Abstract

Financial literacy assessments typically rely on sample surveys containing sets of questions designed to gauge respondents’ comprehension of fundamental financial concepts necessary for making informed decisions. The answers to such questions, either categorical or continuous in nature, generally include a “Do not know” option. If those who choose the “Do not know” option are not a random sample of the population but exhibit peculiar characteristics, treating these observations as either incorrect responses or as missing data may distort the results regarding the determinants of financial literacy. A noteworthy case lies in the observation from survey studies that women tend to choose the “Do not know” option more frequently than men. In similar cases, treating the “Do not know” responses as incorrect answers increases the gender gap in financial literacy while treating them as missing values reduces the gap. We propose using a model with sample selection, which enables us to disentangle the inclination to answer “Do not know” from actual responses. By applying this model to a representative sample of the UK population, we do not find any systematic gender gap in financial knowledge. The study’s novel treatment of “Do not know” responses contributes valuable insights to the broader discourse on the determinants of financial literacy and the related gender-based differences.

JEL Classification:

C8; D14; D91; G53

1. Introduction

Financial literacy, defined by the OECD (2023) as the understanding of financial concepts and risks, significantly influences financial decisions and outcomes. It impacts stock market participation (Hermansson et al. 2022; Van Rooij et al. 2011; Yeh and Ling 2022), portfolio choices (Chu et al. 2017) retirement planning (Lusardi and Mitchell 2017; Yeh 2022, and the references therein), wealth accumulation (Behrman et al. 2012; Jappelli and Padula 2013; Stango and Zinman 2009; Van Rooij et al. 2012), and debt management (Brown et al. 2016; Lusardi and Tufano 2015). Traditionally assessed through sample surveys, financial literacy is often measured using the “Big Three” questions, a concise tool for evaluating essential financial knowledge (Lusardi 2019; Lusardi and Mitchell 2008).

From a methodological standpoint, it is important to note that financial literacy surveys commonly include the option “Do not know” (DK) among the answers to the questions, either categorical or continuous in nature. The way in which the DK observations are treated, either as incorrect or as missing data, may lead to biased results. Recent research highlights the need to address the distinct nature of DK and incorrect responses and the potential non-randomness of DK responses (Kim and Mountain 2019; Wilmarth et al. 2023).

Compelling evidence for the latter case is related to the ongoing debate on the gender gap in financial literacy. Such evidence lies in the fact that women tend to choose DK more often than men. This can be explained by significant behavioural aspects such as framing effects, risk aversion, and self-reported confidence (Angrisani and Casanova 2021; Aristei and Gallo 2022; Bucher-Koenen et al. 2017; Chen and Garand 2018; Van Rooij et al. 2011). In an online experiment, Tinghög et al. (2021) showed that anxiety related to financial operations may also contribute to the gender gap in financial literacy. Moreover, women are often reported as being more risk-averse than men,1 and they may decide to answer DK because, from their point of view, answering a question incorrectly would represent a defeat (Charness and Gneezy 2012; Croson and Gneezy 2009).2

Even if a gender-based difference were the only factor influencing the propensity to choose the DK option, it would unequivocally vouch for the non-randomness of the sample who choose not to answer the financial literacy questions, thereby arguing in favour of sample selection bias. Using an arbitrary rule to assign the DK responses to a certain category, without appropriately correcting for such a bias, may increase the gender gap if the DK response is treated as an incorrect answer or decrease it if it is treated as missing observation.

More recently, researchers have turned to laboratory experiments to gauge the relevance of the DK option in measuring financial literacy and disentangling its effect from the real lack of financial knowledge. Bucher-Koenen et al. (2021) carried out an experiment proposing two questionnaire versions, with and without the DK option, to the same group of respondents twice, six weeks apart. Tranfaglia et al. (2024) conducted a similar experiment in 2021, but using a between-subject design, administering the two questionnaire versions to two distinct groups, eliminating concerns about potential learning effects. They both continue to find a gender gap even when the DK option has been removed. Hospido et al. (2023) conducted an online survey featuring three variations in answer options: (i) multiple-choice without the DK option; (ii) multiple-choice with the DK option but without monetary incentives for a DK answer; (iii) a nudging statement. Removing DK, providing incentives, and offering information effectively reduce this gap; however, only information provision closed the gender gap in the DK option and reduced the financial literacy gender gap by half.

Accurate measurement of financial literacy and the related gender gap requires redefining parameters. Considering factors affecting selection processes and correct answer probabilities, we employ an econometric model with sample selection to assess financial literacy and gender gaps accurately, enhancing understanding of their dynamics and implications for policy and interventions.

The analysis we propose relies on the 2018 wave of the UK Financial Capability Survey data to estimate the determinants of financial literacy in the UK population, focusing on exploring the possible gender gap and its explanations. The use of survey data enables us to conduct our analysis on a more heterogeneous sample representative of the UK population and provides access to a wider range of personal information than what is typically gathered in laboratory experiments. In particular, this survey explores various behavioural aspects of respondents’ lives that can serve as controls for the aforementioned potential determinants of financial literacy in general and gender disparity in specific.

Our contribution to the literature on financial literacy and related gender differences is multifaceted. Firstly, we focus on the econometric analysis of data with a DK option. To date, only a few studies have pursued this approach, with notable contributions from Chen and Garand (2018) and Kim and Mountain (2019). Chen and Garand (2018) employed linear regression and multinomial logit regressions to predict the probabilities of incorrect and DK responses relatively to correct ones. Notoriously, multinomial logit models are valid under the independence of irrelevant alternatives assumption, which asserts that the attributes of one specific choice option do not influence the relative probabilities of selecting other options. The assumption cannot be sustained in this case, as the investigation into the effect of including or excluding the DK option among the response options on the probability of responding correctly is still ongoing. On the other hand, Kim and Mountain (2019) introduced a binomial-latent regression model to assess the influence of educational interventions and group differences on correct answers to financial literacy questions, particularly those concealed within DK responses. Their result is strictly dependent on the assumption that the probability of responding correctly is equal for those who answer the question (either correctly or incorrectly) and those who choose the DK option. However, this may well not be the case. Our paper aligns with the second strand of research, proposing a distinct econometric approach that sets it apart from the methodologies employed by these two works.

Secondly, our analysis is strengthened by the use of survey data. Unlike laboratory data, survey data provide access to a broader range of personal information, facilitating a more comprehensive exploration of the factors and dynamics relevant to our research objectives. This approach not only enhances the external validity of our findings but also contributes to a more nuanced understanding of the complexities inherent in determining the financial literacy of the population and the existence of a gender gap in financial literacy.

Finally, our analysis yields at least three noteworthy findings: (i) those who choose the DK option are not a random sample from the population but show peculiar characteristics, strengthening our reasons for choosing a model with sample selection; (ii) the absence of a systematic gender gap in financial knowledge; (iii) the only systematic factor that positively influences financial literacy is an individual’s confidence in working with numbers. Both findings carry important policy implications that will be discussed throughout the work.

2. Data and Variables

2.1. Data

We use data from the Financial Capability Survey (Money Advice Service 2020) carried out by the Money and Pensions Service to support the development and delivery of the Financial Capability Strategy for the UK by 2030.3

The 2018 edition surveys 5974 adults aged 18 and over and residents in the UK.4 Interviews were conducted between 26 March 2018 and 20 May 2018. The questionnaire covers the building blocks required for people to feel financially resilient, confident, and empowered. It investigates money management behaviours, preparation for life events, coping with financial challenges, and various practices like saving, spending, credit use, and budgeting. Additionally, it explores factors influencing financially capable behaviour, such as skills, knowledge, attitudes, motivations, and accessibility. The observations are weighted for national representativeness.

We assess respondents’ financial literacy using questions that measure their knowledge in three key financial concepts: (i) the ability to calculate compound interest rates, (ii) understanding of inflation, and (iii) comprehension of risk diversification.

The Financial Capability Survey questionnaire employed in this paper differs from the typical “Big Three” commonly used in the literature in some respects. Firstly, there are two questions about the knowledge and understanding of interest rates: simple interest and compound interest. Moreover, unlike other surveys and the other two questions, the question related to simple interest calculation requires an open-ended response rather than offering multiple-choice options. Finally, no specific question addresses knowledge of risk. The survey questions we use to evaluate participants’ financial literacy are as follows:

- I

- (Inflation) If the inflation rate is 5% and the interest rate you get on your savings is 3%, will your savings have more, less or the same amount of buying power in a year’s time? More/The same/Less/Do not know.

- SI

- (Simple interest) Suppose you put £100 into a savings account with a guaranteed interest rate of 2% per year. You don’t make any further payments into this account, and you don’t withdraw any money. How much would be in the account at the end of the first year once the interest payment is made? Enter the amount/Do not know.

- CI

- (Compound interest) And how much would be in the account at the end of five years (remembering there are no fees or tax deductions). Would it be? More than £110/ Exactly £110/ Less than £110/ It is impossible to tell from the information given/ Do not know.

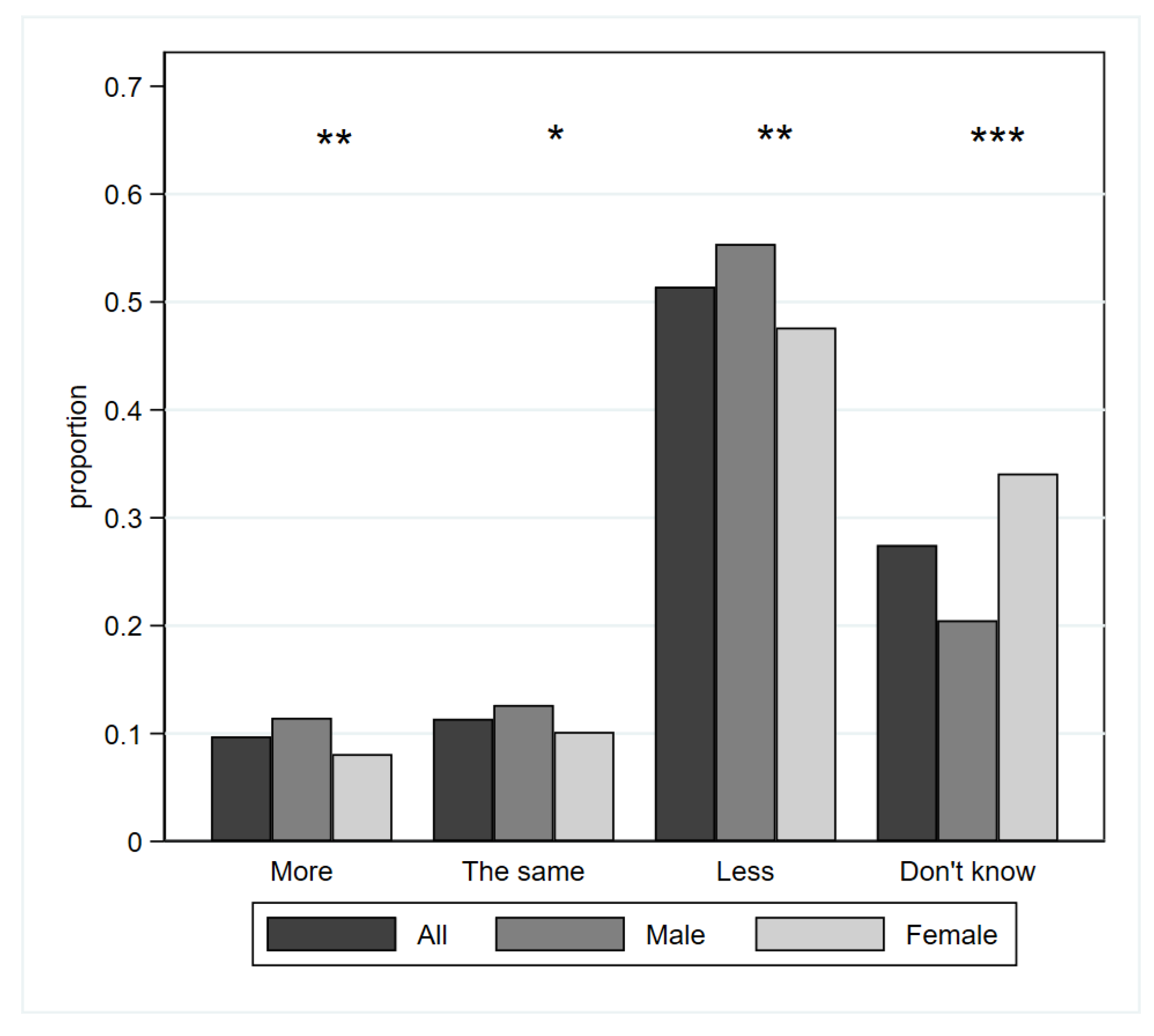

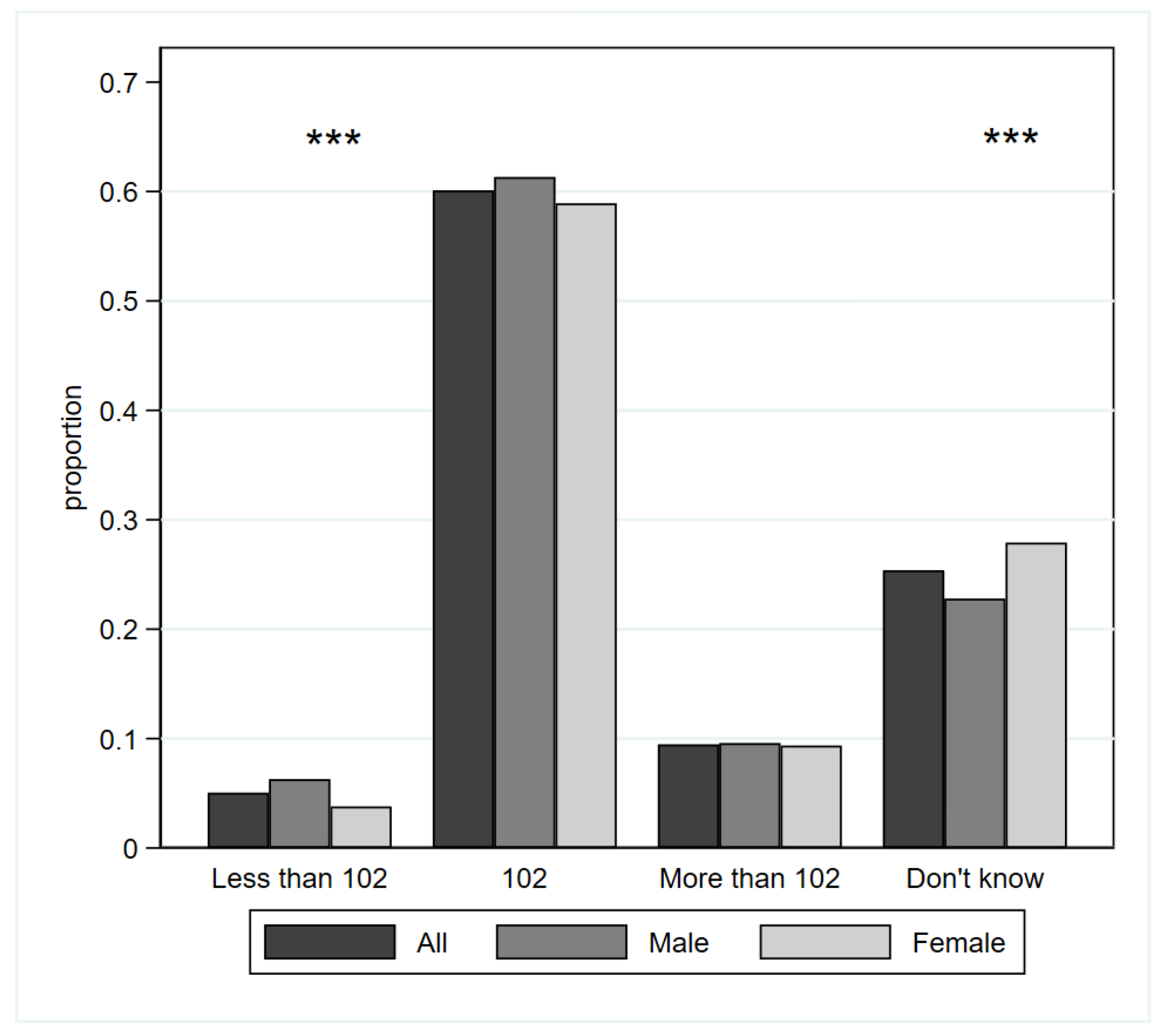

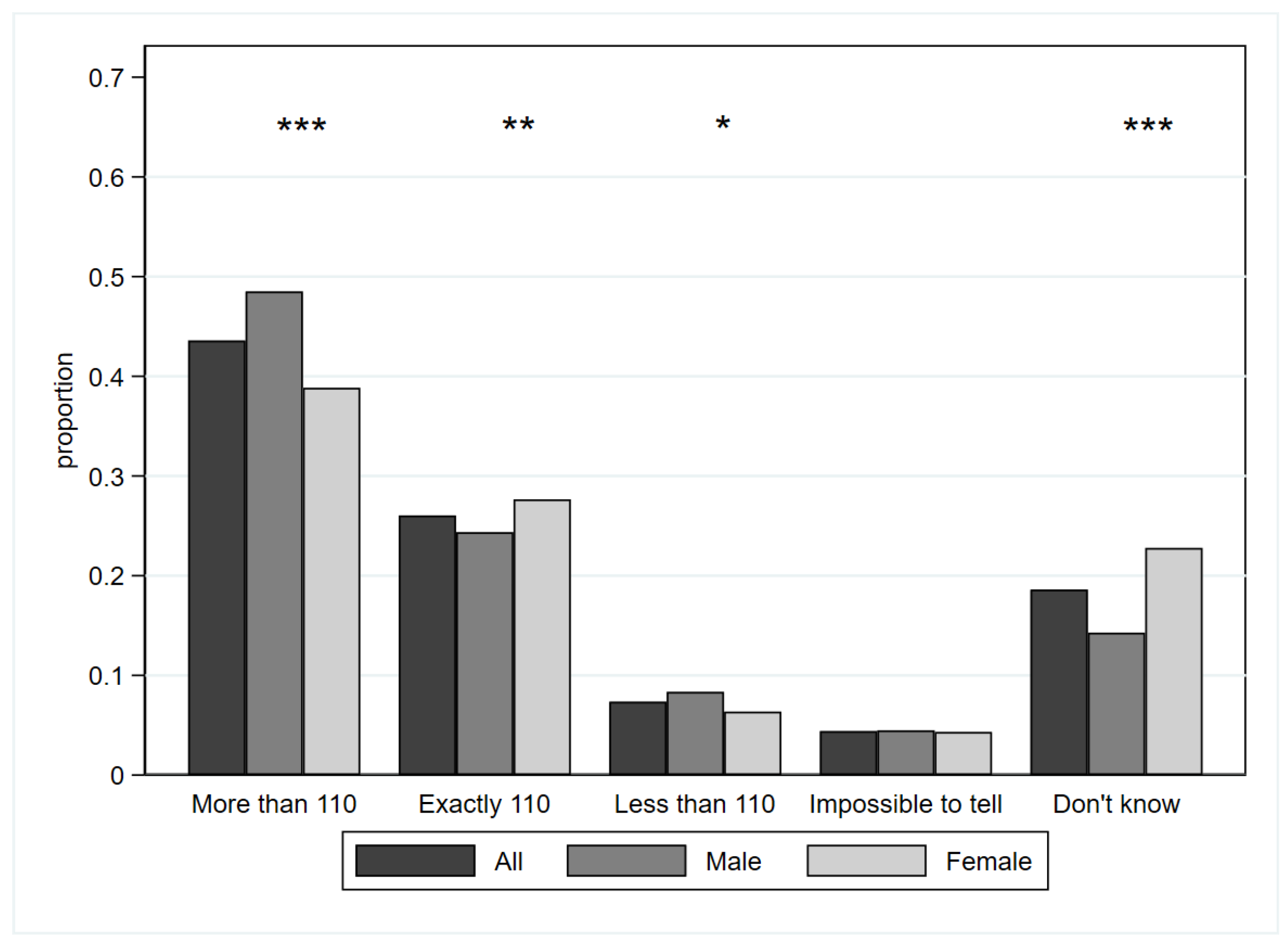

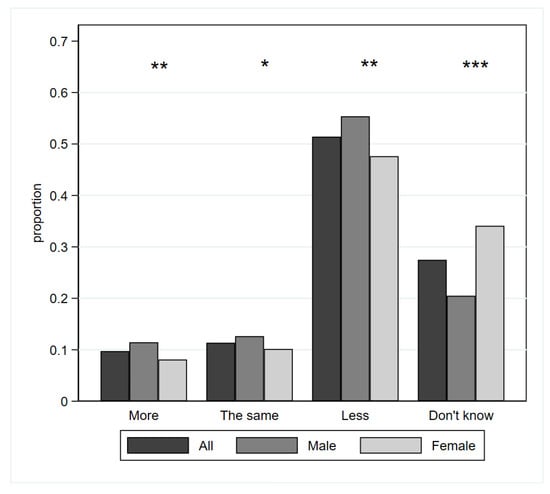

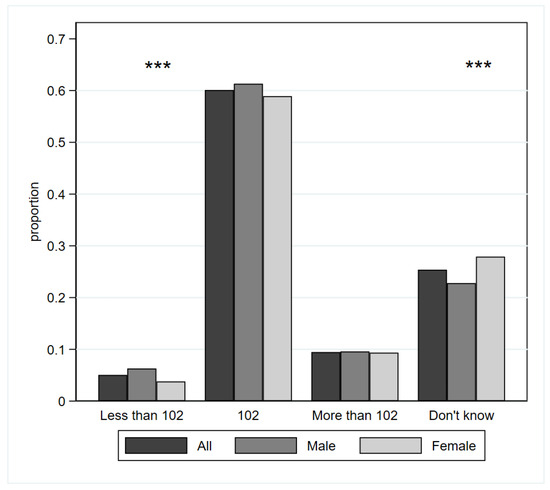

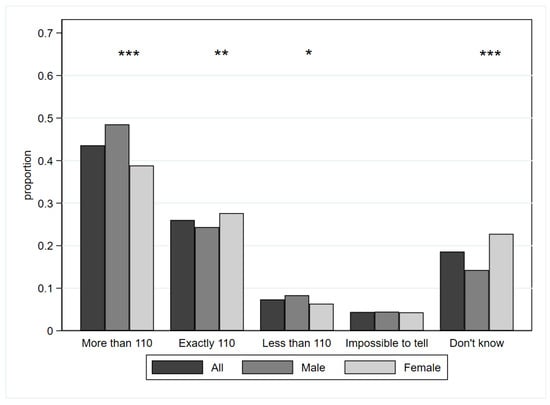

Figure 1, Figure 2 and Figure 3 depict the distribution of responses to the three financial literary questions. Figure 1 focuses on the inflation question (I), showing that the majority picked the right answer (i.e., “Less”), with women being 8 percentage points less likely than men to answer the question correctly. Notably, there is an appreciable difference in the DK responses, with women being 14 percentage points more likely than men to select this option. A similar pattern emerges in Figure 2, with the majority of respondents answering correctly (i.e., “102”), but this time with a minor 2 percentage point difference between women and men; for the DK option as well, there is a small gender difference, with women being 5 percentage points more likely to choose this option than men.5 The responses to the compound interest question (CI) displayed in Figure 3 show greater heterogeneity, probably due to the question’s increased mathematical complexity compared to the previous two. The proportion of correct answers does not stand out as prominently as in the previous figures. The percentage of correct answers for women is notably lower than for men (10 percentage points difference), while the female proportion of DK responses is notably higher (9 percentage points difference).

Figure 1.

Distribution of responses to question I. Note: The graph shows how responses to the inflation question (I) are distributed across the entire sample (All) and the subsamples of males and females. The correct answer is “Less”. Stars on top of options represent the p-value of the adjusted Wald test for the equality of the proportion of males and females choosing that particular option, with *, **, and *** representing p-values < 0.10, 0.05, and 0.01, respectively. The design-based F test of the equality of the distribution of responses between males and females strongly rejects the null hypothesis (, p-value < 0.001). Sampling weights are used.

Figure 2.

Distribution of responses to question SI. Note: The graph shows how responses to the simple interest question (SI) are distributed across the entire sample (All) and the subsamples of males and females. The correct answer is “102”. As the question requires an open-ended response and incorrect answers are highly fragmented and scattered, we have grouped all responses below 102 and those above 102, for presentation purposes. Stars on top of options represent the p-value of the adjusted Wald test for the equality of the proportion of males and females choosing that particular option, with *** representing p-values < 0.01. The design-based F test of the equality of the distribution of responses between males and females strongly rejects the null hypothesis (, p-value < 0.001). Sampling weights are used.

Figure 3.

Distribution of responses to CI. Note: The graph shows how responses to the compound interest question (CI) are distributed among males, females and the entire sample. The correct answer is “More than 110”. Stars on top of options represent the p-value of the Adjusted Wald test for the equality of the proportion of males and females choosing that particular option, with *, **, and *** representing p-values < 0.10, 0.05 and 0.01, respectively. The design-based F test of the equality of the distribution of responses between males and females strongly rejects the null hypothesis (, p-value < 0.001). Sampling weights are used.

These simple summary statistics and comparisons are consistent with prior findings in the literature, indicating a widespread gender gap in correctly answering financial literacy questions, observed globally across advanced and emerging countries (Klapper and Lusardi 2020).

2.2. Key Variables

Along the lines of the literature that explores the effect of financial competence mentioned in the Introduction, we consider different types of confidence in financial decision-making abilities, gauged on a Likert scale ranging from 0 (“Not at all confident”) to 10 (“Very confident”). These are then transformed into dummy variables, taking the value of 1 if the response is greater than 5, and 0 otherwise. We construct the following four variables: Confidence managing money, refers to the question: “How confident do you feel managing your money?”; Confidence decisions fin. prods. refers to the question: “How confident do you feel making decisions about financial products and services?”; Confidence with numbers refers to the question: “How confident do you feel working with numbers when you need to in everyday life?”; Confidence planning fin. future refers to the question: “How confident do you feel planning for your financial future?”

Other non-cognitive abilities could predict individuals’ financial literacy. In particular, we can label behaviour as “vicious” or “virtuous” according to whether it can help predict adverse or favourable effects on the decision-making process concerning financial matters. When a person makes financial decisions, they6 face an ongoing conflict between gaining short-term compensation (short-horizon doer) and obtaining long-term rewards (long-horizon planner) (Shefrin and Thaler 1988). The person’s ability to control the initial impulses and think about the long run (i.e., self-control) shapes their consumption behaviour; subsequently, it affects several financial behaviours (e.g., saving, indebtedness, or help-seeking). Therefore, the way in which self-control influences individuals’ decision-making (Atkinson and Messy 2011) affects how those individuals manage their personal finances (Farrell et al. 2016). When self-control failure occurs, people act in a non-optimal way.

To represent “vicious” cognitive abilities, we used the following variables. Living for today is a dummy variable which is equal to 1 if the participant responded “Strongly agree” or “Tend to agree” to the following statement: “When it comes to money, I prefer to live for today rather than plan for tomorrow”. The variable No fin. diff. is a dummy variable equal to 1 for participants who responded “Strongly agree” or “Tend to agree” to this question: “Nothing I do will make much difference to my financial situation”. Too busy for fin. matters is a dummy variable taking value 1 if participants answered “Strongly agree” or “Agree” to the question: “I am too busy to sort out my finances at the moment”. Hate to borrow is a dummy variable taking value 1 if the respondents chose “Strongly agree” or “Tend to agree” to the question: “I hate to borrow - I would much rather save up in advance”. We also constructed three other dummy variables using the question, “To what extent would you say the following statements apply to you personally?” with the answer given on a Likert scale ranging from 0 (“Does not sound like me at all”) to 10 (“Sound a lot like me”), by setting the variable equal to 1 if the answer is up to 5, and 0 otherwise. By doing so, we obtained the dummy Buy on impulse from the agreement to the statement “I often buy things on impulse”, and the dummy Peer emulation, which equals 1 if the respondent feels pressured to spend like their friends even when they can’t afford it, and 0 otherwise, capturing the agreement to the statement “I feel under pressure to spend like my friends even when I can’t afford it”.

To represent “virtuous” cognitive abilities, we used the following variables. Adjust to financial situation is a dummy variable constructed using the question encompassing the endorsement of the statement “I adjust to the amount of money I spend on non-essential when my life changes”, measured on a 1-10 Likert scale. Internet banking is a dummy variable taking value 1 if the respondent chooses “Strongly agree” or “Tend to agree” to the remark: “I would be happy to use the Internet to carry out day-to-day banking transactions”. The variable Tracking expenditure is equal to 1 if the participant responds “Very important” or “Fairly important” to the statement: “Keep track of your household’s income and expenditure”. Saving money is a dummy variable taking the value 1 if the participants own savings and 0 otherwise. This can be regarded as a virtuous behaviour in that savings can always shield from financial troubles.

Our survey does not have specific questions about risk attitude, so we employ ownership of risky activities as a proxy for risk attitude. This results in Risky investments being a dummy variable that equals 1 if participants own stocks and/or bonds and 0 otherwise.

We consider two questions to capture how the task of managing finances is divided within the household (HH): (1) “Who is the Chief Income Earner in your household?” and we define the dummy variable Principal income earner, which takes the value 1 if the respondent chooses the option “Myself” and “Me together with another household member”, and 0 otherwise. (2) “Which of the following best describes your household’s approach to managing money?” and we define the dummy variable In charge of HH money which takes the value 1 if the respondents choose “I am the main person doing this” or “I share this with my spouse, partner or other adult”, and 0 otherwise. We also define two interaction variables: Female income earner and Female in charge of HH money, when a woman is the principal income earner or the person in charge of managing money, respectively.

3. Dealing with DK Answers and the Gender Gap in Financial Literacy

The survey questionnaire, for the three questions of interest, includes the option DK, in addition to an open-ended answer option (SI), or a correct and several incorrect answer options (I and CI).

It has often been demonstrated in the literature that women are more likely than men to choose the DK option when it is available (Agnew et al. 2008; Bucher-Koenen et al. 2017; Hung et al. 2012; Lusardi and Mitchell 2009). As stated by Chen and Garand (2018), this finding underscores the need for heightened attention when measuring the gender gap in financial literacy. Consistently with part of the literature (Bucher-Koenen et al. 2017; Lusardi and Mitchel 2011a; Mondak and Davis 2001), we argue that selecting the DK option is not equivalent to providing an incorrect answer and should not be treated as such. Individuals may opt not to answer for various reasons: they may wish to avoid situations that could impact their self-esteem (Tang and Baker 2016); they may possess a principled aversion to dealing with financial or numerical issues (Tinghög et al. 2021); they may prefer not to disclose their weaknesses in terms of financial or numerical knowledge (Mondak 1999); they may simply lack confidence in their knowledge (Bucher-Koenen et al. 2017; Lizotte and Sidman 2009); they may fear regretting having made an incorrect answer (Charness and Gneezy 2012); they may lack the motivation to provide an answer (Krosnick and Presser 2010); they may attribute to the time required to answer a question with a high time cost (Lina Gálvez-Muñoz and Domínguez-Serrano 2011); and so on.

If the characteristics of the population who opt not to answer the question differ from those who do answer,7 completely disregarding the DK responses could lead to biased results in determining the factors that influence financial literacy. A similar problem would occur if we treated the DK option as an incorrect answer (on this, see Kim and Mountain 2019).

In the previous section, we observed how the distribution of responses differs between males and females. Notably, for two out of the three questions, the proportion of males giving the correct answer is different (specifically higher) than that of women. These results do not consider that the proportion of those who answer the question (opting out of the DK response) may differ between males and females. In fact, in all cases, the proportion of males choosing DK is significantly different from that of females, specifically lower, so inflating the statistics on the gender gap in financial literacy reported.

We need to redefine the limits within which we can measure the population’s financial knowledge and test for the existence of a gender gap. In the presence of a DK option, the assessment of financial literacy, and particularly the gender gap widely discussed in the literature, is limited to those who do answer the question either correctly or incorrectly, without disregarding the characteristics of those who select themselves out of the responder sample, that is, choose not to answer the question.

3.1. The Selection Mechanism and Data Recoding

In redefining financial knowledge, it is beneficial to conceptualise an underlying selection process influencing whether the interviewee opts for the DK alternative or responds to the question. With this perspective, we define two binary variables for each financial literacy question denoted by the subscript : (i) , which equals 1 if the individual provides an answer and 0 if DK is chosen; and (ii) , which equals 1 if, having answered (), the response is correct and 0 if incorrect. A value for is missing when .

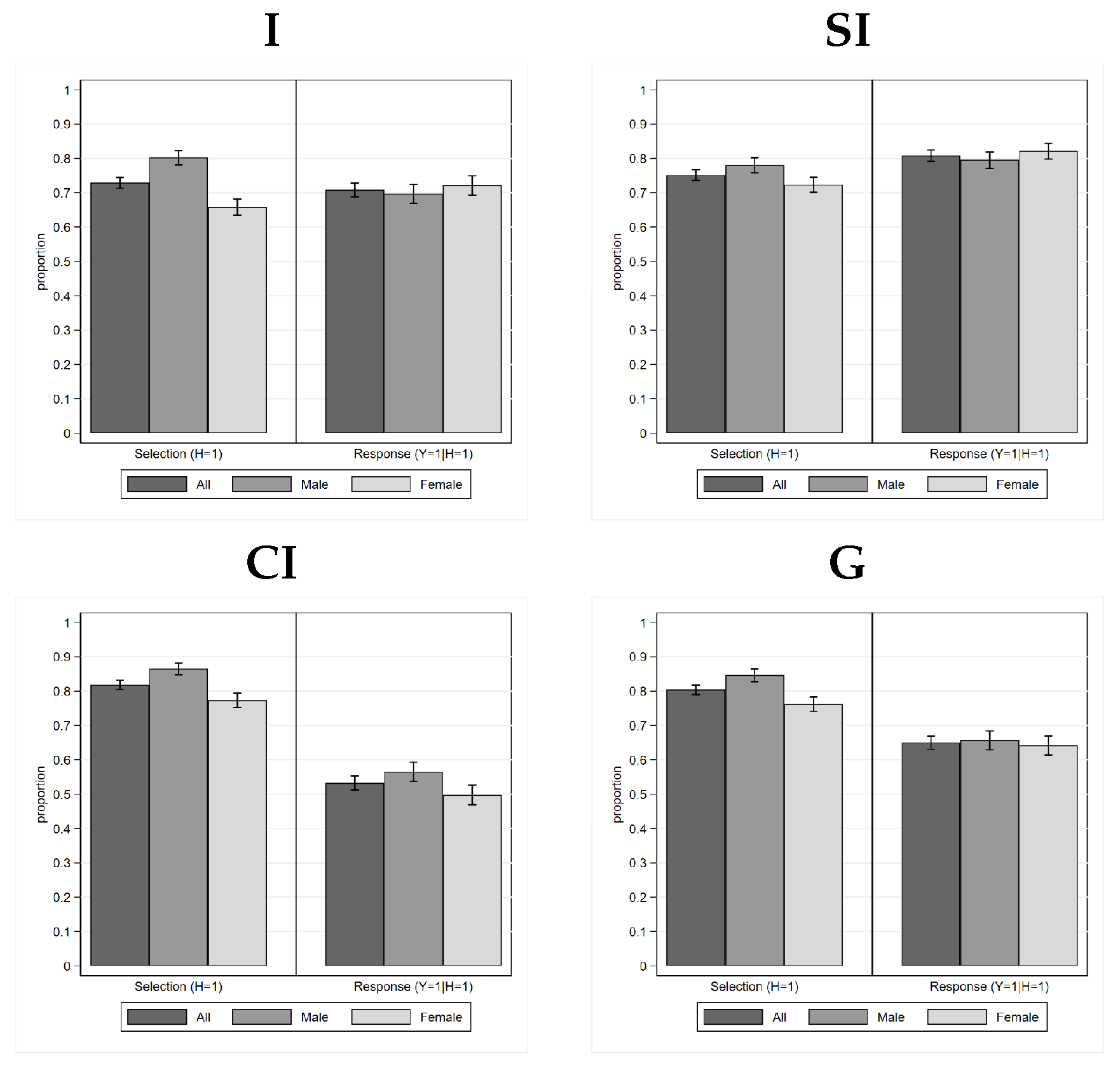

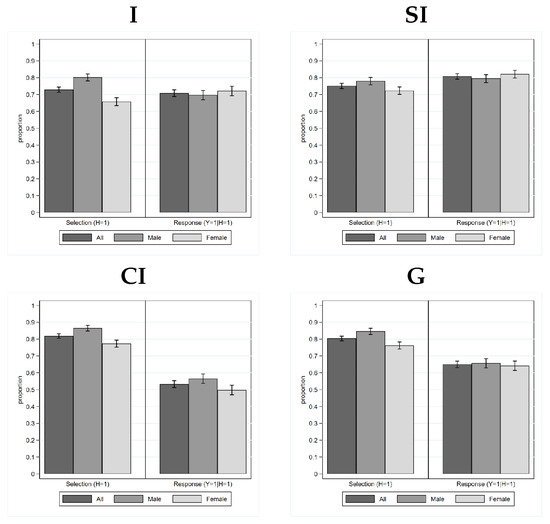

This data recoding produces plots in Figure 4, where we disregard the bottom-right panel for now. Each panel, representing the entire sample (All) and male and female subsamples, is divided into two parts. On the left, proportions of those self-selecting to answer the question () are displayed. On the right, proportions of those, having chosen to respond (), providing the correct answer () are shown. Sampling weights are applied in producing these plots.

Figure 4.

Distributions of the recoded financial literacy questions. Note: Each figure is divided into two panels. The left panel displays the proportions of the sample selected in the respondent group (selection) and the proportion of correct responses given by the respondents (response). Capped spikes represent confidence intervals. To produce the plots, sampling weights are used.

The “Selection” part displays proportions that are the complement to 1 of those under DK in Figure 1, Figure 2 and Figure 3, included here for completeness. All previous considerations and tests remain unchanged. Conversely, the “Response” part shows the proportions of the population answering correctly, given they have chosen to respond. The conditional correct response proportions are approximately 70%, 80%, and 55% for questions I, SI, and CI, respectively. While female proportions for questions I and SI are slightly higher than males, differences are not statistically significant (I: design-based , p-value = 0.220; SI: design-based , p-value 0.120). Conversely, for the CI question, a statistically significant difference between male and female correct response proportions exists (CI: design-based , p-value = 0.0010), albeit slightly higher for males.

We consolidate the three questions into a global (G) financial literacy indicator, encompassing responses to all three survey questions.8 The new indicator registers a correct response if given to all three questions or at least two; it records DK if similar to all three or at least two questions; otherwise, an incorrect response is recorded if answered at least twice and failing in at least one. This rule disambiguates cases of two correct and one DK answers in favour of the former, considering such a person financially literate. Proportions of DK and conditional correct response for aggregated indicator G align closely with individual question figures, with about 80% of the population selected as respondents and about 65% financially literate among them, irrespective of gender (G: design-based , p-value = 0.4634).

The gender gap in financial literacy is a primary focus in much of the literature on the topic. Our descriptive analysis reveals that women are more likely to refrain from answering than men. However, when they respond, the probability of incorrect answers is not significantly different from that of men for two of the three questions (and the aggregated question, G). Gender differences tend to emerge in response inclination and, to a lesser extent, in the financial literacy level among the respondents. The following analysis explores influences on selection and response processes and gender differences therein.

Consideration is needed regarding the proportions of respondents to each question. Counterintuitively, the proportion of respondents to the CI question, clearly the most difficult, is higher than that of the other two questions, regardless of gender. This is even more paradoxical considering CI is consequential to SI. Even though SI is the only open-ended question, there is a higher proportion of correct responses among respondents. This suggests that CI question respondents may feel guilty or ashamed for not answering previous questions. Those answering CI but not SI may do so as the latter is open-ended. The proportion of correct CI answers among non-SI respondents is much lower than among SI respondents. In experimental protocols, these biases are commonly avoided by randomising the order of the questions.

3.2. The Probit Model with Sample Selection

In light of the selection and response processes explained in the previous section, we envision that interviewees have a propensity to answer the question, and they respond if a certain level of propensity is reached. Hence, their final response, which can be either correct or incorrect, depends by their propensity to respond and their level of financial literacy. Accordingly, we model each of the three questions and the aggregated one separately via a probit model with sample selection (Van de Ven and Van Praag 1981), comprised of two simultaneously estimated components: a selection equation and a response equation.

Let be the latent variable representing subject i’s level of financial knowledge in question T, with , and that it is related to the subject’s vector of characteristics by the following relationship

Here, is a vector of coefficients on the variables in and is an error term. is not directly observed. What we observe is the dummy which is linked to via the observation rule

where is an indicator function taking the value 1 if the statement in brackets is true and 0 otherwise. In other words, a missing value is observed any time a subject chooses the DK option, while 1 (0) is observed for any correct (incorrect) answer to the financial literacy question provided. The propensity to answer the question is also a latent variable related to the subject’s characteristics in the following way

Here, is a vector of coefficients on the variables in and is an error term. This equation describes whether the subject answers the question or not via the following rule

The binary variable simply indicates whether the subject answers the question or not, with corresponding values of 1 and 0, respectively. Equation (3) plays a crucial role in this model by selecting those individuals who provide an answer (either positive or negative) to the question, distinguishing them from those who do not. It implicitly establishes (or, more properly, normalises) the threshold that the latent propensity to answer, , must surpass to provide a response to the question, setting it at 0.

The two behavioural Equations (1) and (3) are interconnected and estimated simultaneously. Therefore, the full model is

The error terms follow a joint normal distribution with 0 means, unit variances and correlation coefficient . For the sake of identification, the selection equation must contain at least one regressor different from those contained in the behavioural equation, referred to as “exclusion restriction”. The choice of such variables is discussed in the next section.

Given the distributional assumptions in Equation (7), the individual likelihood contributions are

Here, and denote the cumulative standard normal distribution and joint cumulative distribution of the bivariate normal with correlation , respectively.

The full-sample log-likelihood is

Here, denotes the subset of individuals who select themselves into the responders’ group (for whom ) for question T and is a sampling weight for observation i.

The model is estimated with maximum likelihood in Stata 17, using data from the whole sample.9

4. Estimation Results

The model delineated in the previous section is estimated separately for each financial knowledge question and from the global one from the entire sample. The estimation results are displayed in Table A3, Table A4, Table A5 and Table A6 in Appendix B. Conversely, Table 1 synthetically showcases a selection of these results, displaying only the sign of the estimated coefficient in red against a grey background if the coefficient is significantly different from 0. The outcomes for each question are organised into two panels: one showing the coefficient estimates for the selection equation and the other for the response equation. Each panel is further divided into three columns: one displaying coefficient estimates for the male subsample (M); one displaying coefficient estimates for the female subsample (F); and one showing the difference in the coefficients between females and males (). We follow the technique used by Bacon et al. (2024), which simultaneously estimates coefficients distinguishing by gender and enables us to test the hypothesis that they are equal (i.e., ) against a bivariate alternative (i.e., ).10

Table 1.

Selection of the estimation results.

As mentioned in the previous section, for identification, the models necessitate at least one exclusion restriction—an explanatory variable that reasonably accounts for the selection but not for the financial literacy level. We posit that the choice not to answer is an attitude that may be reflected in responses to other questions throughout the survey and that has nothing to do with familiarity with a particular question. Therefore, we created three indices. The first index, named DKbankstat, is a binary variable taking the value 1 if the subject answers DK to a question about a bank statement. In particular, respondents are asked to answer the question: “Looking at this example of a bank statement, please can you tell me how much money was in the account at the end of February?” Reading a bank statement is a common daily activity, and errors in understanding figures may occur due to lapses in concentration or carelessness. However, answering DK to such a straightforward question may reveal an attitude of avoiding inquiries related to numbers, counting, or financial matters, which may also capture a similar inclination in the three questions under investigation. A second dichotomic index is DKattitude, which is constructed to take the value one whenever the option DK is chosen for a list of statements or questions concerning financial situations that may reveal an inusitation, unwillingness, or aversion to financial matters.11 The last exclusion restriction introduced is the dummy variable DKindex, assigned a value of 1 when individuals respond with DK to inquiries regarding their proactive efforts to seek better deals in areas such as electricity, phone, internet, or TV packages, as well as inquiries about car or home insurance and credit cards. Specifically, this variable is set to 1 if respondents indicate DK to questions related to housing tenure, number of owned cars, or the existence of a will. This variable is meant to capture an attitude to avoid answering questions whose answers should be known. In each question, the coefficients on two of these exclusion restrictions at a time are used and shown to be significant. Therefore, the model is well identified. This finding vouches for our idea that choosing DK is an attitude that manifests in other questions.

When discussing the estimation results, our main emphasis will be on identifying a systematic effect of a variable across all the analysed questions to establish a pattern in financial literacy. While differences between questions may exist, we will focus on factors that consistently affect financial literacy, as it is an underlying trait unaffected by the question’s wording or framing. Thus, our conclusions must emerge from a joint inspection of the estimation results for all questions.

The literature cited in the Introduction indicates that women exhibit underconfidence in their financial competencies and actual financial knowledge. We will start the discussion with the four dummy variables representing individuals’ confidence in various activities: managing their money, making decisions about financial products and services, working with numbers when needed in everyday life, and planning for their financial future.

In general, Confidence managing money harms the likelihood that a female will answer the question and has no significant effect on males, while it negatively impacts males’ financial literacy with no effect on females. However, females who declare confidence in managing money are more financially knowledgeable than males who make a similar declaration.

Confidence decision fin. prods exhibits no clear effect on the likelihood of answering the question, but it negatively impacts the financial literacy of males only, revealing their overconfidence.

Confidence with numbers appears to exert the strongest systematic effect across all the questions about confidence, irrespective of the responder’s gender. Stating confidence in numerical matters is reflected in a higher probability of answering each of the four questions for females. Additionally, it leads to a higher probability of providing the correct answer to questions about inflation, compound interest rates, and the general one for males, who tend to respond more accurately than females declaring confidence with numbers.12

Regarding Confidence planning fin. future, the coefficient estimates show no systematic effect on the selection process and only a significant positive effect on the likelihood to respond correctly for males in the general question.

In summarising the impact of confidence on financial literacy and the associated gender gap, our results indicate that the only declared confidence with a systematic effect is the numerical confidence. This positively influences females’ likelihood to respond to questions and increases the probability of providing correct answers, although only for questions on inflation and simple interest. On the other hand, male confidence in mathematics results in a higher likelihood of providing correct answers, contributing to a gender gap in their favour. Essentially, male convictions lead to greater financial knowledge, while female confidence makes no substantial difference.

Despite the literature suggesting a strong link between HH financial management responsibilities, captured by the dummy variables In charge of HH money and Principal income earner, and financial literacy, we find evidence of a negative impact of the latter only on the likelihood of males responding correctly. Additionally, a significant positive gender difference indicates that females who are the principal income earners in the household respond more accurately than males in the same position. This contradicts the findings reported by Fonseca et al. (2012).

The dummy variable Risky investments, serving as a proxy for attitude to risk, identifies individuals involved in financially risky investments. Despite males exhibiting a higher propensity for risk-taking than females, as evident from the descriptive statistics presented in Table A1 in Appendix A, this characteristic exerts a similar effect on the likelihood of answering the question for both genders. However, this does not imply greater financial knowledge compared to those who do not invest in such a manner.13

The two dummy variables Peer emulation and Too busy for financial matters capture various cognitive abilities. The first predominantly leads to diminished financial knowledge for males across all the questions and for females in the general question. The second tends to induce mainly females to respond more likely, but negatively and significantly affects males’ likelihood to respond correctly. Both attitudes show no effect on the gender gap.

The last four variables in Table 1 capture virtuous cognitive habits. We find a pervasive positive effect on the likelihood of answering correctly across all the financial literacy questions for both genders on those who use Internet banking daily. Keeping track of HH expenditures positively impacts females’ attitude to respond correctly, making them more financially knowledgeable than males. Adjusting to financial situations and saving money have both a positive and significant impact on the propensity to respond of males and females in the G and more mixed for the other questions.

We note that testing the null hypothesis that the correlation between the errors of the two equations is zero () is equivalent to testing the independence of the two equations (selection and response). The statistically significant and negative estimates of for all questions reinforce our findings that the explanatory variables have varying effects on both the likelihood of responding and, when applicable, responding correctly, justifying our choice of a model with sample selection for these data.

Moreover, part of the literature suggests that the higher degree of financial literacy observed in men compared to women can be attributed to socio-demographic characteristics. These include factors such as age (Boyle et al. 2012; Finke et al. 2017; Hsu and Willis 2013), education and income level (Bucher-Koenen et al. 2017; Fonseca et al. 2012; Perry and Morris 2005), occupational status (Klapper and Lusardi 2020; Struckell et al. 2022), geographical area of residence (Bumcrot et al. 2011; Cucinelli et al. 2019; Lusardi and Mitchell 2011b), and urban or rural location (Boisclair et al. 2017; Bucher-Koenen and Lusardi 2011; Klapper and Panos 2011). In light of this literature, our analysis considered these features and their potential impact on the gender gap in financial literacy. Our findings reveal that there is no evidence of a systematic impact from socio-demographic features as a possible explanation for gender differences in financial knowledge, both regarding the decision to respond and the correctness of the response.

In conclusion, our findings reveal that certain factors play a role in respondents’ decisions to provide an answer to questions opting out the DK alternative. For women, feeling confident in handling numerical information is associated with a greater likelihood of offering a response. Furthermore, for both men and women, professing virtuous financial behaviours (such as tracking expenditures, adapting to financial situations, and saving money), displaying a propensity for risk in accordance with (Chen and Garand 2018), and considering oneself too busy to deal with financial matters (thus demonstrating overconfidence in such cases) are all linked to an increased inclination to respond to questions rather than opting for the DK choice.

Regarding the findings on the quality of the response, we do not find a gender gap in financial literacy between males and females. More specifically, the results unequivocally demonstrate that confidence in dealing with numbers is the sole behavioural factor capable of determining an advantage in financial knowledge for men. Nevertheless, women counterbalance the advantage men have in financial knowledge when they assume responsibilities for household financial management and consistently track household expenditures. This result aligns with evidence indicating that social norms dictate the allocation of tasks between men and women. Domestic work is usually assigned to women because perceived as a “feminine” task, while financial matters are typically considered the domain of men (Akerlof and Kranton 2000; Barber and Odean 2001). However, this division is often based on gender stereotypes rather than skills, yielding sub-optimal financial choices (Becker 1974). Our results debunk such stereotypes and consequently suggest that adopting more egalitarian norms can enhance the selection of household decision-makers, ensuring the role is assigned to the spouse best suited for it (Guiso and Zaccaria 2023).

Predictions

In this section, we conduct a “what if” exercise to predict the (marginal) probability of correctly answering for those who answered DK. We assume this probability is the same as that of the overall respondents’ sample, based on the estimation results in Table A3, Table A4, Table A5 and Table A6.

Table 2 shows the summary statistics of such probabilities for the entire sample (TOT), the male and female subsamples (M and F), for all data, and for those who, during the survey, opted not to answer the question (i.e., those who selected themselves out of the respondent sample).

Table 2.

Predictions of the probability of answering correctly.

We observe a significant difference between females and males, with a higher probability of a correct response for the former for questions I and SI, both among the entire population and those who selected themselves out. Contrarily, for the CI question, there is a gender difference in the population in favour of males. These discrepancies compensate in the G question that shows no difference.

These findings suggest that if women answer the questions, they are likely to answer as correctly as males, indicating a need to encourage their participation. The lack of significance in the G question is due to the compensation of the opposite effects of the single questions. All in all, we cannot find evidence of a systematic gender gap in financial literacy between males and females.

It is crucial to specify that predictions about the behaviour of those who opted for the “Do not know” response assume that those individuals have an equal probability of answering it correctly as those for whom we have a definite response. This may not be the case, and this is fertile ground for future research.

In Appendix C, we report the results of a similar prediction exercise using the approaches the most commonly encountered in the literature, that is the one that treats the DK answers as missing values and the one that treats them as incorrect answers.14 In both cases, the predicted probabilities differ from those in Table 2, which were obtained using our preferred model, and are notably lower in all instances.

5. Conclusions

This study has provided insights into the determinants of financial literacy and gender disparities, particularly regarding the econometric modelling of “Do not Know” responses. We argue against excluding or treating “Do not Know” responses as missing values, proposing a sample selection model to handle the DK responses together with the other question responses, which can be categorical or continuous in nature.

Our proposal has been motivated by the observation that the subsample of those who choose not to answer the questions does not share the same characteristics as those who do answer. A remarkable case, which we have used as a sort of case study given its relevance in the literature, is that of gender. In fact, females tend to choose the “Do not know” option more than males, and this suffices to support the non-randomness of the subsample who choose not to answer the questions.

The estimation results have revealed several key factors influencing respondents’ decisions to provide answers, with women’s confidence in handling numerical information emerging as a significant predictor of response likelihood. Both genders display a higher inclination to answer when exhibiting virtuous financial behaviours and perceiving themselves as too busy to address financial matters. Importantly, we find no systematic gender gap in financial literacy, challenging traditional assumptions about gender roles in financial decision-making. Women’s active involvement in managing household finances and tracking expenditures counterbalances any advantage men may have in financial knowledge solely through confidence in dealing with numbers.

Our results emphasise the importance of moving away from stereotypical assumptions about gender roles and promoting more egalitarian norms for optimal household financial decision-making. Furthermore, they underscore the intricate relationship between self-assurance and financial literacy, suggesting the need for targeted interventions to bolster confidence levels among females.

We have used the 2018 UK Financial Capability Survey. Unlike most OECD countries, the UK does not mandate studying maths until age eighteen. The former Prime Minister Rishi Sunak’s “Maths to 18” plan aims to improve numeracy, essential for everyday tasks like finding the best mortgage deal and saving money.15

Despite the theoretical robustness of our proposal, we acknowledge certain limitations inherent in our work. These include limitations stemming from the survey structure and posed questions, such as the absence of specific questions regarding individuals’ mathematical skills and the lack of randomisation in question order. Additionally, our analysis’ assumptions regarding “Do not Know” responses may warrant further exploration and refinement in future studies.

Author Contributions

Conceptualization, P.P. and J.T.; methodology, A.C.; software, P.P.; validation, J.T.; formal analysis, P.P. and J.T.; investigation, P.P.; resources, J.T.; data curation, P.P.; writing—original draft preparation, A.C., P.P. and J.T.; writing—review and editing, P.P. and J.T.; visualization, J.T.; supervision, A.C.; project administration, P.P.; funding acquisition, A.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Sapienza Ateneo 2021 Project n. 1798/2022: “Athena vs. Lyssa: the role of financial literacy and emotions in financial decisions”, coordinated by Prof. Anna Conte.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are not available from the authors, who can share the code for replicating the analysis. The data source is the UK Data Service.

Conflicts of Interest

The authors have no competing interests to declare that are relevant to the content of this article.

Abbreviations

The following abbreviations are used in this manuscript:

| DK | Do not know |

| HH | Household |

Appendix A. Descriptive Statistics

Table A1.

Descriptive statistics.

Table A1.

Descriptive statistics.

| Variable | Definition | Mean | p-Value | ||

|---|---|---|---|---|---|

| All | Female | Male | |||

| Exclusion restrictions | |||||

| DKbankstat | =1 if answer DK to the financial statement question; =0 otherwise | 0.100 | |||

| DKattitude | =1 if answer DK to at least one of the questions; =0 otherwise | 0.058 | |||

| DKindex | =1 if answer DK to at least one of the questions; =0 otherwise | 0.100 | |||

| Socio-demographics | |||||

| Female | =1 if female; =0 otherwise | 0.508 | |||

| Age | Categorical: age ranges | ||||

| 18 to 24 | 0.121 | 0.118 | 0.124 | 0.570 | |

| 25 to 44 | 0.371 | 0.367 | 0.376 | 0.641 | |

| 45 to 64 | 0.320 | 0.317 | 0.323 | 0.727 | |

| 65 to 74 | 0.113 | 0.115 | 0.111 | 0.748 | |

| 75 or more | 0.074 | 0.083 | 0.065 | 0.044 | |

| Unemployed | =1 if unemployed; =0 otherwise | 0.393 | 0.449 | 0.336 | 0.000 |

| Income | Categorical: income ranges | ||||

| Less than £25,000 | 0.409 | 0.417 | 0.401 | 0.401 | |

| £25,000 to £49,999 | 0.237 | 0.240 | 0.234 | 0.708 | |

| £50,000 to £99,999 | 0.113 | 0.090 | 0.137 | 0.000 | |

| £100,000 or more | 0.028 | 0.016 | 0.040 | 0.000 | |

| Do not know | 0.066 | 0.075 | 0.057 | 0.402 | |

| Prefer not to say | 0.147 | 0.163 | 0.131 | 0.012 | |

| Civil status | Categorical: status categories | ||||

| Married | 0.501 | 0.478 | 0.525 | 0.012 | |

| Never married | 0.350 | 0.350 | 0.350 | 0.977 | |

| Divorced or separated | 0.092 | 0.103 | 0.082 | 0.042 | |

| Widowed | 0.057 | 0.070 | 0.043 | 0.000 | |

| Education | Categorical: education levels | ||||

| No formal education | 0.118 | 0.123 | 0.112 | 0.346 | |

| Secondary education | 0.455 | 0.470 | 0.440 | 0.098 | |

| University | 0.427 | 0.407 | 0.448 | 0.028 | |

| Child | =1 if there is at least one child; =0 otherwise | 0.328 | 0.304 | 0.353 | 0.006 |

| Mortgage | =1 if own house with mortgage; =0 otherwise | 0.332 | 0.337 | 0.326 | 0.550 |

| City | =1 if live in a large city; =0 otherwise | 0.503 | 0.450 | 0.557 | 0.000 |

| Region | Categorical: geographical regions | ||||

| London | 0.131 | 0.121 | 0.142 | 0.117 | |

| South East (not London) | 0.137 | 0.137 | 0.137 | 0.990 | |

| South West | 0.089 | 0.089 | 0.090 | 0.940 | |

| East of England | 0.087 | 0.091 | 0.082 | 0.415 | |

| North East | 0.045 | 0.043 | 0.048 | 0.491 | |

| North West | 0.101 | 0.106 | 0.096 | 0.391 | |

| East Midlands | 0.076 | 0.076 | 0.076 | 0.965 | |

| West Midlands | 0.082 | 0.078 | 0.086 | 0.447 | |

| Yorkshire and the Humber | 0.085 | 0.091 | 0.078 | 0.244 | |

| Scotland | 0.089 | 0.090 | 0.087 | 0.546 | |

| Wales | 0.050 | 0.050 | 0.050 | 0.922 | |

| Northern Ireland | 0.028 | 0.028 | 0.028 | 0.960 | |

| Confidence | |||||

| Confidence managing money | =1 if feel confident in managing money; =0 otherwise | 0.838 | 0.826 | 0.850 | 0.076 |

| Confidence decision fin. prods. | =1 if feel confident in decisions about financial products; =0 otherwise | 0.783 | 0.755 | 0.813 | 0.000 |

| Confidence with numbers | =1 if feel confident in working with numbers; =0 otherwise | 0.852 | 0.834 | 0.872 | 0.004 |

| Confidence planning fin. future | =1 if feel confident in planning for financial future; =0 otherwise | 0.724 | 0.696 | 0.752 | 0.001 |

| Attitude | |||||

| Living for today | =1 if prefer to live for today; =0 otherwise | 0.303 | 0.250 | 0.357 | 0.000 |

| No fin. diff. | =1 if nothing will make difference to financial situation; 0 otherwise | 0.332 | 0.328 | 0.336 | 0.623 |

| Too busy for fin. matters | =1 if too busy to sort out my financial situation; =0 otherwise | 0.165 | 0.130 | 0.202 | 0.000 |

| Hate to borrow | =1 if hate to borrow; =0 otherwise | 0.719 | 0.744 | 0.694 | 0.004 |

| Internet banking | =1 if use internet for day-to-day banking transactions; 0 otherwise | 0.648 | 0.645 | 0.651 | 0.722 |

| Tracking expenditure | =1 if keep track of income and expenditure; =0 otherwise | 0.819 | 0.848 | 0.789 | 0.000 |

Note: The table displays the mean values for the entire sample and separately for females and males concerning the variables considered in our empirical analysis. The total sample size is N = 5774. Sampling weights are used.

In this section, we describe demographic and socioeconomic characteristics (Sociodemographics) that serve as controls. Age is categorised into five groups with the following ranges: 18 to 24 years old, 25 to 44 years old, 45 to 64 years old, 65 to 74 years old, and 75 years or older.

The variable Income represents the annual household gross income (in British pounds), categorised into five groups with the following bands: less than £25,000, between £25,000 and £49,999, between £50,000 and £99,999, £100,000 and over, “Don’t know”, and “Prefer not to say”. We have considered the last two categories because the first might indicate a lack of interest in financial matters and the second might either indicate very low income or the opposite. Hence, we cannot exclude them.

Civil status is a categorical variable that classifies respondents into four groups: married, never married, divorced or separated, and widowed.

Education is divided into four categories: no formal education (which includes people who are still studying), secondary education (which includes vocational training), and university (which includes higher education).

Unemployed is a dummy variable equal to 1 if the respondent does not have a job and 0 otherwise.

Child is a dummy variable which takes the value 1 if the respondent has at least one child aged 17 or under financially dependent on the respondent, either currently living in the HH or not, and 0 otherwise.

Mortgage is a dummy variable equal to 1 if the respondent has a home mortgage and 0 otherwise.

We consider also the variable Region, which is a categorical variable with twelve categories, each representing a region, to account for potential regional differences impacting financial literacy.

Finally, the variable City is a dummy equal to 1 if the respondent lives in a large city or large town (including suburbs) and 0 otherwise.

Table A2 displays a cross-tabulation of the responses to the three financial literacy questions, where 1 represents correct, 0 represents incorrect, and ‘.’ represents DK answers. In this table, we observe that about one fourth of the sample answers all three questions correctly, as well as those who answer two of the questions correctly. On the other hand, about 14% and 7% of the sample choose the DK option for all three questions or only twice, respectively. These figures reveal that both positive financial literacy and the tendency to choose the DK option are substantial and systematic.

Table A2.

Cross-tabulation of responses to the financial literacy questions.

Table A2.

Cross-tabulation of responses to the financial literacy questions.

| I | SI | CI | % |

|---|---|---|---|

| 0 | 0 | 0 | 2.38 |

| 0 | 0 | 1 | 2.81 |

| 0 | 0 | . | 0.20 |

| 0 | 1 | 0 | 5.17 |

| 0 | 1 | 1 | 3.06 |

| 0 | 1 | . | 0.15 |

| 0 | . | 0 | 2.34 |

| 0 | . | 1 | 1.32 |

| 0 | . | . | 1.27 |

| 1 | 0 | 0 | 1.89 |

| 1 | 0 | 1 | 3.18 |

| 1 | 0 | . | 0.15 |

| 1 | 1 | 0 | 15.27 |

| 1 | 1 | 1 | 27.70 |

| 1 | 1 | . | 0.32 |

| 1 | . | 0 | 1.36 |

| 1 | . | 1 | 0.77 |

| 1 | . | . | 1.57 |

| . | 0 | 0 | 0.79 |

| . | 0 | 1 | 1.34 |

| . | 0 | . | 0.84 |

| . | 1 | 0 | 5.64 |

| . | 1 | 1 | 3.40 |

| . | 1 | . | 1.07 |

| . | . | 0 | 1.57 |

| . | . | 1 | 0.65 |

| . | . | . | 13.78 |

| Total | 100 |

Note: The values 0 and 1 represent incorrect and correct responses, respectively, while the symbol ‘.’ represents the DK response. Sampling weights are used.

Appendix B. Estimation Results: Details

Table A3.

Estimation results question I.

Table A3.

Estimation results question I.

| Selection | Response | |||||

|---|---|---|---|---|---|---|

| Variable | M | F | M | F | ||

| DKbankstat | −0.673 *** | |||||

| (0.080) | ||||||

| DKattitude | −0.336 *** | |||||

| (0.105) | ||||||

| 25 to 44 | −0.024 | 0.227 ** | 0.251 | 0.238 | 0.117 | −0.121 |

| (0.155) | (0.107) | (0.188) | (0.151) | (0.136) | (0.202) | |

| 45 to 64 | 0.285 * | 0.583 *** | 0.298 | 0.641 *** | 0.476 *** | −0.165 |

| (0.153) | (0.124) | (0.196) | (0.159) | (0.164) | (0.220) | |

| 65 to 64 | 0.633*** | 0.810 *** | 0.177 | 0.510 ** | 0.664 *** | 0.154 |

| (0.193) | (0.165) | (0.254) | (0.215) | (0.219) | (0.296) | |

| 75 or more | 0.322 | 0.971 *** | 0.649 ** | 0.885 *** | 0.564 ** | −0.320 |

| (0.225) | (0.177) | (0.286) | (0.257) | (0.238) | (0.344) | |

| Unemployed | 0.0395 | −0.089 | −0.129 | 0.196 * | −0.002 | −0.198 |

| (0.115) | (0.086) | (0.144) | (0.118) | (0.102) | (0.157) | |

| £25,000 to £49,999 | −0.0344 | 0.041 | 0.075 | 0.167 | 0.039 | −0.128 |

| (0.116) | (0.102) | (0.155) | (0.120) | (0.115) | (0.166) | |

| £50,000 to £99,999 | 0.574 *** | 0.057 | −0.517 ** | 0.245 * | −0.016 | −0.261 |

| (0.167) | (0.153) | (0.226) | (0.142) | (0.181) | (0.230) | |

| £100,000 or more | −0.121 | 0.212 | 0.333 | −0.035 | −0.135 | −0.100 |

| (0.310) | (0.301) | (0.433) | (0.198) | (0.383) | (0.431) | |

| Do not know | −0.567 *** | −0.552 *** | 0.015 | 0.065 | −0.168 | −0.233 |

| (0.166) | (0.134) | (0.213) | (0.212) | (0.173) | (0.271) | |

| Prefer not to say | −0.336 *** | −0.402 *** | −0.066 | −0.072 | 0.124 | 0.196 |

| (0.117) | (0.101) | (0.154) | (0.140) | (0.133) | (0.194) | |

| Never married | −0.216 | −0.318 *** | −0.102 | 0.013 | 0.274 ** | 0.261 |

| (0.136) | (0.097) | (0.167) | (0.128) | (0.122) | (0.177) | |

| Divorced or separated | −0.020 | −0.078 | −0.058 | −0.122 | 0.053 | 0.175 |

| (0.165) | (0.127) | (0.208) | (0.175) | (0.152) | (0.232) | |

| Widowed | −0.117 | −0.094 | 0.023 | −0.255 | −0.157 | 0.098 |

| (0.203) | (0.150) | (0.253) | (0.217) | (0.177) | (0.280) | |

| Secondary education | 0.467 *** | 0.277 ** | −0.190 | −0.162 | −0.089 | 0.073 |

| (0.123) | (0.115) | (0.168) | (0.162) | (0.153) | (0.219) | |

| University | 0.723 *** | 0.553 *** | −0.171 | −0.006 | 0.127 | 0.133 |

| (0.140) | (0.132) | (0.191) | (0.174) | (0.176) | (0.239) | |

| Child | 0.072 | 0.115 | 0.0427 | −0.181 | −0.288 ** | −0.107 |

| (0.115) | (0.095) | (0.149) | (0.110) | (0.117) | (0.161) | |

| Mortgage | −0.045 | 0.003 | 0.0486 | 0.019 | 0.092 | 0.073 |

| (0.107) | (0.090) | (0.139) | (0.101) | (0.109) | (0.148) | |

| City | −0.0816 | 0.170 ** | 0.251 ** | −0.109 | −0.193 ** | −0.0838 |

| (0.0902) | (0.077) | (0.119) | (0.0942) | (0.091) | (0.131) | |

| South East (not London) | 0.133 | −0.071 | −0.203 | 0.132 | 0.117 | −0.015 |

| (0.177) | (0.160) | (0.238) | (0.162) | (0.181) | (0.242) | |

| South West | 0.0938 | 0.149 | 0.056 | 0.018 | 0.141 | 0.123 |

| (0.200) | (0.170) | (0.263) | (0.188) | (0.200) | (0.274) | |

| East of England | 0.203 | −0.152 | −0.355 | 0.227 | −0.008 | −0.235 |

| (0.204) | (0.175) | (0.269) | (0.201) | (0.203) | (0.286) | |

| North East | 0.205 | 0.075 | −0.130 | 0.140 | −0.081 | −0.221 |

| (0.240) | (0.208) | (0.318) | (0.238) | (0.301) | (0.383) | |

| North West | 0.462 ** | 0.285 * | −0.177 | 0.213 | −0.123 | −0.336 |

| (0.208) | (0.166) | (0.266) | (0.188) | (0.191) | (0.267) | |

| East Midlands | −0.063 | −0.194 | −0.131 | 0.286 | 0.051 | −0.235 |

| (0.199) | (0.179) | (0.268) | (0.204) | (0.219) | (0.300) | |

| West Midlands | 0.316 * | 0.027 | −0.289 | 0.052 | −0.314 | −0.366 |

| (0.184) | (0.173) | (0.252) | (0.200) | (0.217) | (0.295) | |

| Yorkshire and the Humber | 0.185 | 0.058 | −0.127 | −0.067 | 0.131 | 0.198 |

| (0.186) | (0.174) | (0.255) | (0.198) | (0.198) | (0.280) | |

| Scotland | 0.131 | −0.051 | −0.182 | 0.368 ** | 0.131 | −0.237 |

| (0.158) | (0.135) | (0.208) | (0.151) | (0.158) | (0.219) | |

| Wales | 0.207 | 0.133 | −0.074 | 0.081 | −0.046 | −0.127 |

| (0.161) | (0.139) | (0.213) | (0.151) | (0.161) | (0.220) | |

| Northern Ireland | 0.148 | 0.112 | −0.037 | 0.219 | −0.271 | −0.490 ** |

| (0.165) | (0.142) | (0.218) | (0.153) | (0.167) | (0.226) | |

| Confidence managing money | 0.021 | −0.085 | −0.105 | −0.124 | 0.001 | 0.124 |

| (0.150) | (0.126) | (0.196) | (0.171) | (0.163) | (0.236) | |

| Confidence decision fin. prods. | −0.013 | 0.090 | 0.103 | −0.433 *** | −0.161 | 0.272 |

| (0.133) | (0.116) | (0.176) | (0.159) | (0.143) | (0.213) | |

| Confidence with numbers | 0.219 | 0.242 ** | 0.023 | 0.530 *** | 0.296 * | −0.234 |

| (0.145) | (0.120) | (0.188) | (0.178) | (0.152) | (0.230) | |

| Confidence planning | 0.134 | 0.268 *** | 0.133 | −0.073 | −0.340 ** | −0.268 |

| (0.119) | (0.102) | (0.157) | (0.138) | (0.137) | (0.195) | |

| Living for today | 0.009 | 0.041 | 0.032 | −0.227 ** | −0.037 | 0.190 |

| (0.103) | (0.090) | (0.137) | (0.101) | (0.106) | (0.146) | |

| No fin. diff. | −0.128 | 0.008 | 0.137 | −0.063 | −0.072 | −0.009 |

| (0.094) | (0.080) | (0.124) | (0.100) | (0.092) | (0.136) | |

| Too busy for fin. matters | 0.443 *** | 0.246 ** | −0.197 | −0.230 * | −0.159 | 0.071 |

| (0.124) | (0.112) | (0.167) | (0.118) | (0.129) | (0.175) | |

| Hate to borrow | −0.217 ** | −0.107 | 0.110 | 0.079 | 0.024 | −0.055 |

| (0.097) | (0.087) | (0.129) | (0.099) | (0.102) | (0.141) | |

| Internet Banking | 0.071 | −0.143 * | −0.214 * | 0.231 ** | 0.349 *** | 0.118 |

| (0.089) | (0.081) | (0.120) | (0.095) | (0.098) | (0.136) | |

| Tracking investments | 0.201 * | −0.028 | −0.228 | 0.046 | 0.345 *** | 0.299 * |

| (0.103) | (0.102) | (0.146) | (0.115) | (0.117) | (0.163) | |

| Saving money | 0.240 ** | 0.074 | −0.166 | −0.227 * | 0.031 | 0.257 |

| (0.108) | (0.089) | (0.140) | (0.128) | (0.116) | (0.172) | |

| Risky investments | 0.360 *** | 0.364 *** | 0.004 | 0.046 | 0.084 | 0.0385 |

| (0.111) | (0.096) | (0.147) | (0.100) | (0.100) | (0.142) | |

| In charge of HH money | −0.0131 | −0.194 ** | −0.181 | 0.0975 | 0.140 | 0.0428 |

| (0.109) | (0.089) | (0.141) | (0.115) | (0.104) | (0.155) | |

| Principal income earner | −0.022 | 0.155 * | 0.177 | −0.184 | −0.129 | 0.0551 |

| (0.125) | (0.080) | (0.149) | (0.123) | (0.096) | (0.156) | |

| Buy on impulse | 0.184 * | −0.044 | −0.228 * | −0.130 | −0.058 | 0.073 |

| (0.095) | (0.076) | (0.121) | (0.098) | (0.091) | (0.134) | |

| Adjust to financial situation | 0.111 | 0.182 * | 0.071 | 0.222 * | 0.023 | −0.199 |

| (0.108) | (0.102) | (0.148) | (0.118) | (0.130) | (0.175) | |

| Peer emulation | 0.041 | 0.145 | 0.104 | −0.585 *** | −0.369 *** | 0.215 |

| (0.109) | (0.092) | (0.142) | (0.108) | (0.109) | (0.153) | |

| Keep track of personal income | 0.124 | 0.136 | 0.0119 | −0.286 ** | −0.280 ** | 0.006 |

| (0.118) | (0.104) | (0.157) | (0.125) | (0.132) | (0.181) | |

| Constant | −0.603 * | −0.699 ** | −0.096 | 0.858 ** | 0.529 | −0.329 |

| (0.364) | (0.291) | (0.462) | (0.363) | (0.375) | (0.486) | |

| −0.711 *** | ||||||

| (0.103) | ||||||

| Log-likelihood | −4726.492 | |||||

| Observations | 5774 | |||||

| Selected in | 4118 | |||||

| Selected out | 1656 | |||||

Note: Results are obtained using the model in Section 3.2. Reference categories: 18–24 years old, income less than £25,000, married, no formal education, London. M and F refer to the male and female subsamples, respectively; Δ indicates the difference in the estimates between female and male subsamples. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% levels, respectively. Robust standard errors are reported in parenthesis. Sampling weights are used.

Table A4.

Estimation results question SI.

Table A4.

Estimation results question SI.

| Selection | Response | |||||

|---|---|---|---|---|---|---|

| Variable | M | F | M | F | ||

| DKbankstat | −1.411 *** | |||||

| (0.092) | ||||||

| DKattitude | −0.238 *** | |||||

| (0.086) | ||||||

| 25 to 44 | −0.256 * | 0.238 ** | 0.493 ** | 0.043 | −0.117 | −0.159 |

| (0.152) | (0.118) | (0.193) | (0.168) | (0.146) | (0.223) | |

| 45 to 64 | 0.307 * | 0.431 *** | 0.124 | 0.122 | 0.084 | −0.038 |

| (0.158) | (0.136) | (0.208) | (0.183) | (0.160) | (0.242) | |

| 65 to 64 | 0.161 | 0.706 *** | 0.545 ** | 0.400 * | 0.079 | −0.321 |

| (0.197) | (0.178) | (0.264) | (0.239) | (0.215) | (0.317) | |

| 75 or more | 0.118 | 0.547 *** | 0.428 | 0.295 | 0.181 | −0.114 |

| (0.238) | (0.206) | (0.315) | (0.287) | (0.238) | (0.371) | |

| Unemployed | 0.112 | −0.117 | −0.229 | 0.139 | 0.132 | −0.007 |

| (0.123) | (0.094) | (0.155) | (0.137) | (0.114) | (0.177) | |

| £25,000 to £49,999 | 0.331 *** | 0.016 | −0.315 * | 0.194 | 0.276 ** | 0.082 |

| (0.125) | (0.114) | (0.169) | (0.125) | (0.123) | (0.176) | |

| £50,000 to £99,999 | 0.569 *** | 0.207 | −0.362 | 0.302 ** | 0.185 | −0.117 |

| (0.165) | (0.183) | (0.247) | (0.145) | (0.190) | (0.238) | |

| £100,000 or more | 0.240 | 0.273 | 0.033 | 0.197 | 0.224 | 0.027 |

| (0.255) | (0.316) | (0.406) | (0.273) | (0.342) | (0.436) | |

| Do not know | −0.705 *** | −0.744 *** | −0.039 | −0.035 | 0.541 *** | 0.576 |

| (0.184) | (0.136) | (0.229) | (0.309) | (0.203) | (0.356) | |

| Prefer not to say | 0.058 | −0.270 ** | −0.327 ** | 0.447 *** | 0.525 *** | 0.078 |

| (0.128) | (0.106) | (0.166) | (0.159) | (0.142) | (0.213) | |

| Never married | 0.012 | 0.035 | 0.023 | 0.307 ** | 0.169 | −0.139 |

| (0.139) | (0.109) | (0.176) | (0.143) | (0.131) | (0.194) | |

| Divorced or separated | 0.021 | −0.216 | −0.429 ** | 0.412 * | 0.083 | −0.329 |

| (0.169) | (0.137) | (0.217) | (0.210) | (0.161) | (0.265) | |

| Widowed | −0.038 | −0.074 | −0.035 | 0.076 | −0.173 | −0.249 |

| (0.218) | (0.179) | (0.282) | (0.227) | (0.188) | (0.294) | |

| Secondary education | 0.301 ** | 0.266 ** | −0.036 | 0.229 | 0.405 ** | 0.176 |

| (0.133) | (0.121) | (0.180) | (0.171) | (0.174) | (0.239) | |

| University | 0.540 *** | 0.496 *** | −0.044 | 0.116 | 0.565 *** | 0.449 * |

| (0.149) | (0.137) | (0.202) | (0.179) | (0.190) | (0.251) | |

| Child | 0.030 | −0.216 ** | −0.246 | −0.416 *** | 0.103 | 0.519 *** |

| (0.117) | (0.100) | (0.154) | (0.121) | (0.124) | (0.173) | |

| Mortgage | −0.048 | 0.130 | 0.178 | 0.345 *** | 0.009 | −0.336 ** |

| (0.111) | (0.105) | (0.154) | (0.116) | (0.114) | (0.163) | |

| City | −0.167 * | −0.029 | 0.138 | −0.335 *** | −0.084 | 0.251 * |

| (0.095) | (0.085) | (0.127) | (0.102) | (0.099) | (0.142) | |

| South East (not London) | 0.089 | −0.000 | −0.089 | 0.006 | 0.147 | 0.141 |

| (0.177) | (0.164) | (0.242) | (0.186) | (0.204) | (0.276) | |

| South West | 0.244 | −0.024 | −0.268 | −0.035 | 0.500 ** | 0.535 |

| (0.207) | (0.175) | (0.273) | (0.225) | (0.244) | (0.330) | |

| East of England | 0.274 | −0.122 | −0.396 | −0.174 | 0.423 * | 0.596 * |

| (0.196) | (0.191) | (0.274) | (0.209) | (0.229) | (0.309) | |

| North East | 0.344 | −0.157 | −0.501 | −0.521 ** | 0.281 | 0.803 ** |

| (0.234) | (0.220) | (0.323) | (0.246) | (0.322) | (0.405) | |

| North West | 0.180 | −0.032 | −0.212 | 0.058 | 0.103 | 0.046 |

| (0.199) | (0.166) | (0.259) | (0.212) | (0.219) | (0.303) | |

| East Midlands | 0.133 | 0.155 | 0.022 | 0.273 | 0.316 | 0.043 |

| (0.210) | (0.204) | (0.295) | (0.245) | (0.250) | (0.348) | |

| West Midlands | 0.331 | 0.231 | −0.100 | −0.389 * | 0.033 | 0.422 |

| (0.205) | (0.203) | (0.289) | (0.213) | (0.214) | (0.301) | |

| Yorkshire and the Humber | −0.004 | −0.144 | −0.140 | −0.164 | 0.193 | 0.357 |

| (0.200) | (0.182) | (0.271) | (0.221) | (0.211) | (0.305) | |

| Scotland | 0.533 *** | 0.159 | −0.373 * | 0.095 | 0.151 | 0.056 |

| (0.161) | (0.143) | (0.215) | (0.174) | (0.181) | (0.248) | |

| Wales | 0.251 | 0.185 | −0.066 | −0.231 | 0.080 | 0.311 |

| (0.164) | (0.147) | (0.220) | (0.175) | (0.180) | (0.250) | |

| Northern Ireland | 0.265 | 0.186 | −0.079 | 0.202 | 0.195 | −0.007 |

| (0.176) | (0.149) | (0.230) | (0.181) | (0.187) | (0.257) | |

| Confidence managing money | −0.067 | −0.234 * | −0.167 | −0.249 | −0.009 | 0.240 |

| (0.154) | (0.130) | (0.202) | (0.187) | (0.178) | (0.257) | |

| Confidence decision fin. prods. | 0.235 * | 0.096 | −0.139 | −0.287 * | 0.067 | 0.354 |

| (0.138) | (0.116) | (0.180) | (0.170) | (0.152) | (0.228) | |

| Confidence with numbers | 0.305 ** | 0.630 *** | 0.325 * | 0.347 | 0.366 ** | 0.019 |

| (0.152) | (0.117) | (0.191) | (0.221) | (0.174) | (0.265) | |

| Confidence planning | −0.215 | −0.159 | 0.056 | 0.138 | −0.170 | −0.308 |

| (0.137) | (0.106) | (0.173) | (0.146) | (0.131) | (0.194) | |

| Living for today | −0.161 * | −0.127 | 0.033 | −0.140 | −0.202 * | −0.061 |

| (0.099) | (0.092) | (0.133) | (0.109) | (0.115) | (0.158) | |

| No fin.diff. | −0.203 ** | −0.120 | 0.083 | −0.177 | 0.005 | 0.182 |

| (0.098) | (0.086) | (0.131) | (0.113) | (0.096) | (0.148) | |

| Too busy for fin. Matters | 0.125 | 0.334 *** | 0.209 | −0.586 *** | −0.337 *** | 0.249 |

| (0.121) | (0.122) | (0.172) | (0.129) | (0.129) | (0.184) | |

| Hate to borrow | −0.154 | 0.086 | 0.240 * | 0.013 | −0.181 | −0.194 |

| (0.100) | (0.092) | (0.135) | (0.108) | (0.113) | (0.156) | |

| Internet Banking | 0.243 *** | 0.255 *** | 0.011 | 0.262 ** | 0.200 * | −0.062 |

| (0.092) | (0.090) | (0.129) | (0.103) | (0.113) | (0.149) | |

| Tracking investments | 0.181 * | 0.101 | −0.080 | 0.028 | 0.383 *** | 0.355 * |

| (0.109) | (0.111) | (0.156) | (0.123) | (0.139) | (0.183) | |

| Saving money | 0.032 | 0.127 | 0.095 | 0.147 | −0.116 | −0.263 |

| (0.122) | (0.098) | (0.156) | (0.141) | (0.126) | (0.189) | |

| Risky investments | 0.217 * | 0.480 *** | 0.263 * | −0.129 | −0.107 | 0.022 |

| (0.111) | (0.100) | (0.149) | (0.102) | (0.109) | (0.149) | |

| In charge of HH money | 0.206 * | 0.002 | −0.205 | −0.053 | 0.111 | 0.164 |

| (0.112) | (0.092) | (0.145) | (0.130) | (0.118) | (0.175) | |

| Principal income earner | −0.198 | −0.045 | 0.153 | −0.043 | −0.194 * | −0.237 |

| (0.131) | (0.086) | (0.157) | (0.133) | (0.105) | (0.169) | |

| Buy on impulse | 0.082 | −0.064 | −0.147 | −0.005 | 0.117 | 0.123 |

| (0.103) | (0.083) | (0.132) | (0.108) | (0.095) | (0.144) | |

| Adjust to financial situation | 0.238 ** | 0.385 *** | 0.148 | 0.103 | −0.157 | −0.260 |

| (0.111) | (0.107) | (0.154) | (0.128) | (0.146) | (0.192) | |

| Peer emulation | −0.192 * | −0.119 | 0.073 | −0.382 *** | −0.099 | 0.284 * |

| (0.113) | (0.099) | (0.150) | (0.122) | (0.119) | (0.169) | |

| Keep track of personal income | 0.203 * | −0.026 | −0.229 | −0.285 ** | −0.380 *** | −0.096 |

| (0.116) | (0.110) | (0.160) | (0.133) | (0.143) | (0.195) | |

| Constant | −0.329 | −0.642 ** | −0.313 | 1.011 ** | 0.258 | −0.753 |

| (0.381) | (0.308) | (0.488) | (0.434) | (0.465) | (0.581) | |

| −0.440 * | ||||||

| (0.202) | ||||||

| Log-likelihood | −4114.946 | |||||

| Observations | 5774 | |||||

| Selected in | 4118 | |||||

| Selected out | 1401 | |||||

Note: Results are obtained using the model in Section 3.2. Reference categories: 18–24 years old, income less than £25,000, married, no formal education, London. M and F refer to the male and female subsamples, respectively; Δ indicates the difference in the estimates between female and male subsamples. ***, **, * indicate statistical significance at the 1%, 5%, and 10% level, respectively. Robust standard errors are reported in parenthesis. Sampling weights are used.

Table A5.

Estimation results question CI.

Table A5.

Estimation results question CI.

| Selection | Response | |||||

|---|---|---|---|---|---|---|

| Variable | M | F | M | F | ||

| DKbankstat | −1.022 *** | |||||

| (0.082) | ||||||

| DKattitude | −0.191 ** | |||||

| (0.086) | ||||||

| 25 to 44 | −0.195 | 0.122 | 0.317 | 0.182 | −0.077 | −0.259 |

| (0.161) | (0.128) | (0.205) | (0.141) | (0.117) | (0.183) | |

| 45 to 64 | 0.0471 | 0.265 * | 0.218 | 0.406 *** | 0.053 | −0.353 * |

| (0.169) | (0.141) | (0.220) | (0.143) | (0.132) | (0.194) | |

| 65 to 64 | 0.118 | 0.356 * | 0.238 | 0.297 | −0.140 | −0.437 * |

| (0.217) | (0.184) | (0.284) | (0.182) | (0.175) | (0.252) | |

| 75 or more | −0.143 | 0.507 ** | 0.650 ** | 0.047 | 0.057 | 0.009 |

| (0.254) | (0.197) | (0.321) | (0.226) | (0.199) | (0.304) | |

| Unemployed | 0.137 | −0.187 ** | −0.325 ** | 0.153 | −0.002 | −0.155 |

| (0.120) | (0.091) | (0.151) | (0.106) | (0.090) | (0.139) | |

| £25,000 to £49,999 | 0.00959 | −0.103 | −0.112 | 0.115 | 0.265 *** | 0.150 |

| (0.128) | (0.115) | (0.172) | (0.100) | (0.102) | (0.143) | |

| £50,000 to £99,999 | 0.495 ** | −0.453 *** | −0.948 *** | 0.230 * | 0.381 ** | 0.150 |

| (0.214) | (0.175) | (0.276) | (0.131) | (0.155) | (0.203) | |

| £100,000 or more | 0.155 | 0.015 | −0.140 | 0.244 | 0.370 | 0.126 |

| (0.315) | (0.371) | (0.486) | (0.213) | (0.327) | (0.390) | |

| Do not know | −0.768 *** | −0.799 *** | −0.031 | −0.063 | 0.151 | 0.213 |

| (0.173) | (0.134) | (0.219) | (0.212) | (0.173) | (0.256) | |

| Prefer not to say | −0.371 *** | −0.481 *** | −0.111 | −0.154 | 0.071 | 0.226 |

| (0.122) | (0.108) | (0.163) | (0.125) | (0.117) | (0.167) | |

| Never married | −0.086 | −0.053 | 0.034 | −0.007 | 0.098 | 0.105 |

| (0.137) | (0.106) | (0.173) | (0.115) | (0.102) | (0.154) | |

| Divorced or separated | 0.121 | −0.223 * | −0.344 | −0.127 | −0.076 | 0.051 |

| (0.175) | (0.132) | (0.219) | (0.145) | (0.140) | (0.202) | |

| Widowed | −0.289 | −0.127 | 0.162 | −0.132 | 0.134 | 0.266 |

| (0.211) | (0.175) | (0.273) | (0.201) | (0.162) | (0.258) | |

| Secondary education | 0.373 *** | 0.273 ** | −0.100 | 0.0206 | 0.072 | 0.051 |

| (0.134) | (0.116) | (0.177) | (0.134) | (0.132) | (0.184) | |

| University | 0.724 *** | 0.624 *** | −0.100 | 0.195 | 0.153 | −0.042 |

| (0.160) | (0.136) | (0.210) | (0.148) | (0.148) | (0.197) | |

| Child | 0.292 ** | 0.075 | −0.217 | −0.003 | −0.161 | −0.158 |

| (0.127) | (0.105) | (0.165) | (0.099) | (0.100) | (0.141) | |

| Mortgage | 0.133 | 0.111 | −0.0217 | −0.0662 | −0.101 | −0.0345 |

| (0.124) | (0.103) | (0.161) | (0.092) | (0.093) | (0.131) | |

| City | −0.100 | 0.138 | 0.238 * | −0.094 | −0.143 * | −0.049 |

| (0.100) | (0.085) | (0.131) | (0.083) | (0.082) | (0.116) | |

| South East (not London) | 0.204 | 0.225 | 0.022 | 0.031 | −0.132 | −0.163 |

| (0.203) | (0.175) | (0.269) | (0.154) | (0.163) | (0.224) | |

| South West | 0.072 | 0.110 | 0.038 | 0.043 | 0.070 | 0.0264 |

| (0.226) | (0.185) | (0.291) | (0.175) | (0.183) | (0.252) | |

| East of England | 0.253 | 0.126 | −0.127 | −0.109 | −0.387 ** | −0.278 |

| (0.217) | (0.195) | (0.294) | (0.172) | (0.182) | (0.250) | |

| North East | 0.085 | 0.236 | 0.151 | −0.408 ** | −0.731 * | −0.323 |

| (0.237) | (0.222) | (0.324) | (0.205) | (0.237) | (0.313) | |

| North West | 0.143 | 0.244 | 0.101 | 0.279 * | −0.060 | −0.339 |

| (0.207) | (0.170) | (0.267) | (0.168) | (0.174) | (0.241) | |

| East Midlands | −0.0544 | 0.155 | 0.209 | 0.059 | −0.200 | −0.259 |

| (0.222) | (0.199) | (0.299) | (0.187) | (0.193) | (0.269) | |

| West Midlands | 0.468 ** | 0.385 * | −0.083 | −0.447 ** | −0.230 | 0.217 |

| (0.222) | (0.204) | (0.304) | (0.176) | (0.187) | (0.256) | |

| Yorkshire and the Humber | 0.058 | −0.020 | −0.078 | −0.445 ** | −0.019 | 0.426 * |

| (0.217) | (0.184) | (0.285) | (0.184) | (0.181) | (0.258) | |