Abstract

The existing literature has explained the causality flow from the exchange rates toward the stock market without explaining the role of the economic crisis in effecting this nexus. This study examines the role of the financial crisis in affecting the nonlinear causality flowing from the exchange rates toward the stock market indexes of the ASEAN-5 region. The precrisis, postcrisis, and overall sample duration comprised 365, 650, and 1085 observations over the periods from January 2002 to January 2008, January 2010 to January 2020, and January 2002 to January 2020, respectively. The results showed that the conventional symmetrical panel ARDL (PARDL) model was not able to formulate long-run cointegration between currency value fluctuations and stock market indexes for both regimes, i.e., the post recessionary and pre recessionary periods. However, asymmetrical cointegration was established between the currency values and stock market indexes for the pre recessionary period and the overall sampling time frame by utilizing the panel-based NARDL framework (PNARDL). The study suggests practical implications for the exporters and importers to consider the regime as well as both the negative and positive shocks in the international dollar values while making forward contractual agreements.

1. Introduction

The international economic recession has not only affected developed economies but also adversely impacted the stock indexes of developing regions of the world (Athukorala and Chongvilaivan 2010; Makin 2019; Sheikh et al. 2020a). According to a Federal Reserve Bank of San Francisco report, there were three noteworthy aspects of the rapid historic crisis in exporting shipments to Asia from different parts of the world in the wake of the economic recessionary regime of 2008. First, there had been a strongly coordinated decline in exports throughout Asia, mainly from Japanese borders to Indonesia, covering the timespan from July 2008 to February 2009 (Keat 2009). Second, there was a rapid and sharp compression in exports from 2008 to 2009 of over 35%. This was significantly worse than the 18% decline during the IT sector slump in 2001 and the 16% decline during the Asian economic recession, where Asia was the main epicenter of the economic crunch. Third, intra-Asian exports declined significantly more than shipments to developed countries. Intra-Asian exports dropped by 48% to a higher rate, compared with a 29% decrease in the United States and the major developed economies of the European Union over a similar timespan (Keat 2009).

Southeast Asian nations have struggled economically since 1997, and their harshest global financial meltdown occurred in 2008 (Brem et al. 2020; Demirguc-Kunt et al. 2021; Fidrmuc and Korhonen 2010; Park and Shin 2020; Rasiah et al. 2014; Zhang et al. 2020). During the recession of 2008, the GDP of most of the Southeast Asian economies depreciated; however, exports to GDP remained higher for the Malaysian, Singaporean, and Thailand economies. These economies were known to implement adequate policy instruments to enforce resilience against the crisis and full dynamism for economic growth (Athukorala and Chongvilaivan 2010). Southeast Asia offers a great platform for strategic analysis to prevent and overcome the similar damaging impacts of the 2008 economic recession, when the economic development of most of these countries shrank during the crisis (Rasiah et al. 2014). The international financial recession in 2008 had an impact on the overall economic development of ASEAN-5 economies by adversely affecting the equity market returns, and the impact lasted till 2009 (Athukorala and Chongvilaivan 2010). The financial recession utilized the transmission channel of the bank industry and adversely effected economic productivity in Philippines, Singapore, and Thailand. Additionally, the equity market returns and real estate situation in Malaysia and Indonesia were significantly impacted by the recessionary era of 2008–2009. The influence of the 2008 international economic recession could be linked to weak regulation and bank failure in three out of the five ASEAN member economies (Rillo 2009). Owing to the significant structural shocks of financial recession on economic productivity and transmission of international error variance toward the equity returns, the forex market also suffered an adverse declination trend against the US dollar (Asad et al. 2020). (Boubaker et al. 2022) also found that globalized equity markets can be more susceptible to foreign crises, with significant nonhomogeneities. Therefore, our study focused on how Southeast Asian shareholders’ perceptions of both positive and negative variations in currency prices changed as a result of the 2008 global economic meltdown.

According to the flow-oriented approach, any fluctuation in an international currency, such as the US dollar, causes the local currencies of the ASEAN-5 nations to depreciate or appreciate, leading toward changes in the region’s stock indexes (Reddy and Sebastin 2008). The major reason for the fluctuations in stock indexes due to the appreciation or depreciation in the exchange rate against international dollar values is the disturbances in international competitiveness and balance of trade. Therefore, most of these disturbances arise owing to fluctuations in real income and costs of the import-dominated and export-dominated economy, and these costs are directly associated with the stock indexes for firms (Andriansyah and Messinis 2019; Arif et al. 2014). For example, a depreciation in the domestic currency against international US currency causes the expense of the exports to decrease and, in turn, increases exporter’s profitability.

It is evident that an appreciation of local currency may be harmful to exporters but is equally beneficial to importers. Therefore, appreciation in US dollars against the import-dominating economy’s domestic exchange rate causes a depreciative influence on the stock market indexes. In contrast, a depreciative impact on the local currency of an export-dominated economy is due to an increase in US dollars, causing the stock market indexes to rise. First, among the already-published mainstream literature, authors have utilized either time-series symmetrical models (Taufeeq 2017; Ho 2018; Chiu et al. 2018; Camilleri et al. 2019; Ghulam 2018; Zhang et al. 2019; Sheikh et al. 2020b; Tabash et al. 2020; Keswani and Wadhwa 2018; Neveen 2018; Shahbaz 2013; Shiva and Sethi 2015) or time-series asymmetrical models (Liang et al. 2020; Shahzad et al. 2017; Kumar 2019; Salvatore 2019; Shahzad et al. 2017; Sheikh et al. 2020c; Kumar 2019; Rajesh 2019) to explain the stock market shocks caused by exchange rate variations.

Second, this study focused on the impact of the international economic crisis of 2008 on Southeast Asian shareholders’ reactions to positive and negative partial sums of international dollar values against the local currency. However, previous researchers have focused on country-specific stock markets (Anisak and Mohamad 2019; Bai and Koong 2018; Chang et al. 2019; Kumar 2019; Mahapatra and Bhaduri 2019; Umar and Sun 2015; Vezos and Lael Joseph 2006; Sheikh et al. 2020b) or certain regional stock markets outside the context of Southeast Asia to explore the links between the variables (see Agyire-Tettey and Kyereboah-Coleman 2008; Anisak and Mohamad 2019; Blau 2018; Kumar 2019; Mohamed Dahir et al. 2018; Salvatore 2019; Taufeeq 2017; Wong 2017). Similarly, some of the researchers have also utilized a panel-based linear modeling framework to examine the symmetrical connotation between stock market indexes and currency rate oscillations of the region outside the context of ASEAN-5 (Aktürk 2016; Andriansyah and Messinis 2019; Tuna 2018; Xie et al. 2020). Thanks to the existence of hidden asymmetrical cointegration, Bahmani-Oskooee and Saha (2016) advised utilizing the nonlinear econometric approaches for the evaluation of nonlinear linkages between the variables.

Third, some studies (Andriansyah and Messinis 2019; Xie et al. 2020) have placed a strong emphasis on panel-based estimation for the influence of exchange rate variations on the stock indexes but neglected the influence of the financial crisis on influencing the connotations between stock market indexes and currency value variations of the top-performing economies of the Southeast Asian region in asymmetric ways. However, Sheikh et al. (2020a) found that the heterogeneous nonlinear panel-based ARDL model is deemed more appropriate in establishing nonlinear associations between currency value fluctuations and stock indexes for the South Asian region by dividing the total time frame into multiple regimes. Therefore, this is the first study that has explained that 2008 financial crisis has affected the asymmetrical causality, moving from the positive and negative currency rate shocks toward the ASEAN-5 equity market.

2. Literature Review

The exchange rate fluctuations have not only affected the cash flow statement of the firms relying on both importing and exporting goods and services but also proven to be a major risk for contractual transactions. An appreciation in the local currency of Southeast Asian member economies may have an adverse impact on the profitability of businesses relying on exporting goods and services. Therefore, a depreciation in the dollar values against local currency is beneficial for the businesses dependent on imported products. Using the GARCH model, Anisak and Mohamad (2019) investigated the relationship between the exchange rates and the stock prices of the listed firms on the Indonesian stock exchange, covering the period from 1994 to 2015. The findings yielded that exchange rate variability affects nearly all the firms’ stock values. Agyire-Tettey and Kyereboah-Coleman (2008) also found a linear connotation between stock market indexes and macroeconomic volatility in the less developed economy by using linear econometric approaches such as ECT and linear cointegration approaches. The results indicated that the relationship between inflationary pressures and interest rates was inverse. However, because of the depreciation in local currency, investors are benefiting. By employing the EGARCH modeling approach, Sikhosana and Aye (2018) discovered asymmetrical volatility spillovers between currency value fluctuations and South African stock indexes.

Through the utilization of the Granger causation methodology of Toda and Yamamoto (1995), Andriansyah and Messinis (2019) extended the Dumitrescu and Hurlin (2012) method of Granger causality for the panel-based data into a trivariate model. They reported that stock indexes are an imperative determining factor in Granger, causing the currency value fluctuations. Taufeeq (2017) explored the nonlinear dynamism between the currency value variations and stock market indexes in the developing country’s context. The author has utilized the NARDL modeling approach to study the presence of asymmetries between the underlying variables and found evidence for the existence of nonlinearity between them.

Shiva and Sethi (2015) utilized symmetrical approaches such as the VECM modeling framework and systems of equations to investigate the nexus between Indian stock indexes and currency value fluctuations during 1998 to 2014. Additionally, Wei et al. (2019) employed multiple threshold cointegration approaches to determine the role of exchange rate variations as a transmission medium between the stock indexes of China and future oil prices. Through the utilization of multiple threshold cointegration approaches, the authors found that the exchange rate fluctuations in China were proven to be a more significant variable in influencing the relationship between oil future prices and Chinese stock market indexes after the occurrence of the financial recession of 2008. Al-hajj et al. (2018) examined whether an increase or decrease in currency value fluctuations had the same influence on the stock market by utilizing Shin et al. (2013) NARDL modeling approach and found the existence of nonlinearity between the variables. Similarly, Bahmani-Oskooee and Saha (2015) debated the asymmetrical possibilities between variations in stock market indexes and the exchange rate. The authors proposed that negative shocks in US dollars against domestic currency value (appreciation in domestic exchange rate) may lead toward stock market appreciation because of a depreciation in producer prices. However, appreciative impact in US dollars against a local currency may have a major advantageous influence on an economy’s stock market index (Reddy and Sebastin 2008), as most companies can afford the increased burden of devaluation in local currencies to sustain their customer base (Kassouri and Altıntaş 2020). Therefore, the negative shock to international dollar prices against a local currency may also have a positive influence on the stock indexes (Bahmani-Oskooee and Saha 2015, 2016), and the local currency depreciation may also have the same positive influence or no influence on the stock market indexes of an economy (Sikhosana and Aye 2018; Wei et al. 2019). For the purposes of creating the best possible portfolios and conducting risk transmission analyses, academics and finance professionals have paid close attention to the rising interconnection between capital markets (BenSaïda et al. 2018).

Based on the above discussion, it is important to look for both +ve and -ve shocks in the international dollar values against local currencies on the stock market indexes because of the existence of asymmetries between the variables (Tabash et al. 2020). Investors and regulators must also concentrate on both favorable and adverse changes associated with variations in currency valuation because investors may respond differently to both positive and negative shocks in exchange rate fluctuations (Jung et al. 2020; Kumar 2019; Salvatore 2019). Simbolon and Purwanto (2018) investigated the magnitude of the effects for several economic variables on the stock market indexes of Indonesian real estate firms. The results showed that several macroeconomic fluctuations, such as the cost of debt, currency value oscillations, and inflationary pressures, have been forecasted by the stock indexes of Indonesian real estate firms. However, economic growth remains statistically insignificant. In a relevant context, another study has found that a complex correlational interrelationship between stock indexes and implied volatility indexes is affected by currency value fluctuations (Rehman 2017). Singhal et al. (2019) utilized the daily time-series data to explore the symmetrical dynamism between the volatility in gold prices, currency rate variations, oil-price unpredictability, and stock indexes through the usage of a linear framework of the ARDL modeling approach. The results yielded that both stock market indexes and currency rate variations are influenced by the volatile shocks of oil prices.

Sikhosana and Aye (2018) indicated the existence of volatile transmission between stock indexes and currency value variations of the South African region by utilizing an exponential generalized autoregressive conditional heteroscedasticity modeling approach over monthly time-series data. These results indicated that although volatile transmission in any of the underlying variables can be utilized to predict fluctuations in another, both assets for the diversification of risks must not be held in the same portfolio. Roubaud and Arouri (2018) found the association between variation in currency rates and stock market indexes by employing the Markov-switching VAR modeling approach. The authors demonstrated that the relationship between them is not only nonlinear but also regime dependent. In another relevant study conducted in the context of a developing country, Sheikh et al. (2020a) investigated the association between stock indexes and currency value fluctuation and found that it is not only regime dependent but also asymmetrical in nature. Furthermore, the authors claimed that during the 2008 financial crisis, Pakistani shareholders’ reactions to both positive and negative shocks to currency variations changed (Sheikh et al. 2020a). Chkir et al. (2020) explored the interrelationship between exchange rate variations, stock market indexes, and oil-price fluctuations by employing Vine cupolas methodology. The results showed that, with the exception of the British pound and Japanese yen, an oil-exchange reliance is substantially negative over different time frames. In addition, in the context of oil export- and import-oriented economies, oil acts as a poor haven for exchange rates.

Kumar (2019) utilized nonlinear econometric approaches, for example, the asymmetrical Granger causality model in parallel with the NARDL modeling approach to investigate nonlinear causality and symmetries between currency value variations, stock indexes, and oil-price unpredictability. Their findings reported the existence of asymmetrical Granger causation that runs from currency rates to oil prices and oil prices toward stock indexes. On the contrary, there is only a shred of evidence for the unidirectional Granger causation from currency value fluctuations toward stock indexes. Several researchers have also reported that the asymmetrical ARDL model is more efficient in examining the nonlinearity between currency rate fluctuations and stock indexes (Sheikh et al. 2020a; Tabash et al. 2020). Wong (2017) utilized a generalized autoregressive conditional heteroskedastic modeling approach with dynamic conditional correlational parameters and found contrasting results regarding the influence of currency value variations on stock indexes. The authors reported an indirect link between exchange rate fluctuations and stock indexes for Korea, the United Kingdom, Malaysia, and Singapore. However, an insignificant association was also reported for the impact of exchange rate fluctuations on the stock indexes of Japan, Germany, and the Philippines. Blau (2018) also found symmetrical linkages between stock market indexes and currency variations in the developed countries context. In the context of developing and developed economies, Xie et al. (2020) utilized both linear and nonlinear Granger causality approaches to investigate the linear and nonlinear causality link between the stock indexes and currency value fluctuations. proved that stock indexes are causing the currency value fluctuations, by utilizing heterogeneous panel data modeling approaches after taking into account cross-sectional dependencies and nonlinearity issues in the panel settings.

3. Methodology and Data

Monthly level data sets on international US dollar values against local Southeast Asian economies were compiled from investing.com (accessed on 1 October 2019) for three time frames. Monthly level data sets for stock indexes of top-performing Southeast Asian economies (ASEAN-5) were incorporated from the country-specific stock market websites of Thailand, Singapore, Philippines, Malaysia, and Indonesia.

The data sets were separated into three scenarios to examine the impact of different shareholder responses to local currency appreciation and depreciation under various regimes. While the pre-economic recession comprised 366 observations, ranging from 1 January 2002 to 1 January 2008, the post-economic recession and overall sampling time frame constituted 606 and 1086 observations, respectively. The post-economic recessionary regime covered the period from 1 January 2010 to 1 January 2020 and the overall sampling time frame from 1 January 2002 to 1 January 2020. Therefore, under diverse and compounded scenarios, we can account for the various responses of investors to multiple fluctuations in the value of the international dollar relative to the local currencies of the economies of the ASEAN-5 region. Furthermore, in order to counter for the structural breaks (see Chang et al. 2019), we divided the data into two periods, i.e., the precrisis and postcrisis periods. The selection of the samples and division of data into three multiple regimes is in line with (Hung 2019; Neveen 2018; Taufeeq 2017; Chang et al. 2019).

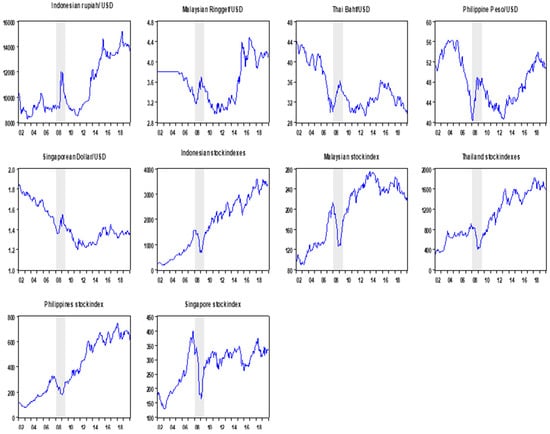

According to Figure 1, currency variations and stock indexes of the ASEAN-5 region moved in contrary directions and displayed both positive and negative oscillations. The shaded area in Figure 1 represents the financial crisis regime. Exchange rates moved in an upward direction during the crisis, whereas the stock indexes of Indonesia, Malaysia, Philippines, Thailand, and Singapore moved in an opposite, downward direction. Moreover, both currency variations and stock indexes had positive and negative shocks. This situation, in turn, motivated researchers to investigate the effect of negative and positive shocks in currency value variations on the stock indexes during three regimes: the pre recessionary time frame, the post recessionary time frame, and the overall sampling time frame.

Figure 1.

Exchange rate and stock indexes of the ASEAN-5 region.

3.1. Econometric Estimation

This methodological section is divided into three subsections. First, we incorporated a cross-sectional dependence test by Pesaran (2004) for examining the presence of cross-sectional dependency in panel data series. Second, the cross-sectional augmented IPS unit root-testing method developed by Pesaran (2007) was also included in the same section. More information on the panel-based symmetrical ARDL modeling approach by Pesaran et al. (1999) is provided in Section 2. Third, the PNARDL model presented as an extension of the linear PARDL model, and the estimation procedure for Granger causation by (Hatemi-J 2012) was also covered. For the purpose of detecting the existence of nonlinearity between the panel data series, Broock et al.’s (1996) test of nonlinearity was utilized. Several studies have utilized identical distribution tests to determine the presence of nonlinearity between exchange rate fluctuations and stock indexes (Tabash et al. 2020). The BDS test of nonlinearity can be categorized as follows:

is defined as a standard deviation of .

The BDS test (Broock et al. 1996) was used to ascertain whether the unstructured and undated panel data series were identically distributed or independent. We can therefore infer that the PNARDL model is more suitable for the study than symmetrical modeling techniques in the case that the null hypothesis of BDS test is rejected. To confirm the asymmetrical link between stock market indexes and the currency rate volatilities of the ASEAN-5 region, both panel-based NARDL and ARDL modeling frameworks with the PMG approach were utilized. The Housman test was utilized to determine the appropriation of the pooled mean group approach for the panel-based NARDL modeling framework.

3.2. Cross-Sectional Dependence Test by Pesaran (2004) and Cross-Sectional Augmented IPS Unit Root Test by Pesaran (2007)

The cross-sectional dependence test was utilized to investigate the presence of cross-sectional dependencies in panel data series. In the case of cross-sectional dependency, the incorporation of first-generation panel-based unit root-testing procedures may lead toward spurious results. For the same reason, we incorporated cross-sectional dependence test proposed by Pesaran (2004) in order to confirm the appropriation of either first-generation panel-based unit root tests such as the langrage multiplier (LM) panel unit root test by Hadri (2000), the LLC by Levin et al. (2002), the Fisher-type pane unit root test by Choi (2001), or the second-generation panel-based unit root test by Pesaran (2007) for the detection of seasonality within the panel data series. The cross-sectional dependence test can be utilized as follows:

In Equation (1), CD is denoted by cross-sectional dependence test of Pesaran (2004), T and N are denoted by total number of observations and number of countries incorporated for data analysis. In our case, five Southeast Asian economies were included, and they jointly formulated a legitimate association for economic cooperation in the region known as ASEAN-5, whereas correlated residuals in the form of pairwise dynamics can be represented by . In the cross-sectional presence of cross-sectional dependence, the cross-sectional augmented IPS unit root-testing procedure is more reliable and robust over all other first-generation panel-based unit root estimations. The panel-based CIPSs by Pesaran (2007) are denoted as follows:

3.3. Symmetrical PARDL Modeling Approach

After the estimation of a cross-sectional dependency test (Pesaran 2004) and a panel-based unit root test (CIPS) (Pesaran 2007), we incorporated both the panel-based symmetrical ARDL modeling approach by Pesaran et al. (1999) and the asymmetrical PNARDL modeling framework on the balanced panel data series. The purpose of estimating both linear and nonlinear econometric techniques was to examine the role of negative and positive shocks in currency rate variability on influencing the stock market indexes of ASEAN-5-member economies during different scenarios: precrisis, postcrisis, and overall sampling time frame. Symmetrical PARDL model is given in Equation (3), and the ECT terms of the linear PARDL model is given in Equation no (4),

In Equation (3), is the first difference of the dependent variable, and is classified as the lagged dependent variable, which transforms the equation into a dynamic model. The long-term coefficients are represented by and , and the short-term parameters are denoted by and . For the purpose of establishing a longer-term symmetrical cointegrating association between regressor and regress, we utilized the values of the F-statistics of the Pesaran et al. (2001) table. A longer-term linear cointegration is established if the value of the F-statistic exceeds the lower-bound and upper-bound critical values. However, the error correction term given in Equation (4) is also utilized to investigate the cointegrating association between the regressors and regress and whether the value of F-statistics falls in between the lower-bound and upper-bound critical values. One of the disadvantages of the symmetrical ARDL model is its incapacity to decompose independent regressors into their respective partial sums; therefore, we utilized the panel-based NARDL modeling approach in order to decompose fluctuations in currency values into their negative and positive cumulative signs. In the literature, few studies have estimated linear modeling approaches in order to explain the linear linkages between currency fluctuations and volatile movements in stock indexes (Keswani and Wadhwa 2018; Shiva and Sethi 2015), but the actual relationship is nonlinear (Bahmani-Oskooee and Saha 2015, 2016; Tabash et al. 2020).

The mean group approach is used when the non-homogeneity in the panel data series is calculated by averaging each coefficient in the panel data sets (Boubaker and Jouini 2014). It is furthermore noted that the components of broad-based macro-level panel data series are normally long enough to conduct independent regression techniques for every independent regression coefficient. Dependencies in cross sections are also probable given that these cross-sectional units display correlation features. This is primary due to certain widely associated, overlooked components that may influence each segment of the panel data configuration. The non-homogenous technical advances in all the ASEAN-5 economies, the geographic and geopolitical locations of cross section units, and others may justify the heterogeneity in the panel data series of ASEAN-5 economies. These commonly found associated properties are likely to be excluded from the predicted dynamic patterns of regression and may interact with the regressing variables. In this case, the mean group estimator is inaccurate and cannot yield effective and stable outcomes (Boubaker and Jouini 2014). Pesaran (2006) aimed to resolve the approximation of unobserved, commonly found, associated attributes in the cross-sectional unit, with a view to taking the mean of regressors of multiple cross sections. This approach is known as the pooled mean group because of the unbiased estimating procedure by augmenting the framework in the form of common correlated effects.

3.4. Asymmetrical PARDL Modeling with the PMG Approach

Equations (3) and (4) explained the linear interrelationship between fluctuations in international dollar values and ASEAN-5 stock indexes. However, as proposed by Shin et al. (2013), independent variables can be divided as follows:

Hence, the panel-based NARDL and the nonlinear ECT model can be written as:

In Equations (6) and (7), every regressor is broken down into −ve and +ve cumulative signs, e.g., , where is for the estimation of the longer-term nonlinear impact of shocks in currency value variations on stock market indexes. is the representation of dependent variable such as the Southeast Asian stock indexes of a country i in a time t. is the representation of the decomposition of currency value variations into their respective cumulative −ve and +ve shocks, which can capture short-term nonlinearities. Moreover, the estimation technique for longer-term nonlinear cointegration between regress and regressors was similar, adopted from (Pesaran et al. 1999). Wald test statistics were utilized to confirm the presence of asymmetries between negative and positive shocks to currency rate oscillations and stock indexes over the longer term. The null hypothesis of Wald test statistics indicated that positive and negative impact of partial sums of exchange rate fluctuations on Southeast Asian stock indexes are equal to each other, which is the identification of short-term ( and long-term symmetries ( = ). On the contrary, an asymmetrical relationship is established if the -ve and +ve impacts of currency rate fluctuations on the stock market indexes are not equal for the shorter ( and longer terms ( ≠ ). However, the long-term asymmetrical impact of +ve and –ve shocks on stock indexes is examined on the basis of an F-statistics value. If the value of F-statistics is greater than lower- and upper-bound critical values, then we can establish a longer-term asymmetrical cointegration by rejecting the null hypothesis of no cointegration (Ho: = against the alternate hypothesis of longer-term asymmetrical cointegration (H1: = . We rely on the Akaike and Schwarz information criteria for the selection of the appropriate lag length of the regressors.

3.5. Granger Causation

The Granger causation methodology (Hatemi-J 2012) was applied to examine the unidirectional or bidirectional Granger causation flowing from −ve and +ve shocks in international dollar values against local Southeast Asian currencies toward the stock indexes. The objective of disintegrating the negative and positive shocks of regressors was to investigate the different casual impact of ASEAN-5 economies’ positive and negative shocks in local currency rates on the stock indexes of the region. In order to assess the nonlinear cointegration between the dependent and independent variables, Shin et al. (2013) extended the approach of splitting the exchange rates into two particle cumulative signs (Granger and Yoon 2002). However, Granger and Yoon (2002) decomposed the independent variables into positive and negative shocks to examine the hidden cointegration between the variables. We have utilized both the asymmetrical cointegration (Shin et al. 2013) and nonlinear Granger causation approaches (Hatemi-J 2012). Consider that both exchange rate fluctuations () and stock indexes ( are integrated and follow the random walk procedure as follows:

In Equations (8) and (9), the error term is represented by and , and the time frame is denoted by t. Furthermore, the error terms can be disintegrated into positive and negative shocks in such a way that = , = , = , and = . Therefore, = + and = + . Similarly, and are equal to and respectivey. Hence, Equations (8) and (9) can be rewritten as follows:

In Equations (10) and (11), each of the variables, e.g., and , is decomposed into positive and negative shocks, such as , and , . The positive and negative shocks of the underlying variables, such as , and , , are equal to and , respectively. Therefore and are both equal to , and , . In order to establish an asymmetrical causal association between the variables, Hatemi-J (2012) has utilized the vector autoregressive (VAR) framework with a specific lag order p, as follows:

According to Equation (12), the 2 × 1 vector of variables, intercepts, and error terms in association with the variables disintegrated into +ve shocks are represented by , v, and , respectively. Moreover, the selection of the appropriate lag orders for the variables is as follows:

The determining factor for the calculated variance–covariance matrix of the error term is denoted by (||), and number of observations is represented by T. Moreover, j is the appropriate lag orders of the variables under the VAR framework with a total number of equations. After the appropriate lag orders for the variables by utilizing the HJC criteria in Equation (13) have been set, the alternative hypothesis is against the null that the kth element of does Granger cause ωth element of Therefore the null hypothesis for asymmetrical non-Granger causality can be written as follows as in Equation (14):

The results for asymmetrical Granger causality and the panel-based NARDL model with the pooled mean group approach are presented in Section 5.

4. Results and Discussions

Table 1 illustrates the descriptive data on the fluctuation of currency valuations and stock indexes in the Southeast Asian region’s leading economies in three scenarios: pre-2008 economic crisis phase, post-2008 economic crisis phase, and the overall sampling time frame.

Table 1.

Descriptive statistics.

According to Table 1, the mean values of international US dollar value fluctuations against the selected local Southeast Asian economies (ASEAN-5) and stock indexes were much less during the postcrisis regime. Hence, during the postcrisis regime, the stock indexes of ASEAN-5 economies continued to progress despite experiencing financial turbulences. However, the greater mean values of the US dollar against the local Southeast Asian economies depicted the depreciation of the domestic currency against international dollars. The depreciation of the US dollar against the local economy’s currency has been favorable for importers but proven to be disastrous for exporters of developing as well as developed economies (Chang et al. 2019; Mohamed Dahir et al. 2018; Singhal et al. 2019; Tiwari and Kyophilavong 2017). Greater standard deviation values during the postcrisis regime symbolize the financial risk for the country because of the unpredictability of stock indexes and exchange rate depreciation (Adjasi 2009; Anisak and Mohamad 2019; Mahapatra and Bhaduri 2019; Umar and Sun 2015; Sikhosana and Aye 2018). However, descriptive statistics yielded that the skewness and kurtosis of stock index and exchange rate variations were larger in the prerecession period than in the post recessionary period. Leptokurtic distributions with big outliers and heavy tails were indicated by higher positive kurtosis, representing a financial risk for business investments. However, the maximum values of stock indexes and currency rate variations during the post financial recessionary period were higher, increasing at an exponential rate after 2008, indicating that despite experiencing financial and environmental turbulences, stock indexes appreciated along with the devaluation of the domestic currency. Along with the differences between maximum values, mean values, skewness, and kurtosis, wide differences between the coefficients of variation in currency value fluctuations and stock market indexes for the two time frames were also traced (see Table 2).

Table 2.

Coefficient of variation across currency rate variations and ASEAN-5 stock indexes during multiple time frames.

The higher positive skewness during the pre-recessionary regime indicates that there were higher returns during the pre-economic crisis period than during the postcrisis period. However, the overall sampling time frame’s descriptive statistics depicted that skewness for stock indexes of ASEAN-5 economies was greater than those of the precrisis and postcrisis regime. Hence, the overall performance of the stock indexes of ASEAN-5 economies remained better as compared with reoccurrence of the 2008 financial crisis and the post occurrence of the economic downturn. According to Table 2, the coefficient of currency value fluctuation variation and stock indexes for the pre-economic downturn period were less than those of the post-economic crisis period. Thus, the precrisis regime was more favorable for investors and shareholders of ASEAN-5 stock indexes. However, risk-taking investors invested in stocks of a greater coefficient of variation because of greater returns and profitability potential.

The coefficient of variation (COV) remained different for three multiple regimes, such as the time frame before the occurrence of crisis, the time frame after the financial downturn, and the overall sampling time frame. According to Table 2, the overall period’s stock indexes and variations in the international US dollar against domestic currency displayed highly volatile characteristics, in contrast with pre financial downturn period and post financial downturn. Thus, the COV of currency variations and stock market indexes of the ASEAN-5 region were regime dependent, showing the presence of heterogeneity in panel data series across multiple time periods. Figure 1 confirms the presence of both negative and positive shocks in the currency variations and stock indexes of ASEAN-5 economies. Several researchers have highlighted the presence of nonlinearity in the exchange rate variation and stock indexes of developed and developing economies (Bahmani-Oskooee and Saha 2015, 2016). For the said scenario (in the case of the detection of nonlinearity in data series), nonlinear econometric approaches were deemed more appropriate in examining the cointegration between the variables (Baz et al. 2019; Charfeddine and Barkat 2020; S. Kumar 2019; Rajesh 2019). Table 3 confirms the presence of nonlinearity in the panel data series of the currency rate variations and stock indexes of the ASEAN-5 region during different and multiple regimes.

Table 3.

BDS test of nonlinearity purposed by Broock et al. (1996).

According to Table 4, cross-sectional dependencies were present in the panel data series. Therefore, all the first-generation panel-based unit root tests by Choi (2001), Hadri (2000), and Levin et al. (2002) may provide spurious and biased results. Therefore, the Table CS-augmented IPS unit root test by Pesaran (2007) was utilized at different lag periods (CIPS1, CIPS2, and CIPS3). According to Table 5, critical values at level were less than the CS-augmented IPS unit root values, depicting the non-stationarity properties of the Table stock indexes and currency rate variations of ASEAN-5 economies. After the initial discrepancies were taken into account, however, all variables under various regimes became stationary. Therefore, owing to the presence of nonlinearity in the panel data series (see Table 3) and cross-sectional dependencies (see Table 4), the Table panel-based NARDL model was deemed more appropriate for the estimation of the nonlinear influence of exchange rate variations on the ASEAN-5 stock indexes.

Table 4.

Cross-sectional dependence test during the three regimes.

Table 5.

Second-generational panel-based unit root estimation in presence of cross-sectional dependence by Pesaran (2007).

According to Table 6 and Table 7, the symmetrical panel-based ARDL model was unable to formulate a linear cointegration between the ASEAN-5 stock indexes and currency rate variations. Nevertheless, in the longer term and during the time frame of the pre-economic recessionary regime, asymmetrical cointegration between the currency value variations and stock market indexes existed. According to Table 6, an appreciation in the US dollar against the local currency of the ASEAN-5 region had a negative impact on the stock indexes of the ASEAN-5 region, whereas negative shocks in international US dollars against the ASEAN-5-member economies’ local currencies further deteriorate the stock market indexes. Therefore, in the case of a positive shock to the local currency depreciation, stock indexes decreased by 0.06%, and in the case of domestic currency appreciation, the stock market indexes of the ASEAN-5 region decreased by 0.035%. This shows that appreciation and depreciation in local currency has dissimilar impacts on the stock market indexes of the ASEAN-5 stock market. This can be explained, by utilizing the traditional flow-oriented approach, as follows; the local currency appreciation may be harmful to the local exporters because of the increase in their expenses, but local currency depreciation is also equally harmful to the importers (Kumar 2013; Salvatore 2019). In addition, the harmful impact of local currency depreciation against the international US dollar on the local importers may be due to the increase in their expenses in lieu of high prices for raw materials and the cost of the other goods sold (Reddy and Sebastin 2008). Therefore, domestic currency appreciation (negative shocks to international dollar values against local Southeast Asian economies’ currency values) did not yield the same impact on the ASEAN-5 stock indexes as compared with the increase in local currency depreciation (positive shocks to the international dollar values against the ASEAN-5 local currencies). In the short term and during the period of pre-economic recession, positive shocks to local currency depreciation had no impact on the stock indexes, whereas a local currency appreciation had a positive impact on the ASEAN-5 stock indexes. Thus, long-term investors should focus on both -ve and +ve shocks associated with the currency value fluctuations while investing in the stock indexes. Short-term investors should consider the episodes of the local currency appreciation to gain short-term advantages. There are other practical implications for the importers and exporters of the ASEAN-5 region, such as emphasizing both the positive and negative shocks associated with US dollars against local exchange rate fluctuations. These results are in contrast with (Bai and Koong 2018; Chen 2009; Jain and Biswal 2016; Mazuruse 2014; Mohamed Dahir et al. 2018; Umar and Sun 2015; Shakil et al. 2018; Umar and Sun 2015) because they exploited only time-series symmetrical models and also with (Jung et al. 2020; Kumar 2013; Kumar 2019; Salvatore 2019), owing to their reliance on asymmetrical time-series econometric approaches.

Table 6.

Heterogeneous linear and nonlinear panel ARDL modeling approach with PMG.

Table 7.

Heterogeneous linear and nonlinear panel ARDL modeling approach with PMG.

According to Table 7, there was no asymmetrical long-term cointegration between the stock market indexes of the ASEAN-5 region and currency rate variations. However, a shorter-term asymmetrical association was established between the variables during the time frame of the post-economic recessionary regime. The absence of nonlinear cointegration between the stock indexes of the ASEAN-5 region and currency rate variations can be explained by the asset market approach. According to the asset market approach, there is an existence of weak or nominal impact of exchange rate fluctuations on the stock indexes. A nominal or weak connotation between the exchange rate variations and stock indexes may be due to the asset value of international dollar values against the local Southeast Asian currencies (Reddy and Sebastin 2008). Currencies may be treated as an asset; the current value of the currencies may be determined on the basis of the expectation and information about the future exchange rate; and such information is typically different from those that may have an impact on the stock indexes (Mahapatra and Bhaduri 2019; Mollick and Nguyen 2015; Hatemi-J 2012; Othman et al. 2019). According to these facts, exchange rate fluctuations have no impact on the stock indexes, because of the independent behavior and information efficiency of both financial assets (Chang et al. 2019; Shakil et al. 2018; Singhal et al. 2019). Nevertheless, in the shorter term and during the post recessionary period, only local currency appreciation has an adverse influence on the stock indexes. This can be explained by the flow-oriented approach: negative fluctuation in local currency caused by an appreciation in the international dollar values is very beneficial to exporters but equally harmful to importers. In the shorter horizons and during the time frame of the post-economic recessionary regime, local currency appreciation (negative shocks in the international dollar values against local currency) has a strong negative impact on the stock indexes. This may be due to the increase in expenses of the local exporters, and this is again reflected by the stock indexes. However, during the prerecession period, short-term local currency appreciation positively influences the ASEAN-5-member economies’ stock indexes. These findings are in contrast with (Delgado et al. 2018; Bai and Koong 2018; Chang et al. 2019; Jain and Biswal 2016; Mohamed Dahir et al. 2018; Shakil et al. 2018; and Singhal et al. 2019) in that they have not studied the importance of regime in impacting the asymmetrical connotations between both variables. These findings pose important practical implications for exporters, importers, financial institutions, foreign exchange brokers, central banks, academics or researchers, and shareholders. After the results of Table 6 (precrisis period) with Table 7 (postcrisis period) have been compared, it is noted that investors have reacted differently during both regimes. For the longer term and during the pre-economic recession, shareholders responded negatively to both positive and negative fluctuations in the currency rates. However, only in the short term and during the precrisis regime was local currency appreciation beneficial for the local importers, because of the positive response of the regional stock indexes. After the economic recession regime and for the longer term, asymmetrical cointegration cannot be established, revealing that the long-term dependence of the ASEAN-5 region on imports and exports has changed during the postcrisis regime, in contrast with the pre-economic recessionary regime. The exporters, importers, and shareholders should maintain their focus on the regime rather than seeing the impact of currency rate variations on the stock indexes over the whole time frame (see Table 8). Moreover, investors and shareholders should also focus on both the negative and positive shocks associated with currency rate fluctuations to make rational investment decisions. Additionally, as opposed to the positive impact of local currency appreciation on stock indexes during the precrisis regime, there was a short-term negative impact of currency appreciation on the ASEAN-5 stock market indexes during the postcrisis regime. Therefore, this is the first study that explained that how financial crises impact the short-term and longer-term asymmetrical cointegrations between the stock market and exchange rate nexus.

Table 8.

Heterogeneous linear and nonlinear panel ARDL modeling approach with PMG.

According to Table 8, longer-term asymmetrical cointegration between the ASEAN-5 stock indexes and currency value fluctuations existed; however, symmetrical cointegration was not established. Moreover, in the shorter term and over the entire sample time frame, positive and negative shocks to the currency value fluctuations remained statistically insignificant and value irrelevant to the ASEAN-5 shareholders. Hence, shareholders, exporters, and importers should emphasize the type of regime, such as precrisis or the post-economic recessionary regime, before investing, and academicians or researchers should also focus on the nonlinear association between both variables. Table 9 presents the results of application of unidirectional or bidirectional asymmetrical Granger causality between positive shocks (local currency depreciation) and negative shocks (local currency appreciation) to the international US dollar against the local ASEAN-5 currencies and stock indexes of the ASEAN-5 region.

Table 9.

Asymmetrical Granger causation by Hatemi-J (2012).

According to Table 9, there was a bidirectional asymmetrical Granger causation flowing from the positive shocks in the international dollar values to ASEAN-5 local currencies (local currency depreciation) toward the ASEAN-5 stock indexes, and a unidirectional asymmetrical Granger causation flowing from exchange rate negative shocks toward the ASEAN-5 market indexes. However, during the postcrisis period, asymmetrical bidirectional Granger causation existed, flowing from −ve and +ve shocks in US dollars to the local ASEAN-5-member economies’ currency values toward the ASEAN-5 stock indexes, and vice versa. Hence, the regime plays a contributing role while estimating the asymmetrical association between both variables for researchers. Moreover, the investors or shareholders need to consider the regime while investing in the stock market indexes. Exporters, importers, and shareholders also need to consider both the +ve and –ve shocks in the currency value fluctuations of the ASEAN-5 region while making contractual agreements and financial transactions. Academics also need to consider the hidden nonlinear cointegration between the variables rather than considering the association as linear.

5. Conclusions and Future Research Directions

In conclusion, the symmetrical panel-based ARDL (PARDL) model is unable to formulate linear cointegration between the ASEAN-5 stock indexes and currency variations. However, in the longer term and during the time frame of the pre-economic recessionary regime, asymmetrical cointegration between the stock indexes and currency variations exists. During the precrisis regime, a depreciation in the local currency causes a negative impact on the stock indexes of the ASEAN-5 region, and a local currency appreciation deteriorates the stock market indexes of the ASEAN-5 economies. This can be explained by the traditional flow-oriented approach as the local currency appreciation may be harmful to the local exporters because of the increase in their expenses, but local currency depreciation is also equally harmful to the importers. The harmful impact of local currency depreciation against the international US dollars on the local importers may be due to the increase in their expenses in lieu of the high prices of raw materials and the cost of the other goods sold. Conversely, in the shorter term and during the period of pre financial crisis, positive shocks to local currency depreciation have not influenced the stock indexes, but a local currency appreciation has a positive impact on the ASEAN-5 indexes. This scenario verifies that longer-term shareholders should focus on both negative and positive shocks associated with currency value fluctuations while investing in the stock indexes. Short-term investors should consider the episodes of the local currency appreciation to gain short-term advantages.

Other practical implications for the importers and exporters of the ASEAN-5 region include the emphasis on both the positive and negative shocks associated with US dollars against the local exchange rate fluctuations. During the post-economic recessionary regime, the absence of the nonlinear cointegration between the currency rate oscillations and stock indexes of the ASEAN-5 region can be explained by the asset market approach. According to the asset market approach, the weak or nominal influence of exchange rate fluctuations exist on the indexes. A nominal or weak association between the currency variations and stock indexes may be due to the asset value of international dollar values against the local Southeast Asian currencies. Exporters, importers, and shareholders should maintain their focus on the regime, rather than seeing the impact of exchange rate fluctuations on the stock indexes over the whole period.

According to the estimated findings, it is advised that policymakers implement appropriate exchange rate policies in order to stabilize the financial market. This is generally because local currency stabilization and appreciation yielded a more profound short-term adverse impact on the equity market returns during the era of post-economic recession. This was due to the export-centric nature of the region. Therefore, policymakers need to consider the sample period before stabilizing or destabilizing the currency. This is due to the fact despite their greatest efforts to improve economic development, their initiatives may have an adverse effect on the equity market returns of ASEAN-5 economies. If investments in the financial markets are to be encouraged, the Monetary Committee must implement appropriate strategies and must also take into account the sampling time frame. During the precrisis era, currency devaluation yielded a short-term positive impact on the equity returns. However, the magnitude of the positivity was relatively smaller. This was due to the fact that significant currency fluctuations skewed share price performing patterns, leaving shareholders to speculate what they should do next since they might be unable to forecast the futuristic status of the business with confidence. Future researchers should focus on the time-series NARDL modeling framework to compare the effects of exchange rates on the stock indexes of every individual country.

Author Contributions

Conceptualization, M.I.T. and U.A.S.; methodology, A.M. and A.A.; software, D.K.T.; validation, A.A., A.M. and D.K.T.; formal analysis, U.A.S.; investigation, M.I.T.; resources, U.A.S.; data curation, A.M.; writing—original draft preparation, M.I.T. and U.A.S.; writing—review and editing, A.M. and A.A.; visualization, D.K.T.; supervision, M.I.T.; project administration, M.I.T. and U.A.S.; funding acquisition, D.K.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research was partly funded by the University of Economics Ho Chi Minh City, Vietnam (UEH).

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Acknowledgments

This research was partly funded by the University of Economics Ho Chi Minh City, Vietnam (UEH).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Adjasi, Charles K. D. 2009. Macroeconomic uncertainty and conditional stock-price volatility in frontier African markets: Evidence from Ghana. The Journal of Risk Finance 10: 333–49. [Google Scholar] [CrossRef]

- Agyire-Tettey, Kwame F., and Anthony Kyereboah-Coleman. 2008. Impact of macroeconomic indicators on stock market performance: The case of the Ghana Stock Exchange. The Journal of Risk Finance 9: 365–78. [Google Scholar] [CrossRef]

- Aktürk, Halit. 2016. Do stock returns provide a good hedge against inflation? An empirical assessment using Turkish data during periods of structural change. International Review of Economics & Finance 45: 230–246. [Google Scholar] [CrossRef]

- Al-hajj, Ekhlas, Usama Al-Mulali, and Sakiru Adebola Solarin. 2018. Oil price shocks and stock returns nexus for Malaysia: Fresh evidence from nonlinear ARDL test. Energy Reports 4: 624–37. [Google Scholar] [CrossRef]

- Andriansyah, Andriansyah, and George Messinis. 2019. Stock Prices, Exchange Rates and Portfolio Equity Flows: A Toda-Yamamoto Panel Causality Test. Journal of Economic Studies 46: 399–421. [Google Scholar] [CrossRef]

- Anisak, N., and A. Mohamad. 2019. Foreign Exchange Exposure of Indonesian Listed Firms. Global Business Review 21: 918–36. [Google Scholar] [CrossRef]

- Delgado, Nancy Areli Bermudez, Estefanía Bermudez Delgado, and Eduardo Saucedo. 2018. The relationship between oil prices, the stock market and the exchange rate: Evidence from Mexico. The North American Journal of Economics and Finance 45: 266–75. [Google Scholar] [CrossRef]

- Arif, Billah Dar, Aasif Shah, Niyati Bhanja, and Amaresh Samantaraya. 2014. The relationship between stock prices and exchange rates in Asian markets: A wavelet based correlation and quantile regression approach. South Asian Journal of Global Business Research 3: 209–24. [Google Scholar] [CrossRef]

- Asad, Muzaffar, Mosab I. Tabash, Umaid A. Sheikh, Mesfer Mubarak Al-Muhanadi, and Zahid Ahmad. 2020. Gold-oil-exchange rate volatility, Bombay stock exchange and global financial contagion 2008: Application of NARDL model with dynamic multipliers for evidences beyond symmetry. Cogent Business and Management 7. [Google Scholar] [CrossRef]

- Athukorala, Prema-chandra, and Aekapol Chongvilaivan. 2010. The Global Financial Crisis and Asian Economies: Impacts and Trade Policy Responses. ASEAN Economic Bulletin 27: 1–4. Available online: http://www.jstor.org/stable/41317106 (accessed on 1 October 2019). [CrossRef]

- Bahmani-Oskooee, Mohsen, and Sujata Saha. 2015. On the relation between stock prices and exchange rates: A review article. Journal of Economic Studies 42: 707–32. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Sujata Saha. 2016. Do exchange rate changes have symmetric or asymmetric effects on stock prices? Global Finance Journal 31: 57–72. [Google Scholar] [CrossRef]

- Bai, Shuming, and Kai S. Koong. 2018. Oil prices, stock returns, and exchange rates: Empirical evidence from China and the United States. The North American Journal of Economics and Finance 44: 12–33. [Google Scholar] [CrossRef]

- Baz, Khan, Deyi Xu, Gideon M. K. Ampofo, Imad Ali, Imran Khan, Jinhua Cheng, and Hashmat Ali. 2019. Energy consumption and economic growth nexus: New evidence from Pakistan using asymmetric analysis. Energy 189: 116254. [Google Scholar] [CrossRef]

- BenSaïda, Ahmed, Sabri Boubaker, and Nguyen Duc Khuong. 2018. The shifting dependence dynamics between the G7 stock markets. Quantitative Finance 18: 801–12. [Google Scholar] [CrossRef]

- Blau, Benjamin M. 2018. Exchange rate volatility and the stability of stock prices. International Review of Economics & Finance 58: 299–311. [Google Scholar] [CrossRef]

- Boubaker, Sabri, and Jamel Jouini. 2014. Linkages between emerging and developed equity markets: Empirical evidence in the PMG framework. The North American Journal of Economics and Finance 29: 322–35. [Google Scholar] [CrossRef]

- Boubaker, Sabri, John W. Goodell, Dharen Kumar Pandey, and Vineeta Kumari. 2022. Heterogeneous impacts of wars on global equity markets: Evidence from the invasion of Ukraine. Finance Research Letters 48: 102934. [Google Scholar] [CrossRef]

- Brem, Alexander, Petra Nylund, and Eric Viardot. 2020. The impact of the 2008 financial crisis on innovation: A dominant design perspective. Journal of Business Research 110: 360–9. [Google Scholar] [CrossRef]

- Broock, William A., J. A. Scheinkman, W. D. Dechert, and B. LeBaron. 1996. A test for independence based on the correlation dimension. Econometric Reviews 15: 197–235. [Google Scholar] [CrossRef]

- Camilleri, Silvio John, Nicolanne Scicluna, and Ye Bai. 2019. Do stock markets lead or lag macroeconomic variables? Evidence from select European countries. The North American Journal of Economics and Finance 48: 170–86. [Google Scholar] [CrossRef]

- Chang, Bisharat Hussain, Muhammad Saeed Meo, Qasim Raza Syed, and Zahida Abro. 2019. Dynamic analysis of the relationship between stock prices and macroeconomic variables: An empirical study of Pakistan stock exchange. South Asian Journal of Business Studies 8: 229–45. [Google Scholar] [CrossRef]

- Charfeddine, Lanouar, and Karim Barkat. 2020. Short- and long-run asymmetric effect of oil prices and oil and gas revenues on the real GDP and economic diversification in oil-dependent economy. Energy Economics 86: 104680. [Google Scholar] [CrossRef]

- Chen, Shiu-Sheng. 2009. Predicting the bear stock market: Macroeconomic variables as leading indicators. Journal of Banking & Finance 33: 211–23. [Google Scholar] [CrossRef]

- Chiu, Ching-wai Jeremy, Richard D. F. Harris, Evarist Stoja, and Michael Chin. 2018. Financial market Volatility, macroeconomic fundamentals and investor Sentiment. Journal of Banking & Finance 92: 130–45. [Google Scholar] [CrossRef]

- Chkir, Imed, Khaled Guesmi, A. Ben Brayek, and Kamel Naoui. 2020. Modelling the nonlinear relationship between oil prices, stock markets, and exchange rates in oil-exporting and oil-importing countries. Research in International Business and Finance 54: 101274. [Google Scholar] [CrossRef]

- Choi, In. 2001. Unit root tests for panel data. Journal of International Money and Finance 20: 249–72. Available online: https://econpapers.repec.org/RePEc:eee:jimfin:v:20:y:2001:i:2:p:249-272 (accessed on 5 October 2019). [CrossRef]

- Demirguc-Kunt, Asli, Alvaro Pedraza, and Claudia Ruiz-Ortega. 2021. Banking Sector Performance During the COVID-19 Crisis. Journal of Banking & Finance 133: 106305. [Google Scholar]

- Dumitrescu, Elena-Ivona, and Christophe Hurlin. 2012. Testing for Granger non-causality in heterogeneous panels. Economic Modelling 29: 1450–60. [Google Scholar] [CrossRef]

- Fidrmuc, Jarko, and Iikka Korhonen. 2010. The impact of the global financial crisis on business cycles in Asian emerging economies. Journal of Asian Economics 21: 293–303. [Google Scholar] [CrossRef]

- Ghulam, A. 2018. Conditional volatility nexus between stock markets and macroeconomic variables. Journal of Economic Studies 45: 77–99. [Google Scholar] [CrossRef]

- Granger, Clive, and Gawon Yoon. 2002. Hidden Cointegration. Available online: https://econpapers.repec.org/RePEc:ecj:ac2002:92 (accessed on 27 October 2022).

- Hadri, Kaddour. 2000. Testing for stationarity in heterogeneous panel data. The Econometrics Journal 3: 148–61. [Google Scholar] [CrossRef]

- Hatemi-J, Abdulnasser. 2012. Asymmetric causality tests with an application. Empirical Economics 43: 447–56. [Google Scholar] [CrossRef]

- Ho, Sin-Yu. 2018. Macroeconomic determinants of stock market development in South Africa. International Journal of Emerging Markets 14: 322–42. [Google Scholar] [CrossRef]

- Hung, Ngo Thai. 2019. Spillover Effects Between Stock Prices and Exchange Rates for the Central and Eastern European Countries. Global Business Review 23: 259–86. [Google Scholar] [CrossRef]

- Jain, Anshul, and Pratap Chandra Biswal. 2016. Dynamic linkages among oil price, gold price, exchange rate, and stock market in India. Resources Policy 49: 179–185. [Google Scholar] [CrossRef]

- Jung, Young Cheol, Anupam Das, and Adian McFarlane. 2020. The asymmetric relationship between the oil price and the US-Canada exchange rate. The Quarterly Review of Economics and Finance 76: 198–206. [Google Scholar] [CrossRef]

- Kassouri, Yacouba, and Halil Altıntaş. 2020. Threshold cointegration, nonlinearity, and frequency domain causality relationship between stock price and Turkish Lira. Research in International Business and Finance 52: 101097. [Google Scholar] [CrossRef]

- Keat, Heng Swee. 2009. The Global Financial Crisis: Impact on Asia and Policy Challenges Ahead. San Francisco: Federal Reserve Bank, pp. 268–75. [Google Scholar]

- Keswani, Sarika, and Bharti Wadhwa. 2018. An Empirical Analysis on Association Between Selected Macroeconomic Variables and Stock Market in the Context of BSE. The Indian Economic Journal 66: 170–89. [Google Scholar] [CrossRef]

- Kumar, Manish. 2013. Returns and volatility spillover between stock prices and exchange rates: Empirical evidence from IBSA countries. International Journal of Emerging Markets 8: 108–28. [Google Scholar] [CrossRef]

- Kumar, Satish. 2019. Asymmetric impact of oil prices on exchange rate and stock prices. The Quarterly Review of Economics and Finance 72: 41–51. [Google Scholar] [CrossRef]

- Levin, Andrew, Chien-Fu Lin, and James Chia-Shang Chu. 2002. Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics 108: 1–24. Available online: https://econpapers.repec.org/RePEc:eee:econom:v:108:y:2002:i:1:p:1-24 (accessed on 1 July 2019). [CrossRef]

- Liang, Chin Chia, Carol Troy, and Ellen Rouyer. 2020. U.S. uncertainty and Asian stock prices: Evidence from the asymmetric NARDL model. The North American Journal of Economics and Finance 51: 101046. [Google Scholar] [CrossRef]

- Mahapatra, Smita, and Saumitra N. Bhaduri. 2019. Dynamics of the impact of currency fluctuations on stock markets in India: Assessing the pricing of exchange rate risks. Borsa Istanbul Review 19: 15–23. [Google Scholar] [CrossRef]

- Makin, Anthony J. 2019. Lessons for macroeconomic policy from the Global Financial Crisis. Economic Analysis and Policy 64: 13–25. [Google Scholar] [CrossRef]

- Mazuruse, Peter. 2014. Canonical correlation analysis: Macroeconomic variables versus stock returns. Journal of Financial Economic Policy 6: 179–96. [Google Scholar] [CrossRef]

- Mohamed Dahir, Ahmed, Fauziah Mahat, Nazrul H. Ab Razak, and A. N. Bany-Ariffin. 2018. Revisiting the dynamic relationship between exchange rates and stock prices in BRICS countries: A wavelet analysis. Borsa Istanbul Review 18: 101–13. [Google Scholar] [CrossRef]

- Mollick, Andre, and Khoa H. Nguyen. 2015. U.S. oil company stock returns and currency fluctuations. Managerial Finance 41: 974–94. [Google Scholar] [CrossRef]

- Neveen, Ahmed. 2018. The effect of the financial crisis on the dynamic relation between foreign exchange and stock returns: Empirical evidence from MENA region. Journal of Economic Studies 45: 994–1031. [Google Scholar] [CrossRef]

- Othman, Anwar Hasan Abdullah, Syed Musa Alhabshi, and Razali Haron. 2019. The effect of symmetric and asymmetric information on volatility structure of crypto-currency markets: A case study of bitcoin currency. Journal of Financial Economic Policy 11: 432–50. [Google Scholar] [CrossRef]

- Park, Cyn-Young, and Kwanho Shin. 2020. Contagion through National and Regional Exposures to Foreign Banks during the Global Financial Crisis. Journal of Financial Stability 46: 100721. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem. 2004. General Diagnostic Tests for Cross Section Dependence in Panels. Cambridge Working Papers in Economics No. 0435. Cambridge: University of Cambridge, Faculty of Economics. [Google Scholar]

- Pesaran, M. Hashem. 2006. Estimation and Inference in Large Heterogeneous Panels with a Multifactor Error Structure. Econometrica 74: 967–1012. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem. 2007. A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics 22: 265–312. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard P. Smith. 1999. Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. Journal of the American Statistical Association 94: 621–34. [Google Scholar] [CrossRef]

- Rajesh, S. 2019. Dynamism between selected macroeconomic determinants and electricity consumption in India. International Journal of Social Economics 46: 805–21. [Google Scholar] [CrossRef]

- Rasiah, Rajah, Kee Cheok Cheong, and Richard Doner. 2014. Southeast Asia and the Asian and Global Financial Crises. Journal of Contemporary Asia 44: 572–80. [Google Scholar] [CrossRef]

- Reddy, Y. V., and A. Sebastin. 2008. Interaction between forex and stock markets in India: An entropy approach. Vikalpa 33: 27–46. [Google Scholar] [CrossRef]

- Rehman, Mobeen U. 2017. Dynamics of Co-movements among Implied Volatility, Policy Uncertainty and Market Performance. Global Business Review 18: 1478–87. [Google Scholar] [CrossRef]

- Rillo, Aladdin D. 2009. ASEAN ECONOMIES: Challenges and Responses Amid the Crisis. Southeast Asian Affairs 2009: 17–27. Available online: http://www.jstor.org/stable/27913375 (accessed on 1 May 2019). [CrossRef]

- Roubaud, David, and Mohamed Arouri. 2018. Oil prices, exchange rates and stock markets under uncertainty and regime-switching. Finance Research Letters 27: 28–33. [Google Scholar] [CrossRef]

- Salvatore, Capasso. 2019. The long-run interrelationship between exchange rate and interest rate: The case of Mexico. Journal of Economic Studies 46: 1380–97. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad. 2013. Linkages between inflation, economic growth and terrorism in Pakistan. Economic Modelling 32: 496–506. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Shahzad Mohd Nor, Roman Ferrer, and Shawkat Hammoudeh. 2017. Asymmetric determinants of CDS spreads: U.S. industry-level evidence through the NARDL approach. Economic Modelling 60: 211–30. [Google Scholar] [CrossRef]

- Shakil, Mohammad Hassan, Mashiyat Tasnia, and Buerhan Saiti. 2018. Is gold a hedge or a safe haven? An application of ARDL approach. Journal of Economics, Finance and Administrative Science 23: 60–76. [Google Scholar] [CrossRef]

- Sheikh, Umaid A., Mosab I. Tabash, and Muzaffar Asad. 2020a. Global Financial Crisis in Effecting Asymmetrical Co-integration between Exchange Rate and Stock Indexes of South Asian Region: Application of Panel Data NARDL and ARDL Modelling Approach with Asymmetrical Granger Causality. Cogent Business & Management 7: 1843309. [Google Scholar] [CrossRef]

- Sheikh, Umaid A., Muzaffar Asad, Aqeel Israr, Mosab I. Tabash, and Zahid Ahmed. 2020b. Symmetrical cointegrating relationship between money supply, interest rates, consumer price index, terroristic disruptions, and Karachi stock exchange: Does global financial crisis matter? Cogent Economics and Finance 8: 1838689. [Google Scholar] [CrossRef]

- Sheikh, Umaid A., Muzaffar Asad, Zahid Ahmed, and U. Mukhtar. 2020c. Asymmetrical relationship between oil prices, gold prices, exchange rate, and stock prices during global financial crisis 2008: Evidence from Pakistan. Cogent Economics and Finance 8: 1757802. [Google Scholar] [CrossRef]

- Shin, Yongcheol, Byungchul Yu, and Matthew Greenwood-Nimmo. 2013. Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework. New York: Springer. [Google Scholar] [CrossRef]

- Shiva, Atul, and Monica Sethi. 2015. Understanding Dynamic Relationship among Gold Price, Exchange Rate and Stock Markets: Evidence in Indian Context. Global Business Review 16: 93S–111S. [Google Scholar] [CrossRef]

- Sikhosana, Ayanda, and Goodness C. Aye. 2018. Asymmetric volatility transmission between the real exchange rate and stock returns in South Africa. Economic Analysis and Policy 60: 1–8. [Google Scholar] [CrossRef]

- Simbolon, Lentina, and Purwanto. 2018. The Influence of Macroeconomic Factors on Stock Price: The Case of Real Estate and Property Companies. Global Tensions in Financial Markets 34: 2–19. [Google Scholar] [CrossRef]

- Singhal, Shelly, Sangita Choudhary, and Pratap Chandra Biswal. 2019. Return and volatility linkages among International crude oil price, gold price, exchange rate and stock markets: Evidence from Mexico. Resources Policy 60: 255–61. [Google Scholar] [CrossRef]

- Tabash, Mosab I., Umaid A. Sheikh, and Muzaffar Asad. 2020. Market miracles: Resilience of Karachi stock exchange index against terrorism in Pakistan. Cogent Economics & Finance 8: 1821998. [Google Scholar]

- Taufeeq, Ajaz. 2017. Stock prices, exchange rate and interest rate: Evidence beyond symmetry. Journal of Financial Economic Policy 9: 2–19. [Google Scholar] [CrossRef]

- Tiwari, Aviral Kumar, and Phouphet Kyophilavong. 2017. Exchange Rates and International Reserves in India: A Frequency Domain Analysis. South Asia Economic Journal 18: 76–93. [Google Scholar] [CrossRef]

- Toda, Hiro Y., and Taku Yamamoto. 1995. Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics 66: 225–50. [Google Scholar] [CrossRef]

- Tuna, Gülfen. 2018. Interaction between precious metals price and Islamic stock markets. International Journal of Islamic and Middle Eastern Finance and Management 12: 96–114. [Google Scholar] [CrossRef]

- Umar, Muhammad, and Gang Sun. 2015. Country risk, stock prices, and the exchange rate of the renminbi. Journal of Financial Economic Policy 7: 366–76. [Google Scholar] [CrossRef]

- Vezos, Panayiotis, and N. Lael Joseph. 2006. The sensitivity of US banks’ stock returns to interest rate and exchange rate changes. Managerial Finance 32: 182–99. [Google Scholar] [CrossRef]

- Wei, Yu, Songkun Qin, Xiafei Li, Sha Zhu, and Guiwu Wei. 2019. Oil price fluctuation, stock market and macroeconomic fundamentals: Evidence from China before and after the financial crisis. Finance Research Letters 30: 23–9. [Google Scholar] [CrossRef]

- Wong, Hock Tsen. 2017. Real exchange rate returns and real stock price returns. International Review of Economics & Finance 49: 340–352. [Google Scholar] [CrossRef]

- Xie, Zixiong, Shyh-Wei Chen, and An-Chi Wu. 2020. The foreign exchange and stock market nexus: New international evidence. International Review of Economics & Finance 67: 240–266. [Google Scholar] [CrossRef]

- Zhang, Tianding, Tianwen Du, and Jie Li. 2019. The impact of China’s macroeconomic determinants on commodity prices. Finance Research Letters 36: 101323. [Google Scholar] [CrossRef]

- Zhang, Jia-Bing, Ya-Chun Gao, and Shi-Min Cai. 2020. The hierarchical structure of stock market in times of global financial crisis. Physica A: Statistical Mechanics and Its Applications 542: 123452. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).