Does Engaging in Global Market Orientation Strategy Affect HEIs’ Performance? The Mediating Roles of Intellectual Capital Readiness and Open Innovation

Abstract

1. Introduction

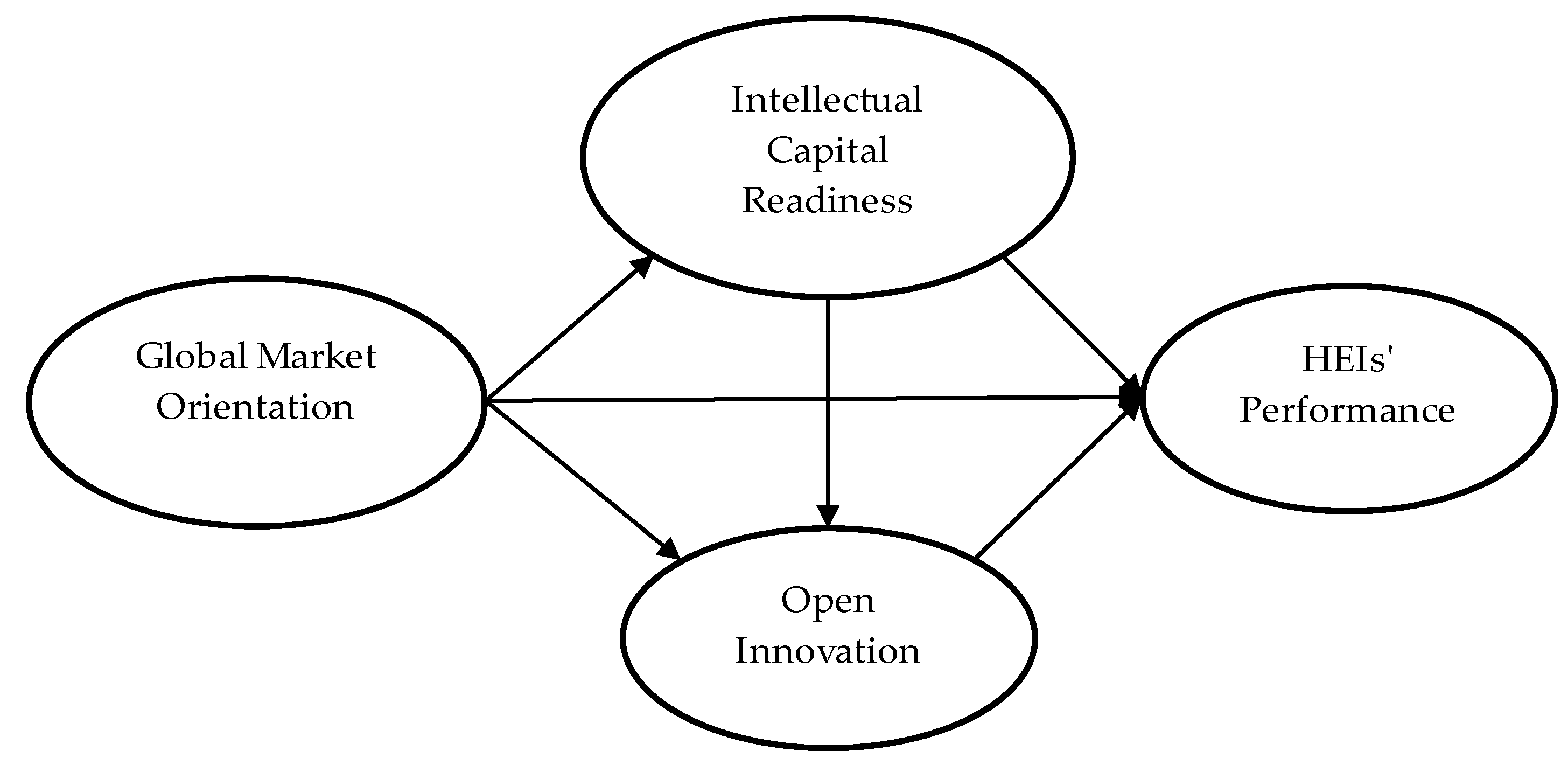

2. Literature Review and Hypothesis Development

2.1. Previous Studies

2.2. Global Market Orientation Strategy and HEIs’ Performance

2.3. The Mediating Role of Intellectual Capital Readiness on Global Market Orientation Strategy—HEIs’ Performance Relationship

2.4. The Mediating Role of Open Innovation on Global Market Orientation Strategy—HEIs’ Performance Relationship

2.5. The Mediating Role of Intellectual Capital Readiness and Open Innovation on Global Market Orientation Strategy—HEIs’ Performance Relationship

3. Methodology

3.1. Sample

3.2. Data Collection

3.3. Definitions and Measurements

3.3.1. Global Market Orientation Strategy

3.3.2. Intellectual Capital Readiness

3.3.3. Open Innovation

3.3.4. HEIs’ Performance

3.4. Analysis

4. Results

4.1. Characteristics of Respondents

4.2. Measurement Model Analysis

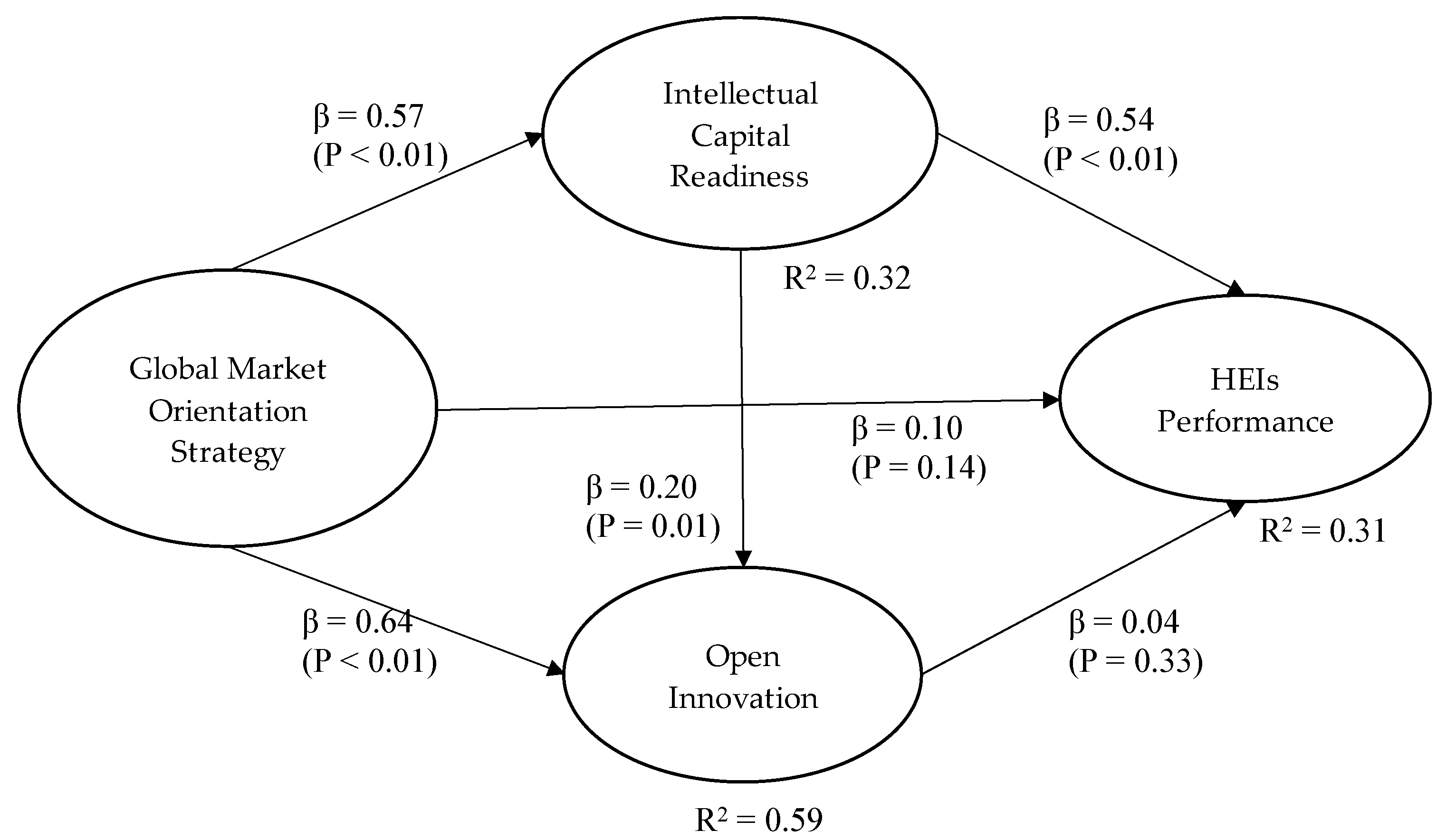

4.3. Structural Model Analysis

4.4. Common Method Variance

5. Discussion

5.1. Effect of Global Market Orientation Strategy on HEIs’ Performance

5.2. Mediating Role of Intellectual Capital Readiness on the Global Market Orientation Strategy—HEIs’ Performance Relationship

5.3. Mediating Role of Open Innovation on Global Market Orientation Strategy—HEIs’ Performance Relationship

5.4. Mediating Role of Intellectual Capital Readiness and Open Innovation on Global Market Orientation—HEIs’ Performance Relationship

6. Conclusions, Contributions, Limitations, and Future Research

6.1. Theoretical Contribution

6.2. Practical Contribution

6.3. Contribution to Society

6.4. Limitations and Future Research

6.5. Implication

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bae, T.J.; Qian, S.; Miao, C.; Fiet, J.O. The Relationship between Entrepreneurship Education and Entrepreneurial Intentions: A Meta–Analytic Review. Entrep. Theory Pract. 2014, 38, 217–254. [Google Scholar] [CrossRef]

- Passaro, R.; Quinto, I.; Thomas, A. The impact of higher education on entrepreneurial intention and human capital. J. Intellect. Cap. 2018, 19, 135–156. [Google Scholar] [CrossRef]

- Masnun, M.; Sulistyowati, E.; Ronaboyd, I. Questioning the Management of Intellectual Property in Universities in Indonesia. In Proceedings of the International Conference on Social Science 2019 (ICSS 2019), Surabaya City, Indonesia, 17–18 October 2019. [Google Scholar] [CrossRef]

- Penrose, E. The Theory of the Growth of the Firm; Wiley: New York, NY, USA, 1959. [Google Scholar]

- Wernerfelt, B. A resource-based view of the firm. Strat. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Chabowski, B.R.; Mena, J.A. A Review of Global Competitiveness Research: Past Advances and Future Directions. J. Int. Mark. 2017, 25, 1–24. [Google Scholar] [CrossRef]

- Jogaratnam, G. The effect of market orientation, entrepreneurial orientation and human capital on positional advantage: Evidence from the restaurant industry. Int. J. Hosp. Manag. 2017, 60, 104–113. [Google Scholar] [CrossRef]

- Kirca, A.H.; Jayachandran, S.; Bearden, W.O. Market Orientation: A Meta-Analytic Review and Assessment of its Antecedents and Impact on Performance. J. Mark. 2005, 69, 24–41. [Google Scholar] [CrossRef]

- Walliser, E.; Mignon, S. General presentation: Society of knowledge, intellectual capital and innovation. J. Innov. Econ. 2015, 17, 3–11. [Google Scholar] [CrossRef]

- Mailath, G.J.; Nocke, V.; Postlewaite, A. Business Strategy, Human Capital, and Managerial Incentives. J. Econ. Manag. Strat. 2004, 13, 617–633. [Google Scholar] [CrossRef][Green Version]

- Keyghobandi, A.; Damankeshideh, M. The Impact of Business Strategy and Corporate Governance on Intellectual Capital Dis-closure in Selected Companies of Tehran Stock Exchange Using the panel data model. Financ. Eng. Secur. Manag. 2020, 11, 199–219. [Google Scholar]

- Rylander, A.; Peppard, J. From implementing strategy to embodying strategy. J. Intellect. Cap. 2003, 4, 316–331. [Google Scholar] [CrossRef]

- Obeidat, B.Y.; Tarhini, A.; Masa’deh, R.E.; Aqqad, N.O. The impact of intellectual capital on innovation via the mediating role of knowledge management: A structural equation modelling approach. Int. J. Knowl. Manag. Stud. 2017, 8, 273–298. [Google Scholar] [CrossRef]

- Najar, T.; Dhaouadi, K.; Ben Zammel, I. Intellectual Capital Impact on Open Innovation: The Case of Technology-Based Sectors in Tunisia. J. Innov. Econ. 2020, 32, 75–106. [Google Scholar] [CrossRef]

- Oltra-Mestre, M.J.; Flor, M.L.; Alfaro, J.A. Open innovation and firm performance: The role of organizational mechanisms. Bus. Process. Manag. J. 2018, 24, 814–836. [Google Scholar] [CrossRef]

- Weerasinghe, I.; Dedunu, H. Contribution of academics to university–industry knowledge exchange: A study of open innovation in Sri Lankan universities. Ind. High. Educ. 2020, 35, 233–243. [Google Scholar] [CrossRef]

- Sjafrizal, T.; Pratami, D. Exploring Academic Patenting in Indonesia (1990–2015). J. Phys. Conf. Ser. 2019, 1150, 12061. [Google Scholar] [CrossRef]

- Yumhi, Y.; Martoyo, D.; Tunnufusm, Z.; Timotius, E. Determinant Factors of the Performance of Higher Institutions in Indonesia. J. Asian Financ. Econ. Bus. 2021, 8, 667–673. [Google Scholar] [CrossRef]

- Wernerfelt, B. Harmonised implementation of Application-Specific Messages (ASMs). Strateg. Manag. J. 1984, 2, 1–12. [Google Scholar]

- Assensoh-Kodua, A. The resource-based view: A tool of key competency for competitive advantage. Probl. Perspect. Manag. 2019, 17, 143–152. [Google Scholar] [CrossRef]

- Bontis, N. Intellectual capital: An exploratory study that develops measures and models. Manag. Decis. 1998, 36, 63–76. [Google Scholar] [CrossRef]

- Kamasak, R. The contribution of tangible and intangible resources, and capabilities to a firm’s profitability and market performance. Eur. J. Manag. Bus. Econ. 2017, 26, 252–275. [Google Scholar] [CrossRef]

- Yang, C.-S.; Lirn, T.-C. Revisiting the resource-based view on logistics performance in the shipping industry. Int. J. Phys. Distrib. Logist. Manag. 2017, 47, 884–905. [Google Scholar] [CrossRef]

- Chatzoglou, P.D.; Chatzoudes, D.; Sarigiannidis, L.; Theriou, G. The role of firm-specific factors in the strategy-performance relationship: Revisiting the resource-based view of the firm and the VRIO framework. Manag. Res. Rev. 2018, 41, 46–73. [Google Scholar] [CrossRef]

- Secundo, G.; Beer, C.D.; Schutte, C.; Passiante, G. Mobilising intellectual capital to improve European universities’ competi-tiveness: The technology transfer offices’ role. J. Intellect. Cap. 2017, 18, 607–624. [Google Scholar] [CrossRef]

- Buenechea-Elberdin, M. Structured literature review about intellectual capital and innovation. J. Intellect. Cap. 2017, 18, 262–285. [Google Scholar] [CrossRef]

- Mahaputra, N.K.A.; Wiagustini, N.L.P.; Yadnyata, I.K.; Artini, N.L.G.S. Organization Behavior, Intellectual Capital, and Per-formance: A Case Study of Microfinance Institutions in Indonesia. J. Asian Financ. Econ. Bus. 2021, 8, 549–561. [Google Scholar] [CrossRef]

- Veltri, S.; Mastroleo, G.; Schaffhauser-Linzatti, M. Measuring intellectual capital in the university sector using a fuzzy logic expert system. Knowl. Manag. Res. Pract. 2014, 12, 175–192. [Google Scholar] [CrossRef]

- Guthrie, J.; Parker, L.D. Reflections and projections. Account. Audit. Account. J. 2017, 30, 2–17. [Google Scholar] [CrossRef]

- Pedro, E.D.M.; Leitão, J.; Alves, H. Bridging Intellectual Capital, Sustainable Development and Quality of Life in Higher Education Institutions. Sustainability 2020, 12, 479. [Google Scholar] [CrossRef]

- Guthrie, J.; Dumay, J. New frontiers in the use of intellectual capital in the public sector. J. Intellect. Cap. 2015, 16, 258–266. [Google Scholar] [CrossRef]

- Hitt, M.A.; Dacin, M.T.; Levitas, E.; Arregle, J.-L.; Borza, A. Partner selection in emerging and developed market contexts: Resource-based and organizational learning perspectives. Acad. Manag. J. 2000, 43, 449–467. [Google Scholar] [CrossRef]

- Sanders, J.S.; Wong, T. International partner selection among higher education institutions in Hong Kong, Singapore and Japan: A resource-based view. J. High. Educ. Policy Manag. 2020, 43, 214–229. [Google Scholar] [CrossRef]

- Baierle, I.C.; Benitez, G.B.; Nara, E.O.B.; Schaefer, J.L.; Sellitto, M.A. Influence of Open Innovation Variables on the Competitive Edge of Small and Medium Enterprises. J. Open Innov. Technol. Mark. Complex. 2020, 6, 179. [Google Scholar] [CrossRef]

- Santoro, G.; Ferraris, A.; Giacosa, E.; Giovando, G. How SMEs Engage in Open Innovation: A Survey. J. Knowl. Econ. 2018, 9, 561–574. [Google Scholar] [CrossRef]

- Mengüç, B. Creating a Firm-Level Dynamic Capability through Capitalizing on Market Orientation and Innovativeness. J. Acad. Mark. Sci. 2006, 34, 63–73. [Google Scholar] [CrossRef]

- Greenley, G.E. Market Orientation and Company Performance: Empirical Evidence from UK Companies. Br. J. Manag. 1995, 6, 1–13. [Google Scholar] [CrossRef]

- Appiah-Adu, K. Market orientation and performance: Empirical tests in a transition economy. J. Strat. Mark. 1998, 6, 25–45. [Google Scholar] [CrossRef]

- Caruana, A.; Ramaseshan, B.; Ewing, M. Market Orientation and Performance in the Public Sector: The Role of Organizational Commitment. J. Glob. Mark. 1999, 12, 59–79. [Google Scholar] [CrossRef]

- Grewal, R.; Tansuhaj, P. Building Organizational Capabilities for Managing Economic Crisis: The Role of Market Orientation and Strategic Flexibility. J. Mark. 2001, 65, 67–80. [Google Scholar] [CrossRef]

- Sandvik, I.L.; Sandvik, K. The impact of market orientation on product innovativeness and business performance. Int. J. Res. Mark. 2003, 20, 355–376. [Google Scholar] [CrossRef]

- Langerak, F.; Hultink, E.J.; Robben, H.S.J. The role of predevelopment activities in the relationship between market orientation and performance. R&D Manag. 2004, 34, 295–309. [Google Scholar] [CrossRef]

- Xie, H.; Liu, C.; Chen, C. Relationships among market orientation, learning orientation, organizational innovation and organizational performance: An empirical study in the Pearl River Delta region of China. Front. Bus. Res. China 2007, 1, 222–253. [Google Scholar] [CrossRef]

- Zebal, M.A.; Goodwin, D.R. Market orientation and performance in private universities. Mark. Intell. Plan. 2012, 30, 339–357. [Google Scholar] [CrossRef]

- Masa’Deh, R.; Al-Henzab, J.; Tarhini, A.; Obeidat, B.Y. The associations among market orientation, technology orientation, entrepreneurial orientation and organizational performance. Benchmarking Int. J. 2018, 25, 3117–3142. [Google Scholar] [CrossRef]

- Sampaio, C.; Hernández-Mogollón, J.M.; Rodrigues, R.G. Assessing the relationship between market orientation and business performance in the hotel industry—The mediating role of service quality. J. Knowl. Manag. 2019, 23, 644–663. [Google Scholar] [CrossRef]

- Nakos, G.; Dimitratos, P.; Elbanna, S. The mediating role of alliances in the international market orientation-performance relationship of smes. Int. Bus. Rev. 2018, 28, 603–612. [Google Scholar] [CrossRef]

- Udriyah, U.; Tham, J.; Azam, S.M.F. The effects of market orientation and innovation on competitive advantage and business performance of textile SMEs. Manag. Sci. Lett. 2019, 1419–1428. [Google Scholar] [CrossRef]

- Bamfo, B.A.; Kraa, J.J. Market orientation and performance of small and medium enterprises in Ghana: The mediating role of innovation. Cogent Bus. Manag. 2019, 6. [Google Scholar] [CrossRef]

- Anabila, P.; Kastner, A.N.A.; Bulley, C.A.; Allan, M.M. Market orientation: A key to survival and competitive advantage in Ghana’s private universities. J. Mark. High. Educ. 2019, 30, 125–144. [Google Scholar] [CrossRef]

- Abbu, H.R.; Gopalakrishna, P. Synergistic effects of market orientation implementation and internalization on firm performance: Direct marketing service provider industry. J. Bus. Res. 2019, 125, 851–863. [Google Scholar] [CrossRef]

- Lim, J.-S.; Darley, W.K.; Marion, D. Market orientation, innovation commercialization capability and firm performance relationships: The moderating role of supply chain influence. J. Bus. Ind. Mark. 2017, 32, 913–924. [Google Scholar] [CrossRef]

- Alotaibi, M.B.G.; Zhang, Y. The relationship between export market orientation and export performance: An empirical study. Appl. Econ. 2016, 49, 2253–2258. [Google Scholar] [CrossRef]

- Joensuu-Salo, S.; Sorama, K.; Viljamaa, A.; Varamäki, E. Firm Performance among Internationalized SMEs: The Interplay of Market Orientation, Marketing Capability and Digitalization. Adm. Sci. 2018, 8, 31. [Google Scholar] [CrossRef]

- Yayla, S.; Yeniyurt, S.; Uslay, C.; Cavusgil, E. The role of market orientation, relational capital, and internationalization speed in foreign market exit and re-entry decisions under turbulent conditions. Int. Bus. Rev. 2018, 27, 1105–1115. [Google Scholar] [CrossRef]

- Fernandes, C.I.; Ferreira, J.; Lobo, C.; Raposo, M. The impact of market orientation on the internationalisation of SMEs. Rev. Int. Bus. Strat. 2020, 30, 123–143. [Google Scholar] [CrossRef]

- He, X.; Wei, Y. Linking market orientation to international market selection and international performance. Int. Bus. Rev. 2010, 20, 535–546. [Google Scholar] [CrossRef]

- Jawad, S.U.R.S.; Naushad, S.; Yousaf, S.; Yousaf, Z. Exploring performance of software houses: Market orientation and mediating role of firm innovativeness. World J. Entrep. Manag. Sustain. Dev. 2019, 16, 1–11. [Google Scholar] [CrossRef]

- Sanchez, R.G.; Bolívar, M.P.R.; Hernandez, A.M.L. Which Are the Main Factors Influencing Corporate Social Responsibility Information Disclosures on Universities’ Websites. Int. J. Environ. Res. Public Health 2021, 18, 524. [Google Scholar] [CrossRef]

- Prifti, R.; Alimehmeti, G. Market orientation, innovation, and firm performance—an analysis of Albanian firms. J. Innov. Entrep. 2017, 6, 8. [Google Scholar] [CrossRef]

- Sujudi, N.; Komariah, A. Leadership Characteristics Era Disruption: Strategy for Intellectual Capital Building Leadership in Higher Education. In Proceedings of the 3rd International Conference on Research of Educational Administration and Management (ICREAM 2019), Bandung, Indonesia, 17 July 2019. [Google Scholar] [CrossRef]

- Andreeva, T.; Garanina, T. Do All Elements of Intellectual Capital Matter for Organizational Performance? Evidence from Russian Context. J. Intellect. Cap. 2016, 17, 397–412. [Google Scholar] [CrossRef]

- Kianto, A.; Sáenz, J.; Aramburu, N. Knowledge-based human resource management practices, intellectual capital and innovation. J. Bus. Res. 2017, 81, 11–20. [Google Scholar] [CrossRef]

- Rossi, F.M.; Nicolò, G.; Polcini, P.T. New trends in intellectual capital reporting: Exploring online intellectual capital disclosure in Italian universities. J. Intellect. Cap. 2018, 19, 814–835. [Google Scholar] [CrossRef]

- Huang, C.-C.; Huang, S.-M. External and internal capabilities and organizational performance: Does intellectual capital matter? Asia Pac. Manag. Rev. 2020, 25, 111–120. [Google Scholar] [CrossRef]

- Brusca, I.; Cohen, S.; Manes-Rossi, F.; Nicolo, G. Intellectual capital disclosure and academic rankings in European universities: Do they go hand in hand? Meditari Account. Res. 2019, 28, 51–71. [Google Scholar] [CrossRef]

- Nicolò, G.; Raimo, N.; Polcini, P.T.; Vitolla, F. Unveiling the link between performance and Intellectual Capital disclosure in the context of Italian Public universities. Eval. Program Plan. 2021, 88, 101969. [Google Scholar] [CrossRef] [PubMed]

- Saengchai, S.; Sutduean, J. The impact of intellectual capital on performance of Universities in Thailand: The mediating role of entrepreneur orientation. Int. J. Innov. Creat. Chang. 2019, 6, 381–401. [Google Scholar]

- Cricelli, L.; Greco, M.; Grimaldi, M.; Dueñas, L.P.L. Intellectual capital and university performance in emerging countries. J. Intellect. Cap. 2018, 19, 71–95. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. Strategic Maps: Converting Intangible Assets into Tangible Outcomes; Harvard Business Press: Boston, MA, USA, 2004. [Google Scholar]

- Knight, G.A.; Kim, D. International business competence and the contemporary firm. J. Int. Bus. Stud. 2009, 40, 255–273. [Google Scholar] [CrossRef]

- Tjahjadi, B.; Soewarno, N.; Nadyaningrum, V.; Aminy, A. Human capital readiness and global market orientation in Indonesian Micro-, Small- and-Medium-sized Enterprises business performance. Int. J. Prod. Perform. Manag. 2020, 71, 79–99. [Google Scholar] [CrossRef]

- Aminu, I.M.; Shariff, M.N.M. Strategic Orientation, Access to Finance, Business Environment and SMEs Performance in Nigeria: Data Screening and Preliminary Analysis. Eur. J. Bus. Manag. 2014, 6, 124–131. [Google Scholar]

- Slater, S.F.; Narver, J.C. The Positive Effect of a Market Orientation on Business Profitability: A Balanced Replication. J. Bus. Res. 2000, 48, 69–73. [Google Scholar] [CrossRef]

- Alhakimi, W.; Mahmoud, M. The impact of market orientation on innovativeness: Evidence from Yemeni SMEs. Asia Pac. J. Innov. Entrep. 2020, 14, 47–59. [Google Scholar] [CrossRef]

- Poole, S.M. Developing relationships with school customers: The role of market orientation. Int. J. Educ. Manag. 2017, 31, 1054–1068. [Google Scholar] [CrossRef]

- Edwards, A.L. Techniques of Attitude Scale Construction; Creative Media Partners Limited: London, UK, 1957. [Google Scholar]

- Ramírez, Y.; Gordillo, S. Recognition and measurement of intellectual capital in Spanish universities. J. Intellect. Cap. 2014, 15, 173–188. [Google Scholar] [CrossRef]

- Bogers, M.; Chesbrough, H.; Moedas, C. Open Innovation: Research, Practices, and Policies. Calif. Manag. Rev. 2018, 60, 5–16. [Google Scholar] [CrossRef]

- Gentile-Lüdecke, S.; De Oliveira, R.T.; Paul, J. Does organizational structure facilitate inbound and outbound open innovation in SMEs? Small Bus. Econ. 2019, 55, 1091–1112. [Google Scholar] [CrossRef]

- Chesbrough, H. Open Innovation: A New Paradigm for Understanding Industrial Innovation. In Open Innovation: Researching a New Paradigm; Chesbrough, H., Vanhaverbeke, W., West, J., Eds.; Oxford University Press: Oxford, UK, 2006. [Google Scholar]

- Popa, S.; Soto-Acosta, P.; Martinez-Conesa, I. Antecedents, moderators, and outcomes of innovation climate and open innovation: An empirical study in SMEs. Technol. Forecast. Soc. Chang. 2017, 118, 134–142. [Google Scholar] [CrossRef]

- Tjahjadi, B.; Soewarno, N.; Astri, E.; Hariyati, H. Does intellectual capital matter in performance management sys-tem-organizational performance relationship? Experience of higher education institutions in Indonesia. J. Intellect. Cap. 2019, 20, 533–554. [Google Scholar] [CrossRef]

- Asiedu, M.A.; Anyigba, H.; Ofori, K.S.; Ampong, G.O.A.; Addae, J.A. Factors influencing innovation performance in higher education institutions. Learn. Organ. 2020, 27, 365–378. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. Partial Least Squares Structural Equation Modeling: Rigorous Applications, Better Results and Higher Acceptance. Long Range Plan. 2013, 46, 1–12. [Google Scholar] [CrossRef]

- Chin, W.W. Issues and Opinion on Structural Equation Modeling. Manag. Inf. Syst. Q. 1998, 22, 1–8. [Google Scholar]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Segars, A. Assessing the unidimensionality of measurement: A paradigm and illustration within the context of information systems research. Omega 1997, 25, 107–121. [Google Scholar] [CrossRef]

- Ratmono, D.; Sholihin, D. Analisis SEM-PLS Dengan WarpPLS 3.0 Untuk Hubungan Nonlinier Dalam Penelitian Sosial Dan Bisnis, 1st ed.; Penerbit Andi: Yogyakarta, Indonesia, 2013. [Google Scholar]

- Shmueli, G.; Ray, S.; Estrada, J.M.V.; Chatla, S.B. The elephant in the room: Predictive performance of PLS models. J. Bus. Res. 2016, 69, 4552–4564. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-Reports in Organizational Research: Problems and Prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Alves, C.A.; Gama, A.P.M.; Augusto, M. Family influence and firm performance: The mediating role of stewardship. J. Small Bus. Enterp. Dev. 2020, 28, 185–204. [Google Scholar] [CrossRef]

- Kock, N. Common method bias in PLS-SEM: A full collinearity assessment approach. Int. J. e-Collab. 2015, 11, 1–10. [Google Scholar] [CrossRef]

- Wang, Y.; Shi, S.; Chen, Y.; Gursoy, D. An examination of market orientation and environmental marketing strategy: The case of Chinese firms. Serv. Ind. J. 2018, 39, 1046–1071. [Google Scholar] [CrossRef]

- Greco, M.; Grimaldi, M.; Cricelli, L. An analysis of the open innovation effect on firm performance. Eur. Manag. J. 2016, 34, 501–516. [Google Scholar] [CrossRef]

- Elche-Hotelano, D. Sources of knowledge, investments and appropriability as determinants of innovation: An empirical study in service firms. Innovation 2011, 13, 220–235. [Google Scholar] [CrossRef]

- Lin, J.-Y. Effects on diversity of R&D sources and human capital on industrial performance. Technol. Forecast. Soc. Chang. 2014, 85, 168–184. [Google Scholar] [CrossRef]

| # | Researcher(s), Year | Independent Variable | Dependent Variable | Subject | Result |

|---|---|---|---|---|---|

| 1 | Greenley (1995) | Market Orientation | Performance | Companies in UK | No effect |

| 2 | Appiah-Adu (1998) | Market Orientation | Performance (ROI dan Sales Growth) | Companies in Ghana | No effect |

| 3 | Caruana, Ramaseshan and Ewing (1999) | Market Orientation | Performance | Governmental departments in Australia | Positive effect |

| 4 | Grewal and Tansuhaj (2001) | Market Orientation and StrategicFlexibility | Performance After Crisis | Companies in Thailand | Negative effect |

| 5 | Sandvik and Sandvik (2003) | Market Orientation | Business Performance | Hotels in Norway | Negative effect |

| 6 | Langerak, Jan Hultink and Robben (2004) | Market Orientation | Organizational Performance | Companies in Netherland | No effect |

| 7 | Xie, Liu and Chen (2007) | Market Orientation | Organizational Performance | Companies in China | No effect |

| 8 | Zebal and Goodwin (2012) | Market Orientation | Performance | Private universities in Bangladesh | Positive effect |

| 9 | Masa’deh et al. (2018) | Market orientation, technology orientation, entrepreneurial orientation | Organizational Performance | Pharmaceutical companies in Jordan | Positive effect |

| 10 | Sampaio, Hernández-Mogollón and Rodrigues (2019) | Market Orientation | Business Performance | Hotels in Portugal | Positive effect |

| 11 | Nakos, Dimitratos and Elbanna (2019) | Global Market Orientation | International Performance | Companies in UAE | Positive effect |

| 12 | Udriyah and Azam (2019) | Market Orientation | Competitive Advantage and Business Performance | Textile SMEs | Positive effect |

| 13 | Bamfo and Kraa (2019) | Competitor Orientation | Business Performance | SMEs in Ghana | No effect |

| 14 | Anabila et al. (2020) | Market Orientation | Market Performance of HEIs | Private universities in Ghana | Positive effect |

| 15 | Abbu and Gopalakrishna (2021) | Market Orientation | Firm Performance | Companies | Positive effect |

| Levene’s Test | t-Test | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Variable | Cutoff | N | Mean | F | Sig | Assumption | t | Sig (Two-Tailed) | Conclusion |

| GMOS | Early | 32 | 4.83 | 0.000 | 0.999 | Equal Variances assumed | −0.900 | 0.928 | Not statistically different |

| Late | 37 | 4.85 | |||||||

| ICR | Early | 32 | 4.93 | 0.340 | 0.562 | Equal Variances assumed | 0.631 | 0.530 | Not statistically different |

| Late | 37 | 4.83 | |||||||

| OI | Early | 32 | 4.76 | 4.652 | 0.035 | Equal Variances not assumed | 0.687 | 0.495 | Not statistically different |

| Late | 37 | 4.65 | |||||||

| HEI PERF | Early | 32 | 4.30 | 0.017 | 0.898 | Equal Variances assumed | 0.396 | 0.693 | Not statistically different |

| Late | 37 | 4.24 | |||||||

| Classification Data | Sub-Classification | Frequency | |

|---|---|---|---|

| Absolute | Percentage | ||

| Gender | Male | 85 | 71% |

| Female | 34 | 29% | |

| Position | Professor | 27 | 23% |

| Non-Professor | 92 | 77% | |

| Age | <40 years | 10 | 8% |

| 40–50 years | 45 | 38% | |

| >50 years | 64 | 54% | |

| Experience | <5 years | 56 | 47% |

| >5 years | 63 | 53% | |

| University Status | State University-BH (a) | 41 | 34% |

| State University-BLU (b) | 56 | 47% | |

| State University-Satker (c) | 2 | 2% | |

| Private University | 20 | 17% | |

| Accreditation | Excellent | 90 | 76% |

| Very Good | 23 | 19% | |

| Good | 2 | 2% | |

| Not filled | 4 | 3% | |

| Construct | Factor Loading | p-Value | Construct | Factor Loading | p-Value |

|---|---|---|---|---|---|

| HEI’s Performance | ICR 2 | 0.804 | <0.001 | ||

| HEI 1 | 0.714 | <0.001 | ICR 3 | 0.808 | <0.001 |

| HEI 2 | 0.721 | <0.001 | ICR 4 | 0.769 | <0.001 |

| HEI 4 | 0.608 | <0.001 | ICR 5 | 0.805 | <0.001 |

| HEI 5 | 0.796 | <0.001 | ICR 6 | 0.800 | <0.001 |

| HEI 6 | 0.815 | <0.001 | ICR 7 | 0.737 | <0.001 |

| HEI 8 | 0.729 | <0.001 | ICR 8 | 0.671 | <0.001 |

| HEI 9 | 0.751 | <0.001 | ICR 9 | 0.818 | <0.001 |

| HEI 10 | 0.767 | <0.001 | ICR 10 | 0.842 | <0.001 |

| HEI 12 | 0.684 | <0.001 | ICR 11 | 0.784 | <0.001 |

| HEI 13 | 0.753 | <0.001 | ICR 12 | 0.833 | <0.001 |

| HEI 15 | 0.622 | <0.001 | ICR 13 | 0.736 | <0.001 |

| Composite Reliability (CR): 0.924 AVE: 0.527 | ICR 14 | 0.655 | <0.01 | ||

| Global Market Orientation Strategy | Composite Reliability (CR): 0.955 AVE: 0.605 | ||||

| GMO 2 | 0.652 | <0.001 | Open Innovation | ||

| GMO 3 | 0.673 | <0.001 | OI 1 | 0.762 | <0.001 |

| GMO 4 | 0.695 | <0.001 | OI 2 | 0.783 | <0.001 |

| GMO 5 | 0.835 | <0.001 | OI 3 | 0.782 | <0.001 |

| GMO 6 | 0.812 | <0.001 | OI 4 | 0.738 | <0.001 |

| GMO 7 | 0.779 | <0.001 | OI 5 | 0.689 | <0.001 |

| GMO 8 | 0.834 | <0.001 | OI 6 | 0.814 | <0.001 |

| GMO 9 | 0.785 | <0.001 | OI 7 | 0.834 | <0.001 |

| GMO 10 | 0.728 | <0.001 | OI 8 | 0.824 | <0.001 |

| Composite Reliability (CR): 0.923 AVE: 0.574 | OI 10 | 0.760 | <0.001 | ||

| Intellectual Capital Readiness | Composite Reliability (CR): 0.927 AVE: 0.589 | ||||

| ICR 1 | 0.801 | <0.001 | |||

| HEI | ICR | GMO | OI | |

|---|---|---|---|---|

| Global market orientation strategy | 0.726 | 0.498 | 0.201 | 0.246 |

| Open innovation | 0.498 | 0.778 | 0.554 | 0.546 |

| Intellectual capital readiness | 0.201 | 0.554 | 0.758 | 0.748 |

| HEIs’ performance | 0.246 | 0.546 | 0.748 | 0.767 |

| Panel A: Direct Influence (Before Mediation) | |||

| Variable | Path to | ||

| HEIs’ Performance | |||

| Global Market Orientation Strategy | β = 0.23 ***; R2 = 0.05 | ||

| Panel B: Indirect Influence (After Mediation) | |||

| Variable | Path to | ||

| Intellectual Capital Readiness | Open Innovation | HEIs’ Performance | |

| Global Market Orientation Strategy | 0.57 *** | 0.64 *** | 0.10 |

| Intellectual Capital Readiness | 0.20 ** | 0.54 *** | |

| Open Innovation | 0.04 | ||

| R2 | 0.32 | 0.59 | 0.31 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tjahjadi, B.; Soewarno, N.; Jermias, J.; Hariyati, H.; Fairuzi, A.; Anwar, D.N. Does Engaging in Global Market Orientation Strategy Affect HEIs’ Performance? The Mediating Roles of Intellectual Capital Readiness and Open Innovation. J. Open Innov. Technol. Mark. Complex. 2022, 8, 29. https://doi.org/10.3390/joitmc8010029

Tjahjadi B, Soewarno N, Jermias J, Hariyati H, Fairuzi A, Anwar DN. Does Engaging in Global Market Orientation Strategy Affect HEIs’ Performance? The Mediating Roles of Intellectual Capital Readiness and Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(1):29. https://doi.org/10.3390/joitmc8010029

Chicago/Turabian StyleTjahjadi, Bambang, Noorlailie Soewarno, Johnny Jermias, Hariyati Hariyati, Atika Fairuzi, and Dewi Nabilah Anwar. 2022. "Does Engaging in Global Market Orientation Strategy Affect HEIs’ Performance? The Mediating Roles of Intellectual Capital Readiness and Open Innovation" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 1: 29. https://doi.org/10.3390/joitmc8010029

APA StyleTjahjadi, B., Soewarno, N., Jermias, J., Hariyati, H., Fairuzi, A., & Anwar, D. N. (2022). Does Engaging in Global Market Orientation Strategy Affect HEIs’ Performance? The Mediating Roles of Intellectual Capital Readiness and Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 8(1), 29. https://doi.org/10.3390/joitmc8010029