A Relationship between Climate Finance and Climate Risk: Evidence from the South Asian Region

Abstract

1. Introduction

2. Literature Review

3. Methodology

3.1. Data Collection

3.2. Methods

4. Results and Analysis

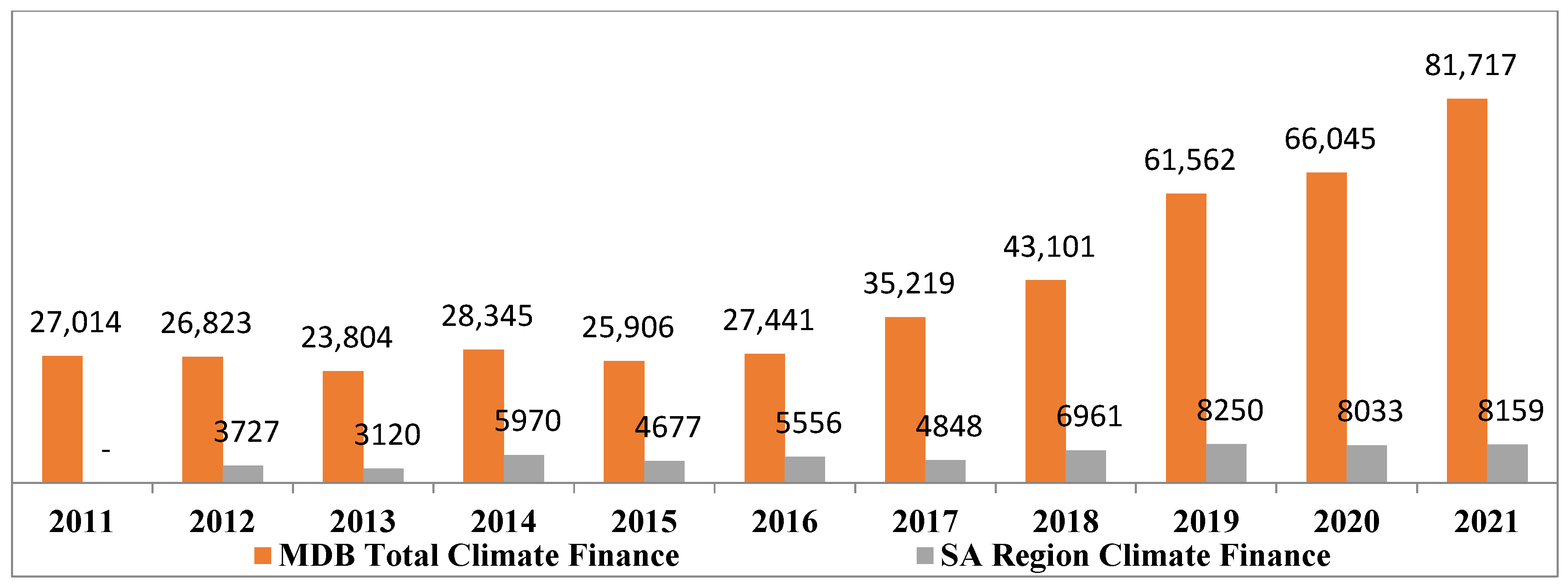

4.1. MDB Climate Finance (Amount in USD Million)

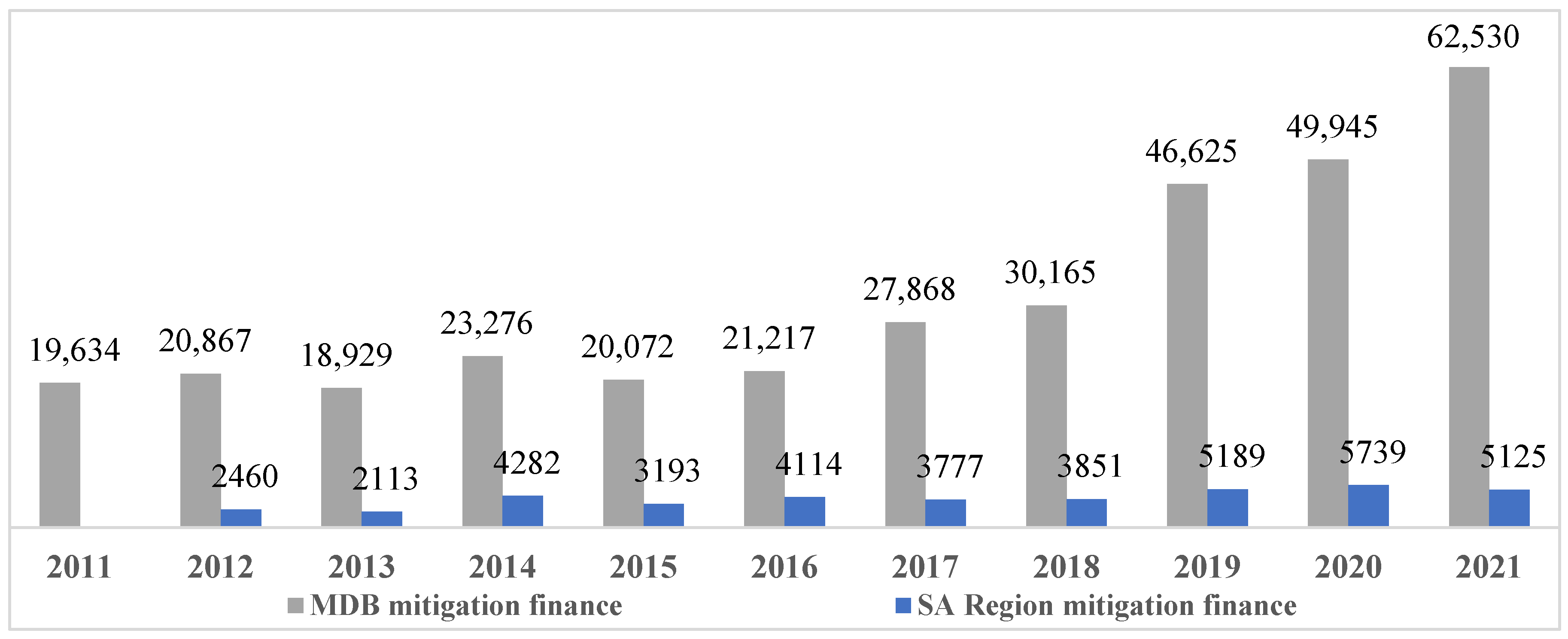

4.2. MDB Mitigation Finance (Amount in USD Million)

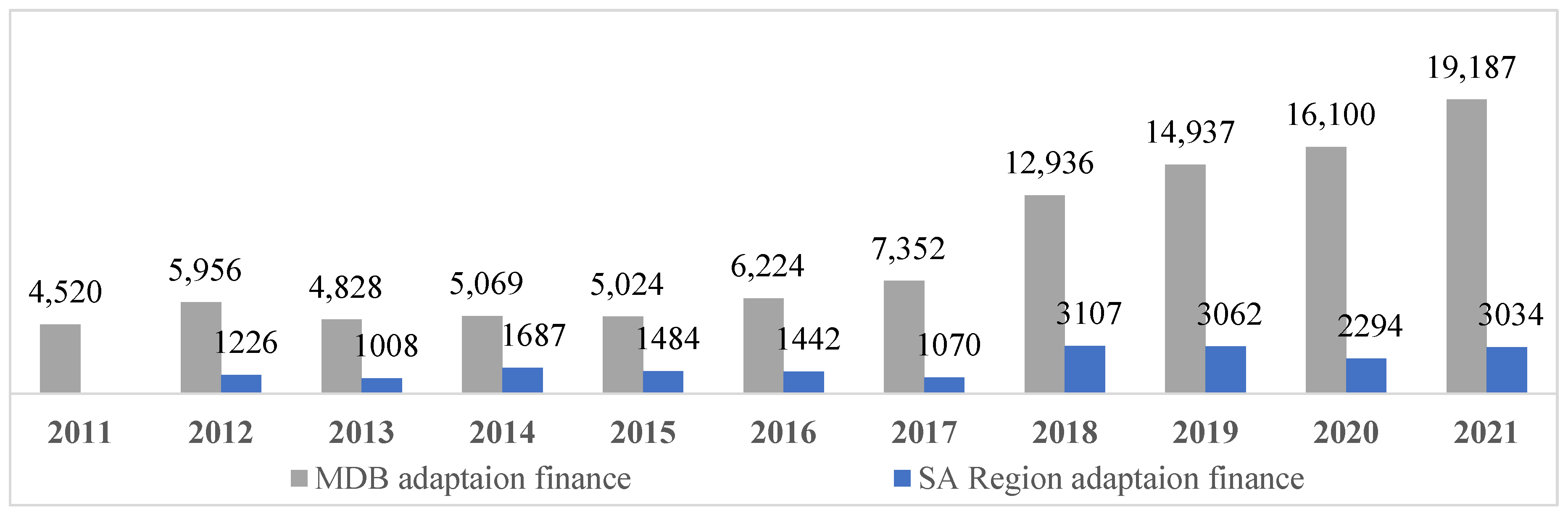

4.3. MDBs’ Adaptation Finance (Amount in USD Million)

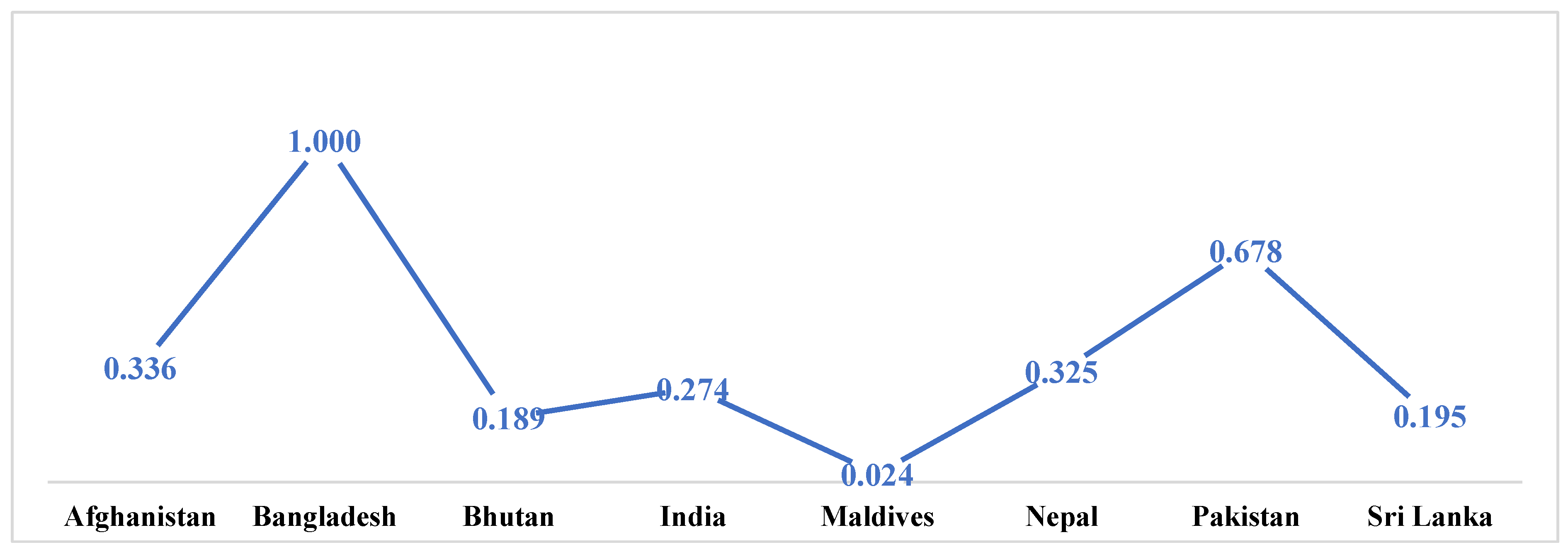

4.4. MDBs’ Country-Wise Climate Finance Rank in the SA Region

4.5. GCF Climate Finance to SA Region

4.6. Long-Term Climate Risk in the SA Region

4.7. GDP Losses Due to Climate Risk

4.8. Comparative Analysis of Climate finance, Climate Risk, and GDP Losses

4.9. GDP Growth and Carbon Emission in the SA Region

4.10. Statistical Analysis

5. Discussion and Conclusions

- Mutually exclusive and strong political leadership is required at the regional level for climate justice.

- It is crucial to share and exchange information among the eight countries to determine the possible common threats and how they can cooperate to solve them.

- Institutional efficiency, capacity building, technical efficiency, and resource mobilization are essential for the region’s countries to combat climate challenges.

- The regional cooperation forum SARRC needs to address climate risk vigorously.

- The region should establish a climate risk fund for all eight countries to access climate finance.

5.1. Theoretical Implications

5.2. Practical Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | Meaning | Source |

|---|---|---|

| CFin | Annual MDBs’ climate finance | Joint Report on Multilateral Development Banks’ Climate Finance. www.ebrd.com (accessed on 21 May 2023) |

| LTCRS | Long-term climate risk score of Germanwatch | https://www.germanwatch.org (accessed on 21 May 2023) |

| YCRS | Yearly climate risk score of Germanwatch | https://www.germanwatch.org (accessed on 21 May 2023) |

| LTGDPL | Long-term GDP losses according to climate risk index of Germanwatch | https://www.germanwatch.org (accessed on 21 May 2023) |

| YGDPL | Yearly GDP losses according to climate risk index of Germanwatch | https://www.germanwatch.org (accessed on 21 May 2023) |

| GDPG | Yearly GDP growth rate | https://data.worldbank.org/indicator (accessed on 21 May 2023) |

| CO2 | Annual CO2 emission of each country | http://www.globalcarbonatlas.org/en/CO2-emissions (accessed on 21 May 2023) |

References

- Diffenbaugh, N.S.; Burke, M. Global warming has increased global economic inequality. Proc. Natl. Acad. Sci. USA 2019, 116, 201816020. [Google Scholar] [CrossRef]

- Liu, R.; Wang, D.; Zhang, L.; Zhang, L. Can green financial development promote regional ecological efficiency? A case study of China. Nat. Hazards 2019, 95, 325–341. [Google Scholar] [CrossRef]

- Halimanjaya, A. Climate mitigation finance in leveraging private investments in Indonesia. J. Sustain. Finance Invest. 2017, 7, 335–359. [Google Scholar] [CrossRef]

- Tashmin, N. Can climate finance in Bangladesh be helpful in making transformational change in ecosystem management? Environ. Syst. Res. 2016, 5, 2. [Google Scholar] [CrossRef]

- Field, C.B.; Barros, V.; Stocker, T.F.; Dahe, Q. (Eds.) Intergovernmental Panel on Climate Change. In Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation; Cambridge University Press: Cambridge, UK, 2012. [Google Scholar]

- Burke, M.; Hsiang, S.M.; Miguel, E. Global non-linear effect of temperature on economic production. Nature 2015, 527, 235–239. [Google Scholar] [CrossRef]

- Duffy, P.B.; Field, C.B.; Diffenbaugh, N.S.; Doney, S.C.; Dutton, Z.; Goodman, S.; Heinzerling, L.; Hsiang, S.; Lobell, D.B.; Mickley, L.J.; et al. Strengthened scientific support for the Endangerment Finding for atmospheric greenhouse gases. Science 2019, 363, eaat5982. [Google Scholar] [CrossRef]

- Kulp, S.A.; Strauss, B.H. New elevation data triple estimates of global vulnerability to sea-level rise and coastal flooding. Nat. Commun. 2019, 10, 4844. [Google Scholar] [CrossRef]

- Bernstein, S.; Hoffmann, M. Climate politics, metaphors and the fractal carbon trap. Nat. Clim. Change 2019, 9, 919–925. [Google Scholar] [CrossRef]

- Lyster, R. Climate justice, adaptation and the Paris Agreement: A recipe for disasters? Environ. Politics 2017, 26, 438–458. [Google Scholar] [CrossRef]

- UNFCCC. 2015. Available online: http://www4.unfccc.int/ndcregistry/PublishedDocuments/Bangladesh%20First/INDC_2015_of_Bangladesh.pdf/ (accessed on 25 October 2017).

- Masud, M.; Hossain, M.; Kim, J. Is Green Regulation Effective or a Failure: Comparative Analysis between Bangladesh Bank (BB) Green Guidelines and Global Reporting Initiative Guidelines. Sustainability 2018, 10, 1267. [Google Scholar] [CrossRef]

- Masud, M.A.; Nurunnabi, M.; Bae, S.M. The effects of corporate governance on environmental sustainability reporting: Empirical evidence from South Asian countries. Asian J. Sustain. Soc. Responsib. 2018, 3, 3. [Google Scholar] [CrossRef]

- Zafarullah, H.; Huque, A.S. Climate change, regulatory policies and regional cooperation in South Asia. Public Adm. Policy Asia Pac. J. 2018, 21, 22–35. [Google Scholar] [CrossRef]

- Masud, M.; Bae, S.; Kim, J. Analysis of Environmental Accounting and Reporting Practices of Listed Banking Companies in Bangladesh. Sustainability 2017, 9, 1717. [Google Scholar] [CrossRef]

- Economist Intelligence. 2022. Available online: https://www.eiu.com/n/campaigns/global-liveability-index-2021/ (accessed on 14 April 2022).

- Air Quality Index. Air Quality in Bangladesh. 2022. Available online: https://www.iqair.com/bangladesh (accessed on 14 April 2022).

- The Daily Star. 2023. Available online: https://www.thedailystar.net/environment/weather/news/dhaka-temperature-breaks-another-record-3298201 (accessed on 12 May 2023).

- Foreign Policy. 2023. Available online: https://foreignpolicy.com/2021/08/12/south-asia-climate-ipcc-report-front-lines/ (accessed on 12 May 2023).

- UNICEF. The Climate Crisis is a Child Rights Crisis: Introducing the Children’s Climate Risk Index. 2021. Available online: https://www.unicef.org/reports/climate-crisis-child-rights-crisis (accessed on 12 May 2023).

- Eckstein, D.; Künzel, V.; Schäfer, L.; Winges, M. Global Climate Risk Index 2021; Germanwatch e.V.: Bonn, Germany, 2021. [Google Scholar]

- Diaz-Rainey, I.; Robertson, B.; Wilson, C. Stranded research? Leading finance journals are silent on climate change. Clim. Change 2017, 143, 243–260. [Google Scholar] [CrossRef]

- Dörry, S.; Schulz, C. Green financing, interrupted. Potential directions for sustainable finance in Luxembourg. Local Environ. 2018, 23, 717–733. [Google Scholar] [CrossRef]

- Pickering, J.; Mitchell, P. Erratum to: What drives national support for multilateral climate finance? International and domestic influences on Australia’s shifting stance. Int. Environ. Agreem. Politics Law Econ. 2017, 17, 127. [Google Scholar] [CrossRef]

- Jin, I.; Kim, Y. Analysis of the impact of achieving NDC on public climate finance. J. Sustain. Finance Invest. 2017, 7, 309–334. [Google Scholar] [CrossRef]

- Steffen, B.; Schmidt, T.S. A quantitative analysis of 10 multilateral development banks’ investment in conventional and renewable power-generation technologies from 2006 to 2015. Nat. Energy 2019, 4, 75–82. [Google Scholar] [CrossRef]

- Doku, I. Are Developing Countries Using Climate Funds for Poverty Alleviation? Evidence from Sub-Saharan Africa. Eur. J. Dev. Res. 2022, 34, 3026–3049. [Google Scholar] [CrossRef]

- Doku, I.; Ncwadi, R.; Phiri, A. Determinants of climate finance: Analysis of recipient characteristics in Sub-Sahara Africa. Cogent Econ. Finance 2021, 9, 1964212. [Google Scholar] [CrossRef]

- Bae, S.M.; Masud, M.A.K.; Rashind, M.H.U.; Kim, J.D. Determinants of climate financing and the moderating effect of politics: Evidence from Bangladesh. Sustain. Account. Manag. Policy J. 2021, 13, 247–272. [Google Scholar] [CrossRef]

- Delina, L. Correction to: Multilateral development banking in a fragmented climate finance system: Shifting priorities in energy finance at the Asian Development Bank. Int. Environ. Agreem. Politics Law Econ. 2018, 18, 467. [Google Scholar] [CrossRef]

- Green Climate Fund. 2021. Available online: https://greenclimate.fund (accessed on 10 June 2021).

- Huang, H.H.; Kerstein, J.; Wang, C. The impact of climate risk on firm performance and financing choices: An international comparison. J. Int. Bus. Stud. 2018, 49, 633–656. [Google Scholar] [CrossRef]

- Harmeling, S. Global Climate Risk Index 2011; Germanwatch e.V.: Bonn, Germany, 2011. [Google Scholar]

- Harmeling, S. Global Climate Risk Index 2012; Germanwatch e.V.: Bonn, Germany, 2012. [Google Scholar]

- Harmeling, S.; Eckstein, D. Global Climate Risk Index 2013; Germanwatch e.V.: Bonn, Germany, 2013. [Google Scholar]

- Kreft, S.; Eckstein, D. Global Climate Risk Index 2014; Germanwatch e.V.: Bonn, Germany, 2014. [Google Scholar]

- Kreft, S.; Eckstein, D.; Junghans, L.; Kerestan, C.; Hagen, U. Global Climate Risk Index 2015; Germanwatch e.V.: Bonn, Germany; p. 2015.

- Kreft, S.; Eckstein, D.; Dorsch, L.; Fischer, L. Global Climate Risk Index 2016; Germanwatch e.V.: Bonn, Germany, 2016. [Google Scholar]

- Kreft, S.; Eckstein, D.; Melchior, I. Global Climate Risk Index 2017; Germanwatch e.V.: Bonn, Germany, 2017. [Google Scholar]

- Eckstein, D.; Hutfils, M.; Winges, M. Global Climate Risk Index 2019; Germanwatch e.V.: Bonn, Germany, 2019. [Google Scholar]

- Eckstein, D.; Künzel, V.; Schäfer, L.; Winges, M. Global Climate Risk Index 2020; Germanwatch e.V.: Bonn, Germany, 2020. [Google Scholar]

- Dillard, J.F.; Rigsby, J.T.; Goodman, C. The making and remaking of organization context: Duality and the institutionalization process. Account. Audit. Account. J. 2004, 17, 506–542. [Google Scholar] [CrossRef]

- Comyns, B. Determinants of GHG Reporting: An Analysis of Global Oil and Gas Companies. J. Bus. Ethics 2016, 136, 349–369. [Google Scholar] [CrossRef]

- Yang, D.; Wang, A.X.; Zhou, K.Z.; Jiang, W. Environmental Strategy, Institutional Force, and Innovation Capability: A Managerial Cognition Perspective. J. Bus. Ethics 2019, 159, 1147–1161. [Google Scholar] [CrossRef]

- Scott, W.R. Institutions and Organizations; Sage: Thousand Oaks, CA, USA, 1995. [Google Scholar]

- Baldini, M.; Maso, L.D.; Liberatore, G.; Mazzi, F.; Terzani, S. Role of Country- and Firm-Level Determinants in Environmental, Social, and Governance Disclosure. J. Bus. Ethics 2018, 150, 79–98. [Google Scholar] [CrossRef]

- Rahman, S.; Khan, T.; Siriwardhane, P. Sustainable development carbon pricing initiative and voluntary environmental disclosures quality. Bus. Strat. Environ. 2019, 28, 1072–1082. [Google Scholar] [CrossRef]

- Meyer, J.W.; Rowan, B. Institutionalized organizations: Formal structure as myth and ceremony. Am. J. Sociol. 1977, 83, 340. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. What drives corporate social performance? The role of national-level institutions. J. Int. Bus. Stud. 2012, 43, 834–864. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. The impact of corporate social responsibility on investment recommendations: Analysts’ perceptions and shifting institutional logics. Strateg. Manag. J. 2015, 36, 1053–1081. [Google Scholar] [CrossRef]

- Atteridge, A.; Canales, N. Climate Finance in the Pacific: An Overview of Flows to the Region’s Small Island Developing States, Working Paper 2017-04; Stockholm Environmental Institute: Stockholm, Sweden, 2017. [Google Scholar]

- Carrozza, I. Climate Finance in the Asia-Pacific: Trends and Innovative Approaches: MPDD Working Paper WP/15/08. 2015. Available online: www.unescap.org/our-work/macroeconomic-policydevelopment/financing-development (accessed on 25 April 2020).

- Multilateral Development Banks. Joint Report on Multilateral Development Banks (2011–2021); Multilateral Development Banks: London, UK, 2021. [Google Scholar]

- Zou, S.; Ockenden, S. What Enables Effective International Climate Finance in the Context of Development Co-Operation? OECD Working Paper No. 28; OECD: Paris, France, 2016. [Google Scholar]

- World Bank. 2022. Available online: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG (accessed on 18 December 2022).

- Global Carbon Atlas. 2022. Available online: http://www.globalcarbonatlas.org/en/CO2-emissions (accessed on 18 December 2022).

- Aye, G.C.; Edoja, P.E. Effect of economic growth on CO2 emission in developing countries: Evidence from a dynamic panel threshold model. Cogent Econ. Finance 2017, 5, 1379239. [Google Scholar] [CrossRef]

- Azam, M.; Khan, A.Q.; Abdullah, H.B.i.n.; Qureshi, M.E. The impact of CO2 emissions on economic growth: Evidence from selected higher CO2 emissions economies. Environ. Sci. Pollut. Res. 2016, 23, 6376–6389. [Google Scholar] [CrossRef]

- Mikayilov, J.I.; Galeotti, M.; Hasanov, F.J. The impact of economic growth on CO2 emissions in Azerbaijan. J. Clean. Prod. 2018, 197, 1558–1572. [Google Scholar] [CrossRef]

- Skovgaard, J. Limiting costs or correcting market failures? Finance ministries and frame alignment in UN climate finance negotiations. Int. Environ. Agreem. Politics Law Econ. 2017, 17, 89–106. [Google Scholar] [CrossRef]

| Year | Most Affected Countries Yearly (Among the Top Ten) | Most Long-Term Affected Countries (20 Years; Among the Top Ten) |

|---|---|---|

| 2011 | Bangladesh; Bhutan; Nepal | Bangladesh |

| 2012 | Pakistan | Bangladesh; Pakistan |

| 2013 | Pakistan; Sri Lanka | Bangladesh; Pakistan |

| 2014 | Pakistan | Bangladesh |

| 2015 | India; Pakistan | Bangladesh; Pakistan |

| 2016 | Afghanistan; Pakistan; Nepal; India | Bangladesh; Pakistan |

| 2017 | India | Bangladesh; Pakistan |

| 2018 | Sri Lanka; India | Bangladesh; Pakistan |

| 2019 | Sri Lanka; Nepal; Bangladesh | Bangladesh; Pakistan |

| 2020 | India; Sri Lanka | Pakistan; Bangladesh; Nepal |

| 2021 | Afghanistan; India | Pakistan; Bangladesh; Nepal |

| Country | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | CF | (%) | Rank |

|---|---|---|---|---|---|---|---|---|---|---|

| Afghanistan | 0 | 173 | 147 | 144 | 281 | 65 | 485 | 1295 | 2.86 | 6 |

| Bangladesh | 899 | 1315 | 200 | 1296 | 2144 | 1127 | 732 | 7713 | 17.01 | 3 |

| Bhutan | 2 | 17 | 7 | 4 | 2 | 20 | 24 | 76 | 0.17 | 8 |

| India | 1948 | 3017 | 2678 | 3703 | 3671 | 3549 | 3735 | 22,301 | 49.18 | 1 |

| Maldives | 5 | 35 | 19 | 2 | 2 | 148 | 83 | 294 | 0.65 | 7 |

| Nepal | 567 | 111 | 204 | 435 | 252 | 1022 | 280 | 2871 | 6.33 | 4 |

| Pakistan | 1161 | 673 | 1018 | 1305 | 1294 | 944 | 2704 | 9099 | 20.07 | 2 |

| Sri Lanka | 84 | 212 | 574 | 72 | 604 | 192 | 87 | 1825 | 4.02 | 5 |

| Total CF | 4666 | 5553 | 4847 | 6961 | 8121 | 7067 | 8130 | 45,345 |

| Country | Projects Approved | GCF Finance | Total GCF Finance | (%) | Rank | ||||

|---|---|---|---|---|---|---|---|---|---|

| Mitig. | Adapt. | Cross-Cut | Mitig. | Adapt. | Cross-Cut | ||||

| Afghanistan | 1 | 0 | 0 | 17.2 | 0 | 0 | 17.2 | 1.7 | 8 |

| Bangladesh | 1 | 3 | 1 | 256 | 74.7 | 20 | 350.7 | 34.4 | 1 |

| Bhutan | 0 | 1 | 1 | 0 | 25.3 | 26.6 | 51.9 | 5.1 | 6 |

| India | 2 | 1 | 1 | 232.5 | 34.4 | 43.4 | 310.3 | 30.4 | 2 |

| Maldives | 0 | 1 | 0 | 0 | 23.6 | 0 | 23.6 | 2.3 | 7 |

| Nepal | 0 | 0 | 2 | 0 | 0 | 66.7 | 66.7 | 5.4 | 5 |

| Pakistan | 1 | 2 | 0 | 49 | 72 | 0 | 121 | 11.9 | 3 |

| Sri Lanka | 0 | 2 | 0 | 0 | 77.9 | 0 | 77.9 | 7.6 | 4 |

| Total | 20 (173) | 554.7 | 307.9 | 157 | 1019.3 | 100 | |||

| Country | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | Avg. LT CR Score | Rank |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Afghanistan | 37 | 38 | 38 | 37 | 35 | 36 | 44 | 44 | 42 | 38 | 39 | 4 |

| Bangladesh | 8 | 21 | 20 | 21 | 23 | 25 | 27 | 27 | 30 | 28 | 23 | 1 |

| Bhutan | 82 | 85 | 84 | 81 | 39 | 98 | 96 | 98 | 97 | 95 | 86 | 7 |

| India | 38 | 41 | 39 | 40 | 97 | 38 | 37 | 37 | 39 | 39 | 44 | 5 |

| Maldives | 138 | 171 | 174 | 167 | 176 | * | 169 | 169 | 169 | 167 | 167 | 8 |

| Nepal | 37 | 36 | 35 | 40 | 41 | 44 | 46 | 34 | 32 | 31 | 38 | 3 |

| Pakistan | 31 | 31 | 32 | 32 | 31 | 31 | 31 | 30 | 29 | 29 | 30 | 2 |

| Sri Lanka | 80 | 72 | 65 | 64 | 63 | 64 | 59 | 48 | 40 | 40 | 59 | 6 |

| Rank | Climate Finance (2015–2021) | LT Climate Risk (2012–2021) | GDP Losses (2012–2021) |

|---|---|---|---|

| 1 | India | Bangladesh | Bangladesh |

| 2 | Pakistan | Pakistan | Pakistan |

| 3 | Bangladesh | Nepal | Afghanistan |

| 4 | Nepal | Afghanistan | Nepal |

| 5 | Sri Lanka | India | India |

| 6 | Afghanistan | Sri Lanka | Sri Lanka |

| 7 | Maldives | Bhutan | Bhutan |

| 8 | Bhutan | Maldives | Maldives |

| GDP Growth (%) | Afghanistan | Bangladesh | Bhutan | India | Maldives | Nepal | Pakistan | Sri Lanka |

|---|---|---|---|---|---|---|---|---|

| 2015 | 1.45 | 6.55 | 6.64 | 8 | 2.89 | 3.32 | 4.73 | 5.01 |

| 2016 | 2.26 | 7.11 | 8.13 | 8.26 | 6.34 | 0.59 | 5.53 | 4.49 |

| 2017 | 2.65 | 7.28 | 4.65 | 7.04 | 7.21 | 8.22 | 5.55 | 3.58 |

| 2018 | 1.19 | 7.86 | 3.06 | 6.12 | 8.13 | 6.7 | 5.84 | 3.31 |

| 2019 | 3.91 | 8.15 | 5.47 | 4.18 | 6.99 | 6.99 | 0.99 | 2.28 |

| 2020 | −2.4 | 3.4 | −10.1 | −6.6 | −33.5 | −2.4 | −1.6 | −3.6 |

| 2021 | NA | 6.9 | NA | 8.9 | 31 | 4.2 | 6 | 3.7 |

| Avg. | 1.51 | 6.75 | 2.98 | 5.13 | 4.15 | 3.95 | 3.86 | 2.68 |

| Rank | 8 | 1 | 6 | 2 | 3 | 4 | 5 | 7 |

| CO2 (Mt) | Afghanistan | Bangladesh | Bhutan | India | Maldives | Nepal | Pakistan | Sri Lanka |

|---|---|---|---|---|---|---|---|---|

| 2015 | 10 | 73 | 1 | 2271 | 1 | 7 | 167 | 20 |

| 2016 | 9 | 76 | 1 | 2384 | 1 | 10 | 196 | 23 |

| 2017 | 10 | 81 | 1 | 2435 | 2 | 12 | 217 | 23 |

| 2018 | 11 | 82 | 1 | 2600 | 2 | 15 | 205 | 21 |

| 2019 | 11 | 92 | 1 | 2626 | 2 | 13 | 206 | 22 |

| 2020 | 12 | 91 | 1 | 2445 | 2 | 14 | 210 | 22 |

| 2021 | 12 | 93 | 2 | 2710 | 2 | 14 | 230 | 21 |

| Avg. | 11 | 84 | 1 | 2496 | 2 | 12 | 204 | 22 |

| Rank | 6 | 3 | 8 | 1 | 7 | 5 | 2 | 4 |

| Variables (Appendix A) | CFin | LTCRS | YCRS | LTGDPL | YGDPL | GDPG | CO2 |

|---|---|---|---|---|---|---|---|

| CFin | 1 | −0.743 ** | −0.674 ** | 0.630 ** | 0.659 ** | 0.032 | 0.869 ** |

| LTCRS | 1 | 0.539 ** | −0.882 ** | −0.633 ** | 0.046 | −0.560 ** | |

| YCRS | 1 | −0.533 ** | −0.858 ** | 0.159 | −0.609 ** | ||

| LTGDPL | 1 | 0.659 ** | −0.020 | 0.532 ** | |||

| YGDPL | 1 | −0.196 | 0.540 ** | ||||

| GDPG | 1 | 0.155 | |||||

| CO2 | 1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Masud, M.A.K.; Sahara, J.; Kabir, M.H. A Relationship between Climate Finance and Climate Risk: Evidence from the South Asian Region. Climate 2023, 11, 119. https://doi.org/10.3390/cli11060119

Masud MAK, Sahara J, Kabir MH. A Relationship between Climate Finance and Climate Risk: Evidence from the South Asian Region. Climate. 2023; 11(6):119. https://doi.org/10.3390/cli11060119

Chicago/Turabian StyleMasud, Md. Abdul Kaium, Juichiro Sahara, and Md. Humayun Kabir. 2023. "A Relationship between Climate Finance and Climate Risk: Evidence from the South Asian Region" Climate 11, no. 6: 119. https://doi.org/10.3390/cli11060119

APA StyleMasud, M. A. K., Sahara, J., & Kabir, M. H. (2023). A Relationship between Climate Finance and Climate Risk: Evidence from the South Asian Region. Climate, 11(6), 119. https://doi.org/10.3390/cli11060119