1. Introduction

Classical finance is built on the assumptions that economic agents in the equity market are perfectly rational, have perfect self-control, and make decisions based on utilitarian theory in a perfect market under the framework of a risky environment. However, the real investment behavior of economic agents influenced by their psychological and emotional traits is completely incompatible with what rational expectation theory dictates. An alternative approach to rational theory is prospect theory, originated by

Tversky and Kahneman (

1979). This theory is treated as the foundation of behavioral finance, a theory that describes the thinking process of risky investors. The striking insights of behavioral finance have recognized the ubiquitous, subconscious cognitive biases in the human decision-making process and revealed a completely new perspective to study what drives investors’ unusual, unwanted behaviors.

One of the most powerful empirical findings documented in the behavioral finance field is the disposition effect bias, a behavioral tendency on the part of investors in the equity market to actualize stocks more readily, whose values are in the domain of gains than in the domain of losses

Shefrin and Statman (

1985);

Odean (

1998);

Grinblatt and Keloharju (

2001);

Frazzini (

2006).

Shefrin and Statman (

1985) first documented the phenomenon of disposition effect bias from the equity market perspective, which was proven to be the most substantial and economically meaningful finding in behavioral finance.

Pioneering work on the disposition effect has been conducted by

Odean (

1998) to empirically test whether investors are more reluctant to realize losing investments than gaining investments. One possible explanation for the disposition effect is that investors tend to behave like this, which is the loss aversion phenomenon, a key element in prospect theory. The basics of loss aversion state that the pain of losses coming from an investment is more than twice as great as the pleasure of gaining from it. They simply wanted to avoid regret and pursue pleasure. This kind of investor behavior opens avenues for academic researchers to pursue the scope of behavioral finance to determine the psychological and emotional aspects behind this irrational decision.

The Bangladesh equity market is a volatile and not integrated market in the South Asian region characterized by an insufficient level of regulations, manipulation by stalwart investors, unstructured trading behaviors by investors, and assorted market irregularities. Against the backdrop of the above-mentioned nature of the Bangladesh equity market, it would be unique and worthwhile to investigate whether disposition effect bias prevails in the Bangladesh equity market, a frontier market, through different market conditions.

The disposition effects have been extensively investigated in the worldwide corpus of behavioral finance literature, using both experimental and empirical versions of Odean’s framework (

Odean 1998;

Shapira and Venezia 2001;

Dhar and Zhu 2002;

Barber et al. 2007;

Barberis and Xiong 2012;

De Albuquerque Barreto et al. 2023). As an alternative to

Odean (

1998),

Hermann et al. (

2019) used the methodology framework of

Weber and Camerer (

1998) to measure the disposition effects (DE) of investors using the last period’s stock prices as reference points. The study used this alternative methodology to measure DE, incorporating the influence of the aggregate market trading volume based on the movements of the previous day’s market index. This alternative methodology has not yet been applied to measure DE in any frontier or emerging equity markets and to understand its behavior across different market conditions. In order to fill this gap in the existing literature, this study intends to investigate the disposition effect in a frontier market like Bangladesh, emphasizing its behavior across various market conditions. To the best of our knowledge, the disposition effect in boom and bust markets was only examined by

Bernard et al. (

2022) in the context of developed equity markets; however, it was not examined across different market conditions. In light of this research gap, the following research question is formulated:

whether the disposition effect persists in the bull-bear trends of market conditions in the Bangladesh equity market, i.e., do investors intend to sell the stocks in a profitable position more promptly than the stocks in a losing position across market conditions?The objective of the study is to examine disposition effects in the Bangladesh equity market, with a focus on investors’ trading behavior displaying disposition effects in various market conditions. The research adds to the body of knowledge on behavioral biases in the following ways: We employ the daily aggregate stock market volume of the Dhaka Stock Exchange throughout a period of 27 years, from January 1993 to December 2020 that includes bubbles and crashes in 1996–1997 and 2010–2011. Second, while most research uses individual trade records from big brokerage companies to study the disposition effect, alternatively, we try to quantify this behavioral bias of the disposition effect using aggregate market-level data. Third, the research offers an intuitive investigation of the disposition effect in frontier markets, like Bangladesh, with a particular focus on investors’ trading behavior displaying disposition effects in different market conditions, such as bullish, bearish, crisis, and prolonged crisis. Fourth, the study’s novelty lies in its application of a methodological framework of the disposition effect measure of Weber and Camerer, aiming to understand disposition effects through market segmentation. To identify the bull-bear trends in market conditions, this study has applied the Dow Theory.

The remainder of this paper is organized as follows.

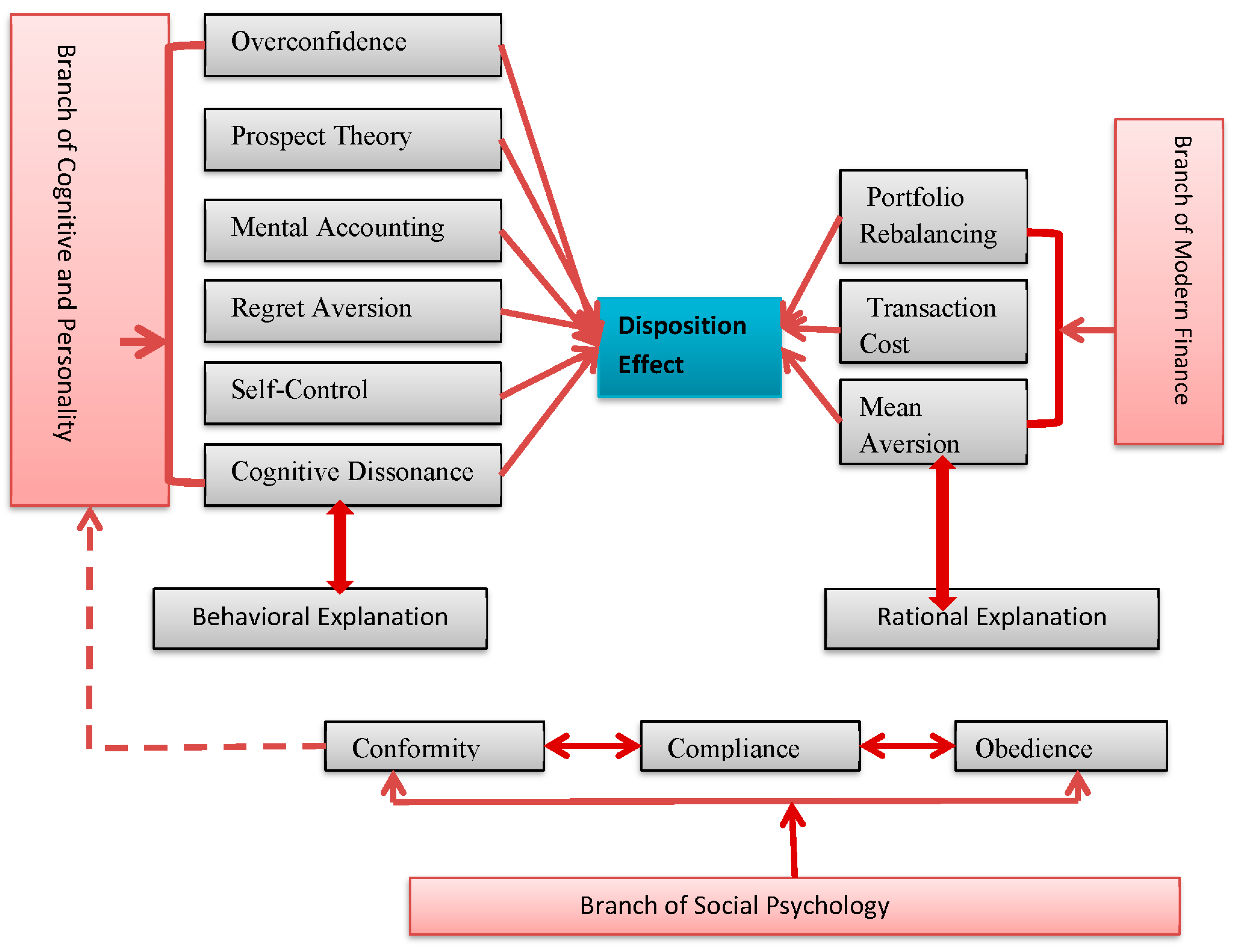

Section 2 describes the theoretical framework of disposition effect bias.

Section 3 presents a literature review.

Section 4 describes the study’s data and methodology.

Section 5 discusses the findings and analyses.

Section 6 makes the conclusion.

3. Literature Review

Numerous empirical studies have reported on the issue of disposition effect biases incurred by investors from the equity market. The section below makes an effort to summarize the literature on the disposition effect bias from the existing literature.

Shefrin and Statman (

1985) were the pioneers who contributed to the literature to document the presence of the disposition effect in the equity market. They mainly developed the theoretical framework for why investors display the disposition effect.

Odean (

1998) examined the behavior of individual investors in the US equity market, analyzing 10,000 accounts over the period of 1987–1993 at a large discount brokerage house, and found that investors showed a strong preference for realizing profitable stocks over the losing stocks except for December.

According to the study of

Dhar and Zhu (

2002), wealthier investors with professional experiences demonstrate a lower level of disposition effect in the equity market using trading data from a major discount brokerage house.

Shapira and Venezia (

2001) tested the disposition effect considering the trading records of all transactions of large major brokerage houses in Israel during the whole period of 1994. Results manifest that both types of investors (individual vs professional) in the Israeli equity market seem to exhibit the disposition effect, but it was found to be more robust for individual investors.

Brown et al. (

2006) discovered that the disposition effect is extensive for all classes of investors in both initial public offerings (IPO) and index stocks in the Australian equity market.

Barber et al. (

2007) found strong evidence in favor of the disposition effect for aggregate market as well as individual investors.

Goetzmann and Massa (

2008) evidence that if the behavior of investors describes the presence of disposition effect, the return, volatility, and volume of a stock will decline. In the Chinese equities market,

Zhang et al. (

2022) discover evidence that retail investors will exhibit stronger disposition effects when they approach the market for the first time during periods of lower market return, higher market volatility, or worse investor sentiment.

Barberis and Xiong (

2009) find no strong connection between the existence of the disposition effect and prospect theory preferences.

Hur et al. (

2010) provide evidence that the disposition effect is found to be stronger with a greater presence of individual investors in the stock market. The results are consistent across different momentum strategies developed from alternative ways of measuring individual investors’ presence in the market. The study of

Kaustia (

2010) observes that the tendency of an investor to sell a stock remains constant over a wide range of gains and losses. They show that the disposition effect was not explained by the prospect theory.

Ben-David and Hirshleifer (

2012) demonstrated that disposition was not motivated based on the preferences of selling a stock according to a gain versus a loss. Rather, it was the belief of investors that could affect their trading behavior.

Li and Yang (

2013) find that prospect theory has the capacity to predict the disposition effect, producing a momentum phenomenon in cross-sectional returns.

Kadous et al. (

2014) experiment with the self-regard and confidence of investors as possible causes of the disposition effect. Results find that investors who have higher confidence and lower self-regard maintain losing stocks longer than those who have lower confidence and higher self-regard.

Frino et al. (

2015) examined the investors’ characteristics in their trading behaviors in the Australian equity market and found that women, older investors, and investors with Chinese backgrounds displayed significant levels of disposition effect bias. By analyzing trade data from retail investors in the Korean equity market,

Yongkil Ahn (

2022) states that certain investor characteristics like gender, loss aversion, and investor sophistication are the key elements that can be used to grasp the disposition effects.

Aren et al. (

2016) found investor experience and overconfidence to be two determinants of disposition effect.

The portfolio-driven disposition effect was studied by

An et al. (

2023) based on experimental data for the US and China stock markets. They document a severe existence of disposition effect when the portfolio is at a loss, and it nearly disappears when the portfolio is at a gain.

The two competing explanations for the disposition effect developed from existing literature are the prospect theory and the regret theory.

Sudirman et al. (

2017) critically studied both the prospect and regret theories as the two available competing explanations for the disposition effect, along with a new explanation for this phenomenon called regulatory-focus theory. The key idea behind this theory is that investors can be categorized into the prevention group and the promotion group. They find that regulatory-focus theory points out a specific argument that the disposition effect is more pronounced for the prevention group rather than the promotion group.

Bernard et al. (

2022) investigated the disposition effect in the German stock market and observed that individual investors are more interested in confirming their gain during burst periods relative to boom periods. Findings prove that the disposition effect changes countercyclically, implying that the disposition effect rises in the bust period and declines in the boom period.

Hermann et al. (

2019) analyze experimental evidence on the disposition effect of investors when making trading decisions for other investors. They developed that trading decisions of inexperienced investors made on behalf of others are influenced by self-control behavior, and they exhibit more disposition because they feel comfortable for the other (effect of investor’s intrinsic motivation).

Dierick et al. (

2019) studied the relationship between financial attention and disposition effect. They revealed that more attentive investors are less inclined to recognize a loss, whereas less attentive investors have more tendency to realize the profitable position.

Guenther and Lordan (

2023) studied the behavior of professional traders and reported that before the informational intervention, the disposition effect prevails for mean-reverting but not for the non-mean reverting securities. However, when information intervention becomes effective, the change in the disposition effect has the same order of magnitudes regardless of whether professional traders consider investment decisions over mean-reverting or non-mean-reverting securities.

Bharandev and Rao (

2020) calculated winning and losing days for a stock, applying the 52-week high and low prices as reference points to measure the disposition effect in the Indian equity market. Results indicate that an abnormal trading volume of a stock has a positive relationship with the percentage of winning days, even after controlling for liquidity and volatility aspects of the market. The disposition effect is the phenomenal behavioral response of investors, which may produce suboptimal trading decisions, leading to exacerbating market volatility. This irrational trading behavior can contribute to changes in the Economic Value Added (EMV) index used by (

Alqahtani et al. 2020) to measure increased equity market volatility. EMV is a text-based index where the algorithm captures the concerns of investors as an essential element in understanding their behavior toward volatility in depth. The disposition effect, influenced by the irrational trading behavior of investors, may convincingly capture the elements of noise and information flows into the equity market. The disposition effect-driven volatilities can be reflected in realized volatilities (RV) developed from intra-day equity prices. The importance of information flow has been incorporated in techniques like common diffusion indices and the heterogeneous autoregressive (HAR) for forecasting the volatilities of international equity markets, which may amplify market volatility (

Zhang et al. 2020).

By adopting the methodology of

Grinblatt and Keloharju (

2001), the relationship between disposition effect and momentum was examined by

Sadhwani and Bhayo (

2021) in the US stock market. The results confirm that the disposition effect drives momentum and its reverse causality.

Liu et al. (

2023) conducted an examination of the disposition effect and the unique characteristics of momentum/contrarian behaviors on the Taiwan stock exchange. Among the conclusions is the fact that individual investors have a stronger disposition effect than other investors. Furthermore, they discover that whilst individual investors tend to pursue more contrarian strategies, investment trusts, as well as foreign investors, are found to be momentum traders.

De Albuquerque Barreto et al. (

2023) found that Brazilian stock investors display the disposition effect in their trading behavior. Their study reveals that gaining stock is more quickly realized by investors than losing stock, which signifies the presence of the disposition effect.

The investors’ target and tolerance level (the investor preference context) are taken into consideration by

Kiky et al. (

2024) in their investigation of the disposition effects while making investment decisions, which will be evaluated by bounded rationality. They discovered that the original disposition effects coefficient generated less desirable results than the new disposition effect in the context of bounded rationality.

Quispe-Torreblanca et al. (

2024) measure the disposition effects using a new reference point by analyzing trading records from a UK online brokerage. In comparison to the trade measure of disposition effects on returns after purchase, they discover a high presence of disposition effects based on equity returns since the investor last logged into their account.

Ahn (

2024) reveals a positive relationship exists between the disposition effect indicator in the gain domain and

Odean’s (

1998) measure. In contrast,

Odean’s (

1998) measure and the disposition effect indicator in the loss domain do not show any correlation. The study discovers asymmetric behaviors in the gain and loss domains of investment decision-making, which could produce suboptimal outcomes.

4. Development of Hypotheses

In the Chinese equities market,

Zhang et al. (

2022) provide evidence that retail investors will exhibit stronger disposition effects when they approach the market for the first time during periods of lower market return, higher market volatility, or worse investor sentiment. As both bullish and crisis markets often lead to high market volatility, investors tend to display disposition effects that are high in volatile markets. As a consequence, it is expected that investor trading behavior will display disposition effects that are high in both bullish and crisis market conditions.

Using data from German retail investors,

Bernard et al. (

2022) demonstrate that disposition effects are countercyclical, suggesting that they are low in boom markets and large in crash markets. This occurs as a consequence of shifting investor attitudes and risk aversion during market cycles.

The above findings and arguments have led to the development of the following research hypotheses:

Hypothesis 1. Investors in the Bangladesh equity market, a frontier market, will exhibit a disposition effect in their trading behavior for the entire period.

Hypothesis 2. Investors’ trading behavior will display disposition effects that are high in volatile markets, and therefore, it is also high in bullish and crisis markets on account of their market volatility.

Hypothesis 3. The disposition effect may become more pronounced and stronger in the crisis (crash) market period in relation to the bullish (boom) market period.

5. Data and Methodology

We employ a large data set spanning from 1 January 1993 to 31 December 2020 that includes bubble and crash in 1996–1997 and 2010–2011 to measure the disposition effect in the Bangladesh equity market. These events are crucial for understanding the disposition effect for the entire period only as they represent investor behavior during periods of extreme market volatility. We extend the data until 2020, which will enable us to examine various market conditions, including bearish, bullish, crisis, and extended crisis periods. We applied the Dow Theory to differentiate between bullish and bearish markets from 2008 to 2020. This methodology provides deeper insights into the disposition effect across different market conditions and may help identify and analyze market trends with more precision.

Two types of data are formulated for the study: One is the Dhaka Stock Exchange broad index, and the other is the trading volume of the aggregate market determined by summing up the turnover ratio of all the listed common stocks on the Dhaka Stock Exchange. All data we collected from the data source of the Dhaka Stock Exchange library.

5.1. Application of Dow Theory to Recognize the Bullish and Bearish Periods

This study attempts to segregate the bull and bear stock markets using the concept of the Dow Theory. It was discovered by Charles Dow in the late 19th century and treated as the father of modern-day technical analysis. Dow’s Theory formulates a formidable specific mechanism to identify bull and bear markets. When each successive trend reaches a higher level than the previous trend, each reaction simultaneously creates a higher level than the preceding one, which is depicted as a bull market. Conversely, when each intermediate reaction rally stops at a successively lower level, each uptrend rally reaches a lower level compared to the previous trend and is depicted as a bear market.

According to Dow’s theory, the two fascinating principles must be affirmed to identify bull and bear market trends. The first principle is that volume must support price change. Based on this principle, the following relationship can be developed.

Table 1 points out that in a bull market, market volume increases when prices increase and dwindle as prices decrease. In a bear market, volume increases when prices drop and dries up as prices increase. The second principle that Dow stressed to confirm the bull or bear market is that the two indices must converge to have the same opinion, indicating that no bull or bear marker could be confirmed unless both indices produce the same results.

Figure 2 represents the segregation of the bull and bear periods for the Dhaka stock exchange over the 2008–2020 period, applying the concept of Dow Theory. Incorporating trading volume in the lower part of

Figure 1 may help understand a comprehensive view of the equity market dynamics and the relationship between market trading volume and equity price movements.

Trading volume tends to reflect the confirmation of the strength of a price trend. An increase in trade volume may suggest a strong uptrend, and a decrease in trade volume may indicate a deteriorating trend in the bull market. On the other hand, an increase in volume could signal a strong downward momentum, and a decrease in volume may indicate a prospective trend reversal. Trading volume may also provide insights into market sentiment and behaviors of investors during the bullish and bearish phases of the market, which may lead us to explore their psychological tendencies to sell winners and hold losers.

5.2. Methodology for the Measurement of Disposition Effect

The majority of the empirical studies on disposition effect behavioral bias prevalent in the equity market thoroughly evidenced the

Odean (

1998) framework, which is the ratio of the proportion of gain realized (PGR) to the proportion of loss realized (PLR). The disposition effect states that throughout the year, trading volume in capital-losing stocks will always be less than trading activity in gain-producing stocks (

Ferris et al. 1988).

In the present study, to compute disposition effects–the propensity of investor investors to sell stocks that have increased in price while holding onto those that have decreased–we utilize

Weber and Camerer’s (

1998) measure.

Hermann et al. (

2019) have also computed the disposition effects (DE) with the measure (alpha) of

Weber and Camerer (

1998), in addition to the DE measure of

Odean (

1998). Hermann et al. refer to this metric as the “alpha” metric.

1 Though alpha looks at whether investors made use of the market prices from the previous period as a benchmark, this paper replaces the market price in the previous period with the market index of the previous day.

To calculate the coefficient of the disposition effect, the methodology incorporates the influence of the level of daily trading volume of the aggregate market based on the direction of the rate of return of the preceding day’s market index. The model

2 of measuring the disposition effect is as follows:

where,

= is the disposition effect coefficient of

i + 1 week,

i = 0, 1, 2, …, m

= is the trading volume of the present day if the market index of the preceding day increased

= is the trading volume of the present day if the market index of the preceding day decreased

= Sum of from the j day to the n day

= Sum of from the j day to the n day

j = Starting day where, j = 5i + 1

n = Ending day where n = 5(i + 1)

A positive value of αi+1 indicates that the disposition effect prevails in the market; on the contrary, a negative value of αi+1 represents that the disposition effect does not prevail. That α value equals to 1, which signifies a stronger form of the disposition effect.

The statistical significance of the coefficient of the disposition effect was tested using both distributional and distribution-free tests (Nonparametric).

5.2.1. Distributional Test

The

t-test is the basic distributional test used to determine the data for normality, which can be described by two parameters (mean and standard deviation). The

t statistic for a typical

t-test is:

This statistic indicates how precisely the sample estimates the population mean.

5.2.2. Distribution Free Test

The proportion test is a nonparametric test employed to measure whether an observed proportion possesses a specific trait and is statistically different from the hypothesized value. The test statistic (known as the

Z-test) is developed as follows:

It approximates to Normal distribution with a mean of 0 and a standard deviation of 1.

The Wilcoxon rank sign test is a rank-based nonparametric location test to assess whether the median value of the sample is statistically different from the theoretical value.

Suppose the sample from where is the specified value of the median. Let us mention where, here, indicates the rank of when are developed in order of magnitude.

The Wilcoxon rank sign test statistics can be identified as:

6. Empirical Results and Findings

Before we analyze the results of the disposition effect,

Table 2 presents the scenarios of movement of the Dhaka Stock Exchange broad index and the aggregate trading volume of the market associated with various market sub-periods. The average rate of market return was 0.055% during the entire study period, whereas it was 0.10% and 0.17% for bullish and bearish periods, respectively. In the case of trading volume, the mean value remains persistent during all market sub-periods except for the entire period. Aggregate market volume was increased by 750% during this period. However, the movement of median trading volume registered a negative change during each segmentation category. Although the Bangladesh equity market is treated as an unpredictable frontier market, the changes in its broad index are found to be trivial in all break-down categories of the study periods. A similar finding is observed for trading volume direction, except for the entire period. The characteristics of the overall movement of the equity market in Bangladesh presented in

Table 3 are deemed to be a curious concern in examining whether investors demonstrate disposition effect bias.

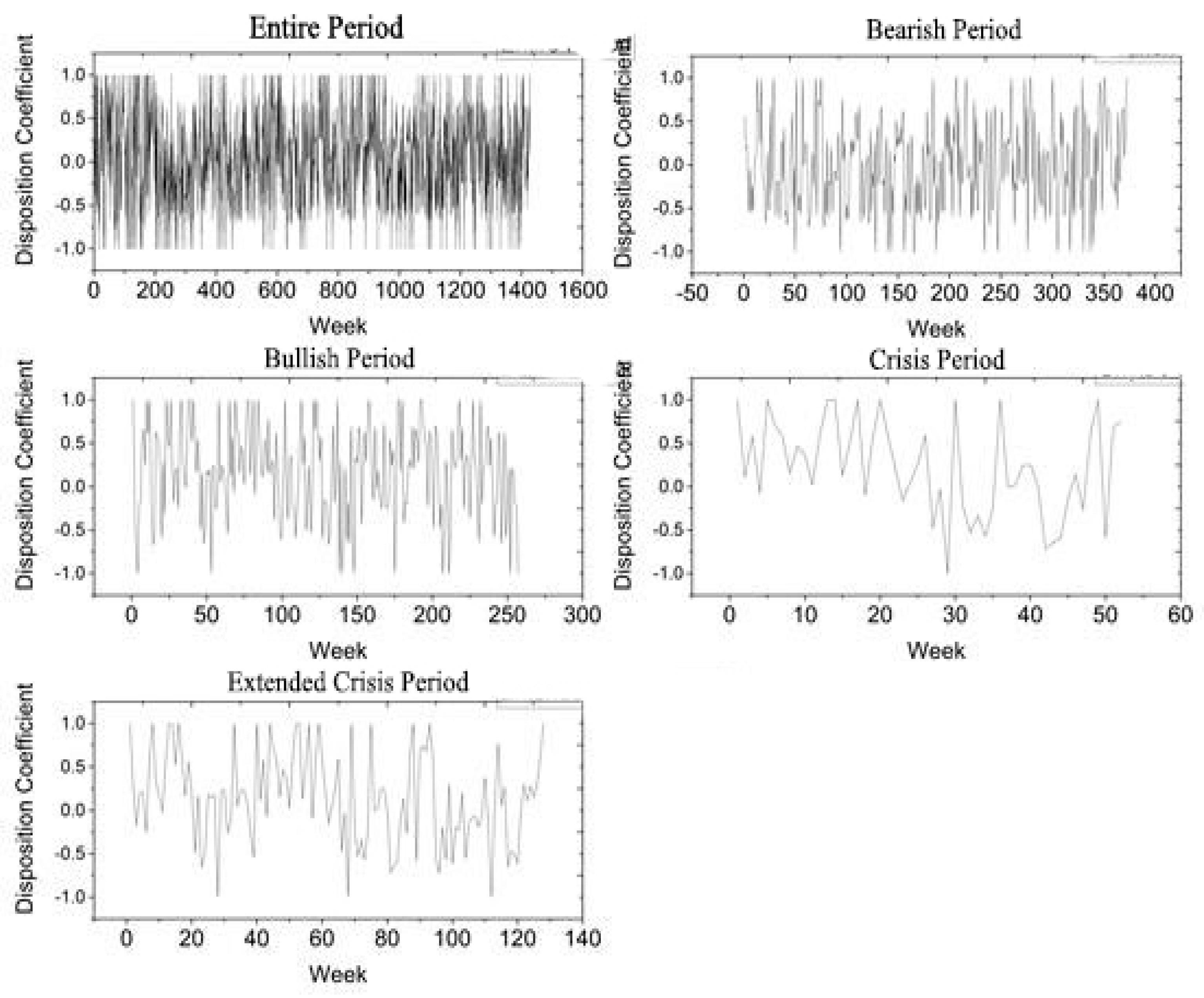

Table 3 reports the summary results of the disposition coefficients test using the distributional

t-test. The results reveal that the coefficient of disposition effect has been found to be positive and statistically significant for the entire study period. It is also noticed that the disposition effect persists significantly for the bullish period, crisis period, and extended crisis period. However, the coefficient is negative and not significant for the bearish period. The deduction can be drawn that investors, in general, actively participating in Bangladesh equity markets display the disposition effect bias in their investment decision behaviors. Although the disposition effect is present in the Bangladesh equity market, the magnitude of the disposition coefficient is not very strong. However, the findings that the relatively higher mean (proportion) coefficients of disposition effects for bullish and crisis market periods than those of other market conditions suggest that stronger DE does exist in these bullish and crisis market periods, as consistent with hypothesis 2. The results show that the magnitude of the coefficient of DE for the crisis marker period is 0.223, while the magnitude of the coefficient of DE for the bullish market is 0.178, implying that stronger disposition effects are pronounced for the crisis market period in relation to the bullish market period validating hypothesis 3. The study also finds that disposition effects in Bangladesh’s equity market oscillate in crisis period.

The findings of the disposition coefficients developed by using a non-parametric proportion test are shown in

Table 4. The key objective of the proportion test is to determine if there is a significant difference between the hypothesized mean and the population proportion of the positive disposition coefficient. According to the proportion test results, the proportion of majority disposition coefficients is positive and statistically significant across all market phases except for the bearish period. The null hypothesis is rejected, suggesting that there is sufficient evidence of disposition effect bias in the Bangladeshi equities market, where positive disposition coefficients are much bigger than negative disposition coefficients.

The result was in line with what was shown in the t-test paradigm. As a consequence, the distribution-free proportion test also confirms that investors in the Bangladeshi equities market exhibit behavioral bias in the form of disposition effect.

Table 5 presents the statistical findings of the disposition coefficients enforcing the non-parametric Wilcoxon ranked sign test. This test has a significant benefit over the distributional

t-test since it estimates the distribution location using the median value as opposed to the mean parameter in the former. The findings demonstrate that the disposition coefficients’ median values are positive and significant across market periods, including entire, bullish, crisis, and extended crisis markets. We can conclude that all statistical tests performed in the study revealed the same unambiguous decision: the disposition effect prevails in the Bangladeshi equity market.

The statistical properties of the disposition coefficients estimated are outlined in

Table 6,

Table 7 and

Table 8 for the entire study period, bearish, bullish, crisis and extended crisis periods respectively.

The coefficient represents the extent to which investors tend to exhibit the disposition effects.

Figure 3 describes how fluctuations in the value of the disposition coefficient happened across various market segmentations. The graph would provide insight into the pattern of investors’ behavior in the Bangladesh equity market, which can influence their trading and investment strategies.

7. Discussion of the Results

In this paper, we investigated the disposition effects in the Bangladesh equity market across various market conditions (bear, bull, crisis, and extended crisis markets). This section provides insights into the summary of our empirical findings provided in

Section 6.

We document empirical evidence of the relatively high disposition effect in the bullish market. The finding of investors trading behavior revealing the disposition effect in the bullish market in the Bangladesh equity market is consistent with the findings of (

Zhang et al. 2022;

Bernard et al. 2022;

Muhl and Talpsepp 2018). This indicates that investors in our market are risk-averse, suggesting that they are more inclined to capitalize on winning stocks in a bullish market.

The statistical significance of the estimated parameter shows that the degree of the coefficient of disposition effect is higher for the crisis (crash) market than that of the bull market, which supports our hypothesis that investors may exhibit a stronger disposition effect in the crisis market period in relation to the bullish market period. The finding is consistent with

Bernard et al. (

2022). We may argue that the changes in investors’ selling behavior in a crisis market are driven by changes in preferences and beliefs, subject to increased gain realization.

The hypothesis that the trading behavior of market participants in selling winning stocks too early and holding losing stocks too long is examined across various market conditions. The nature of a changing market environment may make it challenging to understand the extent of the disposition effect. The market participants may exhibit distinct trading behavior across market conditions. The novelty of this study lies in its investigation of the disposition effect in frontier markets like Bangladesh across different market conditions, such as bearish, bullish, crisis, and extended crisis markets. The results show a strong propensity for the disposition effect in each of the distinct market phases except the bearish period. The disposition effect is more noticeably pronounced in crisis periods, followed by bullish and extended crisis periods. We can conclude that our findings strongly demonstrate the relevance of investigating the disposition effect across different market conditions in the Bangladesh equity market.