1. Introduction

Energy demand and pricing are affected by climate change, and production is thereby impacted. A most sensitive sector is hydropower. Recently, the effect of climate change on hydrological regimes [

1,

2], and on the related production of hydroelectric energy, especially from high altitude water bodies and reservoirs, has been the subject of several studies [

3].

A most important issue is the change of the price and demand for electricity, the latter being visibly influenced by meteorological changes, as recently evidenced, e.g., by Gaudard [

4] under the umbrella of the project “Assessing Climate impacts on the Quantity and quality of Water”, AQWA [

5]. In fact, at the European level, hydropower is still one of the main renewable energy sources, accounting for ca. 15% of total capacity, i.e., about 141 GW [

6]. The average net energy produced by European hydroelectric plants is nearby 569 TWh yearly. At the country level, Russia is first in Europe, and fifth in the world rankings with 52 GW, second is Norway with 31 GW, and France follows with 25 GW. Italy, with an installed capacity of 22.5 GW of hydropower, is fourth in Europe, and 11th worldwide. In Italy hydroelectric plants, 3700 units, achieved a total production of 42.4 TWh, ca. 14% of the country’s production. Most such plants are small, and have marginal influence. In fact, in 2015, 77% of Italian hydropower was produced by plants with power >10 MW, covering merely 17% of the total [

7].

However, hydropower energy depends largely upon meteorological conditions and, therefore, productivity can have significant variations seasonally, and from year to year. Climate conditions influence (i) the hydrological cycle, (ii) the energy demand, and (iii) the electricity price, the latter two especially depending upon temperature. These three factors influence hydroelectric production because energy managers need to manage water storages, so as to cover periods of peaking electricity prices resulting from high energy demand, to reach the goal of maximum profit.

The average annual temperatures in Italy grew by +1.7 °C since the end of the 17th century, but the most relevant contribution to this increase was recorded in the latest 50 years, with an increase of about +1.4 °C [

8]. Additionally, in a study carried by ISPRA (Higher Institute for Environmental Protection and Research of Italy) [

9], based upon 140 meteorological stations, the average temperature decreased in Italy during 1961–1981, with a subsequent increase until 2008, for a net increase of ca. +1 °C.

Given the impact of climate upon the energy market as examined here, one needs to investigate the present and potential future effect of climate, and climate change, on energy systems. One can do so by applying models of the energy market explicitly depending upon weather variables.

Several models aimed at estimating the electricity prices were recently introduced in Europe in the wake of the liberalization of the energy market at the end of the 1990s. Such liberalization brought to the country-wise definition of the free market as indicated by Weron [

10]. In Italy the Legislative Decree 79/99, also called Decreto Bersani, allowed such liberalization.

As indicated, e.g., by Weron [

10], in the available literature there are various types of models for estimating electricity prices [

11], and some categories can be highlighted, however, arbitrarily, and prone to some overlapping.

A first category is given by multi-agent models. Agents are defined as entities able to reproduce the behaviour of (parts of) the system, pending specific tuning [

12]. Such models are flexible in studying the interactions between various components, but they require strong functional assumptions, possibly limiting the field of application. In parametric models, the progress of the system is described via some operators (e.g., black-box type), that accounts for different responses against different inputs, and need parameters’ tuning against data. Given the large number of parameters required for the depiction of complex systems, more compact models have been developed, such as the supply curve, described by Kanamura and Ohashi [

13], linking the energy demand to the energy price, with use of functions previously calibrated, e.g., on a daily basis.

These models may be strongly limited by the possibly very high number of samples necessary for tuning. In addition, they lack in considering the potential for stochastic (random) fluctuations in the energy systems, not foreseeable deterministically. To deal with such issues, stochastic models may be used. These models derive future electricity prices using a combination of previous (past) prices, by applying statistical methods, mostly based on regressive or self-regressive assumptions (AR, ARX, GARCH) [

14,

15,

16]. The accuracy of the forecast depends on the quality of the data available, and on the ability to incorporate the different factors affecting the process and the forecast.

Another important category is given by computational models [

17], able to consider the large non-linearity of the system, e.g., using neural networks. These methods normally achieve good results in the short-term, and their performance depends on the calibration data and periods. Hybrid, or mixed, models can be also developed. As an instance, the s-MTSIM model by RSE [

18] is made of two components (stochastic/heuristic), and it is derived from the existing deterministic Medium-Terms power system Simulator (MTSIM), originally developed by RSE SpA.

This latter model was applied, e.g., in the GridTech project, “Innovative grid-impacting technologies enabling a clean, efficient and secure electricity system in Europe”, which was supported by the Intelligent Energy Europe Programme (IEE). The main objective of GridTech was the performance of an assessment of new grid-impacting technologies (e.g., solar, wind, etc.), and their implementation into the European electricity system. This would allow a comparison of different technological options, towards the exploitation of the full potential of future electricity production from renewable energy sources (RES-E), with the lowest possible total energy system cost. The time window considered in the GridTech analyses was until 2050, with special consideration of the target years 2020, 2030 and 2050, each one under a scenario of energy demand and electricity price.

Another work of interest is the e-Highway2050 project [

19], launched from a European consortium supported by the EU Seventh Framework Programme (FP7), and devoted to develop a long-term planning methodology for the expansion and restructuring of European electricity transmission grids until 2050. The project consortium, involving some partners on the Italian side, is examining conditions and solutions for the planning of the European electricity grid until 2030, 2040 and 2050, based on energy demand forecasting for different scenarios.

An additional example is given by ClimateCost, a project with the objective to describe the impacts and the costs of climate change in the European energy system. The consortium therein elaborated the POLES model [

20], a market-oriented model that can define the equilibrium price for several energy sources, simulating the energy system behaviour.

Here, we propose a simplified hybrid method that can be applied in developing future projections of electricity price and energy demand according to future scenarios of climate change. The model, general in its nature, can be used henceforth for the benchmarking of adaptation measures for energy production, and most notably for hydropower [

21], under potentially variable climate in the future.

The manuscript is organized as follows: In the section “Case Study” we quickly describe the main features of the Italian energy system, of interest for our work. In the section “Methods” we depict the methodology, and in the “Data” section we describe the database used here. In the section “Results”, we demonstrate the accuracy of our method for the Italian energy market, and we display the projected evolution therein under climate change scenarios. In the section “Discussion”, we benchmark our results against findings from recent studies, and we discuss the application of our model for the specific aim of assessing hydropower production. We then draw some conclusions and outline possible future efforts.

2. Case Study

Our method will be applied to the Italian electricity system. Such a system is made of a network, where different activities are carried out by different subjects, within a free energy market environment.

Such activities cover production, transmission, and distribution of electricity, subject to various technical constraints (i.e., limitations in energy distribution, node-limited grid capacity). Non-compliance with such constraints, even when limited in time, can produce rapid system crises. The electric power fed into the network is not traceable, so that every local imbalance falls out upon the network through variations in voltage and frequency.

The main issues affecting proper supply are given by (i) the variability, poor elasticity and limited predictability of demand, (ii) the absence of storage capacity, and (iii) the dynamic change of the technical constraints, in response to real market adjustment.

Management of the electricity market is entrusted to the Gestore dei Mercati Energetici (Energy Markets Operator, herein GME), with the mission of promoting the development of a national competitive electricity system, according to the criteria of neutrality, transparency and objectivity. The electricity market is particularly sensitive to these criteria.

Competition in the electricity market is introduced via the action of Borsa Elettrica, an electricity stock market. It promotes the application of efficient equilibrium prices, allowing the sale and purchase of electricity according to the greater economic convenience. It is organised as a real physical market, with the definition of sales and purchases through hourly charts, according to the criterion of economic merit. This consists of considering, for sales, the prices in increasing order and, for purchases, the prices in decreasing order. Price definition takes place by all means as in a physical market, according to matching of supply and demand. Electricity offers are accepted in order of economic merit, i.e., in order of increasing price, until their sum in terms of kWh completely meets the demand.

The kWh price of the last accepted bidder, i.e., the one with the highest price, is attributed to all offers, and according to European Directive 2009/28, renewable energies, like hydropower, have priority in terms of access to the market.

In so doing, in each zone of the Italian territory with given technical constraints, the equilibrium prices are defined, i.e., those that are found at the intersection of the supply and demand curves. Subsequently, the Prezzo Unico Nazionale (PUN, National Single Price), which is the Italian electric energy market index, is established by GME. This represents the average selling price, weighed on total purchases, and it is a result of different auctions, in which GME covers the expected energy demand hour by hour, with offers by various operators. The auction accepts, first, the cheapest energy offers, and then the most expensive to cover the needs of that particular hour, and the price applied to all the operators is that of the most expensive source selected.

As a mere example, we could hypothesize to have a market made of three operators, each one producing 1 MWh of energy, each one with a different price, say of 10, 20 and 30 €/MWh, and a total energy demand of the market of 2 MWh. In this case, the chosen operators would be those pricing energy at 10 and 20 €/MWh, i.e., the most advantageous. The price at which the energy would be paid, i.e., PUN, is 20 €/MWh, that is, from the most expensive source selected.

In this work the PUN, which is defined for each hour of every day on the basis of the match between supply and demand, is also called the Electricity Price, given that a homogenous price distribution is met, in practice, in the whole Italian territory.

6. Discussion

6.1. Benchmark with Recent Literature

We could find some results in the available literature for benchmarking of our findings. In the Gridtech project reported above [

28], the authors defined scenarios of future electric system’s behaviour until 2050, introducing a number of hypothesis concerning use of renewables. We compared our scenarios of annual load (TWh), and price until 2050 against the findings of the Gridtech project, to assess the capability of our simple model to represent future energy demand as set out using a more complex scheme.

In the EU project Highway2050 (2018) [

19] the participants set out different scenarios (at 2050) for future schemes of the energy market, in terms of energy mix (solar, thermo, wind, nuclear, fossil, hydro) for production, also driving energy demand. Their five scenarios for energy demand could be used as a benchmark for our results.

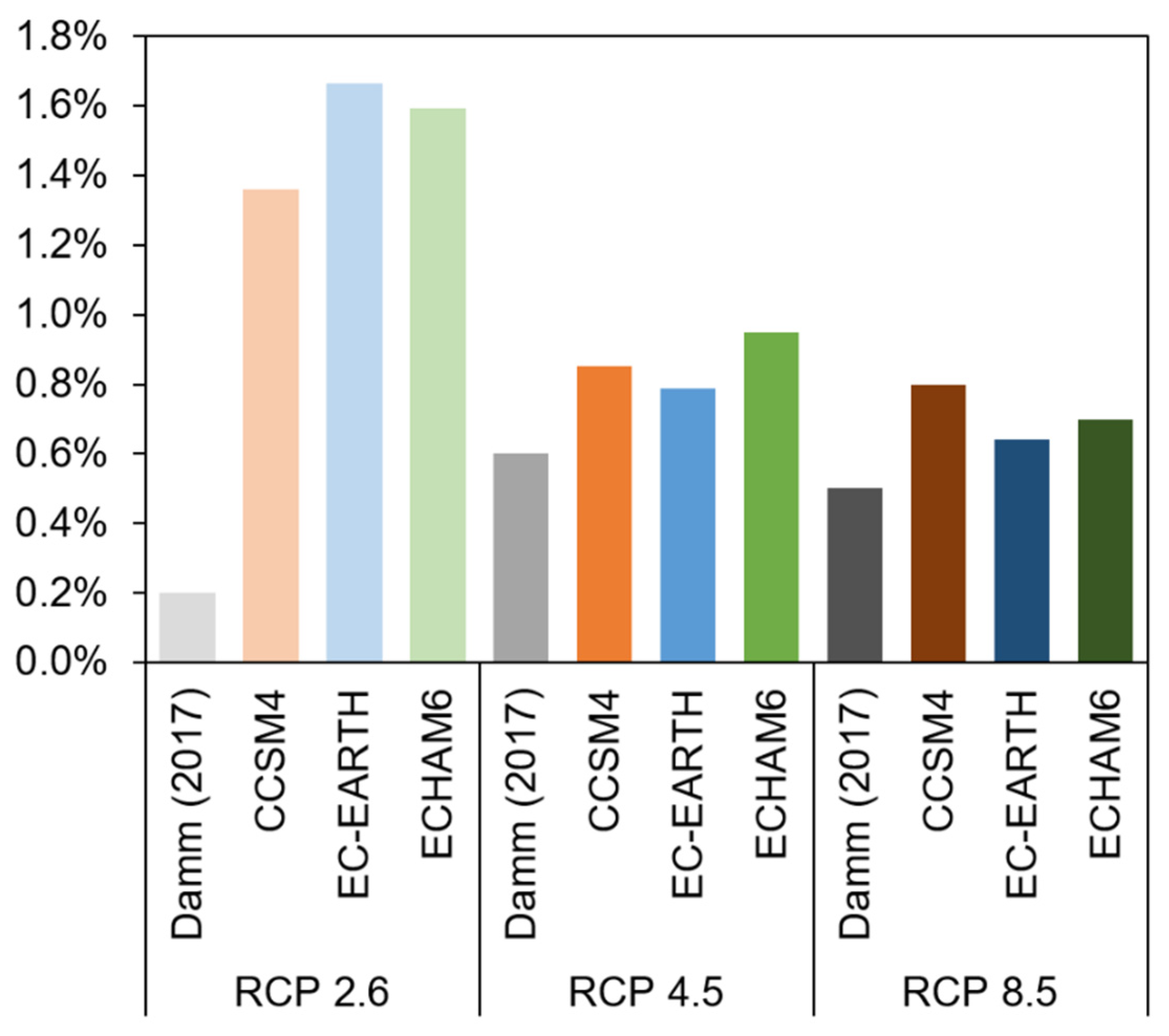

Damm et al. [

29] built a temperature-driven model, to account for the impact on energy demand, given by an increase of temperature fixed at +2 °C within time windows of 30 years, centred on variable years, as depending on different RCPs (2071–2100 for RCP2.6, 2036–2065 for RCP4.5, 2006–2055 for RCP8.5). They used temperature data from five regional climate models (RCMs) from CMIP5, and provided averaged results for each RCP.

We could use these results to benchmark our climate-driven variation of demand under the same RCPs and periods.

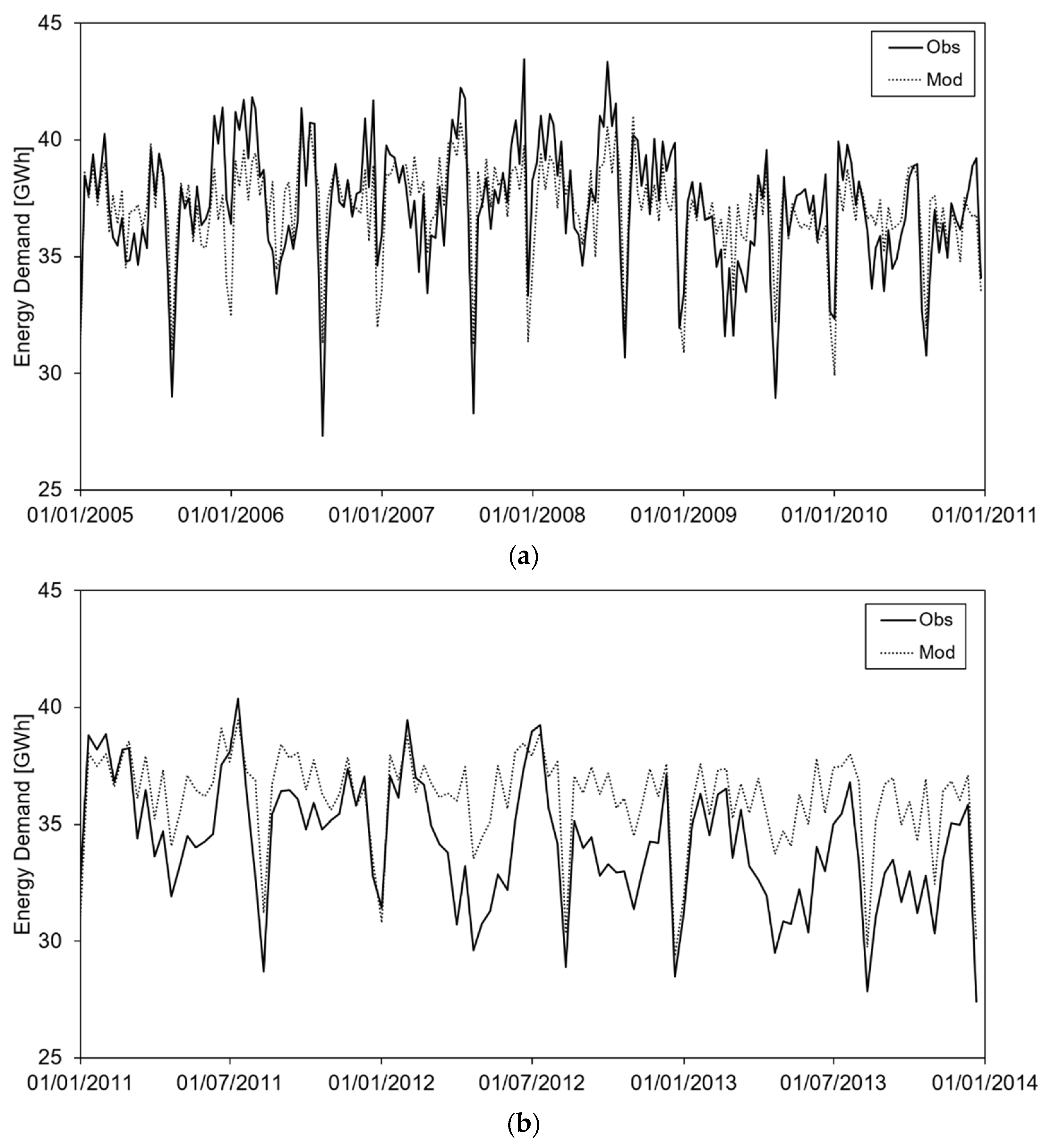

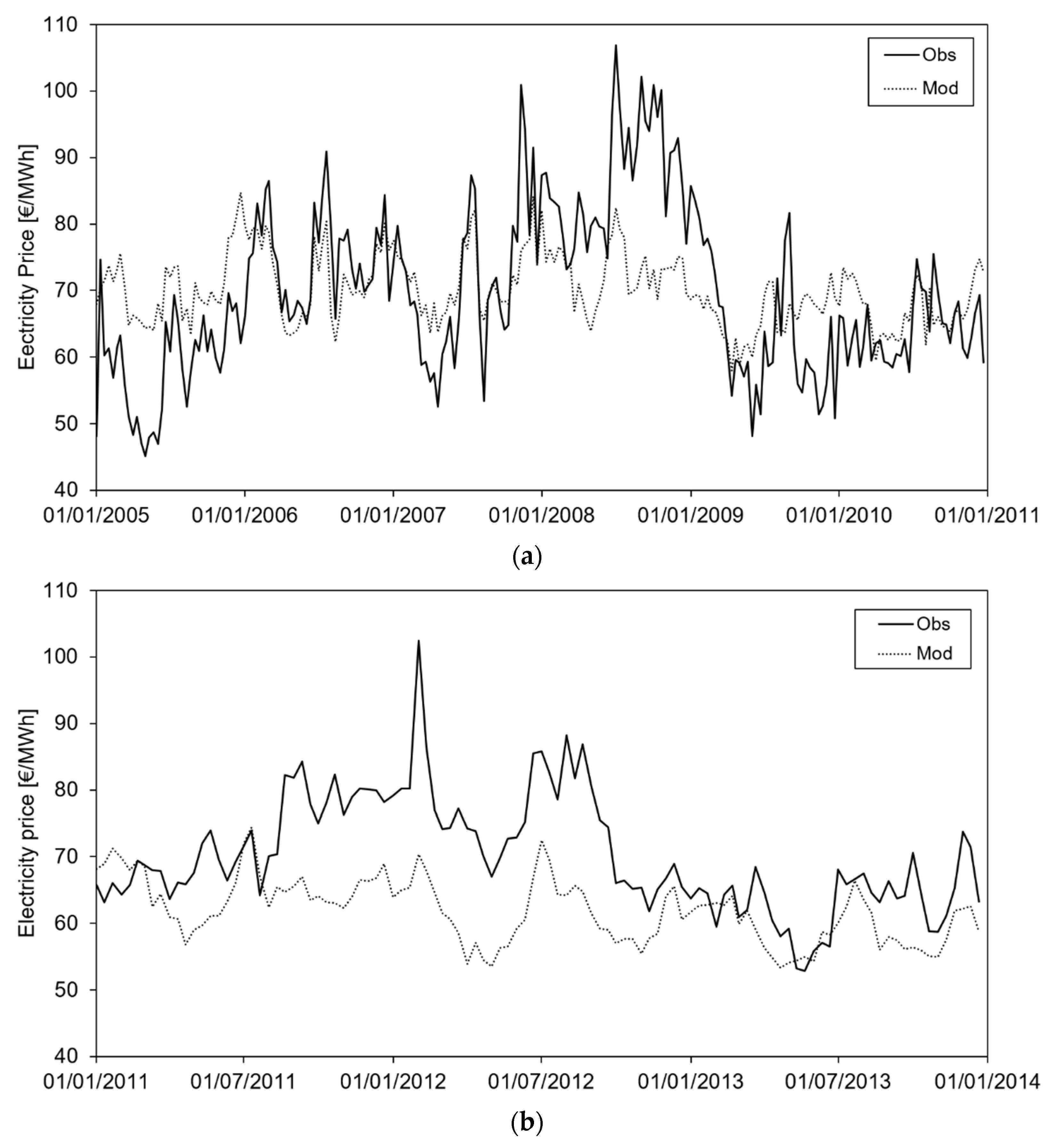

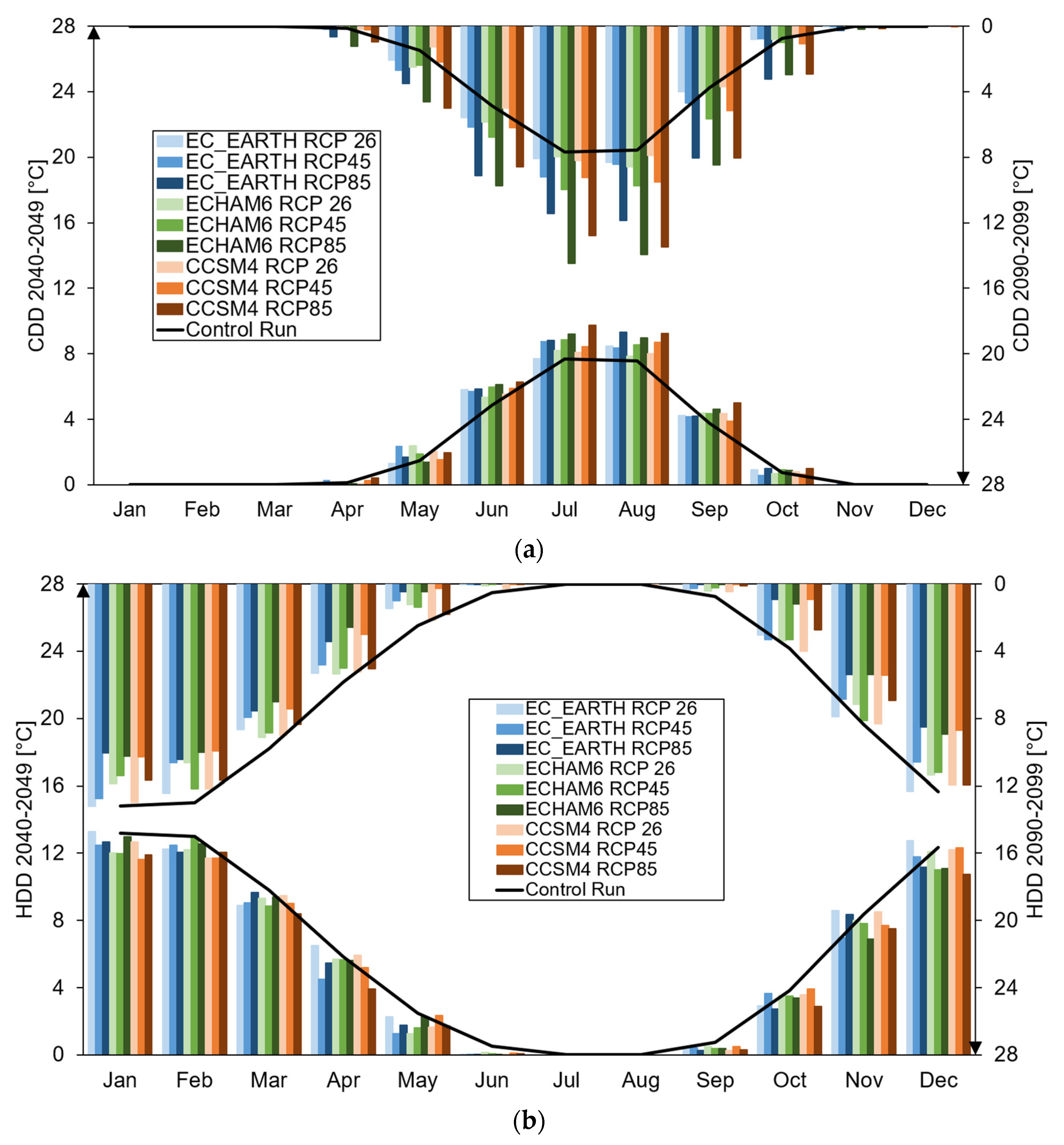

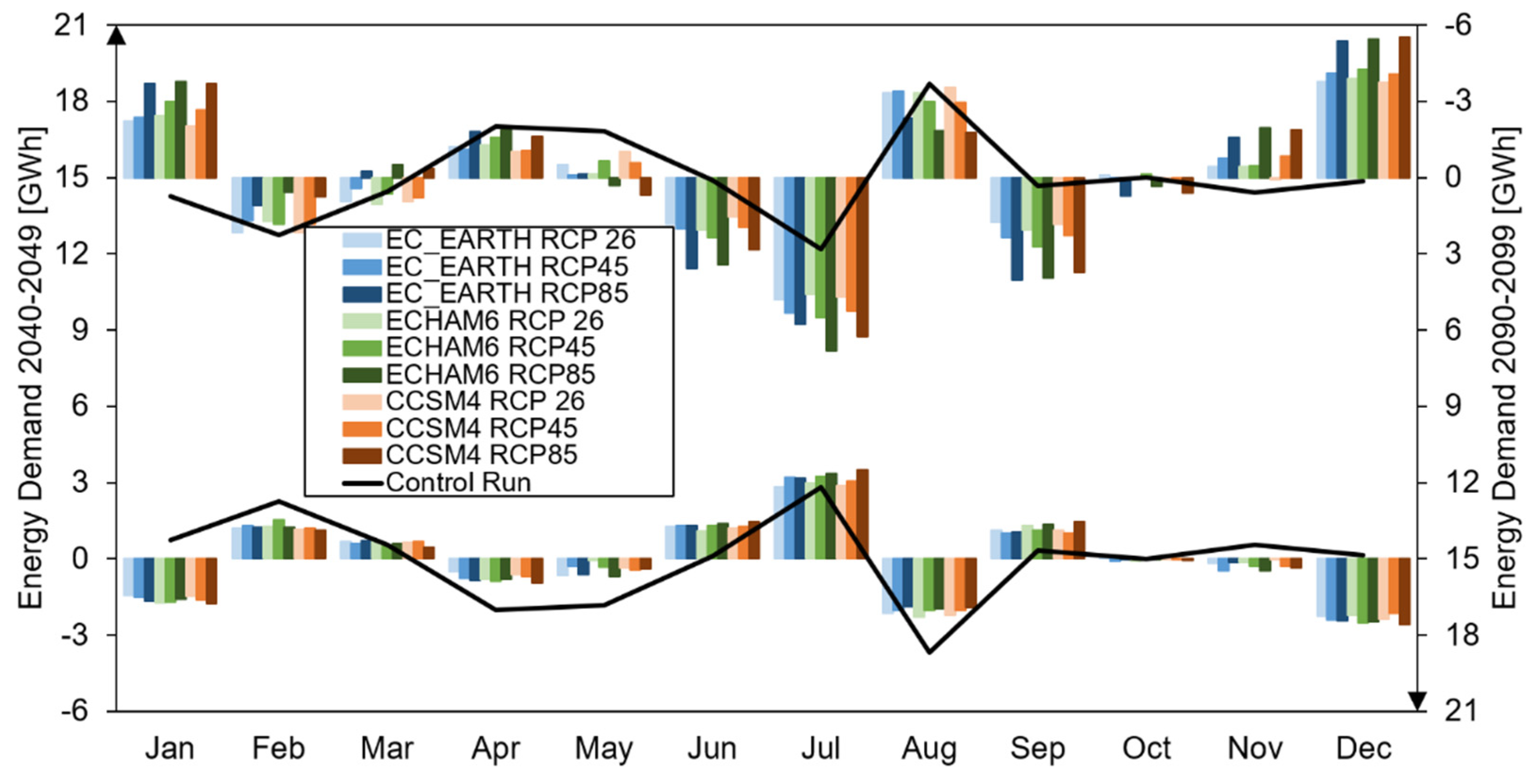

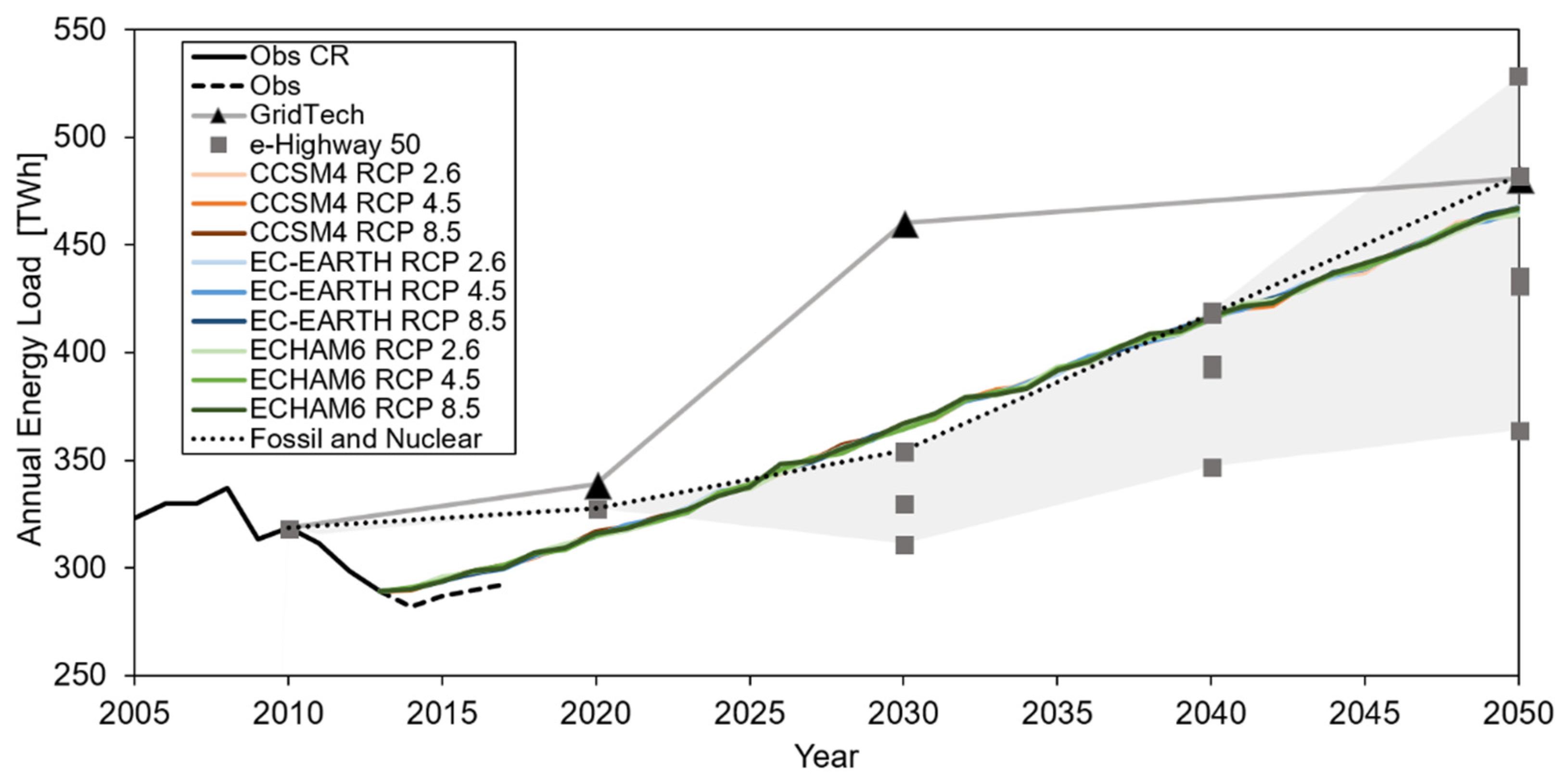

Figure 6 reports the annually observed load values in the CR period (2005–2013), plus the observed values during 2014–2017 (the latter years were not modelled in lack of meteorological data). Additionally, projected values until 2050 are reported for comparison, for the nine projected scenarios, somewhat overlapping, given the large contribution as given by the GDP term (that could not be extracted based on the available information from the two projects used for the benchmark).

Our model provides results that are somewhat consistent with those from the e-Highway2050 project until the half-century point (i.e., included within the boundaries of their five scenarios). The e-Highway2050 project and our model should have a largest correspondence in term of the scenario “Fossil and Nuclear”, highlighted in

Figure 6. This scenario, as indicated by the name, considers an energy production system that is somewhat similar to the current one where, at the European level, large use of non-renewable sources and nuclear energy is pursued. Our model provides +3.2% at 2030 against the Fossil and Nuclear scenario, −0.5% in 2040, and −3.2% in 2050.

Conversely, the GridTech project displays annual loads comparable with our values near year 2020 (+6.9% against our model), with a subsequent large increase, much higher than our model (and e-Highway2050). Then, at the half-century point, GridTech converges (+3%). The Gridtech project considered different projections for the GDP until the half-century. Visibly, they assumed a larger increase than we did until 2040. However, it is not fully clear from their report how they projected GDP in the future. We used projections from the OEDC, which should be dependable enough for the present exercise.

A comparison of our results against Damm et al. [

29] is given in

Figure 7. We report therein the annual variation of the climate driven component of energy demand for our different scenarios, for the same periods as set out by the authors therein. Our model visibly diverges from theirs under RCP2.6, whereas it provides basically consistent changes under RCP4.5 and RCP8.5.

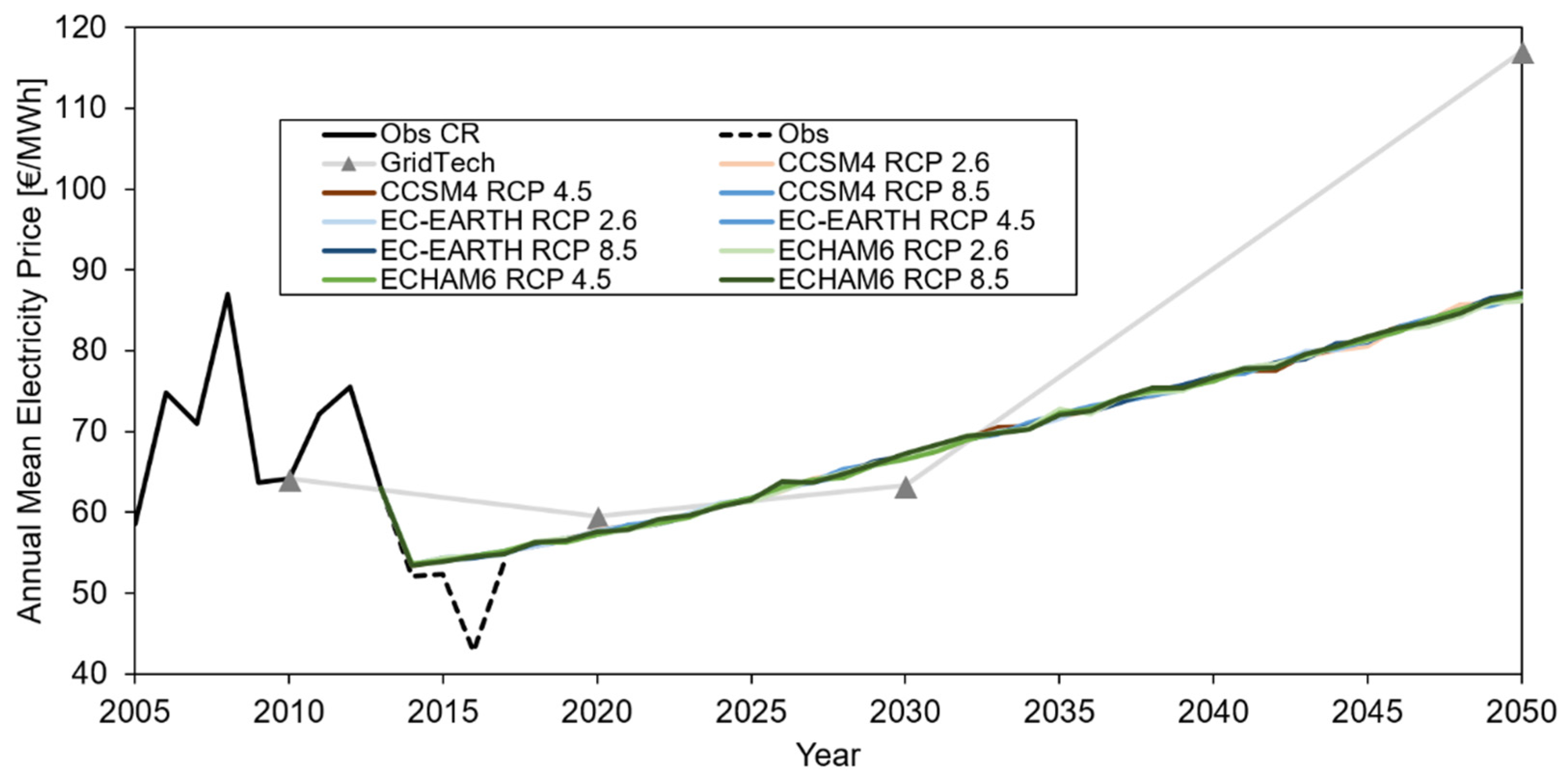

The electricity price model was benchmarked against the results of the GridTech project, the only one available for this purpose that we could find.

Figure 8 shows the annually averaged energy price in the CR period (2005–2013), plus observed values during 2014–2017 (again not modelled due to a lack of meteorological data). Additionally, projected values until 2050 are reported for comparison, for the nine projected scenarios, again somewhat overlapping, given the large contribution as given by the GDP term.

Comparing with the GridTech project, our model provides similar values at 2020, and 2030 (+3.3% in 2020, and −5.9% in 2030, our model against GridTech). In 2050 our model delivers a much lower price instead (−25.7%). In our understanding, this results from the underlying assumption of GridTech, that no changes in the energy system would occur at 2050. Such assumption produces an increasing price, in response to the inability of the system to adapt to an increase in energy demand. Our model instead is able to react to an increase in demand, by increasing energy production (Equation (4)), and thus decreasing the final energy price consistently. In this sense, our model is slightly more consistent with the real-world behaviour of energy systems, being normally able to adjust the selling prices to increased demand over the long-term.

6.2. Hydropower Price and Production Assessment

The outputs of our methodology, namely present and future projected energy demand, and price, in response to climate, can be used as external drivers to force simulations of energy production from specific sectors for the purpose of testing the dependability and profitability of the sector themselves, under future climate changes.

The hydropower sector in Italy is a most critical one, as reported, and the proposed methodology can help develop credible projections of hydropower production in the future, as constrained by climate and hydrological conditions, demand and the market.

Indeed, expected climate change will affect, on the one hand, water availability and, on the other hand, energy demand and price [

21] and, accordingly, one needs tools for proper hydropower regulation (i.e., reservoir management) under modified boundary conditions.

Among others, Ravazzani et al. [

3] assessed the impacts of climate change on hydropower production of the largely regulated Toce river basin in the Italian Alps. They used simulations from two regional climate models to force Toce hydrology, and subsequently used a model of the hydropower system (SOdA,

Simulatore ed Ottimizzatore di Aste idroelettriche, developed by the Company Enel Green Power-Energie Rinnovabili, of Italy), to define management rules under profit maximization constraints until 2050. They considered modified energy demand in response to temperature variations, but with a constant energy price in the future. Under such a hypothesis of constant energy prices, the changes of the hydrological regime expected during 2011–2050 would lead to significant changes in the reservoirs’ management policy, with anticipation of maximum storage, from August to July, and a drawdown of stored volume in August and September, to prepare for autumn inflows. At the half-century point, energy production would increase (+11%–+19%) in response to large precipitation increases until 2050 (+17%–+40%), with much uncertainty, however.

Gaudard et al. [

4] studied the effect of modified hydropower production in Valais, Switzerland, under reduced streamflows in response to climate change. They showed that adequate management may mitigate losses. However, they would consider constant boundary conditions of price and demand. Gaudard et al. [

30] further discussed potential changes of revenues of hydropower energy management throughout the century, highlighting large uncertainty in response to changes in prices.

Solaun et al. [

31] analysed the effect climate change will have on the revenues and operations of hydroelectric power plants in a long-term frame. They found, in the absence of adaptive measures, that a decrease in the productivity is to be expected for the power plants they considered. However, they applied a methodological decision system that they define “ceteris paribus approach”, i.e., they considered many parameters constant in time, in particular, energy price.

Aili et al. ([

32,

33]) recently studied the hydropower system of the Mallero River, in the Northern Italian Alps. They used the hydrological model

Poly-Hydro [

1], fed with IPCC climate projections under three models and three RCPs, as here, and the SOdA production model (same as [

3]), to project forward future streamflows, and subsequently evaluate future energy production. They foresaw a stream flow decrease at 2100 (from +1 to −25%, on average −7%), with the potential for increased flows during fall and winter, and a large decrease in summer, with subsequent decreased energy production at the half-century point (−2% similar for all scenarios), and end-of-century (−24%–+6%, −12% on average).

A preliminary investigation was pursued using our energy model here by Bombelli et al. [

21,

34]. They used

Poly-Hydro to model and project forward hydrological fluxes in the complex Alta Valtellina valley hydropower system, based on IPCC climate projections under three models and three RCPs, as here. They included our energy price model within a hydropower management tool

Poly-Power, able to mimic optimal hydropower management under given hydrological fluxes, and given demand/price conditions. They found that annual stream flows for hydropower production may decrease along the century (−21–+7%, on average −5% at the half-century; −17% to −2%, average −8%, at end-of-century). Energy production may be substantially constant under proper management (−9% to +15%, +3% on average) at the half-century, but at the end-of-century, under the warmest (and possibly most likely, see the Discussion in [

21]) scenario RCP 8.5, a decrease of energy production would be consistently projected (−4% on average).

Stucchi et al. [

35] coupled

Poly-Hydro and

Poly-Power to assess future energy production and revenues for the largely ice-fed Sabbione hydropower plant, at 2460 m asl in the Piemonte region of Italy. They projected largely modified future stream fluxes (−22% to −3%, −10% on average at the half-century, and −28% to −1%, average −13%, at the end-of-century), as due to reduced ice contribution, and uncertainly changing precipitation. Power production, driven by seasonal demand and water availability, would change (decrease) in the future (−27% to −8%, −15% on average at the half-century, and −32% to −5%, −16% on average at the end-of-century).

Accordingly, large uncertainty dwells into projections of scenarios of hydropower production throughout the 21st century, due to complex interaction between (i) the modified hydrological cycle in response to changing precipitation (with a large projected variability in positive/negative direction), temperature (ever increasing), and availability of ice melting in the glacierized areas (decreasing), (ii) energy demand (seasonally changing), and (iii) energy price (increasing on average, with large seasonal dependence), also under complex plants’ regulation.

The use of constant demand, and energy prices under future scenarios of water availability, may indeed reduce the credibility of future hydropower production scenarios.

Within such complex scenarios, the use of properly projected demand, and price conditions from our energy price models, may help in highlighting most realistic scenarios for reservoir management, and proper maximization until the end of the century.

The methodology proposed here is, therefore, likely to be useful, and will be exploited in the future to generate more dependable scenarios of hydropower production and, in general, of energy demand and price under expected climate change.

7. Conclusions

We introduced here a methodology to model the behaviour of energy demand and electricity price, and for projecting their trends under climate change, which we applied to the Italian electricity market. The method requires data of temperature, energy demand and electricity price in the region of interest, and can operate without a detailed knowledge of the internal system’s components. Its results are, however, comparable to other, more complex methods that take into account the main drivers of the energy system. The subsequent use of climate projections, e.g., from IPCC scenarios, as shown here, allows to build dependable projections under a what-if perspective.

Again, our projections reasonably match those from other more sophisticated methods. The method is general enough that it can be applied ideally to any energy system, provided proper data are available.

We developed the method with specific reference to application in the field of hydropower, most subject to climate change as reported [

21,

35], and we briefly reported examples of assessment of hydropower production under uncertain future climate change scenarios.

Present and prospective hydropower production depends upon an array of factors, including climate and hydrology, energy demand and price, and plants’ operation. Accordingly, proper assessment of modified energy demand/price, as displayed here, may improve the modelling chain for assessment of the hydropower potential, for management of present plants, and the design of future ones.

Notwithstanding the focus on hydropower here, our proposed approach can be virtually applied in several fields of energy production, whenever information of the present and future energy price, depending upon social and climate conditions, would be needed.

The method and results here, therefore, seem of great interest for policy-makers in the field of hydropower production (and energy, in general), for the study of future change in energy production demand, price and profitability.