Investor Sentiment Index: A Systematic Review

Abstract

1. Introduction

2. Literature Review

3. Data Collection and Methodology

3.1. Selection of Search Term

3.2. Search Method

3.3. Study Method

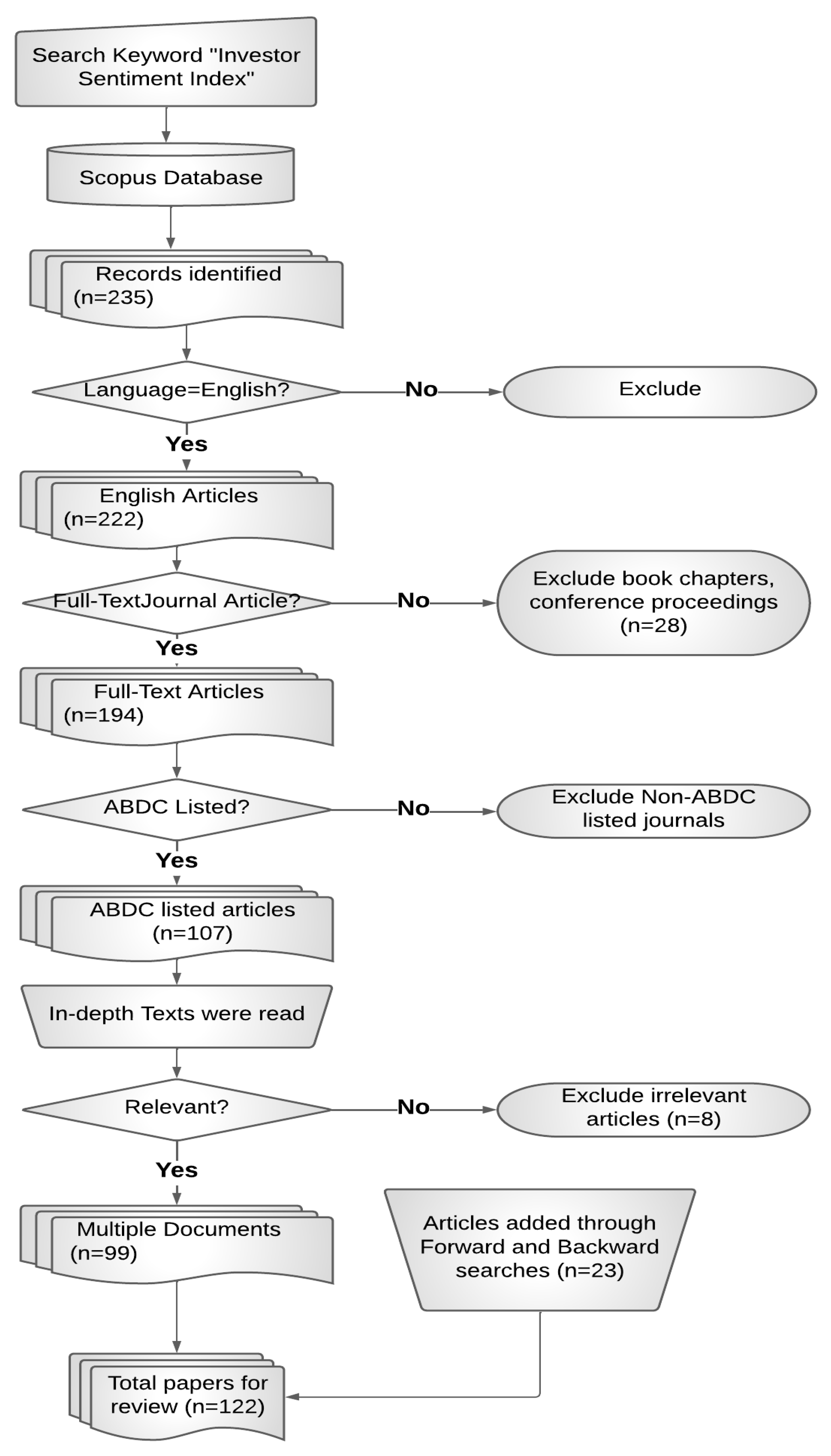

3.4. Selection Procedure

4. Results and Discussion

4.1. Content Analysis

4.1.1. Sentiment and Stock Market

4.1.2. Sentiment and Cryptocurrency

4.1.3. Sentiment and COVID-19

4.1.4. Sentiment and Mutual Fund Market

4.1.5. Investor Sentiment Index Methodologies

Composite Investor Sentiment Index

Internet Search-Based Sentiment

Online Post-Based Sentiment

Other Sentiment Measures

4.1.6. Statistical Techniques and Methods

4.2. Research Trends

4.2.1. Countries/Territories, Year, and Publication

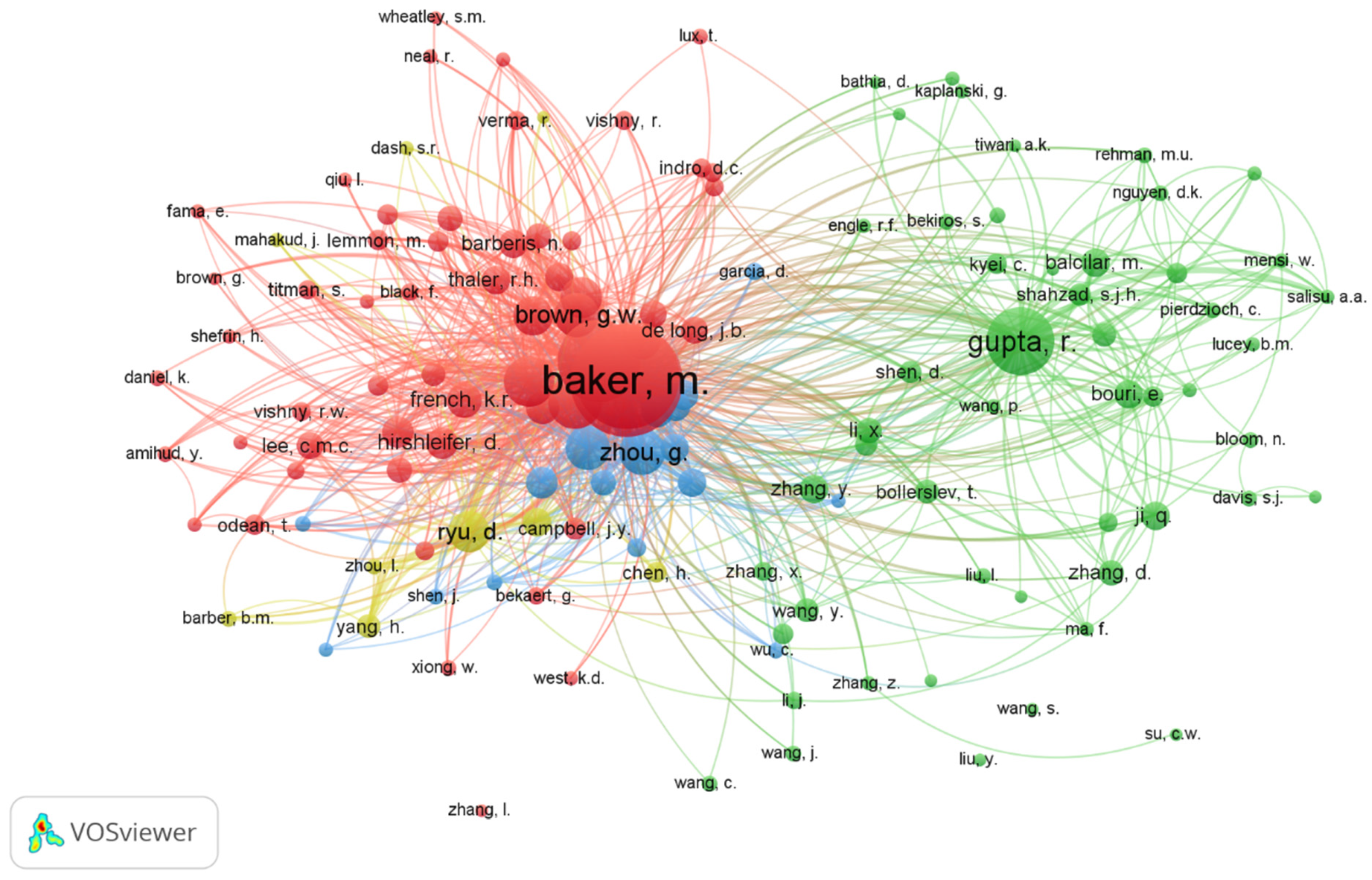

4.2.2. Influential Studies

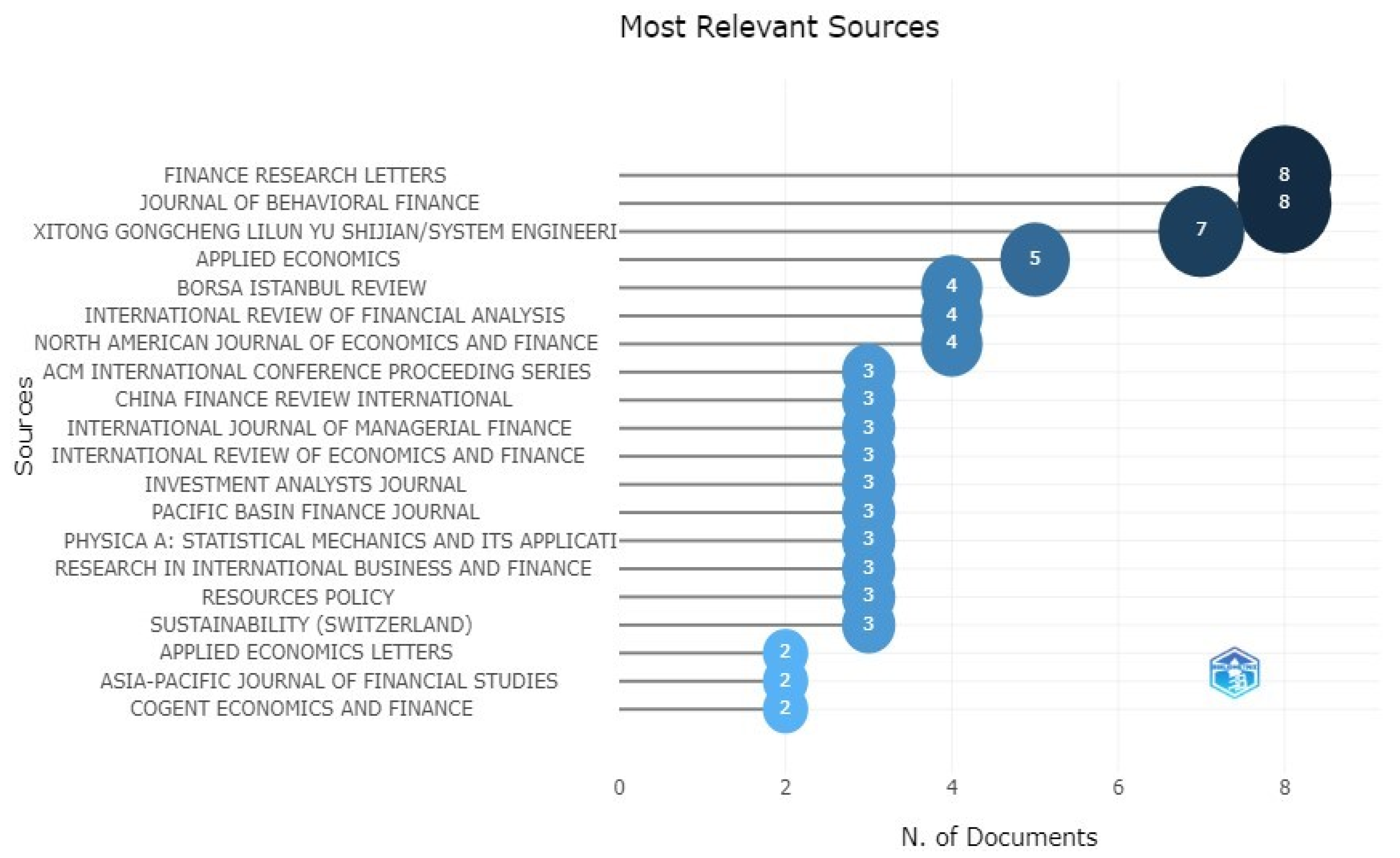

4.2.3. Journal of Publication

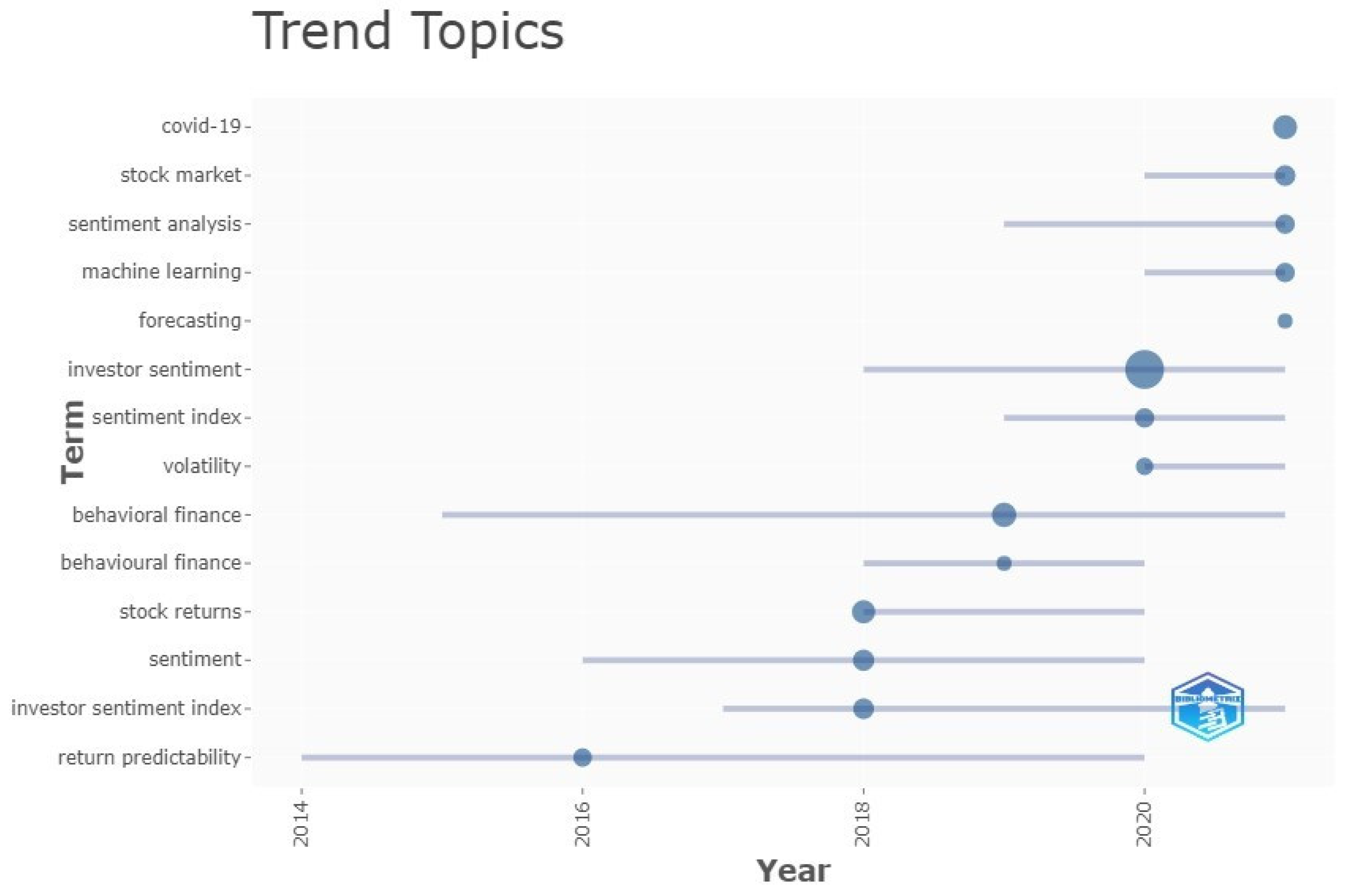

4.2.4. Term Analysis

4.2.5. Trend of Topics

4.2.6. Citation Analysis

5. Conclusions

5.1. Direction for Future Research

5.1.1. Lack of Research in Developing Nations

5.1.2. The Predominance of Secondary Data-Based Empirical Research

5.1.3. Lack of Studies Using a Qualitative Approach

5.1.4. High Focus on Stock Return

Funding

Conflicts of Interest

Appendix A

| Countries/Territories | Documents | Citations | Total Link Strength |

|---|---|---|---|

| China | 91 | 1122 | 28 |

| United States | 26 | 1051 | 19 |

| India | 18 | 89 | 7 |

| France | 16 | 126 | 29 |

| United Kingdom | 15 | 72 | 21 |

| South Africa | 15 | 16 | 20 |

| South Korea | 14 | 72 | 3 |

| Taiwan | 11 | 46 | 5 |

| Pakistan | 10 | 70 | 14 |

| Vietnam | 10 | 19 | 13 |

| Tunisia | 10 | 82 | 8 |

| Russian Federation | 9 | 24 | 21 |

| Portugal | 9 | 33 | 4 |

| Australia | 8 | 8 | 10 |

| Turkey | 7 | 40 | 9 |

| New Zealand | 6 | 27 | 18 |

| Spain | 6 | 29 | 3 |

| Malaysia | 6 | 22 | 2 |

| Greece | 5 | 37 | 11 |

| Hong Kong | 5 | 50 | 5 |

| Thailand | 5 | 8 | 4 |

| Node | Betweenness | Closeness | Page Rank |

|---|---|---|---|

| Cluster 1 | |||

| Baker and Wurgler (2006) | 219.527662 | 0.015625 | 0.06794045 |

| Baker and Wurgler (2007) | 104.969595 | 0.015625 | 0.05313294 |

| Stambaugh et al. (2012) | 13.0175666 | 0.01470588 | 0.02821573 |

| Da et al. (2015) | 20.7103689 | 0.01449275 | 0.02920612 |

| De Long et al. (1990) | 16.6890793 | 0.01449275 | 0.02847767 |

| Lee et al. (2002) | 14.9154615 | 0.01428571 | 0.02221078 |

| Tetlock (2007) | 5.14245998 | 0.01333333 | 0.01984227 |

| Antweiler and Frank (2004) | 2.04708981 | 0.01219512 | 0.01647175 |

| Shleifer and Vishny (1997) | 3.55202593 | 0.0125 | 0.01434914 |

| Yu and Yuan (2011) | 2.66153437 | 0.01265823 | 0.01212042 |

| Bekiros et al. (2016) | 0.48448461 | 0.01162791 | 0.00926938 |

| Da et al. (2011) | 0.28948147 | 0.01111111 | 0.01109502 |

| F. Jiang et al. (2019) | 0.14734679 | 0.01086957 | 0.01130509 |

| Hirshleifer et al. (2015) | 0.29120514 | 0.01123596 | 0.01023975 |

| Das and Chen (2007) | 0.26191219 | 0.01086957 | 0.00907961 |

| García (2013) | 0.11110769 | 0.01098901 | 0.01092196 |

| Cluster 2 | |||

| Baker et al. (2012) | 133.275032 | 0.01612903 | 0.03466891 |

| Huang et al. (2015) | 60.4277639 | 0.01538462 | 0.02913402 |

| Lee et al. (1991) | 0.91129218 | 0.01190476 | 0.00966337 |

| L. Sun et al. (2016) | 5.03801823 | 0.01298701 | 0.01526918 |

| Zhou (2018) | 2.91107578 | 0.01204819 | 0.01321668 |

| Smales (2017) | 3.17586941 | 0.01282051 | 0.01520091 |

| Yang and Zhou (2016) | 0.88054476 | 0.01219512 | 0.0159711 |

| Yang et al. (2015) | 1.10600412 | 0.01204819 | 0.01470128 |

| Benhabib et al. (2016) | 0.58930151 | 0.01149425 | 0.01197713 |

| Kumari and Mahakud (2015) | 0.47192681 | 0.01162791 | 0.01185564 |

| Zouaoui et al. (2011) | 1.72164751 | 0.0125 | 0.0135497 |

| Aboody et al. (2018) | 1.93355472 | 0.01176471 | 0.01007205 |

| Cluster 3 | |||

| Brown and Cliff (2004) | 35.355213 | 0.01351351 | 0.04593274 |

| Schmeling (2009) | 47.8490956 | 0.01408451 | 0.04240872 |

| Baker and Stein (2004) | 26.4708547 | 0.01388889 | 0.03499847 |

| Brown and Cliff (2005) | 13.9896384 | 0.0131579 | 0.03578223 |

| Lemmon and Portniaguina (2006) | 22.0861202 | 0.01333333 | 0.03157943 |

| Fisher and Statman (2000) | 16.4136195 | 0.0131579 | 0.03379941 |

| Black (1986) | 3.05404379 | 0.01190476 | 0.02359622 |

| Barberis et al. (1998) | 2.74820488 | 0.01190476 | 0.01924595 |

| Fama and French (1993) | 1.95957462 | 0.01204819 | 0.02076118 |

| Neal and Wheatley (1998) | 5.18809219 | 0.01265823 | 0.0205036 |

| Kumar and Lee (2006) | 3.04898806 | 0.01219512 | 0.01652273 |

| Ben-Rephael et al. (2012) | 0.61266555 | 0.01149425 | 0.01214606 |

| Lee et al. (1991) | 0.55018123 | 0.01162791 | 0.0120838 |

| Fama and French (1992) | 0.71136692 | 0.01123596 | 0.01226741 |

| Fisher and Statman (2003) | 0.73347916 | 0.01162791 | 0.01314629 |

| Kaplanski and Levy (2010) | 0.20524729 | 0.01111111 | 0.00884246 |

| Carhart (1997) | 0.77567473 | 0.01176471 | 0.01099706 |

| Lee et al. (1991) | 0.18835298 | 0.00980392 | 0.0114623 |

| Shleifer and Summers (1990) | 0.42133972 | 0.01098901 | 0.01130597 |

| Fama (1970) | 2.16838917 | 0.01176471 | 0.01205322 |

| Kahneman and Tversky (1979) | 0.05667317 | 0.0106383 | 0.01171225 |

| Baker and Stein (2004) | 0.15277281 | 0.01098901 | 0.00969449 |

| Region | Frequency |

|---|---|

| China | 288 |

| USA | 38 |

| India | 35 |

| South Korea | 30 |

| South Africa | 24 |

| Pakistan | 22 |

| UK | 21 |

| Tunisia | 18 |

| Australia | 15 |

| Portugal | 15 |

| Malaysia | 14 |

| France | 12 |

| Spain | 11 |

| Thailand | 9 |

| Turkey | 9 |

| Brazil | 6 |

| Greece | 6 |

| Czech Republic | 5 |

| Poland | 5 |

| Germany | 4 |

| Cited References | Citations |

|---|---|

| Baker and Wurgler (2006) | 32 |

| Brown and Cliff (2004) | 30 |

| Baker et al. (2012) | 25 |

| Schmeling (2009) | 24 |

| Baker and Stein (2004) | 21 |

| Baker and Wurgler (2007) | 15 |

| Fisher and Statman (2000) | 15 |

| De Long et al. (1990) | 14 |

| Barberis et al. (1998) | 13 |

| Huang et al. (2015) | 13 |

| Lemmon and Portniaguina (2006) | 11 |

| Stambaugh et al. (2012) | 11 |

| Ben-Rephael et al. (2012) | 10 |

| Brown and Cliff (2005) | 9 |

| Black (1986) | 8 |

| Item | Frequency | Year_Q1 | Year_Med | Year_Q3 |

|---|---|---|---|---|

| Return Predictability | 7 | 2014 | 2016 | 2020 |

| Stock Returns | 15 | 2018 | 2018 | 2020 |

| Sentiment | 11 | 2016 | 2018 | 2020 |

| Investor Sentiment Index | 10 | 2017 | 2018 | 2021 |

| Behavioral Finance | 18 | 2015 | 2019 | 2021 |

| Behavioral Finance | 5 | 2018 | 2019 | 2020 |

| Investor Sentiment | 86 | 2018 | 2020 | 2021 |

| Sentiment Index | 8 | 2019 | 2020 | 2021 |

| Volatility | 6 | 2020 | 2020 | 2021 |

| COVID-19 | 17 | 2021 | 2021 | 2021 |

| Stock Market | 10 | 2020 | 2021 | 2021 |

| Machine Learning | 8 | 2020 | 2021 | 2021 |

| Sentiment Analysis | 8 | 2019 | 2021 | 2021 |

| Forecasting | 5 | 2021 | 2021 | 2021 |

| 1 | See Sureka et al. (2022) for further justification on the benefits of use of the triangulation method over traditional SLR or BA techniques. |

References

- Aboody, D., O. Even-Tov, R. Lehavy, and B. Trueman. 2018. Overnight Returns and Firm-Specific Investor Sentiment. Journal of Financial and Quantitative Analysis 53: 485–505. [Google Scholar] [CrossRef]

- Aharon, D. Y., E. Demir, C. K. M. Lau, and A. Zaremba. 2022. Twitter-Based uncertainty and cryptocurrency returns. Research in International Business and Finance 59: 101546. [Google Scholar] [CrossRef]

- Aissia, D. Ben. 2016. Home and foreign investor sentiment and the stock returns. Quarterly Review of Economics and Finance 59: 71–77. [Google Scholar] [CrossRef]

- Akhtaruzzaman, M., S. Boubaker, B. M. Lucey, and A. Sensoy. 2021. Is gold a hedge or a safe-haven asset in the COVID–19 crisis? Economic Modelling 102: 105588. [Google Scholar] [CrossRef]

- Akhtaruzzaman, M., S. Boubaker, D. K. Nguyen, and M. R. Rahman. 2022. Systemic risk-sharing framework of cryptocurrencies in the COVID–19 crisis. Finance Research Letters 47: 102787. [Google Scholar] [CrossRef]

- Antweiler, W., and M. Z. Frank. 2004. Is all that talk just noise? The information content of Internet stock message boards. Journal of Finance 59: 1259–94. [Google Scholar] [CrossRef]

- Apergis, N., A. Cooray, and M. U. Rehman. 2018. Do Energy Prices Affect U.S. Investor Sentiment? Journal of Behavioral Finance 19: 125–40. [Google Scholar] [CrossRef]

- Baker, M., and J. C. Stein. 2004. Market liquidity as a sentiment indicator. Journal of Financial Markets 7: 271–99. [Google Scholar] [CrossRef]

- Baker, M., and J. Wurgler. 2006. Investor sentiment and the cross-section of stock returns. Journal of Finance 61: 1645–80. [Google Scholar] [CrossRef]

- Baker, M., and J. Wurgler. 2007. Investor sentiment in the stock market. Journal of Economic Perspectives 21: 129–51. [Google Scholar] [CrossRef]

- Baker, M., J. Wurgler, and Y. Yuan. 2012. Global, local, and contagious investor sentiment. Journal of Financial Economics 104: 272–87. [Google Scholar] [CrossRef]

- Balcilar, M., E. Bouri, R. Gupta, and C. K. Kyei. 2021. High-Frequency Predictability of Housing Market Movements of the United States: The Role of Economic Sentiment. Journal of Behavioral Finance 22: 490–98. [Google Scholar] [CrossRef]

- Balcilar, M., R. Gupta, and C. Kyei. 2018. Predicting Stock Returns and Volatility With Investor Sentiment Indices: A Reconsideration Using a Nonparametric Causality-in-Quantiles Test. Bulletin of Economic Research 70: 74–87. [Google Scholar] [CrossRef]

- Banerjee, A. K., M. Akhtaruzzaman, A. Dionisio, D. Almeida, and A. Sensoy. 2022. Nonlinear nexus between cryptocurrency returns and COVID–19 COVID-19 news sentiment. Journal of Behavioral and Experimental Finance 36: 100747. [Google Scholar] [CrossRef] [PubMed]

- Barberis, N., A. Shleifer, and R. Vishny. 1998. A model of investor sentiment. Journal of Financial Economics 49: 307–43. [Google Scholar] [CrossRef]

- Bekiros, S., R. Gupta, and C. Kyei. 2016. A non-linear approach for predicting stock returns and volatility with the use of investor sentiment indices. Applied Economics 48: 2895–98. [Google Scholar] [CrossRef]

- Ben-Rephael, A., S. Kandel, and A. Wohl. 2012. Measuring investor sentiment with mutual fund flows. Journal of Financial Economics 104: 363–82. [Google Scholar] [CrossRef]

- Benhabib, J., X. Liu, and P. Wang. 2016. Sentiments, financial markets, and macroeconomic fluctuations. Journal of Financial Economics 120: 420–43. [Google Scholar] [CrossRef]

- Bhardwaj, A., Y. Narayan, Vanraj, Pawan, and M. Dutta. 2015. Sentiment Analysis for Indian Stock Market Prediction Using Sensex and Nifty. Procedia Computer Science 70: 85–91. [Google Scholar] [CrossRef]

- Bissoondoyal-Bheenick, E., H. Do, X. Hu, and A. Zhong. 2022. Sentiment and stock market connectedness: Evidence from the U.S.–China trade war. International Review of Financial Analysis 80: 102031. [Google Scholar] [CrossRef]

- Black, F. 1986. Noise. The Journal of Finance 41: 528–43. [Google Scholar] [CrossRef]

- Blasco, N., P. Corredor, and E. Ferrer. 2018. Analysts herding: When does sentiment matter? Applied Economics 50: 5495–509. [Google Scholar] [CrossRef]

- Bonato, M., K. Gkillas, R. Gupta, and C. Pierdzioch. 2021. A note on investor happiness and the predictability of realized volatility of gold. Finance Research Letters 39: 101614. [Google Scholar] [CrossRef]

- Boubaker, S., Z. Liu, and Y. Zhan. 2022. Customer relationships, corporate social responsibility, and stock price reaction: Lessons from China during health crisis times. Finance Research Letters 47: 102699. [Google Scholar] [CrossRef]

- Boudabbous, A., S. Boujelben, and M. Abdelhedi. 2021. The effect of the investors’ sentiment on the trade-off between earnings management strategies: The case of tunisian market. Asian Academy of Management Journal of Accounting and Finance 17: 225–59. [Google Scholar] [CrossRef]

- Brereton, P., B. A. Kitchenham, D. Budgen, M. Turner, and M. Khalil. 2007. Lessons from applying the systematic literature review process within the software engineering domain. Journal of Systems and Software 80: 571–83. [Google Scholar] [CrossRef]

- Brown, G. W., and M. T. Cliff. 2004. Investor sentiment and the near-term stock market. Journal of Empirical Finance 11: 1–27. [Google Scholar] [CrossRef]

- Brown, G. W., and M. T. Cliff. 2005. Investor sentiment and asset valuation. Journal of Business 78: 405–40. [Google Scholar] [CrossRef]

- Budiharto, W., and M. Meiliana. 2018. Prediction and analysis of Indonesia Presidential election from Twitter using sentiment analysis. Journal of Big Data 5: 1–10. [Google Scholar] [CrossRef]

- Burggraf, T., T. L. D. Huynh, M. Rudolf, and M. Wang. 2020. Do FEARS drive Bitcoin? Review of Behavioral Finance 13: 229–58. [Google Scholar] [CrossRef]

- Carhart, M. M. 1997. On Persistence in Mutual Fund Performance. The Journal of Finance 52: 57–82. [Google Scholar] [CrossRef]

- Çepni, O., I. E. Guney, R. Gupta, and M. E. Wohar. 2020. The role of an aligned investor sentiment index in predicting bond risk premia of the U.S. Journal of Financial Markets 51: 100541. [Google Scholar] [CrossRef]

- Cepni, O., R. Gupta, and Q. Ji. 2021. Sentiment Regimes and Reaction of Stock Markets to Conventional and Unconventional Monetary Policies: Evidence from OECD Countries. Journal of Behavioral Finance, 1–17. [Google Scholar] [CrossRef]

- Chen, H., T. T. L. Chong, and Y. She. 2014. A principal component approach to measuring investor sentiment in China. Quantitative Finance 14: 573–79. [Google Scholar] [CrossRef]

- Chen, R., J. Yu, C. Jin, and W. Bao. 2019. Internet finance investor sentiment and return comovement. Pacific Basin Finance Journal 56: 151–61. [Google Scholar] [CrossRef]

- Chen, T. 2017. Investor Attention and Global Stock Returns. Journal of Behavioral Finance 18: 358–72. [Google Scholar] [CrossRef]

- Chen, X., and H. Xie. 2020. A Structural Topic Modeling-Based Bibliometric Study of Sentiment Analysis Literature. Cognitive Computation 12: 1097–129. [Google Scholar] [CrossRef]

- Da, Z., J. Engelberg, and P. Gao. 2011. In Search of Attention. The Journal of Finance 66: 1461–99. [Google Scholar] [CrossRef]

- Da, Z., J. Engelberg, and P. Gao. 2015. The Sum of All FEARS Investor Sentiment and Asset Prices. Review of Financial Studies 28: 1–32. [Google Scholar] [CrossRef]

- Das, S. R., and M. Y. Chen. 2007. Yahoo! for Amazon: Sentiment Extraction from Small Talk on the Web. Management Science 53: 1375–88. [Google Scholar] [CrossRef]

- Dash, S. R., and D. Maitra. 2018. Does sentiment matter for stock returns? Evidence from Indian stock market using wavelet approach. Finance Research Letters 26: 32–39. [Google Scholar] [CrossRef]

- De Long, J. B., A. Shleifer, L. H. Summers, and R. J. Waldmann. 1990. Noise Trader Risk in Financial Markets. Journal of Political Economy 98: 28–52. [Google Scholar] [CrossRef]

- Debata, B., S. R. Dash, and J. Mahakud. 2021. Stock market liquidity: Implication of local and global investor sentiment. Journal of Public Affairs, 21. [Google Scholar] [CrossRef]

- Diks, C., and V. Panchenko. 2006. A new statistic and practical guidelines for nonparametric Granger causality testing. Journal of Economic Dynamics and Control 30: 1647–69. [Google Scholar] [CrossRef]

- Ding, Z., Z. Liu, Y. Zhang, and R. Long. 2017. The contagion effect of international crude oil price fluctuations on Chinese stock market investor sentiment. Applied Energy 187: 27–36. [Google Scholar] [CrossRef]

- Donthu, N., S. Kumar, D. Mukherjee, N. Pandey, and W. M. Lim. 2021. How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research 133: 285–96. [Google Scholar] [CrossRef]

- Duan, Y., L. Liu, and Z. Wang. 2021. COVID-19 Sentiment and the Chinese Stock Market: Evidence from the Official News Media and Sina Weibo. Research in International Business and Finance 58: 101432. [Google Scholar] [CrossRef]

- Eachempati, P., and P. R. Srivastava. 2021. Accounting for unadjusted news sentiment for asset pricing. Qualitative Research in Financial Markets 13: 383–422. [Google Scholar] [CrossRef]

- Fama, E. F. 1970. Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Fama, E. F., and K. R. French. 1992. The Cross-Section of Expected Stock Returns. The Journal of Finance 47: 427–65. [Google Scholar] [CrossRef]

- Fama, E. F., and K. R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fisher, K. L., and M. Statman. 2000. Investor Sentiment and Stock Returns. Financial Analysts Journal 56: 16–23. [Google Scholar] [CrossRef]

- Fisher, K. L., and M. Statman. 2003. Consumer Confidence and Stock Returns. The Journal of Portfolio Management 30: 115–27. [Google Scholar] [CrossRef]

- French, J. J. 2021. #Bitcoin, #COVID-19: Twitter-based uncertainty and bitcoin before and during the pandemic. International Journal of Financial Studies 9: 28. [Google Scholar] [CrossRef]

- Ftiti, Z., and S. Hadhri. 2019. Can economic policy uncertainty, oil prices, and investor sentiment predict Islamic stock returns? A multi-scale perspective. Pacific-Basin Finance Journal 53: 40–55. [Google Scholar] [CrossRef]

- Fu, J., X. Wu, Y. Liu, and R. Chen. 2021. Firm-specific investor sentiment and stock price crash risk. Finance Research Letters 38: 101442. [Google Scholar] [CrossRef]

- García, D. 2013. Sentiment during Recessions. Journal of Finance 68: 1267–300. [Google Scholar] [CrossRef]

- García Petit, Juan Jose, Vaquero E. Lafuente, and Rúa A. Vieites. 2019. How information technologies shape investor sentiment: A web-based investor sentiment index. Borsa Istanbul Review 19: 95–105. [Google Scholar] [CrossRef]

- Garg, D., and P. Tiwari. 2021. Impact of social media sentiments in stock market predictions: A bibliometric analysis. Business Information Review 38: 170–82. [Google Scholar] [CrossRef]

- Ghallab, A., A. Mohsen, and Y. Ali. 2020. Arabic Sentiment Analysis: A Systematic Literature Review. Applied Computational Intelligence and Soft Computing 2020: 7403128. [Google Scholar] [CrossRef]

- Goel, G., and S. R. Dash. 2021. Investor sentiment and government policy interventions: Evidence from COVID-19 spread. Journal of Financial Economic Policy. [Google Scholar] [CrossRef]

- Goel, G., and S. R. Dash. 2022. GREEDS and Stock Returns: Evidence from Global Stock Markets. Journal of Behavioral Finance, 1–16. [Google Scholar] [CrossRef]

- Gong, X., W. Zhang, J. Wang, and C. Wang. 2022. Investor sentiment and stock volatility: New evidence. International Review of Financial Analysis 80: 102028. [Google Scholar] [CrossRef]

- Gupta, R., J. Nel, and C. Pierdzioch. 2021a. Investor Confidence and Forecastability of US Stock Market Realized Volatility: Evidence from Machine Learning. Journal of Behavioral Finance, 1–12. [Google Scholar] [CrossRef]

- Gupta, V., S. Singh, and S. S. Yadav. 2021b. The impact of media sentiments on IPO underpricing. Journal of Asia Business Studies. [Google Scholar] [CrossRef]

- Hajiali, M. 2020. Big data and sentiment analysis: A comprehensive and systematic literature review. Concurrency and Computation: Practice and Experience 32: 1–15. [Google Scholar] [CrossRef]

- He, Y., L. Qu, R. Wei, and X. Zhao. 2022. Media-based investor sentiment and stock returns: A textual analysis based on newspapers. Applied Economics 54: 774–92. [Google Scholar] [CrossRef]

- Hirshleifer, D., J. Li, and J. Yu. 2015. Asset pricing in production economies with extrapolative expectations. Journal of Monetary Economics 76: 87–106. [Google Scholar] [CrossRef]

- Hong, Y.-G., S.-H. Kim, and H. G. Kang. 2011. Tactical Asset Allocation Using Korean Investors’ Sentiment. SSRN Electronic Journal 56: 177–95. [Google Scholar] [CrossRef][Green Version]

- Hsu, C. C., and M. L. Chen. 2018. Timing of advertising and the MAX effect. Journal of Behavioral and Experimental Finance 20: 105–14. [Google Scholar] [CrossRef]

- Hu, M., D. Zhang, Q. Ji, and L. Wei. 2020. Macro factors and the realized volatility of commodities: A dynamic network analysis. Resources Policy 68: 101813. [Google Scholar] [CrossRef]

- Huang, D., F. Jiang, J. Tu, and G. Zhou. 2015. Investor sentiment aligned: A powerful predictor of stock returns. Review of Financial Studies 28: 791–837. [Google Scholar] [CrossRef]

- Hudson, Y., M. Yan, and D. Zhang. 2020. Herd behaviour and investor sentiment: Evidence from UK mutual funds. International Review of Financial Analysis, 71. [Google Scholar] [CrossRef]

- Hussein, D. M. E. D. M. 2018. A survey on sentiment analysis challenges. Journal of King Saud University-Engineering Sciences 30: 330–38. [Google Scholar] [CrossRef]

- Ji, Q., J. Li, and X. Sun. 2019. Measuring the interdependence between investor sentiment and crude oil returns: New evidence from the CFTC’s disaggregated reports. Finance Research Letters 30: 420–25. [Google Scholar] [CrossRef]

- Jiang, F., J. Lee, X. Martin, and G. Zhou. 2019. Manager sentiment and stock returns. Journal of Financial Economics 132: 126–49. [Google Scholar] [CrossRef]

- Jiang, S., and X. Jin. 2021. Effects of investor sentiment on stock return volatility: A spatio-temporal dynamic panel model. Economic Modelling 97: 298–306. [Google Scholar] [CrossRef]

- Jiang, Y., B. Mo, and H. Nie. 2018. Does investor sentiment dynamically impact stock returns from different investor horizons? Evidence from the US stock market using a multi-scale method. Applied Economics Letters 25: 472–76. [Google Scholar] [CrossRef]

- Kahneman, D., and A. Tversky. 1979. On the interpretation of intuitive probability: A reply to Jonathan Cohen. Cognition 7: 409–11. [Google Scholar] [CrossRef]

- Kaplanski, G., and H. Levy. 2010. Sentiment and stock prices: The case of aviation disasters. Journal of Financial Economics 95: 174–201. [Google Scholar] [CrossRef]

- Khan, M. A., J. A. Hernandez, and S. J. H. Shahzad. 2020. Time and frequency relationship between household investors’ sentiment index and US industry stock returns. Finance Research Letters 36: 101318. [Google Scholar] [CrossRef]

- Kim, J. S., D. H. Kim, and S. W. Seo. 2017. Investor Sentiment and Return Predictability of the Option to Stock Volume Ratio. Financial Management 46: 767–96. [Google Scholar] [CrossRef]

- Kim, K., and J. Byun. 2010. Effect of investor sentiment on market response to stock split announcement. Asia-Pacific Journal of Financial Studies 39: 687–719. [Google Scholar] [CrossRef]

- Kim, K., D. Ryu, and H. Yang. 2019. Investor sentiment, stock returns, and analyst recommendation changes: The KOSPI stock market. Investment Analysts Journal 48: 89–101. [Google Scholar] [CrossRef]

- Koo, B., J. Chae, and H. Kim. 2019. Does Internet Search Volume Predict Market Returns and Investors’ Trading Behavior? Journal of Behavioral Finance 20: 316–38. [Google Scholar] [CrossRef]

- Kumar, A., and C. M. C. Lee. 2006. Retail investor sentiment and return comovements. Journal of Finance 61: 2451–86. [Google Scholar] [CrossRef]

- Kumar, P., and M. Firoz. 2022. Does Accounting-based Financial Performance Value Environmental, Social and Governance (ESG) Disclosures? A detailed note on a corporate sustainability perspective. Australasian Business, Accounting and Finance Journal 16: 41–72. [Google Scholar] [CrossRef]

- Kumari, J., and J. Mahakud. 2015. Does investor sentiment predict the asset volatility? Evidence from emerging stock market India. Journal of Behavioral and Experimental Finance 8: 25–39. [Google Scholar] [CrossRef]

- Lee, C. M. C., A. Shleifer, and R. H. Thaler. 1991. Investor Sentiment and the Closed-End Fund Puzzle. The Journal of Finance 46: 75–109. [Google Scholar] [CrossRef]

- Lee, W. Y., C. X. Jiang, and D. C. Indro. 2002. Stock market volatility, excess returns, and the role of investor sentiment. Journal of Banking & Finance 26: 2277–99. [Google Scholar] [CrossRef]

- Lemmon, M., and E. Portniaguina. 2006. Consumer confidence and asset prices: Some empirical evidence. Review of Financial Studies 19: 1499–529. [Google Scholar] [CrossRef]

- Li, X. 2021. Does Chinese investor sentiment predict Asia-pacific stock markets? Evidence from a nonparametric causality-in-quantiles test. Finance Research Letters 38: 101395. [Google Scholar] [CrossRef]

- Liang, T. P., X. Li, C. T. Yang, and M. Wang. 2015. What in Consumer Reviews Affects the Sales of Mobile Apps: A Multifacet Sentiment Analysis Approach. International Journal of Electronic Commerce 20: 236–60. [Google Scholar] [CrossRef]

- Liu, H., Y. Wang, D. He, and C. Wang. 2020. Short term response of Chinese stock markets to the outbreak of COVID-19. Applied Economics 52: 5859–72. [Google Scholar] [CrossRef]

- Liu, S. 2015. Investor Sentiment and Stock Market Liquidity. Journal of Behavioral Finance 16: 51–67. [Google Scholar] [CrossRef]

- Lu, X., K. K. Lai, and L. Liang. 2012. Dependence between stock returns and investor sentiment in Chinese markets: A copula approach. Journal of Systems Science and Complexity 25: 529–48. [Google Scholar] [CrossRef]

- Ma, C., S. Xiao, and Z. Ma. 2018. Investor sentiment and the prediction of stock returns: A quantile regression approach. Applied Economics 50: 5401–15. [Google Scholar] [CrossRef]

- Maheu, J.M., and T. H. McCurdy. 2000. Identifying Bull and Bear Markets in Stock Returns. Journal of Business & Economic Statistics 18: 100–12. [Google Scholar] [CrossRef]

- Massa, M., and V. Yadav. 2015. Investor sentiment and mutual fund strategies. Journal of Financial and Quantitative Analysis 50: 699–727. [Google Scholar] [CrossRef]

- Mathur, S., and A. Rastogi. 2018. Investor sentiment and asset returns: The case of Indian stock market. Afro-Asian Journal of Finance and Accounting 8: 48–64. [Google Scholar] [CrossRef]

- Medhat, W., A. Hassan, and H. Korashy. 2014. Sentiment analysis algorithms and applications: A survey. Ain Shams Engineering Journal 5: 1093–113. [Google Scholar] [CrossRef]

- Mezghani, T., M. Boujelbène, and M. Elbayar. 2021. Impact of COVID-19 pandemic on risk transmission between googling investor’s sentiment, the Chinese stock and bond markets. China Finance Review International 11: 322–48. [Google Scholar] [CrossRef]

- Mohsin, M., S. Naseem, L. Ivașcu, L. I. Cioca, M. Sarfraz, and N. C. Stănică. 2021. Gauging The Effect of Investor Sentiment on Cryptocurrency Maker: An Analysis of Bitcoin Currency. Romanian Journal of Economic Forecasting 24: 87–102. [Google Scholar]

- Naeem, M. A., I. Mbarki, M. T. Suleman, X. V. Vo, and S. J. H. Shahzad. 2021. Does Twitter Happiness Sentiment predict cryptocurrency? International Review of Finance 21: 1529–38. [Google Scholar] [CrossRef]

- Neal, R., and S. M. Wheatley. 1998. Do Measures of Investor Sentiment Predict Returns? The Journal of Financial and Quantitative Analysis 33: 523. [Google Scholar] [CrossRef]

- Ni, Z. X., D. Z. Wang, and W. J. Xue. 2015. Investor sentiment and its nonlinear effect on stock returns-New evidence from the Chinese stock market based on panel quantile regression model. Economic Modelling 50: 266–74. [Google Scholar] [CrossRef]

- Niu, H., Y. Lu, and W. Wang. 2021. Does investor sentiment differently affect stocks in different sectors? Evidence from China. International Journal of Emerging Markets 18. [Google Scholar] [CrossRef]

- Obaid, K., and K. Pukthuanthong. 2022. A picture is worth a thousand words: Measuring investor sentiment by combining machine learning and photos from news. Journal of Financial Economics 144: 273–97. [Google Scholar] [CrossRef]

- Qazi, A., R. G. Raj, G. Hardaker, and C. Standing. 2017. A systematic literature review on opinion types and sentiment analysis techniques: Tasks and challenges. Internet Research 27: 608–30. [Google Scholar] [CrossRef]

- Rahman, M. R., and A. K. Misra. 2021. Bank Competition Using Networks: A Study on an Emerging Economy. Journal of Risk and Financial Management 14: 402. [Google Scholar] [CrossRef]

- Ravi, K., and V. Ravi. 2015. A survey on opinion mining and sentiment analysis: Tasks, approaches and applications. Knowledge-Based Systems 89: 14–46. [Google Scholar] [CrossRef]

- Reis, P. M. N., and C. Pinho. 2020. A new European investor sentiment index (EURsent) and its return and volatility predictability. Journal of Behavioral and Experimental Finance 27: 100373. [Google Scholar] [CrossRef]

- Reis, P. M. N., and C. Pinho. 2021. A dynamic factor model applied to investor sentiment in the European context. Investment Management and Financial Innovations 18: 299–314. [Google Scholar] [CrossRef]

- Rousseau, D. M., J. Manning, and D. Denyer. 2008. 11 Evidence in Management and Organizational Science: Assembling the Field’s Full Weight of Scientific Knowledge Through Syntheses. The Academy of Management Annals 2: 475–515. [Google Scholar] [CrossRef]

- Roy, S., A. K. Misra, P. C. Padhan, and M. R. Rahman. 2019. Interrelationship among Liquidity, Regulatory Capital and Profitability- A Study on Indian Banks. Cogent Economics & Finance 7: 1664845. [Google Scholar] [CrossRef]

- Schmeling, M. 2009. Investor sentiment and stock returns: Some international evidence. Journal of Empirical Finance 16: 394–408. [Google Scholar] [CrossRef]

- Shleifer, A., and L. H. Summers. 1990. The Noise Trader Approach to Finance. Journal of Economic Perspectives 4: 19–33. [Google Scholar] [CrossRef]

- Shleifer, A., and R. W. Vishny. 1997. The Limits of Arbitrage. The Journal of Finance 52: 35–55. [Google Scholar] [CrossRef]

- Sibley, S. E., Y. Wang, Y. Xing, and X. Zhang. 2016. The information content of the sentiment index. Journal of Banking & Finance 62: 164–79. [Google Scholar] [CrossRef]

- Singh, V. K., P. Singh, M. Karmakar, J. Leta, and P. Mayr. 2021. The journal coverage of Web of Science, Scopus and Dimensions: A comparative analysis. Scientometrics 126: 5113–42. [Google Scholar] [CrossRef]

- Smales, L. A. 2017. The importance of fear: Investor sentiment and stock market returns. Applied Economics 49: 3395–421. [Google Scholar] [CrossRef]

- Smales, L. A. 2021. Investor attention and global market returns during the COVID-19 crisis. International Review of Financial Analysis 73: 101616. [Google Scholar] [CrossRef]

- Stambaugh, R. F., J. Yu, and Y. Yuan. 2012. The short of it: Investor sentiment and anomalies. Journal of Financial Economics 104: 288–302. [Google Scholar] [CrossRef]

- Sun, L., M. Najand, and J. Shen. 2016. Stock return predictability and investor sentiment: A high-frequency perspective. Journal of Banking & Finance 73: 147–64. [Google Scholar] [CrossRef]

- Sun, Y., X. Zeng, S. Zhou, H. Zhao, P. Thomas, and H. Hu. 2021. What investors say is what the market says: Measuring China’s real investor sentiment. Personal and Ubiquitous Computing 25: 587–99. [Google Scholar] [CrossRef] [PubMed]

- Sureka, R., S. Kumar, S. Colombage, and M. Z. Abedin. 2022. Five decades of research on capital budgeting–A systematic review and future research agenda. Research in International Business and Finance 60: 101609. [Google Scholar] [CrossRef]

- Tetlock, P. C. 2007. Giving content to investor sentiment: The role of media in the stock market. Journal of Finance 62: 1139–68. [Google Scholar] [CrossRef]

- Tiwari, A. K., E. J. A. Abakah, C. O. Bonsu, N. K. Karikari, and S. Hammoudeh. 2022. The effects of public sentiments and feelings on stock market behavior: Evidence from Australia. Journal of Economic Behavior and Organization 193: 443–72. [Google Scholar] [CrossRef]

- Ur Rehman, M., I. D. Raheem, A. R. Al Rababa’a, N. Ahmad, and X. V. Vo. 2022. Reassessing the Predictability of the Investor Sentiments on US Stocks: The Role of Uncertainty and Risks. Journal of Behavioral Finance, 1–16. [Google Scholar] [CrossRef]

- Valencia, F., Gómez-A. Espinosa, and Valdés-B. Aguirre. 2019. Price Movement Prediction of Cryptocurrencies Using Sentiment Analysis and Machine Learning. Entropy 21: 589. [Google Scholar] [CrossRef]

- Văn, L., and N. K. Q. Bảo. 2022. The relationship between global stock and precious metals under COVID-19 and happiness perspectives. Resources Policy 77: 102634. [Google Scholar] [CrossRef]

- Xiao, Y., and M. Watson. 2019. Guidance on Conducting a Systematic Literature Review. Journal of Planning Education and Research 39: 93–112. [Google Scholar] [CrossRef]

- Xiong, X., Y. Meng, X. Li, and D. Shen. 2020. Can overnight return really serve as a proxy for firm-specific investor sentiment? Cross-country evidence. Journal of International Financial Markets, Institutions and Money 64: 101173. [Google Scholar] [CrossRef]

- Yang, C., and L. Zhou. 2016. Individual stock crowded trades, individual stock investor sentiment and excess returns. The North American Journal of Economics and Finance 38: 39–53. [Google Scholar] [CrossRef]

- Yang, S. Y., S. Y. K. Mo, and A. Liu. 2015. Twitter financial community sentiment and its predictive relationship to stock market movement. Quantitative Finance 15: 1637–56. [Google Scholar] [CrossRef]

- Yu, J., and Y. Yuan. 2011. Investor sentiment and the mean–variance relation☆. Journal of Financial Economics 100: 367–81. [Google Scholar] [CrossRef]

- Zhou, G. 2018. Measuring investor sentiment. Annual Review of Financial Economics 10: 239–59. [Google Scholar] [CrossRef]

- Zouaoui, M., G. Nouyrigat, and F. Beer. 2011. How Does Investor Sentiment Affect Stock Market Crises? Evidence from Panel Data. Financial Review 46: 723–47. [Google Scholar] [CrossRef]

| Study | Methodology | Articles | Research Objective |

|---|---|---|---|

| Medhat et al. (2014) | MA | 54 | A comprehensive review of studies of sentiment analysis algorithms and applications |

| Ravi and Ravi (2015) | MA | Over 100 | Tasks, approaches, and applications of sentiment analysis. |

| Qazi et al. (2017) | MA | 24 | Challenges and types faced in classification techniques. How does adopting improved methods address the issue of traditional classification techniques? |

| Hussein (2018) | MA | 47 | How do sentiment analysis challenges affect sentiment evaluation? |

| X. Chen and Xie (2020) | BA | 4373 | Evolution of research topics with time. Coverage of research topics in sentiment analysis. Collaboration of significant contributors and their topic distributions. |

| Ghallab et al. (2020) | SLR | 108 | Review of studies based on Arabic sentiment analysis (ASA). What techniques are the most effective used for ASA? |

| Hajiali (2020) | SLR | 23 | What are the different big data methodologies used to construct investor sentiment? |

| Garg and Tiwari (2021) | BA | 1450 | Research trends in studies showing stock market prediction using social media sentiment. |

| This study | SLR + BA | 122 | In-depth review of studies on ISI. |

| Effect | Empirical Findings |

|---|---|

| Stock market return | Baker and Wurgler (2006) showed that, for stocks without pay-out or profitability, and stocks with small size, high volatility, extreme growth, distress, and young age, the sentiment was low initially, but later returns were comparatively high. When sentiment was strong, these equities’ subsequent returns were low. Dash and Maitra (2018), using the nonlinear, nonparametric causality of Diks and Panchenko (2006), showed that Indian stocks with higher returns (small-cap and mid-cap) were more influenced by investor sentiment. A strong bidirectional causality existed between sentiment and returns of small-cap and mid-cap stocks. Tiwari et al. (2022) showed that the predictability between sentiments and industry stock returns was high in the normal market state but dropped during extreme bearish and bullish states. Reis and Pinho (2020) showed that volatility index (VIX) and VSTOXX, put and call ratios, gold, government bond yield spreads, mispricing, and economic and confidence sentiment indicators predicted stock returns after controlling fundamentals, macroeconomic, market, and technical analysis variables. |

| Stock price crash risk, volatility | Fu et al. (2021) showed the same directional association between stock price crash risk and firm-specific investor sentiment. S. Jiang and Jin (2021) revealed that stock return volatility was affected positively by sentiment. |

| Effect | Empirical Findings |

|---|---|

| All cryptocurrencies | Naeem et al. (2021) showed a nonlinear relationship between cryptocurrencies and Twitter Happiness Sentiment (Ethereum, Ripple, Dash, Monero, Bitcoin, and Litecoin). Moreover, extreme sentiment predicted cryptocurrency returns (except Dash). Banerjee et al. (2022), based on thirty cryptocurrencies, showed a causality in cryptocurrency returns from news sentiment. |

| Bitcoin | Aharon et al. (2022) depicted a strong causality between cryptocurrency returns and the uncertainty shown in social media (especially for bitcoins). Mohsin et al. (2021) showed that investor sentiment significantly positively influenced Bitcoin returns. |

| Effect | Empirical Findings |

|---|---|

| Stock Market | Văn and Bảo (2022) found that before the pandemic, precious metals positively influenced stock markets. Mezghani et al. (2021) observed two-way causality between the financial market and investor sentiment, which was at a peak during the Chinese recession and the pandemic. Pessimistic investors’ sentiment negatively impacted the banking, healthcare, and utility sectors. Duan et al. (2021) showed that sentiment on COVID-19 positively predicts stock returns and turnover rates. In addition, growth in sentiment also resulted in short-selling and high-margin trading. Goel and Dash (2021) found a moderating role of government policies on sentiment and stock return relationship. FEARS (“Financial and Economic Attitudes Revealed by Search Index”) significantly adversely affected the stock returns because of an increase in COVID-19 spread. |

| Crypto and Mutual Fund Market | French (2021) revealed that the Twitter-based Market Uncertainty (TMU) index had a high predictive power for Bitcoin returns, especially during the pandemic. The impact of information on Twitter on cryptocurrency markets intensified post-pandemic. Kumar and Firoz (2022) found that internet searches were at peak volume during the pandemic. During the high sentiment period, the mutual fund companies paid high dividends and received more cashflows. |

| Effect | Empirical Findings |

|---|---|

| Dividend | Kumar and Firoz (2022) showed that corporate policies and asset prices were influenced by dividend sentiment. Moreover, shifts in dividend sentiment predicted higher returns for stocks paying high dividends to their shareholders. In addition, the mutual funds had the intention to pay out and receive more cash inflows during strong dividend sentiment. |

| Fund Strategy | Massa and Yadav (2015) found that low Fund Sentiment Beta (FSB) funds performed better than high FSB funds, even if they controlled for the fund characteristics and standard risk factors. Moreover, relatively high exposure to stocks with low sentiment beta leads to disproportionate inflows. |

| Herd Behavior | Based on the UK market-wide ISI, Hudson et al. (2020) observed that the mutual fund managers were suffering from herd behavior. There was a causality from investor sentiment to the herd behavior of fund managers. Moreover, the sentiment factors affecting managers’ herd behavior were different and subject to fund structure. The herd behavior for open-end fund managers was initially negatively influenced by sentiment, which later sharply reversed to positive and then gradually returned to normal. On the contrary, investors’ sentiment positively affected the herd behavior of closed-end fund managers. |

| Study | Empirical Findings |

|---|---|

| Market proxy-based | Baker and Wurgler (2006) showed that initially sentiment was low, and then subsequent returns were comparatively high, for high-return stocks. On the contrary, high-return stocks earned comparatively low following returns when sentiment was high. |

| Search-Based | Da et al. (2015), using a Google-search-based ISI (FEARS), showed that the index could predict aggregate market return. The index was strongly related to VIX future returns. There was evidence of noise trading. Similarly, by building a positive sentiment index, Goel and Dash (2022) showed a positive correlation between the index and global stock returns, and the index had a non-symmetric impact on stock returns (especially for developed nations). However, Koo et al. (2019), following the same methodology but using NAVER search results, showed that the index (NAVER SVI) was negatively associated with market returns in the initial two weeks and then reversed in the later week. |

| Text Analysis | Gupta et al. (2021b), with the help of text analysis, showed that the computed sentiment score had a positive relationship with traditional underpricing (significant for pre-market underpricing but not for post-market underpricing). However, no evidence of the influence of the number of media articles on IPO underpricing was found to be significant. Similarly, He et al. (2022), conducting text analysis on newspapers, showed that sentiment was positively (negatively) associated with stock returns over the short (long) term. Firms with cleaner audit opinions, more analyst coverage, and non-state ownership had fewer chances of being overvalued in the short run. |

| Twitter Happiness Index | Bonato et al. (2021), with the help of Twitter’s daily happiness sentiment index, showed that RV was negatively related to the index. Moreover, the out-of-sample analysis revealed that extending the HAR-RV (Heterogeneous Autoregressive–Realized Volatility) model to include investor happiness improved the power of forecasts of volatility in the short and medium-term forecasts. Later, Văn and Bảo (2022), with the same Twitter index, found that prior to the pandemic, precious metals influenced stock markets in a positive manner, implying a demand for precious metals during crisis periods. |

| Picture Analysis | A recent study by Obaid and Pukthuanthong (2022), with the help of an analysis of pictures in financial newspapers, constructed an ISI (Photo Pessimism). Photo Pessimism can predict market trading volume and return reversals. The association was strongest in high fear periods and especially for the stocks withhigh limits to arbitrage. |

| Method | Empirical Findings |

|---|---|

| Quantile | Goel and Dash (2022) showed that the GREEDS index has a positive relation with global stock returns. Moreover, the index had an asymmetric effect on stock returns (stronger for developed countries). There was a spillover effect of the global index on the country/territory-specific indexes. |

| Backward Rolling | Khan et al. (2020) revealed the existence of one-way causality from the FEARS index to short- and medium-term stock returns. No evidence of all sector stock returns causing FEARS was found. |

| Predictive | Gong et al. (2022) observed that only NISI (New ISI) was effective and had robust predictability (even after controlling for the leverage effect) even in the crisis period. In addition, the NISI was superior in longer horizons forecasting. |

| Effect | Empirical Findings |

|---|---|

| Linear | Debata et al. (2021) showed that one-way sentiment causes stock market liquidity (with different liquidity measures). The results still held after controlling for local sentiments. Ding et al. (2017) showed that oil price volatility caused a negative influence on investor sentiment in China (specifically in the long term). The influence was stronger and more significant, with an average delay of eight months. S. Liu (2015) found that the market had high liquidity in the high sentiment period, even after controlling for market trading activity. In addition, investor sentiment causes stock market liquidity. The sentiment positively influenced market trading activity. |

| Non-linear non-parametric | Balcilar et al. (2021) detected that economic sentiment has predictive power for housing returns and volatility. Dash and Maitra (2018), following Diks and Panchenko’s (2006) causality test, showed that sentiment influenced higher-return stocks (small-cap and mid-cap) significantly more than the stocks with lower returns (large-cap). Fear (VIX) performed better as a measure of sentiment. There was a solid two-way causality between sentiment and small- and mid-cap stock returns. |

| Linear and nonlinear integrated | Y. Jiang et al. (2018) opined that there was solid bilateral causality (both linear and nonlinear) between stock returns and investor sentiment in the long term but not in the short term. |

| Author | Study | Journal | Citation | TLS |

|---|---|---|---|---|

| Baker and Wurgler (2006) | Investor Sentiment and The Cross-Section of Stock Returns | Journal of Finance | 5753 | 45 |

| Brown and Cliff (2004) | Investor Sentiment and The Near-Term Stock Market | Journal of Empirical Finance | 1699 | 43 |

| Baker and Stein (2004) | Market Liquidity as A Sentiment Indicator | Journal of Financial Markets | 1655 | 37 |

| Baker et al. (2012) | Global, Local, and Contagious Investor Sentiment | Journal of Financial Economics | 1011 | 45 |

| Schmeling (2009) | Investor Sentiment and Stock Return | Journal of Empirical Finance | 866 | 46 |

| Terms | Frequency |

|---|---|

| Investor Sentiment | 86 |

| Behavioral Finance | 18 |

| COVID-19 | 17 |

| Stock Returns | 15 |

| Sentiment | 11 |

| Investor Sentiment Index | 10 |

| Stock Market | 10 |

| Machine Learning | 8 |

| Sentiment Analysis | 8 |

| Sentiment Index | 8 |

| Studies | TC | TC per Year | Normalized TC |

|---|---|---|---|

| Baker et al. (2012) | 448 | 40.7273 | 7.7688 |

| Huang et al. (2015) | 311 | 38.875 | 3.9202 |

| H. Liu et al. (2020) | 204 | 68 | 18.5455 |

| Ding et al. (2017) | 89 | 14.8333 | 7.4685 |

| Ni et al. (2015) | 75 | 9.375 | 0.9454 |

| S. Liu (2015) | 57 | 7.125 | 0.7185 |

| Ji et al. (2019) | 48 | 12 | 4.6154 |

| Hu et al. (2020) | 40 | 13.3333 | 3.6364 |

| Ftiti and Hadhri (2019) | 39 | 9.75 | 3.75 |

| Sibley et al. (2016) | 38 | 5.4286 | 3.093 |

| Zhou (2018) | 35 | 7 | 3.8636 |

| H. Y. Liu et al. (2020) | 30 | 10 | 2.7273 |

| Valencia et al. (2019) | 30 | 7.5 | 2.8846 |

| H. Chen et al. (2014) | 29 | 3.2222 | 4.1429 |

| Apergis et al. (2018) | 22 | 4.4 | 2.4286 |

| Massa and Yadav (2015) | 22 | 2.75 | 0.2773 |

| K. Kim and Byun (2010) | 22 | 1.6923 | 1 |

| R. Chen et al. (2019) | 21 | 5.25 | 2.0192 |

| K. Kim et al. (2019) | 20 | 5 | 1.9231 |

| Balcilar et al. (2018) | 20 | 4 | 2.2078 |

| Study | Year | LC | GC | LC/GC Ratio (%) | NLC | NGC |

|---|---|---|---|---|---|---|

| Baker et al. (2012) | 2012 | 57 | 448 | 12.72 | 6.66 | 7.77 |

| Huang et al. (2015) | 2015 | 39 | 311 | 12.54 | 4.42 | 3.92 |

| Balcilar et al. (2018) | 2018 | 17 | 20 | 85 | 6.42 | 2.21 |

| Bekiros et al. (2016) | 2016 | 14 | 19 | 73.68 | 3.27 | 1.55 |

| Lu et al. (2012) | 2012 | 14 | 16 | 87.5 | 1.64 | 0.28 |

| Zhou (2018) | 2018 | 13 | 35 | 37.14 | 4.91 | 3.86 |

| Çepni et al. (2020) | 2020 | 10 | 10 | 100 | 10 | 0.91 |

| García Petit et al. (2019) | 2019 | 10 | 11 | 90.91 | 8.62 | 1.06 |

| Sibley et al. (2016) | 2016 | 10 | 38 | 26.32 | 2.33 | 3.09 |

| Reis and Pinho (2021) | 2020 | 7 | 7 | 100 | 7 | 0.64 |

| Study | Suggestions |

|---|---|

| He et al. (2022) | Researchers can use the Word2Vec technique that researchers can use to construct a sentiment dictionary for their purpose. |

| Khan et al. (2020) | Investigation of time-varying asymmetric impact on stocks. |

| Dash and Maitra (2018) | VIX was a better measure than the sentiment index. Is this true now? Why was the AD ratio insignificant in measuring investor sentiment? |

| Bekiros et al. (2016) | Validation of results using frequency-domain-based causality to detect causality at different time horizons. In addition, the robustness of the results can be verified with nonlinear models. |

| Cepni et al. (2021) | A comparative cross-country/territory analysis in emerging markets showing the impact of fiscal policy shocks contingent on sentiment levels. |

| Gupta et al. (2021b) | Extension of the study to other countries/territories. |

| Hudson et al. (2020) | A further extension may include market factors to examine institutional herding from different perspectives wherein a wider and deeper perspective is required. |

| Ni et al. (2015) | Because of the unique legal environment, the Chinese market needs more academic attention. Factors such as policies, regulations, culture, and psychological factors of individuals can be considered in future studies. |

| H. Chen et al. (2014) | The multiple-threshold variable model can be used instead of the single-threshold variable model. In addition, a duration-dependent Markov switching model (Maheu and McCurdy 2000) with the transition probabilities for classifying different market states can be used. |

| Tiwari et al. (2022) | The effects of public sentiments on other markets can be extended. The influence of factors such as liquidity variations, EPU, and geopolitical risk can be examined in different markets. |

| Baker et al. (2012) | Extension of the contagion effect of investor sentiment within and across international markets. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Prasad, S.; Mohapatra, S.; Rahman, M.R.; Puniyani, A. Investor Sentiment Index: A Systematic Review. Int. J. Financial Stud. 2023, 11, 6. https://doi.org/10.3390/ijfs11010006

Prasad S, Mohapatra S, Rahman MR, Puniyani A. Investor Sentiment Index: A Systematic Review. International Journal of Financial Studies. 2023; 11(1):6. https://doi.org/10.3390/ijfs11010006

Chicago/Turabian StylePrasad, Sourav, Sabyasachi Mohapatra, Molla Ramizur Rahman, and Amit Puniyani. 2023. "Investor Sentiment Index: A Systematic Review" International Journal of Financial Studies 11, no. 1: 6. https://doi.org/10.3390/ijfs11010006

APA StylePrasad, S., Mohapatra, S., Rahman, M. R., & Puniyani, A. (2023). Investor Sentiment Index: A Systematic Review. International Journal of Financial Studies, 11(1), 6. https://doi.org/10.3390/ijfs11010006