Abstract

Political risk, one of the most significant uncertainty shocks, affects firms’ future attitudes toward risks and plays a crucial role in their decision making. A stock price crash risk is a classical topic in financial markets; therefore, this paper probes the relationship between firm-level political risk and stock price crash risk based on a sample of Chinese listed firms from 2011 to 2020. This paper collects the MD&A textual material of Chinese listed firms and calculates the firm-level political risk of Chinese listed firms. Our results show that a firm’s stock price crash risk is positively associated with its firm-level political risk exposure. Our findings hold after conducting various robustness tests, including instrument variable regression and altering the measurement of stock price crash risk. Further discussion reveals that political involvement mitigates the positive effect of firm-level political risk on the risk of a stock price jump.

Keywords:

political uncertainty; political engagement; financial market; stock price crash; risk measurement JEL Classification:

G12; G14; G34

1. Introduction

Political risk, including political and economic uncertainty, has a significant negative impact on global economic activities. Alesina et al. (1997) examined how electoral laws, the timing of elections, the ideological orientation of governments, and the nature of competition between political parties influence unemployment, economic growth, inflation, and monetary as well as fiscal policy. Later, the real options theory summarized the relationship between uncertainty and economic activities as a “wait-and-see” effect: if an enterprise suddenly finds itself in a more uncertain environment, it will stop investing and recruiting, and the economy will fall into a recession (Bernanke 1983). Specifically, when the cancellation cost of investment projects is high, or employees’ employment and dismissal costs are high, the high uncertainty will cause enterprises to delay investment and recruitment. It will also reduce the investment efficiency of enterprises. At the same time, the increase in uncertainty will lead to a rise in bond premiums, and the financing costs of enterprises will face upward pressure. To avoid defaulting, enterprises have to reduce investment (Pastor and Veronesi 2012). With an increase in uncertainty, households have gradually reduced their consumption expenditure, making it more difficult for government decision makers to regulate the economy, thus causing a macroeconomic recession.

Political risk increases the volatility of stock prices in various countries. In a weak economic situation, political risk brings a more significant risk premium and makes the stock market more relevant. In the bond market, the spread between sovereign and corporate bonds positively correlates with political risk (Bekaert et al. 2016). There is also empirical evidence that the price, variance, and tail risks of the option market tend to increase when the economy is weak and uncertainty is high (Kelly et al. 2016). As a new category of uncertainty, political risk literature pays more attention to political conflicts between countries. The existing literature mainly studied the impact of certain types of political events. A typical example is cross-border military conflict. Rigobon and Sack (2005) found that when there is war risk, investors shift from risky assets to assets with higher security or liquidity. War risk led to the decline of stock prices and exacerbated the stock market’s volatility. Caldara and Iacoviello (2022) innovatively used keywords related to political risk to search for news reports. They constructed a political risk index based on the number of news reports, effectively measuring political risk and its changes in the United States since 1985. Balcilar et al. (2016) have studied the impact of political risks on the stock markets of the BRIC countries and South Africa and found that Russia has the most extensive exposure to political risk; its stock market has been significantly affected.

Recently, Gala et al. (2023) used novel measures of politics–policy uncertainty and found that a global political risk factor is not spanned and commands a risk premium of 11% per annum across countries; however, the identified P-factor is at the country level. Until Gala et al. (2023) and the theory of spillovers (Pastor and Veronesi 2012), the conventional view was that political risk is idiosyncratic to countries. Similarly, within a country at the firm level, political exposure contains both systematic and idiosyncratic parts. We follow the extensive recent literature on firm-specific political betas (Wang et al. 2023a), recognizing that an individual firm’s response to political risk varies across firm-level (idiosyncratic) exposure and perception, to investigate the second-moment effect of political risk on the stock market from a firm-level perspective. Our study can take a firm’s perception of political risk into consideration.

Therefore, this paper analyzes the relationship between firm-level political risk and stock price crash risk based on a sample of Chinese listed firms from 2011 to 2020. This paper collects the MD&A textual material of Chinese listed firms and calculates the firm-level political risk of Chinese listed firms. Our results indicate a positive relationship between firm-level political participation and a potentially significant decline in stock prices. Our findings stay robust after we conduct various robustness tests, including instrument variable regression, ruling out the explanation of local embeddedness, and altering the measurement of stock price crash risk. Further discussions reveal that political involvement mitigates the positive impact of firm-level political risk on the risk of stock price jumps. The results demonstrate that corporate political participation can boost the aggravation of decreasing stock price trends. Thus, the implications of our results may provide valuable insights for investors, managers, and policymakers, especially on how to comprehensively evaluate the economic outcomes of political events and conduct better scenario and sensitivity analyses.

This study, therefore, makes several marginal contributions to the literature. First, to the best of our knowledge, this study is the first research attempt to investigate how corporate political risk exposure affects the risk of a stock price crash in the context of emerging market institutions, which deepens the understanding of the impacts of political risk through the lens of financial market risk (Ahsan and Qureshi 2021; Kim et al. 2019; Nguyen and Nguyen 2020; Pham 2019).

Second, our study extends the textual analysis as well as accounting and finance disclosure literature by providing out-of-sample empirical evidence, i.e., text-based firm-level political risk influencing the price crash risk in the equity market. This paper advances and expands the extant studies about the potential determinants of significant and sudden decreases in stock prices (Chen et al. 2022; Jia 2018; Kim et al. 2011; Luo and Zhang 2020).

Third, this study discovered that firm-specific political risk enhances the probability of stock price jumps, which echoes the related literature view of considering political risk as a negative shock (Christensen et al. 2022; El Ghoul et al. 2021; Wellman 2017). Our findings are consistent with prior research suggesting that political involvement is critical in mitigating the political risk faced by firms. This study contributes to the current literature regarding the link between two risks—corporate political risk and stock crash risk—by discussing the effect of political involvement and enriching the literature about the benefits of political involvement (Christensen et al. 2022; Ding et al. 2022; Liu et al. 2021; Wellman 2017). Moreover, our findings highlight the dark side of political risk faced by individual firms and provide a comprehensive analysis of the influence of firm-level political risk on financial markets, with significant implications for practitioners and policymakers.

2. Literature Review

2.1. Consequences of Political Risks

Political risk represents an uncertain event or situation whose impact can range from politics, the economy, culture, and other aspects of human society. The first viewpoint is expressed from a political perspective. The occurrence of political events will affect not only domestic politics but also relationships between countries. The “Arab Spring” movement, which took place in Arab countries in 2010, is a typical example. The occurrence resulted in infrastructure damages amounting to USD 900 billion, a death toll of over 1.4 million, and the displacement of over 15 million individuals. Although Tunisia overthrew its dictatorship and established a democratically elected government, from an economic perspective the country’s GDP growth has remained stagnant since 2010, with the per capita GDP declining from USD 4000 to USD 3600 annually. Since then, the movement has also led to a civil war in Syria, which later escalated into a political struggle between the United States and Russia, causing many refugees to flow into European countries, which also hurts European countries (Neacsu 2016). For another milder example, approximately 66% of the British population believe that Brexit has had an adverse effect on the economy (Portes 2023).

The first consequence of political risks relates to institutional quality and public governance style. Hassan et al. (2019) investigated the influence of political risk in the context of a developed country and focused on the effect of political risk on firms’ operation activities; however, institutional foundations in emerging markets are different from those in developed countries. For instance, Chinese publicly listed firms are very sensitive to political risks because a critical foundation of Chinese institutions is that governments at different levels control resource allocations that can affect firms’ behaviors (Wang 2023). Much attention has been given to the influence of FPR in developed countries (Choi et al. 2022). Less attention has been paid to the influence of FPR in emerging markets; therefore, we examine the influence of political risk in the context of a developing country and emphasize the effect of political risk on the price crash risk aspect of the stock market. Roe and Siegel (2011) found that political instability impedes financial development. Girma and Shortland (2008) argued that, in countries where a narrow elite controls political decisions, financial development may be obstructed to deny access to finance to potential competitors. Chletsos and Sintos (2024) point out that heightened levels of political stability substantively foster the advancement of financial development.

Second, let us take an economic perspective. Political risks negatively impact the economy, including macroeconomic operation, international capital flow, international trade, and microenterprise operation. Small countries and emerging economies are weak in resisting risks and uncertainties, so they are more vulnerable to political risks. The research results of the Bank of England and the European Central Bank show that political risks significantly negatively impact the economies of the United Kingdom and the Netherlands. In 2012, the sanctions imposed by the United States and the European Union on Iran’s finances and exports led to a decline of more than 50% in Iran’s oil export revenue (Carney 2016; Rivlin 2018). Hassan et al. (2019) also explored the potential impact of political risk on the economic outcomes of firms operating in the developed world. In contrast, we examine the influence of political risk in the context of an economically developing country and focus on the effect of political risk perceived and faced by individual firms on their performance in financial markets (i.e., stock price crash risk).

The last perspective can be related to social and cultural fields. An increase in political risks will lead to a rise in social instability and will further bring out a devastating impact on cultural resources. Taking the Arab Spring as an example, the event led to substantial social unrest in the Middle East and North Africa, making it difficult for citizens to sustain their daily lives and economic activities. It eventually triggered a flood of refugees into EU countries. The refugee tide also harms the social situation of European countries. Social employment, welfare, population structure, etc., have suffered negative impacts. It has also intensified the polarization and opposition of domestic societies in Britain, France, Germany, and other countries, and led to an overall right-leaning trend in European countries (Wang and Xu 2017). Xiong et al. (2020) summarized the damage caused by geopolitical events to the world cultural heritage of Middle Eastern countries, such as Iraq, Egypt, Afghanistan, and Syria.

2.2. The Influence of Political Events on Financial Markets

Because this article studies the impact of political risk on stock prices, we focus on reviewing the impact of political risk on financial markets in this subsection. Early studies focused on the effects of specific political events. Increasing political risks will reduce stock returns and increase stock market volatility (Benhmad 2012). A typical example is cross-border military conflicts, such as the Iraq War in 2003, which had a massive impact on global stock markets. Bittlingmayer (1998) investigated the extreme political struggle in Germany during the First World War. He believed that political uncertainty would increase the volatility of stocks and trigger the pressure of a stock market recession. Rigobon and Sack (2005) found that, when there is war risk, investors shift from risky assets to assets with higher security or liquidity. War risk leads to a decline in stock price and can explain the fluctuation of the stock market. Berkman et al. (2011) did not investigate a single political event but analyzed 447 international political crises. They concluded that the annual return of global stock markets would increase by 3.6% in the absence of a political crisis. Wisniewski (2009) took the US stock market as the research object and concluded that the stock market value was lower than its fundamental value during conflict periods such as World War II and the Korean War.

In addition to war, another growing problem related to political risks is terrorism. Since the 9/11 attacks, terrorism has become the focus of the media and the public. Karolyi and Martell (2010), in addition to Brounen and Derwall (2010), studied the changes in stock market indexes in countries where terrorist attacks occurred. After an attack, stock price will drop significantly. In addition, the stock market’s reaction to terrorist activities varies from industry to industry. Carter and Simkins (2004) and Chesney et al. (2011) confirmed in their literature on airline share prices that they are more sensitive to terrorism. This seems unsurprising because, when it happened, the destruction of the World Trade Center in New York was the most prominent insurance loss event in history.

Unlike focusing only on specific types of political events, Caldara and Iacoviello (2022) quantified political risks based on a text search of mainstream newspapers to prove their negative impact on US stock returns. Balcilar et al. (2016) studied the influences of political events on stock markets in BRIC countries and South Africa. They found that Russia had the most considerable exposure to political risk and significant impact on its stock market, while India’s stock market had the strongest elasticity. Apergis et al. (2018) further linked political risk with the stock prices of 24 global defense companies, indicating that political risk had no significant impact on their returns. Pan (2018) used a political risk index to study the effects of political risk on asset markets in 17 developed countries from 1899 to 2016. Compared with the return rate of the real estate market, the stock return rate is more sensitive to the growth of political risk. In addition, a high level of political risk will generate high-risk spillovers in the stock market price. With respect to macroeconomic indicators, it will change the discount rate, hindering GDP growth, especially in private consumption and investment.

As for the impact of political risk on other asset prices, Murray (2018) studied the relationship between political risk and commodity prices. He concluded that, although this relationship is vague, in some cases commodity prices may be the driving factor of political risks. Antonakakis et al. (2017) showed that political risk reduced oil returns and volatility, reducing the covariance between the stock and oil markets. Baur and Smales (2018) found that gold showed a unique behavior among all precious metals: Gold’s income was significantly positively correlated with political risk, but gold price changes had no response to political events. At the same time, political risks did not lead to a further increase in gold yield volatility. These findings provide new evidence for the unique position of gold as a global hedge asset.

2.3. Political Risk and Corporate Finance

In recent years, as more and more scholars pay attention to investor behavior, corporate finance factors play an increasingly prominent role in asset pricing, and investor attention and sentiment have gradually become hot spots in this field. In the traditional asset pricing model, the market is efficient, and public information will immediately be reflected in stock price changes, so there is no excess return in the market; however, investors have limited attention. They can only pay attention to part of the information in the market and make investment decisions based on this part; therefore, changes in stock prices only include certain pieces of information. Investors with limited attention may resort to simple decision-making rules, such as classification, or focus only on those stocks that attract their attention (Peng and Xiong 2006). When studying the impact of limited attention on the economy, many studies focus on how attention paid to a specific stock affects the dynamics of stock prices. Only when investors pay attention to information can the information be included in the price.

In addition, the attention hypothesis proposed by Barber and Odean (2008) believes that individual investors are net buyers of “attention-attracting” stocks, and this attention-based trading behavior will, in turn, lead to temporary price pressures and subsequent price reversals. Da et al. (2011) found that an increase in Google’s search volume indicates the rise of a stock price in the short term and the final reversal in the long term, which is consistent with the attention theory. Contrary to the classical theory, there are irrational investors in the market, and the differences in stock cross-sectional returns caused by the cognitive biases of these investors, such as overconfidence, overoptimism, and reaction, have also become popular research topics in recent years. Investor sentiment has a negative impact on the expected returns of stocks, but the degree of the negative impact also varies by the characteristics of stocks. For stocks with a small market capitalization, high volatility of returns, and high opacity of corporate information, investor sentiment significantly impacts their returns (Baker and Wurgler 2006).

Unlike traditional earnings indicators, such as book value, dividend indicators, etc., investor attention and sentiment are more challenging to measure. Traditional research mainly uses stock trading data and financial statements to indirectly measure attention and sentiment indicators. With the application of online big data in the fields of economics and finance, more direct measurement methods emerge. Currently, the commonly used techniques include online news data, search engine data, social networking data, online forum data, etc. Using online big data, many studies have constructed various investor attention and investor sentiment indexes. Research shows that investors’ pessimism has a negative impact on stock prices, and news about rising corporate performance can increase stock returns (Tetlock 2007; Heston and Sinha 2016). Short-selling restrictions will reduce the market’s automatic adjustment function, and investor sentiment will have a higher impact on earnings (Gao et al. 2020). Stocks with low investor attention often display a higher degree of information asymmetry and hence face a higher level of risk, which requires higher risk compensation, confirming the information risk hypothesis (Antweiler and Frank 2004).

3. Data Source, Variables, and Empirical Specification

3.1. Data Source and Sample Selection

This study obtained all of our data, including political risk measures evaluated at the firm level, proxies for stock price fluctuations, and firm-level financial variables, except for the text-based innovation from the China Stock Market & Accounting Research (CSMAR) database. These management discussion and analysis (MD&A) reports are used as textual analysis material with which to determine text-based firm-level political risk. This MD&A content is extracted manually from annual reports retrieved from the official websites of related companies. Our method is consistent with the firm-level political risk index developed by Wang (2023).

Furthermore, to maintain coherence with the relevant academic works (Hasan and Jiang 2023), we exclude enterprises categorized as ST, *ST, or PT. We applied winsorization to all of the continuous variables, setting the 1st and 99th percentiles as the cutoff points to mitigate the potential impact of outliers. Subsequently, we eliminate financial institutions and observations that need to provide data on the most pertinent factors. Our sample comprises 23,677 firm-year observations covering the period from 2008 to 2020.

3.2. Variable Construction

We first introduce the dependent variable for measuring the risk of a stock price crash. In our research, we utilized the “negative return skewness coefficient” (NCSKEW) and the “up and down volatility of stock returns” (DUVOL) as measures with which to assess the probability of stock price crashes, based on the relevant literature (Wang et al. 2023a). Our methodology aligns with the approach outlined by Chen et al. (2001). For more details on computation, we specify the corresponding calculation formulas in Appendix A. The bottom line is that a higher stock price crash risk is associated with greater values of NCSKEW and DUVOL.

Next, consider the independent variable of corporate political risk (CPR). This paper employs a proxy based on text analysis to quantify the firm-specific political risk of companies publicly listed in the Chinese A-share market, which is consistent with the method proposed by Wang (2023). For more details on the calculation of CPR, we report the related calculation details in Appendix B. A higher CPR value represents a higher level of firm-level political risk.

At last, to maintain consistent with the related literature (e.g., Lim and Nguyen 2021), we add several key control variables, which include firms’ fundamental characteristics and CEO traits, such as corporate age since establishment (Firm age), corporate asset size (Firm size), the state-owned enterprise dummy (Soe), board structure (Indep), board scale (Board), power concentration of executives (CEO dual role), CEO age (CEO age), CEO gender (CEO gender), and business group affiliation (Bga), are adopted as control variables (), which are the same as those used in previous research (He et al. 2013). The details of the control variables’ calculation methods are described in Table A1 in Appendix C.

3.3. Model Specification

To examine the connections between firm-level risk exposures to political events and to equity price crashes, we present our baseline econometric model below:

In the above model (1), the variable denotes the probability of a significant decline in the stock price of firm i during year t. The notation represents the political risk of firm i in year t. In model (2), denotes the probability of a sudden and significant decrease in the stock price of firm i within a specific year. The notation represents the political risk of firm i in year t. We refer to the literature by Liu et al. (2022) and Wu et al. (2022) to define as the collection of control variables that have been specified in Section 3.2. and denote time-fixed effects and firm-fixed effects, respectively. The symbol represents the error term. Furthermore, this work uses industry-level clustering to estimate standard errors.

4. Empirical Results

4.1. Benchmark Regression Estimation

Table 1 shows the results of baseline regression models (1) and (2). The results described in column (1) of Table 1 show that the coefficient of the variable CPR is 0.0767 at a 1% significance level under the condition of without control variables. The results in column (2) of Table 1 show that the coefficient of the variable CPR is 0.0451 at a 1% significance level under the condition of without control variables.

Table 1.

Baseline results.

The results described in column (3) of Table 1 show that the coefficient of the variable CPR is 0.0726 at a 1% significance level under the condition of including all control variables. The results in column (4) of Table 1 show that the coefficient of the variable CPR is 0.0442 at a 1% significance level under the condition of including all control variables. Thus, the above results prove that firm-specific political risk can positively exert an influence on the risk of stock price crashes. Based on the asset pricing theory, our findings reveal that firm-level political risk is a negative factor for stock return.

4.2. Robustness Checks: Altering the Measurement of Stock Price Crash Risk

To prove the robustness of our main findings, we replaced the measurement of stock price crash risk with the difference between the number of days with negative extreme firm-specific daily returns and the number of days with positive extreme firm-specific daily returns (represented by Crash) according to the method proposed by Callen and Fang (2015). The related estimation regression results are reported in columns (1) and (2) of Table 2.

Table 2.

Robustness checks: alteration of stock price crash risk.

Observing the estimated statistics reported in Table 2, we find in columns (1)–(2) that the coefficient of CPR is positive at a 1% significance level, irrespective of a simple setup or a specification including all controls. The above empirical evidence supports the validity of our main finding.

4.3. Robustness Checks: Instrumental Variable Regression

To address potential issues of endogeneity, we adopt the approach used in previous studies (Wang et al. 2023b) by treating the average of all other firms in the same industry as an instrument variable for . When firms are in the same industry, they operate in the same environment and enjoy similar firm-level political risk; therefore, the instrumental variable satisfies the relevance criterion. Furthermore, it is challenging to establish a direct link between a firm’s stock price crash risk and the political risk of its peer firms, which satisfies the exclusion criterion for selecting instrumental variables. The IV regression estimation results are presented in Table 3. The results show that the F-statistic in column (1) of the first stage is 104.139, which is greater than 10. This large value of the F-statistic indicates the instrumental variable’s validity. The coefficients associated with CPR in columns (2)–(3) of Table 3 are positive and statistically significant at a 1% level. This demonstrates the resilience of the baseline results, even after accounting for the possible issue of endogeneity.

Table 3.

Robustness checks: results of IV estimation.

4.4. Robustness Checks: Altering the Measurement of Political Risk

To prove the robustness of our main findings, we replace the measurement of political risk with political sentiment (labeled as PS) according to the method proposed by Wang (2023). The related estimation regression results are reported in columns (1) and (2) of Table 4.

Table 4.

Robustness checks: alteration of political risk.

Observing the estimated statistics reported in Table 4, we find in columns (1)–(2) that the coefficient of CPR is positive at a 1% significance level in the specification including all controls. The above empirical evidence supports the validity of our main finding.

4.5. Robustness Checks: Winsorization of Stock Price Crash Risk

To prove the robustness of our main findings, we conducted the winsorization of stock price crash risk at the 98% level. The related estimation regression results are reported in columns (1) and (2) of Table 5.

Table 5.

Robustness checks: winsorization of stock price crash risk at the 98% level.

Observing the estimated statistics reported in Table 5, we find in columns (1)–(2) that the coefficient of CPR is positive at a 1% significance level. The above empirical evidence supports the validity of our main finding.

We then conducted the winsorization of stock price crash risk at the 95% level. The related estimation regression results are reported in columns (1) and (2) of Table 6.

Table 6.

Robustness checks: winsorization of stock price crash risk at the 95% level.

Observing the estimated statistics reported in Table 6, we find in columns (1)–(2) that the coefficient of CPR is positive at a 1% significance level. The above empirical evidence supports the validity of our main finding.

Finally, we repeat the winsorization of stock price crash risk at the 90% level. The related estimation regression results are reported in columns (1) and (2) of Table 7.

Table 7.

Robustness checks: winsorization of stock price crash risk at the 90% level.

Observing the estimated statistics reported in Table 7, we find in columns (1)–(2) that the coefficient of CPR is positive at a 1% significance level. The above empirical evidence supports the validity of our main finding.

5. Further Discussions on the Effect of Political Involvement

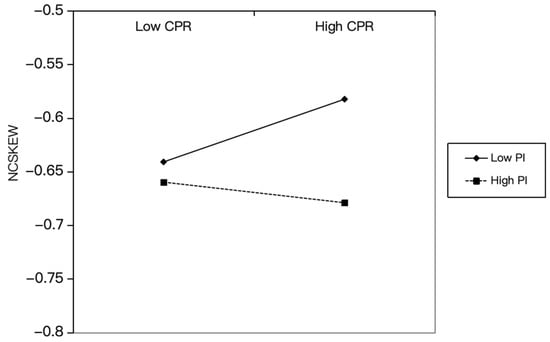

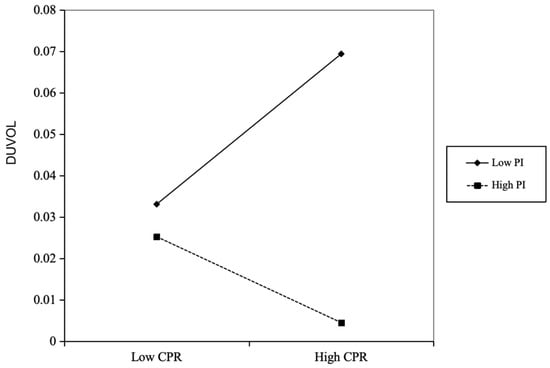

Considering that political involvement might reduce the political risk faced by a firm (Ding et al. 2022), we followed the related literature and calculated political involvement, which is defined as the overlapping ratio of members between a firm’s board of directors and a Party Committee (labeled as PI). Then, we further test whether political involvement mitigates the nexus between CPR and stock price crash risk. To perform such tests, we add an interaction term, , to both Equations (1) and (2). This paper hence obtains the following Equations (3) and (4), which can shed light on non-linear relationships:

The related regression estimation results of Equations (3) and (4) are described in columns (1)–(2) of Table 8. According to the results in Table 5, the coefficients of are negative at a 1% significance level, illustrating that political involvement exerts a mitigating effect on the nexus between CPR and stock price crash risk. The coefficients associated with CPR in columns (1)–(2) of Table 8 are positively and significantly significant at the 1% level. This demonstrates the robustness of the baseline results, even after accounting for the potential endogeneity problem.

Table 8.

Further discussions: the effect of political involvement.

The regression estimation results of Equations (3) and (4) are also illustrated in Figure 1 and Figure 2. As can be seen, political involvement exerts a mitigating effect on the nexus between CPR and stock price crash risk.

Figure 1.

The margins plot of interaction (dependent variable NCSKEW).

Figure 2.

The margins plot of interaction (dependent variable DUVOL).

6. Concluding Remarks

The present study drew on a sample of Chinese listed firms from 2011 to 2020 and discovered that firms at political risk face significant increases in their likelihood of encountering stock price crashes. This paper collected the MD&A textual material of Chinese listed firms and calculated the firm-level political risk of Chinese listed firms. Our results document a positive linkage between corporate political risk and stock price crash probability. Our findings stayed robust even after we conducted various robustness tests, including instrument variable regression, ruling out the explanation of local embeddedness and altering the measurement of stock price crash risk. Further discussion reveals that political involvement mitigates the positive effect of firm-level political risk on stock price crash risk. Our findings offer several implications of practical value. First, investors and shareholders learn from our research that firm-level political risks are critical in determining stock price crash risk. With this information, they can form an effective financial market risk management policy. Second, policymakers benefit from our findings as they can mitigate the political risk that firms face, which may significantly reduce financial market risk and foster stability. Overall, our research has important implications for both practitioners and policymakers, since it offers an in-depth investigation of the influence of the political risk endured by enterprises on financial market risk, as represented by the events of equity price crashes.

Author Contributions

Conceptualization, Y.M. and Q.W.; methodology, Y.M.; software, Y.M.; validation, Y.M., Q.W. and X.G.; formal analysis, Y.M.; investigation, Y.M.; resources, X.G.; data curation, X.G.; writing—original draft preparation, Y.M.; writing—review and editing, X.G.; visualization, Y.M.; supervision, Q.W.; project administration, Q.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available upon request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Calculation Process of Stock Price Crash Risk

First, let us consider the following regression specification:

where represents the return of stock i on week t, and denotes the weighted average stock market return over week t. The firm-specific weekly return is ; is the error term of regression Equation (A1).

Second, we calculated the following two proxies to quantify the crash risk. One proxy is referred to as the negative return skewness coefficient (NCSKEW), and is calculated by Equation (A2). The other proxy is called the up and down volatility of stock returns (DUVOL), defined in Equation (A3).

where is the annual trading week number of stock i specified in Equation (A2). A larger value of NCSKEW is associated with a higher stock crash risk level.

where and indicate the numbers of up and down weeks in Equation (A3), respectively. Similarly, a larger value of DUVOL corresponds to a higher probability of crash risk.

Appendix B. Calculation Process of the Corporate Political Risk (CPR) Index

For a given Chinese publicly listed firm’s MD&A text in year t, we count the number of cases in which we find risk-related and political terms in the same sentence. This count is then normalized by the length of the MD&A report. Formally, the firm-level political risk (CPR) index for firm i in year t is calculated according to Equation (A4):

where w = 1, …, and Rit is the total number of words in the MD&A text of firm i in year t. The length of report Tit is measured as the total number of sentences in the MD&A text, and r is the position of the nearest risk-related terms (i.e., r ∈ termsRisk). According to Equation (A4), our CPR index counts the number of cases in which political terms are contained in the same sentence as risk-related terms. Specifically, our choice of the listed political and risk-related terms was consistent with that used by Wang (2023).

Appendix C. Variable Measure Descriptions

Table A1.

Variable definitions.

Table A1.

Variable definitions.

| Variable | Definition |

|---|---|

| NCSKEW | Negative return skewness coefficient |

| DUVOL | Up and down volatility of stock returns |

| CPR | Firm-level political risk index |

| Firm_age | Number of years after the firm’s establishment |

| Firm_size | Natural logarithm of total assets |

| Soe | Dummy variable that equals 1 if a firm is state-owned and 0 otherwise |

| Indep | Ratio of the number of independent directors to the number of board directors |

| Board | Natural logarithm of the number of board of directors |

| CEO_duality | Dummy variable that equals 1 if the CEO is also the chairperson of the board and 0 otherwise |

| CEO_age | CEO age |

| CEO_gender | Dummy variable equaling 1 if the CEO is male and 0 otherwise |

| Bga | Equals 1 if a firm’s group affiliation in each year of its ultimate controlling entity had more than one firm in that year and equals 0 otherwise |

| PI | The overlapping ratio of members between the firm’s board of directors and a Party Committee |

Notes: This table reports the variable definitions.

Table A2.

Correlation Matrix.

Table A2.

Correlation Matrix.

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) NCSKEW | 1.000 | ||||||||||

| (2) DUVOL | 0.881 | 1.000 | |||||||||

| (3) CPR | −0.034 | −0.038 | 1.000 | ||||||||

| (4) Firm_age | −0.049 | −0.056 | 0.053 | 1.000 | |||||||

| (5) Firm_size | −0.070 | −0.098 | 0.264 | 0.161 | 1.000 | ||||||

| (6) Soe | −0.085 | −0.096 | 0.243 | 0.140 | 0.336 | 1.000 | |||||

| (7) Indep | 0.006 | 0.007 | −0.009 | −0.011 | 0.026 | −0.058 | 1.000 | ||||

| (8) Board | −0.033 | −0.041 | 0.124 | 0.004 | 0.257 | 0.264 | −0.486 | 1.000 | |||

| (9) CEO_duality | 0.037 | 0.047 | −0.098 | −0.083 | −0.167 | −0.291 | 0.108 | −0.178 | 1.000 | ||

| (10) CEO_age | −0.027 | −0.022 | 0.061 | 0.121 | 0.122 | 0.082 | 0.015 | 0.043 | 0.172 | 1.000 | |

| (11) CEO_gender | −0.004 | −0.006 | 0.040 | −0.023 | 0.039 | 0.066 | −0.053 | 0.074 | 0.021 | 0.029 | 1.000 |

| (12) Bga | 0.019 | 0.022 | −0.082 | −0.066 | −0.084 | −0.158 | −0.009 | −0.027 | 0.168 | 0.022 | −0.034 |

References

- Ahsan, Tanveer, and Muhammad Azeem Qureshi. 2021. The nexus between policy uncertainty, sustainability disclosure and firm performance. Applied Economics 53: 441–53. [Google Scholar] [CrossRef]

- Alesina, Alberto, Nouriel Roubini, and Gerald D. Cohen. 1997. Political Cycles and the Macroeconomy. Cambridge, MA: MIT Press. [Google Scholar] [CrossRef]

- Antonakakis, Nikolaos, Rangan Gupta, Christos Kollias, and Stephanos Papadamou. 2017. Geopolitical risks and the oil-stock nexus over 1899–2016. Finance Research Letters 23: 165–73. [Google Scholar] [CrossRef]

- Antweiler, Werner, and Murray Z. Frank. 2004. Is all that talk just noise? The information content of internet stock message boards. The Journal of Finance 59: 1259–94. [Google Scholar] [CrossRef]

- Apergis, Nicholas, Matteo Bonato, Rangan Gupta, and Clement Kyei. 2018. Does geopolitical risks predict stock returns and volatility of leading defense companies? Evidence from a nonparametric approach. Defence and Peace Economics 29: 684–96. [Google Scholar] [CrossRef]

- Baker, Malcolm, and Jeffrey Wurgler. 2006. Investor sentiment and the cross-section of stock returns. The Journal of Finance 61: 1645–80. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Rangan Gupta, Clement Kyei, and Mark E. Wohar. 2016. Does economic policy uncertainty predict exchange rate returns and volatility? Evidence from a nonparametric causality-in-quantiles test. Open Economies Review 27: 229–50. [Google Scholar] [CrossRef]

- Barber, Brad M., and Terrance Odean. 2008. All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. The Review of Financial Studies 21: 785–818. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Lee A. Smales. 2018. Gold and Geopolitical Risk. SSRN Working Paper No. 3109136. Rochester: SSRN. [Google Scholar]

- Bekaert, Geert, Campbell R. Harvey, Christian T. Lundblad, and Stephan Siegel. 2016. Political risk and international valuation. Journal of Corporate Finance 37: 1–23. [Google Scholar] [CrossRef]

- Benhmad, François. 2012. Modeling nonlinear Granger causality between the oil price and U.S. dollar: A wavelet based approach. Economic Modelling 29: 1505–14. [Google Scholar] [CrossRef]

- Berkman, Henk, Ben Jacobsen, and John B. Lee. 2011. Time-varying rare disaster risk and stock returns. Journal of Financial Economics 101: 313–32. [Google Scholar] [CrossRef]

- Bernanke, Ben S. 1983. Irreversibility, uncertainty, and cyclical investment. The Quarterly Journal of Economics 98: 85–106. [Google Scholar] [CrossRef]

- Bittlingmayer, George. 1998. Output, stock volatility, and political uncertainty in a natural experiment: Germany, 1880–940. The Journal of Finance 53: 2243–57. [Google Scholar] [CrossRef]

- Brounen, Dirk, and Jeroen Derwall. 2010. The impact of terrorist attacks on international stock markets. European Financial Management 16: 585–98. [Google Scholar] [CrossRef]

- Caldara, Dario, and Matteo Iacoviello. 2022. Measuring geopolitical risk. American Economic Review 112: 1194–225. [Google Scholar] [CrossRef]

- Callen, Jeffrey L., and Xiaohua Fang. 2015. Short interest and stock price crash risk. Journal of Banking & Finance 60: 181–94. [Google Scholar] [CrossRef]

- Carney, Mark. 2016. Uncertainty, the Economy and Policy. London: Bank of England. [Google Scholar]

- Carter, David A., and Betty J. Simkins. 2004. The market’s reaction to unexpected, catastrophic events: The case of airline stock returns and the September 11th attacks. The Quarterly Review of Economics and Finance 44: 539–58. [Google Scholar] [CrossRef]

- Chen, Joseph, Harrison Hong, and Jeremy C Stein. 2001. Forecasting crashes: Trading volume, past returns, and conditional skewness in stock prices. Journal of Financial Economics 61: 345–81. [Google Scholar] [CrossRef]

- Chen, Shihua, Yan Ye, and Khalil Jebran. 2022. Tax enforcement efforts and stock price crash risk: Evidence from China. Journal of International Financial Management & Accounting 33: 193–218. [Google Scholar] [CrossRef]

- Chesney, Marc, Ganna Reshetar, and Mustafa Karaman. 2011. The impact of terrorism on financial markets: An empirical study. Journal of Banking & Finance 35: 253–67. [Google Scholar] [CrossRef]

- Chletsos, Michael, and Andreas Sintos. 2024. Political stability and financial development: An empirical investigation. The Quarterly Review of Economics and Finance 94: 252–66. [Google Scholar] [CrossRef]

- Choi, Wonseok, Chune Young Chung, and Kainan Wang. 2022. Firm-level political risk and corporate investment. Finance Research Letters 46: 102307. [Google Scholar] [CrossRef]

- Christensen, Dane M., Hengda Jin, Suhas A. Sridharan, and Laura A. Wellman. 2022. Hedging on the hill: Does political hedging reduce firm risk? Management Science 68: 4356–79. [Google Scholar] [CrossRef]

- Da, Zhi, Joseph Engelberg, and Pengjie Gao. 2011. In search of attention. The Journal of Finance 66: 1461–99. [Google Scholar] [CrossRef]

- Ding, Haoyuan, Yi Li, Chang Xue, and Liang Wang. 2022. The Belt and Road Initiative, political involvement, and China’s OFDI. International Studies of Economics 17: 459–83. [Google Scholar] [CrossRef]

- El Ghoul, Sadok, Omrane Guedhami, Yongtae Kim, and Hyo Jin Yoon. 2021. Policy uncertainty and accounting quality. The Accounting Review 96: 233–60. [Google Scholar] [CrossRef]

- Gala, Vito D., Giovanni Pagliardi, and Stavros A. Zenios. 2023. Global political risk and international stock returns. Journal of Empirical Finance 72: 78–102. [Google Scholar] [CrossRef]

- Gao, Zhenyu, Haohan Ren, and Bohui Zhang. 2020. Googling investor sentiment around the world. Journal of Financial and Quantitative Analysis 55: 549–80. [Google Scholar] [CrossRef]

- Girma, Sourafel, and Anja Shortland. 2008. The political economy of financial development. Oxford Economic Papers 60: 567–96. [Google Scholar] [CrossRef]

- Hasan, Mostafa Monzur, and Haiyan Jiang. 2023. Political sentiment and corporate social responsibility. The British Accounting Review 55: 101170. [Google Scholar] [CrossRef]

- Hassan, Tarek A., Stephan Hollander, Laurence van Lent, and Ahmed Tahoun. 2019. Firm-level political risk: Measurement and effects. The Quarterly Journal of Economics 134: 2135–202. [Google Scholar] [CrossRef]

- He, Jia, Xinyang Mao, Oliver M. Rui, and Xiaolei Zha. 2013. Business groups in China. Journal of Corporate Finance 22: 166–92. [Google Scholar] [CrossRef]

- Heston, Steven L., and Nitish Ranjan Sinha. 2016. News vs. sentiment: Predicting stock returns from news stories. Financial Analysts Journal 73: 67–83. [Google Scholar] [CrossRef]

- Jia, Ning. 2018. Corporate innovation strategy and stock price crash risk. Journal of Corporate Finance 53: 155–73. [Google Scholar] [CrossRef]

- Karolyi, G. Andrew, and Rodolfo Martell. 2010. Terrorism and the stock market. International Review of Applied Financial Issues and Economics 2: 285. [Google Scholar] [CrossRef]

- Kelly, Bryan, Ľuboš Pástor, and Pietro Veronesi. 2016. The price of political uncertainty: Theory and evidence from the option market. The Journal of Finance 71: 2417–80. [Google Scholar] [CrossRef]

- Kim, Chansog (Francis), Incheol Kim, Christos Pantzalis, and Jung Chul Park. 2019. Policy uncertainty and the dual role of corporate political strategies. Financial Management 48: 473–504. [Google Scholar] [CrossRef]

- Kim, Jeong-Bon, Yinghua Li, and Liandong Zhang. 2011. Corporate tax avoidance and stock price crash risk: Firm-level analysis. Journal of Financial Economics 100: 639–62. [Google Scholar] [CrossRef]

- Lim, Ivan, and Duc Duy Nguyen. 2021. Hometown lending. Journal of Financial and Quantitative Analysis 56: 2894–933. [Google Scholar] [CrossRef]

- Liu, Guanchun, May Hu, and Chen Cheng. 2021. The information transfer effects of political connections on mitigating policy uncertainty: Evidence from China. Journal of Corporate Finance 67: 101916. [Google Scholar] [CrossRef]

- Liu, Haiyue, Yile Wang, Rui Xue, Martina Linnenluecke, and Cynthia Weiyi Cai. 2022. Green commitment and stock price crash risk. Finance Research Letters 47: 102646. [Google Scholar] [CrossRef]

- Luo, Yan, and Chenyang Zhang. 2020. Economic policy uncertainty and stock price crash risk. Research in International Business and Finance 51: 101112. [Google Scholar] [CrossRef]

- Murray, Daniel. 2018. Geopolitical risk and commodities: An investigation. Global Commodities Applied Research Digest 3: 95–106. [Google Scholar]

- Neacsu, Marius-Cristian. 2016. Geoeconomic vs. geostrategic conflicts case study: Russia–western world. Strategic Impact 58: 13–22. [Google Scholar]

- Nguyen, My, and Justin Hung Nguyen. 2020. Economic policy uncertainty and firm tax avoidance. Accounting & Finance 60: 3935–78. [Google Scholar] [CrossRef]

- Pan, Wei-Fong. 2018. Geopolitical Risk Impacts on Asset Markets: Evidence from Data over Century. SSRN Working Paper No. 3222468. Rochester: SSRN. [Google Scholar] [CrossRef]

- Pastor, Lubos, and Pietro Veronesi. 2012. Uncertainty about government policy and stock prices. The Journal of Finance 67: 1219–64. [Google Scholar] [CrossRef]

- Peng, Lin, and Wei Xiong. 2006. Investor attention, overconfidence and category learning. Journal of Financial Economics 80: 563–602. [Google Scholar] [CrossRef]

- Pham, Anh Viet. 2019. Political risk and cost of equity: The mediating role of political connections. Journal of Corporate Finance 56: 64–87. [Google Scholar] [CrossRef]

- Portes, Jonathan. 2023. The impact of Brexit on the UK economy: Reviewing the evidence. VOXEU Column. Available online: https://cepr.org/voxeu/columns/impact-brexit-uk-economy-reviewing-evidence (accessed on 15 May 2024).

- Rigobon, Roberto, and Brian Sack. 2005. The effects of war risk on US financial markets. Journal of Banking & Finance 29: 1769–89. [Google Scholar] [CrossRef]

- Rivlin, Paul. 2018. Leverage of economic sanctions: The case of US sanctions against Iran, 1979–2016. In Geo-Economics and Power Politics in the 21st Century. London: Routledge, pp. 99–113. [Google Scholar]

- Roe, Mark J., and Jordan I. Siegel. 2011. Political instability: Effects on financial development, roots in the severity of economic inequality. Journal of Comparative Economics 39: 279–309. [Google Scholar] [CrossRef]

- Tetlock, Paul C. 2007. Giving content to investor sentiment: The role of media in the stock market. The Journal of Finance 62: 1139–68. [Google Scholar] [CrossRef]

- Wang, Bo, and Chao Xu. 2017. The impacts of Muslim refugee crisis on European society. Arab World Studies 3: 60–74. (In Chinese). [Google Scholar]

- Wang, Liang. 2023. Mitigating firm-level political risk in China: The role of multiple large shareholders. Economics Letters 222: 110960. [Google Scholar] [CrossRef]

- Wang, Liang, Qikai Wang, and Fan Jiang. 2023a. Booster or stabilizer? Economic policy uncertainty: New firm-specific measurement and impacts on stock price crash risk. Finance Research Letters 51: 103462. [Google Scholar] [CrossRef]

- Wang, Liang, Yu Zhang, and Chengshuang Qi. 2023b. Does the CEOs’ hometown identity matter for firms’ environmental, social, and governance (ESG) performance? Environmental Science and Pollution Research 30: 69054–63. [Google Scholar] [CrossRef] [PubMed]

- Wellman, Laura A. 2017. Mitigating political uncertainty. Review of Accounting Studies 22: 217–50. [Google Scholar] [CrossRef]

- Wisniewski, Tomasz Piotr. 2009. Can political factors explain the behaviour of stock prices beyond the standard present value models? Applied Financial Economics 19: 1873–84. [Google Scholar] [CrossRef]

- Wu, Keping, Yumei Fu, and Dongmin Kong. 2022. Does the digital transformation of enterprises affect stock price crash risk? Finance Research Letters 48: 102888. [Google Scholar] [CrossRef]

- Xiong, Chenran, Limao Wang, Qiushi Qu, Ning Xiang, and Bo Wang. 2020. Progress and prospect of geopolitical risk research. Progress in Geography 39: 695–706. (In Chinese). [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).