Business Digital Maturity in Europe and Its Implication for Open Innovation

Abstract

:1. Introduction

- What is the concentration of the use of Industry 4 technologies in EU enterprises?

- What is the level of digital maturity among the EU countries?

- In which of the Industry 4.0 technologies that have been implemented in enterprises do individual EU countries show similarities?

2. Theoretical Background

2.1. Industry 4.0

2.2. Open Innovation Dynamics in the Context of Industry 4.0

3. Materials and Methods

3.1. Data

3.2. The Gini Coefficient

3.3. The WASPAS Method

3.4. The K-Means Method

- Assign cases (EU countries) to individual clusters on the basis of designated Euclidean distances dij for individual cases Pi from the centers of clusters mi. The Euclidean distance is determined based on the following relationship

- Determine new cluster centers using the cumulative method based on the equation:

- Determine the displacement of the clusters ∆m:

- Assign cases to new clusters.

- Determine new cluster centers.

4. Results

4.1. Preliminary Statistical Analysis

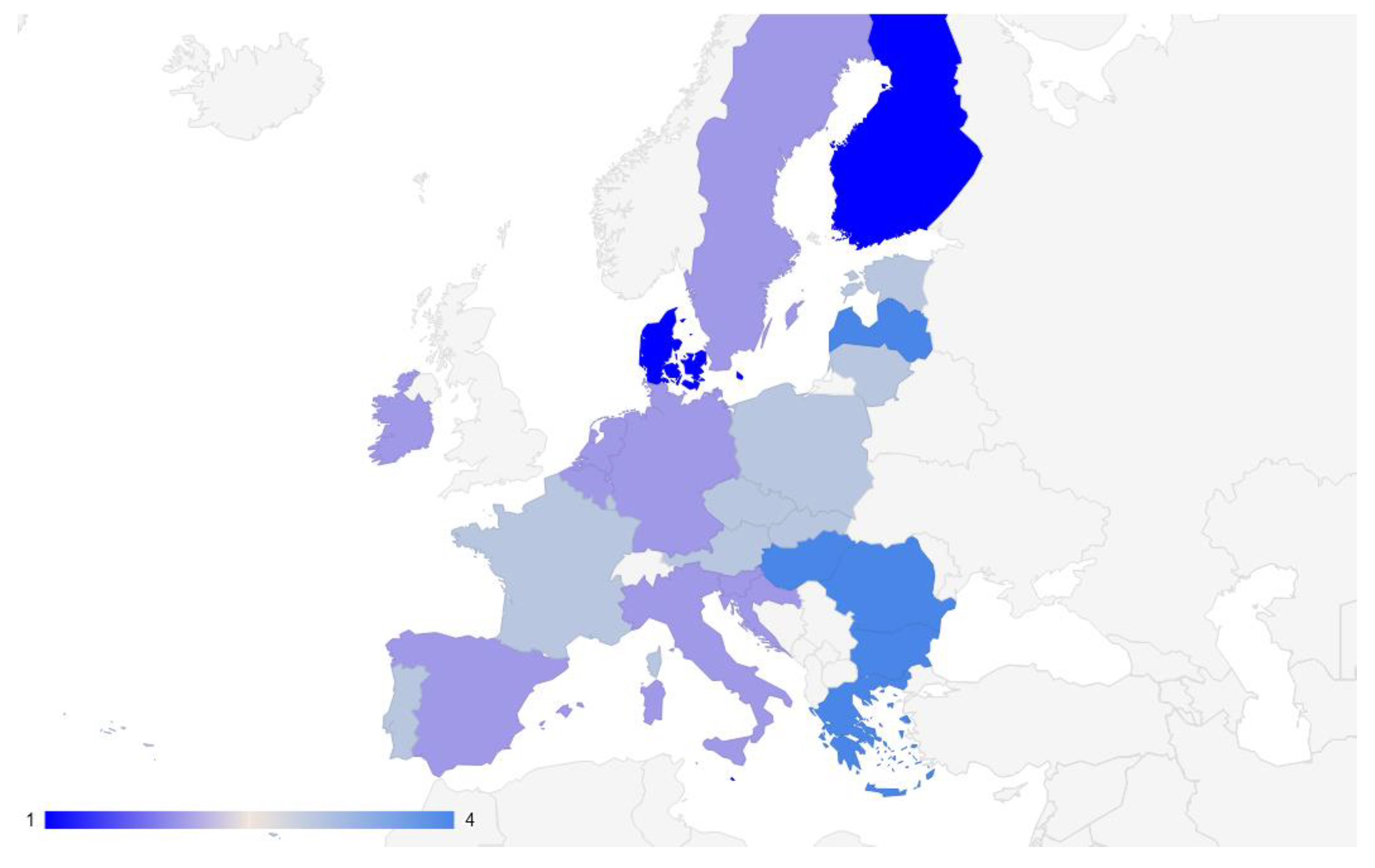

4.2. Results of the Ranking and Assessment of the Level of Business Digital Maturity in the EU-27 Countries

- (1)

- Class 4: Expert:

- (2)

- Class 3: Experienced:

- (3)

- Class 2: Intermediate:

- (4)

- Class 1: Novice:where is the digital maturity indicator of a country, is the mean value of the indicator for the population of countries under study, and is the standard deviation from the mean value of the indicator determined for the population of countries.

4.3. Results of the Similarity Analysis of the EU Countries in Terms of Digital Business Maturity

5. Discussion

5.1. Business Digital Transformation in Europe

5.2. The Relation between Digital Transformation and Open Innovation in Europe

6. Limitations and Future Directions

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Alqahtani, A.Y.; Gupta, S.M.; Nakashima, K. Warranty and maintenance analysis of sensor embedded products using internet of things in industry 4.0. Int. J. Prod. Econ. 2019, 208, 483–499. [Google Scholar] [CrossRef]

- Cristians, A.; Methven, J.M. Industry 4.0: Fundamentals and a quantitative analysis of benefits through a discrete event simulation. Challenges for technology innovation: An agenda for the future. Proc. Int. Conf. Sustain. Smart Manuf. 2017, 2016, 177–182. [Google Scholar]

- Jazdi, N. Cyber physical systems in the context of Industry 4.0. In Proceedings of the 2014 IEEE International Conference on Automation, Quality and Testing, Robotics, Cluj-Napoca, Romania, 22–24 May 2014; pp. 14–16. [Google Scholar]

- Lee, J. Industry 4.0 in big data environment. Ger. Harting Mag. 2013, 1, 8–10. [Google Scholar]

- Gholami, H.; Abu, F.; Lee, J.K.Y.; Karganroudi, S.S.; Sharif, S. Sustainable Manufacturing 4.0—Pathways and Practices. Sustainability 2021, 13, 13956. [Google Scholar] [CrossRef]

- Bellantuono, N.; Nuzzi, A.; Pontrandolfo, P.; Scozzi, B. Digital Transformation Models for the I4.0 Transition: Lessons from the Change Management Literature. Sustainability 2021, 13, 12941. [Google Scholar] [CrossRef]

- Tripathi, V.; Chattopadhyaya, S.; Mukhopadhyay, A.K.; Sharma, S.; Singh, J.; Pimenov, D.Y.; Giasin, K. An Innovative Agile Model of Smart Lean–Green Approach for Sustainability Enhancement in Industry 4.0. J. Open Innov. Technol. Mark. Complex. 2021, 7, 215. [Google Scholar] [CrossRef]

- Eremina, Y.; Lace, N.; Bistrova, J. Digital maturity and corporate performance: The case of the Baltic States. J. Open Innov. Technol. Mark. Complex. 2019, 5, 54. [Google Scholar] [CrossRef] [Green Version]

- Shim, S.-O.; Park, K.; Choi, S. Sustainable Production Scheduling in Open Innovation Perspective under the Fourth Industrial Revolution. J. Open Innov. Technol. Mark. Complex. 2018, 4, 42. [Google Scholar] [CrossRef] [Green Version]

- Silva, F.; Resende, D.; Amorim, M.; Borges, M. A Field Study on the Impacts of Implementing Concepts and Elements of Industry 4.0 in the Biopharmaceutical Sector. J. Open Innov. Technol. Mark. Complex. 2020, 6, 175. [Google Scholar] [CrossRef]

- Hizam-Hanafiah, M.; Soomro, M.A. The Situation of Technology Companies in Industry 4.0 and the Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 34. [Google Scholar] [CrossRef]

- UN Sustainable Development Goals. Available online: https://sdgs.un.org/goals (accessed on 15 December 2021).

- Stock, T.; Seliger, G. Opportunities of sustainable manufacturing in industry 4.0. Procedia CIRP 2016, 40, 536–541. [Google Scholar] [CrossRef] [Green Version]

- Herceg, I.V.; Kuc, V.; Mijušković, V.M.; Herceg, T. Challenges and driving forces for industry 4.0 implementation. Sustainability 2020, 12, 4208. [Google Scholar] [CrossRef]

- European Parliament. The Ubiquitous Digital Single Market. 2015. Available online: https://www.europarl.europa.eu/factsheets/en/sheet/43/powszechny-jednolity-rynek-cyfrowy (accessed on 3 December 2021).

- European Commission. Digital Europe Programme: A Proposed €7.5 Billion of Funding for 2021–2027. Available online: https://ec.europa.eu/digital-single-market/en/news/digital-europe-programme-proposed-eu75-billion-funding-2021-2027 (accessed on 3 December 2021).

- Kagermann, H.; Wahlster, W.; Helbig, J. Recommendations for Implementing the Strategic Initiative Industrie 4.0: Final Report of the Industrie 4.0 Working Group; Forschungsunion: Berlin, Germany, 2013. [Google Scholar]

- Kong, X.T.; Zhong, R.Y.; Zhao, Z.; Shao, S.; Li, M.; Lin, P.; Chen, Y.; Wu, W.; Shen, L.; Yu, Y.; et al. Cyber physical ecommerce logistics system: An implementation case in Hong Kong. Comput. Ind. Eng. 2020, 139, 106170. [Google Scholar] [CrossRef]

- Manavalan, E.; Jayakrishna, K. A review of Internet of Things (IoT) embedded sustainable supply chain for industry 4.0 requirements. Comput. Ind. Eng. 2018, 127, 925–953. [Google Scholar] [CrossRef]

- Schroeder, A.; Bigdeli, A.Z.; Zarcos, C.G.; Baines, T. Capturing the benefits of industry 4.0: A business network perspective. Prod. Plan. Control 2019, 30, 1305–1321. [Google Scholar] [CrossRef]

- Ober, J. Innovation Adoption: Empirical Analysis on the Example of Selected Factors of Organizational Culture in the IT Industry in Poland. Sustainability 2020, 12, 8630. [Google Scholar] [CrossRef]

- Brodny, J.; Tutak, M. Assessing the level of digitalization and robotization in the enterprises of the European Union Member States. PLoS ONE 2021, 16, e0254993. [Google Scholar] [CrossRef] [PubMed]

- Brodny, J.; Tutak, M. Assessing the level of digital maturity of enterprises in the Central and Eastern European countries using the MCDM and Shannon’s entropy methods. PLoS ONE 2021, 16, e0253965. [Google Scholar] [CrossRef] [PubMed]

- Pivoto, D.G.S.; de Almeida, L.F.F.; da Rosa Righi, R.; Rodrigues, J.J.P.C.; Lugli, A.B.; Alberti, A.M. Cy-berphysical systems architectures for industrial internet of things applications in Industry 4.0: A literature review. J. Manuf. Syst. 2021, 58, 176–192. [Google Scholar] [CrossRef]

- Rüßmann, M.; Lorenz, M.; Gerbert, P.; Waldnerm, M.; Justus, J.; Engel, P.; Harnisch, M. Industry 4.0: The future of productivity and growth in manufacturing industries. Boston Consult. Group 2015, 9, 54–89. [Google Scholar]

- Sony, M.; Naik, S. Key ingredients for evaluating Industry 4.0 readiness for organizations: A literature review. Benchmark. Int. J. 2019, 27, 2213–2232. [Google Scholar] [CrossRef]

- Gilchrist, A. Industry 4.0: The Industrial Internet of Things; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar]

- Ahuett-Garza, H.; Kurfess, T. A brief discussion on the trends of habilitating technologies for Industry 4.0 and Smart manufacturing. Manuf. Lett. 2018, 15, 60–63. [Google Scholar] [CrossRef]

- Guoping, L.; Yun, H.; Aizhi, W. Fourth industrial revolution: Technological drivers, impacts and coping methods. Chin. Geogr. Sci. 2017, 27, 626–637. [Google Scholar]

- Caiazzo, F. Laser-aided directed metal deposition of Ni-based superalloy powder. Opt. Laser Technol. 2018, 103, 193–198. [Google Scholar] [CrossRef]

- Dombrowski, U.; Richter, T.; Krenkel, P. Interdependencies of Industrie 4.0 & lean production systems—A use case analysis. Procedia Manuf. 2017, 1, 1061–1068. [Google Scholar]

- Liu, Y.; Xu, X. Industry 4.0 and cloud manufacturing: A comparative analysis. J. Manuf. Sci. Eng. 2017, 139, 034701. [Google Scholar] [CrossRef]

- Xu, L.D.; Xu, E.L.; Li, L. Industry 4.0: State of the art and future trends. Int. J. Prod. Res. 2018, 56, 2941–2962. [Google Scholar] [CrossRef] [Green Version]

- Schuh, G.; Anderl, R.; Jürgen, J.; Gausemeier, J.; Michael, T.; Hompel, M.; Wahlster, W. Industrie 4.0 Maturity Index; Acatech National Academy of Science and Engineering: Berlin, Germany, 2017. [Google Scholar]

- Basll, J.; Doucek, P. A metamodel for evaluating enterprise readiness in the context industry 4.0. Information 2019, 10, 89. [Google Scholar] [CrossRef] [Green Version]

- Lichtblau, K.; Stich, V.; Bertenrath, R.; Blum, M.; Bleider, M.; Millack, A.; Schmitt, K.; Schmitz, E.; Schröter, M. IMPULS—Industrie 4.0 Readiness. Aachen-Köln: Impuls-Stiftung des VDMA. 2015. Available online: https://www.industrie40-readiness.de (accessed on 15 December 2021).

- Pacchini, A.P.T.; Lucatoa, W.C.; Facchini, F.; Mummolo, G. The degree of readiness for the implementation of Industry 4.0. Comput. Ind. 2019, 113, 103125. [Google Scholar] [CrossRef]

- Mittal, S.; Khan, M.A.; Romero, D.; Wuest, T. A critical review of Smart Manufacturing & Industry 4.0 maturity models: Implications for small and medium size enterprises (SMEs). J. Manuf. Syst. 2018, 49, 194–214. [Google Scholar]

- Schumacher, A.; Erol, S.; Sihn, W. A maturity approach for assessing Industry 4.0 readiness and maturity of manufacturing enterprises. Procedia Cirp 2016, 52, 161–166. [Google Scholar] [CrossRef]

- Corallo, A.; Lazoi, M.; Lezzi, M. Cybersecurity in the context of industry 4.0: A structured classification of critical assets and business impacts. Comput. Ind. 2020, 114, 103165. [Google Scholar] [CrossRef]

- Rajapathirana, R.P.J.; Hui, Y. Relationship between innovation capability, innovation type, and firm performance. J. Innov. Knowl. 2018, 3, 44–55. [Google Scholar] [CrossRef]

- Tylżanowski, R. Using Open Innovation Concept in Development of Modern Enterpris. Available online: https://repozytorium.uwb.edu.pl/jspui/bitstream/11320/10911/1/R_Tylzanowski_Wykorzystanie_koncepcji_Open_Innovation_w_rozwoju_wspolczesnych_przedsiebiorstw.pdf (accessed on 15 December 2021).

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business Press: Harvard, MA, USA, 2003. [Google Scholar]

- Yuana, R.; Prasetio, E.A.; Syarief, R.; Arkeman, Y.; Suroso, A.I. System Dynamic and Simulation of Business Model Innovation in Digital Companies: An Open Innovation Approach. J. Open Innov. Technol. Mark. Complex. 2021, 7, 219. [Google Scholar] [CrossRef]

- Radziwon, A.; Bogers, M. Open innovation in SMEs: Exploring inter-organizational relationships in an ecosystem. Technol. Forecast. Soc. Chang. 2019, 146, 573–587. [Google Scholar] [CrossRef]

- Almeida, F. Open-Innovation Practices: Diversity in Portuguese SMEs. J. Open Innov. Technol. Mark. Complex. 2021, 7, 169. [Google Scholar] [CrossRef]

- Surya, B.; Menne, F.; Sabhan, H.; Suriani, S.; Abubakar, H.; Idris, M. Economic Growth, Increasing Productivity of SMEs, and Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 20. [Google Scholar] [CrossRef]

- Bogers, M.; Zobel, A.K.; Afuah, A.; Almirall, E.; Brunswicker, S.; Dahlander, L.; Frederiksen, L.; Gawer, A.; Gruber, M.; Haefliger, S.; et al. The open innovation research landscape: Established perspectives and emerging themes across different levels of analysis. Ind. Innov. 2017, 24, 8–40. [Google Scholar] [CrossRef]

- Chiaroni, D.; Chiesa, V.; Frattini, F. The Open Innovation Journey: How firms dynamically implement the emerging innovation management paradigm. Technovation 2011, 31, 34–43. [Google Scholar] [CrossRef]

- Lichtenthaler, U. Open innovation: Past research, current debates, and future directions. Acad. Manag. Perspect. 2011, 25, 75–93. [Google Scholar]

- Ferraris, A.; Santoro, G.; Dezi, L. How MNC’s subsidiaries may improve their innovative performance? The role of external sources and knowledge management capabilities. J. Knowl. Manag. 2017, 21, 540–552. [Google Scholar] [CrossRef]

- Chesbrough, H.W. The era of open innovation. Manag. Innov. Chang. 2006, 127, 34–41. [Google Scholar]

- Chesbrough, H. Business model innovation: Opportunities and barriers. Long Range Plan. 2010, 43, 354–363. [Google Scholar] [CrossRef]

- Witt, U. Capitalism as a complex adaptive system and its growth. J. Open Innov. Technol. Mark. Complex. 2017, 3, 12. [Google Scholar] [CrossRef] [Green Version]

- Yun, J.J.; Won, D.; Park, K. Dynamics from open innovation to evolutionary change. J. Open Innov. Technol. Mark. Complex. 2016, 2, 7. [Google Scholar] [CrossRef] [Green Version]

- West, J.; Bogers, M. Leveraging External Sources of Innovation: A Review of Research on Open Innovation. J. Prod. Innov. Manag. 2013, 31, 814–831. [Google Scholar] [CrossRef]

- Mawson, S.; Brown, R. Entrepreneurial acquisitions, open innovation and UK high growth SMEs. Ind. Innov. 2016, 24, 382–402. [Google Scholar] [CrossRef]

- Felin, T.; Zenger, T.R. Closed or Open Innovation? Problem Solving and the Governance Choice. Res. Policy 2014, 43, 914–925. [Google Scholar] [CrossRef]

- Eurostat. Database. Available online: https://ec.europa.eu/eurostat/web/main/data/database (accessed on 3 December 2021).

- Eurostat. Statistical Classification of Economic Activities in the European Community, Rev. 2. Available online: https://ec.europa.eu/eurostat/ramon/nomenclatures/index.cfm?TargetUrl=LST_NOM_DTL&StrNom=NACE_REV2&StrLanguageCode=EN (accessed on 3 December 2021).

- Rokicki, T.; Perkowska, A. Diversity and Changes in the Energy Balance in EU Countries. Energies 2021, 14, 1098. [Google Scholar] [CrossRef]

- Brauers, W.K.M.; Zavadskas, E.K. Robustness of MULTIMOORA: A Method for Multi-Objective Optimization. Informatica 2012, 23, 1–25. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Turskis, Z.; Antucheviciene, J.; Zakarevicius, A. Optimization of weighted aggregated sum product assessment. Elektron. Elektrotech. 2012, 122, 3–6. [Google Scholar] [CrossRef]

- Brodny, J.; Tutak, M. Analyzing Similarities between the European Union Countries in Terms of the Structure and Volume of Energy Production from Renewable Energy Sources. Energies 2020, 13, 913. [Google Scholar] [CrossRef] [Green Version]

- Mardia, K.V.; Kent, J.T.; Bibby, J.M. Multivariate Analysis. In Probability and Mathematical Statistics; Academic Press: Cambridge, MA, USA, 1979. [Google Scholar]

- Brodny, J.; Tutak, M. The analysis of similarities between the European Union countries in terms of the level and structure of the emissions of selected gases and air pollutants into the atmosphere. J. Clean. Prod. 2021, 279, 123641. [Google Scholar] [CrossRef] [PubMed]

- GfK Enigma Umfrage in Mittelständischen Unternehmen Zum Thema Digitalisierung—Bedeutung für den Mittelstand im Auftrag der DZ Bank. Available online: https://www.dzbank.de/content/dam/dzbank_de/de/library/presselibrary/pdf_dokumente/DZ_Bank_Digitalisierung_Grafiken.pdf (accessed on 3 December 2021).

- Schulz, A. Industrie 4.0 Steht Noch Ganz am Anfang. Available online: https://www.flyacts.com/industrie-4-0-steht-noch-ganz-am-anfang/ (accessed on 3 December 2021).

- Kelkar, O.; Heger, R.; Dao, D.K. Studie Industrie 4.0—Eine Standortbestimmung der Automobil- und Fertigungsindustrie. Available online: https://www.mhp.com/fileadmin/mhp.de/assets/studien/MHP-Studie_Industrie4.0_V1.0.pdf (accessed on 3 December 2021).

- Lusarczyk, B. Industry 4.0—Are We Ready? Pol. J. Manag. Stud. 2018, 17, 232–248. [Google Scholar] [CrossRef]

- Brozzi, R.; Forti, D.; Rauch, E.; Matt, D.T. The Advantages of Industry 4.0 Applications for Sustainability: Results from a Sample of Manufacturing Companies. Sustainability 2020, 12, 3647. [Google Scholar] [CrossRef]

- Ghobakhloo, M. The future of manufacturing industry: A strategic roadmap toward Industry 4.0. J. Manuf. Technol. Manag. 2018, 29, 910–936. [Google Scholar] [CrossRef] [Green Version]

- Tortorella, G.L.; Giglio, R.; van Dun, D. Industry 4.0 adoption as a moderator of the impact of lean production practices on operational performance improvement. Int. J. Oper. Prod. Manag. 2019, 39, 860–886. [Google Scholar] [CrossRef]

- Szabo, R.Z.; Vuksanović Herceg, I.; Hanák, R.; Hortovanyi, L.; Romanová, A.; Mocan, M.; Djuričin, D. Industry 4.0 Implementation in B2B Companies: Cross-Country Empirical Evidence on Digital Transformation in the CEE Region. Sustainability 2020, 12, 9538. [Google Scholar] [CrossRef]

- Kamble, S.S.; Gunasekaran, A.; Sharma, R. Analysis of the driving and dependence power of barriers to adopt industry 4.0 in Indian manufacturing industry. Comput. Ind. 2018, 101, 107–119. [Google Scholar] [CrossRef]

- Gottge, S.; Menzel, T.; Forslund, H. Industry 4.0 technologies in the purchasing process. Ind. Manag. Data Syst. 2020, 120, 730–748. [Google Scholar] [CrossRef]

- PWC. Opportunities and Challenges of the Industrial Internet. Available online: https://www.pwc.pl/pl/pdf/industry-4-0.pdf (accessed on 3 December 2021).

- Rolinek, L.; Kopta, D.; Plevny, M.; Rost, M.; Kubecova, J.; Vrchota, J.; Marikova, M. Level of process management implementation in SMEs and some related implications. Transform. Bus. Econ. 2015, 14, 360–377. [Google Scholar]

- Vrchota, J.; Pech, M. Readiness of Enterprises in Czech Republic to Implement Industry 4.0: Index of Industry 4.0. Appl. Sci. 2019, 9, 5405. [Google Scholar] [CrossRef] [Green Version]

- DESI. Digital Economy and Society Index 2020. Available online: https://ec.europa.eu/digital-single-market/en/digital-economy-and-society-index-desi (accessed on 3 February 2021).

- Novak, J.; Purta, M.; Marciniak, T.; Ignatowicz, K.; Rozenbaum, K.; Yearwood, K. The Rise of Digital Challengers. How Digitization Can Become the Next Growth Engine for Central and Eastern Europe; Digital/McKinsey: Atlanta, GA, USA, 2018. [Google Scholar]

- Erol, S.; Jäger, A.; Hold, P.; Ott, K.; Sihn, W. Tangible industry 4.0: A scenario-based approach to learning for the future of production. Procedia CIRP 2016, 54, 13–18. [Google Scholar] [CrossRef]

- Kiel, D.; Müller, J.M.; Arnold, C.; Voigt, K.I. Sustainable industrial value creation: Benefits and challenges of Industry 4.0. Int. J. Innov. Manag. 2017, 21, 1740015. [Google Scholar] [CrossRef]

- Müller, J.; Voigt, K.-I. Industrie 4.0 für kleine und mittlere Unternehmen. Prod. Manag. 2016, 3, 28–30. [Google Scholar]

- Adolph, S.; Tisch, M.; Metternich, J. Challenges and approaches to competency development for future production. Educ. Altern. 2014, 12, 1001–1010. [Google Scholar]

- Vrchota, J.; Mařiková, M.; Řehoř, P.; Rolínek, L.; Toušek, R. Human Resources Readiness for Industry 4.0. J. Open Innov. Technol. Mark. Complex. 2020, 6, 3. [Google Scholar] [CrossRef] [Green Version]

- Shamim, S.; Cang, S.; Yu, H.; Li, Y. Management approaches for Industry 4.0: A human resource management perspective. In Proceedings of the 2016 IEEE Congress on Evolutionary Computation (CEC), Vancouver, BC, Canada, 24–29 July 2016; pp. 5309–5316. [Google Scholar]

- Karre, H.; Hammer, M.; Kleindienst, M.; Ramsauer, C. Transition towards an Industry 4.0 State of the LeanLab at Graz University of Technology. Procedia Manuf. 2017, 9, 206–213. [Google Scholar] [CrossRef]

- Zhou, K.; Liu, T.; Zhou, L. Industry 4.0: Towards future industrial opportunities and challenges. In Proceedings of the 12th International Conference on Fuzzy Systems and Knowledge Discovery (FSKD), Zhangjiajie, China, 15–17 August 2015; pp. 2147–2152. [Google Scholar]

- Sung, T.K. Industry 4.0: A Korea perspective. Technol. Forecast. Soc. Chang. 2018, 132, 40–45. [Google Scholar] [CrossRef]

- Orzes, G.; Rauch, E.; Bednar, S.; Poklemba, R. Industry 4.0 Implementation Barriers in Small and Medium Sized Enterprises: A Focus Group Study. In Proceedings of the 2018 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Bangkok, Thailand, 16–19 December 2018; pp. 1348–1352. [Google Scholar]

- Raj, A.; Dwivedi, G.; Sharma, A.; de Sousa Jabbour, A.B.L.; Rajak, S. Barriers to the adoption of industry 4.0 technologies in the manufacturing sector: An inter-country comparative perspective. Int. J. Prod. Econ. 2020, 224, 107546. [Google Scholar] [CrossRef]

- Ingaldi, M.; Ulewicz, R. Problems with the Implementation of Industry 4.0 in Enterprises from the SME Sector. Sustainability 2020, 12, 217. [Google Scholar] [CrossRef] [Green Version]

- von Leipzig, T.; Gamp, M.; Manz, D.; Schöttle, K.; Ohlhausen, P.; Oosthuizen, G.; Palm, D.; von Leipzig, K. Initialising customer-orientated digital transformation in enterprises. Procedia Manuf. 2017, 8, 517–524. [Google Scholar] [CrossRef]

- Vey, K.; Fandel-Meyer, T.; Zipp, J.S.; Schneider, C. Learning & Development in Times of Digital Transformation: Facilitating a Culture of Change and Innovation. Int. J. Adv. Corp. Learn. 2017, 10, 22. [Google Scholar] [CrossRef] [Green Version]

- Bertello, A.; De Bernardi, P.; Ricciardi, F. Open Innovation for Digital Transformation in Low- and Medium-Tech SMEs: Analysis of Pre-competitive Collaborative Projects. In Exploring Innovation in a Digital World. Lecture Notes in Information Systems and Organisation; Ceci, F., Prencipe, A., Spagnoletti, P., Eds.; Springer: Cham, Switzerland, 2021; Volume 51. [Google Scholar]

- Dodgson, M.; Gann, D.; Salter, A. The role of technology in the shift towards open innovation: The case of Procter & Gamble. R&D Manag. 2006, 36, 333–346. [Google Scholar] [CrossRef]

- Natalicchio, A.; Messeni Petruzzelli, A.; Garavelli, A.C. Markets for ideas. Literature review and unanswered questions. Technovation 2014, 34, 65–76. [Google Scholar] [CrossRef]

- Agostini, L.; Gastaldi, L.; Savino, T.; Appio, F.P. The Digitalization of the Innovation Process: Challenges and Opportunities from a Managerial Perspective. Available online: http://www.emeraldgrouppublishing.com/authors/writing/calls.htm?id=7345 (accessed on 15 December 2021).

- Del Vecchio, P.; Di Minin, A.; Messeni Petruzzelli, A. Big Data for Open Innovation: Unveiling Challenges and Opportunities. Available online: http://www.continuous-innovation.net/events/cimworkshops/2016/cfp-si-big-data-and-open-innovation.pdf (accessed on 15 December 2021).

- European Commission. Innovation Union. Available online: https://ec.europa.eu/info/research-and-innovation/strategy/past-research-and-innovation-policy-goals/innovation-union_en (accessed on 15 December 2021).

- European Commission. Open Innovation Resources. Available online: https://ec.europa.eu/info/research-and-innovation/strategy/past-research-and-innovation-policy-goals/open-innovation-resources_en (accessed on 15 December 2021).

- Enkel, E.; Heil, S.; Hengstler, M.; Wirth, H. Exploratory and exploitative innovation: To What Extent do the Dimensions of Individual Level Absorptive Capacity Contribute? Technovation 2017, 60, 29–38. [Google Scholar] [CrossRef]

| Sources | The Described Technologies of Industry 4.0 |

|---|---|

| [28] | Big data; autonomous robots; Internet of Things; additive manufacturing; artificial intelligence |

| [29] | Big data; autonomous robots; horizontal and vertical system integration; Internet of Things; cyber security; cloud computing; additive mfg.; augmented reality |

| [30] | Internet of Things; additive mfg.; augmented reality |

| [31] | Big data; horizontal and vertical system integration; Internet of Things; cloud computing; augmented reality; cyber–physical systems |

| [32] | Big data; autonomous robots; simulation; horizontal and vertical system integration; Internet of Things; cyber security; cloud computing; additive mfg.; augmented reality; cyber–physical systems; artificial intelligence |

| [33] | Horizontal and vertical system integration; Internet of Things; cloud computing; cyber–physical systems |

| Sources | Maturity and Readiness Models |

|---|---|

| [34] | ACATECH Maturity Index |

| [35] | The Singapore Smart Industry Readiness Index |

| [36] | IMPULS—Industry 4.0 Readiness |

| [37] | The degree of readiness for the implementation of Industry 4.0—a structure based on the Society of Automotive Engineers (SAE) J4000 standard |

| [38] | DREAMY—Digital Readiness Assessment Maturity Approach |

| [39] | A maturity approach for assessing Industry 4.0 readiness and maturity of manufacturing enterprises |

| [40] | Assessing Industry 4.0 readiness in manufacturing—based on PCA methods |

| Indicators | Mean | Median | Min | Max | Standard Deviation | Coefficient of Variation, % | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|---|

| Analysis of big data internally using machine learning | 3.41 | 2.00 | 1.00 | 20.00 | 4.01 | 117.75 | 3.27 | 11.88 |

| Use of 3D printing | 4.59 | 5.00 | 2.00 | 9.00 | 1.95 | 42.39 | 0.36 | −0.51 |

| Use of industrial or service robots | 6.44 | 7.00 | 2.00 | 13.00 | 2.56 | 39.76 | 0.29 | 0.24 |

| Analysis of big data internally from any data source | 12.37 | 9.00 | 3.00 | 29.00 | 7.52 | 60.79 | 0.75 | −0.66 |

| Purchase of cloud computing services used over the internet | 38.22 | 33.00 | 11.00 | 75.00 | 17.42 | 45.57 | 0.57 | −0.62 |

| Enterprises sending eInvoices, suitable for automated processing | 29.89 | 22.00 | 9.00 | 95.00 | 22.80 | 76.27 | 1.58 | 1.86 |

| Enterprises that have ERP software | 35.78 | 35.00 | 14.00 | 53.00 | 9.59 | 26.81 | −0.13 | −0.45 |

| ICT security measure used: strong password authentication | 73.70 | 74.00 | 53.00 | 91.00 | 10.27 | 13.94 | −0.32 | −0.64 |

| X1 | X2 | X3 | X4 | X5 | X6 | X7 | X8 | |

|---|---|---|---|---|---|---|---|---|

| X1 | 1.00 | 0.12 | −0.09 | 0.58 | 0.45 | 0.06 | 0.03 | 0.36 |

| X2 | 0.12 | 1.00 | 0.69 | 0.51 | 0.60 | 0.33 | 0.44 | 0.43 |

| X3 | −0.09 | 0.69 | 1.00 | 0.33 | 0.40 | 0.47 | 0.56 | 0.36 |

| X4 | 0.58 | 0.51 | 0.33 | 1.00 | 0.54 | 0.08 | 0.45 | 0.44 |

| X5 | 0.45 | 0.60 | 0.40 | 0.54 | 1.00 | 0.73 | 0.34 | 0.36 |

| X6 | 0.06 | 0.33 | 0.47 | 0.08 | 0.73 | 1.00 | 0.17 | 0.11 |

| X7 | 0.03 | 0.44 | 0.56 | 0.45 | 0.34 | 0.17 | 1.00 | 0.20 |

| X8 | 0.36 | 0.43 | 0.36 | 0.44 | 0.36 | 0.11 | 0.20 | 1.00 |

| Technology | Artificial Intelligence | 3D Printing | Big Data Analytics | Robotics | Cloud Computing Services | Horizontal Integration | Vertical Integration | Cybersecurity |

|---|---|---|---|---|---|---|---|---|

| Indicator | Analysis big data internally using machine learning | Use of 3D printing | Analysis of big data internally from any data source | Use of industrial or service robots | Purchase of cloud computing services used over the internet | Enterprises sending eInvoices, suitable for automated processing | Enterprises that have ERP software | ICT security measure used: strong password authentication |

| Gini coefficient | 0,459 | 0.234 | 0.216 | 0.3296 | 0.250 | 0.375 | 0.150 | 0.078 |

| Technology | Artificial Intelligence | 3D Printing | Big Data Analytics | Robotics | Cloud Computing Services | Horizontal Integration | Vertical Integration | Cybersecurity |

|---|---|---|---|---|---|---|---|---|

| Indicator | Analysis of big data internally using machine learning | Use of 3D printing | Analysis of big data internally from any data source | Use of industrial or service robots | Purchase of cloud computing services used over the internet | Enterprises sending eInvoices, suitable for automated processing | Enterprises that have ERP software | ICT security measure used: strong password authentication |

| Weight of indicator | 0.26 | 0.26 | 0.13 | 0.11 | 0.06 | 0.15 | 0.02 | 0.01 |

| Countries | Ranking | |||

|---|---|---|---|---|

| Belgium | 0.496 | 0.068 | 0.282 | 8 |

| Bulgaria | 0.222 | 0.027 | 0.125 | 23 |

| Czechia | 0.368 | 0.046 | 0.207 | 14 |

| Denmark | 0.717 | 0.105 | 0.411 | 1 |

| Germany | 0.425 | 0.054 | 0.240 | 9 |

| Estonia | 0.315 | 0.045 | 0.180 | 18 |

| Ireland | 0.512 | 0.066 | 0.289 | 4 |

| Greece | 0.194 | 0.025 | 0.109 | 25 |

| Spain | 0.406 | 0.061 | 0.233 | 10 |

| France | 0.380 | 0.051 | 0.216 | 13 |

| Croatia | 0.404 | 0.056 | 0.230 | 12 |

| Italy | 0.504 | 0.063 | 0.284 | 7 |

| Cyprus | 0.295 | 0.031 | 0.163 | 20 |

| Latvia | 0.187 | 0.026 | 0.106 | 26 |

| Lithuania | 0.303 | 0.047 | 0.175 | 19 |

| Luxembourg | 0.334 | 0.045 | 0.189 | 17 |

| Hungary | 0.214 | 0.028 | 0.121 | 24 |

| Malta | 0.664 | 0.103 | 0.383 | 2 |

| Netherlands | 0.503 | 0.073 | 0.288 | 5 |

| Austria | 0.359 | 0.052 | 0.205 | 15 |

| Poland | 0.258 | 0.032 | 0.145 | 22 |

| Portugal | 0.357 | 0.051 | 0.204 | 16 |

| Romania | 0.179 | 0.025 | 0.102 | 27 |

| Slovenia | 0.410 | 0.054 | 0.232 | 11 |

| Slovakia | 0.283 | 0.034 | 0.158 | 21 |

| Finland | 0.655 | 0.099 | 0.377 | 3 |

| Sweden | 0.496 | 0.077 | 0.287 | 6 |

| Cluster 1 | Distances from the Center of Cluster 1 | Cluster 2 | Distances from the Center of Cluster 2 | Cluster 3 | Distances from the Center of Cluster 3 | Cluster 4 | Distances from the Center of Cluster 4 |

|---|---|---|---|---|---|---|---|

| Belgium | 5.68 | Greece | 7.58 | Bulgaria | 6.70 | Denmark | 8.12 |

| Ireland | 6.53 | Spain | 4.31 | Czechia | 4.02 | Estonia | 7.24 |

| Malta | 3.73 | France | 5.44 | Germany | 4.73 | Italy | 10.63 |

| Netherlands | 3.82 | Croatia | 8.89 | Cyprus | 5.30 | Slovenia | 10.88 |

| Lithuania | 3.80 | Latvia | 3.99 | Finland | 10.09 | ||

| Austria | 4.36 | Luxembourg | 4.68 | Sweden | 8.36 | ||

| Romania | 8.65 | Hungary | 7.15 | ||||

| Poland | 1.51 | ||||||

| Portugal | 4.97 | ||||||

| Slovakia | 1.61 |

| Mean | Standard Deviation | Variance | |

|---|---|---|---|

| Cluster 1–4 Objects | |||

| Analysis of big data internally using machine learning | 9.75 | 7.93 | 62.92 |

| Use of 3D printing | 5.50 | 2.52 | 6.33 |

| Use of industrial or service robots | 6.25 | 2.99 | 8.92 |

| Analysis of big data internally from any data source | 24.75 | 3.40 | 11.58 |

| Purchase of cloud computing services used over the internet | 52.50 | 1.00 | 1.00 |

| Enterprises sending eInvoices, suitable for automated processing | 23.00 | 3.16 | 10.00 |

| Enterprises that have ERP software package | 40.25 | 12.12 | 146.92 |

| ICT security measure used: strong password authentication | 79.50 | 5.32 | 28.33 |

| Cluster 2–7 objects | |||

| Analysis of big data internally using machine learning | 2.29 | 1.11 | 1.24 |

| Use of 3D printing | 3.71 | 1.38 | 1.90 |

| Use of industrial or service robots | 6.00 | 2.16 | 4.67 |

| Analysis of big data internally from any data source | 10.14 | 5.40 | 29.14 |

| Purchase of cloud computing services used over the internet | 27.71 | 9.12 | 83.24 |

| Enterprises sending eInvoices, suitable for automated processing | 24.86 | 10.99 | 120.81 |

| Enterprises that have ERP software package | 38.43 | 10.15 | 102.95 |

| ICT security measure used: strong password authentication | 63.71 | 6.82 | 46.57 |

| Cluster 3–10 objects | |||

| Analysis big data internally using machine learning | 1.50 | 0.71 | 0.50 |

| Use of 3D printing | 4.20 | 1.62 | 2.62 |

| Use of industrial or service robots | 5.80 | 1.93 | 3.73 |

| Analysis of big data internally from any data source | 8.80 | 4.76 | 22.62 |

| Purchase of cloud computing services used over the internet | 26.20 | 6.76 | 45.73 |

| Enterprises sending eInvoices, suitable for automated processing | 14.10 | 2.42 | 5.88 |

| Enterprises that have ERP software | 31.20 | 8.40 | 70.62 |

| ICT security measure used: strong password authentication | 77.90 | 7.26 | 52.77 |

| Cluster 4–6 objects | |||

| Analysis of big data internally using machine learning | 3.67 | 1.51 | 2.27 |

| Use of 3D printing | 5.67 | 2.34 | 5.47 |

| Use of industrial or service robots | 8.17 | 3.43 | 11.77 |

| Analysis of big data internally from any data source | 12.67 | 7.50 | 56.27 |

| Purchase of cloud computing services used over the internet | 61.00 | 12.85 | 165.20 |

| Enterprises sending eInvoices, suitable for automated processing | 66.67 | 18.60 | 345.87 |

| Enterprises that have ERP software package | 37.33 | 8.31 | 69.07 |

| ICT security measure used: strong password authentication | 74.50 | 13.35 | 178.30 |

| Determinants | Between SS | df | Inside SS | df | F | Significance p |

|---|---|---|---|---|---|---|

| Analysis of big data internally using machine learning | 206.51 | 3 | 212.01 | 23 | 7.47 | 0.001 |

| Use of 3D printing | 17.16 | 3 | 81.36 | 23 | 1.62 | 0.21 |

| Use of industrial or service robots | 23.48 | 3 | 147.18 | 23 | 1.22 | 0.32 |

| Analysis of big data internally from any data source | 775.76 | 3 | 694.54 | 23 | 8.56 | 0.0005 |

| Purchase of cloud computing services used over the internet | 6146.64 | 3 | 1740.03 | 23 | 27.08 | 0.0000001 |

| Enterprises sending eInvoices, suitable for automated processing | 10975.58 | 3 | 2537.09 | 23 | 33.17 | 0.00000002 |

| Enterprises that have ERP software package | 353.27 | 3 | 2039.40 | 23 | 1.33 | 0.29 |

| ICT security measure used: strong password authentication | 1012.80 | 3 | 1730.83 | 23 | 4.49 | 0.013 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tutak, M.; Brodny, J. Business Digital Maturity in Europe and Its Implication for Open Innovation. J. Open Innov. Technol. Mark. Complex. 2022, 8, 27. https://doi.org/10.3390/joitmc8010027

Tutak M, Brodny J. Business Digital Maturity in Europe and Its Implication for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(1):27. https://doi.org/10.3390/joitmc8010027

Chicago/Turabian StyleTutak, Magdalena, and Jarosław Brodny. 2022. "Business Digital Maturity in Europe and Its Implication for Open Innovation" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 1: 27. https://doi.org/10.3390/joitmc8010027

APA StyleTutak, M., & Brodny, J. (2022). Business Digital Maturity in Europe and Its Implication for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 8(1), 27. https://doi.org/10.3390/joitmc8010027