Abstract

Disruptive innovations (DI) have the potential to fundamentally change markets and their power relations: Specifically, established companies are confronted with the threat of being forced out of the market by DI. At the same time, companies also have the opportunity to control the market’s development by developing DI themselves. This raises the question of how a proactive management of DI can be systematized. Here, the approach of innovation portfolio management (IPM) provides support by identifying, evaluating, and selecting a company’s most promising product ideas. The management of DI is challenging due to their characteristics, such as diversity, high uncertainty, especially with regard to customer acceptance, difficult comparability with existing products, potential for cannibalization, and substitution of existing products. For this reason, new approaches to managing DI are required in literature and practice. This paper presents a novel methodology to support—especially established—companies in proactively generating DI via existing processes in their IPM. For this purpose, the methodology supports the early identification of the product idea’s disruptive potential so that these can be handled appropriately in the further course of the process, such as the evaluation of all product ideas in the company during IPM. Thus, the risk can be minimized that promising DI are not rejected due to unsuitable procedures, but are brought to market maturity. The methodology contributes to the literature by showing how DI can be pursued embedded in existing corporate structures and also in competition with other product ideas in the company—in existing approaches, DI is primarily considered singularly and detached from the existing corporate context. The methodology is validated by the example of the digital camera, which disrupted the photo industry, as well as through interviews in a practical context.

1. Introduction

Today’s markets and industries are characterized by high dynamics, which show up, e.g., in highly segmented and volatile customer needs. This causes new competitors to enter the market with novel products that can gain a significant market share from established companies. Disruption occurs when established companies are completely forced out of the market [1,2]. Thus, particularly dynamic markets promote the occurrence of product innovations with the potential for disruption.

The management of disruptive innovations (DI) poses a challenging problem due to their characteristics, such as targeting latent customer needs, difficult comparability with existing products, possible cannibalization, and substitution of other products of the company [3,4]. Particularly, established companies often have fixed structures with institutionalized procedures and a focus on short-term financial goals in innovation management. This hinders an appropriate handling of DI and thus increases the risk of being forced out of the market [2,3].

Besides this threat, there is also the opportunity for companies to develop DI themselves in order to proactively influence market development [5,6,7]. The approach of innovation portfolio management (IPM) provides support in the proactive planning of product innovations [8]. Due to the holistic focus in IPM, it is important that companies not only concentrate on high-risk DI, but simultaneously also implement lower-risk product ideas, for example, as an incremental improvement of existing products [6,7].

In practice, many examples exist that reveal the relevance of DI: Blockbuster®, as the former market leader for the rental of movies, was forced out by the new competitor Netflix® by video streaming [3]. Here, the Internet enabled the disruption by making movies available to customers in new ways, which made the previous concept of stationary video rental no longer competitive. With the iPhone, Apple® was able to push existing cell phone manufacturers out of the market [3]. Here, the App Store was crucial for disruption, enabling customers to install new programs and thus continuously expand the functionality and value of their device. For this paper, particularly relevant is the digital camera and the failure of Kodak® [9]; as the former market leader for analog photography, the company was unable to transform to digital photography and ultimately had to declare bankruptcy. The tragedy of the company’s story is that it invented the digital camera itself but misjudged its potential and decided not to launch it on the market. In retrospect, Kodak® made the wrong decision in IPM to dismiss the digital camera as a potentially disruptive product idea and instead stuck to the further improvement of the analog camera with its ecosystem of film rolls and photographic paper, which had been lucrative until then.

Against this background, the question arises of how DI can also be integrated into IPM; in other words, how could the Kodak® managers have been supported in order to pursue the launch of the digital camera in addition to the further development of the analog camera? In this context, the literature and practice demand new approaches for the integration of DI in IPM [6,7]. Against this background, this paper presents a new methodology in the form of a methodologically supported process model that can be used, especially by established companies, to proactively generate DI as part of their IPM. In specific terms, the methodology aims to identify the disruptive potential of well-founded product ideas in order to evaluate and pursue the product ideas according to their potential in specific and appropriate procedures. The methodology results in the creation of a holistic portfolio of both DI and different product ideas, which are later technically realized in the adjacent process of development and ultimately brought to market maturity.

1.1. Related Research Fields

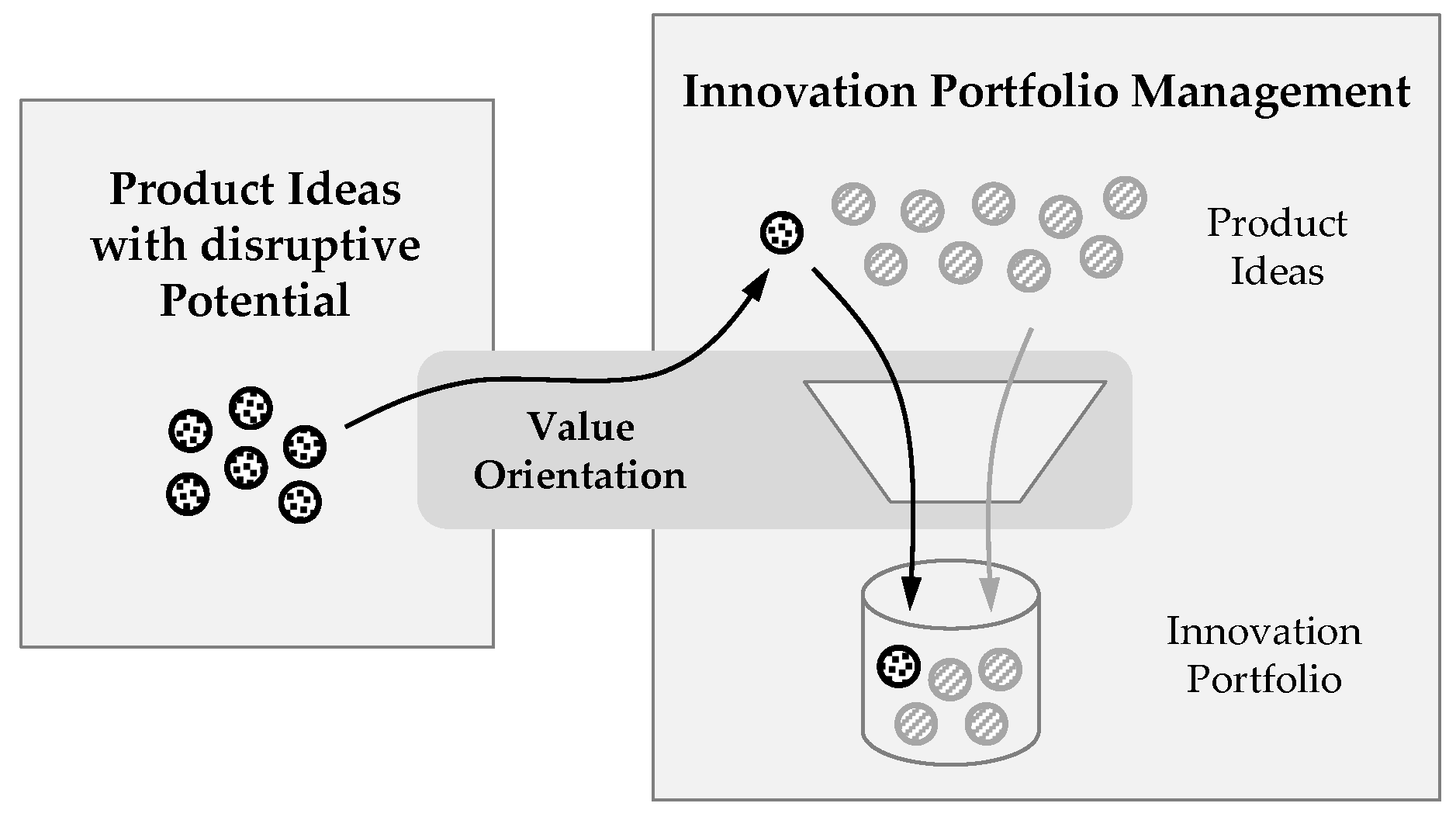

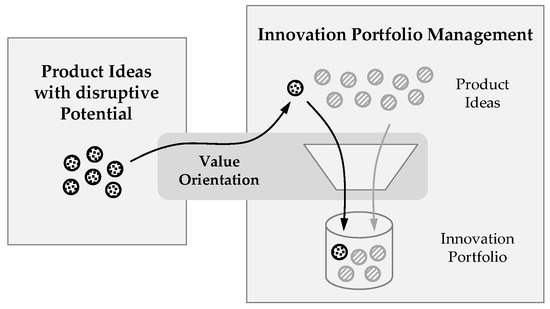

This paper focuses on the research fields of DI, IPM, and value orientation in the context of innovation management, which are explained in the following (Figure 1).

Figure 1.

Managing DI by value-oriented IPM, based on [6].

Due to their characteristics, DI require special handling, consequently also in the context of IPM when comparing them with other types of product ideas (e.g., sustaining innovation). Here, the orientation to customer value is essential for the determination of the disruptive potential of product ideas and the holistic value assessment of diverse product ideas.

In his disruption theory, Christensen [1] distinguishes between disruptive and sustaining innovations (SI); while SI represent a more-or-less high-level evolution of existing products, DI are characterized by novel product attributes with a high potential for transformations of markets [1,2,3]. DI are particularly threatening to established companies that are usually focused too much on short-term financial goals and consequently lucrative SI [1,3]. This intense focus on SI comes with the risk that the products will over-fulfill customer needs through constant improvement and will no longer offer any value, causing customers to look for an alternative solution. This opens up opportunities for new competitive products with disruptive potential that serve customer needs in a better way. Disruption occurs when a company’s main customers also switch to the new solution and thus leave. Established companies are often unprepared for the occurrence of DI, so that an appropriate reaction is usually not possible [1,2,3].

IPM can be placed in the early phase of product development and aims to identify and evaluate the most promising product ideas and select them for technical realization [8,10]. Due to the diverse and often opposing characteristics of the product ideas, their appropriate management is challenging and requires customized approaches for each type of product ideas [8,10,11]. Studies underline the relevance of IPM, as it directly contributes to the company’s success through its focus on the most promising product ideas [10,11]. Due to the focus on product ideas in IPM, the abbreviation ‘DI’ used in this paper refers to both disruptive innovations and product ideas with disruptive potential.

Value can be understood as the benefit that the product provides to the customer and the company [12]. Compared to SI, DI offer customers a novel and improved value experience due to new types of product attributes [2,3,13]. Customer value thus describes how the product is perceived by the customers and what advantages the customers experience by using it and in achieving their goals [12]. Especially in the context of DI, a key factor is how well the product fulfills the customer needs or the job-to-be-done, because DI fulfills the (often latent) customer needs to a higher degree and therefore generally leads to higher customer value compared to SI [2,3,6].

1.2. Research Focus and Methods

Due to the increasing relevance of DI, the need for support in its management in practice, and the lack of approaches in the literature, this paper presents a new methodology for considering DI in IPM. The structure of this paper is therefore based on the following research questions:

- How can the disruptive potential of product ideas be profoundly anticipated as such?

- How can a process model for the management of DI in IPM be designed?

- How can decision makers be methodically supported in managing DI in IPM?

For this purpose, Section 2 describes the state-of-the-art in managing DI and in IPM, derived from a systematic literature review and interviews with selected practice partners. In the context of DI, the literature review primarily involved sources that present not only the identification of disruptive potential of product ideas, but also integrated approaches for the proactive management of DI. It was found that existing approaches cannot be applied in the context of IPM due to their singular view on DI and the lack of taking existing company structures into account. In the context of IPM, the focus of the literature review is centered on integrated approaches that can appropriately deal with diverse product ideas, e.g., by presenting procedures adapted to different product idea types. It was found that although comprehensive methods exist for different types of product ideas, no approach exists to specifically consider DI in IPM, because the special characteristics of DI are not addressed. Accompanied by semi-structured interviews in the automotive and software industry, it was surveyed to what extent DI are taken into account in the current corporate context, what challenges exist in their handling, and how methodological support for the practical management of DI can be designed.

Section 3 identifies requirements for the developed methodology. These requirements were derived based on the key findings of the literature review and interviews, which, for example, relate to the core decision in IPM, the appropriate and value-oriented handling of DI, and the practical applicability of IPM approaches adapted for DI, especially in established companies.

Section 4 presents the methodology developed for considering DI in IPM. For this purpose, a process model with five phases is derived from the literature and complemented by methods that support the structuring of product ideas, the identification of their disruptive potential, their holistic evaluation, the creation of a holistic portfolio, and the continuous monitoring of ideas and environmental influences. Section 5 validates the developed methodology using a practical example and in a practical context through expert interviews to confirm its functionality and practical applicability. Section 6 discusses the results in the context of a critical reflection and with an outlook on further research needs, before Section 7 closes with a summary of the key findings.

With respect to the research methodology, the paper, systematic literature review, and semi-structured interviews with selected practice partners from the automotive and software industry follow the guidelines of the Design Research Methodology (DRM) according to Blessing and Chakrabarti [14], who present a framework for structuring complex research projects. The DRM suggests dividing a research project into the phases of clarifying the research need (Research Clarification), detailing the research gap (Descriptive Study I), developing the solution approach (Prescriptive Study), and validating the solution approach (Descriptive Study II). Within DRM, this paper can be classified as Descriptive Study II, which aims to present a detailed solution approach for a derived research gap and to validate it via an application based on practical examples and in a corporate context. For this purpose, the authors have systematically derived the research gap via corresponding literature reviews in previous papers by showing the need for a methodological support for the management of DI in IPM [6] and proposed a methodological solution concept [7]. Therefore, this paper builds on the solution concept developed by Weinreich et al. [7], detailing and validating it using practical examples and with selected practice partners from the automotive and software industries.

2. State-of-the-Art on Managing Disruptive Innovation and Innovation Portfolios

This Section presents the challenges in managing DI and IPM and related scientific approaches in literature and practice.

2.1. Proactive Management of Disruptive Innovation

The management of DI is challenging due to their characteristics, so their clear description is important: DI are not valued by a company’s mainstream customers, especially at their market launch, because they perform worse on the characteristics that are important to this customer segment (e.g., the first digital camera had poorer image quality compared to the analog camera) [1,2,13]. DI specifically address the needs of so-far unserved customers by offering generally more user-friendly products that are either cheaper and perform worse (low-end disruption) or more expensive and perform better (high-end disruption) compared to the reference solution [1,13,15,16]. Low-end DI in particular target price-sensitive customers initially at their market launch, through which only low margins can be achieved so that they are not very attractive for established companies [1,2]. As DI is further developed, it increasingly serves the needs of mainstream customers, who perceive and accept DI as an alternative solution and migrate from the previous product/company [1,3].

There is no standard definition of DI in the literature, even Christensen [1,4] does not provide an explicit definition of DI. Existing definitions often appear rather abstract and complex and thus not very practical, so there is a need for a standardized and practical definition of DI to develop a methodology. The following definition of DI is based on a literature review and industrial interviews. It divides the understanding of DI into two levels, where the classical understanding according to Christensen can be understood as DI in a narrower sense, complemented by DI in a broader sense, which includes a more practical and value-oriented understanding [1,2,3,4,5,13,17]:

- DI in a narrower sense: DI are—mostly highly—new products that lead to a transformation of the market and its power balance. Especially from the perspective of established companies, the market penetration of DI happens in disguise and can therefore be an existential threat to them.

- DI in a broader sense: DI address new customer needs or existing needs in a new way. Through new product attributes, DI provide customers with new possibilities for using the product and for achieving their goals, which the conventional solutions do not offer.

Most of the existing approaches focus on a rather passive handling of DI. For example, they focus on recognizing the disruptive potential of innovations already introduced to the market [15,16,18] and on actions for delaying the disruption of the market by corresponding competitive reactions [13,18]. However, these passive approaches do not reduce the risk of disruption, as it is often not possible to respond appropriately to DI that have already been launched [5,7]. Furthermore, this retrospective view (ex-post) does not support the proactive planning of DI. Thus, the goal of this paper is to support the proactive control of market developments with the help of DI.

There are only a few approaches in research that support companies in the proactive planning of DI [5,7,13]. This proactive approach requires the disruptive potential of product ideas to be identified in advance (ex ante), which is challenging due to the high uncertainty and diversity of DI [4,5,6,15]. For a proactive management of DI, the literature suggests, e.g., the formation of separate business units to pursue DI independently from existing and potentially inappropriate practices and metrics [3,6]. This procedure implies that the product ideas in the separate business units are very likely to be disruptive and ignores the fact that product ideas with disruptive potential can also occur in other business contexts. These assumptions are therefore in contradiction to the essential characteristic of DI that they arise primarily by fortunate coincidence (serendipity) [17].

Against this background, Weinreich et al. [7] propose a methodological concept to proactively pursue DI with established processes, even in an existing corporate context: The first step is to identify the disruptive potential of the product ideas so that they can be dealt with appropriately (see abstracted Figure 1). Because DI are also in competition with other product ideas within the company, a holistic and comparative consideration of all product ideas in the company is done, e.g., in the context of value assessment [6,7]. For this comparative view, the literature suggests an evaluation based on customer value, which can be applied to all types of product ideas, e.g., in terms of the customer’s goal achievement or the degree to which the customer’s needs are fulfilled [6,12,17].

The disruptive potential depends heavily on how well product ideas fulfill customer needs. Customer needs and, thus, also their degree of fulfillment by the DI can change over time, which is why the market acceptability of DI is also time-dependent and disruption can be understood as a process [1,3]. Against this background, it is particularly important for DI to capture the disruptive potential on the basis of varying environmental conditions, for which the literature suggests continuous monitoring of the environment’s development [3,7].

Summarizing, it can be stated that there is a high relevance for companies to consider DI. Due to their characteristics, the management of DI requires adapted processes and methods, because inappropriate procedures can reduce their chances for market success [3]. Research also highlights the need for new approaches to support companies in the proactive management of DI [5], especially in the context of IPM [6,7].

2.2. Holistic Management of Innovation Portfolios

IPM focuses on the identification, evaluation, and selection of the most promising product ideas [10]. IPM can be placed in the early phase of product development, which is characterized by high uncertainty and goal diversity as well as low information quality and availability [10,19]. Extensive approaches for IPM exist in the literature, most of them based on the work of Cooper et al., who propose the dimensions of strategic fit, value maximization, and balance for structuring the evaluation and selection of product ideas [8,10]:

Strategic fit describes how product ideas are assessed in terms of their conformity with the corporate and innovation strategy [10].

Value maximization aims to identify the value of product ideas from different perspectives [10]. The majority of approaches in literature and practice focus on assessing direct business value using financial methods [10,11]. Studies confirm that this financial focus promotes short-term and hinders long-term success, because very new product ideas are particularly difficult to evaluate financially due to the lack of information available [10,11]. The evaluation based on customer value is recommended by research, especially for high-level product ideas [6,12]. However, customer value is only used in a few approaches, which is mainly due to its high level of abstraction and thus difficult practical applicability [10,11]. Customer value is also strongly influenced by external factors and is therefore very dynamic, which requires continuous adjustment of the assessment [20,21].

Balance describes the composition of the portfolio in terms of different product ideas (e.g., high and low risk, type and degree of innovation, short and long term) in order to reduce the risk of development and market launch, e.g., through high diversification of product ideas [10]. As a result, different product ideas should be pursued simultaneously in IPM [8,20]. In this context, ambidexterity describes the ability of a company to simultaneously drive forward opposing activities, such as both generating new products (exploration) and being efficient in day-to-day business (exploitation) [22]. To implement ambidexterity, the literature suggests pursuing product ideas appropriately according to their characteristics, e.g., to avoid rejecting high-level product ideas systemically due to inappropriate approaches [6,22]. Despite specific procedures, the product ideas should not be considered fully independently of each other because there may be constraints and synergy interdependencies between them [8,10].

Summarizing, the literature provides a variety of approaches that support IPM. However, due to the complexity and diversity of use cases, no approach exists that is universal and applicable to all types of product ideas. Therefore, the literature demands new approaches that are adapted to the specific use cases [23,24], such as the consideration of DI in IPM [6,7].

3. Requirements on a Methodology for Managing DI in IPM

In this Section, six requirements for the methodology are derived, which relate to the decisions in IPM, the value-oriented handling of diverse product ideas, and the practicable application of the methodology, especially in established companies.

3.1. Decisional Requirements in IPM

R1: Because IPM can be placed in the early phase of product development, a methodology should deal appropriately with the boundary conditions there, such as high uncertainty, low information availability/quality, and high goal and stakeholder diversity.

R2: IPM focuses on the identification, evaluation, and selection of promising product ideas. For this, the literature demands a systematic multi-stage evaluation and selection process in order to be able to take into account, for example, the different quality of information and degrees of maturity of the product ideas [19,25]. The proceeding should also be able to deal appropriately with product ideas with opposing characteristics (see ambidexterity).

3.2. Value-Oriented Requirements for Managing Diverse Product Ideas

R3: In order to take DI into account in IPM, the disruptive potential of product ideas needs to be identified. For a proactive approach, it is necessary to determine the disruptive potential of product ideas in advance (ex ante).

R4: Because the disruptive potential of product ideas can change over time due to environmental shifts, the methodology should provide a flexible way to consider these changes.

3.3. Practical Requirements

R5: The practical applicability of the methodology appears trivial, but it is challenging due to the complexity of IPM and DI. Here, a structured handling of complex information is important, and the procedure should be comprehensible and repeatable [26]. Universal applicability also requires the flexible customizability of the methodology to the diverse use cases in companies.

R6: Especially when applied in established companies, the challenge is to integrate an approach into existing process environments with minimal invasiveness. Consequently, handy tools and methods should be proposed rather than fundamentally new procedures.

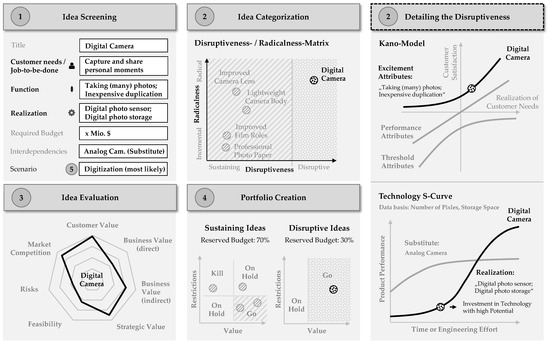

4. Development of a Methodology for Managing DI in IPM

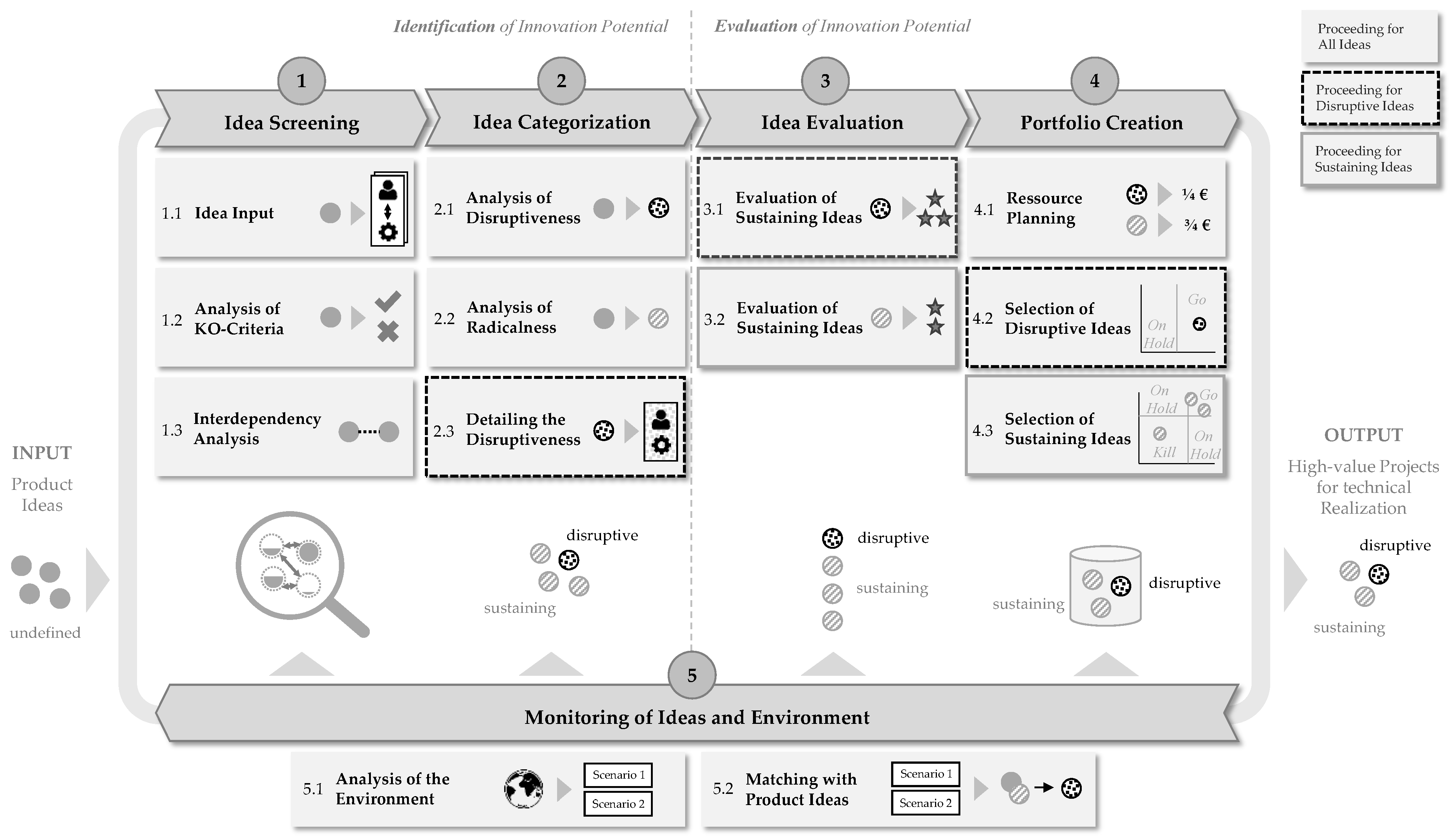

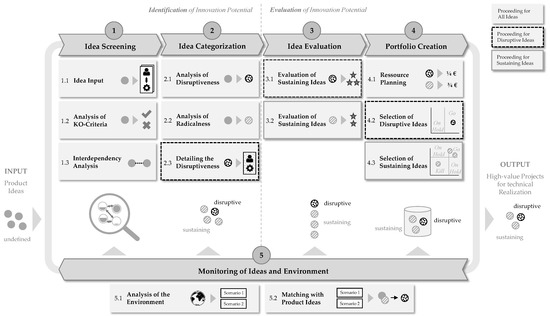

This Section presents the developed methodology for considering DI in IPM (see Figure 2). The methodology can be placed in the early phase of product development and focuses on identifying, evaluating, and selecting the most promising product ideas as the core decision in IPM [10,19]. The process of the methodology is based on the product planning approaches of Feldhusen and Grote [27] and VDI2220 [25]. The work of Eversheim [19] is decisive for the procedure in IPM, with VDI2220 [25] providing a detailed description of the multi-stage evaluation and selection process. With regard to content, the methodology specifies and extends the work of Weinreich et al. [7], who presented a methodological concept to consider DI in IPM.

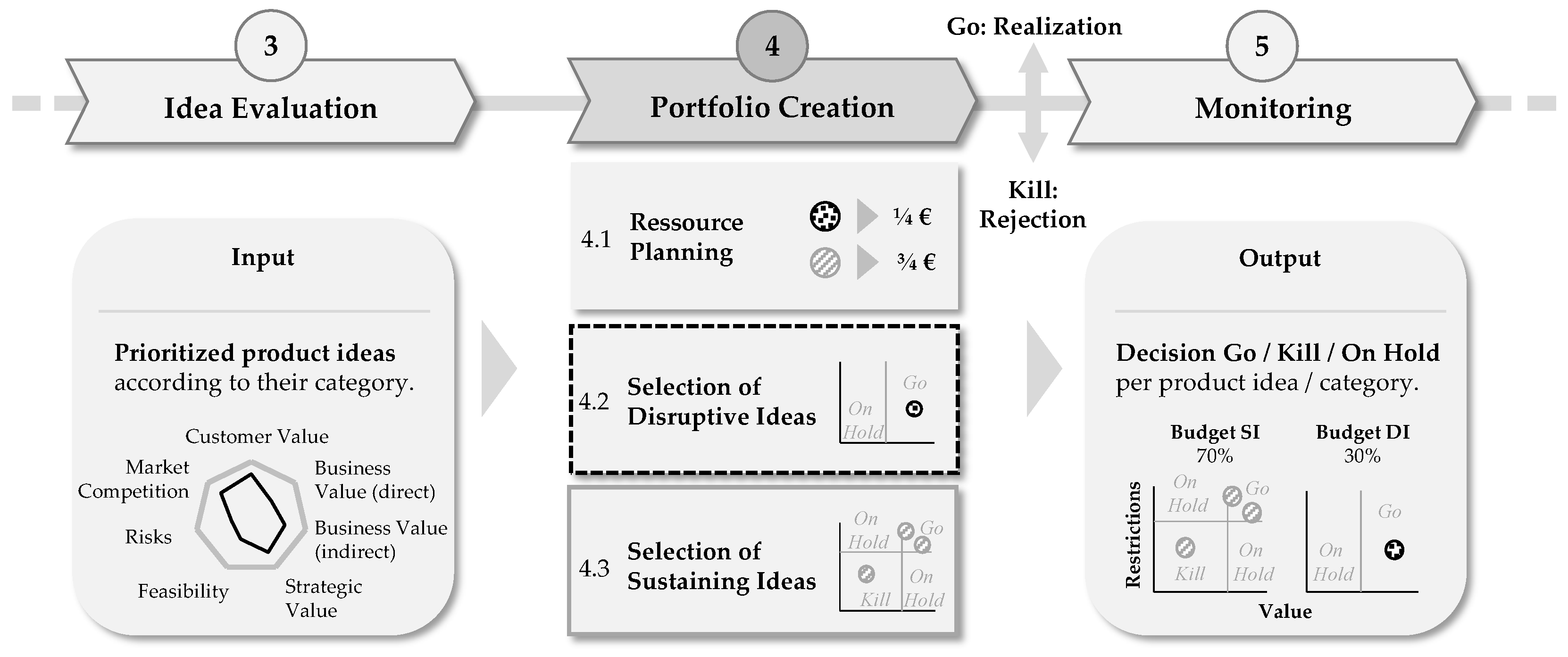

Figure 2.

Methodology to integrate disruptive innovation into value-oriented portfolio planning, based on [7].

The inputs for the methodology are the diverse product ideas of a company, whose technical realization has to be decided. Accordingly, the outputs are promising product ideas that are to be transferred to technical realization for their future market launch.

The methodology is roughly divided into the steps of identifying and evaluating the potential (see also Figure 1). First, the disruptive potential of the product ideas is identified so that the following evaluation and selection can take place appropriately on the basis of the ideas’ characteristics. For this purpose, the methodology provides idea-specific procedures, e.g., in order to examine DI more intensively via iterations. The monitoring step adds a cyclical nature to the procedure, so that product ideas can be re-evaluated due to changes in the environment.

During the potential identification, the variety of available product ideas is described in a structured form using a standardized template (Section 4.1, Idea screening). On this basis, the product ideas can be assessed and categorized in terms of their market impact (disruptive/sustaining) and their degree of novelty (incremental/radical) (Section 4.2 Idea categorization). With this categorization, the product ideas can be appropriately pursued according to their characteristics, for example, in the following value evaluation (Section 4.3, Idea evaluation). The product ideas prioritized in this way are then selected for transfer to technical realization (Section 4.4, Portfolio creation). Product ideas that are less promising and therefore are not transferred are stored in an idea repository. There, they are constantly checked to identify whether their disruptive potential, and thus their chances of later realization, have increased as a result of changes in the environment (Section 4.5, Monitoring of ideas and environment).

4.1. Idea Screening

Idea screening addresses the challenge in companies of dealing with a variety of highly divergent product ideas. The goal is therefore to structure this diversity by describing the product ideas in a standardized and uniform manner. For this purpose, idea screening is divided into the sub-steps of idea input, analysis of the ideas using knockout criteria, and analysis of interdependencies.

4.1.1. Idea Input

For the standardized presentation of product ideas, it is important which aspects and levels of description are purposeful for their appropriate handling. Comprehensive profiles for the presentation of product ideas exist in the literature [19,28,29]. For the purpose of this paper, an idea profile should be applicable to different types of product ideas, e.g., it should reflect their different attributes on a minimum common denominator. This paper is therefore based on Weinreich et al. [7], who have derived three levels of description for dealing with DI:

- Level of customer needs (‘Which need is served by the idea and how?’): Orientation on customer needs is crucial for customer acceptance and thus the success of DI and SI (exemplary need ‘capturing and sharing personal moments’).

- Level of product function (‘What function does the idea have?’): The function of an idea is crucial for determining which customer need is addressed and should be described in a solution-neutral way in the sense of systems engineering [30] (e.g., the need ‘capturing and sharing personal moments’ is addressed by the function ‘taking photos’).

- Level of product realization (‘How is the idea realized?’): Product realization describes the technical solution of idea and function and is decisive to what degree a customer need is fulfilled (e.g., the need ‘capturing and sharing personal moments’ is more fulfilled by the digital camera than by the analog camera).

These three description levels form the core of the idea profile and are rounded off by administrative and organizational aspects such as title, brief description, and budget required for realization (see Figure 7 for an example).

4.1.2. Analysis Using KO Criteria

In order to reduce the effort of dealing with the diversity of ideas, the product ideas are checked to determine whether they are suitable for further consideration, whereby inappropriate ideas can be sorted out. For this analysis, the KO criteria according to Messerle are applied [28], see Table 1.

Table 1.

KO criteria for checking the general suitability of product ideas, based on [28].

4.1.3. Interdependency Analysis

Between product ideas there can be synergy, constraint and—especially in the case of DI—substitution dependencies, which influence their handling. Therefore, the interdependency analysis aims at revealing dependencies between product ideas. For this purpose, the method of the interconnection matrix is applied, in which the interactions between the ideas can be shown with the help of pair-wise comparisons. Thus, related ideas can be identified, and their functionality can be ensured by linking them for further process steps [31].

The result of the idea screening is that the diverse product ideas are now presented in a structured and uniform way, also with regard to their interactions, and are generally suitable for their realization.

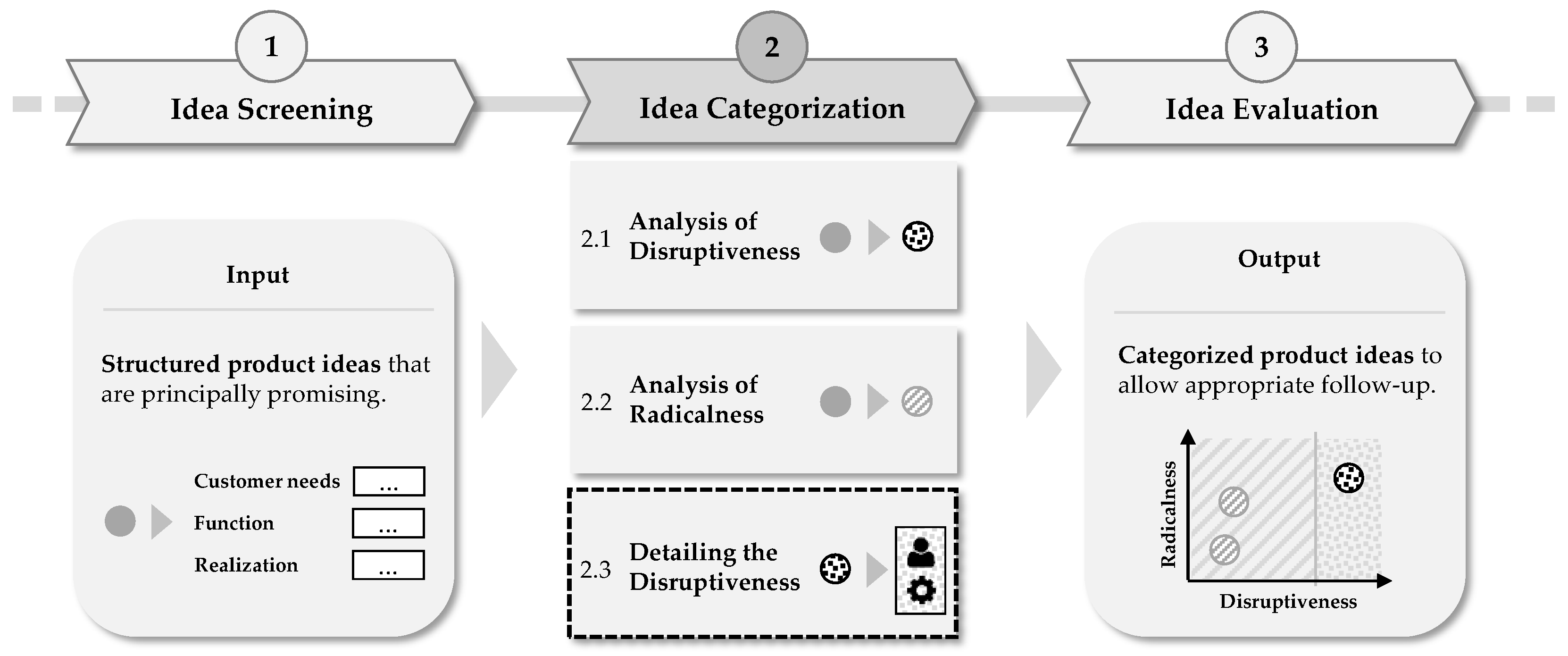

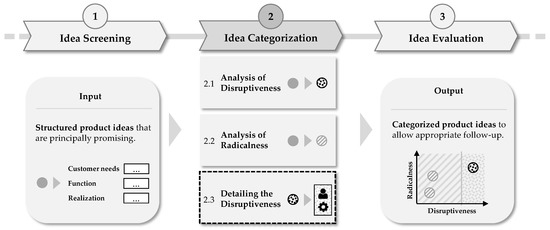

4.2. Idea Categorization

It is possible that suboptimal procedures can lead to promising product ideas being rejected. For this reason, the literature demands specific procedures for different product ideas in order to ensure their appropriate handling [3,6,10]. For this purpose, it is necessary to divide the product ideas into meaningful categories, within which an appropriate handling is ensured by an optimized use of methods.

For this, this paper follows the categorization of Schimpf [17], where product ideas are classified according to their market impact (disruptive/sustaining) and their degree of novelty (radical/incremental). This results in the sub-steps of analyzing the disruptiveness and radicalness of product ideas as well as a more in-depth presentation of DI (Figure 3).

Figure 3.

Idea Categorization: Input/output and procedure.

4.2.1. Analysis of Disruptiveness

The aim of the disruptiveness analysis is to identify the disruptive potential of product ideas. For this purpose, systematic literature research and analyses of past DI were used to derive characteristics that are typical for DI. These characteristics are used to make predictions (ex ante) regarding the disruptive potential of product ideas. These characteristics are examined using a checklist, in which it is selected to what extent the respective characteristic is present for the considered product idea (see Table 2). The more typically disruptive characteristics are selected, the more disruptive the potential of the idea can be interpreted [7]. For consistency and traceability within the methodology, the structure of the checklist follows the three description levels from the idea screening (see Section 4.1.1).

Table 2.

Criteria to analyze the disruptiveness of product ideas, based on [1,2,5,7,13,15,16,18,32].

4.2.2. Analysis of Radicalness

Interviews with practitioners confirmed the statement in the literature that disruptive potential is often wrongly assigned to very new SI due to their high degree of uncertainty [7]. Therefore, the goal of the analysis of radicalness is to increase transparency within SI in order to clearly distinguish radical SI from DI and to avoid confusion.

The radicalness of product ideas can be determined using the evaluation model of Hermann et al. (see Table 3) [33]. Here, the ideas are assessed on a 5-level scale, with higher values indicating greater novelty and thus radicalness. Because Hermann et al. do not propose a clear distinction between incremental and radical ideas, it is up to the applying company to set its own limit for the distinction between radical and incremental ideas [33].

Table 3.

Criteria to analyze the radicalness of product ideas, based on [33].

The result of the analysis of disruptiveness and radicalness can be presented concisely and practically in the disruptiveness-radicalness matrix (see Figure 7 for an example).

4.2.3. Detailing the Disruptiveness

To what extent product ideas are pursued further in the company depends partly on the level of detail with which they are described. DI can often only be presented with a low level of information quality, which means that they can be systemically rejected simply because of this poor presentation [3,6,28]. In this process step, which is only for DI, the goal is to describe DI in depth and in a comprehensible way. For this purpose, the two description levels of the customer need and the realization are deepened (see Section 4.1.1), which is supported methodologically as follows:

- Customer needs: DI not only leads to customer satisfaction, but also to customer delight, which is an extraordinary positive expression of satisfaction [1,2,6]. The Kano model can be used to analyze the extent to which the fulfillment of customer needs generates delight, satisfaction, or indifference [34]. For this, by combining functional and dysfunctional questions, the expected reaction of the customer can be estimated if the need is fulfilled (functional question) or not fulfilled (dysfunctional question) [35]. Customer delight, which is relevant for DI, exists when the customer does not expect the fulfillment of the (latent) need, but is extraordinarily satisfied as a result. Results of the Kano analysis can be visualized in a practical way via the three graphs of the Kano model (see exemplary Figure 7) [34,35].

- Realization: DI are often based on technologies with a low level of maturity and thus a high potential for further development, so that they can outperform competing products in the long term despite their initially lower performance [1]. The current and potential performance of a product idea can be analyzed using the technology S-curve [36,37]. To model the S-curve, the performance characteristics of a product idea are selected and can be mapped via easily quantifiable parameters (e.g., number of transistors on chips, number of pixels in cameras, storage capacity of hard disks) [37]. Based on these parameters, the S-curve can be modeled mathematically using the Gompertz function, which is also used as an asymmetric saturation function for trend research or modeling biological growth processes (see Figure 7 for an example) [38]. Depending on the position on the S-curve, recommendations for the handling of the product idea can be derived (e.g., investment in case of expected increase in performance and S-curve, restraint in case of flattening S-curve) [36].

The result of the idea categorization is the classification of the product ideas with regard to their market impact (disruptive/sustaining) and their degree of novelty (radical/incremental), in order to enable an appropriate treatment per category. The presentation of DI was detailed to deepen their understanding.

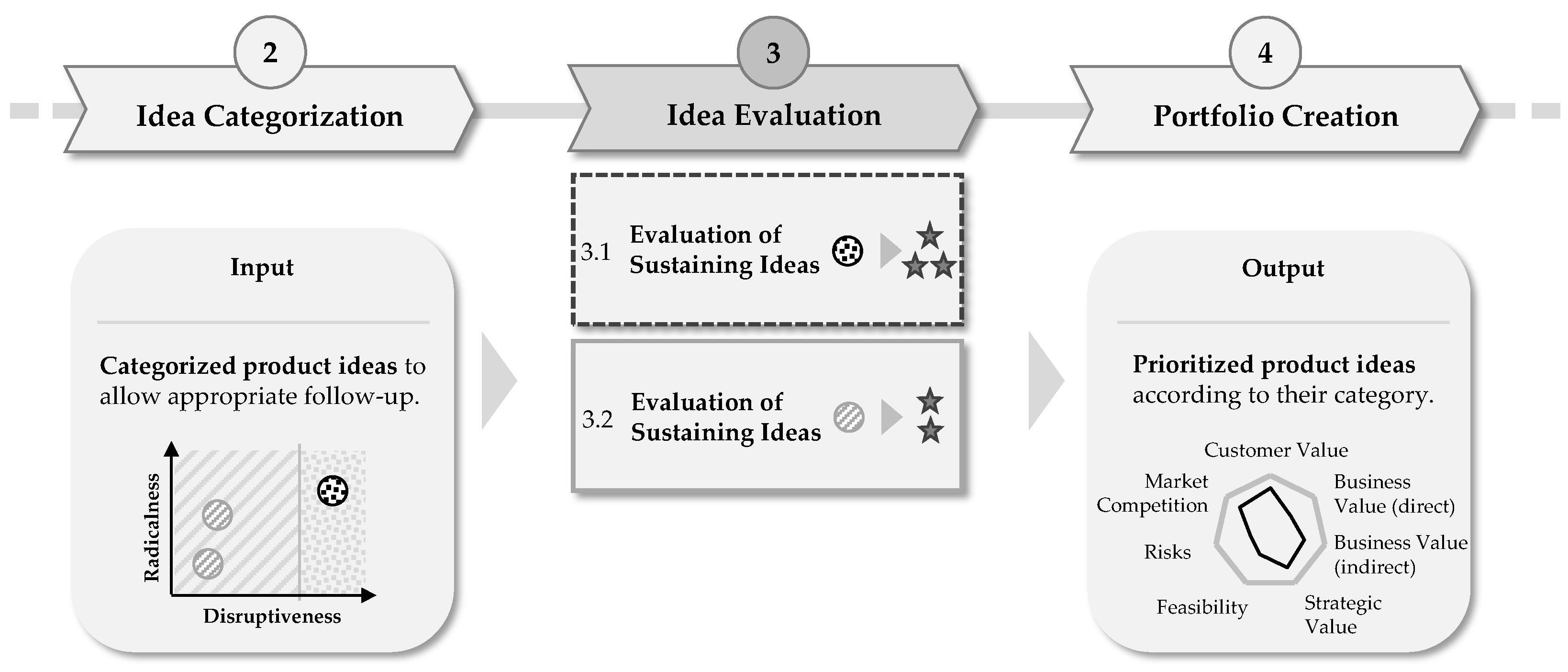

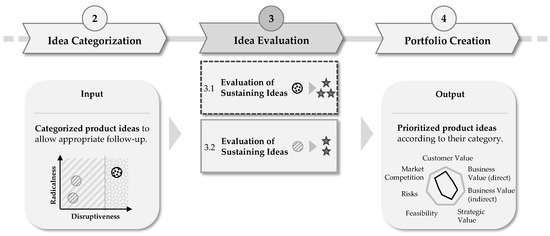

4.3. Idea Evaluation

Through inappropriate methods, even generally promising product ideas can be rejected [8,20]. To ensure appropriate handling, the product ideas were categorized (see Section 4.2) so that they can now be comprehensively evaluated according to these categories. The result of this process step is a ranking of the product ideas in terms of their value contribution within the categories.

In the literature, a variety of approaches exist for evaluating different types of product ideas [10,24,28]. However, due to the diversity of use cases, there is no universally valid evaluation approach. Against this background, an evaluation procedure is proposed in the following, which provides procedures adapted to the idea categories and can be flexibly adapted to the different use cases in the company (Figure 4).

Figure 4.

Idea Evaluation: Input/output and procedure.

4.3.1. Selection of the Evaluation Method and Criteria

The scoring model is a universal evaluation method that can be used in the early phase. It allows product ideas to be comprehensively evaluated on the basis of various criteria with variable weighting [24,39]. The literature provides comprehensive catalogs of evaluation criteria [19,25,28], but due to the diversity of product ideas and use cases, it is not purposeful to specify a specific set of criteria for a rigid evaluation. Therefore, it remains the task of the companies to select suitable evaluation criteria for their respective use cases. In order to ensure the holistic focus required in IPM, Şahin et al. [40] and Weinreich et al. [7] derived seven dimensions into which the evaluation criteria can be classified: customer value, business value (direct), business value (indirect), strategic value, market competition, feasibility, and risk (see left column in Table 4). For a holistic evaluation, companies should ensure that the evaluation of product ideas is based on criteria from all dimensions, whereby the specific evaluation criteria per dimension can be selected individually [7,40].

Table 4.

Suitability of evaluation criteria for idea categories.

4.3.2. Suitability of Evaluation Criteria for Idea Categories

In addition to a holistic evaluation, it should also be ensured that appropriate evaluation criteria are applied per idea category because, e.g., financial criteria can hinder DI [6,10,11]. On the basis of the systematic literature review and the analysis of past DI, tendencies were determined as to which evaluation criteria are more or less suitable for which idea categories. Specifically, the question was examined of which evaluation criteria are discussed and applied in the context of which idea category. The more often a criterion is mentioned in the context of an idea category, the more suitable the criterion appears for the respective idea category. Abstractly, the statement regarding the suitability for different idea categories can also be made on the level of the seven dimensions. The extent to which the dimensions are suitable for DI and SI is shown in Table 4. In this context, Customer Value can be particularly highlighted and can be applied across all innovation categories, supporting a comparative view and practicable applicability [6]. The suitability of the dimensions can also serve as an orientation for weighting the evaluation criteria. For practical communication, the results of the idea evaluation can be visualized in portfolio maps (see Figure 7 for an example) [8,10].

As a result of the idea evaluation, the product ideas are comprehensively evaluated and prioritized within their categories according to value and restrictions.

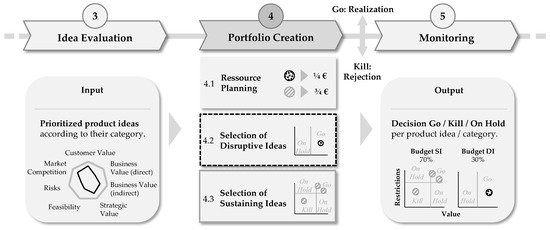

4.4. Portfolio Creation

In portfolio creation, the most promising product ideas are selected for the innovation portfolio in order to allocate them the budget required for their realization. In this context, literature and practice emphasize that DI is often rated lower than competing ideas and is therefore not considered for realization (see Kodak®) [3,7]. Against this background, the challenge of this process step is to consider DI in addition to SI in resource allocation to ensure balance in IPM [6,7]. This results in the sub-steps of resource planning and idea selection (Figure 5).

Figure 5.

Portfolio Creation: Input/output and procedure.

4.4.1. Resource Planning

To ensure that budget is allocated to DI besides SI, the method of Strategic Buckets can be used [41]. Here, the company’s available budget is divided into fixed parts, each of which is reserved for a specific purpose [10,41]. This allows companies to individually split their budget for SI and DI, e.g., in a ratio of 80/20, thus ensuring that the budget is allocated to DI even if its evaluation result is generally worse than that of SI [7].

4.4.2. Idea Selection

The selection of product ideas for their realization is also of a highly qualitative nature due to its location in the early phase and thus dependent on subjective expert knowledge [25,27]. To objectify this selection decision, the previous results of the methodology can be used:

- The disruptiveness/radicalness analysis can be used to estimate which product ideas have greater disruptive potential (see Section 4.2).

- The idea evaluation is used to prioritize the product ideas in terms of their value (see Section 4.3).

- The interdependency analysis indicates which product ideas should/must be pursued in a bundled manner or which are mutually excluding (see Section 4.1.3).

Based on these results from the idea analysis and evaluation, a decision can be made on how to deal with the product idea. This results in the following decision alternatives [7]:

- Go: The product idea is classified as promising, is allocated the budget required for its technical realization, and is transferred to the responsible development departments. The planning phase of the idea is thus completed, and the idea leaves the process of the methodology.

- On Hold: The product idea is generally promising, but its technical realization is not recommended at the current time. The idea is not transferred to its technical realization but is parked in an idea repository. If, for example, changes in the environment increase the (disruptive) potential of this idea, a re-evaluation can be initiated at a later point in time, which can then lead to budgeting and realization of the idea (see Section 4.5).

- Kill: The product idea is definitely not promising with sufficient certainty. Its further pursuit is rejected, as is a possible re-evaluation at a later point in time. There is neither a transfer to technical realization nor to the idea repository, and the idea leaves the process of the methodology.

The result of the portfolio creation is a portfolio of promising product ideas that are to be implemented in the technical realization and ultimately brought to market maturity. Generally promising product ideas that, however, are not intended for realization at the current time form a repository of ideas and can be re-evaluated and realized at a later point in time.

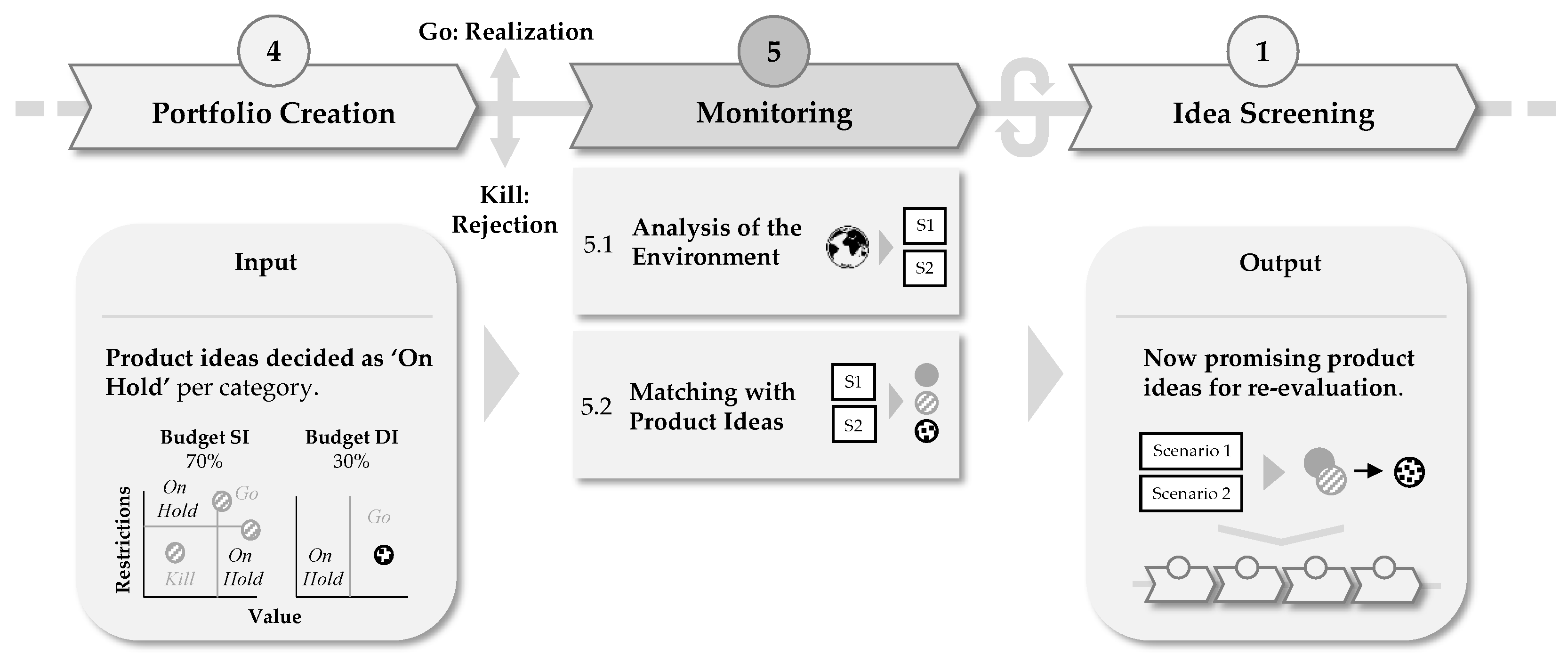

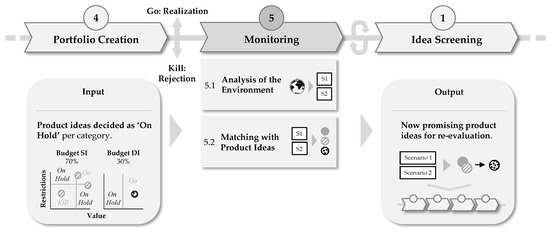

4.5. Monitoring of Ideas and Environment

The disruptive potential of product ideas might emerge or intensify only over time [3]. For example, the digital camera was invented as early as 1975, but did not experience its breakthrough until the 1990s, partly because the necessary conditions for market success were only created later with the introduction of PCs and the awareness of digital issues in society [9]. Against this background, it is therefore important to also take changes in the environment into account when determining the (disruptive) potential of product ideas [3,7]. The aim of this process step is therefore to examine, particularly for the product ideas parked in the idea memory (see Section 4.4.2), the extent to which their implementation and market launch at a later point in time is promising due to changed circumstances. This results in the sub-steps for deriving possible future scenarios and re-evaluating the product ideas (Figure 6).

Figure 6.

Monitoring: Input/output and procedure.

4.5.1. Deriving Possible Future Scenarios

How the business environment and general circumstances will change can be anticipated using the scenario technique [42]. Market and future research, as well as expert knowledge, are used to estimate how possible future scenarios can be characterized (e.g., best/worst case or most/least likely) [43]. The PESTEL factors (Politics, Economy, Social, Technology, Ecology, and Legal) can be used to ensure that these scenarios are described holistically from different perspectives [44]. In addition, the probabilities of occurrence of the scenarios can be estimated, although their validity is strongly influenced by the high degree of uncertainty of the time horizon considered.

4.5.2. Re-Evaluating Product Ideas

The future scenarios can be used to anticipate the extent to which changing circumstances will influence the (disruptive) potential of product ideas. This is done by analyzing how well a product idea fits the respective scenario. Specifically, a scenario is selected as a basis on which to run through the procedure model of the methodology. Particularly during idea categorization and evaluation, the results the product idea achieves in the respective scenario are consequently analyzed. This procedure is repeated until each relevant product idea has been analyzed on the basis of the individual scenarios. The individual evaluations of the product ideas per scenario can be combined into an overall evaluation by adding them up, with a weighting corresponding to the probability of occurrence of the scenarios.

This procedure allows one to anticipate the conditions under which product ideas could be promising or even disruptive. When it becomes clear which scenario the actual development of the environment is approaching, the corresponding anticipated analyses and evaluations of the product idea can be used to execute its market launch without delay.

The result of the idea and environment monitoring is an estimation of to what extent the product ideas parked in the idea repository can be promising or even disruptive if circumstances change. This enables one to anticipate developments in the environment in order to optimize the market timing of product ideas and reduce the risk of DI.

5. Validation of the Methodology for Managing DI in IPM

In this Section, the methodology is validated in three steps: First, in accordance with the Support Evaluation of the Design Research Methodology (DRM) [14], the functionality of the methodology is examined using the example of the digital camera to determine how far the decision ‘market launch of digital camera vs. further development of analog camera’ could have been supported at Kodak®. The practical example of the digital camera and Kodak® was chosen because the disruption has already been completed here. Consequently, the digital camera can objectively be assigned disruptive potential as well as the characteristics typical for a DI. Modern product ideas where market disruption has not been completed are not suitable as validation examples, as their disruptive potential has not been proven and thus cannot be assumed with sufficient certainty. A methodology to support the management of DI would consequently have to detect the digital camera’s disruptive potential and accordingly take it into account in the further planning process.

Then, according to the Application Evaluation of DRM [14], the applicability, usability, and usefulness is evaluated with experts from the automotive and software industries. Finally, the extent to which the methodology fulfills the requirements from Section 3 is examined.

5.1. Support Evaluation through an Example (Digital Camera vs. Analog Camera)

Kodak® was a leader in the photographic industry, particularly in the second half of the 20th century, with a portfolio that included an ecosystem of analog cameras, film rolls, and photographic paper [9,45]. In 1975, the company invented the world’s first digital camera, but failed to recognize its potential and refused to develop it further into a marketable product [9,45]. From the mid-1990s, new competitors entered the market with their own digital cameras and were able to gain a significant market share from Kodak®, ultimately forcing the company to announce bankruptcy in 2012 [9].

Focus for the application of the methodology is the portfolio decision at Kodak® regarding which product ideas should be technically realized and thus brought to market maturity. At Kodak®, there were other product ideas competing for realization besides the digital camera, especially from the analog photography ecosystem, such as improvements in lens technology, film rolls, and photographic paper. Because Kodak® would have been able to produce the industry-transforming DI itself with its own research and development, one reason for the company’s failure was the suboptimal identification and selection of the most promising product ideas. How the methodology presented here could have assisted with this problem is examined below.

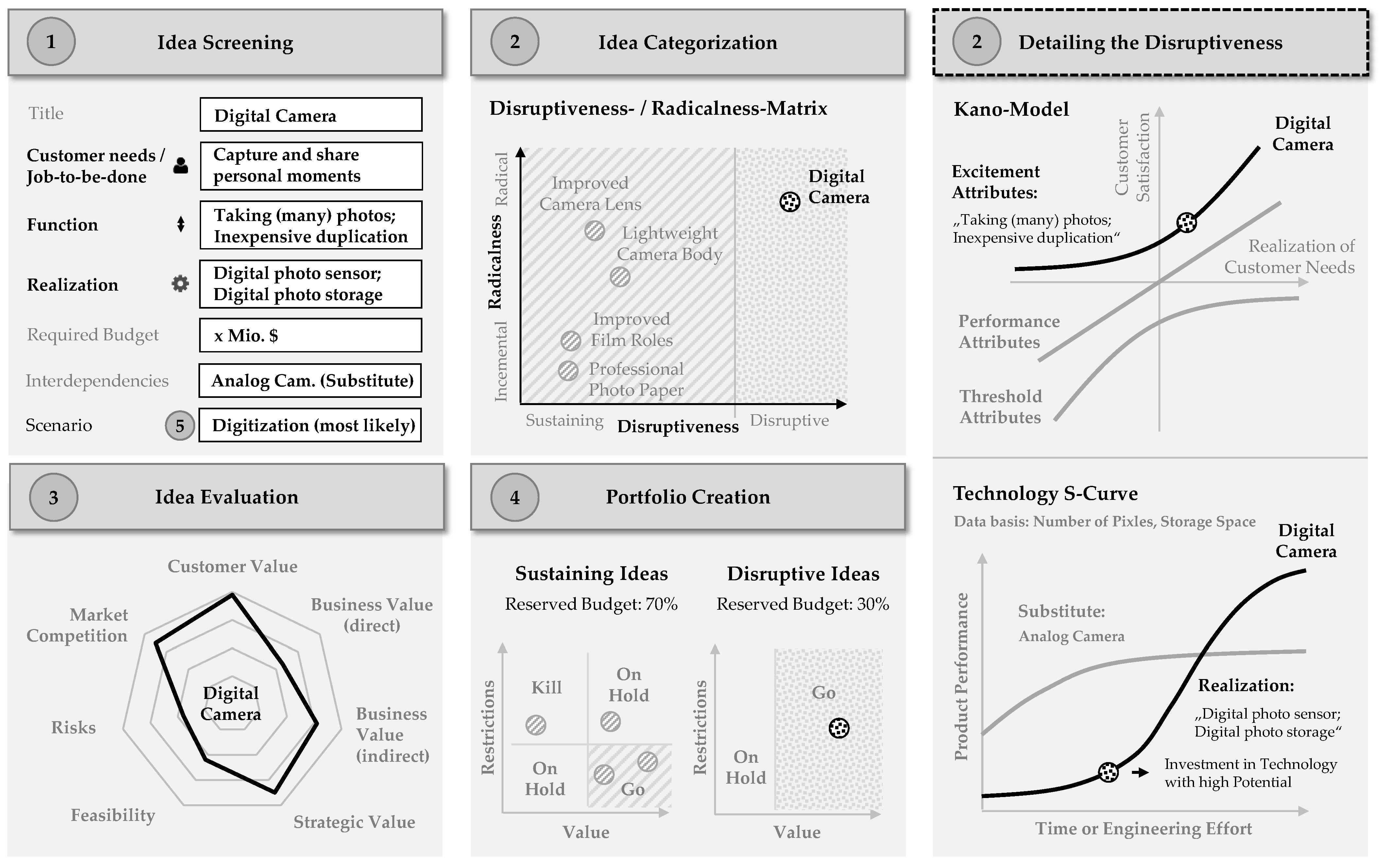

For the application of the methodology, various product ideas were defined that could have been in competition with the digital camera at Kodak® for their technical realization. The methodology was applied to these product ideas—Figure 7 shows the findings using the idea profile of the digital camera as an example.

Figure 7.

Support Evaluation of the proposed methodology by the example of the digital camera.

The first field illustrates the attributes of the digital camera, represented according to the three description levels proposed in the idea screening (Section 4.1). The disruptiveness/radicalness matrix in the second field is the result of the idea categorization (Section 4.2) and shows which product ideas have disruptive potential and which are incremental or high-level further developments of existing solutions. Using the developed checklist (Section 4.2.1), disruptive potential could be identified for the digital camera. To deepen the picture of the disruptive potential of the digital camera, the right-hand column shows the detailed analysis of disruptiveness (Section 4.2.3). Here, the Kano model is used to illustrate which functions of the digital camera lead to customer delight. The exemplary function of being able to take and share many photos at no extra cost, for example, leads to customer delight because it is not expected by customers and is perceived positively when it is fulfilled. Beneath the Kano model, the technology S-curve shows the degree of maturity and the potential for further development of the technology of digital photography compared with analog photography as the substitute solution. The curves were modeled using the Gompertz function, while the number of pixels and memory size of the cameras serve as description parameters. Results of the idea evaluation (Section 4.3) are visualized in a cobweb diagram using the derived seven dimensions for evaluation criteria. The portfolio maps for SI and DI in the lower center of Figure 7 display which product ideas are selected for realization based on the results of the previous process steps (Section 4.4). The assessment of the product ideas was based on the most likely scenario that the market for photography changes according to the trend towards digitization (Section 4.5). The consideration of other scenarios (e.g., continuation of an analog world) can lead accordingly to other results in idea categorization and evaluation, stating, for example, that the digital camera would be assigned a lower disruptive potential.

The application of the methodology using the selected practical example illustrates that it meets the intended purpose of assisting in the identification and selection of DI in the context of IPM.

5.2. Application Evaluation in a Practical Context

In addition to the support evaluation, the applicability and usability of the methodology was evaluated with selected experts from the automotive and software industry. The methodology was jointly applied in workshops with participants from various company departments (e.g., product management, sales, research and development), with the procedure being oriented to the guidelines of the Design Research Methodology [14].

The methodology was generally found to be practicable, mainly due to the comprehensible and simple methods and the precise visualization of the analysis and evaluation results (see Figure 7). The workshop participants positively emphasized the structured support in dealing with information complexity, while at the same time the methodology also enables adaptation to company- and department-specific procedures and integration of the expert knowledge. This ensures the flexible adaptability of the methodology to company-specific use cases, e.g., in the context of idea evaluation and selection.

For a purposeful handling of DI, it was found that the necessary mindset and awareness for a separate treatment of DI could be conveyed, e.g., via the practical disruptiveness analysis (Section 4.2.1) and the concise visualization of the analysis results. This made it possible to achieve a certain solidity and objectivity in the generally qualitative handling of DI. In order to achieve the holistic view required for DI, adapted teams and organizational structures may be necessary, especially for complex products, due to the high level of cross-disciplinary networking.

The suggestions for improvement resulting from the workshops have already been implemented in the presented methodology: For instance, the criteria for identifying the disruptive potential of product ideas have been sharpened so that only minimum prior knowledge is required for an effective use. In addition, the pre-selection of specific criteria within potential evaluation was avoided in favor of a universal applicability, in order to enable the flexible integration of individual criteria. An essential request was also the support in convincing decision makers by a comprehensible communication of DI. For this purpose, the results of the analysis of product ideas are visualized in a concise way, e.g., with the help of the Kano model commonly used in practice (see Figure 7).

The application of the methodology with selected practice partners illustrates that it meets the intended purpose of practical applicability.

5.3. Evaluation of Requirements

This section examines to what extent the methodology meets the requirements of Section 3:

- R1 (Applicability in the early phase): The methodology takes into account the challenges of the early phase, for example, by describing the diverse product ideas in a standardized way, increasing the quality of information by deepening DI, and proposing procedures adapted to the quality of the information, for example, in the value evaluation.

- R2 (Appropriate handling of diverse product ideas): Based on the categorization of product ideas, specific procedures for value evaluation and idea selection are proposed for each idea type, which ensures an appropriate handling of diverse product ideas.

- R3 (Identification of the disruptive potential ex ante): For a well-planned handling of DI, a method was developed in the process step of idea categorization to be able to anticipate the idea’s disruptive potential in advance.

- R4 (Consideration of changes in idea potential): The dynamics in the boundary conditions and resulting changes in the disruptive potential of the product ideas can be detected and taken into account in the monitoring step with the help of the scenario technique.

- R5 (Adaptability to company-specific use cases): Universal applicability was ensured in the methodology, for example, by making the idea input product-independent, allowing company-specific criteria to be selected for the value evaluation, and allowing the budget allocation to be designed flexibly.

- R6 (Manageable methods and tools): Especially in established companies, manageable tools are important for a practical application, so that simple methods such as product profile, checklist, scoring model, Kano model and technology S-curve are used in the methodology. The practicability could also be confirmed by the application with selected practice partners.

6. Discussion

In this Section, the findings of the paper are discussed and placed in a broader research context. With regard to content, this section builds directly on the evaluation of the presented methodology based on the derived requirements (Section 5.3). Finally, the need for further research is identified.

The literature describes the well-founded identification of the disruptive potential of product ideas as a key challenge for dealing with DI [1,5,6]. The majority of management approaches identify the disruptive potential of product ideas in the context of a specific use case, which hinders their flexible applicability [32]. In only a few management approaches DI are considered in a generalized way to ensure flexible and universal applicability [5,7]. The methodology presented here is designed to deal with diverse product ideas without limiting itself to specific use cases. Therefore, criteria for the identification of the disruptive potential of product ideas were derived in this paper that support universal applicability (Section 4.2). When formulating these criteria, attention was paid not only to scientific validity but also to practical applicability. This universality can be seen, for example, in the process steps of idea screening through the documentation concept (Section 4.1) and idea evaluation through the scoring model, which can be adapted to different types of product ideas (Section 4.3).

In existing approaches, the disruptive potential of product ideas is primarily identified retrospectively, i.e., in the case of products that have already been launched on the market (ex post) [5,15]. In this retrospective view, an appropriate response to a DI is often no longer possible, so that the danger of DI for established companies remains. Forward-looking approaches for a planned handling of DI (ex ante) are only rarely seen [5,7], but are necessary especially for established companies in order to proactively generate DI and reduce the risk of being forced out of the market by them. In the presented methodology, the focus is on proactive planning of DI. For this purpose, product ideas that are still in the planning stage are focused on, which enables a forward-looking view. In order to deal with these product ideas appropriately, for example, idea screening (Section 4.1) and idea evaluation (Section 4.3) examine how the low information quality and availability characteristic of the early phase have to be taken into account.

The literature emphasizes that the disruptive potential of product ideas depends on the environment and is thus variable over time [1,3]. In existing approaches, the disruptive potential is often identified on the basis of the currently existing environmental influences, whereby the integration of possible environmental changes is not taken into account [13,32]. In the methodology presented here, the dynamics of the environmental conditions and thus of the disruptive potential are considered in the monitoring step (Section 4.5), for example by testing the suitability of product ideas for certain scenarios and thus anticipating their disruptive potential.

For the management of DI in the corporate context, the literature suggests primarily the formation of separate business units [3,4]; approaches to integrate DI into an existing process environment in the company, for example, are only available in few cases [5,6]. Since ideas for DI arise particularly by coincidence in the course of processes and institutionalized processes often exist in established companies, the literature also calls for methodological support in integrating DI into existing structures [7,17]. The presented methodology is designed along established product planning procedures and also takes into account adjacent processes of IPM such as the preceding idea generation and the subsequent technical development. This is implemented in concrete terms, for example, by defining the information required for a continuous process flow in the idea description (Section 4.1), proposing separate process models for different types of product ideas (Section 4.3) and also taking account of internal company specifications when designing the portfolio (Section 4.4).

In IPM, the decision is made which product ideas are promising and should therefore be pursued further [10]. In accordance with the holistic focus in IPM, different types of product ideas should also be taken into account, which each require adapted procedures [8,10]. In this context, comprehensive approaches in IPM exist in the literature [11,19], but so far without taking DI into account [6,7]. The presented methodology allows to handle DI in parallel to other types of product ideas like SI within IPM. For this purpose, DI are identified as such (Section 4.2) in order to propose separate procedures for DI and SI, for example in the context of idea evaluation (Section 4.3) and portfolio creation (Section 4.4).

In summary, it can be stated that the presented methodology makes a comprehensive contribution to the literature by serving identified needs: For example, the methodology supports the standardized understanding of DI, the identification of disruptive potential already during the planning phase, the consideration of potential changes due to environmental dynamics, and enables a flexible and universal handling of DI in the existing corporate context, especially in the context of IPM.

This contribution leads to open questions for further research: The methodology was validated by a Support Evaluation and Application Evaluation according to the DRM, meaning the application with an example in a practice context [14]. Additionally, the Success Evaluation [14] could be used to examine if the methodology has actually led to DI. In order to promote the handling, especially of complex products, manageable methods for interdependency analysis should be provided (e.g., according to [46]). In this paper, criteria were described for the anticipatory identification of the disruptive potential of product ideas—further studies could be conducted on the weighting of these criteria to examine their varying relevance for the assessment of disruptive potential. Further studies could also investigate the suitability of evaluation criteria for different types of product ideas, for example, in order to improve the value evaluation of DI through a well-founded recommendation of specific criteria. Furthermore, studies could investigate which evaluation criteria can be used to evaluate DI in a practicable and comprehensible way in a corporate context, so that the financial methods primarily used in practice, but which hinder innovation, can be counterbalanced. In dealing with DI, market timing is of high relevance, which could be supported by a more in-depth coupling with release planning approaches, see Şahin et al. [40], for example.

7. Conclusions

Disruptive innovations (DI) offer the potential to fundamentally change markets and their power relations, whereby the current dynamic markets foster the occurrence of DI [1,3]. Especially for established companies, this means that the risk of being forced out of the market by DI increases. At the same time, companies also have an increasing opportunity to generate their own DI to shape market developments, for example, by innovation portfolio management (IPM) [7]. However, the management of DI is challenging due to their characteristics, resulting in demand for appropriate approaches in literature and industrial practice [5,6].

This paper presents a methodology that particularly supports established companies to also consider DI within existing structures in IPM. The presented methodology consists of a five-stage methodically supported process model, whereby in the first step the variety of available product ideas is made manageable through a standardized and purposeful description for the further process flow. Based on this, the methodology presents a checklist for identifying the disruptive potential of product ideas in a well-founded manner in order to pursue them appropriately according to their potential. Thus, for example, the product ideas can be evaluated according to their potential in the following value evaluation so that “apples are not compared to pears”. Based on their evaluation and prioritization, the various product ideas are bundled into an innovation portfolio, whereby the most promising receive the budget required for their technical realization. In this context, the methodology ensures that DI also receive the appropriate budget, even if their value might seem less favorable, e.g., due to high uncertainty. Finally, a monitoring concept allows one to optimize the market timing, especially for DI, by examining their fit to current and future environmental influences. Summarizing, the presented methodology supports the consideration of DI in IPM to ensure their technical realization in the adjacent development process and ultimately their market launch.

The methodology was validated using a practical example: In retrospect, the methodology could have supported Kodak® in advancing its own digital camera as the DI of the photographic industry, in addition to the further development of the analog camera, in order to master the transition to digitalization. In addition, the methodology was applied by industrial experts from the automotive and software industry, where its purposeful and practicable applicability was confirmed.

Author Contributions

Conceptualization, S.W.; methodology, S.W., T.Ş.; validation, S.W. and M.K.; formal analysis, S.W.; investigation, S.W., T.Ş. and M.K.; resources, S.W. and T.V.; writing—original draft preparation, S.W., T.Ş. and M.K.; writing—review and editing, S.W., T.Ş., M.K. and T.V.; visualization, S.W.; supervision, T.V.; project administration, S.W.; funding acquisition, T.V. All authors have read and agreed to the published version of the manuscript.

Funding

We acknowledge support by the Open Access Publication Funds of Technische Universität Braunschweig.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Disclaimer

The results, opinions and conclusions expressed in this paper are not necessarily those of Volkswagen AG.

References

- Christensen, C.M. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail; Harvard Business School Press: Boston, MA, USA, 1997. [Google Scholar]

- Christensen, C.M.; Raynor, M.E. The Innovator’s Solution: Creating and Sustaining Successful Growth; Harvard Business School Press: Boston, MA, USA, 2003. [Google Scholar]

- Christensen, C.M.; Raynor, M.; McDonald, R. What Is Disruptive Innovation? Available online: https://hbr.org/2015/12/what-is-disruptive-innovation (accessed on 15 November 2021).

- Danneels, E. Disruptive technology reconsidered: A critique and research agenda. J. Prod. Innov. Manag. 2004, 21, 246–258. [Google Scholar] [CrossRef]

- Rasool, F.; Koomsap, P.; Afsar, B.; Panezai, B.A. A framework for disruptive innovation. Foresight 2018, 20, 252–270. [Google Scholar] [CrossRef]

- Weinreich, S.; Şahin, T.; Inkermann, D.; Huth, T.; Vietor, T. Managing disruptive innovation by value-oriented portfolio planning. Proc. Des. Soc. DESIGN Conf. 2020, 1, 1395–1404. [Google Scholar] [CrossRef]

- Weinreich, S.; Şahin, T.; Huth, T.; Breimesser, H.; Vietor, T. How to manage disruptive innovation—A conceptual methodology for value-oriented portfolio planning. Procedia CIRP 2021, 100, 403–408. [Google Scholar] [CrossRef]

- Cooper, R.G.; Edgett, S.J.; Kleinschmidt, E.J. New product portfolio management: Practices and performance. J. Prod. Innov. Manag. 1999, 16, 333–351. [Google Scholar] [CrossRef]

- Estrin, J. Kodak’s First Digital Moment. Available online: https://lens.blogs.nytimes.com/2015/08/12/kodaks-first-digital-moment/ (accessed on 22 November 2021).

- Cooper, R.G.; Edgett, S.J.; Kleinschmidt, E.J. Portfolio Management: Fundamental to New Product Success. Available online: https://www.stage-gate.com/wp-content/uploads/2018/06/wp12.pdf (accessed on 15 November 2021).

- Killen, C.P.; Hunt, R.A.; Kleinschmidt, E.J. Project portfolio management for product innovation. Int. J. Qual. Reliab. Manag. 2008, 25, 24–38. [Google Scholar] [CrossRef] [Green Version]

- Woodruff, R.B. Customer value: The next source for competitive advantage. J. Acad. Mark. Sci. 1997, 25, 139–153. [Google Scholar] [CrossRef]

- Hang, C.C.; Chen, J.; Yu, D. An assessment framework for disruptive innovation. Foresight 2011, 13, 4–13. [Google Scholar] [CrossRef]

- Blessing, L.T.M.; Chakrabarti, A. DRM, A Design Research Methodology; Springer: London, UK, 2009. [Google Scholar]

- Govindarajan, V.; Kopalle, P.K. The Usefulness of Measuring Disruptiveness of Innovations Ex Post in Making Ex Ante Predictions. J. Prod. Innov. Manag. 2006, 23, 12–18. [Google Scholar] [CrossRef]

- Nagy, D.; Schuessler, J.; Dubinsky, A. Defining and identifying disruptive innovations. Ind. Mark. Manag. 2016, 57, 119–126. [Google Scholar] [CrossRef]

- Schimpf, S. Praxisstudie Disruption. Available online: http://publica.fraunhofer.de/documents/N-540819.html (accessed on 16 November 2021).

- Christensen, C.M.; Johnson, M.W.; Rigby, D.K. Foundations for growth: How to identify and build disruptive new businesses. MIT Sloan Manag. Rev. 2002, 43, 22–31. [Google Scholar]

- Eversheim, W. Innovationsmanagement für Technische Produkte; Springer: Berlin/Heidelberg, Germany, 2003. [Google Scholar]

- Killen, C.P.; Hunt, R.A.; Kleinschmidt, E.J. Project portfolio management and enterprise decision making: Benchmarking practices and outcomes. In Proceedings of the 11th Annual Conference of Asia Pacific Decision Sciences Institute (APDSI 2006), Hong Kong, China, 14–18 June 2006. [Google Scholar]

- Fitzgerald, M.E.; Ross, A.M. Sustaining lifecycle value: Valuable changeability analysis with era simulation. In Proceedings of the 2012 IEEE International Systems Conference SysCon 2012, Vancouver, BC, Canada, 19–22 March 2012. [Google Scholar]

- Tushman, M.L.; O’Reilly, C.A., III. Ambidextrous Organizations: Managing Evolutionary and Revolutionary Change. Calif. Manag. Rev. 1996, 38, 8–29. [Google Scholar] [CrossRef] [Green Version]

- Brasil, V.C.; Salerno, M.S.; Gomes, L.A.D.V. Valuation of innovation projects with high uncertainty: Reasons behind the search for real options. J. Eng. Technol. Manag. 2018, 49, 109–122. [Google Scholar] [CrossRef]

- Flechas Chaparro, X.A.; de Vasconcelos Gomes, L.A.; de Souza Nascimento, P.T. The evolution of project portfolio selection methods: From incremental to radical innovation. Rev. Gestão 2019, 26, 212–236. [Google Scholar] [CrossRef] [Green Version]

- Deutsche Norm. Multiprojektmanagement—Management von Projektportfolios, Programmen und Projekten—Teil 2: Prozesse, Prozessmodell; Beuth Verlag: Berlin, Germany, 2013. [Google Scholar]

- Becerril, L.; Guertler, M.; Longa, E. Developing design methods—A conceptual requirement framework. Proc. Des. Soc. Int. Conf. Eng. Des. 2019, 1, 1463–1472. [Google Scholar] [CrossRef] [Green Version]

- Feldhusen, J.; Grote, K.-H. Produktplanung. In Pahl/Beitz Konstruktionslehre: Methoden und Anwendung Erfolgreicher Produktentwicklung, 8th ed.; Springer: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Messerle, M. Methodik zur Identifizierung der erfolgversprechendsten Produktideen in den Frühen Phasen des Produktentwicklungsprozesses. Ph.D. Thesis, Universität Stuttgart, Stuttgart, Germany, 2016. [Google Scholar]

- Vahs, D.; Burmester, R. Innovationsmanagement. Von der Produktidee zur Erfolgreichen Vermarktung, 3rd ed.; Schäffer-Poeschel: Stuttgart, Germany, 2005. [Google Scholar]

- Schulze, S.-O. Systems Engineering. In Handbuch Produktentwicklung; Carl Hanser Verlag: Munich, Germany, 2016. [Google Scholar]

- Ruhe, G. Product Release Planning: Methods, Tools, and Applications; CRC Press: Boca Raton, FL, USA, 2010. [Google Scholar]

- Keller, A.; Hüsig, S. Ex ante identification of disruptive innovations in the software industry applied to web applications: The case of Microsoft’s vs. Google’s office applications. Technol. Forecast. Soc. Change 2009, 76, 1044–1054. [Google Scholar] [CrossRef]

- Herrmann, T.; Roth, D.; Binz, H. Derivation of criteria for radical product ideas. In Proceedings of the DESIGN 2018 15th International Design Conference, Dubrovnik, Croatia, 21–24 May 2018. [Google Scholar]

- Kano, N.; Seraku, N.; Takahashi, F.; Tsuji, S. Attractive Quality and Must-Be Quality. J. Jpn. Soc. Qual. Control 1984, 14, 147–156. [Google Scholar] [CrossRef]

- Berger, C.; Blauth, R.; Boger, D. Kano’s Methods for Understanding Customer-Defined Quality. Cent. Qual. Manag. J. 1993, 2, 3–36. [Google Scholar]

- Foster, R.N. Innovation: Die Technologische Offensive; Gabler Verlag: Wiesbaden, Germany, 1986. [Google Scholar]

- Foster, R.N. Working The S-Curve: Assessing Technological Threats. Res. Manag. 1986, 29, 17–20. [Google Scholar] [CrossRef]

- Adamuthe, A.C.; Thampi, G.T. Technology forecasting: A case study of computational technologies. Technol. Forecast. Soc. Change 2019, 143, 181–189. [Google Scholar] [CrossRef]

- Archer, N.; Ghasemzadeh, F. An Integrated Framework for Project Portfolio Selection. Int. J. Proj. Manag. 1999, 17, 207–216. [Google Scholar] [CrossRef]

- Şahin, T.; Huth, T.; Axmann, J.; Vietor, T. A methodology for value-oriented strategic release planning to provide continuous product upgrading. In Proceedings of the 2020 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Singapore, 14–17 December 2020. [Google Scholar] [CrossRef]

- Chao, R.O.; Kavadias, S. A theoretical framework for managing the new product development portfolio: When and how to use strategic buckets. Manag. Sci. 2008, 54, 907–921. [Google Scholar] [CrossRef]

- Vahs, D.; Brem, A. Innovationsmanagement. Von der Idee zur Erfolgreichen Vermarktung, 5th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2015. [Google Scholar]

- Geschka, H. Szenariotechnik als Instrument der Frühaufklärung. In Management von Innovation und Risiko: Quantensprünge in der Entwicklung Erfolgreich Managen; Springer: Berlin/Heidelberg, Germany, 2006. [Google Scholar]

- Schomaker, R.M.; Sitter, A. Die PESTEL-Analyse—Status quo und innovative Anpassungen. Der Betr. 2020, 61, 3–21. [Google Scholar] [CrossRef]

- Lemm, K. Steven Sasson—Wer Steckt Hinter der Digitalkamera? Available online: https://www.stern.de/digital/technik/steven-sasson-wer-steckt-hinter-der-digitalkamera--3763180.html (accessed on 20 November 2021).

- Wilms, R.; Kronsbein, P.; Inkermann, D.; Huth, T.; Reik, M.; Vietor, T. Using a cross-domain product model to support engineering change management. Proc. Des. Soc. DESIGN Conf. 2020, 1, 1165–1174. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).