1. Introduction

Insider trading refers to the act of conducting securities transactions by taking advantage of non-public information. This behavior seriously undermines the fairness and transparency of the market. It not only harms the ordinary investors’ profits but also exacerbates information asymmetry, causing securities prices to deviate from their true value. In the field of financial economics, the optimal trading strategies of insiders with information advantages and their impact on market efficiency are key research topics in the academic community.

Kyle (

1985) established an insider trading model to analyze the dynamic game among insider traders, market makers, and noise traders. The research shows that the insider traders adjust their trading strategies to balance information advantages and market impact, thereby maximizing their profits. This article is a pioneering work in insider trading, providing theoretical support for subsequent scholars’ research on insider trading and information asymmetry issues. Many studies on insider trading are based on this model for extension and expansion.

The issue of information disclosure has been a key topic of research for many scholars.

Huddart et al. (

2001) extended Kyle’s model, assuming that private information is long-lasting and can be gradually released through insider trading. The study found that insider traders would mix noise trading with private information trading to consume private information at a specific rate and avoid detection of their information advantage by external traders.

Zhou (

2016) added the condition of information leakage to Huddart’s model and studied the impact of uncertain information leakage on equilibrium results. The research found that information leakage increases price efficiency and the amount of information.

Holden and Subrahmanyam (

1994) and

Subrahmanyam (

1991) demonstrated that when there are a large number of informed traders with the same information in the market, the market price reacts to accurate information more quickly.

Goenka (

2003) found that information leakage reduces the value of information.

Shin and Singh (

2010) indicated that insider traders would voluntarily disclose some private information to gain more profits.

Lenkey (

2016) explored the impact of information disclosure on information risk, liquidity risk, and price risk. The study showed that disclosing part of the information before trading reduces insider traders’ information risk and liquidity risk but increases the price risk. Usually, the choice of information leakage by insider traders is motivated by maximizing their profits. In the actual market, factors such as reputation and social responsibility (CSR) can also affect the choice of information leakage.

Xue et al. (

2024) explored the interaction among reputation mechanisms, pre-commitment strategies and financial market supervision, and analyzed the repeated interactions among market participants. The research finds that negative reputation feedback has a greater impact on market behavior than positive reputation feedback. In the absence of strict regulatory enforcement, market efficiency decreases. According to the hierarchical regulatory framework of reputation, resource allocation can be optimized and the effectiveness of financial market regulation can be enhanced.

Balakrishnan et al. (

2014) and

Schoenfeld (

2017) demonstrated that voluntary information disclosure by enterprises can significantly improve market liquidity.

X. Liu et al. (

2019) proposed a model where an insider trader shares partial information with multiple informed external traders and analyzed the motives of insider traders to disclose information to market makers voluntarily. The research found that insider traders would choose different information leakage strategies based on the number of external traders, and compared with public disclosure of private information, disclosing information to market makers would enable insider traders to obtain more profits.

Dev (

2013) established a model where insider traders disclose information to external traders and showed that insider traders would never fully disclose information to external traders but would disclose noisy signals. This is consistent with the conclusion of this paper that the insider trader chooses to disclose imprecise information to external traders.

Gormley et al. (

2018) conducted an empirical study to explore the negative impact of mandatory disclosure of mutual fund holdings and transactions on the market. The study found that mandatory public information disclosure would intensify market noise and price distortions. The above literature on information disclosure provides a theoretical reference for studying market supervision and the insider trader information disclosure.

To improve the market’s fairness, transparency, and operation efficiency and reduce the trading losses of liquidity traders, the government has introduced market regulators to limit and crack down on insider trading. The impact of market supervision on the trading market has been studied and paid attention to by many scholars at home and abroad, and many achievements have been made. For example,

Chowdhry and Nanda (

1991) considered the expropriation of trading profits by insider traders and showed that the market optimal regulation either does not restrict insider trading or prohibits insider trading altogether.

Shin (

1996) discussed the optimization problem of insider trading regulation and proposed the optimal regulatory framework. The results show that insider trading will aggravate information asymmetry, harm the profits of liquidity traders, and reduce market efficiency. Banning insider trading altogether or allowing insider trading without restrictions is not the optimal regulatory strategy. Tolerating some insider trading may be the optimal regulation. This study provides a theoretical basis for the regulation of insider trading and provides an important reference for subsequent research on market microstructure and information asymmetry and policymakers to optimize the regulatory framework.

H. Liu and Li (

2022), by studying the insider trading model in the case of public information and market supervision, found that the optimal market supervision is no regulation when there is only one insider trader in the market, and the market supervision becomes strict when there are multiple insider traders; the existence of market supervision makes the market more stable, and the price efficiency is reduced.

Li et al. (

2024) constructed an insider trading regulation model and explored how market supervision affects the decision of insider traders to disclose information to market makers voluntarily. Research shows that the optimal regulation is complete or no regulation. As regulation intensifies, insider traders leak more information to market makers. When there is only one outside trader in the market, the insider chooses not to disclose information to the market maker. When there are multiple outside traders in the market, the insider provides more precise information to the market maker.

Zhang (

2007) gave the problem of how to build an effective regulatory system to promote the stability and healthy development of the market; this paper analyzes the characteristics of China’s securities market as an emerging market, discusses the key elements of the balanced regulatory mode, puts forward the regulatory ideas to make the market stable, and optimizes the regulatory strategy.

Moussa et al. (

2024) conducted an in-depth investigation into the governance dynamics and ESG activities that affect financial results and found that regulators can improve the information environment and increase market efficiency by strengthening governance requirements in accordance with ESG disclosure standards, providing an important reference for regulators to formulate regulatory policies.

Enoch et al. (

2024) explored the impact of CSR innovation based on digital platforms during the crisis, and the research provided a reference for reconstructing the market order in the crisis. Market regulators can utilize CSR technology to formulate reasonable regulatory policies during periods of market instability, thereby reducing information asymmetry and enhancing the efficiency of market supervision.

Elmarzouky et al. (

2024) provided an excellent systematic review of Key Audit Matters and disclosure implications, which provided important references for regulatory agencies in formulating regulatory policies and information disclosure. High-quality KAM disclosure can be adopted to enhance information transparency, curb insider trading, and formulate more reasonable market supervision policies to reduce supervision costs.

Wang and Zhang (

2025) studied the A-share listed companies in Shanghai Stock Exchange and Shenzhen Stock Exchange from 2012 to 2022 and found that market supervision effectively inhibited internal trading, which is consistent with the results of this paper on the impact of market supervision on insider trading.

Inspired by the above literature, based on

Shin (

1996)’s market supervision policy, this paper studies the key factors that affect the decision of the insider trader to disclosure information. The insider trader in this model voluntarily leaks information to

n outside traders. This study shows that market supervision effectively inhibits insider trading behavior and impacts the trading decisions of outside traders. The market optimal intensity of regulation varies with the number of outside traders: when the number of outside traders is

, and there are no outside traders, the market optimal regulation is full regulation. The optimal market supervision when

is either complete regulation or no regulation; that is, market supervision either imposes no restrictions on insider trading or prohibits insider trading, which is consistent with the findings of

Chowdhry and Nanda (

1991) and

Li et al. (

2024). Since insider traders compete with outside traders to maximize their profits, they disclose imprecise information to outside traders regardless of the number of outside traders or the degree of supervision. This behavior leads to a less efficient market price and increased residual information. In addition, with the strengthening of market supervision, the trading behavior of insider traders is inhibited, which reduces price efficiency and increases the amount of residual information. This study provides a reference for formulating differentiated regulatory policies for insider trader information leakage in market competition and supervision.

The rest of the paper is arranged as follows. The second section introduces the model, the market equilibrium, and the optimal market supervision policy for different numbers of outside traders. The third section discusses the insider trader’s choice of divulging information. In the fourth section, we analyze the impact of market supervision intensity and information leakage precision on price efficiency and residual information quantity. The fifth section presents the conclusion.

2. The Model

This model assumes that there is a risky asset in the market whose value consists of two parts: the demand for the company’s product and the company’s developed technology , where and are independent of each other, and . It is assumed that and , , . The market has four types of trading agents: an insider trader, n external traders, noise traders, and market makers. The insider trader has information about both and , and for strategic purposes, actively discloses information containing the signal to n external traders in the form of , where , and . Obviously, the smaller , the more exact . When , ; and , .

The insider trader submits an order flow

x based on the information set

. Each external trader then submits an order flow

,

, with information

. Due to the symmetry of the equilibrium, all external traders have the same order flow, that is,

. Noise traders submit liquidity needs

, where

and

. The market maker can only observe the market’s total order flow

w, based on which the equilibrium price

is determined. The market maker cannot separately distinguish the order volume of each trader, and the total order flow satisfies

. The random variables

, and

are assumed to be independent of each other. The information structure is shown in

Table 1.

The model assumes a market regulator in the market whose scope of regulation is limited to insider traders. Referring to the modeling method of market supervision by

Shin (

1996), the regulatory strategy

R announced by the market regulator before trading consists of two parts: one is the probability

q of insider trading being detected; the other is that if the insider is convicted, the acceptable amount is

z times the square of his order volume—that is, the fine is

. In the trading process, the market maker first announces the pricing rules; then, the insider trader formulates the information disclosure strategy, and all kinds of traders decide the trading strategy and submit the order according to their information, denoted by

. Market makers flow according to the order of

pricing, determining the equilibrium price of

. In the trading process, regulatory authorities supervise insider trading and examine and punish insider traders according to pre-announced regulatory strategies.

Considering the probability

q of being detected by the regulator and the fine, the insider trader’s expected profit after the market maker announces the pricing rule is

where

represents the earnings of the insider when he is not detected by the market regulator, and

represents that the profit of the insider trader will be confiscated. An additional fine of

will be imposed after the market regulator discovers the insider trader. When formulating their trading strategies, the insider trader considers the probability of detection and the possible fine to maximize the expected net profit, including the fine. Referring to the study of

Shin (

1996), the parameter

is used to measure the strictness of market supervision.

q is the probability that the insider trader is detected, and

z is the penalty coefficient. Conversely, a smaller value of

R indicates a more lenient regulation. This parameter reflects the strength of regulation in constraining the behavior of insider traders.

As in

Kyle (

1985), this paper discusses equilibria under linear pricing rules where all traders base their trading strategies on linear equations with their respective information. The linear equilibrium strategies

satisfy the following three conditions:

(1) Profit maximization: given the true values of

as

, and any alternative trading strategies

, insider and external traders expected profit of

, respectively:

(2) Market efficiency condition:

where

(3) Loss minimization: The market regulator chooses the level of regulation R to minimize the loss of expected profits of noise traders .

Based on the above conditions, we obtain the following equilibrium model and the meaning of each symbol is shown in

Table 2.

Theorem 1. Given the insider trading strategy, the external trader trading strategy, the market maker pricing strategy and the regulation strategy , there exists a unique linear equilibrium and it has the following form:wherewhere . Through Equation (

6) of the above theorem, it can be seen that the strategic trading intensity

of the insider trader’s leakage signal

is inversely proportional to the trading intensity

c of the external trader. This is because after the disclosure of information

, the advantage of the external trader in information

increases, and the external trader will use this information to trade, causing the insider trader to lose this information advantage.

In financial market analysis, denotes market depth and measures the market’s liquidity. Given and R, we have . This indicates that the less precise the signal leaked by the insider trader is, the less intense the external traders will trade using that information. When , , at which point external traders no longer trade using the signal and exit the market. When the market regulatory intensity , that is, there is no market regulation, the following lemma is obtained.

Lemma 1. When the market supervision intensity , there isand It follows that the existence of market supervision leads to lower trading intensity for the insider trader and higher trading intensity for external traders. This shows that market supervision effectively inhibits insider trading and also impacts external trading.

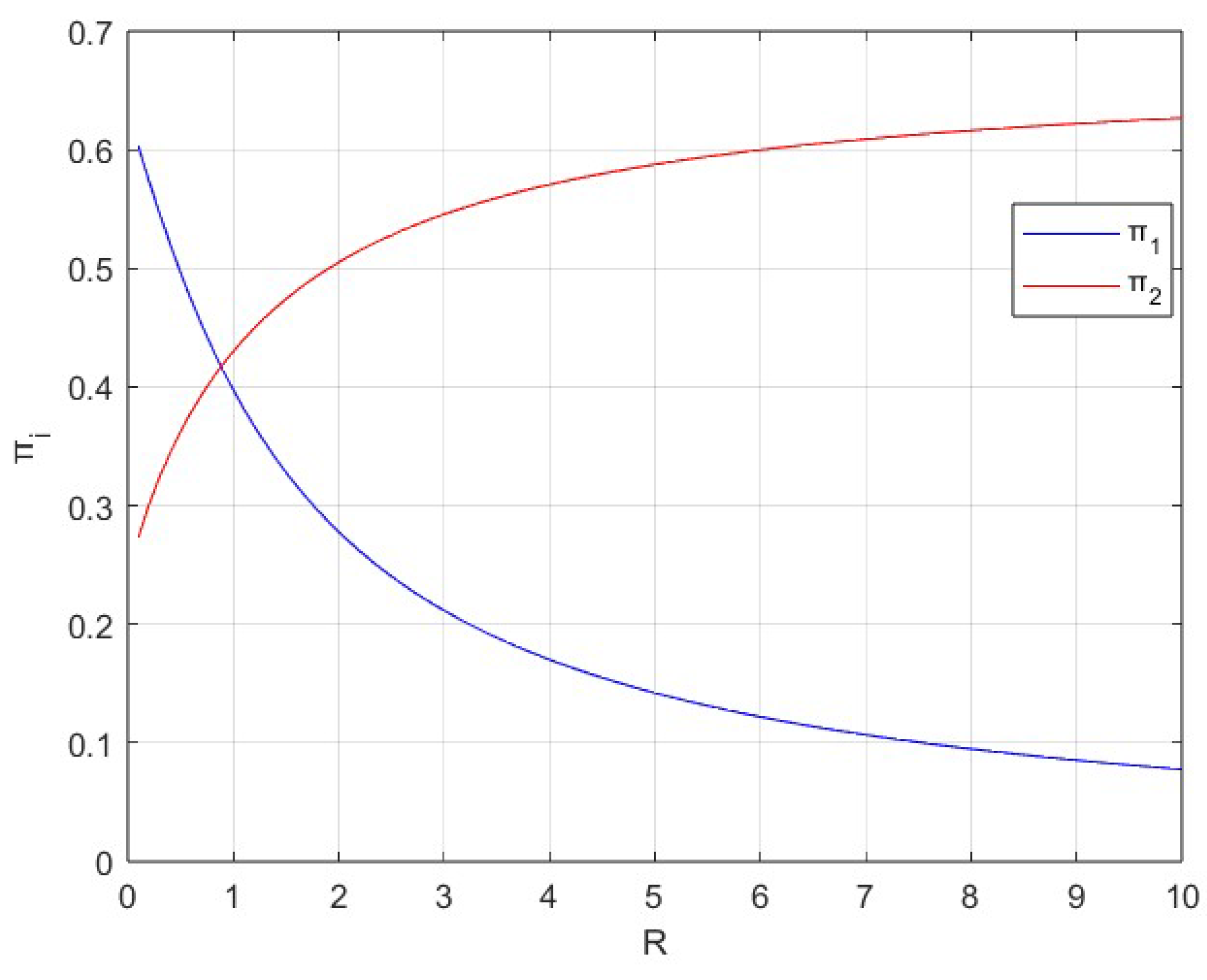

To present the above results more intuitively,

Figure 1 clearly shows how the expected profit of the insider versus outsiders vary with the intensity of market supervision.

The figure shows that market supervision constrains the trading behavior of the insider trader, reducing their expected profits, while the expected profits of external traders increase with the intensity of market supervision.

According to the equilibrium result of Theorem 1, the expected loss of liquidity traders is

The expected profit of the insider trader

is

The expected profit of the external traders

is

Market supervision aims to minimize the expected loss of liquidity traders, who are also noise traders. The (9) equation shows that the expected loss of the

minimum liquidity trader is the smallest when

is determined. To ensure the smooth completion of the trade, the market maker only sets the price according to the order flow, and its expected profit is zero during the trade. Therefore, the expected loss of the liquidity trader is equal to the sum of the expected trading profits of the insider and the

n external traders. Thus, market regulators should formulate regulatory policies to minimize the sum of profits scheduled by the insider trader and external traders. The following equation is obtained:

By taking the partial derivative of both sides of Equation (

10) concerning the regulatory intensity

R, when

is fixed, we obtain the following results: when

,

, which is consistent with the conclusion of

Ren (

2023); when

, with different values of

, we have

or

; when

,

. Therefore, when

,

is minimized when

, thus yielding the minimum value of

; when

,

is minimized when

, thus yielding the minimum value of

.

It is calculated by Theorem 1 that when

and

,

The following corollary is obtained.

Corollary 1. Given a linear equilibrium of the insider trader, external traders, and market makers, the optimal market supervision strategy is as follows:

- (1)

When , that is, when there are no external traders in the market, the optimal regulation is complete.

- (2)

When , if , the optimal regulation is complete regulation; if , the optimal regulation is no regulation at all.

- (3)

When , the optimal regulation is complete regulation.

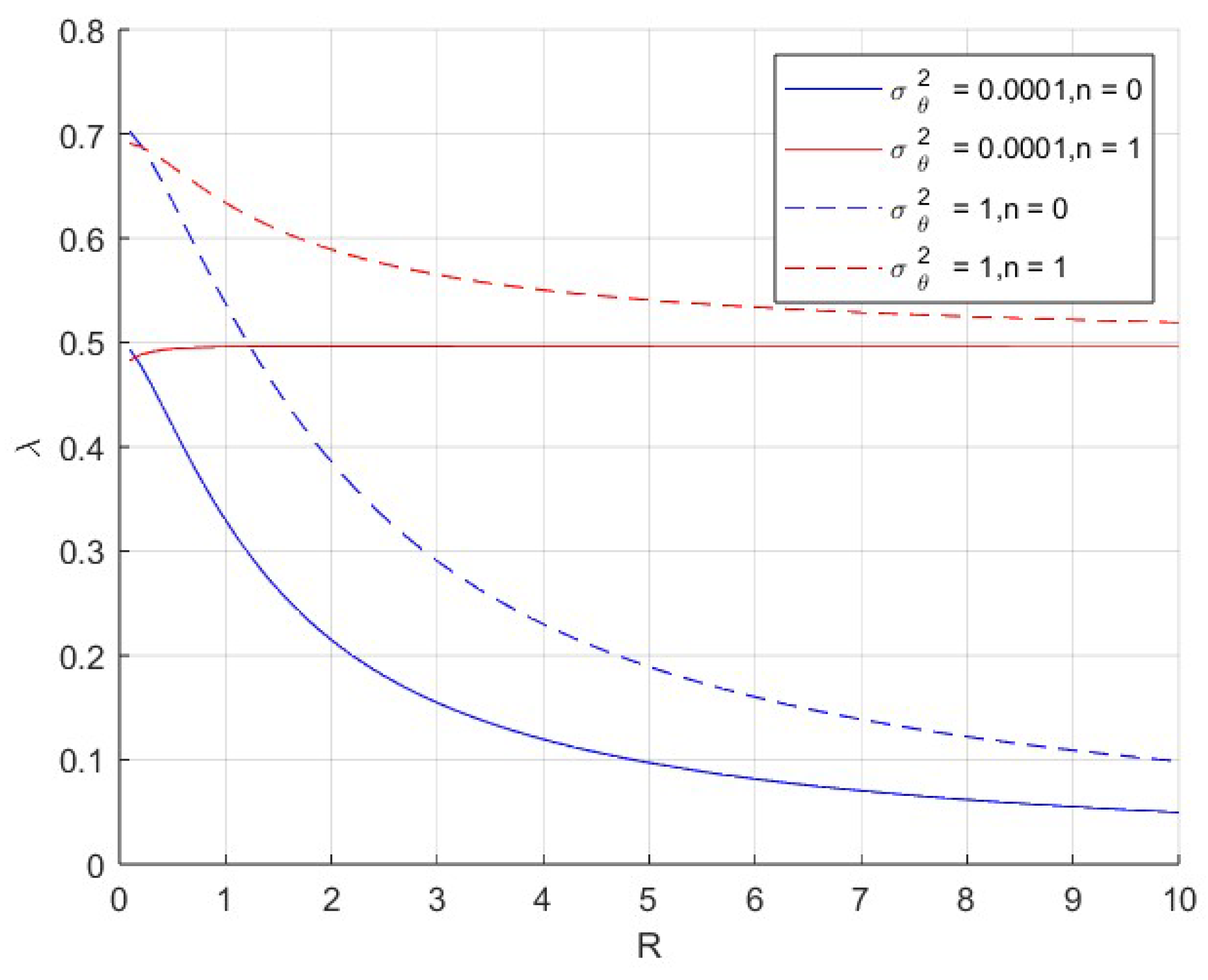

To present the above results more intuitively,

Figure 2 clearly shows how

varies with the intensity of market supervision when the number of external traders

. The figure shows that when the other parameters are fixed, and there are no external traders in the market, the optimal market supervision is complete regulation. There is only one external trader in the market, and the optimal market supervision is complete when

. In contrast, the optimal market supervision is no regulation when

is small.

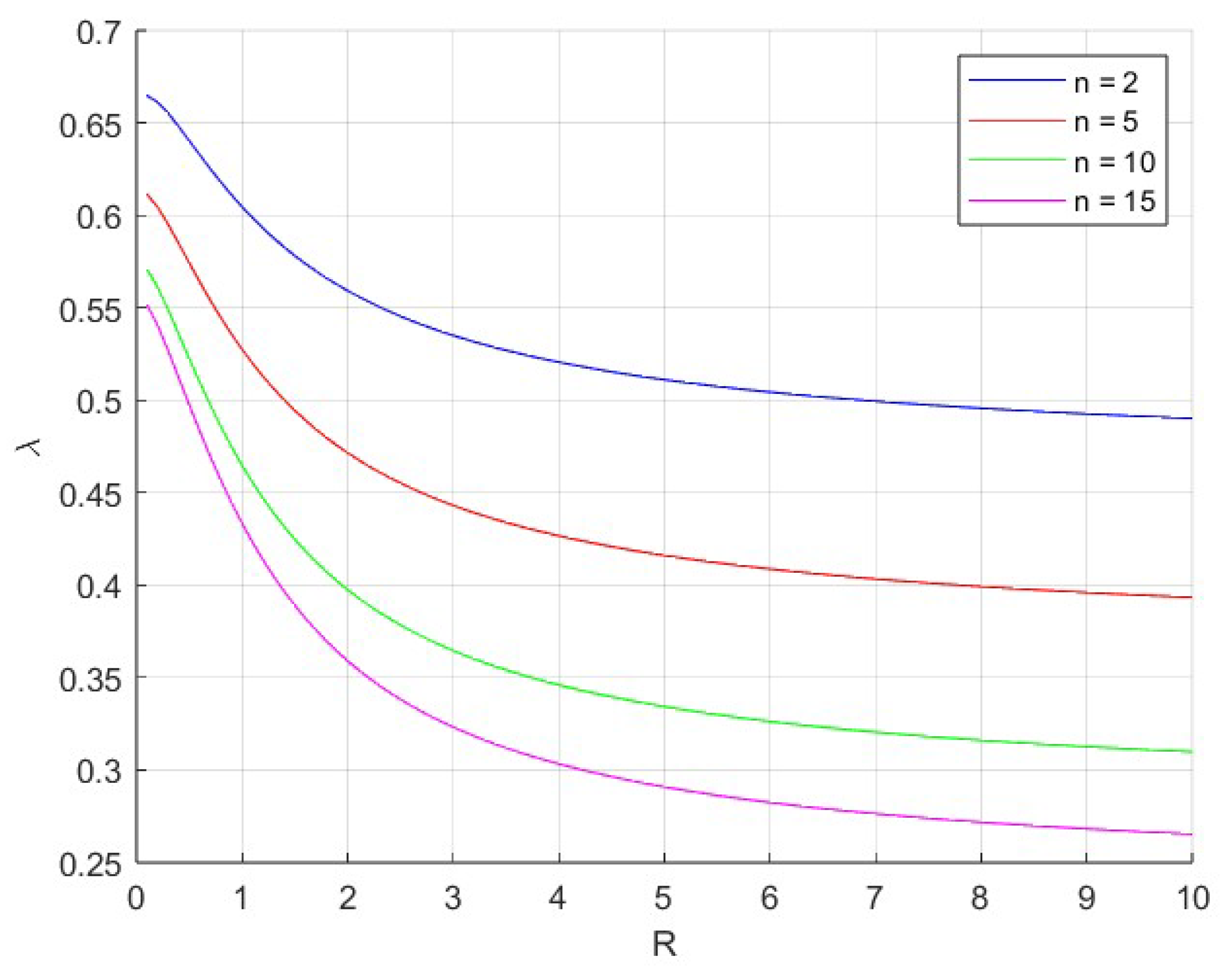

Figure 3 plots how

varies with the intensity of market supervision for the number of external traders

. The figure shows that the optimal regulation is complete when the number of external traders is

. Moreover, as the number of external traders increases,

decreases, indicating that the increase in external traders makes the market more stable.

The optimal market supervision policy would be to ban insider trading altogether, minimizing noise traders’ losses. However, market regulators cannot fully supervise insider traders, so they can choose how to disclose information to maximize their profits before market regulators issue regulatory policies.

3. Insider Traders’ Choices Regarding Information Disclosure

Insider traders will voluntarily disclose information to external traders only if they can profit more by revealing information. When the market depth is constant, we obtain the following inference by calculating and analyzing the partial derivative of the expected profit of the insider trader concerning the accuracy of leaked information .

Corollary 2. When the market depth is constant, the insider trader will choose to disclose inaccurate information regardless of the number of external traders and the strength of market supervision.

This is because the insider trader and external traders are in competition in the market, and the more accurate information leaked by the insider trader to external traders, the more the insider trader will lose the advantage of such information, thus reducing the expected profit of insider trading. Therefore, in order to obtain more profits, the insider trader will choose to disclose inaccurate information.

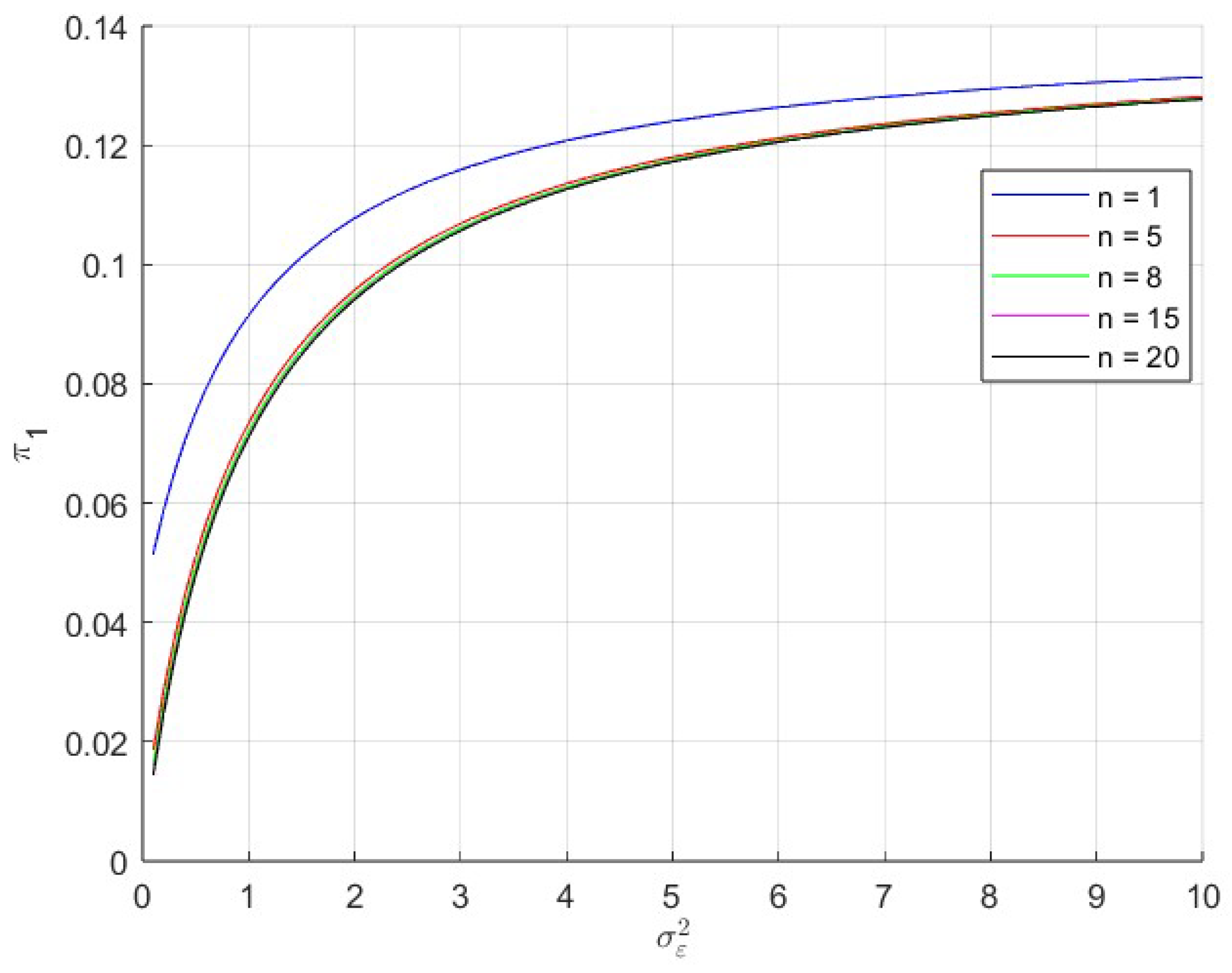

To present the above inference results more intuitively,

Figure 4 and

Figure 5, respectively, show how the expected profit of the insider trader changes with the accuracy of leaked information

when the number of external traders

n is different. The market supervision

R is different. It can be seen from the figure that when the market depth is constant, the number of external traders

n is different, and the market supervision

R is different, it can be concluded that the more inaccurate the information leaked, the higher the expected profit of the insider trader will be. So, the insider trader divulges inaccurate information no matter how many external traders or how tightly regulated the market is. Since the insider trader and external traders compete in the market, when the market depth, the accuracy of information disclosure, and the strength of market supervision are constant, the more external traders there are, the less the expected profit of the insider trader will be.

In the actual market, in addition to disclosing information motivated by profit maximization, insider traders will also consider reputation issues or repeated market interactions, choosing full or partial disclosure. For example, technology firms voluntarily disclose details of their research and development to build a reputation for “reliability” and thus attract long-term investors; from the perspective of management’s personal interests, the CEO may choose partial disclosure to maintain stability to avoid the impact of stock price fluctuations on their compensation (such as the value of options); from the perspective of social responsibility and ESG demand, enterprises may make the choice of full disclosure of negative environmental impacts to cater to specific investor groups in the context of ESG investment, even though this may reduce short-term profits; from the perspective of behavioral economics, if investors panic and overreact to bad news, then insiders may choose to disclose part of the information to cushion the shock. These provide a reference for insider traders to choose information strategies.

4. Price Efficiency and Remaining Price Information

Under the market supervision background, the insider trader leaks information to external traders, which directly affects the price efficiency and the amount of residual information in the market to a certain extent. Price efficiency is characterized by the correlation coefficient

between the value and price of risky assets, which reflects the response degree of market price to the actual value of assets. The amount of residual information is described by

, which reveals the amount of information contained in the price. After introducing these two indicators, the model clearly shows the impact of information leakage and market supervision on the formation of market price and the degree of information asymmetry, which provides a reference for market supervision to formulate regulatory policies. From Theorem 1, the following results can be obtained.

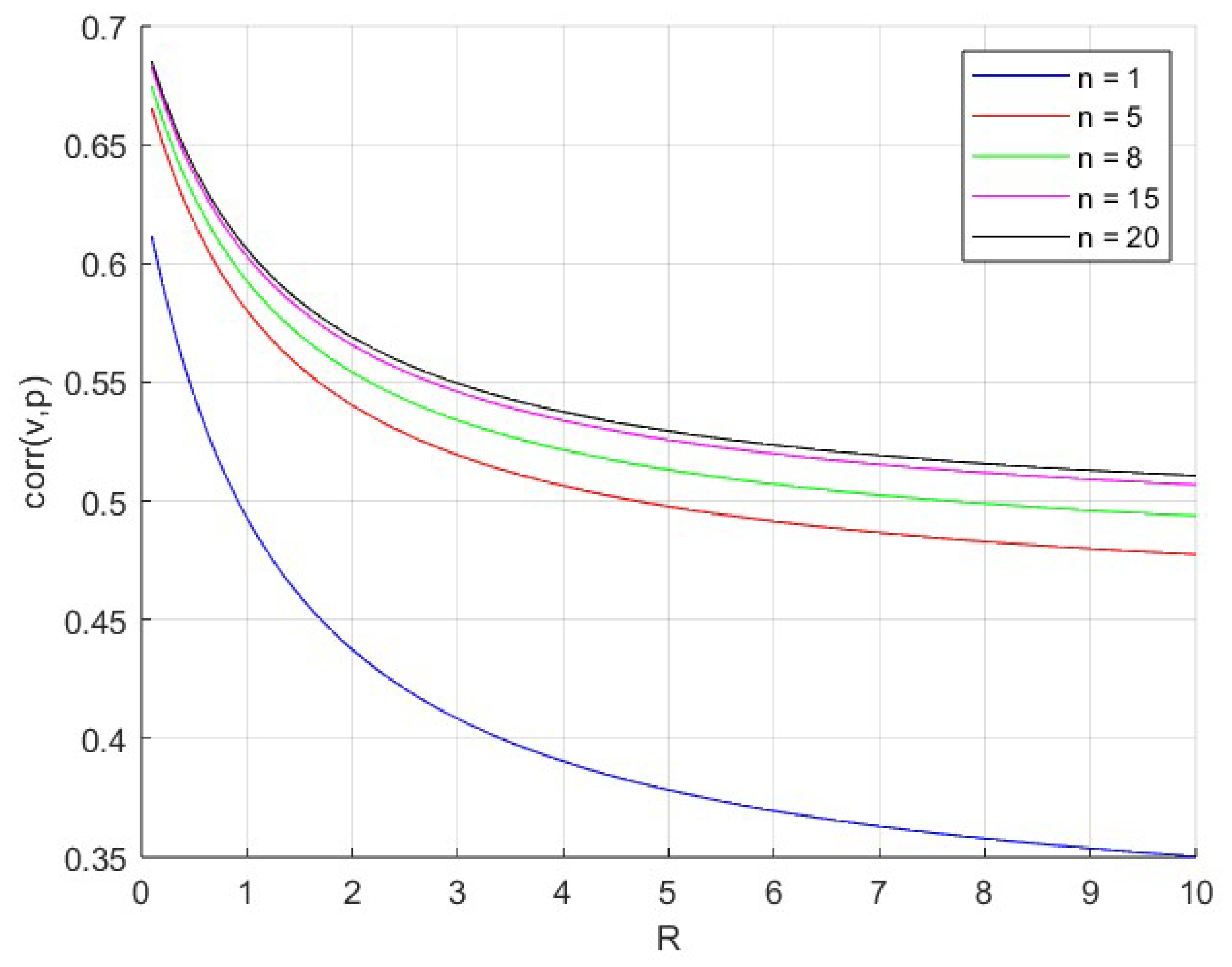

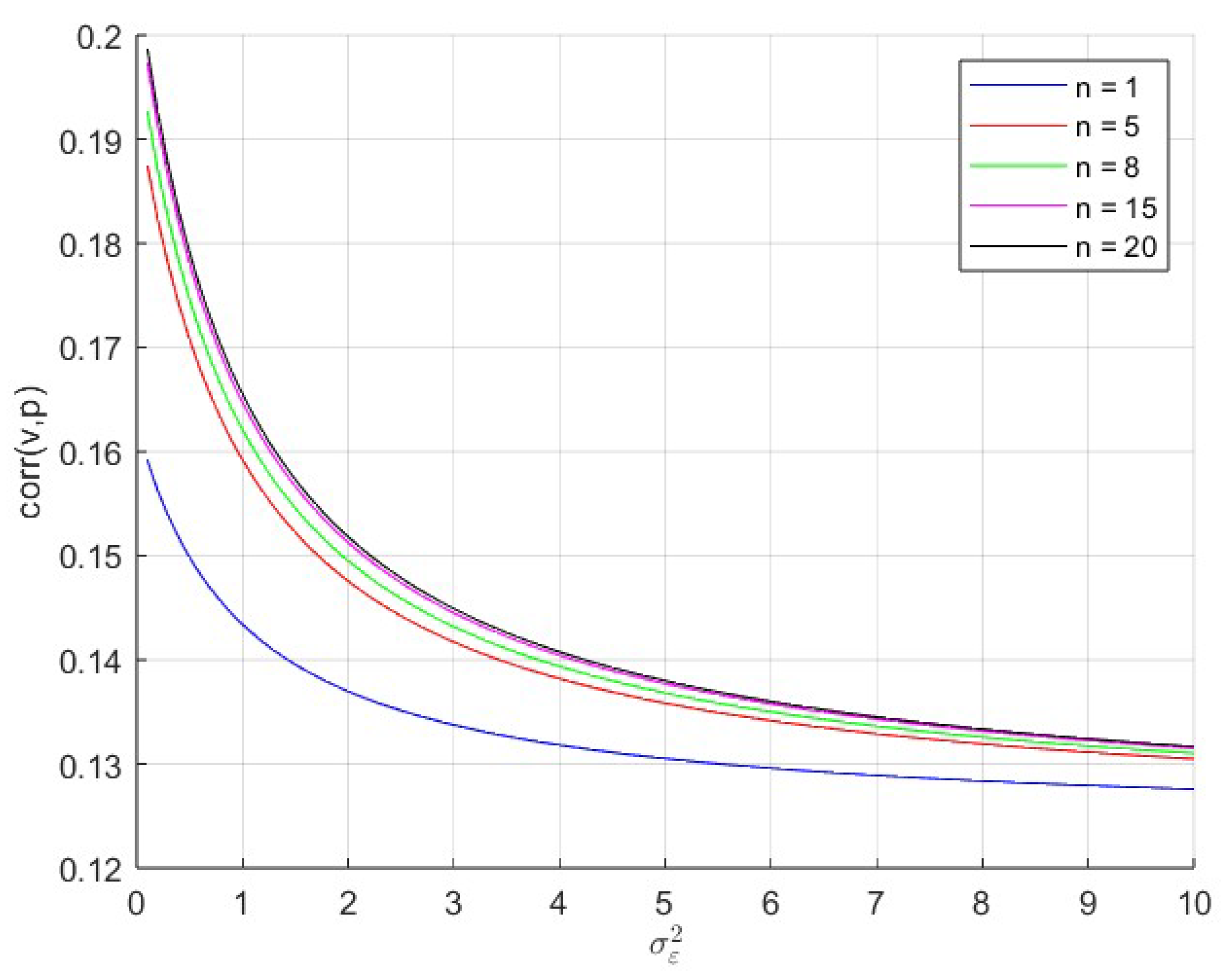

According to Equations (11) and (12),

Figure 6 and

Figure 7, respectively, depict the impact of market supervision intensity and information leakage accuracy on price efficiency. As can be seen from the figure, strengthening market supervision significantly reduces price efficiency, and the more precise the information leaked by insider traders to external traders, the more efficient the price is. Moreover, the higher the number of external traders, the higher the price efficiency.

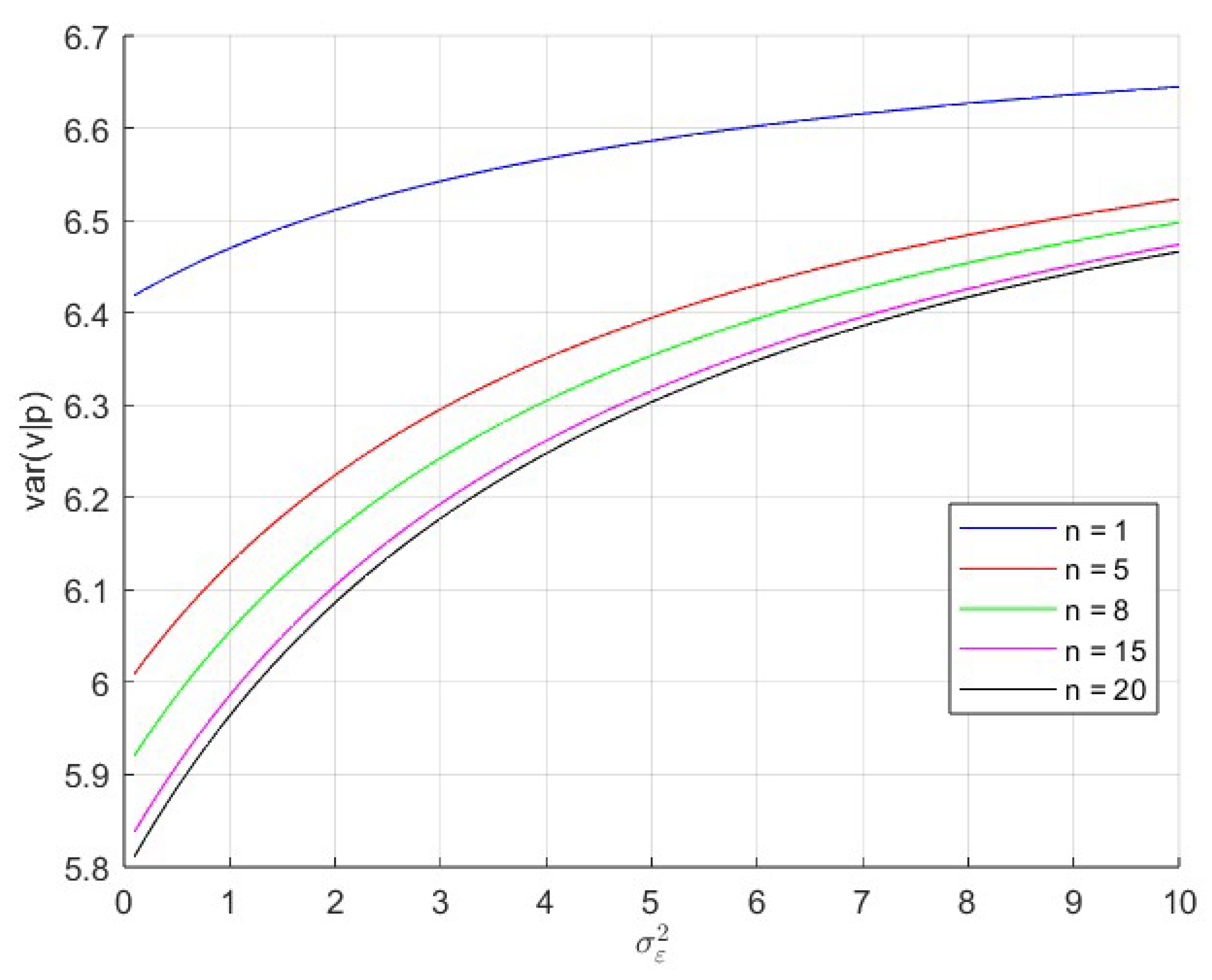

Figure 8 and

Figure 9 depict the impact of market supervision intensity and information leakage accuracy on the amount of residual information, respectively. It can be seen from the figure that strengthening market supervision will increase the amount of residual information, and the more imprecise the info leaked by the insider trader, the greater the amount of residual information. At the same time, an increase in the number of external traders reduces the amount of residual information.

These findings provide a new perspective for understanding the impact of market supervision and the precision of information leakage on the behavior of market traders. Specifically, with the strengthening of market supervision, the trading behavior of insider traders is more strictly constrained, and their trading volume decreases, resulting in a decrease in the amount of information disclosed, a reduction in price efficiency, and an increase in the amount of residual information. On the other hand, when the accuracy of information leaked by the insider trader to external traders decreases, the trading behavior of external traders tends to be conservative, and the amount of information disclosed decreases, which in turn leads to a reduction in price efficiency and an increase in the amount of residual information. These results reveal the critical role of market supervision and the precision of information leakage in shaping the market information environment and provide a theoretical basis for improving the market supervision policy.

5. Conclusions

Under the assumption that market supervision only targets insider trading and the insider traders disclose information to external traders, this paper analyzes the impact of market supervision on the trading strategies of the insider traders and external traders, the relationship between the number of external traders and the optimal market supervision, the information disclosure method chosen by insider traders, and the impact of information disclosure accuracy and supervision intensity on price efficiency and residual information quantity. We find the following:

(1) Market supervision effectively inhibits insider trading.

(2) When , the optimal regulation strategy is complete regulation. When , the optimal regulatory strategy exhibits two extreme cases: complete regulation or no regulation. When the number of external traders is , the market optimal regulation strategy is full regulation. The correlation between the number of external traders and the optimal supervision intensity shows that the supervision policy needs to be dynamically adjusted according to the structure of market participants, which provides a reference for regulators to design differentiated supervision. In a market with many participants, complete supervision can effectively inhibit the damage of insider trading to market fairness. In contrast, when there are fewer participants, it is necessary to weigh the costs and benefits of supervision and avoid excessive intervention. For example, in some regional equity trading markets, the participants are relatively limited, and regulators need to carefully assess the input–output ratio of regulatory resources. In mature markets such as the Shanghai and Shenzhen stock markets and the international futures market, there are numerous participants and insider trading has great potential harm. High-intensity supervision can better maintain market fairness. Therefore, the regulatory authorities should establish a dynamic assessment mechanism and flexibly adjust the regulatory intensity based on factors such as market size and the composition of participants to avoid a “one-size-fits-all” policy.

(3) When the market depth is constant, regardless of the strength of market supervision and the number of external traders, insider trading tends to disclose inaccurate information to maximize its interests. This strategy indicates that the insider trader actively reduces information transparency in the information game to avoid regulatory risks and maintain information advantages. This strategy is widely manifested in reality. For example, executives of listed companies convey signals to specific investors through vague “insider information”, or use social media to release ambiguous hints, making it difficult for the recipients of the information to clearly define its nature. This kind of behavior increases the difficulty of supervision and also aggravates the asymmetry of market information. Therefore, in the trading market, traders need to enhance their ability to distinguish information to avoid excessive losses.

(4) Regarding market price efficiency and residual information, the less accurate the information leaked by insider trading and the greater the market supervision is, the lower the market price efficiency and the more the residual information there is. However, the larger the number of external traders, the more efficient the market price is and the less residual information there is.

The negative impact of market supervision on price efficiency (the stricter the regulation is, the lower the price efficiency is) reveals the potential contradiction of regulation. Although strict regulation can reduce the profit margin of the insider trader and the expected loss of noise traders, it may aggravate the market information asymmetry due to the increase in residual information, resulting in the distortion of price signals. This result shows that regulators must seek a balance between “deterring insider trading” and “maintaining market information efficiency”. Finally, the impact of the number of external traders on price efficiency and the amount of residual information indicates that the expansion of market participants may lead to the “information dilution effect”; that is, more traders will reduce the overall information processing capacity of the market. These conclusions provide a reference for investors to evaluate market structure and information competition environment, optimize regulatory policies, improve market trading rules, and guide participants to make rational decisions. This phenomenon is particularly evident in the financial market. For instance, after some strong regulatory policies were introduced, asset prices fluctuated more intensely instead due to excessive accumulation of information. This indicates that regulators need to explore more sophisticated regulatory tools. For example, as mentioned by Moussa et al, through the utilization of ESG disclosure standards and CSR technologies, high-quality KAM disclosure methods formulate reasonable regulatory strategies and enhance the efficiency of market supervision.