Cannabis Stocks Returns: The Role of Liquidity and Investors’ Attention via Google Metrics

Abstract

:1. Introduction

2. Related Literature

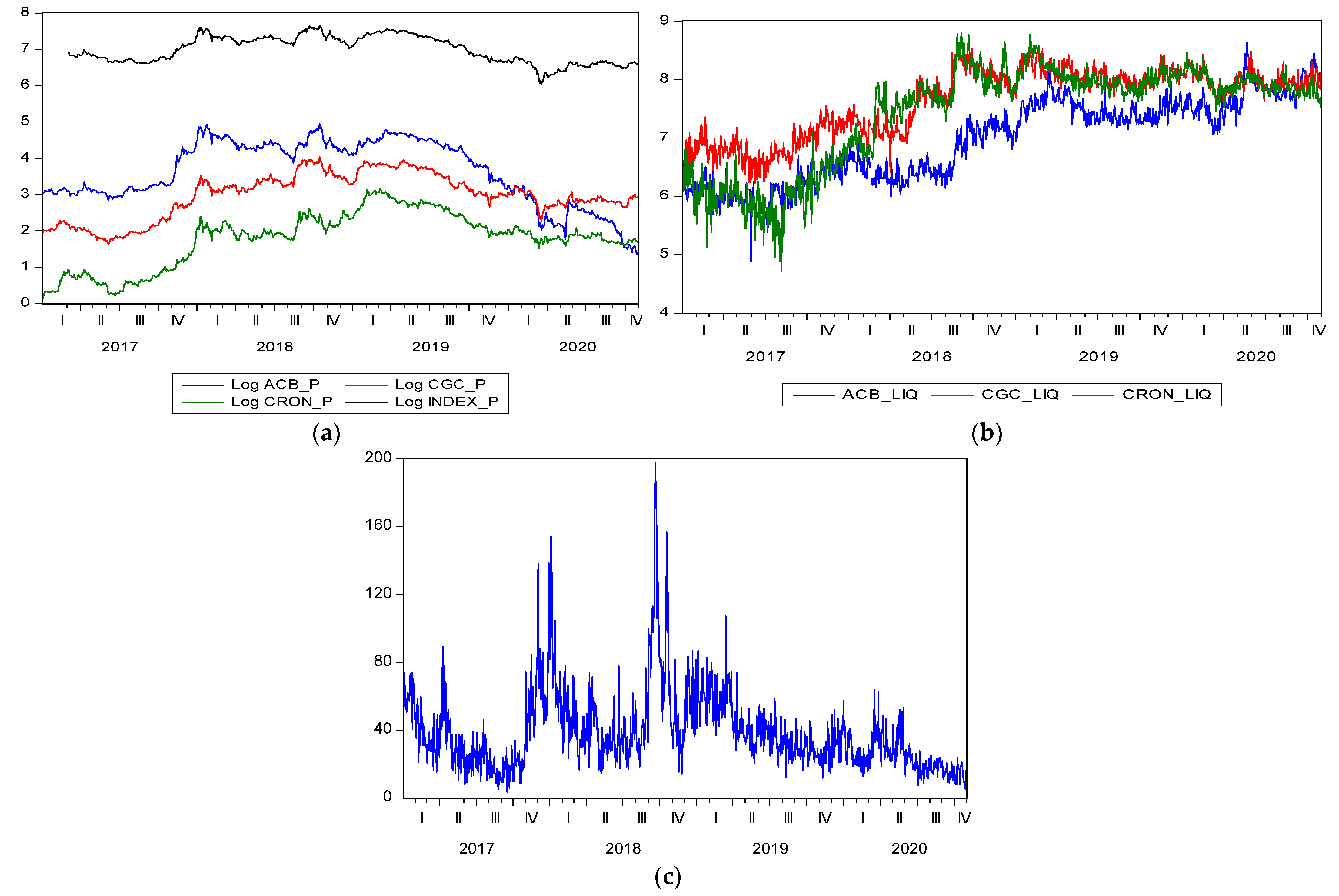

3. Materials and Methods

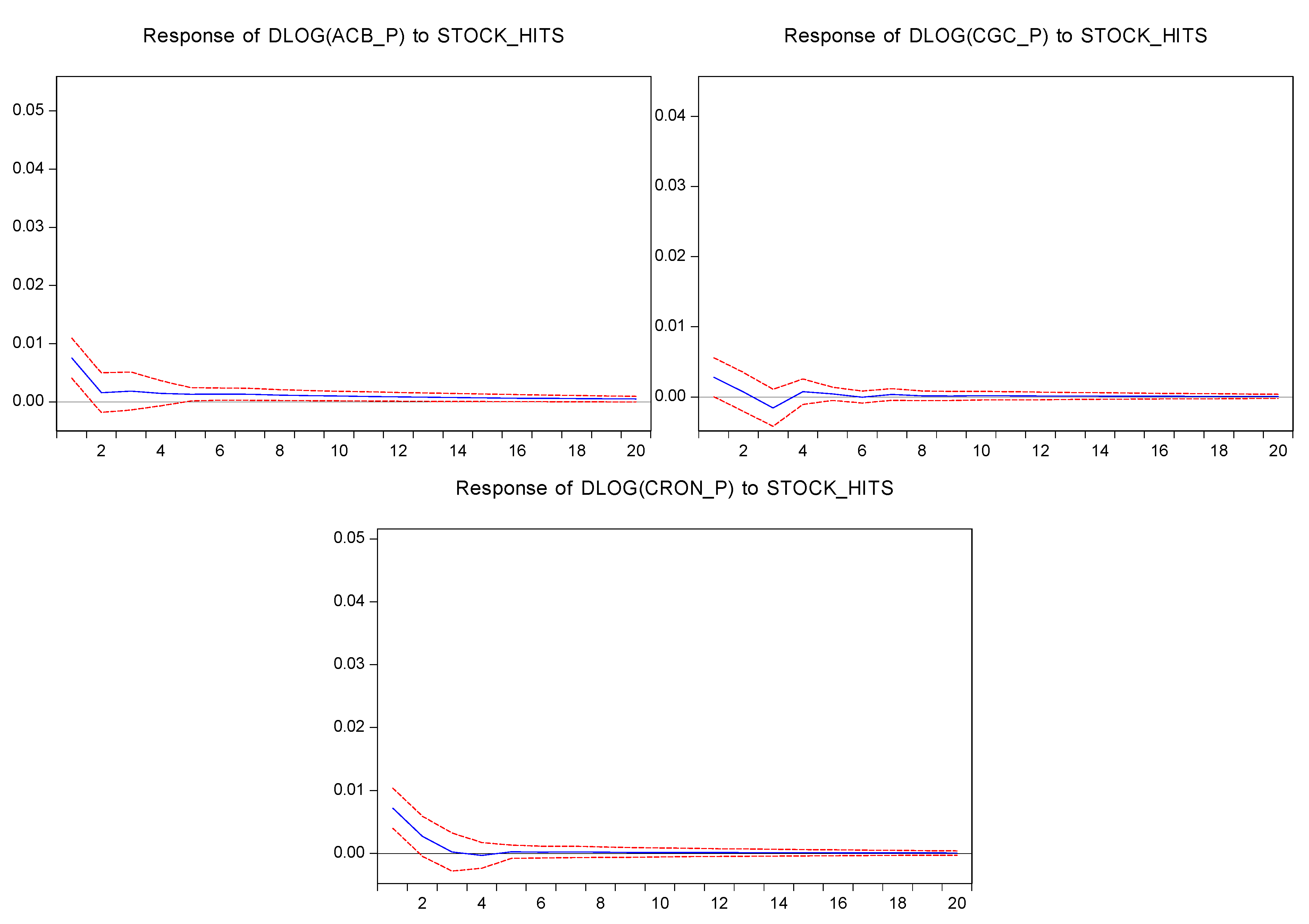

4. Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Acharya, Vital V., and Lasse Heje Pedersen. 2005. Asset pricing with liquidity risk. Journal of Financial Economics 77: 375–410. [Google Scholar] [CrossRef] [Green Version]

- Akhtaruzzaman, Md, Sabri Boubaker, and Zaghum Umar. 2021. COVID-19 media coverage and ESG leader indices. Finance Research Letters, 102170, in press. [Google Scholar] [CrossRef]

- Amihud, Yakov, and Haim Mendelson. 1986. Asset pricing and the bid-ask spread. Journal of Financial Economics 17: 223–49. [Google Scholar] [CrossRef]

- Amihud, Yakov, Allaudeen Hameed, Wenjin Kang, and Huiping Zhang. 2015. The illiquidity premium: International evidence. Journal of Financial Economics 117: 350–68. [Google Scholar] [CrossRef]

- Amihud, Yakov. 2002. Illiquidity and stock returns: Cross-section and time series effects. Journal of Financial Markets 5: 31–56. [Google Scholar] [CrossRef] [Green Version]

- Andrikopoulos, Panagiotis, Bartosz Gebka, and Vasileios Kallinterakis. 2021. Regulatory mood-congruence and herding: Evidence from cannabis stocks. Journal of Economic Behavior & Organization 185: 842–64. [Google Scholar]

- Assoil, Ayad, Ndéné Ka, and Jules Sadefo-Kamdem. 2021. Analysis of the dynamic relationship between liquidity proxies and returns on the French CAC 40 index. SN Business & Economics 1: 1–23. [Google Scholar]

- Bahji, Anees, and Callum Stephenson. 2019. International perspectives on the implications of cannabis legalization: A systematic review & thematic analysis. International Journal of Environmental Research and Public Health 16: 3095. [Google Scholar]

- Boubaker, Sabri, Dimitrios Gounopoulos, and Hatem Rjiba. 2019. Annual report readability and stock liquidity. Financial Markets, Institutions & Instruments 28: 159–86. [Google Scholar]

- Brennan, Michael, and Avanidhar Subrahmanyam. 1996. Market microstructure and asset pricing: On the compensation for illiquidity in stock returns. Journal of Financial Economics 41: 441–64. [Google Scholar] [CrossRef]

- Carrière-Swallow, Yan, and Felipe Labbé. 2013. Nowcasting with Google Trends in an emerging market. Journal of Forecasting 32: 289–98. [Google Scholar] [CrossRef] [Green Version]

- Chen, Feilong, Sungchul Choi, Chengbo Fu, and Joshua Nycholat. 2021. Too high to get it right: The effect of cannabis legalization on the performance of cannabis-related stocks. Economic Analysis and Policy 72: 715–34. [Google Scholar] [CrossRef]

- Chiang, Thomas C., and Dazhi Zheng. 2015. Liquidity and stock returns: Evidence from international markets. Global Finance Journal 27: 73–97. [Google Scholar] [CrossRef]

- Choi, Hyunyoung, and Hal Varian. 2012. Predicting the present with Google Trends. Economic Record 88: 2–9. [Google Scholar] [CrossRef]

- Chronopoulos, Dimitris K., Fotios I. Papadimitriou, and Nikolaos Vlastakis. 2018. Information demand and stock return predictability. Journal of International Money and Finance 80: 59–74. [Google Scholar] [CrossRef] [Green Version]

- Da, Zhi, Joseph Engelberg, and Pengjie Gao. 2011. In search of attention. The Journal of Finance 66: 1461–99. [Google Scholar] [CrossRef]

- Da, Zhi, Joseph Engelberg, and Pengjie Gao. 2015. The sum of all FEARS investor sentiment and asset prices. The Review of Financial Studies 28: 1–32. [Google Scholar] [CrossRef] [Green Version]

- Danyliv, Oleh, Bruce Bland, and Daniel Nicholass. 2014. Convenient Liquidity Measure for Financial Markets. Available online: https://ssrn.com/abstract=2385914 (accessed on 27 January 2014).

- Dimpfl, Thomas, and Stephan Jank. 2016. Can internet search queries help to predict stock market volatility? European Financial Management 22: 171–92. [Google Scholar] [CrossRef] [Green Version]

- Ding, Rong, and Wenxuan Hou. 2015. Retail investor attention and stock liquidity. Journal of International Financial Markets, Institutions and Money 37: 12–26. [Google Scholar] [CrossRef]

- Drake, Michael S., Darren T. Roulstone, and Jacob R. Thornock. 2012. Investor information demand: Evidence from Google searches around earnings announcements. Journal of Accounting Research 50: 1001–40. [Google Scholar] [CrossRef]

- Eckstein, Zvi, and Daniel Tsiddon. 2004. Macroeconomic consequences of terror: Theory and the case of Israel. Journal of Monetary Economics 51: 971–1002. [Google Scholar] [CrossRef]

- Fama, Eugene, and Kenneth French. 1993. Common Risk Factors in the Returns on Stocks and Bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Ginsberg, Jeremy, Matthew H. Mohebbi, Rajan S. Patel, Lynnette Brammer, Mark S. Smolinski, and Larry Brilliant. 2009. Detecting influenza epidemics using search engine query data. Nature 457: 1012–14. [Google Scholar] [CrossRef]

- Goddard, John, Arben Kita, and Qingwei Wang. 2015. Investor attention and FX market volatility. Journal of International Financial Markets, Institutions and Money 38: 79–96. [Google Scholar] [CrossRef] [Green Version]

- Hasbrouck, Joel. 2009. Trading costs and returns for US equities: Estimating effective costs from daily data. Journal of Finance 64: 1445–77. [Google Scholar] [CrossRef] [Green Version]

- Joseph, Kissan, M. Babajide Wintoki, and Zelin Zhang. 2011. Forecasting abnormal stock returns and trading volume using investor sentiment: Evidence from online search. International Journal of Forecasting 27: 1116–27. [Google Scholar] [CrossRef]

- Kyriazis, Νikolaos, and Paraskevi Prassa. 2019. Which Cryptocurrencies Are Mostly Traded in Distressed Times? Journal of Risk and Financial Management 12: 135. [Google Scholar] [CrossRef] [Green Version]

- Lang, Mark, Karl Lins, and Mark Maffett. 2012. Transparency liquidity and valuation: International evidence on when transparency matters most. Journal of Accounting Research 50: 729–74. [Google Scholar] [CrossRef]

- Lee, Kuan-Hui. 2011. The world price of liquidity risk. Journal of Financial Economics 99: 136–61. [Google Scholar] [CrossRef]

- Leirvik, Thomas, Sondre R. Fiskerstrand, and Anders B. Fjellvikås. 2017. Market liquidity and stock returns in the Norwegian stock market. Finance Research Letters 21: 272–76. [Google Scholar] [CrossRef]

- Liu, Weimin. 2006. A liquidity-augmented capital asset pricing model. Journal of Financial Economics 82: 631–71. [Google Scholar] [CrossRef]

- Metaxas, P. T., and E. Mustafaraj. 2012. Social media and the elections. Science 338: 472–73. [Google Scholar] [CrossRef] [Green Version]

- Mondria, Jordi, Thomas Wu, and Yi Zhang. 2010. The determinants of international investment and attention allocation: Using internet search query data. Journal of International Economics 82: 85–95. [Google Scholar] [CrossRef] [Green Version]

- Padungsaksawasdi, Chaiyuth, Sirimon Treepongkaruna, and Robert Brooks. 2019. Investor Attention and Stock Market Activities: New Evidence from Panel Data. International Journal of Financial Studies 7: 30. [Google Scholar] [CrossRef] [Green Version]

- Papadamou, Stephanos, Athanasios P. Fassas, Dimitris Kenourgios, and Dimitrios Dimitriou. 2020. Direct and Indirect Effects of COVID-19 Pandemic on Implied Stock Market Volatility: Evidence from Panel Data Analysis. Munich Personal RePEc Archive (MPRA). Paper No. 100020. May. Available online: https://mpra.ub.uni-muenchen.de/100020/ (accessed on 18 November 2021).

- Papadamou, Stephanos, Athanasios P. Fassas, Dimitris Kenourgios, and Dimitrios Dimitriou. 2021. Flight-to-quality between global stock and bond markets in the COVID era. Finance Research Letters 38: 101852. [Google Scholar] [CrossRef]

- Parker, Karen A., Attilio Di Mattia, Fatima Shaik, Juan Carlos Cerón Ortega, and Robert Whittle. 2019. Risk management within the cannabis industry: Building a framework for the cannabis industry. Financial Markets, Institutions & Instruments 28: 3–55. [Google Scholar]

- Polgreen, Philip M., Yiling Chen, David M. Pennock, Forrest D. Nelson, and Robert A. Weinstein. 2008. Using internet searches for influenza surveillance. Clinical Infectious Diseases 47: 1443–48. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Polykalas, Spyros E., George N. Prezerakos, and Agisilaos Konidaris. 2013. An algorithm based on Google Trends’ data for future prediction. Case study: German elections. Paper presented at IEEE International Symposium on Signal Processing and Information Technology, Athens, Greece, December 12–15; pp. 69–73. [Google Scholar] [CrossRef]

- Poutachidou, Nikoletta, and Stephanos Papadamou. 2021. The Effect of Quantitative Easing through Google Metrics on US Stock Indices. International Journal of Financial Studies 9: 56. [Google Scholar] [CrossRef]

- Preis, Tobias, Helen Susannah Moat, and H. Eugene Stanley. 2013. Quantifying trading behavior in financial markets using Google Trends. Scientific Reports 3: 1684. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Smith, Geoffrey Peter. 2012. Google Internet search activity and volatility prediction in the market for foreign currency. Finance Research Letters 9: 103–10. [Google Scholar] [CrossRef]

- Vlastakis, Nikolaos, and Raphael N. Markellos. 2012. Information demand and stock market volatility. Journal of Banking & Finance 36: 1808–21. [Google Scholar]

- Vozlyublennaia, Nadia. 2014. Investor attention, index performance, and return predictability. Journal of Banking & Finance 41: 17–35. [Google Scholar]

- Weisskopf, Jean-Philippe. 2020. Breaking bad: An investment in cannabis. Finance Research Letters 33: 101201. [Google Scholar] [CrossRef]

- Yang, Ann Shawing, and Airin Pangastuti. 2016. Stock market efficiency and liquidity: The Indonesia Stock Exchange merger. Research in International Business and Finance 36: 28–40. [Google Scholar] [CrossRef]

| ACB | CGC | CRON | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean Equation | FF-Model + Liquidity | FF-Model + Liquidity + Google Trends | FF-Model + Liquidity | FF-Model + Liquidity + Google Trends | FF-Model + Liquidity | FF-Model + Liquidity + Google Trends | |||||||

| Variables | Coef. | Prob. | Coef. | Prob. | Coef. | Prob. | Coef. | Prob. | Coef. | Prob. | Coef. | Prob. | |

| β0 | Intercept | −0.004 | 0.000 | −0.0067 | 0.000 | −0.001 | 0.272 | −0.002 | 0.203 | −0.003 | 0.010 | −0.003 | 0.000 |

| β1 | RNAMMAR | 1.4551 | 0.000 | 1.451 | 0.000 | 1.398 | 0.000 | 1.403 | 0.000 | 1.337 | 0.000 | 1.304 | 0.000 |

| β2 | RM-r | 0.009 | 0.000 | 0.009 | 0.000 | 0.009 | 0.000 | 0.0087 | 0.000 | 0.011 | 0.000 | 0.011 | 0.000 |

| β3 | HML | 0.004 | 0.000 | 0.004 | 0.000 | 0.002 | 0.027 | 0.002 | 0.031 | 0.002 | 0.179 | 0.002 | 0.000 |

| β4 | SMB | 0.004 | 0.009 | 0.004 | 0.006 | 0.008 | 0.000 | 0.008 | 0.000 | 0.004 | 0.049 | 0.005 | 0.000 |

| β5 | %LIX(t) | 0.121 | 0.000 | 0.116 | 0.000 | 0.066 | 0.038 | 0.064 | 0.048 | 0.084 | 0.063 | 0.084 | 0.000 |

| β6 | %LIX(t−1) | 0.148 | 0.000 | 0.147 | 0.000 | −0.034 | 0.399 | −0.034 | 0.401 | 0.068 | 0.059 | 0.066 | 0.000 |

| β7 | GTrend(t) | 0.00012 | 0.045 | 0.0001 | 0.037 | 0.0001 | 0.000 | ||||||

| β8 | GTrend(t−1) | −0.00004 | 0.563 | 0.000 | 0.631 | −0.0001 | 0.000 | ||||||

| Variance Equation | |||||||||||||

| α0 | Intercept | 0.000 | 0.000 | 2.6 × 10−4 | 0.000 | 3.0 × 10−4 | 0.000 | 3.3 × 10−4 | 0.000 | 1.8 × 10−4 | 0.000 | 1.4 × 10−4 | 0.000 |

| α1 | ARCH | 0.311 | 0.000 | 0.313 | 0.000 | 0.116 | 0.000 | 0.116 | 0.000 | 0.130 | 0.000 | 0.135 | 0.000 |

| α2 | GARCH | 0.495 | 0.000 | 0.471 | 0.000 | 0.413 | 0.000 | 0.356 | 0.021 | 0.760 | 0.000 | 0.735 | 0.000 |

| Diagnostics | |||||||||||||

| Adjusted R-squared | 59% | 60% | 70% | 71% | 54% | 55% | |||||||

| Log likelihood | 1978.320 | 1980.950 | 2171.230 | 2174.000 | 1935.020 | 1978.840 | |||||||

| Q(12) | 0.880 | 0.880 | 0.710 | 0.620 | 0.580 | 0.720 | |||||||

| Qsq(12) | 0.900 | 0.980 | 0.530 | 0.460 | 0.940 | 0.980 | |||||||

| ARCH(1) | 0.410 | 0.720 | 0.570 | 0.610 | 0.670 | 0.240 | |||||||

| ACB Company | CGC Company | CRON Company | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean Equation | FF-Model + Liquidity | FF-Model + Liquidity + Google Trends | FF-Model + Liquidity | FF-Model + Liquidity + Google Trends | FF-Model + Liquidity | FF-Model + Liquidity + Google Trends | |||||||

| Variables | Coef. | Prob. | Coef. | Prob. | Coef. | Prob. | Coef. | Prob. | Coef. | Prob. | Coef. | Prob. | |

| β0 | Intercept | −0.0023 | 0.000 | −0.0048 | 0.000 | −0.001 | 0.234 | −0.002 | 0.203 | −0.003 | 0.010 | −0.003 | 0.000 |

| β1 | RNAMMAR | 1.45096 | 0.000 | 1.4446 | 0.000 | 1.400 | 0.000 | 1.304 | 0.000 | 1.337 | 0.000 | 1.304 | 0.000 |

| β2 | RM-r | 0.009 | 0.000 | 0.009 | 0.000 | 0.008 | 0.000 | 0.010 | 0.000 | 0.011 | 0.000 | 0.011 | 0.000 |

| β3 | HML | 0.004 | 0.000 | 0.004 | 0.000 | 0.0014 | 0.064 | 0.001 | 0.000 | 0.002 | 0.179 | 0.002 | 0.000 |

| β4 | SMB | 0.004 | 0.007 | 0.004 | 0.005 | 0.008 | 0.000 | 0.004 | 0.000 | 0.004 | 0.049 | 0.005 | 0.000 |

| β5 | %LIX(t) | 0.127 | 0.000 | 0.125 | 0.000 | 0.067 | 0.045 | 0.078 | 0.000 | 0.084 | 0.063 | 0.084 | 0.000 |

| β6 | %LIX(t−1) | 0.180 | 0.000 | 0.177 | 0.000 | −0.045 | 0.240 | −0.034 | 0.000 | 0.068 | 0.059 | 0.066 | 0.000 |

| β7 | GTrend(t) | 0.00015 | 0.013 | 0.0006 | 0.000 | 0.0001 | 0.000 | ||||||

| β8 | GTrend(t−1) | −0.00007 | 0.206 | −0.0007 | 0.000 | −0.0001 | 0.000 | ||||||

| Variance Equation | |||||||||||||

| α0 | Intercept | −1.6743 | 0.000 | −1.691 | 0.000 | −3.967 | 0.000 | −0.732 | 0.000 | 1.8 × 10−4 | 0.000 | 1.4 × 10−4 | 0.000 |

| α1 | ARCH | 0.496 | 0.000 | 0.497 | 0.000 | 0.267 | 0.000 | 0.194 | 0.000 | 0.130 | 0.000 | 0.135 | 0.000 |

| α2 | GARCH | 0.048 | 0.030 | 0.048 | 0.046 | −0.019 | 0.000 | 0.064 | 0.030 | 0.760 | 0.000 | 0.735 | 0.000 |

| α2 | GARCH | 0.810 | 0.000 | 0.808 | 0.000 | 0.489 | 0.000 | 0.941 | 0.000 | 0.760 | 0.000 | 0.735 | 0.000 |

| Diagnostics | |||||||||||||

| Adjusted R-squared | 59% | 60% | 71% | 55% | 54% | 55% | |||||||

| Log likelihood | 1974.330 | 1977.056 | 2170.240 | 1978.212 | 1935.020 | 1978.840 | |||||||

| Q(12) | 0.860 | 0.860 | 0.760 | 0.730 | 0.580 | 0.720 | |||||||

| Qsq(12) | 0.700 | 0.670 | 0.470 | 0.980 | 0.940 | 0.980 | |||||||

| ARCH(1) | 0.320 | 0.291 | 0.470 | 0.410 | 0.670 | 0.240 | |||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Papadamou, S.; Koulis, A.; Kyriakopoulos, C.; Fassas, A.P. Cannabis Stocks Returns: The Role of Liquidity and Investors’ Attention via Google Metrics. Int. J. Financial Stud. 2022, 10, 7. https://doi.org/10.3390/ijfs10010007

Papadamou S, Koulis A, Kyriakopoulos C, Fassas AP. Cannabis Stocks Returns: The Role of Liquidity and Investors’ Attention via Google Metrics. International Journal of Financial Studies. 2022; 10(1):7. https://doi.org/10.3390/ijfs10010007

Chicago/Turabian StylePapadamou, Stephanos, Alexandros Koulis, Constantinos Kyriakopoulos, and Athanasios P. Fassas. 2022. "Cannabis Stocks Returns: The Role of Liquidity and Investors’ Attention via Google Metrics" International Journal of Financial Studies 10, no. 1: 7. https://doi.org/10.3390/ijfs10010007

APA StylePapadamou, S., Koulis, A., Kyriakopoulos, C., & Fassas, A. P. (2022). Cannabis Stocks Returns: The Role of Liquidity and Investors’ Attention via Google Metrics. International Journal of Financial Studies, 10(1), 7. https://doi.org/10.3390/ijfs10010007