An Overview of the Global Market, Fleet, and Components in the Field of Aviation Gasoline

Abstract

:1. Introduction

- Avgas 100LL (Low Lead)—the most universal and widespread aviation gasoline grade in the world in terms of production and consumption, which is approved for use in almost all piston aircrafts. Requirements for this fuel grade are set in the specifications ASTM D910 and UK DEF STAN 91-90. There is also a more environmentally friendly modification of Avgas 100LL—Avgas 100VLL (Very Low Lead)—for which the maximum lead content is set to 0.45 g Pb/L (from 0.56 g Pb/L for Avgas 100LL) [5].

- B-91/115—a grade developed in the USSR, produced according to the Russian standard GOST 1012 or Polish specification WT-06/OBR PR/PD/60 [6]; it is mainly used in Russia and in the CIS for aircrafts equipped with Russian engines (ASH-62ir, AI-26V, M-14B, M-14P and M-14V-26); it is also allowed on most engines produced by Continental and Lycoming. It differs from Avgas 100LL in its lower antiknock resistance and less stringent lead content standard.

- UL82 and UL87—unleaded aviation gasoline, designed for engines with a low-compression ratio. Requirements are regulated according to ASTM D6227.

- UL91 and UL94—the most researched and widely used unleaded grades of aviation gasoline that were developed to replace Avgas 100LL and have been approved for more than 90% of the fleet. The standards are established according to the ASTM D7547 standard.

- UL100 and UL 102—promising grades of aviation gasoline designed to replace Avgas 100LL. The standards for test gasoline blends are established in the specifications ASTM D7960 and ASTM D7719.

- To assess the aviation gasoline market globally and in key regions according to consumers/producers, as well as the relation to economic indicators (presented in Section 3.1 and Section 3.2).

- Evaluate the state of the fleet: the number and types of aircraft and its development prospects (described in Section 3.3).

- Analyze aviation gasoline key components (presented in Section 3.4).

2. Methodology

- According to market analysis, not all countries publish open information about the aviation gasoline market; for such regions as the APR (namely China) and some African countries, UN information is not available or may be unreliable.

- Using the average cost of aviation gasoline allows for only a rough estimate of the level of revenue from fuel sales.

- Technology is also evaluated only through public information found in patents and articles; the actual components may be slightly different.

3. Results and Discussions

3.1. Aviation Gasoline Market

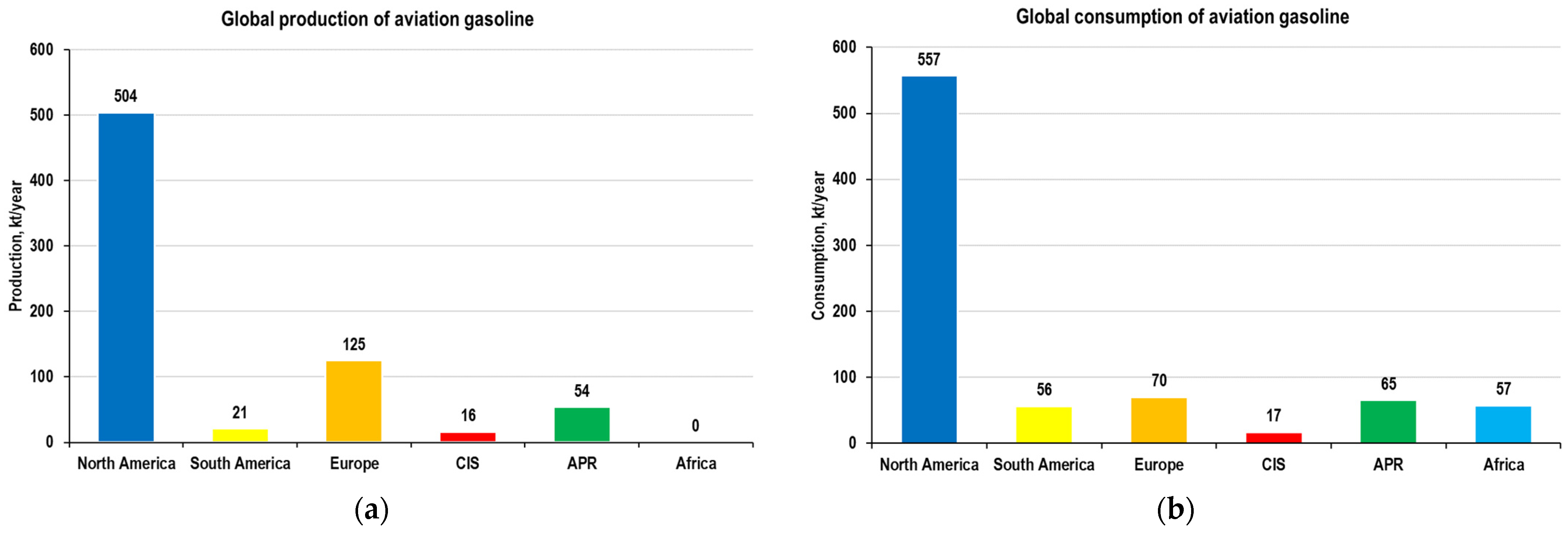

3.1.1. Global Aviation Gasoline Market

3.1.2. The European Aviation Gasoline Market

3.1.3. The North American Aviation Gasoline Market

3.1.4. The South American Aviation Gasoline Market

3.1.5. The Aviation Gasoline Market of the Asia–Pacific Region

3.1.6. The African Aviation Gasoline Market

3.1.7. The Aviation Gasoline Market of CIS Countries

3.2. Production and Economic Performance Relations

3.3. The State of the World’s Piston Aviation Fleet

3.4. An Overview of Components Used in the Production of Aviation Gasoline

- (1)

- oxygen-containing compounds (oxygenates);

- (2)

- aromatic amines;

- (3)

- manganese antiknock agents;

- (4)

- individual aromatic hydrocarbons (other than toluene);

- (5)

- combinations of the compounds above.

4. Conclusions

- The largest share of aviation gasoline production in a GDP is observed in developed countries with a high GDP per capita, such as the USA, Canada, Australia, Poland, and the Netherlands. Just 5 of these countries account for 88% of aviation gasoline production. A total of 77% of consumption is in the USA, Canada, Brazil, France, and Australia. In general, less than 10 market players influence its development.

- The decarbonization of civil aviation has not yet reached light aviation; there are currently no roadmaps, except for the phase-out of leaded fuel. However, as civil aviation decarbonizes and moves away from piston engines, the use of aviation gasoline will gradually decline. It will be replaced with jet-powered aircraft as well as hydrogen and electricity.

- However, before piston aircraft are phased out, the primary issue of lead in fuel needs to be resolved, and fuel can be standardized. Today’s aircraft fleet are 100% covered by 100LL gasoline; the recent approval of G100UL fuel for all engine types holds great promise for the introduction of unleaded aviation gasolines. Once the leaded gasoline ban is implemented, the market is expected to switch to 100% unleaded gasoline.

- The average composition of UL91 and UL94 unleaded grades based on alkylate, isomerate, isopentane fraction, and an aromatic component was formulated. The main directions for the possible development of aviation gasolines with a MON over 100 have been determined as follows: the use of aromatic amines, manganese antiknock agents, and individual aromatic hydrocarbons in the composition of oxygenates.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Sarathy, S.M.; Farooq, A.; Kalghatgi, G.T. Recent progress in gasoline surrogate fuels. Prog. Energy Combust. Sci. 2018, 65, 67–108. [Google Scholar] [CrossRef]

- Thanikasalam, K.; Rahmat, M.; Fahmi, A.G.M.; Zulkifli, A.M.; Shawal, N.N.; Ilanchelvi, K.; Ananth, M.; Elayarasan, R. Piston Aviation Fuel Initiative (PAFI)—A Review. IOP Conf. Ser. Mater. Sci. Eng. 2018, 370, 012010. [Google Scholar] [CrossRef]

- Danilov, A.M. Introduction to Chemotology; Publishing House “Technique”: London, UK, 2003. [Google Scholar]

- Lovestead, T.M.; Bruno, T.J. Application of the Advanced Distillation Curve Method to the Aviation Fuel Avgas 100LL. Energy Fuels 2009, 23, 2176–2183. [Google Scholar] [CrossRef]

- Hemighaus, G.; Boval, T.; Bacha, J.; Barnes, F.; Franklin, M.; Gibbs, L.; Hogue, N.; Jones, J.; Lesnini, D.; Lind, J.; et al. Aviation Fuels Technical Review; Report of Shevron; Chevron Corporation: San Ramon, CA, USA, 2006. [Google Scholar]

- Ershov, M.A.; Klimov, N.A.; Burov, N.O.; Abdellatief, T.M.M.; Kapustin, V.M. Creation a novel promising technique for producing an unleaded aviation gasoline 100UL. Fuel 2021, 284, 118928. [Google Scholar] [CrossRef]

- Zahran, S.; Iverson, T.; McElmurry, S.P.; Weiler, S. The Effect of Leaded Aviation Gasoline on Blood Lead in Children. J. Assoc. Environ. Resour. Econ. 2017, 4, 2. [Google Scholar] [CrossRef]

- Klemick, H.; Guignet, D.; Bui, L.T.; Shadbegian, R.; Milani, C. Cardiovascular Mortality and Leaded Aviation Fuel: Evidence from Piston-Engine Air Traffic in North Carolina. Int. J. Environ. Res. Public Health 2022, 19, 5941. [Google Scholar] [CrossRef] [PubMed]

- Pritchett, A.R.; German, B.J.; Griffith, J.D.; Kenville, K.A.; Miranda, M.L.; Mitchell, R.A.K.; Passavant, G.W.; Robertson, B.I.; Turner, J.R.; Whiteside, A.J. Options for Reducing Lead Emissions from Piston-Engine Aircraft; Special Report 336; The National Academies Press: Washington, DC, USA, 2021. [Google Scholar]

- Zahran, S.; Keyes, C.; Lanphear, B. Leaded aviation gasoline exposure risk and child blood lead levels. PNAS Nexus 2023, 2, 285. [Google Scholar] [CrossRef] [PubMed]

- Miranda, M.L.; Anthopolos, R.; Hastings, D. A Geospatial Analysis of the Effects of Aviation Gasoline on Childhood Blood Lead Levels. Env. Health Perspect 2011, 119, 1513–1516. [Google Scholar] [CrossRef] [PubMed]

- Zhao, Z.; Cui, H. Numerical investigation on combustion processes of an aircraft piston engine fueled with aviation kerosene and gasoline. Energy 2022, 239, 122264. [Google Scholar] [CrossRef]

- Yu, L.; Wu, H.; Zhao, W.; Qian, Y.; Zhu, L.; Lu, X. Experimental study on the application of n-butanol and n-butanol/kerosene blends as fuel for spark ignition aviation piston engine. Fuel 2021, 304, 121362. [Google Scholar] [CrossRef]

- Chen, L.; Raza, M.; Xiao, J. Combustion Analysis of an Aviation Compression Ignition Engine Burning Pentanol–Kerosene Blends under Different Injection Timings. Energy Fuels 2017, 31, 9429–9437. [Google Scholar] [CrossRef]

- Wallner, T.; Miers, S.A.; McConnell, S. A comparison of ethanol and butanol as oxygenates using a direct-injection, spark-ignition engine. J. Eng. Gas Turbines Power 2009, 131, 32802–32809. [Google Scholar] [CrossRef]

- Environmental Protection Agency—Federal Register. Available online: https://public-inspection.federalregister.gov/2022-22223.pdf (accessed on 20 June 2023).

- Olislagers, R. Eliminate Aviation Gasoline Lead Emissions Initiative; AirVenture: Oshkosh, WI, USA, 2022. [Google Scholar]

- General Aviation Moves Closer to an Unleaded Future. Available online: https://www.eaa.org/eaa/news-and-publications/eaa-news-and-aviation-news/news/moving-closer-to-unleaded (accessed on 1 June 2023).

- Kumar, T.; Mohsin, R.; Majid, Z.A.; Ghafir, M.F.A.; Wash, A.M. Experimental optimisation comparison of detonation characteristics between leaded aviation gasoline low lead and its possible unleaded alternatives. Fuel 2020, 281, 118726. [Google Scholar] [CrossRef]

- Su-ungkavatin, P.; Tiruta-Barna, L.; Hamelin, L. Biofuels, electrofuels, electric or hydrogen?: A review of current and emerging sustainable aviation systems. Prog. Energy Combust. Sci. 2023, 96, 101073. [Google Scholar] [CrossRef]

- Yusaf, T.; Mahamude, A.S.F.; Kadirgama, K.; Ramasamy, D.; Farhana, K.; Dhahad, H.A.; Talib, A.B.R.A. Sustainable hydrogen energy in aviation—A narrative review. Int. J. Hydrogen Energy 2023, in press. [Google Scholar] [CrossRef]

- Brisbane Airport Corporation. Hydrogen Flight Alliance launches in Brisbane. Available online: https://newsroom.bne.com.au/hydrogen-flight-alliance-launches-in-brisbane/ (accessed on 4 September 2023).

- NASA’s Electrified Aircraft Propulsion. Research and Development Efforts. 2023. Available online: https://oig.nasa.gov/docs/IG-23-014.pdf (accessed on 4 September 2023).

- Petroleum & Other Liquids. Prime Supplier Sales Volumes. Available online: https://www.eia.gov/dnav/pet/pet_cons_prim_dcu_nus_a.htm (accessed on 7 June 2023).

- Canadian Centre for Energy Information. Available online: https://energy-information.canada.ca/en/subjects/refined-petroleum-products (accessed on 1 June 2023).

- Eurostat. Available online: https://ec.europa.eu/eurostat/databrowser/view/NRG_CB_OIL__custom_1383955/default/table?lang=en (accessed on 1 June 2023).

- Aviation Gasoline. Available online: http://data.un.org/Data.aspx?q=aviation+gasoline&d=EDATA&f=cmID%3aAV (accessed on 1 June 2023).

- Klimov, N.A. Development of Promising Low- and Unleaded Aviation Gasoline. Ph.D. Thesis, Gubkin Russian State University of Oil and Gas (National Research University), Moscow, Russia, 2 April 2020. [Google Scholar]

- Fuelprice Overview. Available online: https://www.iaopa.eu/AOPAFuelPriceServlet (accessed on 2 June 2023).

- Fuel Price Report. Available online: https://www.airnav.com/fuel/report.html (accessed on 6 June 2023).

- Aviation Gasoline Pricing. Available online: https://www.shellharbourairport.com.au/operational-information/aviation-fuel/ (accessed on 15 June 2023).

- Detailed Import Data of Ll Aviation Gasoline. Available online: zauba.com/import-ll+aviation+gasoline/hs-code-27101950-hs-code.html (accessed on 3 June 2023).

- Gross Domestic Product 2022. Available online: https://databankfiles.worldbank.org/public/ddpext_download/GDP.pdf (accessed on 15 June 2023).

- US and World Population Clock. Available online: https://www.census.gov/popclock/ (accessed on 10 June 2023).

- Canada’s Population Clock (Real-Time Model). Available online: https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2018005-eng.htm (accessed on 10 June 2023).

- National Population Clock. Available online: https://www.census.gov/ (accessed on 10 June 2023).

- National Quarterly Estimate. Available online: https://www.economy.com/mexico/population/not-seasonally-adjusted (accessed on 10 June 2023).

- 2022 Census Result. Available online: https://censo2022.ibge.gov.br/panorama/ (accessed on 10 June 2023).

- Official Projection. Available online: https://www.dane.gov.co/files/censo2018/proyecciones-de-poblacion/Nacional/DCD-area-proypoblacion-Nac-2020-2070.xlsx (accessed on 10 June 2023).

- New Provisional Data from the 2022 Census: Argentina Has 46,044,703 Inhabitants. Available online: https://www.infobae.com/politica/2023/01/31/nuevos-datos-provisorios-del-censo-2022-argentina-tiene-46044703-habitantes/ (accessed on 10 June 2023).

- Demography—Population at the Beginning of the Month—France (Including Mayotte from 2014). Available online: https://www.insee.fr/fr/statistiques/serie/001641607 (accessed on 10 June 2023).

- Estimates of the Population for the UK, England, Wales, Scotland and Northern Ireland. Available online: https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationestimates/datasets/populationestimatesforukenglandandwalesscotlandandnorthernireland (accessed on 10 June 2023).

- Population by Nationality and Sex (Quarterly Figures). Available online: https://www.destatis.de/EN/Themes/Society-Environment/Population/Current-Population/Tables/liste-current-population.html (accessed on 10 June 2023).

- Statistics Poland. Available online: https://stat.gov.pl/en/topics/other-studies/informations-on-socio-economic-situation/statistical-bulletin-no-42023,4,150.html (accessed on 10 June 2023).

- Dashboard Population. Available online: https://www.cbs.nl/nl-nl/visualisaties/dashboard-bevolking (accessed on 10 June 2023).

- Rosstat, Federal State Statistics Service, Population of the Russian Federation by Gender as of Jan 1, 2023. Available online: https://rosstat.gov.ru/storage/mediabank/PrPopul2023_Site_.xlsx (accessed on 10 June 2023).

- National Bureau of Statistics. Available online: https://stat.gov.kz/ (accessed on 10 June 2023).

- Uzbekistan by the Numbers. Available online: https://stat.uz/en/ (accessed on 10 June 2023).

- Population Clock. Available online: https://www.abs.gov.au/AUSSTATS/abs@.nsf/Web+Pages/Population+Clock?opendocument (accessed on 10 June 2023).

- Estimated Population of NZ. Available online: https://www.stats.govt.nz/indicators/population-of-nz/ (accessed on 10 June 2023).

- S. Korean Population Falls for 3rd Consecutive Year in 2022. Available online: https://en.yna.co.kr/view/AEN20230115001800320 (accessed on 10 June 2023).

- Population and Regions and Districts Report—Volume 3 Highlights. Available online: https://census2021.statsghana.gov.gh/gssmain/fileUpload/reportthemelist/Volume%203%20Highlights.pdf (accessed on 10 June 2023).

- Projection of the Population 2019–2025. Available online: https://web.archive.org/web/20210429022734/https://www.statgabon.ga/wp-content/uploads/2020/08/Rapport-Projection_Final.pdf (accessed on 10 June 2023).

- National Institute of Statistics. Available online: http://www.stat-guinee.org/ (accessed on 10 June 2023).

- World Population Prospects 2022. Available online: https://population.un.org/wpp/ (accessed on 10 June 2023).

- FAA. Aerospace Forecast Fiscal Years 2023–2043. Available online: https://www.faa.gov/dataresearch/aviation/aerospaceforecasts/faa-aerospace-forecast-fy-2023-2043 (accessed on 21 June 2023).

- Australian Government. Department of Industry, Science, Energy and Resources. Available online: https://www.energy.gov.au/sites/default/files/Australian%20Petroleum%20Statistics%20-%20Issue%20281%20December%202019.xlsx (accessed on 17 June 2023).

- Brazil’s Aviation Gasoline Market Disrupted Amid Quality Concerns. Available online: https://www.reuters.com/article/us-petrobras-jetfuel-idUSKCN24E1OZ (accessed on 14 June 2023).

- Aircraft Blood—Aviation Gasoline. Available online: http://news.carnoc.com/list/316/316850.html (accessed on 12 June 2023).

- Three New Aviation Gasoline with Low Lead Content and Unleaded Gasoline “Guanghan Made” Received Airworthiness Approval. Available online: http://www.sc.xinhuanet.com/content/2019-09/03/c_1124956451.htm (accessed on 10 June 2023).

- India Launches Special Grade Aviation Gasoline Production to Cut Imports from Europe. Available online: https://sputnikglobe.com/20220926/india-launches-special-grade-aviation-fuel-production-to-cut-imports-from-europe-1101233376.html (accessed on 21 June 2023).

- India’s Petronet Eyes Lower Prices under Renewed Long-Term Deal with Qatar. Available online: https://economictimes.indiatimes.com/industry/energy/oil-gas/indias-petronet-eyes-lower-prices-under-renewed-long-term-deal-with-qatar/articleshow/102284831.cms (accessed on 21 June 2023).

- The Ferghana Refinery Has Developed an Improved Type of Aviation Gasoline B-92. Available online: https://nuz.uz/nauka-i-tehnika/1196806-na-ferganskom-npz-razrabotali-uluchshennyj-vid-aviaczionnogo-benzina-b-92.html (accessed on 1 August 2023).

- Turkmenbashi Refinery Plans to Start Production of Aviation Gasoline for Airplanes. Available online: https://www.trend.az/business/3479106.html (accessed on 21 June 2023).

- 2019 General Aviation Statistical Databook. Available online: https://gama.aero/wp-content/uploads/GAMA_2019Databook_Final-2020-03-20.pdf (accessed on 23 June 2023).

- ASTM D7547-11; Standard Specification for Unleaded Aviation Gasoline. ASTM: West Conshohocken, PA, USA, 2013.

- DEF STAN 91-090-2015; Gasoline Aviation: Grades UL91, 100/130 and 100/130LL. Ministry of Defence: Bristol, UK, 2015.

- ASTM D7960-21; Standard Specification for Unleaded Aviation Gasoline Test Fuel Containing Non-hydrocarbon Components. ASTM: West Conshohocken, PA, USA, 2022.

- ASTM D 7719-12; Standard Specification for High Octane Unleaded Test Fuel. ASTM: West Conshohocken, PA, USA, 2014.

- ASTM WK69284; New Specification for Unleaded Aviation Gasoline Test Fuel Containing Organo-Metallic Additive. ASTM: West Conshohocken, PA, USA, 2018.

- Global Expert Group. Customs Union Technical Regulations on Requirements to Automobile and Aviation Gasoline, Diesel and Marine Fuel, Jet Fuel and Heating Oil; CU TR 013/2011; Global Expert Group: Saint Petersburg, Russia, 2011. [Google Scholar]

- Creek, R.J. Manufacturing Aviation Gasoline, Future Fuels for General Aviation, ASTM STP 1048; Strauss, K.H., Gonzalez, C., Eds.; American Society for Testing and Materials: Philadelphia, PA, USA, 1989; pp. 5–16. [Google Scholar]

- CRC. Research Results Unleaded High Octane Aviation Gasoline; Final Report CRC Project No. AV-7-07; CRC Press: Boca Raton, FL, USA, 2010. [Google Scholar]

- D’Acosta, C.; Albuzat, T. High-Octane Unleaded Aviation Gasoline. U.S. Patent 2,018,016,509 A1, 18 January 2018. [Google Scholar]

- Mcafee, Z.J.; Calderon, J.A., III. Aviation Gasoline Containing Branched Aromatic Compounds with a Manganese Additive That Increases the Octane Number. RU Patent 2017141731 A3, 31 May 2019. [Google Scholar]

- Goldsmith, A.B.; Juno, E.; Burger, J.C.; Mathur, I. Aviation Gasoline Compositions. U.S. Patent 10,883,061 B2, 5 January 2021. [Google Scholar]

- Mcafee, Z.J.; Calderon, J.A., III. Aviation Gasoline Additive Scavenger. U.S. Patent US2,017,283,728 A1, 5 October 2017. [Google Scholar]

- Danilov, A.M. Application of Additives in Fuels: Handbook; HIMIZDAT: St. Petersburg, Russia, 2010; 368p. [Google Scholar]

- De Oliveira, E.J.; Rocha, M.I. Aviation Gasoline Formulation. EP Patent 1650289 B1, 26 April 2006. [Google Scholar]

- Grant, G.R. Unleaded Aviation Gasoline. U.S. Patent 2,010,263,262 A1, 21 October 2010. [Google Scholar]

- Helder, D.; Behnken, J.; Aulich, T. Design of Ethanol Based Fuels for Aviation. SAE Trans. 2000, 109, 243–256. [Google Scholar]

- Ziulkowski, J.D. Collective Knowledge on Aviation Gasolines. Master’s Thesis, Purdue University, West Lafayette, IN, USA, 7 October 2011. [Google Scholar]

- Hjelmberg, L. Aviation Gasoline Composition, Its Preparation and Use. U.S. Patent 2,017,204,345 A1, 20 July 2017. [Google Scholar]

- Studzinski, W.M.; Valentine, J.N.; Dorn, P.; Campbell, T.G.; Liiva, P.M. High Octane Unleaded Aviation Gasolines. U.S. Patent 2,002,005,008 A1, 17 January 2002. [Google Scholar]

- ASTM D7618-13(Reapproved 2021); Standard Specification for Ethyl Tertiary-Butyl Ether (ETBE) for Blending with Aviation Spark-Ignition Engine Fuel. ASTM: West Conshohocken, PA, USA, 2021.

- Emelyanov, V.E.; Deineko, P.S.; Nikitina, E.A.; Grebenshchikov, V.P. Methyl-tert-butyl ether as a component of aviation gasoline. Chem. Technol. Fuels Oils 1991, 27, 484–486. [Google Scholar] [CrossRef]

- Michael, S.T.; Clifford, M.M.; Belmokaddem, B.H. High Octane Unleaded Aviation Gasoline. U.S. Patent 2,015,113,865 A1, 30 April 2015. [Google Scholar]

- Mcafee, Z.J.; Calderon, J.A., III. Aviation Gasoline Containing Branched Aromatics with a Manganese Octane Enhancer. U.S. Patent 2,018,155,648 A1, 7 June 2018. [Google Scholar]

| Company | AVGAS Grade|Standard | Country of Import |

|---|---|---|

| Shell (London, UK) | 100LL|ASTM D910 and DEF STAN 91-90 | North and South America, EU, Asia–Pacific |

| TotalEnergies (Paris, France) | UL91|ASTM D7547 and DEF STAN 91-90 100LL|ASTM D910 and DEF STAN 91-90 | EU |

| Vitol Group (Rotterdam, The Netherlands) | 100LL|ASTM D910 and DEF STAN 91-90 | EU, Asia–Pacific, North America, Africa |

| BP (London, UK) | UL91|ASTM D7547 and DEF STAN 91-90 100LL|ASTM D910 and DEF STAN 91-90 | EU, Asia–Pacific, North and South America, Africa |

| Repsol (Madrid, Spain) | 100LL|ASTM D910 | EU, Asia–Pacific, North and South America, Africa |

| Warter Aviation (Plock, Poland) | UL91|ASTM D7547 and DEF STAN 91-90 100LL|WT-09/OBR PR/PD/48 B-91/115|GOST 1012-72 and WT-06/OBR PR/PD/60 | EU, CIS |

| Hjelmco Oil (Sollentuna, Sweden) | 91/96UL|ASTM D7547 mod. 100LL ASTM D910 and DEF STAN 91-90 | Sweden, Japan |

| Company | Avgas Grade|Standard | Country of Import |

|---|---|---|

| ConocoPhillips (Houston, TX, USA) | 100LL|ASTM D910 | North America |

| ExxonMobil (Irving TX, USA) | 100LL|ASTM D910 | North and South America, EU, Asia–Pacific, Africa |

| Phillips66 (Houston, TX, USA) | 100LL|ASTM D910 | North America |

| Shell (London, UK) | 100LL|ASTM D910 and DEF STAN 91-90 | North and South America, EU, Asia–Pacific |

| Vitol Group (Rotterdam, The Netherlands) | 100LL|ASTM D910 and DEF STAN 91-90 | EU, Asia–Pacific, North America, Africa |

| BP (London, UK) | UL91|ASTM D7547 and DEF STAN 91-90 100LL|ASTM D910 and DEF STAN 91-90 | EU, Asia–Pacific, North and South America, Africa |

| Repsol (Madrid, Spain) | 100LL|ASTM D910 | EU, Asia–Pacific, North and South America, Africa |

| Swift Fuels (West Lafayette, IN, USA) | UL94|ASTM D7547 | USA |

| The Region | The Country | Consumption, kt/Year | Population, Million | Consumption per Capita | GDP, Billion USD | Production, kt/Year | GDP per Capita | Share in GDP, % |

|---|---|---|---|---|---|---|---|---|

| North America | USA | 507 | 335.16 | 1.52 | 24,462 | 468 | 73.0 | 0.0046 |

| Canada | 27 | 40.2 | 0.67 | 2273 | 36 | 56.5 | 0.0038 | |

| Mexico | 18 | 129.04 | 0.14 | 2742 | 0 | 21.3 | - | |

| South America | Brazil | 27 | 203.06 | 0.13 | 3837 | 2 | 18.9 | 0.0002 |

| Colombia | 10 | 52.26 | 0.19 | 1052 | 11 | 20.1 | 0.0031 | |

| Argentina | 5 | 46.05 | 0.11 | 1225 | 0 | 26.6 | - | |

| Europe | France | 20 | 68.128 | 0.30 | 3769 | 25 | 55.3 | 0.0018 |

| United Kingdom | 12 | 67.026 | 0.18 | 3656 | 0 | 54.5 | - | |

| Germany | 4 | 84.358 | 0.05 | 5309 | 0 | 62.9 | - | |

| Poland | 5 | 37.726 | 0.12 | 1625 | 32 | 43.1 | 0.0054 | |

| Netherlands | 1 | 17.886 | 0.07 | 1231 | 63 | 68.8 | 0.0139 | |

| CIS | Russia | 10 | 146.424 | 0.07 | 5326 | 9 | 36.4 | 0.0005 |

| Kazakhstan | 6 | 19.854 | 0.30 | 604 | 6 | 30.4 | 0.0027 | |

| Uzbekistan | 1 | 36.197 | 0.03 | 339 | 1 | 9.4 | 0.0008 | |

| Asia–Pacific | Australia | 43 | 26.659 | 1.61 | 1626 | 39 | 61.0 | 0.0044 |

| New Zealand | 7 | 5.199 | 1.35 | 237 | 0 | 45.6 | - | |

| Republic of Korea | 1 | 51.439 | 0.02 | 2585 | 13 | 50.3 | 0.0008 | |

| Africa | Ghana | 7 | 30.832 | 0.23 | 196 | 0 | 6.4 | - |

| Gabon | 19 | 2.233 | 8.51 | 35 | 0 | 15.7 | - | |

| Guinea | 13 | 13.261 | 0.98 | 39 | 0 | 2.9 | - | |

| Mali | 5 | 23.293 | 0.21 | 51 | 0 | 2.2 | - |

| Indicator | UL91 | UL94 | 100LL | Total |

|---|---|---|---|---|

| Airplanes, pcs. | 8149 | 9533 | 19,511 | 19,511 |

| Helicopters, pcs. | 3383 | 3383 | 5688 | 5688 |

| Total, pcs. | 11,532 | 12,916 | 25,199 | 25,199 |

| Scope among airplanes % | 41.8 | 48.9 | 100.0 | 100.0 |

| Scope among helicopters % | 59.5 | 59.5 | 100.0 | 100.0 |

| Scope among all aircraft, % | 45.8 | 51.3 | 100.0 | 100.0 |

| Airplanes, pcs. | 8149 | 9533 | 19,511 | 19,511 |

| Property | Limit | TR TS 013/2011 | 100VLL ASTM D910 | UL91 ASTM D7547 | UL91 DEF STAN 91-090 | UL94 ASTM D7547 | UL102 ASTM D7719 | UL102 ASTM D7960 | 100M ASTM D8434 |

|---|---|---|---|---|---|---|---|---|---|

| Motor Octane Number | Min. | 91.0 | 99.6 | 91.0 | 91.0 | 94.0 | 102.2 | 102.5 | 99.6 |

| Rated Octane Number | - | - | - | 95.0 | - | - | - | - | |

| Performance number | Min. | 115 1 | 130 | - | - | - | - | - | 130 |

| Lead content, g Pb/L | Max. | - | 0.45 | 0.013 | 0.013 | 0.013 | 0.013 | 0.013 | 0.013 |

| Manganese content, g Mn/L | Min.–Max. | - | - | - | - | - | - | - | 0.05–0.1 |

| Density at 15 °C, kg/m3 | Min.–Max. | - | report | report | report | report | 790–825 | report | report |

| Distillation: | |||||||||

| Initial boiling point, °C | Min. | - | report | report | report | report | report | report | report |

| 10% is evaporated at temperature, °C | Max. | 82 | 75 | 75 | 75 | 75 | 75 | 75 | 75 |

| 40% is evaporated at temperature, °C | Min. | - | 75 | 75 | 75 | 75 | 75 | 75 | 75 |

| 50% is evaporated at temperature, °C | Max. | 105 | 105 | 105 | 105 | 105 | 165 | 105 | 105 |

| 90% is evaporated at temperature, °C | Max. | 170 | 135 | 135 | 135 | 135 | 165 | 135 | 135 |

| Final boiling point, °C | Max. | - | 170 | 170 | 170 | 170 | 180 | 210 | 170 |

| Sum of 10 and 50% evaporated, °C | Min. | - | 135 | 135 | 135 | 135 | 135 | 135 | 135 |

| Recovery, % vol. | Min. | - | 97 | 97 | 97 | 97 | 97 | 97 | 97 |

| Residue, % vol. | Max. | 1.5 | 1.5 | 1.5 | 1.5 | 1.5 | 1.5 | 1.5 | 1.5 |

| Loss, % vol. | Max. | 1.5 | 1.5 | 1.5 | 1.5 | 1.5 | 1.5 | 1.5 | 1.5 |

| Vapor pressure, kPa | Min.–Max. | 29.3–49.0 | 38.0–49.0 | 38.0–49.0 | 38.0–49.0 | 38.0–49.0 | 38.0–49.0 | 38.0–49.0 | 38.0–49.0 |

| Freezing point, °C | Max. | −60 | −58 | −58 | −58 | −58 | −58 | report | −58 |

| Sulfur content, % by mass | Max. | 0.03 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 |

| Net heat of combustion, kJ/kg | Min. | - | 43.5 | 43.5 | 43.5 | 43.5 | 41.5 | 42 | 43.5 |

| Corrosion of copper strip, 2 h at 100 °C | Max. | - | No. 1 | No. 1 | No. 1 | No. 1 | No 1 | No 1 | No 1 |

| Oxidation stability, potential gum mg/100 mL | Max | - | 6 | 6 | 6 | 6 | 6 | 6 | 6 |

| residue | Max | - | - | 3 | 2 | 3 | - | - | - |

| Total gum, mg/100 mL | Max. | 3 | - | - | - | - | - | 1 | - |

| Mechanical impurities and water content | Max | absence | - | absence | - | absence | - | - | - |

| Water reaction, volume change, mL | Max. | - | ±2 | ±2 | ±2 | ±2 | ±2 | ±2 | ±2 |

| Electrical conductivity, pSm/m 3 | Min.–Max. | - | 50–450 | 50–450 | 50–600 | 50–450 | 50–450 | 50–450 | 50–450 |

| Color | - | Green 2 | - | - | - | - | - | - | - |

| Content of aromatic hydrocarbons, % wt. | Min. | - | - | - | - | - | 70 | - | - |

| Benzene content, % wt. | Max. | - | - | - | - | - | 0.1 | - | - |

| Component | Concentration, % wt. |

|---|---|

| Alkylate | up to 70 |

| Isomerate and isopentane fraction | 10–20 |

| Toluene | 10–25 |

| Isooctane | up to 90 |

| TEL | up to 0.19 |

| Antioxidant, mg/kg, max. | 16 |

| Dye, mg/kg, max | 2.7 |

| Component | CRC [73] | CRC [73] | CRC [73] | D7960 [68] | D7960 [68] | D7719 [69] | D7719 [69] | WK69284 [70] | WK69284 [70] |

|---|---|---|---|---|---|---|---|---|---|

| Alkylate | - | - | - | - | - | - | - | 74.5 | 77.1 |

| Aviation Alkylate | - | 4.02 | - | 13.0 | 12.0 | - | - | - | - |

| Technical purity iso-octane | 42.51 | 39.98 | 46.98 | - | - | - | - | - | - |

| Toluene | 25.01 | 25.00 | 25.01 | 35.0 | 45.0 | - | - | 11.5 | 8.9 |

| ETBE | 29.98 | 29.79 | 24.99 | - | - | - | - | - | - |

| Iso-octane 99% | 26.0 | 12.0 | 33.0 | 13.0 | - | - | |||

| Isopentane | 20.0 | 21.0 | 10.0 | 10.0 | 9.6 | 12.9 | |||

| Butane | - | - | 2 | 2 | 4.4 | 1.1 | |||

| Isobutanol | - | 5.0 | - | - | - | - | |||

| Mesitylene | - | 55.0 | 75.0 | - | - | ||||

| Meta-toluidine | 2.50 | 1.03 | 3.02 | 6.0 | - | - | - | - | - |

| Aniline | 5.0 | - | - | - | - | ||||

| MMT (mg Mn/L) | 71.7 | 125 | |||||||

| Test results | |||||||||

| Motor Octane Number | 101.0 | 99.8 | 101.2 | 101.0 | 103.7 | 99.8 | 101.3 | 99.8 | 100.2 |

| Performance number | 131.2 | 146.1 | 152.5 | - | - | - | - | 133.3 | 131.5 |

| Density at 15 °C, kg/m3 | 765.1 | 760.2 | 764.0 | 766.0 | 779.0 | 773.1 | 815.4 | 708.1 | 702.6 |

| Fraction composition: Initial boiling point, °C | 81.0 | 79.5 | 82.5 | - | - | - | - | 36.0 | 37.0 |

| 10% is evaporated at temperature, °C | 89.5 | 88.5 | 90.0 | 63.3 | 65.5 | - | - | 68.0 | 68.5 |

| 40% is evaporated at temperature, °C | 93.5 | 93.0 | 94.5 | 101.6 | 101.4 | - | - | 95.0 | 95.5 |

| 50% is evaporated at temperature, °C | 95.0 | 94.5 | 96.5 | 103.9 | 104.0 | - | - | 97.0 | 98.0 |

| 90% is evaporated at temperature, °C | 112.5 | 109.5 | 113.5 | 120.4 | 115.5 | - | - | 98.5 | 103.0 |

| Final boiling point, °C | 191.5 | 178.0 | 189.5 | 196.9 | 179.0 | - | - | 116.5 | 138.0 |

| Sum of 10 and 50% evaporated, °C | 184.5 | 183.0 | 186.5 | 167.2 | 169.5 | - | - | 165.5 | 166.5 |

| Recovery, % vol. | 99.0 | 98.9 | 98.5 | - | - | - | - | 98.5 | 98.5 |

| Residue, % vol. | 0.9 | 1.0 | 0.8 | - | - | - | - | 0.7 | 0.9 |

| Loss, % vol. | 0.1 | 0.1 | 0.7 | - | - | - | - | 0.8 | 0.6 |

| Vapor pressure, kPa | 17.4 | 18.7 | 16.6 | 42.5 | 44.1 | - | - | 47.8 | 41.2 |

| Freezing point, °C | <−70 | −41 | −47 | −70 | −65.5 | - | - | <−70 | <−78 |

| Net heat of combustion, MJ/kg | 40.61 | 40.78 | 40.96 | 42.5 | 42.13 | 42.40 | 41.70 | 43.8 | 44.0 |

| Oxidation stability (5 h aging): | |||||||||

| potential gum, mg/100 cm3 | 2 | 3 | 4 | - | - | - | - | 2 | 2 |

| residue, mg/100 cm3 | <0.1 | 0.3 | <0.1 | - | - | - | - | 0.3 | 0 |

| Water reaction, volume change, cm3 | 0 | 0 | 0 | - | - | - | - | 0 | 0 |

| Component | UL102 ASTM D7960 | UL102 ASTM D7719 | UL100 ASTM WK69284 |

|---|---|---|---|

| Alkylate | 15–30 | 0–5 | 50–85 |

| Technical purity iso-octane | 15–30 | 0–15 | - |

| Isomerate C5–C6 | 15–30 | - | - |

| Isopentane fraction | 15–30 | 10–20 | 0–15 |

| Aromatic hydrocarbons | 35–55 | 58–88 | 0–20 |

| Butane | - | 0–2 | 0–5 |

| Aromatic amines | 2–10 | - | - |

| Oxygenates | 4–10 | - | - |

| MMT | - | - | up to 125 mg Mn/L |

| TOTAL | 100 | 100 | 100 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ershov, M.A.; Klimov, N.A.; Savelenko, V.D.; Makhova, U.A.; Burov, N.O.; Karpunin-Ozherovskiy, E.V.; Aleksanyan, D.R.; Donskaya, E.S.; Mukhina, D.Y.; Kapustin, V.M.; et al. An Overview of the Global Market, Fleet, and Components in the Field of Aviation Gasoline. Aerospace 2023, 10, 863. https://doi.org/10.3390/aerospace10100863

Ershov MA, Klimov NA, Savelenko VD, Makhova UA, Burov NO, Karpunin-Ozherovskiy EV, Aleksanyan DR, Donskaya ES, Mukhina DY, Kapustin VM, et al. An Overview of the Global Market, Fleet, and Components in the Field of Aviation Gasoline. Aerospace. 2023; 10(10):863. https://doi.org/10.3390/aerospace10100863

Chicago/Turabian StyleErshov, Mikhail A., Nikita A. Klimov, Vsevolod D. Savelenko, Ulyana A. Makhova, Nikita O. Burov, Egor V. Karpunin-Ozherovskiy, David R. Aleksanyan, Elena S. Donskaya, Daria Y. Mukhina, Vladimir M. Kapustin, and et al. 2023. "An Overview of the Global Market, Fleet, and Components in the Field of Aviation Gasoline" Aerospace 10, no. 10: 863. https://doi.org/10.3390/aerospace10100863

APA StyleErshov, M. A., Klimov, N. A., Savelenko, V. D., Makhova, U. A., Burov, N. O., Karpunin-Ozherovskiy, E. V., Aleksanyan, D. R., Donskaya, E. S., Mukhina, D. Y., Kapustin, V. M., Ovchinnikov, K. A., Podlesnova, E. V., & Kleymenov, A. V. (2023). An Overview of the Global Market, Fleet, and Components in the Field of Aviation Gasoline. Aerospace, 10(10), 863. https://doi.org/10.3390/aerospace10100863