Abstract

This analysis investigates the performance and underlying dynamics of the Fama–French Five-Factor Model (FF5M) in the context of the COVID-19 pandemic, exploring its implications on the U.S. stock market across 30 industries. Our findings reveal marked shifts in the significance of factors. The SMB (size) gained in strength, while the HML (value) factor rose and fell in response to shifting flight-to-quality, liquidity, and inflation concerns. Both the RMW (profitability) and CMA (investment) factors saw a decline in their overall significance during the pandemic. Our results illustrate the oscillation of investor preferences from 2018 to 2023, capturing three distinct periods: pre-COVID-19, COVID-19, and post-COVID-19.

Keywords:

COVID-19; investor preferences; equities; Fama–French; risk factors; crises; industrial finance JEL Classification:

G01; G10; G11

1. Introduction

The classification of the COVID-19 virus as a global pandemic by the World Health Organisation on 11 March 2020 sent shockwaves across global financial markets. Preceding economic crises such as the Russian Crisis (1998), the Dot-com Bubble (2001), and the Global Financial Crisis (2007) originated within the financial system, spreading into financial markets relatively slowly. COVID-19, on the other hand, originated outside the financial system and arguably outside the bounds of human control (Worobey 2021; Gao et al. 2022). Unlike preceding crises, the emergence of COVID-19 as a global pandemic was realized almost immediately by financial markets, introducing a structural break in trading dynamics (Michaelides and Poudyal 2024). In the 22 trading days between 24 February 2020 and 24 March 2020, Baker et al. (2020) reported daily market movements of 2.5% or more in 18 of the 22 trading sessions. On 12 March 2020, the Dow Jones and the S&P 500 experienced their worst trading days since Black Monday of 1987, falling over 9% and hitting 52-week lows (Stevens et al. 2020). An abundance of literature has emerged since the beginning of the pandemic, highlighting the significant volatility that emerged as the virus took hold, grew, and spread into a global pandemic, deeply affecting financial markets (Chaudhary et al. 2020; Liu et al. 2020; Al-Awadhi et al. 2020; Goodell 2020; Ali et al. 2020; O’Donnell et al. 2021; Ashraf 2021; Kostin et al. 2022; Essa and Giouvris 2023; Yarovaya et al. 2022; Karamti and Belhassine 2022). As such, COVID-19 presents a unique opportunity to assess the impact of this truly exogenous shock on the short-term drivers of risk and return in financial markets. Analysing thirty significant sectors of the U.S. stock market, this research investigates the sustained impact of drivers of risk and return in the aftermath of the COVID-19 pandemic.

A core tenet of empirical finance is the analysis of the drivers of both risk and return. Beginning with Sharpe (1964) and Lintner (1965), the Capital Asset Pricing Model (CAPM) was proposed, which claimed that the expected return on a stock was proportional to the stock’s level of systematic risk, or beta. Expanding on this, Fama and French (1993) incorporated two new firm-specific factors: the value, or book-to-market value of a company, and the size of the firm. Improving on the CAPM, the Fama–French Three-Factor Model (FF3M) explained 80% of the cross-sectional variation in stock returns, compared to 67% observed in the CAPM. Drawing on the dividend discount model and theoretical underpinnings from Miller and Modigliani (1961), Fama and French (2015a) then expanded their Three-Factor Model into a Five-Factor Model (FF5M) with the implementation of two new firm-specific factors: profitability and investment level of the company. Incorporating these two new dimensions into the understanding of stock returns, the FF5M explained 94% of the cross-sectional variation in stock returns. While these theories provide a cornerstone basis for understanding the drivers of stock market returns, they are based on the assumption that stock returns follow a normal distribution. However, while accepted in theory, this is not always the case in practice as elevated levels of skewness, kurtosis, and time-varying volatility are often observed. The non-normality of stock returns and the presence of both skewness and kurtosis is widely observed in the literature (Mandelbrot 1963; Fama and French 1997; Episcopos 1996). Meanwhile, several authors (Engle 1982; Episcopos 1996; Andersen et al. 2001) provide empirical evidence showcasing the time-varying volatility of historical stock returns. In other words, the level of risk or volatility oscillates over different time periods. As such, the COVID-19 pandemic and the unique economic environment resulting from this new risk presents a set of financial market conditions propitious for empirical investigation under this longstanding model. Preliminary research by Baig et al. (2021) and Baig et al. (2023), who found that COVID-19 intensity significantly influenced the level of stock liquidity across the U.S.A. over the initial months of the COVID-19 pandemic, further highlights the need to examine the shifting dynamics of trading through the pre-to-post pandemic period.

The primary objective of this analysis is to examine stock market conditions in thirty distinct stock market sectors before, during, and after the COVID-19 pandemic. From this, we use the FF5M methodology to examine three distinct research areas surrounding financial markets and the COVID-19 pandemic. Firstly, we evaluate whether the explanatory power of the FF5M sustains under the distinct crisis setting that COVID-19 presented. Secondly, we examine the significance of the five Fama–French factors before, during, and after the pandemic, identifying noteworthy shifts within the factors driving overall market returns. Finally, across the thirty distinct sectors under analysis, we investigate whether there was a consistent or asymmetric shift in the significance and explanatory power of each of the five factor weightings in the Fama-French Five-Factor Model, highlighting the sector-specific characteristics that may have influenced the shifts. To address these questions, we apply the FF5M to all stocks listed on the NYSE, AMEX, and NASDAQ in three distinct periods.

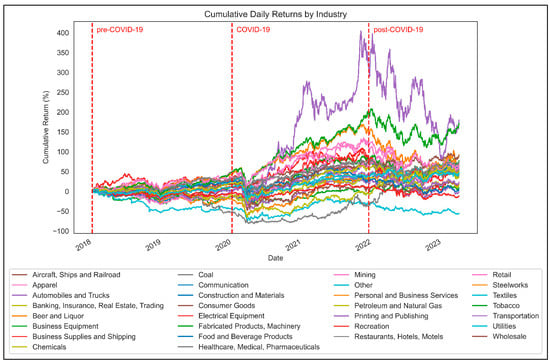

We examine thirty sectors in total outlined in Figure 1, during these pre-defined periods, covering all main sectors of the U.S. economy. We sourced industry portfolio data and Fama–French factor data from the open-source Kenneth French Data Library Centre, compiled from stock market data from the Centre for Research in Security Prices (CRSP) database (French 2023), which lists industry-by-industry portfolio data for stocks listed on the NYSE, AMEX, and NASDAQ. Considering the time limitations and the data accessible in the post-pandemic period, we opted to use daily returns for our analysis. This choice was made to ensure a substantial sample size and to capture the level of detail needed to account for the short-term market fluctuations that occurred during the COVID-19 pandemic.

Figure 1.

Performance of each industry over the analysis period, between 2018 and 2023. The sharp initial reaction of stock markets to the onset of the COVID-19 pandemic is evident, before a significant rebound in returns.

We define the pre-pandemic window as the 2-year period encompassing 1 January 2018 to 1 January 2020, totalling n = 503 trading days. The pandemic window is defined as the period encompassing the first confirmed case of the virus on 18 January 2020 (CDC 2020) until 15 December 2021, whereby the Federal Reserve (2021) announced its decision to wind down its significant pandemic stimulus monetary policies, totalling n = 482 trading days. By this date, over 75% of the population in the U.S.A. had received at least one dose of the COVID-19 vaccine (CDC 2023), with a notable decline in the COVID-19 Government Response Stringency Index observed also (Hale et al. 2021)1. We include this period as the introduction of the COVID-19 vaccine significantly altered financial markets within the U.S.A. (O’Donnell et al. 2023; Kucher et al. 2023). Finally, we define the post-COVID window as the period following this COVID window to the most recently available data, as of 31 March 2023, totalling n = 290 trading days. As such, three distinct time periods are defined for this analysis. We select these short estimation periods in line with methodological precedents set in the current literature emerging from the COVID-19 pandemic (Lee 2020; Li et al. 2020; Alqadhib 2022) and to capture the variation in factor weightings over three distinctly notable periods in financial markets. Blitz et al. (2022) argue that while the FF5M was initially proposed over long multi-year periods to capture the long-term drivers of stock returns, market anomalies such as COVID-19 can result in significant and prolonged drawdowns among factors on a shorter-term horizon. As such, this analysis fills an essential gap in the literature, quantifying the short-term oscillation of stock market drivers during the COVID-19 pandemic. From both a retrospective analysis and real-time trading perspective, the insights and implications garnered from the use of short-term estimation windows can be used to inform event-driven trading and portfolio reallocations in times of crisis.

Our empirical results confirm the utility of the FF5M in explaining excess market returns across industries, with statistical significance observed in our model tests throughout. The adjusted R2 values varied across the three time periods under analysis. Pre-COVID: 0.63 (moderate effect), COVID: 0.77 (strong effect), and post-COVID: 0.71 (moderate effect). The FF5M showed increased explanatory power during and after the pandemic, likely due to the uniform impact of the crisis on asset returns. Across the three time periods, notable shifts in factor weightings and exposures were also observed. During and after the pandemic, small-cap stocks outperformed large-cap stocks, reflected in the increased strength of the SMB factor. The HML factor indicated a significant outperformance of value stocks over growth stocks, aligning with a ‘flight-to-quality’ amidst increased market uncertainty. Both the RMW and CMA coefficients decreased significantly during and after the pandemic, signifying a reduced spread in returns between highly profitable and weakly profitable firms, and highly conservative and aggressive firms, likely influenced by pandemic-induced economic conditions and a ‘flight-to-quality’ once more.

The body of pandemic-related literature covering the Fama–French factors is currently limited but growing. Several short-term sectoral analyses have emerged examining the impact of COVID-19 on the factors driving stock returns. Horvath and Wang (2021) found a substantial decrease in the explanatory R2 during the pandemic, in line with previous analyses undertaken during both the Dot-com Bubble and the Financial Crisis of 2008. Hou and Chen (2021) investigated the American steel industry in isolation, finding that the profitability factor transitioned from significant to insignificant upon the onset of COVID-19. Both the size and value factors remained significant in both stages, while the investment factor was insignificant during both. Similarly, Hou (2021) examined U.S. retail stocks between September 2019 and August 2020, finding that both the profitability and investment factors became redundant during the pandemic. Instead, most small-size companies performed better than their large counterparts, while companies with high book-to-market ratios, or value companies, outperformed growth companies in the same industry. Findings from Alqadhib (2022) suggest that small firms outperformed big firms by 0.1%, while firms with conservative investment objectives outperformed aggressive firms by 0.03%. On the other hand, value firms underperformed growth firms by 0.55%, while robustly profitable firms underperformed weakly profitable firms by approximately 0.06%. Additionally, Alqadhib (2022) found growth in COVID-19 cases to be a new factor impacting the performance of mutual funds, echoing findings from O’Donnell et al. (2021) and O’Donnell et al. (2023). Analysing returns in the energy sector, Kostin et al. (2022) tested the validity of the FF3M and FF5M during COVID-19 using the period from January 2000 to April 2022. The findings indicated that the currently available factors are insufficient for explaining the behaviour of stocks during times of crisis when using models that do not incorporate the expected occurrence of such crises. These results align with previous tests of the Fama–French multi-factor models during times of anomalous market behaviours (Fama and French 2008).

Our paper adds to and extends the current literature in several ways. Firstly, given the limited nature of the research currently available on the FF5M during the COVID-19 pandemic, this research fills an important gap in the literature, providing both a quantitative and qualitative assessment of the drivers of stock returns in key sectors of international stock markets. Secondly, using a 6-year timeframe spanning 2018–2023 inclusive, this analysis builds on the preceding shorter-term COVID-19 studies present in the literature, providing a more robust assessment of the shifting exposures of multiple stock market sectors in the years preceding, during, and after the COVID-19 pandemic. As mentioned above, the current literature provides insights into the changing factor exposures to individual sectors. This research complements the current literature with a comparative analysis of the oscillating significance of the Fama–French factors across thirty industries and three distinct time periods. As such, this analysis provides a robust analysis of the FF5M and the drivers of stock market returns under the distinct crisis setting that COVID-19 produced. Finally, as Blitz et al. (2022) state, market anomalies can lead to substantial and extended declines in factor performance within a short timeframe. Therefore, although the FF5M was initially designed for assessing long-term drivers of stock returns, this analysis addresses a noteworthy gap in the existing literature by quantifying the short-term fluctuations in stock market drivers during the COVID-19 pandemic.

The study proceeds as follows. Section 2 further examines the current literature on this research question, defining and summarizing the utility of the Fama–French methodology. It thereafter describes the empirical methodology and data employed in this investigation. Section 3 outlines the empirical results and further explores the findings and implications that can be drawn from the results in the context of financial market dynamics before, during, and after the COVID-19 pandemic. Section 4 concludes the analysis.

2. Materials and Methods

2.1. Methods

The Capital Asset Pricing Model (CAPM), developed by Sharpe (1964) and Lintner (1965), was underpinned by the work of Markowitz (1952) and the emergence of the Modern Portfolio Theory (MPT). This theory outlines how the risk of an asset can be divided into two distinct parts. Firstly, the idiosyncratic risk of an asset, or the risk specific to each asset, and secondly, the systematic risk of an asset or the risk inherent to all assets in the market. Therefore, given a defined level of risk, investors can construct a portfolio of assets which achieves greater returns without a higher level of risk through diversification and, thus, the reduction of both covariance and correlation between assets in a portfolio. As a well-established paradigm, it remains the cornerstone of modern portfolio theory, robustly tested and accepted in the literature (Brinson et al. 1986; Elton et al. 2007; DeMiguel et al. 2009).

The CAPM builds on the fundamental assumptions of MPT surrounding efficient markets and market risk and seeks to describe the relationship between the expected return of an asset and its specific exposure to market risk, or beta, given by the formula:

where: is the expected return, is the risk-free rate, is the beta of the asset, and is the return on the market.

Under testing, the CAPM was able to explain approximately 67% of the variation in expected returns (Black et al. 1972; Fama and MacBeth 1973). However, the model’s assumption of only rational risk-averse and not risk-seeking investors (Roy 1952; Markowitz 1952), the limited applicability over different time periods (Roll and Ross 1994), and the weak explanatory power of beta (Black et al. 1972) have all been subject to criticism. While these criticisms emerged over time, the utility of the CAPM as a seminal framework in understanding the relationship between risk and return was still broadly regarded and incorporated into emerging financial research (Black 1972; Jensen 1972; Sharpe 1991).

As mentioned previously, Fama and French (1993) added two firm-specific factors in addition to the beta factor proposed in the CAPM; the book-to-market value of a company (‘value’), and the market capitalisation of the firm (‘size’). Previous research uncovered the utility of both the size and value factors, motivating their inclusion in the FF3M. Banz (1981) and Basu (1983) found that small companies typically provided higher risk-adjusted returns than their large counterparts, while Chan et al. (1991) found that value companies (companies with high book-to-market ratios) provided higher risk-adjusted returns than growth companies (companies with low book-to-market ratios).

The FF3M is given by the formula:

where: is the return on a portfolio, is the risk-free rate, is the return on the market, is the sensitivity of the asset to the market, (SMB) is the historic excess returns of small-cap companies over large-cap companies, and (HML) is the historic excess return of value stocks (high book-to-market ratio) over growth (low book-to-market ratio).

As Fama and French (1996) state, the CAPM failed to explain the relationship between average returns and firm-specific characteristics. Addressing this criticism, the FF3M was able to explain 80% of the cross-sectional variation in stock returns, compared to 67% observed in the CAPM. While achieving a statistically significant increase in explanatory power, criticisms remained regarding the model’s inability to capture the variation in average returns related to both the profitability and investment activities of a firm (Titman et al. 2004; Novy-Marx 2013). As such, Fama and French (2015a) augmented the Three-Factor Model and added both profitability and investment factors, drawing on the dividend discount model and theoretical underpinnings from Miller and Modigliani (1961). The FF5M is thus given by:

where: is the return on a portfolio , is the risk-free rate, is the return on the market, is the sensitivity of the asset to the market, (SMB) is the excess returns of small companies over large companies, (HML) is the excess return of value stocks over growth stocks, (RMW) is the excess returns of robustly profitable companies over weakly profitable companies, and (CMA) is the historic excess return of companies with conservative investments versus aggressive investments.

Upon the inclusion of both operating profitability and investment dimensions into the understanding of stock returns, the model consistently accounted for approximately 90% of the cross-sectional variation in stock returns (Fama and French 2015a; Hou et al. 2014; Harvey et al. 2016). The literature is abundant with confirmations of the explanatory power of the Fama–French models in various regions and time periods. Faff (2001) confirms the validity of the FF3M for 24 Australian stock market sectors, observing a negative relationship between firm size and expected return. In other words, the return on small firms exceeded that of large firms. Additionally, value firms with high book-to-market ratios provided higher returns than growth firms, in line with Fama and French (1993). Similarly, Gaunt (2004) found that the FF3M provided a significant improvement in the explanatory power of the CAPM, with a distinct significance of the value factor in the observed asset pricing.

Nartea et al. (2009) confirmed this value effect for the New Zealand stock market, as did Davis et al. (2007) for U.S. stock market returns between 1929 and 1963. Shaharuddin et al. (2018) examined Islamic equity indices under the same model, once again confirming both the size and value effect in the period preceding the Global Financial Crisis of 2008. However, in the period following the crisis, a reversal of the size effect was observed, suggesting that larger firms outperformed smaller firms, in contrast to what is proposed by Fama and French (1993). This reversal of the size effect and anomaly of the Fama–French model is commonly observed in the literature surrounding times of economic uncertainty, whereby larger, reputable firms may be seen as less risk-prone and thus, more favourable as investor sentiment changes with economic conditions. Examining common stocks on the NYSE, Banz (1981) suggests that a reversal of the size effect is observed during periods of recession, while Dimson and Marsh (1999) observe the same for U.K. stock market returns in the time period following recessions. In Asian stock markets, Ziemba and Schwartz (1991) and Nartea et al. (2013) echo these findings, a salient point to note going forward in this analysis of the COVID-19 pandemic.

The aforementioned literature confirms the relevance and utility of the Fama–French model internationally over long time horizons and normal financial market conditions. This analysis extends the limited set of COVID-19-related literature outlined in the Section 1 with an examination of the most recent recession observed in financial markets. The volatility and non-normality of such crises present challenges to any theoretical model. As such, this analysis complements and contributes further to the current pandemic-related literature outlined in the previous section. While the literature is currently limited in scope, this analysis provides a robust assessment of both the explanatory power and oscillating factor weightings across key stock market sectors before, during, and after the COVID-19 pandemic.

2.2. Materials

2.2.1. Returns Data

In this study, we sourced industry portfolio data from the open-source Centre for Research in Security Prices (CRSP) database, available from the Kenneth French Data Library and extensively used in financial literature. Firstly, each CRSP-listed firm on the NYSE, AMEX, and NASDAQ was assigned a four-digit standard industrial classification (SIC) code. Following this, the average daily return across the stocks in the assigned industry portfolio was computed, with each return weighted by its market capitalisation in the entire industry portfolio to form an average daily return of each industry portfolio. Our analysis included all firms listed in the CRSP database that were actively traded and had complete return data for the periods under study. To minimize potential biases from data limitations, firms that were delisted or had incomplete return data were excluded from the analysis. While this could introduce a small bias by under-representing industries with higher delisting rates, the impact is mitigated by the broad coverage of active firms in the CRSP database and the robustness checks conducted to ensure data integrity.

Given the time constraint and data availability in the period following the pandemic, we selected daily returns for this analysis to ensure a robust sample size while also capturing the necessary level of granularity required to capture the short-term fluctuations present in the market during the COVID-19 pandemic. The Fama–French model was originally estimated using monthly returns (Fama and French 1993, 2015a). However, due to the short-term research objective in question and the limited availability of data, daily returns were considered for this analysis. While monthly returns may be more suitable for the estimation of long-term relationships, the scope of this analysis is to examine the immediate impact that the unforeseen and exogenous shock of COVID-19 had on financial markets and the immediate effect this had on factor exposures in each sector. As such, the selection of daily returns was the most appropriate choice for this analysis. While criticisms exist due to the additional noise inherent in daily returns, evidence in the current literature suggests that the Fama–French models can achieve comparable performance with daily returns. Brown and Warner (1985) found that the use of daily returns provides comparable results when compared to monthly returns. Despite the potential for noise, both MacKinlay (1997) and Jegadeesh and Titman (1993) also demonstrated that daily data provide reliable results and can capture momentum and short-term reversal patterns critical for understanding market dynamics during periods of uncertainty. As such, we propose that the use of daily returns in this analysis provides the necessary level of granularity required to capture the short-term fluctuations present in the market during the COVID-19 pandemic.

We sourced the data from 1 January 2018 to 31 March 2023, with three distinct periods defined within this window. The pre-COVID period was defined as the period from 1 January 2018 to 1 January 2020 (n = 503 trading days), while the COVID period was defined as the period from 18 January 2020 to 15 December 2021 (n = 482 trading days). The post-COVID period was defined as the period from 1 January 2022 to 31 March 2023 (n = 290 trading days). The selection of the pre-COVID period was chosen as the two years before the emergence of the pandemic in the first months of 2020. The COVID period was chosen as the date of the announcement of the first case in the U.S.A. (CDC 2020) until the Federal Reserve (2021) announced its intentions to unwind the stimulus policies implemented for pandemic relief. Finally, the post-COVID period was selected as the month following this announcement until the most recent date when data were available. In total, thirty distinct industries within the U.S. stock market have been considered in this analysis. Each industry is outlined in Figure 1 alongside its respective cumulative daily return over the entire period under analysis. Stock returns in the U.S. stock market displayed distinct patterns across three key periods: pre-COVID, COVID, and post-COVID. Relative to the following two time periods, the pre-COVID phase was characterized by relative stability, with mixed stock returns. In 2018, a clear upward trend is observed, reflecting investor confidence amid favourable monetary policy conditions, low interest rates, and low inflation metrics. In late 2018, a significant correction is evident, with all sectors dropping from their peaks in September to the end of December. This correction was influenced by concerns about global economic growth, trade tensions (particularly between the U.S. and China), and fears of rising interest rates.

As the COVID-19 pandemic emerged, stock market returns fell significantly as the market responded to the potential for widespread societal and economic implications from the pandemic. As evident in Figure 1, global stock markets fell significantly in response to rising cases, deaths, and other pandemic-related metrics which were emerging at the time (Ashraf 2020b; Al-Awadhi et al. 2020; O’Donnell et al. 2021). As significant monetary policy supports were announced by central facilities across the world, stock markets began to rise in response (Chen and Yeh 2021; Heyden and Heyden 2021; O’Donnell et al. 2024). A clear rise in stock market returns is observed in late 2020, also in response to news of successful vaccination trials (O’Donnell et al. 2023). As abundant liquidity supports continued throughout 2021, stock market returns continued to rise. However, as we enter the post-COVID phase, we observe a significant increase in the volatility of returns, amid an overarching downward trend. This coincides with the Federal Reserve (2021) announcing its decision to wind down its significant pandemic stimulus monetary policies and to increase interest rates, as inflation metrics rose significantly. This trend of increasing interest rates and increasing inflation continued throughout this period, characterised by the persistent downward trend in stock market returns as the market digested unfavourable macroeconomic conditions.

Fama–French Factors

Similarly, the Fama–French factors for the market portfolio are sourced from the Kenneth French Data Library. Unlike the industrial portfolios, the Fama–French factors are computed for the entire market portfolio of all CRSP-listed firms on the NYSE, AMEX, and NASDAQ. The Fama–French model suggests that the factors driving average returns are common across all assets and industries. As such, it is appropriate to use the factor weightings present in the whole market portfolio as a comparison against industry-specific returns to capture the behaviour and significance of the common risk factors which drive asset returns across all industries (Fama and French 1993, 2015a; Hou and Robinson 2006). Each factor and its computation are outlined below in Table 1. As per Fama and French (2015a), the aforementioned stocks are sorted into six value-weighted portfolios formed on size and book-to-market (Small Value, Small Neutral, Small Growth, Big Value, Big Neutral, and Big Growth). Six value-weighted portfolios formed on size and operating profitability are also computed (Small Robust, Small Neutral, Small Weak, Big Robust, Big Neutral, and Big Weak). Finally, six value-weighted portfolios formed on size and investment are computed (Small Conservative, Small Neutral, Small Aggressive, Big Conservative, Big Neutral, and Big Aggressive). The stocks are ranked and sorted by the respective sorting category and firm-specific characteristic and split accordingly to form the 18 total portfolios stated above. With this data, the daily Fama–French factors are then joined by date to the average industry portfolio returns data to form a complete dataset of both average daily return per industry and the Fama–French factor weighting in the market for each day of our chosen date range.

2.2.2. Application of Fama–French Model

In this study, we used the FF5M with the regression equation outlined in Equation (3) above. We used Python to conduct the regression analyses, the source code of which is available from the authors upon request. Following methodological precedents in factor modelling literature (Fama and French 2015a), we use the standard OLS methodology and iterate through each industry and time period with the dependent variable, , being the observed average return for each industry, and the set of independent variables, , being the five Fama–French factors outlined above. As such, we generated a total of 90 regression models across 30 industries and 3 time periods, the results of which are outlined in the following section.

Robustness Tests

To ensure robustness in our analysis, we performed four checks to verify that the underlying assumptions of the FF5M and the OLS regression methodology are satisfied. Firstly, we tested the stationarity of our data using the Augmented Dickey-Fuller (ADF) test introduced by Dickey and Fuller (1979) to ensure the time series portrays a constant mean and variance over time. As shown in Table 2, p-values indistinguishable from zero are returned for each regression analysis, implying that the time series is stationary at a one percent level of significance. Secondly, we tested for autocorrelation using the Durbin–Watson test introduced by Durbin and Watson (1950). If autocorrelation is absent from the residuals of a regression model, then the residuals of each variable should be randomly distributed with a mean of zero. Table 1 presents an average Durbin–Watson Statistic of 1.99. The Durbin–Watson distribution is symmetrical around the value 2 (its mean value), and ranges from 0 to 4, with 2 indicating no autocorrelation, 0 indicating positive autocorrelation, and 4 indicating negative correlation. As such, no serial autocorrelation was detected in our analysis. Thirdly, we tested if our data were homoscedastic, that is, the residuals of the variables were normally distributed with equal or similar variance. We used the Breusch–Pagan–Godfrey (BPG) Heteroscedasticity test introduced by Breusch and Pagan (1979). The squared residuals from the original model were regressed against the independent variables to identify any significant relationship between the variance of the residual, and any independent variable. The chi-squared test statistic and corresponding p-value were then assessed to identify evidence of heteroscedasticity. As Table 1 shows, an average p-value of 0.39 was observed across our models. Therefore, we cannot reject the null hypothesis of the Breusch–Pagan–Godfrey test that the data are homoscedastic. As such, we can infer that the residuals do not vary over time and that our data does not contain heteroscedasticity. Finally, to test for multicollinearity and correlation between our independent variables, we employed the Variance Inflation Test (VIF). Vittinghoff et al. (2005) suggest that a VIF value greater than 10 is problematic, while Witten et al. (2013) take a more conservative approach of values greater than 5. As Table 1 outlines, the average VIF value for each factor does not exceed 2.62. As such, we can infer that multicollinearity does not present a serious concern for our variables.

Table 1.

Each of the five Fama–French factors used in the empirical framework of Fama and French (2015a); the factor, symbol, and firm-specific metric used for each respective factor, the calculation of the factor, and finally how this is computed from the 16 portfolios constructed from the market portfolio.

Table 1.

Each of the five Fama–French factors used in the empirical framework of Fama and French (2015a); the factor, symbol, and firm-specific metric used for each respective factor, the calculation of the factor, and finally how this is computed from the 16 portfolios constructed from the market portfolio.

| Factor | Factor Symbol | Firm Metric | Calculation | Computation |

|---|---|---|---|---|

| Market Risk | Mkt-RF (Market Risk Premium) | Excess Return of Market | Difference in return between the market portfolio and the risk-free rate | |

| Size | SMB (Small Minus Big) | Market Capitalization | Difference in return between small-cap stocks and large-cap stocks. | |

| Value | HML (High Minus Low) | Book-to-Market Ratio | Difference in return between high book-to-market (value) and low book-to-market (growth) stocks. | |

| Profitability | RMW (Robust Minus Weak) | Operating Profitability | Difference in return between firms with high and low operating profitability. | |

| Investment | CMA (Conservative Minus Aggressive) | Ratio of Capital Expenditure to Assets | Difference in return between firms with low and high investment. |

Table 2.

Results of the 4 robustness tests conducted on our data to test for stationarity, autocorrelation, heteroskedasticity, and multicollinearity. Our results suggest that our data satisfy the assumptions of the standard OLS regression methodology and that our data are stationary, with no significant autocorrelation, heteroskedasticity, or multicollinearity present.

Table 2.

Results of the 4 robustness tests conducted on our data to test for stationarity, autocorrelation, heteroskedasticity, and multicollinearity. Our results suggest that our data satisfy the assumptions of the standard OLS regression methodology and that our data are stationary, with no significant autocorrelation, heteroskedasticity, or multicollinearity present.

| Average Value across Regression Analyses (n = 90) | |

|---|---|

| Robustness Test | Value |

| ADF Test p-Value | 0.00 |

| Durbin–Watson Statistic | 1.99 |

| BPG Test p-Value | 0.39 |

| VIF—Mkt-RF | 1.01 |

| VIF—SMB | 1.31 |

| VIF—HML | 1.39 |

| VIF—RMW | 2.62 |

| VIF—CMA | 1.45 |

| VIF—Constant | 2.39 |

3. Results and Discussion

3.1. Summary Statistics

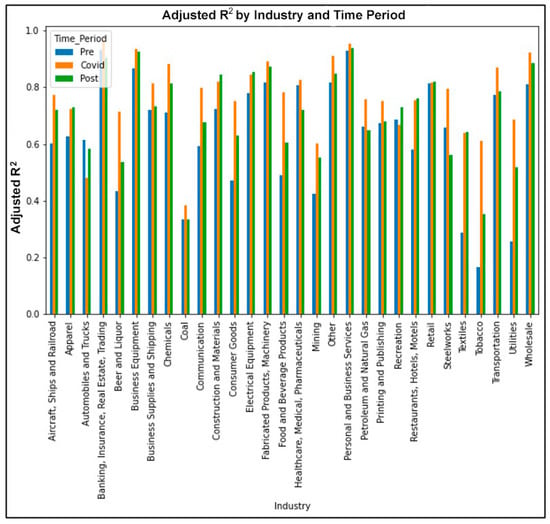

The regression results for each industry in the pre-COVID, COVID, and post-COVID windows are outlined in Appendix A (Table A1, Table A2 and Table A3). As evidenced by the respective p-values of the F-statistic, all of the 90 regression analyses yielded statistically significant models at the 1% confidence level. As Kostin et al. (2022) state, within the literature on asset pricing models, it is a commonly accepted metric of validity if the intercept value is as close to zero as possible. Examining our regression models, we observe an average intercept value of 0.001 across all industries and time periods. Before discussing the results on an industry-by-industry and factor-by-factor basis, it is instructive to examine summary statistics for the regression results generated. As an initial measure of both the performance and efficiency of the Fama–French Model, we use the adjusted R2 value as a broad indicator of the goodness-of-fit. We observe an average R2 of 0.63 in the pre-COVID period, 0.77 in the COVID period, and 0.71 in the post-COVID period. Interestingly, the FF5M showed moderate to strong explanatory power in the COVID and post-COVID window, with the weakest effect observed in the 2-year period before the onset of the pandemic2.

Figure 2 illustrates these findings also, showing a distinct increase in the R2 value across most industries upon the onset of the COVID-19 pandemic. These results contrast with Horvath and Wang (2021), who observed a substantial drop in R2 values during COVID-19. However, unlike this analysis, their period of analysis was only as far as March 2020. This increase in explanatory power may, in part, be due to the homogenous impact of the pandemic on investor sentiment and stock market performance. The relatively uniform impact of the pandemic on all sectors (illustrated in Figure 1) shows the homogeneity of the crisis on asset returns in all industries. As such, the initial shock and subsequent rebound arguably led to a set of financial market conditions more efficiently explained by the factors within the FF5M. This echoes the findings of Yamani and Swanson (2014), who found that financial crises which exhibited global effects rather than regional effects resulted in more integrated financial markets.

Figure 2.

Adjusted R2 values of the Fama–French regression analysis per industry per period. As can be seen, the explanatory power of the model in explaining average industry returns increased in almost all industries upon the onset of the pandemic.

An analysis of the standard errors across the three time periods (Table A4 in Appendix A) reveals increased uncertainty during the COVID-19 period, as reflected in higher standard errors. This indicates that the relationships between the Fama–French factors and stock returns were less predictable due to the market volatility induced by the pandemic. As the market stabilized in the post-COVID period, the standard errors decreased slightly, although they remained higher than in the pre-COVID period. These findings demonstrate the sensitivity of the Fama–French model to extreme market conditions and provide insight into the model’s precision in different market environments. This suggests that while the model remains robust, the unprecedented market conditions introduced variability that naturally affected the precision of the estimates.

3.2. Fama–French Factor Weightings

Table 3 below illustrates the average Fama–French factor weighting across all industries in each period. As the period moves from the pre-COVID window to the COVID and post-COVID windows, several interesting results are observed.

Table 3.

Average Fama–French Factor weightings across the three time periods under analysis.

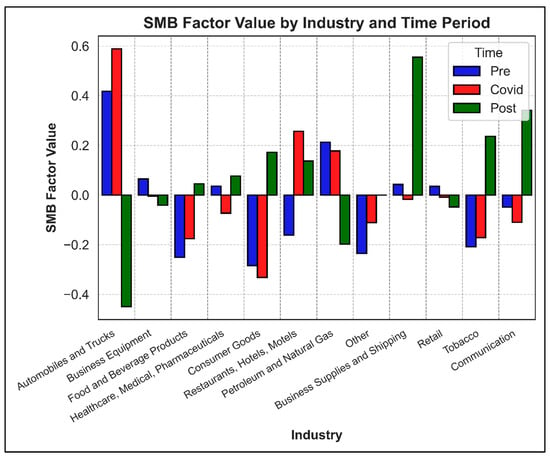

Firstly, the strength of the SMB factor increased from 0.168 in the pre-COVID window to 0.217 and 0.315 in the COVID and post-COVID windows. This increase in the positive coefficient would suggest that during the pandemic and beyond, small-cap stocks, which would typically be considered riskier, outperformed large-cap stocks. This contrasts with Lim et al. (2014), who examined the Fama–French factors during the Global Financial Crisis of 2007 and 2008. In their analysis, it was found that the relationship between the SMB factor and both volatility and market returns were consistent with investors ‘flying to quality,’ when the expected risk in the market increased. Findings from Abel (1988) and Barsky (1989) echo Lim et al. (2014), albeit in reverse. Here, a reduction in risk leads to a shift away from pursuing high quality. In the context of the COVID-19 pandemic, Figure 1 shines some light on a possible explanation for our counterintuitive results. Firstly, while the initial shock of the pandemic was swift and severe, an unprecedented rebound in stock markets was observed in financial markets soon after. While the sustaining presence of the pandemic was still evident within society, Figure 1 does not reflect this sustaining negative outlook. Findings from Lim et al. (2014) support this view, whereby positive shocks to overall market returns increased the strength of the SMB factor. In other words, despite the overarching uncertainty and risk of the COVID-19 pandemic, the rising market led to greater investor confidence in smaller stocks. With prevailing low interest rates, abundant liquidity supports from the Federal Reserve and supportive inflation metrics (at the time), the willingness of investors to engage in an increased level of risk and invest in smaller companies with higher growth potential arguably explains the findings in this analysis.

Behavioural explanations for the SMB effect have also historically been presented in the literature. Kumar and Lee (2006) argue that the SMB effect may instead be attributable to fluctuating investor sentiment within retail trading, while Durand et al. (2007) find that the SMB effect in the Australian stock market could be explained by disproportionate reactions by investors in the market. Here, it is argued that the premium earned by small stocks is significantly determined by behavioural factors. Outside of behavioural finance, findings from several studies (Jensen et al. 1997; Jensen and Mercer 2002) suggest that a positive SMB effect exists only when an expansive monetary policy approach has been adopted by the respective central bank. In the context of COVID-19 we find these explanations true, with significant credit, liquidity, and financial supports provided by the Federal Reserve to both consumers and businesses. These expansive monetary policies concurrently came with a significant increase in retail trading. The online trading app Robinhood experienced a 115% increase in online activity in the first half of 2020, while legacy brokers TD Ameritrade, E-Trade, Fidelity, and Schwab also recorded sharp increases of 52%, 46%, 38%, and 32%, respectively (Ozik et al. 2021). As such, abundant liquidity, low interest rates, a significant increase in retail trading, and the subsequent effects of behavioural finance can be used to explain the increased SMB premium in both the COVID and post-COVID window, compared to the pre-COVID window.

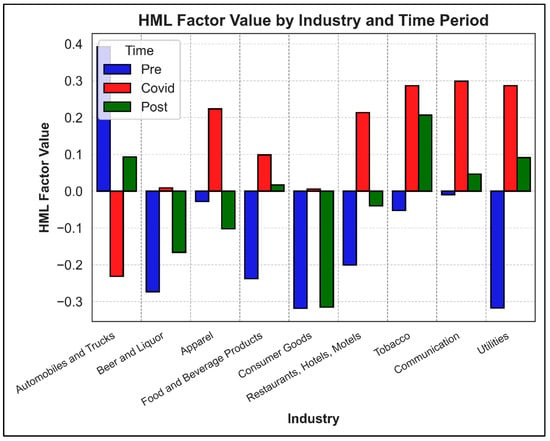

Secondly, we observe an even more significant increase in the HML factor, from 0.055 in the pre-COVID window to 0.216 and 0.17 in the COVID and post-COVID windows, respectively. This increase represents a significant increase in the outperformance of value stocks over growth stocks upon the onset of the pandemic. This is in line with the conventional wisdom outlined in Fama and French (1993) and reaffirmed by Lim et al. (2014), who found a rising value premium during the Global Financial Crisis of 2007 and 2008. Here, the ‘flight-to-quality’ during times of increased market risk is evident. In other words, during times of increased uncertainty in the market, more established companies with high book-to-market ratios, perceived to be safer, may be sought out by investors. This flight-to-quality effect introduced by Abel (1988) and Barsky (1989) is thus reinforced by our findings from the COVID-19 pandemic, as investors sought out less risky investments once the pandemic emerged.

While we suggest that rising market levels increased the confidence in more risky smaller stocks, resulting in an increase in the SMB factor, rising market levels may also have had a concurrent positive impact on the HML factor. While the substantial increase in the HML factor as the COVID-19 pandemic emerged may be indicative of a flight-to-quality as market conditions improved, this HML effect may also be consistent with increasingly confident investors increasing their exposure to value stocks in the market. Research from J.P. Morgan by Weng and Butler (2022) echoes the strengthening HML factor observed in our results. Here it was found that value has outperformed growth since late 2020, with the MSCI World Value Index outperforming the Growth Index by 15% since November 2020. In addition to this, value stocks also tend to outperform during times of rising inflation and interest rates, highly relevant to our post-COVID window and the macroeconomic environment faced by financial markets. As such, both the flight-to-quality identified in the literature and the macroeconomic environment following the pandemic can be used to explain the increased weighting of the HML factor in our results.

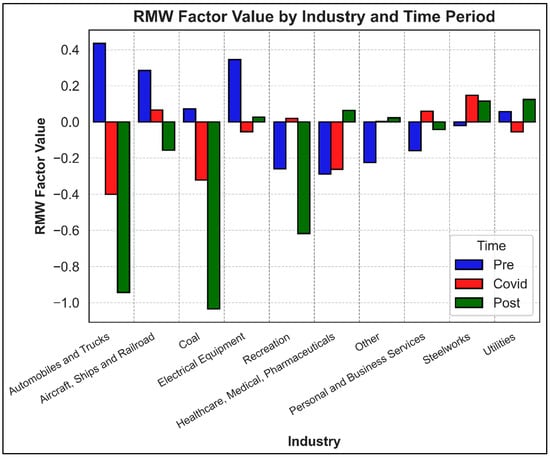

Thirdly, we observe a sharp reduction in the RMW coefficient, reducing from 0.209 in the pre-COVID window to 0.074 and 0.042 in the COVID and post-COVID windows, respectively. This would indicate that throughout the pandemic, the spread in returns between highly profitable and weakly profitable companies narrowed significantly. This is in line with findings from Essa and Giouvris (2023), who found that between 2001 and 2020, indicators of financial distress and liquidity issues in the market had a substantially negative impact on RMW premiums. In the context of COVID-19, our results are consistent with this. As the pandemic emerged, both the LIBOR-OIS and TED Spread, two indicators of credit and liquidity risk in the economy, rose to their highest levels since the crisis in 2008, with the TED Spread spiking to 1.42% on 26th March 2020 (OECD 2021). An economic explanation for this reduced factor weighting amid the COVID-19 uncertainty is offered by Essa and Giouvris (2023). Here, it is suggested that with an increase in default risk and the probability of a liquidity crisis occurring, investors may be more inclined to direct capital towards robustly profitable firms, enhancing the prices, and having a downward impact on the compensatory premium required by investors. Blitz and Hanauer (2021) examine the rise and overperformance of growth stocks in the years preceding the pandemic. Within this, the strength of the profitability factor was uncovered to be driven by an implicit exposure to large growth stocks. As such, as we see the HML factor weightings shift in favour of value stocks over growth stocks in the wake of the COVID-19 pandemic, we observe a concurrent reduction in the profitability factor.

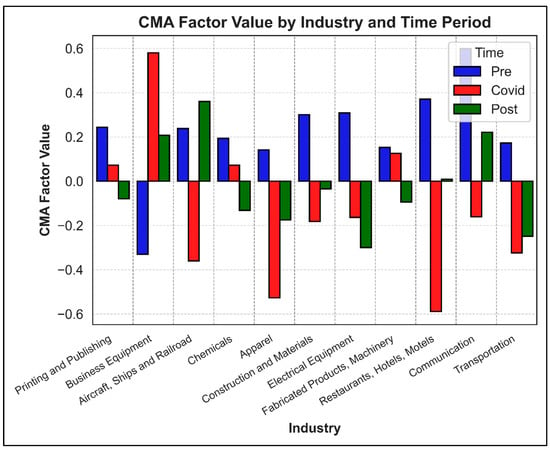

Lastly, a similar substantial decrease of the CMA coefficient was observed, reducing from 0.265 in the pre-COVID window to 0.0232 and 0.0958 in the COVID and post-COVID windows, respectively. These findings suggest that as the COVID-19 pandemic took hold, the excess returns attained by companies that invest conservatively reduced versus those which invest aggressively. As per Fama and French (2015a), each of the model factors aim to depict the risk attributes of companies for which investors require a compensatory premium, or excess return. In the case of the CMA factor, the additional risk of conservative companies includes their lower growth prospects relative to companies who invest more aggressively in the market. Thus, one may expect that as liquidity, credit and systemic risks in the market are increasing, the excess return required by investors on these riskier companies would also increase. However, our results suggest this excess return decreased during the pandemic.

To explain the reduction, we revisit the HML factor increase and the ‘flight-to-quality’ hypothesis. Here, investors seek established companies with high book-to-market ratios, perceiving them as safer. Conservative firms, seen as riskier by the FF5M, may also be appealing due to lower leverage and stock price volatility (Dogan 2015). Lamont (2000) shows that higher expected investment rates are linked to lower subsequent stock returns. In a ‘flight-to-quality’, demand for aggressive firms may drop, causing conservative company prices to rise due to increased investor preference. As conservative company prices rise, excess returns decrease, while the opposite occurs for aggressive companies. Investor flight-to-quality narrows the CMA factor spread, reducing its value.

Policy Analysis: Hypothetical Impact of Varying Fiscal and Monetary Responses

To contextualize the observed dynamics of the FF5M during the COVID-19 pandemic, we analyse three hypothetical policy response scenarios based on historical crises, using the findings of Horvath and Wang (2021) as a useful reference point.

- Minor Response: Dot-com Bubble (2000–2002)The Dot-com Bubble primarily led to significant market corrections without extremely aggressive fiscal or monetary interventions (Labonte 2015). The market corrections were mainly driven by technology stocks, with increased MKT-RF volatility and a shift to value (HML) as investors sought safer investments.

- Average Response: European Debt Crisis (2010–2012)The European Debt Crisis saw a significant, but not extreme, policy response with notable monetary easing by the European Central Bank, alongside some country-specific fiscal interventions aimed at austerity and stabilizing the eurozone economies (Hobelsberger et al. 2022). Horvath and Wang (2021) observed a rise in SMB and HML factors, reflecting the perceived risk in larger financial institutions.

- Strong Response: Global Financial Crisis (2007–2009)The Global Financial Crisis elicited a severe and comprehensive response, including drastic rate cuts to nearly zero and unprecedented fiscal stimulus measures globally, such as the Troubled Asset Relief Program (TARP) and quantitative easing in the United States (Mishkin and White 2014). HML saw significant gains as investors fled to value, while MKT-RF volatility reflected the severe downturn and recovery efforts.

By integrating findings from Horvath and Wang (2021) and examining our results within this framework, we conclude that strong, balanced fiscal and monetary interventions, similar to those observed during the Global Financial Crisis, are most effective in mitigating adverse market impacts and supporting a swift recovery during crises such as COVID-19. Strong fiscal and monetary interventions, as seen during the Global Financial Crisis and COVID-19, stabilize markets and support recovery. As seen in our findings, SMB gained strength from liquidity support, while HML fluctuated with inflation concerns and flight-to-quality behaviour. The decline in RMW and CMA reflects reduced premiums on profitability and investment in a supported market. A mild response, similar to the Dot-com Bubble, would have likely resulted in weaker SMB gains and greater volatility. An average response, akin to the European Debt Crisis, might have dampened HML movements and slowed recovery. The strong response during COVID-19, like that of the Global Financial Crisis, proved optimal, stabilizing key factors and enabling a swifter recovery of financial markets.

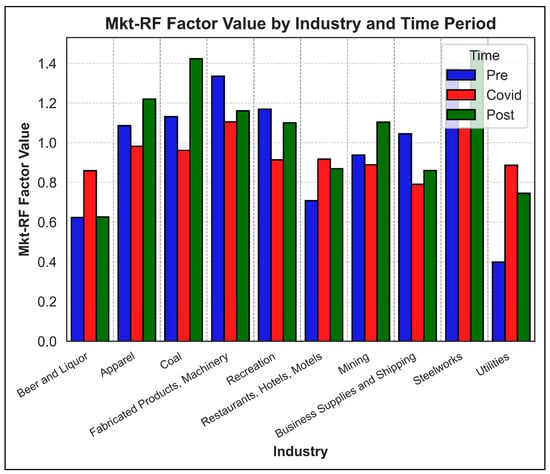

This section outlined the overarching market-wide results of the FF5M and the factors in each period. The following section will be divided into five subheadings, each representing one of the Fama–French factors. In the case of the Market Risk Factor (Mkt-RF), we examine industries where the value changed by 20% or more as the market transitioned through each period. Examining each subsequent factor, we expand on the previous section and analyse the industries where the value of the Fama–French factor coefficient went from positive to negative, or vice versa, as we moved from the pre-COVID-19 window to the COVID-19 and post-COVID-19 windows. Through this, we highlight significant sectoral changes in the behaviour of the Fama–French factors throughout the pandemic.

3.3. Sectoral Analysis

While the previous section examined the overarching movement of the Fama–French factors over the three time periods, it is important to granularly examine the specific industries which also underwent significant changes during this time. Figure 3, Figure 4, Figure 5, Figure 6 and Figure 7 illustrate these occurrences where the strength of the Fama–French factor reversed in value, from positive to negative, or vice versa. For the case of the Mkt-RF, since all values were positive, we examine industries where the explanatory power of excess market returns over the risk-free rate changed by 20% or more in each industry.

Figure 3.

Illustrates significant changes in the strength of the Market Risk Factor in the industries analysed.

3.3.1. Market Risk Factor—Mkt-RF

As outlined above, the Market Risk Factor represents the excess return of the market over the risk-free rate. In essence, it captures the systematic risk exposure of each industry to the wider market. A conditional relationship between the Market Risk Factor and stock returns is often observed in the literature. Fletcher (2000), Tang and Shum (2003), Riyath (2018), and Horvath and Wang (2021) all identify a generally flat relationship between market returns and the Market Risk Factor. However, during periods of market growth (decline), a positive (negative) relationship is observed. Figure 3 illustrates industries where this relationship varied substantially over the time periods in question. As can be seen, 7 of the 10 industries experienced an increased positive exposure to the excess returns of the market from the pre-COVID window to the COVID and post-COVID windows. The Apparel, Coal, Recreation, Steelworks, and Business Supplies and Shipping industries all experience a decrease in value from the initial COVID-19 window. However, in all cases, these recovered and increased in the following period.

This is in line with the current literature during times of crisis. Resende and Sales (2021) analysed the Brazilian stock market and found an increase in the beta values of stocks during the COVID-19 pandemic. Examining the global financial crisis of 2008, Silmane et al. (2017) also found increasing beta values during the crisis period in both North American and European financial markets. Examining the effect of global crises on stock market returns, both Das et al. (2019) and Tronzano (2021) identified significant contagion effects and a convergence of stock market returns during times of crisis. As such, the results observed in this analysis are in line with previous analyses of global stock markets during times of crisis.

3.3.2. Size Effect—SMB

Figure 4 illustrates how industries reacted to the size effect, with some transitioning from positive to negative or vice versa. Firstly, Automobiles and Trucks had a positive exposure to the size effect in the pre-COVID and COVID windows. However, as the market transitioned to the post-COVID stage, this flipped significantly from approximately 0.6 to approximately −0.4. Referring to Figure 1, it can be seen that despite the initial negative shock at the beginning of the pandemic, Automobiles and Trucks performed exceptionally well throughout the entire COVID-19 period. Findings from Lim et al. (2014) echo our results, whereby positive shocks to overall market returns increased the strength of the SMB factor. However, the post-COVID window was a period of exceptional downturn. The excess return gained on riskier smaller firms ceased to exist, as investors may have turned their focus towards larger, more established companies over smaller, riskier companies. This reversal of the size effect during times of economic uncertainty is in line with the current literature (Banz 1981; Dimson and Marsh 1999; Ziemba and Schwartz 1991; Nartea et al. 2013).

Similarly, Petroleum and Natural Gas underwent a pivot from positive to negative exposure to the SMB factor in the post-COVID window. Cumulative returns in this period were positive overall, in contrast to Automobiles and Trucks. The energy crisis triggered by Russia’s war in Ukraine bolstered profits for the entire oil and gas industry, with profits in 2022 reaching $4 trillion up from an average of $1.5 trillion in recent years, as reported by Adomaitis (2023). Within the industry, a report by the International Energy Agency (2020c) states that the largest 50 oil and gas companies account for 90% of the industry’s overall profits. As such, it is unsurprising that as the market trended upwards, a pivot into the largest and most profitable companies was observed, leading to this reversal in the size effect.

On the other hand, several industries experienced a pivot from negative to positive. This was observed for Food and Beverage Products, Consumer Goods, Restaurants, Hotels & Motels, Business Supplies and Shipping, Tobacco, and Communication. Ashraf (2020a) found that social distancing measures resulted in negative stock market returns due to their adverse impact on economic activity. Examining sectors across travel, tourism, and leisure, Chen et al. (2020) found that stock prices of smaller firms were more resilient to COVID-19-induced restrictions, while larger firms experienced a greater drop in stock price. Our results echo these findings in Restaurants, Hotels, Motels, Food and Beverage Products, and Consumer Goods, with pivots to positive exposure to the SMB factor in these sectors.

The most significant pivots came in the Communication and Business Supplies and Shipping sectors, from negative to positive. Drawing on Ozik et al. (2021), a significant increase in retail trading activity has been observed since the onset of the pandemic. Using stock ownership data attained from Robinhood, Miller (2020) examined shipping stocks widely owned by retail investors during the pandemic. While traditional large-cap firms were present, the five most owned firms by retail investors were exclusively small-cap and micro-cap stocks, indicating a strong investor preference for small-cap stocks in this sector. Durand et al. (2007) argue that the small-firm premium is driven significantly by traders and changes in investor sentiment. Given this, it can be argued that the small-firm effect present in the shipping industry in our results is driven by the distinct risk appetite for small-cap stocks by retail traders.

Figure 4.

Significant changes in the strength of the size effect factor in the industries analysed.

3.3.3. Value Effect—HML

As illustrated in Figure 5, increases in the HML factor were observed upon the onset of COVID-19 for all of the top industries excluding Automobiles and Trucks. This reaffirms Fama and French’s (1993) conventional wisdom outlined in the previous section, where amid an increase in market risk as COVID-19 took hold, investors favoured established companies with high book-to-market ratios for safety. High dividend-yielding industries such as Utilities, Communications, and Consumer Goods all underwent a significant reversal of the HML factor into the positive territory, indicating that investors favoured value companies over growth companies.

Figure 5.

Significant changes in the strength of the value effect factor in the industries analysed.

However, following the initial COVID period, Figure 5 illustrates a reversal of this COVID-19 HML effect, with a pivot back towards growth stocks. This period coincides with both rising inflation and interest rates throughout 2022 and 2023. While Leite et al. (2020) show that value stocks outperform growth stocks when inflation and interest rates are rising, the high dividend-yielding nature of these industries must also be considered. High dividend-yielding stocks, by their nature, tend to have a longer duration, meaning they are more interest rate-sensitive and experience greater price declines as interest rates rise and the discount rate on future dividend cash flows increases (Jiang and Sun 2015; Mueller and Pauley 1995; Chance 1982). Given this, it is unsurprising that the excess return gained on these value stocks during the flight-to-quality period as COVID-19 took hold reverted, as high dividend-yielding sectors became more susceptible to the rising inflation and interest rate environment which followed.

An exception to the overall market trend, however, was observed in the Automobiles and Trucks sector. In the pre-COVID period, a strongly positive HML factor was observed, indicating an investor preference for value companies. As COVID-19 took hold, the results indicate that Automobiles and Trucks defied the traditional ‘flight-to-quality’ HML effect. The excess return gained on value stocks fell below that of growth stocks, indicating an investor preference for growth stocks during the COVID time-period. Despite the continued presence of COVID-19 and uncertainty surrounding the pandemic, this period aligned with significant growth in stock markets, illustrated in Figure 1. While some sectors experienced a more traditional ‘flight-to-quality’ effect during the COVID period, prevailingly low interest rates, ample liquidity supports, and a ‘transitory inflation’ narrative arguably encouraged investors to engage in an increased level of risk and invest in companies with higher growth potential. A report by the International Energy Agency (2020a) highlights how even as the pandemic significantly and negatively impacted the auto industry, electric vehicles reached a record share of the overall car market. The unique industry prospects of electric vehicles within the industry coupled with a market-wide appetite for growth stocks explains the outlier results of this industry in our HML findings. As the market moved into the post-COVID phase, a return to value was observed with a positive coefficient. Global supply chain issues, a persistent chip shortage, and rising inflationary pressures on production have collectively resulted in a significant drop in stock prices across the industry following the pandemic period. Although the ‘risk’ of COVID-19 has passed, the subsequent economic impacts of the pandemic are now being realised, as investor preference shifts towards value stocks and a flight-to-quality amid persistent supply chain disruptions.

3.3.4. Profitability Effect—RMW and Investment Effect—CMA

Referring to Table 3, we observe that the overall strength of the RMW and CMA factors reduce significantly as the strength of the other factors increase, indicating a reduced significance of these factors in the explanation of excess market returns. Nonetheless, on a sector-by-sector basis, some interesting findings are observed as the period moves from the pre-COVID to COVID and post-COVID stages, as illustrated in Figure 6 and Figure 7. Due to the observably synchronous behaviour of these factors upon the onset of the pandemic, we will analyse both the RMW and CMA factors together in this section. Fama and French (2015b) dissected anomalies associated with the FF5M, focusing on the RMW and CMA factors specifically. They noted that positive exposures to RMW and CMA substantially contribute to explaining the average returns of low-volatility stocks. On the other hand, average returns on stocks linked with high volatility are significantly accounted for by negative exposures to RMW and CMA, characteristic of less profitable firms with aggressive investment approaches. As discussed in Section 4 and outlined in Table 3, the overall spread between the excess return gained on robust firms versus weak, and conservative firms versus aggressive, narrowed significantly upon the onset of the pandemic, indicating that little premium was to be attained by investing in this factor to achieve excess returns on the market.

In a heightened-risk environment such as the COVID-19 pandemic, weakly profitable firms may be perceived as more vulnerable to economic shocks. During the pandemic, it would be expected that investors reevaluate their risk tolerance and avoid or reduce exposure to weaker, more vulnerable firms. However, our findings reveal a negative exposure to the RMW factor across several sectors, indicating that investors exposed to weakly profitable firms expect a premium. Similarly, a negative CMA value indicates that being exposed to firms with aggressive investment behaviours provides a premium for investors. In the context of the COVID-19 pandemic, we suggest that in addition to the findings of Fama and French (2015b), a significant shift in investor preferences may explain a deviation from these usual interpretations of negative RMW and CMA values, and the apparent counter intuitiveness of weakly profitable and aggressively investing firms outperforming their robust and conservative counterparts.

The onset of the COVID-19 pandemic brought about significant volatility in financial markets amid heightened economic uncertainty (Zhang et al. 2020). During this period, investors exhibiting a clear aversion to risk may favour more conservative investment strategies and firms with robust profitability (RMW) and a conservative approach to investments (CMA). As a result, the demand for aggressively investing firms reduces, causing their prices to drop and subsequently increasing the premium expected by investors to invest in these firms. In other words, they are trading at a discount. Conversely, the demand for safer, more robustly profitable, and conservatively investing companies surged, driving up their prices and reducing the future expected excess return in the market. As a result, the heightened level of risk in the market as a result of the pandemic and a flight-to-quality from investors may narrow the spread captured by both the RMW and CMA factors, reducing their values.

In the context of specific industries, the pandemic had a varying impact on firms within different sectors. Referring to Figure 6, we observe that the Automobiles and Trucks, Coal, and Recreation sectors underwent a significant shift from a positive exposure in the RMW factor to a negative exposure. Automobiles and Trucks (Vitale 2020), Coal (International Energy Agency 2020b), and Recreation (Lee and Chen 2022; Afridi et al. 2022) all saw a significant decline in profitability and increased vulnerability during the pandemic due to reduced consumer demand, supply chain disruptions, and travel restrictions. Consequently, these industries witnessed a negative slope for the RMW factor. This echoes the findings of Fama and French (2015b), whereby returns linked to high volatility and reduced profitability are significantly accounted for by negative exposures to RMW. Similarly, Figure 7 illustrates how Aircraft, Ships, Railroads, Transportation, Apparel, Restaurants, Hotels, and Motels all underwent a significant shift from a positive CMA exposure to a negative exposure. Evident from the implicit nature of each industry’s business operations, Aircrafts, Ships, and Railroads (Tardivo et al. 2021; Schofer et al. 2022; Bouwer et al. 2022), Transportation (McKinsey 2020; IRU 2021), Restaurants, Hotels, and Motels (Fowler 2022), and Apparel (Wood Mackenzie 2020), all experienced substantial disruptions to investment operations. The amplification of operating costs by pandemic-induced expenditures in addition to reduced consumer demand levels added a significant strain, culminating in marked disruptions not only to their profitability but also to their investment operations.

Figure 6.

Illustrates significant changes in the strength of the profitability effect factor in the industries analysed.

Figure 7.

Significant changes in the strength of the investment effect factor in the industries analysed.

Given this, our findings suggest that the substantial impact of the pandemic on these specifically susceptible industries led to a transformation in the exposures to the RMW and CMA factors, initially positive, to negative. The decrease in expected excess returns as demand and prices rose for robustly profitable firms (RMW) and conservatively investing firms (CMA) narrowed the spread captured by these factors, reflecting the altered market dynamics and heightened risk aversion during the pandemic.

4. Conclusions and Future Research Avenues

Examining the FF5M before, during, and after the COVID-19 pandemic, this study has shed light on the intricate dynamics of financial markets under extreme stress. The unprecedented disruptions caused by the pandemic rippled through economies and financial systems, challenging long-established paradigms and assumptions. Understanding how these disruptions manifested within the framework of the FF5M is pivotal, providing deeper insights into how risk, size, value, profitability, and investment strategies were affected across industries, and how investors valued these factors under the distinct crisis setting that COVID-19 presented. This understanding is crucial for researchers, investors, and all financial market practitioners, allowing for informed decision-making, investing, and the establishment of more resilient and adaptive financial models adequately calibrated to weather future crises.

Our findings confirm that the assumptions of the Fama–French Five-Factor Model were largely satisfied, ensuring the robustness of our results. However, the increased standard errors observed during the COVID-19 period highlight the uncertainty and volatility in financial markets at that time, making it more difficult to precisely estimate factor relationships. As the market stabilized in the post-COVID period, the standard errors decreased, though they remained higher than in the pre-COVID period, reflecting lingering uncertainty. These findings underscore the adaptability of the Fama–French model in capturing market dynamics during periods of extreme stress and provide a deeper understanding of how risk factors behave in crisis environments.

Our results provide practical insights on the evolving behaviour of the Fama–French factors in the market, and on a sector-by-sector basis as the COVID-19 pandemic occurred. From our findings, the SMB factor’s strength increased on average. The resilience of smaller firms across hospitality and leisure sectors, industry-specific profit distributions, the overall upward trend of the market, and surges in retail trading activity, among other factors, influenced these dynamics.

Similarly, the strength of the HML factor increased as the COVID-19 pandemic began, with investors favouring established companies with high book-to-market ratios for safety. Sectors considered ‘recession-proof’ with high dividend yields such as Utilities, Communications, and Consumer Goods shifted positively, indicating a preference for value companies over growth companies as the initial impact of the pandemic was digested by markets. Following the initial COVID period, a reversal occurred, favouring growth stocks as liquidity supports continued from central banks. Post-COVID, a return to value was observed as the positive coefficient on the HML factor returned, aligning with a shift towards value stocks and a flight to quality amid the persistent economic impacts of the pandemic.

Lastly, the RMW and CMA factors’ overall strength reduced significantly during the pandemic, indicating a diminished significance in explaining excess market returns. The spread between the excess return gained by robustly profitable and weakly profitable firms narrowed significantly, as did the spread between the excess return gained on conservatively investing firms over aggressively investing firms. Pandemic-induced disruptions, reduced consumer demand, and the overall increased vulnerability of high-cost industries altered market dynamics and heightened risk aversion during the pandemic, narrowing the spread captured by these factors.

As fears of recurring waves of COVID-19 diminish, the avenues for further research on this topic are abundant. For example, Leite et al. (2020) examined the economic meaning of the Fama–French factors, finding that innovations in state economic variables such as the one-month T-bill rate and consumer price index are correlated to and proxy for several of the Fama–French factors. Given the substantial implementation of monetary policies by central facilities throughout the pandemic, examining how changes to state macroeconomic variables co-interact with the performance of the FF5M is an area propitious for investigation.

Furthermore, while this analysis takes a largely overarching view of the impact of the COVID-19 pandemic on individual sectors, further analysis should deeply examine the intricate and unique structure of individual firms within each sector. From this, a more granular view of how risk, size, value, profitability, and investment strategies are affected in times of crisis can be analysed. One limitation of this analysis is the consideration of each factor’s movement in isolation. Incorporating analysis of variance (ANOVA) techniques and the co-movement of factors together in future research will add further insights to the shifting co-relationships of risk factor returns over time. We intend to investigate these areas in our future research. As society and financial markets emerge from the sustaining economic implications of the COVID-19 pandemic, continued research in these areas is critical to ensure informed decision-making by policymakers, governments, and all stakeholders within financial markets in the event of future pandemics or extreme societal disruptions.

Author Contributions

Conceptualization, N.O.; methodology, N.O.; software, N.O.; validation, N.O., D.S., and B.S.; formal analysis, N.O.; investigation, N.O., D.S., B.S.; resources, All; data curation, N.O.; writing—original draft preparation, N.O.; writing—review and editing, D.S., B.S., B.N.A.; visualization, N.O.; supervision, D.S., B.S.; project administration, All; funding acquisition, D.S., B.N.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

The dataset(s) used and analysed during the current study is available from the corresponding author upon reasonable request due to originally being extracted from a proprietary source.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Regression results for the thirty industries during the “Pre-COVID” time period. The table presents the intercept and its t-statistic, overall model significance (F-statistic and its p-value), and coefficients for the Market Risk Factor (Mkt-RF), Size Factor (SMB), Value Factor (HML), Profitability Factor (RMW), and Investment Factor (CMA). The adjusted R2 value indicates the proportion of variance in the dependent variable explained by the model.

Table A1.

Regression results for the thirty industries during the “Pre-COVID” time period. The table presents the intercept and its t-statistic, overall model significance (F-statistic and its p-value), and coefficients for the Market Risk Factor (Mkt-RF), Size Factor (SMB), Value Factor (HML), Profitability Factor (RMW), and Investment Factor (CMA). The adjusted R2 value indicates the proportion of variance in the dependent variable explained by the model.

| Industry | Time | Intercept | T-Stat | F-Stat | F-p-Value | Mkt-RF | SMB | HML | RMW | CMA | Adj R2 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Automobiles and Trucks | Pre | −0.0143 | −0.3586 | 160.96 | 2 × 10−101 | 1.1620 | 0.4181 | 0.3928 | 0.4348 | −0.0388 | 0.6144 |

| Beer and Liquor | Pre | −0.0134 | −0.4411 | 78.26 | 2 × 10−60 | 0.6235 | −0.3824 | −0.2732 | 0.5215 | 0.7381 | 0.4349 |

| Printing and Publishing | Pre | −0.0392 | −1.3757 | 207.60 | 3 × 10−119 | 0.8995 | 0.7146 | 0.1246 | 0.4020 | 0.2437 | 0.6730 |

| Business Equipment | Pre | 0.0320 | 1.4570 | 643.74 | 2 × 10−214 | 1.2114 | 0.0651 | −0.1591 | 0.2300 | −0.3301 | 0.8649 |

| Aircraft, Ships, and Railroad | Pre | −0.0041 | −0.1087 | 153.03 | 4 × 10−98 | 1.1108 | 0.0001 | 0.0168 | 0.2846 | 0.2381 | 0.6023 |

| Chemicals | Pre | −0.0411 | −1.4104 | 247.64 | 2 × 10−132 | 1.0945 | 0.2109 | 0.1502 | 0.2144 | 0.1936 | 0.7107 |

| Apparel | Pre | 0.0506 | 1.4002 | 169.46 | 6 × 10−105 | 1.0859 | 0.3618 | −0.0280 | 0.6508 | 0.1413 | 0.6266 |

| Construction and Materials | Pre | −0.0150 | −0.5374 | 262.76 | 5 × 10−137 | 1.0312 | 0.6096 | 0.0447 | 0.4078 | 0.3009 | 0.7228 |

| Coal | Pre | −0.1338 | −1.8423 | 51.00 | 1 × 10−42 | 1.1319 | 0.7931 | 0.5460 | 0.0724 | 0.1673 | 0.3325 |

| Electrical Equipment | Pre | −0.0006 | −0.0211 | 352.08 | 1 × 10−160 | 1.2277 | 0.5524 | 0.1915 | 0.3448 | 0.3087 | 0.7776 |

| Fabricated Products, Machinery | Pre | −0.0060 | −0.2234 | 447.42 | 2 × 10−181 | 1.3353 | 0.3390 | 0.2746 | 0.3227 | 0.1528 | 0.8164 |

| Banking, Insurance, Real Estate, Trading | Pre | 0.0274 | 2.2297 | 1366.50 | 1 × 10−287 | 1.0034 | −0.0818 | 0.7290 | −0.2096 | −0.5009 | 0.9315 |

| Food and Beverage Products | Pre | −0.0115 | −0.4395 | 97.62 | 2 × 10−71 | 0.6356 | −0.2505 | −0.2378 | 0.3723 | 0.9933 | 0.4904 |

| Recreation | Pre | 0.0198 | 0.4765 | 220.75 | 1 × 10−123 | 1.1695 | 0.3059 | −0.2619 | −0.2595 | −0.8297 | 0.6864 |

| Healthcare, Medical, Pharmaceuticals | Pre | 0.0028 | 0.1366 | 417.38 | 3 × 10−175 | 0.9329 | 0.0358 | −0.4111 | −0.2887 | 0.5104 | 0.8057 |

| Consumer Goods | Pre | 0.0142 | 0.4677 | 90.62 | 1 × 10−67 | 0.6971 | −0.2839 | −0.3184 | 0.4724 | 0.9117 | 0.4717 |

| Restaurants, Hotels, Motels | Pre | 0.0203 | 0.8064 | 139.18 | 4 × 10−92 | 0.7080 | −0.1610 | −0.2007 | 0.1085 | 0.3710 | 0.5792 |

| Mining | Pre | −0.0201 | −0.4385 | 75.19 | 1 × 10−58 | 0.9385 | 0.3537 | 0.0889 | −0.1424 | 0.4663 | 0.4249 |

| Petroleum and Natural Gas | Pre | −0.0326 | −0.8918 | 196.84 | 2 × 10−115 | 1.1846 | 0.2134 | 0.4856 | −0.8411 | 0.8051 | 0.6611 |

| Other | Pre | −0.0019 | −0.0992 | 447.71 | 2 × 10−181 | 0.9759 | −0.2352 | 0.3757 | −0.2245 | 0.2589 | 0.8165 |

| Business Supplies and Shipping | Pre | −0.0417 | −1.6109 | 259.17 | 6 × 10−136 | 1.0451 | 0.0430 | 0.0053 | 0.4320 | 0.6634 | 0.7200 |

| Retail | Pre | 0.0172 | 0.7587 | 434.60 | 8 × 10−179 | 1.0283 | 0.0351 | −0.1820 | 0.4073 | −0.2340 | 0.8120 |