1. Introduction

An entrepreneurial ecosystem is a dynamically balanced system consisting of interdependent subjects and an entrepreneurial environment (

Lu et al. 2021). Its input layer is based on attributes—conditions that allow or restrict entrepreneurship (

Stam 2018). Productive entrepreneurship forms the output of an entrepreneurial ecosystem (

Stam 2015). It refers to the innovation activity of entrepreneurs that contributes to the commercialisation of new ideas and knowledge and leads to economic growth in a certain territory (

Aidis 2005;

Acs and Szerb 2007).

The entrepreneurial ecosystem approach has gained prominence among scholars and practitioners in understanding an environment for productive entrepreneurship (

Feld 2020;

Szerb et al. 2019). However, the link between ecosystem attributes and productive entrepreneurship remains relatively unclear (

Nicotra et al. 2018). Understanding this link is important to ensure the most favourable conditions for developing productive entrepreneurship, which can lead to economic growth in a particular territory.

This paper focuses on FinTech ecosystems (FEs); they are considered a type of entrepreneurial ecosystem that supports the development of FinTech companies (FinTechs), which are high-growth companies that disrupt or contribute to the provision of traditional financial services (

Laidroo et al. 2021). FEs are characterised by the proliferation of FinTechs (

Alaassar et al. 2021), which are often presented by start-ups and apply innovation in the financial sector. In the first half of 2019, 48 FinTech unicorns, start-ups valued at over USD 1 billion, accounted for 1% of the global financial industry (

CBInsights 2019). This emphasises the high entrepreneurial activity in a FinTech ecosystem (FE) and allows one to perceive it as an entrepreneurial ecosystem.

Nevertheless, to our knowledge, there is no measurement tool for FE attributes based on a survey that would allow us to aggregate the opinions of the FinTech community about the entrepreneurship environment in the financial sector. This study attempts to fill these gaps in the context of Russian regions.

Therefore, the goal of the study is measuring FE attributes and productive entrepreneurship, investigating the relationship between them and determining territories with more productive entrepreneurship.

The context of Russia is an interesting case for investigation for the following reasons. In 2021, Russia emerged as a TOP-20 country in the Global FinTech Index, rising 13 positions from the previous year (

Findexable 2021). Russia has also been ranked in the TOP-3 countries for applying innovative solutions in the financial sector (

Kuhn 2021). According to

Ernst and Young (

2019), the FinTech Adoption Index in Russia amounted to 82% in 2019, exceeding the global average rate. The above-mentioned achievements indicate that Russia has cultivated a favourable climate for FinTech development.

There is no consensus in the ecosystem literature on the level of analysis—city, region, country, or other levels. This study is based on the regional level, like other empirical research on ecosystems (

DeFries and Nagendra 2017;

Leendertse et al. 2021;

Stam 2018). The suggested tool for measuring FE attributes was tested for 10 Russian regions where most FinTechs are located.

The FE index recognises a similar environment in the analysed regions for financial sector entrepreneurship. These regions have high estimates of physical infrastructure, demand, and talent. New knowledge and networks appear to be this environment’s weak sides in terms of financial sector entrepreneurship. Among these regions, Moscow has the most favourable environment for entrepreneurship in the financial sector. Such attributes as finance and leadership mostly determine Moscow’s superiority over other regions. At the same time, the Chelyabinsk region has the lowest FE index value.

The correlation analysis showed a positive link between FE attributes and productive entrepreneurship, as measured by the number of FinTechs. Data envelopment analysis (DEA) indicated territories with productive entrepreneurship. With the additive FE index, Moscow was recognised as a region that has effectively created an environment for productive entrepreneurship. Regarding the multiplicative FE index, the Chelyabinsk region achieved the best results. The contrary results can be explained by the features of the FE index calculation and highlight the importance of choosing an adequate measure of FE attributes. The results of the DEA analysis also indicate that the physical infrastructure and demand in Russian regions are underutilised by entrepreneurs. In addition, the results highlight finance, intermediate services, and formal institutions as attributes maximally used by entrepreneurs and require additional attention from policymakers for entrepreneurship development. Improving the understanding of FE attributes and their links to productive entrepreneurship would benefit both policymakers and entrepreneurs.

This article is structured as follows. The theoretical and empirical backgrounds are summarised in

Section 2. The methodology and data are presented in

Section 3.

Section 4 concentrates on the results of this study. Finally,

Section 5 provides a discussion and conclusion.

3. Data and Methodology

3.1. Initial Data

In the framework of this research, a FinTech is defined as a company that contributes to the provision of financial services and has generally innovative information technology elements in its activities. It can be an independent or bank-owned company. To measure FE attributes and productive entrepreneurship and investigate the relationship between them, it was necessary to collect data on FinTechs in Russian regions. To collect data on companies, different official data sources were analysed (e.g., banks’ and accelerators’ websites, media)

1. As a result, a list of 332 companies was compiled and registered in 2020 in a certain region of Russia. The distribution of FinTechs across the Russian regions is presented in

Table 3.

FinTechs’ uneven regional distributions may indicate different stages of development and distribution of FinTech services. To achieve the goal of this research, 10 identified regions were selected for further analysis. Based on

Stam’s (

2015) model, the data on FE attributes were collected mostly via an online survey and covered the conceptual framework developed earlier. The focus group for the survey comprised FinTech owners, board members, or executives.

Table 4 presents empirical indicators of each attribute, source, and scale.

The initial idea was to develop the FE index based only on the survey results. After designing the draft survey, a pre-test was performed on five respondents to define any inadequate and potentially ambiguous expressions. Most respondents reflected that they were not competent in assessing demand and physical infrastructure. Therefore, information on these attributes was added from official statistics. Data collected from official statistics reflected the situation in specific regions at the end of 2021. The final survey questionnaire and its correspondence to empirical indicators and sources are presented in

Appendix A.

Google Forms was used as the main survey platform. The survey was carried out from May to August 2021 by representatives of Russian FinTechs. Links to the online questionnaire were sent to FinTechs via email or by mobile application in the framework of the conference TechWeek (31 May–2 June 2021). Suitable emails were determined based on the data presented on the companies’ web pages or were found via personal contacts. The first email was followed by two to three reminders.

As a result, the dataset includes 137 responses: 100 from Moscow, 10 from Saint Petersburg, 5 from the Sverdlovsk region, 4 from the Novosibirsk region, 3 from each the Republic of Tatarstan, Nizhny Novgorod, Perm, Voronezh, Chelyabinsk, and Rostov regions. For Moscow, St. Petersburg, and the Republic of Tatarstan, the survey covered part of FinTechs’ population. This is explained by the large number of FinTechs in the regions, which led to the necessity of assessing the severity of the sampling bias. For other regions, the survey covered all representatives of FinTechs.

To assess the severity of sampling bias, the representativeness of the sample was tested using a chi-square test statistic and two indicators: the type of FinTech owner and Skolkovo membership. Skolkovo is an innovation centre that aims to develop technology entrepreneurship and research in Russia. To benefit from Skolkovo, FinTechs aim to be a member of the innovation centre. The choice of indicators is explained by the availability of relevant information. In the case of the presence of several types of owners in one company, all were included in a further analysis. Therefore, the number of owners can be greater than the number of FinTechs.

It was necessary to test whether the distribution of FinTechs in the sample was the same as in the original sample. These and further calculations were carried out in the STATA. The results of the chi-square test are presented in

Table 5.

3.2. Methodology

This section is structured according to the goal of the study. First, the author suggests the approaches of measuring the FE attributes and productive entrepreneurship. Then, the tool of evaluating the association between the identified indicators is discussed.

3.2.1. Calculating the FE Index

To map FE attributes, the FE index was constructed. This index compares different regions and ranks them in terms of a set of indicators. The algorithm for constructing the FE index was developed based on existing studies (

Stam 2018;

Stam and van de Ven 2019;

Leendertse et al. 2021;

Laidroo et al. 2021) and by considering the limitations of the developed measures of ecosystem attributes.

Constructing the FE index included five main stages. The first step was to calculate the average value of the empirical indicators measured by the survey. According to the information presented in

Table 4, the scales of the indicators differed. The second step was to normalise the scales of the indicators. To index formalisation, it was necessary to ensure equal weight (

Leendertse et al. 2021). Therefore, indicators from official statistics were adapted to a Likert scale (from 1 to 5 (best)).

The third step was the reduction of FE indicators to a comparable value. This was achieved by normalising the average value of each indicator to 1 (

Stam 2018). This means that indicators in the regions performing below average have a value below 1, while indicators performing better than average have a value above 1. The fourth step consisted of ensuring the same weight of attributes in the FE index. Each ecosystem attribute was represented by two indicators. The same number of indicators for each attribute ensures the same weight in the FE index. In future research, the weighing methodology may change based on the opinions of experts or the professional community.

Finally, the value of the attributes was summed into one index. The index value remained close to 10. This means that the regions performing on average for all scoring attributes had an index value of 10. Regions performing higher than average for all scoring attributes had an index value greater than 10, while regions performing lower than average for all scoring attributes had an index value lower than 10.

Stam (

2018) also analysed complex interactions among entrepreneurial ecosystem attributes and suggested calculating a multiplicative ecosystem index. This leads to index values with a much larger variation. In this research, two approaches to calculating the FE index were also used. The suggested approach overcame the limitations of previous measures of ecosystem attributes via these aspects.

First, the survey-based approach provided the opportunity to represent the opinions of many representatives of FinTechs. As a result, the data gathered better describe an ecosystem’s attributes (

Mathers et al. 1998). To assess the severity of sampling bias, the representativeness of the sample was tested using the chi-square test statistic with different criteria. The survey-based approach ensured the comparability of the collected data using the same questions in the same way. Second, the survey-based approach allowed for the collection of data within a particular territory and avoided the use of information from different territory levels to assess the attributes of ecosystems at a certain level. The normalisation of the scales of the indicators ensures their equal weight-to-index formalisation.

3.2.2. Indicating the Productive Entrepreneurship

There is no universal measure of productive entrepreneurship. The literature review by

Nicotra et al. (

2018) revealed three approaches to measuring entrepreneurship: gross-based, assumption-based, and performance-based. Gross entrepreneurship focuses on the net entry of regional indicators. For example,

Piergiovanni et al. (

2012) analysed the growth of companies in specialised industries.

Carree and Thurik (

2008) focused on changes in labour productivity at the regional level. The assumption-based approach to productive entrepreneurship focuses on the survival of start-ups.

Coad and Rao (

2008) indicated that innovation-based start-ups are more survival-oriented than not. Thus, innovation-based start-ups can be a possible indicator of productive entrepreneurship.

Performance-based productive entrepreneurship focuses on the number of high-growth start-ups as an indicator. According to

Acs and Szerb (

2007), high-growth start-ups play a special role in contributing to the economic growth of territories.

Leendertse et al. (

2021) suggested focusing on the number of gazelles—companies that increase their revenue by at least 20%, starting from a revenue base of USD 1 million.

Acs et al. (

2017) insisted on using a stronger term: the number of unicorns.

Measuring productive entrepreneurship in Russian regions is not an easy task. The official statistics of Russian regions do not allow diversification of indicators—labour productivity or gross regional product—depending on a specific industry (including FinTech). There are also no unicorns in Russia (

Stas 2021). We also found no gazelles in the Russian regions. Based on an assumption-based approach to productive entrepreneurship, the number of FinTechs is identified as a possible measure. Thus, FE attributes were measured by the FE index, and productive entrepreneurship by the number of FinTechs.

3.2.3. Testing the Association between the FE Index and Productive Entrepreneurship

To analyse the links between the indicators, a correlation analysis was conducted on a dataset of 10 Russian regions. This was selected partly because correlation analysis was the most common tool used in previous studies (

Stam 2018;

Stam and van de Ven 2019). However, the small sample size reduced the relevance of the regression analysis.

DEA was used to estimate the efficiency of Russian regions using FE attributes in productive entrepreneurship. This method was originally developed for the efficiency measurement of different units and is widely used in the context of entrepreneurship (

Lafuente et al. 2018;

Pandey 2018). DEA is a nonparametric approach based on linear programming that determines the efficiency level for each unit in a sample. The efficiency level of the decision-making units (DMUs) was identified in comparison with the best unit in the sample by deriving the compared efficiency. DEA calculates a single relative ratio for each DMU in a sample by comparing input and output information.

In the context of this current research, the DMU was a particular region in Russia, the input was the value of the FE index, and the output was the number of FinTechs. The main advantage of DEA is its ability to compare diverse and heterogeneous inputs–outputs simultaneously, with no assumption about the data distribution (

Lee and Ji 2009). The number of DMUs should be not less than the multiplication of the numbers of outputs and inputs and not less than three times the sum of the numbers of outputs and inputs (

Cooper et al. 2007). Therefore, the DEA analysis based on 10 regions in Russia was considered fair. The DEA efficiency value ranged from 0.0 to 1.0. Regions with a DEA efficiency value equal to 1.0 were considered effective. Regions with an efficiency value lower than 1.0 were considered ineffective.

Two types of DEA are widely used by researchers. They are input-oriented (focused on the minimisation of input information) and output-oriented (focused on the maximisation of output information) analyses. In the framework of this research, the DEA model was oriented towards the output. Policymakers and entrepreneurs aim to engage in a created environment by maximally developing entrepreneurship in a region.

DEA allows for determining slacks (

Sharma et al. 2009), represented by the magnitude of inefficiency in particular inputs. Due to slacks, we additionally analysed the separate attributes of FEs and indicated ones that used inefficiency in a certain Russian region.

4. Results

4.1. The FE Index

Based on the algorithm discussed in

Section 3.2, the distribution of the average values of FE attributes (normalised to one scale) in Russian regions is presented in

Appendix B.

In the analysed regions, the attributes’ values are distributed similarly. This indicates a similar approach to creating an environment to develop entrepreneurship in the financial sector. The regions have high-quality physical infrastructures. Ninety percent of the population (or companies) in the Russian regions has access to the internet. This means that around 90% of the population or companies are potential customers of FinTech services. This number is comparable to the value of the 2019 FinTech Adoption Index in Russia. According to

Ernst and Young (

2019), 82% of people have used FinTech services.

Physical infrastructure influences customers’ adoption of FinTech services and customers’ related demands. In the case of Russian regions, demand achieves sufficiently high evaluations. It reflects a significant portion of customers, including companies, who use the internet for financial transactions. The attribute talent evaluated highly. If the founders of FinTechs do not have adequate knowledge, they will need a team of experts with such knowledge to support the launch of a FinTech (

Koroleva et al. 2021). A high score for this attribute means that the representatives of FinTechs do not encounter the problem of finding experts with knowledge supporting a FinTech’s launch in Russian regions.

New knowledge and networks are recognised as the weak sides of the environment for entrepreneurship in the financial sector. According to the opinions of FinTech representatives, organisations are not investing enough in R&D. The application of innovative solutions is associated with difficulties in legislation and the risk of customers’ negative attitudes towards a service (

Arner et al. 2017;

Chuang et al. 2016). Therefore, companies are not very interested in scientific developments and prefer to suggest services based on proven solutions.

In addition, an ecosystem’s actors have unequal access to the financial sector. The feature of FinTech development in Russia is the superiority of banks and the state (

Stas 2021). Currently, the focus of the Central Bank of Russia is to create an infrastructure environment (e.g., remote identification, a fast payment system, etc.) that would provide equal access and ensure competition for each FE actor. However, despite the Central Bank’s efforts, evaluations of networks remain low.

Intermediate services (support of incubators, accelerators, or other advisers) receive high evaluations in Moscow, St. Petersburg, and the Republic of Tatarstan. Most intermediate services in Russia are in innovation centres. A significant share of FinTechs that participated in the survey were Skolkovo members. Perhaps such high values are due to this aspect.

In comparison with other regions, Moscow has high values in leadership. This can be explained by the location of the Central Bank of Russia and most cluster organisations in the financial sector. Moscow also has a sufficiently high evaluation of access to finance. Generally, alternative financing has not developed in Russia compared to other countries (

Lyasnikov et al. 2017). Nonetheless, Moscow is more attractive for FinTech entrepreneurship than other regions. Most exhibitions and competitions for obtaining additional financial resources are held in Moscow. Therefore, for FinTechs, it is easier to acquire information about possible financing and to participate in competitions there. Finance and leadership mostly determine Moscow’s superiority over other regions.

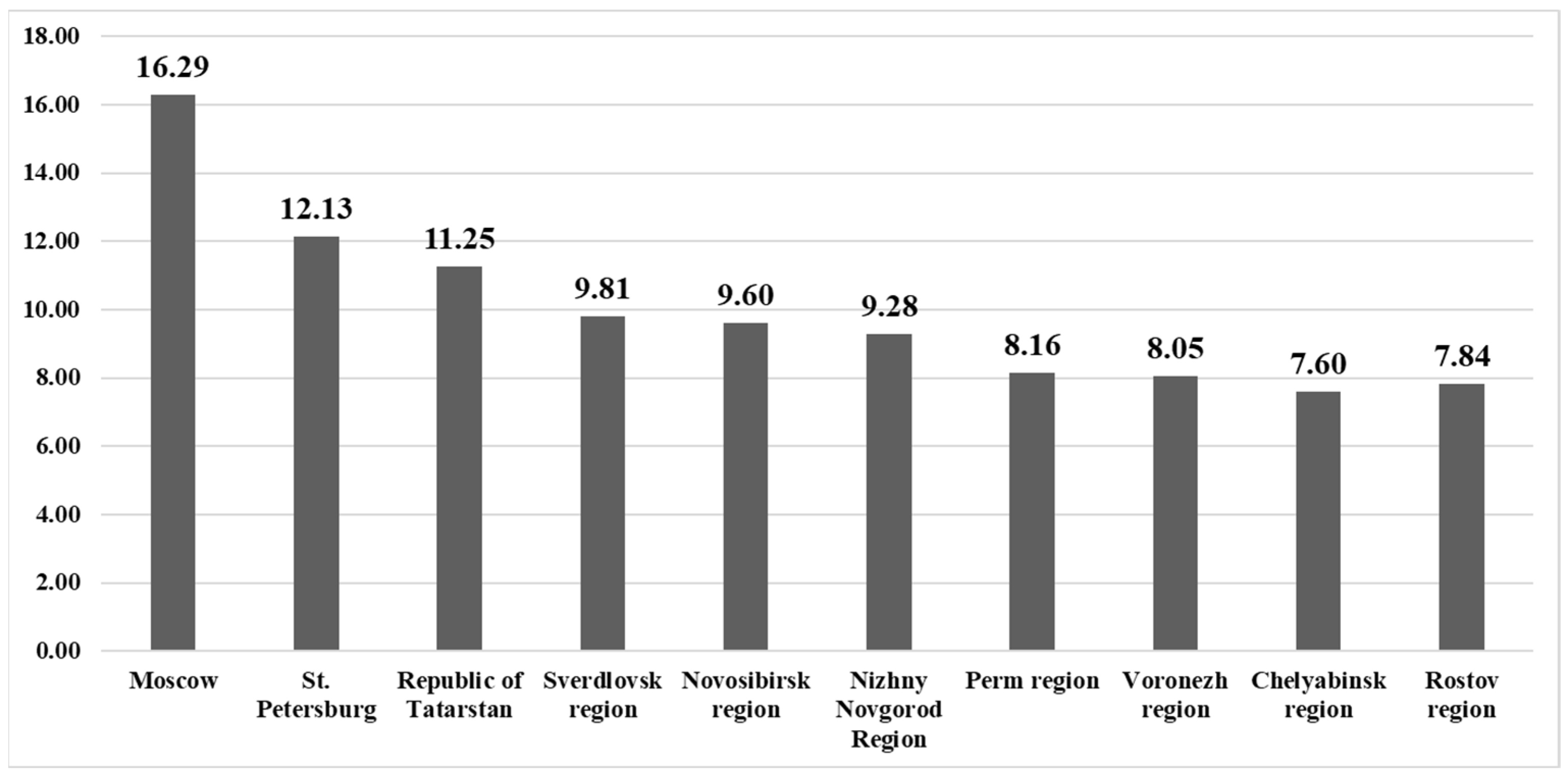

With the implementation of the proposed algorithm, the following results were obtained with the additive FE index (see

Figure 1).

Moscow, St. Petersburg, and the Republic of Tatarstan perform better than the average for most attributes and had an index value higher than 10. The Novosibirsk and Nizhny Novgorod regions have FE index values of around 10 (9.73 and 9.6, respectively). Other regions performed lower than average for most attributes and had an index value below 10.

The maximum ranges of attribute evaluations are in intermediate services, finance, and formal institutions. This highlights the differences in access to finance, local and state programmes, and support from intermediate business services in the regions. Demand and physical infrastructures varied the least and achieved high evaluations. This shows the relevance of internet access and customers’ readiness to use FinTech services in all Russian regions.

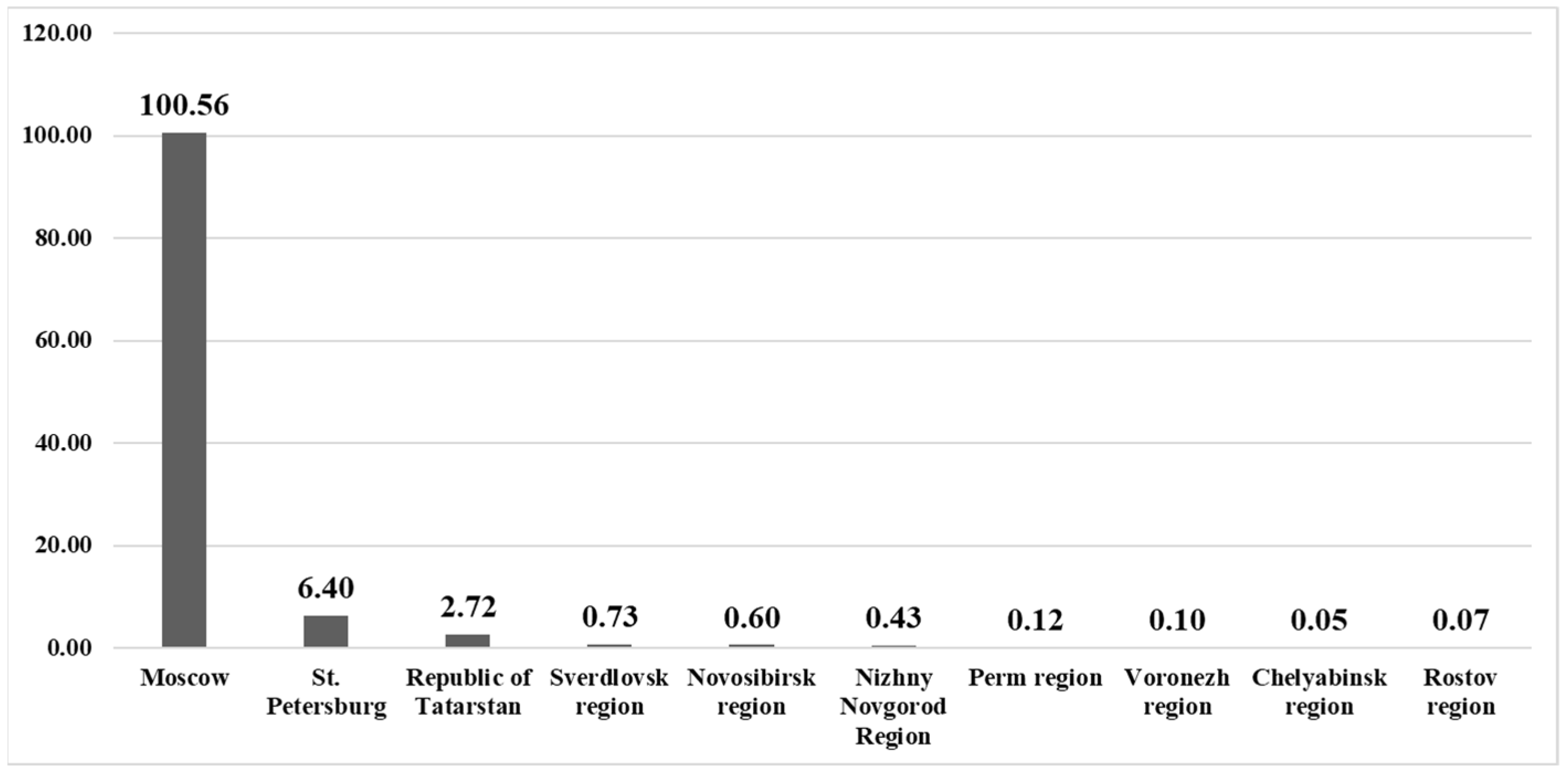

The disadvantage of the additive FE index is that attributes with above-average evaluations have a stronger effect on the index than do attributes with below-average values. Supporting

Stam (

2018), the results of the calculation of the multiplicative FE index are presented in

Figure 2. The multiplicative FE index has a variation much larger than the additive index.

As expected, the multiplicative FE index highlights a significant gap in all attributes of Moscow from other regions but does not contradict the conclusions drawn from the additive FE index. Considering the complex and nonlinear relationship between an entrepreneurial ecosystem’s attributes (

Stam 2018), we support that the multiplicative index is superior to the additive index.

4.2. Relationship between FE Attributes and Productive Entrepreneurship

To test the link between FE attributes and productive entrepreneurship, a correlation analysis was conducted (see

Table 6).

Both FE indices were positively and statistically correlated significantly with the number of FinTechs. This result supports the positive association between FE attributes (input) and productive entrepreneurship (output).

Applying DEA allows for defining Russian regions with productive entrepreneurship, considering the value of the FE index. The results are presented in

Table 7.

Using different approaches to calculate the FE index led to opposite results. This can be explained by differences in the initial data. Moscow has a 1633.16 times higher multiplicative FE index value than the Chelyabinsk region and a 2.12 times higher value with the additive FE index. Such a huge difference in measuring the environment for entrepreneurship in the financial sector led to contrary results and highlights the importance of choosing adequate measures for FE attributes.

The results based on the additive index indicate that Moscow is the region that effectively creates an environment for productive entrepreneurship. The results of the multiplicative index rank the Chelyabinsk region as the most efficient. Recall that this region received the lowest FE index value. The recognition of a region as effective means that it makes the most of the environment created in the region for productive entrepreneurship in the financial sector.

The DEA analysis, by additionally calculating slacks, revealed attributes with enough high value and that are underutilised by entrepreneurs in their activities within the framework of the financial sector. The results are presented in

Table 8.

In the context of Russian regions, physical infrastructure and demand are attributes underutilised by entrepreneurs in their financial sector activities. The insufficient use of attributes is explained by the insufficient development of other attributes. This was also visible in

Spigel (

2017), who showed a significant dependence between attributes in an ecosystem.

Finance, intermediate services, and formal institutions are identified as attributes maximally used by entrepreneurs and require additional attention from policymakers for developing entrepreneurship. This partly supports the conclusions made earlier in the results of analysing the FE index. In Russian regions, alternative finance (e.g., venture capital, business angels, etc.) is poorly developed. Most FinTechs are financed by their owners (

Koroleva et al. 2021). Intermediate services are located mostly near innovation centres. Therefore, support from incubators or accelerators is accessible only to members of these centres. Formal institutions highlight the necessity of developing FinTech-friendly legislation and special state programmes. Thus, improving the understanding of FE attributes and their links to productive entrepreneurship could benefit policymakers and entrepreneurs.

5. Conclusions and Discussion

This paper provides evidence of the relationship between FE attributes and productive entrepreneurship in regions of Russia. We propose a survey-based tool for measuring the attributes of FEs that seems to properly capture underlying phenomena. This approach expands the application of

Stam’s (

2015) model and

Liguori et al.’s (

2018) perceptual measure to FEs in terms of measuring attributes. The suggested approach provides the opportunity to represent the opinions of many FinTech representatives. A survey-based approach allows for the consideration of FEs’ uniqueness and remains flexible in terms of covered territory.

The creation of a favourable environment for entrepreneurship had a positive association with productive entrepreneurship in the financial sector of Russian regions. In addition, the DEA analysed the regions with productive entrepreneurship, based on the results of measuring FE attributes. These results can help policymakers and entrepreneurs understand the strengths and weaknesses of a certain region’s environment and use them to accelerate business activity in the financial sector. The results of the DEA analysis support

Spigel (

2017) in matters of the interdependence of an FE’s attributes and highlight the need for more balanced development of an entrepreneurial environment in the financial sector.

This paper extends the literature on measuring FE attributes (

Ernst and Young 2014;

Gagliardi 2018;

Findexable 2021;

Sinai Lab 2020;

Alaassar et al. 2021;

Laidroo et al. 2021) by developing a survey-based approach. It also contributes to FinTech research in Russia (

Kleiner et al. 2020;

Koroleva et al. 2021;

Vaganova et al. 2020) by being the first to measure FE attributes in regions of Russia. The approbation of the algorithm determines a similar approach for creating an environment to develop entrepreneurship in the financial sectors of different regions. The regions have sufficiently developed physical infrastructures and high demand for FinTech services. New knowledge and networks were defined as weak aspects of the entrepreneurial environment in Russia’s financial sector. It is also possible to highlight the unbalanced development of FE attributes throughout the regions.

This paper contributes to the literature on entrepreneurial ecosystems (

Stam and van de Ven 2019;

Mateos and Amorós 2019;

Villegas-Mateos 2020;

Leendertse et al. 2021) by analysing the link between ecosystem attributes and productive entrepreneurship and by suggesting a tool for revealing effective regions in the context of FE attributes and productive entrepreneurship. This allows us to determine the attributes that are underutilised or not sufficiently developed to contribute to entrepreneurs’ activities.

Our results have limitations. The analysis was based on a relatively small number of regions in one period. To arrive at more robust findings, this analysis should be repeated in multiple periods. This would deliver more data points of FE index values and productive entrepreneurship and allow for feedback effects of productive entrepreneurship on FE attributes. The analyses should also be repeated in other contexts, potentially estimating different relationships between FE attributes and productive entrepreneurship. The approbation of a developed survey-based approach was realised at the regional level. However, it can be debated whether regional borders provide the most adequate boundaries for FEs. Boundaries are almost always arbitrary, likely somewhere between the municipal and national levels (

Stam 2018;

Stam and van de Ven 2019;

Leendertse et al. 2021).

Despite these limitations, and due to the increasing role of FinTechs, this paper provided a unique example of measuring FE attributes based on the survey approach, understanding the link between attributes and productive entrepreneurship, and indicating territories that effectively use a created environment to develop entrepreneurship in the financial sector.