Why Did Uber China Fail? Lessons from Business Model Analysis

Abstract

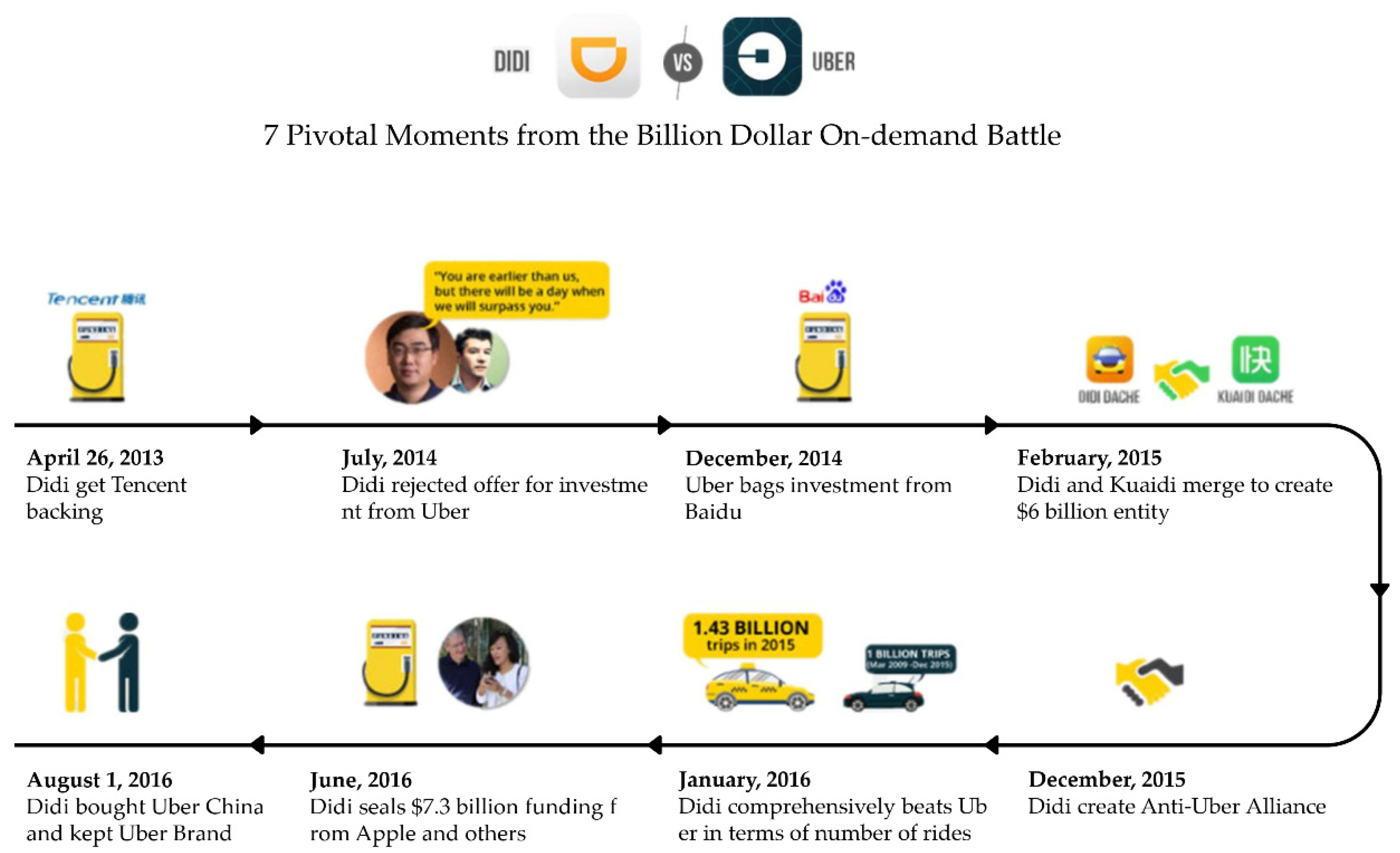

:1. Introduction

2. Two Ride-Hailing Platforms with Two Value Propositions

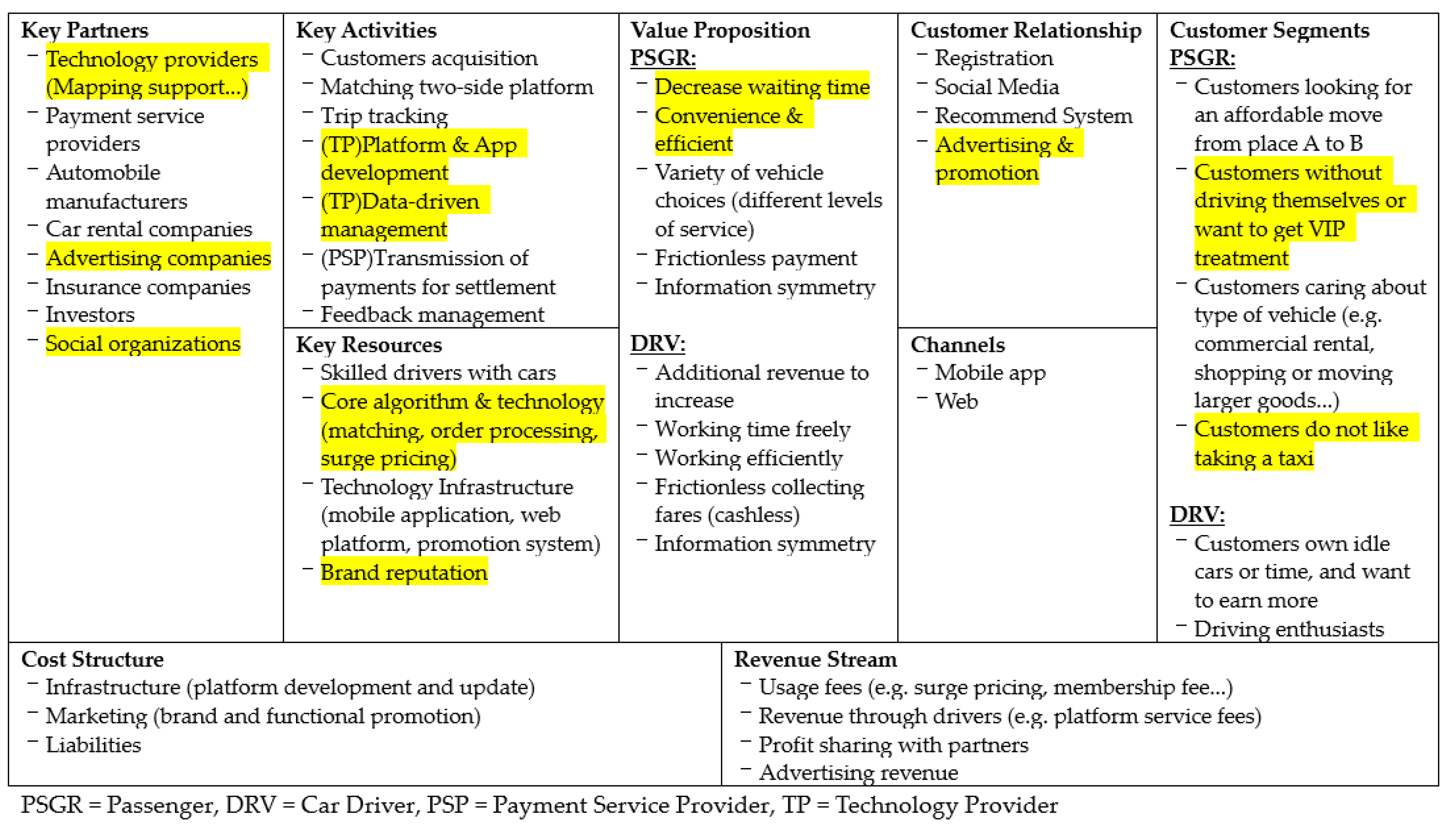

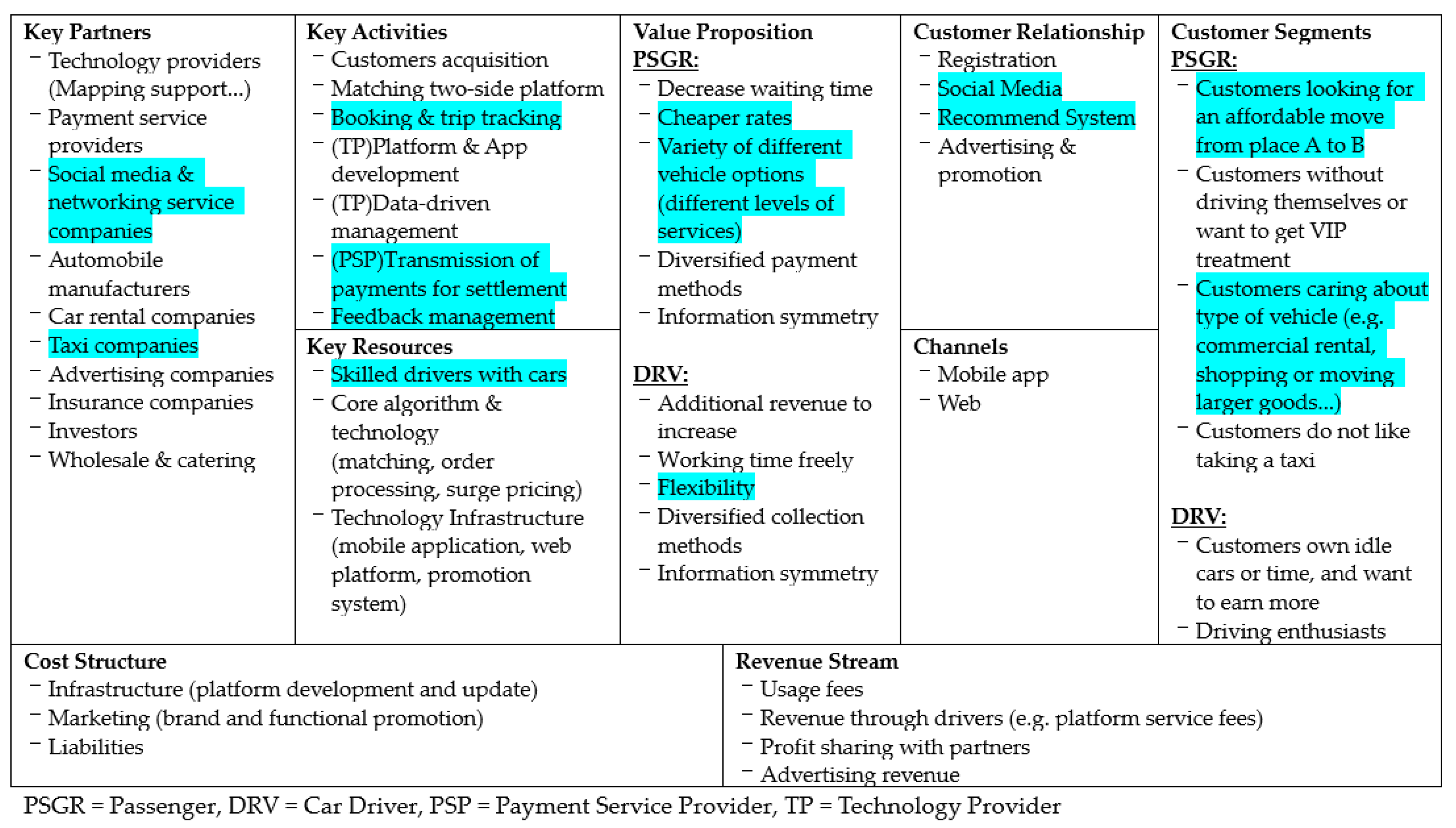

2.1. Backgrounds and Research Framework: BM Building Blocks

2.2. Value Propositions

3. Business Model Comparisons

3.1. Demand-Side BM Building Blocks

3.1.1. Customer Relationship: Brand Effect

3.1.2. Channel Management

3.1.3. Service Offerings and Strategic Positioning

3.1.4. Alignment between Value Proposition and Strategic Positioning

3.1.5. Pricing and Incentive Schemes

3.2. Supply Side BM Building Blocks

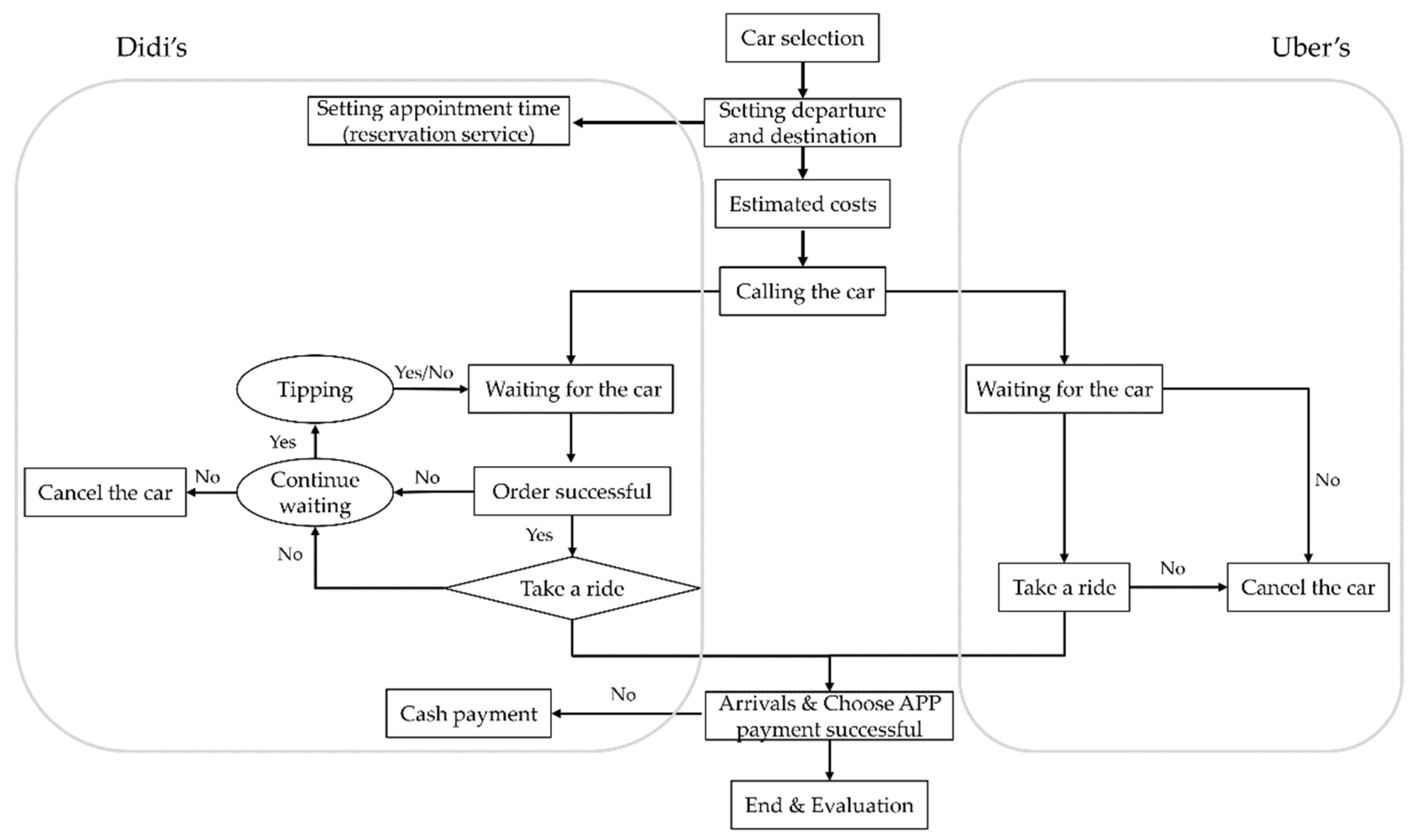

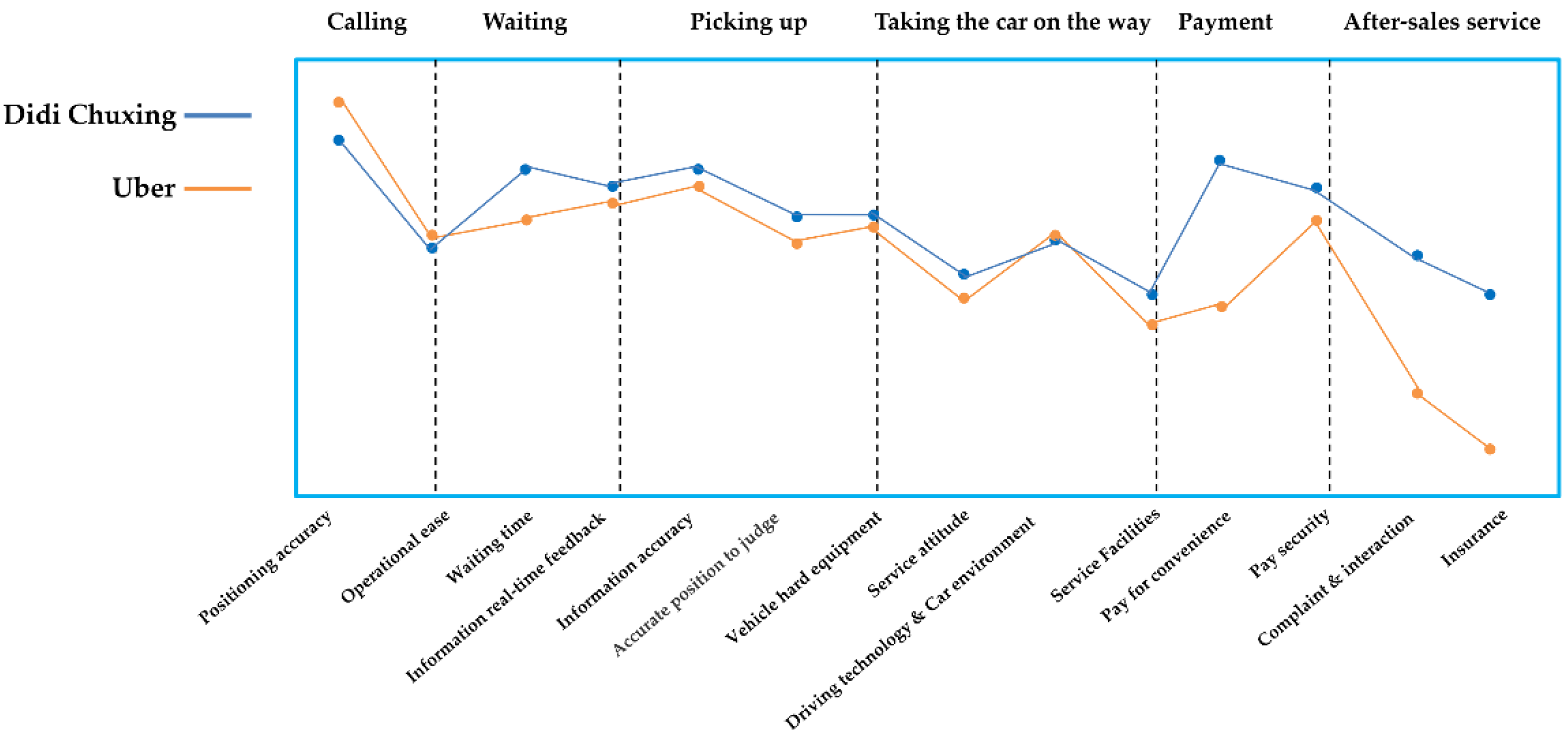

3.2.1. Service Operations and Value Features

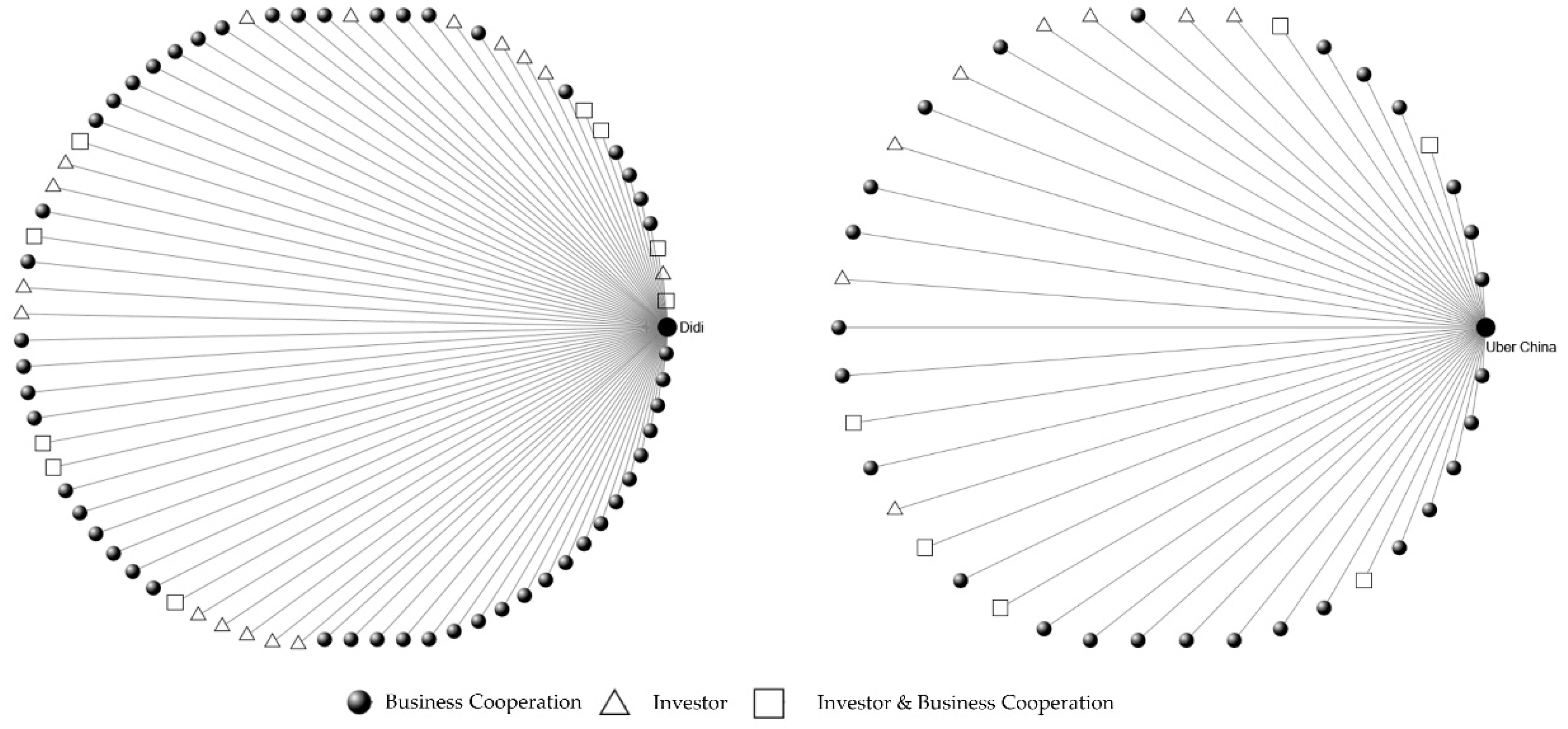

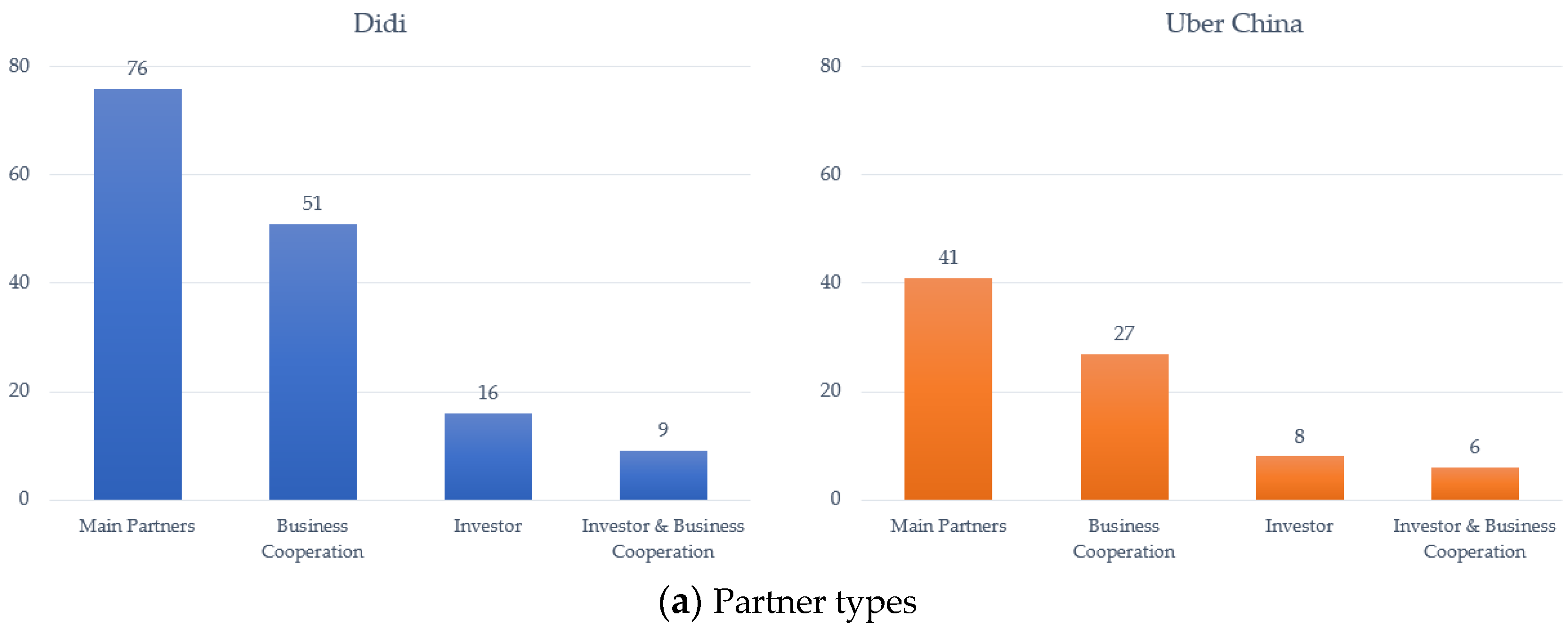

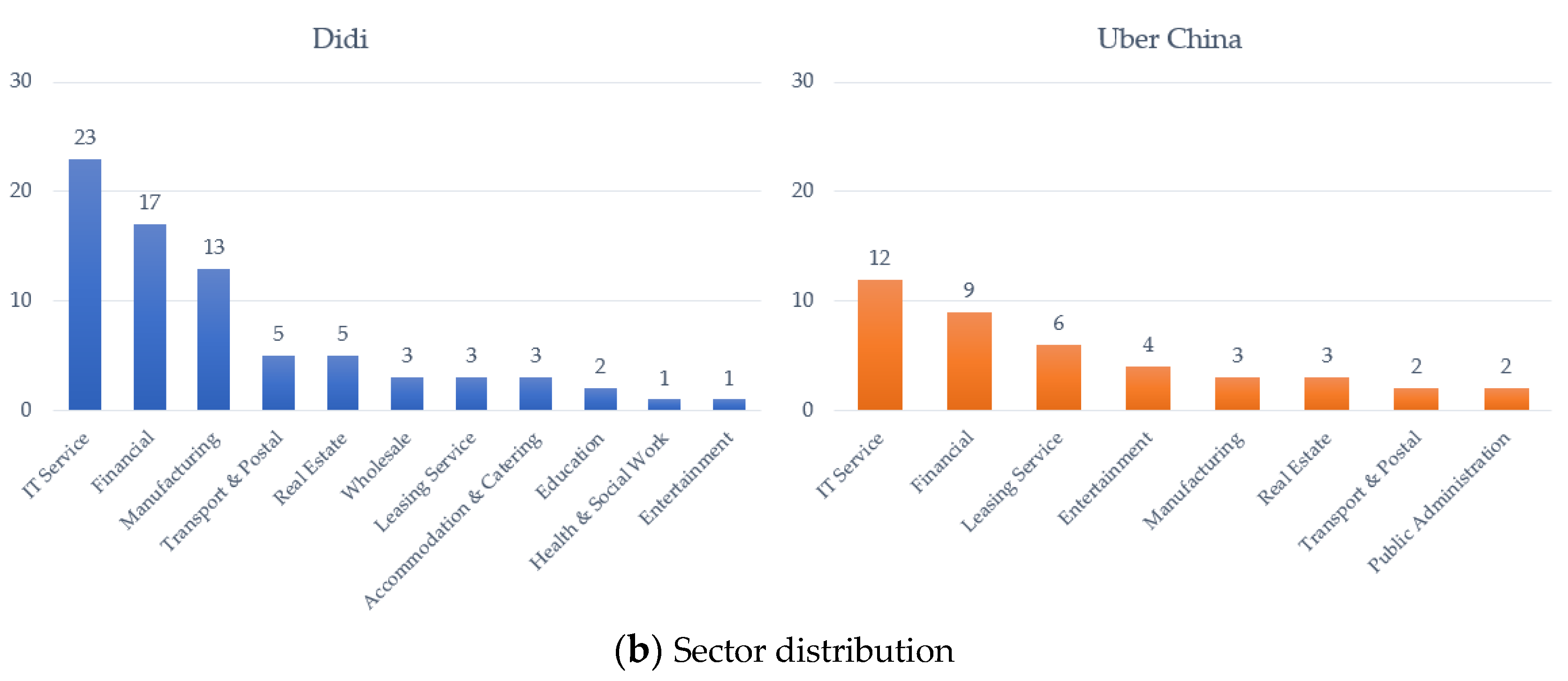

3.2.2. Value Chain Partnership and Investments

4. Discussions

5. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Tracxn. More Uber than Uber: How Didi Won the Ride Hailing Market in China. Tracxn Technologies Limited. 2016. Available online: https://blog.tracxn.com/2016/09/15/didi-vs-uber/ (accessed on 15 September 2016).

- The Times. 6 Things to Know about Uber’s Surrender in China. The Times. 2016. Available online: http://time.com/4434206/uber-china-didi-chuxing/ (accessed on 1 August 2016).

- Michael, G.; Editor, I.C.; Startup, G. After a $35 Billion Merger, Uber and Didi Are Set to Take Over the Ridesharing Universe. Inc. 2016. Available online: https://www.inc.com/michael-gasiorek/5-reasons-uber-gave-up-to-didi-and-won-in-china.html (accessed on 8 August 2016).

- Bloomberg News. Uber Wins by Losing in China. Bloomberg Limited Partnership. 2016. Available online: https://www.bloomberg.com/gadfly/articles/2016-08-01/uber-may-end-up-winning-big-by-losing-out-in-china (accessed on 2 August 2016).

- Leslie, H. Uber’s battle for China. The Financial Times Ltd. 2016. Available online: https://ig.ft.com/sites/uber-in-china/ (accessed on 2 June 2016).

- Robert, S. Why Uber Couldn’t Crack China.Fortune Media Limited Partnership. 2016. Available online: http://fortune.com/2016/08/07/uber-china-didi-chuxing/ (accessed on 7 August 2016).

- Rolandberger. The Report of China Ride-Hailing Market Analysis. Roland Berger. 2016. Available online: https://www.rolandberger.com/publications/publication_pdf/roland_berger_chinas_premium_chauffeured_car_20160318.pdf (accessed on 18 March 2016).

- China News. Nielsen Survey Show That Didi Is Leading the Mobile Travel Market in China. People’s Daily Online. 2016. Available online: http://it.people.com.cn/n1/2016/0311/c1009-28192845.html (accessed on 11 March 2016).

- Belk, R. Sharing versus pseudo-sharing in Web 2.0. Anthropologist 2014, 18, 7–23. [Google Scholar] [CrossRef]

- Belk, R. Sharing. J. Consum. Res. 2010, 36, 715–734. [Google Scholar] [CrossRef]

- Belk, R. Why not share rather than own? Ann. Am. Acad. Political Soc. Sci. 2007, 611, 126–140. [Google Scholar] [CrossRef] [Green Version]

- Belk, R. You are what you can access: Sharing and collaborative consumption online. J. Bus. Res. 2014, 67, 1595–1600. [Google Scholar] [CrossRef]

- Botsman, R.; Rogers, R. Beyond Zipcar: Collaborative consumption. Harv. Bus. Rev. 2010, 88, 30. [Google Scholar]

- Codagnone, C.; Martens, B. Scoping the Sharing Economy: Origins, Definitions, Impact and Regulatory Issues. Institute for Prospective Technological Studies Digital Economy Working Paper 2016/01. European Commission, Joint Research Centre. Available online: https://joint-research-centre.ec.europa.eu/publications/scoping-sharing-economy-origins-definitions-impact-and-regulatory-issues_en (accessed on 25 February 2022).

- Möhlmann, M. Collaborative consumption: Determinants of satisfaction and the likelihood of using a sharing economy option again. J. Consum. Behav. 2015, 14, 193–207. [Google Scholar] [CrossRef]

- Rachel, B. The Sharing Economy Lacks a Shared Definition. Fast Company. 2013. Available online: http://www.fastcoexist.com/3022028/the-sharing-economy-lacks-a-shareddefinition (accessed on 21 November 2013).

- Zolnowski, A.; Weiß, C.; Böhmann, T. Representing service business models with the service business model canvas—The case of a mobile payment service in the retail industry. In Proceedings of the 47th Hawaii International Conference on System Sciences, HICSS 2014, Waikoloa, HI, USA, 6–9 January 2014; pp. 718–727. [Google Scholar]

- Parente, R.C.; Geleilate, J.M.G.; Rong, K. The sharing economy globalization phenomenon: A research agenda. J. Int. Manag. 2018, 24, 52–64. [Google Scholar] [CrossRef]

- Salomon, R. Global Vision: How Companies Can Overcome the Pitfalls of Globalization, 1st ed.; Palgrave Macmillan: New York, NY, USA, 2016. [Google Scholar]

- Täuscher, K.; Kietzmann, J. Learning from failures in the sharing economy. Sci. Technol. 2017, 67, 2047–2059. [Google Scholar]

- Jamie, C. China Gives Ride-Hailing a Green Light. MIT Technology Review. 2016. Available online: https://www.technologyreview.com/s/602034/china-gives-ride-hailing-a-green-light/ (accessed on 29 July 2016).

- Wirtz, J.; Lovelock, C. Services Marketing: People, Technology, Strategy, 8th ed.; World Scientific: Hackensack, NJ, USA, 2016; pp. 626–632. [Google Scholar]

- Custer, C. Uber Who? Didi Kuaidi Completed 1.43b Rides in 2015. Tech in Asia. 2016. Available online: http://en.acnnewswire.com/press-release/english/27544/didi-kuaidi-completed-1.43-billion-rides-in-2015 (accessed on 11 January 2016).

- Davey, A. Judge Rejects Uber’s $100 Million Settlement with Drivers. Condé Nast. 2016. Available online: https://www.wired.com/2016/08/uber-settlement-rejected/ (accessed on 18 July 2016).

- Bloomberg News. Uber Slayer: How China’s Didi Beat the Ride-Hailing Superpower. Bloomberg Limited Partnership. 2016. Available online: https://www.bloomberg.com/features/2016-didi-cheng-wei/?cmpid=BBD100616_BIZ (accessed on 6 October 2016).

- Nanette, B. With Its Sale in China, Uber Drives a Better Bargain. MIT Technology Review. 2016. Available online: https://www.technologyreview.com/s/602057/with-its-sale-in-china-uber-drives-a-better-bargain/ (accessed on 1 August 2016).

- Barquet, A.P.B.; Cunha, V.P.; Oliveira, M.G.; Rozenfeld, H. Business Model Elements for Product-Service System. In Proceedings of the 3rd International Conference on Industrial Product Service Systems, Technische Universitaät Braunschweig, Braunschweig, Germany, 5–6 May 2011; Springer: New York, NY, USA, 2011; pp. 332–337. [Google Scholar]

- Barquet, A.P.B.; Oliveira, M.G.; De Amigo, C.R.; Cunha, V.P.; Rozenfeld, H. Employing the business model concept to support the adoption of product—service systems (PSS). Ind. Mark. Manag. 2013, 42, 693–704. [Google Scholar] [CrossRef]

- Lee, J.H.; Shin, D.I.; Hong, Y.S.; Kim, Y.S. Business Model Design Methodology for Innovative Product-Service Systems: A Strategic and Structured Approach. In Proceedings of the Annual SRII Global Conference (SRII 2011), San Jose, CA, USA, 29 March–2 April 2011; pp. 663–673.00E4. [Google Scholar]

- Zhu, F.; Iansiti, M. Why Some Platforms Thrives... and Others Don’t What Alibaba, Tencent, and Uber teach us about networks that flourish. The five characteristcs that make the difference. Harv. Bus. Rev. 2019, 97, 118–125. [Google Scholar]

- Turoń, K. Open innovation business model as an opportunity to enhance the development of sustainable shared mobility industry. J. Open Innov. Technol. Mark. Complex. 2022, 8, 37. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y.; Tucci, C.L. Clarifying business models: Origins, present and future of the concept. Commnications Assoc. Inf. Syst. 2005, 15, 1–40. [Google Scholar] [CrossRef] [Green Version]

- Eisenmann, T.; Parker, G.; Van Alstyne, M.W. Strategies for two-sided markets. Harv. Bus. Rev. 2006, 84, 92. [Google Scholar]

- Stabell, C.B.; Fjeldstad, Ø.D. Configuring value for competitive advantage: On chains, shops, and networks. Strateg. Manag. J. 1998, 19, 413–437. [Google Scholar] [CrossRef]

- Porter, M.E. The five competitive forces that shape strategy. Harv. Bus. Rev. 2008, 86, 25–40. [Google Scholar]

- IResearch. The Research Report of Chinese Ride-Hailing Market in 2016. iResearch Consulting Group. 2016. Available online: http://report.iresearch.cn/report/201603/2556.shtml (accessed on 22 March 2016).

- IResearch. User Research Report of China Ride-Hailing Service in 2015. iResearch Consulting Group. 2015. Available online: http://report.iresearch.cn/report/201512/2502.shtml (accessed on 17 December 2015).

- Wang, C.X. Analysys: Chinese Ride-hailing Service Accelerated the Internationalization Process and the Service Diversified in the First Quarter of 2016. Beijing Analysys Network Technology Company Limited. 2016. Available online: https://www.analysys.cn/article/analysis/detail/1000036 (accessed on 3 June 2016).

- 199it. Didi Chuxing: China Urban Traffic Travel Report in the First Half of 2016. Beijing Siji Zhiku Technology Company Limited. 2016. Available online: http://www.199it.com/archives/495160.html (accessed on 15 July 2016).

- QuestMobile. QuestMobile Daily List of Ride-Hailing APP. Beijing Guishi Information Technology Limited. 2016. Available online: https://www.questmobile.com.cn/blog/blog-36.html (accessed on 7 April 2016).

- He, C. Uber China Will Enter the New 18 Cities and Cover More than 55 Cities. Phoenix New Media Limited. 2016. Available online: http://tech.ifeng.com/a/20160126/41544838_0.shtml (accessed on 26 January 2016).

- Wan, J. The Competition Analysis with APPs of Didi, Uber China and Shenzhou. Huike Group. 2016. Available online: http://www.chanpin100.com/article/46196 (accessed on 25 March 2016).

- CBNData. The Report of China Smart Traffic Travel with Big Data in 2015. Shanghai Yingfan Digital Technology Company Limited. 2016. Available online: https://cbndata.com/report/54?isReading=report&page=1 (accessed on 20 January 2016).

- Rochet, J.; Tirole, J. Platform competition in two-sided markets. J. Eur. Econ. Assoc. 2003, 1, 990–1029. [Google Scholar] [CrossRef] [Green Version]

- Katz, M.L.; Shapiro, C. Systems competition and network effects. J. Econ. Perspect. 1994, 8, 93–115. [Google Scholar] [CrossRef] [Green Version]

- Hong Yuan Securities. Industry In-Depth Research Report: One of Smart Transportation Series Reports—Interpretation of Industries with Key Data. Hong Yuan Securities Company Limited. 2016. Available online: http://www.hysec.com/f/tsnr/[D2016]/2016-05/TSNR100/03/RR_3003382547.pdf (accessed on 27 April 2016).

- CNIT-Research. The Research Report of Chinese Ride-Hailing Market in the First Quarter of 2016. China Internet Network Information Center. 2016. Available online: http://www.wenshubang.com/baogao/93789.html (accessed on 30 November 2016).

- Sarasini, S.; Linder, M. Integrating a business model perspective into transition theory: The example of new mobility services. Environ. Innov. Soc. Transit. 2018, 27, 16–31. [Google Scholar] [CrossRef]

- Turoń, K.; Kubik, A. Business innovations in the new mobility market during the COVID-19 with the possibility of open business model innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 195. [Google Scholar] [CrossRef]

- Schafer, A.; Victor, D.G. The future mobility of the world population. Transp. Res. Part A Policy Pract. 2000, 34, 171–205. [Google Scholar] [CrossRef]

- Kamargianni, M.; Li, W.; Matyas, M.; Schäfer, A. A critical review of new mobility services for urban transport. Transp. Res. Procedia 2016, 14, 3294–3303. [Google Scholar] [CrossRef] [Green Version]

- Turoń, K. From the Classic Business Model to Open Innovation and Data Sharing—The Concept of an Open Car-Sharing Business Model. J. Open Innov. Technol. Mark. Complex. 2022, 8, 36. [Google Scholar] [CrossRef]

- Zhu, F.; Li, X.; Valavi, E.; Iansiti, M. Network interconnectivity and entry into platform markets. Inf. Syst. Res. 2021, 32, 1009–1024. [Google Scholar] [CrossRef]

- Cramer, J.; Krueger, A.B. Disruptive change in the taxi business: The case of Uber. Am. Econ. Rev. 2016, 106, 177–182. [Google Scholar] [CrossRef] [Green Version]

- Edelman, B.G.; Geradin, D. Efficiencies and regulatory shortcuts: How should we regulate companies like Airbnb and Uber. Stanf. Technol. Law Rev. 2015, 19, 293. [Google Scholar] [CrossRef] [Green Version]

- Wallsten, S. The Competitive Effects of the Sharing Economy: How Is Uber Changing Taxis; Technology Policy Institute: Washington, DC, USA, 2015. [Google Scholar]

- Witt, A.; Suzor, N.; Wikström, P. Regulating Ride-sharing in the Peer Economy. Commun. Res. Pract. 2015, 1, 174–190. [Google Scholar] [CrossRef] [Green Version]

| 2016 Q1–Q2 | DiDi Chuxing | Uber China |

|---|---|---|

| Number of Cities Covered [39,41] | 400 | 37 |

| Active User Coverage [38] | 85.6% | 15.4% |

| Monthly Active Users [40] (unit: 10,000) | 5886.7 | 1848.8 |

| Monthly Active Users Growth Rate [40] | 195.9% | 890.5% |

| Daily Active Users [40] (unit: 10,000) | 908.6 | 229.6 |

| Service Class | DiDi Chuxing | Uber China |

|---|---|---|

| Carpool | DiDi Express; DiDi Hitch | People’s Uber (+) |

| Economy | DiDi Express | UberX |

| Premium | DiDi Premier; DiDi Lux | UberBlack; UberXL * |

| Others | DiDi Taxi; DiDi Designated Driving | - |

| DiDi Chuxing | Uber China | |||

|---|---|---|---|---|

| Carpool | DiDi Express and DiDi Hitch | 270.8 (~90%) | People’s Uber (+) | 53.4 (~92%) |

| Economy | DiDi Express | UberX | ||

| Premium | DiDi Premier and DiDi Lux | 29.5 (~10%) | UberBlack and UberXL | 4.6 (~8%) |

| Service Class | DiDi Chuxing | Uber China | ||

|---|---|---|---|---|

| Carpool | DiDi Express and Hitch | 5% | People’s Uber (+) | 0% |

| Economy | DiDi Express | 5% | UberX | 20% |

| Premium | DiDi Premier and Lux | 20% | UberBlack and UberXL | 20% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Y.; Kim, D. Why Did Uber China Fail? Lessons from Business Model Analysis. J. Open Innov. Technol. Mark. Complex. 2022, 8, 90. https://doi.org/10.3390/joitmc8020090

Liu Y, Kim D. Why Did Uber China Fail? Lessons from Business Model Analysis. Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(2):90. https://doi.org/10.3390/joitmc8020090

Chicago/Turabian StyleLiu, Yunhan, and Dohoon Kim. 2022. "Why Did Uber China Fail? Lessons from Business Model Analysis" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 2: 90. https://doi.org/10.3390/joitmc8020090

APA StyleLiu, Y., & Kim, D. (2022). Why Did Uber China Fail? Lessons from Business Model Analysis. Journal of Open Innovation: Technology, Market, and Complexity, 8(2), 90. https://doi.org/10.3390/joitmc8020090