1. Introduction

In the ever-evolving landscape of finance and banking, the application of agent-based modeling (ABM) has emerged as a powerful tool to unravel the complex dynamics of these sectors.

Financial markets, banking networks, and systemic risk management are characterized by interdependence (

Chinazzi & Fagiolo, 2013;

Acemoglu et al., 2015;

X. Liu, 2024), adaptive behaviors (

Farmer et al., 2012;

Mertzanis, 2014), and emergent phenomena that traditional analytical models often fail to capture effectively (

Ionescu et al., 2023;

Nica et al., 2024a).

Traditional models are frequently limited in their ability to simulate dynamic interactions and behavioral heterogeneity. In contrast, ABM enables the simulation of diverse agents with different decision-making rules, allowing for a more realistic exploration of market dynamics, financial stability, and risk propagation (

Khodabandelu et al., 2024;

Ionescu et al., 2024;

Fan et al., 2025).

Our study aims to provide a comprehensive bibliometric analysis of research on ABM in finance and banking, highlighting its evolution, key contributors, and thematic trends. By systematically analyzing a dataset of 489 scholarly articles extracted from the ISI Web of Science database spanning the years 2000 to 2024, this research offers a structured assessment of how ABM has influenced the study of financial systems. The bibliometric approach enables us to quantify the impact of this methodology, identifying research trends, prominent authors, institutional affiliations, and the most influential publications in the field.

ABM is a specific technique within the field of complexity science, as a key technique in economic cybernetics. It facilitates the simulation of agent behavior in virtual environments (

Wang et al., 2018), offering insights into the development of sustainable strategies and the anticipation of systemic risk.

In our research, we selected and analyzed papers focused on the application of ABM as a methodological tool for simulating and understanding the complex behaviors of financial and banking entities, as well as their interactions within the broader financial system. The selected papers were further analyzed using a bibliometric approach as suggested in similar studies (

Burak & Küsbeci, 2023;

Nguyen et al., 2023). For instance, a highly sensitive and majorly impactful phenomenon within financial institutions is financial contagion. To capture potential systemic risks that can underscore a financial contagion effect, numerous research studies employ agent-based modeling (

Gai & Kapadia, 2010;

Wang et al., 2018;

A. Liu et al., 2020), simulating interactions between banks or interactions among agents in a financial market.

A bibliometric analysis involves collecting and analyzing metadata from scientific publications to track the development of a research field over time (

El Bied et al., 2024;

Garg et al., 2023;

Milosavljević et al., 2023;

Nica et al., 2024b;

Sahid et al., 2023). This includes evaluating publication trends, citation patterns, co-authorship networks, and keyword dynamics. By employing robust bibliometric techniques, this study contributes to a deeper understanding of the role that ABM plays in financial and banking research, offering insights into emerging trends and key areas of impact.

While bibliometric analysis primarily relies on citation data, we acknowledge its limitations in fully capturing the conceptual significance of scientific contributions. To address this, we complement the quantitative indicators with a critical synthesis of the most cited papers, highlighting not only their visibility but also their substantive contributions to ABM applications in finance and banking. Moreover, this study goes beyond a simple ranking of the most cited works. While citation-based metrics are useful, they can be distorted by social dynamics such as citation cascades, academic trends, or disciplinary herding behaviors. Therefore, our analysis integrates quantitative metrics with qualitative assessments to provide deeper contextual insights. We place highlighting not only on substantially cited publications but also on studies with methodological innovation or thematic relevance, even if less cited. This dual approach ensures added value by identifying influential yet potentially under-recognized contributions, offering a more comprehensive and balanced mapping of the field.

To structure our investigation, we define the following research questions (RQs):

- ➢

RQ1: How has the academic literature on ABM in finance and banking evolved in terms of theoretical focus, methodological development, and empirical validation over the past two decades?

- ➢

RQ2: Who are the key authors, institutions, and journals that have most influenced the development of agent-based modeling in finance and banking?

- ➢

RQ3: What patterns of international collaboration can be observed in the ABM research community, and how do these collaborations contribute to knowledge diffusion and interdisciplinary integration?

- ➢

RQ4: What are the dominant and emerging thematic clusters in the ABM-related financial literature, and how do they reflect the methodological innovations and policy relevance of ABM in addressing financial complexity?

Addressing these research questions is important for understanding how ABM has been adopted in financial research and where it is headed in the future. This study contributes to the scientific literature in three key ways. First, it provides a quantitative evaluation of the evolution of ABM in finance and banking, offering a data-driven perspective on its impact. Second, it identifies leading scholars and institutions, helping to map the intellectual structure of the field. Third, it uncovers emerging research trends and methodological developments, shedding light on potential gaps and future opportunities for innovation.

By systematically assessing the development of ABM in financial research, this study not only enhances our understanding of how this methodology has shaped financial modeling but also provides guidance for researchers, policymakers, and practitioners interested in leveraging ABM for decision making and risk management in financial systems. The insights derived from this bibliometric analysis can serve as a foundation for further interdisciplinary collaborations, fostering advancements in financial cybernetics, systemic risk analysis, and adaptive economic modeling, offering valuable evidence for both researchers and policymakers seeking robust tools for regulatory design and systemic resilience.

This research is structured as follows:

Section 2 presents the current state of knowledge regarding the use of ABM, particularly in the financial and banking domain, with the aim of providing a comprehensive and clear overview of the utility of employing agent-based modeling.

Section 3 outlines the initial steps taken in building the database required for the bibliometric analysis, which will be utilized in

Section 4. This constitutes the practical part of this study, which includes the proposed bibliometric analysis.

Section 5 synthesizes and discusses the main research directions identified in the bibliometric analysis, grouping them into key thematic areas that highlight the role of ABM in financial market analysis, risk management, monetary policy, banking system stability, and emerging trends.

Section 6 concludes this research, incorporating discussions, limitations, and future research directions.

2. The Stage of Knowledge in the Field

ABM represents a method employed to simulate the actions and interactions of diverse individuals and organizations, with the objective of uncovering the underlying principles governing their collective conduct. ABM provides an alternative to traditional modeling techniques, which frequently rely on equation-based representations to describe specific events or phenomena. The transformative essence of ABM lies in its emphasis on characterizing the subject under investigation by focusing on individual agents and their intricate interactions (

Steinbacher et al., 2021). As it has evolved, ABM has found diverse applications across various domains (

Delcea & Chirita, 2023), including the financial and banking sector (

Chakraborti et al., 2011;

A. Liu et al., 2020;

Steinbacher et al., 2021).

ABM is employed across a considerable range of scientific areas, remaining a widely accepted approach due to the increasing computational power that contributes to the ease of modeling social interactions (

Steinbacher et al., 2021;

Mehdizadeh et al., 2022), the ability to employ decision rules (

Monti et al., 2023), the importance of ensuring the stability of financial systems (

Loomis et al., 2009;

Wellman & Wah, 2017), and the advancements in the development, implementation, validation, and calibration of agent-based models that offer a robust and holistic perspective on their fit with empirical data (

Ionescu et al., 2023;

Nica et al., 2024a).

The fields of applicability for the ABM methodology are vast, and they include, but they are not limited to, the electricity market (

Zhou et al., 2007), dynamic optimization problems (

Baykasoglu & Durmusoglu, 2014), modeling and simulation (

Railsback et al., 2006;

Gürcan et al., 2013;

El-Amine et al., 2017), global sensitivity analysis (

Fonoberova et al., 2013), travel behavior and transport planning (

Sunitiyoso, 2017;

Kagho et al., 2020;

Delcea & Chirita, 2023), airplane boarding strategies (

Delcea et al., 2018;

Milne et al., 2019;

Cotfas et al., 2020), complex adaptive systems (

Zhang & Li, 2010;

Kanzari & Said, 2023), social learning (

Steinbacher et al., 2021) (

Sunitiyoso, 2017), financial network (

Gai & Kapadia, 2010;

Wellman & Wah, 2017;

Neri, 2023;

Wang et al., 2018;

Westphal & Sornette, 2023), banking systems (

Braun, 2023;

Chan-Lau, 2017), etc.

Economic activity networks, such as those related to transportation, telecommunications, energy, and commerce, are integral to modern society, enabling the flow of vehicles, messages, fuel, and goods. When studying the behavior of economic systems at the national or global level, banks emerge as sensitive institutions with a significant impact on the entire system. The 2007–2009 financial crisis stands as a prominent example of how the interconnection of financial institutions can create systemic risks that reverberate throughout the global economy. When a highly interconnected institution experiences losses due to adverse events, its counterparts may also incur losses and encounter difficulties in accessing liquidity. Consequently, economists and decision makers have sought ways to regulate financial networks and analyze systemic risks.

Viewed as a complex adaptive system, the bank exhibits all the properties of such systems, highlighting that all significant economic systems, regardless of their functions and structures, are complex adaptive systems. Therefore, the banking system plays an essential role in the economy (

Chan-Lau, 2017;

Gupta & Jain, 2022), considering its functions and nature. It serves as a financial intermediary that helps facilitate the circulation of capital and lending, contributing to economic growth. Additionally, the banking system offers products and services that enable businesses to manage specific financial risks, such as hedging instruments. Furthermore, banks contribute to maintaining the stability of the financial system, ensuring that transactions occur efficiently and that risks are managed appropriately.

The International Monetary Fund (IMF) (

Chan-Lau, 2017) released a research paper introducing a simple modular agent-based model called ABBA. Its purpose is to analyze risks and interactions within the banking system. The IMF’s study acknowledges that employing ABM instead of the commonly used highly aggregated models by central banks allows for the consideration of heterogeneity and adaptive behavior within the banking system. The ABBA model can capture the dynamics of a traditional banking system, where banks attract deposits and interbank loans are utilized to address liquidity shortfalls.

Another study conducted by

Jalilian et al. (

2021) suggests the use of ABM to optimize specific service processes within the supply chain of Tejarat Bank, a major bank in Iran. It identifies the most efficient processes within the banking supply chain, analyzes their interactions, and conducts ABM in a simulated environment. The simulation results are analyzed using the Taguchi experimental method to present selected combinations of elements from the integrated marketing communications program aimed at reducing Tejarat Bank’s liquidity risk. Another research perspective is conducted by

Peters et al. (

2022), emphasizing the emerging discussions in macroeconomics regarding alternative monetary systems and their impact on systemic risk in advanced financial systems. The authors have identified the economic requirements for modeling the current monetary system in their research and introduced a macroeconomic agent-based model in a continuous-time stochastic agent-based simulation environment. This model serves as a starting point for exploring and analyzing monetary reforms and addresses the impact of the monetary system on banks’ lending capacity and the dynamics of financial crises. Through the model, emergent dynamics of financial crises can be replicated, institutional changes within a financial system can be analyzed, and macro-financial stability can be measured. The simulation environment used makes the model more accessible and facilitates the assessment of the impact of different hypotheses and mechanisms in a less complex manner. Additionally, the model reproduces a wide range of stylized economic facts, validating it as an analysis tool for implementing and comparing changes in the monetary regime.

Another study focuses on analyzing the residual financial contagion effect and employs ABM to construct simulations that illustrate how the residual financial contagion effect propagates within the banking network in Romania (

Ionescu et al., 2023). The simulations have highlighted the significant importance of the degree of connectivity among commercial banks in Romania and the way they are interconnected in the emergence and propagation of contagion effects.

Banking systems are carefully monitored by specific authorities, and sensitive topics are closely analyzed and researched. For example, the European Central Bank (

Halaj, 2018) published a working paper in which they created an agent-based model that focuses on systemic aspects of liquidity and its connections with solvency, analyzing relevant interactions between market participants in an agent-based model. The model was evaluated using data from the 2014 EU stress test, covering all major banking groups in the EU. Additionally, the potential amplification role of asset managers is considered in a stylized manner. The study focuses on identifying the channels through which funding shocks can spread throughout the entire financial system.

ABM plays an essential role in understanding and enhancing various aspects of the financial and banking sector. This modeling technique offers an alternative to conventional approaches, which often rely on equation-based representations, allowing researchers to focus on characterizing economic systems through individual agents and their complex interactions. In the context of financial and banking systems, this modeling approach is crucial for addressing systemic risks, liquidity dynamics, and solvency conditions. It enables researchers to consider the complexities arising from heterogeneity and adaptive behaviors within the banking system.

Moreover, ABM has broad applications across diverse fields and remains a widely accepted approach due to advances in computational power, modeling social interactions, employing decision rules, and the necessity of ensuring financial system stability. It provides a holistic perspective on the models’ fitness with empirical data, making it a valuable tool for research and policy development.

3. Materials and Methods

Bibliometric analysis relies on statistical tools and specialized software to extract, process, and interpret data related to scientific production. This method should provide an objective overview of the evolution of a research field, the contributions of authors or institutions to it, as well as identify future research directions and opportunities. In our study’s bibliometric analysis, we used the R Studio (version 2024.12.1+563) software application, the bibliometrix package (version 4.3.3), and the “biblioshiny()” function. The “biblioshiny()” (

Kemeç & Altınay, 2023) function provides us with a wide range of functionalities for the proposed bibliometric analysis. It offers the possibility to extract bibliometric data from various sources such as Scopus, Web of Science, and it can generate bibliometric indicators such as the number of publications, the H-index, the number of citations, etc. Comparative analyses can be performed, results can be visualized using interactive graphics such as network maps, diagrams, geographic maps, and it also provides the ability to export these results.

The bibliometric approach found applications across multiple fields, particularly in notable studies related to finance (

Ahmed & Hussainey, 2023), artificial intelligence (

Delcea & Cotfas, 2023;

Li et al., 2023;

Jing et al., 2023), big data (

Burak & Küsbeci, 2023), risk (

Nguyen et al., 2023), and ABM (

Trinidad Segovia et al., 2022;

Romero et al., 2023).

Using the Web of Science (WoS) (

WoS: Web of Science, n.d.) platform, papers within the scope of ABM in finance and banking were extracted. Although other databases such as Scopus offer broad coverage, the Web of Science Core Collection was selected to maintain consistency in indexing standards, citation metrics, and journal classification. This decision aligns with practices found in previous bibliometric studies (

Visser et al., 2021), which highlight the use of a single well-structured database to minimize metadata inconsistencies and avoid duplication. Furthermore, the WoS Core Collection is widely recognized for its stringent selection criteria, enhancing the reliability and impact of the included publications. The analysis took place in multiple steps, emphasizing a rigorous approach to identifying relevant works. Titles, abstracts, and keywords were used to cover various aspects of each paper. The first step describes the keywords found in titles. These are used to identify relevant works in the field of ABM in finance and banking. These keywords are closely related to the research subject and were used to filter works by relevance. A variety of specific finance and banking domain keywords, as well as ABM-related keywords, were included. This selection process helps in identifying and analyzing works that address how ABM is used in the financial and banking context.

In the second step, we used keywords from abstracts to complement the process of identifying relevant works. In this stage, the abstracts of the works were examined to identify keywords that relate to the subject of ABM in finance and banking. Keywords from abstracts are important to ensure a more comprehensive coverage of the topic and to ensure that the selected works are thematically significant. Thus, both title and abstract keywords are used in a complementary manner to select and evaluate works within the bibliometric analysis.

The third step analyzes the keywords associated with each work to identify those that contain specific finance and banking domain keywords. This step is important to focus on works that have a direct connection to the field of interest, namely, ABM in finance and banking. The keywords of each work were examined, and those works that contain keywords related to finance and banking were retained for further analysis. Therefore, this step contributes to ensuring the relevance and suitability of the selected works for the objective of bibliometric analysis regarding ABM in the financial and banking domain.

The analysis of work titles to identify those containing specific finance and banking domain keywords was carried out in the fourth step. This step builds upon the previous three steps by applying a stricter logical filter (‘AND’) across the title, abstract, and keyword fields. This ensured that only those documents that consistently reference both ABM and financial/banking topics across all metadata components were retained. It acts as a convergence step, narrowing the corpus to highly relevant studies. By examining titles, relevant words or terms were sought that indicate a direct connection to the subject of ABM in finance and banking.

Step five involves selecting works written only in the English language, which is the international language of scientific communication, facilitating access to a wider range of resources and citations. Step six involves the selection of document types for analysis. In the case of bibliometric analysis of research papers, the selection was limited to scientific articles. This was carried out to ensure that the analysis focused on academic works that made significant contributions to the field of ABM in finance and banking. In step seven, a temporal limitation was applied to exclude works published in the year 2025. In step 8, a manual screening process was conducted to validate the thematic alignment of all remaining documents with the core research scope. Articles that, despite matching keywords, focused on unrelated domains (e.g., agent-based modeling in biology, agriculture, or ecology) were excluded after inspecting titles, abstracts, and keywords. This step improved the validity and thematic precision of the final corpus, which was reduced to 489 highly relevant articles.

For better readability, the main keywords used in each query from

Table 1 can be grouped into two core domains:

- ➢

Finance and Banking-related keywords, including the following: banking, bank, credit risk, financial markets, financial stability, capital markets, stock market, corporate finance, market volatility, interest rates, investments, financial derivatives, fintech, behavioral finance, financial contagion, and portfolio management.

- ➢

Agent-Based Modeling-related keywords, including the following: agent-based model, agent-based modeling, agent-based models, agent-based modelling.

Table 1.

Data selection steps.

Table 1.

Data selection steps.

| Exploration Steps | Questions on Web of Science | Description | Query | Query Number | Count |

|---|

| 1 | Title | Contains one of the finance and banking specific keywords | ((((((((((((((((((((((((((((TI = (banking)) OR TI = (portfolio_management)) OR TI = (financial_markets)) OR TI = (asset_pricing)) OR TI = (bank)) OR TI = (banks)) OR TI = (financial_stability)) OR TI = (credit_risk)) OR TI = (interest_rate)) OR TI = (interest_rates)) OR TI = (investments)) OR TI = (portfolios_management)) OR TI = (financial_market)) OR TI = (capital_market)) OR TI = (capital_markets)) OR TI = (corporate_finance)) OR TI = (financial_derivatives)) OR TI = (fintech)) OR TI = (behavioral_finance)) OR TI = (behavioural_finance)) OR TI = (financial_planning)) OR TI = (financial_contagion)) OR TI = (market_volatility)) OR TI = (financial_bubble)) OR TI = (financial_bubbles)) OR TI = (credit_loss)) OR TI = (stock_market)) OR TI = (stock_markets)) OR TI = (financial_volatility) | #1 | 211,685 |

| Contains one of the agent-based modeling specific keywords | (((TI = (“agent-based modeling”)) OR TI = (“agent-based modelling”)) OR TI = (“agent-based model”)) OR TI = (“agent-based models”) | #2 | 5791 |

| Contains #1 and #2 | #1 AND #2 | #3 | 113 |

| 2 | Abstract | Contains one of the finance and banking specific keywords | ((((((((((((((((((((((((((((AB = (banking)) OR AB = (portfolio_management)) OR AB = (financial_markets)) OR AB = (asset_pricing)) OR AB = (bank)) OR AB = (banks)) OR AB = (financial_stability)) OR AB = (credit_risk)) OR AB = (interest_rate)) OR AB = (interest_rates)) OR AB = (investments)) OR AB = (portfolios_management)) OR AB = (financial_market)) OR AB = (capital_market)) OR AB = (capital_markets)) OR AB = (corporate_finance)) OR AB = (financial_derivatives)) OR AB = (fintech)) OR AB = (behavioral_finance)) OR AB = (behavioural_finance)) OR AB = (financial_planning)) OR AB = (financial_contagion)) OR AB = (market_volatility)) OR AB = (financial_bubble)) OR AB = (financial_bubbles)) OR AB = (credit_loss)) OR AB = (stock market)) OR AB = (stock_markets)) OR AB = (financial_volatility) | #4 | 636,922 |

| Contains one of the agent-based modeling specific keywords | (((AB = (“agent-based modeling”)) OR AB = (“agent-based modelling”)) OR AB = (“agent-based model”)) OR AB = (“agent-based models”) | #5 | 12,784 |

| Contains #4 and #5 | #4 AND #5 | #6 | 899 |

| 3 | Keywords | Contains one of the finance and banking specific keywords | ((((((((((((((((((((((((((((AK = (banking)) OR AK = (portfolio_management)) OR AK = (financial_markets)) OR AK = (asset_pricing)) OR AK = (bank)) OR AK = (banks)) OR AK = (financial_stability)) OR AK = (credit_risk)) OR AK = (interest_rate)) OR AK = (interest_rates)) OR AK = (investments)) OR AK = (portfolios_management)) OR AK = (financial_market)) OR AK = (capital_market)) OR AK = (capital_markets)) OR AK = (corporate_finance)) OR AK = (financial_derivatives)) OR AK = (fintech)) OR AK = (behavioral_finance)) OR AK = (behavioural_finance)) OR AK = (financial_planning)) OR AK = (financial_contagion)) OR AK = (market_volatility)) OR AK = (financial_bubble)) OR AK = (financial_bubbles)) OR AK = (credit_loss)) OR AK = (stock_market)) OR AK = (stock_markets)) OR AK = (financial_volatility) | #7 | 149,006 |

| Contains one of the agent-based modeling specific keywords | (((AK = (“agent-based modeling”)) OR AK = (“agent-based modelling”)) OR AK = (“agent-based model”)) OR AK = (“agent-based models”) | #8 | 10,130 |

| Contains #7 and #8 | #7 AND #8 | #9 | 266 |

| 4 | Title/Abstract/Keywords | Contains one of the agent-based modeling in finance and banking specific keywords | #3 OR #6 OR #9 | #10 | 1072 |

| 5 | Language | Limit to English | (#10) AND LA = (English) | #11 | 1063 |

| 6 | Document Type | Limit to Article | (#11) AND DT = (Article) | #12 | 805 |

| 7 | Year | Exclude 2025 | (#12) NOT PY = (2025) | #13 | 789 |

| 8 | Manual relevance screening | Excluded documents unrelated to agent-based modeling in financial or banking contexts based on title, abstract, and keywords. Only publications aligned with the research scope were retained. | Manual step | #14 | 489 |

Full search queries are retained in

Table 1 to ensure methodological transparency and allow for future reproducibility of the data collection process.

Table 1 presents the steps for extracting the articles’ database needed in the bibliometric analysis concerning ABM in finance and banking:

In the title field, a total of 211,685 documents were identified that contain specific keywords related to finance and banking, while 5791 documents contain ABM keywords. The combination of these criteria yielded 113 documents.

In the abstract field, 636,922 documents contain finance and banking keywords, and 12,784 contain ABM keywords. The intersection of these criteria resulted in 899 documents.

In the keywords field, 149,006 documents contain finance and banking keywords, and 10,130 contain ABM keywords. The combination of these criteria yielded 266 documents.

The search of title, abstract, and keywords yielded 1072 documents that contain ABM in finance and banking specific keywords.

Further refinement was performed by limiting the documents to the English language, resulting in 1063 documents.

The document type was further narrowed down to articles, resulting in 805 documents.

To exclude documents from the year 2025, 489 documents were retained for the analysis. Refining the documents to 489 articles (by excluding non-essential documents, including those from 2025) ensures that the bibliometric analysis focuses only on the established literature, without the influence of recent fluctuations or articles not yet fully validated through peer review.

The increasing use of ABM in the financial and banking domain is reflected in a significant number of studies mentioning ABM in the title, abstract, or keywords, as later illustrated in

Figure 1. The significantly higher number of articles referencing ABM in abstracts (899) compared to titles (113) suggests that, in many cases, authors incorporate ABM as an analytical framework or tool embedded within broader financial topics, rather than the sole focus of the research.

Following initial extraction and filtering steps, by field, language, document type, and publication year, a number of 789 articles was identified. However, to ensure thematic precision and alignment with the specific scope of this research (ABM applied strictly in finance and banking), a final manual relevance screening was conducted. This involved reviewing titles, abstracts, and keywords to exclude studies where ABM was applied in unrelated domains (e.g., biology, ecology, agriculture, etc.).

As a result, the final dataset was refined to 489 documents, representing a focused and high-quality body of literature. This curated selection reflects a clearly defined yet expanding niche at the intersection of ABM and finance/banking, offering a solid foundation for conducting a bibliometric analysis and mapping the intellectual landscape of this interdisciplinary field.

4. Dataset Analysis

The papers that have been worked with were extracted from Web of Science, as they were related to the area of ABM in finance and banking. In the following sections, these have been discussed with regard to their sources, authors, and citations.

4.1. Dataset Overview

Comprehensive details about the dataset considered can be found from

Table 2,

Table 3,

Table 4 and

Table 5. Papers selected for the analysis were published between 2000 and 2024 and distributed across a number of 180 journals, according to

Table 2. The average age of the documents is 8.36 years, which indicates a moderate temporal distribution between older and more recent publications. The average citations per document (12.98) and average yearly citation rate (1.08) suggest constant and consistent academic interest over time. with regard to the references, 15,540 have been recorded in the selected titles.

When it comes to the document contents, we can mention that the number of Keywords Plus (automatically generated index based on the titles of the articles that have been cited) is equal to 785, whereas the authors’ keywords register a value of 1200 (see

Table 3). The higher number of authors’ keywords compared to Keywords Plus suggests that researchers use a wide range of specific terms to describe their work. This indicates a diversity of research directions and methodological perspectives regarding the application of ABM in finance and banking. Keywords Plus are automatically generated based on the titles of cited references (

Uddin & Khan, 2016), which means that they often reflect generalized themes rather than the precise focus of the articles. Since authors’ keywords are chosen directly by the researchers, they tend to be more detailed and context-specific, capturing nuanced topics such as particular modeling techniques or case studies. As such, the prevalence of tailored author-defined keywords highlights the heterogeneous and interdisciplinary nature of this emerging field, underscoring its potential for further specialization and thematic depth.

Table 3.

Document contents.

Table 3.

Document contents.

| Indicator | Value |

|---|

| Keywords Plus | 785 |

| Authors’ keywords | 1200 |

According to

Table 4, the dataset includes a total of 991 authors, with 94 authors contributing to single-authored documents and 897 authors participating in multi-authored publications. The significant gap between the number of single-authored and multi-authored contributions highlights the highly collaborative nature of research on ABM in finance and banking. The overwhelming majority of authors are engaged in joint research efforts, suggesting that the field requires interdisciplinary collaboration, likely integrating expertise from computational modeling, finance, and economics. The relatively low number of single-authored papers suggests that independent contributions are less common, possibly due to the technical and methodological complexity of ABM-based studies. This reinforces the idea that team-based research is essential for advancing knowledge in this domain.

Table 4.

Authors.

| Indicator | Value |

|---|

| Authors | 991 |

| Authors of single-authored documents | 94 |

| Authors of multi-authored documents | 897 |

Based on

Table 5, the analysis of author collaboration in ABM research for finance and banking reveals several key insights. For example, single-authored documents represent a relatively small portion of the total research output, further reinforcing the idea that studies in this field are predominantly collaborative. The average number of authors per document suggests that most papers are written by small research teams rather than large research groups. This indicates that, while collaboration is common, it typically involves focused, smaller teams rather than large-scale groups. The average number of co-authors per document is higher than the average number of authors per document, suggesting that some authors contribute to multiple papers or collaborate across different projects. This may reflect a dense and interconnected research network, where researchers frequently co-author studies with various colleagues. International co-authorships indicate that more than a third of the studies involve researchers from multiple countries. This highlights the global nature of ABM research in finance and banking, demonstrating that knowledge exchange across borders is a key driver of innovation and methodological advancements in this domain. Overall, the data suggest that, while ABM research in finance and banking is highly collaborative, it is primarily conducted in small to mid-sized teams with a notable degree of international cooperation. Future research could explore geographical distribution, key institutions, and co-authorship networks to further understand the evolution of collaboration patterns in this field.

Table 5.

Author collaborations.

Table 5.

Author collaborations.

| Indicator | Value |

|---|

| Single-authored documents | 94 |

| Authors per document | 2.02 |

| Co-authors per documents | 2.71 |

| International co-authorships (%) | 33.33 |

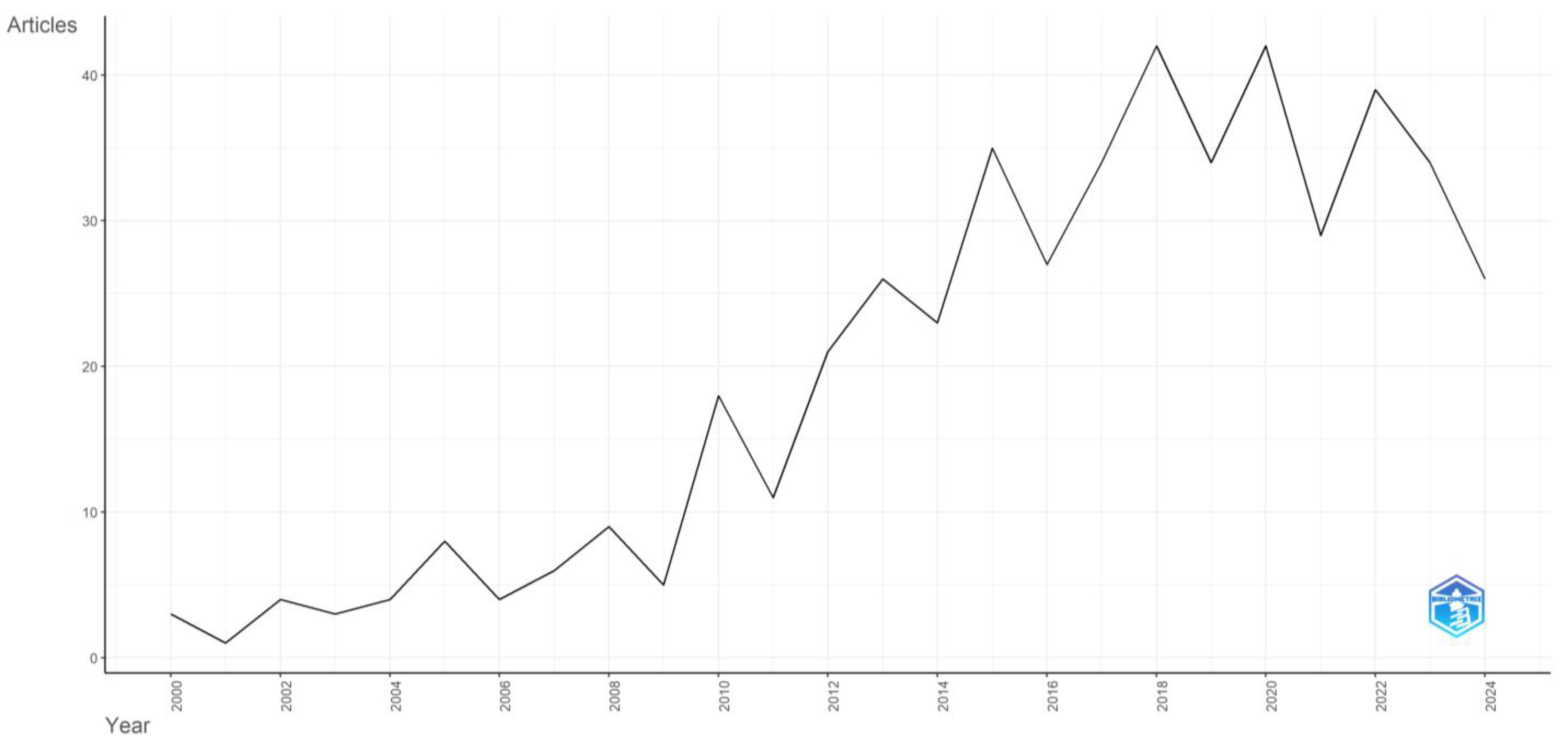

Figure 1 illustrates the annual scientific production of articles related to ABM in finance and banking over the period 2000–2024. The data show a gradual increase in research output, with a notable growth acceleration after 2011. The highest volume in publication is observed in 2018, respectively, 2022 (42 articles), indicating a heightened interest in the field. Despite slight fluctuations in recent years, the overall trend suggests a maturing and expanding research domain, reflecting the growing significance of ABM in financial studies.

Figure 2 presents the yearly average number of citations for publications addressing agent-based modeling (ABM) in finance and banking. The trend line reveals notable fluctuations, with a visible increase in 2001, suggesting that early contributions in this field received substantial attention, likely due to the pioneering nature of those studies. In contrast, the period between 2004 and 2020 is marked by relatively stable but modest citation levels, indicating that, while the field matured, no single publication dominated scholarly attention. A brief citation rebound is observed around 2021, possibly reflecting renewed interest in ABM during periods of financial uncertainty. However, average citations decline again in 2022–2024, which can be attributed to citation lag, as recent publications have had limited time to be cited. Overall, this citation pattern highlights the importance of both timing and topic relevance in influencing scholarly impact within this niche domain.

4.2. Sources

The data presented in

Figure 3 highlight the prominent journals where papers related to ABM in finance and banking have been published.

Physica A-Statistical Mechanics and its Applications stands out as the leading journal in terms of the number of papers, with a total of 41 publications. It is followed closely by two other journals, namely, the

Journal of Economic Interaction and Coordination with 36 publications and the

Journal of Economic Dynamics & Control with 32 publications. This suggests that ABM research is often published in journals that focus on complex systems, economic modeling, and computational economics. Other significant contributors include the

Journal of Economic Behavior & Organization (22),

JASSS–The Journal of Artificial Societies and Social Simulation (19), and

PLOS ONE (19) underlining the interdisciplinary and open-access nature of ABM research dissemination. Journals such as

Computational Economics,

Quantitative Finance, and

Economic Modelling also play key roles in advancing ABM applications, particularly in modeling financial market behavior and systemic dynamics.

The broad spectrum of journals, from evolutionary economics to complexity science and simulation, demonstrates that ABM research in finance and banking is positioned at the intersection of economics, computation, and complex adaptive systems, making it highly versatile and applicable across domains.

Bradford’s law, as explained by

Nash-Stewart et al. (

2012), classifies journals into three distinct categories based on their citation patterns. Bradford’s Law is a fundamental bibliometric principle that examines the dispersion of scientific publications within a specific research domain (

Nica et al., 2024b;

Peritz, 1990). It organizes sources into distinct zones according to their publication frequency, highlighting that a small number of highly influential sources account for the majority of published articles (

Desai et al., 2018). In the first category, known as “Zone 1”, are a select few journals that hold significant influence, frequently appearing in citations within the scientific literature. The second category, “Zone 2”, encompasses journals with moderate productivity, receiving an average number of citations. Finally, the third category, “Zone 3”, represents a larger group of sources characterized by diminishing productivity, as they are rarely cited in academic works. This classification system underscores the varying degrees of importance and impact that journals hold within the academic sphere.

Applying Bradford’s law against the selected paper, it can be seen in

Figure 4 that Zone 1 includes a total number of six sources (

Physic A-Statistical Mechanics and its Applications, Journal of Economic Interaction and Coordination, Journal of Economic Dynamics & Control, Journal of Economic Behavior & Organization, JASSS–The Journal of Artificial Societies and Social Simulation, and

PLOS One).

Furthermore, the influence and significance of these journals have been thoroughly assessed by utilizing the H-index indicator. The H-index is a metric that indicates the number of articles published within a journal that have garnered a minimum of H citations each.

Figure 5 presents the local impact of journals publishing research on ABM in finance and banking, measured using the H-index. The

Journal of Economic Dynamics & Control has the highest impact, indicating that its published articles on ABM in finance and banking have received the most citations, making it a key reference in the field. Other high-impact journals include the

Journal of Economic Behavior & Organization, the

Journal of Economic Interaction and Coordination, and

Physica A: Statistical Mechanics and Its Applications, suggesting that ABM research is well established in economics, behavioral finance, and statistical mechanics.

As anticipated, the journals classified within Zone 1 according to Bradford’s law continue to affirm their prominence when considering the H-index. These journals managed to achieve H-index values ranging from 3 to 17, further highlighting their significance and impact in the considered field for this paper.

With regard to the growth registered by considering the number of published papers in the area of study, the data in

Figure 6 were obtained for the top-6 journals. As expected, the journal that stood out from a growth perspective is

Physica A-Statistical Mechanics and its Applications, followed by the

Journal of Economic Interaction and Coordination and the

Journal of Economic Dynamics & Control.

4.3. Authors

Figure 7 presents the top contributing authors in the field of ABM applied to finance and banking, based on the number of publications within the analyzed dataset. The most prolific author is Gallegati M, with 13 publications, followed closely by Roventini A (12) and Napoletano M (10). These authors are well known for their work in complex economic systems and macroeconomic modeling using ABM techniques, suggesting a consistent and influential contribution to this interdisciplinary research domain.

Other notable contributors include Sornette D (9 publications), Dosi G (7), and Feldman T, Kononovicius A, and Gontis V (each with 7), all of whom have played a significant role in advancing theoretical and applied aspects of ABM in economic systems.

The presence of numerous authors with five to six publications (e.g., Farmer JD, Lux T, Raberto M) reflects a broader community of experts actively shaping this research landscape. The balanced distribution of publication counts among top authors indicates a healthy, collaborative field with multiple centers of expertise rather than domination by a single research group.

Overall, this author productivity analysis highlights a core network of scholars whose work has significantly shaped the theoretical foundations and real-world applications of ABM in financial and banking contexts. These individuals may also represent key nodes in future collaboration networks or citation analyses.

Building upon the insights from

Figure 7, which identified the most productive authors in ABM applied to finance and banking,

Figure 8 provides a temporal dimension to their scholarly contributions. It visualizes both the number of articles published (bubble size) and their total citations per year (TC per Year) (color intensity), mapped across time. Authors such as Gallegati M, Roventini A, and Napoletano M not only lead in publication count but also exhibit sustained and highly cited contributions over multiple years, highlighting their long-term influence and consistent presence in the field. The darker shades and larger bubbles associated with their names in recent years (especially 2015–2021) confirm their work’s continued relevance.

Additionally, authors like Sornette D, Farmer JD, and Lux T may have fewer total publications but show notable citation density in specific years, indicating impactful, possibly seminal, studies. Meanwhile, authors such as Kononovicius A, Gontis V, and Feldman T demonstrate a more recent emergence, suggesting a new generation of contributors actively shaping current research trajectories.

Together,

Figure 7 and

Figure 8 describe a research domain characterized by both established thought leaders and emerging scholars, reflecting a dynamic and evolving intellectual ecosystem in the study of ABM in finance and banking.

Figure 9 provides a listing of the leading 17 affiliations associated with the authors of the selected papers. The chart displays the number of articles published by various universities and research institutions. Leading the ranking is Scuola Superiore Sant’Anna with 21 articles, followed by the University of Oxford (18) and Centre National de la Recherche Scientifique (CNRS) (17). Other major contributors include Marche Polytechnic University (16), Catholic University of the Sacred Heart and Université Côte d’Azur (14 each), and Boston University (13).

Institutions such as ETH Zurich, Swiss Federal Institutes of Technology Domain, and the University of Kiel also show strong research engagement with 12–13 publications. The list further includes prestigious universities from Asia and North America, such as Beijing Normal University, Chinese Academy of Sciences, and the Santa Fe Institute, emphasizing the global and interdisciplinary interest in ABM for financial and banking systems.

This institutional distribution demonstrates that research in this field is not limited to one region or continent but rather spans across Europe, Asia, and North America, reflecting a widespread academic commitment to understanding and simulating financial complexities through agent-based approaches.

Figure 10 illustrates the distribution of publications on agent-based modeling in finance and banking by country, distinguishing between national (SCP) and international (MCP) collaborations. China leads with the highest number of publications, showing a strong balance between domestic and international research. Italy and the USA follow, with Italy notably engaged in cross-border collaborations. Germany and the UK also contribute significantly, though Germany shows more national output. Overall, the figure highlights both the geographic spread and the collaborative intensity of research, indicating that ABM in finance is a globally relevant and increasingly interconnected field.

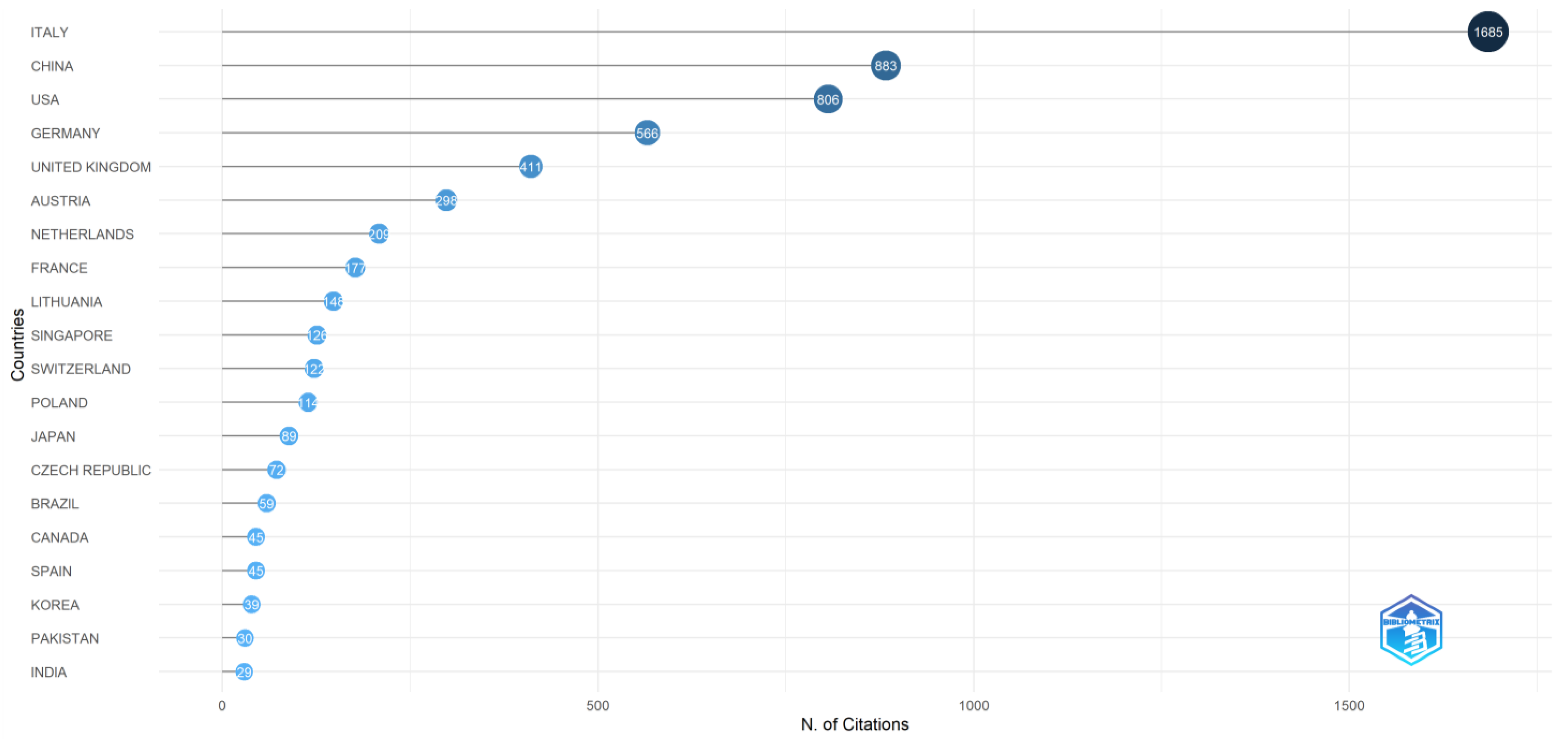

Examining current trends in scientific research, we note that Italy leads with 1685 citations for papers by its researchers, followed by China at 883 citations and USA at 806, as illustrated in

Figure 11. When considering average citations per paper, Italy averages 23.40, while China records an average of 11.30, and USA scores an average of 14.10 citations per article. These figures provide insights into the evolving landscape of global research and publication impact.

From the collaborations’ network perspective,

Figure 12 showcases the country collaboration map. The shading of countries (in blue) represents the volume of research output (darker shades indicate higher publication counts). Lines between countries represent international research collaborations, with thicker lines indicating stronger collaboration ties. Notably, the USA, China, and several European countries (UK, Germany, France, and Italy) serve as the main hubs of research collaboration.

Building on the previous analysis,

Figure 13 presents a collaboration network among countries, with node size indicating the number of publications and link strength representing co-authorship intensity. Italy emerges as a central hub in this network, maintaining strong collaborative ties with China, the USA, the UK, and Germany. The density of connections around Italy highlights its central role in fostering international cooperation in agent-based modeling research within the finance and banking domain. Clusters of countries with similar collaboration patterns are also visible, highlighting the formation of regional and thematic collaborations in this field.

4.4. Analysis of the Literature

In our study, we initially focused on the top seven most cited papers. These papers were examined for various aspects, including authorship, country of origin, citation counts, citations per year, and more. Furthermore, each paper was summarized to provide insights into the key areas explored in the analysis of ABM within finance and banking. Additionally, we extended our analysis to encompass the entire dataset of papers. We extracted the most frequently used words, generating word clouds and tracking word dynamics to observe prevalent topics and trends. These findings are presented in the subsequent sections.

4.4.1. Top 8 Most Cited Papers–Overview

Table 6 presents the top eight most cited papers, featuring key details such as the lead author’s name, publication year, journal, and the number of authors. The eight most cited papers were selected to provide an in-depth look at influential contributions based on both impact (citations) and conceptual relevance. The selection balances visibility with thematic diversity, enabling a better understanding of how ABM has been applied in different financial context. Additionally, the table includes total citations (TCs) and introduces two important metrics: total citations per year (TCYs) and normalized TCs (NTCs). TCY calculates the annual citation rate, while NTC ensures the equitable attribution of citations to all authors referencing a document.

The most cited work is by

Battiston et al. (

2021), with 193 citations and the highest normalized citation (NTC = 12.22), indicating recent and intense scholarly attention. Classic contributions such as

Mike and Farmer (

2008) and

Chen and Yeh (

2001) also stand out, showing long-term impact with high citation volumes. Several papers were published in the

Journal of Economic Dynamics and Control, confirming its role as a key outlet in this research field. Overall, the selected articles reflect both foundational and emerging contributions, providing a mix of methodological innovation and application across financial systems.

Considering the refined dataset of 489 papers retrieved using specific keywords relevant to ABM in finance and banking, the citation performance of the top-cited articles highlights their significant impact within the field. On average, these highly cited papers involved 2.88 authors, with individual articles co-authored by two to five researchers. This suggests a balanced level of collaboration, where influential contributions stem both from small, focused teams (e.g., Mike and Farmer, Chen and Yeh, Gilli and Winker–each with two authors) and more interdisciplinary groups (e.g., Lamperti et al. with 5 authors and Battiston et al. with 3). The variation in team size reflects both methodological depth and collaborative breadth within top-tier research on agent-based modeling in financial systems.

4.4.2. Top 8 Most Cited Papers–Review

Below, a summary of the papers featured in the list of the seven most cited papers is provided, along with a summarization of their contents.

Within the paper that has the highest number of citations,

Battiston et al. (

2021) emphasized climate change as a risk source for the financial systems. The researchers designed specific climate-stress scenarios in order to properly assess whether the financial system may prove as being vulnerable to any climate changes. It was underscored that there is a lack of methodologies revolving around this topic, since traditional approaches rely solely on the financial risk and macroeconomic analyses. Therefore, the authors, in order to achieve their goal of analyzing the implications of the climate-related financial risks, had to extend the already existing methodology by including an agent-based model approach as well. More than this, the researchers’ insights can help the central banks’ decision-makers to take climate change into account when it comes to the banks’ financial risk assessments as well.

Mike and Farmer (

2008) developed an agent-based model designed for liquidity and volatility with regard to the London Stock Exchange trading order flow. The authors studied the way that trading orders were placed and canceled. Constructed against a single stock (AZN), the scientists’ model proved to have really good predictions for low volatility with regard to small-tick-size stocks yet rather unprecise predictions for stocks that were outside the small-tick-size stocks. Therefore, the researchers emphasized the fact that the conducted analysis was relevant only for small-tick-size stocks, underscoring that the heavy tails of prices and the volatility are highly tied to the market microstructure effects.

Chen and Yeh (

2001) had a new architecture approach over the artificial stock markets by their paper, where a ‘school’ mechanism was taken into account, in order to map genetics’ programming phenotype archetype to the genotype, further used later in an agent-based model approach, where the ‘school’ was considered to be the evolving population. The designed model also took into account the traders’ search behavior and psychological factors, such as standard of living or peer pressure. After the model was run against an artificial stock market, the researchers observed the fact that the return series is independently and identically distributed, therefore pointing out that the market is an efficient one.

Dosi et al. (

2015), in their study, used an agent-based model to reproduce a various list of macro-empirical and micro-empirical regularities. After the simulations were run, the researchers were able to point out the fact that monetary policies and counter-cyclical fiscal policies were of utmost importance in order to stabilize the economy, emphasizing the fact that the effects of these kind of policies tend to become more and more negative as long as the income inequality increases.

Similarly,

Gilli and Winker (

2003) introduce a heuristic optimization framework tailored for parameter estimation in financial market ABMs. Recognizing that the underlying objective function is often non-convex and subject to Monte Carlo variance, they integrate elements of the Nelder–Mead simplex algorithm with the threshold accepting heuristic to refine parameter selection. Their methodology explicitly accounts for the stochastic nature of simulation-based estimation, ensuring robustness in the face of inherent randomness. By applying their approach to the estimation of parameters within an agent-based model of the DM/USD foreign exchange market, the authors demonstrate its effectiveness in improving parameter calibration. The results suggest that such hybrid optimization methods can significantly enhance the precision of ABM-based financial market models, particularly when traditional gradient-based techniques are unsuitable.

Lamperti et al. (

2021) underscored the fact that climate change and natural disasters that significantly impact banks, firms, or other financial institutions require an immediate policy response in this regard. As such, the researchers proposed an agent-based model focused around the interaction between climate change and economic dynamics, testing a variety of policy interventions. The authors tested the model against a set of “green” finance policies, addressing all the risks that the climate change may have over the aforementioned types of institutions. Based on this, the researchers were able to prove that, even if in a moderate amount, all of the used policies reduced carbon emissions. Regardless of this, the authors pointed out that there may still be some policy combinations that contribute to the financial instability. More than this, even if the authors pointed out that there are still a few missing pieces to fully comprehend the climate change topic, the policies used to test the model stood out by being able to increase the stability in the financial sector, leading to a higher economic growth, along with reducing the carbon emissions.

Feng et al. (

2012) explained why financial returns have long-term memories and fat-tailed distributions. The development of an agent-based model shows that, when investors use the same technical trading strategies, fat tails and long memory features show up. The author derives quantitative claims that explain the lengthy memory of absolute and squared returns from this model’s further development into a stochastic model. This is a recollection of how investors assess their investments over different time periods. In addition to offering a behavioral justification for the widely used stochastic models in finance, the paper demonstrates how these models can be calibrated using real market data rather than just statistical fitting.

Assenza et al. (

2015) proposed an extension of the framework developed by Delli Gatti et al., consisting of a macroeconomic agent-based model that takes into account the Capital and Credit (CC-MABM). The paper’s novelty relies on the introduction of a customized supply chain between upstream (i.e., producers) and downstream (i.e., consumers) firms, both of them dependent on bank loans in order to have their financial needs satisfied. As such, the authors were able to demonstrate that the interactions that these kind of firms are accountable for, along with their financial condition evolution, are the key components of a “crisis”.

The reviewed highly cited papers confirm the relevance and adaptability of agent-based modeling (ABM) as a methodological framework for analyzing complex dynamics in finance and banking. These studies highlight the use of ABM in capturing micro-level behaviors and systemic interactions, whether assessing market volatility, investor behavior, monetary policy, or the financial implications of climate change. The diversity in their applications, from stock markets to macroeconomic policy and environmental–financial risks, illustrates that ABM is not only a computational tool, but a conceptual approach tailored to tackle nonlinearities, feedback loops, and interdependencies that define modern financial systems. Collectively, these influential works reinforce the value of ABM as a core method for understanding and navigating complexity in finance and banking.

4.4.3. Word Analysis

An analysis was conducted to identify the most frequently used words in Keywords Plus, providing insights into the thematic focus of the retrieved documents. The search explored keyword frequencies across titles, abstracts, and keywords, revealing the dominant concepts in the ABM literature applied to finance and banking. As shown in

Table 7, the most frequent term is “model(s)” with 97 occurrences, followed by “dynamics” (73 occurrences) and “behavior” (56 occurrences). Other prominent terms include “market(s)”, “risk”, “volatility”, “credit”, and “systemic risk”, all central to financial modeling. These recurring keywords reflect both the methodological core of ABM, capturing complex, dynamic behaviors through simulation, and its applied focus on understanding risk propagation, credit fluctuations, and contagion in financial systems. The presence of terms like “volatility”, “systemic risk”, and “contagion” further emphasizes ABM’s role in analyzing instability and interconnectedness, reinforcing its value in studying financial crises and regulatory responses.

Figure 14 represents the co-occurrence network for the top 50 words that are included in Keywords Plus, which divided the words in a number of eight main clusters. The size of each term represents its frequency of occurrence, and the depth of the connecting lines indicates the strength of association between terms. Different color clusters suggest thematic groupings of related research topics.

The central cluster, built around “dynamics” and “behavior”, connects to keywords like “risk”, “models”, “market”, and “fluctuations”, indicating the foundational role of dynamic modeling and behavioral analysis in financial systems. A second cluster focused on “volatility”, “financial markets”, and “herd behavior” highlights studies on trader behavior and market microstructure. The third cluster centers on “credit”, “systemic risk”, “contagion”, and “policy”, pointing out research related to macro-financial stability, crisis propagation, and regulatory intervention. Other clusters deal with simulation and systems theory, investment impact and heterogeneity, as well as innovation and performance. The structure of this network reinforces the multidisciplinary character of ABM in finance, where behavioral dynamics, market fluctuations, and systemic risk are interconnected and frequently studied together.

An analysis of the most frequently used words in authors’ keywords provides valuable insights into the dominant themes within ABM research applied to finance and banking. As shown in

Table 8, the most prominent term group is “agent-based model(s)/modeling/modelling”, with a cumulative 293 occurrences. This overwhelming presence confirms that ABM is the foundational methodological core of the field. The most cited application context is “financial market(s)” (43 occurrences), which highlights the strong focus on understanding market dynamics, trading behavior, and complex interactions within financial systems. “Econophysics” (21 occurrences) underscores the interdisciplinary contributions from physics, particularly in modeling statistical behaviors and emergent phenomena in economics. Similarly, “systemic risk” (21) and “financial stability” (15) emphasize concerns over crisis propagation and resilience in banking and financial networks. The appearance of “artificial stock market(s)” (20) and “monetary policy” (18) suggests that researchers frequently use simulation environments to test regulatory policies and market responses. The keywords “behavioral finance” (13), “simulation” (10), and “contagion” (9) further reinforce the experimental, behavioral, and network-centric approach adopted in the recent literature. Together, these terms reflect a research domain that is both methodologically robust and application-driven, integrating computational simulations with real-world financial challenges.

Figure 15 presents a visual comparison of the top 50 keywords based on two distinct sources: (A) Keywords Plus and (B) authors’ keywords. These word clouds illustrate the dominant thematic trends in the literature on ABM within finance and banking.

Panel (A) shows the most frequent Keywords Plus, with terms like “model”, “dynamics”, “behavior”, “risk”, and “market” standing out. These concepts highlight core methodological and conceptual foundations, including the use of simulation-based modeling to capture the dynamic behavior of financial systems. The presence of keywords like “volatility”, “credit”, “contagion”, and “systemic risk” further points to the literature’s focus on financial instability and risk propagation.

Panel (B) highlights authors’ keywords, where variations in “agent-based modeling” dominate the visualization, underscoring ABM as the central methodological lens. Alongside these, recurring terms like “financial markets”, “econophysics”, “systemic risk”, and “monetary policy” reflect the field’s interdisciplinary nature and practical focus on market behavior, regulation, and crisis modeling.

Together, these visualizations reinforce the alignment between author-driven thematic focus and algorithmically derived keyword relevance, confirming the centrality of ABM in addressing complex financial dynamics and systemic risk.

Figure 16 displays the co-occurrence network based on the top 50 keywords extracted from article titles, grouped into seven thematic clusters using Bibliometrix. The network highlights the most frequent terms and their interconnections, revealing core research directions in ABM applied to finance and banking.

The blue cluster centers around the terms “agent-based”, “financial”, and “model”, underscoring the methodological backbone of the field. It reflects the central use of agent-based models in simulating financial systems, regulatory frameworks, and banking dynamics.

The green cluster focuses on market behavior and microstructure, with terms like “market”, “trading”, “volatility”, “heterogeneity”, and “stock”. This suggests intensive research on how agents behave in financial markets and how these behaviors generate complex price dynamics.

The red cluster reflects concerns around systemic risk and financial fragility, including keywords like “systemic”, “credit”, “banks”, “system”, and “risk”. This area emphasizes modeling financial contagion and stress propagation across networks of institutions.

The purple cluster includes “monetary” and “policy”, pointing to macro-level studies on regulatory frameworks and the impact of central bank actions on financial stability.

Overall, this figure illustrates that ABM in finance and banking spans micro- and macroeconomic dynamics, with clear focus areas on market complexity, systemic vulnerability, and policy design, capturing the multidimensional nature of complexity in financial systems.

An analysis of the most frequent bigrams and trigrams in abstracts provides a deeper understanding of the recurring themes and methodological focus areas in ABM research within finance and banking. As shown in

Table 9, the most dominant bigram is “agent-based model(s)”, with 516 occurrences in abstracts, reaffirming ABM as the central methodological approach in the field. Related variations such as “agent-based modeling”, “models”, and “modelling” also appear prominently, as seen in the top trigram group (94 occurrences), further point out this trend.

In terms of application areas, “financial markets” (253) and “stock markets” (133) rank high among bigrams, indicating a strong research focus on simulating and analyzing trading behavior, price dynamics, and systemic effects. Trigrams such as “artificial stock market(s)” and “artificial financial market” (each with 30 occurrences) reflect interest in modeling controlled environments for financial experimentation. Other key bigrams and trigrams include “monetary policy” (48/19) and “climate change” (54), suggesting that ABM is increasingly applied to assess the effects of macroeconomic policy and environmental risks. The presence of terms like “time series”, “trading strategies”, and “investment strategies” further supports the view that agent-based models are employed to explore empirical data patterns and test decision-making rules.

In summary, the alignment between abstract bigrams and keyword frequencies confirms the central role of ABM in modeling complex financial systems, with growing interest in market dynamics, systemic risk, policy evaluation, and climate–finance interactions.

4.5. Mixed Analysis

Taking into consideration the elements discussed above and using three-field plots, a mixed analysis was conducted to highlight the connections between different categories, such as author, affiliation, journal, and country keywords in the field of ABM in finance and banking. Firstly, an analysis regarding the correspondence between the top elements in the categories of authors, countries, and journals was carried out, according to

Figure 17.

The analysis reveals Italy as the leading contributor to the field, with numerous prominent authors such as Gallegati, Roventini, Napoletano, Dosi, and Russo, all affiliated with institutions like Scuola Superiore Sant’Anna and Marche Polytechnic University. Other countries with significant author presence include China, France, the USA, Germany, and the United Kingdom, showcasing the international spread of ABM research.

The plot also highlights important institutional hubs, including the CNRS (France), the University of Oxford (UK), ETH Zurich (Switzerland), and Boston University (USA). These affiliations reflect the strong academic ecosystems supporting interdisciplinary research that combines economics, complexity science, and computational modeling.

Overall, the figure highlights both the geographic diversity and the collaborative nature of ABM research, with many authors working across national boundaries, reflecting the integrative and global character of this research field.

An analysis was conducted to examine the relationship between authors, affiliations, and keywords in ABM in finance and banking.

Figure 18 illustrates the interconnections between key authors, their countries, and the most frequently associated keywords in the field of ABM in finance and banking. The dominant keywords, such as agent-based model, financial markets, systemic risk, financial stability, monetary policy, and artificial stock market, highlight the methodological and thematic focus of this research domain.

Italy remains a central node, with prominent contributors like Roventini, Dosi, Gallegati, and Napoletano, who are frequently linked with terms like “agent-based modeling” and “financial stability.” The USA and China also play significant roles, especially in producing work tied to keywords like “monetary policy” and “systemic risk”.

This three-field analysis confirms the strong alignment between leading authors, top research-producing countries, and core themes in the literature, reinforcing the idea that ABM has become an established interdisciplinary tool for studying complex financial and economic phenomena on a global scale.

5. Discussions

In this section, we synthesize and discuss the main research directions identified in the bibliometric analysis of ABM applications in finance and banking. Based on our findings, we have identified five major discussion themes. The first theme focuses on the use of ABM in analyzing financial markets and asset price formation, providing a detailed perspective on market dynamics and investor behavior. The second theme examines the role of ABM in financial risk management and contagion, highlighting how these models can help understand and anticipate the propagation of financial shocks within banking networks. The third research direction addresses the impact of monetary policies and financial regulations, analyzed through ABM, demonstrating the potential of these models in assessing the effectiveness of macroeconomic measures. The fourth theme explores the applicability of ABM in evaluating banking system stability, allowing for the identification of structural vulnerabilities and the optimization of regulatory strategies. Finally, the fifth theme highlights emerging trends and recent applications of ABM in finance and economics, with a particular focus on its integration with advanced technologies such as artificial intelligence and big data. These research directions underscore the growing relevance of ABM in understanding complex financial phenomena and informing economic policy decisions.

5.1. ABM in Financial Market Analysis

One of the most extensively explored applications of ABM in finance is the simulation of financial markets and the mechanisms underlying asset price formation. By replicating agent interactions, these models provide a detailed perspective on decision-making processes and market dynamics.

Mike and Farmer (

2008) propose an agent-based model for analyzing liquidity and volatility in the London Stock Exchange, highlighting the impact of trader behavior on financial markets. Their model, developed using trading order flow data, demonstrated accurate predictions for low-volatility stocks with small tick sizes but exhibited limitations when applied to stocks with larger tick sizes. This study underscores the importance of market microstructure in determining price fluctuations and order flow dynamics.

Similarly,

Brock and Hommes (

1998) investigate the heterogeneity of investor expectations and their impact on asset prices, showing that financial markets can transition between stability and instability due to agent learning and adaptation. These studies demonstrate that ABM provides a robust framework for testing market efficiency hypotheses and understanding the mechanisms behind financial bubbles. By modeling investor heterogeneity and adaptive behavior, ABM facilitates a deeper comprehension of how price bubbles form, evolve, and eventually burst, offering valuable insights for policymakers and market regulators.

Riccetti et al. (

2016) introduce a model with a threefold financial accelerator, leverage effects, stock market valuation, and credit networks to assess the real economy’s vulnerability to stock market volatility. Their findings suggest that an overly dominant stock market can amplify economic shocks, providing relevant implications for monetary policy.

Oldham (

2017) investigates financial markets through the lens of investor networks and dividend policy, revealing how market fluctuations can be influenced by social topology and firm behavior. His agent-based model shows that network structure significantly affects asset returns, especially when investors mimic their peers. In a behavioral perspective,

Lee and Lee (

2021) show that herding behavior by a small group (approximately 3% of agents) can drastically increase volatility and return, while larger herding groups dilute this effect. Their model underscores the nonlinear impact of behavioral patterns in stock price movements.

Tran et al. (

2020) apply Bayesian optimization to an ABM to estimate the distribution of trader types in the stock market, finding that fundamental traders make up 9–11% of all participants. The model successfully replicates stylized facts such as volatility clustering and heavy tails, validating its relevance in capturing real market dynamics.

Axtell and Farmer (

2025) presents a comprehensive review of agent-based modeling in economics and finance, emphasizing its capacity to relax traditional economic assumptions and enhance the understanding of systemic risk, clustered volatility, and market impact.

Anbaee Farimani et al. (

2024) extend ABM by integrating it with deep learning to capture non-stationary price dynamics using multimodal data, such as news sentiment and technical indicators, demonstrating the relevance of ABM in adaptive price prediction.

Rangarajan and Ventre (

2025) develop an ABM framework to simulate market manipulation in dark pools, particularly the “pinging” strategy, and quantify its impact on institutional trading costs. These studies reflect the evolving intersection of ABM with machine learning, behavioral finance, and market microstructure, further validating its value in capturing real-world financial complexities.

5.2. ABM in Financial Risk Managmeent and Contagion

Another major area of ABM application is the analysis of financial risks, particularly systemic risk and the propagation of contagion within banking networks.

Battiston et al. (

2021) emphasize climate change as a source of financial system risk. They design specific climate-stress scenarios to assess whether financial institutions exhibit vulnerabilities to climate-related shocks. Their study highlights the lack of methodologies that integrate climate risk into financial risk assessment, as traditional approaches focus primarily on financial and macroeconomic factors.

The integration of ABM offers a new perspective for central banks and financial regulators to factor in climate-related risks when evaluating financial stability. Extending the exploration of systemic vulnerability,

Gai and Kapadia (

2010) investigate the transmission of shocks in interbank networks, revealing that excessive connectivity among financial institutions increases systemic vulnerabilities.

A. Liu et al. (

2020) apply ABM to model interbank networks, analyzing how failures of financial institutions can escalate into a systemic crisis. These studies underscore the importance of macroprudential regulations in mitigating contagion effects and ensuring the resilience of the financial system. By capturing complex interdependencies and feedback loops within financial networks, ABM provides policymakers with valuable insights for designing robust risk management frameworks and crisis prevention strategies.

These studies underscore the importance of macroprudential regulations in mitigating contagion effects and ensuring the resilience of the financial system. By capturing complex interdependencies and feedback loops within financial networks, ABM provides policymakers with valuable insights for designing robust risk management frameworks and crisis prevention strategies.

5.3. Monetary Policies and Financial Regulation Analyzed Through ABM

Agent-based models are increasingly used to assess the impact of monetary policies and financial regulations on economic and financial stability.

Dosi et al. (

2015) explore the effectiveness of various combinations of fiscal and monetary policies in an emerging economy, demonstrating that countercyclical policies help mitigate economic fluctuations. Similarly,

Peters et al. (

2022) develop an agent-based model to evaluate monetary reforms and their impact on advanced financial systems.

Halaj (

2018), in a working paper published by the European Central Bank (ECB), employs ABM to analyze how funding shocks affect the European banking system as a whole.

The findings of these studies suggest that ABM is a valuable tool for testing the effectiveness of various economic policies before they are implemented in practice. By simulating the complex interactions between financial institutions, regulators, and economic agents, ABM enables policymakers to anticipate potential risks and refine their strategies accordingly.

5.4. ABM and Banking System Stability

Banking systems are frequently modeled using ABM due to the complexity of interactions between financial institutions and their significant impact on the broader economy.

Chan-Lau (

2017) introduces the ABBA (Agent-Based Banking Analysis) model, developed by the International Monetary Fund (IMF) to examine interbank interactions and liquidity management. Additionally,

Jalilian et al. (

2021) utilize ABM to optimize the banking service supply chain in Tejarat Bank (Iran), while

Braun (

2023) investigates the impact of banking regulations on real estate and financial market stability.

Furthermore,

Bieber et al. (