Variable Considerations in ASC 606, Earnings Management and Business Continuity during Crisis

Abstract

1. Introduction

- −

- To explore the use of the variable considerations in ASC 606 as a tool to manage earnings during COVID-19;

- −

- To examine the way in which earnings management is used to keep firms operating during COVID-19;

- −

- To assess the effect of using the variable considerations in ASC 606 on the continuity of firms during COVID-19;

- −

- To investigate the mediating role of managing earnings on the relationship between using the variable considerations in ASC 606 and the business continuity for business entities during COVID-19.

2. Literature Review

2.1. Theoretical Foundation

2.2. Background of Variable Considerations in ASC 606

- −

- Identification of the contract with a customer, outlining the criteria that should be met when contracting a customer;

- −

- Identification of the performance obligations, separating the distinct performance obligations from others in the contract;

- −

- Determination of the transaction price, which determines the payment that is expected to be received for the transfer of products or services to a customer;

- −

- Allocation of the transaction price, which indicates how to allocate the price of the transaction across the distinct performance obligations;

- −

- Revenue recognition, which specifies how revenues have to be recognized as meeting the distinct performance obligations.

2.3. Variable Considerations and Earnings Management

2.4. Earnings Management and Going Concerns

2.5. Variable Considerations and Going Concerns

2.6. Variable Considerations, Earnings Management, and Going Concerns

3. Methodology

3.1. Research Model and Hypotheses Development

3.2. Sampling and Data Collection

3.3. Questionnaire

3.4. Measurement

3.4.1. Variable Considerations

3.4.2. Earnings Management

3.4.3. Going Concerns

4. Results

4.1. Validity and Reliability

4.2. Hypotheses Testing

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abba, Magaji, Lawan Yahaya, and Naziru Suleiman. 2018. Explored and critique of contingency theory for management accounting research. Journal of Accounting and Financial Management 4: 40–50. [Google Scholar]

- Al-Sraheen, Dea’a Al-Deen. 2019. The role of the audit committee in moderating the negative effect of non-audit services on earnings management among industrial firms listed on the Amman Stock Exchange. Afro-Asian Journal of Finance and Accounting 9: 349–61. [Google Scholar]

- Arnedo, Laura, Fermin Lizarraga, and Santiago Sánchez. 2008. Going-concern Uncertainties in Pre-bankrupt Audit Reports: New Evidence Regarding Discretionary Accruals and Wording Ambiguity. International Journal of Auditing 12: 25–44. [Google Scholar] [CrossRef]

- Arora, Sanjeev. 2019. Implications of ASC 606 on Airline Financial Statements. Management Accounting Quarterly 21: 15–24. Available online: https://www.proquest.com/docview/2410489834/fulltext/2E77A79CF6414CEEPQ/1?accountid=146540 (accessed on 14 August 2022).

- Barth, Mary, Javier Gómez-Biscarri, and Ron Kasznik. 2012. Fair Value Accounting, Earnings Management and the Use of Available-for-Sale Instruments by Bank Managers. Available online: dadun.unav.edu (accessed on 14 August 2022).

- Basu, Sudipta. 1997. The conservatism principle and the asymmetric timeliness of earnings. Journal of Accounting and Economics 24: 3–37. [Google Scholar] [CrossRef]

- BDO. 2018. Ready for Revenue Recognition? Implementation Lessons Learned for Tech Companies. Chicago: BDO USA LLP. [Google Scholar]

- Benavides, Luis. 2015. Flattening the Revenue Recognition Standard. April 22. Available online: https://ssrn.com/abstract=2597787 (accessed on 14 August 2022).

- Bhattacharaya, Nilabhra, Ervin Black, Theodore Christensen, and Chad Larson. 2003. Assessing the relative informativeness and permanence of pro forma earnings and GAAP operating earnings. Journal of Accounting and Economics 36: 285–319. [Google Scholar] [CrossRef]

- Bjornsen, Matt. 2019. Principles-based accounting standards and corporate governance considerations. Journal of Accounting and Management 9: 7–13. Available online: http://zbw.eu/econis-archiv/bitstream/11159/4316/1/1694160939.pdf (accessed on 14 August 2022).

- Butler, Marty, Andrew Leone, and Michael Willenborg. 2004. An empirical analysis of auditor reporting and its association with abnormal accruals. Journal of Accounting & Economics 37: 139–65. [Google Scholar]

- Capkun, Vedran, Daniel Collins, and Thomas Jeanjean. 2016. The effect of IAS/IFRS adoption on earnings management (smoothing): A closer look at competing explanations. Journal of Accounting and Public Policy 35: 352–94. [Google Scholar] [CrossRef]

- Charitou, Andreas, Neophytos Lambertides, and Lenos Trigeorgis. 2007. Earnings behaviour of financially distressed firms: The role of institutional ownership. Abacus 43: 271–96. [Google Scholar] [CrossRef]

- Chenhall, Robert, and Deigan Morris. 1986. The impact of structure, environment and interdependence on the perceived usefulness of management accounting system. The Accounting Review 61: 16–53. Available online: https://www.jstor.org/stable/247520 (accessed on 25 August 2022).

- Chi, Der-Jang, and Zong-De Shen. 2022. Using Hybrid Artificial Intelligence and Machine Learning Technologies for Sustainability in Going-Concern Prediction. Sustainability 14: 1810. [Google Scholar] [CrossRef]

- Chua, Yan Piaw. 2023. A Step-by-Step Guide: PLS-SEM Data Analysis Using SmartPLS 4. Researchtree Education. Available online: www.researchgate.net (accessed on 14 August 2022).

- Cohen, Daniel, Aiyesha Dey, and Thomas Lys. 2008. Real and accrual-based earnings management in the pre-and post-Sarbanes-Oxley periods. The Accounting Review. Available online: meridian.allenpress.com (accessed on 14 August 2022).

- Comporek, Michał. 2020. Real earnings management in companies punished by the uknf for irregularities regarding ias/ifrs principles. Research Papers of Wroclaw University of Economics and Business 64: 17–30. [Google Scholar] [CrossRef]

- Condren, Paige. 2021. The Impact of the New Revenue Standard-ASC 606. Available online: https://shareok.org/handle/11244/332586 (accessed on 18 August 2022).

- Damayanthi, I. Gusti Ayu Eka, Ni Wiagustini, I. Wayan Suartana, and Henny Rahyuda. 2022. Loan restructuring as a banking solution in the COVID-19 pandemic: Based on contingency theory. Banks and Bank Systems 17: 196–206. [Google Scholar] [CrossRef]

- Donaldson, Lex. 2001. The Contingency Theory of Organization. London: SAGE Publication. [Google Scholar]

- Du, Ning, and Ray Wnittington. 2017. Implementing Variable Considerations in Revenue Recognition. The CPA Journal 87: 57–58. [Google Scholar]

- Ferreira, Petrus. 2021. The Liquidity, Precision, and Comparability Effects of ASC 606: Revenue from Contracts with Customers. Chapel Hill. Available online: https://kenaninstitute.unc.edu/ (accessed on 14 August 2022).

- Financial Accounting Standards Board. 2014. UPDATE NO. 2014-09—REVENUE FROM CONTRACTS WITH CUSTOMERS (TOPIC 606) SECTION C—BACKGROUND INFORMATION AND BASIS FOR CONCLUSIONS. UPDATE NO. 2014-09—REVENUE FROM CONTRACTS WITH CUSTOMERS (TOPIC 606) SECTION C—BACKGROUND INFORMATION AND BASIS FOR CONCLUSIONS. Available online: https://www.iasplus.com/en/news/2014/08/asu-2014-15 (accessed on 10 August 2022).

- Financial Accounting Standards Board. 2020. REVENUE FROM CONTRACTS WITH CUSTOMERS: Comparison of Topic 606 and IFRS 15. Available online: https://www.iasplus.com/en/resources/regional/fasb (accessed on 14 May 2022).

- Financial Force. 2022. What Is ASC 606? From Financial Force. Available online: https://www.financialforce.com/learn/revenue-recognition/complying-with-asc-606-and-ifrs-15/#:~:text=ASC%20606%20is%20the%20new%20revenue%20recognition%20standard,now%20based%20on%20the%202017%20and%202018%20deadlines (accessed on 10 August 2022).

- Financial Reporting Council. 2019. IFRS 15 Thematic Review: Review of Disclosures in the First Year of Application. London: Financial Reporting Council. Available online: https://www.frc.org.uk/ (accessed on 3 August 2022).

- Fornell, Claes, and David Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Franceschetti, Bruno Maria. 2020. Financial Crisis: Time to Manage Earnings? Australasian Accounting, Business and Finance Journal 14: 26–41. [Google Scholar] [CrossRef]

- Francis, Jere, and Jagan Krishnan. 1999. Accounting accruals and auditor reporting conservatism. Contemporary Accounting Research 16: 135–65. [Google Scholar] [CrossRef]

- Glaze, Jesse, A. Nicole Skinner, and Andrew Stephan. 2020. When are concurrent quarterly reports useful for investors? Evidence from ASC 606. Review of Accounting Studies, 1–47. [Google Scholar] [CrossRef]

- Gould, Stathis, and Christopher Arnold. 2020. The Financial Reporting Implications of COVID-19. IFAC/Supporting International Standards. Available online: https://www.ifac.org/ (accessed on 3 August 2022).

- Greenwood, Robin, Benjamin Iverson, and David Thesmar. 2020. Sizing up Corporate Restructuring in the COVID Crisis. Available online: http://www.nber.org/papers/w28104 (accessed on 1 September 2022).

- Hagos, Amanda, and Marcus Svensson. 2021. How does IFRS 15 Influence Swedish Auditors and Financial analysts’ Understanding of Companies’ Revenue Transactions? November. Available online: https://www.diva-portal.org/smash/get/diva2:1586420/FULLTEXT01.pdf (accessed on 3 August 2022).

- Hair, Joseph, Jeffrey Risher, Marko Sarstedt, and Christian Ringle. 2019. When to Use and How to Report the Results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Hair, Joseph, William Black, Barry Babin, and Rolph Anderson. 2018. Multivariate Data Analysis, 8th ed. London: Cengage. [Google Scholar]

- Haw, I. N-Mu, Daqing Qi, Donghui Wu, and Woody Wu. 2005. Market consequences of earnings management in response to security regulations in China. Contemporary Accounting Research 22: 95–140. [Google Scholar] [CrossRef]

- Healy, Paul, and James Wahlen. 1999. A review of the earnings management literature and its implications for standard setting. Accounting Horizons 13: 365–83. [Google Scholar] [CrossRef]

- Hepp, John. 2018. ASC 606: Challenges in understanding and applying revenue recognition. Journal of Accounting Education 42: 49–51. [Google Scholar] [CrossRef]

- Herbohn, Kathleen, and Vanitha Ragunathan. 2008. Auditor reporting and earnings management: Some additional evidence. Accounting and Finance 48: 575–601. [Google Scholar] [CrossRef]

- Hinson, Lisa, Gabriel Pundrich, and Mark Zakota. 2022. The Decision-Usefulness of ASC 606 Revenue Disaggregation. May 7. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4108032 (accessed on 14 May 2022).

- Iatridis, George. 2010. International Financial Reporting Standards and the quality of financial statement information. International Review of Financial Analysis 19: 193–204. [Google Scholar] [CrossRef]

- International Financial Standards Board. 2018. Revenue from Contracts with Customers IFRS 15. IFRS 15—2021 Issued IFRS Standards (Part A). Available online: https://www.ifrs.org/ (accessed on 14 May 2022).

- Jensen, Michael, and William Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Kim, Hak Woon, and Sooro Lee. 2016. Does Revenue-Expense Matching Relate To Going-Concern Audit OpinionConditional On Firm’s Financial Distress? The Journal of Applied Business Research 32: 947–66. Available online: https://clutejournals.com/index.php/JABR/article/view/9665/9766 (accessed on 14 August 2022).

- Kim, Yongmi. 2022. The Impact of ASC 606 on the Usefulness of Discretion in Revenue Recognition. Journal of Academic Presentations of the Korea Accounting Society 2: 1–61. Available online: https://papersearch.net/thesis/article.asp?key=3949325 (accessed on 14 August 2022).

- Lee, Kyungran, and Shinwoo Lee. 2020. Rules-based vs. Principles-based Accounting Standards: Earnings Quality and the Role of Earnings in Contracting (An Analysis employing the adoption of ASC 606). Empirical Studies eJournal 7: 20. [Google Scholar] [CrossRef]

- Levy, Howard. 2020. Financial Reporting and Auditing Implications of the COVID-19 Pandemic. The CPA Journal 90: 26–33. Available online: https://www.proquest.com/docview/2420173071?pq-origsite=gscholar&fromopenview=true (accessed on 14 August 2022).

- Moss Adams. 2022. Going Concern Evaluation Checklist. from Moss Adams LLP Web Site. Available online: https://www.mossadams.com/getmedia/91941edf-b668-471c-809d-e1a660415b3c/Moss-Adams_Going-Concern-Evaluation-Checklist.pdf (accessed on 14 May 2022).

- Napier, Christopher, and Christian Stadler. 2020. The real effects of a new accounting standard: The case of IFRS 15 “Revenue from contracts with customers”. Accounting and Business Research 50: 474–503. [Google Scholar] [CrossRef]

- O’Donovan, James, and Manfred Zentner. 2020. Towards a Better Understanding of the Impact of COVID-19 on the Youth Sector. Council of Europe: Youth Partnership. Available online: https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwiBg6Wqnr6DAxUAk68BHfZ6DIgQFnoECBQQAQ&url=https%3A%2F%2Fpjp-eu.coe.int%2Fdocuments%2F42128013%2F72351197%2FRevised_Covid%2Bimpact%2BEECA.pdf%2F9cf17487-f37d-30cd-99e6-c4f3300d21f1&usg=AOvVaw0p4SjLzqfSq0f4O4YMceTf&opi=89978449 (accessed on 14 May 2022).

- Pennings, Johannes. 1975. The Relevance of the Structural-Contingency Model for Organizational Effectiveness. Administrative Science Quarterly 20: 393–410. Available online: http://www.jstor.org/stable/2391999 (accessed on 20 May 2022). [CrossRef]

- PwC. 2017. Revenue from Contracts with Customers: The Standard Is Final—A Comprehensive Look at the New Revenue Model. Available online: https://www.pwc.com/ (accessed on 14 May 2022).

- Rosner, Rebecca. 2003. Earnings manipulation in failing firms. Contemporary Accounting Research 20: 361–408. [Google Scholar] [CrossRef]

- Saleh, Isam, Malik Abu Afifa, and Fares Alsufy. 2020. Does Earnings Quality Affect Companies’ Performance? New Evidence from the Jordanian Market. Journal of Asian Finance, Economics and Business 7: 33–43. [Google Scholar] [CrossRef]

- Sengupta, Partha, and Min Shen. 2007. Can Accruals Quality Explain Auditors’ Decision Making? The Impact of Accruals Quality on Audit Fees, Going Concern Opinions and Auditor Change. August. Available online: http://ssrn.com/abstract=1178282 (accessed on 14 May 2022). [CrossRef]

- Teixeira, Jaime Fernandes, and Lucia Lima Rodrigues. 2022. Earnings management: A bibliometric analysis. International Journal of Accounting & Information Management. ahead-of-print. [Google Scholar] [CrossRef]

- Toumeh, Ahmad, and Sofri Yahya. 2019. A Review of Earnings Management Techniques: An IFRS Perspective. Global Business and Management Research: An International Journal 11: 1–13. [Google Scholar]

- Tsipouridou, Maria, and Charalambos Spathis. 2014. Audit opinion and earnings management: Evidence from Greece. Accounting Forum 38: 38–54. [Google Scholar] [CrossRef]

- Tutino, Marco, Carlo Regoliosi, Giorgia Mattei, Niccolo Paoloni, and Marco Pompili. 2019. Does the IFRS 15 impact earnings management? Initial evidence from Italian listed companies. African Journal of Business Management 13: 226–38. [Google Scholar] [CrossRef]

- U.S. Census Bureau. 2020. Small Business Pulse Survey Data; Washington, DC: U.S. Census Bureau. Available online: https://portal.census.gov/pulse/data/ (accessed on 20 May 2022).

- Ventura, Luigi. 2020. COVID-19 Bankruptcies: A Global Snapshot. August 12. Available online: https://www.gfmag.com/ (accessed on 1 September 2022).

- Wang, Jialan, Jeyul Yang, Benjamin Iverson, and Raymond Kluender. 2020. Bankruptcy and the COVID-19 Crisis. September 10. Available online: https://www.hbs.edu/faculty/Pages/download.aspx?name=21-041.pdf (accessed on 20 May 2022). [CrossRef]

- Waqar, Ali, and Ayung Tseng. 2022. The Effects of ASC 606 on Revenue Recognition. Edited by Georgetown McDonough. School of Business Research Paper No. 4084006. Available online: https://ssrn.com/abstract=4084006 (accessed on 20 May 2022).

- Yap, Kiew-Heong, Zakiah Saleh, and Masoud Abessi. 2011. Internet financial reporting and corporate governance in Malaysia. Australian Journal of Basic and Applied Sciences 5: 1273–89. [Google Scholar]

- Yassin, Mohammed, Ahmad Abdallah, and Omran Al-Ibbini. 2015. Earnings Quality Determinants: Literature Review and Research Opportunities. International Journal of Business and Management 10: 126–33. [Google Scholar]

- Yassin, Mohammed, and Esraa Al-Khatib. 2019. Internet financial reporting and expected stock return. Journal of Accounting, Finance & Management Strategy 14: 1–28. [Google Scholar]

- Yassin, Mohammed, and Osama Shaban. 2022. Earnings Management and Going Concern during COVID-19: Evidence from IFRS Context. In Global Business Conference 2022 Proceedings. Dubrovnik: Innovation Institute, p. 215. [Google Scholar]

- Yassin, Mohammed, Osama Shaban, Dea’a Al-Deen Al-Sraheen, and Khaldoon Al Daoud. 2022. Revenue standard and earnings management during the COVID-19 pandemic: A comparison between IFRS and GAAP. Journal of Governance and Regulation 11: 80–93. [Google Scholar] [CrossRef]

- Young, Tony. 2016. Questionnaires and Surveys. In Research Methods in Intercultural Communication: A Practical Guide. Edited by Zhu Hua. Oxford: Wiley, pp. 165–80. [Google Scholar]

- Zhan, Weiwei, and Hao Jing. 2022. Does Fintech Development Reduce Corporate Earnings Management? Evidence from China. Sustainability 14: 16647. [Google Scholar] [CrossRef]

- Zhou, Shuyu. 2021. Current Income Recognition Principle Analysis of IFRS 15, ASC 606 and CAS 14. Paper Presented at the 6th International Conference on Financial Innovation and Economic Development (ICFIED 2021), Sanya, China, January 29–31; pp. 38–44. Available online: https://www.atlantis-press.com/proceedings/icfied-21/125954362 (accessed on 20 August 2022).

| Respondents | n | % | |

|---|---|---|---|

| Gender | |||

| Male | 209 | 52 | |

| Female | 194 | 48 | |

| Total | 403 | 100 | |

| Age | |||

| <30 | 117 | 29 | |

| 30–60 | 202 | 50 | |

| >60 | 84 | 21 | |

| Total | 403 | 100 | |

| Education | |||

| Diploma degree | 116 | 29 | |

| Bachelor’s degree | 218 | 54 | |

| Post-graduate degree | 69 | 17 | |

| Total | 403 | 100 | |

| Job Level | |||

| Owner/executive | 105 | 26 | |

| Senior management | 56 | 14 | |

| Middle management | 94 | 23 | |

| Intermediate | 111 | 28 | |

| Entry level | 37 | 9 | |

| Total | 403 | 100 | |

| Construct | No. of Items | Sources |

|---|---|---|

| Variable considerations | 8 | FASB (2020); PwC (2017); IFRS (2018) |

| Earnings management | 6 | Cohen et al. (2008); Barth et al. (2012) |

| Going concern | 8 | Moss Adams (2022) |

| Construct | Code | Item |

|---|---|---|

| Variable considerations | Considering ASC 606 “Revenue from Contracts with Customers standard”, during the COVID-19 crisis: | |

| ASC1 | Re-estimation of revenues has been used | |

| ASC2 | Re-estimation of variable considerations has been used | |

| ASC3 | Re-estimation of discounts has been used | |

| ASC4 | Re-estimation of refunds has been used | |

| ASC5 | Re-estimation of price concessions has been used | |

| ASC6 | Re-estimation of bonuses or penalties on performance has been used | |

| ASC7 | A revision of variable considerations will be assessed | |

| ASC8 | Revenues estimation will be conservative | |

| Earnings management | ||

| EM1 | When the firm is in financial distress, earnings management is used | |

| EM2 | Discounts, lenient, and flexible credit terms are used to accelerate the timing of sales | |

| EM3 | Mends policies judgments are used to meet financial position expectations | |

| EM4 | An accounting treatment is selected to meet the expected earnings number | |

| EM5 | An increase in revenue is claimed without a corresponding increase in cash flows | |

| EM6 | An increase in earnings is reported only in the last quarter of the year | |

| Going concern | ||

| GC1 | Have you documented all events that are related to the firm’s ability to continue operating as a going concern? | |

| GC2 | If the firm’s ability to continue is substantially doubtful, have you documented your opinion about any plans to mitigate the relevant events and conditions? | |

| GC3 | Have you evaluated whether events substantially affect the firm’s ability to continue as a going concern? | |

| GC4 | Have you evaluated the management’s plans about mitigating the relevant events that raised substantial doubt about the entity’s going concern? | |

| GC5 | Have you documented the conditional and unconditional commitments due or anticipated within the coming year? | |

| GC6 | Have you documented your consideration of management’s plans to overcome the problem of substantial doubt about the going concern, if any? | |

| GC7 | Have you provided the required disclosures when substantial doubt was determined, and this doubt was existed in a prior period but no longer existed in the current? | |

| GC8 | Have you provided the required disclosures regarding the continuity in case of changing the conditions or events have between reporting periods? |

| Variable | Cronbach’s Alpha | Rho A | Composite Reliability | AVE |

|---|---|---|---|---|

| Variable considerations in ASC 606 (ASC) | 0.946 | 0.949 | 0.945 | 0.684 |

| Earnings management (EM) | 0.890 | 0.891 | 0.890 | 0.575 |

| Going concern (GC) | 0.915 | 0.915 | 0.915 | 0.573 |

| Variable | ASC | EM | GC |

|---|---|---|---|

| Variable considerations in ASC 606 (ASC) | 0.827 | ||

| Earnings management (EM) | 0.586 | 0.758 | |

| Going concern (GC) | 0.667 | 0.737 | 0.757 |

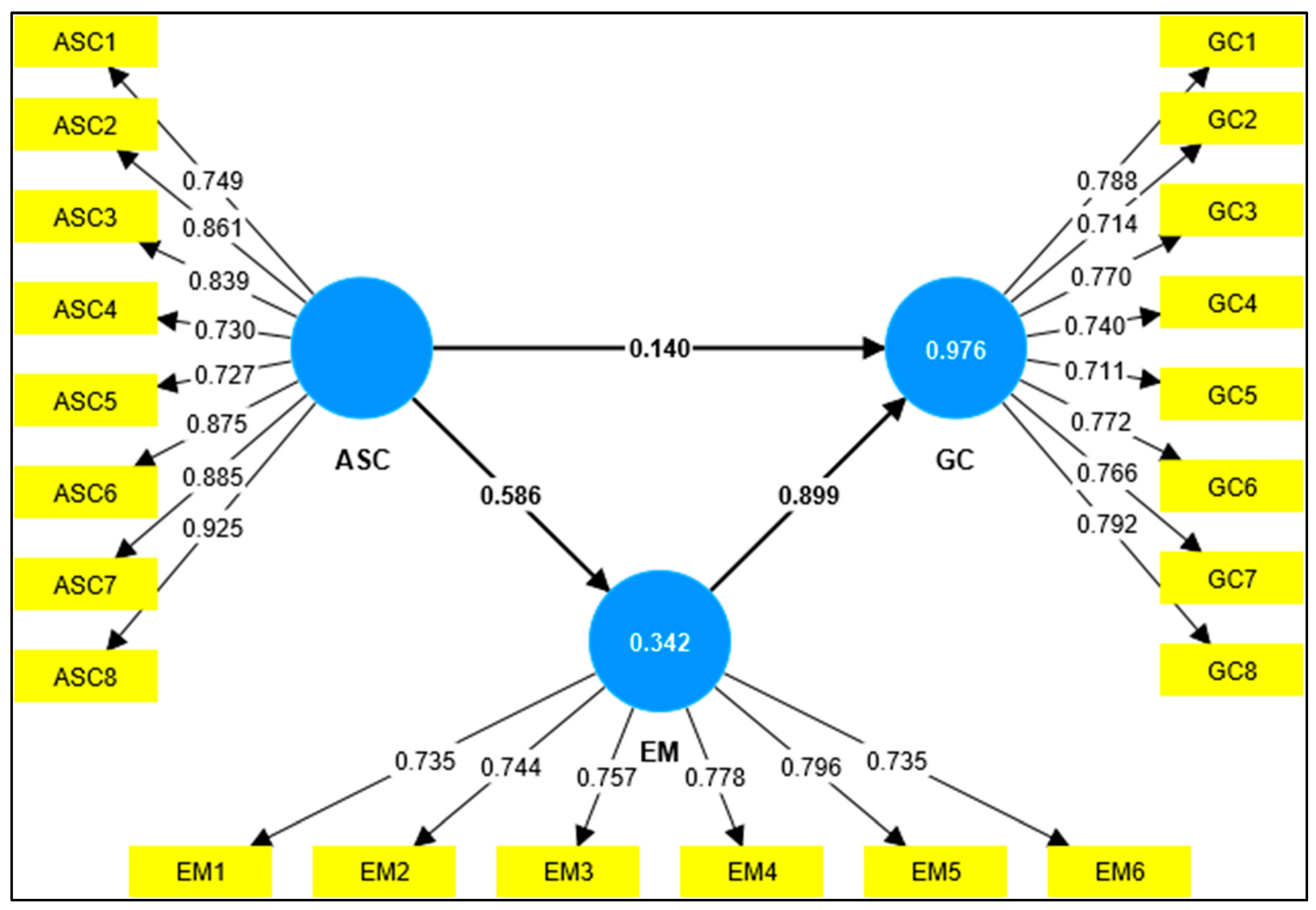

| Panel A: Hypotheses testing | ||||

| Hypothesis | Path | Beta | t-statistic | p-Value |

| 1 | ASC-EM | 0.586 | 10.221 | 0.000 |

| 2 | EM-GC | 0.140 | 2.916 | 0.004 |

| 3 | ASC-GC | 0.899 | 21.033 | 0.000 |

| Panel B: Mediating effect | ||||

| Hypothesis | Path | z-statistic | p-Value | |

| 4 | ASC-EM-GC | 9.735 | 0.000 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yassin, M.M.; Al-Sraheen, D.A.-D.; Al Daoud, K.A.; Alhadab, M.; Altahtamouni, F. Variable Considerations in ASC 606, Earnings Management and Business Continuity during Crisis. Int. J. Financial Stud. 2024, 12, 1. https://doi.org/10.3390/ijfs12010001

Yassin MM, Al-Sraheen DA-D, Al Daoud KA, Alhadab M, Altahtamouni F. Variable Considerations in ASC 606, Earnings Management and Business Continuity during Crisis. International Journal of Financial Studies. 2024; 12(1):1. https://doi.org/10.3390/ijfs12010001

Chicago/Turabian StyleYassin, Mohammed M., Dea’a Al-Deen Al-Sraheen, Khaldoon Ahmad Al Daoud, Mohammad Alhadab, and Farouq Altahtamouni. 2024. "Variable Considerations in ASC 606, Earnings Management and Business Continuity during Crisis" International Journal of Financial Studies 12, no. 1: 1. https://doi.org/10.3390/ijfs12010001

APA StyleYassin, M. M., Al-Sraheen, D. A.-D., Al Daoud, K. A., Alhadab, M., & Altahtamouni, F. (2024). Variable Considerations in ASC 606, Earnings Management and Business Continuity during Crisis. International Journal of Financial Studies, 12(1), 1. https://doi.org/10.3390/ijfs12010001