1. Introduction

Extant scholarship indicates that financial development and accessibility to external financing are associated with entrepreneurial activities (

Coronel-Pango et al. 2023;

Kerr and Nanda 2009;

Vyrostková and Kádárová 2023). Nevertheless, research still needs to explore the way through which ease of access to financial services is associated with entrepreneurship. This association is theoretically relevant because it may shed light on an important factor that potentially shapes the heterogeneity in the levels of entrepreneurship in a given context, such as a country or a region. From a policy perspective, it is also important, especially in the context of an emerging country, in which accessibility to different sources of funding, such as banking loans or microfinance, is highly heterogenous (

Beck and Demirguc-Kunt 2006;

Dong and Chao 2014).

To address the topic, we investigate if the number of conventional bank branches, as a proxy for financial development and external financing access, is associated with the number of firms in a municipality, which indicates the strength of entrepreneurial behavior.

Thus, our main research question is the following: Does bank accessibility improve entrepreneurial activity? We hypothesize that this association is positive: the number of bank branches in a given municipality is correlated with an increase in the number of firms in that municipality.

We empirically analyze an unbalanced panel of 2104 Brazilian municipalities spanning 2010–2021 and comprising 23,769 municipality-year observations. Brazil constitutes a rich empirical setting for our study because it presents a great level of heterogeneity in the density of bank branches, which varies both across time and municipalities. It also fits with our purposes in this study because, as data from the Brazilian Central Bank (BCB) indicate, the standard banking industry plays an important role when it comes to developing business in Brazil. Our empirical strategy involves estimating panel data regression models and testing the significance of the correlation between the number of bank branches and the natural logarithm of the total number of firms in a municipality. We use different specifications to check the robustness of our findings.

Our empirical findings confirm the hypothesized association. For example, we find that an additional bank branch in a municipality is correlated to a 0.1% to 0.3% increase in the number of firms. Moreover, the results also indicate that the relationship is nonlinear: the availability of bank branches in a given municipality affects more larger firms than smaller ones. We find that one additional bank branch is correlated to an increase of 0.2% in the number of small firms, but for large firms, this correlation increases to 0.6%.

Our study contributes to the literature by corroborating that financial development and access to external financing shape entrepreneurial activities. It also illuminates the role that the standard banking industry plays in fostering entrepreneurship, especially in settings where other options, such as microfinance, are less available.

The remainder of the article is organized as follows:

Section 2 presents the factual background, highlighting the characteristics of our empirical setting and why it is relevant to the study of the topic.

Section 3 presents the underlying theoretical background and hypothesis development.

Section 4 describes the dataset that was used in the analysis as well as the methods employed in the empirical strategy.

Section 5 describes the results of the econometric models. Finally,

Section 6 discusses the findings and presents the conclusions with the final remarks, contributions, and limitations of the study.

2. Institutional Background

Alongside other Latin American countries, Brazil went through a period of hyperinflation in the latter part of the 1980s and early 1990s that had profound significance on its economic history (

Fajardo and Dantas 2017). After five years of persistent governmental interventions to stabilize its financial market (1989–1994), Brazil was able to control its inflation in 1994 by implementing the “Plano Real”, which introduced its currency—Real (R

$)—used until this day.

Following the implementation of the stabilization plan, Brazilian financial institutions endeavored to mitigate inflation-induced losses by increasing credit provision. Notably, the aggregate loans within the financial system witnessed a substantial surge of 43.7 percentage points within the initial eight months after the initiation of the stabilization plan. The accelerated extension of credit, however, transpired without due diligence in scrutinizing the risk profiles of credit applicants. This led to bank insolvency in the following year, which required the government to use the bailout mechanism named PROER to perform one of the following: (a) Increase bank capital; (b) Transfer its shareholder control; (c) Merge or be acquired by another bank (

Nakane and Weintraub 2005).

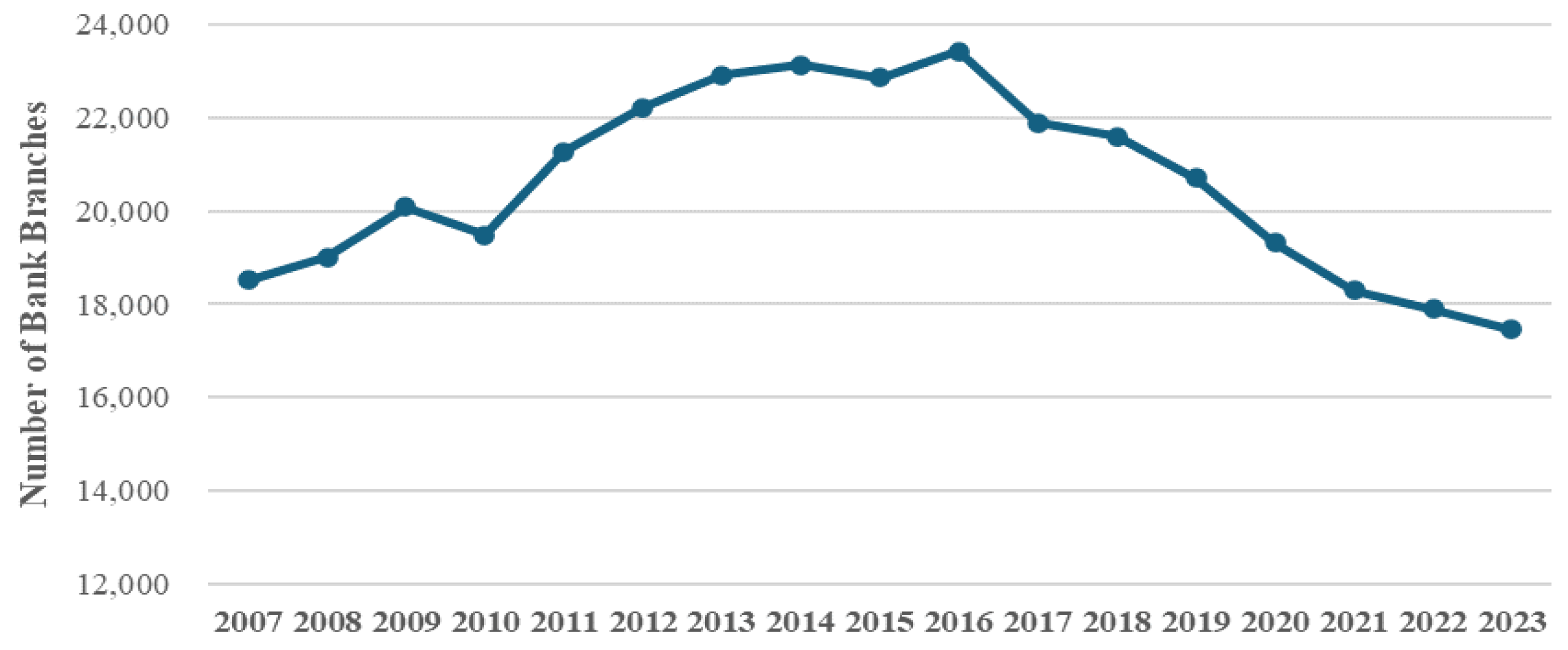

With the success of the PROER, Brazil was able to develop its financial system, leading to an increase in its banking activities across national territory. According to data from the Brazilian Central Bank (BCB) from 2007 (the first time it was measured), the number of bank branches significantly increased until the recent digitalization process that enabled banks to reduce human and physical capital costs (See

Figure 1).

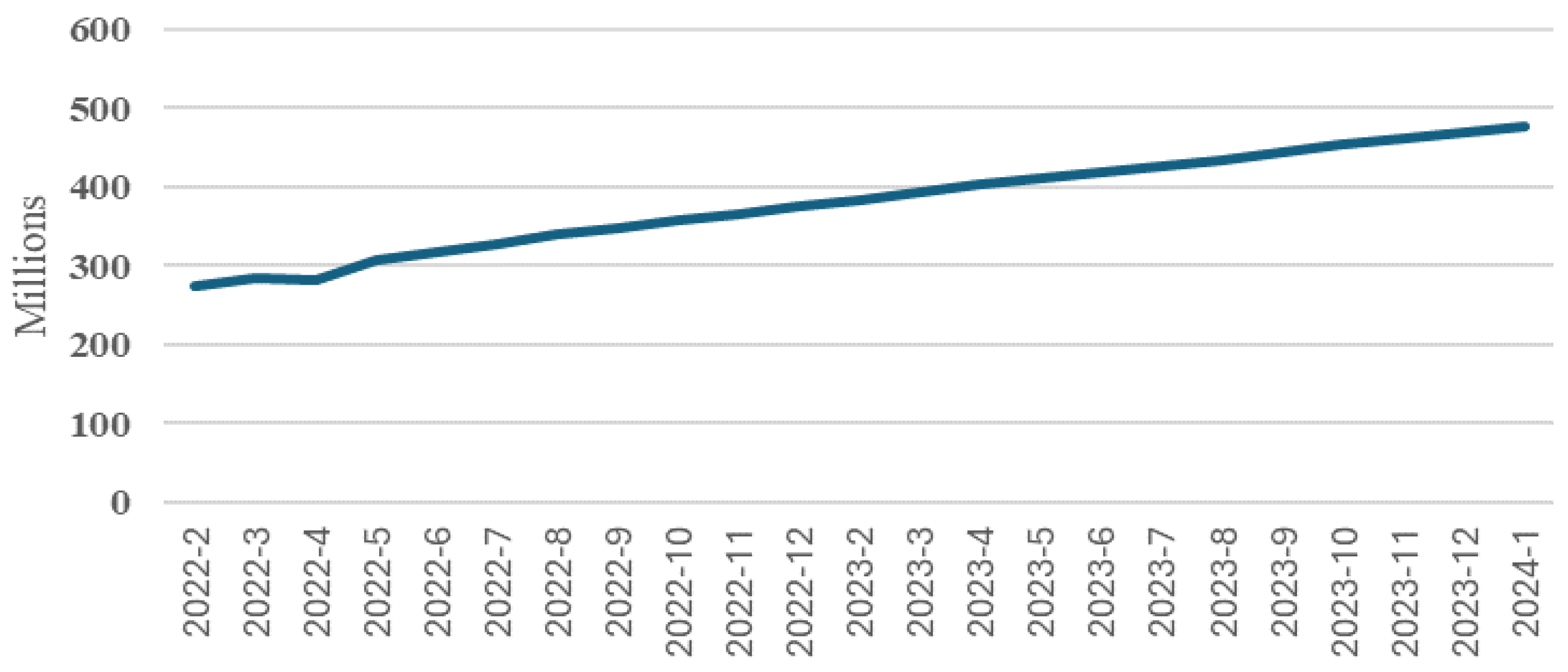

Despite the recent decrease in the number of bank branches, it is relevant to observe that the financial landscape was supplemented by digitalization that allowed consumers more accessibility. Following the worldwide FinTech rise, Brazil introduced PIX in 2020 (i.e., a feeless instant payment system) to reach more consumers and further advance the Brazilian financial system. As a result, 17.6 billion transactions were made through PIX in the first semester of 2023, which corresponds to 93% of total bank transactions, and more than 450 million bank accounts had been registered on Pix in January of 2024 (See

Figure 2). Therefore, we believe that the recent decline in bank branches is related to economic growth and financial accessibility than a decrease in financing reach.

In line with the literature that will be discussed in the next section, which suggests a positive relationship between financial development and economic growth (

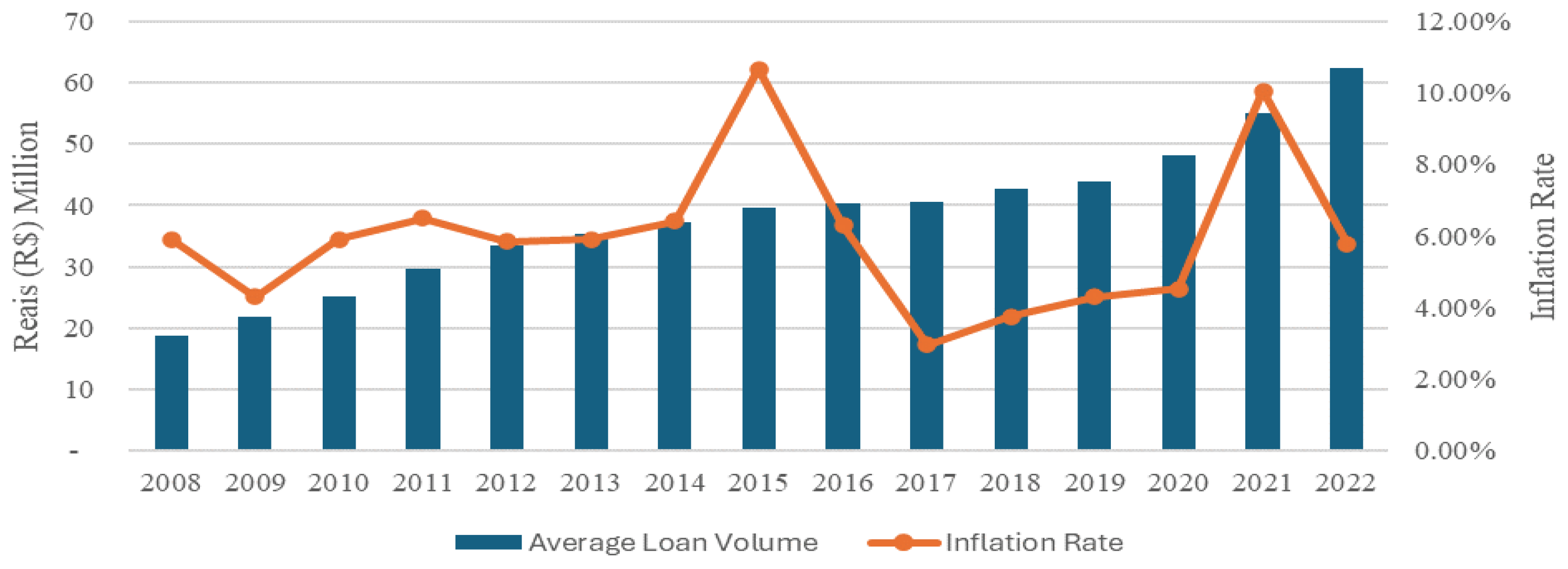

Kerr and Nanda 2009), Brazil was able to consolidate its financial market through a stable economy and raised its Gross Domestic Product (GDP) since 1996 (Brazilian Institute of Geography and Statistics). In the banking industry, loan volume increased by 233% while the inflation rate maintained itself stable on an average of 5.9 percentage points (See

Figure 3).

Based on the fact that macroeconomic variables such as inflation rate and access to funding are highly associated with entrepreneur behavior (

Vyrostková and Kádárová 2023), it is possible to infer that the Brazilian financial market growth affected the number of businesses created. Relying on the increased number of bank branches in the Brazilian financial landscape as a proxy for financial and banking growth, business owners should benefit in several manners. For example, access to external financing with lower interest rates should become easier as asymmetric information between agents is expected to decrease. This makes Brazil to become a relevant empirical context for our objectives in this study.

Finally, while some scholars advocate for microfinance as a solution for start-up funding and it might be a good source of financing (

Coronel-Pango et al. 2023), microfinance activities in Brazil only represented 5 percent of all financing operations in 2022. As data from BCB demonstrates, in 2023, loan volume reached 18 trillion reais vis a vis 886 billion reais from microcredit firms. Therefore, the standard banking industry plays an important role when it comes to developing business in Brazil.

3. Literature Review and Hypothesis Development

According to

Kerr and Nanda (

2009), there is a positive relationship between financial development and economic growth, as an enhanced financial industry contributes to more efficient ex-ante capital allocation in investment opportunities. As economic growth supports a body of literature that encompasses benefits in trading goods, services, and financial contracts (

Levine 1997), businesses could benefit from market development by obtaining external financing and more effectively allocating their assets. Empirical evidence also backs those claims by suggesting that financial intermediaries exert a large and positive impact on total factor productivity growth and physical capital growth (

Beck et al. 2000).

Another body of literature investigates the obstacles to entrepreneurial activities.

Coronel-Pango et al. (

2023) argue that access to external financing is pivotal when it comes to creating new businesses. For instance, the accessibility of bank branches in one municipality plays such an important role in the local market that when a client decides to move from one bank to another, he/she can obtain a greater discount in comparison with other funding options. However, when a branch closes and clients need to forcefully move to another bank, they do not receive similar benefits (

Bonfim et al. 2021). Along these lines, the increase in bank branches also supports the local economy through labor finance. As evidenced by

Bruhn and Love (

2013), which investigated the opening of 800 bank branches across Mexico in an almost simultaneous manner, there is a significant effect on access to finance on the labor market and income levels, especially in areas with little to no bank penetration. Following that, not only can business owners increase their operations by investing in machinery, supplies, and human capital, but individuals can also enjoy a better quality of life.

Furthermore, according to

Agarwal and Hauswald (

2010), borrowers’ proximity to lenders facilitates the compilation of soft information, leading to better contract terms. Moreover, through continuous bank relationships (e.g., number of loans), borrowers can obtain an advantage in times of crisis. According to

Berger et al. (

2024), relationship borrowers can obtain more favorable terms during the crisis, which was compensated by not as many advantageous terms in normal times.

There is also literature demonstrating that a more developed financial market contributes to better firm monitoring. As firms can increase their productivity through newly injected money, their capital structure becomes more aligned with different agents, which, among other issues, increases their survival chances (

Morton 1954). Therefore, the ideal capital structure is the one that maximizes company performance and value (

Nguyen et al. 2023). Nonetheless, the path between capital structure and a firm’s performance is not so clear.

Ross (

1977) makes a pivotal contribution to this research by suggesting that a firm’s value increases through leverage as the expansion would signal the market about its value; the underlying mechanisms that play a role when it comes to maximizing firms’ value through leverage are not clear.

Notwithstanding, scholarship converges on how much firms, especially newly created ones, can benefit from a stable economy and proximity to financial agents. As asymmetric information would decrease due to access to hard and soft information between agents and better scrutiny of one’s finances, entrepreneurs could obtain loans at better terms in such a way that they could maximize their utility and survival chances. Based on the aforementioned points, we explore the association of financial access with entrepreneurship creation.

Using the number of bank branches as a proxy for financial development and external financial access, we expect that the higher the number of bank branches in a municipality, the higher the number of overall businesses that will be developed as a consequence of an increased entrepreneurial behavior. For that reason, we develop the following hypothesis:

H1. The number of bank branches is positively associated with entrepreneurial activity, as measured by the number of firms in a municipality.

In this study, we test H1 by analyzing a dataset of municipalities from a relevant emerging country, Brazil, which was classified as the eleventh biggest economy in the world in 2022. Hence, the next section describes our empirical setting.

4. Empirical Strategy

4.1. Data

We collected data on the number of firms in a municipality using the RAIS dataset from Brazil. The RAIS dataset is maintained by the Ministry of Social Security to track how many employees a firm has in order to collect Social Security taxes. This dataset provides information on the number of employees from each firm, which allows us to differentiate between smaller and larger firms. In this paper, we categorize smaller firms as having fewer than five employees and larger firms as having 100 or more employees.

Additionally, we collected the number of bank branches in each municipality from the ESTBAN dataset of the Brazilian Central Bank. After merging the datasets, we have information on 2104 from all states in Brazil. In the end, our dataset is an unbalanced panel going from 2010 to 2021, the last year on the RAIS dataset. In total, our dataset comprises 23,769 municipality-year observations.

In

Table 1, we provide the descriptive statistics from our sample. The variable “Number of Firms” counts the number of registered firms in a municipality in a given year. As previously mentioned, the variable “Small Firms” captures the number of firms with fewer than five employees, and the variable “Large Firms” captures the number of firms with 100 or more employees. Finally, the “Number of Bank Branches” variable captures the total number of bank branches in a municipality-year observation.

The observations are municipality-level aggregate numbers for bank branches of all banks. Regarding firms, each observation comprises all registered firms in the municipality. On average, each municipality has about 13,271 firms registered, with about 1312 being classified as “small” (fewer than five employees) and about 5857 being classified as “large” (100 or more employees). Additionally, each municipality has, on average, around seven bank branches in its territory.

4.2. Estimations

Our empirical strategy for the main results involves estimating a panel data regression model and testing the significance of the correlation between the number of bank branches and the natural logarithm of the total number of firms in a municipality. We take the natural logarithm of our main dependent variable in order to reduce the impact of outliers and to improve the interpretation of the coefficients from the regression, which can be interpreted as marginal percentages.

Our baseline regression is as follows:

The subscript ijt denotes a municipality i in a state j on a year t. Additionally, is the municipality fixed-effect, is the state fixed-effect, and represents the year fixed effect. The error term is represented by .

We recognize that this model is correlational in nature, and in additional estimations, we estimate further models that increase the robustness of our findings. Nevertheless, this model is important since it shows the baseline correlations between our variables of interest.

5. Results

5.1. Main Results

Table 2 provides the results from the main estimations. We find that an additional bank branch in a municipality is correlated to a 0.1% to 0.3% increase in the number of firms. All coefficients are significant at the 5% level. On Model 1, only year fixed effects are estimated; on Model 2, year and state fixed effects are used; and, finally, on Model 3, year and municipality fixed effects are estimated. Coefficients and significance levels remain stable across all these models. However, municipality fixed effects overfitted the model and decreased the number of degrees of freedom. Thus, in subsequent estimations, we will employ state and year fixed effects on all models.

5.2. Heterogeneity of the Number of Bank Branches

In this subsection, we explore the heterogeneity of the number of bank branches in terms of entrepreneurial activity. First, we estimate the effect of a low number of bank branches on entrepreneurial activity. Due to the fact that there are a total of five large commercial banks in Brazil (

Banco do Brasil,

Caixa Econômica Federal,

Itaú,

Bradesco, and

Santander), we proxy a low number of branches as a municipality having five or fewer branches. Hence, the model is estimated as follows:

We also estimated the impact of having one single bank branch on entrepreneurial activity. This is assessed via a dummy variable, “Single Bank Branch”, that assumes the value of 1 if there is a single bank branch in the municipality. The model is estimated as follows:

These results help to find more robust correlations since we now compare only two types of municipalities instead of estimating a monotonic effect of the number of bank branches on entrepreneurial activity.

Table 3 and Models 4 and 5 present the results.

We find that municipalities with five or fewer bank branches had, on average, about 29% fewer firms than municipalities with more than five bank branches (Model 4). We also find that a municipality with a single bank branch had a 14% smaller entrepreneurial activity, as proxied by the number of firms (Model 5). Hence, we again find a strong correlation between banking presence in a municipality and entrepreneurial activity.

5.3. Closings and Openings of Bank Branches

As previously highlighted, the previous findings, albeit robust, are correlational in nature. Thus, we estimate the main model using a variable that captures the effect of a bank branch opening or closing in a municipality in a year. We first calculate the variable

as follows:

This first difference allows us to estimate, causally, the effect of bank presence on entrepreneurial activity since the only way that this correlation could be spurious is for a third variable that caused a diminishing (increasing) of entrepreneurial activity and also caused a closing (or opening) of a bank branch at the same time.

We find this to be implausible since the number of bank branches in a municipality tends to be stable over time. In 86% of the sample, this first difference is zero; in about 6%, there was an increase in the number of bank branches; and in about 8%, there was a decrease in this number. This empirical evidence, coupled with the fact that opening and/or closing a bank branch in Brazil is extremely costly, due to labor laws and fines on vacating business leases, makes the inference much more causal than the baseline regression using the natural logarithm of the number of bank branches.

Hence, the coefficient of this difference can be interpreted as the causal effect on entrepreneurial activity of opening (or closing) a bank branch in a municipality. Therefore, we estimate the following panel regression:

Results are presented in

Table 3, Model 6. We find that the opening of a bank branch increases the number of firms in a municipality by 0.2%; conversely, closing a bank branch decreases entrepreneurial activity by 0.2%. Given that, on average, a municipality has 13,000 firms, this translates into an increase of about 26 firms due to a new bank branch opening in that municipality. This estimation is of similar magnitude to our main results, which lends credibility to our estimations.

5.4. Firm Sizes

Up to this point, we estimated the effect of the number of bank branches on entrepreneurial activity proxied by the total number of firms. Nevertheless, these firms are of different sizes. It can be that bank presence increases the number of small firms but not of large firms, and vice-versa. Thus, in this subsection, we estimate the correlation between the number of bank branches and three different dependent variables: the number of small firms, the number of larger firms, and the ratio of small firms to the total firms.

We proxy “small firms” as the natural logarithm of the number of firms that employ fewer than five people (four or fewer workers). We consider “large firms” to be ones that employ 100 or more people. This is the actual classification of the Ministry of Social Security in the RAIS dataset.

Thus, we estimate the following three models via panel regression:

Results are presented in

Table 4. We find that one additional bank branch is correlated to an increase of 0.2% in the number of small firms (Model 7), but for large firms, this correlation increases to 0.6% (Model 8). The effect on the ratio of small firms is negative and significant but of a small magnitude (−0.01%, Model 9). Thus, we find evidence that bank presence in a municipality affects more larger firms than smaller ones. This is expected since larger firms are the ones that tend to have better credit lines and better relationships with banks, and they face less credit rationing (

Elyasiani and Goldberg 2004;

Cenni et al. 2015;

Angori et al. 2020).

6. Discussion, Conclusions, and Implications

Our study empirically demonstrates that the higher the number of bank branches in a municipality, the higher the number of overall businesses that will be developed. In other words, we show that external financial access shapes entrepreneurial behavior. For instance, our analysis evidenced that an additional bank branch in a municipality is correlated to a 0.1% to 0.3% increase in the number of firms. More importantly, the results also demonstrated that the relationship is nonlinear: the availability of bank branches in a given municipality affects more larger firms than smaller ones. We find that one additional bank branch is correlated to an increase of 0.2% in the number of small firms, but for large firms, this correlation increases to 0.6%.

These findings are important from a theoretical point of view because they shed light on a factor that potentially shapes the heterogeneity in the levels of entrepreneurship in a given context such as within a municipality. More importantly, it shows a nonlinear pattern that explains the heterogeneity of the effects across different firm sizes. The results contribute to the extant literature by corroborating the idea that borrowers’ proximity to lenders facilitates the compilation of soft information, leading to better contract terms and, hence, to entrepreneurial success. It also advances literature investigating obstacles to entrepreneurial activities by demonstrating that, despite the growth of digitalization and microfinance, the traditional bank branches’ presence is important for fostering entrepreneurship, especially in emerging settings, in which other options of external funding, such as microfinance, are less developed or heterogeneous across regions.

The policy implications of this research can be summarized in two points. First, we show that firms can benefit from better banking relationships and accessibility. Thus, governments should foster the establishment of bank branches. Moreover, we show that this effect is stronger for municipalities with a lower number of branches, which provides a clear policy path of fostering entrepreneurship via an increased number of bank branches in smaller municipalities.

There are, nonetheless, some limitations in our study. Although our empirical setting is characterized by a great level of heterogeneity across municipalities, it considers only a single country. Therefore, further studies should include cross-country samples with a greater diversity of institutional characteristics, such as levels of financial development and accessibility to external funding. Moreover, our models are correlational in nature, which inhibits us from claiming a fully causal relationship. Indeed, we addressed this issue by running various additional estimations to increase the robustness of our findings, including a model that captures the effects of a bank branch opening or closing in a year. However, further studies should address causality in more depth. Another important limitation of our study is the extent to which foreign direct investments (FDI) affect the relationship between bank accessibility and entrepreneurial activity, which we cannot test due to the fact that there are no data on the municipality-level FDI in Brazil. This is also an avenue for future studies.

Author Contributions

Conceptualization, R.d.O.L. and M.M.; methodology, R.d.O.L.; validation, M.M., L.M. and L.H.L.d.P.; data curation, M.M.; writing—original draft preparation, R.d.O.L., M.M., L.M. and L.H.L.d.P.; writing—review and editing, R.d.O.L., M.M., L.M. and L.H.L.d.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by FAPERJ, Grant “Jovem Cientista do Nosso Estado” SEI-260003/003309/2022.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available upon contact with authors.

Acknowledgments

L.P. acknowledges the support from Serzedello Corrêa Institute, School of Government of the Brazilian Federal Court of Accounts (ISC/TCU). The content of this article is the sole responsibility of the authors and does not necessarily reflect the opinions of the institutions they are affiliated with.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Agarwal, Sumit, and Robert Hauswald. 2010. Distance and Private Information in Lending. The Review of Financial Studies 23: 2757–88. [Google Scholar] [CrossRef]

- Angori, Gabriele, David Aristei, and Manuela Gallo. 2020. Banking Relationships, Firm-Size Heterogeneity and Access to Credit: Evidence from European Firms. Finance Research Letters 33: 101231. [Google Scholar] [CrossRef]

- Beck, Thorsten, and Asli Demirguc-Kunt. 2006. Small and Medium-Size Enterprises: Access to Finance as a Growth Constraint. Journal of Banking & Finance 30: 2931–43. [Google Scholar]

- Beck, Thorsten, Ross Levine, and Norman Loayza. 2000. Finance and the Sources of Growth. Journal of Financial Economics 58: 261–300. [Google Scholar] [CrossRef]

- Berger, Allen N., Christa H. S. Bouwman, Lars Norden, Raluca A. Roman, Gregory F. Udell, and Teng Wang. 2024. Piercing Through Opacity: Relationships and Credit Card Lending to Consumers and Small Businesses during Normal Times and the COVID-19 Crisis. Journal of Political Economy 132: 139–47. [Google Scholar] [CrossRef]

- Bonfim, Diana, Gil Nogueira, and Steven Ongena. 2021. “Sorry, We’re Closed” Bank Branch Closures, Loan Pricing, and Information Asymmetries. Review of Finance 25: 1211–59. [Google Scholar] [CrossRef]

- Bruhn, Miriam, and Inessa Love. 2013. The Real Impact of Improved Access to Finance: Evidence from Mexico. The Journal of Finance 69: 1347–76. [Google Scholar] [CrossRef]

- Cenni, Stefano, Stefano Monferrà, Valentina Salotti, Marco Sangiorgi, and Giuseppe Torluccio. 2015. Credit Rationing and Relationship Lending. Does Firm Size Matter? Journal of Banking & Finance 53: 249–65. [Google Scholar]

- Coronel-Pango, Katherine, Doménica Heras-Tigre, Jonnathan Jiménez Yumbla, Juan Aguirre Quezada, and Pedro Mora. 2023. Microfinance, an Alternative for Financing Entrepreneurship: Implications and Trends-Bibliometric Analysis. International Journal of Financial Studies 11: 83. [Google Scholar] [CrossRef]

- Dong, Yan, and Men Chao. 2014. SME Financing in Emerging Markets: Firm Characteristics, Banking Structure and Institutions. Review of Finance 50: 120–49. [Google Scholar] [CrossRef]

- Elyasiani, Elyas, and Lawrence G. Goldberg. 2004. Relationship Lending: A Survey of The Literature. Journal of Economics and Business 56: 315–30. [Google Scholar] [CrossRef]

- Fajardo, José, and Manuela Dantas. 2017. Understanding The Impact of Severe Hyperinflation Experience on Current Household Investment Behavior. Journal of Behavioral and Experimental Finance 17: 60–67. [Google Scholar] [CrossRef]

- Kerr, William R., and Ramana Nanda. 2009. Democratizing Entry: Banking Deregulations, Financing Constraints, and Entrepreneurship. Journal of Financial Economics 94: 124–49. [Google Scholar] [CrossRef]

- Levine, Ross. 1997. Financial Development and Economic Growth: Views and Agenda. Journal of Economic Literature 35: 688–726. [Google Scholar]

- Morton, Walter A. 1954. The Structure of the Capital Market and the Price of Money. The American Economic Review 44: 440–54. [Google Scholar]

- Nakane, Márcio I., and Daniela B. Weintraub. 2005. Bank privatization and productivity: Evidence for Brazil. Journal of Banking & Finance 29: 2259–89. [Google Scholar]

- Nguyen, Soa La, Cuong Duc Pham, Tu Van Truong, Trong Van Phi, Linh Thuy Le, and Trang Thu Thi Vu. 2023. Relationship between Capital Structure and Firm Profitability: Evidence from Vietnamese Listed Companies. International Journal of Financial Studies 11: 45. [Google Scholar] [CrossRef]

- Ross, Stephen A. 1977. The Determination of Financial Structure: The Incentive-Signaling Approach. The Bell Journal of Economics 8: 23–40. [Google Scholar] [CrossRef]

- Vyrostková, Lenka, and Jaroslava Kádárová. 2023. Entrepreneurship Dynamics: Assessing the Role of Macroeconomic Variables on New Business Density in Euro Area. International Journal of Financial Studies 11: 139. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).