Timely, Cheap, or Risk-Free? The Effect of Regulation on the Price and Availability of New Drugs

Abstract

1. Introduction

2. Methods

- Observable patient characteristics, which determine the “distance” from the profile of the ideal patient for which the drug was developed;

- Individual characteristics that cause heterogeneity in effectiveness within groups of patients with similar characteristics.

3. Results

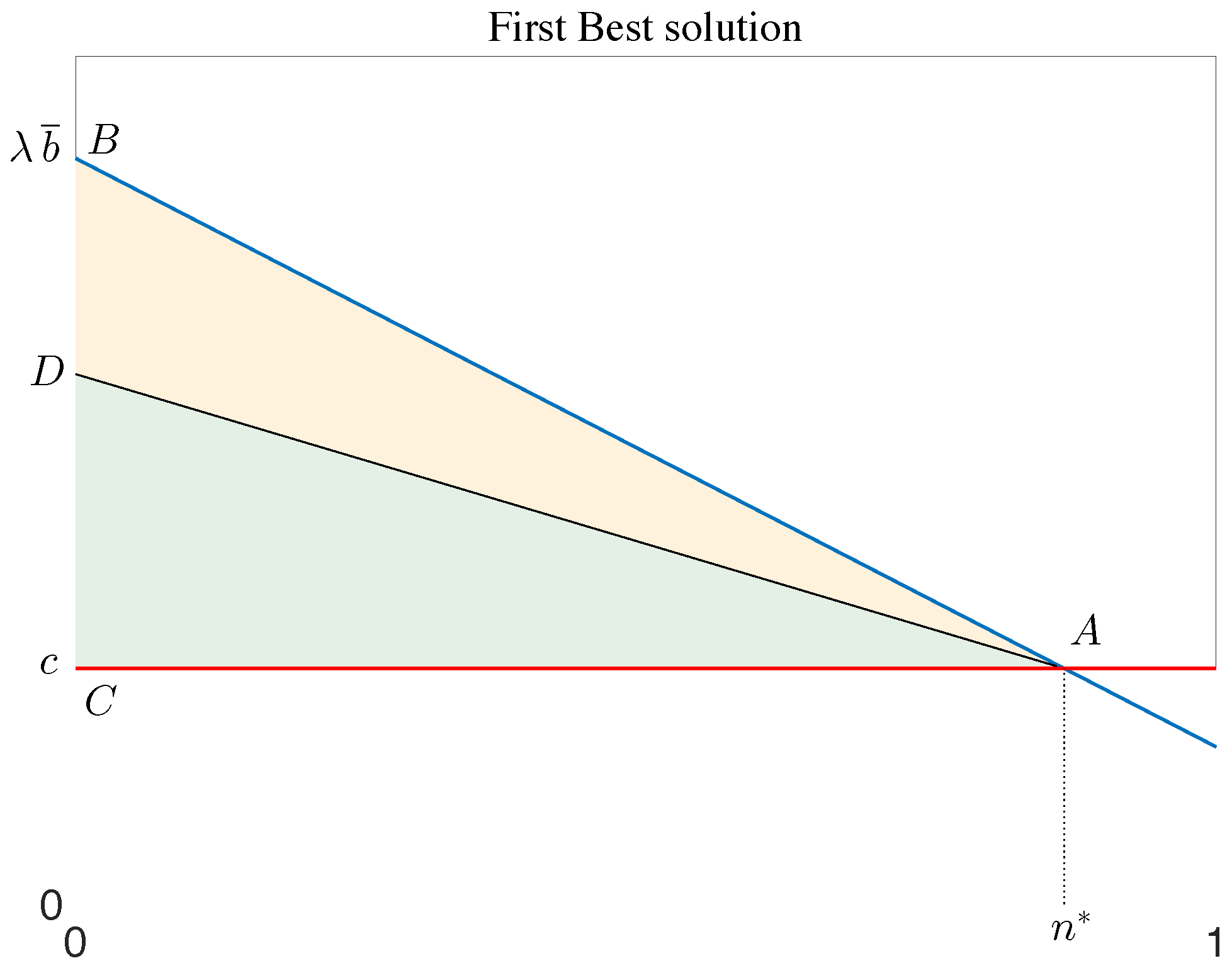

3.1. Second-Best Solutions

3.2. Value-Based Price Schemes

4. Drug Price When Effectiveness Is Uncertain

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Frech, H.; Pauly, M.; Comanor, W.; Martinez, J. Pharmaceutical Pricing and R&D as a Global Public Good; Technical Report; NBER: Cambridge, MA, USA, 2023. [Google Scholar] [CrossRef]

- Mulcahy, A.W.; Schwam, D.; Lovejoy, S.L. International Prescription Drug Price Comparisons: Estimates Using 2022 Data; RAND Corporation: Santa Monica, CA, USA, 2024. [Google Scholar] [CrossRef]

- Sachs, R.; Adler, L.; Frank, R. A holistic view of innovation incentives and pharmaceutical policy reform. Health Aff. Sch. 2023, 1, qxad004. [Google Scholar] [CrossRef]

- Carone, G.; Schwierz, C.; Xavier, A. Cost-Containment Policies in Public Pharmaceutical Spending in the EU; European Economy-Economic Papers; European Commission-Economic and Financial Affairs, 2012. [Google Scholar] [CrossRef]

- Panos, K.; Taylor, D.; Manning, J.; Carr, M. Implementing Value-Based Pricing for Pharmaceuticals in the UK; 2020Health: London, UK, 2010. [Google Scholar]

- Danzon, P.M.; Chao, L.W. Does Regulation Drive out Competition in Pharmaceutical Markets? J. Law Econ. 2000, 43, 311–357. [Google Scholar] [CrossRef]

- PhRMA. Annual Report 2011; PhRMA: Wasington, DC, USA, 2011. [Google Scholar]

- DiMasi, J.A.; Grabowski, H.G.; Hansen, R.W. Innovation in the pharmaceutical industry: New estimates of R&D costs. J. Health Econ. 2016, 47, 20–33. [Google Scholar] [CrossRef]

- Blind, K. The influence of regulations on innovation: A quantitative assessment for OECD countries. Res. Policy 2012, 41, 391–400. [Google Scholar] [CrossRef]

- Varol, N.; Costa-Font, J.; McGuire, A. Does adoption of pharmaceutical innovation respond to changes in the regulatory environment? Appl. Econ. Perspect. Policy 2012, 34, 531–553. [Google Scholar] [CrossRef]

- Danzon, P.; Chao, L.W. Prices, Competition and Regulation in Pharmaceuticals; Office of Health Economics, 2000; p. 84. [Google Scholar]

- OECD. Pharmaceutical Pricing Policies in a Global Market; OECD: Paris, France, 2008. [Google Scholar] [CrossRef]

- Vogler, S.; Paris, V.; Ferrario, A.; Wirtz, V.J.; de Joncheere, K.; Schneider, P.; Pedersen, H.B.; Dedet, G.; Babar, Z.U.D. How Can Pricing and Reimbursement Policies Improve Affordable Access to Medicines? Lessons Learned from European Countries. Appl. Health Econ. Health Policy 2017, 15, 307–321. [Google Scholar] [CrossRef]

- Vogler, S. Medicines Pricing: Limitations of Existing Policies and New Models. In Global Pharmaceutical Policy; Springer: Singapore, 2020; pp. 99–137. [Google Scholar] [CrossRef]

- Barrenho, E.; Lopert, R. Exploring the Consequences of Greater Price Transparency on the dynamics of Pharmaceutical Markets; Technical Report; OECD: Paris, France, 2022. [Google Scholar] [CrossRef]

- Haslam, A.; Kim, M.S.; Prasad, V. Overall survival for oncology drugs approved for genomic indications. Eur. J. Cancer 2022, 160, 175–179. [Google Scholar] [CrossRef]

- Mailankody, S.; Prasad, V. Five Years of Cancer Drug Approvals. JAMA Oncol. 2015, 1, 539. [Google Scholar] [CrossRef] [PubMed]

- Capri, S.; Antonanzas, F. Efficiency ratio and rocketing drug prices: Old concerns and new possibilities. Eur. J. Health Econ. 2020, 21, 1273–1277. [Google Scholar] [CrossRef] [PubMed]

- Pertile, P.; Forster, M.; Torre, D.L. Optimal Bayesian sequential sampling rules for the economic evaluation of health technologies. J. R. Stat. Soc. Ser. A 2014, 177, 419–438. [Google Scholar] [CrossRef]

- Jobjornsson, S.; Forster, M.; Pertile, P.; Burman, C.F. Late-stage pharmaceutical R&D and pricing policies under two-stage regulation. J. Health Econ. 2016, 50, 298–311. [Google Scholar] [CrossRef]

- Brekke, K.R.; Dalen, D.M.; Straume, O.R. Competing with precision: Incentives for developing predictive biomarker tests. Scand. J. Econ. 2023. [Google Scholar] [CrossRef]

- Lakdawalla, D.N. Economics of the Pharmaceutical Industry. J. Econ. Lit. 2018, 56, 397–449. [Google Scholar] [CrossRef]

- Gibson, S.; von Tigerstrom, B. Orphan drug incentives in the pharmacogenomic context: Policy responses in the US and Canada. J. Law Biosci. 2015, 2, 263–291. [Google Scholar] [CrossRef]

- Bach, P.B. Indication-Specific Pricing for Cancer Drugs. JAMA 2014, 312, 1629–1630. [Google Scholar] [CrossRef]

- Kaltenboeck, A.; Bach, P. Value-based pricing for drugs: Theme and variations. JAMA 2018, 319, 2165–2166. [Google Scholar] [CrossRef]

- Howard, D.H.; Bach, P.B.; Berndt, E.R.; Conti, R.M. Pricing in the Market for Anticancer Drugs. J. Econ. Perspect. 2015, 29, 139–162. [Google Scholar] [CrossRef]

- Yu, N.; Helms, Z.; Bach, P.B. R&D Costs For Pharmaceutical Companies Do Not Explain Elevated US Drug Prices. Health Aff. Blog 2017. [Google Scholar] [CrossRef]

- Salas-Vega, S.; Shearer, E.; Mossialos, E. Relationship between costs and clinical benefits of new cancer medicines in Australia, France, the UK, and the US. Soc. Sci. Med. 2020, 258, 113042. [Google Scholar] [CrossRef]

- Angelis, A.; Polyakov, R.; Wouters, O.J.; Torreele, E.; McKee, M. High drug prices are not justified by industry’s spending on research and development. BMJ 2023, 380, e071710. [Google Scholar] [CrossRef]

- Ledley, F.D.; McCoy, S.S.; Vaughan, G.; Cleary, E.G. Profitability of Large Pharmaceutical Companies Compared With Other Large Public Companies. JAMA 2020, 323, 834. [Google Scholar] [CrossRef]

- Fried, M. Prescription for Poverty: Drug Companies as Tax Dodgers, Price Gougers, and Influence Peddlers; Oxfam International: Oxford, UK, 2018. [Google Scholar] [CrossRef]

- Yu, J.S.; Chin, L.; Oh, J.; Farias, J. Performance-Based Risk-Sharing Arrangements for Pharmaceutical Products in the United States: A Systematic Review. J. Manag. Care Spec. Pharm. 2017, 23, 1028–1040. [Google Scholar] [CrossRef]

- Bardey, D.; Bommier, A.; Jullien, B. Retail price regulation and innovation: Reference pricing in the pharmaceutical industry. J. Health Econ. 2010, 29, 303–316. [Google Scholar]

- Bouvy, J.; Vogler, S. Pricing and reimbursement policies: Impacts on innovation. In Priority Medicines for Europe and the World—2013 Update; Kaplan, W., Wirtz, V., Mantel-Teuwisse, A., Laing, R., Eds.; World Health Organization: Geneva, Switzerland, 2013. [Google Scholar]

- Civan, A.; Maloney, M.T. The effect of price on pharmaceutical R&D. J. Econ. Anal. Policy 2009, 9, 15. [Google Scholar]

- Danzon, P.M.; Wang, Y.R.; Wang, L. The impact of price regulation on the launch delay of new drugs-evidence from twenty-five major markets in the 1990s. Health Econ. 2005, 14, 269–292. [Google Scholar] [CrossRef] [PubMed]

- Danzon, P.M.; Epstein, A.J. Effects of Regulation on Drug Launch and Pricing in Interdependent Markets; NBER Working Papers 14041; National Bureau of Economic Research, Inc: Cambridge, MA, USA, 2008. [Google Scholar]

- Houy, N.; Jelovac, I. Drug Launch Timing and International Reference Pricing. Health Econ. 2015, 24, 978–989. [Google Scholar] [CrossRef] [PubMed]

- Janssen Daalen, J.M.; den Ambtman, A.; Van Houdenhoven, M.; van den Bemt, B.J.F. Determinants of drug prices: A systematic review of comparison studies. BMJ Open 2021, 11, e046917. [Google Scholar] [CrossRef] [PubMed]

- Mardetko, N.; Kos, M.; Vogler, S. Review of studies reporting actual prices for medicines. Expert Rev. Pharmacoecon. Outcomes Res. 2018, 19, 159–179. [Google Scholar] [CrossRef] [PubMed]

- Vogler, S.; Zimmermann, N.; Babar, Z.U.D. Price comparison of high-cost originator medicines in European countries. Expert Rev. Pharmacoecon. Outcomes Res. 2016, 17, 221–230. [Google Scholar] [CrossRef]

- Levaggi, R. Pricing schemes for new drugs: A welfare analysis. Soc. Sci. Med. 2014, 102, 69–73. [Google Scholar] [CrossRef] [PubMed]

- Gravelle, H.S. Ex post Value Reimbursement for Pharmaceuticals. Med. Decis. Mak. 1998, 18, S27–S38. [Google Scholar] [CrossRef]

- Heikkinen, I.; Eskola, S.; Acha, V.; Morrison, A.; Walker, C.; Weil, C.; Bril, A.; Wegner, M.; Metcalfe, T.; Chibout, S.D.; et al. Role of innovation in pharmaceutical regulation: A proposal for principles to evaluate EU General Pharmaceutical Legislation from the innovator perspective. Drug Discov. Today 2023, 28, 103526. [Google Scholar] [CrossRef]

- Hlavka, J.P.; Yu, J.C.; Goldman, D.P.; Lakdawalla, D.N. The economics of alternative payment models for pharmaceuticals. Eur. J. Health Econ. 2021, 22, 559–569. [Google Scholar] [CrossRef]

- Dubois, P.; Gandhi, A.; Vasserman, S. Bargaining and International Reference Pricing in the Pharmaceutical Industry; Technical Report; NBER, 2022. [Google Scholar] [CrossRef]

- Campillo-Artero, C.; Puig-Junoy, J.; Segú-Tolsa, J.L.; Trapero-Bertran, M. Price Models for Multi-indication Drugs: A Systematic Review. Appl. Health Econ. Health Policy 2020, 18, 47–56. [Google Scholar] [CrossRef]

- Wright, D.J. The drug bargaining game: Pharmaceutical regulation in Australia. J. Health Econ. 2004, 23, 785–813. [Google Scholar] [CrossRef] [PubMed]

- Coyle, D.; Buxton, M.J.; O’Brien, B.J. Stratified cost-effectiveness analysis: A framework for establishing efficient limited use criteria. Health Econ. 2003, 12, 421–427. [Google Scholar] [CrossRef] [PubMed]

- Levaggi, L.; Levaggi, R. Pricing Personalised Drugs: Comparing Indication Value Based Prices with Performance Based Schemes. BE J. Econ. Anal. Policy 2024, forthcoming. [Google Scholar] [CrossRef]

- Appleby, J.; Devlin, N.; Parkin, D.; Buxton, M.; Chalkidou, K. Searching for cost effectiveness thresholds in the NHS. Health Policy 2009, 91, 239–245. [Google Scholar] [CrossRef] [PubMed]

- Levaggi, L.; Levaggi, R. Welfare properties of restrictions to healthcare based on cost effectiveness. Health Econ. 2011, 20, 101–110. [Google Scholar] [CrossRef] [PubMed]

- Danzon, P.; Towse, A.; Mestre-Ferrandiz, J. Value-Based Differential Pricing: Efficient Prices for Drugs in a Global Context. Health Econ. 2015, 24, 294–301. [Google Scholar] [CrossRef]

- Zaric, G.S.; O’Brien, B.J. Analysis of a pharmaceutical risk sharing agreement based on the purchaser’s total budget. Health Econ. 2005, 14, 793–803. [Google Scholar] [CrossRef]

- Gamba, S.; Pertile, P.; Vogler, S. The impact of managed entry agreements on pharmaceutical prices. Health Econ. 2020, 29, 47–62. [Google Scholar] [CrossRef]

- Devlin, N.; Parkin, D. Does NICE have a cost?effectiveness threshold and what other factors influence its decisions? A binary choice analysis. Health Econ. 2004, 13, 437–452. [Google Scholar] [CrossRef]

- Office of Fair Trading (UK). The pharmaceutical price regulation system: An OFT study. In Annexe K: International Survey of Pharmaceutical Pricing and Reimbursement Schemes; 2007. Available online: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1808121/ (accessed on 3 March 2010).

- Jena, A.B.; Philipson, T. Cost-effectiveness analysis and innovation. J. Health Econ. 2008, 27, 1224–1236. [Google Scholar] [CrossRef]

- Jena, A.B.; Philipson, T.J. Endogenous cost-effectiveness analysis and healthcare technology adoption. J. Health Econ. 2013, 32, 172–180. [Google Scholar] [CrossRef]

- McCabe, C.; Claxton, K.; Culyer, A.J. The NICE Cost-Effectiveness Threshold: What it is and What that Means. PharmacoEconomics 2008, 26, 733–744. [Google Scholar] [CrossRef]

- Vernon, J.A.; Goldberg, R.; Golec, J. Economic Evaluation and Cost-Effectiveness Thresholds: Signals to Firms and Implications for R&D Investment and Innovation. PharmacoEconomics 2009, 27, 797–806. [Google Scholar] [PubMed]

- Filson, D. A Markov-perfect equilibrium model of the impacts of price controls on the performance of the pharmaceutical industry. RAND J. Econ. 2012, 43, 110–138. [Google Scholar] [CrossRef]

- Vernon, J.A. Examining the link between price regulation and pharmaceutical R&D investment. Health Econ. 2005, 14, 1–16. [Google Scholar] [CrossRef] [PubMed]

- Sharman Moser, S.; Tanser, F.; Siegelmann-Danieli, N.; Apter, L.; Chodick, G.; Solomon, J. The reimbursement process in three national healthcare systems: Variation in time to reimbursement of pembrolizumab for metastatic non-small cell lung cancer. J. Pharm. Policy Pract. 2023, 16, 22. [Google Scholar] [CrossRef] [PubMed]

- Hawkins, N.; Scott, D.A. Reimbursement and value-based pricing: Stratified cost-effectiveness analysis may not be the last word. Health Econ. 2011, 20, 688–698. [Google Scholar] [CrossRef] [PubMed]

- Capri, S.; Antonanzas, F.; Levaggi, R. The impact of conventional cost-effectiveness analysis on pricing dynamics in the market of new medicines: A proposed countervailing approach. Expert Rev. Pharmacoecon. Outcomes Res. 2023, 23, 431–438. [Google Scholar] [CrossRef] [PubMed]

- Claxton, K.; Sculpher, M.; Carroll, S. Value-Based Pricing for Pharmaceuticals: Its Role, Specification and Prospects in a Newly Devolved NHS; Working Papers 60; Centre for Health Economics, University of York: New York, NY, USA, 2011. [Google Scholar]

- Webb, D.; Walker, A. Value-based pricing of drugs in the UK. Lancet 2007, 369, 1415–1416. [Google Scholar] [CrossRef] [PubMed]

- Claxton, K. Oft, Vbp: Qed? Health Econ. 2007, 16, 545–558. [Google Scholar] [CrossRef] [PubMed]

- Claxton, K.; Briggs, A.; Buxton, M.; Culyer, A.; McCabe, C.; Walke, S.; Sculpher, M. Value based pricing for NHS drugs: An opportunity not to be missed? BMJ 2008, 336, 252–254. [Google Scholar] [CrossRef] [PubMed]

- Levaggi, R.; Pertile, P. Which valued-based price when patients are heterogeneous? Health Econ. 2020, 29, 923–935. [Google Scholar] [CrossRef] [PubMed]

- Vokinger, K.N.; Kesselheim, A.S. Value-based pricing of drugs with multiple indications or in combinations—Lessons from Europe. Nat. Rev. Clin. Oncol. 2021, 19, 1–2. [Google Scholar] [CrossRef]

- Mestre-Ferrandiz, J.; Zozaya, N.; Alcalá, B.; Hidalgo-Vega, Á. Multi-Indication Pricing: Nice in Theory but Can it Work in Practice? PharmacoEconomics 2018, 36, 1407–1420. [Google Scholar] [CrossRef]

- Chandra, A.; Garthwaite, C. The Economics of Indication-Based Drug Pricing. N. Engl. J. Med. 2017, 377, 103–106. [Google Scholar] [CrossRef]

- Mills, M.J.; Michaeli, D.; Miracolo, A.; Kanavos, P. Launch sequencing of pharmaceuticals with multiple therapeutic indications: Evidence from seven countries. BMC Health Serv. Res. 2023, 23, 150. [Google Scholar] [CrossRef] [PubMed]

- Michaeli, D.T.; Mills, M.; Kanavos, P. Value and Price of Multi-indication Cancer Drugs in the USA, Germany, France, England, Canada, Australia, and Scotland. Appl. Health Econ. Health Policy 2022, 20, 757–768. [Google Scholar] [CrossRef]

- Vokinger, K.N.; Glaus, C.E.G.; Kesselheim, A.S.; Serra-Burriel, M.; Ross, J.S.; Hwang, T.J. Therapeutic value of first versus supplemental indications of drugs in US and Europe (2011–2020): Retrospective cohort study. BMJ 2023, 382, e074166. [Google Scholar] [CrossRef]

- McGuire, A.; Raikou, M.; Kanavos, P. Pricing pharmaceuticals: Value based pricing in what sense. Eurohealth 2008, 14, 3–5. [Google Scholar]

- Towse, A.; Garrison, L. Can’t get no satisfaction? Will pay for performance help? Toward an economic framework for understanding performance-based risk sharing agreements for innovative medical products. Pharmacoeconomics 2010, 28, 93–102. [Google Scholar] [CrossRef]

- Levaggi, R.; Pertile, P. Value-Based Pricing Alternatives for Personalised Drugs: Implications of Asymmetric Information and Competition. Appl. Health Econ. Health Policy 2020, 18, 357–362. [Google Scholar] [CrossRef]

- Levaggi, L.; Levaggi, R. Competition, Value-Based Prices and Incentives to Research Personalised Drugs. Socio-Econ. Plan. Sci. 2024; forthcoming. [Google Scholar] [CrossRef]

- Shu, C.A.; Rizvi, N.A. Into the Clinic With Nivolumab and Pembrolizumab. Oncologist 2016, 21, 527–528. [Google Scholar] [CrossRef][Green Version]

- Toumi, M.; Jarosławski, S.; Sawada, T.; Kornfeld, Å. The Use of Surrogate and Patient-Relevant Endpoints in Outcomes-Based Market Access Agreements. Appl. Health Econ. Health Policy 2017, 15, 5–11. [Google Scholar] [CrossRef]

- Lilico, A. Risk Sharing Pricing Models in the Distribution of Pharmaceuticals; Staff Working Papers 2003.1; Europe Economics: London, UK, 2003. [Google Scholar]

- De Pouvourville, G. Risk-sharing agreements for innovative drugs. Eur. J. Health Econ. 2006, 7, 155–157. [Google Scholar] [CrossRef]

- Cook, J.; Vernon, J.; Mannin, R. Pharmaceutical risk-sharing agreements. Pharmacoeconomics 2008, 26, 551–556. [Google Scholar] [CrossRef]

- Adamski, J.; Godman, B.; Ofierska-Sujkowska, G.; Osinska, B.; Herholz, H.; Wendykowska, K.; Laius, O.; Jan, S.; Sermet, C.; Zara, C.; et al. Risk sharing arrangements for pharmaceuticals: Potential considerations and recommendations for European payers. BMC Health Serv. Res. 2010, 10, 153. [Google Scholar] [CrossRef]

- Neumann, P.J.; Chambers, J.D.; Simon, F.; Meckley, L.M. Risk-Sharing Arrangements That Link Payment For Drugs To Health Outcomes Are Proving Hard To Implement. Health Aff. 2011, 30, 2329–2337. [Google Scholar] [CrossRef]

- Antonanzas, F.; Juarez-Castello, C.; Rodriguez-Ibeas, R. Should health authorities offer risk-sharing contracts to pharmaceutical firms? A theoretical approach. Health Econ. Policy Law 2011, 6, 391–403. [Google Scholar] [CrossRef]

- Barros, P.P. The simple economics of risk sharing agreements between the NHS and the pharmaceutical industry. Health Econ. 2011, 20, 461–470. [Google Scholar] [CrossRef]

- Zaric, G.S.; Xie, B. The Impact of Two Pharmaceutical Risk-Sharing Agreements on Pricing, Promotion, and Net Health Benefits. Value Health 2009, 12, 838–845. [Google Scholar] [CrossRef][Green Version]

- Strohbehn, G.W.; Cooperrider, J.H.; Yang, D.; Fendrick, M.A.; Ratain, M.J.; Zaric, G.S. Pfizer and Palbociclib in China: Analyzing an Oncology Pay-for-Performance Plan. Value Health Reg. Issues 2022, 31, 34–38. [Google Scholar] [CrossRef]

- Levaggi, L.; Levaggi, R. Value-based drug price schemes: A welfare analysis. J. Pharm. Health Serv. Res. 2021, 12, 357–362. [Google Scholar] [CrossRef]

- Zaric, G.S. How Risky Is That Risk Sharing Agreement? Mean-Variance Tradeoffs and Unintended Consequences of Six Common Risk Sharing Agreements. MDM Policy Pract. 2021, 6, 2381468321990404. [Google Scholar] [CrossRef]

- Pauwels, K.; Huys, I.; Vogler, S.; Casteels, M.; Simoens, S. Managed Entry Agreements for Oncology Drugs: Lessons from the European Experience to Inform the Future. Front. Pharmacol. 2017, 8, 171. [Google Scholar] [CrossRef]

- Wenzl, M.; Chapman, S. Performance-Based Managed Entry Agreements for New Medicines in OECD Countries and EU Member States: How They Work and Possible Improvements Going Forward; OECD Health Working Papers 115; OECD: Paris, France, 2019. [Google Scholar] [CrossRef]

- Dabbous, M.; Chachoua, L.; Caban, A.; Toumi, M. Managed Entry Agreements: Policy Analysis From the European Perspective. Value Health 2020, 23, 425–433. [Google Scholar] [CrossRef]

- Jommi, C.; Bertolani, A.; Armeni, P.; Costa, F.; Otto, M. Pharmaceutical pricing and managed entry agreements: An exploratory study on future perspectives in Europe. Health Policy Technol. 2023, 12, 100771. [Google Scholar] [CrossRef]

- Ciulla, M.; Marinelli, L.; Di Biase, G.; Cacciatore, I.; Santoleri, F.; Costantini, A.; Dimmito, M.P.; Di Stefano, A. Healthcare Systems across Europe and the US: The Managed Entry Agreements Experience. Healthcare 2023, 11, 447. [Google Scholar] [CrossRef] [PubMed]

- Houy, N.; Jelovac, I. Comparing approval procedures for new drugs. World Econ. 2019, 42, 1598–1619. [Google Scholar] [CrossRef]

- Voehler, D.; Koethe, B.C.; Synnott, P.G.; Ollendorf, D.A. The impact of external reference pricing on pharmaceutical costs and market dynamics. Health Policy OPEN 2023, 4, 100093. [Google Scholar] [CrossRef] [PubMed]

- Levaggi, R.; Moretto, M.; Pertile, P. Static and dynamic efficiency of irreversible healthcare investments under alternative payment rules. J. Health Econ. 2012, 31, 169–179. [Google Scholar] [CrossRef]

- Refoios Camejo, R.; Miraldo, M.; Rutten, F. Cost-Effectiveness and Dynamic Efficiency: Does the Solution Lie Within? Value Health 2017, 20, 240–243. [Google Scholar] [CrossRef][Green Version]

- Conti, R.; Frank, R.; Gruber, J. Addressing the Trade-Off between Lower Drug Prices and Incentives for Pharmaceutical Innovation; Technical Report; Brookings Institution: Washington, DC, USA, 2021. [Google Scholar]

- Levaggi, R.; Moretto, M.; Pertile, P. The Dynamics of Pharmaceutical Regulation and R&D Investments. J. Public Econ. Theory 2016, 19, 121–141. [Google Scholar] [CrossRef]

- Scherer, F.M. Pricing, Profits, and Technological Progress in the Pharmaceutical Industry. J. Econ. Perspect. 1993, 7, 97–115. Available online: http://www.jstor.org/stable/2138445 (accessed on 27 February 2024). [CrossRef]

- Maini, L.; Pammolli, F. Reference Pricing as a Deterrent to Entry: Evidence from the European Pharmaceutical Market. Am. Econ. J. Microecon. 2023, 15, 345–383. [Google Scholar] [CrossRef]

- Woods, B.; Lomas, J.; Sculpher, M.; Weatherly, H.; Claxton, K. Achieving dynamic efficiency in pharmaceutical innovation: Identifying the optimal share of value and payments required. Health Econ. 2024, 33, 804–819. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Levaggi, L.; Levaggi, R. Timely, Cheap, or Risk-Free? The Effect of Regulation on the Price and Availability of New Drugs. Pharmacy 2024, 12, 50. https://doi.org/10.3390/pharmacy12020050

Levaggi L, Levaggi R. Timely, Cheap, or Risk-Free? The Effect of Regulation on the Price and Availability of New Drugs. Pharmacy. 2024; 12(2):50. https://doi.org/10.3390/pharmacy12020050

Chicago/Turabian StyleLevaggi, Laura, and Rosella Levaggi. 2024. "Timely, Cheap, or Risk-Free? The Effect of Regulation on the Price and Availability of New Drugs" Pharmacy 12, no. 2: 50. https://doi.org/10.3390/pharmacy12020050

APA StyleLevaggi, L., & Levaggi, R. (2024). Timely, Cheap, or Risk-Free? The Effect of Regulation on the Price and Availability of New Drugs. Pharmacy, 12(2), 50. https://doi.org/10.3390/pharmacy12020050