Optimizing the Financial Performance of SMEs Based on Sharia Economy: Perspective of Economic Business Sustainability and Open Innovation

Abstract

:1. Introduction

2. Literature Review and Research Framework

3. Material and Method

3.1. Research Design

3.2. Study Area

3.3. Method of Collecting Data

3.3.1. Research Questionnaire

3.3.2. Respondents

3.4. Data Validity and Reliability

3.5. Data Analysis Method

4. Results

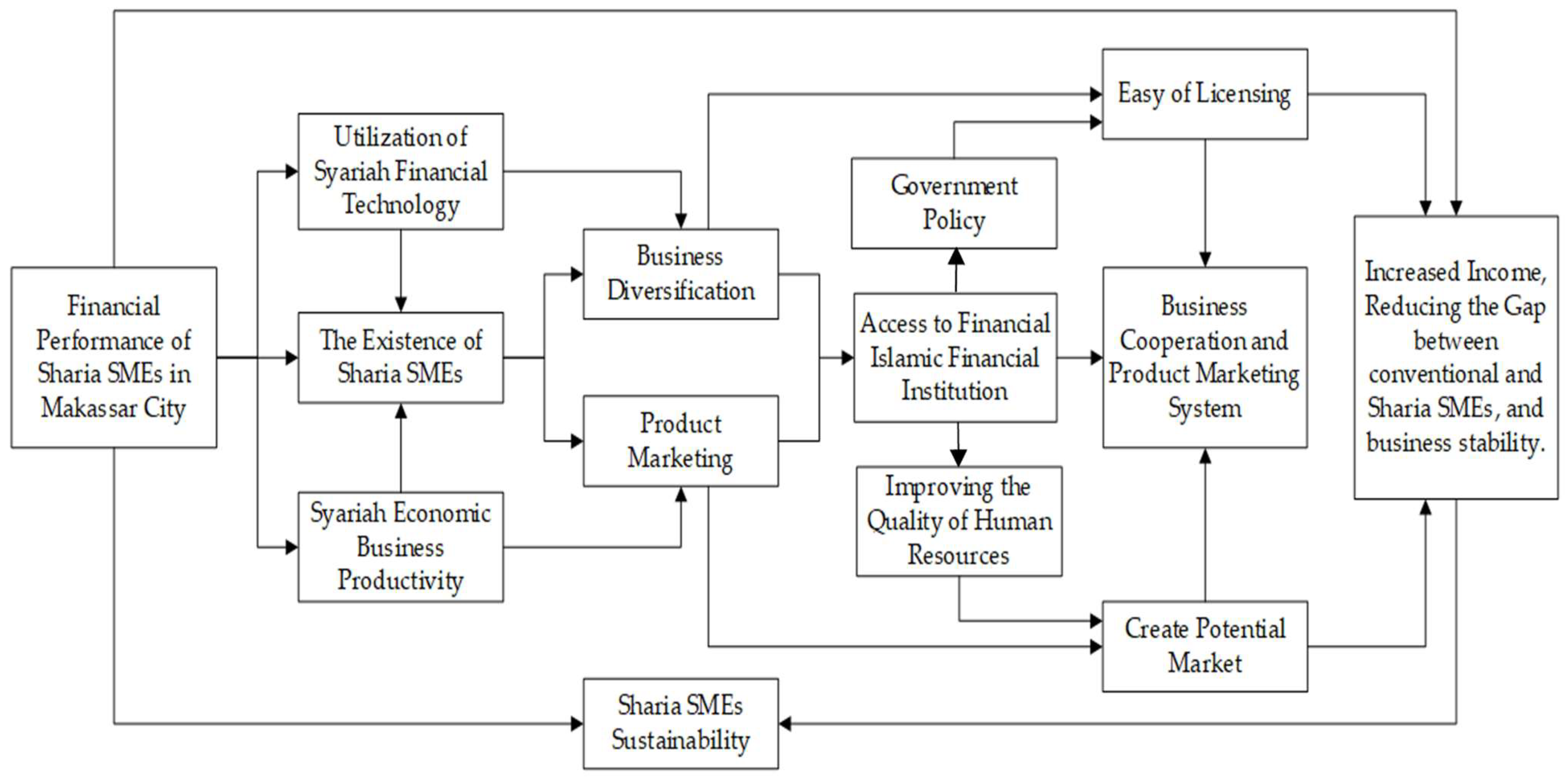

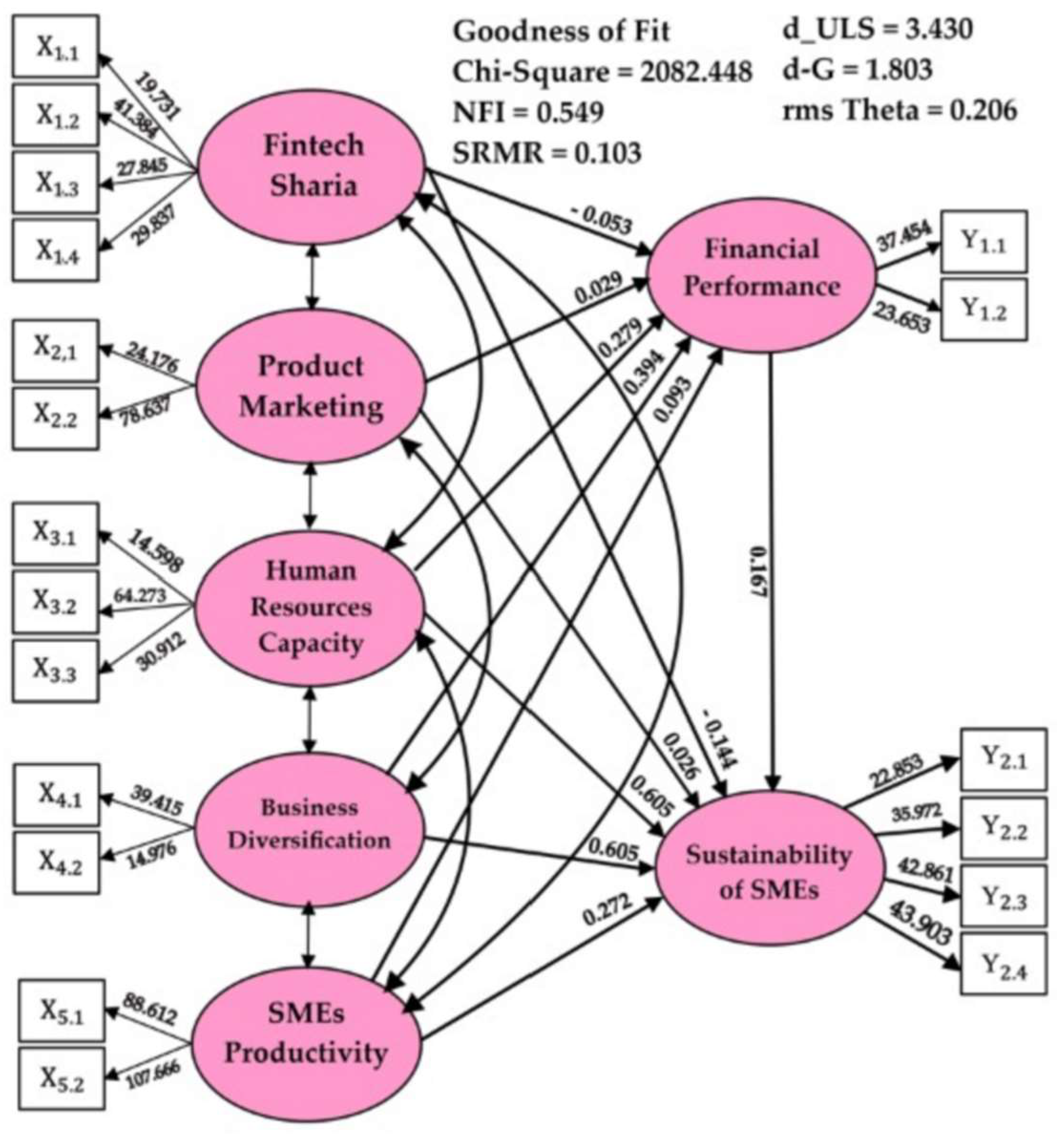

4.1. Determinants of Financial Performance and Sustainability of SMEs

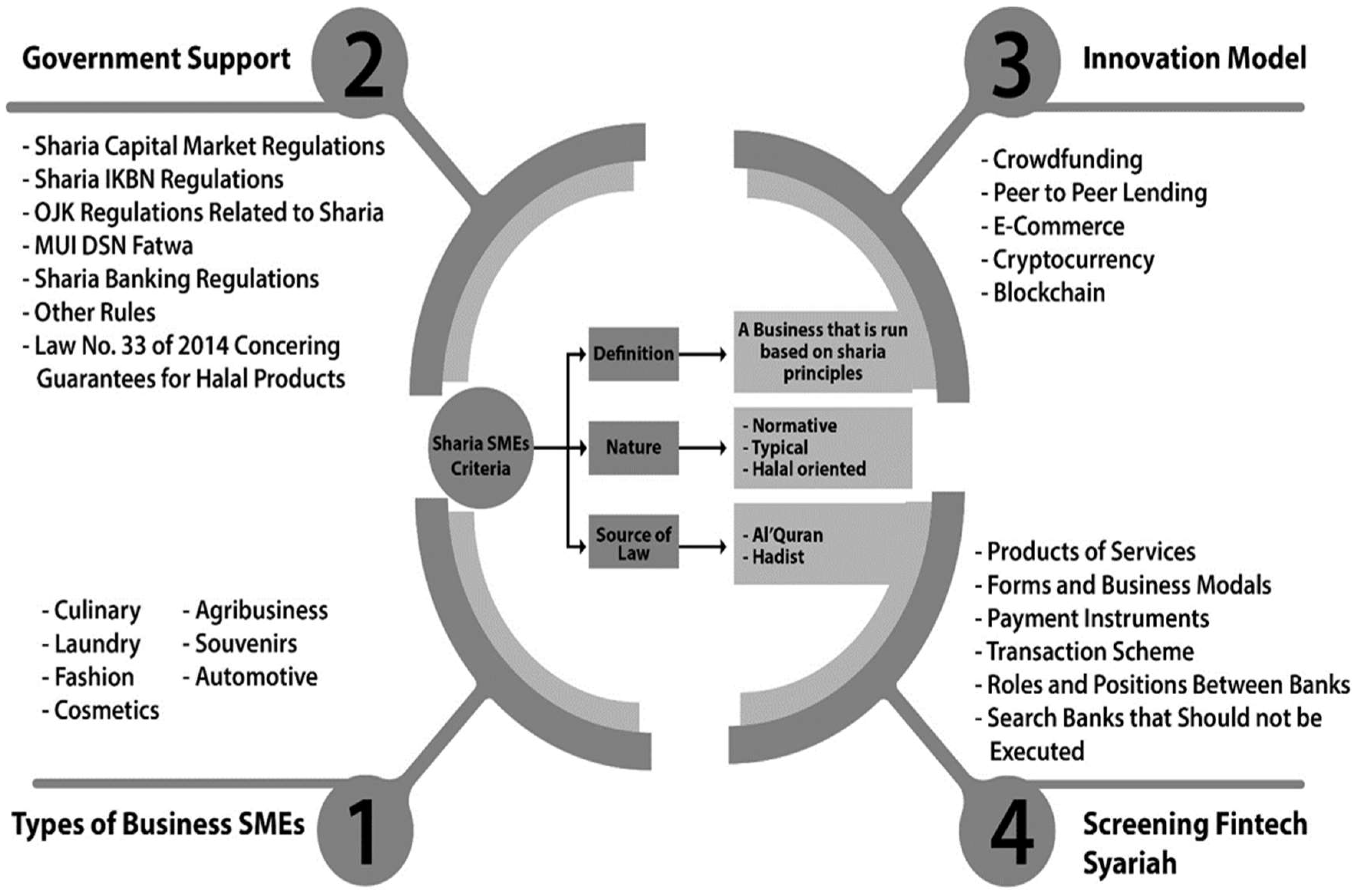

4.2. Sharia Economics and Open Innovation

5. Discussion

5.1. Increasing the Financial Performance of SMEs

5.2. Sustainability of SMEs and Open Innovation

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Jan, A.; Marimuthu, M.; Hassan, R.; Mehreen. Sustainable Business Practices and Firm’s Financial Performance in Islamic Banking: Under the Moderating Role of Islamic Corporate Governance. Sustainability 2019, 11, 6606. [Google Scholar] [CrossRef] [Green Version]

- Saleem, A.; Setiawan, B.; Barczi, J.; Sagi, J. Achieving Sustainable Economic Growth: Analysis of Islamic Debt and the Islamic Equity Market. Sustainability 2021, 13, 8319. [Google Scholar] [CrossRef]

- Jiang, X.; Wang, X.; Ren, J.; Xie, Z. The Nexus between Digital Finance and Economic Development: Evidence from China. Sustainability 2021, 13, 7289. [Google Scholar] [CrossRef]

- Thathsarani, U.S.; Wei, J.; Samaraweera, G. Financial Inclusion’s Role in Economic Growth and Human Capital in South Asia: An Econometric Approach. Sustainability 2021, 13, 4303. [Google Scholar] [CrossRef]

- Saleem, A.; Sagi, J.; Setiawan, B. Islamic Financial Depth, Financial Intermediation, and Sustainable Economic Growth: ARDL Approach. Economies 2021, 9, 49. [Google Scholar] [CrossRef]

- Rabbani, M.R.; Ali, M.A.M.; Ur Rahiman, H.; Atif, M.; Zulfikar, Z.; Naseem, Y. The Response of Islamic Financial Service to the COVID-19 Pandemic: The Open Social Innovation of the Financial System. J. Open Innov. Technol. Mark. Complex. 2021, 7, 85. [Google Scholar] [CrossRef]

- Solahudin, D.; Fakhruroji, M. Internet and Islamic Learning Practices in Indonesia: SocialMedia Religious Populism, and Religious Authority. Religions 2020, 11, 19. [Google Scholar] [CrossRef] [Green Version]

- Barus, E.E.; Nasution, M.Y.; Soemitra, A. Effectiveness of Fintech-Based Sharia Cooperative Development in the New Normal Era: Interpretative Structural Model Approach. Int. J. Sci. Technol. Manag. 2021, 2, 120–126. [Google Scholar] [CrossRef]

- Najib, M.; Ermawati, W.J.; Fahma, F.; Endri, E.; Suhartanto, D. FinTech in the Small Food Business and Its Relation with Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 88. [Google Scholar] [CrossRef]

- Poon, J.; Chow, Y.W.; Ewers, M.; Ramli, R. The Role of Skills in Islamic Financial Innovation: Evidence from Bahrain and Malaysia. J. Open Innov. Technol. Mark. Complex. 2020, 6, 47. [Google Scholar] [CrossRef]

- Azman, N.H.N.; Zabri, M.Z.M.; Masron, T.A.; Malim, N.A.K. The Utilisation of Islamic Fintech (I-Fintech) in Promoting Sustainable Inclusive Growth: Evidence from Micro-Entrepeneurs in Malaysia. J. Islamic Monet. Econ. Financ. 2020, 6, 555–576. [Google Scholar] [CrossRef]

- Surya, B. Spatial Interaction Pattern and the Process of City Activity Formation System (Case study, Ternate City, Tidore Archipelago City and Sofifi City of North Maluku, Indonesia). Res. J. Appl. Sci. 2015, 10, 880–892. [Google Scholar] [CrossRef]

- Mallinguh, E.; Wasike, C.; Zoltan, Z. Technology Acquisition and SMEs Performance, the Role of Innovation, Export and the Perception of Owner-Managers. J. Risk Financ. Manag. 2020, 13, 258. [Google Scholar] [CrossRef]

- Kijkasiwat, P.; Phuensane, P. Innovation and Firm Performance: The Moderating and Mediating Roles of Firm Size and Small and Medium Enterprise Finance. J. Risk Financ. Manag. 2020, 13, 97. [Google Scholar] [CrossRef]

- Surya, B. The Dynamics of Spatial Structure and Spatial Pattern Changes at the Fringe Area of Makassar City. Indones. J. Geogr. 2015, 47, 11–19. [Google Scholar] [CrossRef]

- Hamadamin, H.H.; Atan, T. The Impact of Strategic Human Resource Management Practices on Competitive Advantage Sustainability: The Mediation of Human Capital Development and Employee Commitment. Sustainability 2019, 11, 5782. [Google Scholar] [CrossRef] [Green Version]

- Lee, M.H.; Yun, J.J.; Pyka, A.; Won, D.; Schiuma, G.; Park, H.; Jeon, J.; Park, K.; Jung, K.; Yan, M.R.; et al. How to Respond to the Fourth Industrial Revolution, or the Second Information Technology Revolution? Dynamic New Combinations between Technology, Market, and Society through Open Innovation. J. Open Innov. Technol. Mark. Complex. 2018, 4, 21. [Google Scholar] [CrossRef] [Green Version]

- Oseni, U.A.; Ali, S.N. Fintech in Islamic Finance; Theory and Practices, Routledge; Taylor & Francis Group, London & New York. 2019. Available online: https://www.routledge.com/Fintech-in-Islamic-Finance-Theory-and-Practice/Oseni-Ali/p/book/9781138494800 (accessed on 25 October 2021).

- Toader, E.; Firtescu, B.N.; Roman, A.; Anton, S.G. Impact of Information and Communication Technology Infrastructure on Economic Growth: An Empirical Assessment for the EU Countries. Sustainability 2018, 10, 3750. [Google Scholar] [CrossRef] [Green Version]

- Bahrini, R.; Qaffas, A.A. Impact of Information and Communication Technology on Economic Growth: Evidence from Developing Countries. Economies 2019, 7, 21. [Google Scholar] [CrossRef] [Green Version]

- Kaplinsky, R. Technology and Innovation for Sustainable Development. In The Palgrave Handbook of Development Economics; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 589–626. Available online: https://link.springer.com/book/10.1007%2F978-3-030-14000-7 (accessed on 27 October 2021).

- Rohim, A.N.; Priyatno, P.D. Pola Konsumsi dalam Implementasi Gaya Hidup Halal Consumption Patterns in the Impelementation of Halal Lifestyle. J. Ekon. Syariah Dan Bisnis 2021, 4, 26–35. [Google Scholar]

- Adinugraha, H.H.; Sartika, M.; Ulama’i, A.H.A. Halal Lifestyle Di Indonesia. Nisbah J. Ekon. Syariah 2019, 5, 57–81. [Google Scholar] [CrossRef] [Green Version]

- Masyrafina, I. Industri Keuangan Syariah Inggris Makin Meningkat 2019. Available online: https://republika.co.id/berita/ekonomi/syariah-ekonomi/pqo0dd440/industri-keuangan-syariah-inggris-makin-meningkat (accessed on 30 October 2021).

- Rabbani, M.R.; Bashar, A.; Nawaz, N.; Karim, S.; Mohd, A.; Rahiman, H.U.; Alam, M.S. Exploring the Role of Islamic Fintech in Combating the Aftershocks of COVID-19: The Open Social Innovation of the Islamic Financial System. J. Open Innov. Technol. Mark. Complex. 2021, 7, 136. [Google Scholar] [CrossRef]

- Alaa Alaabed, F.; Mirakhor, A. Accelerating Risk Sharing Finance via Fintech: NextGen Islamic Finance. In Proceedings of the 1st International Colloqium on Islamic Banking and Islamic Finance, Tehran, Iran, 29–30 November 2017; Available online: https://www.sid.ir/FileServer/SE/433e20170101.pdf (accessed on 24 June 2021).

- Xirogiannis, G.; Chytas, P.; Glykas, M.; Valiris, G. Intelligent Impact Assesment of HRM to Shareholder Value. Expert Syst. Appl. 2008, 35, 2017–2031. [Google Scholar] [CrossRef]

- Ghazali, N.H. Awareness and Perception Analysis of Small Medium Enterprise and Start-Up towards FinTech Instruments; Crowdfunding and Peeer-to-Peer Lending in Malaysia. Int. J. Financ. Bank. Res. 2018, 4, 13–24. [Google Scholar] [CrossRef] [Green Version]

- Hasan, R.; Hassan, M.K.; Aliyu, S. Fintech and Islamic Finance: Literature Review and Research. Int. J. Islamic Econonomis Financ. 2020, 3, 75–94. [Google Scholar] [CrossRef] [Green Version]

- Smith, S. Understanding and Acquiring Technology Assets for Global Competition. Technovation 2007, 27, 643–649. [Google Scholar] [CrossRef]

- Kholis, N. Potret Perkembangan dan Praktik Keuangan Islam di Dunia. Millah Jurnal Studi Agama 2017, XVII, 1–30. [Google Scholar] [CrossRef]

- Akmal, H.; Ghozali, M. Analisis Perkembangan Ekonomi Islam di Asia Tenggara (Sebuah Kajian Historis). Jurnal Baabu Al-Ilmi 2017, 2, 1–15. [Google Scholar] [CrossRef]

- Ghozali, M.; Azmi, M.U.; Nugroho, W. Perkembangan Bank Syariah di Asia Tenggara; Kajian Historis. Falah Jurnal Ekonomi Syariah 2019, 4, 44–55. [Google Scholar] [CrossRef]

- Musyafah, A.A. Perkembangan Perekonomian Islam di Beberapa Negara di Dunia. Diponegoro Private Law Review 2019, 4, 419–427. Available online: https://ejournal2.undip.ac.id/index.php/dplr/article/view/5103 (accessed on 3 November 2021).

- Sriprasert, P.; Chainin, O.; Rahman, H.A. Understanding Behavior and Needs of Halal Tourism in Andaman Gulf of Thailand: A Case of Asian Muslim. J. Adv. Manag. Sci. 2014, 2, 216–219. [Google Scholar] [CrossRef]

- Martin, J.C.; Orden, C.C.; Zergane, S. Islamic Finance and Halal Tourism: An Unexplored Bridge for Smart Specialization. Sustainability 2020, 12, 5736. [Google Scholar] [CrossRef]

- ISEF. Seeing the Potential of the Global Halal Industry. 2021. Available online: https://isef.co.id/blog-en/seeing-the-potential-of-the-global-halal-industry/ (accessed on 25 November 2021).

- Karim, A.; Setiawan, M.; Indrawati, N.K.; Mugiono, M. Impact of Halal Standards on Logistic Employee Performance. Acta Logist.-Int. Sci. J. About Logist. 2021, 8, 268–276. [Google Scholar] [CrossRef]

- Bank Indonesia (BI). Kontribusi Ekonomi Syariah terhadap PDB Meningkat. Available online: https://databoks.katadata.co.id/datapublish/2021/06/30/kontribusi-ekonomi-syariah-terhadap-pdb-terus-meningkat (accessed on 2 November 2021).

- Nirwandar, S. Halal Lifestyle In Indonesia. UNWTO Seminar. 16 November 2015. Available online: https://webunwto.s3-eu-west-1.amazonaws.com/imported_images/43659/best_practice_halal_life_indonesia.pdf (accessed on 8 November 2021).

- Dinarstandar. State of the Global Islamic Economy Report. 2020. Available online: https://cdn.salaamgateway.com/reports/pdf/862e1c9a9d925c5cd6aacae31b0ea102e21778a9.pdf (accessed on 28 July 2021).

- Hidayat, K. Jadi Sumber Pertumbuhan Ekonomi, Kontribusi Ekonomi Syariah ke PDB Terus Meningkat. Available online: https://nasional.kontan.co.id/news (accessed on 28 July 2021).

- Surya, B.; Menne, F.; Sabhan, H.; Suriani, S.; Abubakar, H.; Idris, M. Economic Growth, Increasing Productivity of SMEs, and Open Innovatioan. J. Open Innov. Technol. Mark. Complex. 2021, 7, 20. [Google Scholar] [CrossRef]

- Oshora, B.; Desalegn, G.; Gorgenyi, H.E.; Fekete, F.M.; Zeman, Z. Determinants of Financial Inclusion in Small and Medium Enterprises: Evidence from Ethiopia. J. Risk Financ. Manag. 2021, 14, 286. [Google Scholar] [CrossRef]

- Hsien, W.C.; Yuan, L.L.; Bein, C.C. Evaluating Firm Technological Innovation Capability Under Uncertainty. Technovation 2008, 28, 349–363. [Google Scholar] [CrossRef]

- Liu, J.; Tang, J.; Zhou, B.; Liang, Z. The Effect of Governance Quality on Economic Growth: Based on China’s Provincial Panel Data. Economies 2018, 6, 56. [Google Scholar] [CrossRef] [Green Version]

- Surya, B.; Hadijah, H.; Suriani, S.; Baharuddin, B.; Fitriyah, A.T.; Menne, F.; Rasyidi, E.S. Spatial Transformation of a New City in 2006–2020: Perspectives on the Spatial Dynamics, Environmental Quality Degradation, and Socio—Economic Sustainability of Local Communities in Makassar City, Indonesia. Land 2020, 9, 324. [Google Scholar] [CrossRef]

- Sira, E.; Vavrek, R.; Kravčáková Vozárová, I.; Kotulič, R. Knowledge Economy Indicators and Their Impact on the Sustainable Competitiveness of the EU Countries. Sustainability 2020, 12, 4172. [Google Scholar] [CrossRef]

- Setyowati, N. Macroeconomic Determinants of Islamic Banking Products in Indonesia. Economies 2019, 7, 53. [Google Scholar] [CrossRef] [Green Version]

- Sima, V.; Gheorghe, I.G.; Subi´c, J.; Nancu, D. Influences of the Industry 4.0 Revolution on the Human Capital Development and Consumer Behavior: A Systematic Review. Sustainability 2020, 12, 4035. [Google Scholar] [CrossRef]

- Bank Indonesia (BI). The Role of the Government in Zakat Development in the Era of Industrial Revolution 4.0. Islamic Economic and Finance Department. 2019. Available online: https://www.puskasbaznas.com/images/OfficialNews/191003-The-Role-of-Government-in-Zakat-Development-in-the-Era-Industrial-Revolution-4.pdf (accessed on 7 December 2021).

- Maksum, I.R.; Rahayu, A.Y.S.; Kusumawardhani, D. A Social Enterprise Approach to Empowering Micro, Small and Medium Enterprises (SMEs) in Indonesia. J. Open Innov. Technol. Mark. Complex. 2020, 6, 50. [Google Scholar] [CrossRef]

- Diabate, A.; Allate, B.M.; Wei, D.; Yu, L. Do Firm and Entrepreneur Characteristics Play a Role in SMEs’ Sustainable Growth in a Middle-Income Economy like Côte d’Ivoire? Sustainability 2019, 11, 1557. [Google Scholar] [CrossRef] [Green Version]

- Yusuf, M.; Ichsan, R.N.; Saparuddin. Determinasi Investasi dan Pasar Modal Syariah terhadap Pertumbuhan Ekonomi di Indonesia. J. Kaji. Ekon. Publik 2021, 6, 397–401. Available online: https://jurnal.pancabudi.ac.id/index.php/jepa/article/view/1121 (accessed on 5 September 2021).

- Roser, M. “Economic Growth”. 2013. Available online: https://ourworldindata.org/economic-growth (accessed on 28 July 2021).

- Cristina, I.O.M.; Nicoleta, C.; Cătălin, D.R.; Margareta, F. Regional Development in Romania: Empirical Evidence Regarding the Factors for Measuring a Prosperous and Sustainable Economy. Sustainability 2021, 13, 3942. [Google Scholar] [CrossRef]

- Zada, M.; Zada, S.; Ali, M.; Zang, Y.; Begum, A.; Han, H.; Ariza, M.A.; Vega, M.A. Development of Local Economy through the Strengthening of Small-Medium-Sized Forest Enterprises in KPK, Pakistan. Sustainability 2021, 13, 10502. [Google Scholar] [CrossRef]

- Hussain, M.E.; Haque, M. Impact of Economic Freedom on the Growth Rate: A Panel Data Analysis. Economies 2016, 4, 5. [Google Scholar] [CrossRef] [Green Version]

- Arner, D.W.; Buckley, R.P.; Zetzsche, D.A. Sustainability, FinTech and Financial Inclusion. Eur. Bus. Org. Law. Rev. 2020, 21, 7–35. [Google Scholar] [CrossRef]

- Garcia-Castro, R.; Ariño, M.A.; Canela, M.A. Does social performance really lead to financial performance? Accounting for endogeneity. J. Bus. Ethics 2010, 92, 107–126. [Google Scholar] [CrossRef]

- Lassala, C.; Apetrei, A.; Sapena, J. Sustainability Matter and Financial Performance of Companies. Sustainability 2017, 9, 1498. [Google Scholar] [CrossRef] [Green Version]

- Akben-Selcuk, E. Corporate Social Responsibility and Financial Performance: The Moderating Role of Ownership Concentration in Turkey. Sustainability 2019, 11, 3643. [Google Scholar] [CrossRef] [Green Version]

- López, M.V.; Garcia, A.; Rodriguez, L. Sustainable development and corporate performance: A study based on the Dow Jones sustainability index. J. Bus. Ethics 2007, 75, 285–300. [Google Scholar] [CrossRef]

- Faiz, I.A. Fintech Syariah dan Bisnis Digital. Penerbit: Media Rakyat Nusantara, Yogyakarta. 2020. Available online: http://opac.lib.ugm.ac.id/index.php?mod=book_detail&sub=BookDetail&act=view&typ=htmlext&buku_id=807048&obyek_id=1&unitid=200&jenis_id= (accessed on 5 December 2021).

- Soytas, M.A.; Denizel, M.; Usar, D.D. Addressing endogeneity in the causal relationship between sustainability and financial performance. Int. J. Prod. Econ. 2019, 210, 56–71. [Google Scholar] [CrossRef]

- Mallin, C.; Farag, H.; Ow-Yong, K. Corporate Social Responsibility and Financial Performance in Islamic banks. J. Econ. Behav. Organ. 2014, 103, S21–S38. [Google Scholar] [CrossRef]

- Menne, F.; Winata, L.; Hossain, M. The Influence of CSR Practices on Financial Performance: Evidence from Islamic Financial Institution in Indonesia. J. Mod. Account. Audit. 2016, 12, 77–90. [Google Scholar] [CrossRef]

- Torugsa, N.A.; O’Donohue, W.; Hecker, R. Capabilities, Proactive CSR and Financial Performance in SMEs: Empirical Evidence from an Australian Manufacturing Industry Sector. J. Bus. Ethics. 2012, 109, 483–500. [Google Scholar] [CrossRef] [Green Version]

- Ali Qalati, S.; Li, W.; Ahmed, N.; Mirani, M.A.; Khan, A. Examining the Factors Affecting SME Performance: The Mediating Role of Social Media Adoption. Sustainability 2021, 13, 75. [Google Scholar] [CrossRef]

- Syed, M.H.; Khan, S.; Rabbani, M.R.; Thalassinos, Y.E. An Artificial Intelligence and NLP based Islamic FinTech Model Combining Zakat and Qardh-Al-Hasan for Countering the Adverse Impact of COVID 19 on SMEs and Individuals. Int. J. Econ. Bus. Adm. 2020, VIII, 351–364. [Google Scholar] [CrossRef]

- Khan, S.; Rabbani, M.R. In Depth Analysis of Blockchain, Cryptocurrency and Sharia Compliance. Int. J. Bus. Innov. Res. 2020, 1, 1. [Google Scholar] [CrossRef]

- Suryono, R.R.; Budi, I.; Purwandari, B. Challenges and Trends of Financial Technology (Fintech): A Systematic Literature Review. Information 2020, 11, 590. [Google Scholar] [CrossRef]

- Gheeraert, L. Does Islamic finance spur banking sector development? J. Economic. Behav. Organ. 2014, 103. [Google Scholar] [CrossRef]

- Ahmed, A. Global financial crisis: An Islamic finance perspective. Int. J. Islamic Middle East. Financ. Manag. 2010, 3, 306–320. [Google Scholar] [CrossRef]

- Pitluck, A.Z. Islamic banking and finance: Alternative or façade? In Oxford Handbook of the Sociology of Finance; Oxford University Press: Oxford, UK, 2012; pp. 431–449. Available online: https://www.oxfordhandbooks.com/view/10.1093/oxfordhb/9780199590162.001.0001/oxfordhb-9780199590162-e-23 (accessed on 7 December 2021).

- Ishak, K. The role of Islamic finance in economic development. Lingnan J. Bank. Financ. Econ. 2016, 6, 6. Available online: https://commons.ln.edu.hk/cgi/viewcontent.cgi?article=1036&context=ljbfe (accessed on 5 December 2021).

- Mansoor, M.; Ellahi, N.; Hassan, A.; Malik, Q.A.; Waheed, A.; Ullah, N. Corporate Governance, Shariah Governance, and Credit Rating: A Cross-Country Analysis from Asian Islamic Banks. J. Open Innov. Technol. Mark. Complex. 2020, 6, 170. [Google Scholar] [CrossRef]

- Hernita, H.; Surya, B.; Perwira, I.; Abubakar, H.; Idris, M. Economic Business Sustainability and Strengthening Human Resource Capacity Based on Increasing the Productivity of Small and Medium Enterprises (SMEs) in Makassar City, Indonesia. Sustainability 2021, 13, 3177. [Google Scholar] [CrossRef]

- Surya, B.; Salim, A.; Hernita, H.; Suriani, S.; Menne, F.; Rasyidi, E.S. Land Use Change, Urban Agglomeration, and Urban Sprawl: A Sustainable Development Perspective of Makassar City, Indonesia. Land 2021, 10, 556. [Google Scholar] [CrossRef]

- Kucharčíková, A.; Mičiak, M. Human Capital Management in Transport Enterprises with the Acceptance of Sustainable Development in the Slovak Republic. Sustainability 2018, 10, 2530. [Google Scholar] [CrossRef] [Green Version]

- Mehmood, R.; Hunjra, A.I.; Chani, M.I. The Impact of Corporate Diversification and Financial Structure on Firm Performance: Evidence from South Asian Countries. J. Risk Financ. Manag. 2019, 12, 49. [Google Scholar] [CrossRef] [Green Version]

- Han, M.; Lee, S.; Kim, J. Effectiveness of Diversification Strategies for Ensuring Financial Sustainability of Construction Companies in the Republic of Korea. Sustainability 2019, 11, 3076. [Google Scholar] [CrossRef] [Green Version]

- Ibarra, D.; Bigdeli, A.Z.; Igartua, J.I.; Jaione, G. Business Model Innovation in Established SMEs: A Configurational Approach. J. Open Innov. Technol. Mark. Dan Complex. 2020, 6, 76. [Google Scholar] [CrossRef]

- MacDonald, A.; Clarke, A.; Huang, L.; Seitanidi, M.M. Partner Strategic Capabilities for Capturing Value from Sustainability-Focused Multi-Stakeholder Partnerships. Sustainability 2019, 11, 557. [Google Scholar] [CrossRef] [Green Version]

- Amrina, U.; Hidayatno, A.; Zagloel, T.Y.M. A Model-Based Strategy for Developing Sustainable Cosmetics Small and Medium Industries with System Dynamics. J. Open Innov. Technology. Mark. Complex. 2021, 7, 225. [Google Scholar] [CrossRef]

- Lestari, D.; Darma, D.C.; Muliadi, M. Fintech and Micro, Small and Medium Enterprise Development: Special Reference to Indonesia. Entrep. Rev. 2020, 1, 1–9. [Google Scholar] [CrossRef]

- Khan, S. The Role of Product Marketing and Why Startups Need to Define it. 2021. Available online: https://openviewpartners.com/blog/role-of-product-marketing-in-your-startup/#.YZQz4GBBw2w (accessed on 17 November 2021).

- Tosovic-Stevanovic, A.; Ristanovic, V.; Calovic, D.; Lalic, G.; ZuZa, M.; Cvijanovic, G. Small Farm Business Analysis Using the AHP Model for Efficient Assessment of Distribution Channels. Sustainability 2020, 12, 10479. [Google Scholar] [CrossRef]

- Ungerman, O.; Dedkova, J. Marketing Innovations in Industry 4.0 and Their Impacts on Current Enterprises. Appl. Sci. 2019, 9, 3685. [Google Scholar] [CrossRef] [Green Version]

- Hair, J.F., Jr.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, G. Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Fàbregues, S.; Hong, Q.N.; Escalante, B.E.L.; Guetterman, T.C.; Meneses, J.; Fetters, M.D. A Methodological Review of Mixed Methods Research in Palliative and End-of-Life Care (2014–2019). Int. J. Environ. Res. Public Health 2020, 17, 3853. [Google Scholar] [CrossRef] [PubMed]

- Jusman. Potensi Pembangunan Kota Makassar. Available online: https://disnaker.makassar.go.id/2017/11/08/potensi-pembangunan-kota-makassar (accessed on 6 November 2021).

- BPS Kota Makassar. Kota Makassar dalam Angka 2021. Available online: https://makassarkota.bps.go.id/publication/2021/02/26/be312e3f776bcfd005978bda/kota-makassar-dalam-angka-2021.html (accessed on 6 November 2021).

- Sugiono. Metode Penelitian Kuantantif, Kualitatif dan R&D. 2017. Available online: https://www.pdfdrive.com/prof-dr-sugiyono-metode-penelitian-kuantitatif-kualitatif-dan-rd-intro-e56379944.html (accessed on 12 November 2021).

- Lwanga, S.K.; Lemeshow, S. Adequacy of Sample Size in Health Studies. Available online: https://apps.who.int/iris/bitstream/handle/10665/41607/0471925179_eng.pdf?sequence=1&isAllowed=y (accessed on 18 November 2021).

- Bell, E.; Bryman, A.; Harley, B. Business Research Methods, 5th ed.; Jilid., I., Ed.; Erlangga: Jakarta, Indonesia, 1996; Available online: https://library.ui.ac.id/detail?id=20148789 (accessed on 18 November 2021).

- Cantele, S.; Vernizzi, S.; Campedelli, B. Untangling the Origins of Sustainable Commitment: New Insights on the Small vs. Large Firms’ Debate Untangling the Origins of Sustainable Commitment: New Insights on the Small vs. Large Firms’ Debate. Sustainability 2020, 12, 671. [Google Scholar] [CrossRef] [Green Version]

- Manzaneque, L.M.; Alfaro, C.E.; de la Cruz, A.M.P. Stakeholders and Long-Term Sustainability of SMEs. Who Really Matters in Crisis Contexts, and When. Sustainability 2019, 11, 6551. [Google Scholar] [CrossRef] [Green Version]

- Ellitan, L. Creating Sustainability of Small and Medium Enterprises in Surabaya and Surrounding Area. Int. J. Res. Manag. Econ. Commer. 2018, 8, 157–167. [Google Scholar]

- Phan, T.T.H.; Tran, H.X.; Le, T.T.; Nguyen, N.; Pervan, S.; Tran, M.D. The Relationship between Sustainable Development Practices and Financial Performance: A Case Study of Textile Firms in Vietnam. Sustainability 2020, 12, 5930. [Google Scholar] [CrossRef]

- Masocha, R. Social Sustainability Practices on Small Businesses in Developing Economies: A Case of South Africa. Sustainability 2019, 11, 3257. [Google Scholar] [CrossRef] [Green Version]

- Herr, H.; Nettekoven, Z.M. The Role of Small and Medium-sized Enterprises in Development What Can be Learned from the German Experience? 2017. Available online: https://library.fes.de/pdf-files/iez/14056.pdf (accessed on 22 November 2021).

- United Nations. Digital Technologies for a New Future. 2021. Available online: https://www.cepal.org/sites/default/files/publication/files/46817/S2000960_en.pdf (accessed on 21 October 2021).

- Surya, B.; Syafri, S.; Hadijah, H.; Baharuddin, B.; Fitriyah, A.T.; Sakti, H.H. Management of Slum-Based Urban Farming and Economic Empowerment of the Community of Makassar City, South Sulawesi, Indonesia. Sustainability 2020, 12, 7324. [Google Scholar] [CrossRef]

- Surya, B.; Muhibuddin, A.; Suriani, S.; Rasyidi, E.S.; Baharuddin, B.; Fitriyah, A.T.; Abubakar, H. Economic Evaluation, Use of Renewable Energy, and Sustainable Urban Development Mamminasata Metropolitan, Indonesia. Sustainability 2021, 13, 1165. [Google Scholar] [CrossRef]

- Baboshkin, P.; Yegina, N.; Zemskova, E.; Stepanova, D.; Yuksel, S. Non-Classical Approach to Identifying Groups of Countries Based on Open Innovation Indicators. J. Open Innov. Technology. Mark. Complex. 2021, 7, 77. [Google Scholar] [CrossRef]

- Yang, X. FinTech in Promoting the Development of Green Finance in China against the Background of Big Data and Artificial Intelligence. In 2020 4th International Seminar on Education Innovation and Economic Management (SEIEM); Francis Academic Press: London, UK, 2020; Available online: https://www.semanticscholar.org/paper/FinTech-in-Promoting-the-Development-of-Green-in-of-Yang/671a78edabf0dc5eb7038bd41c819856cea9d456 (accessed on 25 October 2021).

- Menne, F. Nilai-Nilai Spiritual dalam Entitas Bisnis Syariah. Celebes Media Perkasa. 2017. Available online: https://bit.ly/3ipDK1x (accessed on 28 October 2021).

- Lee, J.L. Green Finance and Sustainable Development Goals: The Case of China. J. Asian Financ. Econ. Bus. 2020, 7, 577–586. [Google Scholar] [CrossRef]

- Babeľová, Z.G.; Stareček, A. Evaluation of Industrial Enterprises’ Performance by Different Generations of Employees. Entrep. Sustain. Issues 2021, 9, 346–362. [Google Scholar] [CrossRef]

- Babel’ová, Z.G.; Starecek, A.; Koltnerová, K.; Dagmar, C. Perceived Organizational Performance in Recruiting and Retaining Employees with Respect to Different Generational Groups of Employees and Sustainable Human Resource Management. Sustainability 2020, 12, 574. [Google Scholar] [CrossRef] [Green Version]

- Moro, V.R.; Rambaud, S.C.; Pascual, J.L. Sustainability in FinTechs: An Explanation through Business Model Scalability and Market Valuation. Sustainability 2020, 12, 10316. [Google Scholar] [CrossRef]

- George, G.; Schillebeeckx, S. Digital Sustainability and its Implications for Finance and Climate Change. Macroeconomic Review. 2021. Available online: https://www.mas.gov.sg/-/media/MAS/EPG/MR/2021/Apr/MRApr21_SF_A.pdf (accessed on 29 October 2021).

- Ferreira, M.C.R.; de Carvalho, F.M.; Sobreiro, V.A. A systematic review of literature about finance and sustainability. J. Sustain. Financ. Investig. 2016, 6, 112–147. [Google Scholar] [CrossRef]

- Boikova, T.; Sandija, Z.R.S.; Rivza, P.; Rivza, B. The Determinants and Effects of Competitiveness: Digitalization in the European Economies. Sustainability 2021, 13, 11689. [Google Scholar] [CrossRef]

- Pizzi, S.; Corbo, L.; Caputo, A. Fintech and SMEs Sustainable Business Models: Reflection and Considerations for a circular economy. J. Clean. Prod. 2020, 281, 1. [Google Scholar] [CrossRef]

- Surya, B.; Suriani, S.; Menne, F.; Abubakar, H.; Idris, M.; Rasyidi, E.S.; Remmang, H. Community Empowerment and Utilization of Renewable Energy: Entrepreneurial Perspective for Community Resilience Based on Sustainable Management of Slum Settlements in Makassar City, Indonesia. Sustainability 2021, 13, 3178. [Google Scholar] [CrossRef]

| Number | District | Population (Person) | Number of SMEs (Units) | Percentage (%) |

|---|---|---|---|---|

| 1 | Biringkanaya | 220,456 | 225 | 4.18 |

| 2 | Bontoala | 57,197 | 139 | 2.58 |

| 3 | Makassar | 85,515 | 256 | 4.75 |

| 4 | Mamajang | 61,452 | 305 | 5.66 |

| 5 | Manggala | 149,487 | 1199 | 22.26 |

| 6 | Mariso | 60,499 | 242 | 4.49 |

| 7 | Panakkukang | 149,664 | 355 | 6.59 |

| 8 | Rappocini | 170,121 | 551 | 10.23 |

| 9 | Sangkarrang Islands | 14,531 | 86 | 1.60 |

| 10 | Tallo | 140,330 | 429 | 7.96 |

| 11 | Tamalanrea | 115,843 | 150 | 2.78 |

| 12 | Tamalate | 205,541 | 668 | 12.40 |

| 13 | Ujung Pandang | 29,054 | 415 | 7.70 |

| 14 | Ujung Tanah | 35,534 | 207 | 3.84 |

| 15 | Wajo | 31,453 | 160 | 2.97 |

| Number | District | Number of SMEs (Units) | Number of Respondents (Units) |

|---|---|---|---|

| 1 | Biringkanaya | 225 | 15 |

| 2 | Bontoala | 139 | 9 |

| 3 | Makassar | 256 | 17 |

| 4 | Mamajang | 305 | 20 |

| 5 | Manggala | 1.199 | 78 |

| 6 | Mariso | 242 | 16 |

| 7 | Panakkukang | 355 | 23 |

| 8 | Rappocini | 551 | 36 |

| 9 | Sangkarrang Islands | 86 | 5 |

| 10 | Tallo | 429 | 28 |

| 11 | Tamalanrea | 150 | 10 |

| 12 | Tamalate | 668 | 43 |

| 13 | Ujung Pandang | 415 | 27 |

| 14 | Ujung Tanah | 207 | 13 |

| 15 | Wajo | 160 | 10 |

| Variabel | Indikator | Outer Loading | Description |

|---|---|---|---|

| Shariah Fintech | 0.774 | Valid | |

| 0.859 | Valid | ||

| 0.785 | Valid | ||

| 0.848 | Valid | ||

| Product Marketing | 0.690 | Invalid | |

| 0.672 | Invalid | ||

| 0.814 | Valid | ||

| 0.810 | Valid | ||

| Human Resources Capacity | 0.747 | Valid | |

| 0.911 | Valid | ||

| 0.818 | Valid | ||

| Business Diversification | 0.920 | Valid | |

| 0.819 | Valid | ||

| 0.636 | Invalid | ||

| SMEs Productivity | 0.773 | Valid | |

| 0.875 | Valid | ||

| 0.517 | Invalid | ||

| Financial Performance | 0.827 | Valid | |

| 0.846 | Valid | ||

| 0.226 | Invalid | ||

| Sustainabilty of SMEs | 0.784 | Valid | |

| 0.855 | Valid | ||

| 0.787 | Valid | ||

| 0.872 | Valid | ||

| 0.887 | Valid |

| Variabel | Average Variance Extracted (AVE) | Description |

|---|---|---|

| 0.662 | Valid | |

| 0.790 | Valid | |

| 0.680 | Valid | |

| 0.659 | Valid | |

| 0.876 | Valid | |

| 0.723 | Valid | |

| 0.699 | Valid |

| Variabel | Cronbach’s Alpha | Composite Reliability | Description |

|---|---|---|---|

| 0.829 | 0.887 | Reliable | |

| 0.740 | 0.836 | Reliable | |

| 0.767 | 0.863 | Reliable | |

| 0.490 | 0.756 | Reliable | |

| 0.859 | 0.822 | Reliable | |

| 0.618 | 0.786 | Reliable | |

| 0.892 | 0.921 | Reliable |

| Correlation | Coefficient | Error | T-Count | T-Table |

|---|---|---|---|---|

| Sharia Fintech toward Financial Performance | 0.040 | 0.086 | 0.459 | 1.92 |

| Sharia Fintech toward Sustainability of SMEs | −0.159 | 0.054 | 2.927 | 1.92 |

| Product Marketing toward Financial Performance | −0.095 | 0.089 | 1.067 | 1.92 |

| Product Marketing toward Sustainability of SMEs | 0.092 | 0.053 | 1.714 | 1.92 |

| Human Resources Capacity toward Financial Performance | 0.341 | 0.085 | 3.990 | 1.92 |

| Human Resources Capacity toward Sustainability of SMEs | 0.528 | 0.052 | 10.107 | 1.92 |

| Business Diversification toward Financial Performance | 0.276 | 0.065 | 4.217 | 1.92 |

| Business Diversification toward Sustainability of SMEs | 0.112 | 0.051 | 2.392 | 1.92 |

| SMEs Productivity toward Financial Performance | 0.128 | 0.098 | 1.299 | 1.92 |

| SMEs Productivity toward Sustainability of SMEs | 0.213 | 0.056 | 3.787 | 1.92 |

| Financial Performance toward Sustainability of SMEs | 0.167 | 0.053 | 3.130 | 1.92 |

| Regression Residual | R Square | R Square Adjusted | ||

| Financial Performance Sustainability of SMEs | 0.418 0.659 | 0.405 0.652 | ||

| Business Process | Interaction | SMEs Involvement |

|---|---|---|

| Payments | C2C | Moderate |

| Investments | B2C | Low |

| Financing | B2B | Moderate |

| Insurance | B2C | Low |

| Advisory | C2C | Low |

| Cross Process (e.g., Big data analytic and predictive modelling) | B2B | Low |

| Infrastructure (e.g., security) | B2C | Low |

| Description: | C2C = Consumer to Consumer, B2C = Business to Consumer, B2B = Business to Business | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Menne, F.; Surya, B.; Yusuf, M.; Suriani, S.; Ruslan, M.; Iskandar, I. Optimizing the Financial Performance of SMEs Based on Sharia Economy: Perspective of Economic Business Sustainability and Open Innovation. J. Open Innov. Technol. Mark. Complex. 2022, 8, 18. https://doi.org/10.3390/joitmc8010018

Menne F, Surya B, Yusuf M, Suriani S, Ruslan M, Iskandar I. Optimizing the Financial Performance of SMEs Based on Sharia Economy: Perspective of Economic Business Sustainability and Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(1):18. https://doi.org/10.3390/joitmc8010018

Chicago/Turabian StyleMenne, Firman, Batara Surya, Muhammad Yusuf, Seri Suriani, Muhlis Ruslan, and Iskandar Iskandar. 2022. "Optimizing the Financial Performance of SMEs Based on Sharia Economy: Perspective of Economic Business Sustainability and Open Innovation" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 1: 18. https://doi.org/10.3390/joitmc8010018

APA StyleMenne, F., Surya, B., Yusuf, M., Suriani, S., Ruslan, M., & Iskandar, I. (2022). Optimizing the Financial Performance of SMEs Based on Sharia Economy: Perspective of Economic Business Sustainability and Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 8(1), 18. https://doi.org/10.3390/joitmc8010018