1. Introduction

From the global financial crisis (GFC) to the COVID-19 pandemic, the debt-to-GDP ratio has risen largely due to higher fiscal deficits in response to emergency budgets undertaken by governments to limit the human and economic impact in both crisis periods (

Bianchi et al. 2020). Interestingly, even if fiscal expansion (essential to face economic stress times) fell to pre-crisis levels, public debt soared. Borrowing was a global phenomenon across the crisis periods, and the argument is that interest rates were expected to remain below the economy’s growth rate so as to ease debt rollovers, that is, debt issuance without any fiscal cost (

Debrun et al. 2019;

Blanchard 2019;

Giannini and Oldani 2022). This is what we refer to as the sustainability or solvency condition. However, a complication that might arise is that investors may believe that high(er) debt is risky as governments may not be able to meet future payment obligations. As a result, they will require high risk premiums. Consequently, interest rates will start rising because of higher risk premiums, thus straining and eventually violating the solvency condition. Crucially, the key issue is that a country’s solvency condition ensures the smooth and uninterrupted servicing of sovereign debt contracts, while sovereign

insolvency is conceived as a country’s inability to pay its debts as well as its inability to continuously ensure access to borrowing because of high risk premiums. However, there is little evidence in the literature that more debt puts higher pressure on interest rates, leading to violation of the solvency condition and turning a country insolvent. Also, there is no evidence about the growth rate above which debt does not derail.

From the theoretical point of view, the Keynesian school recognizes that the impact of deficits in stress periods is temporary, and timely deficits have favorable effects on the economy. As a result, temporarily elevated debt drops to previous levels. However, the Neoclassical analysis argues that higher debt levels driven by the budget deficits created to face a crisis period (for example, when a crisis hits) are not temporary, and austerity policy needs to be undertaken to restore to previous levels. Interestingly, recent studies claim that higher debt levels might be welfare-enhancing if the growth rate is higher than the borrowing cost, and economic growth is the main factor stabilizing the dynamics of debt, which is essential for debt sustainability in the medium and long term (

Debrun et al. 2019;

Blanchard 2019;

Giannini and Oldani 2022).

In several euro countries, the fiscal deficit fell to pre-crisis levels, and economic growth was higher than interest rates despite a soaring public debt. The main reasons were the sizeable budget deficits and the low cost of borrowing which, over the past few years, became more appealing due to the central bank’s (the Fed) extensive quantitative easing. Although the cost of borrowing may seem sustainable, the indirect cost of not reducing the public debt appears to be very high. The reason may be that higher debt may cause either a higher risk premium or changes in the multiplier effect of the stability of public debt. This second effect can be very important if debt levels are high.

Based on the above discussion, this study aims to investigate how the dynamic stability of solvent affects the sustainability of public debt in view of crisis and regular periods. We use a sample of 11 euro-area countries over the period of about 42 years starting from 1980. We contribute to the literature in four different ways. First, we examine the impact of the dynamic stability/instability of debt on the development of public debt, not only in regular periods but also in times of stress. Second, we examine how the sustainability of public debt fares with increasing interest rates, which, in turn, reflects the fear of default on public debt through high risk premiums. Third, we provide new insights into the threshold effects above which dynamic stability of the debt-to-GDP ratio conditional on interest rates and vice versa, turns into debt instability. Fourth, as economic growth is considered as one of the main factors that can contribute to debt reduction, we examine threshold effects for annual growth to GDP, above which the country’s insolvency condition starts to disappear, thus making the solvency condition recover.

In essence, we pay much more attention to the proper accounting of how the stability of debt (dynamics) affects debt development (growth) in conjunction with continuous budget deficits from before GFC to the COVID-19 pandemic period. We also explore how the debt solvency condition, represented by the interest rate being less than the country’s growth rate, affects the debt’s dynamics and sustainability. Doing so, we provide new insights about the interest rates’ threshold effects above which sustainability of government debt turns to unsustainability (or instability). We also examine the limits of debt dynamics above which the solvency condition is at risk—that is, when the interest rate is growing faster than economic growth because of higher sovereign risk premia. We further investigate the low limits of economic growth above which government debt starts to become sustainable (the solvency condition). We perform a number of estimations of our models during a number of periods during which crises took place. Given that these periods entailed different economic and financial complexities, the insights derived from the findings will be of importance to all market agents. The results provide important implications for governments that may become insolvent and help them avoid being forced to default, given the knowledge of the levels of unsustainable debt dynamics. Also, government authorities can use the borderline (threshold) between a solvent and insolvent public debt and hence avoid any signals of uncertainty being made to the markets.

The remainder of this paper is organized as follows:

Section 2 provides a short review of the literature.

Section 3 describes the theoretical model, the data sources and variable construction, and the empirical model specification.

Section 4 presents and discusses the estimated results, and

Section 5 summarizes the main findings.

2. Short Literature Review

Even though many factors go into assessing how much debt an economy can safely carry, a large number of studies in the empirical literature dealing with debt sustainability have focused on fiscal sustainability instead. Early studies on government debt found that debt sustainability can be achieved in the sense of stationary primary deficit, satisfying an intertemporal budget constraint by raising the primary surplus, or equivalently, by reducing the budget deficit in the years that follow (

Hamilton and Flavin 1985;

Trehan and Walsh 1991;

Bohn 1995,

1998). Another strand of literature provided substantial evidence that the non-stationarity of the debt cannot be rejected as government spending is growing faster than revenue (

Kremers 1988;

Wilcox 1989;

Davig 2005). Nevertheless, the authors argued that the consequent rejections of stationarity do not invalidate the propositions of

Hamilton and Flavin (

1985) and showed that the U.S. government stabilized the ratio of Federal debt to GNP.

Contradictory conclusions are also drawn across studies where different samples of countries are examined, and the sustainability of fiscal deficits has been receiving increasing attention, particularly for advanced economies and in the newly formed euro area. Empirical results by

Hamilton and Flavin (

1985) and

Afonso (

2005) suggest that fiscal policy may not have been sustainable

1 in a sample of 18 OECD countries over the period 1970–2003 they examined, whereas fiscal sustainability was evidenced for euro-area countries, either by having a high debt-to-GDP ratio or violating the Maastricht treaty by permitting more than three percent of the deficit-to-GDP ratio (

Greiner et al. 2007).

In crisis periods, governments attempt to boost household consumption through financial support for the unemployed, thus increasing public spending, which in turn increases government debt, and the main approach for investigating debt sustainability is still fiscal sustainability (

Challes et al. 2011). In line with the Keynesian school, empirical evidence suggests that in a depressed economy, any expansionary fiscal policy does not impose a future burden, and the primary mechanism is the extra output because of the government purchases multiplier effects, whereas attempts to reduce the public debt via fiscal consolidation resulted in a high level of debt-to-GDP ratio through their negative impact on output (

DeLong et al. 2012;

Fatás and Summers 2018).

However, in line with the Neoclassical school, empirical evidence suggests that higher debt levels are driven by budget deficits, mostly created by governments to face a crisis or stress periods. In turn, these fiscal shocks could deteriorate macroeconomic imbalances, and chronic fiscal imbalances might lead to vicious austerity cycles, where only fiscal discipline is a means of achieving credible and shorter adjustments. The stability of public debt depends on a continuing tendency of fiscal policy to reduce the primary deficit (

Neaime 2015;

Agnello et al. 2015;

Dawood et al. 2017;

Goedl and Zwick 2018;

Gaysset et al. 2019).

Another approach to examining debt sustainability is fiscal solvency, and the basic idea is to verify whether the present value of budget constraint would be pursued over the distant future. The findings suggest that a very high ratio of government debt to GDP affects the spread between government bond yields and increases the risk premium, which subsequently affects the cost of financing for budget deficits. Thus, the solvency condition is at risk (

Ardagna et al. 2007;

Cournède 2010;

Furceri and Mourougane 2012). Furthermore,

Ghosh et al. (

2013) explored the debt limit above which the solvency condition is rejected, thus measuring the fiscal space, and showed that, as the debt is around 90–100 percent of GDP, the risk premium increases due to the higher probability of default, making higher interest rate expenses and, in turn, increasing the possibility of a permanently increasing debt-to-GDP ratio.

Nevertheless, after the GFC, a prolonged period of low interest rates in the European Union has favored the stockpiling of debt because of the countries’ increased capacity to borrow, but this does not necessarily translate to an ability to service higher debt levels. One question is whether debt-carrying capacities can sufficiently handle the elevated debt levels as additional burdens of debt need to be more carefully managed. Also, controlling the sustainability of fiscal deficits is insufficient if the countries are unable to roll over their debt, and the intertemporal solvency condition imposes mild restrictions on the paths of fiscal balances and debt levels that are consistent with a country being solvent. From our perspective, the intertemporal solvency condition seems to be a weak criterion since only adjustments through taxes and spending have to be made to achieve debt sustainability. The solvency condition through fiscal adjustments is not supported; a change in policy or in relevant macroeconomic variables (growth, inflation, interest rate) must occur to stabilize the debt ratio and satisfy the solvency condition. If the debt-to-GDP ratio increases over time, dynamic stability may become unstable, which, in turn, violates the solvency condition reflected by higher risk premiums. This implies that dynamic instability is a stronger condition.

3. Methodology and Data

In this section, we lay out the theoretical motivation of the study and then the econometric specification. We also include a section on the data sources and variable construction. We begin with the theoretical model.

3.1. Theoretical Model

Before proceeding to the empirical analysis, we first introduce the theoretical Keynesian model for government debt, which is proposed by

Schmitt-Grohé and Uribe (

2003),

Philippopoulos et al. (

2017), and

Blanchard and Johnson (

2017). The main macroeconomic policy instruments (fiscal and monetary) are linked through the government budget constraint as below:

where, on the left-hand side, we have government revenue (comprising taxes,

Tt, change in debt,

Bt −

Bt−1, and seigniorage,

Mt −

Mt−1) equaling the government expenditure on the right-hand side (government spending,

Gt, and interest payments on previous debt,

it−1 ×

Bt−1).

Dividing all terms by nominal output,

Yt =

Ptyt, the public debt-to-output ratio and the dynamics of public debt are given below:

or

where

represents the public debt to GDP at period t;

denotes the growth rate of real output at period t;

denotes the inflation rate at period t;

is the real change in the monetary base or seigniorage at period t.

Other things equal, dynamic stability of the debt-to-GDP ratio depends on the magnitude on the inherited debt in Equation (1) above. Dynamic instability means that the debt-to-GDP ratio increases over time. Also, fiscal solvency holds when it is believed that , which suggests that the current level of budget deficit should be equal to the expected discounted present value of future primary surpluses. If it is believed that which implies that future deficits become worse, then the fiscal solvency condition is violated, and we have fiscal insolvency.

3.2. Data Sources and Variable Construction

This study employs annual data for a panel of 11-euro area countries over the period 1980–2021 with a total of 462 observations. The sample countries are Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Portugal and Spain.

Table 1 presents the data and their sources.

Following Equation (1) of the theoretical model, we construct the variable describing (measuring) dynamic stability as follows:

where

is the long-term interest rates for government bonds at time

t − 1;

and

stand for economic growth and inflation rate at time

t, respectively; and

is the level of public debt in the previous year.

Table 2 displays some summary statistics on the main magnitudes for the entire period. First, we can observe that the general government debt (

ggd) ranged from a low value of 10.89% to a high of 212.4% for the sample of countries examined. This high range shows up in the high standard deviation value as well. Hence, we have countries with tractable levels of debt to GDP and others that far exceed their GDP value. Second, the GDP growth rate (

ggdp) or economic growth magnitude ranged from negative to positive among these countries, which suggests that they have gone through contraction or recession periods. Third, the negative interest rates,

int, followed by very high inflation rates (the

cpi magnitude), suggest desperate efforts by these countries’ central banks to boost investments and thus economic growth. Fourth, this is also corroborated by the very high rate of growth of the money supply (

ms), which is seen to have exceeded 150%. Fifth, the values of the two indicators of foreign exposure/influences (

fdi and

open) suggest additional attempts to spur economic growth. Finally, the negative skewness values of the interest rate and the primary balance (

pb) imply frequent, unexpected, asymmetric, and negative changes in these magnitudes, both of which adversely affect economic growth and, consequently, budget deficits and debt.

3.3. Econometric Model

Equation (2) below presents our panel model used to investigate how dynamic instability affects public debt:

where the dependent variable

is the general government debt (

ggd) expressed as a percentage of

GDP. Next, matrix

X1 includes the dynamic stability of public debt (

dyn) and the primary balance (

pb). Matrix

includes some macroeconomic variables—to be used as control variables—that are considered significant for the debt evolution, namely, foreign direct investment (

fdi) and trade openness (

open). Foreign direct investment and trade openness are both expected to be negatively associated with public debt because of the endogenous relationship with economic growth (

Li and Liu 2005;

Asteriou et al. 2023). Trade openness is the sum of exports and imports to GDP and constitutes an index for the degree of international trade.

Next, in Equation (3), we investigate the mechanisms linking dynamic stability with public debt:

where the dependent variable

is dynamic stability (

dyn), and matrix

X2 contains the lag of dependent variable (

L_dyn) and the primary balance (

pb).

In Equations (4) and (5) below, we examine the feedback of debt’s dynamic stability (

dyn) with regard to two main components of its coefficient (the fraction constructed following Equation (1) above): interest rates and economic growth. In this sense, we investigate how the solvency condition is affected by dynamic stability.

where the dependent variables

and

are interest rates (

int) and economic growth (

ggdp), respectively, while matrices

X3 in Equation (4) and

X4 in Equation (5) contain the lag of dependent variables, dynamic stability (

L_dyn), and economic growth (

L_ggdp). In essence, we examine the nature and extent of the mutual interdependence between the two magnitudes.

and

, are

matrices representing the dependent variables and error terms, respectively, while

are

associated with unobservable variables.

are

matrices for coefficients.

Panel methodologies such as OLS and fixed effects estimators are consistent when

N (No. of variables) is large but also when

T (No. of periods) is large (

Baltagi et al. 2016). However, a number of econometric problems plague such panel models, such as the existence of bi-directional causality between variables, omitted variable bias, time-invariant (time-fixed effects), and country characteristics (country-fixed effects), which may be correlated with the explanatory variables that can lead to endogeneity and misspecification-as well as the presence of autocorrelation (

Bond and Windmeijer 2002). Hence, the generalized method of moments (GMM) estimator was developed to overcome the above shortcomings as it controls for possible specification bias (

Blundell and Bond 1998), and it is suited well for datasets with small

T and larger

N. Following

Holtz-Eakin et al. (

1988),

Arellano and Bond (

1991) developed a GMM estimator that instruments the differenced variables with all their available lags in levels. A problem with this estimator is that lagged levels are poor instruments for first differences if the variables are close to behaving like a random walk. A system GMM is an augmented version developed by

Blundell and Bond (

1998) that overcomes this issue by employing both levels and differences as instruments, while the assumption is that these differences are uncorrelated with the country-specific effects.

Difference- and System-GMM are applied in one- and two-step variants. The two-step variants use a weighting matrix that makes two-step GMM asymptotically efficient. In this paper, we employ the system GMM estimator proposed by

Roodman (

2009) using a two-step approach and obtain robust standard errors with

Windmeijer’s (

2005) finite sample correction. We provide results for the robustness and sensitivity of the instruments and coefficients and report Hansen’s test of instrument validity and overidentifying restrictions, as well as the Arellano and Bond test for serial correlation.

3.4. Model Specification for Threshold Effects

Further, we attempt to investigate possible threshold effects of dynamic stability and solvency conditions on public debt. For this reason, we examine the panel threshold effects of the interest rates above which dynamic stability is converted to instability or debt derailment. We also examine the solvency to insolvency transition mechanism. If the debt-to-GDP ratio increases, the impact of interest rates will increase because of the risk premium, thus violating the solvency condition. We apply the fixed-effect panel threshold model proposed by

Hansen (

1999). All panel threshold models are examined for a triple threshold, which divides the equations into three distinct regimes with

βs and

δs coefficients. Each regime has different coefficients for the regime-dependent variable while maintaining common coefficients for the control variables. The empirical models are provided below.

and

where

y is a

matrix representing the dependent variable general government debt (

ggd),

µ and

η are

matrices associated with unobservable variables,

X is a matrix that includes the primary balance (budget deficit/surplus) variable and the control variables (that is, net foreign direct investment and trade openness), and

ϵ1it,

ϵ2it are the error terms. In Equation (6),

int is the variable used as the regime-dependent variable to split the sample into regimes, and

dyn is the threshold variable, while in Equation (7),

dyn is the variable used as the regime-dependent variable to split the sample into regimes, and

int is the threshold variable. Finally,

γs,

ζs are the unknown threshold parameters for the threshold variables of debt dynamics and interest rates, respectively.

I is the indicator (dummy) variable, which takes the value 1 if the argument in parenthesis is valid and 0 otherwise.

We also apply the fixed-effects panel threshold model (Equation (8)) to examine possible threshold effects above which economic growth can recover the solvency condition.

where

dyn is the variable used as the regime-dependent variable, and economic growth,

ggdp, is the threshold variable.

θs are the unknown threshold parameters for the threshold variable economic growth.

4. Estimation Results

4.1. System GMM Panel Estimation Results

To investigate the impact of dynamic stability during several crisis periods, we conducted estimates with different samples along the time dimension. The results of the empirical model (2) are presented in

Table 3. We employed six different ranges of time periods, including normal and stress times, in the examined period 1981–2021. In version I of the model, we examine the period 1980–1990, when the savings and loan (1980) and Latin America sovereign debt (1982) crises occurred, as well as a stock market crash (1987) and crash of junk bonds (1989). In version II of the model, the period 1990–2000 is examined, where a massive interest rate crisis occurred in Mexico (1994), while in 1997–1998 and 1999–2000, the Asia crisis and

dotcom bubble occurred, respectively. In versions III and IV of the models, two subperiods are examined: the tranquil period in Europe (2000–2007), where the new euro currency was created, and the global financial crisis (GFC) (2007–2013), which is a period that includes the EU debt crisis (2012) as well. Finally, in version V of the model, a normal (tranquil) period is examined covering the post-GFC period up to the COVID-19 health crisis (2012–2018), while version VI examines the stress time during the pandemic.

The findings of

Table 3 reveal that across all examined periods, debt dynamics have a significantly positive effect on public debt, while the impact of budget deficit

2 is significantly negative. Both signs were expected since debt dynamics include the past accumulated debt, thus having higher levels of debt to service, whereas lower levels of budget deficit lead to lower levels of public debt. Interestingly, the results indicate that the impact of dynamic stability is stronger compared to the effect of budget deficit on public debt over the periods 2000–2007 (pre-GFC), 2012–2018 (post-GFC), and during the pandemic (2018–2021).

A general conclusion is that debt dynamics seem to prevail in regular, normal economic periods rather than in stressful economic times, while this is not the case for budget deficit, which has a stronger impact when the aforementioned stress events occur. However, during the 2020 health crisis, the effects of both variables tended to be equivalent.

Regarding foreign direct investment (fdi), a significantly negative impact on debt was found before the GFC period, while in the post-GFC period, the impact seems to be very weak. Additionally, international trade (open) seems to be the driver in the reduction in public debt after the crisis. However, this is not the case during the GFC, as openness is significantly positive.

We further investigated the mechanisms for higher levels of debt dynamics (dyn), and the results are presented in

Table 4. The results indicate that lower budget deficits increase the debt dynamics in the pre-GFC period, but this is not the case in the after-GFC period and until the pandemic period. This suggests that austerity through lower budget deficits contributes to dynamic stability. In contrast, the findings imply that before the GFC, foreign direct investment contributed to the dynamic stability of debt, but again, this was not the case during and after the GFC until the pandemic period. Moreover, trade openness corroborates the above result not only in the pre-GFC period but also in financial stress times by indicating that international trade contributes to debt sustainability.

Next, we investigated the feedback of debt dynamics to borrowing costs, thus examining the relationship between dynamic instability and solvency conditions expressed by the relationship between the interest and economic growth rates. The results are reported in

Table 5. The findings show that dynamic instability was not a problem before the GFC, but during and after the GFC periods, debt instability emerged and contributed to higher borrowing costs (interest rates), thus endangering (and violating) the debt solvency condition. However, this was not the case during the pandemic period.

Finally, in

Table 6, we present the results from the feedback of debt dynamics to economic growth. The overall findings suggest that debt dynamics contributed to higher economic activity only in the early period between 1980 and 1990, while after 2000, this effect was converted to negative, indicating that higher levels of debt hinder economic performance. Additional results imply that trade openness (

open) positively (and statistically) contributes to economic growth, whereas foreign direct investment (

fdi) is not always significant and with the correct sign (it is possible to assume that its impact is embedded or absorbed by the

open magnitude). These findings are in line with the findings by

Alsamara et al. (

2024) for their oil- and non-oil-producing countries sample.

4.2. Panel Threshold Results

Table 7 reports the results of estimating Equations (6), (7), and (8), respectively. In

Table 6, we first examine the effect of interest rates, which is the regime-dependent variable for public debt conditional on debt dynamics (dynamic stability), and which, in turn, acts as the threshold variable. The results suggest that debt sustainability (or the solvency condition) is not a problem when the debt level is under 69.28% (as a fraction of GDP): that is, when the impact of interest rates is negative and statistically insignificant. This negative effect converts to significantly positive when the level of debt lies between 69.28% and 91.86%, when the estimated coefficient turns from negative (−0.109) to positive (0.250) and statistically significant. When debt dynamics (

dyn) exceed the 91.86% threshold value, we observe that the magnitude of the estimated coefficient on interest rates rises significantly, from 0.250 to 6.275, with a significantly positive effect at the 1% level of significance. This indicates that when the debt level is around 92%, interest rates start to push debt to higher levels, and this will trigger a violation of the debt solvency condition, turning it to insolvency. This obviously implies that investors doubt that countries will be able to meet their financial obligations to repay their debt via the means of higher risk premia (which causes higher interest rates).

Next, we provide new insights within the estimated results, where dynamic stability is used as a regime-dependent variable and interest rates act as the threshold variable. The findings suggest that dynamic stability (dyn) starts to push to higher levels of debt when the interest rate is above 3.3% and becomes even stronger when it goes beyond 4.4%, thus leading to unsustainability of debt dynamics. However, when economic growth is examined as the threshold variable, the results show that dynamic instability reverses to stability when economic growth exceeds 3.4%.

The findings of threshold effects of public debt are in line with the existing literature (

Checherita-Westphal and Rother 2012;

Alsamara et al. 2024), but threshold effects of interest rates and economic growth above which debt raises or drops are not demonstrated. Our results provide new insights regarding the mechanisms—the solvency condition and dynamic instability—through which public debt rises and creates threshold effects of interest rates and economic growth on public debt.

4.3. Discussion of Results

The overall results indicate that in regular periods, the debt dynamics of euro countries present a stronger effect on debt development rather than fiscal deficits, while during stress times, the latter’s impact is more pronounced. The dominance of budget deficits in the debt’s evolution in periods of crisis is in line with the Keynesian theoretical perspective as well as many empirical findings (

Bianchi et al. 2020;

Fatás and Summers 2018;

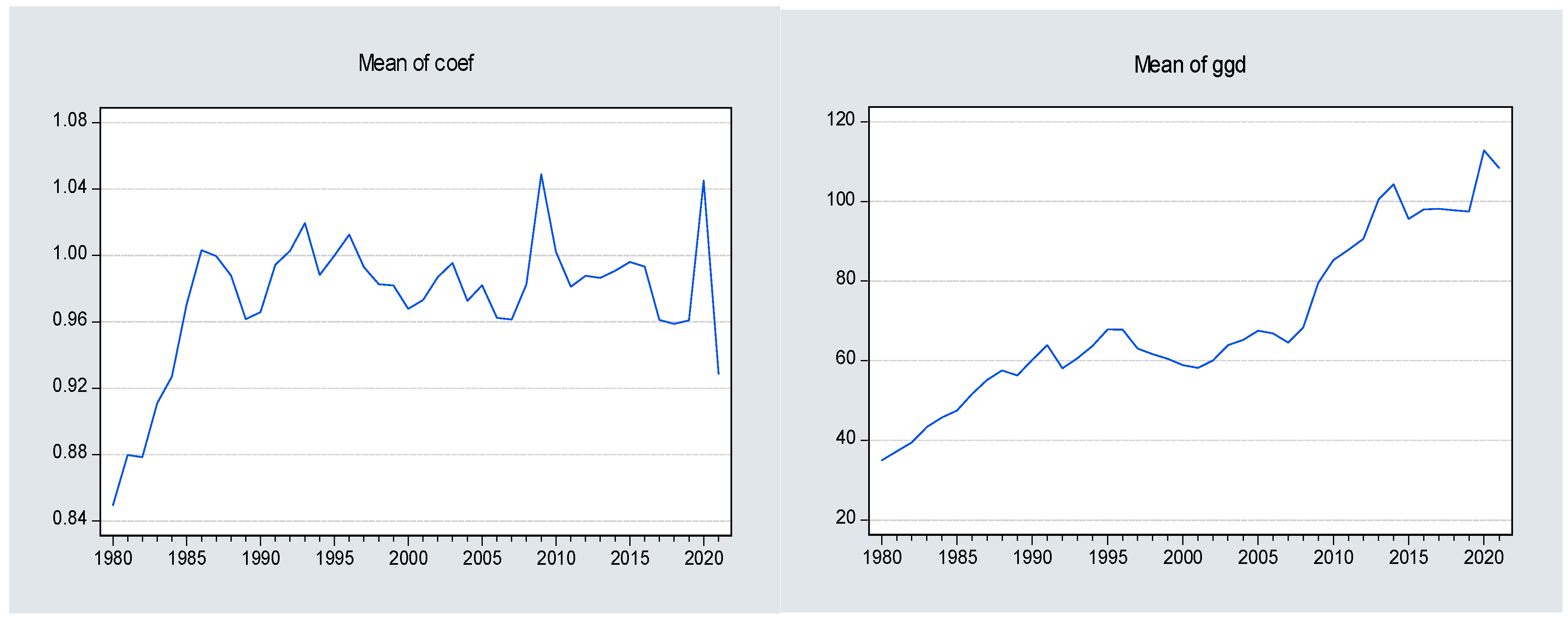

DeLong et al. 2012). However, one of the most important findings in the current study is that the main mechanism of the stronger effect of debt dynamics on debt development appears to be the multiplier effect of the coefficient

. That is, when this coefficient tends to be greater than 1 (

Figure 1-left graph), dynamic stability is converted to instability, and the results in

Table 5,

Table 6 and

Table 7 indicate that this is attributable to higher interest rates (nominator of the coefficient), lower economic growth, and the inflation rate (the denominator of the coefficient). Moreover, the detrimental multiplier effect on debt dynamics started with the onset of GFC (

Figure 1-right graph). In this sense, the left graphs in

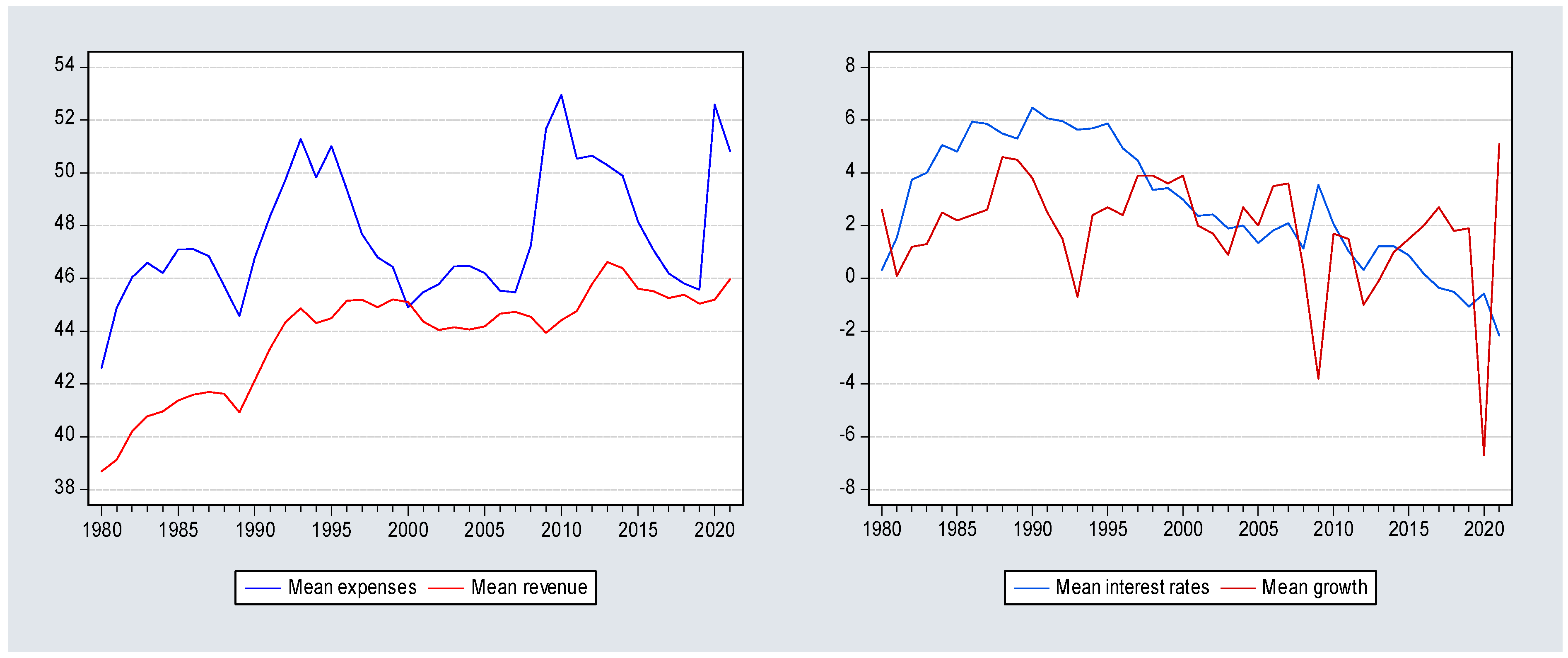

Figure 1 and

Figure 2 illustrate that a possible mechanism of the multiplier effect is government expenses in crisis periods.

Finally, the panel threshold results show that interest rates above 3% might be a problem for debt stability and seem to be true during the GFC period (

Figure 2-right graph), but after the crisis, they remained low for a long time until the pandemic. On the other hand, the findings reveal that economic growth above 3.4% helps to stabilize public debt, but it appears that is hovering around 2% and never exceeds the 3.4% (see

Figure 2-right graph). Regarding the debt dynamics threshold being above 92%, we can infer that, on the one hand, it exerts pressure on interest rates to rise, but on the other hand, it hinders economic performance and keeps growth at levels lower than 3.4%. Regarding the threshold of public debt, our results are in line with a more recent study from

Alsamara et al. (

2024), who found that low public debt ratios promote economic growth, whereas relatively high public debt beyond the 90%–91% threshold impedes economic growth in MENA countries. However, in our study, we provide new evidence of mechanisms and threshold of interest rates and growth above which debt becomes unsustainable or sustainable.

The overall conclusion that can be drawn from the discussion of results is that low interest rates might tempt governments to borrow more, thus leading to higher debt accumulation, and instead of leading to higher risk premia as was expected, they hinder economic growth and lead to a dynamic, self-reinforcing high-debt loop, which can drive it to an explosive path.

5. Conclusions

In this study, we used a Keynesian theoretical model proposed by

Philippopoulos et al. (

2017) to investigate how the dynamic instability of public debt affects its inter-temporal sustainability (or the solvency condition) in view of the global financial crisis and the health crisis pandemic. We used a sample of 11 euro area countries over the period from 1980 to 2021. Employing the GMM panel dynamic model, the overall results show that dynamic stability was the case before the global financial crisis, thus not violating the debt sustainability condition and that only budget deficits significantly affected the public debt’s evolution. However, after the global financial crisis and until the pandemic period, the public debt’s dynamic stability was converted to instability, and this further impacted the evolution of public debt negatively.

Furthermore, the findings suggest that after the global financial crisis, dynamic instability showed a highly persistent effect on the evolution of debt. The results (estimates) from the panel threshold models revealed that the dynamic instability of debt started to reverse (violate) the debt’s sustainability condition, especially when the borrowing cost was above 3.29% and becoming even stronger when it was above 4.39%. A final finding was that dynamic instability exerted even more pressure when debt to GDP was greater than a threshold level of 91% of GDP. However, the solvency condition recovered when economic growth was higher than 3.4%.

The policy implications of these results are clear. First, low interest rates can create a self-reinforcing loop of high debt, which itself is a serious matter for public authorities when designing economic policies. Hence, the findings of this study can serve as a valuable lesson for other countries which depend heavily on public debt. Second, high debt levels cause stock and other financial instruments’ prices to soar, thus additionally burdening an economy and derailing it. Also, it is interesting to determine the crucial level of general government debt above which the debt becomes unsustainable and poses serious threats to the economy’s agents. Finally, one of the main policy implications of our results for countries without fiscal space is that economic growth is the main discount factor for maintaining debt stability or even drastically reducing it. However, the main limitation of the current study is that the GMM econometric technique is appropriate for short-term periods but not for the long run. Further, it may be necessary to test for cointegration or, more generally, for the existence of a long-run relationship among the variables of interest, but this is an issue for future investigation.