AI in Banking: What Drives Generation Z to Adopt AI-Enabled Voice Assistants in Saudi Arabia?

Abstract

1. Introduction

2. Literature Review

2.1. Research Reviewing the Adoption of AI in Banking

2.2. Empirical Research Examining Consumers’ Adoption of AI in Banking

2.3. Research Examining AI Adoption in the Saudi Arabian Banking Sector

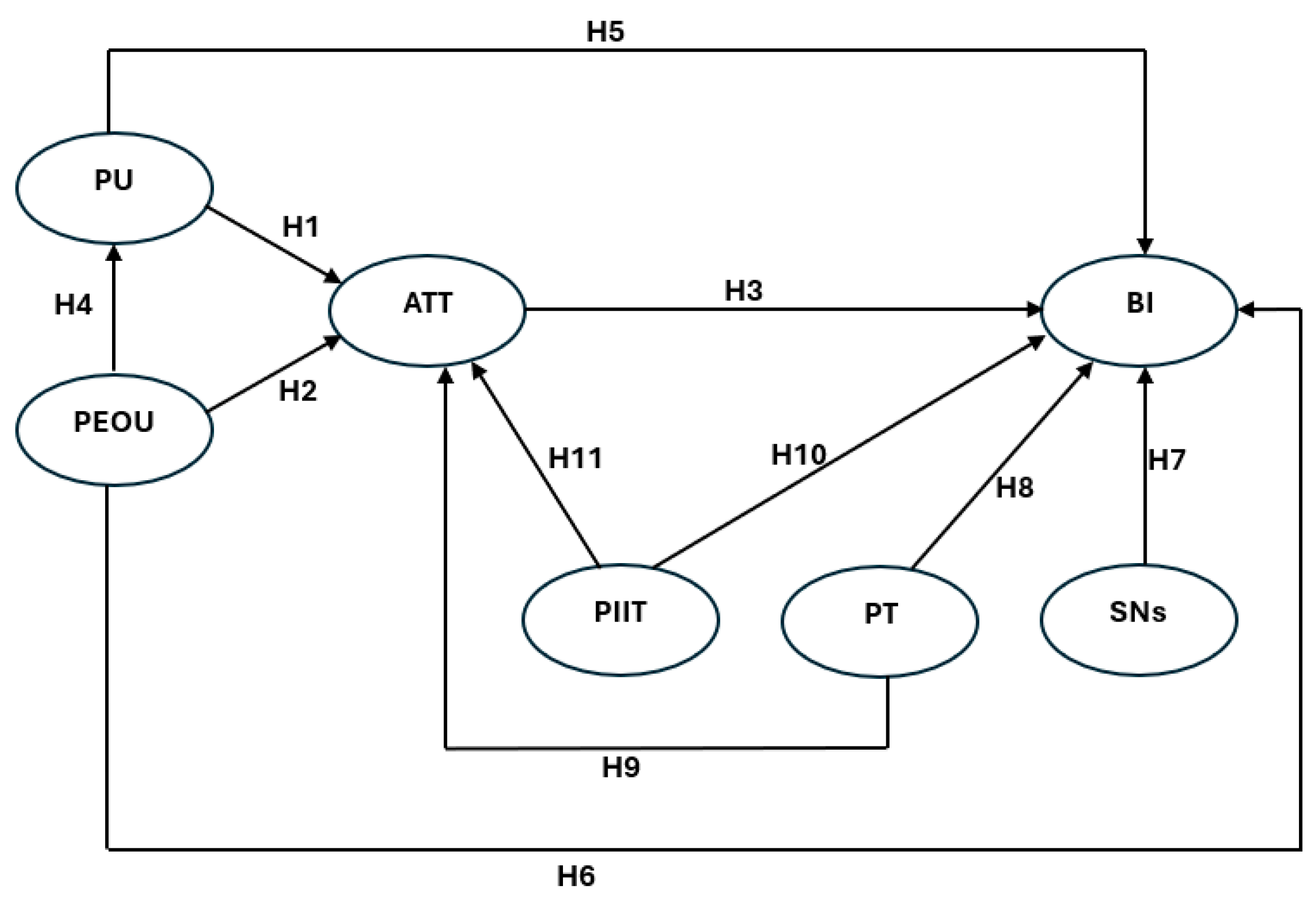

3. Theoretical Framework and Hypotheses Development

3.1. The Technology Acceptance Model

3.2. Subjective Norms

3.3. Perceived Trust (PT)

3.4. Personal Innovativeness (PIIT)

4. Methodology

4.1. Sample Selection and Data Collection

4.2. Measurements and Data Analysis Approach

4.3. Common Method Bias

5. Results and Analysis

5.1. Descriptive Statistics and Respondents’ Profile

5.2. Measurement Model Assessment

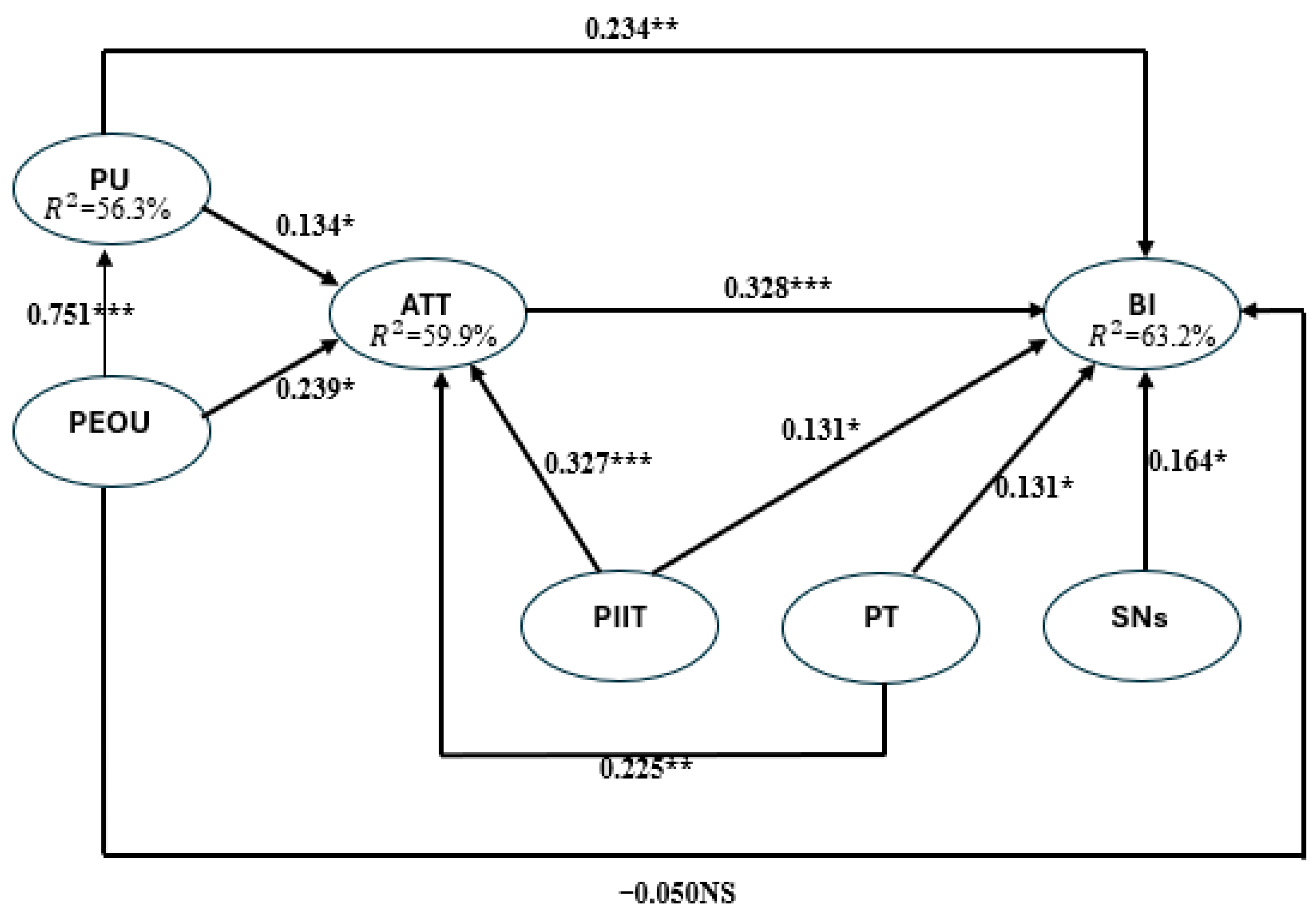

5.3. Structural Model Assessment

6. Discussion and Contributions

6.1. Theoretical Contribution

6.2. Practical Implications

7. Limitations and Directions for Further Research

8. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Agarwal, R., & Prasad, J. (1998). A conceptual and operational definition of personal innovativeness in the domain of information technology. Information Systems Research, 9(2), 204–215. [Google Scholar] [CrossRef]

- Alalwan, A., Dwivedi, Y., Rana, N., & Williams, M. (2016). Consumer adoption of mobile banking in Jordan: Examining the role of usefulness, ease of use, perceived risk and self-efficacy. Journal of Enterprise Information Management, 29(1), 118–139. [Google Scholar] [CrossRef]

- Aldboush, H. H., & Ferdous, M. (2023). Building trust in fintech: An analysis of ethical and privacy considerations in the intersection of big data, AI, and customer trust. International Journal of Financial Studies, 11(3), 90. [Google Scholar] [CrossRef]

- Arab Monetary Fund. (2021). Using artificial intelligence (AI) in banking services. Booklet series. Available online: https://www.amf.org.ae/sites/default/files/publications/2022-01/booklet-series-issue-no-24-using-artificial-intelligence-ai-in-banking-services_0.pdf (accessed on 27 March 2024).

- Basri, W. S., & Almutairi, A. (2023). Enhancing financial self-efficacy through Artificial Intelligence (AI) in banking sector. International Journal of Cyber Criminology, 17(2), 284–311. [Google Scholar]

- Belanche, D., Casalo, L. V., & Flavian, C. (2019). Artificial Intelligence in FinTech: Understanding robo-advisors adoption among customers. Industrial Management and Data Systems, 119(7), 1411–1430. [Google Scholar] [CrossRef]

- Bhattacherjee, A. (2000). Acceptance of e-commerce services: The case of electronic brokerages. IEEE Transactions on Systems, Man, and Cybernetics, Systems and Humans, 30(4), 411–420. [Google Scholar] [CrossRef]

- Bhattacherjee, A. (2012). Social science research: Principles, methods, and practices (2nd ed.). University of South Florida. [Google Scholar]

- Brislin, R. W. (1976). Comparative research methodology: Cross-cultural studies. International Journal of Psychology, 11(3), 215–229. [Google Scholar] [CrossRef]

- Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319–340. [Google Scholar] [CrossRef]

- Dewasiri, N. J., Karunarathne, K. S. S. N., Menon, S., Jayarathne, P. G. S. A., & Rathnasiri, M. S. H. (2023). Fusion of artificial intelligence and blockchain in the banking industry: Current application, adoption, and future challenges. In Transformation for sustainable business and management practices: Exploring the spectrum of industry 5.0 (pp. 293–307). Emerald Publishing Limited. [Google Scholar]

- Fares, O. H., Butt, I., & Lee, S. H. M. (2022). Utilization of artificial intelligence in the banking sector: A systematic literature review. Journal of Financial Services Marketing, 28, 835–852. [Google Scholar] [CrossRef]

- Fintech Saudi. (2022). Fintech Saudi annual report 2021–2022. Available online: https://fintechsaudi.com/wp-content/uploads/2022/11/FintechSaudi_AnnualReport_21_22E.pdf (accessed on 29 February 2024).

- Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention, and behavior: An introduction to theory and research. Addison-Wesley. [Google Scholar]

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. [Google Scholar] [CrossRef]

- Hassan, M. S., Islam, M. A., Abdullah, A. B. M., & Nasir, H. (2024). End-user perspectives on fintech services adoption in the Bangladesh insurance industry: The moderating role of trust. Journal of Financial Services Marketing, 29, 1377–1395. [Google Scholar] [CrossRef]

- Henseler, J., Hubona, G., & Ray, P. A. (2016). Using PLS path modeling in new technology research: Updated guidelines. Industrial Management & Data Systems, 116(1), 2–20. [Google Scholar]

- Iovine, A., Narducci, F., Musto, C., de Gemmis, M., & Semeraro, G. (2023). Virtual Customer Assistants in finance: From state of the art and practices to design guidelines. Computer Science Review, 47, 100534. [Google Scholar] [CrossRef]

- Jambulingam, M., Sinnasamy, I., & Dorasamy, M. (2023). Customer’s perception of voice bot assistance in the banking industry in Malaysia. In Fintech and cryptocurrency (pp. 303–324). Scrivener Publishing LLC. [Google Scholar]

- Kim, G., Shin, B., & Lee, H. G. (2009). Understanding dynamics between initial trust and usage intentions of mobile banking. Information Systems Journal, 19(3), 283–311. [Google Scholar] [CrossRef]

- Lazo, M., & Ebardo, R. (2023). Artificial intelligence adoption in the banking industry: Current state and future prospect. Journal of Innovation Management, 11(3), 54–74. [Google Scholar] [CrossRef]

- Lee, J. C., & Chen, X. (2022). Exploring users’ adoption intentions in the evolution of artificial intelligence mobile banking applications: The intelligent and anthropomorphic perspectives. International Journal of Bank Marketing, 40(4), 631–658. [Google Scholar] [CrossRef]

- Liao, Y. K., Nguyen, H. L. T., Dao, T. C., Nguyen, P. T. T., & Sophea, H. (2023). The antecedents of customers’ attitude and behavioral intention of using e-banking: The moderating roles of social influence and customers’ traits. Journal of Financial Services Marketing, 29, 1037–1061. [Google Scholar] [CrossRef]

- Malodia, S., Islam, N., Kaur, P., & Dhir, A. (2021). Why do people use Artificial Intelligence (AI)-enabled voice assistants? IEEE Transactions on Engineering Management, 71, 491–505. [Google Scholar] [CrossRef]

- Mashhour, A. S., & Saleh, Z. (2015). Community perception of the security and acceptance of mobile banking services in Bahrain: An empirical study. International Journal of Advanced Computer Science and Applications, 6(9), 45–54. [Google Scholar]

- Mei, H., Bodog, S. A., & Badulescu, D. (2024). Artificial intelligence adoption in sustainable banking services: The critical role of technological literacy. Sustainability, 16(20), 8934. [Google Scholar] [CrossRef]

- Mohammed, R. A. S. A. (2024). The Impact of applying artificial intelligence techniques on operational efficiency in Saudi banks. Journal of University Studies for Inclusive Research, 17(35), 15682–15711. [Google Scholar]

- Mueller, R. O., & Hancock, G. R. (2019). Structural equation modeling. In G. R. Hancock, & R. O. Mueller (Eds.), The reviewer’s guide to quantitative methods in the social sciences (2nd ed., pp. 445–456). Routledge. [Google Scholar]

- Nguyen, H. P., & Pham, T. B. D. (2024). Determinants of risky buy-now-pay-later intentions and behaviors of Vietnamese students. Journal of Financial Services Marketing, 29, 1318–1329. [Google Scholar] [CrossRef]

- Noreen, U., Shafique, A., Ahmed, Z., & Ashfaq, M. (2023). Banking 4.0: Artificial intelligence (AI) in banking industry & consumer’s perspective. Sustainability, 15(4), 3682. [Google Scholar] [CrossRef]

- Payne, E. M., Peltier, J. W., & Barger, V. A. (2018). Mobile banking and AI-enabled mobile banking. Journal of Research in Interactive Marketing, 12(3), 328–346. [Google Scholar] [CrossRef]

- Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, P. N. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879. [Google Scholar] [CrossRef] [PubMed]

- Priya, B., & Sharma, V. (2023). Exploring users’ adoption intentions of intelligent virtual assistants in financial services: An anthropomorphic perspectives and socio-psychological perspectives. Computers in Human Behavior, 148, 107912. [Google Scholar] [CrossRef]

- Rahman, M., Ming, T. H., Baigh, T. A., & Sarker, M. (2023). Adoption of artificial intelligence in banking services: An empirical analysis. International Journal of Emerging Markets, 18(10), 4270–4300. [Google Scholar] [CrossRef]

- Rezaei, S., Amin, M., & Herjanto, H. (2024). Pay-per-click (PPC) advertising and continuous banking service intentions. Journal of Financial Services Marketing, 29, 1542–1558. [Google Scholar] [CrossRef]

- Salem, M. Z., & Rassouli, A. (2024). Analyzing the impact of trust in financial institutions on Palestinian consumer attitudes towards AI-powered online banking: Understanding key influencing factors. Competitiveness Review: An International Business Journal 35, 391–408. [Google Scholar] [CrossRef]

- Salimon, M. G., Yusoff, R. Z. B., & Mohd Mokhtar, S. S. (2017). The mediating role of hedonic motivation on the relationship between adoption of e-banking and its determinants. International Journal of Bank Marketing, 35(4), 558–582. [Google Scholar] [CrossRef]

- She, L., Ma, L., Pahlevan Sharif, S., & Karim, S. (2024). Millennials’ financial behaviour and financial well-being: The moderating role of future orientation. Journal of Financial Services Marketing, 29, 1207–1224. [Google Scholar] [CrossRef]

- Singh, P., Roy, N., Bhatt, A. S., Sadual, M. K., & Sahai, A. (2024). Consumer’s Perspective towards Adoption of Artificial Intelligence: An empirical study among banking companies. Pacific Business Review International, 17(3), 131–138. [Google Scholar]

- Singh, R., Kohli, A., & Sharma, J. (2025). Decoding AI adoption in banking: Insights from artificial neural network modelling. International Journal of Economic Perspectives, 19(1), 84–101. [Google Scholar]

- Smida, L., Kaddour, A., & Almshafi, S. (2025). Buy now, pay later practices in the GCC market: Key lessons. In The Palgrave handbook of FinTech in Africa and Middle East: Connecting the dots of a rapidly emerging ecosystem (pp. 1–12). Springer Nature. [Google Scholar]

- Thakur, R., & Srivastava, M. (2014). Adoption readiness, personal innovativeness, perceived risk and usage intention across customer groups for mobile payment services in India. Internet Research, 24(3), 369–392. [Google Scholar] [CrossRef]

- The General Authority for Statistics. (2020). Saudi youth in numbers report for the world youth day 2020. Available online: https://www.stats.gov.sa/en/w/saudi-youth-in-numbers-a-report-for-international-youth-day-2020 (accessed on 28 May 2024).

- White, G. (2022). Generation Z: Cyber-attack awareness training effectiveness. Journal of Computer Information Systems, 62(3), 560–571. [Google Scholar] [CrossRef]

- Yang, S., Lu, Y., Gupta, S., Cao, Y., & Zhang, R. (2012). Mobile payment services adoption across time: An empirical study of the effects of behavioral beliefs, social influences, and personal traits. Computers in Human Behavior, 28(1), 129–142. [Google Scholar] [CrossRef]

- Yoon, C., Jeong, C., & Rolland, E. (2015). Understanding individual adoption of mobile instant messaging: A multiple perspectives approach. Information Technology and Management, 16(2), 139–151. [Google Scholar] [CrossRef]

| Study | Purpose | Country | Methodology | Theoretical Framework | Sample | Type of Analysis | Sig. Variables | Not Sig. |

|---|---|---|---|---|---|---|---|---|

| P. Singh et al. (2024) | Consumer’s Adoption of AI in banking | India | Quantitative | Extended TAM | 810 | Structural Equation Modeling (SEM) | Awareness, Perceived usefulness, Attitude, Subjective norms, Intention | |

| R. Singh et al. (2025) | Decoding AI adoption in banking | India | Quantitative | UTAUT2 | 511 | Artificial Neural Network modeling | Performance Expectancy, Effort Expectancy, Hedonic Motivation, Facilitating Conditions, Behavioral Intentions, Habit, Openness to Change | Social Influence, Perceived Risk, Knowledge |

| Priya and Sharma (2023) | Users’ adoption intentions of intelligent virtual assistants in financial services | India | Quantitative | 435 | SEM | Perceived Intelligence, Perceived anthropomorphism, Perceived animacy, Attitude | Hedonic attitude | |

| Lee and Chen (2022) | Users’ adoption intention of AI mobile banking applications | China | Quantitative | Stimulus-organism-response theory | 451 | SEM | Perceived intelligence, Anthropomorphism, Trust, Task-technology fit | Perceived risk, Perceived cost |

| Mei et al. (2024) | AI adoption in sustainable banking | China | Quantitative | AI Device Use Acceptance model | 435 | SEM | Social influence, Hedonic motivation, Perceived anthropomorphism | |

| Rahman et al. (2023) | Adoption of AI in banking services | Malaysia | Qualitative and Quantitative | Extended TAM | 302 | SEM | Perceived usefulness, Perceived risk, Perceived trust, Subjective norms, Attitude | Perceived ease of use, Awareness |

| Salem and Rassouli (2024) | The impact of trust on consumer attitudes toward AI-powered online banking | Palestine | Quantitative | UTAUT | 362 | SEM | Performance expectancy, Effort expectancy, Social influence, Facilitating conditions, Attitude, Trust | |

| Noreen et al. (2023) | AI in banking industry and consumer’s perspective | Pakistan, China, Iran, Saudi Arabia, and Thailand. | Quantitative | N/A | 799 | Regression analysis, ANOVA | Awareness, Attitude, Subjective norms, Perceived usefulness, Perceived risk, Knowledge of technology | |

| Belanche et al. (2019) | Robo-advisors adoption among Fintech customers | USA, UK, and Portugal | Quantitative | Extended TAM | 765 | SEM | Perceived usefulness, Mass media, Subjective norms, Attitude |

| Construct | Definition | Reference |

|---|---|---|

| Perceived Usefulness (PU) | The extent to which a person expects that using a particular technology would enhance their performance. | (Davis, 1989) |

| Perceived Ease of Use (PEOU) | The degree to which a person anticipates that using a particular technology would be effort-free. | (Davis, 1989) |

| Attitude (ATT) | The degree to which a person considers a specific behavior, such as the adoption of new technology, to be desirable or undesirable. | (She et al., 2024) |

| Subjective Norms (SNs) | The perception that others believe an individual must or must not perform a behavior, influenced by social information and pressures. | (Fishbein & Ajzen, 1975) |

| Perceived Trust (PT) | A person’s belief in a specific service’s ability to meet their expectations and their willingness to rely on its features consistently. | (Hassan et al., 2024) |

| Personal Innovativeness (PIIT) | A person’s willingness to try out new information technologies and adopt new ideas. | (Agarwal & Prasad, 1998) |

| Behavioral Intention (BI) | An individual’s intention to perform a specific behavior, in this case the intention to use AI-enabled voice assistants in banking. | (Davis, 1989), |

| Factor Loading | Cronbach’s Alpha | Composite Reliability (rho_c) | Average Variance Extracted (AVE) | |

|---|---|---|---|---|

| PU | 0.854 | 0.902 | 0.697 | |

| PU1 | 0.873 | |||

| PU2 | 0.851 | |||

| PU3 | 0.865 | |||

| PU4 | 0.745 | |||

| PEOU | 0.865 | 0.909 | 0.715 | |

| PEOU1 | 0.773 | |||

| PEOU2 | 0.834 | |||

| PEOU3 | 0.910 | |||

| PEOU4 | 0.858 | |||

| ATT | 0.867 | 0.919 | 0.790 | |

| ATT1 | 0.869 | |||

| ATT2 | 0.907 | |||

| ATT3 | 0.891 | |||

| SNs | 0.806 | 0.885 | 0.720 | |

| SNs1 | 0.871 | |||

| SNs2 | 0.844 | |||

| SNs3 | 0.829 | |||

| PIIT | 0.894 | 0.926 | 0.759 | |

| PIIT1 | 0.868 | |||

| PIIT2 | 0.836 | |||

| PIIT3 | 0.899 | |||

| PIIT4 | 0.879 | |||

| PT | 0.902 | 0.932 | 0.773 | |

| PT1 | 0.898 | |||

| PT2 | 0.897 | |||

| PT3 | 0.888 | |||

| PT4 | 0.832 | |||

| BI | 0.909 | 0.936 | 0.785 | |

| BI1 | 0.858 | |||

| BI2 | 0.907 | |||

| BI3 | 0.898 | |||

| BI4 | 0.881 |

| ATT | BI | PEOU | PIIT | PT | PU | SNs | |

|---|---|---|---|---|---|---|---|

| ATT | 0.889 | ||||||

| BI | 0.709 | 0.886 | |||||

| PEOU | 0.659 | 0.622 | 0.845 | ||||

| PIIT | 0.649 | 0.611 | 0.530 | 0.871 | |||

| PT | 0.635 | 0.623 | 0.646 | 0.520 | 0.879 | ||

| PU | 0.644 | 0.693 | 0.751 | 0.573 | 0.637 | 0.835 | |

| SNs | 0.587 | 0.650 | 0.771 | 0.555 | 0.599 | 0.773 | 0.848 |

| ATT | BI | PEOU | PIIT | PT | PU | SNs | |

|---|---|---|---|---|---|---|---|

| ATT | |||||||

| BI | 0.795 | ||||||

| PEOU | 0.759 | 0.696 | |||||

| PIIT | 0.729 | 0.667 | 0.599 | ||||

| PT | 0.717 | 0.686 | 0.73 | 0.575 | |||

| PU | 0.745 | 0.782 | 0.871 | 0.649 | 0.725 | ||

| SNs | 0.651 | 0.697 | 0.888 | 0.603 | 0.697 | 0.862 |

| R2 | Q2 | |

|---|---|---|

| BI | 0.632 | 0.521 |

| ATT | 0.599 | 0.567 |

| PU | 0.563 | 0.550 |

| Hypothesis | Path | Original Sample | Sample Mean | Standard Deviation | T Statistics | p Values | Empirical Evidence |

|---|---|---|---|---|---|---|---|

| H1 | PU → ATT | 0.134 | 0.131 | 0.076 | 1.776 * | 0.038 | Supported |

| H2 | PEOU → ATT | 0.239 | 0.240 | 0.080 | 2.971 ** | 0.001 | Supported |

| H3 | ATT → BI | 0.328 | 0.334 | 0.094 | 3.491 *** | 0.000 | Supported |

| H4 | PEOU → PU | 0.751 | 0.752 | 0.034 | 21.868 *** | 0.000 | Supported |

| H5 | PU → BI | 0.234 | 0.230 | 0.079 | 2.962 ** | 0.002 | Supported |

| H6 | PEOU → BI | −0.050 | −0.054 | 0.092 | 0.544 NS | 0.293 | Not Supported |

| H7 | SNs → BI | 0.164 | 0.169 | 0.088 | 1.866 * | 0.031 | Supported |

| H8 | PT → BI | 0.131 | 0.137 | 0.075 | 1.757 * | 0.039 | Supported |

| H9 | PT → ATT | 0.225 | 0.221 | 0.075 | 2.978 ** | 0.001 | Supported |

| H10 | PIIT → BI | 0.131 | 0.126 | 0.075 | 1.745 * | 0.040 | Supported |

| H11 | PIIT → ATT | 0.327 | 0.332 | 0.067 | 4.854 *** | 0.000 | Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alkadi, R.S.; Abed, S.S. AI in Banking: What Drives Generation Z to Adopt AI-Enabled Voice Assistants in Saudi Arabia? Int. J. Financial Stud. 2025, 13, 36. https://doi.org/10.3390/ijfs13010036

Alkadi RS, Abed SS. AI in Banking: What Drives Generation Z to Adopt AI-Enabled Voice Assistants in Saudi Arabia? International Journal of Financial Studies. 2025; 13(1):36. https://doi.org/10.3390/ijfs13010036

Chicago/Turabian StyleAlkadi, Rotana S., and Salma S. Abed. 2025. "AI in Banking: What Drives Generation Z to Adopt AI-Enabled Voice Assistants in Saudi Arabia?" International Journal of Financial Studies 13, no. 1: 36. https://doi.org/10.3390/ijfs13010036

APA StyleAlkadi, R. S., & Abed, S. S. (2025). AI in Banking: What Drives Generation Z to Adopt AI-Enabled Voice Assistants in Saudi Arabia? International Journal of Financial Studies, 13(1), 36. https://doi.org/10.3390/ijfs13010036