Abstract

This research investigates the burgeoning peer-to-peer (P2P) economy, exemplified by platforms such as Airbnb, and its implications within the North American context. The study focuses on understanding the repercussions of Airbnb announcements on capital markets, concentrating specifically on the travel and tourism sector and the real estate sector. The findings unveil a discernible augmentation in index returns preceding the announcement’s publication in both sectors. However, a notable divergence manifests post-announcement: while the real estate sector sustains an upward trajectory in returns, the travel and tourism sector experiences a post-publication decline. These results underscore the strategic advantage available to investors with early access to Airbnb announcements, enabling them to capitalize on excess profits. Furthermore, the broader investor community can leverage the insights gleaned from Airbnb announcements for financial gains. A nuanced examination of regression results reveals the substantial impact of macroeconomic variables on index returns in both the travel and tourism sector and the real estate sector. These insights contribute to a more nuanced understanding of the intricate dynamics shaping these economic domains.

Keywords:

peer-to-peer economy; capital markets; North American region; macroeconomic indicators; policymaker decision-making; Airbnb platform JEL Classifications:

G14; E44; L83; L85; F36

1. Introduction

1.1. Exploring Airbnb’s Expansion: A Focus on North America

In recent years, the proliferation of the peer-to-peer (P2P) economy, epitomized by platforms such as Airbnb, has emerged as a transformative force across diverse industries. This decentralized model facilitates direct transactions between individuals using online platforms, reshaping traditional business paradigms in transportation, housing, finance, and labor markets (Gupta et al. 2019; Hampshire and Gaites 2011; Liu et al. 2019). Airbnb, established in 2008, has particularly exemplified this trend by connecting travelers with local hosts, offering a unique alternative to conventional lodging experiences (Zervas et al. 2017).

This study scrutinizes Airbnb’s expansion within the North American region, a significant travel destination characterized by diverse cultural, natural, and urban attractions. This geographical focus has been selected to elucidate the intricate dynamics between Airbnb’s operations and the distinctive features of this expansive continent. The North American region, comprising various destinations, provides a rich tapestry for understanding the impact of Airbnb on the travel and tourism sector, as well as its influence on real estate dynamics. The choice of this region is underscored by its distinctive landscapes and cultural richness, factors that accentuate Airbnb’s role in reshaping the hospitality industry and influencing real estate dynamics.

The motivation for this study stems from the need to comprehensively explore the dual impact of Airbnb’s growth on financial markets, particularly in the North American context. Despite the existing body of literature examining Airbnb’s effects, the comparative focus on both the travel and tourism sector and the real estate sector is relatively unexplored. This study seeks to address this gap by providing a holistic analysis of Airbnb’s influence on these critical sectors, offering valuable insights for investors, policymakers, and other market participants.

1.2. Airbnb’s Dual Impact: Bridging Tourism, Real Estate, and Global Markets

The intricate interplay between the tourism and real estate sectors and their dynamics within major financial markets represents a multifaceted relationship of paramount significance. This interaction is underscored by the findings of Papathanasiou et al. (2023), who explored volatility spillovers among assets commonly used as hedges against inflation, including real estate. Their study reveals a moderate interconnectedness among these assets, heightened by exogenous shocks such as the US–China trade war and the COVID-19 pandemic. Furthermore, Hu et al. (2024) contributed to this discourse by investigating the volatility connectedness between COVID-19-related stock indices and distinct sub-sectors within the Chinese tourism industry. This exploration aligns with Bardhan et al.’s (2008) insights, which explored the impact of globalization on the tourism industry, encompassing factors such as the expanding pool of international travelers and shifts in tourism-related activities. Their work provides a holistic perspective on the broader implications of global trends for the interconnected realms of tourism and real estate within major financial markets.

The impact of Airbnb on the travel and tourism sector and the real estate sector is twofold. In the travel and tourism sector, Airbnb has democratized tourism, offering an alternative to traditional hotels and enabling travelers to experience local communities authentically. This has led to an increase in tourism in certain areas, catering to the demand for unique and personalized experiences (Wang and Jeong 2018). However, challenges arise, encompassing concerns about potential displacement of local residents, the conversion of long-term rental units into short-term rentals, and the exacerbation of issues related to over-tourism in popular destinations (Barron et al. 2021; Guttentag 2015). These challenges necessitate regulatory measures to strike a balance between economic benefits and the preservation of local communities.

In the real estate sector, Airbnb’s impact is nuanced, with studies reporting varied effects on rental rates and housing prices. While some regions experience positive effects, others face challenges such as housing shortages and affordability concerns. Rabiei-Dastjerdi et al. (2022), Shabrina et al. (2022), and Thackway et al. (2022) provide diverse perspectives on these impacts, highlighting the need for tailored solutions to mitigate the negative consequences while harnessing economic benefits.

This research aims to delve into the impact of Airbnb’s growth on the financial markets in the North American region, concurrently scrutinizing its effects on the travel and tourism sector and the real estate sector. Utilizing a comprehensive methodological framework that includes parametric and non-parametric assessments, regression analysis, and robustness checks, the study seeks to provide valuable insights for participants in the capital markets and policymakers. This research significantly contributes to the existing academic discourse on multiple fronts. To begin, the study distinguishes between communications related to the broader North American region, individual countries within the region, and specific cities within those countries. Furthermore, it introduces seven macroeconomic variables, enriching the Airbnb research landscape and offering a thorough understanding of Airbnb’s impact across diverse economic contexts. Lastly, the study enhances its credibility by utilizing primary data directly sourced from the Airbnb website.

The study’s findings substantiate the impact of Airbnb announcements on the stock markets of North American economies. Specifically, within the realm of travel and tourism, a positive effect on abnormal returns is discerned in the period preceding the announcement’s publication, followed by a subsequent trajectory shift and decline post-publication. In contrast, the real estate sector demonstrates an increase in abnormal returns both before and after the announcement. The conducted regression analysis systematically establishes the influence of various variables on abnormal returns in both the travel and tourism and real estate sectors. Within the travel and tourism industry, the analysis underscores the significant impact of macroeconomic variables on cumulative abnormal returns (CAR) across diverse time intervals. These variables include GDP growth, temporal factors, geographic location, tourism metrics, GDP per capita, Human Development Index score, and population. Conversely, in the real estate industry, the regression analysis reveals weaker effects and a reduced number of variables influencing CAR compared to the travel and tourism sector.

2. Literature Review

2.1. Analyzing the Impact of Tourism on Financial Markets

The interplay between tourism and financial markets unveils a dynamic influence on regional and global economies. Scholars emphasize tourism as a catalyst for economic growth, generating employment opportunities and elevating income levels (Brida et al. 2018). National case studies provide insights into the substantial growth of Malaysia’s tourism sector, contributing significantly to export income via the emergence of new destinations (Jayaraman et al. 2011). Conversely, Borrego-Domínguez et al. (2022) noted a positive link between GDP and the number of beds in tourism, with less impact on stock indices. Shirkhani et al. (2021) highlighted the capacity of tourism-directed loans to foster economic growth, while Ivanov and Webster (2012) presented a contrasting view.

The pronounced seasonality of tourism introduces substantial stock market fluctuations, particularly in tourism-dependent regions (Jiang et al. 2022). This heightened volatility during peak tourism seasons reflects the intricate synergy between tourism and capital markets. Investor overreactions to the US hotel industry’s seasonality, as observed by Park (2013), provide valuable insights into behavioral dynamics influencing stock market fluctuations. Investor interest in tourism-related stocks, including airlines and hotels, has risen. Recent studies by Peng et al. (2023) and Ismail et al. (2023) analyzed stock performance, offering valuable insights for investors. Understanding the nexus between tourism and capital markets requires considering macroeconomic factors (Liu et al. 2023; Shirkhani et al. 2021). Sanford and Dong (2000) linked tourism to foreign investment, while Chen et al. (2010) explored the influence of monetary policy shifts on hospitality companies’ stock performance.

2.2. Airbnb’s Economic Impact in North America

The proliferation of Airbnb within the North American region, a prominent destination for travel, carries substantial economic ramifications for both the travel and tourism industry and the real estate sector. The platform offers property owners opportunities to generate income, fostering entrepreneurship and contributing to local economies (Goyette 2021). Furthermore, Airbnb has played a pivotal role in the growth of tourism in smaller towns, benefiting local businesses and distributing economic benefits more equitably (Lee et al. 2020).

However, the advantages presented by Airbnb also bring forth challenges. Traditional hospitality establishments, such as hotels and bed and breakfast establishments, face heightened competition from Airbnb’s alternative accommodation options, necessitating adaptation within the sector (Dogru et al. 2020). This shift in consumer behavior toward the P2P model has implications for employment patterns, tax revenue generation, and regulatory frameworks in the region, as highlighted by Zervas et al. (2017) in their analysis of Airbnb’s penetration into the Texas market. Beyond the hospitality sector, Airbnb’s influence extends to the real estate market, contributing to rising property prices and housing shortages in popular tourist destinations (Griffiths 2017). Critics argue that property owners find short-term rentals on Airbnb more financially rewarding than long-term rentals, sparking debates on housing affordability, community displacement, and the need for regulations to strike a balance between property rights and community interests.

Wachsmuth and Weisler (2018) provide an empirical examination of the intricate interplay between Airbnb, the gentrification process, and the “rent gap” phenomenon in New York. Their findings offer compelling evidence that Airbnb exerts a strong influence on the gentrification trajectory, hastening neighborhood transformation and contributing to the displacement of residents, particularly in areas grappling with pre-existing challenges related to housing affordability. Furthermore, the rapid growth of Airbnb has prompted municipalities to grapple with adapting existing regulations to the new sharing economy model. Concerns regarding safety, taxation, housing affordability, and the impact on local communities have led to the implementation of new regulations or restrictions on short-term rentals in some cities (Cameron et al. 2023).

2.3. Real Estate Dynamics: Unraveling Interconnections with Financial Markets

In recent years, the dynamic interplay between real estate and financial markets has undergone a notable transformation driven by the escalating financialization trend (Sternik and Safronova 2021). Despite the shifts observed since the 2008 financial crisis, there is a prevailing view that a real estate bubble is unlikely to trigger an immediate downturn in financial markets (Jang et al. 2018). Examining the relationship further, contagion dynamics between Real Estate Investment Trusts (REITs) and equity markets reveal varying degrees of spillovers, particularly accentuated during times of financial crises (Caporin et al. 2021). The stability of the Chinese real estate market emerges as a crucial facet in this evolving landscape, closely tethered to the dynamics of bank credits. A sudden decline in real estate values has the potential to initiate credit contraction, contributing to nuanced financial fluctuations (Qin and Zhang 2007). Moreover, the repercussions extend to underperforming real estate portfolios, casting a shadow on financial institutions, notably impacting stock prices, especially within the realm of insurance companies (Ghosh et al. 1997). This intricate interdependence sets the stage for an exploration of the multifaceted relationship between real estate and financial markets.

2.4. Housing Market Fluctuations

Following the 2008 financial crisis, real estate prices experienced a downturn, contrasted by positive impacts from GDP growth and low interest rates (Januário and Cruz 2023). Diverse financial intermediaries, such as conventional banks and building associations, wield varying influences on housing market cycles (Braun et al. 2022). Government interventions, particularly via the discount rate channel, resonate with spillover effects on the stock market (Akbari and Krystyniak 2021). On average, spillovers between housing, stock, and bond returns exhibit a modest magnitude (He et al. 2018).

2.5. Interest Rates and Housing Demand

Examining the interplay between interest rates and housing dynamics reveals a significant impact on both house prices and transaction volumes (Chen et al. 2022). Deposit interest rates emerge as influential factors, inhibiting price growth but stimulating transaction activity. Conversely, lending rates play a role in transaction volumes without exerting a substantial influence on prices (Oxford Analytica 2022). The pivotal role of central banks in stabilizing housing markets becomes evident via their strategic adjustments of interest rates, addressing market mispricing, and contributing to overall stability (Akimov et al. 2020).

2.6. Real Estate Debt and Financial Stability

In the realm of real estate and financial stability, the “financial accelerator” model by Wang et al. (2022) illustrates how fluctuations in housing prices can magnify impacts on corporate debt and macroeconomic stability. Contrasting this, Zurek (2022) contended that rising real estate prices minimally affect the credit portfolios of savings banks. Examining the global landscape, Nguyen and Bui (2020) identified a positive relationship between the real estate market and stock market volatility in Vietnam. Additionally, Sternik and Teleshev (2018) contributed valuable insights by proposing indicators for strategic portfolio management aimed at mitigating potential risks within the Russian banking sector.

2.7. Real Estate Dynamics: Interplay between Registered and Direct Ownership

This section explores the distinctive attributes of registered real estate compared to direct real estate, drawing from key studies. Lee et al. (2022) noted that listed real estate futures contracts enhance market efficiency, reduce noise, and strengthen price discovery, fostering robust linkages between public and private real estate. In a study conducted by Ling and Naranjo (2015), U.S. unlevered core real estate investment trusts (REITs) were found to outperform their private counterparts by 49 basis points (annualized). This study emphasizes the pivotal role of equity REIT returns as an information conduit to private market returns propelled by enhanced liquidity. In parallel, Olszewski (2012) critically examined the impact of commercial real estate (CRE) on macro-financial stability, proposing valuable insights for central banks. Lastly, employing spectral analysis techniques, Wilson and Okunev (1999) revealed less obvious cyclical patterns in securitized property and financial assets markets compared to direct real estate markets.

2.8. Financial Market Sentiment and Real Estate Investment

The volatility induced by the Global Financial Crisis underscores the pivotal role of investor sentiment in shaping the liquidity of real estate markets (McGough and Berry 2022). Within this context, institutional investors, including pension funds and insurance companies, lean heavily on the sentiment emanating from specialized real estate investors, be it public REITs or private developers/owners, to inform their investment decisions (Freybote and Seagraves 2017). Recognizing the intricate dynamics of the real estate sector becomes imperative for a comprehensive understanding of its broader impact on the business cycle. This nuanced exploration illuminates the interconnectedness of financial market sentiment and real estate dynamics, offering valuable insights for strategic decision making.

2.9. Investment and Portfolio Diversification

Exploring investment dynamics, real estate consistently emerges as a top-performing asset, outshining bonds and stocks on a risk-adjusted basis (Candelon et al. 2021). Beyond its performance metrics, real estate plays a crucial role in portfolios, offering a partial hedge against inflation and contributing to enhanced diversification (Etebari 2016). Within the realm of real estate portfolios, international diversification takes precedence over sectoral diversification, as observed in studies by Mladina (2018) and Śmietana (2014). Notably, geographical diversification, particularly in metropolitan areas, proves effective in bolstering portfolio resilience. This comprehensive examination underscores the multifaceted advantages that real estate brings to investment strategies and portfolio construction.

2.10. Analyzing Dynamics in the Hospitality Sector via Event Studies

2.10.1. The Methodology of Event Studies

The evolution of the event study methodology, introduced in the 1960s by Ball and Brown (1968), Fama and Roll (1968), and Fama et al. (1969), has been marked by significant advancements. Notably, Jensen (1978) and Roll (1984) contributed to its refinement by incorporating diverse methodological approaches and statistical tests. This methodology systematically assesses the impact of events on financial markets, offering insights into market efficiency and the rapid incorporation of information into stock prices. Its applications extend to diverse events, influencing financial decision making, risk management, and policy formulation. In recent years, the scope of the event study methodology has expanded into emerging fields, reflecting the evolving financial landscape. Integrating behavioral finance and investor sentiment analysis (Baker and Wurgler 2006), environmental, social, and governance (ESG) contexts (Gompers et al. 2003; Palatnik et al. 2019; Tavor 2023), and events related to cryptocurrency and blockchain (Urquhart and Zhang 2019) has become pivotal.

2.10.2. Dissecting Hospitality Market Trends: Insights from Event Studies

Event studies within the hospitality sector provide indispensable insights into the intricate relationships among stock market valuations, investor sentiment, and market dynamics. Noteworthy among these studies is the correlation observed between the implementation or intensification of minimum wage policies and downward trajectories in hotel companies’ stock valuations (Che Ahmat et al. 2023). Additionally, leadership transitions within hotel corporations, as investigated by Bloom and Jackson (2016), consistently reveal adverse impacts on firm performance due to heightened uncertainty. Mergers and acquisitions within the hospitality industry have been subject to thorough event studies, serving as essential tools for dissecting corporate activities. Acquisitions, generally favorable, exhibit varying impacts contingent on financial constraints and organizational structures (Dogru 2017).

2.11. Event Studies on Airbnb’s Impact

Researchers utilizing event studies have explored the influence of Airbnb on housing and rental markets. Regions with a significant presence of Airbnb listings witness an increase in housing and rental costs, showcasing a disparity compared to areas with fewer listings (Bibler et al. 2022; Garcia-López et al. 2020). The financial consequences observed during Airbnb’s initial stages deviate from conventional hotel models, raising thought-provoking inquiries about the distinctive traits of this disruptive influence (Bianco et al. 2022a). The introduction of novel offerings and services by Airbnb noticeably influences the stock markets. Investigative results suggest detrimental consequences for publicly traded hotel management firms and real estate investment trusts in the United States (Bianco et al. 2022b). On a worldwide scale, announcements related to Airbnb indicate an unfavorable correlation, pointing to negative impacts on stock markets (Teitler-Regev and Tavor 2023). This ongoing examination into event studies plays a vital role in enhancing our holistic comprehension of the evolving dynamics within the hospitality sector.

3. Hypotheses and Theoretical Framework

Drawing upon the aforementioned empirical findings, the study formulates two hypotheses and tests them:

Hypothesis 1 (H1):

The stock indices for the travel and tourism industry and the real estate industry in the North American region will be impacted by announcements made on Airbnb’s website.

3.1. Rationale for Hypothesis 1

Drawing from the theoretical framework of the peer-to-peer economy, exemplified by Airbnb, the hypothesis is grounded in the platform’s transformative influence on the travel, tourism, and real estate sectors. The existing literature, notably the works of Gupta et al. (2019) and Dogru et al. (2020), highlights Airbnb’s economic implications, from fostering entrepreneurship to challenging traditional hospitality models. Insights from event studies by Bibler et al. (2022) and Bianco et al. (2022b) suggest that Airbnb-related events have noticeable effects on housing and stock markets. This, coupled with the platform’s significant impact on these industries, forms the rationale for anticipating an influence on stock indices in the North American region.

Hypothesis 2 (H2):

The performance of the stock indices around the day of an Airbnb announcement will be influenced by macroeconomic variables.

3.2. Rationale for Hypothesis 2

This hypothesis is grounded in the recognition that stock market dynamics are intertwined with broader macroeconomic conditions. As highlighted by literature such as Liu et al. (2023) and Sanford and Dong (2000), macroeconomic factors like GDP growth play a pivotal role in shaping the relationship between tourism, capital markets, and stock indices. Considering Airbnb’s substantial economic impact, the hypothesis proposes that macroeconomic variables will likely shape the performance of stock indices in the travel, tourism, and real estate sectors, specifically around the time of Airbnb announcements.

4. Data and Empirical Methodology

4.1. Data

To investigate the impact of Airbnb announcements on North American capital markets, a comprehensive data collection process was executed. The study focused on notifications posted on Airbnb’s website related to the North American region from January 2016 to January 2023. The selection of announcements was guided by specific criteria to ensure a comprehensive and representative dataset. The data collection process involved three distinct stages. Firstly, a manual search on the Airbnb platform identified announcements related to the broader North American region. The criteria for inclusion in this category considered the scope and relevance of the announcement to the entire region, taking into account factors such as the extent of geographic coverage and potential impact on multiple markets.

Subsequently, searches were performed for each country in the region, specifically including announcements with the country’s name in their titles. The criteria for selection at this stage focused on announcements directly linked to individual countries. The criteria for selection at this stage included the specificity of the information to a particular country and the potential economic significance of that country. The study then identified the top five major cities in each selected country and collected announcements specific to these urban locations. Criteria for city-specific announcements involved factors such as urban significance, population density, and potential economic impact. This ensured a focused examination of announcements that might have distinct effects at the city level.

This methodological framework allowed for a nuanced examination of Airbnb announcements at different geographic levels, including the regional, national, and city-specific contexts. The dataset included announcements from the following countries: the United States, Canada, Mexico, Haiti, Cuba, El Salvador, and the Bahamas, totaling 182 announcements. These were categorized into 27 announcements related to the broader North American region, 53 specific to countries, and 102 focused on cities. Examples of these announcements are detailed in Table 1.

Table 1.

Examples of Airbnb announcements about the North American region.

To quantify the influence of Airbnb announcements on capital markets, the study utilized both local and global indices. Local indices, namely STOXX North America 600 Travel & Leisure (NATT) and STOXX North America 600 Real Estate (NARE), were employed alongside four global indices: Dow Jones Travel & Leisure (DJTT), Dow Jones Real Estate (DJRE), MSCI North America (MSCINA), and FTSE North America (FTSENA). These indices were chosen to assess the immediate impact of Airbnb announcements on different segments of the capital markets. For the testing, daily returns of the selected indices were collected from Investing.com, covering a period of 231 days for each announcement (215 days before and 15 days after). This approach aimed to capture both pre-announcement insider information effects and the sustained influence of post-announcement publication.

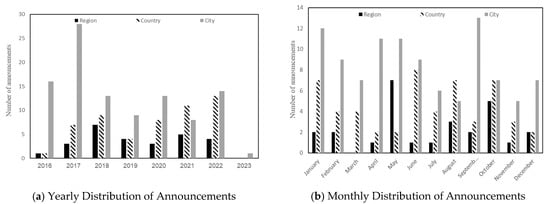

Figure 1a,b portray the temporal distribution patterns of announcements across various regions within North America, with Figure 1a delineating the distribution by year and Figure 1b by month. It is evident from Figure 1a that the distribution of announcements exhibits significant disparities across different years. Notably, a substantial proportion of announcements pertaining to the broader North American region were predominantly published in 2018, comprising 25.93% of the total. Conversely, announcements specifically related to countries within the region were predominantly observed in 2021 and 2022, accounting for 45.28% of the dataset. Furthermore, Figure 1a highlights that 27.45% of the announcements focusing on cities in the North American region were published in 2017.

Figure 1.

Chronological distribution of announcements across North American regions by year and month. Note: Figure 1a,b provide a comprehensive depiction of the distribution of announcements across various North American regions, with a specific emphasis on the temporal dimensions of year and month. Within the figures, the black columns signify announcements related to the broader region as a whole, whereas the columns featuring diagonal lines represent announcements specific to individual countries within the North American region. Additionally, the gray columns indicate announcements that are centered on cities located within North America.

Figure 1b indicates that the distribution of announcements based on the months in which they were published exhibits varying patterns depending on the specific type of announcement. Notably, 44.45% of the announcements concerning the broader region were concentrated in the months of May and October. In contrast, announcements pertaining to specific countries in the North American region were predominantly observed during the months of January, June, August, and October, collectively accounting for 54.72% of the total announcements in this category. Furthermore, Figure 1b reveals that 46.07% of the announcements focusing on cities in the region were published in the months of January, April, May, and September.

4.2. Empirical Strategy

4.2.1. Event Study Methodology

The event study methodology was utilized in this research to examine the impact of announcements made by Airbnb regarding the North American region. The study focused on analyzing the reactions of the travel and tourism (NATT) and real estate (NARE) indices in the region by employing abnormal returns (AR) and cumulative abnormal returns (CAR) as key measures.

To establish a baseline, a market model was constructed to capture the correlation between the performance of the North American indices (NARE and NATT) on day t for event i (Rit) and the corresponding market returns on the same day (Rmt) under normal circumstances. Global indices from the real estate sector (DJRE) and the travel and tourism sector (DJTT) were used to determine the market returns.

The methodology involved defining day zero (t = 0) as the day of the announcement, with adjustments made if no stock trading occurred on that day. Two distinct time windows were then established. The estimation window (L1) consisted of days t = T0 + 1, T0 + 2, …, T1, during which statistical values were calculated. The event window (L2) encompassed days t = T1 + 1, T1 + 2, …, 0, …, T2 and allowed for the analysis of the impact of the announcements across different time periods before, during, and after the event. In this study, the estimation window spanned from t ∈ [−215, −16], while the event window was defined as t ∈ [−15, +15], enabling a comprehensive examination of the announcement effects.

Let Rit represent the daily returns of event i at time t, Rmt denotes the daily market index returns of event i at time t, and ξit signifies the residual of stock i at time t.

The expected return, denoted as , under normal conditions given information I on day t, was computed using ordinary least squares (OLS) regression. The estimations for the intercept and the slope coefficient were then utilized to derive the expected return:

Abnormal returns (AR) were then calculated by comparing the actual returns observed on event days with the expected returns derived from the market model. This method enabled the assessment of the effect of Airbnb’s announcements on the North American indices.

Cumulative abnormal returns (CAR) were calculated by aggregating the abnormal returns over the specified event window, providing a comprehensive view of the cumulative effects of the announcements.

Finally, the cumulative average abnormal returns (CAAR) were calculated by averaging the cumulative abnormal returns across the specified period encompassing the event window (t1 to t2).

By employing these measures and the constructed market model, the study aimed to evaluate the responses of the NATT and NARE indices in the North American region to Airbnb announcements. In order to assess the significance of abnormal returns and cumulative abnormal returns, a set of parametric and non-parametric tests were employed. The first parametric test employed in this study is the ordinary t-test (ORDIN), which is commonly used in event studies (Fama et al. 1969). This test assesses the statistical significance of observed differences between the means of a sample by assuming a normal data distribution. The second parametric test utilized is the Standardized Residual Test (Adj-PATELL) developed by Kolari and Pynnönen (2010). Unlike the regular t-test, this test exhibits robustness in the presence of event-induced volatility, as Patell (1976) noted. Moreover, it takes into account cross-sectional correlation. The third parametric test is the Adjusted Standardized Cross-Section Test (Adj-BMP), also introduced by Kolari and Pynnönen (2010). This test addresses the limitations of the standard t-test in the context of event-induced variation, as Boehmer et al. (1991) pointed out. The fourth parametric test utilized in this study involved applying the F-test for variance equality (FEV), as introduced by Snedecor and Cochran (1989), to assess the equality of variances.

The first non-parametric test employed is the Sign Test (SIGN) developed by Cowan (1992). This test exhibits robustness against skewness in the distribution of returns. The second non-parametric test is the Generalized Sign Test (G-SIGN), also proposed by Cowan (1992). This test compares the rate of positive abnormal returns during an event period to the rate observed during a period unaffected by the event. The third non-parametric test is the Generalized Rank Test (GRANK-T) developed by Kolari and Pynnönen (2011). This test accounts for both cross-sectional and serial correlation of returns, as well as event-induced volatility.

4.2.2. Regression Methodology

Another objective of this study is to assess the influence of macroeconomic factors on the abnormal returns observed within the real estate and travel and tourism sectors in the North American region. To accomplish this objective, a regression analysis is employed, incorporating the heteroskedasticity and autocorrelation consistent (HAC) method developed by Newey and West (1987) to address concerns related to heteroskedasticity and autocorrelation. The model utilized for this analysis is as follows:

In the equation, the subscript k represents the real estate and travel and tourism industries, while the subscript i denotes the event number, ranging from 1 to 182. The variable Year indicates the publication year of the announcement, spanning from 2016 to 2023. The Location variable is a categorical variable that assumes distinct values depending on the nature of the announcement. Specifically, it takes a value of 1 for announcements pertaining to the overall North American region, a value of 2 for announcements regarding specific countries in the North American region, and a value of 3 for announcements related to cities in the North American region.

The variables Tourism and GDPC represent the number of incoming tourists in millions and the GDP per capita in thousands, respectively, for countries in the North American region. Additionally, the variable GDP Growth captures the annual GDP growth rate for countries belonging to the North American region. Furthermore, the variables HDI and Population correspond to the Human Development Index and the population size in millions, respectively, for countries in the North American region. These variables are obtained from The World Bank (2023).

5. Empirical Results

This section presents the findings of the study, focusing on addressing several key research questions. Primarily, the investigation aims to ascertain whether investors can effectively leverage the information provided in announcements on the Airbnb website about the North American region to reap abnormal profits subsequent to the publication of such announcements. Additionally, the study examines whether investors in the real estate industry react differently to such announcements than those invested in the travel and tourism industry. Furthermore, the research explores the presence of supplementary variables that might influence the abnormal returns observed in these two industries around the announcement date. The ensuing sections provide a detailed analysis and interpretation of the empirical results, shedding light on the implications of these findings within the context of investment strategies and the respective industries.

5.1. Descriptive Statistics

The descriptive statistics presented in Table 2 offer valuable insights into the characteristics of the stock indices and macroeconomic variables in the North American region. Panel A of the table furnishes detailed information regarding the six indices gathered for the event study methodology. Specifically, the NATT and NARE indices pertain to the stock indices, while the DJTT and DJRE indices correspond to the market indices during the regular examination. Furthermore, the MSCINA and FTSENA indices represent the market index in the robustness analysis. Panel B of the table showcases the findings obtained for the seven macroeconomic variables employed in the regression analyses, namely: Year, Location, Tourism, GDPC, GDP growth, HDI, and Population.

Table 2.

Quantitative analysis of indices and regression variables: A descriptive summary.

Panel A provides an analysis of the stock indices utilizing the event study approach. The results indicate that the average returns and volatility of the NATT index, which represents the travel and tourism industry, exceed those of the NARE index, which represents the real estate industry. Similarly, the DJTT index, representing the travel and tourism sector in the global market, exhibits higher returns and volatility compared to the DJRE index, representing the real estate sector. In the robustness test, the MSCINA and FTSENA indices demonstrate higher returns compared to the normal test, although their volatility is relatively lower.

Moving to Panel B, the analysis focuses on various macroeconomic variables. The year variable represents the publication year of announcements, ranging from 2016 to 2023, with the average and median number of announcements occurring in 2019. The location variable has an average value of 2.412, indicating that the majority of the announcements deal with cities in the North American region. Moreover, the average annual number of tourists entering the countries is 70.12 million, with the United States having the highest number of tourist arrivals. The average GDP per capita (GDPC) is 45,891, with the US exhibiting the highest GDPC and Haiti registering the lowest. In relation to GDP growth rates, the North American region exhibits an average annual growth rate of 1.61%. Notably, the Bahamas recorded the lowest annual growth rate in 2020, experiencing a substantial contraction at −23.823%. Furthermore, the average number on the Human Development Index (HDI) for the North American region is 0.872, accompanied by a standard deviation of 0.081, signifying a moderate degree of human development in the countries within the area.

5.2. Impact of Announcements on North American Stock Indices Performance

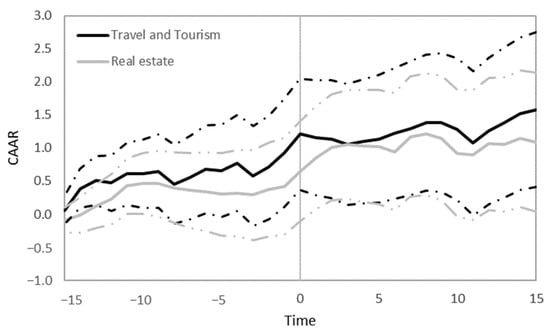

Figure 2 illustrates the cumulative average abnormal returns (CAAR) patterns within the travel and tourism industry as well as the real estate industry over a period extending from 15 days prior to the announcement to 15 days subsequent to it. Table 3 provides a summary of the cumulative abnormal returns (CAR) findings for both industries, with Panel A focusing on the travel and tourism sector and Panel B on the real estate sector. The results are derived from various time intervals surrounding the announcement day and are assessed using three parametric tests (ORDIN, Adj-PATELL, and Adj-BMP) examining the return data in columns 3 to 5. Furthermore, column 6 illustrates the outcomes of the parametric test (FEV) applied to assess variance. Lastly, columns 7–9 present the findings derived from three non-parametric tests (SIGN, G-SIGN, and GRANK-T).

Figure 2.

CAAR Analysis of North American indices: travel and tourism vs. real estate industry across a 31-day event window. Note: The x-axis signifies the time period relative to the event day. The black lines illustrate the cumulative average abnormal returns (CAAR) within a 31-day event window for the travel and tourism industry, while the gray lines depict the CAAR within a 31-day event window for the real estate industry. The dashed lines indicate the 95% confidence intervals.

Table 3.

Cumulative abnormal returns (CAR) in North American stock indices.

In the travel and tourism industry, the cumulative abnormal return (CAR) starts to rise two days preceding the announcement’s publication. However, its trajectory alters upon publication, experiencing a decline over the subsequent three days. The most notable impact becomes evident commencing one day preceding the announcement and extending to the day of the announcement [−1,0], as indicated by a CAR−1,0 value of 0.502%. This effect’s statistical significance is substantiated by the Mean Absolute Value Test (MAVT1) result of 3.148. Conversely, in the real estate industry, the CAR exhibits an upswing in the period preceding the announcement, commencing three days prior. Unlike the travel and tourism sector, the CAR continues its ascent post-announcement, peaking during the two days after the declaration [+1,+2] with a CAR+1,+2 value of 0.361%. The statistical significance of this effect is supported by the MAVT result of 3.167. Examining the results of the F-test for variance equality (FEV), significant outcomes consistently manifest across various window types in both the travel and tourism industry and the real estate industry. This signifies that Airbnb announcements exert an influence not solely on stock returns, as previously illustrated, but also on the variance within these returns. This introduces an additional dimension of unpredictability and risk to the financial instruments, transcending mere fluctuations in stock prices. A comparison of Sharpe ratios between the event and estimation periods, not depicted in the table, reveals that the alteration in abnormal returns compensates for the increased risk introduced by the announcement.

These findings carry implications for diverse investor profiles. Those with privileged access to announcement information before its public disclosure on Airbnb’s website can exploit opportunities for excess profits in both industries by acquiring the respective indices. Additionally, the general public can garner excess profits by strategically engaging in short selling of stock indices in the travel and tourism sector or acquiring stock indices in the real estate industry. These outcomes underscore the expansive impact of announcements, offering potential avenues for profit across all participant categories, regardless of access to confidential information. The study’s findings align with prior research in the travel and tourism industry (Jiménez et al. 2022; Teitler-Regev and Tavor 2023) and the real estate industry (Benitez-Aurioles and Tussyadiah 2020). This consistency with earlier studies lends further credence and validation to the existing body of literature in these domains, affirming the validity of the initial hypothesis and contributing to a better understanding of the relationship between Airbnb announcements and stock market performance.

5.3. Robustness Check

To fortify the robustness of our findings, the study conducted two additional tests employing alternative global market indices—specifically, MSCINA and FTSENA—which represent the broader stocks within the North American region. The results are presented in Table 4, where Panel A elucidates cumulative abnormal returns for the travel and tourism industry, and Panel B provides analogous data for the real estate industry. These supplementary analyses reinforce the conclusions drawn from the initial tests and provide further evidence to support the empirical findings. Notably, in the travel and tourism industry, a significant impact is discerned from the day preceding the announcement until the day of consolidation. Conversely, in the real estate industry, the primary impact is observed during the two days following the announcement.

Table 4.

Cumulative abnormal returns (CAR) in North American regional indices: A robustness analysis.

5.4. Regression Results

This study also conducted a regression analysis that examines the effects of Airbnb’s announcements on the North American region, as shown in Table 5. The analysis incorporates macroeconomic indicators and encompasses six successive time periods around the day of the announcement, examining the cumulative abnormal returns (CAR). The regression results are divided into two panels: Panel A for the travel and tourism industry and Panel B for the real estate industry. In the travel and tourism industry, the regression analysis indicates that most of the variables examined exert an impact on the cumulative abnormal returns (CAR) across various time intervals. These variables include the historical performance of the CAR, GDP growth, year, location, tourism, GDP per capita, the score on the Human Development Index, and population.

Table 5.

Regression estimates of macroeconomic indicators.

The historical performance of CAR exhibits a positive influence on CAR over the three days encompassing the announcement day. Conversely, GDP growth exerts a negative impact on CAR over the five days surrounding the announcement. Late-year announcements have a greater influence on the CAR compared to early-year announcements. The location variable had a partially negative effect before the announcement, with announcements related to the North American region having a more pronounced impact on the CAR compared to those about specific countries and cities in the region. The tourism variable does not significantly influence the CAR at different time intervals. GDP per capita has a negative effect only before the announcement, indicating that announcements regarding economically disadvantaged countries have a greater impact than those concerning wealthier countries. Additionally, the regression analysis highlights the substantial impact of two variables: The Human Development Index score and population. These variables exert the most significant influence on the CAR in the travel and tourism industry. Their positive effect was primarily evident before the announcement, suggesting that larger countries with higher scores on the Human Development Index have a greater influence on the CAR.

In the real estate industry, the regression analysis reveals weaker effects and fewer variables influencing the CAR compared to the travel and tourism industry. The year variable has a positive effect on the CAR only on the announcement day itself, while the GDP per capita has a negative effect on the same day. The location variable demonstrates an adverse impact on CAR during the pre-announcement period; however, this effect transforms into a positive impact during the post-announcement phase. Specifically, preceding the announcement, events associated with the North American region exert a more conspicuous influence on CAR compared to those pertaining to individual countries and cities within the region. Conversely, subsequent to the announcement, there is a discernible shift, whereby announcements pertaining to specific cities exhibit a more robust impact on CAR than those related to countries and the overarching region. Additionally, GDP growth in the real estate industry negatively affects the CAR, while population size has a positive effect, indicating that larger countries have a greater influence on the CAR in this industry. The findings provide support for Hypothesis 2, indicating the significant influence of various variables on the CAR at different time intervals.

6. Conclusions and Policy Implications

6.1. Conclusions

This study conducted an investigation into the impact of Airbnb announcements on North American capital markets, employing a robust methodology that included data collection and various analytical techniques such as parametric and non-parametric tests, robustness examinations, and regression analysis. The primary focus was to assess the financial implications of Airbnb’s expansion in North American economies, with specific attention to the travel and tourism sector and the real estate sector. Key findings revealed distinctive trends: in the travel and tourism industry, the cumulative abnormal return (CAR) exhibited a pre-announcement increase, followed by a subsequent shift and decline post-publication. Conversely, the real estate sector displayed an increase in CAR both before and after the announcement.

These findings have significant implications for diverse investors. Those with early access to listing information prior to public disclosure by Airbnb can leverage excess profit opportunities in both sectors via strategic investments. Additionally, the general public can generate excess profits via short selling of stock indices in the travel and tourism sector or purchasing stock indices in the real estate sector. The study went beyond standard empirical analysis, strengthening its robustness via two additional tests using alternative measures. Regression analysis highlighted that macroeconomic variables had a more pronounced effect on the travel and tourism industry than on the real estate industry. Specifically, in the travel and tourism sector, positive effects on CAR were associated with population size and the human development index, while GDP per capita and GDP growth had a negative impact. In contrast, in the real estate industry, population size positively influenced CAR, while GDP growth and GDP per capita had a negative impact. Furthermore, the study identified that announcements concerning the broader North American region significantly affected CAR in both industries in the pre-announcement period, while announcements related to specific cities impacted CAR in the real estate industry in the post-announcement period.

Despite offering novel insights, it is crucial to acknowledge the study’s limitations. The exclusive focus on Airbnb platform announcements may inadvertently overlook alternative information sources. Future research should expand the sample size and incorporate additional sources to enhance the reliability and relevance of findings. Furthermore, an in-depth exploration of the long-term effects on brand loyalty and consumer behavior is warranted. In conclusion, this study contributes to the existing literature by examining the impact of Airbnb announcements on North American financial markets. The results and policy implications provide valuable guidance for investors and policymakers navigating the intricate dynamics of online notifications, financial markets, and macroeconomic variables in the North American landscape.

6.2. Policy Implications

The research findings underscore policy considerations regarding the impact of Airbnb announcements on North American capital markets, necessitating a reevaluation of existing policies. An essential concern is the potential for information asymmetry and unequal access to Airbnb listing data. Given the proven advantage for some parties with advanced knowledge of Airbnb activity, policymakers should review disclosure policies. Improving transparency and timely dissemination of pertinent Airbnb information could enhance fairness in capital market operations. Regulators may need to enforce more stringent reporting of material non-public information by Airbnb and affiliated entities. Another vital policy insight is the varied impact of Airbnb announcements on industries such as travel and tourism and real estate. This calls for tailored, sector-specific regulations rather than uniform measures. Policy tools should address the unique distortions and risks in each industry segment. Real estate indices may need safeguards against overinflation during Airbnb expansion, while travel and tourism stocks require protection from abrupt negative shocks.

The influence of macroeconomic conditions emphasizes the importance of policymakers fostering steady economic growth. Initiatives promoting positive GDP trends, population growth, and improved human development indices can strengthen the resilience of the travel and tourism industry and mitigate the impacts of Airbnb announcements. A robust macroeconomy acts as a buffer against market volatility. Policy responses should consider the scale of Airbnb announcements and implement context-specific solutions. Localized announcements may require different policy tools than broader plans. An integrated policy approach should differentiate between announcement types and geographical contexts. In summary, key policy insights include enhancing information transparency, implementing tailored industry-specific regulations, supporting broad economic growth, and applying context-specific responses. While more research is needed, these findings offer considerations for policymakers addressing Airbnb’s impact on capital markets.

Funding

This research received no external funding.

Data Availability Statement

The data that support the findings of this study are available in Figshare at https://figshare.com/s/cf76078b0ba7b1585261 (accessed on 7 June 2023). These data were derived from the following resources available in the public domain: https://news.airbnb.com (accessed on 7 June 2023).

Conflicts of Interest

The author declares no conflicts of interest. There were no external funders involved in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Note

| 1 | The Mean Absolute Value Test (MAVT) is the absolute value of the mean of all statistical test results within a specified time window. |

References

- Akbari, Amir, and Karolina Krystyniak. 2021. Government real estate interventions and the stock market. International Review of Financial Analysis 75: 101742. [Google Scholar] [CrossRef]

- Akimov, Alexey, Chyi Lin Lee, and Simon Stevenson. 2020. Interest rate sensitivity in european public real estate markets. Journal of Real Estate Portfolio Management 25: 138–50. [Google Scholar] [CrossRef]

- Baker, Malcolm, and Jeffrey Wurgler. 2006. Investor sentiment and the cross-section of stock returns. The Journal of Finance 61: 1645–80. [Google Scholar] [CrossRef]

- Ball, Ray, and Philip Brown. 1968. An empirical evaluation of accounting income numbers. Journal of Accounting Research 6: 159–78. [Google Scholar] [CrossRef]

- Bardhan, Ashok, Jaclene Begley, Cynthia A. Kroll, and Nathan George. 2008. Global Tourism and Real Estate. 2008 Industry Studies Conference Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1126837 (accessed on 30 April 2008).

- Barron, Kyle, Edward Kung, and Davide Proserpio. 2021. The effect of home-sharing on house prices and rents: Evidence from Airbnb. Marketing Science 40: 23–47. [Google Scholar] [CrossRef]

- Benitez-Aurioles, Beatriz, and Iis Tussyadiah. 2020. What Airbnb does to the housing market. Annals of Tourism Research 90: 103108. [Google Scholar] [CrossRef]

- Bianco, Simone, Florian J. Zach, and Anyu Liu. 2022a. Early and late-stage startup funding in hospitality: Effects on incumbents’ market value. Annals of Tourism Research 95: 103436. [Google Scholar] [CrossRef]

- Bianco, Simone, Florian J. Zach, and Manisha Singal. 2022b. Disruptor recognition and market value of incumbent firms: Airbnb and the lodging industry. Journal of Hospitality & Tourism Research 48: 84–104. [Google Scholar] [CrossRef]

- Bibler, Andrew, Keith Teltser, and Mark J. Tremblay. 2022. Short-term rentals, home prices, and housing affordability: Evidence from Airbnb registration enforcement. Andrew Young School of Policy Studies Research Paper Series. forthcoming. [Google Scholar]

- Bloom, Barry A.N., and Leonard A. Jackson. 2016. Abnormal stock returns and volume activity surrounding lodging firms’ CEO transition announcements. Tourism Economics 22: 141–61. [Google Scholar] [CrossRef]

- Boehmer, Ekkehart, Jim Masumeci, and Annette B. Poulsen. 1991. Event-study methodology under conditions of event-induced variance. Journal of Financial Economics 30: 253–72. [Google Scholar] [CrossRef]

- Borrego-Domínguez, Susana, Fernando Isla-Castillo, and Mercedes Rodríguez-Fernández. 2022. Determinants of Tourism Demand in Spain: A European Perspective from 2000–2020. Economies 10: 276. [Google Scholar] [CrossRef]

- Braun, Julia, Hans-Peter Burghof, Julius Langer, and Dag Einar Sommervoll. 2022. The volatility of housing prices: Do different types of financial intermediaries affect housing market cycles differently? The Journal of Real Estate Finance and Economics, 1–32. [Google Scholar] [CrossRef]

- Brida, Juan Gabriel, Bibiana Lanzilotta, Leonardo Moreno, and Florencia Santiñaque. 2018. A non-linear approximation to the distribution of total expenditure distribution of cruise tourists in Uruguay. Tourism Management 69: 62–68. [Google Scholar] [CrossRef]

- Cameron, Anna, Mukesh Khanal, and Lindsay M. Tedds. 2023. Managing Airbnb: A Cross-Jurisdictional Review of Approaches for Regulating the Short-Term Rental Market. Available online: https://ssrn.com/abstract=4009268 (accessed on 25 October 2023).

- Candelon, Bertrand, Franz Fuerst, and Jean-Baptiste Hasse. 2021. Diversification potential in real estate portfolios. International Economics 166: 126–39. [Google Scholar] [CrossRef]

- Caporin, Massimiliano, Rangan Gupta, and Francesco Ravazzolo. 2021. Contagion between real estate and financial markets: A Bayesian quantile-on-quantile approach. The North American Journal of Economics and Finance 55: 101347. [Google Scholar] [CrossRef]

- Che Ahmat, Nur Hidayah, Jewoo Kim, and Susan W. Arendt. 2023. Examining the impact of minimum wage policy on hospitality financial performance using event study method. International Journal of Hospitality & Tourism Administration 24: 98–122. [Google Scholar]

- Chen, Ming-Hsiang, Chao-Ning Liao, and Shi-Shen Huang. 2010. Effects of shifts in monetary policy on hospitality stock performance. The Service Industries Journal 30: 171–84. [Google Scholar] [CrossRef]

- Chen, Chang, Haoyu Zhai, Zhiruo Wang, Shen Ma, Jie Sun, Chengliang Wu, and Yang Zhang. 2022. Experimental Research on the Impact of Interest Rate on Real Estate Market Transactions. Discrete Dynamics in Nature and Society 2022: 9946703. [Google Scholar] [CrossRef]

- Cowan, Arnold Richard. 1992. Nonparametric event study tests. Review of Quantitative Finance and Accounting 2: 343–58. [Google Scholar] [CrossRef]

- Dogru, Tarik. 2017. Under- vs over-investment: Hotel firms’ value around acquisitions. International Journal of Contemporary Hospitality Management 29: 2050–69. [Google Scholar] [CrossRef]

- Dogru, Tarik, Makarand Mody, Nathan Line, Courtney Suess, Lydia Hanks, and Mark Bonn. 2020. Investigating the whole picture: Comparing the effects of Airbnb supply and hotel supply on hotel performance across the United States. Tourism Management 79: 104094. [Google Scholar] [CrossRef]

- Etebari, Ahmad. 2016. Real estate as a portfolio risk diversifier. Investment Management and Financial Innovations 13: 45–52. [Google Scholar] [CrossRef] [PubMed][Green Version]

- Fama, Eugene F., and Richard Roll. 1968. Some properties of symmetric stable distributions. Journal of the American Statistical Association 63: 817–36. [Google Scholar]

- Fama, Eugene F., Lawrence Fisher, Michael C. Jensen, and Richard Roll. 1969. The adjustment of stock prices to new information. International Economic Review 10: 1–21. [Google Scholar] [CrossRef]

- Freybote, Julia, and Philip A. Seagraves. 2017. Heterogeneous investor sentiment and institutional real estate investments. Real Estate Economics 45: 154–76. [Google Scholar] [CrossRef]

- Garcia-López, Miquel-Àngel, Jordi Jofre-Monseny, Rodrigo Martínez-Mazza, and Mariona Segú. 2020. Do short-term rental platforms affect housing markets? Evidence from Airbnb in Barcelona. Journal of Urban Economics 119: 103278. [Google Scholar] [CrossRef]

- Ghosh, Chinmoy, Randall S. Guttery, and C. F. Sirmans. 1997. The effects of the real estate crisis on institutional stock prices. Real Estate Economics 25: 591–614. [Google Scholar] [CrossRef]

- Gompers, Paul, Joy Ishii, and Andrew Metrick. 2003. Corporate governance and equity prices. The Quarterly Journal of Economics 118: 107–56. [Google Scholar] [CrossRef]

- Goyette, Kiley. 2021. ‘Making ends meet’ by renting homes to strangers: Historicizing Airbnb through women’s supplemental income. City 25: 332–54. [Google Scholar] [CrossRef]

- Griffiths, Sarah Lynn. 2017. Where Home Meets Hotel: Regulating Tourist Accommodations in the Age of Airbnb. Burnaby: Simon Fraser University. [Google Scholar]

- Gupta, Manjul, Pouyan Esmaeilzadeh, Irem Uz, and Vanesa M. Tennant. 2019. The effects of national cultural values on individuals’ intention to participate in peer-to-peer sharing economy. Journal of Business Research 97: 20–29. [Google Scholar] [CrossRef]

- Guttentag, Daniel. 2015. Airbnb: Disruptive innovation and the rise of an informal tourism accommodation sector. Current Issues in Tourism 18: 1192–217. [Google Scholar] [CrossRef]

- Hampshire, Robert C., and Craig Gaites. 2011. Peer-to-peer carsharing: Market analysis and potential growth. Transportation Research Record 2217: 119–26. [Google Scholar] [CrossRef]

- He, Xin, Zhenguo Len Lin, and Yingchun Liu. 2018. Volatility and liquidity in the real estate market. Journal of Real Estate Research 40: 523–50. [Google Scholar] [CrossRef]

- Hu, Yang, Chunlin Lang, Shaen Corbet, and Junchuan Wang. 2024. The Impact of COVID-19 on the Volatility Connectedness of the Chinese Tourism Sector. Research in International Business and Finance 68: 102192. [Google Scholar] [CrossRef]

- Ismail, Eman, Yasser Tawfik Halim, and Mohamed Samy EL-Deeb. 2023. Corporate reputation and shareholder investment: A study of Egypt’s tourism listed companies. Future Business Journal 9: 1–15. [Google Scholar]

- Ivanov, Stanislav Hristov, and Craig Webster. 2012. Tourism’s impact on growth: The role of globalisation. Annals of Tourism Research 41: 231–36. [Google Scholar] [CrossRef]

- Jang, Hanwool, Yena Song, Sungbin Sohn, and Kwangwon Ahn. 2018. Real estate soars and financial crises: Recent stories. Sustainability 10: 4559. [Google Scholar] [CrossRef]

- Januário, João Fragoso, and Carlos Oliveira Cruz. 2023. The Impact of the 2008 Financial Crisis on Lisbon’s Housing Prices. Journal of Risk and Financial Management 16: 46. [Google Scholar] [CrossRef]

- Jayaraman, Krishnaswamy, Soh Keng Lin, Hasnah Haron, and Wooi Leng Ong. 2011. Macroeconomic factors influencing Malaysian tourism revenue, 2002–2008. Tourism Economics 17: 1347–63. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1978. Some anomalous evidence regarding market efficiency. Journal of Financial Economics 6: 95–101. [Google Scholar] [CrossRef]

- Jiang, Yonghong, Gengyu Tian, Yiqi Wu, and Bin Mo. 2022. Impacts of geopolitical risks and economic policy uncertainty on Chinese tourism-listed company stock. International Journal of Finance & Economics 27: 320–33. [Google Scholar]

- Jiménez, Juan Luis, Armando Ortuño, and Jorge V. Pérez-Rodríguez. 2022. How does AirBnb affect local Spanish tourism markets? Empirical Economics 62: 2515–45. [Google Scholar] [CrossRef]

- Kolari, James W., and Seppo Pynnönen. 2010. Event study testing with cross-sectional correlation of abnormal returns. The Review of Financial Studies 23: 3996–4025. [Google Scholar] [CrossRef]

- Kolari, James W., and Seppo Pynnönen. 2011. Nonparametric rank tests for event studies. Journal of Empirical Finance 18: 953–71. [Google Scholar] [CrossRef]

- Lee, Yong-Jin Alex, Seongsoo Jang, and Jinwon Kim. 2020. Tourism clusters and peer-to-peer accommodation. Annals of Tourism Research 83: 102960. [Google Scholar] [CrossRef]

- Lee, Chyi Lin, Simon Stevenson, and Hyunbum Cho. 2022. Listed real estate futures trading, market efficiency, and direct real estate linkages: International evidence. Journal of International Money and Finance 127: 102693. [Google Scholar] [CrossRef]

- Ling, David C., and Andy Naranjo. 2015. Returns and information transmission dynamics in public and private real estate markets. Real Estate Economics 43: 163–208. [Google Scholar] [CrossRef]

- Liu, Yikui, Lei Wu, and Jie Li. 2019. Peer-to-peer (P2P) electricity trading in distribution systems of the future. The Electricity Journal 32: 2–6. [Google Scholar] [CrossRef]

- Liu, Han, Peng Yang, Haiyan Song, and Doris Chenguang Wu. 2023. Global and domestic economic policy uncertainties and tourism stock market: Evidence from China. Tourism Economics. [Google Scholar] [CrossRef]

- McGough, Tony, and Jim Berry. 2022. Real estate risk, yield modelling and market sentiment: The impact on pricing in European office markets. Journal of European Real Estate Research 15: 179–91. [Google Scholar] [CrossRef]

- Mladina, Peter. 2018. Real Estate Betas and the Implications for Asset Allocation. The Journal of Investing 27: 109–20. [Google Scholar] [CrossRef]

- Newey, Whitney K., and Kenneth D. West. 1987. A Simple, Positive Semi-Definite, Heteroskedasticity and Autocorrelation Consistent Covariance Matrix. Econometrica 55: 703–8. [Google Scholar] [CrossRef]

- Nguyen, My-Linh Thi, and Toan Ngoc Bui. 2020. The real estate market and financial stability. International Journal of Mathematical, Engineering and Management Sciences 5: 1270. [Google Scholar] [CrossRef]

- Olszewski, Krzysztof. 2012. The Impact of Commercial Real Estate on the Financial Sector, Its Tracking by Central Banks and Some Recommendations for the Macro-Financial Stability Policy of Central Banks. National Bank of Poland Working Paper, No. 132. Amsterdam: Elsevier. [Google Scholar]

- Oxford Analytica. 2022. Higher Interest Rates Will Stress Real Estate Activity. Bingley: Emerald Expert Briefings. [Google Scholar]

- Palatnik, Ruslana Rachel, Tchai Tavor, and Liran Voldman. 2019. The Symptoms of Illness: Does Israel Suffer from “Dutch Disease”? Energies 12: 2752. [Google Scholar] [CrossRef]

- Papathanasiou, Spyros, Dimitris Kenourgios, Drosos Koutsokostas, and Georgios Pergeris. 2023. Can treasury inflation-protected securities safeguard investors from outward risk spillovers? A portfolio hedging strategy through the prism of COVID-19. Journal of Asset Management 24: 198–211. [Google Scholar]

- Park, Jun-hyoung. 2013. Calendar effect: Do investors overreact to the seasonality of the US hotel Industry? International Journal of Tourism Sciences 13: 80–102. [Google Scholar] [CrossRef]

- Patell, James M. 1976. Corporate forecasts of earnings per share and stock price behavior: Empirical test. Journal of Accounting Research 14: 246–76. [Google Scholar] [CrossRef]

- Peng, Kang-Lin, Chih-Hung Wu, Pearl M. C. Lin, and IokTeng Esther Kou. 2023. Investor sentiment in the tourism stock market. Journal of Behavioral and Experimental Finance 37: 100732. [Google Scholar] [CrossRef]

- Qin, Feng-Ming, and Zhong-Nan Zhang. 2007. The influence of real estate price expansion on financial situation. Journal of Shandong University (Philosophy and Social Sciences) 4: 33–36. [Google Scholar]

- Rabiei-Dastjerdi, Hamidreza, Gavin McArdle, and William Hynes. 2022. Which came first, the gentrification or the Airbnb? Identifying spatial patterns of neighbourhood change using Airbnb data. Habitat International 125: 102582. [Google Scholar] [CrossRef]

- Roll, Richard. 1984. A simple implicit measure of the effective bid-ask spread in an efficient market. The Journal of Finance 39: 1127–39. [Google Scholar]

- Sanford, Douglas M., Jr., and Huiping Dong. 2000. Investment in familiar territory: Tourism and new foreign direct investment. Tourism Economics 6: 205–19. [Google Scholar] [CrossRef]

- Shabrina, Zahratu, Elsa Arcaute, and Michael Batty. 2022. Airbnb and its potential impact on the London housing market. Urban Studies 59: 197–221. [Google Scholar] [CrossRef]

- Shirkhani, Setareh, Sami Fethi, and Andrew Adewale Alola. 2021. Tourism-related loans as a driver of a small island economy: A case of northern Cyprus. Sustainability 13: 9508. [Google Scholar] [CrossRef]

- Śmietana, Katarzyna. 2014. Diversification principles of real estate portfolios. Real Estate Management and Valuation 22: 51–57. [Google Scholar] [CrossRef][Green Version]

- Snedecor, George W., and William G. Cochran. 1989. Statistical Methods, 8th ed. Ames: Iowa State University Press. [Google Scholar]

- Sternik, S. G., and N. B. Safronova. 2021. Financialization of Real Estate Markets as a Macroeconomic Trend of the Digital Economy. Studies on Russian Economic Development 32: 676–82. [Google Scholar] [CrossRef]

- Sternik, Sergey Gennadievich, and Grigory Teleshev. 2018. Impact of banking real estate as an asset class on financial system stability: Monitoring, forecasting, management. Journal of Reviews on Global Economics 7: 851–64. [Google Scholar] [CrossRef][Green Version]

- Tavor, Tchai. 2023. The effect of natural gas discoveries in Israel on the strength of its currency. Australian Economic Papers 62: 236–56. [Google Scholar] [CrossRef]

- Teitler-Regev, Sharon, and Tchai Tavor. 2023. The effect of Airbnb announcements on hotel stock prices. Australian Economic Papers 62: 78–100. [Google Scholar] [CrossRef]

- Thackway, William Thomas, Matthew Kok Ming Ng, Chyi-Lin Lee, Vivien Shi, and Christopher James Pettit. 2022. Spatial variability of the ‘Airbnb effect’: A spatially explicit analysis of Airbnb’s impact on housing prices in Sydney. ISPRS International Journal of Geo-Information 11: 65. [Google Scholar] [CrossRef]

- The World Bank. 2023. Available online: https://data.worldbank.org/country (accessed on 7 February 2023).

- Urquhart, Andrew, and Hanxiong Zhang. 2019. Is Bitcoin a hedge or safe haven for currencies? An intraday analysis. International Review of Financial Analysis 63: 49–57. [Google Scholar] [CrossRef]

- Wachsmuth, David, and Alexander Weisler. 2018. Airbnb and the rent gap: Gentrification through the sharing economy. Environment and Planning A: Economy and Space 50: 1147–70. [Google Scholar] [CrossRef]

- Wang, Chuhan Renee, and Miyoung Jeong. 2018. Whatmakes you choose Airbnb again? An examination ofusers’ perceptions toward the website andtheir stay. International Journal of Hospitality Management 74: 162–70. [Google Scholar] [CrossRef]

- Wang, Jinsong, Luoqiu Tang, and Yueqiao Li. 2022. Real estate assets, heterogeneous firms, and debt stability. Journal of Post Keynesian Economics 45: 1–34. [Google Scholar] [CrossRef]

- Wilson, Patrick, and John Okunev. 1999. Spectral analysis of real estate and financial assets markets. Journal of Property Investment & Finance 17: 61–74. [Google Scholar]

- Zervas, Georgios, Davide Proserpio, and John W. Byers. 2017. The rise of the sharing economy: Estimating the impact of Airbnb on the hotel industry. Journal of Marketing Research 54: 687–705. [Google Scholar] [CrossRef]

- Zurek, Maximilian. 2022. Real Estate Markets and Lending: Does Local Growth Fuel Risk? Journal of Financial Services Research 62: 27–59. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).