Abstract

This study firstly applied a Bayesian symbolic regression (BSR) to the forecasting of numerous commodities’ prices (spot-based ones). Moreover, some features and an initial specification of the parameters of the BSR were analysed. The conventional approach to symbolic regression, based on genetic programming, was also used as a benchmark tool. Secondly, various other econometric methods dealing with variable uncertainty were estimated including Bayesian Model Averaging, Dynamic Model Averaging, LASSO, ridge, elastic net, and least-angle regressions, etc. Therefore, this study reports a concise and uniform comparison of an application of several popular econometric models to forecasting the prices of numerous commodities. Robustness checks and statistical tests were performed to strengthen the obtained conclusions. Monthly data beginning from January 1988 and ending in August 2021 were analysed.

1. Introduction

The objective of this paper is to apply a novel econometric tool in forecasting various commodities’ prices. The novelty of the applied method lies in its fusion of two distinct approaches: symbolic regression (Koza 1998) and Bayesian econometrics (Koop 2017). The rationale behind such an idea stems from the challenges faced by researchers when constructing forecasting models, particularly when selecting explanatory variables for methods such as multilinear regressions. This is a non-trivial task (Tapia Cortez et al. 2018), especially when adopting the (standard) frequentist approach and employing the commonly used ordinary least squares method to estimate regression coefficients.

Of course, there are some classical techniques available for selecting explanatory variables, but the issue of model uncertainty still remains a serious challenge. Researchers sometimes address this problem by using conventional tools such as model averaging techniques (Steel 2020; Burnham and Anderson 2002). However, applying the frequentist approach still requires careful analysis and is susceptible to human bias. Moreover, when dealing with data sets consisting of more variables than the number of observations, the Bayesian approach often becomes a useful alternative (Koop 2017).

Indeed, a viable solution to this issue is transitioning from the frequentist approach to the Bayesian one, which generally is an efficient tool in forecasting commodity prices (Nurmakhanova 2020). In the Bayesian framework, a researcher starts from some prior knowledge or assumptions on estimated coefficients, which are then updated with the new information forming the posterior knowledge. Such an approach offers several advantages. Mathematically, it enables dealing with a higher number of explanatory variables than observations for each time series. Moreover, it closely resembles the real-life market scenarios, in which investors can continuously update their econometric models with the new information in each session, re-estimating coefficients accordingly (Koop 2017).

In other words, the Bayesian approach starts with an initial (prior) belief about the parameter of interest. As the new information becomes available, this belief is updated, leading to the posterior belief. Consequently, a value of the parameter of interest evolves over time as this new information emerges. It is worth noting that these considerations not only apply to the technical challenge of selecting explanatory variables for regression models but are also valid for more complex models (Koop 2017).

Notably, the combination of symbolic regression with Bayesian principles has not been extensively explored yet, despite both approaches being philosophically well-suited to address real market problems, as already described (Jin et al. 2019). Thus, the proposed combination of these two formalisms represents an intriguing endeavour. This can introduce a new econometric tool and contribute to the ongoing scientific discourse surrounding model uncertainty and variable selection. Surprisingly, limited attempts to integrate these formalisms have been made yet (Vazquez et al. 2022; Guimera et al. 2020; Jin et al. 2019; Regolin and Pozo 2005; Zhang 2000).

Nevertheless, it should be noted that Bayesian methods are not always computationally “cheap” in this context (Lan et al. 2022). Moreover, in economics or finance, symbolic regression has not yet been extensively applied. There are some studies on forecasting production or emission quotas, but no application to price forecasting (Yang et al. 2015a, 2015b). Symbolic regression itself, which is a well-known tool (Koza 1998; Sinha et al. 2015), relies heavily on evolutionary algorithms, especially genetic ones (Koza 1998; Bhattacharya et al. 2016; Sinha et al. 2015; Eiben and Smith 2015).

Interestingly, genetic algorithms have been used in various econometric models, and were claimed to be very useful (Claveria et al. 2022; Garcia and Kristjanpoller 2019; Claveria et al. 2016, 2017; Mostafa and El-Masry 2016; Aguilar-Rivera et al. 2015; Sermpinis et al. 2015; Sheta et al. 2013; Hasheminia and Niaki 2006). While widely popular in technical fields, such as engineering, and nature-oriented sciences, such as ecology and medicine (Dimoulkas et al. 2018; Klotz et al. 2017; Golafshani and Ashour 2016; Ceperic et al. 2014; Narotam et al. 2014; Sarradj and Geyer 2014), they have not yet been extensively applied in economics or finance, especially in the context of variable uncertainty, and particularly for forecasting commodity prices.

Indeed, if applied to economics and finance, it was rather as modelling, optimisation, or discovering the “true” equation over some “static” data set (Brabazon et al. 2020). The true forecasting aim, moreover, with (dynamic, temporal changing) time-series, was rarely tackled. As a result, these issues create an important research gap, which this paper aims to fill.

Additionally, in this paper, BSR is compared with other popular forecasting methods dealing with variable uncertainty. These include, for example, Bayesian-based model averaging methods, such as Bayesian Model Averaging and Dynamic Model Averaging (Belmonte and Koop 2014; Koop and Korobilis 2011; Onorante and Raftery 2016; Cross and Nguyen 2017), and shrinkage methods, such as LASSO regression, which resembles the ordinary least squares method, but with the optimisation performed over a penalized function (Steel 2020; Burnham and Anderson 2002). In particular, these methods are compared in the context of their ability to forecast commodity prices, as each of them has their own strengths and limitations in this context.

When undertaking this research, some hypotheses were also claimed. First, that combining symbolic regression with the Bayesian approach can lead to some improvement in forecasting performance compared to using each approach separately. Secondly, that the proposed novel method can outperform other currently developed methods, such as LASSO and RIDGE regressions, Dynamic Model Averaging, Bayesian Model Averaging, and common conventional approaches such as ARIMA models, etc., in terms of forecast accuracy. Thirdly, that the recursive implementation of the proposed algorithm, which aligns with the flow of information from real markets, can further enhance forecasting performance, as model coefficients are re-estimated and updated in each subsequent period (Zhao et al. 2021; Tashman 2000).

This paper is organised in the following way. The next section contains a short review on commodity price determinants and modelling. It also provides references for important and interesting reviews about the topics motivating the study and closely linked with the research described herein. The next section is devoted to a description of the applied data set. The next section briefly describes the BSR, benchmark models, forecast quality measures, and other methods applied in this research. The last sections present the obtained results and conclusions. The additional main advantage of this research is that a large number of commodities, and a large number of forecasting models suitable to deal with variable uncertainty issue, are estimated in a unified and consistent way and compared with each other, contrary to some more tailored research focusing on relatively few methods each and just some narrowed time-series usually covering different time spans. As a result, quite a wide insight over many methods is provided in this paper, and they are tested using many different commodities (time-series) at once in a unified way.

2. Literature Review

Forecasting commodity prices is a challenging but essential task (Drachal 2018b; Harvey et al. 2018; Arango et al. 2012; Byrne et al. 2013; Gargano and Timmermann 2014). There is an obvious practical need and a pure scientific interest in exploring novel econometric methods for this purpose (Herrera et al. 2019). However, despite numerous attempts, it remains difficult to propose an econometric method that consistently outperforms even simple methods, such as ARIMA models, or the naive method (i.e., the method in which the last observed value is taken as a one-step ahead forecast). Nevertheless, the ability to predict commodity prices is highly desirable for investors, policymakers, and governments. Obtaining a good forecast accuracy is indeed a common challenge in finance, and it raises further questions about the extent to which commodities prices are predictable at all (Wang et al. 2015a).

2.1. Forecasting Methods Challenges

In particular, the Bayesian symbolic regression (BSR) described by Jin et al. (2019) seems to be quite a promising forecasting tool. It starts from the assumption that an output function can be expressed as a linear combination of quite simple component functions. These functions are encoded (Weiss 2014) using symbolic trees (i.e., binary expression trees). Bayesian inference with the Markov chain Monte Carlo (MCMC) method is applied to describe the evolution of these trees structures. Jin et al. (2019) claimed that such a method leads to an improvement in the forecast accuracy and reduces complexity and computational issues.

Indeed, the conventional frequentist approach requires certain conditions to be met by the data set. For instance, the ordinary least squares method assumes the availability of enough observations to yield “reasonable” estimates of regression parameters. The solution is obtained by minimizing a specific objective function, requiring the existence and uniqueness of a solution. This process involves computing the Moore–Penrose pseudoinverse matrix, which requires certain matrices to be invertible (subject to specific restrictions). However, these methods become simply infeasible when the number of explanatory variables exceeds the number of observations in each of the considered time-series (Burnham and Anderson 2002).

Thus, conventional methods begin with a rigorous pre-selection process of explanatory variables, heavily reliant on a researcher’s subjective approach. Of course, a researcher is required to conduct a thorough literature review and carefully choose explanatory variables for an econometric model based on previous findings and conclusions. Then, the number of variables is constrained (Burnham and Anderson 2002), but this selection process is a crucial and challenging task.

Indeed, two significant challenges are common. First, the pre-selection of explanatory variables is influenced by the researcher’s subjective approach. Although researchers use their intuition and prior experience to strike a balance between preferences and objectivity, this remains a highly subjective aspect of any research and is naturally biased by human preferences. Therefore, seeking a more “automated” tool for this process is a very desirable aim. Secondly, in modern research, dealing with “big data” has become quite a norm, particularly in forecasting commodity prices (Zhang et al. 2023; Liu and Lv 2020). This means that even after conducting a rigorous literature review, a considerable number of potentially relevant explanatory variables still remain (Koop 2017). As a result, the conventional frequentist approach becomes inadequate. Indeed, in the context of forecasting commodity prices, if a researcher would like to incorporate all the explanatory variables identified through a thorough literature review (Kaya 2016), then the frequentist approach would still face some significant challenges.

However, another important challenge faced with real markets is determining the appropriate model structure even after the potentially important explanatory variables have been pre-selected. For example, researchers must decide whether to construct a multiple linear regression model or apply certain transformations to the variables. Another example is making a decision involving whether to consider linear models versus including powers or logarithms of variables to capture potential non-linear relationships. Unlike the common econometrics practice that seeks data stationarity, the purpose of these transformations is to account purely for possible non-linearities (Caginalp and DeSantis 2011).

A common approach to this issue is considering various models and averaging their results. However, a less explored method is symbolic regression (Koza 1998). This regression analysis automatically explores numerous mathematical expressions to find the “best fitting” model while balancing accuracy and simplicity to address overfitting and over-parametrisation issues. The key advantage of symbolic regression, in the context of the described problems, is its immunity to human bias. It provides an automatic algorithm that simultaneously handles variable selection and model specification, including variable transformations. To be more precise, symbolic regression starts with an initial set of model specifications and later expands or explores more complex models derived from this initial set. Evolutionary algorithms are employed to construct new models (Eiben and Smith 2015).

These algorithms begin with a “population” of models, which, similar to the Darwinian theory of evolution, “crossover” with each other. This process requires specific probabilities to be set up. For example, let f1 and f2 be functions representing two model specifications (i.e., two multiple regression functions). First, both f1 and f2 can slightly change their functional forms through “mutation” with a certain probability. Secondly, a new function can be created with a “crossover” probability by combining a part (e.g., the first few symbols) from function f1 with another part (e.g., the last few symbols) from function f2. Subsequently, the “population” of regression models is expanded with the modified f1 and the modified f2, and their “crossover child”. The most simple approach is to keep these two probabilities fixed throughout the process (Koza 1998).

Concerning symbolic regression, there is quite a limited number of studies in which this method would be applied to economic or financial forecasting, especially in a direct way to forecast commodity prices. Symbolic regression—in this field of science—has been used mostly in forecasting production (Yang et al. 2015b) or emission quotas (Yang et al. 2015a), and modelling energy consumption (Rueda et al. 2019a, 2019b), etc. Senkerik et al. (2017a, 2017b) applied a certain hybridisation of symbolic regression based on analytical programming and differential evolution to forecast exchange rates. Furthermore, some applications in macroeconomic modelling (i.e., unemployment, inflation, etc.) were made (Kronberger et al. 2011). Still, computational issues are an important obstacle when applying symbolic regression and genetic algorithms to certain data sets (Huang et al. 2020).

Orzechowski et al. (2018) provided an extensive benchmarking review of several genetic programming approaches to symbolic regression based on up-to-date machine learning methods (e.g., least-angle regression). They explored over 100 regression problems. In particular, they concluded that symbolic regression outperforms gradient boosting algorithms, despite its relatively high computational price. Their research has been continuously updated to include the newest improvements of algorithms (La Cava et al. 2021). Still, the evolution of processes in symbolic regression optimisation (i.e., the desirable genetic algorithm employed in symbolic regression) has been improved by several researchers (Landajuela et al. 2022; Zegklitz and Posik 2021; Kubalik et al. 2020; Hara et al. 2019). For instance, Haeri et al. (2017) proposed certain modifications to the mutation and crossover procedures (based on coefficients computed over the data set) in order to reduce bloat (i.e., uncontrollable growth of the average tree size in symbolic regression). These issues, as well as a concise review of the advantages and challenges of symbolic regression, are presented by Smits and Kotanchek (2005). Recently, Haider et al. (2023) continued improving symbolic regression algorithms, in particular by focusing on issues with the shape the regression functions and including prior knowledge about it.

In case of variable selection and model uncertainty problems, currently, the most extensively developed approaches are those involving the use of Bayesian methods. These methods are based on the assumption that among numerous potentially interesting models, there exists a “true” model that can be identified. Examples of such approaches are Bayesian Model Averaging, which has been found useful in macroeconomic modelling, and its extension, i.e., Dynamic Model Averaging (Steel 2020; Wang et al. 2017; Raftery et al. 2010). These Bayesian methods rely on model averaging techniques. Multiple regression models are constructed from a set of interesting, potentially important, variables, and each model is assigned a certain (posterior) probability. These probabilities are then used as weights in the model averaging procedure. The final forecast is a combination of forecasts obtained from individual models, resulting in an averaged forecast. There are arguments in favour of model averaging over simply selecting the model with the highest posterior probability (Baumeister and Kilian 2015; Wang et al. 2017). Moreover, some researchers argue that selecting a model with the highest posterior probability is not always the optimal solution, but, in certain conditions, the “median probability model” may perform better (Barbieri and Berger 2004).

While model averaging can be performed in the conventional frequentist approach (for example, using the Akaike Information Criterion as weights), it is still constrained by the limitations on the ratio between the number of variables and the number of observations, as already mentioned in the previous part of this paper. Other methods to deal with model uncertainty include stepwise regression, shrinkage methods (such as LASSO regression), extreme bounds analysis, s-values, general-to-specific modelling, the model confidence set approach, and the best subset regression (Steel 2020). However, the motivation behind the research described in this paper is rooted in the recognition that existing econometric methods used for forecasting commodities prices have both advantages and drawbacks, with no single method clearly superior to others. Moreover, the modern landscape for researchers and practitioners includes quite large and complex data sets. For instance, the FRED Monthly Database for Macroeconomic Research comprises over 150 time-series, necessitating specialised econometric methods beyond the conventional ones (FRED 2015).

Another desirable feature of a commodity price model is to be “flexible”. In particular, in the case of symbolic regression, such “dynamic” approaches are useful and can improve the forecasting performance. For instance, Wagner et al. (2007) already pointed out that dynamic (i.e., with a rolling window) estimations for symbolic regression can outperform static estimations because otherwise, in the case of a time-series, the changing environment issue is ignored. Secondly, they also considered forecast combination advantages over the simple selection of the best fitting solution. An improvement in forecasting with rolling windows was also noticed by Winkler et al. (2015a, 2015b). Furthermore, Lee (1999) advocated recursive computations for time-series modelling with symbolic regression. Besides that, in a more general context, Clark and McCracken (2009) advocated combining recursive and rolling forecasts when dealing with linear models. According to them, such a procedure might improve the forecast accuracy.

To sum up, the desired properties of an econometric model for commodity prices include the following features: the ability to handle a large number of variables on a theoretical basis; “adaptability”, meaning that model coefficients are continuously re-estimated (updated) as new market information becomes available; the ability to minimise the bias towards human decisions, as human subjectivity can influence model outcomes; and the ability to capture the time-varying importance of different explanatory variables (Huang et al. 2021). Indeed, addressing these objectives is crucial in developing a robust econometric approach that can effectively forecast commodities prices in the presence of complex and dynamic data environments (Chai et al. 2018; Yin et al. 2018; Zhao et al. 2017).

The last property can be briefly justified by a quick look at crude oil prices as an example. Prior to the 1980s, most models relied mostly on supply and demand factors to explain oil price movements. On the other hand, a well-documented empirical and theoretical factor that influences oil prices is the interest rate (Baumeister and Kilian 2015; Arango et al. 2012). However, since the 1990s, more attention has been given to the impact of exchange rates (Basher et al. 2012; Reboredo 2012; Chen and Chen 2007). This is because exchange rates can indirectly influence supply and demand forces. The appreciation or depreciation of an exchange rate can impact the real price paid by importers (and thus their demand) and affect the real profit of commodity exporters (and thus their production motivation).

Further, recognizing that the global economic landscape is continuously evolving and influenced by the process of globalisation, researchers began to focus on the importance of global economic activity (Wang et al. 2015b). Indeed, commodity markets are usually global markets with a limited number of significant producing countries and numerous consuming (importing) countries. As a result, changes in the global economic activity can significantly impact demand forces, and should be taken into account in a modelling framework.

Furthermore, since the 2000s, researchers have focused on understanding the intricate links between futures and spot prices. Some have found that factors such as fluctuations in open interest (i.e., the total number of outstanding options or futures contracts that have not yet been settled) can serve as better proxies for the futures market than simply using futures prices (Hong and Yogo 2012). This has led to a growing interest in exploring the relationship between a given commodity price and various stock market indices. Stress market indices (for example, the VIX index) have also been found to be useful in this context. Additionally, policy uncertainty also began to be considered as an important commodity prices driver (Byun 2017; Chen et al. 2014; Gargano and Timmermann 2014; Arslan-Ayaydin and Khagleeva 2013).

Consequently, in the example of the oil market, modelling data before the 1980s require more emphasis on demand and supply variables. In the 1990s, more variables representing fluctuations in exchange rates should be included, and after the 2000s, additional variables from the stock markets should be considered. In other words, the state-space of the model should be allowed to vary in time, in order to account for the changing dynamics of the commodity market (Nonejad 2019; Wang et al. 2017; Arouri et al. 2010; Cross and Nguyen 2017; Drachal 2016).

2.2. Crude Oil

The first group of oil price determinants is strictly connected to the stock markets. Several papers pointed out a link between exchange rates and the demand for oil: a change in a currency’s value in comparison with a currency in which oil is denominated affects the demand positively (in the same direction). Currency appreciation increases the purchasing power, and as a consequence, decreases the relative price of oil (Bal and Rath 2015; Reboredo et al. 2014; Hartley and Medlock 2014; Aloui et al. 2013a, 2013b; Uddin et al. 2013; Tiwari et al. 2013; Akram 2009). This link has been confirmed for emerging markets as well as for developed markets (Chen and Chen 2007; Wang et al. 2004). Xu et al. (2019) found that this impact began especially in the early 2000s, and, moreover, the relationship is non-linear.

Byrne et al. (2013) analysed the role of demand and supply in determining oil prices, while other studies examined the connection between export in developed countries (Riggi and Venditti 2015) and policy uncertainty (Andreasson et al. 2016; Bekiros et al. 2015). Uncertainty shocks hit the real side of an economy, decreasing production and investment (Bloom 2009), which in turn negatively affects commodity prices. Haigh (2018) analysed fundamentals and concluded that in the oil market, supply forces drive prices during geopolitical tensions, but during economic crises demand forces dominate. Ghalayini (2017) concluded that oil inventories impact the short-term oil prices. However, in the long-term the impact of demand, supply, the exchange rate, and speculation in the futures market is also important.

The effect of gross domestic product, stock market activity, and the volatility of the stock market on oil prices was also analysed in the literature (Basher et al. 2012; Arouri et al. 2011; Bernabe et al. 2004; Yousefi and Wirjanto 2004). There is a clear correlation between economic growth and the growth in demand for oil. In recent years, the emerging markets were those where the demand for crude oil grew most rapidly (Basher et al. 2012). Additionally, Mensi et al. (2013) described the process of shock and volatility transmission between various markets in the globalised economy, finding the S&P’s index significance in oil price prediction. A shock (e.g., panic, optimism) in a given market, in this case a stock market, can be easily transferred to a different market, say the commodities market.

Du and He (2015) also found a relationship between the volatility of stock markets and the oil market, similarly to Smiech and Papiez (2013), who noted such a link between exchange rates, stock market volatility, and fossil fuels. Recently, the role of oil futures markets’ financialisaton (Duc Huynh et al. 2020) and of speculative pressures has been discussed (Diaz-Rainey et al. 2017; Liu et al. 2016; Yin and Yang 2016; Kilian and Murphy 2014; Fattouh and Scaramozzino 2011; Hamilton 2009). Financialisation implies a growing role for treating commodities and their derivatives as investment assets (UNCTAD 2012). The investigated mechanism would be the following: an increase (or decrease) in the speculative demand would affect commodity prices similarly to changes in the “regular” demand. Sometimes, the level of inventories was taken as a proxy for the pressure on the market (Hamilton 2009), yet the results were rather ambiguous (Kim et al. 2017). The very role of inventories might be twofold: they might serve as hedging instruments, used in order to decrease the risk in an investment portfolio through its diversification, or as a speculative tool to achieve gains (Irwin et al. 2009). It has been debated how strongly the financialisation of the oil futures market influenced the commodity’s spot price, albeit without yet reaching clear results (Carmona 2015; Fattouh et al. 2013).

It has also been pointed out that oil prices have been strongly affected by the demand growth in rapidly developing Asian countries, most notably by the change in China’s character from a net petroleum exporter until 1992 to the world’s top importer in 2019, surpassing the U.S. in 2017 (EIA 2020; Killian and Hicks 2013; Kaufmann 2011; Li and Leung 2011). For example, Wang and Sun (2017) concluded that economic activity is the most significant factor driver of oil prices compared with other factors. New emerging markets boost the demand for oil further, and, consequently, contribute to enhancing the price growth pressure. Abd Elaziz et al. (2020) obtained promising results in their oil price forecasting model, employing 10 determinants of the commodity’s prices: exchange rates (denominated to the U.S. dollar) of the Canadian dollar, Euro, and Chinese yuan, as well as coal, natural gas, copper, gold, silver, iron, and lagged oil prices. There was a clear positive correlation between oil prices and all other commodities (the strongest being for copper and iron: 0.92), while for exchange rates the correlation was negative. In this case, the most important correlation was found between the oil price and the Canadian dollar exchange rate (−0.75).

2.3. Natural Gas

The natural gas market is much more segmented than the markets for oil or coal (Mohammadi 2011) and is not as globalised. While comparing different countries, one must remember that geographical location, deregulation policies, technological advances, and trade agreements all play a crucial role in determining gas prices (Olsen et al. 2015). These factors, increasing transportation and transaction costs, can be impediments to arbitrage, thus restricting providing homogenous goods, in this case natural oil, at a particular price, according to the law of one price.

Due to this commodity’s characteristics, for example, requirements for transport infrastructure (e.g., pipelines), access to it, and its prices strongly depend on geographical and infrastructural factors. Having said that, it is not at all surprising that differences between states can be large. Ji et al. (2014) observed that while North American gas prices depend on the condition of the global economy, gas prices in Europe and Asia are affected more by crude oil prices. According to Ji et al. (2014), Europe and Asia, as major gas consumers, are characterised by a rigid demand for the commodity, so global economic activity has a relatively small impact on their gas prices. At the same time, these gas markets are relatively immature compared to America. Namely, their pricing mechanisms are based to a much greater extent on oil prices, and are less determined by the internal demand/supply balance.

Some general determinants in the short term include temperature and supply shocks, while in the long term these include coal and long-term oil prices (Nick and Thoenes 2014; Mu 2007), climate uncertainty (Bistline 2014), and even the release of gas storage reports (Rubaszek and Uddin 2020; Linn and Zhu 2004). While temperature affects the amount of gas consumption and, thus, the demand for it, coal (discussed further herein) can be described as the substitute for this commodity (Obadi and Korcek 2020); the gas storage reports can be a determinant due to the previously discussed financialisation of commodity markets. Investors adjust their decisions to the market situation, actualised with the accessible information. Indeed, Chiou-Wei et al. (2020) found that underground storage is an important driver of natural gas prices in the U.S. (as well as the weather, oil price, and macroeconomic news).

Despite the fact that in certain conditions natural gas may be treated as a substitute to crude oil, their linkage is still sometimes found to be unclear (Atil et al. 2014; Ji et al. 2014; Brown and Yucel 2008). Here again, as in the case of oil price determinants, the changing position of the Asian economies is an important factor, affecting gas prices through their influence on the global supply/demand balance (LaRose 2014; Cornelius and Story 2007). According to a general relationship, economic growth in Asian countries was followed by increased energy consumption. As LaRose (2014) pointed out, estimated forecasts give reason to believe that energy demand in Asia will double in the next 50 years.

2.4. Coal

The basic characteristics of the coal market are the price of the commodity and its quality (Li et al. 2014). Furthermore, an important role is played by demand for energy and prices of other fuels (LaRose 2014; Dong et al. 2010). Of course, when the price of substitute goods (other energy sources) falls, the demand for a given commodity based on the past price will also drop, and the price will have to adjust. Regnier (2007) found that coal prices are much less volatile than the price of the other energy commodities, and Yang et al. (2012) pointed out that much of the coal price volatility and its surges have been caused by China and its decision to decontrol the commodity’s prices; uncontrolled prices then had to adjust to the value reflecting production costs and market conditions.

In contrast to past market liberalisations in many countries, the process was not sudden, but more gradual, starting in the early 2000s. As Yang et al. (2012) noted, one of the first steps towards coal market liberalisation in China was allowing producers to sell the excess output on a free market, the initial result of which was coal price increases and greater volatility; from 2003 to 2010, the price of coal more than tripled. Arora and Tanner (2013) found some evidence confirming Hotelling’s hypothesis (Hotelling 1931) that non-renewable commodities are influenced by interest rates. According to Hotelling (1931), in an efficient market, owners of non-renewable resources will provide a supply only if it will be profitable in comparison with financial instruments yielding their interest rate.

Similar general observations were made in the case of energy commodities’ dependency on economic growth and size of labour force (Dogan 2016; Wang et al. 2015b; Apergis and Payne 2010), and on policy uncertainty (Wang et al. 2015a). In the work of Alameer et al. (2020), the following factors proved to be important determinants of coal prices: copper, natural gas, iron, silver, crude oil, and gold prices, as well as the Australian dollar, Indian rupee, and Chinese yuan exchange rates (denominated to the U.S. dollar). The Pearson correlation between the other commodities’ prices and coal prices was positive and rather high (more than 0.80 on average), while for the U.S. dollar to Indian rupee exchange rates it was weaker (0.470), and for the U.S. dollar to the Australian dollar and the U.S. dollar to Chinese yuan it was negative (−0.666 and −0.283, respectively).

2.5. Metals

Of course, fundamentals are agreed to play the major role in driving prices of metal commodities. However, non-fundamental factors can be important, especially in the short-term horizon (Guzman and Silva 2018). Similar to previously discussed commodities, metals prices are also significantly affected by the exchange rates (Chen et al. 2010). For example, Ciner (2017) confirmed that South African rand exchange rates can be used as a predictor of palladium, platinum, and silver prices. It is of note that South Africa is one of the leading producers of these resources. According to Prates (2007), especially in the early 2000s, there was a strong correlation between commodity prices and the global macroeconomic conditions. Chen (2016) found that the stock prices of resource-based companies improve metal price forecasting. On the other hand, Kaur and Dhiman (2017) stated that metal stock returns have a limited impact on metal commodities’ prices. Brown and Hardy (2019) focused on the Chilean exchange rate and its ability to predict the prices of non-ferrous metals. Pincheira and Hardy (2021) concluded that the exchange rates of some commodity exporting countries can be successfully used in forecasting the aluminium price.

Furthermore, in the case of metal commodities, some attempts have been made to predict the commodity prices based on inventories quotas (Geman and Smith 2013). On the other hand, financialisation issues are not commonly agreed for metal markets (Mayer et al. 2019). Weng et al. (2018) employed several financial factors to build iron ore forecasts, while in a more recent study, Ewees et al. (2020) confirmed the following factors to be good predictors of iron ore prices: crude oil, gold, scrap, silver, copper, and lagged iron ore prices; Australian dollar to U.S. dollar and Chinese yuan to U.S. dollar exchange rates; and inflation rates in the U.S. and China. The correlation with other commodity prices was strong and positive (with the highest value for crude oil of 0.919), while for exchange and inflation rates, correlations were rather weaker and negative. For example, the correlation between the U.S. inflation rate and the iron ore price was −0.297. The authors justified the choice of variables corresponding to Australian and Chinese economic conditions with the fact that Australia is one of the biggest producers and exporters of iron ore, and China is the biggest importer.

Similarly, Alameer et al. (2019a) used the Chilean peso, Peruvian sol, and Chinese yuan exchange rates; the inflation rates of the U.S. and China; and the prices of gold, silver, iron, oil, and lagged copper prices in copper price forecasting. Alameer et al. (2019b) provided a similar list of gold price determinants; instead of Peruvian sol and Chilean peso exchange rates, they took South African rand and Indian rupee exchange rates (denominated to the U.S. dollar), and, of course, removed gold as a predictor (since it was a dependent variable). At the same time, Yuan et al. (2020) successfully applied the opinion score based on web scraping technology as one of the predictors of gold prices. An algorithm using text mining methods was employed to retrieve words and phrases describing market sentiments and an opinion score variable was created. Its application enabled reducing the mean absolute percentage error for predictions significantly, and thus improved gold price forecasts.

Gangopadhyay et al. (2016) used the stock market index, exchange rate, U.S. bond rates, oil prices, and the consumer price index to model gold prices in India. Buncic and Moretto (2015) analysed cooper prices based on numerous potential determinants with Dynamic Model Averaging. Geopolitical risk was also found as an important factor in predicting, for example, gold prices. Banerjee et al. (2019) utilised the geopolitical risk index based on political events highlighted in the major newspapers around the world.

2.6. Agricultural Commodities

Agricultural products’ prices are, of course, most of all determined by supply and demand. The latter, as Rezitis and Sassi (2013) noted, is strongly dependent on factors such as population growth, GDP growth, and changes in consumption. The former, on the other hand, is determined by weather and climate conditions, harvest areas, and the cost of fertilizers. Apart from these two groups of variables, crude oil prices and exchange rates may serve as predictors of agricultural goods prices (Fernandez-Diaz and Morley 2019; Osathanunkul et al. 2018; Nazlioglu and Soytas 2012).

The influence of oil prices on agricultural product prices might be twofold; first, higher oil prices result in production cost surges. Second, more expensive crude oil means a higher demand for biofuels. As Sukcharoen and Leatham (2018) have suggested, these correlations are particularly important during economic downturns, yet not in times of prosperity. Chen et al. (2012), as well as Thiyagarajan et al. (2015), added stock market indices to this list, and Ribeiro and Oliveira (2011) noted the significance of stock quotas and convenience yields in forecasting commodity price variations. Similarly, Schewe et al. (2017) identified storage dynamics as crucial in modelling global wheat prices. This factor was also identified by Hamid and Shabri (2017) for palm oil (amongst production quotas and substitute commodity prices). Alam and Gilbert (2017) emphasised the role of global economic conditions, monetary policy, and the U.S. dollar exchange rates, while Hatzenbuehler et al. (2016) provided an analysis supporting a claim regarding the importance of policy shifts.

Frankel and Rose (2010) proposed a model of agricultural goods prices combining three important groups of their determinants, namely, global economic activity, speculation, and monetary policy conditions. The role of economic growth and its influence on demand increase has been discussed previously, as well as the impact of speculation on commodities prices. With respect to monetary policy conditions, they noted that low interest rates, apart from having an effect (also previously discussed) on providing supply (high interest rates diminish supply, and, consequently, increased prices), have a converse effect of high interest rates on the cost of keeping inventories. This contributes to decreasing demand and prices. Such effects were also discussed by Ouyang and Zhang (2020), Etienne et al. (2018), and Algieri et al. (2017).

Borychowski and Czyzewski (2015) added one important factor, namely, conditions of trade policy, to some of the aforementioned determinants of food supply. They noted that export bans, tariffs, and export taxes decrease the supply and restrict providing an optimal amount of agricultural commodities beyond national borders. This, consequently, results in higher prices. Based on Finland’s case, Irz et al. (2013) suggested that the most important determinant of food prices are farm prices, followed by wages in food retail, and then energy prices, the latter playing only a limited role.

2.7. General Remarks on Commodity Price Predictors

In general, certain common predictors for various commodities can be identified. Apart from the above-mentioned exchange rates, which were also analysed in the context of the overall commodity market (Pincheira-Brown et al. 2022; Souza et al. 2021; Ayres et al. 2020; Zhang et al. 2016), and financial factors, it was found that crude oil and gold prices might enable good forecasts of other commodities’ prices (Lubbers and Posch 2016; Chen 2015; Al-Qudsi 2010). As previously discussed, it seems that interest rates can also serve as commodity price predictors (Byrne et al. 2013; Arango et al. 2012). Gargano and Timmermann (2014) provided a broad study, according to which the most important predictors were the investment-to-capital ratio and the growth of industrial production. Ahumada and Cornejo (2015) added supply and demand factors (in particular, with reference to emerging markets such as China), economic growth, and monetary policies. Steermer (2018) argued that in the long term, demand forces play a more important role than supply shocks. This was also confirmed by Jacks and Stuermer (2020). Other predictors common for various commodities are the U.S. inflation rate, world industrial production, and the world stock index (Kagraoka 2016). Furthermore, financialisation issues were discussed in the context of various commodities (Fishe and Smith 2019; Yan and Yuan 2019). Moreover, the recent economic growth of several emerging economies resulted in increasing the demand for commodities (Labys 2006). Tan and Ma (2017) analysed various commodities and confirmed that macroeconomic uncertainty significantly impacts their prices.

The above considerations are summarised in Table 1.

Table 1.

Most important determinants of commodity prices (except supply, demand, and stocks).

3. Data

Monthly data starting in January 1988 and ending in August 2021 were used. Such a time span was chosen due to data availability. The data frequency was selected in a way to satisfactorily capture changes on the market but to exclude some short-term fluctuations (e.g., due to speculative activities). On the other hand, a monthly frequency should allow us to include as explanatory variables some macro data, which are published in quite low frequencies (Alquist et al. 2013).

Commodity prices were taken from The World Bank (2022) and transformed to logarithmic differences. In particular, the logarithmic difference of the variable Yt was defined as log(Yt) − log(Yt−1). Such a transformation is quite standard and common in econometric analysis. In the case of symbolic regression, data transformation is not obligatory. However, some benchmark models require, for example, stationary time-series. Secondly, even if not necessary, transformed data can often result in a better forecast accuracy of the final models (Coulombe et al. 2021; Medeiros et al. 2019; Drachal 2018a). The widest basket of commodities was attempted to be collected. However, due to missing observations, etc., 56 time-series of commodities prices were finally considered (monthly averages of spot prices). They are listed in Table A1 in Appendix A. A detailed description of the time-series can be found in the original source (The World Bank 2022). The set of explanatory variables was constructed in line with the already presented literature review. Furthermore, similar variables were used by Guidolin and Pedio (2021), Salisu et al. (2019), Gargano and Timmermann (2014), and Juvenal and Petrella (2014). The full list is presented in Table 2. In total, 39 explanatory variables were considered.

Table 2.

The list of explanatory variables.

In particular, the dividend-to-price ratio was taken as the difference between the logarithm of U.S. stock dividends (Schiller 2000, 2022) and the logarithm of U.S. stock prices, i.e., the S&P 500 Index (Stooq 2022). Before taking logarithms, dividends were aggregated to 12-month moving sums. The price-to-earnings ratio was taken from Schiller (2000, 2022). It was taken as Cyclically Adjusted Price Earnings Ratio P/E10 (or CAPE). It is based on the average inflation-adjusted earnings from the previous 10 years.

The short-term interest rate was taken as the U.S. 3-month treasury bill rate on the secondary market (FRED 2022). The long-term interest rate was measured using the 10-year government bond yields for the U.S. and the Euro area (FRED 2022; OECD 2022). The term spread was measured as the difference between the U.S. long-term and U.S. short-term interest rates. The default return spread was computed as the difference between the Moody’s seasoned Aaa corporate bond yield, based on bonds with maturities of 20 years and above (FRED 2022; Moody’s 2022), and the short-term interest rate (understood as above).

Inflation was measured using the U.S. Consumer Price Index for all urban consumers and the U.S. Producer Price Index (FRED 2022). Following, for instance, Nonejad (2020), both of these indices can be important explanatory variables. They were transformed into logarithmic differences. Additionally, the U.S. average hourly earnings of production and nonsupervisory employees were taken (FRED 2022). They were also transformed into logarithmic differences.

U.S. money stocks (both real M1 and real M2, deflated by the U.S. Consumer Price Index) were also taken (FRED 2022). These time-series were transformed into logarithmic differences.

Industrial production growth was taken and measured using logarithmic differences of the U.S. industrial production (FRED 2022). Furthermore, the U.S. unemployment rate was taken (FRED 2022). The economic growth was measured using the commonly used (if monthly frequency is desired) Kilian’s Index of Global Real Economic Activity (FRED 2022; Kilian 2009, 2019; Kilian and Zhou 2018). Despite some recent concerns, this index is, indeed, a valid and useful measure (Funashima 2020).

Following, for instance, Cuaresma et al. (2018, 2021), leading indicators were used (CLI, amplitude adjusted, except for China, for which the normalised index was taken due to data availability). The U.S., G7, Euro area, and China were considered (OECD 2022).

The trade balance (i.e., exports less imports) for the U.S. was computed in U.S. dollars (United Nations Statistics Division 2022). Due to the existence of seasonal patterns, 12-month differences were taken. Furthermore, the share of BRIC (Brazil, Russia, India, and China) countries’ trade in the total global trade was computed (United Nations Statistics Division 2022), as these countries are important players on commodities markets (Ghoshray and Pundit 2021). Similarly, 12-month differences were taken.

Exchange rates impacts were measured using real effective exchange rates based on the manufacturing Consumer Price Index for Australia, Canada, India, and the U.S. Furthermore, the Australian dollar to U.S. dollar exchange rate was taken, as well as the Canadian dollar to U.S. dollar and Indian rupee to U.S. dollar exchange rates (Stooq 2022; OECD 2022; FRED 2022). The selection of countries was made with a focus on the largest exporters and importers of commodities and to include so-called “commodities currencies”. Indeed, according to the WTO (2022), amongst the largest commodities exporters and importers in 2020 and 2019 were Australia, Brazil, Canada, China, Germany, India, Japan, Russia, the United Arab Emirates, and the U.S. A similar set of variables was used by Cuaresma et al. (2018, 2021), Gargano and Timmermann (2014), Chen et al. (2010), Clements and Fry (2008), and Cashin et al. (2004). These variables were transformed into logarithmic differences.

Open interest data were taken from the Commodity Futures Trading Commission (2022). Futures-only based data were used. This data set required some cleaning, for instance, due to overlapping commodities codes in some cases. Secondly, contracts are listed in various quantities, which needs to be considered in the computation of the dollar open interest representing the capital engaged. Finally, open interest data must be consistent with price time-series data (The World Bank 2022; Hong and Yogo 2012; Shilling 1996). In particular, each contract was aggregated to its monthly average, and then the sum of contracts of all types in a month was taken. The obtained time-series were transformed into logarithmic differences. Furthermore, Working’s dollar T-index was also computed (Working 1960). This index measures the excess of speculative and hedging positions (Buyuksahin and Robe 2014). In particular, if CL > CS, where CL denotes long positions of commercial traders and CS denotes short positions of commercial traders, then T = 1 + NCS/(CL + CS), where NCS denotes short positions of non-commercial traders. In the opposite case, T = 1 + NCL/(CL + CS), where NCL denotes long positions of non-commercial traders. Non-commercial traders are perceived as a source of speculation, whereas commercial ones are perceived as a source of hedging activities.

Market stress was measured using the VXO index (CBOE 2022; FRED 2022). This index is a measure of implied volatility computed with the 30-day S&P 100 index at-the-money options. The currently more popular VIX index was not chosen because this new volatility index has only been reported and computed since 1990. Additionally, the global Geopolitical Risk Index (The Benchmark GPR Index) was taken. It is based on counting the occurrence of words related to geopolitical tensions in 11 leading newspapers (Caldara and Iacoviello 2022a, 2022b).

The overall behaviour of prices of a wide basket of various commodities was proxied using the S&P GSCI Commodity Total Return Index (Bloomberg 2022). It was transformed into logarithmic differences. Indeed, this index is a common measure of general commodity price movements in the world economy. It is based on the principal physical commodity futures contracts. In other words, the returns are calculated on fully collateralised contracts with full reinvestment (i.e., ones in which the buyers and sellers of a contract make an additional investment in the underlying asset with a value equal to the futures price). It is also a broadly diversified (across the spectrum of commodities) composite index of commodity sector returns. As a result, it aims to represent realizable returns attainable in the commodities markets. In particular, it consists of 24 commodities: energy products, industrial metals, agricultural products, livestock products, and precious metals (Downes and Goodman 2018).

Stock price movements were measured using the S&P 500 Index (Stooq 2022). Additionally, in order to capture the developing economies’ stock markets, the Hang Seng Index was taken before December 1990, and the Shanghai Composite Index afterwards (Stooq 2022). Indeed, for instance, China become the biggest oil importer in 2017, overtaking the position of the U.S., and the trend is going to continue (EIA 2022; Wang et al. 2018). Furthermore, the MSCI stock market indices were taken (MSCI 2022). In particular, the MSCI WORLD for developed markets, the MSCI G7 INDEX, and the MSCI EU were taken. Furthermore, the MSCI EM for emerging markets was taken. All stock market indices were transformed into logarithmic differences.

If not stated otherwise already, time-series were collected to represent the last observed monthly value, as this can lead to a better forecast accuracy than, for example, the use of the mean values from a given month. Furthermore, if time-series follow a random walk, then, by construction, the aggregated time-series derived from the original one (e.g., averages or sums) may not follow a random walk. These features were studied in detail in terms of oil prices by Benmoussa et al. (2020).

Finally, following Koop and Korobilis (2013), the variables were standardised. In other words, before inserting them into the modelling scheme, the mean was subtracted and the outcome was divided by the standard deviation. These statistics were estimated on the basis of the first 100 observations. As a result, the transformed time-series were approximately stationary, but forward-looking bias was omitted. Moreover, the obtained time-series had similar magnitudes, which is an important and helpful feature improving numerical estimations.

The descriptive statistics are presented in Table A2 in Appendix A. Augmented Dickey–Fuller (ADF), Phillips–Perron (PP), and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) stationarity tests outcomes are presented in Table A3 in Appendix A. Assuming a 10% significance level (but for the majority of variables even 5% would be enough), most variables, with few exceptions, can be assumed to be stationary. Nevertheless, for example, gea is stationary by construction. This observed discrepancy is because, herein, the time-series covering a long-term period was trimmed to the shortened period of the analysis.

4. Methodology

Numerical computations were performed in R (R Core Team 2018) and Python (Van Rossum and Drake 1995). Furthermore, a few packages and libraries were very useful in this regard, i.e., “NumPy”, “pandas”, and “SciPy” (Harris et al. 2020; The Pandas Development Team 2020; McKinney 2010).

4.1. Bayesian Symbolic Regression

Bayesian symbolic regression (BSR) was introduced by Jin et al. (2019) and implemented by Jin (2021). This novel approach to symbolic regression aims to overcome certain difficulties (Korns 2011) with incorporating prior knowledge to genetic programming, deals with complexity issues in outcomes expressions, and improves interpretability of the outcomes

Herein, two approaches were applied. First, the estimation of parameters (for example, regression coefficients) was performed over some in-sample period (i.e., first 100 observations), kept fixed, and then applied to out-of-sample forecasting. Second, the in-sample period was recursively expanded, and in each step a forecast for just one period ahead was made. In other words, BSR forecast for the period t + 1 was estimated based on the explanatory variables data set available up to period t. Next, BSR forecast for the period t + 2 was estimated based on the data set expanded with the new data, i.e., the one available up to the period t + 1, etc. Such a recursive implementation resembles the real-life market situation and perspective.

The second crucial aspect of BSR involves enhancing the understandability of the derived expressions. To achieve this goal, BSR strives to capture succinct yet informative signals, assuming their structure to be both linear and additive. The prior distributions describing these components are designed to control the complexity of the obtained expressions, which are represented using symbolic trees (Weiss 2014).

At the heart of BSR lies the utilisation of Markov chain Monte Carlo (MCMC) sampling. This technique is employed to draw samples of these symbolic trees from the posterior distribution. Despite its computational intensity, Jin et al. (2019) demonstrated that this approach can even enhance memory utilisation in comparison with the standard genetic programming methods for symbolic regression. Furthermore, simulations conducted by Jin et al. (2019) showed robustness of BSR across various parameter settings. Notably, the method exhibited an ability to enhance predictive accuracy when contrasted with conventional symbolic regression algorithms, specifically those founded on genetic programming principles.

Herein, only a short outlook on BSR is provided. The full description can be found in the original paper (Jin et al. 2019). Let yt be the forecasted time series, i.e., the given commodity price (possibly transformed as described in the previous section). Let x1,t, …, xn,t be the explanatory time series (also possibly transformed). Then, it is assumed that yt = β0 + β1 * f1(x1,1,t−1, …, x1,i,t−1) + … + βk * fk(xk,1,t−1, …, xk,i,t−1), with xi,j,t standing for those of explanatory variables (out of n possible ones) which are present in the i-th component expression, i.e., fi, with j = {1, …, n} and i = {1, …, k}. The number of components, k, is fixed and must be set up during the initial stage. Coefficients βi are estimated with the ordinary least squares method. Jin et al. (2019) claimed that higher values of k lead to better forecast accuracy, but that this gain diminishes when k becomes large enough.

Each component expression fi is represented by the symbolic tree constructed from operators (such as +, *, and 1/x, etc.). Nicolau and Agapitos (2021) and Keijzer (2004) claimed that the operator lt(x) = a * x + b, with a and b being some real numbers, can improve the set of construable expressions in a noticeable manner. Indeed, the set of operators must be specified during the initial stage of BSR. For this purpose, 6 sets of operators were considered, denoted by F = {1, …, 6}, and k = 10 (i.e., k = 10 linear components, denoted by K = {1, …, 10}) were considered. For each commodity, models for all combinations of F and K were estimated over the data consisting of first 100 observations (i.e., the in-sample period). Next, the combination minimising root-mean-square error (RMSE) was selected for further estimations. For robustness, the mean absolute error (MAE) and mean absolute scaled error (MASE) were analysed (Hyndman and Koehler 2006), but usually the conclusions were the same as those based on RMSE.

In particular, F = 1 represents the set consisting of unary neg(xi,t) = −xi,t and binary add(xi,t,xj,t) = xi,t + xj,t operators. F = 2 expands F = 1 with unary square(xi,t) = (xi,t)2. F = 3 expands F = 1 with unary 12 periods back moving average, i.e., ma12(xi,t) = (xi,t + … + xi,t−11)/12, and unary lag(xi,t) = xi,t−1. F = 4 expands F = 2 with binary mul(xi,t,xj,t) = xi,t * xj,t. F = 5 expands F = 4 with unary inv(xi,t) = 1/xi,t, unary cubic(xi,t) = (xi,t)3, unary sqrt(xi,t) = √xi,t, unary log(xi,t) = ln(|xi,t|), unary ma12, and unary lag. F = 6 expands F = 1 with the unary operator lt(xi,t) = a * xi,t + b, with a and b being some real numbers. For example, Yang et al. (2015b) concluded that narrowing to just simple operators can save computational time, but does not weaken the power of symbolic regression, keeping it effective enough in discovering useful model structures. On the other hand, it can be interesting to consider operators representing some non-linear structures specific to financial and economic time-series.

The Bayesian approach is employed by considering the Bayesian inference over the symbolic trees. In particular, the Bayesian regression tree models of Chipman et al. (1998a, 1998b) were implemented, and the methods of Hastie and Tibshirani (2000). A symbolic tree is represented by g( · ; T, M, ϴ), with g being some function as above, i.e., g = f1 + … + fk. T denotes the set of nodes, M denotes their features, and ϴ denotes their parameters. Initially, uniform priors are taken as they correspond to equal probabilities of selecting possible operators and node features. A node feature determines whether the given node is a terminal one, extends to a one, single, or child node, or splits into some two child nodes. The probability that a given node is terminal is 1 – α(1 + d)−β, with α and β being some parameters and d being the depth of the node (Jin et al. 2019). Following Jin et al. (2019), α = 0.4 and β = −1 were used. High values of β control depth of trees and α controls the symmetric shape of the distribution. The priors for a and b of operators lt were Gaussian and centred around the identity function (Jin et al. 2019).

The prior–posterior inferences in BSR model were performed with the Metropolis–Hastings algorithm (Green 1995; Hastings 1970; Metropolis et al. 1953). It was implemented in such a way that the transition structure penalised high complexity of the outcomes. Following Jin et al. (2019), M = 50 iterations were performed, as the simulations based on various data sets suggest that this is large enough to stabilize the structure of the sought expression (Chen et al. 2016).

Additionally, model averaging schemes were employed. In the basic BSR version, the outcome is taken from the last iteration. However, let y1, …, y50 be the forecasts obtained from M = 50 iterations. Let w1, …, w50 be some weights (such that w1 + … + w50 = 1) ascribed to each of these forecasts. The weighted average forecast is defined as w1 * y1 + … + w50 * y50. Following Steel (2020) and Stock and Watson (2004), two schemes were considered. The first one considers weights inversely proportional to the mean-squared errors (MSEs) of the component models. The second considers equal weights for the component models. In order to sum up to 1, the initial weights were normalised (i.e., divided by the sum of all the individual weights).

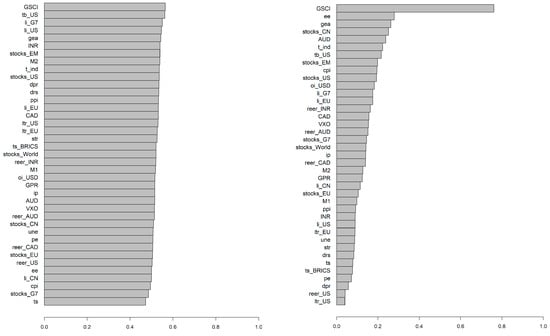

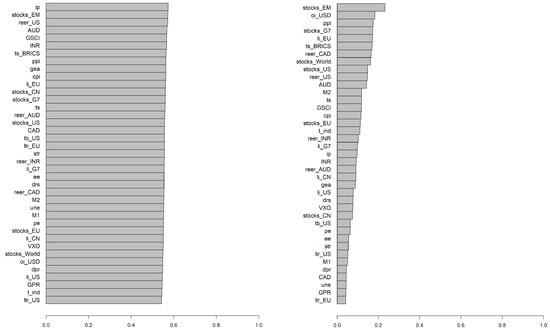

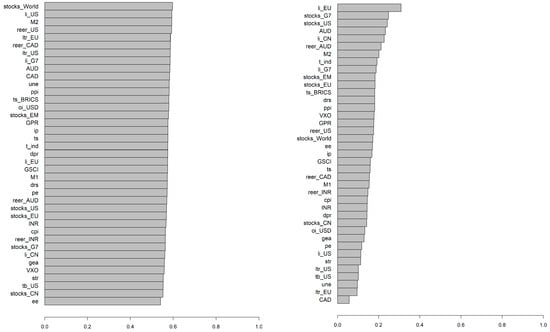

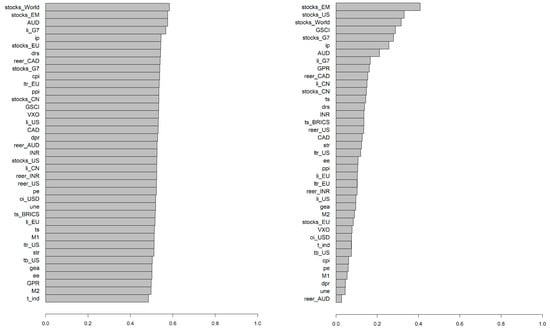

The weights constructed in the above way, except forecasting, can be used to construct relative variable importance (RVI). In particular, after the mentioned rescaling, they sum up to 1. One can sum up the weights of exactly those models which contain a given explanatory variable. Such a sum defines the RVI of this variable. It can be used as some rough measure of the importance of a variable as the commodity price predictor (Burnham and Anderson 2002). Of course, RVI is a number between 0 and 1 by construction. In case of model selection schemes, one can simply indicate just whether a given explanatory variable is present or is not present in the selected individual model. Moreover, weighted average coefficients can be constructed. In particular, if a model averaging scheme would be narrowed only to linear component models (this is for a given explanatory variable to be used in all component models in exactly the same functional form), then w1 * ϴ1 + … + w50 * ϴ50 can be considered, with ϴi being the regression coefficient corresponding to the given explanatory variable in the i-th component model (Drachal 2020; Banner and Higgs 2016; Cade 2015; Burnham and Anderson 2002).

4.2. Benchmark Models

BSR forecasts were compared with some alternative models. Of course, the standard symbolic regression with genetic programming (Stephens 2021; Koza 1998) was employed. Due to computational issues, the population size was taken as 50 and generations were reduced to 10. Earlier pre-simulations with some selected commodities’ time-series indicated that these numbers were high enough and there was no significant gain in forecast accuracy from taking higher values. On the other hand, lower values reduce the computational time. The cross-over probability 0.95 was taken; subtree, hoist, and point mutations probabilities were set up at 0.01. RMSE was applied as a metric. All in all, these are quite standard and common specifications (Stephens 2021; Hassanat et al. 2019; Fuad and Hussain 2015). The set of operators indicated by BSR model was considered for each of the commodity. (Indeed, an estimation of the recursive BSR model for the applied data took approximately 1.6 h on average; whereas, for example, Dynamic Model Averaging with Occam window for the same data took approximately 20 min only.)

Bayesian model combination schemes were also considered (Raftery et al. 2010). In particular, Dynamic Model Averaging (DMA) and Bayesian Model Averaging (BMA). Following Onorante and Raftery (2016), a dynamic Occam window was applied because of the large number of explanatory variables. In particular, the cut-off limit was set at 0.25 and the number of models in the combination scheme was reduced to 100 (Drachal 2020). Dynamic Model Selection (DMS) and Bayesian Model Selection (BMS) schemes were also estimated. Following Koop and Korobilis (2012), an exponentially weighted moving average method with the parameter κ = 0.97 was used to update the state-space equation variance. Furthermore, the mentioned dynamic Occam window, also averaging over models with exactly one explanatory variable, was performed (Drachal 2020). DMA, as described by Raftery et al. (2010), involves averaging over some time-varying parameters regressions. In particular, the time-varying parameters regression (with all 39 explanatory variables) is a special case of DMA, so it is reasonable to consider it as an additional benchmark model. Two versions were considered: one with a forgetting factor equal to 1 (i.e., no forgetting), and one with the (standard recommendation) forgetting factor equal to 0.99 (Raftery et al. 2010).

Additionally, LASSO and RIDGE regressions were estimated in a recursive way (Friedman et al. 2010). The λ parameter was separately selected in each recursive step, with t-fold cross-validation using MSE measure, where t is the time period. Elastic net regression was also employed. The following mixing parameters {0.1, 0.2, …, 0.9} were used. Moreover, Bayesian versions of LASSO and RIDGE regressions were estimated (Gramacy 2019).

Finally, the least-angle regression (LARS) was estimated (Hastie and Efron 2013). Similarly, as before, t-fold cross-validation with MSE was used.

Furthermore, some commonly used models were also employed. In particular, these were the ARIMA model (in a recursive way), the no-change (NAÏVE) method, and the historical average. The number of lags for the ARIMA models was specified with the automatic procedure described by Hyndman and Khandakar (2008).

The list of all estimated models is reported in Table 3.

Table 3.

Estimated models.

4.3. Forecast Evaluation

The forecast accuracy was evaluated with nRMSE (normalised root-mean-square error) and RMSE. In case of comparison between various models for a given commodity, RMSE was used. However, for comparisons between various commodities, nRMSE was used. Additionally, mean absolute error (MAE) and mean absolute scaled error (MASE) were considered (Hyndman and Koehler 2006). nRMSE is understood as RMSE divided by the mean of the analysed time-series.

When two forecasts from two competing models were compared, it was performed with the Diebold–Mariano test (Diebold and Mariano 1995) with Harvey et al. (1997) modification. Multiple forecasts were evaluated with the Model Confidence Set (MCS) of Hansen et al. (2011). In order to be consistent with RMSE measure, the squared errors loss functions were used in these tests (Bernardi and Catania 2018).

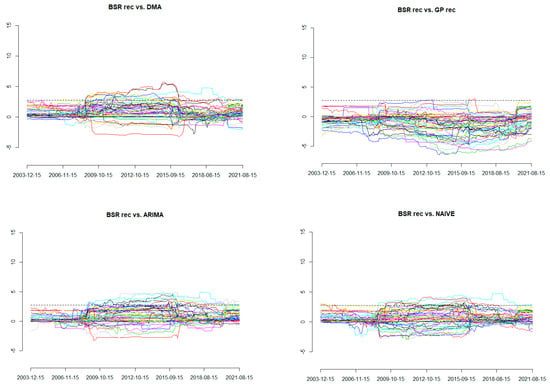

However, these tests evaluate a forecast’s behaviour over the whole analysed period. On the other hand, the relative forecast’s accuracies may vary over time. The Giacomini and Rossi (2010) fluctuation test deals with this issue. As before, squared errors loss function was applied. For the rolling procedure, the parameter μ = 0.3 was used, which corresponds to approximately 7.5-year periods.

5. Results

As 39 explanatory variables and 56 commodities were analysed, this section is divided into sub-sections for reasons of clarity.

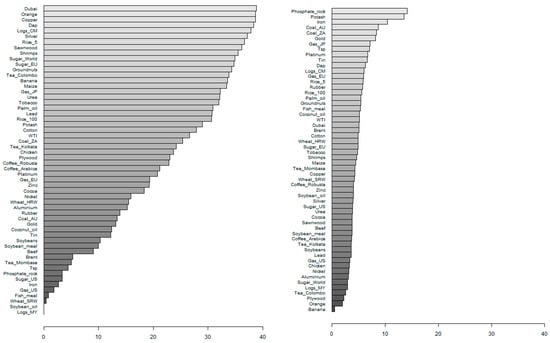

5.1. Forecast Accuracy—Measures

Table 4 reports the nRMSE of various estimated models. It can be seen that in few cases the methods based on symbolic regression resulted in very high errors. GP fix, GP rec, and BSR rec were most robust against generating such outlier results. ARIMA and DMA were the methods that most often minimised the nRMSE. In this regard, it should be noticed that BMA is a special case of DMA (Raftery et al. 2010). The methods based on symbolic regression rarely minimised the nRMSE. These conclusions are more or less the same when RMSE, MAE, or MASE are considered (not reported herein).

Table 4.

nRMSE of the estimated models.

5.2. Forecast Accuracy—Testing

Table A4 in Appendix A reports the outcomes from the Diebold–Mariano test and which model, for each commodity, minimised the RMSE out of all considered models. As mentioned before, finding the model which would generate more accurate forecasts than the ARIMA or the no-change method is often a challenging task for commodity prices. The null hypothesis of the test is that the forecast accuracy of both methods is the same. The alternative is that the forecasts generated by the “best” model are more accurate than those from the competing model (ARIMA or NAÏVE). Assuming a 5% significance level, it can be concluded that only in 13% of cases some other method than the ARIMA method minimised the RMSE, and this difference was statistically significant. Changing the significance level to 10% increased this ratio to 18% of commodities. However, when the NAÏVE method was taken as the benchmark, this was 34% and 48% of commodities, respectively. In 64% of cases, the model minimising the RMSE was neither the ARIMA nor the NAÏVE method. Assuming a 10% significance level, it can be also concluded that for 11% of commodities the model minimising the RMSE was neither the ARIMA nor the NAÏVE method, and, moreover, the model generated statistically significantly more accurate forecasts than both the ARIMA and NAÏVE methods.

Table A5 in Appendix A reports the outcomes from the Diebold–Mariano test, in which forecasts generated using the BSR rec method are tested against those generated using the ARIMA and NAÏVE methods, and the method which minimised the RMSE (named, as previously, “best”). Here, the alternative hypothesis was that forecasts generated using the BSR rec model are less accurate than those of the competing model. The null hypothesis was that forecasts generated using both methods would have the same accuracy. Assuming a 5% significance level, in 46% cases it could not be concluded that the BSR rec model generated statistically significantly less accurate forecasts than the “best” method. In 64% of cases, the BSR rec forecasts could not be said to be significantly less accurate than those of the ARIMA method, and in 71% of cases than those of the NAÏVE method.

Table A6 in Appendix A presents outcomes from the similar test in Table A5, which was previously described, but the BSR rec is replaced by the GP rec. It can be seen that GP rec performed much worse than BSR rec, when considering the forecast accuracy. Only in 21% of cases can it not be said that GP rec generated statistically significantly less accurate forecasts than the “best” method, if a 5% significance level is assumed. If the competing model was ARIMA, then this was only in 32% of cases, and for NAÏVE this was in 36% of cases. In this regard, GP rec performed much worse than BSR rec, and the above conclusions can advocate the use of Bayesian methods in symbolic regression over genetic programming.

Table A7 in Appendix A reports the outcomes from the Diebold–Mariano test, in which forecasts generated using fixed versions of the selected models (‘fix”) are compared with those generated using the recursive versions (“rec”). This was performed for BSR models (the original one and the two considered averaging schemes) and the GP model. The null hypothesis was that the “fix” and “rec” versions’ generated forecasts would have the same accuracy. The alternative hypothesis was that the “rec” version would generate a more accurate forecast than the “fix” version. Even assuming a 10% significance level, only in 1 case did BSR rec generate statistically significantly more accurate forecasts than BSR fix. However, if model averaging schemes are considered, then “rec” models seemed to improve the forecast accuracy more than the “fix” models. Assuming a 5% significance level, BSR av MSE rec generated statistically significantly more accurate forecasts than BSR av MSE fix for 57% of commodities. In the case of the BSR av EW scheme, this was for 68% of commodities. In the case of the GP method, this was for 45% of commodities.

Table A8 in Appendix A reports the outcomes from the Diebold–Mariano test, which compares forecasts generated using the BSR models with those generated using the GP models. The null hypothesis was that the BSR and GP models’ generated forecasts would have the same accuracy. The alternative hypothesis was that the BSR forecasts would be more accurate than the GP ones. Assuming a 5% significance level, BSR rec generated statistically significantly more accurate forecasts than the GP rec method for 38% of commodities, and BSR fix generated statistically significantly more accurate forecasts than the GP fix method for 32% of commodities.

5.3. Selection of Parameters for BSR

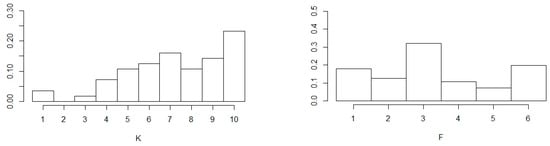

Another considered problem was the selection of parameters for BSR. As mentioned before, it was performed on the basis of in-sample data. Figure 1 presents histograms of the selected K-s and F-s for BSR, if minimisation of RMSE is chosen as the criterion. For most commodities K = 10, i.e., the highest considered value, was selected. The second most often selected value was K = 7. Generally, higher values were preferred. Very small values, such as K = 1 and K = 3, were rarely selected. For example, K = 2 was never selected. The tendency to select high values of K-s may be due to an overfitting issue (which, by the way, was the background for developing LASSO and other model reduction methods). According to Jin et al. (2019), the improvement in forecast accuracy from an increasing K may not be significant if K is already high enough. Indeed, the MCS procedure reported further herein (and some pre-testing over the whole sample, not reported herein) confirmed this statement. Moreover, Jin et al. (2019) argued that if K is too large, then the regression coefficients in the linear combination are close to 0, making these extra components redundant.

Figure 1.

The selected parameters for BSR.

In the case of the set of operators, F = 3 was most often selected. This was the set consisting of simple operators (negation and addition) expanded with a 12-month moving average and 1st lag operator. In other words, these were the operators representing variable selection and transformations usually applied in economics and finance.

Nevertheless, just simple operators (F = 1) or simple operators expanded with an “ln” operator (F = 6) were also selected. However, sets consisting of operators representing non-linearities were not selected often. Similar conclusions were derived if MAE or MASE was considered (not reported herein). Nevertheless, this most often selected combination of parameters cannot be used as a general advice. The Diebold–Mariano test for forecasts generated (over the in-sample period) using the model with K = 10 and F = 3, and the model indicated as that minimising RMSE, rejected the null hypothesis that both forecasts had the same accuracy, in favour of the alternative, that forecasts from the model minimising RMSE would be more accurate, for 32% of commodities (assuming a 5% significance level).

On the other hand, the selection of F seems to be less important. In particular, the Diebold–Mariano test was used to compare forecasts (over the in-sample period) obtained using the model with F = 1 and the model with another F (with both models having the same K parameter). This test was performed for all commodities. As a result, there were 5 * 10 * 56 = 2800 pairwise comparisons. Assuming a 5% significance level, only in 6% of cases was the null hypothesis (that both forecasts have the same accuracy) rejected, and the alternative (that forecasts from the model with F = 1 is less accurate) was assumed. This suggests that if the parameter K is properly chosen, then the set of operators is less important for the forecast accuracy, and the simple set of them can also lead to acceptable forecasts.

Additionally, for each commodity, forecasts generated using all BSR models with all K-s and F-s over the in-sample period were tested using the MCS procedure (with 1000 bootstrapped samples used to construct the statistic test, and with a “TR” statistic and quadratic loss function corresponding to RMSE, and with 90% confidence intervals). Indeed, there might be no statistically significant differences between the forecast accuracy from various BSR models with different K-s and F-s. The particular model, which was most often surviving the MCS procedure, was the one with K = 7 and F = 3, and the one with K = 9 and F = 3. In the case of the set of operators, this was consistent with previous outcomes, but for K a more moderate value is preferred.

5.4. Comparision of Models Performances

Another interesting piece of information derived from the conducted analysis was to see how, over the out-of-sample period, the MCS procedure selected models for each commodity. The same parameters for this procedure were set as previously. Table 5 presents how often (amongst all the analysed commodities) a given model survived the MCS procedure (with the parameters set as previously). It can be seen that ARIMA, DMA, and BMA were most often kept. These outcomes are consistent with those already reported herein. However, some types of BSR models were also kept for approximately 15% of commodities. Of course, the conventional benchmarks, such as ARIMA and NAÏVE, were found useful. DMA and its variations were also found useful. However, BSR-type models were found to be the next best ones, outperforming (in the sense of forecast accuracy), for example, LASSO and RIDGE regressions, and LARS and GP symbolic regression.

Table 5.

Outcomes of the MCS procedure over out-of-sample period.