Business Cycle Estimation with High-Pass and Band-Pass Local Polynomial Regression

Abstract

:1. Introduction

2. Materials and Methods

2.1. Standard (High-Pass) Local Polynomial Regression

2.2. Band-Pass Local Polynomial Regression

3. Results

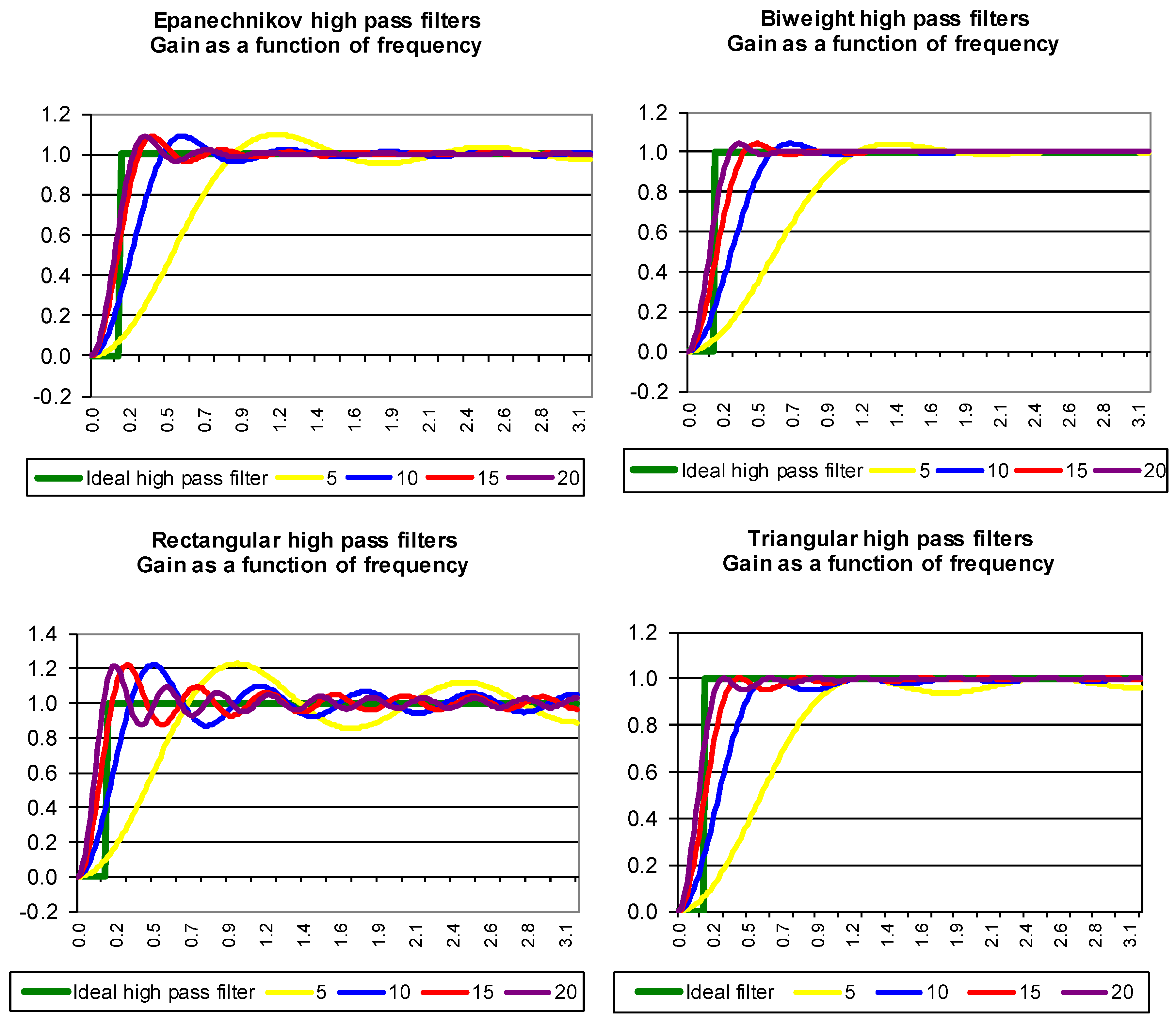

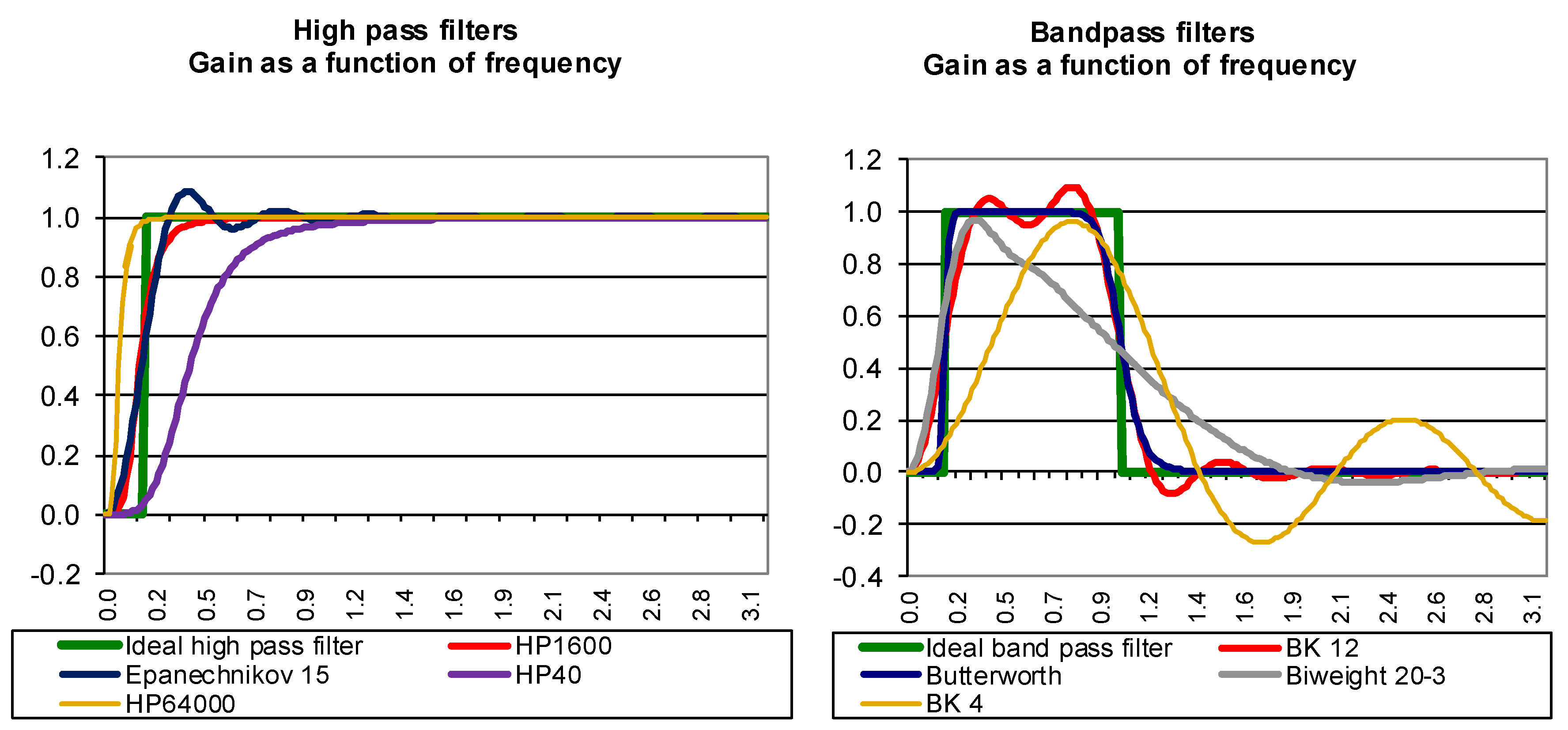

3.1. High-Pass Local Polynomial Regression

3.2. Band-Pass Local Polynomial Regression

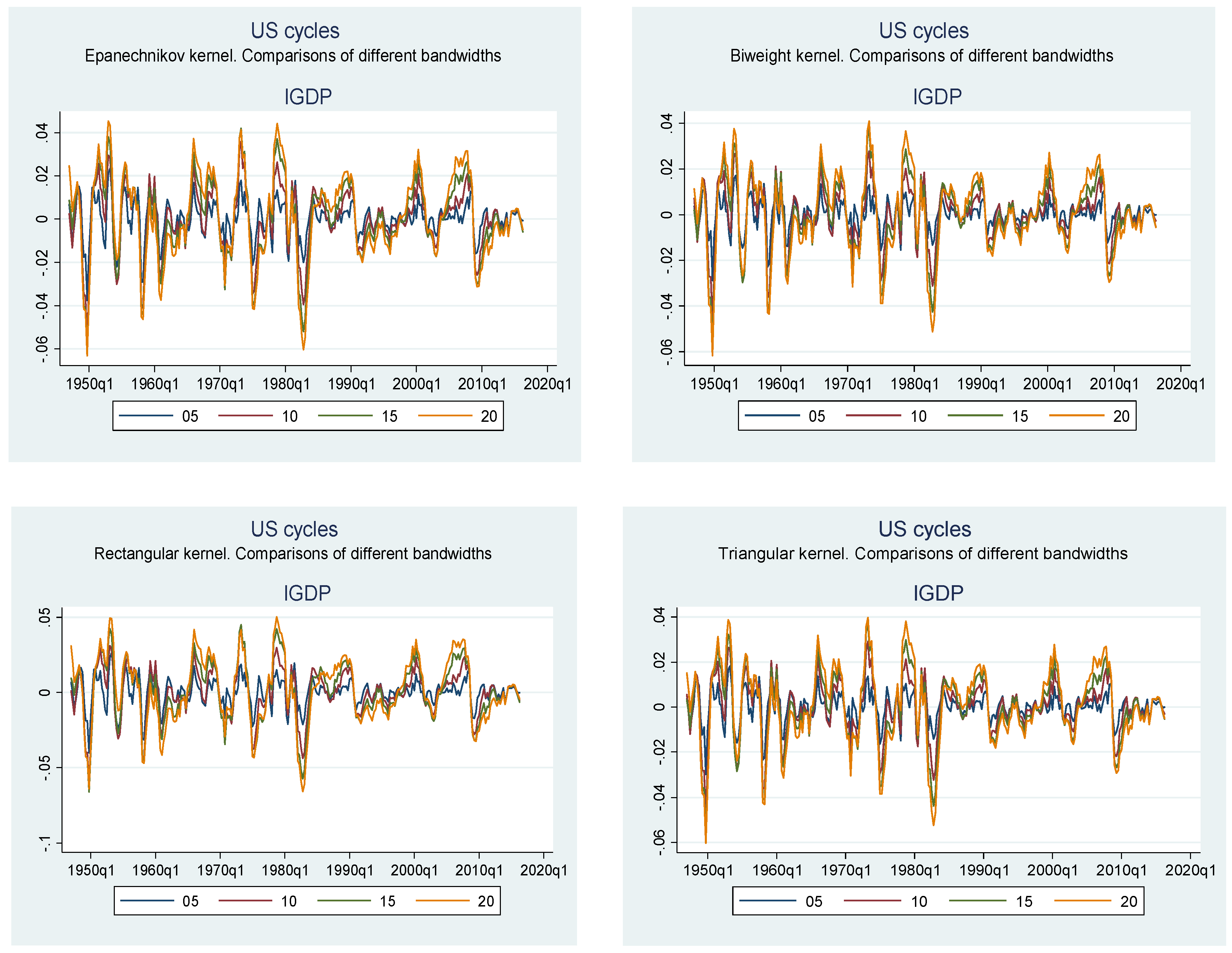

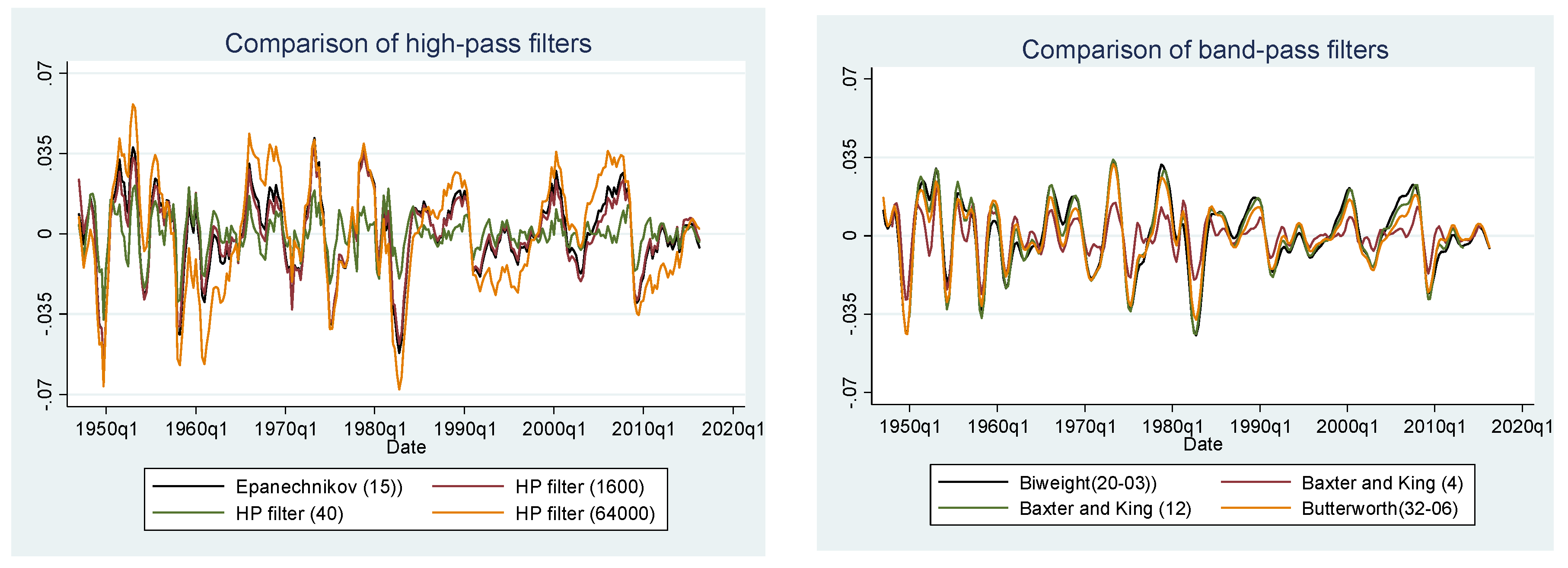

3.3. Empirical Applications: US Business Cycles

4. Discussion

4.1. High-Pass Local Polynomial Regression

4.2. Band-Pass Local Polynomial Regression

Acknowledgments

Author Contributions

Conflicts of Interest

References

- F. Canova. “Detrending and business cycle facts.” J. Monet. Econ. 41 (1998): 475–512. [Google Scholar] [CrossRef]

- T.C. Mills. Modelling Trends and Cycles in Economic Time Series. Basingstoke, UK: Palgrave Macmillan, 2003. [Google Scholar]

- E.B. Dagum. “A cascade linear filter to reduce revisions and false turning points for real time trend-cycle estimation.” Econom. Rev. 28 (2009): 40–59. [Google Scholar] [CrossRef]

- D.S.G. Pollock. “Econometric filters.” Comput. Econ. 48 (2016): 669–691. [Google Scholar] [CrossRef]

- C.J. Stone. “Consistent nonparametric regression.” Ann. Stat. 5 (1977): 595–620. [Google Scholar] [CrossRef]

- W.S. Cleveland. “Robust locally weighted regression and smoothing scatterplots.” J. Am. Stat. Assoc. 74 (1979): 829–836. [Google Scholar] [CrossRef]

- J. Fan, and I. Gijbels. Local Polynomial Modelling and Its Applications: Monographs on Statistics and Applied Probability 66. Boca Raton, FL, USA: CRC Press, 1996. [Google Scholar]

- D.S.G. Pollock. Handbook of Time Series Analysis, Signal Processing, and Dynamics. Cambridge, MA, USA: Academic Press, 1999. [Google Scholar]

- E.E. Leamer. “Housing is the Business Cycle.” NBER Working Paper Series 13428; Cambridge, MA, USA: National Bureau of Economic Research, 2007. [Google Scholar]

- R.J. Hodrick, and E.C. Prescott. “Postwar U.S. Business cycles: An empirical investigation.” J. Money Credit Bank. 29 (1997): 1–16. [Google Scholar] [CrossRef]

- M. Baxter, and R.G. King. “Measuring business cycles approximate band-pass filters for economic time series.” Rev. Econ. Stat. 81 (1999): 575–593. [Google Scholar] [CrossRef]

- S. Butterworth. “On the theory of filter amplifiers.” Exp. Wirel. Wirel. Eng. 7 (1930): 536–541. [Google Scholar]

- V. Gómez. “The use of Butterworth filters for trend and cycle estimation in economic time series.” J. Bus. Econ. Stat. 19 (2001): 365–373. [Google Scholar]

- 1Consideration of higher bandwidths resulted in a worse performance.

| Kernel Name | Kernel Function |

|---|---|

| Epanechnikov (EP) | |

| Biweight (BI) | |

| Rectangular (RE) | |

| Triangular (TR) |

| Bandwidth | Epanechnikov | Biweight | Rectangular | Triangular |

|---|---|---|---|---|

| 5 | 6.79 | 8.76 | 5.77 | 8.10 |

| 10 | 1.43 | 2.24 | 1.23 | 1.92 |

| 15 | 0.66 | 0.79 | 1.27 | 0.73 |

| 20 | 0.75 | 0.71 | 2.33 | 0.82 |

| Bandwidth | Epanechnikov | Biweight | Rectangular | Triangular |

|---|---|---|---|---|

| 5 | 20.38 | 16.70 | 13.05 | 15.54 |

| 10 | 9.15 | 6.35 | 8.63 | 6.53 |

| 15 | 6.87 | 4.60 | 8.27 | 4.87 |

| 20 | 6.69 | 4.46 | 9.08 | 4.82 |

| 25 | 6.97 | 4.98 | 10.11 | 5.30 |

| 30 | 7.43 | 5.57 | 10.92 | 5.89 |

| Lambda | Hodrick-Prescott |

|---|---|

| 40 | 4.91 |

| 1600 | 0.60 |

| 64,000 | 3.04 |

| Baxter & King k = 4 | Baxter & King k = 12 | Butterworth |

|---|---|---|

| 8.64 | 1.41 | 0.76 |

© 2017 by the author; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Álvarez, L.J. Business Cycle Estimation with High-Pass and Band-Pass Local Polynomial Regression. Econometrics 2017, 5, 1. https://doi.org/10.3390/econometrics5010001

Álvarez LJ. Business Cycle Estimation with High-Pass and Band-Pass Local Polynomial Regression. Econometrics. 2017; 5(1):1. https://doi.org/10.3390/econometrics5010001

Chicago/Turabian StyleÁlvarez, Luis J. 2017. "Business Cycle Estimation with High-Pass and Band-Pass Local Polynomial Regression" Econometrics 5, no. 1: 1. https://doi.org/10.3390/econometrics5010001

APA StyleÁlvarez, L. J. (2017). Business Cycle Estimation with High-Pass and Band-Pass Local Polynomial Regression. Econometrics, 5(1), 1. https://doi.org/10.3390/econometrics5010001