1. Introduction

In recent years, research about financial risk has exhibited a clear trajectory of thematic expansion and methodological innovation. Scholars have increasingly focused on credit scoring, green bonds, climate risk, systematic risk, the mean–variance criterion, value-at-risk (VaR), and Hawkes processes. Among these, credit scoring remains a foundational approach for assessing both individual and institutional risk, evolving from traditional statistical models to advanced machine learning algorithms that enhance both predictive accuracy and model interpretability (

Gambacorta et al., 2024;

Tu & Wu, 2025). Simultaneously, growing attention to environmental and sustainability factors have fueled the rise of research on green bonds. These studies primarily explore pricing mechanisms, risk–return characteristics, and policy implications within the broader context of ESG investment frameworks (

Tang & Zhang, 2020;

Flammer, 2021). The concept of climate risk has also expanded considerably, especially in light of global climate agreements and increasing financial regulatory scrutiny. Researchers now widely recognize that climate-related shocks affect not only firm-level operations but also contribute to broader systematic risk across the financial system (

Battiston et al., 2017). Within this context, traditional quantitative tools such as the mean–variance criterion (

Markowitz, 1952) and VaR (

Jorion, 2007) remain central to portfolio management and regulatory compliance. However, these models are increasingly adapted to incorporate nonlinear dynamics, fat-tailed distributions and feedback loops associated with climate and market volatility. Moreover, Hawkes processes have gained traction in high-frequency risk modeling due to their ability to capture event clustering, contagion effects, and temporal dependencies in financial markets (

Bacry et al., 2015;

Lin et al., 2025). These models are especially useful for identifying latent channels of risk transmission across asset classes and financial institutions, thereby enhancing early-warning systems.

Overall, this evolving body of literature signals a shift from traditional portfolio-centric risk analysis toward a more integrated and interdisciplinary paradigm. By embedding data-driven modeling, green finance, and climate resilience into risk research, scholars are broadening the theoretical foundation of financial risk management and advancing more robust frameworks for risk monitoring, asset pricing, and regulatory strategy. However, existing research has overlooked the financial crises of enterprises in corporate finance when examining financial risks, and on the other hand, the existing bibliometric research lacks a systematic theoretical framework, which results in isolated conclusions. To overcome these limitations, this study first provides a definition of financial risk. Then, based on 10,766 articles collected from the Web of Science between 2015 and 2024, it creates a specific framework diagram for the cluster analysis of co-cited articles, the analysis of emergent keywords and the dynamic evolution of co-cited keywords in the field of financial risk. The objective of this study is to answer these three problems, as follows:

- (1)

How has the field of financial risk research evolved from 2015 to 2024 in terms of publications and research areas, and which research organizations have made the most significant cumulative contributions over this period?

- (2)

What are the underlying intellectual foundations, influential contributors, and emergent thematic hotspots that have shaped the development of financial risk research over the past decade?

- (3)

Based on the past decade of research, what are the predicted future research themes in the field of financial risk?

Compared with existing studies, this study makes the following theoretical contributions to the bibliometric analysis of financial risk research: First, although previous studies have mainly examined credit risk, market risk, and systemic risks (

Chen et al., 2020;

Zhou & Yin, 2019), corporate financial distress, which is an important aspect of financial risk, has yet to be systematically included in bibliometric analyses (

Li et al., 2022). This study integrates perspectives from corporate finance, such as financial distress and bankruptcy prediction, into the analytical framework, thereby expanding the theoretical boundaries of financial risk research by drawing on foundational theories of financial crisis (

Altman, 1968;

Ohlson, 1980). Second, in contrast to earlier studies that typically rely on single-dimensional approaches such as keyword co-occurrence (

L. Wang et al., 2021) or highly cited literature analysis (

Xu & Chen, 2019), this study develops a comprehensive multi-dimensional bibliometric framework. It encompasses publication growth trends, collaboration networks, citation structures, and thematic evolution, thus addressing the issue of fragmentation and responding to criticisms of the lack of systematicity and theoretical integration in bibliometric research (

Aria & Cuccurullo, 2017). Finally, this study proposes the SEF-ACLSTM framework, which integrates semantic modeling, deep learning-based prediction, and visual presentation. Unlike conventional topic identification methods that primarily rely on keyword frequency and co-occurrence analysis (

Liu et al., 2021;

J. Wang & Zhang, 2020), this framework introduces deep semantic encoding techniques and an attention-driven LSTM network to model the evolution and predict future trends of research topics in higher dimensions. Moreover, the temporal visualization of topic evolution supplements existing limitations in portraying topic lifecycles, popularity dynamics, and semantic transitions (

Aria & Cuccurullo, 2017), providing a systematic and integrative paradigm for studying knowledge evolution in complex academic ecosystems.

The significance of this study lies in two main aspects. First, it reveals the structural transformation of financial risk research between 2015 and 2024 in terms of thematic evolution, regional characteristics, and academic paradigms. By emphasizing the integration of green finance, intelligent technologies, and interdisciplinary approaches, the study contributes practical insights for risk governance and policy design in an increasingly complex global financial landscape. Second, through a systematic analysis of research hotspots, evolutionary trajectories, and emerging trends in the financial risk literature, this study offers a comprehensive research roadmap that aids scholars in identifying influential works and frontier topics, thereby enhancing the scientific rigor of research design and the theoretical contribution of future studies.

The structure of this study is organized as follows.

Section 1 outlines the conceptual foundation, including the definition and scope of financial risk.

Section 2 details the methodological design, with a focus on the application of the PRISMA framework for literature screening.

Section 3 presents a statistical analysis of financial risk publications, examining trends in publication volume, disciplinary distribution, and contributor networks.

Section 4 conducts an in-depth co-citation network analysis to reveal the intellectual structure, milestone works, and emerging thematic clusters within the field.

Section 5 explores the evolutionary trajectories and predictive analysis of research themes using the SEF-ACLSTM model. Finally,

Section 6 summarizes the main findings and research implications, and offers concrete suggestions for future directions.

2. Analytical Framework for Bibliometric Research on Financial Risk

This study adopts a concept–knowledge–collaboration network framework to conduct a comprehensive bibliometric analysis of the financial risk literature in

Figure 1. The analytical process is structured into four stages: First, the study defines the concept of financial risk and applies the PRISMA framework (

Page et al., 2021) to systematically screen and filter relevant literature, ensuring transparency and methodological rigor in data collection. Second, based on descriptive statistics of the retrieved publications, the study investigates the evolution of research output and disciplinary distribution over time, and identifies the most influential authors, institutions, and countries contributing to the field. Third, to uncover the intellectual structure and thematic development of financial risk research, the study employs co-citation network analysis. This includes identifying highly co-cited articles, recognizing intellectual milestones and paradigm shifts, mapping co-cited authors, and analyzing emergent keywords to highlight emerging research frontiers. Fourth, to explore the temporal evolution and forecast future trajectories of research themes, the study introduces a Semantic Evolution Forecasting with Aligned Clustered LSTM (SEF-ACLSTM). This model aligns annual keyword clusters across years and predicts their semantic evolution using an attention-enhanced LSTM framework, enabling forward-looking insights into theme development between 2025 and 2030.

2.1. Conceptual Foundation: Definition and Scope of Financial Risk

The study defines the concept of financial risk as the analytical foundation. Financial risk refers to the potential for financial loss or bankruptcy faced by firms and financial institutions. It is a multifaceted concept widely discussed in the literature, covering dimensions such as market volatility, liquidity constraints, credit risk, and insolvency (

Fabozzi & Peterson, 2003;

Crouhy et al., 2001;

Rejda & McNamara, 2020). Among these, systemic financial risk is especially critical, as the failure of one or more interconnected institutions may propagate through the financial system, potentially leading to cascading defaults and broad-based macroeconomic instability (

Acharya et al., 2017).

Accordingly, financial risk can be categorized into two interrelated distinct forms: corporate financial risk and systemic financial risk. Corporate financial risk arises from firm-specific operational, legal, or financial failures and reflects the internal financial health of individual firms. Systemic financial risk, by contrast, refers to financial distress that spreads across institutions through interconnected networks, threatening the stability of the broader financial system. Though different in scope and mechanism, the two are closely linked: firm-level failures, particularly in interconnected environments, can escalate into systemic crises. In this sense, corporate risk forms the micro-foundation of systemic risk.

The theoretical basis for these categories originates from seminal models. Altman’s Z-score model (

Altman, 1968) introduced a quantitative approach to assess corporate bankruptcy using financial ratios. Merton’s structural model (

Merton, 1974) introduced a framework in which default risk is modeled as a function of asset volatility and leverage, with corporate equity interpreted as a call option on the firm’s assets. This pioneering approach has since served as a cornerstone for the development of modern systemic risk assessment models.

In sum, financial risk encompasses both firm-level and system-level vulnerabilities. While their analytical focus differs, corporate and systemic risks are deeply interconnected. Weaknesses at the micro level can accumulate into broader systemic fragility.

Table 1 summarizes the distinctions and interdependencies between these two types of risk, along with their theoretical and regulatory implications.

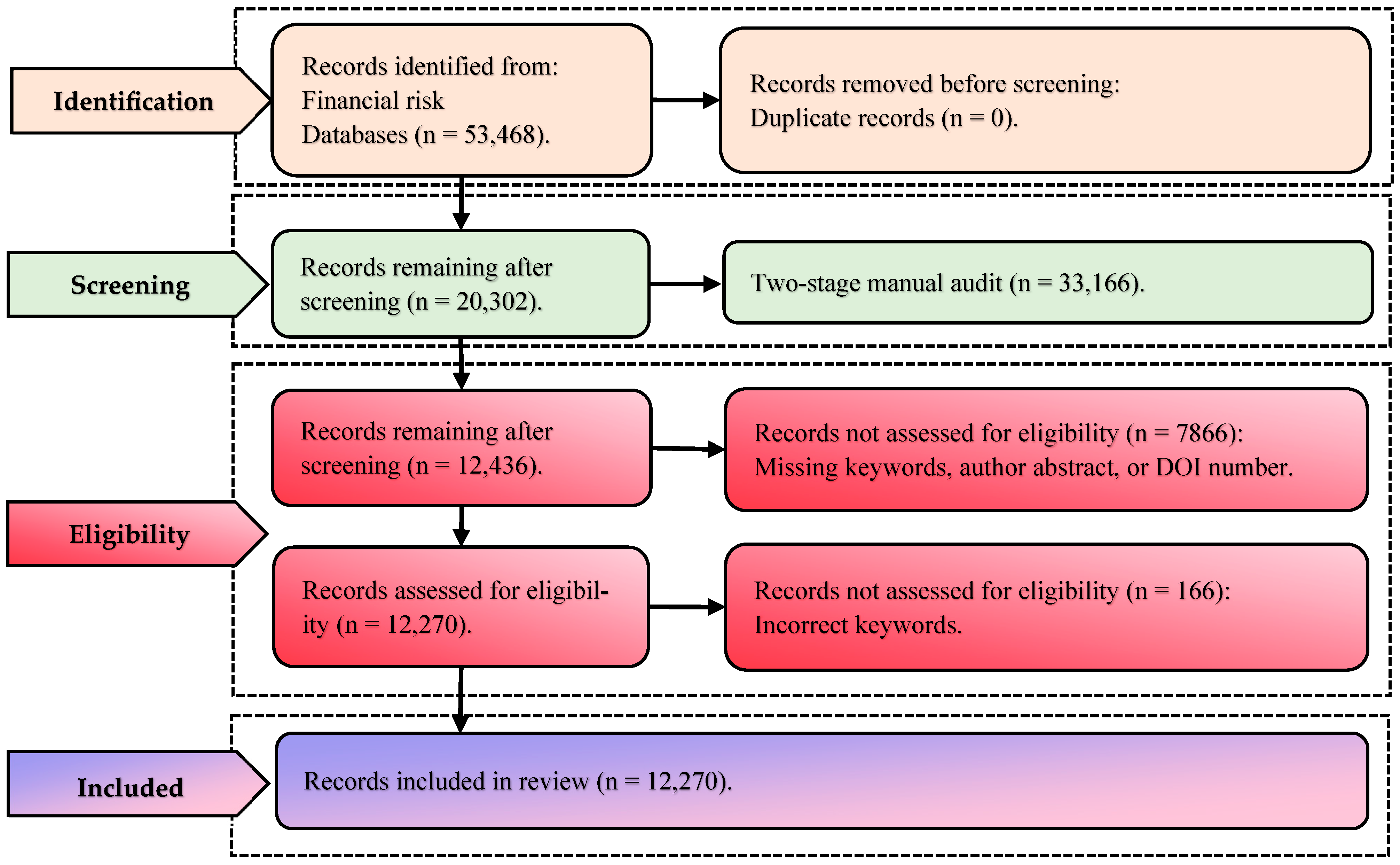

2.2. Methodological Design: Application of the PRISMA Framework

To enhance the transparency and methodological rigor of bibliometric analysis, this study adopts the PRISMA framework, which has been increasingly applied in bibliometric research for its structured and transparent approach to literature selection (

Zupic & Čater, 2015;

Page et al., 2021;

Donthu et al., 2021). The specific implementation process, as illustrated in

Figure 2, follows the four-stage PRISMA procedure and is structured as follows:

- (1)

Identification: A total of 53,468 publications were initially retrieved from the Web of Science Core Collection (SCI-Expanded), using the keyword “financial risk”, with the research areas restricted to Business & Economics, Computer Science, Energy & Fuels, Engineering, Environmental Sciences & Ecology, Mathematics in Social Sciences, Mathematics, Operations Research & Management Science, Other Topics in Science & Technology, and Transportation. The search covered the period from January 2015 to December 2024. This study selects the period from 2015 to 2024 as the time frame for bibliometric analysis, based on the following two key considerations. First, from the perspective of temporal scope, a ten-year span allows for a more comprehensive and systematic examination of the development trajectory and structural evolution of financial risk research, minimizing the influence of short-term fluctuations and stage-specific biases. Second, this decade not only includes the relatively stable early stage of policy and technological development, but also captures the profound impact of major external events on research themes, such as the outbreak of COVID-19 and the advancement of China’s dual carbon strategy. This facilitates the identification of dynamic trends in theoretical expansion and methodological innovation within the field of financial risk.

- (2)

Screening: To ensure the relevance of the dataset, a two-stage manual audit was conducted. Eight scholars with expertise in financial risk research were invited to participate in the screening process. In the first stage, four researchers independently reviewed the titles and abstracts of the retrieved articles to identify and exclude studies that were clearly unrelated to the theme of financial risk (e.g., those focusing solely on physical health risks, biological hazards, or engineering reliability without financial implications). In the second stage, the remaining four scholars cross-validated the initial decisions to enhance consistency and mitigate subjective bias. Through this rigorous two-stage manual audit process, a total of 33,166 irrelevant articles were excluded.

- (3)

Eligibility: Of the remaining records, 7866 articles were excluded due to missing or incorrect essential bibliographic information, such as keywords, author abstracts, or DOI numbers, that rendered them unsuitable for further bibliometric analysis.

- (4)

Inclusion: An additional 166 articles were removed due to incorrectly labeled or misleading keywords. Ultimately, 12,270 high-quality publications that met all inclusion criteria were retained for subsequent bibliometric analysis.

By systematically applying the PRISMA framework and clearly documenting each step through quantitative filtering and quality control, this study ensures the reliability and reproducibility of the analysis. The refined corpus of 12,270 articles provides a solid foundation for subsequent knowledge mapping and trend analysis in the financial risk research domain.

3. Statistical Analysis of Financial Risk Publications

This study presents a comprehensive analysis of the scholarly domain by examining three aspects: the analysis of overall growth trend, the analysis of high-level research institutions and the analysis of core authors.

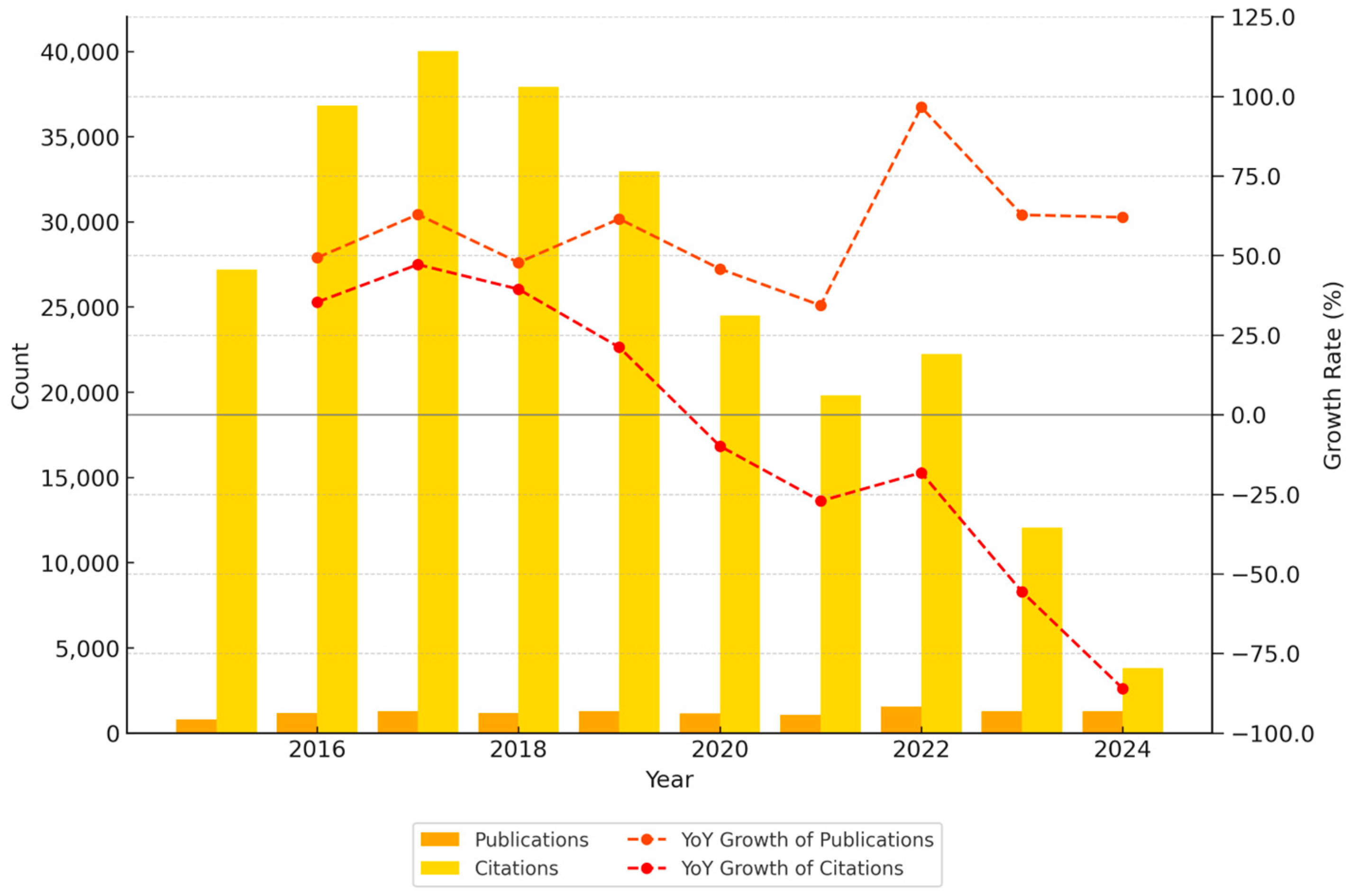

3.1. The Analysis of Overall Growth Trend

The expansion of scientific knowledge and its discernible patterns are intricately linked to the proliferation and distribution of scholarly publications. The fluctuations in the volume of publications serve as a barometer for the evolution of scientific understanding. In this segment, we conduct a quantitative analysis of journal articles to elucidate the overarching growth trajectory of research pertaining to financial risk.

Figure 3 displays statistics on the number and YoY growth rate of published articles and citations from 2015 to 2024. According to the results presented in

Figure 3, research on financial risk from 2015 to 2024 exhibits a trajectory characterized by continuous expansion alongside distinct phases of adjustment. This evolution can be broadly divided into three stages: 2015–2017, 2018–2021, and 2022–2024. In terms of publication volume, the number of articles increased significantly from 795 in 2015 to 1187 in 2016, and further to 1295 in 2017. The YoY growth rates exceeded 40% for two consecutive years, reflecting a surge in academic interest and heightened scholarly attention to the field. In the subsequent period, the number of publications declined slightly to 1175 in 2018 and 1068 in 2021, indicating a transition from the initial phase of explosive growth to a relatively stable period of development. This suggests that the field has entered a phase of steady research output and structural consolidation. In 2022, publication volume experienced a marked increase, reaching 1563 articles, a 46.35% YoY growth, driven by emerging topics such as digital finance, artificial intelligence, and carbon neutrality. This surge signifies a shift in research focus toward more diversified and interdisciplinary directions. Although the number of publications slightly declined to 1294 in 2023, it remained at a relatively high level, indicating sustained research momentum.

From the perspective of citation volume, the field began with 27,197 citations in 2015, which rose to 40,024 by 2017, demonstrating the cumulative impact and growing recognition of early research outputs. Although the number of citation declined after 2018, the number of citation rebounded to 22,240 in 2022, reflecting a delayed citation and the gradual diffusion of foundational works. By 2023, citations decreased to 12,065 but still remained at a substantial level, indicating the formation of a robust knowledge network and a solid foundation of scholarly influence within the field.

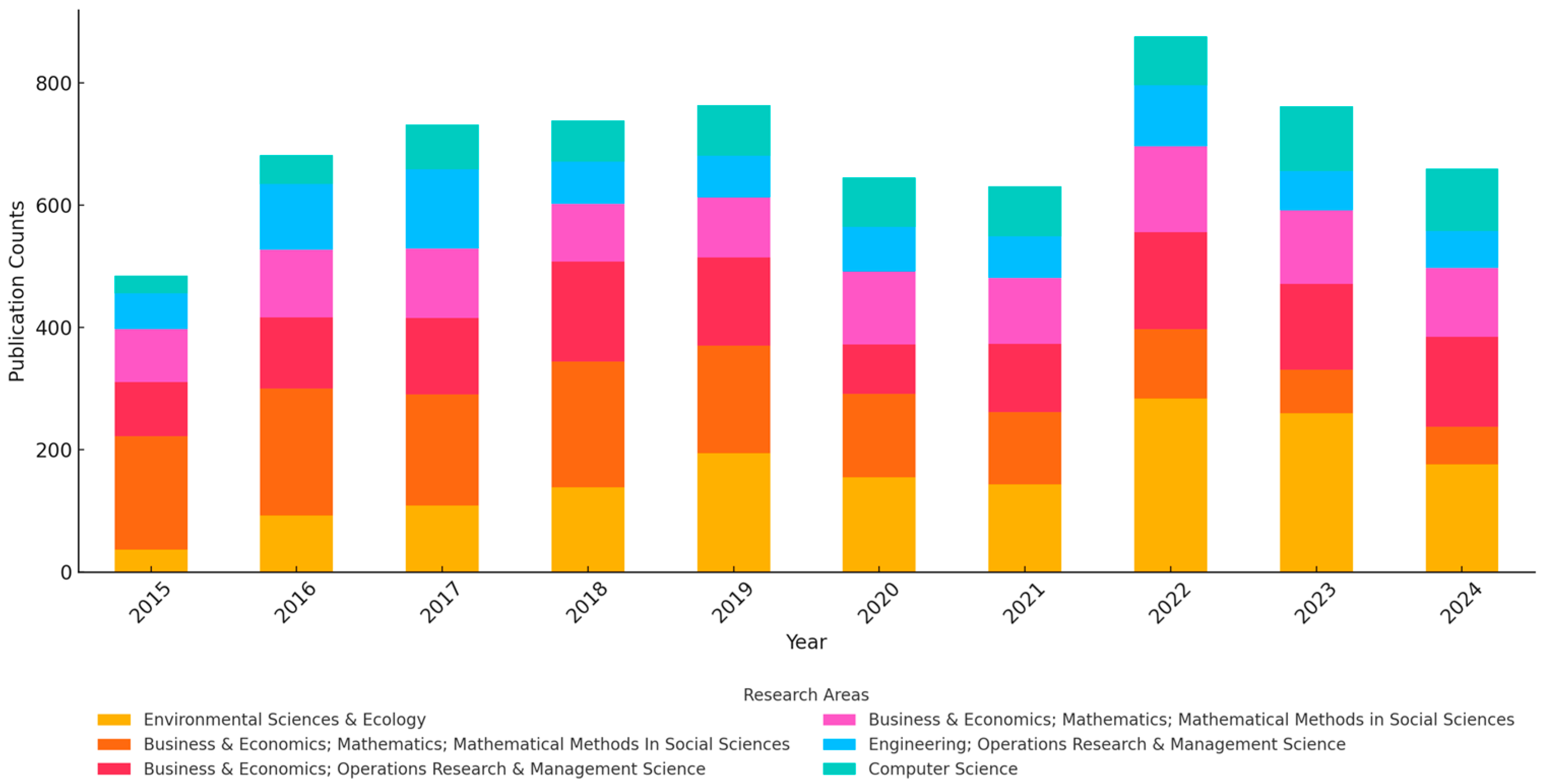

According to the stacked bar chart in

Figure 4, which displays the annual publication volumes of the top six research areas from 2015 to 2024, the structural evolution of academic priorities and the shifting of research hotspots over the past decade can be clearly identified. Between 2015 and 2017, scholarly focus was heavily concentrated in the intersection of management science and quantitative economics. During this period, the categories “Business & Economics; Mathematics; Mathematical Methods in Social Sciences” and “Business & Economics; Operations Research & Management Science” consistently ranked at the top, indicating strong academic interest in the integration of mathematical modeling, optimization analysis, and economic management. These approaches were widely applied to problems related to risk identification, resource allocation, and strategic decision-making efficiency in both financial and managerial contexts. Meanwhile, the area of “Engineering; Operations Research & Management Science” demonstrated steady growth, reflecting a system-optimization trend that bridges engineering and finance. This domain leveraged methodologies such as systems engineering and scheduling algorithms to support the robust operation and risk control of financial systems. From 2018 to 2020, the research structure began to shift toward green topics and sustainable development. The category “Environmental Sciences & Ecology” experienced rapid growth, covering research themes including environmental policy, ecological governance, carbon emission mechanisms, natural resource utilization, ESG risks, carbon finance, and climate shocks. This shift reflects the emergence of green development as a prominent theme in both policy and financial research. Although pandemic-related research was not explicitly marked in

Figure 4, the year 2020 witnessed a notable increase in attention to environmental system resilience and policy adaptability, highlighting the indirect impact of COVID-19 on research directions. Beginning in 2021 and continuing through 2022, the publication volume in “Computer Science” continued to grow, solidifying its central role in methodological innovation and its widespread application in data-driven risk management, intelligent forecasting, automated control, and algorithmic optimization within the domain of financial technology. Concurrently, “Engineering; Operations Research & Management Science” gradually merged with green technologies, fostering the development of interdisciplinary topics such as smart manufacturing, green infrastructure, and system sustainability. By 2023–2024, the research structure evolved further toward composite and system-integrated frameworks. “Environmental Sciences & Ecology” maintained its leading position, underscoring the importance of research on green finance and environmental performance under the backdrop of China’s dual carbon strategy. “Computer Science” accelerated its interdisciplinary integration, showing strong momentum in areas such as energy system modeling, carbon neutrality pathway simulation, and climate-related financial risk forecasting. Applications in AI-based risk control, financial prediction, and fraud detection also became increasingly diverse. At the same time, traditional foundational categories such as “Business & Economics; Mathematics; Mathematical Methods in Social Sciences” remained robust, continuing to provide essential theoretical foundations and methodological tools for interdisciplinary research.

3.2. The Analysis of High-Level Research Institutions

In this section, this study conducts an analysis of the prominent research institutions in the domain of financial risk in

Figure 5 and

Table 2.

Table 2 presents an analysis of high-level research institutions. As shown in

Table 2, ten research institutions stand out globally in the fields of financial risk. Among them, the University of London ranks first with 301 publications, followed closely by the Chinese Academy of Sciences (including the University of the Chinese Academy of Sciences) with 265 publications, demonstrating their significant international influence in this research domain. Other prominent institutions include the French National Centre for Scientific Research (CNRS), the Swiss Federal Institutes of Technology Domain, the University of California system, the Hong Kong Polytechnic University, the University of Waterloo, the University of Hong Kong, the Southwestern University of Finance and Economics (China), and ETH Zurich. Collectively, these institutions represent key academic hubs across Europe, East Asia, and North America, reflecting the global distribution pattern of research in this field.

In terms of research orientation, these institutions primarily focus on several intersecting areas, including financial risk assessment and investment strategies, green finance and sustainable development, insurance and actuarial science, supply chain finance and operations management, financial technology and innovation, as well as environmental and climate risk management. Among these, green finance and sustainable development, along with financial risk management, are the most widely studied core themes, highlighting the academic community’s growing attention to environmental change, policy intervention, and the resilience of financial systems.

From a regional perspective, European institutions such as the University of London, CNRS, the Swiss Federal Institutes of Technology Domain, and ETH Zurich benefit from strong academic foundations and robust policy support, particularly under the impetus of the European Union’s Green Deal and sustainable finance initiatives. Their research tends to concentrate on climate finance, systemic risk, and socio-economic impacts. In China, research institutions have experienced rapid growth in publication output in recent years, with the Chinese Academy of Sciences and the Southwestern University of Finance and Economics standing out for their contributions. Their work is predominantly centered on supply chain finance, green financial policy, and financial risk management, reflecting the influence of China’s dual carbon strategy and green finance pilot zone policies. In North America, institutions such as the University of California system and the University of Waterloo emphasize interdisciplinary research, particularly the integration of finance with health, insurance, and behavioral economics. These institutions demonstrate strong empirical research capabilities and strengths in data-driven approaches. Meanwhile, universities in Hong Kong and Macau are actively engaged in studies on financial technology, corporate social responsibility, and international financial risk, playing a pivotal role in bridging the research frontiers of China and the broader global academic community.

3.3. The Analysis of Author Publication Contribution

This study further analyzes author contribution using the Lorenz Curve. The Lorenz Curve, introduced in 1905 by American economist Max O. Lorenz (

Lorenz, 1905), is a visual tool used to measure the degree of inequality in a given distribution. Originally applied to assess income or wealth distribution, it has since been adopted in bibliometric research to evaluate the concentration of authorship. It also serves as the basis for calculating the Gini coefficient (

Sánchez-Pérez et al., 2025), which quantitatively expresses the inequality in scholarly output among authors. The Gini coefficient ranges from 0 to 1, where a value of 0 represents perfect equality (i.e., all authors contribute equally to the publication output), and a value of 1 denotes perfect inequality (i.e., all publications are produced by a single author). A Lorenz Curve that deviates significantly from the line of equality, along with a high Gini coefficient, indicates a highly concentrated authorship structure dominated by a few core contributors. Conversely, a curve close to the line of equality and a low Gini coefficient suggest a more balanced distribution of scholarly output across authors.

Figure 5 presents the Lorenz Curve for author contributions, illustrating the distribution of publication output among researchers in the field. The horizontal axis represents the cumulative proportion of authors, while the vertical axis denotes the corresponding cumulative proportion of publications. The gray dashed line represents the “line of equality,” which assumes that all authors contribute equally to publication output. The solid orange line represents the actual Lorenz Curve, reflecting the real-world distribution of publications.

As shown in

Figure 6, the orange curve lies distinctly below the line of equality, indicating a certain degree of publication concentration within the field. A small number of authors have contributed disproportionately to the literature. For instance, Faisal I. Khan from Memorial University of Newfoundland has published 49 articles, Yang Yang from Nanjing Audit University has published 41 articles, and Wang Ruodu from the University of Waterloo has published 11 articles. In contrast, the majority of authors have contributed relatively few publications, forming a typical long-tail distribution. The corresponding Gini coefficient is 0.218, which is relatively low. This suggests that, overall, the distribution of publication output among authors is fairly balanced and not highly concentrated. In other words, the field of financial risk research has not yet developed into a landscape dominated by a small group of prolific scholars; rather, a wide range of researchers have made meaningful contributions to its development. It is also noteworthy that the top three most productive authors are not affiliated with the top three institutions in terms of total publication volume. This observation implies that individual author productivity does not necessarily depend on the overall output of their institutions, highlighting a certain degree of decentralization of research contributions at the institutional level.

4. Co-Citation Network Analysis

Co-citation analysis emphasizes the impact of key articles. This study employs Citespace to build a co-citation network for 12,270 articles. This study identifies high citation nodes, milestones, and turning points in co-cited articles, co-cited author cluster analysis and emergent keywords.

4.1. Cluster Analysis of Co-Cited Articles

This study employs CiteSpace software 6.4 R1 for bibliometric visualization analysis, with the following parameter settings for node selection: the g-index (k = 25), indicating that the top 25 most-cited documents are selected within each time slice; LRF (Look Back Years) = 2.5, which considers citation relationships over the preceding 2.5 years; L/N = 10 and LBY (Labeling Year) = 5, giving preference to cluster labels derived from literature published within the past five years; and e (Scaling Factor) = 1.0, used to control the sparsity of the visualized network. In terms of network structure, the final visualization map consists of 994 nodes and 5221 edges, with a network density of 0.0065. All nodes are labeled (Nodes labeled: 1.0). Regarding cluster quality, the network was not pruned (Pruning: None), and the modularity value (Q) is 0.8473, indicating a clearly defined and significantly modular cluster structure. The weighted silhouette score (S) is 0.9596, suggesting high internal consistency and strong inter-cluster differentiation. Furthermore, the harmonic mean of modularity and silhouette values is 0.9, underscoring the robustness and reliability of the clustering results.

Based on the co-occurrence keyword analysis, the financial risk knowledge map reveals the co-citation clustering outcomes, as shown in

Figure 7. A total of 15 major clusters are identified, with their respective IDs, thematic labels, and associated research directions detailed in

Table 3. As illustrated in

Figure 7, the clusters exhibit distinct structural characteristics and evolutionary pathways. Cluster #0 credit scoring serves as the core theme and occupies the central position of the network. It demonstrates a high level of connectivity and centrality, functioning as a critical bridge among research domains. This cluster is closely linked with #7 model accuracy, #9 Hawkes processes, and #10 deep learning, indicating that credit scoring techniques are increasingly integrated with financial risk quantification and evaluation methods, together forming the foundational basis of contemporary financial risk research.

In contrast, themes related to sustainable finance show relatively independent development trajectories. Although clusters #1 green bond and #2 climate risk are spatially adjacent, they are positioned away from the central region of the network. This suggests that green finance, as an emerging hotspot, is gradually expanding from environmental economics into financial risk research.

At the methodological level, the map displays a clear trend toward technology-driven evolution. Clusters such as #10 deep learning, #9 Hawkes processes, and #7 accuracy represent methodology-oriented groupings and are closely connected to traditional risk measurement clusters such as #0 credit scoring and #6 value-at-risk. This reflects the role of advanced algorithms, such as deep learning and high-frequency modeling, in propelling financial risk research toward higher dimensionality, frequency, and precision, thereby enabling more nuanced risk identification and forecasting.

Clusters #3 systemic risk, #4 supply chain finance, #6 value-at-risk, and #7 accuracy form a coherent logical chain in financial risk research. Micro-level credit risks within #4 supply chain finance can propagate through financial networks and potentially trigger #3 systemic risk. The #6 value-at-risk model serves as a key tool for quantifying the magnitude and exposure of such risks. #7 Model accuracy provides essential support by ensuring the reliability of risk prediction and assessment. Together, these clusters build an integrated research framework from risk source identification to system-wide stability evaluation.

Traditional financial theory clusters also occupy important positions in the map. Clusters #5 mean–variance criterion, #13 portfolio selection, and #14 asset pricing are closely interconnected in financial theory research; #5 mean–variance criterion provides the foundational framework for modern portfolio theory, #13 portfolio selection involves asset allocation decisions guided by this criterion, while #14 asset pricing further evaluates the risk and return characteristics of various assets to support optimal portfolio construction. Together, these clusters form a theoretical pathway of valuation, allocation, and optimization in financial decision-making.

Overall, the central part of the map, comprising clusters #0 credit scoring, #3 systematic risk, #6 value-at-risk, #7 accuracy, and #14 asset pricing, forms a convergence zone that connects diverse research themes and serves as the primary channel for knowledge diffusion and interdisciplinary integration. In contrast, peripheral clusters such as #11 political risk and #12 random supply, although smaller in node size, reflect emerging and region-specific research directions, suggesting potential avenues for future scholarly exploration.

4.2. Analysis of Milestone and Turning Nodes in Co-Cited Articles

In the co-citation network of financial risk, several significant studies have emerged as milestones in the knowledge system due to their significant contributions to theoretical development, methodological innovation or paradigmatic shifts. These publications not only occupy central positions within their respective thematic clusters but also function as bridges across multiple clusters.

Figure 8 visualizes the key milestones and turning points in the co-citation network, with

Table 4 providing detailed information on these foundational, transformative, and highly cited works.

A detailed analysis of these milestone publications is as follows. First, in cluster #0 credit scoring,

Lessmann et al. (

2015) conducted a comprehensive evaluation of various classification algorithms for credit scoring, marking a pivotal shift from rule-based models to data-driven approaches. This study serves as a paradigm for the application of machine learning in credit risk prediction and acts as a critical nexus across cluster #0 credit scoring, #7 accuracy, and #4 supply chain finance. However, the research emphasizes “static comparisons” and does not fully account for dynamic market environments or behavioral biases in actual credit markets. Moreover, it relies on traditional datasets (e.g., the German Credit Dataset), raising concerns about its applicability to large-scale, high-frequency financial data. Second, in cluster #1 green bond and #2 climate risk,

Sharif et al. (

2020) introduced wavelet-based methods to capture the dynamic interactions among the pandemic, oil prices, and policy uncertainty. It was an important attempt to incorporate high-frequency event analysis into green finance research.

Battiston et al. (

2017), meanwhile, developed the first climate stress-testing model, integrating climate risk into systemic financial risk assessment and expanding the theoretical boundaries of climate finance. Nevertheless, Sharif’s study suffers from a short time window and sensitivity to variable selection, which may affect the robustness of its findings. Battiston’s framework, while innovative, depends heavily on simulation settings and subjective parameter assumptions, limiting its practical applicability. Third, in cluster #3 systemic risk,

Acharya et al. (

2017) proposed the SRISK model, which innovatively incorporates capital shortfalls of financial institutions into systemic risk quantification and advances vector-based macroprudential supervision. However, the SRISK framework focuses primarily on externalities associated with banks and is less effective in identifying non-bank entities such as shadow banks. Its modeling of cross-market systemic linkages also remains limited. Fourth, in cluster #5 mean–variance criterion,

Björk and Murgoci (

2014) and

Karatzas and Shreve (

2014) represent foundational works in financial mathematics, particularly in asset pricing and investment optimization. Their use of rigorous stochastic calculus provides the theoretical infrastructure for financial engineering models. However, despite their theoretical elegance, these models face challenges in terms of computational complexity and practical applicability, making real-time implementation in high-frequency trading and quantitative risk control difficult. Fifth, in cluster #6 value-at-risk,

Föllmer and Schied (

2016) provided a seminal textbook in the field of stochastic processes in finance, offering a rigorous foundation for risk measures such as VaR and CoVaR. This work has profoundly influenced financial risk education and research. However, as a theoretically oriented contribution, it is largely based on ideal assumptions (e.g., independence and normality) and fails to capture tail risks and extreme events in real-world financial markets. Sixth, in cluster #8 China,

Lee and Lee (

2022) investigate the effects of green finance policies on China’s green productivity, offering valuable empirical evidence at the national level. While policy-relevant within the Chinese context, the study provided only a coarse-grained analysis of the heterogeneous effects of green financial instruments and did not adequately account for regional policy divergence, limiting its generalizability. Seventh, in cluster #9 Hawkes processes,

Aït-Sahalia et al. (

2015) introduced Hawkes processes into the study of contagion in financial markets, modeling jump propagation mechanisms among financial variables during crises. While flexible and insightful, the approach imposes high computational costs for parameter estimation in large-scale systems and is sensitive to data quality, constraining its broader applicability. Collectively, these milestone studies delineate the evolutionary path of financial risk research, beginning with classical financial theories, followed by the development of quantitative risk measurement models, and culminating in the recent integration of green finance and AI-driven methodologies. Each of these works has addressed critical gaps in theory, methodology, or practical application at different stages of the field’s evolution. However, several limitations should also be noted: highly methodological studies may overlook the complexity and dynamism of real-world financial systems; black-box AI models, despite their predictive power, suffer from limited interpretability, which constrains their use in regulatory and policy-making contexts; and modeling efforts in climate finance and systemic risk require greater interdisciplinary integration, open data-sharing mechanisms, and stronger policy feedback loops.

Based on

Figure 7 and

Table 4, the following turning points are analyzed in detail. First,

Papouskova and Hajek (

2019) bridge cluster #0 credit scoring and #7 accuracy. This study introduced a heterogeneous ensemble learning framework that integrates traditional credit risk models with modern machine learning algorithms, significantly improving predictive accuracy. It represented a technological turning point in credit risk modeling, transitioning from isolated algorithmic improvements to embedded real-world applications. However, while ensemble methods enhance precision, they lack interpretability regarding feature importance and face increasing model complexity, which may hinder regulatory acceptance and commercial deployment. Second,

Zhu et al. (

2019) connect cluster #0 credit scoring, #4 supply chain finance, #7 accuracy, and #10 deep learning. By applying machine learning techniques to predict credit risk for small and medium-sized enterprises (SMEs) and incorporating upstream and downstream supply chain features, the study advances the fusion of methodological and contextual dimensions. While this broadened the boundaries of credit modeling and improves risk identification for data-scarce entities, it heavily relied on high-dimensional input features and intensive model training. Moreover, it lacked systematic evaluation of model bias and alignment with business logic. Third,

Lins et al. (

2017) spans cluster #1 green bond, #2 climate risk, and #14 asset pricing. This study demonstrated the role of corporate social responsibility (CSR) in stabilizing financial performance during crises by embedding social capital into the logic of asset pricing, representing an important breakthrough in the integration of ESG factors into traditional financial modeling. While it introduced trust mechanisms and social responsibility into pricing models, the measurement of CSR remained coarse, failing to capture ESG heterogeneity and institutional variations, thereby limiting the generalizability of its conclusions. Fourth,

Krueger et al. (

2020) link cluster #1 green bond, #2 climate risk, and #8 China. His research examined how climate risk influences institutional investors’ asset allocation strategies, contributing to the mainstreaming of climate considerations in investment decision-making. By highlighting the “financial materialization” of climate variables, the study fostered the rationalization and institutionalization of sustainable investment. However, its reliance on survey data introduces sample bias and subjective response issues, and lacked a clearly defined empirical mechanism for “climate pricing.” Fifth,

Brownlees and Engle (

2017) and

Adrian and Brunnermeier (

2016) intersect cluster #1 green bond, #3 systemic risk, #6 value-at-risk, and #9 Hawkes processes. Their respective proposals of the SRISK and CoVaR measures introduced systemic risk quantification into the regulatory framework, making significant contributions to the advancement of macroprudential oversight. While these models offered practical tools for assessing systemic risk and addressed the limitations of traditional risk models in capturing tail dependence, their implementation remained challenging due to strong modeling assumptions, the neglect of behavioral heterogeneity, and the need for high-quality micro-level data. Sixth,

An et al. (

2021) link cluster #4 supply chain finance and #8 China. The study explored the financing efficiency of green credit and trade credit under carbon constraints, enriching the micro-level application scenarios of green finance and responding to China’s dual carbon strategy. However, it leaned heavily on theoretical modeling. The lack of clarity in matching real-world financing data with green classification standards limited its practical applicability. Seventh,

Föllmer and Schied (

2016) reappeared at the intersection of cluster #6 value-at-risk and #9 Hawkes processes, particularly in modeling financial contagion. As a seminal textbook, it provided discrete-time methodologies for financial risk modeling and had exerted substantial influence across multiple subfields. While it laid a strong mathematical foundation that supports theoretical unification and pedagogical development, the gap between theoretical assumptions and actual market operations necessitates data-driven validation to enhance its practical relevance.

4.3. Analysis of Co-Cited Authors

In CiteSpace, co-citation clusters are primarily generated based on the co-citation frequencies among authors. Clustering is performed using algorithms such as path-based community detection (e.g., Louvain method) or log-likelihood ratio (LLR). When multiple authors frequently co-appear in cited literature, the system identifies them as having strong thematic, theoretical, or methodological affinities and groups them into the same cluster. The co-citation network produced for this study is shown in

Figure 9, revealing 12 distinct yet interconnected clusters. These clusters reflect the multidimensional and interdisciplinary nature of financial risk research, particularly in terms of methodology, thematic focus, and cross-disciplinary integration. The modularity of the network (Modularity Q) is 0.9004, and the average silhouette score reaches 0.997, indicating high clustering clarity, strong internal consistency, and clear differentiation between clusters. These results validate the 12 clusters as the optimal solution for the dataset.

From the 12 clusters, this study selects one representative author per cluster, each exemplifying a distinct subdomain of financial risk research.

Table 5 lists the affiliations and research areas of 12 representative authors. Harry Markowitz laid the foundation for modern portfolio theory, establishing the theoretical basis for asset allocation and risk optimization. Eugene F. Fama is a central figure in market efficiency and asset pricing through his development of the Efficient Market Hypothesis and the Fama–French three-factor model. Robert C. Merton advanced continuous-time financial modeling and real options theory, leading financial engineering and risk modeling. Sepp Hochreiter introduced the LSTM neural network, applying deep learning to financial risk forecasting. Francis X. Diebold specializes in macro-financial forecasting and dynamic factor models. Robert F. Engle established the ARCH/GARCH models, foundational to modeling financial volatility. Michael C. Jensen’s development of Jensen’s Alpha significantly enhanced performance evaluation in efficient markets. Edward I. Altman’s Z-score model propelled corporate bankruptcy prediction. In the Chinese context, Chen X. and Wang J. are recognized for their contributions to green finance and complex systems modeling, respectively. Philippe Artzner proposed the coherent risk measure framework, forming the basis for consistency in metrics like VaR and CVaR. Rama Cont focused on market microstructure and systemic risk modeling. In the network layout, the overall structure reveals a core–periphery pattern: Fama, Markowitz, Merton, Artzner, and Engle occupy central positions, underscoring their foundational roles in theory and methodology; in contrast, Hochreiter, Wang J., and Chen X. lie on the periphery, closely associated with emerging technologies, interdisciplinary themes, or region-specific issues. This multipolar structure vividly illustrates the growing diversification of financial risk research.

4.4. Analysis of Emergent Keywords

Emergent keywords refer to those with significant frequency and rapid growth, reflecting the cutting-edge research and future trajectories of a field.

Figure 10 presents the 25 most prominent emergent keywords in financial risk research.

In terms of thematic categories, the emergent keywords can be grouped into three major domains: First, financial risk and market-related themes, such as “transaction costs”, “ruin probability”, “interest rates”, “term structure”, and “stock markets” reflect the core concerns of financial economics: risk pricing, market dynamics, and investment behavior. These terms underscore the emphasis in both academic and applied finance on understanding and optimizing capital allocation under uncertainty. For example,

Fama’s (

1970) Efficient Market Hypothesis and

Merton’s (

1974) structural models have laid the theoretical foundation for analyzing how market risk and interest rates influence asset valuation and portfolio decisions. Additionally, ruin probability has been a fundamental concern in insurance finance, closely linked to Harry Markowitz’s portfolio theory where controlling downside risk remains central to optimal allocation (

Markowitz, 1952). Second, environment and sustainable development themes, like “water”, “environment”, “biodiversity”, “CO

2 emissions”, “climate risk”, and “green innovation” signal a growing research trajectory linking sustainability with finance. Scholars such as

Battiston et al. (

2017) and

Krueger et al. (

2020) have emphasized the financial implications of environmental stress, arguing that environmental shocks can materially impact financial asset valuations and systemic risk. Green innovation, moreover, reflects the increasing need for financial institutions to support sustainable projects through mechanisms like green bonds, green credit, and ESG screening. Third, economic policy and uncertainty themes, such as “economic policy uncertainty”, “economic growth”, and “COVID-19 pandemic” highlight the significant impact of macroeconomic fluctuations and external shocks on financial risk. The concept of Economic Policy Uncertainty (EPU), proposed by Baker, Bloom, and Davis, has become a central tool for evaluating how shifts in policy environments alter investment decisions, market volatility, and credit conditions (

Baker et al., 2016). The COVID-19 pandemic, as noted by

Sharif et al. (

2020), amplified these risks and disrupted both economic and environmental dynamics simultaneously, reshaping global economic priorities.

In terms of the relationships among these emergent keywords, the integration of finance and environmental concerns has clearly emerged as a prominent trend. Keywords such as “climate risk” and “green innovation” suggest that financial institutions are increasingly incorporating environmental indicators into their risk management frameworks. This development is consistent with the principle of coherent risk measures proposed by

Artzner et al. (

1999), indicating that future models are likely to embed environmental risk exposures within traditional financial risk frameworks, thereby promoting the green transformation of risk management. Second, the link between economic policy and financial markets is particularly salient. Policy uncertainty significantly influences investor behavior, which in turn affects stock markets, interest rates, and capital flows. This relationship echoes the insights from

Engle’s (

1982) ARCH model, which captures the dynamics between risk and return, highlighting the critical role of macroeconomic policy in ensuring financial stability. Third, the COVID-19 pandemic has exemplified the far-reaching impact of cross-sectoral shocks. It is not only a public health crisis but also closely intertwined with economic growth, biodiversity, and financial volatility, making it a prototypical example of a global systemic event. The pandemic vividly illustrates how public health emergencies can rapidly permeate financial and environmental systems, thereby triggering cascading effects across multiple domains.

5. Evolutionary Path and Predictive Analysis of Financial Risk Research Themes

Based on research outputs from 2015 to 2024, this study develops a dynamic theme evolution forecasting model titled Semantic Evolution Forecasting with Aligned Clustered LSTM (SEF-ACLSTM), which systematically predicts the trajectories and future trends of research themes for the period from 2025 to 2030. The core objective is to integrate natural language processing techniques, clustering algorithms, and deep learning-based time series models to achieve a quantitative and visual representation of theme life cycles through semantic modeling and trajectory prediction. The forecasting process consists of the following six components:

- (1)

Semantic Encoding and Thematic Clustering. To overcome the limitations of traditional co-occurrence analysis, the study applies SentenceTransformer (specifically, the all-mpnet-base-v2 model) to encode keywords into semantically meaningful vectors. Using these embeddings, K-Means clustering is performed annually to group the keywords into multiple thematic clusters, each representing a latent research theme. The centroid vector of each cluster is preserved as an input feature for subsequent time series modeling.

- (2)

Dynamic Theme Naming Mechanism. To improve interpretability and reduce subjectivity, a module named DynamicNamer is designed. It calculates semantic similarity between each cluster centroid and the keywords, and automatically selects the most representative keywords to serve as the theme label (e.g., deep learning; neural networks; NLP), ensuring intuitive and consistent naming.

- (3)

Time Series Modeling of Theme Evolution. For forecasting theme evolution, the study introduces an enhanced LSTM network architecture integrated with multi-head attention mechanisms. This model effectively captures long-term dependencies and dynamic patterns in the evolution of research themes. By inputting past centroid vectors, the network is trained to predict future vectors. The Huber loss function is adopted to improve prediction stability and generalization performance.

- (4)

Forecasting and Integration of Future Themes. Based on the trained LSTM model, centroid vectors of future themes from 2025 to 2030 are generated and their corresponding theme labels are produced. Historical data and forecasted results are then integrated to construct a comprehensive overview of thematic evolution across years. Additional analyses can be conducted, such as evaluating keyword scale and intensity of thematic prominence.

- (5)

Visualization and Interpretation of Theme Dynamics. As illustrated in

Figure 11, the size of each dot represents the thematic heat (i.e., the number of associated keywords), and color is used to differentiate historical data from forecasted values. Trend lines are drawn to reflect the lifecycle of each theme, providing a visual and temporal interpretation of theme development and future prospects.

Figure 11 presents the evolution and forecast of three thematic clusters in financial risk research from 2015 to 2030. Each subplot represents a thematic cluster. The vertical axis lists specific keywords, and the horizontal axis represents time (2015–2030). The size of the dots indicates keyword frequency, while color distinguishes actual data from predicted values. Trend lines illustrate the lifecycle dynamics of each theme.

Cluster 1 is defined by technical and methodological keywords such as “statistical perturbation”, “nonlinear ensemble”, and “belief propagation”. Although research activity in this cluster remained low from 2015 to 2018, it increased significantly after 2019 and reached its peak between 2020 and 2023, reflecting a growing interest in novel modeling approaches. While there was a slight decline in 2024, projections indicate that this cluster will continue to garner scholarly attention in the future.

Cluster 2 focuses on traditional financial risk management terms such as “financial investment risk”, “finance risk”, and “insurance risk”. Its academic presence steadily increased from 2015, peaking in 2018 and stabilizing thereafter. A slight dip in 2024 suggests that while still a core topic, traditional risk management may gradually be overshadowed by emerging themes.

Cluster 3 is characterized by sustainability-related keywords such as “environmental sustainability”, “environmental”, and “green industries”. This cluster experienced a rapid rise from 2016 to 2018, peaking in 2018. Although attention declined slightly thereafter, it remained moderately active between 2020 and 2023. The continuing importance of environmental issues, especially in the context of the dual-carbon agenda, indicates that the intersection between finance and the environment will remain a critical focus of future research.

Based on the above analysis, this study finds that methodological topics (Cluster 1) exhibit strong growth momentum and sustained development potential. Traditional financial risk topics (Cluster 2) are approaching saturation and may lose prominence in the coming years. Green and sustainability-oriented themes (Cluster 3), though showing fluctuations, remain influential within the context of global environmental policies and offer broad research opportunities.

6. Conclusions

This study conducts a systematic review of literature on the topic of financial risk over the past decade and yields the following three key conclusions:

First, the field of financial risk research from 2015 to 2024 has undergone significant structural evolution. Publications followed a phased trajectory, with a rapid surge and heightened scholarly attention from 2015 to 2017, steady development between 2018 and 2021, and a shift toward diversification and interdisciplinary integration from 2022 to 2024. In terms of research area, financial risk has undergone a structural evolution from a focus on quantitative modeling and economic management to an increasingly diversified and interdisciplinary landscape, prominently integrating green finance, sustainability, and intelligent technologies from 2015 to 2024. From the perspective of research institutions, European institutions focused on climate finance and systemic risk under strong academic and policy support, Chinese institutions emphasized green finance and supply chain risk aligned with national strategies, North American universities pursued interdisciplinary, data-driven research.

Second, the co-citation network analysis reveals an enriched and evolving intellectual structure. Foundational theories, such as Fama’s Efficient Market Hypothesis, Markowitz’s Portfolio Theory, and Altman’s Z-score model, continue to underpin the field by offering core frameworks for market efficiency, portfolio optimization, and corporate default prediction, respectively. At the same time, recent advances increasingly incorporate deep learning approaches (

Hochreiter & Schmidhuber, 1997) and systemic risk modeling (

Cont et al., 2013). These trajectories illustrate the methodological expansion and theoretical fusion that characterize the field’s maturation. Moreover, emergent thematic hotspots such as economic policy uncertainty, climate risk, and green innovation have become focal points of scholarly inquiry, reflecting the growing importance of environmental and macroeconomic dimensions in financial risk research.

Third, SEF-ACLSTM developed in this study demonstrates strong capacity in tracking and forecasting research theme evolution. By aligning annual keyword clusters and modeling their temporal dynamics, the model effectively identifies three major thematic trajectories: (1) methodological innovation, (2) traditional financial risk, and (3) green finance and sustainability. Forecasts for the period from 2025 to 2030 indicate that topics related to advanced modeling techniques, policy-driven risk, and green transformation and are expected to attract increasing academic interest. These patterns signal an ongoing paradigmatic shift in the field toward complexity-aware, forward-looking, and policy-relevant research.

Based on these findings, this study argues that advancing future financial risk research requires coordinated efforts across the data, methodological, and application layers to address current challenges such as thematic fragmentation and overreliance on specific tools. Research is expected to move toward greater integration, interpretability, and adaptability in order to better support the management of complex global financial system risks and inform effective policy governance. First, developing an AI-driven framework that is interpretable, robust, and transferable is essential. Although deep learning has significantly improved predictive performance, it remains constrained by limited explainability and sensitivity to extreme events, such as black swan scenarios. Advancing this line of research entails integrating interpretable machine learning techniques, including SHAP and LIME, and exploring Bayesian deep learning and uncertainty quantification approaches, such as Monte Carlo Dropout and Bayesian Neural Networks, to enhance anomaly detection and model reliability. Testing transferability across markets and time periods is also necessary to ensure practical relevance and policy scalability. Second, greater attention needs to be paid to identifying and simulating the causal relationship between policy uncertainty and systemic financial contagion. While existing studies often examine the effects of shocks, including COVID-19 and carbon pricing mechanisms, they frequently rely on methods such as Granger causality or cointegration, which are insufficient for distinguishing structural shocks from cyclical fluctuations. Advancing this area involves adopting structural causal inference techniques, including Directed Acyclic Graphs, structural equation modeling for time series, and quasi-experimental designs, in combination with contagion models such as DebtRank and the Contagion Index. This enables researchers to map risk transmission channels and optimize macroprudential policy responses. Third, future modeling of green financial risk will benefit from addressing data heterogeneity and cross-scale coupling mechanisms. Although green finance has emerged as a prominent research focus, many studies still rely on static indicators such as green credit or ESG ratings. There remains a significant gap in modeling dynamic interactions among climate risk, carbon asset price volatility, and environmental regulatory shocks. Integrating multi-source heterogeneous data, including remote sensing climate indicators, carbon pricing data, and policy texts, offers a promising pathway for developing dynamic and policy-responsive green financial risk monitoring systems.