Thailand Sustainability Investment Performance on Thailand’s Stock Market and Financial Assets

Abstract

1. Introduction

2. Literature Review

3. Data and Research Method

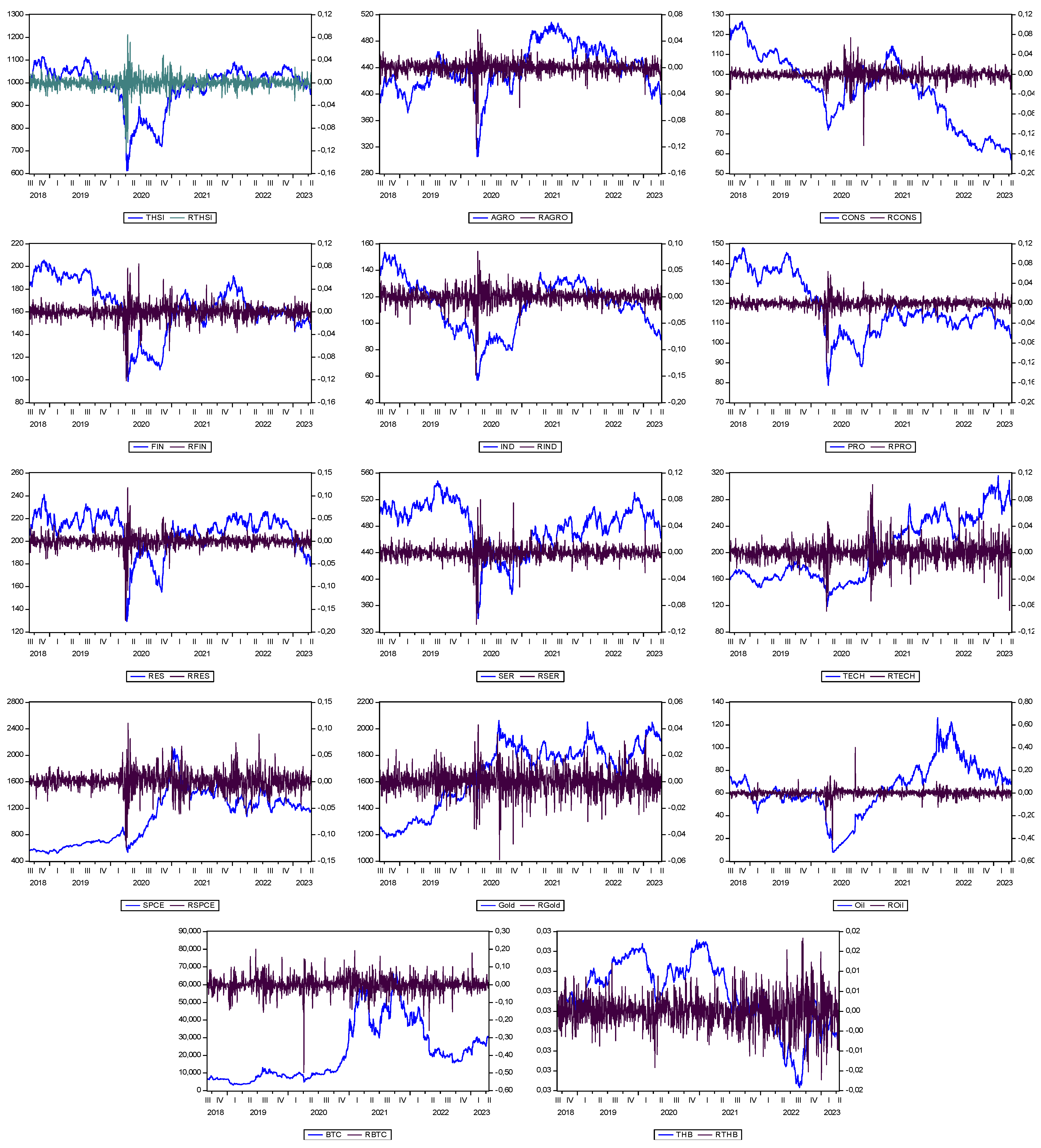

3.1. Data

3.2. Research Method

4. Results and Discussion

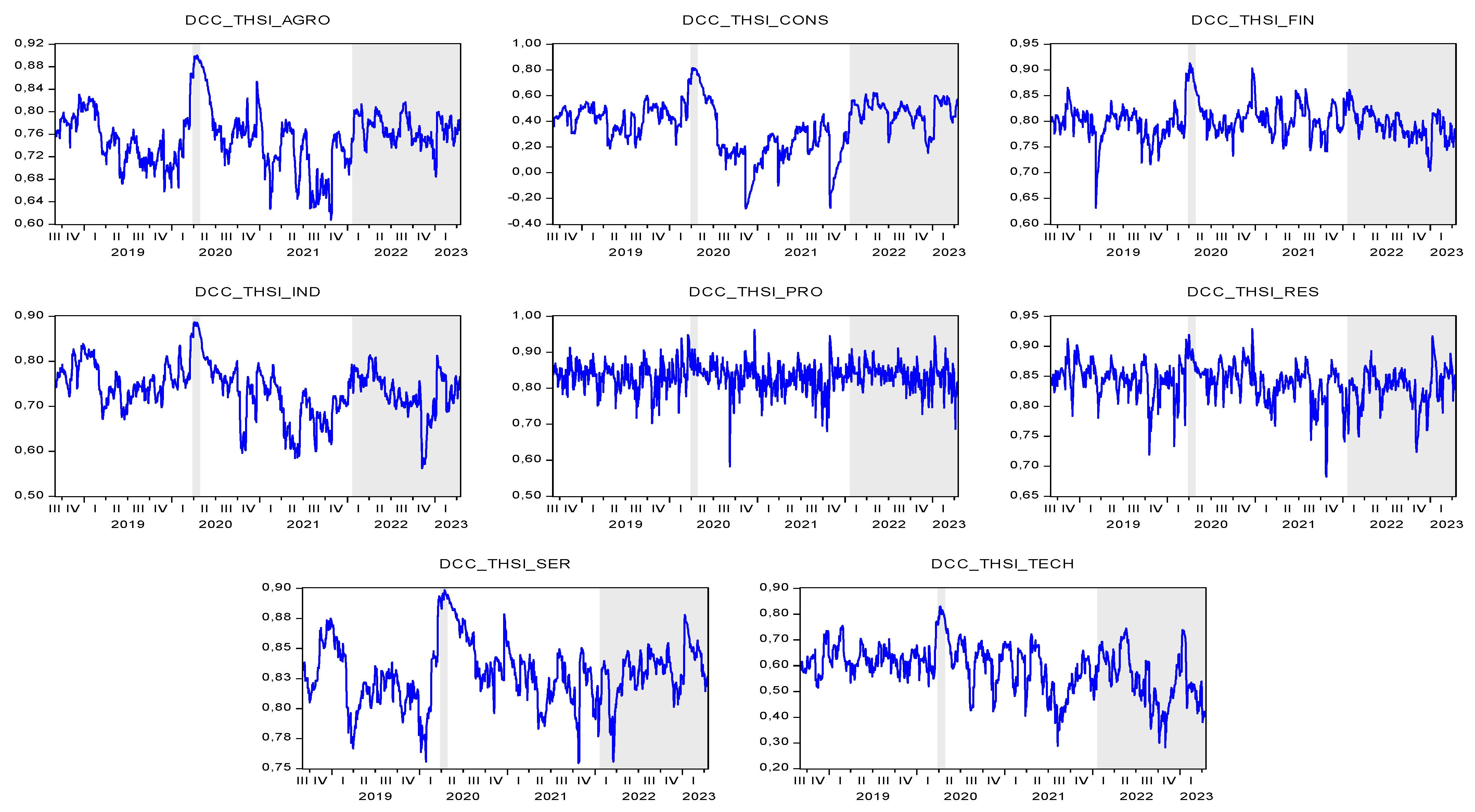

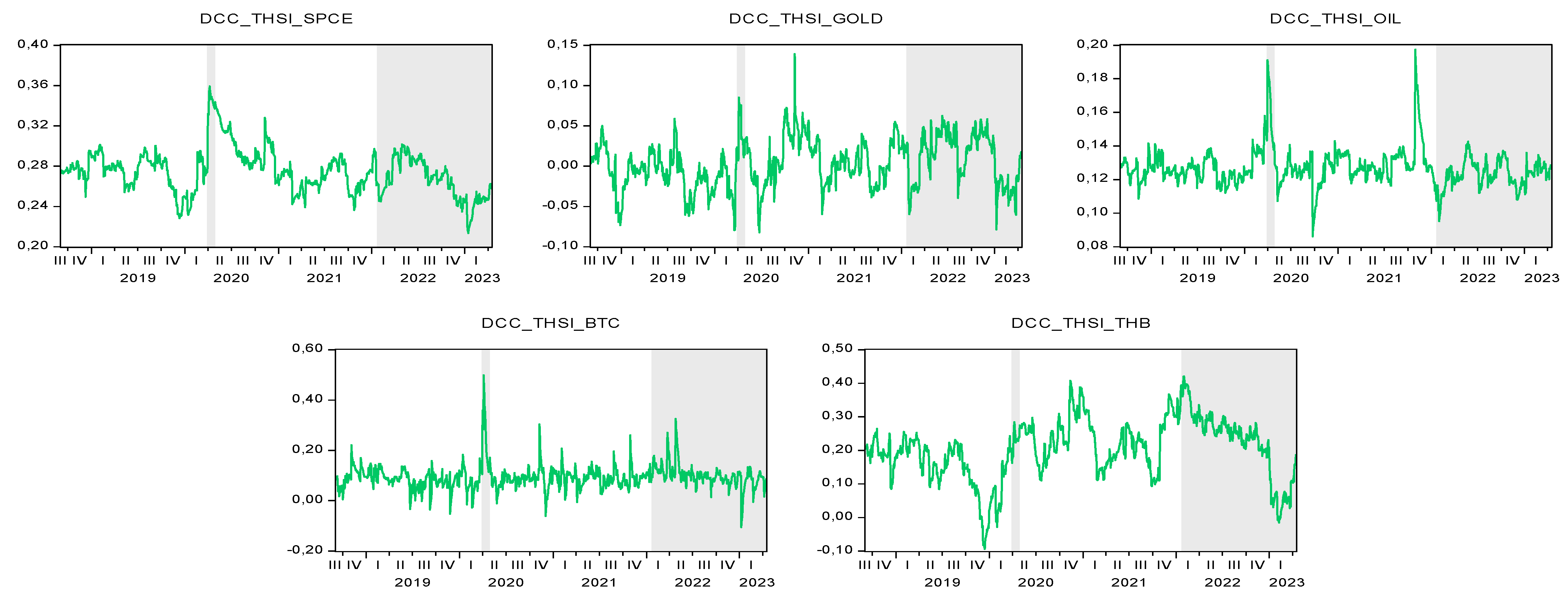

4.1. Dynamic Conditional Correlation Analysis

4.2. Hedge and Safe-Haven Analysis

4.3. Granger Causality Test

5. Conclusions and Future Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Lags | Loglikelihood | LR | AIC | SIC | HQC |

|---|---|---|---|---|---|

| 0 | 54,399.880 | NA | −90.794 | −90.735 * | −90.772 * |

| 1 | 54,645.070 | 484.251 | −90.877 * | −89.985 | −90.541 |

| 2 | 54,818.100 | 337.682 | −90.838 | −89.114 | −90.189 |

| 3 | 54,994.470 | 340.077 | −90.805 | −88.249 | −89.842 |

| 4 | 55,148.490 | 293.389 | −90.735 | −87.346 | −89.459 |

| 5 | 55,316.850 | 316.763 | −90.689 | −86.467 | −89.099 |

| 6 | 55,484.260 | 311.049 | −90.642 | −85.587 | −88.737 |

| 7 | 55,633.830 | 274.435 | −90.564 | −84.677 | −88.346 |

| 8 | 55,775.100 | 255.878 | −90.473 | −83.753 | −87.941 |

| Variables | Mean Equation | Variance Equation | Diagnostic Test | |||

|---|---|---|---|---|---|---|

| Q2(5) | Q2(10) | |||||

| THSI | −1.26 × 10−5 | 2.88 × 10−6 a | 0.109 a | 0.865 a | 8.499 [0.131] | 11.477 [0.386] |

| AGRO | −3.01 × 10−5 | 2.61 × 10−6 a | 0.092 a | 0.884 a | 4.238 [0.516] | 7.962 [0.633] |

| CONS | −7.93 × 10−4 a | 2.02 × 10−7 c | 0.053 a | 0.950 a | 9.548 [0.089] | 9.860 [0.453] |

| FIN | −1.66 × 10−4 | 1.27 × 10−6 a | 0.085 a | 0.912 a | 4.213 [0.519] | 7.263 [0.700] |

| IND | −5.10 × 10−4 | 2.64 × 10−6 a | 0.070 a | 0.917 a | 5.231 [0.388] | 14.207 [0.164] |

| PRO | −1.65 × 10−4 | 1.61 × 10−6 a | 0.083 a | 0.901 a | 7.464 [0.188] | 9.247 [0.509] |

| RES | −4.16 × 10−5 | 3.23 × 10−6 a | 0.102 a | 0.881 a | 2.840 [0.725] | 16.180 [0.104] |

| SER | 4.32 × 10−5 | 2.57 × 10−6 a | 0.086 a | 0.888 a | 3.176 [0.673] | 4.822 [0.903] |

| TECH | 4.25 × 10−4 | 1.30 × 10−5 a | 0.173 a | 0.783 a | 4.244 [0.515] | 10.668 [0.384] |

| SPCE | 8.62 × 10−4 b | 2.90 × 10−6 a | 0.116 a | 0.883 a | 1.684 [0.891] | 5.513 [0.854] |

| Gold | 2.01 × 10−4 | 5.31 × 10−6 a | 0.097 a | 0.844 a | 0.653 [0.985] | 10.709 [0.381] |

| Oil | 1.24 × 10−3 b | 4.72 × 10−5 a | 0.254 a | 0.740 a | 1.506 [0.912] | 6.046 [0.811] |

| BTC | 1.61 × 10−3 | 3.13 × 10−4 a | 0.144 a | 0.722 a | 9.100 [0.105] | 10.487 [0.399] |

| THB | −2.41 × 10−6 | 9.87 × 10−8 b | 0.041 a | 0.953 a | 8.858 [0.115] | 11.262 [0.337] |

| 1 | Based on S&P Goldman Sachs commodity index (GSCI) returns at the end of 2021 compared to the end of 2022. |

| 2 | Based on S&P 500 ESG index returns at the end of 2021 compared to the end of 2022. |

References

- Ahad, M., Imran, Z. A., & Shahzad, K. (2024). Safe haven between European ESG and energy sector under Russian-Ukraine war: Role of sustainable investments for portfolio diversification. Energy Economics, 138, 107853. [Google Scholar] [CrossRef]

- Al-Nassar, N. S., Boubaker, S., Chaibi, A., & Makram, B. (2023). In search of hedges and safe havens during the COVID-19 pandemic: Gold versus Bitcoin, oil, and oil uncertainty. Quarterly Review of Economics and Finance, 90, 318–332. [Google Scholar] [CrossRef] [PubMed]

- Andersson, E., Hoque, M., Rahman, M. L., Uddin, G. S., & Jayasekera, R. (2022). ESG investment: What do we learn from its interaction with stock, currency and commodity markets? International Journal of Finance and Economics, 27(3), 3623–3639. [Google Scholar] [CrossRef]

- Asvathitanont, C., & Tangjitprom, N. (2020). The performance of environmental, social, and governance investment in Thailand. International Journal of Financial Research, 11(6), 253–261. [Google Scholar] [CrossRef]

- Bal, G. R., & Maharana, A. K. (2023). Can equity market risk be diversified with the help of ESG investment and commodities? Global Business Review. in press. [Google Scholar] [CrossRef]

- Barson, Z., Ofori, K. S., Junior, P. O., Boakye, K. G., & Ampong, G. O. A. (2024). Time-varying connectedness between ESG stocks and BRVM traditional stocks. Journal of Emerging Market Finance, 23(3), 306–335. [Google Scholar] [CrossRef]

- Basher, S. A., & Sadorsky, P. (2022). Forecasting bitcoin price direction with random forests: How important are interest rates, inflation, and market volatility? Machine Learning with Applications, 9, 100355. [Google Scholar] [CrossRef]

- Baur, D. G., & Lucey, B. M. (2010). Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review, 45, 217–229. [Google Scholar] [CrossRef]

- Baur, D. G., & McDermott, T. K. (2010). Is gold a safe haven? International evidence. Journal of Banking & Finance, 34, 1886–1898. [Google Scholar] [CrossRef]

- Bloomberg Intelligence. (2022). ESG may surpass $41 trillion assets in 2022, but not without challenges. Available online: https://www.bloomberg.com/company/press/esg-may-surpass-41-trillion-assets-in-2022-but-not-without-challenges-finds-bloomberg-intelligence/ (accessed on 30 July 2023).

- Bunnun, W., & Chancharat, N. (2023). The mediating role of dividend policy in the relationship between ownership structure and firm performance of Thai listed companies. International Journal of Trade and Global Markets, 17(3–4), 340–347. [Google Scholar] [CrossRef]

- Cagli, E. C. C., Mandaci, P. E., & Taşkın, D. (2023). Environmental, social, and governance (ESG) investing and commodities: Dynamic connectedness and risk management strategies. Sustainability Accounting, Management and Policy Journal, 14(5), 1052–1074. [Google Scholar] [CrossRef]

- Chen, M., & Mussalli, G. (2020). An integrated approach to quantitative ESG investing. The Journal of Portfolio Management, 46(3), 65–74. [Google Scholar] [CrossRef]

- Döttling, R., & Kim, S. (2024). Sustainability preferences under stress: Evidence from COVID-19. Journal of Financial and Quantitative Analysis, 59(2), 435–473. [Google Scholar] [CrossRef]

- Engle, R. F. (2002). Dynamic conditional correlation: A simple class of multivariate GARCH models. Journal of Business & Economic Statistics, 20(3), 339–350. [Google Scholar] [CrossRef]

- Ferriani, F., & Natoli, F. (2021). ESG risks in times of COVID-19. Applied Economics Letters, 28(18), 1537–1541. [Google Scholar] [CrossRef]

- Harnphattananusorn, S. (2019). Analysis of relationship and volatilities between foreign exchange market and stock market of Thailand and selected Asian countries. Kasetsart Journal of Social Sciences, 40(1), 262–269. [Google Scholar] [CrossRef]

- Hasan, M. B., Rashid, M. M., Hossain, M. N., Rahman, M. M., & Amin, M. R. (2023). Using green and ESG assets to achieve post-COVID-19 environmental sustainability. Fulbright Review of Economics and Policy, 3(1), 25–48. [Google Scholar] [CrossRef]

- Iglesias-Casal, A., López-Penabad, M. C., López-Andión, C., & Maside-Sanfiz, J. M. (2020). Diversification and optimal hedges for socially responsible investment in Brazil. Economic Modelling, 85, 106–118. [Google Scholar] [CrossRef]

- Imran, Z. A., Ahad, M., Shahzad, K., Ahmad, M., & Hameed, I. (2024). Safe haven properties of industrial stocks against ESG in the United States: Portfolio implication for sustainable investments. Energy Economics, 136, 107712. [Google Scholar] [CrossRef]

- Katsampoxakis, I., Xanthopoulos, S., Basdekis, C., & Christopoulos, A. G. (2024). Can ESG stocks be a safe haven during global crises? Evidence from the COVID-19 pandemic and the Russia-Ukraine war with time-frequency wavelet analysis. Economies, 12(4), 89. [Google Scholar] [CrossRef]

- Lei, H., Xue, M., Liu, H., & Ye, J. (2023). Precious metal as a safe haven for global ESG stocks: Portfolio implications for socially responsible investing. Resources Policy, 80, 103170. [Google Scholar] [CrossRef]

- Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91. [Google Scholar] [CrossRef]

- Mousa, M., Saleem, A., & Sági, J. (2022). Are ESG shares a safe haven during COVID-19? Evidence from the Arab region. Sustainability, 14, 208. [Google Scholar] [CrossRef]

- Naeem, M. A., & Karim, S. (2021). Tail dependence between bitcoin and green financial assets. Economics Letters, 208, 110068. [Google Scholar] [CrossRef]

- Naeem, M. A., Karim, S., Uddin, G. S., & Junttila, J. (2022). Small fish in big ponds: Connections of green finance assets to commodity and sectoral stock markets. International Review of Financial Analysis, 83, 102283. [Google Scholar] [CrossRef]

- Naeem, M. A., Rabbani, M. R., Karim, S., & Billah, S. M. (2023). Religion vs. ethics: Hedge and safe haven properties of Sukuk and green bonds for stock markets pre-and during COVID-19. International Journal of Islamic and Middle Eastern Finance and Management, 16(2), 234–252. [Google Scholar] [CrossRef]

- Nittayakamolphun, P., Bejrananda, T., & Pholkerd, P. (2022). Stablecoins as safe haven or hedging asset for cryptocurrencies. Applied Economics Journal, 29(2), 45–70. Available online: https://so01.tci-thaijo.org/index.php/AEJ/article/view/260150 (accessed on 30 July 2023).

- Nittayakamolphun, P., Bejrananda, T., & Pholkerd, P. (2024a). Green bonds and ESG stocks as safe haven or hedging asset for other financial assets. Kasetsart Journal of Social Sciences, 45(4), 1307–1318. [Google Scholar] [CrossRef]

- Nittayakamolphun, P., Bejrananda, T., & Pholkerd, P. (2024b). Asymmetric effects of uncertainty and commodity markets on sustainable stock in seven emerging markets. Journal of Risk and Financial Management, 17(4), 155. [Google Scholar] [CrossRef]

- Omura, A., Roca, E., & Nakai, M. (2021). Does responsible investing pay during economic downturns: Evidence from the COVID-19 pandemic. Finance Research Letters, 42, 101914. [Google Scholar] [CrossRef]

- Pedini, L., & Severini, S. (2022). Exploring the hedge, diversifier and safe haven properties of ESG investments: A cross-quantilogram analysis. Available online: https://mpra.ub.uni-muenchen.de/112339/1/MPRA_paper_112339.pdf (accessed on 30 July 2023).

- Piserà, S., & Chiappini, H. (2024). Are ESG indexes a safe-haven or hedging asset? Evidence from the COVID-19 pandemic in China. International Journal of Emerging Markets, 19(1), 56–75. [Google Scholar] [CrossRef]

- Prinyapon, Y., Nittayagasetwat, A., & Nittayagasetwat, W. (2022). Performance of ESG stocks: Case of stock exchange of Thailand. NIDA Business Journal, 31, 42–60. Available online: https://so10.tci-thaijo.org/index.php/NIDABJ/article/view/89 (accessed on 30 July 2023).

- Ratner, M., & Chiu, C. C. (2013). Hedging stock sector risk with credit default swaps. International Review of Financial Analysis, 30, 18–25. [Google Scholar] [CrossRef]

- Rubbaniy, G., Khalid, A. A., Rizwan, M. F., & Ali, S. (2022). Are ESG stocks safe-haven during COVID-19? Studies in Economics and Finance, 39(2), 239–255. [Google Scholar] [CrossRef]

- Sharma, I., Bamba, M., Verma, B., & Verma, B. (2024). Dynamic connectedness and investment strategies between commodities and ESG stocks: Evidence from India. Australasian Accounting, Business and Finance Journal, 18(3), 67–84. [Google Scholar] [CrossRef]

- Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425–442. [Google Scholar] [CrossRef]

- Singh, A. (2020). COVID-19 and safer investment bets. Finance Research Letters, 36, 101729. [Google Scholar] [CrossRef]

- Sinlapates, P., & Chancharat, S. (2022). Contrarian profits in Thailand sustainability investment-listed versus in stock exchange of Thailand-listed companies. Risks, 10, 229. [Google Scholar] [CrossRef]

- Suttipun, M. (2023). ESG performance and corporate financial risk of the alternative capital market in Thailand. Cogent Business & Management, 10, 2168290. [Google Scholar] [CrossRef]

- Suttipun, M., Khunkaew, R., & Wichianrak, J. (2023). The impact of environmental, social and governance (ESG) reporting and female board members on financial performance: Evidence from Thailand. Journal of Accounting Profession, 19(61), 89–111. [Google Scholar] [CrossRef]

- The Stock Exchange of Thailand. (2023a). SETTHSI index. Available online: https://www.set.or.th/en/market/index/setthsi/overview (accessed on 30 July 2023).

- The Stock Exchange of Thailand. (2023b). List of Thailand sustainability investment in 2022. Available online: https://www.setsustainability.com/libraries/710/item/thailand-sustainability-investment-lists (accessed on 30 July 2023).

- Umar, Z., Kenourgio, D., & Papathanasiou, S. (2020). The static and dynamic connectedness of environmental, social, and governance investments: International evidence. Economic Modelling, 93, 112–124. [Google Scholar] [CrossRef]

- Umar, Z., Polat, O., Choi, S. Y., & Teplova, T. (2022). The impact of the Russia-Ukraine conflict on the connectedness of financial markets. Finance Research Letters, 48, 102976. [Google Scholar] [CrossRef]

| Variables | Symbol | Definition |

|---|---|---|

| Thailand sustainability investment | THSI | Thailand sustainability investment index |

| Thailand’s stock market | AGRO | Agro and food industry stocks: Agro and food industry group index |

| CONS | Consumer products stocks: Consumer products group index | |

| FIN | Financials stocks: Financials group index | |

| IND | Industrials stocks: Industrials group index | |

| PRO | Property and construction stocks: Property and construction group index | |

| RES | Resources stocks: Resources group index | |

| SER | Services stocks: Services group index | |

| TECH | Technology stocks: Technology group index | |

| Financial assets | SPCE | Clean energy: S&P Global clean energy index |

| Gold | Gold: Gold price (USD per ounce) | |

| Oil | Crude oil: West Texas intermediate crude oil price (USD per barrel) | |

| BTC | Bitcoin: Bitcoin price (USD) | |

| THB | Thai baht: Exchange rate (1 Thai baht to US dollars) |

| Variables | Average (%) | S.D. (%) | Max (%) | Min (%) | Skewness | Kurtosis | J-B | ADF | PP | ARCH (5) | Corr-THSI |

|---|---|---|---|---|---|---|---|---|---|---|---|

| THSI | −0.003 | 1.194 | 8.479 | −12.322 | −1.733 | 26.688 | 28,800 a | −8.647 a | −37.070 a | 176.441 a | 1.000 |

| AGRO | 0.000 | 1.088 | 5.744 | −12.248 | −2.055 | 23.649 | 22,274 a | −37.125 a | −37.039 a | 132.408 a | 0.825 a |

| CONS | −0.062 | 1.166 | 7.404 | −14.344 | −1.432 | 25.943 | 26,863 a | −33.115 a | −33.098 a | 22.594 a | 0.297 a |

| FIN | −0.017 | 1.352 | 8.489 | −12.156 | −1.191 | 18.309 | 12,062 a | −12.450 a | −35.469 a | 124.197 a | 0.852 a |

| IND | −0.035 | 1.453 | 8.571 | −14.817 | −1.465 | 18.999 | 13,293 a | −12.881 a | −35.830 a | 178.127 a | 0.809 a |

| PRO | −0.020 | 1.032 | 6.430 | −11.910 | −2.179 | 30.588 | 39,199 a | −34.760 a | −35.087 a | 126.927 a | 0.887 a |

| RES | −0.010 | 1.435 | 11.782 | −17.470 | −1.843 | 34.273 | 49,826 a | −13.479 a | −36.324 a | 157.477 a | 0.894 a |

| SER | −0.005 | 1.092 | 8.037 | −10.818 | −0.856 | 22.650 | 19,549 a | −37.567 a | −37.463 a | 109.332 a | 0.882 a |

| TECH | 0.045 | 1.593 | 10.244 | −8.858 | 0.138 | 9.829 | 2347.0 a | −35.276 a | −35.384 a | 185.610 a | 0.587 a |

| SPCE | 0.061 | 1.858 | 11.033 | −12.497 | −0.356 | 9.683 | 2270.0 a | −31.456 a | −31.646 a | 249.771 a | 0.365 a |

| Gold | 0.036 | 0.940 | 4.297 | −5.898 | −0.333 | 6.287 | 565.101 a | −34.077 a | −34.134 a | 59.249 a | 0.022 |

| Oil | −0.004 | 3.559 | 40.352 | −41.765 | −1.766 | 48.214 | 103,353 a | −30.003 a | −30.321 a | 161.406 a | 0.092 a |

| BTC | 0.127 | 4.555 | 20.079 | −49.728 | −1.205 | 17.253 | 10,500 a | −35.952 a | −35.940 a | 17.211 a | 0.155 a |

| THB | −0.005 | 0.402 | 1.835 | −1.726 | 0.042 | 4.637 | 134.945 a | −33.592 a | −34.233 a | 77.651 a | 0.184 a |

| Variables | AGRO | CONS | FIN | IND | PRO | RES | SER | TECH | SPCE | Gold | Oil | BTC | THB |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Average DCC | 0.754 | 0.370 | 0.799 | 0.737 | 0.833 | 0.840 | 0.829 | 0.588 | 0.275 | 0.003 | 0.127 | 0.093 | 0.203 |

| 0.025 a | 0.039 a | 0.032 c | 0.028 a | 0.099 a | 0.048 a | 0.018 a | 0.044 b | 0.004 | 0.009 c | 0.003 | 0.023 | 0.018 b | |

| 0.955 a | 0.946 a | 0.906 a | 0.941 a | 0.589 a | 0.832 a | 0.959 a | 0.927 a | 0.971 a | 0.941 a | 0.916 a | 0.793 a | 0.963 a |

| Variables | Safe-Haven | |||

|---|---|---|---|---|

| AGRO | 0.753 a | 0.005 | 0.010 | 0.046 a |

| CONS | 0.373 a | 0.002 | −0.044 | −0.073 |

| FIN | 0.798 a | 0.003 | 0.015 a | 0.052 a |

| IND | 0.734 a | 0.009 | 0.025 a | 0.067 a |

| PRO | 0.833 a | 0.003 | 0.005 | 0.029 a |

| RES | 0.839 a | −0.005 | 0.003 | 0.017 c |

| SER | 0.828 a | 0.001 | 0.009 b | 0.025 a |

| TECH | 0.589 a | −0.005 | −0.008 | 0.047 c |

| SPCE | 0.274 a | 0.001 | −0.001 | 0.022 a |

| Gold | 0.002 b | −0.000 | 0.006 | 0.015 c |

| Oil | 0.127 a | −0.001 | 0.001 | 0.016 a |

| BTC | 0.092 a | 0.000 | 0.006 | 0.013 |

| THB | 0.201 a | 0.015 | 0.017 | 0.013 |

| Variables | COVID-19 | Russia–Ukraine War | ||

|---|---|---|---|---|

| AGRO | 0.757 a | −0.008 a | 0.748 a | 0.020 a |

| CONS | 0.444 a | −0.181 a | 0.332 a | 0.140 a |

| FIN | 0.792 a | 0.017 a | 0.802 a | −0.011 a |

| IND | 0.744 a | −0.018 a | 0.739 a | −0.010 a |

| PRO | 0.834 a | −0.001 | 0.832 a | 0.004 c |

| RES | 0.838 a | 0.003 | 0.842 a | −0.010 a |

| SER | 0.824 a | 0.011 a | 0.829 a | 0.002 |

| TECH | 0.586 a | 0.007 | 0.606 a | −0.065 a |

| SPCE | 0.269 a | 0.013 a | 0.278 a | −0.013 a |

| Gold | 0.000 | 0.007 a | 0.000 | 0.010 a |

| Oil | 0.124 a | 0.006 a | 0.128 a | −0.005 a |

| BTC | 0.091 a | 0.004 | 0.091 a | 0.007 b |

| THB | 0.183 a | 0.047 a | 0.195 a | 0.029 a |

| Variables | AGRO | CONS | FIN | IND | PRO | RES | SER | TECH | SPCE | Gold | Oil | BTC | THB |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| b | a | b | |||||||||||

| b | c | b | a | a | b |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nittayakamolphun, P.; Bunnun, W.; Phong-a-ran, N.; Uttarin, R.; Pholkerd, P. Thailand Sustainability Investment Performance on Thailand’s Stock Market and Financial Assets. Int. J. Financial Stud. 2025, 13, 71. https://doi.org/10.3390/ijfs13020071

Nittayakamolphun P, Bunnun W, Phong-a-ran N, Uttarin R, Pholkerd P. Thailand Sustainability Investment Performance on Thailand’s Stock Market and Financial Assets. International Journal of Financial Studies. 2025; 13(2):71. https://doi.org/10.3390/ijfs13020071

Chicago/Turabian StyleNittayakamolphun, Pitipat, Wiwatwong Bunnun, Nathaporn Phong-a-ran, Raweepan Uttarin, and Panjamapon Pholkerd. 2025. "Thailand Sustainability Investment Performance on Thailand’s Stock Market and Financial Assets" International Journal of Financial Studies 13, no. 2: 71. https://doi.org/10.3390/ijfs13020071

APA StyleNittayakamolphun, P., Bunnun, W., Phong-a-ran, N., Uttarin, R., & Pholkerd, P. (2025). Thailand Sustainability Investment Performance on Thailand’s Stock Market and Financial Assets. International Journal of Financial Studies, 13(2), 71. https://doi.org/10.3390/ijfs13020071