Blockchain, Cryptocurrencies, and Decentralized Finance: A Case Study of Financial Inclusion in Morocco

Abstract

1. Introduction

2. Literature Review

2.1. Cryptocurrencies and Financial Inclusion

2.2. Theoretical Frameworks and Multidimensional Determinants of Cryptocurrency Adoption

2.3. Financial Literacy, Digital Infrastructure, and Institutional Environments: Drivers and Constraints of Inclusion

3. Research Method

3.1. General Approach

3.2. Data Collection

3.3. Sample Selection, Measures and Variables

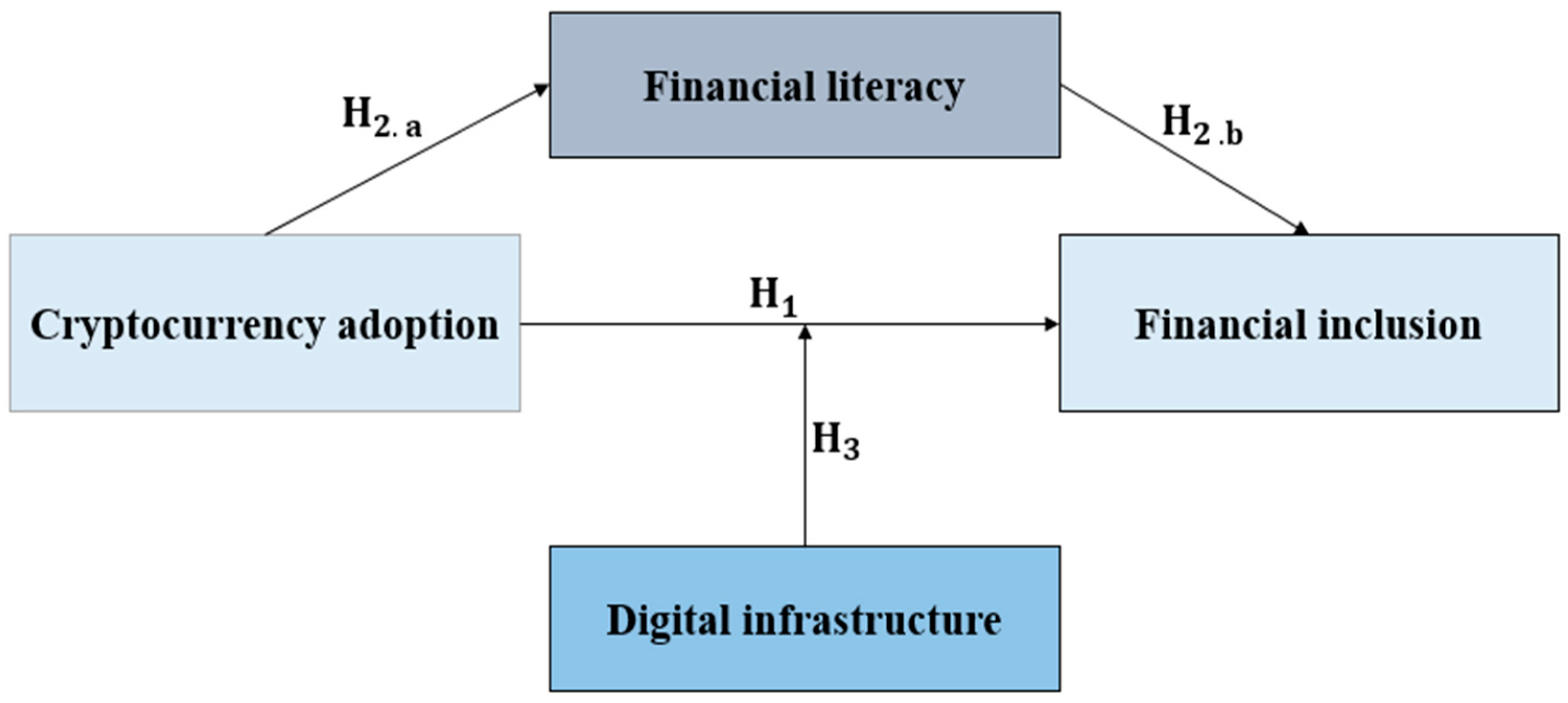

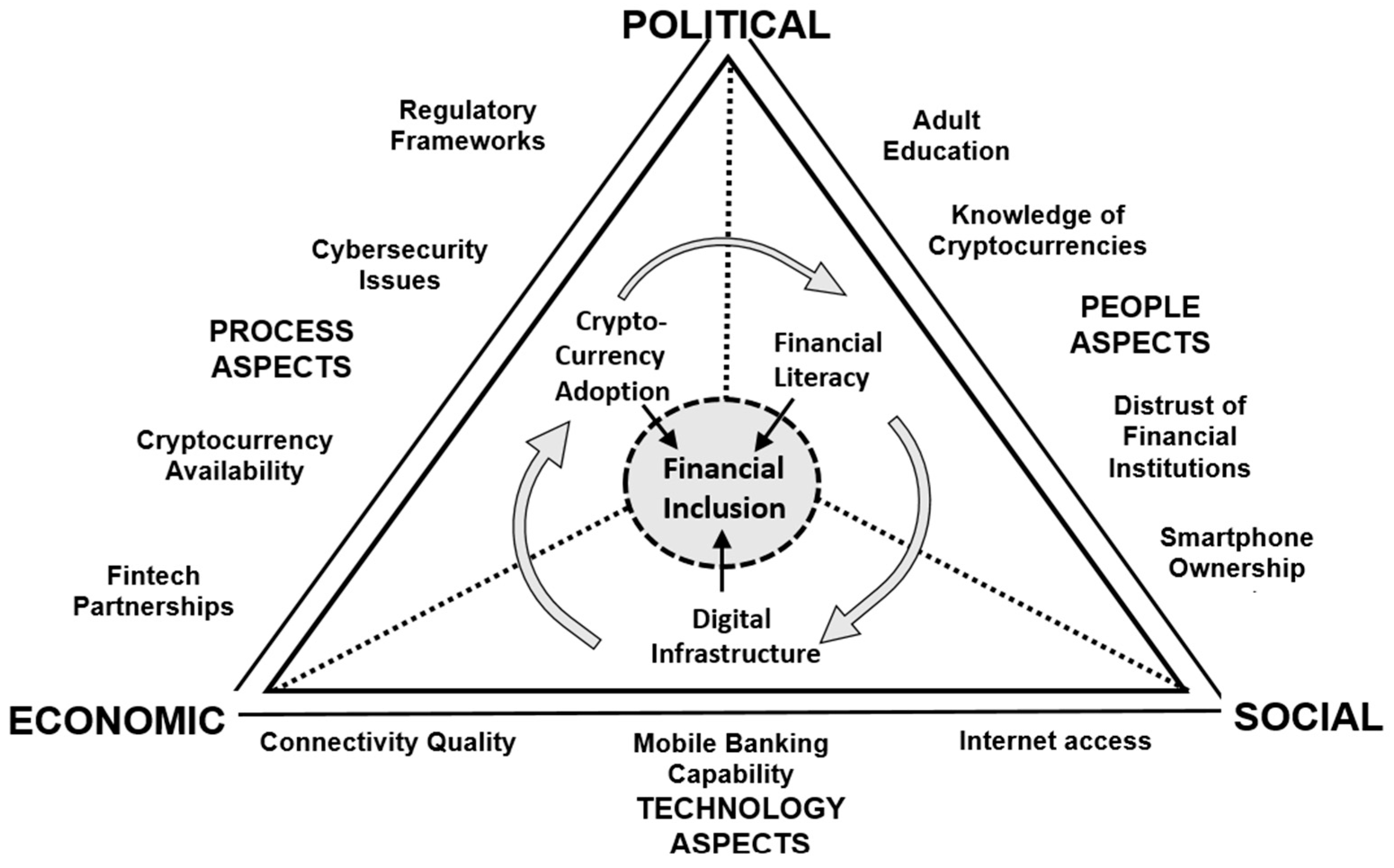

3.4. Structural Model, Provisional Conceptual Framework and Hypotheses Development

- Validating an integrated theoretical model by simultaneously testing the relationships between cryptocurrency adoption, financial inclusion, and mediating factors (financial literacy, digital infrastructure).

- Analyzing both direct and indirect effects: for example, the impact of cryptocurrencies on financial inclusion may be mediated by financial literacy.

- Managing latent variables of concepts such as financial inclusion or financial literacy, which cannot be directly measured but are modeled from observable indicators.

- η is the vector of dependent latent variables (financial inclusion).

- ξ is the vector of independent latent variables (cryptocurrency adoption).

- B and Γ are the matrices of structural coefficients.

- ζ is the error term.

3.5. Data Analysis

4. Results

4.1. Demographic Characteristics of the Sample

4.2. Results of Hypothesis Testing

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdallah-Ou-Moussa, S., Wynn, M., Kharbouch, O., El Aoufi, S., & Rouaine, Z. (2025). Technology innovation and social and behavioral commitment: A case study of digital transformation in the Moroccan insurance industry. Big Data and Cognitive Computing, 9(2), 31. [Google Scholar] [CrossRef]

- Abdallah-Ou-Moussa, S., Wynn, M., Kharbouch, O., & Rouaine, Z. (2024). Digitalization and corporate social responsibility: A case study of the moroccan auto insurance sector. Administrative Sciences, 14(11), 282. [Google Scholar] [CrossRef]

- Adamyk, B., Benson, V., Adamyk, O., & Liashenko, O. (2025). Risk management in DeFi: Analyses of the innovative tools and platforms for tracking DeFi transactions. Journal of Risk and Financial Management, 18(1), 38. [Google Scholar] [CrossRef]

- Akartuna, E. A., Johnson, S. D., & Thornton, A. (2022). Preventing the money laundering and terrorist financing risks of emerging technologies: An international policy Delphi study. Technological Forecasting and Social Change, 179, 121632. [Google Scholar] [CrossRef]

- Akeel, H., & Wynn, M. G. (2015, February 22–27). ERP implementation in a developing world context: A case study of the waha oil company, Libya. eKnow 2015 7th International Conference on Information, Process and Knowledge Management (pp. 126–131), Lisbon, Portugal. Available online: https://eprints.glos.ac.uk/2072/ (accessed on 30 May 2025).

- Alamsyah, A., Kusuma, G. N. W., & Ramadhani, D. P. (2024). A review on decentralized finance ecosystems. Future Internet, 16(3), 76. [Google Scholar] [CrossRef]

- Alharbi, A., & Sohaib, O. (2021). Technology readiness and cryptocurrency adoption: PLS-SEM and deep learning neural network analysis. IEEE Access, 9, 21388–21394. [Google Scholar] [CrossRef]

- Alkhwaldi, A. F. (2024). Digital transformation in financial industry: Antecedents of fintech adoption, financial literacy and quality of life. International Journal of Law and Management. Available online: https://www.emerald.com/insight/content/doi/10.1108/ijlma-11-2023-0249/full/html (accessed on 21 January 2025). [CrossRef]

- Allen, F., Gu, X., & Jagtiani, J. (2022). Fintech, cryptocurrencies, and CBDC: Financial structural transformation in China. Journal of International Money and Finance, 124, 102625. [Google Scholar] [CrossRef]

- Almeida, D., Dionísio, A., Vieira, I., & Ferreira, P. (2022). Uncertainty and risk in the cryptocurrency market. Journal of Risk and Financial Management, 15(11), 532. [Google Scholar] [CrossRef]

- Alomari, A. S. A., & Abdullah, N. L. (2023). Factors influencing the behavioral intention to use Cryptocurrency among Saudi Arabian public university students: Moderating role of financial literacy. Cogent Business & Management, 10(1), 2178092. [Google Scholar] [CrossRef]

- Al-Saedi, K., Al-Emran, M., Ramayah, T., & Abusham, E. (2020). Developing a general extended UTAUT model for M-payment adoption. Technology in Society, 62, 101293. [Google Scholar] [CrossRef]

- Analytica, O. (2022). Crypto market to grow in middle east and north africa. Emerald Expert Briefings; oxan-db. [Google Scholar]

- Arner, D. W., Buckley, R. P., Zetzsche, D. A., & Veidt, R. (2020). Sustainability, FinTech and financial inclusion. European Business Organization Law Review, 21(1), 7–35. [Google Scholar] [CrossRef]

- Asongu, S. A., & Nwachukwu, J. C. (2019). ICT, financial sector development and financial access. Journal of the Knowledge Economy, 10(2), 465–490. [Google Scholar] [CrossRef]

- Auer, R., Cornelli, G., & Frost, J. (2020). Rise of the central bank digital currencies: Drivers, approaches and technologies. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3723552 (accessed on 15 January 2025).

- Auer, R., Farag, M., Lewrick, U., Orazem, L., & Zoss, M. (2023). Banking in the shadow of Bitcoin? The institutional adoption of cryptocurrencies. CESifo Working Paper. Available online: https://www.econstor.eu/handle/10419/271999 (accessed on 12 November 2024).

- Baur, D. G., & Dimpfl, T. (2021). The volatility of Bitcoin and its role as a medium of exchange and a store of value. Empirical Economics, 61(5), 2663–2683. [Google Scholar] [CrossRef] [PubMed]

- Beck, T., Senbet, L., & Simbanegavi, W. (2015). Financial inclusion and innovation in Africa: An overview. Journal of African Economies, 24(Suppl. S1), i3–i11. [Google Scholar] [CrossRef]

- Bhimani, A., Hausken, K., & Arif, S. (2022). Do national development factors affect cryptocurrency adoption? Technological Forecasting and Social Change, 181, 121739. [Google Scholar] [CrossRef]

- Borri, N. (2019). Conditional tail-risk in cryptocurrency markets. Journal of Empirical Finance, 50, 1–19. [Google Scholar] [CrossRef]

- Böhme, R., Christin, N., Edelman, B., & Moore, T. (2015). Bitcoin: Economics, technology, and governance. Journal of economic Perspectives, 29(2), 213–238. [Google Scholar] [CrossRef]

- Bziker, Z. (2021). The status of cryptocurrency in Morocco. Research in Globalization, 3, 100040. [Google Scholar] [CrossRef]

- Celtekligil, K. (2020). Resource dependence theory. In H. Dincer, & S. Yüksel (Eds.), Strategic outlook for innovative work behaviours (pp. 131–148). Springer International Publishing. [Google Scholar] [CrossRef]

- Cermeño, J. S. (2016). Blockchain in financial services: Regulatory landscape and future challenges for its commercial application. BBVA Research Madrid, Spain. Available online: https://www.smallake.kr/wp-content/uploads/2017/01/WP_16-20.pdf (accessed on 13 March 2025).

- Chen, X., Miraz, M. H., Gazi, M. A. I., Rahaman, M. A., Habib, M. M., & Hossain, A. I. (2022). Factors affecting cryptocurrency adoption in digital business transactions: The mediating role of customer satisfaction. Technology in Society, 70, 102059. [Google Scholar] [CrossRef]

- Chen, Y., & Bellavitis, C. (2020). Blockchain disruption and decentralized finance: The rise of decentralized business models. Journal of Business Venturing Insights, 13, e00151. [Google Scholar] [CrossRef]

- Cumming, D. J., Johan, S., & Pant, A. (2019). Regulation of the crypto-economy: Managing risks, challenges, and regulatory uncertainty. Journal of Risk and Financial Management, 12(3), 126. [Google Scholar] [CrossRef]

- Dabbous, A., Merhej Sayegh, M., & Aoun Barakat, K. (2022). Understanding the adoption of cryptocurrencies for financial transactions within a high-risk context. The Journal of Risk Finance, 23(4), 349–367. [Google Scholar] [CrossRef]

- Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13, 319–340. [Google Scholar] [CrossRef]

- Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989). User acceptance of computer technology: A comparison of two theoretical models. Management Science, 35(8), 982–1003. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A., Klapper, L., Singer, D., Ansar, S., & Hess, J. (2020). The Global Findex Database 2017: Measuring financial inclusion and opportunities to expand access to and use of financial services. The World Bank Economic Review, 34(Suppl. S1), S2–S8. [Google Scholar] [CrossRef]

- Depietro, R., Wiarda, E., & Fleischer, M. (1990). The context for change: Organization, technology and environment. The processes of Technological Innovation, 199, 151–175. [Google Scholar]

- Desmond, D. B., Lacey, D., & Salmon, P. (2019). Evaluating cryptocurrency laundering as a complex socio-technical system: A systematic literature review. Journal of Money Laundering Control, 22(3), 480–497. [Google Scholar] [CrossRef]

- El Chaarani, H., EL Abiad, Z., El Nemar, S., & Sakka, G. (2024). Factors affecting the adoption of cryptocurrencies for financial transactions. EuroMed Journal of Business, 19(1), 46–61. [Google Scholar] [CrossRef]

- El Hajj, M., & Farran, I. (2024). The cryptocurrencies in emerging markets: Enhancing financial inclusion and economic empowerment. Journal of Risk and Financial Management, 17(10), 467. [Google Scholar] [CrossRef]

- Elouardighi, I., & Oubejja, K. (2023). Can digital financial inclusion promote women’s labor force participation? Microlevel evidence from Africa. International Journal of Financial Studies, 11(3), 87. [Google Scholar] [CrossRef]

- Ferreira, A., & Sandner, P. (2021). Eu search for regulatory answers to crypto assets and their place in the financial markets’ infrastructure. Computer Law & Security Review, 43, 105632. [Google Scholar]

- Flyvbjerg, B. (2006). Five misunderstandings about case-study research. Qualitative Inquiry, 12, 219–245. [Google Scholar] [CrossRef]

- Foley, S., Karlsen, J. R., & Putniņš, T. J. (2019). Sex, drugs, and bitcoin: How much illegal activity is financed through cryptocurrencies? The Review of Financial Studies, 32(5), 1798–1853. [Google Scholar] [CrossRef]

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50. [Google Scholar] [CrossRef]

- Gelman, A., & Loken, E. (2014). The statistical crisis in science. American Scientist, 102(6), 460–465. [Google Scholar] [CrossRef]

- Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W. (2018). On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of Management Information Systems, 35(1), 220–265. [Google Scholar] [CrossRef]

- Goutte, S., Le, H.-V., Liu, F., & Von Mettenheim, H.-J. (2023). Deep learning and technical analysis in cryptocurrency market. Finance Research Letters, 54, 103809. [Google Scholar] [CrossRef]

- GSMA, G. (2017). State of the industry report on mobile money. GSMA. [Google Scholar]

- Guo, Y., Yousef, E., & Naseer, M. M. (2025). Examining the drivers and economic and social impacts of cryptocurrency adoption. FinTech, 4(1), 5. [Google Scholar] [CrossRef]

- Hair, J. F., Ringle, C. M., Gudergan, S. P., Fischer, A., Nitzl, C., & Menictas, C. (2019). Partial least squares structural equation modeling-based discrete choice modeling: An illustration in modeling retailer choice. Business Research, 12(1), 115–142. [Google Scholar] [CrossRef]

- Hayashi, F., & Routh, A. (2025). Financial literacy, risk tolerance, and cryptocurrency ownership in the United States. Journal of Behavioral and Experimental Finance, 46, 101060. [Google Scholar] [CrossRef]

- Heeks, R. (2002). Information systems and developing countries: Failure, success, and local improvisations. The Information Society, 18(2), 101–112. [Google Scholar] [CrossRef]

- Hidegföldi, M., Csizmazia, G. L., & Karpavičė, J. (2025). Understanding the drivers of cryptocurrency acceptance: An empirical study of individual adoption. Procedia Computer Science, 256, 547–556. [Google Scholar] [CrossRef]

- Howson, P., & de Vries, A. (2022). Preying on the poor? Opportunities and challenges for tackling the social and environmental threats of cryptocurrencies for vulnerable and low-income communities. Energy Research & Social Science, 84, 102394. [Google Scholar]

- Islam, H., Rana, M., Saha, S., Khatun, T., Ritu, M. R., & Islam, M. R. (2023). Factors influencing the adoption of cryptocurrency in Bangladesh: An investigation using the technology acceptance model (TAM). Technological Sustainability, 2(4), 423–443. [Google Scholar] [CrossRef]

- Jorgensen, T. D., Pornprasertmanit, S., Schoemann, A. M., & Rosseel, Y. (2012). semTools: Useful tools for structural equation modeling (pp. 1–175). Available online: https://cran.r-project.org/web/packages/semTools/semTools.pdf (accessed on 23 May 2025).

- Kanga, D., Oughton, C., Harris, L., & Murinde, V. (2022). The diffusion of fintech, financial inclusion and income per capita. The European Journal of Finance, 28(1), 108–136. [Google Scholar] [CrossRef]

- Kauffman, S. A. (1993). Origins of order: Self-organization and selection in evolution. Oxford University Press. [Google Scholar]

- Khan, M. T. I. (2023). Literacy, profile, and determinants of Bitcoin, Ethereum, and Litecoin: Survey results. Journal of Education for Business, 98(7), 367–377. [Google Scholar] [CrossRef]

- Khan, R., & Hakami, T. A. (2022). Cryptocurrency: Usability perspective versus volatility threat. Journal of Money and Business, 2(1), 16–28. [Google Scholar] [CrossRef]

- Klapper, L., & Lusardi, A. (2020). Financial literacy and financial resilience: Evidence from around the world. Financial Management, 49(3), 589–614. [Google Scholar] [CrossRef]

- Kouam, H. (2023). Challenges and implications of cryptocurrencies, central bank digital currencies, and electronic money. In F. A. Yamoah, & A. U. Haque (Eds.), Corporate management ecosystem in emerging economies (pp. 147–163). Springer International Publishing. [Google Scholar] [CrossRef]

- Krejcie, R. V., & Morgan, D. W. (1970). Determining sample size for research activities. Educational and Psychological Measurement, 30(3), 607–610. [Google Scholar] [CrossRef]

- Kumar, G., Murty, A., Ratna, D. R., & Ranjan, D. A. (2024). Impact of digital financial literacy on financial inclusion—the role fintech services. Available online: https://ssrn.com/abstract=4954800 (accessed on 13 February 2025).

- Kumar, M., & Thakur, A. (2024). NFTS, Blockchain and Cryptocurrency: Legal Scenario Across the Globe. In Comparative law: Unraveling global legal systems (pp. 73–86). Springer Nature Singapore. [Google Scholar]

- Kumari, V., Bala, P. K., & Chakraborty, S. (2023). An empirical study of user adoption of cryptocurrency using blockchain technology: Analysing role of success factors like technology awareness and financial literacy. Journal of Theoretical and Applied Electronic Commerce Research, 18(3), 1580–1600. [Google Scholar] [CrossRef]

- Kyriazis, N., Papadamou, S., & Corbet, S. (2020). A systematic review of the bubble dynamics of cryptocurrency prices. Research in International Business and Finance, 54, 101254. [Google Scholar] [CrossRef]

- Long, T. Q., Morgan, P. J., & Yoshino, N. (2023). Financial literacy, behavioral traits, and ePayment adoption and usage in Japan. Financial Innovation, 9(1), 101. [Google Scholar] [CrossRef] [PubMed]

- Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature, 52(1), 5–44. [Google Scholar] [CrossRef]

- Lyons, A. C., & Kass-Hanna, J. (2021). Financial inclusion, financial literacy and economically vulnerable populations in the middle east and North Africa. Emerging Markets Finance and Trade, 57(9), 2699–2738. [Google Scholar] [CrossRef]

- Maciejasz, M., Poskart, R., & Wotzka, D. (2024). Perceptions of cryptocurrencies and modern money before and after the COVID-19 pandemic in poland and Germany. International Journal of Financial Studies, 12(3), 64. [Google Scholar] [CrossRef]

- Makarov, I., & Schoar, A. (2022). Cryptocurrencies and decentralized finance. NBER Working Paper. [Google Scholar]

- Metelski, D., & Sobieraj, J. (2022). Decentralized finance (DeFi) projects: A study of key performance indicators in terms of DeFi protocols’ valuations. International Journal of Financial Studies, 10(4), 108. [Google Scholar] [CrossRef]

- Mhlanga, D. (2023). Block chain for digital financial inclusion towards reduced inequalities. In D. Mhlanga (Ed.), FinTech and artificial intelligence for sustainable development (pp. 263–290). Springer Nature Switzerland. [Google Scholar] [CrossRef]

- Miles, M. B. (1994). Qualitative data analysis: An expanded sourcebook. Sage. Available online: https://books.google.com/books?hl=fr&lr=&id=U4lU_-wJ5QEC&oi=fnd&pg=PR12&dq=85.%09Miles,+M.+B.%3B+Huberman,+A.+M.+Qualitative+data+analysis:+An+expanded+sourcebook.+Sage:+Thousand+Oaks,+CA,+USA,+1994.&ots=kGWEZLVXYN&sig=RrWCFfmaf7TiRsz6gu0CNMriPhU (accessed on 12 May 2025).

- Mohammed, M. A., De-Pablos-Heredero, C., & Montes Botella, J. L. (2023). Exploring the factors affecting countries’ adoption of blockchain-enabled central bank digital currencies. Future Internet, 15(10), 321. [Google Scholar] [CrossRef]

- Morgan, P. J. (2021). Fintech, financial literacy, and financial education. In The routledge handbook of financial literacy (pp. 239–258). Routledge. [Google Scholar]

- Muralidhar, A., & Lakkanna, M. (2024). Regulating cryptocurrency and decentralized finance for an inclusive economy. arXiv, arXiv:2407.01532. [Google Scholar] [CrossRef]

- Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Available online: https://assets.pubpub.org/d8wct41f/31611263538139.pdf (accessed on 15 April 2025).

- Nandal, N., Nandal, N., Gulati, S., & Mehta, C. (2024). The growth of cryptocurrency across the globe: Its challenges and potential impacts on legislation. In Integrating advancements in education, and society for achieving sustainability (pp. 228–235). Routledge. Available online: https://www.taylorfrancis.com/chapters/edit/10.4324/9781032708461-36/growth-cryptocurrency-across-globe-challenges-potential-impacts-legislation-nisha-nandal-naveen-nandal-shaurya-gulati-chakshu-mehta (accessed on 2 May 2025).

- Nchofoung, T. N., & Asongu, S. A. (2022). Effects of infrastructures on environmental quality contingent on trade openness and governance dynamics in Africa. Renewable Energy, 189, 152–163. [Google Scholar] [CrossRef]

- Nishibe, M. (2024). The transdisciplinary approach to evolutionary economics: An integrated science of economics and biology. In K. Yagi, Y. Shiozawa, Y. Aruka, M. Nishibe, & A. Isogai (Eds.), Present and future of evolutionary economics (Vol. 31, pp. 25–39). Springer Nature Singapore. [Google Scholar] [CrossRef]

- Olayinka, O., & Wynn, M. G. (2022). Digital transformation in the nigerian small business sector. In M. G. Wynn (Ed.), Advances in E-business research (pp. 359–382). IGI Global. [Google Scholar] [CrossRef]

- Ozili, P. K. (2022). Decentralized finance research and developments around the world. Journal of Banking and Financial Technology, 6(2), 117–133. [Google Scholar] [CrossRef]

- Ozili, P. K. (2023a). CBDC, Fintech and cryptocurrency for financial inclusion and financial stability. Digital Policy, Regulation and Governance, 25(1), 40–57. [Google Scholar] [CrossRef]

- Ozili, P. K. (2023b). Determinants of interest in eNaira and financial inclusion information in Nigeria: Role of Fintech, cryptocurrency and central bank digital currency. Digital Transformation and Society, 2(2), 202–214. [Google Scholar] [CrossRef]

- Özdemir, O. (2022). Cue the volatility spillover in the cryptocurrency markets during the COVID-19 pandemic: Evidence from DCC-GARCH and wavelet analysis. Financial Innovation, 8(1), 12. [Google Scholar] [CrossRef] [PubMed]

- Pfeffer, J., & Salancik, G. (2015). External control of organizations—Resource dependence perspective. In Organizational behavior 2 (pp. 355–370). Routledge. Available online: https://www.taylorfrancis.com/chapters/edit/10.4324/9781315702001-24/external-control-organizations%E2%80%94resource-dependence-perspective-jeffrey-pfeffer-gerald-salancik (accessed on 15 April 2025).

- Ramayah, T., Cheah, J., Chuah, F., Ting, H., & Memon, M. A. (2018). Partial least squares structural equation modeling (PLS-SEM) using smartPLS 3.0. An updated Guide and Practical Guide to Statistical Analysis, 1(1), 1–72. [Google Scholar]

- Rezaeian, M., & Wynn, M. (2016). The implementation of ERP systems in Iranian manufacturing SMEs. International Journal on Advances in Intelligent Systems, 9(3 & 4), 600–614. [Google Scholar]

- Rogers, E. M. (2003). Diffusion of innovations (5th ed). Simon and Schuster. [Google Scholar]

- Rzayev, K., Sakkas, A., & Urquhart, A. (2025). An adoption model of cryptocurrencies. European Journal of Operational Research, 323(1), 253–266. [Google Scholar] [CrossRef]

- Schaupp, L. C., Festa, M., Knotts, K. G., & Vitullo, E. A. (2022). Regulation as a pathway to individual adoption of cryptocurrency. Digital Policy, Regulation and Governance, 24(2), 199–219. [Google Scholar] [CrossRef]

- Schuetz, S., & Venkatesh, V. (2020). Blockchain, adoption, and financial inclusion in India: Research opportunities. International Journal of Information Management, 52, 101936. [Google Scholar] [CrossRef]

- Shahzad, F., Xiu, G., Wang, J., & Shahbaz, M. (2018). An empirical investigation on the adoption of cryptocurrencies among the people of mainland China. Technology in Society, 55, 33–40. [Google Scholar] [CrossRef]

- Sham, R., Aw, E. C.-X., Abdamia, N., & Chuah, S. H.-W. (2023). Cryptocurrencies have arrived, but are we ready? Unveiling cryptocurrency adoption recipes through an SEM-fsQCA approach. The Bottom Line, 36(2), 209–233. [Google Scholar] [CrossRef]

- Shin, D., & Rice, J. (2022). Cryptocurrency: A panacea for economic growth and sustainability? A critical review of crypto innovation. Telematics and Informatics, 71, 101830. [Google Scholar] [CrossRef]

- Shuhaiber, A., Al-Omoush, K. S., & Alsmadi, A. A. (2025). Investigating trust and perceived value in cryptocurrencies: Do optimism, FinTech literacy and perceived financial and security risks matter? Kybernetes, 54(1), 330–357. [Google Scholar] [CrossRef]

- Sila Money. (2022). Cryptocurrency and mobile banking. Sila Money. Available online: https://silamoney.com/ach/cryptocurrency-and-mobile-banking (accessed on 25 January 2025).

- Sousa, A., Calçada, E., Rodrigues, P., & Pinto Borges, A. (2022). Cryptocurrency adoption: A systematic literature review and bibliometric analysis. EuroMed Journal of Business, 17(3), 374–390. [Google Scholar] [CrossRef]

- Steinmetz, F., Von Meduna, M., Ante, L., & Fiedler, I. (2021). Ownership, uses and perceptions of cryptocurrency: Results from a population survey. Technological Forecasting and Social Change, 173, 121073. [Google Scholar] [CrossRef]

- Tapscott, D., & Tapscott, A. (2017). La revolución blockchain. Deusto Barcelona. Available online: https://static0planetadelibroscommx.cdnstatics.com/libros_contenido_extra/35/34781_La_revolucion_blockchain.pdf (accessed on 12 December 2024).

- Van Dyk, R., & Van Belle, J.-P. (2019, September 1–4). Factors influencing the intended adoption of digital transformation: A South African case study. 2019 Federated Conference on Computer Science and Information Systems (Fedcsis) (pp. 519–528), Leipzig, Germany. Available online: https://ieeexplore.ieee.org/abstract/document/8860025/ (accessed on 15 January 2024).

- Venkatesh, V., Brown, S. A., & Bala, H. (2013). Bridging the qualitative-quantitative divide: Guidelines for conducting mixed methods research in information systems. MIS Quarterly, 37, 21–54. [Google Scholar] [CrossRef]

- Venkatesh, V., Morris, M. G., & Ackerman, P. L. (2000). A longitudinal field investigation of gender differences in individual technology adoption decision-making processes. Organizational Behavior and Human Decision Processes, 83(1), 33–60. [Google Scholar] [CrossRef]

- Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 27, 425–478. [Google Scholar] [CrossRef]

- Venkatesh, V., Thong, J. Y., & Xu, X. (2012). Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Quarterly, 36, 157–178. [Google Scholar] [CrossRef]

- Wang, Y. (2024). Do cryptocurrency investors in the UK need more protection? Journal of Financial Regulation and Compliance, 32(2), 230–249. [Google Scholar] [CrossRef]

- Wątorek, M., Drożdż, S., Kwapień, J., Minati, L., Oświęcimka, P., & Stanuszek, M. (2021). Multiscale characteristics of the emerging global cryptocurrency market. Physics Reports, 901, 1–82. [Google Scholar] [CrossRef]

- Williams, M. D., Rana, N. P., & Dwivedi, Y. K. (2015). The unified theory of acceptance and use of technology (UTAUT): A literature review. Journal of Enterprise Information Management, 28(3), 443–488. [Google Scholar] [CrossRef]

- Wong, K. K.-K. (2013). Partial least squares structural equation modeling (PLS-SEM) techniques using SmartPLS. Marketing Bulletin, 24(1), 1–32. [Google Scholar]

- Wong, L.-W., Tan, G. W.-H., Lee, V.-H., Ooi, K.-B., & Sohal, A. (2020). Unearthing the determinants of Blockchain adoption in supply chain management. International Journal of Production Research, 58(7), 2100–2123. [Google Scholar] [CrossRef]

- Wynn, M. G., Adejumo, D., & Vale, V. (2024). Digitalization and country image: Key influencing factors (A case example of Nigeria). Journal of Policy and Society, 2(2), 1–16. [Google Scholar] [CrossRef]

- Xie, R. (2019). Why China had to ban cryptocurrency but the US did not: A comparative analysis of regulations on crypto-markets between the US and China. Washington University Global Studies Law Review, 18, 457. [Google Scholar]

- Xu, Q., Zhang, Y., & Zhang, Z. (2021). Tail-risk spillovers in cryptocurrency markets. Finance Research Letters, 38, 101453. [Google Scholar] [CrossRef]

- Yeong, Y.-C., Kalid, K. S., & Sugathan, S. K. (2019). Cryptocurrency adoption in Malaysia: Does age, income and education level matter? International Journal of Innovative Technology and Exploring Engineering, 8(11), 2179–2184. [Google Scholar] [CrossRef]

- Yin, R. K. (2018). Case study research and applications: Design and methods (6th ed.). Sage Publications Ltd. [Google Scholar]

- Yoon, C. (2011). Theory of planned behavior and ethics theory in digital piracy: An integrated model. Journal of Business Ethics, 100(3), 405–417. [Google Scholar] [CrossRef]

- Zetzsche, D. A., Arner, D. W., & Buckley, R. P. (2020). Decentralized finance. Journal of Financial Regulation, 6(2), 172–203. [Google Scholar] [CrossRef]

- Zetzsche, D. A., Buckley, R. P., & Arner, D. W. (2019). Regulating libra: The transformative potential of facebook’s cryptocurrency and possible regulatory responses. Available online: http://hub.hku.hk/handle/10722/276462 (accessed on 24 January 2025).

- Zins, A., & Weill, L. (2016). The determinants of financial inclusion in Africa. Review of Development Finance, 6(1), 46–57. [Google Scholar] [CrossRef]

- Zohar, A. (2015). Bitcoin: Under the hood. Communications of the ACM, 58(9), 104–113. [Google Scholar] [CrossRef]

| Variable | Category | Percentage |

|---|---|---|

| Age | 18–30 years | 40% |

| 31–45 years | 35% | |

| 46 years and above | 25% | |

| Gender | Male | 55% |

| Female | 45% | |

| Education Level | Primary or below | 25% |

| Secondary | 40% | |

| University | 35% | |

| Monthly Income | Less than 3500 MAD | 30% |

| 3500–6500 MAD | 50% | |

| More than 6500 MAD | 20% | |

| Use of Financial Services | Bank account | 65% |

| Unbanked | 35% | |

| Cryptocurrency Adoption | Users | 20% |

| Non-users | 80% |

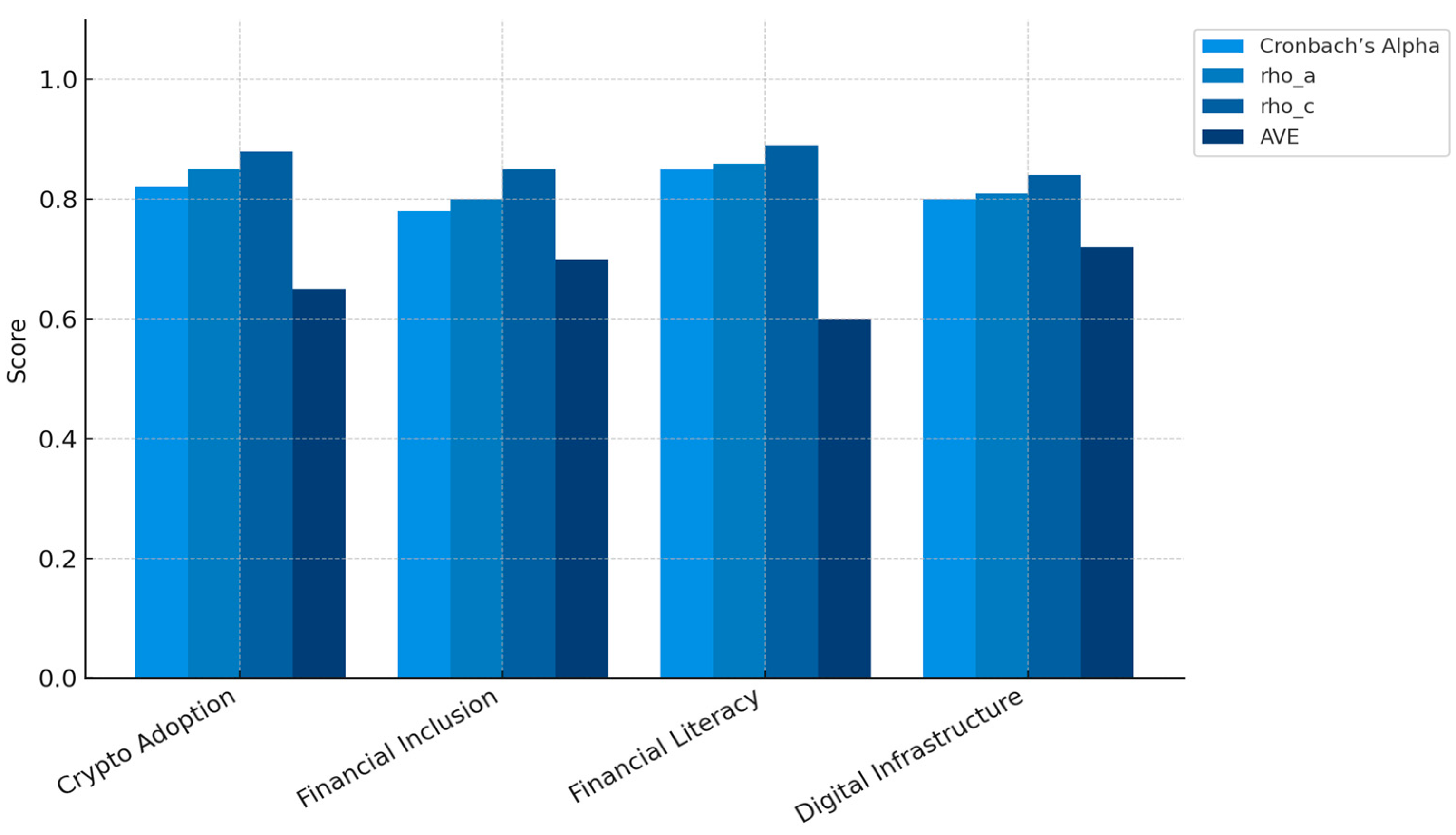

| Latent Variable | Cronbach’s Alpha | rho_a | rho_c | AVE |

|---|---|---|---|---|

| Cryptocurrency Adoption | 0.82 | 0.85 | 0.88 | 0.65 |

| Financial Inclusion | 0.78 | 0.80 | 0.85 | 0.70 |

| Financial Literacy | 0.85 | 0.86 | 0.89 | 0.60 |

| Digital Infrastructure | 0.80 | 0.81 | 0.84 | 0.72 |

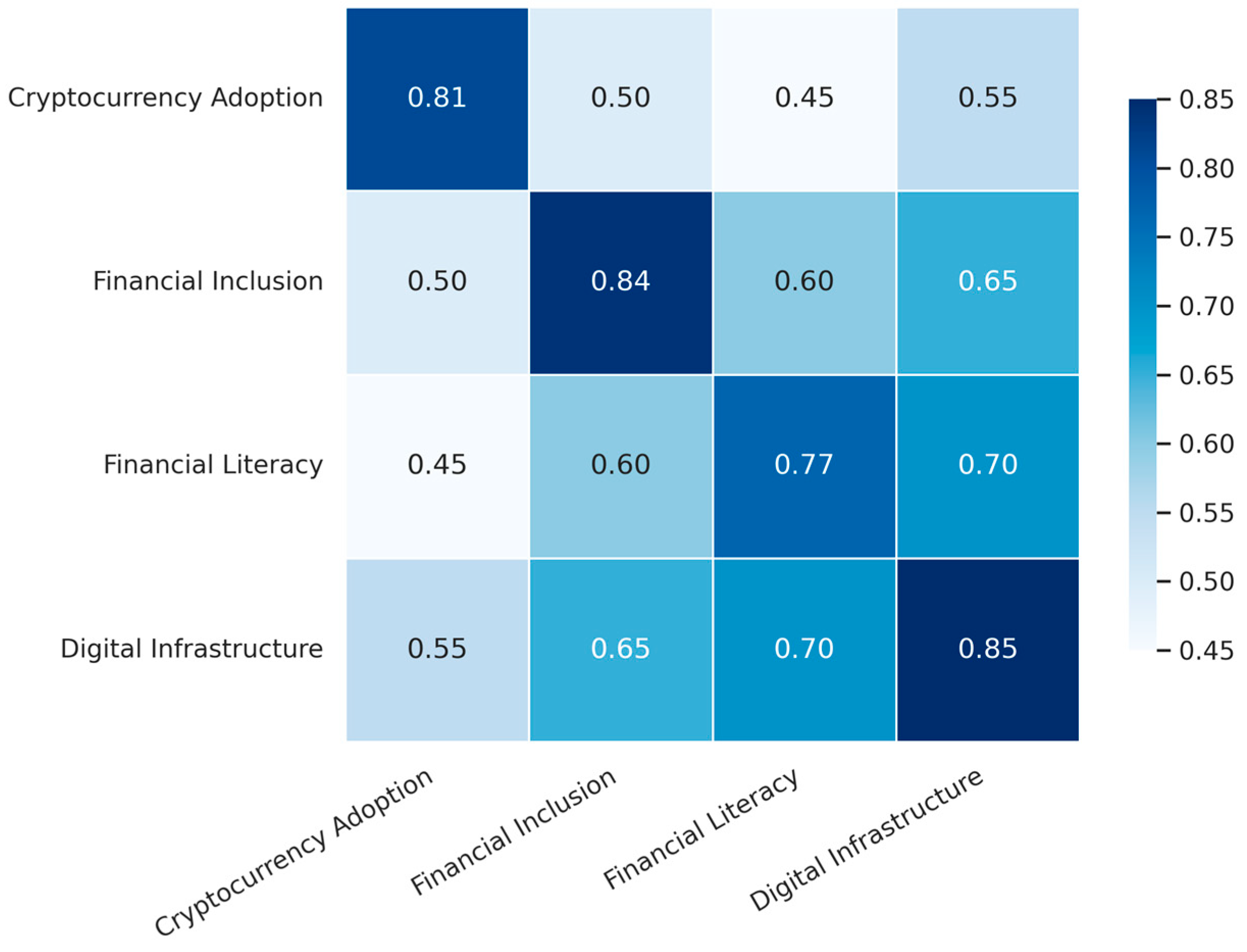

| Latent Variable | Cryptocurrency Adoption | Financial Inclusion | Financial Literacy | Digital Infrastructure |

|---|---|---|---|---|

| Cryptocurrency Adoption | 0.81 | |||

| Financial Inclusion | 0.50 | 0.84 | ||

| Financial Literacy | 0.45 | 0.60 | 0.77 | |

| Digital Infrastructure | 0.55 | 0.65 | 0.70 | 0.85 |

| Hypothesis | Tested Relationship | Coefficient (β) | p-Value | Result |

|---|---|---|---|---|

| H1: Cryptocurrency adoption has a positive impact on financial inclusion. | Cryptocurrency Adoption → Financial Inclusion | 0.45 | <0.001 | Supported (positive and significant impact) |

| H2: Financial literacy mediates the effect of cryptocurrencies on financial inclusion. | Cryptocurrency Adoption → Financial Literacy → Financial Inclusion | 0.28 (indirect effect) | <0.01 | Supported (partial mediation effect) |

| H3: Digital infrastructure moderates the effect of cryptocurrencies on financial inclusion. | Cryptocurrency Adoption × Digital Infrastructure → Financial Inclusion | 0.32 (moderating effect) | <0.05 | Supported (positive moderating effect) |

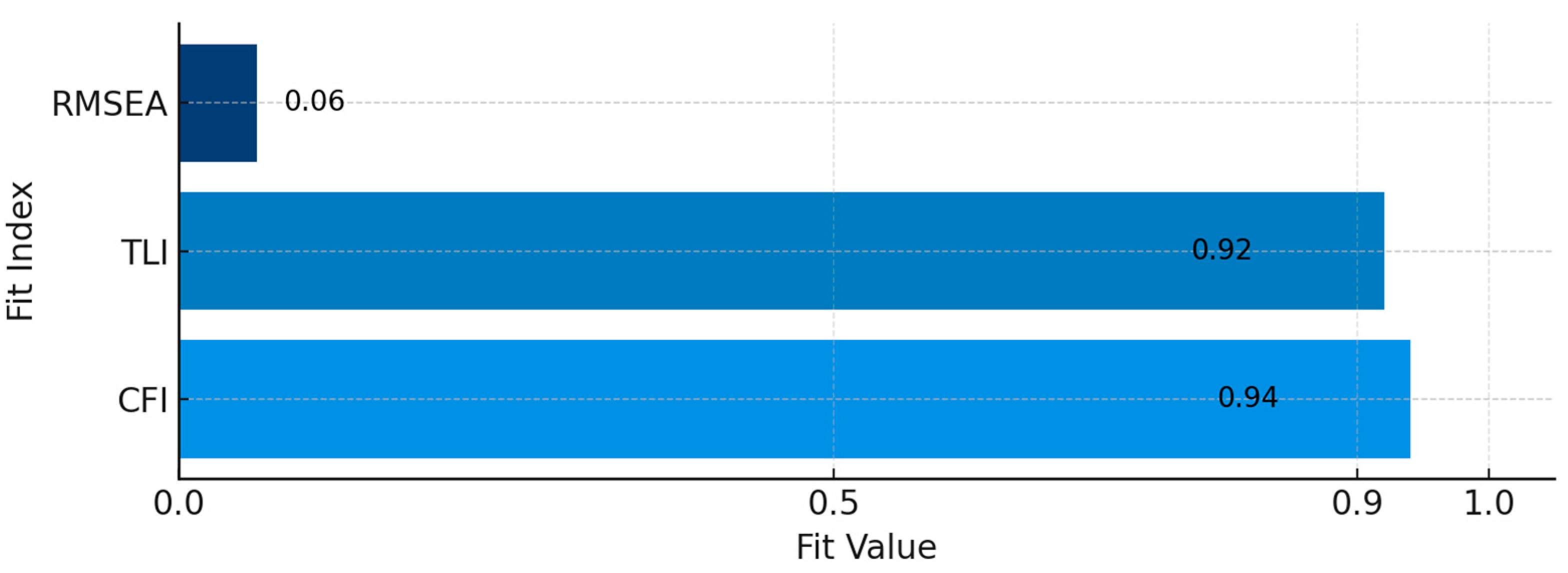

| Fit Index | Value | Reference Threshold | Result |

|---|---|---|---|

| CFI (Comparative Fit Index) | 0.94 | >0.90 | Good fit |

| TLI (Tucker–Lewis Index) | 0.92 | >0.90 | Good fit |

| RMSEA (Root Mean Square Error of Approximation) | 0.06 | <0.08 | Good fit |

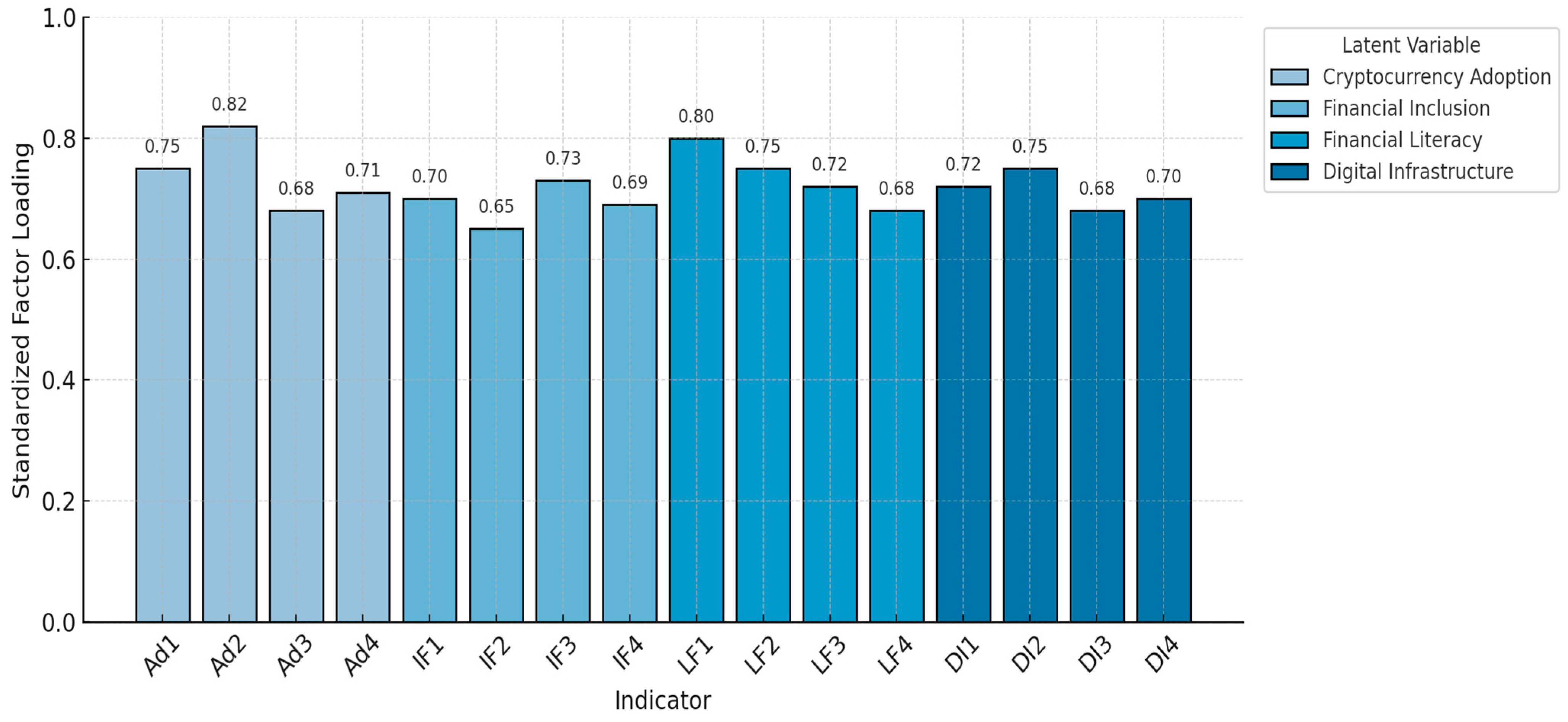

| Variables | Indicators | Factor Loading | |

|---|---|---|---|

| Cryptocurrency Adoption | Ad1 | Frequency of use | 0.75 |

| Ad2 | Transaction volume | 0.82 | |

| Ad3 | Knowledge of cryptocurrencies | 0.68 | |

| Ad4 | Future intention to use | 0.71 | |

| Financial Inclusion | IF1 | Number of bank accounts | 0.70 |

| IF2 | Frequency of use | 0.65 | |

| IF3 | Access to credit | 0.73 | |

| IF4 | Use of savings services | 0.69 | |

| Financial Literacy | LF1 | Understanding score | 0.80 |

| LF2 | Knowledge of interest rates | 0.75 | |

| LF3 | Ability to compare offers | 0.72 | |

| LF4 | Personal budget management | 0.68 | |

| Digital Infrastructure | DI1 | Internet access | 0.72 |

| DI2 | Smartphone ownership | 0.75 | |

| DI3 | Quality of connectivity | 0.68 | |

| DI4 | Frequency of Internet usage | 0.70 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abdallah-Ou-Moussa, S.; Wynn, M.; Kharbouch, O. Blockchain, Cryptocurrencies, and Decentralized Finance: A Case Study of Financial Inclusion in Morocco. Int. J. Financial Stud. 2025, 13, 124. https://doi.org/10.3390/ijfs13030124

Abdallah-Ou-Moussa S, Wynn M, Kharbouch O. Blockchain, Cryptocurrencies, and Decentralized Finance: A Case Study of Financial Inclusion in Morocco. International Journal of Financial Studies. 2025; 13(3):124. https://doi.org/10.3390/ijfs13030124

Chicago/Turabian StyleAbdallah-Ou-Moussa, Soukaina, Martin Wynn, and Omar Kharbouch. 2025. "Blockchain, Cryptocurrencies, and Decentralized Finance: A Case Study of Financial Inclusion in Morocco" International Journal of Financial Studies 13, no. 3: 124. https://doi.org/10.3390/ijfs13030124

APA StyleAbdallah-Ou-Moussa, S., Wynn, M., & Kharbouch, O. (2025). Blockchain, Cryptocurrencies, and Decentralized Finance: A Case Study of Financial Inclusion in Morocco. International Journal of Financial Studies, 13(3), 124. https://doi.org/10.3390/ijfs13030124