent empirical contributions.

2.1. Green Innovation and Productivity

This stream of research examines how green finance promotes technological development, R&D activities, and gains in green total factor productivity (GTFP). Studies in this category often highlight the mediating role of industrial structure or the alleviation of financial constraints, particularly in developing economies such as China.

A growing number of empirical studies, particularly in the Chinese context, have investigated the role of green finance in promoting green innovation and sustainability outcomes.

Several studies highlight the positive influence of green finance on green innovation. Irfan et al. (2022) demonstrate, using panel VAR and mediation models, that inclusive green finance significantly fosters green innovation in China, with industrial structure and R&D as key transmission channels. Similarly, C. H. Yu et al. (2021) emphasize that green finance policies help alleviate financing constraints for green innovation, particularly in privately-owned enterprises. This is further confirmed by Jiakui et al. (2023), who integrate green finance, financial development, and technological innovation into a unified framework, showing that these elements jointly boost green total factor productivity (GTFP). In terms of green finance’s impact on productivity and growth, Lee and Lee (2022) find that green finance development significantly enhances GTFP, especially in regions with higher pollution and lower public environmental participation. X. Zhou et al. (2020) also conclude that green finance positively contributes to both economic development and environmental quality, although regional heterogeneity is evident.

2.2. ESG and Firm Performance

A second group of studies explores the relationship between environmental, social, and governance (ESG) indicators and corporate financial outcomes. The literature emphasizes how strong ESG performance can enhance firm value, reduce financing costs, and improve investment efficiency, especially under institutional or regulatory pressures. G. Zhou et al. (2022a) show that ESG performance increases firm value through its influence on financial performance, highlighting an indirect pathway through which green finance might operate.

2.3. Financial Instruments and Policy Frameworks

This thematic cluster covers the design and evaluation of green financial instruments—including green bonds, sustainability-linked loans, and fintech-based solutions—as well as policy mechanisms such as credit guarantees and fiscal incentives. It includes both theoretical proposals and empirical assessments of effectiveness. Flammer (2021) investigates corporate green bonds, finding that their issuance signals firms’ environmental commitment, leading to improved environmental performance and increased green investment. Taghizadeh-Hesary and Yoshino (2019) propose policy mechanisms—such as green credit guarantees and tax revenue recycling—to reduce risk and attract private sector participation in green finance. Muganyi et al. (2021) and G. Zhou et al. (2022b) also emphasize the role of fintech in advancing green finance, showing its effectiveness in reducing emissions and supporting regional green growth.

2.4. Renewable Energy and Environmental Outcomes

Finally, a growing body of work investigates how green finance supports renewable energy deployment and contributes to environmental goals such as carbon emission reduction or improved energy efficiency. These studies often integrate macro-level policy analysis with sectoral or firm-level data. The relationship between green finance and renewable energy is another key area. He et al. (2019) and C. Li and Umair (2023) show that green finance, while positively influencing renewable energy development, can have mixed effects depending on credit structures and private sector engagement. Rasoulinezhad and Taghizadeh-Hesary (2022) confirm that green bonds play a critical role in promoting energy efficiency and reducing emissions in the long run.

Finally, broader macro-level analyses like that of Tian et al. (2022) address the post-COVID-19 dynamics of global energy transition. They highlight both the threats to green investment and the opportunities for reinforcing green recovery schemes, suggesting that expanding financial instruments and international cooperation are essential for a sustainable transition. While the literature consistently shows that green finance contributes to environmental sustainability, innovation, and firm performance, significant regional and institutional disparities remain. Most studies concentrate on China, suggesting a need for broader geographic coverage and comparative perspectives in future research. Collectively, these four streams demonstrate that green finance is a multifaceted field, where innovation, firm behavior, financial policy, and environmental goals intersect to shape both scholarly inquiry and practical financial decision-making.

3. Research Methodology

Several studies have examined green finance publications and their intellectual and network structure, using bibliometric data extracted from databases such as Scopus and Web of Science (Cai & Guo, 2021; Fahim & Mahadi, 2022; Mohanty et al., 2023; Muchiri et al., 2022; X. Yu et al., 2021). According to these studies, countries leading in green finance publications are those with high economic development, prominent environmental problems, and strong demand for ecological protection (X. Yu et al., 2021; Zhang et al., 2022). In addition, it has been identified that the most prolific journals on green finance and carbon emission reduction are Climate Policy, Journal of Cleaner Production and Energy Policy, and furthermore, in terms of collaboration among authors, most publications involve less than three researchers (Zhang et al., 2022). The research topics have also evolved, from the establishment of the green financial system to the challenges facing sustainable financial systems in different countries to empirical evidence of the vigorous development of green finance (X. Yu et al., 2021).

In this study, the literature review of green finance is investigated through a systematic literature search. We found 1372 papers in the Web of Science (WoS) database using the following search equation: “green finance” OR “sustainable finance”, the search was filtered only for article and review type papers and the download was performed on 2024.

We retrieved the data exclusively from the Web of Science Core Collection (WoSCC), which was selected due to its rigorous indexing criteria, high-quality metadata, and frequent use in bibliometric studies on sustainability-related topics.” Although our primary focus is on green finance, we included both ‘green finance’ and ‘sustainable finance’ as keywords in the search strategy to ensure broader coverage of relevant studies. In academic databases, these terms are often used interchangeably or overlap in scope, with many papers related to green finance being indexed under the label of sustainable finance. Including both terms helped avoid missing key literature and allowed for a more comprehensive analysis of the field.

To analyze bibliometrics, we utilized the R library Bibliometrix, which was developed by Aria and Cuccurullo (2017). This library offers various bibliometric tools that allow for the mapping of scientific production. By utilizing data mining techniques, we were able to extract pertinent information from highly-cited papers, specifically related to the main research topics or trends. To determine the most representative terms or words within a document, we employed the TF-IDF statistic, which was first introduced by Salton and Buckley (1988). This statistic measures the significance of a word for a document within a collection of documents by considering its relevance, rather than just its frequency. Although the TF-IDF statistic has been useful in various text mining and search engine applications, some information theory experts have expressed doubts about its theoretical foundations. The inverse document frequency for a given term is defined as Equation (1).

Furthermore, we utilized topic modeling, an unsupervised classification method, to extract words that reveal latent themes or general research trends from the most cited articles. Jelodar et al. (2019) define a topic in topic modeling as a list of words that have statistically significant occurrences. This technique involves selecting words from possible sets of words to combine any part of the text. The Latent Dirichlet allocation (LDA) is one of the most widely used methods in topic modeling, which was initially proposed by Blei et al. (2003). LDA presents topics based on the probabilistic distribution of relevant words within a corpus set of documents. Following Blei et al. (2003), the probability of the observed data from a corpus consisting of documents, where document has words , is calculated using Equation (2).

The process involves selecting a multinomial distribution for subject from a Dirichlet distribution with parameters . Similarly, a multinomial distribution is chosen for document from a Dirichlet distribution with parameters . Lastly, for a word in document : (a) a topic is chosen from , (b) a word is selected from . In this model, documents are considered observed variables, while and are considered latent variables, and are hyperparameters. The variables and are both word-level variables.

4. Results

4.1. Timeline of Publications and Citations

The analysis window of the documents spans from 2004 to 2024. The data were retrieved on 15 March 2024. A total of 1372 documents were analyzed, involving 2921 authors. The annual growth rate in publications is 30.9%, mainly driven by the last period, with an average document age of 2.1 years, reflecting the exponential growth of interest in the topic. Among the contributing authors, 199 have published single-authored papers. The average number of co-authors per paper is approximately three.

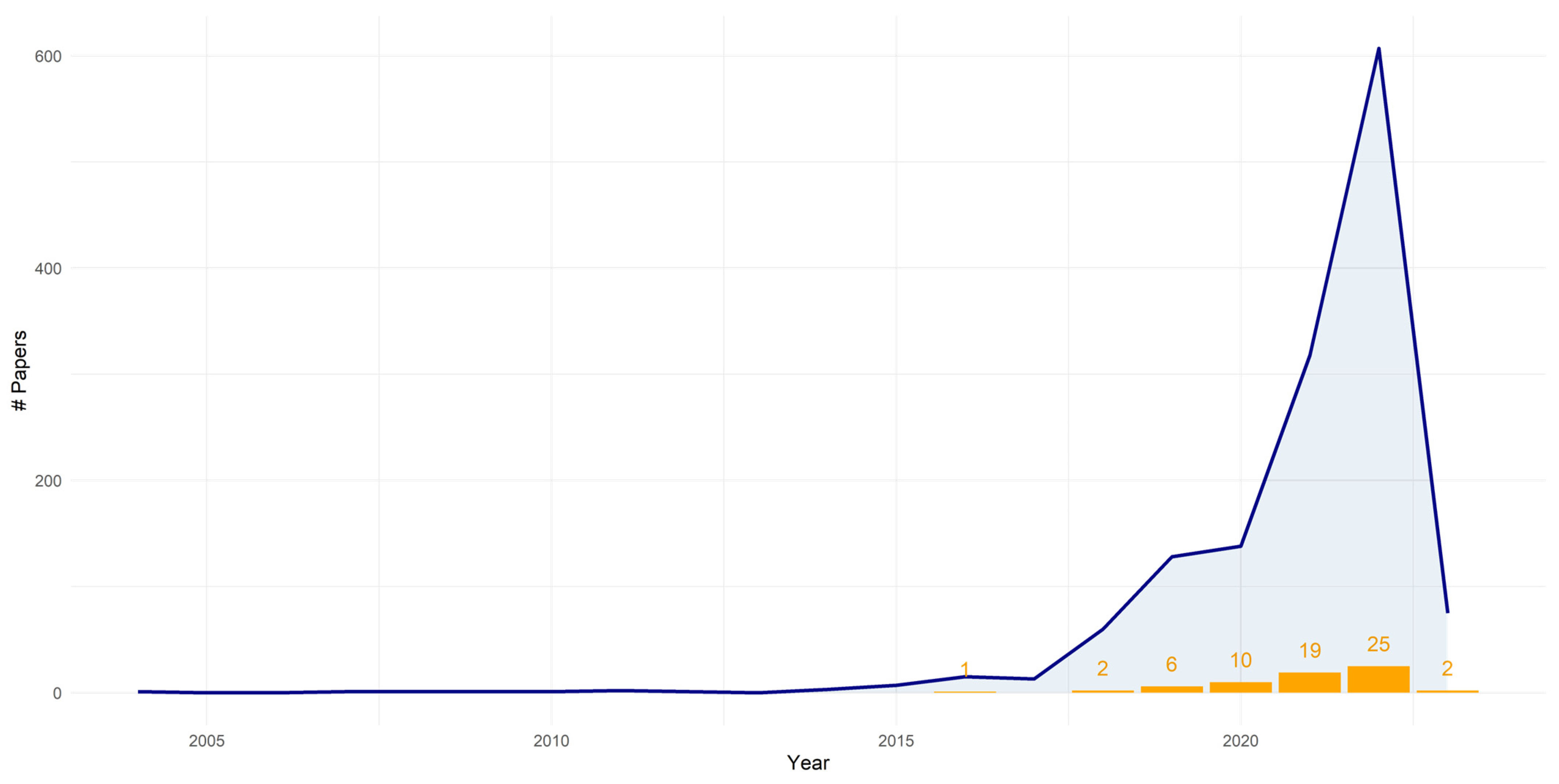

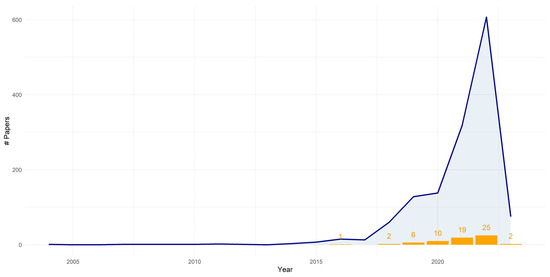

Figure 1 shows the annual trend of publications during the study period. It is highlighted that the publication trend in the field increased from 2017, presenting its highest peak in the year 2022, but according to the partial results of 2023, this year is expected to have a higher production. Within the graph the number of documents published under the review category are represented by bars, proportionally the same publication trend is shown. This graphic representation is a clear fact of the current boom of the subject, in addition to showing that it is a line that is in its birth.

Figure 1.

Annual scientific production. Note: The number of papers published in the review category is represented by bars in the graph. Although it seems to have decreased in 2023, the trend of publications, it should be noted that the data were taken in 2024, on the contrary, a large growth is expected.

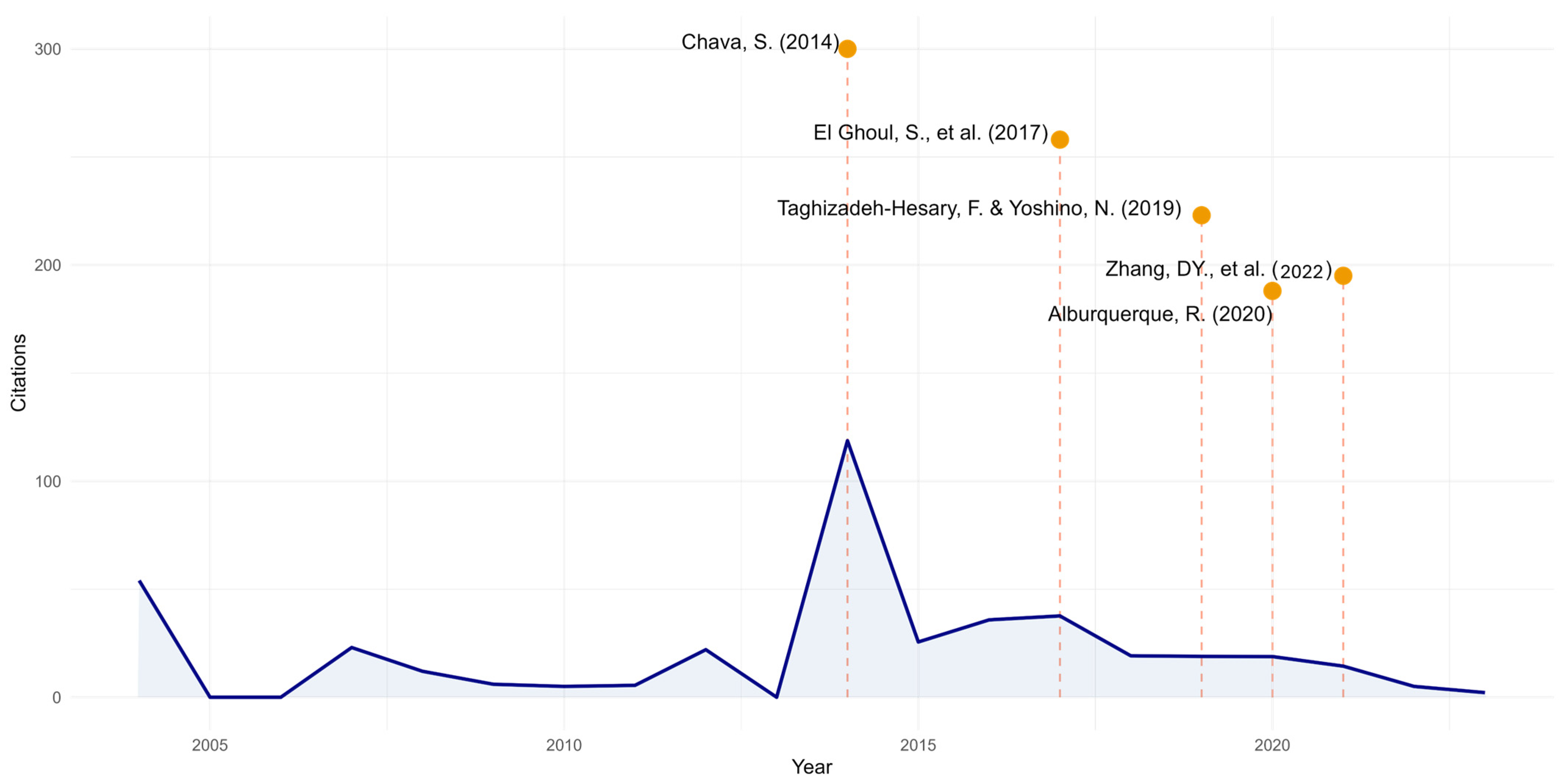

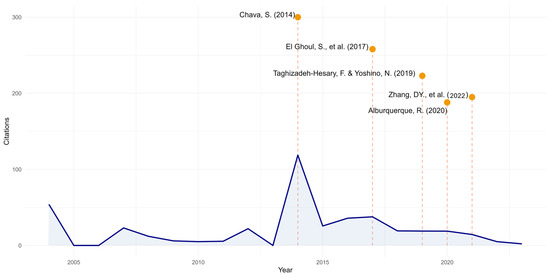

Figure 2 complements what is represented in Annual scientific production in Figure 1. Figure 2 shows the average annual number of citations, which shows a decreasing trend over time. It is evident that older articles have a higher number of citations compared to more recent ones. In addition, 5 articles with the highest number of citations stand out, represented by yellow dots. The year with the highest average number of citations was 2014, where the article published by Chava (2014) clearly stands out. This study shows that companies with environmental concerns have a higher cost of debt capital and equity. This highlights the importance of green or sustainable financing to encourage environmentally responsible business practices. The study is considered one of the most relevant in this field. Other authors with a high number of citations such as El Ghoul et al. (2017) indirectly address the issue of green finance or sustainable finance. This study shows that corporate social responsibility (CSR) initiatives are more valuable in countries with weak market institutions. Although green or sustainable finance is not directly addressed, the study suggests that companies can improve their access to finance in countries with weak equity and credit markets by implementing CSR initiatives.

Figure 2.

Average total citations per year. Note: It is evident that older articles have a higher number of citations compared to more recent ones. The dots represent the 5 articles with the highest number of citations (Albuquerque, 2020; Chava, 2014; El Ghoul et al., 2017; Taghizadeh-Hesary & Yoshino, 2019; Zhang et al., 2022).

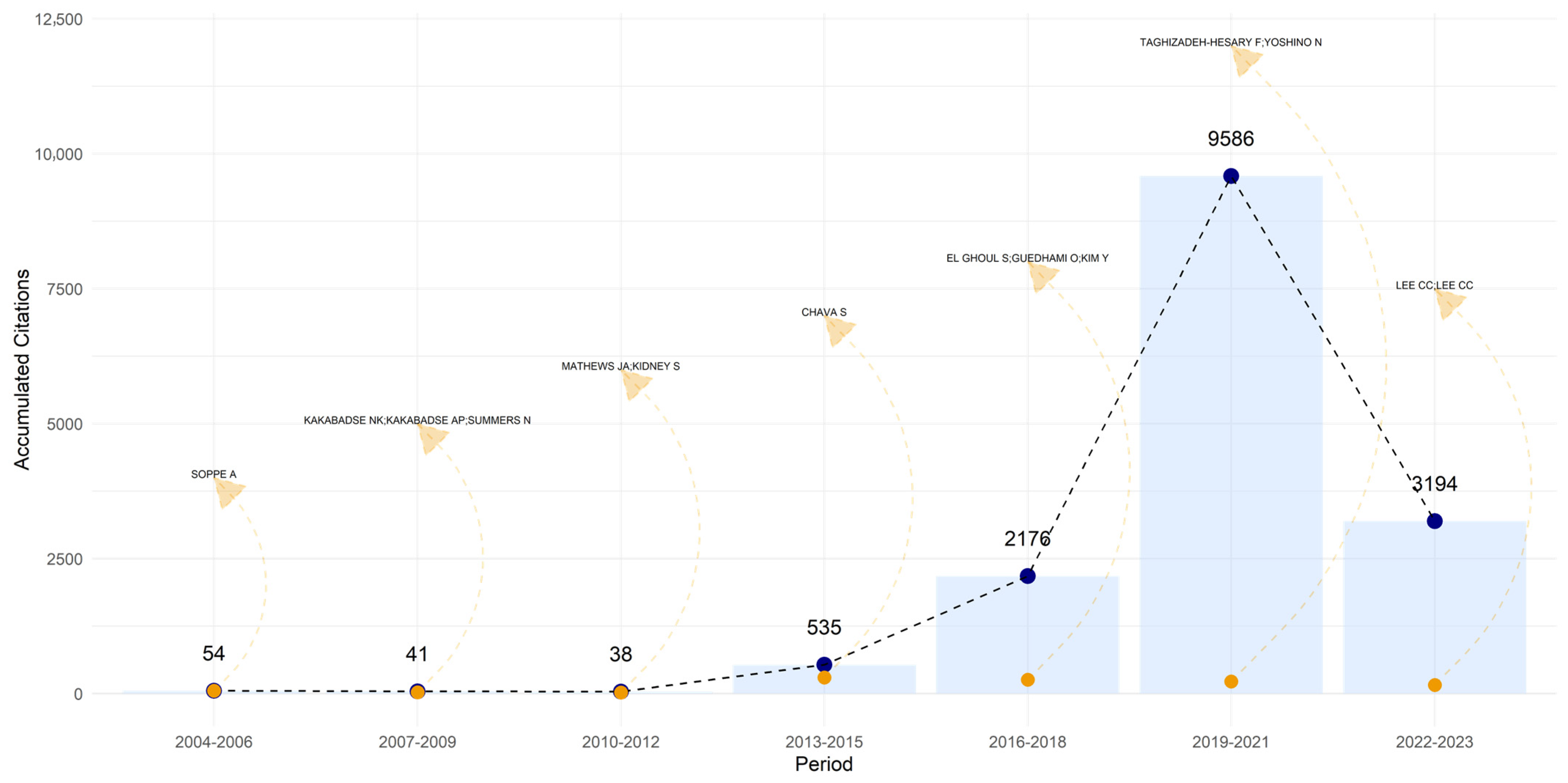

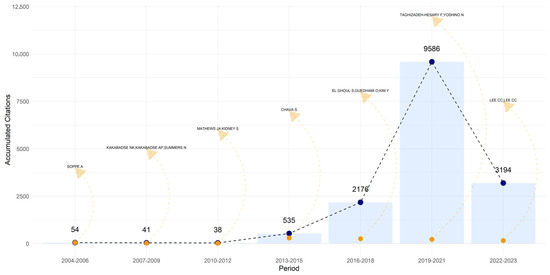

Figure 3 presents the cumulative citations by 3-year periods, we also identify the most relevant authors in terms of citations within each period. The period from 2019 to 2021 presents the highest number of citations (9586), in this period the work of Taghizadeh-Hesary and Yoshino (2019) stands out. This is a clear sign that recent papers use recent literature reviews, since it is the new production of recent years that has the most cited papers from this period.

Figure 3.

Accumulated citations per 3-year periods. Note: The orange dots represent the most cited authors within each three-year period. The blue dots represent the total number of citations within each period.

This information complements Figure 2, although the paper by Chava (2014) has the most citations, the work by Taghizadeh-Hesary and Yoshino (2019), looks like a great reference in the coming years, since in less time it has managed to consolidate a large number of citations. In addition, Table 1 shows specifically each relevant paper in these three-year periods.

Table 1.

Most cited articles published within 3 years.

The observed discrepancy between the rapid growth in publication volume (Figure 1) and the relatively low average citation counts in recent years (Figure 2) can be explained by the typical citation lag in academic publishing. Newly published articles require time to be disseminated, read, and cited, especially in rapidly evolving fields like green finance. As a result, while the production of research has increased notably after 2018, the corresponding citation impact is still maturing. This pattern reflects the normal dynamics of emerging research domains and suggests that many recent contributions may gain greater influence in the coming years.

4.2. Most Relevant Journals

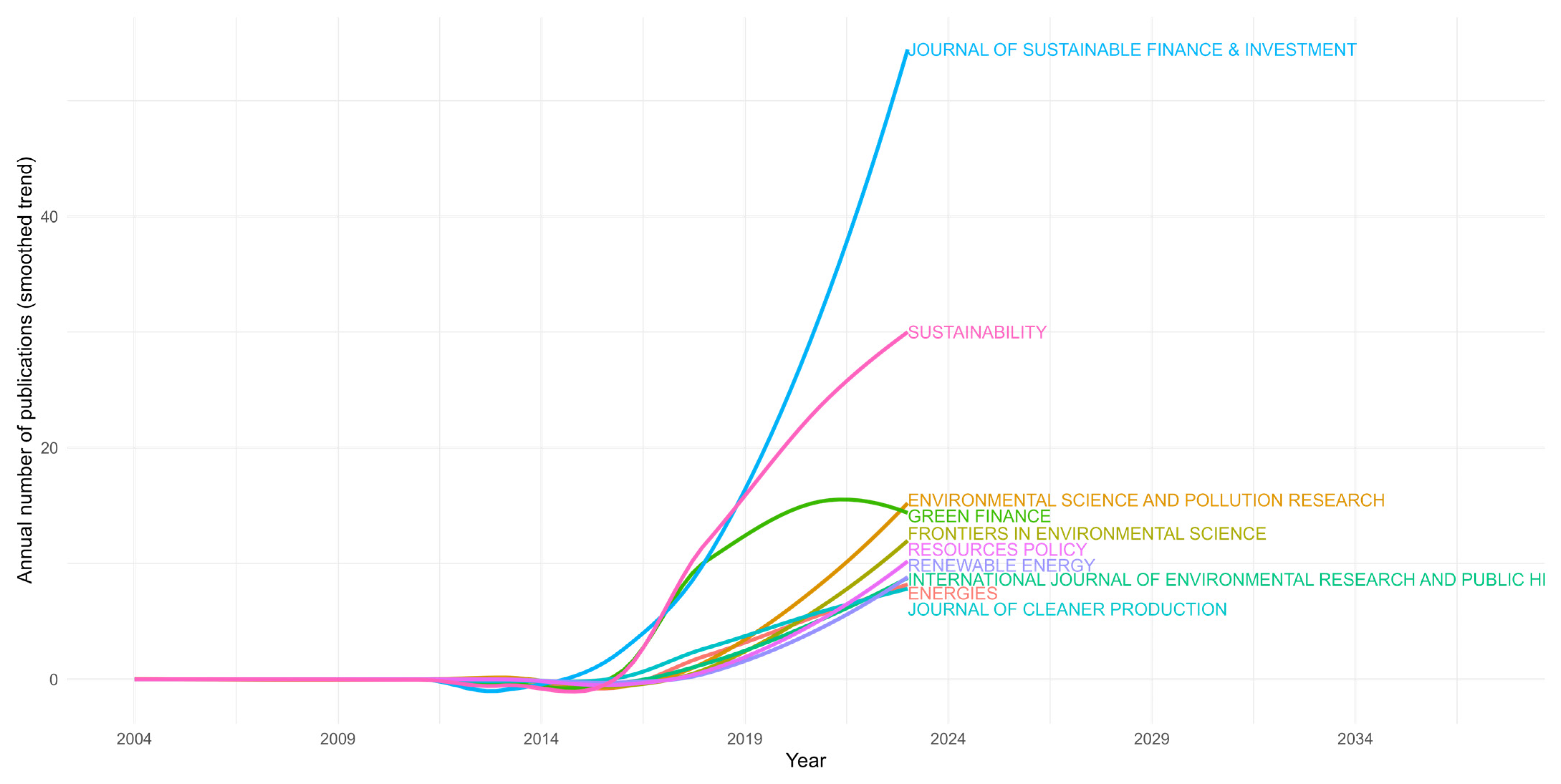

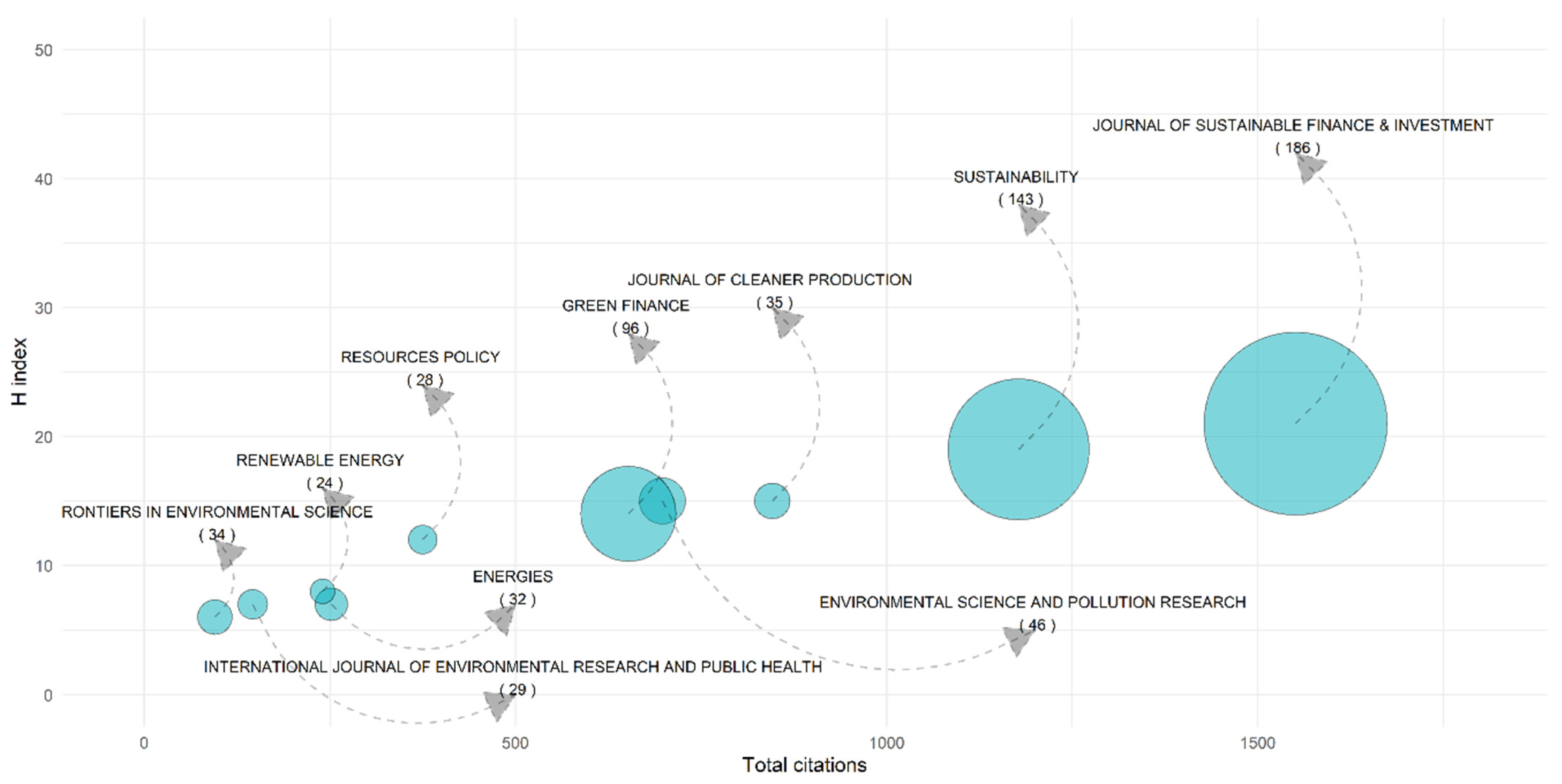

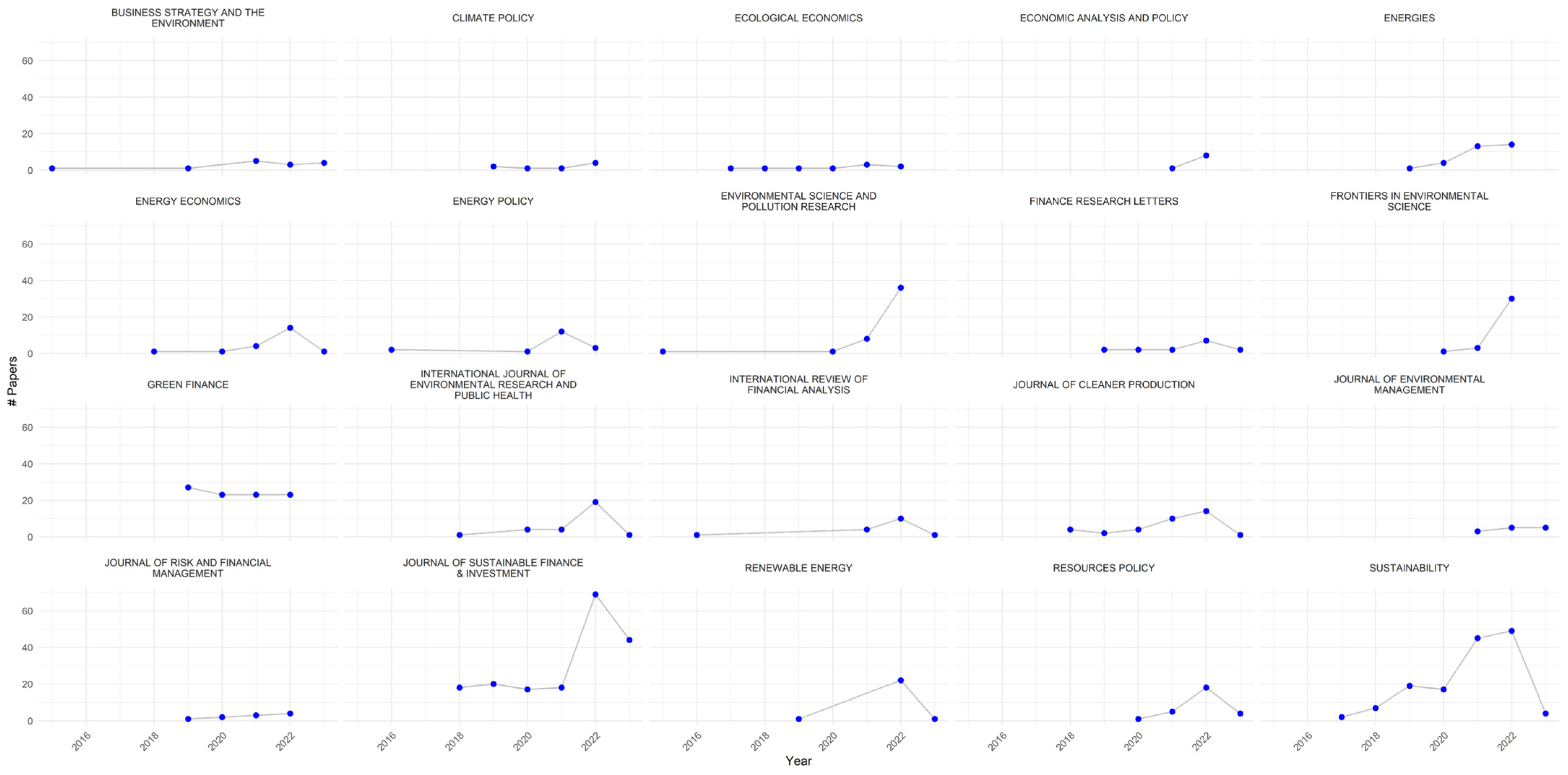

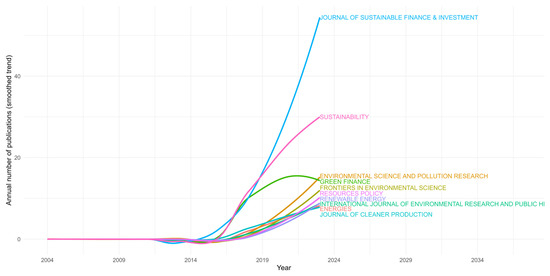

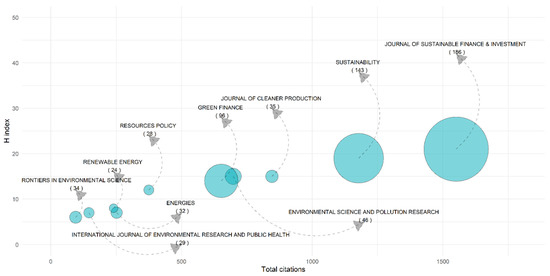

Figure 4 shows the growth of the 10 journals with the highest number of publications. It can be seen how around 2016 the boom of publications in this field began. Currently, the Journal of Sustainable Finance & Investment is the leader in publications on this topic, followed by the journal of Sustainability. The green finance journal shows a decrease in publications for the last year, while the rest of the journals are in a positive trend. Another clear sign that we are in the active research season in the field of green finance or sustainable finance. In addition to this information, Figure 5 shows the top 10 most relevant journals in the area. Here, complete information is presented regarding the analysis of the total number of citations (x-axis), H index (y-axis) and number of publications on green finance or sustainable finance (number in parentheses in the label, dot size) for the 10 most relevant journals.

Figure 4.

Journals growth top 10. Note: This figure shows the smoothed annual number of publications for the 10 most relevant journals in the field of green finance and sustainable finance.

Figure 5.

Top 10 Most relevant journals regarding number of publications. Note: This figure relates three variables: total number of citations (x-axis), H index (y-axis) and number of publications (circle size).

Figure 5 shows that the Journal of Sustainable Finance & Investment and Sustainability are the journals with the highest impact in the field. Although the Journal of Cleaner Production does not have a high number of publications, it manages to consolidate as the third journal with the highest impact because it presents a high number of citations and H index, a situation similar to that of the journal of Green Finance, which as we highlighted above in the last year 2024, according to the date of data download, presents a decrease in its publications in the field.

Table 2 shows in a more complete way the top 20 most relevant journals, here the number of publications is taken into account, in addition to the number of total citations, H index and the year of start of publications in the field. The first three journals identified above remain stable, but now the journal Energy Policy takes relevance since it has a higher number of citations with only 18 publications in the area, which started since 2016. Likewise, the journal Finance Research Letters gains relevance when evaluating the number of citations with respect to 15 papers published since 2019. Another journal that appears in comparison to Figure 5, is the journal Energy Economics, this journal has 383 citations in a total of 21 papers starting from 2018.

Table 2.

Top 20 Most relevant journals. Note: This table shows the relevance of the journals according to the total number of citations.

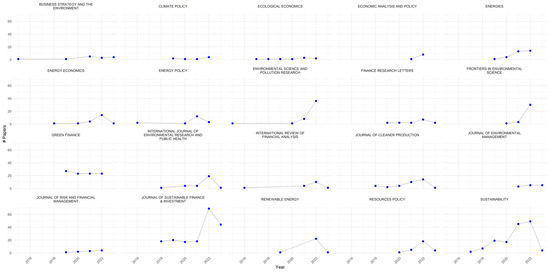

Complementing Table 2, Figure 6 shows the dynamics of the number of publications for each journal from 2015 to 2022. While journals such as Sustainability show a clear drop in the last year, others such as Enviromental Science and Pollution Research, and Frontiers in Enviromental Science show an upward trend in the last period.

Figure 6.

Publication dynamics for the top 20 journals. Note: This figure shows the number of papers published in each of the most relevant journals in the area. “#” indicates “number of”.

4.3. Most Relevant Authors

Table 3 presents the 20 most relevant authors on the topics of green finance or sustainable finance. The order presented is linked to the total number of citations of each author. The top 5 most influential authors are: Taghizadeh-Hesary, F., Lee, CC., Zhang, D., Wang, Y. and Crifo, P. Author Zhang, D. is the author with the highest number of papers as single author, with only two publications and with the highest dominance index. This index is relevant for measuring the dominance factor, which is a ratio that indicates the fraction of multi-authored papers in which a scholar appears as first author.

Table 3.

Top 20 Most relevant authors. Note: This table shows the most relevant authors with respect to the total number of citations. In addition, it includes information such as H-index, number of publications and Dominance factor which indicates the fraction of multi-authored articles in which an academic appears as first author.

On the other hand, Taghizadeh-Hesary, F. is the author with the highest number of citations (1018), he has 16 publications and all of them are in collaboration, only 6 of them as first author. The author with the highest number of publications is Wang, Y. with a total of 25 publications, but he is the fourth most cited author with 410 citations, clearly this is the author who has been active for the longest time since his first publication which was in 2014.

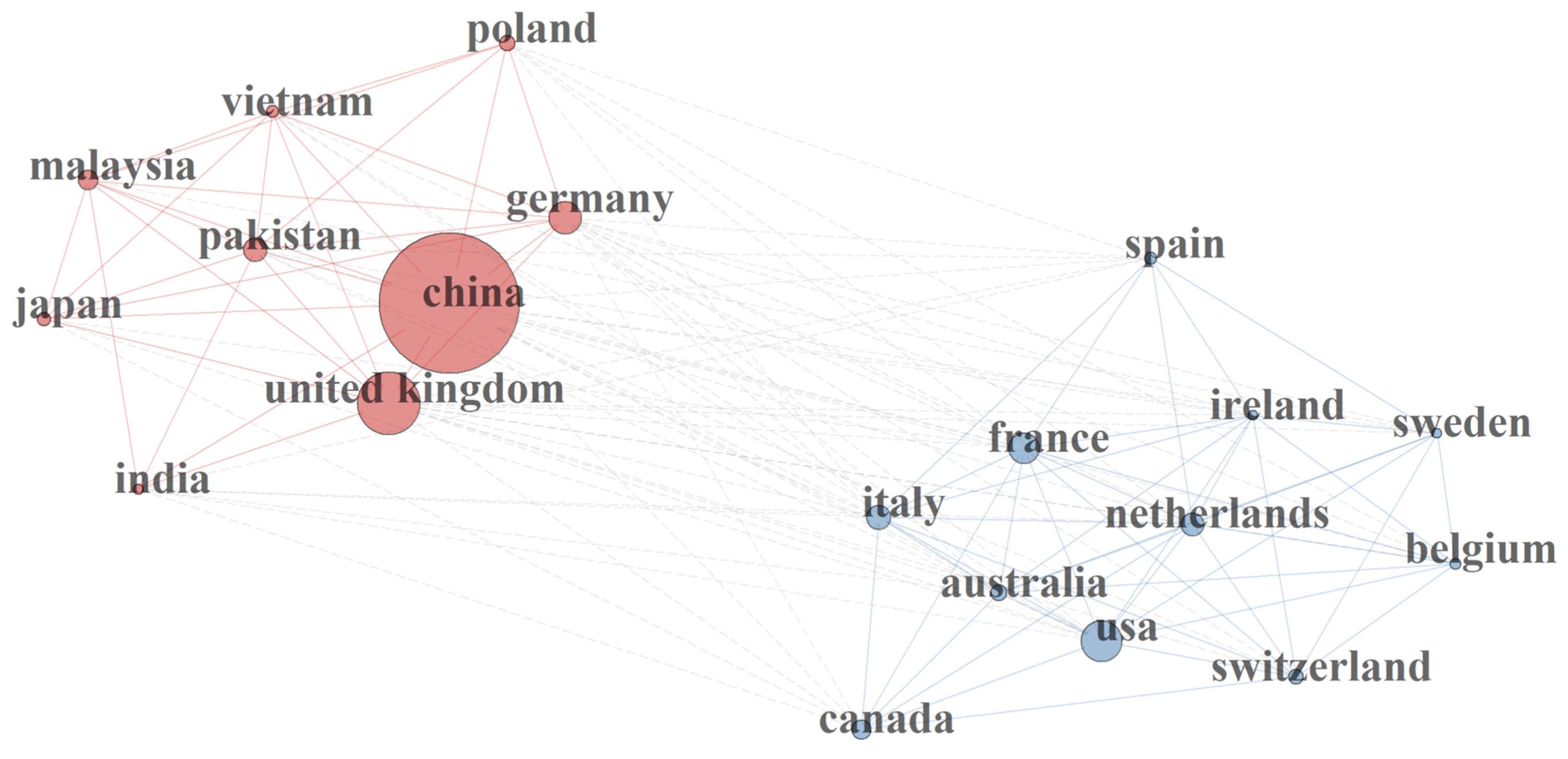

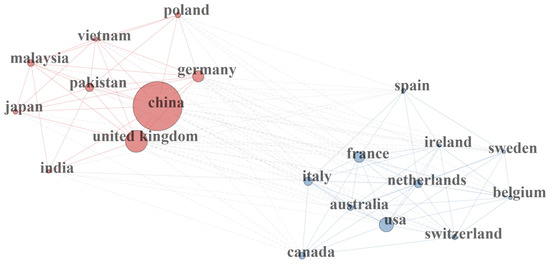

Figure 7 presents the collaboration network between countries based on co-authorships in green finance publications. The size of each node reflects the volume of scientific production per country, while the thickness and density of the edges indicate the strength of collaborative ties. Two distinct clusters are observed: one led by China and the United Kingdom, and another composed mainly of European and Anglo-Saxon countries such as France, the Netherlands, the USA, and Switzerland. China emerges as the dominant contributor, both in terms of volume and collaborative intensity, suggesting its central role in shaping the global research agenda on green finance. The presence of multiple cross-national linkages also highlights the increasing internationalization of the field.

Figure 7.

Collaboration network between countries based on co-authorships in green finance publications. Note: Node size represents the number of publications per country; edge thickness reflects the strength of international collaboration.

4.4. Most Relevant Papers

This section shows the 20 most relevant articles on specific green finance topics. Table 4 presents detailed information on each article, including title, authors, journal and year of publication. In addition, the table includes two important columns: APY, which represents the average number of citations per year, and TC, which represents the total number of citations. It is important to keep in mind that the total number of citations can be influenced by the time elapsed since the publication of the article, so the ranking of the most relevant articles is generated based on the APY. In this sense, the most relevant article was “How does green finance affect green total factor productivity? Evidence from China” with an APY of 79, which was published by Lee and Lee (2022) in the journal Energy Economics, according to Table 1 this is the most cited article in the last period 2020–2024. The article with the highest number of citations according to Figure 1, falls to position 18 in Table 4 according to APY relevance. One thing we highlight is that the most relevant papers according to APY are recent publications generally ranging between 2019 and 2022. This shows that the topic is very young and still needs to be explored much more, in addition to the fact that a very solid network can be glimpsed since the number of citations is quite large for such recent papers.

Table 4.

Top 20 Most relevant papers. Note: This table shows the 20 most relevant papers with respect to the average number of citations per year (APY). In addition, it also shows information on the total number of citations (TC).

4.5. Most Relevant Co-Occurance Keywords

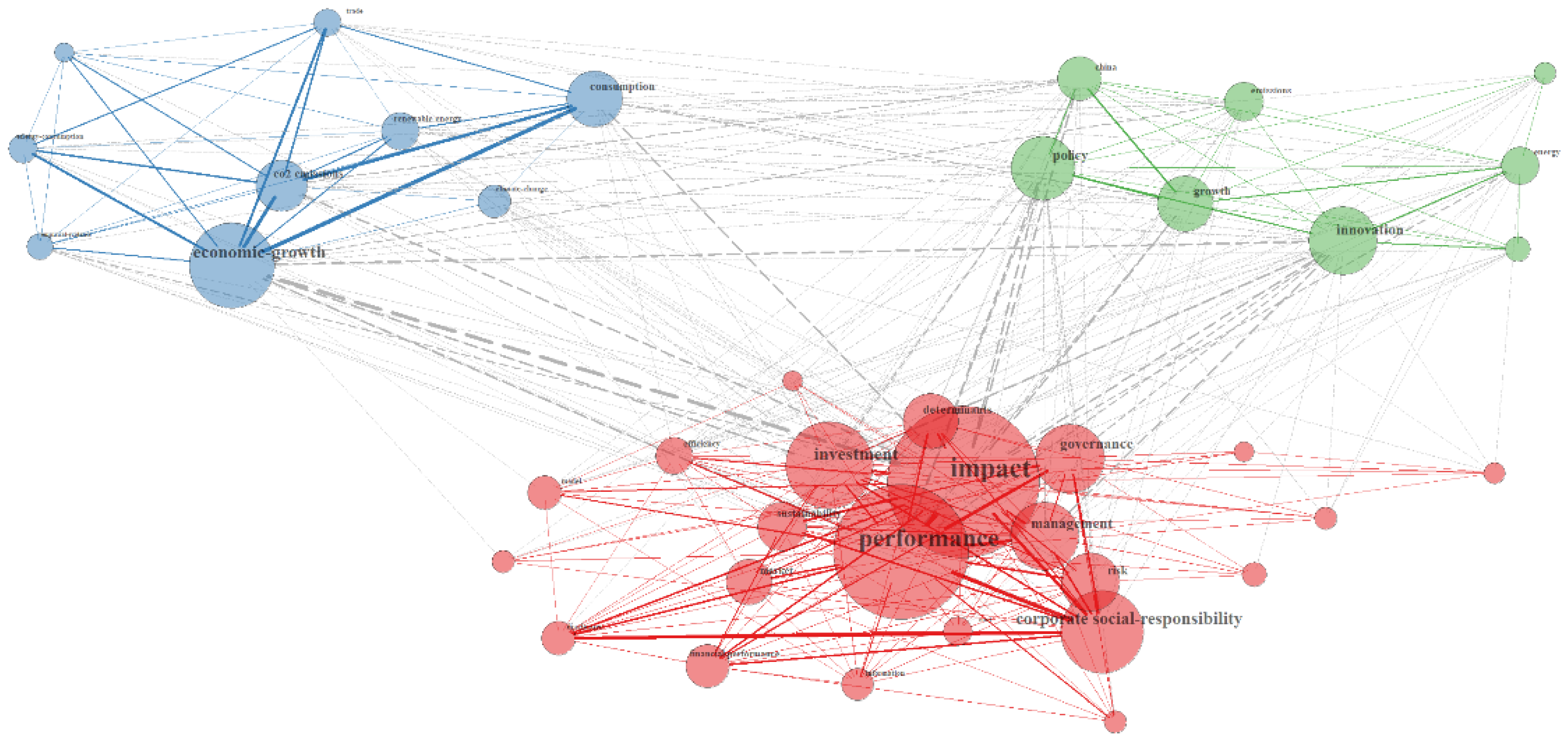

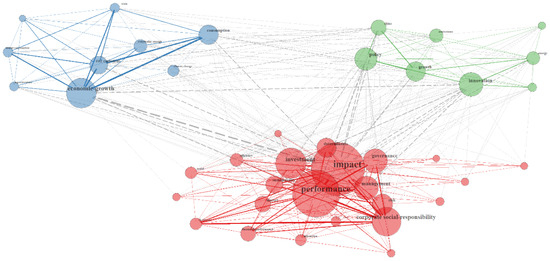

Figure 8 shows the co-occurrence of the author’s keywords. We can distinguish large clusters mainly associated (net) with key aspects of green finance, such as performance, impact, investment, governance, management and corporate social responsibility. A second cluster (blue) of words that allows the identification of relevant topics, is associated with green finance and the transition to a low carbon economy, and finally, a topic to highlight (green) could be Innovative green energy policies in China and their impact on sustainability.

Figure 8.

Bibliometric map of most frequently mentioned author keywords. Note: This figure shows 3 clusters that determine the network of keywords that exist in the area.

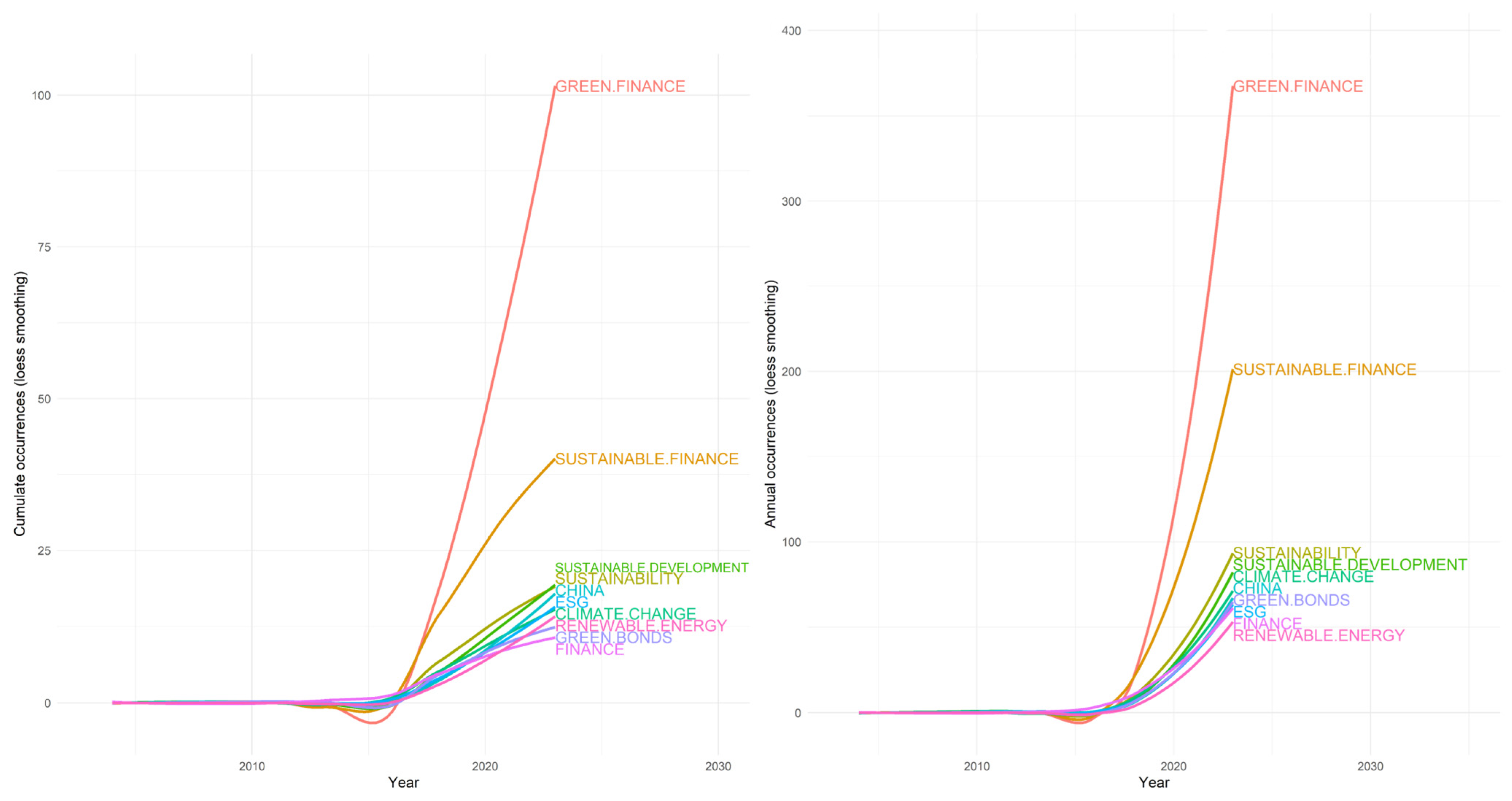

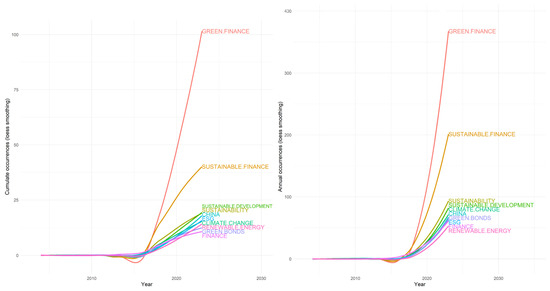

Complementing Figure 8, Figure 9 shows the dynamics of the author’s keywords. The left panel shows the annual co-occurrences while the right panel shows the cumulative co-occurrences. As expected, one of the most relevant keywords is “Green Finance” and “Sustainable Finance”, the figures corroborate the exponential growth that is occurring in the field. Other terms such as Sustainability, Sustainable Development, and China among others stand out. These results show a clear influence of papers with context or empirical evidence for China.

Figure 9.

Author keywords dynamics. Note: This figure shows the smoothing of the occurrence of each keyword. The left panel shows the annual co-occurrences. The right panel shows the cumulative co-occurrences.

4.6. Topic Modelling

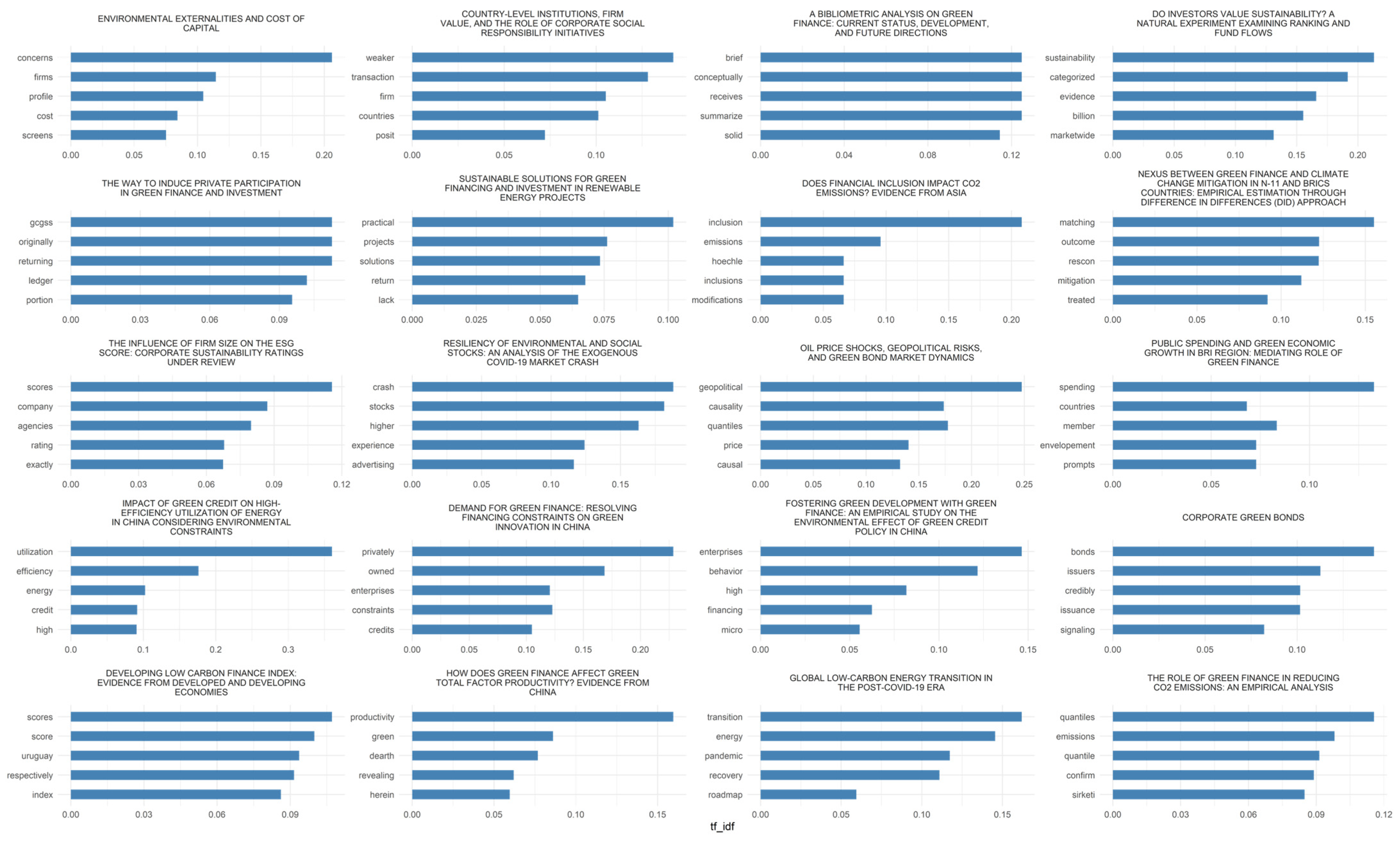

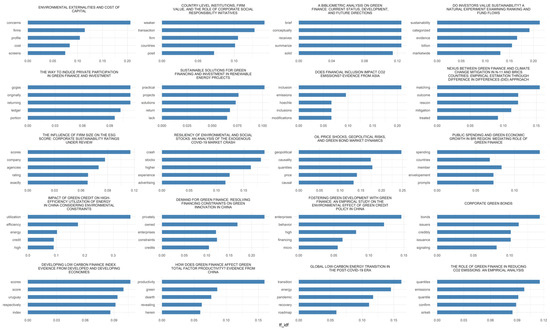

We applied text mining methodologies to the abstracts of all 1372 papers in the sample. Figure 10 allows us to identify which are the most important words on the 20 most relevant papers, this is done using the TF-IDF statistic. This allows us to have an idea about which topics are being talked about in the relevant literature of the field, we have the following: The main theme seems to be, the transition towards a more sustainable and environmentally friendly economy. The words “sustainability”, “emissions”, “mitigation”, “green”, “energy”, “enterprises”, “bonds” and “transition” suggest that the need to reduce greenhouse gas emissions and improve energy efficiency in both companies and countries is being discussed. Also mentioned are “scores” and “quantiles”, which could indicate that there is discussion of measuring and tracking carbon emissions and progress in the transition to a low-carbon economy. In addition, the words “geopolitical”, “stocks”, “prices” and “spending” suggest that the transition to a sustainable economy may also have global economic and political implications.

Figure 10.

Top 5 single terms identified based on TF-IDF. Note: This figure shows the relevance of each term within each article. It is presented for the 20 papers classified as the most relevant.

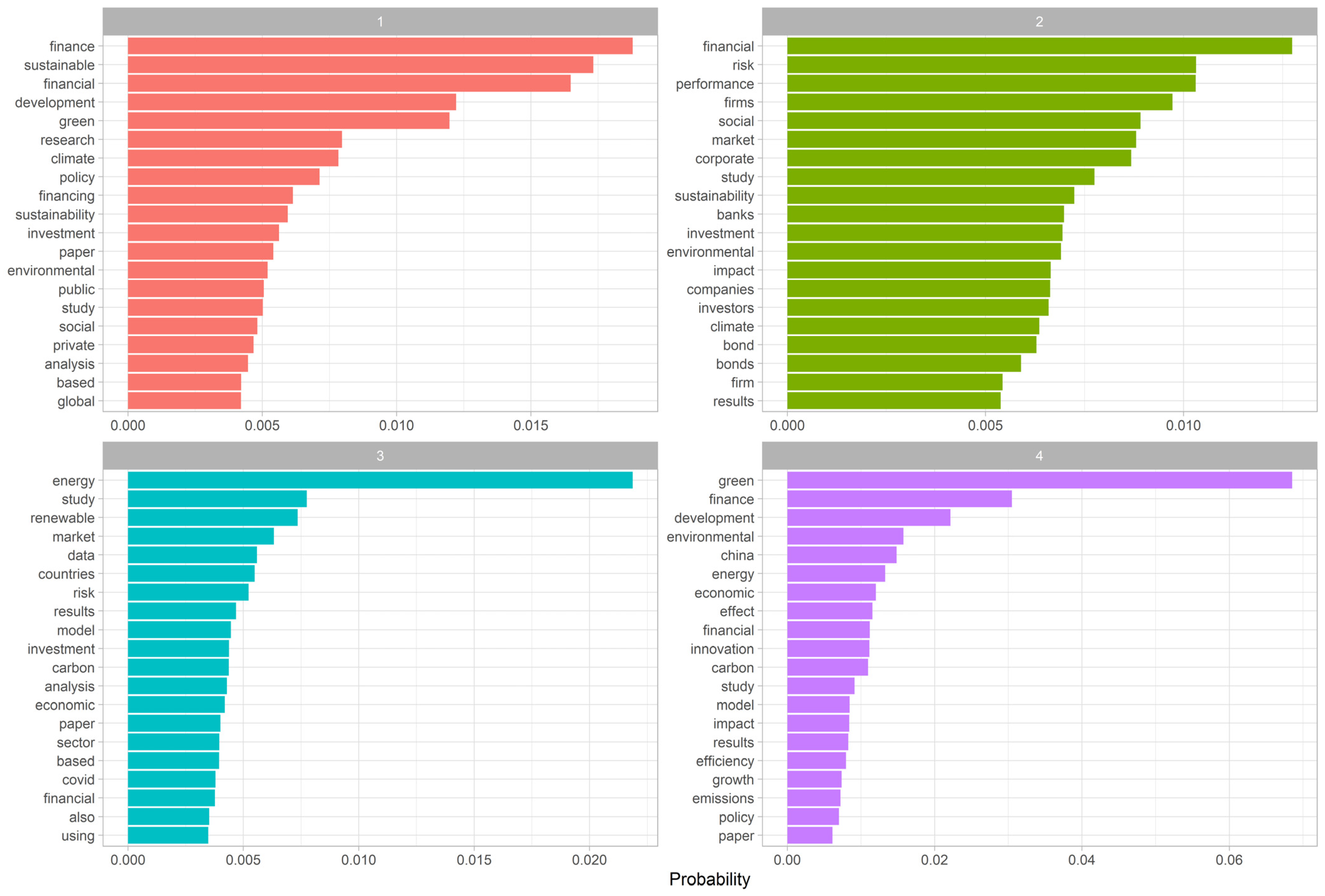

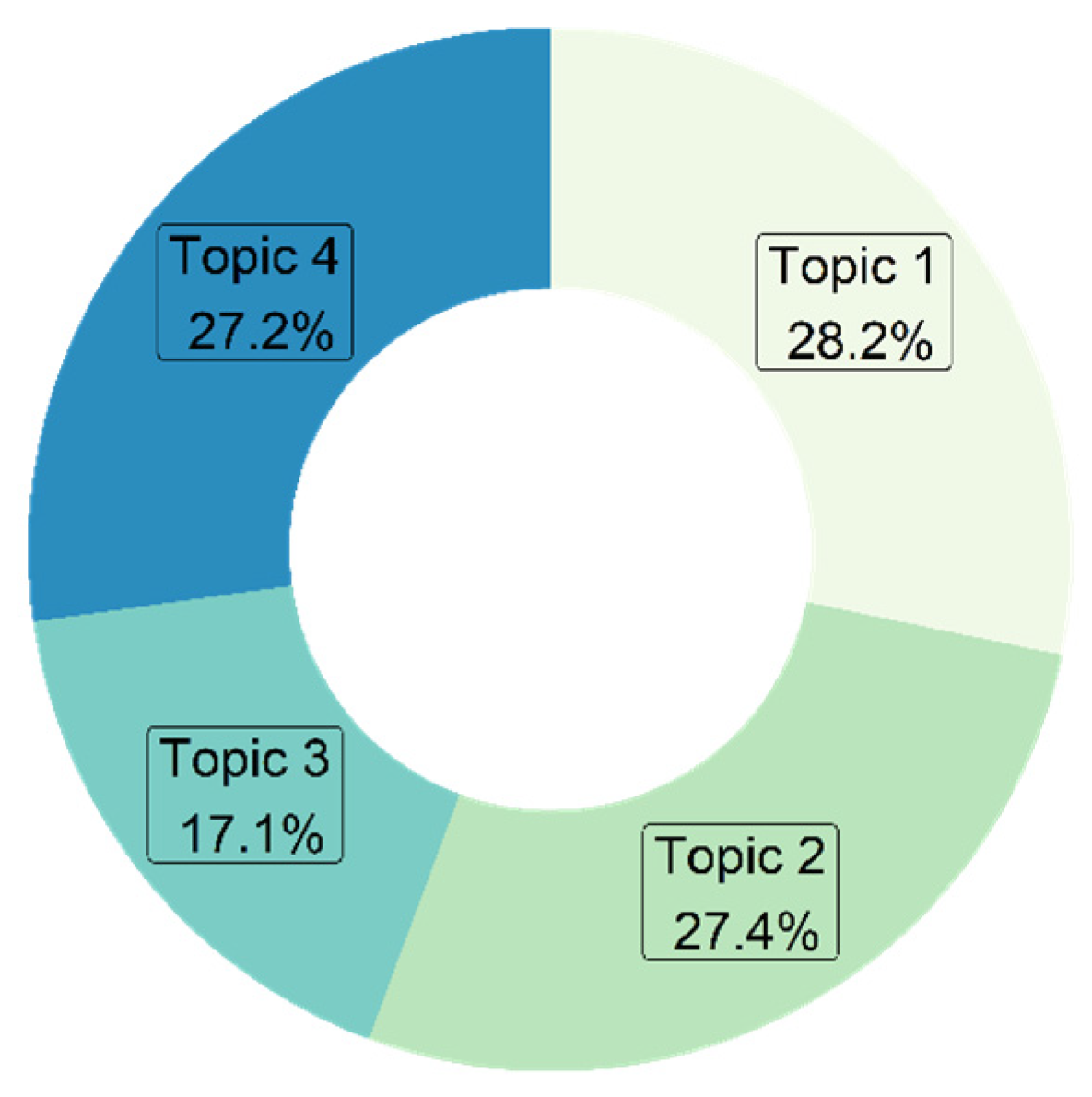

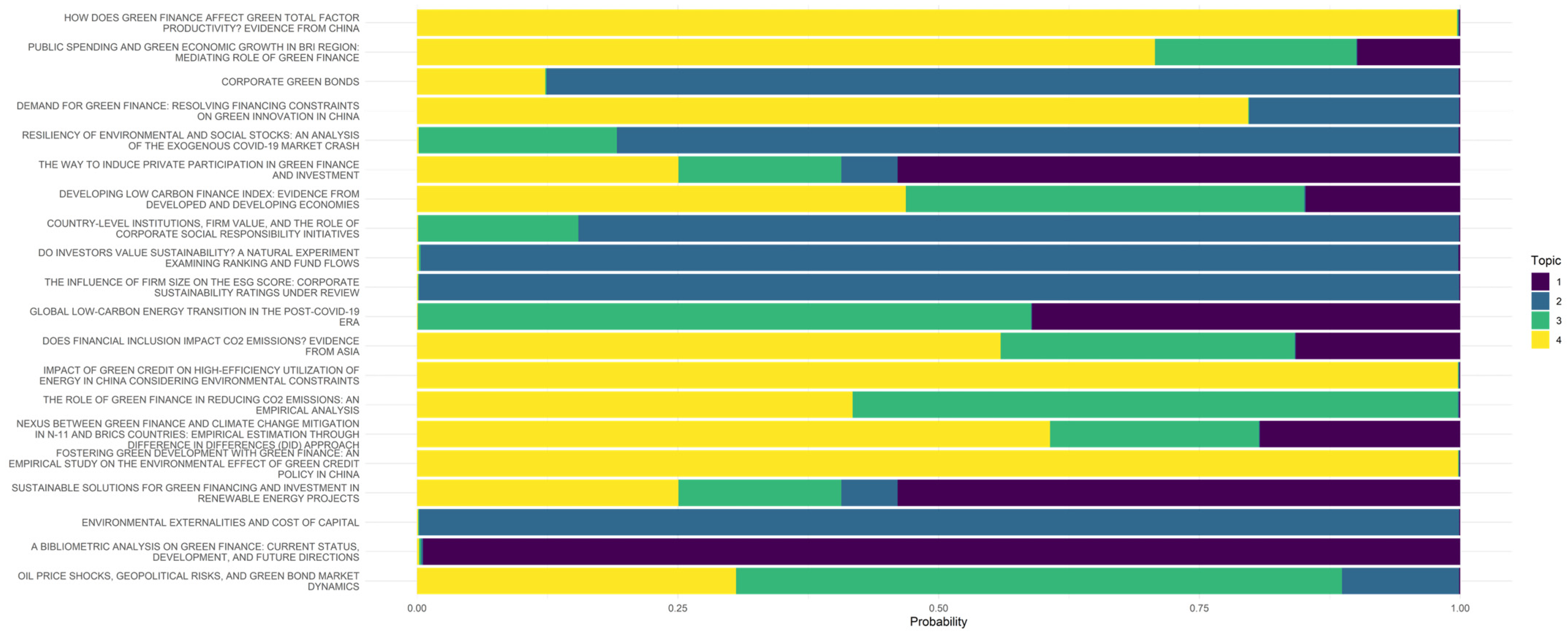

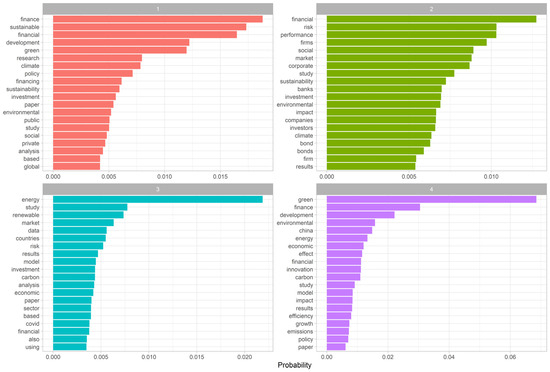

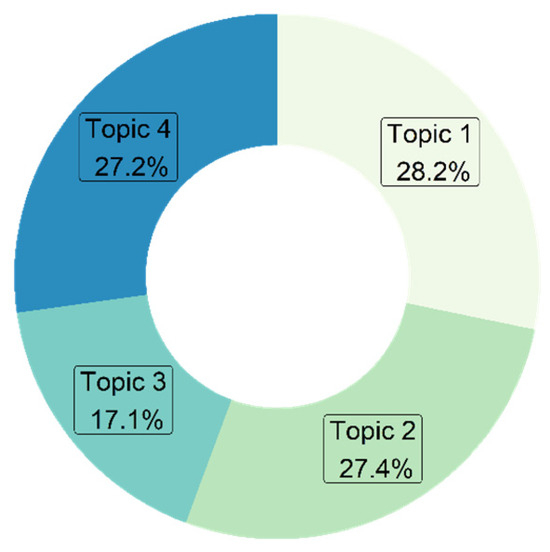

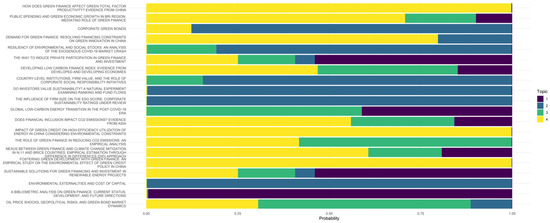

In addition to the above, using the text data we were able to perform a topic modeling that allows us to identify among all the documents in the sample which are the latent topics in the scientific production of green finance. Figure 11 shows the most relevant terms in four estimated themes. Theme one, could be described as: “The role of sustainable finance in economic development and the transition to a green economy”, the second theme could be classified as: “The impact of environmental and social sustainability on the financial performance of companies and investors”, the third theme: “Renewable energy investment trends and associated economic risks: Data-driven analysis and market outcomes during the COVID-19 pandemic” and finally, “Green finance and its impact on energy efficiency and carbon emission reduction in China”. In addition, from this identification we obtain the classification of all the papers into these four estimated topics. Figure 12 represents the distribution of the 1372 documents in each of the topics. The distribution tends to be equal, however, theme 3 has a lower dominance in the set of papers analyzed, recalling that this theme links contexts of the COVID-19 pandemic.

Figure 11.

Top 20 most relevant terms in the topics. Note: This figure shows the 20 words that make up each of the latent topics within the set of 1372 abstracts analyzed. Topics are labeled numerically from 1 to 4.

Figure 12.

Distribution according to the dominance theme of the 1372 articles. Note: This figure shows the classification of all the documents in the four estimated themes.

Finally, we estimate the probability of dominance of the estimated theme over the 20 most relevant papers. There is a clear dominance of theme 4, followed by theme 2. Both themes converge on the importance of environmental and social sustainability in financial and investment decisions. The former examines how environmental and social sustainability affects the financial performance of companies and investors, while the latter focuses on the impact of green finance on energy efficiency and carbon emission reduction in China.

Both themes suggest that the literature is moving in the direction where environmental and social sustainability is a key factor to consider in financial and investment decisions, as it can have a significant impact on financial performance, economic growth and environmental development. Furthermore, as these are the most relevant paper dominance themes we could conclude that researchers seek to highlight the importance of economic policy in promoting sustainable financial practices and the transition to a low-carbon economy. Overall, both themes show how environmental and social sustainability is increasingly integrated into financial and investment decision making around the world.

As shown in Figure 13, the most influential articles are predominantly aligned with Theme 4, focused on green finance, carbon mitigation, and energy efficiency, suggesting a consolidated scholarly emphasis on the environmental impact of financial instruments. This thematic dominance is followed by Theme 2, which relates to the financial consequences of ESG and CSR practices. While Themes 1 and 3, centered on sustainable development finance and renewable energy transitions, are less prevalent individually, they often appear in combination, reflecting their complementary role within broader empirical inquiries. This distribution reinforces the idea that recent academic contributions are shifting toward applied, policy-relevant research, especially in emerging markets. It also echoes the evolution of the field from fragmented theoretical debates toward a more integrated and outcome-oriented discourse.

Figure 13.

Distribution according to the dominance theme of the 20 most relevant papers. Note: This figure shows the predominance of the theme in each article of the 20 most relevant papers. There is a large predominance of theme 4 (yellow), followed by theme 2 (blue), theme 1 (violet) and theme 3 (green).

5. Discussion

The results of this study reveal that green and sustainable finance has rapidly evolved into a dynamic and expansive research field, with a sharp increase in academic contributions particularly from 2017 onward. This trend reflects growing global attention to environmental concerns and the financial sector’s role in addressing climate change. Our bibliometric analysis highlights that the most influential contributions are clustered around themes such as environmental risk pricing, green bonds, corporate ESG performance, and green innovation financing—particularly in emerging economies like China. These findings align with prior literature (e.g., Zhang et al., 2022; Lee & Lee, 2022), underscoring a shift from conceptual discussions to more empirical, policy-relevant analyses. Journals such as Journal of Sustainable Finance & Investment, Sustainability, and Energy Policy have emerged as central platforms, not only due to their publication volume but also for their scholarly impact measured through citation patterns. The topic modeling analysis further uncovers four latent themes dominating the field: (1) sustainable finance and economic development, (2) the financial impact of ESG and CSR practices, (3) investment in renewable energy amid global disruptions like COVID-19, and (4) green finance’s contribution to carbon emission reduction and energy efficiency—especially in the Chinese context. The predominance of themes 2 and 4 in the most cited papers suggests a growing consensus on the financial materiality of sustainability factors and the relevance of green finance for policy implementation.

The exponential increase in publications on green finance observed since 2017 highlights a significant shift in the academic community’s attention toward sustainability-related financial mechanisms. This surge not only reflects growing environmental concerns, but also an increasing demand for research that bridges economic decision-making with ecological impact. The field’s youth is evident in the limited citation accumulation of recent papers, yet this also signals an active, rapidly evolving domain ripe for methodological innovation and interdisciplinary collaboration.

The dominance of topics related to carbon emissions, energy efficiency, and ESG performance suggests a strong policy-oriented focus in green finance research. However, areas such as the role of small and medium enterprises (SMEs), fintech applications in emerging markets, and behavioral finance approaches remain relatively underexplored. These gaps represent promising avenues for future work that can connect green finance to broader socioeconomic dynamics.

Despite the field’s growth, certain gaps persist. For instance, while China dominates empirical applications, other developing regions remain underrepresented. Additionally, interdisciplinary integration—combining finance, policy, and environmental science—could further enrich the analytical frameworks used. There is also potential for advancing the methodological rigor through the application of machine learning, causal inference techniques, or network science to understand the interconnectedness of green financial instruments and macroeconomic resilience.

While China has emerged as a dominant contributor in both volume and thematic influence, this concentration underscores the need for greater geographic diversification in future research. The current literature may risk over-reliance on a single national context, potentially limiting the applicability of findings across different institutional, economic, and cultural environments. Encouraging studies from underrepresented regions, particularly in Latin America, Africa, and Southeast Asia, could provide valuable comparative insights and enhance the global relevance of the field.

From a practical perspective, the mapping of journals, authors, and thematic clusters can serve as a roadmap for researchers entering the field, journal editors seeking to consolidate thematic specializations, and policymakers looking for evidence-based guidance. The integration of bibliometric and text mining techniques also demonstrates how data-driven approaches can support strategic knowledge development in sustainability finance.

Overall, this study provides a roadmap for researchers, journal editors, and policymakers to navigate the complex and expanding landscape of green finance. The findings call for more inclusive, diversified, and methodologically innovative research agendas that contribute not only to academic knowledge but also to real-world financial sustainability transitions.

6. Conclusions

This study provides a comprehensive overview of the intellectual structure and emerging trends in green and sustainable finance. By employing bibliometric and topic modeling techniques, we identified an exponential growth in academic output over the last two decades, pinpointed key contributors and journals, and classified the literature into four dominant thematic areas: green innovation, productivity and firm performance, green financial instruments, and renewable energy transitions. These findings reflect not only the maturity of the field but also its increasing relevance in global efforts to address environmental and financial sustainability.

The results underscore the pivotal role of green finance in reshaping investment strategies and financial practices, with particular emphasis on the Chinese context, where policy-driven initiatives have significantly influenced the trajectory of green finance research. Moreover, the interaction between fintech and environmental objectives emerges as a promising area of study, expanding the scope of green finance beyond traditional instruments.

Despite the rapid development of the field, regional disparities and methodological gaps remain. Future research should focus on comparative analyses across different institutional and cultural settings, especially in emerging economies, and adopt integrative approaches that combine machine learning, econometric analysis, and sustainability metrics. By doing so, researchers can provide more nuanced insights into the mechanisms through which green finance contributes to environmental and economic transformation.

Overall, this work offers a valuable foundation for guiding future research and informing policy design in the evolving landscape of sustainable finance, encouraging interdisciplinary collaboration and the adoption of innovative methodologies.

Author Contributions

Conceptualization, O.J.-B., J.H.-C., S.L.-E. and D.-T.A.; methodology, O.J.-B.; software, S.L.-E.; validation, O.J.-B. and J.H.-C.; formal analysis, O.J.-B., S.L.-E. and D.-T.A.; investigation, J.H.-C.; data curation, S.L.-E.; writing—original draft preparation, O.J.-B., J.H.-C., S.L.-E. and D.-T.A.; writing—review and editing, O.J.-B., J.H.-C., S.L.-E. and D.-T.A.; visualization, O.J.-B. and S.L.-E. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within paper.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Albuquerque, R. (2020). Resiliency of environmental and social stocks: An analysis of the exogenous COVID-19 market crash. The Review of Corporate Finance Studies, 9(3), 593–621. [Google Scholar] [CrossRef] [PubMed]

- Alvi, S., Ahmad, I., Nawaz, S. M. N., Connell, W., Anser, M. K., & Ul Hassan, M. (2025). The role of green finance, energy transition, and digitalization in OECD greenhouse gas emissions. Journal of Cleaner Production, 518, 145865. [Google Scholar] [CrossRef]

- Aria, M., & Cuccurullo, C. (2017). Bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), 959–975. [Google Scholar] [CrossRef]

- Blei, D. M., Ng, A. Y., & Jordan, M. I. (2003). Latent Dirichlet allocation. Journal of Machine Learning Research, 3(4–5), 139–159. [Google Scholar] [CrossRef]

- Cai, R., & Guo, J. (2021). Finance for the environment: A scientometrics analysis of green finance. Mathematics, 9(13), 1537. [Google Scholar] [CrossRef]

- Chava, S. (2014). Environmental externalities and cost of capital. Management Science, 60(9), 2223–2247. [Google Scholar] [CrossRef]

- Cojoianu, T. F., French, D., Hoepner, A. G. F., Sheenan, L., & Vu, A. (2025). On the origin of green finance policies. Journal of Financial Stability, 79, 101418. [Google Scholar] [CrossRef]

- El Ghoul, S., Guedhami, O., & Kim, Y. (2017). Country-level institutions, firm value, and the role of corporate social responsibility initiatives. Journal of International Business Studies, 48(3), 360–385. [Google Scholar] [CrossRef]

- Fahim, F., & Mahadi, B. (2022). Green supply chain management/green finance: A bibliometric analysis of the last twenty years by using the Scopus database. Environmental Science and Pollution Research International, 29(56), 84714–84740. [Google Scholar] [CrossRef] [PubMed]

- Flammer, C. (2021). Corporate green bonds. Journal of Financial Economics, 142(2), 499–516. [Google Scholar] [CrossRef]

- Fu, Q., & Zhao, S. (2025). Influence of green finance on new-quality productivity of enterprises: Evidence from Chinese A-share listed companies. International Review of Financial Analysis, 105, 104356. [Google Scholar] [CrossRef]

- Gharbi, I., Rahman, M. H., Muryani, M., Esquivias, M. A., & Ridwan, M. (2025). Exploring the influence of financial development, renewable energy, and tourism on environmental sustainability in Tunisia. Discover Sustainability, 6(1), 1–23. [Google Scholar] [CrossRef]

- Han, J., Zhang, W., Liu, X., Muhammad, A., Li, Z., & Işık, C. (2025). Climate policy uncertainty and green total factor energy efficiency: Does the green finance matter? International Review of Financial Analysis, 104, 104293. [Google Scholar] [CrossRef]

- He, L., Liu, R., Zhong, Z., Wang, D., & Xia, Y. (2019). Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renewable Energy, 143, 974–984. [Google Scholar] [CrossRef]

- Hermala, I., Sunitiyoso, Y., & Sudrajad, O. Y. (2025). Green financing using islamic finance instruments in indonesia: A bibliometrics and literature review. International Journal of Energy Economics and Policy, 15(1), 239–248. [Google Scholar] [CrossRef]

- Hou, M., Xie, Y., Lu, W., Cui, X., Xi, Z., & Han, Y. (2025). Green finance drives the synergy of pollution control and carbon reduction in China: Dual perspective of effect and efficiency. Energy, 330, 136873. [Google Scholar] [CrossRef]

- Irfan, M., Razzaq, A., Sharif, A., & Yang, X. (2022). Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technological Forecasting and Social Change, 182, 121882. [Google Scholar] [CrossRef]

- Jelodar, H., Wang, Y., Yuan, C., Feng, X., Jiang, X., Li, Y., & Zhao, L. (2019). Latent Dirichlet allocation (LDA) and topic modeling: Models, applications, a survey. Multimedia Tools and Applications, 78(11), 15169–15211. [Google Scholar] [CrossRef]

- Jiakui, C., Abbas, J., Najam, H., Liu, J., & Abbas, J. (2023). Green technological innovation, green finance, and financial development and their role in green total factor productivity: Empirical insights from China. Journal of Cleaner Production, 382, 135131. [Google Scholar] [CrossRef]

- Kumar, B., Kumar, J., Amjad, A. Q., Kumar, L., & Sassanelli, C. (2025). Sustainable aviation finance: Integration of environmental impact mitigation and green investment strategies. Research in Transportation Business and Management, 61. [Google Scholar] [CrossRef]

- Lee, C. C., & Lee, C. C. (2022). How does green finance affect green total factor productivity? Evidence from China. Energy Economics, 107, 105863. [Google Scholar] [CrossRef]

- Li, C., & Umair, M. (2023). Does green finance development goals affects renewable energy in China. Renewable Energy, 203, 898–905. [Google Scholar] [CrossRef]

- Li, X., Mo, F., & Li, X. (2025). Environmental information disclosure, green finance, and corporate investment efficiency. Finance Research Letters, 82, 107594. [Google Scholar] [CrossRef]

- Liu, X., & Liu, D. (2025). How green finance drives new-quality productivity from the perspective of Chinese modernization. Finance Research Letters, 82, 107496. [Google Scholar] [CrossRef]

- Lu, K., Han, D., Li, C., & Chen, Y. (2025). Research on the impact of green finance on collaborative governance of pollution reduction and carbon reduction. Scientific Reports, 15(1), 13394. [Google Scholar] [CrossRef] [PubMed]

- Mohanty, S., Nanda, S. S., Soubhari, T., Vishnu, N. S., Biswal, S., & Patnaik, S. (2023). Emerging research trends in green finance: A bibliometric overview. Journal of Risk and Financial Management, 16(2), 108. [Google Scholar] [CrossRef]

- Muchiri, M. K., Erdei-Gally, S., Fekete-Farkas, M., & Lakner, Z. (2022). Bibliometric analysis of green finance and climate change in post-Paris agreement era. Journal of Risk and Financial Management, 15(12), 561. [Google Scholar] [CrossRef]

- Muganyi, T., Yan, L., & Sun, H. (2021). Green finance, fintech and environmental protection: Evidence from China. Environmental Science and Ecotechnology, 7, 100107. [Google Scholar] [CrossRef] [PubMed]

- Nguyen, L. T. M., Nguyen, P. T., & Vo, V. X. (2025). Funding green activities: The national cultural profiles of high green bond issuance countries. Renewable Energy, 253, 123412. [Google Scholar] [CrossRef]

- Rasoulinezhad, E., & Taghizadeh-Hesary, F. (2022). Role of green finance in improving energy efficiency and renewable energy development. Energy Efficiency, 15(2), 14. [Google Scholar] [CrossRef] [PubMed]

- Salton, G., & Buckley, C. (1988). Term-weighting approaches in automatic text retrieval. Information Processing & Management, 24(5), 513–523. [Google Scholar] [CrossRef]

- Surwanti, A., & Mahmoud, M. I. (2025). Financial strategies for sustainable business transformation: A comprehensive bibliometric review. Multidisciplinary Reviews, 8(11), 2025353. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F., & Yoshino, N. (2019). The way to induce private participation in green finance and investment. Finance Research Letters, 31, 98–103. [Google Scholar] [CrossRef]

- Tian, J., Yu, L., Xue, R., Zhuang, S., & Shan, Y. (2022). Global low-carbon energy transition in the post-COVID-19 era. Applied Energy, 307, 118205. [Google Scholar] [CrossRef] [PubMed]

- Tung, P.-H., Chiu, Y.-H., & Huang, C.-H. (2025). Exploring the research development trajectory and trends of green finance. Asia Pacific Management Review, 30(3), 100329. [Google Scholar] [CrossRef]

- Wang, C., Nazar, R., Ali, S., & Meo, M. S. (2025). Eco-friendly algorithms: Artificial intelligence and green finance in European intelligent nations. Technology in Society, 83, 102960. [Google Scholar] [CrossRef]

- Yu, C. H., Wu, X., Zhang, D., Chen, S., & Zhao, J. (2021). Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy, 153, 112255. [Google Scholar] [CrossRef]

- Yu, X., Mao, Y., Huang, D., Sun, Z., & Li, T. (2021). Mapping global research on green finance from 1989 to 2020: A bibliometric study. Advances in Civil Engineering, 2021(1), 9934004. [Google Scholar] [CrossRef]

- Zaid, M. A. K., Khan, M. F., Al-Mekhlafi, A.-W. A.-G. S., Al Koliby, I. S., Saoula, O., Saeed, H. A. E. M., & Mohammad, R. A. (2025). The future of green finance: How digital transformation and FinTech drive sustainability. Discover Sustainability, 6(1). [Google Scholar] [CrossRef]

- Zhang, Z., Liu, Y., Han, Z., & Liao, X. (2022). Green finance and carbon emission reduction: A bibliometric analysis and systematic review. Frontiers in Environmental Science, 10, 929250. [Google Scholar] [CrossRef]

- Zhou, G., Liu, L., & Luo, S. (2022a). Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Business Strategy and the Environment, 31(7), 3371–3387. [Google Scholar] [CrossRef]

- Zhou, G., Zhu, J., & Luo, S. (2022b). The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecological Economics, 193, 107308. [Google Scholar] [CrossRef]

- Zhou, X., Tang, X., & Zhang, R. (2020). Impact of green finance on economic development and environmental quality: A study based on provincial panel data from China. Environmental Science and Pollution Research, 27(16), 19915–19932. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).